Safeguarding of Key Minerals Deposits as a Basis of Sustainable Development of Polish Economy

Abstract

1. Introduction

2. Materials and Methods

- Group 1—domestic and mainly domestic minerals characterized by a stable, growing, or strongly growing consumption trend,

- Group 2—scarce minerals characterized by a stable, growing, or strongly growing consumption trend, for which the proven resource base is known.

- Group 1—domestic or mainly domestic minerals: elemental sulfur, refined copper (due to the fact that silver is a co-occurring mineral in copper deposits, in many cases these resources must be analyzed together; this is why it appears in some of the analyses below), refined lead, metallic zinc, raw industrial dolomite, gypsum and anhydrite, raw magnesite, foundry sand, glass sand, coking coal, dimension stone, kaolin, and feldspar raw materials;

- Group 2—scarce minerals: titanium ores and concentrates, crude oil, nickel metal, potassium salts, natural gas, ball clays, and refractory clays.

3. Results

3.1. Key Minerals for the Polish Economy

3.1.1. General Remarks on Key Minerals for the Polish Economy

3.1.2. Consumption Trends of Selected Key Minerals for Polish Economy

3.1.3. Resources and Extraction of Minerals for Production of Selected Key Minerals in Poland

3.2. Indications on the Safeguarding of Deposits for the Production of Selected Key Minerals

- National—deposits of the greatest economic importance for the country, for which decisions on their safeguarding and development should be taken at the level of national administration;

- Regional—deposits of significant economic importance for the region, which should be decided at the level of regional (provincial) administration.

3.3. Key Polish Minerals against the Background of the Minerals Market in Europe

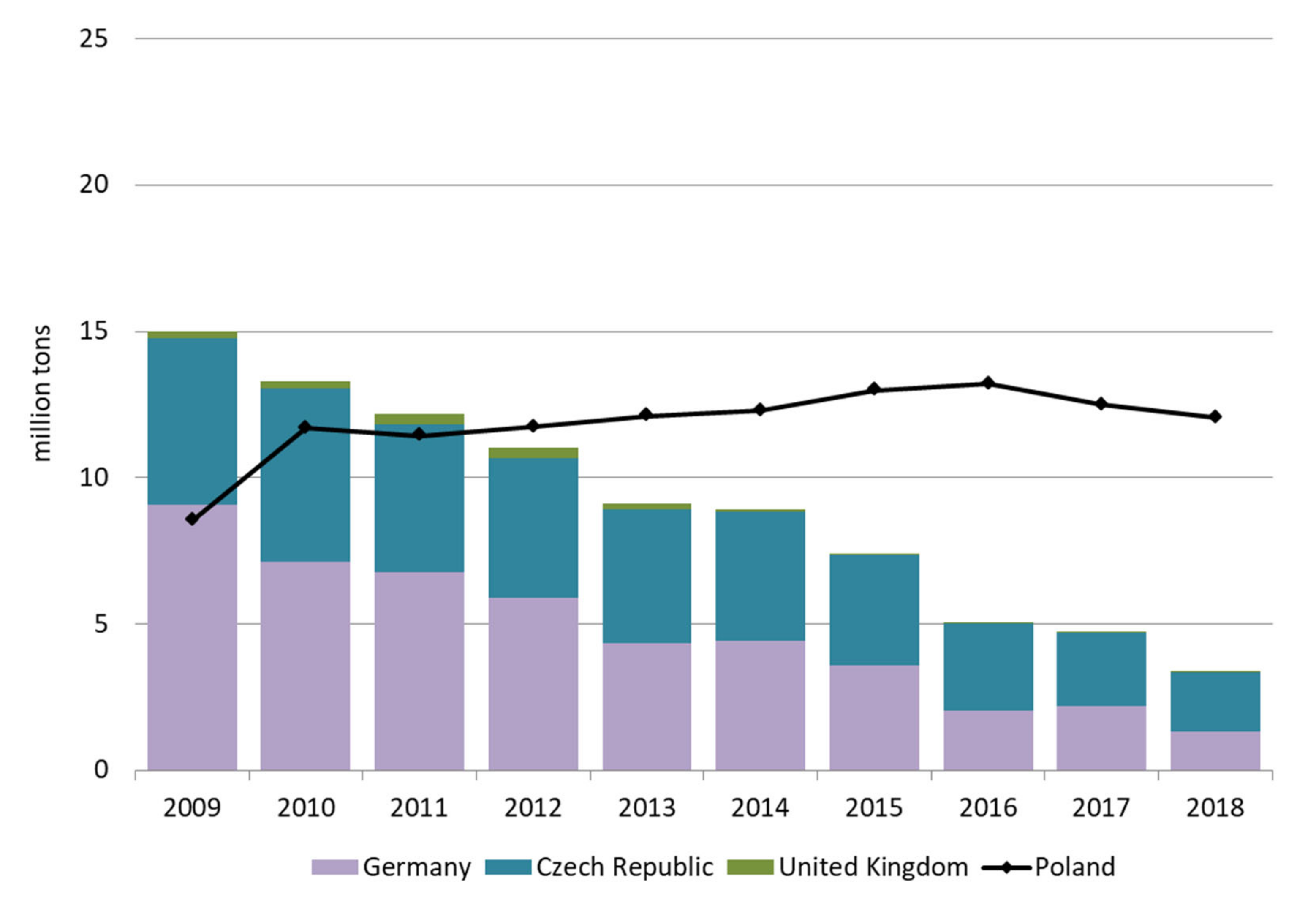

3.3.1. Coking Coal

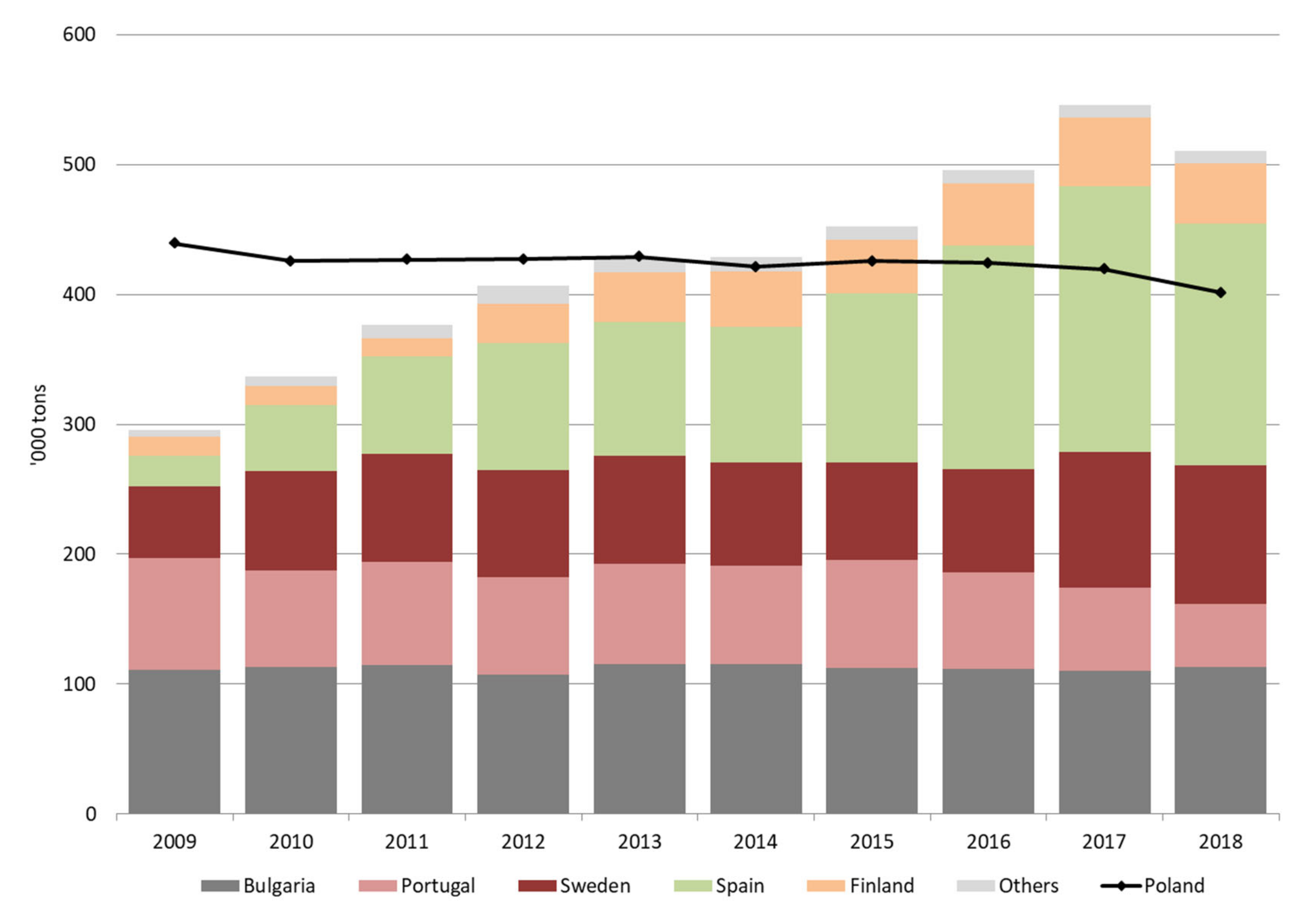

3.3.2. Copper and Silver

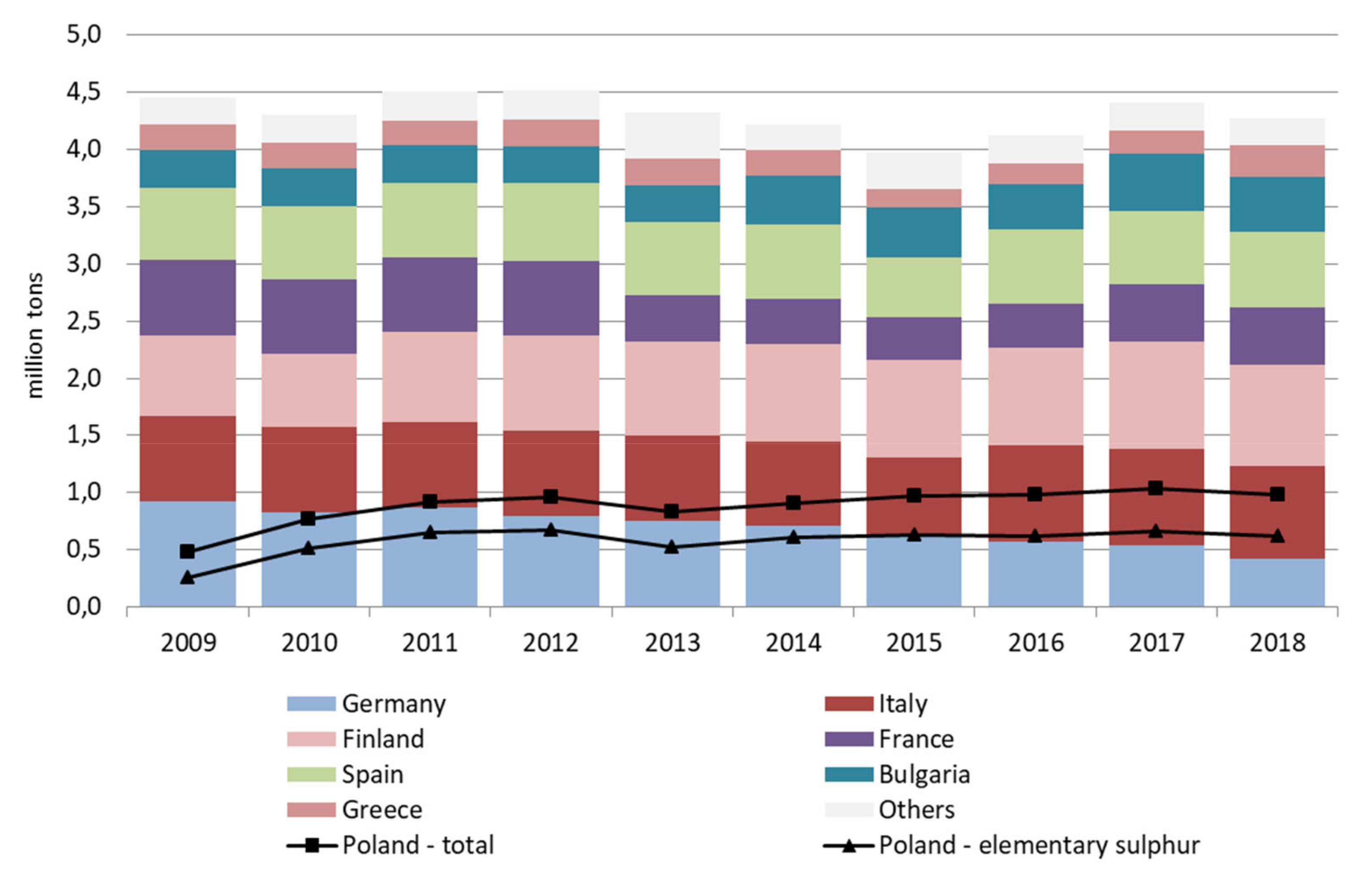

3.3.3. Sulfur

4. Discussion

5. Conclusions

- Fossil fuels: coking coal;

- Metallic raw materials: copper (including silver);

- Construction minerals (crushed and dimension stone);

- Other minerals for various industries (kaolin, feldspar raw materials, glass sand, magnesite, industrial dolomite, foundry sand, elemental sulfur, gypsum and anhydrite).

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- The 2030 Agenda for Sustainable Development. Report of the World Commission on Environment and Development: Our Common Future. Available online: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (accessed on 10 February 2021).

- Organization for Economic Cooperation and Development. Policies to Enhance Sustainable Development; Meating of the OECD Council at Ministerial Level; OECD Publishing: Paris, France, 2001; Available online: https://www.oecd.org/greengrowth/1869800.pdf (accessed on 10 February 2021).

- Mancini, L.; Vidal Legaz, B.; Vizzarri, M.; Wittmer, D.; Grassi, G.; Pennington, D. Mapping the Role of Raw Materials in Sustainable Development Goals. A Preliminary Analysis of Links, Monitoring Indicators and Related Policy Initiatives; Publications Office of the European Union: Luxembourg, 2019. [Google Scholar] [CrossRef]

- Ericsson, M.; Löf, O. Mining’s contribution to national economies between 1996 and 2016. Miner. Econ. 2019, 32, 223–250. [Google Scholar] [CrossRef]

- European Commission. Critical Raw Materials Resilience: Charting a Path towards Greater Security and Sustainability; Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM (2020) 474 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. A New Industrial Strategy for Europe; Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM (2020) 102 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- World Trade Organization. Trade and Development: Recent Trends and the Role of the WTO; World Trade Report; WTO: Geneva, Switzerland, 2014; Available online: https://www.wto.org/english/res_e/booksp_e/world_trade_report14_e.pdf (accessed on 10 February 2021).

- Nieć, M.; Galos, K.; Szamałek, K. Main challenges of mineral resources policy of Poland. Resour. Policy 2014, 42, 93–103. [Google Scholar] [CrossRef]

- Galos, K.; Tiess, G.; Kot-Niewiadomska, A.; Murguia, D.; Wertichova, B. Mineral Deposits of Public Importance (MDoPI) in relation to the Project of National Mineral Policy of Poland. Gospod. Surowcami Miner. Miner. Resour. Manag. 2018, 34, 5–24. [Google Scholar] [CrossRef]

- Lewicka, E.; Burkowicz, A. Ocena obecnego stanu pokrycia potrzeb surowcowych gospodarki krajowej (Assessment of the current state of coverage of the domestic economy’s demand for mineral raw materials). Przegląd Geol. 2018, 66, 144–152, (In Polish with English Abstract). [Google Scholar]

- Lewicka, E. Rational use of selected mining by-products in the ceramic industry in Poland. Gospod. Surowcami Miner. Miner. Resour. Manag. 2020, 36, 59–76. [Google Scholar] [CrossRef]

- Galos, K.; Lewicka, E.; Burkowicz, A.; Guzik, K.; Kot-Niewiadomska, A.; Kamyk, J.; Szlugaj, J. Approach to identification and classification of the key, strategic and critical minerals important for the mineral security of Poland. Resour. Policy 2021, 70, 101900. [Google Scholar] [CrossRef]

- European Commission. The Raw Materials Initiative: Meeting our Critical Needs for Growth and Jobs in Europe; Communication from the Commission to the European Parliament and the Council, COM (2008) 699 Final; European Commission: Brussels, Belgium, 2008. [Google Scholar]

- SIP 2013. Strategic Implementation Plan (SIP) of the European Innovation Partnership (EIP) on Raw Materials. Part II. Priority Areas, Action Areas and Actions. Final Version-18/09/2013. Available online: https://ec.europa.eu/growth/sectors/raw-materials/eip/strategic-implementation-plan_en (accessed on 30 April 2021).

- European Commission. EUROPE 2020. A Strategy for Smart, Sustainable and Inclusive Growth; Communication from the Commission, COM(2010) 2020 Final; European Commission: Brussels, Belgium, 2010. [Google Scholar]

- European Commission. Roadmap to a Resource Efficient Europe; Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, COM (2011) 571 Final; European Commission: Brussels, Belgium, 2011. [Google Scholar]

- European Commission. The European Green Deal; Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions, COM (2019) 640 Final; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- European Commission. Regulation of the European Parliament and of the Council of 18 June 2020 on the Establishment of a Framework to Facilitate Sustainable Investment, and Amending Regulation; (EU) 2019/2088. O.J.E.U. L 198/13; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Commission. Proposal for a Regulation of the European Parliament and of the Council Establishing a Recovery and Resilience Facility; COM(2020) 408 Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Tiess, G.; Majumder, T.; Cameron, P. (Eds.) Encyclopedia of Mineral and Energy Policy; Springer: Berlin/Heidelberg, Germany, 2016. [Google Scholar]

- Endl, A. Addressing “wicked problems” through governance for sustainable development—a comparative analysis of national mineral policy approaches in the European Union. Sustainability 2017, 9, 1830. [Google Scholar] [CrossRef]

- Lewicka, E.; Lewicka, E.; Guzik, K.; Galos, K. On the Possibilities of the Critical Raw Materials Production from the EU’s Primary Sources. Resources 2021. under review. [Google Scholar]

- European Commission. Improving Framework Conditions for Extracting Minerals for the EU. Report of the RMSG Ad-Hoc Working Group on Exchanging Best Practices on Land Use Planning, Permitting and Geological Knowledge Sharing; European Commission: Brussels, Belgium, 2010. [Google Scholar]

- Sivek, M.; Kavina, P.; Jirásek, J. New mineral policy of the Czech Republic of June 2017. Resour. Policy 2019, 60, 246–254. [Google Scholar] [CrossRef]

- Tiess, G.; Murguía, D. Report on Policy Reommendations and Stakeholder Feedback. SCRREEN Project, Deliverable 7.4. 2019. Available online: SCRREEN-D7.4-Report-on-policy-recommendations-and-stakeholder-feedback.pdf (accessed on 30 April 2021).

- Ruokonen, E. Preconditions for successful implementation of the Finnish standard for sustainable mining. Extr. Ind. Soc. 2020, 7, 611–620. [Google Scholar]

- Haikola, S.; Anshelm, J. Mineral policy at a crossroads? Critical reflections on the challenges with expanding Sweden’s mining sector. Extr. Ind. Soc. 2016, 3, 508–516. [Google Scholar] [CrossRef]

- Lesser, P.; Gugerell, K.; Poelzer, G.; Hitch, M.; Tost, M. European mining and the social licence to operate. Extr. Ind. Soc. 2020. [Google Scholar] [CrossRef]

- Vesalon, L.; Cretan, R. Cyanide kills! Environmental movements and the construction of environmental risk at Rosia Montana, Romania. Area 2013, 45, 443–451. [Google Scholar] [CrossRef]

- Guzik, K.; Galos, K.; Kot-Niewiadomska, A.; Eerola, T.; Eilu, P.; Carvalho, J.; Fernandez-Naranjo, F.J.; Arvidsson, R.; Arvanitidis, N. A look at the potential benefits and constraints of development of CRMs production in the EU—Analysis of selected case studies. Resources 2021. under review. [Google Scholar]

- Radwanek-Bąk, B.; Galos, K.; Nieć, M. Surowce kluczowe, strategiczne i krytyczne dla polskiej gospodarki (Key, strategic and critical raw materials for the Polish economy). Przegląd Geol. 2018, 66, 153–159, (In Polish with English Abstract). [Google Scholar]

- Erdmann, L.; Graedel, T.E. Criticality of non-fuel minerals: A review of major approaches and analyses. Environ. Sci. Technol. 2011, 45, 7620–7630. [Google Scholar] [CrossRef] [PubMed]

- Graedel, T.E.; Barr, R.; Chandler, C.; Chase, T.; Choi, J.; Christoffersen, L.; Friedlander, E.; Henly, C.; Jun, C.; Nassar, N. Methodology of metal criticality determination. Environ. Sci. Technol. 2012, 46, 1063–1070. [Google Scholar] [CrossRef] [PubMed]

- Hounari, Y.; Speirs, J.; Gross, R. Materials Availability: Comparison of Material Criticality Studies—Methodologies and Results Working Paper III; UK Energy Research Centre: London, UK, 2013; Available online: https://d2e1qxpsswcpgz.cloudfront.net/uploads/2020/03/materials-availability-working-paper-iii.pdf (accessed on 25 March 2021).

- Bedder, J.C.M. Classifying critical materials: A review of European approaches. Appl. Earth Sci. 2015, 124, 207–212. [Google Scholar] [CrossRef]

- Dewulf, J.; Blengini, G.A.; Pennington, D.; Nuss, P.; Nasaar, N.T. Criticality on the international scene: Quo vadis? Resour. Policy 2016, 50, 169–176. [Google Scholar] [CrossRef]

- Jin, Y.; Kim, J.; Guillaume, B. Review of critical materials studies. Resour. Conserv. Recycl. 2016, 113, 77–87. [Google Scholar] [CrossRef]

- Blengini, G.A.; Nuss, P.; Dewulf, J.; Nita, V.; Peiro, L.T.; Vidal-Legaz, B.; Latunussa, C.; Mancini, L.; Blagoeva, D.; Pennington, D.; et al. EU methodology for critical raw materials assessment: Policy needs and proposed solutions for incremental improvements. Resour. Policy 2017, 53, 12–19. [Google Scholar] [CrossRef]

- Graedel, T.; Harper, E.M.; Nassar, N.T.; Nuss, P.; Reck, B.K. Criticality of metals and metalloids. Proc. Natl. Acad. Sci. USA 2015, 112, 4257–4262. [Google Scholar] [CrossRef] [PubMed]

- Schrijvers, D.; Hool, A.; Blengini, G.A.; Chen, W.Q.; Dewulf, J.; Eggert, R.; Ellen, L.; Gauss, R.; Gossin, J.; Habib, K.; et al. A review of methods and data to determine raw material criticality. Resour. Conserv. Recycl. 2020, 155, 104617. [Google Scholar] [CrossRef]

- Yu, Y. Assessing the criticality of minerals used in emerging technologies in China. Gospod. Surowcami Miner. Miner. Resour. Manag. 2020, 36, 5–20. [Google Scholar] [CrossRef]

- Galos, K.; Smakowski, T. Wstępna propozycja metodyki identyfikacji surowców kluczowych dla polskiej gospodarki (The initial proposal of methodology for identification of raw materials key for Polish economy). Bull. Miner. Energy Econ. Res. Inst. Pol. Acad. Sci. 2014, 88, 59–79, (In Polish with English Abstract). [Google Scholar]

- Radwanek-Bąk, B. Zasoby kopalin w Polsce w aspekcie oceny surowców krytycznych dla Unii Europejskiej (Mineral resources in Poland in the view of the assessment of raw materials critical for the European Union). Gospod. Surowcami Miner. Miner. Resour. Manag. 2014, 27, 5–19, (In Polish with English Abstract). [Google Scholar]

- Radwanek-Bąk, B. Określenie surowców kluczowych dla polskiej gospodarki (Determining raw materials key for Polish economy). Bull. Miner. Energy Econ. Res. Inst. Pol. Acad. Sci. 2016, 96, 241–254, (In Polish with English Abstract). [Google Scholar]

- Kulczycka, J.; Pietrzyk-Sokulska, E.; Koneczna, R.; Galos, K.; Lewicka, E. Surowce Kluczowe dla Polskiej Gospodarki (Key Raw Materials for the Polish Economy), 1st ed.; Publishing House of MEERI PAS: Kraków, Poland, 2016; (In Polish with English Abstract). [Google Scholar]

- National Mineral Policy (Draft). Ministry of Environmental. Poland. 2019. Available online: http://psp.mos.gov.pl/images/pdf/PSP_projekt.pdf (accessed on 10 September 2020).

- Nieć, M. Stulecie idei ochrony złóż kopalin (Century of the idea of mineral deposits safeguarding). Gospod. Surowcami Miner. Miner. Resour. Manag. 2008, 24, 47–50, (In Polish with English Abstract). [Google Scholar]

- Paulo, A. Kierunki ochrony zasobów kopalin (Direction of mineral deposit safeguarding). In Geologiczne Aspekty Ochrony Środowiska Naturalnego (Geological Aspects of Environmental Protection), 1st ed.; Wydawnictwo AGH: Poland, Kraków, 1991. (In Polish) [Google Scholar]

- Ney, R. Ochrona złóż i zasobów kopalin (Safeguarding of mineral deposits and resources). In Przemiany Środowiska Naturalnego a Ekorozwój (Changes in the Natural Environment and Eco-Development), 1st ed.; Wydawnictwo GEOSFERA: Kraków, Poland, 2001. (In Polish) [Google Scholar]

- Nieć, M. Problemy Ochrony Złóż Kopalin (The problems of mineral deposits safeguarding). Przegląd Geol. 2003, 51, 870–875, (In Polish with English Abstract). [Google Scholar]

- Kasztelewicz, Z.; Ptak, M. Wybrane problemy zabezpieczania złóż węgla brunatnego w Polsce dla odkrywkowej działalności górniczej (Chosen problems of securing brown coal deposits in Poland for opencast mining activity). Polityka Energetyczna 2009, 12, 263–276, (In Polish with English Abstract). [Google Scholar]

- Nieć, M.; Radwanek-Bąk, B. Propozycja ustawowej ochrony niezagospodarowanych złóż kopalin (The proposition of statutory protection of undeveloped mineral deposits). Bezpieczeństwo Pr. Ochr. Sr. Górnictwie 2011, 7, 12–17. (In Polish) [Google Scholar]

- Szamałek, K. Ochrona niezagospodarowanych złóż kopalin (Safeguarding of undeveloped mineral deposits). Stud. Kom. Przestrz. Zagospod. Kraj. 2011, 141, 39–45, (In Polish with English Abstract). [Google Scholar]

- Gałaś, S.; Gałaś, A. Protection of mineral resources as a part of spatial planning in Poland and in Slovakia. Pol. J. Environ. Stud. 2012, 21, 73–77. [Google Scholar]

- Kasztelewicz, Z.; Ptak, M. Zabezpieczenie niezagospodarowanych złóż kopalin jako najważniejszy gwarant istnienia i rozwoju polskiego górnictwa odkrywkowego (Protection of non-developed mineral deposits as the most important guarantor of existence and development of the Polish surface mining). Przegląd Górniczy 2012, 8, 20–26, (In Polish with English Abstract). [Google Scholar]

- Nieć, M.; Radwanek-Bąk, B. Ochrona złóż kopalin jako element planowania i zagospodarowania przestrzennego—problem prawne i mentalne (Protection of mineral deposits as an element of planning and land development—formal and mental problems). Przegląd Górniczy 2012, 8, 3–6, (In Polish with English Abstract). [Google Scholar]

- Kostka, E.A. Ochrona złóż kopalin w planach zagospodarowania przestrzennego w świetle prawa geologicznego i górniczego—Uwagi de lege lata i de legi ferenda (Mineral deposits protection in area development plan, under the geological and mining law—Comments de lege lata and de lege ferenda). Gór. Odkryw. 2014, 56, 25–31, (In Polish with English Abstract). [Google Scholar]

- Lipiński, A. Niektóre problemy ochrony złóż kopalin w planowaniu przestrzennym (Selected problems of mineral deposits protection in spatial planning). Zesz. Nauk. IGSMiE PAN 2015, 91, 135–148, (In Polish with English Abstract). [Google Scholar]

- Wiland, M. Złoża kopalin i ich wydobywanie a planowanie i zagospodarowanie przestrzenne (Mineral deposits and their extraction with respect to planning and spatial development). Zesz. Nauk. IGSMiE PAN 2015, 91, 227–245, (In Polish with English Abstract). [Google Scholar]

- Gałaś, S.; Gałaś, A. Mineral deposits protection in terms of spatial conflicts with road construction projects. In Ecology, Economics, Education and Legislation. Vol. 3 Environmental Economics, Education and Accreditation in Geosciences. Book 5 Vol. 3, Proceedings of the 16th International Multidisciplinary Scientific Geoconference, Albena, Bulgaria, 30 June–6 July 2016; Stef92 Technology Ltd.: Sofia, Bulgaria, 2016. [Google Scholar]

- Gałaś, S. Assessment of implementation of protection of mineral deposits in spatial planning in Poland. Land Use Policy 2017, 67, 584–596. [Google Scholar] [CrossRef]

- Kasztelewicz, Z.; Ptak, M. Zabezpieczenie złóż kopalin a Polityka Surowcowa Państwa (The issue of resources protection in the context of the National Mineral Policy). Zesz. Nauk. IGSMiE PAN 2018, 106, 53–60, (In Polish with English Abstract). [Google Scholar]

- Stefanowicz, J. Polityka surowcowa—Ochrona obszarów prognostycznych i perspektywicznych złóż kopalin dla rozwoju kraju w świetle regulacji zintegrowanego zarządzania przestrzenią (Mineral policy—Protection of prognostic and perspective mineral deposits for national development in the light of integrated space management regulations). Zesz. Nauk. IGSMiE PAN 2018, 106, 163–180, (In Polish with English Abstract). [Google Scholar]

- Gałaś, S.; Kot-Niewiadomska, A.; Gałaś, A.; Kondela, J.; Wertichová, B. Instruments of Mineral Deposit Safeguarding in Poland, Slovakia and Czechia—Comparative Analysis. Resources 2021, 10, 16. [Google Scholar] [CrossRef]

- Biała Księga Ochrony Złóż Kopalin (White Book of Mineral Deposit Safeguarding). Ministerstwo Środowiska. Warszawa. 2015. Available online: https://infolupki.pgi.gov.pl/sites/default/files/czytelnia_pliki/1/biala_ksiega_zloz_kopalin.pdf (accessed on 20 January 2021).

- Better Policies for 2030. An OECD Action Plan on the Sustainable Development Goals. OECD. 2016. Available online: https://www.oecd.org/dac/Better%20Policies%20for%202030.pdf (accessed on 19 March 2021).

- Espey, J.; Lafortune, G.; Schmidt-Traub, G. Delivering the Sustainable Development Goals for all: Policy priorities for leaving no one behind. In Development Cooperation Report 2018. Joining Forces to Leave No One Behind; OECD Publishing: Paris, France, 2018; Available online: https://www.oecd-ilibrary.org/docserver/dcr-2018-9-en.pdf?expires=1616157384&id=id&accname=guest&checksum=0A95C3CD57CF93082C2A8D025490D251 (accessed on 20 January 2021).

- European Commission. Raw Materials Scoreboard 2018; European Innovation Partnership on Raw Materials; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Production-Imports-Exports. In Statistical Data for the Years 2000–2018; The Central Statistical Office: Warsaw, Poland, 2018.

- Szuflicki, M.; Malon, A.; Tymiński, M. The Balance of Mineral Resources Deposits in Poland, Editions 2011–2019; The Polish Geological Institute—National Research Institute: Warsaw, Poland, 2019; (In Polish with English Online Version). Available online: http://geoportal.pgi.gov.pl/surowce (accessed on 10 January 2021).

- PRODCOM Database. Available online: https://ec.europa.eu/eurostat/web/prodcom/data/database (accessed on 20 January 2021).

- World Mineral Production. Years 2010–2018. British Geological Survey: Nottingham, UK. Available online: https://www2.bgs.ac.uk/mineralsUK/statistics/worldStatistics.html (accessed on 20 January 2021).

- World Mining Data. Available online: https://www.world-mining-data.info/ (accessed on 20 January 2021).

- Pepłowska, M.; Gawlik, L. Gaz ziemny w zrównoważonym rozwoju krajowej gospodarki (Natural gas in the sustainable development of the domestic economy). Zesz. Nauk. IGSMiE PAN 2017, 98, 39–50, (In Polish with English Abstract). [Google Scholar]

- National Report of the President of The Energy Regulatory Office. Energy Regulator Office: Warszawa, Poland, 2019. Available online: https://www.ure.gov.pl/en/about-us/reports/67,Reports.html (accessed on 15 March 2021).

- Rybak, A.; Manowska, A. The future of crude oil and hard coal in the aspect of Poland’s energy security. Polityka Energetyczna-Energy Policy J. 2018, 21, 141–154. [Google Scholar] [CrossRef]

- Kamyk, J.; Kot-Niewiadomska, A.; Galos, K. The criticality of crude oil for energy security: A case of Poland. Energy 2021, 220. [Google Scholar] [CrossRef]

- Kamyk, J.; Kot-Niewiadomska, A. Obroty międzynarodowe ropą naftową w Polsce w latach 1990–2017 (International crude oil trade in Poland in 1990–2017). In Proceedings of the XXIII National Conference The Issues of Energy Resources and Energy in the National Economy, Kościelisko, Poland, 13–16 October 2019. (In Polish). [Google Scholar]

- European Commission. Study on the EU’s List of Critical Raw Materials (2020). Critical Raw Materials Factsheets; Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Metallurgical Coal. Resources and Energy Quarterly. 2019. Available online: https://publications.industry.gov.au/publications/resourcesandenergyquarterlymarch2019/documents/Resources-and-Energy-Quarterly-March-2019-Met-Coal.pdf (accessed on 3 April 2021).

- Galos, K.; Lewicka, E. Ocena znaczenia surowców mineralnych nieenergetycznych dla gospodarki krajowej (Assessment of importance of non-energy mineral raw materials for the domestic economy). Zesz. Nauk. IGSMiE PAN 2016, 92, 7–36. [Google Scholar]

- Mineral Yearbook of Poland 2013; Mineral and Energy Economy Research Institute Polish Academy of Science, Polis Geological Institute-National Research Institute: Warszawa, Poland, 2014. Available online: http://geoportal.pgi.gov.pl/css/surowce/images/2013/Minerals_Yearbook_of_Poland_2013.pdf (accessed on 10 February 2021).

- Szlugaj, J.; Naworyta, W. Analiza zmian podaży gipsu w Polsce w świetle rozwoju odsiarczania spalin w elektrowniach konwencjonalnych (Analysis of the changes in Polish gypsum resources in the context of flue gas desulfuruzation in conventional power plants). Gospod. Surowcami Miner. Miner. Resour. Manag. 2015, 31, 93–108. [Google Scholar] [CrossRef]

- Kamyk, J.; Kot-Niewiadomska, A. Ocena dostępności polskich złóż siarki rodzimej w kontekście zapotrzebowania na surowiec (Assessment of availability of Polish native sulfur deposits in the context of raw material demand). Gór. Odkryw. 2018, 3, 47–56, (In Polish with English Abstract). Available online: https://www.igo.wroc.pl/wp-content/uploads/2018/12/GO_03_2018_07_47_56.pdf (accessed on 15 February 2020).

- Galos, K.; Burkowicz, A.; Czerw, H.; Figarska-Warchoł, B.; Gałaś, A.; Guzik, K.; Kamyk, J.; Kot-Niewiadomska, A.; Lewicka, E.; Szlugaj, J. Ocena Obecnego Oraz Przyszłego Zapotrzebowania Gospodarki Krajowej na Surowce w Perspektywie 2025, 2030, 2040 i 2050 Roku (Assessment of the Current and Future Demand of the National Economy for Raw Materials in the Perspective of 2025, 2030, 2040 and 2050); Mineral and Energy Economy Research Institute PAS: Kraków, Poland, 2020; Unpublished. [Google Scholar]

- Energy Policy of Poland until 2040. Ministry of Climate and Environment. Poland. 2021. Available online: https://www.gov.pl/web/klimat/polityka-energetyczna-polski (accessed on 10 March 2021).

- EUROCOAL. Country Profiles—Poland. Available online: https://euracoal.eu/info/country-profiles/poland/ (accessed on 10 February 2021).

- Błachowicz, K. Życie po życiu akumulator (Life after life of battery). Recykling 2017, 1, 48–55. (In Polish) [Google Scholar]

- Izba Gospodarcza Metali Nieżelaznych i Recyklingu (Economic Chamber of Non-Ferrous Metals and Recycling). Available online: http://www.igmnir.pl/zlom-odpady-metali-niezelaznych/olowiu (accessed on 10 March 2021).

- Szamałek, K. Rational mineral deposit management in the light of mineral resources theory. Gospod. Surowcami Miner. Miner. Resour. Manag. 2011, 27, 5–15. [Google Scholar]

- Piwocki, M.; Kasiński, J. Metoda ekonomiczno-sozologicznej waloryzacji złóż węgla brunatnego. Przegląd Geol. 1993, 35, 346–359. [Google Scholar]

- Bromowicz, J.; Figarska-Warchoł, B.; Karwacki, A.; Kolasa, A.; Magiera, J.; Rembiś, M.; Smoleńska, A.; Stańczyk, G. Waloryzacja Polskich Złóż Kamieni Budowlanych i Drogowych na tle Przepisów Unii Europejskiej (Valorization of Polish Deposits of Crushed and Dimension Stones in Comparison with European Union Regulations), 1st ed.; Uczelniane Wydawnictwo Naukowo-Dydaktyczne AGH: Kraków, Poland, 2005. (In Polish) [Google Scholar]

- Nieć, M. Waloryzacja złóż i obszarów perspektywicznych. In Programowanie Eksploatacji i Zagospodarowania Terenów Pogórniczych Złóż Kruszywa Naturalnego w Dolinach Rzek Karpackich na Przykładzie Karpat Zachodnich (PO ANG), 1st ed.; Stryszewski, M., Ed.; Uczelniane Wydawnictwo Naukowo-Dydaktyczne AGH: Kraków, Poland, 2006. (In Polish) [Google Scholar]

- Kasiński, J.R.; Piwocki, A.H.; Mazurek, S. Waloryzacja i ranking złóż węgla brunatnego w Polsce (Valorization and ranking list of lignite deposits in Poland). Prace Państwowego Inst. Geol. 2006, 187, 1–79. [Google Scholar]

- Nieć, M.; Ślizowski, K.; Kawulak, M.; Lankof, L.; Salamon, E. Kryteria Ochrony Złóż Pozostawionych Przez Likwidowane Kopalnie w Warunkach Zrównoważonego Rozwoju na Przykładzie Modelowym Złóż Siarki Rodzimej (PO ANG), 1st ed.; Publishing House of MEERI PAS: Kraków, Poland, 2007. (In Polish) [Google Scholar]

- Sermet, E.; Górecki, J. Ocena geologiczno-górniczej atrakcyjności złóż kamieni łamanych i blocznych (Assessment of geological and mining attractiveness of crushed and dimension stones). Kruszywa 2007, 5, 8–12. (In Polish). Available online: https://www.kieruneksurowce.pl/Resources/art/827/bmp_4790ad438f5ff.pdf (accessed on 3 March 2021).

- Jureczka, J.; Galos, K. Propozycja kryteriów waloryzacji złóż oraz obszarów prognostycznych i perspektywicznych złóż węgla kamiennego pod kątem ich ochrony (Proposals of criteria for valorization of deposits and prognostic/perspective areas of hard coal for their protection). Zesz. Nauk. IGSMiE PAN 2010, 79, 289–297. [Google Scholar]

- Uliasz-Misiak, B.; Winid, B. Criteria for the Valorization of Hydrocarbon Deposits in Terms of Their Protection. Rocz. Ochr. Srodowiska 2013, 15, 2204–2217. [Google Scholar]

- Radwanek-Bąk, B.; Nieć, M. Valorization of undeveloped industrial rock deposits in Poland. Resour. Policy 2014, 45, 290–298. [Google Scholar] [CrossRef]

- Wołkowicz, S.; Olimpia, K.; Andrzejewska-Kubrak, K.; Brzeziński, D. Ochrona złóż kopalin—Koncepcja waloryzacji i selekcji złóż o znaczeniu publicznym (Safeguarding of mineral raw materials deposits—A concept of valorization and selection of mineral deposits of public importance). Biul. PIG 2018, 472, 171–184. [Google Scholar] [CrossRef]

- Kot-Niewiadomska, A.; Galos, K.; Lewicka, E.; Burkowicz, A.; Kamyk, J.; Szlugaj, J. Methodology of assignment of Mineral Deposits of Public Importance proposed by MINATURA2020 Project and results of its pilot testing in the Dolnośląskie Province (SW Poland). Gospod. Surowcami Miner. Miner. Resour. Manag. 2017, 33, 71–94. [Google Scholar] [CrossRef]

- The Act of 27 March 2003 on Spatial Planning and Development (Journal of Laws 2003 No 80, Item 717) as Amended (Poland). Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20030800717/U/D20030717Lj.pdf (accessed on 10 January 2021).

- The Act of 9 June 2011 Geological and Mining Law (Journal of Laws of 2011, No. 163, item 981) as Amended. Available online: https://isap.sejm.gov.pl/isap.nsf/download.xsp/WDU20111630981/U/D20110981Lj.pdf (accessed on 10 March 2021).

- Nieć, M.; Radwanek-Bąk, B. Ochrona i Racjonalne Wykorzystywanie Złóż Kopalin (Protection and Rational Use of Mineral Deposits), 1st ed.; Publishing House of MEERI PAS: Kraków, Poland, 2014. (In Polish) [Google Scholar]

- Nieć, E.; Salamon, E.; Auguścik, J. Zmiany i zużycie zasobów złóż rud cynku i ołowiu w Polsce (Variation and utilization of zinc-lead ore resources in Poland). Zesz. Nauk. IGSMiE PAN 2018, 102, 129–152. Available online: https://journals.pan.pl/dlibra/publication/123733/edition/107940/content (accessed on 10 March 2021).

- Mikulski, S.Z. Występowanie i zasoby perspektywiczne rud niklu w Polsce (The occurrence and prospective resources of nickel ores in Poland). Biul. PIG 2012, 448, 287–296. Available online: https://geojournals.pgi.gov.pl/bp/article/view/29461/21117 (accessed on 10 March 2021).

- Nieć, M. Ocena geologiczno-gospodarcza złóż wanadonośnych rud tytanomagnetytowych masywu suwalskiego (Geo-economic evaluation of vanadiferous titanomagnetite deposits in Suwałki massif in Poland). Gospod. surowcami Miner. Miner. Resour. Manag. 2003, 19, 5–28. Available online: https://gsm.min-pan.krakow.pl/Geo-economic-evaluation-of-vanadiferous-titanomagnetite-deposits-in-Suwalki-massif,96372,0,2.html (accessed on 15 March 2021).

- Wiszniewska, J.; Petecki, Z. Mezoproterozoiczne złoże rud tytanomagnetytowych w suwalskim masywie anortozytowym i jego środowisko geologiczne (A Mesoproterozoic titanomagnetite ore deposit in Suwalki Anorthosite Massif and its geological environment). Górnictwo Odkryw. 2014, 2–3, 44–50. Available online: https://www.igo.wroc.pl/wp-content/uploads/2015/09/GO_2-3_7.pdf (accessed on 15 March 2021).

- Siemiątkowski, J. The ilmenite-magnetite ore deposit Krzemianka in northeastern Poland: Brief history of discovery and exploration. Geol. Q. 1998, 42, 443–450. [Google Scholar]

- Świerubska, T. Historia powoływania pierwszego parku krajobrazowego w Polsce a projekt wydobycia rud tytanomagnetytowych masywu suwalskiego (History of the first landscape park established in Poland in regards to a project of titano-magnetite ores in Suwalki Massif). Górnictwo Odkryw. 2014, 2–3, 40–43. Available online: https://www.igo.wroc.pl/wp-content/uploads/2015/09/GO_2-3_6.pdf (accessed on 15 March 2021).

- Nieć, M. (Ed.) Waloryzacja Niezagospodarowanych Złóż Kopalin Skalnych w Polsce (Valorisation of Undeveloped Rock Mineral Deposits in Poland), 1st ed.; Poltegor Institute: Wrocław, Poland, 2013. (In Polish) [Google Scholar]

- MINATURA Project. Available online: https://minatura2020.eu/ (accessed on 10 January 2021).

- Galos, K.; Nieć, M. Europejska koncepcja złóż kopalin o znaczeniu publicznym (projekt MINATURA2020 (European concept of mineral deposits of public importance (MINATURA2020 project). Zesz. Nauk. IGSMiE 2015, 91, 35–43. Available online: https://min-pan.krakow.pl/wp-content/uploads/sites/4/2017/12/03-galos-niec.pdf (accessed on 10 March 2021).

- Manowska, A.; Osadnik, K.; Wyganowska, M. Economic and social aspects of restructuring Polish coal mining: Focusing on Poland and the EU 2017. Resour. Policy 2017, 52, 192–200. [Google Scholar] [CrossRef]

- Climate and Energy Policies in Poland; European Parliament: Brussels, Belgium, 2017. Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2017/607335/IPOL_BRI(2017)607335_EN.pdf (accessed on 10 March 2021).

- Alves Dias, P.; Kanellopoulos, K.; Medarac, H.; Kapetaki, Z.; Miranda Barbosa, E.; Shortall, R.; Czako, V.; Telsnig, T.; Vazquez Hernandez, C.; Lacal Arantegui, R.; et al. EU Coal Regions: Opportunities and Challenges Ahead; Publications Office of the European Union: Luxembourg, 2018. [Google Scholar]

- Brauers, H.; Oei, P.-U. The political economy of coal in Poland: Drivers and barriers for a shift away from fossil fuels. Energy Policy 2020, 140. [Google Scholar] [CrossRef]

- EUROCOAL. Country Profiles—Germany. Available online: https://euracoal.eu/info/country-profiles/germany/ (accessed on 10 February 2021).

- Coal Production and Consumption Statistics. Eurostat. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php/Coal_production_and_consumption_statistics#Consumption_and_production_of_hard_coal (accessed on 20 January 2021).

- Jastrzębska Spółka Węglowa, S.A. Consolidated Annual Report for 2018. Available online: https://www.jsw.pl/raportroczny-2018/en/download-center/ (accessed on 9 March 2021).

- Wardell Armstrong International; Jastrzębska Spółka Węglowa SA. Mineral Expert’s Report. 2013. Available online: https://www.jsw.pl/fileadmin/user_files_ri/raporty_ds_zloz/Mineral_Experts_Report__2013.pdf (accessed on 12 March 2021).

- Strategia JSW, SA. z Uwzględnieniem Spółek Zależnych Grupy Kapitałowej JSW na Lata 2020–2030. Jastrzębska Spółka Węglowa. Jastrzębie Zdrówj. 2020. Available online: https://www.jsw.pl/fileadmin/user_files_ri/strategia/2020/prezentacja_-_strategia_gk_jsw_2020-2030_final_2020_03_19.pdf (accessed on 9 March 2021).

- Oszczepalski, S.; Speczik, S.; Zieliński, K.; Chmielewski, A. The Kupferschiefer Deposits and Prospects in SW Poland: Past, Present and Future. Minerals 2019, 9, 592. [Google Scholar] [CrossRef]

- Kombinat Górniczo-Hutniczy Miedzi SA. Consolidated Annual Report for 2018. Available online: https://kghm.com/en/investors/results-center/financial-reports (accessed on 20 January 2021).

- CRU Group. Available online: https://www.crugroup.com/ (accessed on 5 January 2021).

- European Commission. Study on the EU’s list of the Critical Raw Materials 2020. Non-Critical Raw Materials Factsheet; Final; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- Galos, K.; Burkowicz, A.; Czerw, H.; Figarska-Warchoł, B.; Gałaś, A.; Guzik, K.; Kamyk, J.; Kot-Niewiadomska, A.; Lewicka, E.; Szlugaj, J. Określenie Przepływów Handlowych Surowców Kluczowych i Strategicznych dla Polskiej Gospodarki (Determining the Trade Flows of Key and Strategic Raw Materials for the Polish Economy); Mineral and Energy Economy Research Institute PAS: Poland, Kraków, 2020; Unpublished. [Google Scholar]

- Zieliński, K.; Speczik, S. Deep copper and silver deposits—A chance for Polish metal mining industry. Biul. Państw. Inst. Geol. 2017, 468, 153–164. [Google Scholar] [CrossRef]

- Projekty Rozwojowe—Głogów Głęboki. KGHM S.A. Available online: https://kghm.com/pl/biznes/projekty-rozwojowe/glogow-gleboki (accessed on 10 March 2021).

- Zieliński, K.; Speczik, S.; Bieńko, T.; Pietrzela, A. Land management recommendations for protecting potential copper and silver mining areas in Lubuskie Province, western Poland. Gospod. Surowcami Miner. Miner. Resour. Manag. 2021, 37, 99–116. [Google Scholar] [CrossRef]

- Geological Concessions. Information Bulletin of the Ministry of Climate and Environment. Available online: https://bip.mos.gov.pl/koncesje-geologiczne/mapy-koncesji-na-poszukiwanie-rozpoznawanie-i-wydobywanie-kopalin-ze-zloz-pliki-jpeg-i-shapefile/rok-2021/szczegoly/news/luty-2021/ (accessed on 5 March 2021).

- Metal Ore Mining in Europe. AT Mineral Processing. 2018. Available online: https://www.at-minerals.com/en/artikel/at_Metal_ore_mining_in_Europe_3257608.html (accessed on 10 March 2021).

- Ober, J.A. Materials Flow of Sulfur; Open File Report; U.S. Geological Survey: Reston, VA, USA, 2012. Available online: https://pubs.usgs.gov/of/2002/of02-298/of02-298.pdf (accessed on 8 March 2021).

- Sermet, E.; Nieć, M. Not Mining Sterilization of Explored Mineral Resources. The Example of Native Sulfur Deposits in Poland Case History. Resources 2021, 10, 30. [Google Scholar] [CrossRef]

- European Mineral Statistics 2010–2014. British Geological Survey. 2016. Available online: https://www2.bgs.ac.uk/mineralsuk/download/ems/EMS20102014.pdf (accessed on 10 January 2021).

- Raw Materials Information System (RMIS). Sulphur. Available online: https://rmis.jrc.ec.europa.eu/uploads/rmprofiles/Sulphur.pdf (accessed on 1 March 2021).

- Statistical Yearbook of the Republic of Poland 2018; Statistics Poland: Warszawa, Poland, 2018. Available online: https://stat.gov.pl/en/topics/statistical-yearbooks/statistical-yearbooks/statistical-yearbook-of-the-republic-of-poland-2018,2,19.html (accessed on 1 April 2021).

- Statistical Yearbook of Industry—Poland 2020; Statistics Poland: Warszawa, Poland, 2020. Available online: https://stat.gov.pl/en/topics/statistical-yearbooks/statistical-yearbooks/statistical-yearbook-of-industry-poland-2020,5,14.html (accessed on 1 April 2021).

- Structural Business Statistics—Overview. Eurostat. Available online: https://ec.europa.eu/eurostat/web/structural-business-statistics (accessed on 1 April 2021).

- Górnicza Izba Przemysłowo-Handlowa (Mining Chamber of Industry and Commerce). Available online: http://www.giph.com.pl/ (accessed on 1 April 2021).

- Role of Mining in National Economies. Mining Contribution Index (MCI), 5th ed.; International Council on Mining & Metals (ICMM): London, UK, 2020; Available online: https://www.icmm.com/website/publications/pdfs/social-performance/2020/research_mci-5.pdf (accessed on 1 April 2021).

- Raw Material Policy of the Czech Republic in the Field of Mineral Resources and their Resources, Ministry of Industry and Trade. Czech Republic. 2017. Available online: https://www.mpo.cz/en/construction-and-raw-materials/raw-material-policy/rawmaterial-policy-minerals-in-the-cr/new-raw-material-policy-for-minerals-and-their-resources---mpo-2017--233052/ (accessed on 10 September 2020).

- Przemysł Chemiczny w Polsce—Pozycja, Wyzwania, Perspektywy (Chemical Industry in Poland—Position, Challenges and Perspectives). Polska Izba Przemysłu Chemicznego. 2017. Available online: http://www.pipc.org.pl/files/794915256/file/Raport_Final.pdf (accessed on 1 April 2021).

- Jelonek, I.; Jelonek, Z. Wpływ parametrów petrograficznych węgli kamiennych na jakość koksu metalurgicznego (The influence of petrographic properties of bituminous coal on the quality of metallurgical coke). Zesz. Nauk. IGSMiE PAN 2017, 100, 49–66. [Google Scholar]

- The Observatory of Economic Complexity (OEC). Coke—Exporters and Importers. Available online: https://oec.world/en/profile/hs92/coke (accessed on 2 April 2021).

- Gospodarka Morska. 2019. Available online: https://www.gospodarkamorska.pl/porty-transport-zobacz-zaladunek-koksu-w-pge-w-gdansku-trafi-do-usa-39525. (accessed on 2 April 2021).

- Galos, K.; Szlugaj, J.; Lewicka, E.; Burkowicz, A.; Guzik, K.; Kamyk, J.; Kot-Niewiadomska, A. Wstępna Ocena Ekonomiczna Możliwości Udostępniania i Eksploatacji Zasobów Przemysłowych Wyznaczonych w Poszczególnych Obszarach Perspektywicznych i Prognostyczne Węgla kamiennego; Mineral and Energy Economy Research Institute PAS: Poland, Kraków, 2019. Unpublished. (In Polish) [Google Scholar]

- Mertas, B.; Ściążko, M. Zmienność właściwości węgli koksowych w zależności od ich uziarnienia (Coking coal properties changes depending on grain size fraction). Zesz. Nauk. IGSMiE PAN 2019, 108, 111–126. [Google Scholar] [CrossRef]

- Schipperac, W.B.; Lin, H.-C.; Meloni, M.A.; Wansleeben, K.; Heijungs, R.; Voet, E. Estimating global copper demand until 2100 with regression and stock dynamics. Resour. Conserv. Recycl. 2018, 132, 28–36. [Google Scholar] [CrossRef]

- Top 3 Copper Trends to Watch in 2019. Copper Aliance. Available online: https://sustainablecopper.org/top-3-copper-trends-to-watch-in-2019/ (accessed on 2 April 2021).

- The International Copper Study Group. Available online: https://www.icsg.org/ (accessed on 5 January 2021).

- Oszczepalski, S.; Speczik, S.; Małecka, K.; Chmielewski, A. Prospective copper resources in Poland. Gospod. Surowcami Miner. Miner. Resour. Manag. 2016, 32, 5–30. [Google Scholar] [CrossRef][Green Version]

- Pozytywny Wpływ Gospodarki Obiegu Zamkniętego na Środowisko Naturalne. Serwis Gazeta Prawna. Available online: https://serwisy.gazetaprawna.pl/forumbiznesu/artykuly/1445625,pozytywny-wplyw-gospodarki-obiegu-zamknietego-na-srodowisko-naturalne.html (accessed on 2 April 2021).

- Badera, J. Geneza konfliktów społeczno-środowiskowych związanych z górnictwem (Origin of socio-environmental conglicts connected to mining activity). Górnictwo Odkryw. 2018, 3, 28–30. [Google Scholar]

- Polish Press Agency. Poland is Europea’s Third-Largest Ceramic Tile Producer. 2016. Available online: https://www.pap.pl/en/news/news,622947,poland-is-europes-third-largest-ceramic-tile-producer.html (accessed on 2 April 2021).

- Rynek Płytek Ceramicznych 2019. Monitoring Branżowy. Analizy Sektorowe. PKO Bank Polski. 2019. Available online: https://www.pkobp.pl/media_files/2f69d180-db0f-4c03-87c7-9111714f48d3.pdf (accessed on 2 April 2021).

- Paving the Way to 2050. The Ceramic Industry Roadmap. The European Ceramic Industry Association. 2017. Available online: https://www.ceramtec.com/files/cu_ceramic_industry_roadmap_en.pdf (accessed on 2 April 2021).

- Przemysł Chemiczny w Polsce. Raport Polskiej Izby Przemysłu Chemicznego. (Chemical Industry in Poland. Report of The Polish Chamber of Chemical Industry). Available online: https://www.pipc.org.pl/files/Publikacje/Raportyroczne/666095045/lib/raport_ekonomiczny_2018.pdf (accessed on 2 April 2021).

- Zalewski, A.; Piwowar, A. Światowy Rynek Nawozów Mineralnych z Uwzględnieniem Zmian Cen i Nośników Energii (The Global Market of Mineral Fertilizers, Taking into Account Changes in the Prices of Raw Materials and Direct Energy Carriers), 1st ed.; Instytut Ekonomiki Rolnictwa i Gospodarki Żywnościowej—Państwowy Instytut Badawczy: Warszawa, Poland, 2018. [Google Scholar]

- Integrated Report of Grupa Azoty. 2018. Available online: https://raport2018.grupaazoty.com/ (accessed on 2 April 2021).

- Sole Potasowo-Magnezowe. (Potassium-Magnesium Salts); Państwowy Instytut Geologiczny—Państwowy Instytut Badawczy: Warszawa, Poland, 2019.

- Glass Alliance Europe. Statistical Report 2018–2019. Available online: https://www.wko.at/branchen/industrie/glasindustrie/statistical-report-glass-alliance-europe-2018-2019.pdf (accessed on 3 April 2019).

- Glass Industry. Polish Glass Manufactures Federation. Available online: http://www.polish-glass.pl/?menubok=oszkle&page=oszkle_przemysl (accessed on 3 April 2021).

- Burkowicz, A.; Galos, K.; Guzik, K. The Resource Base of Silica Glass Sand versus Glass Industry Development: The Case of Poland. Resources 2021, 9, 134. [Google Scholar] [CrossRef]

- Guzik, K.; Galos, K. Wystarczalność zasobów kamieni łamanych i blocznych (Sufficiency of resources of crushed and dimension stone resources in Poland). Krus. Miner. 2020, 4, 55–68. [Google Scholar]

- Górniak-Zimroz, J.; Pactwa, K. Identification of Social and Environmental Conflicts Resulting from Open-Cast Mining. IOP Conf. Ser. Earth Environ. Sci. 2020, 44, 1–7. [Google Scholar] [CrossRef]

- Ptak, M.; Belzyt, J.I.; Badera, J. Rozwiązywanie Konfliktów W Górnictwie. Polskie i Saksońskie Doświadczenia w Ramach Projektu Życie z Górnictwem (MineLife). 2020. Available online: https://www.oba.sachsen.de/download/2020-03-13_OBA_MineLife_Konfliktleitfaden_PL.pdf (accessed on 10 March 2021).

- Kaźmierczak, U.; Górniak-Zimróz, J. Accessibility of Selected Key Non-Metallic Mineral Deposits in the Environmental and Social Context in Poland. Resources 2021, 10, 6. [Google Scholar] [CrossRef]

| Threshold of the Average Annual Value of Mineral Consumption | General Tendency of Mineral Consumption | Nature of Mineral Expressed As Its Net Imports Reliance (NIR) * | Tendency of Mineral Primary Production (Mining Output) | Sufficiency of Mineral Reserves |

|---|---|---|---|---|

| Over 40 million PLN/y | Stable Decreasing Increasing Strongly increasing Variable ** | Domestic mineral—NIR<10% Mainly domestic mineral—NIR 10–50% Scarce mineral—NIR >50% | Stable Decreasing Increasing Strongly increasing | Short (<15 years) Medium (15–30 years) Long (>30 years) |

| Tendency of Consumption/Nature of Mineral | Decreasing Consumption | Stable Consumption | Increasing Consumption | Strongly Increasing Consumption | Variable Consumption | TOTAL |

|---|---|---|---|---|---|---|

| Domestic mineral | Lignite | Elemental sulfur; foundry sand | Copper; industrial dolomite; gypsum and anhydrite; glass sand | Lead; zinc; raw magnesite | Silver; crushed aggregates; sand and gravel aggregates | 13 (9) |

| Mainly domestic mineral | Steam coal | Coking coal; Kaolin | Dimension stone; feldspars and related minerals | - | Gold; salt | 7 (4) |

| Scarce mineral | - | Titanium ores and concentrates | Crude oil; bauxite and alumina; silicon metal; magnesium; manganese minerals; nickel; ferroalloys; phosphorus; corundum (synthetic and natural); potash salts; calcined, dead-burned and fused magnesite; talc and steatite | Natural gas; aluminium;ball clays and refractory clays | Tin; platinum group metals; tungsten; iron ores and concentrates; amber; phosphate rock | 22 (6) |

| TOTAL number of key minerals | 2 | 5 (5) | 18 (9) | 6 (5) | 11 | 42 (19) |

| No. | Mineral | Average Value of Domestic Consumption 2009–2018 (Million PLN) | Consumption Tendency | Net Imports Reliance 2009–2018 (%) | Nature of Mineral | Recognized Resource Base | Production from Primary Sources (Mineral Deposits) | Production from Secondary Sources |

|---|---|---|---|---|---|---|---|---|

| Fuels | ||||||||

| 1 | Coking coal | 6393.9 | Stable | 21.1 | Mainly domestic | Y | Y | - |

| 2 | Crude oil | 44,916.8 | Increasing | 97.4 | Scarce | Y | Y | - |

| 3 | Lignite | 1351.4 | Decreasing | 0.4 | Domestic | Y | Y | - |

| 4 | Natural gas | >13,000 | Strongly increasing | 85.9 | Scarce | Y | Y | - |

| 5 | Steam coal | 16,486.3 | Decreasing | 14.5 | Mainly domestic | Y | Y | - |

| Metallic minerals | ||||||||

| 1 | Aluminium (non-alloyed) | 955.7 | Strongly increasing | 100 | Scarce | N | N | Y |

| 2 | Bauxite and alumina | 175.4 | Increasing | 100 | Scarce | N | N | N |

| 3 | Copper | 6,326.3 | Increasing | 4.3 | Domestic | Y | Y | Y |

| 4 | Ferroalloys | 274.1 | Increasing | 100 | Scarce | N | N | N |

| 5 | Gold | >100 | Variable | <30 | Mainly domestic | Y 1 | Y | Y |

| 6 | Iron ores and concentrates | 1746.6 | Variable | 100 | Scarce | Y 2 | N | Y |

| 7 | Lead | 542.1 | Strongly increasing | <10 | Domestic | Y | Y | Y |

| 8 | Magnesium | 61.6 | Increasing | 100 | Scarce | N | N | N |

| 9 | Manganese minerals | 46.7 | Increasing | 100 | Scarce | N | N | N |

| 10 | Nickel | 100.1 | Increasing | 100 | Scarce | Y | N | Y |

| 11 | Platinium group metals | 130.9 | Variable | >90 | Scarce | Y 1 | Y | Y |

| 12 | Silicon metal | 203.3 | Increasing | 100 | Scarce | Y 3 | N | N |

| 13 | Silver | >60 | Variable | <10 | Domestic | Y | Y | Y |

| 14 | Tin | 52.6 | Variable | 83.5 | Scarce | Y | N | Y |

| 15 | Titanium ores and concentrates | 86.6 | Stable | 100 | Scarce | Y2 | N | N |

| 16 | Tungsten | 41.7 | Variable | 100 | Scarce | Y | N | N |

| 17 | Zinc | 876.5 | Strongly increasing | <10 | Domestic | Y | Y | Y |

| Industrial minerals | ||||||||

| 1 | Amber | >40 | Variable | >85 | Scarce | Y | Y | - |

| 2 | Ball clays and refractory clays | 138.1 | Increasing | 70.9 | Scarce | Y | Y | - |

| 3 | Corundum (synthetic and natural) | 133.9 | Increasing | 98.7 | Scarce | N | N | - |

| 4 | Crushed aggregates | 1838.1 | Variable | 4.3 | Domestic | Y | Y | Y 4 |

| 5 | Dimension stone | 572.6 | Increasing | 12.4 | Mainly domestic | Y | Y | - |

| 6 | Dolomite industrial | 145.9 | Increasing | 5.4 | Domestic | Y | Y | - |

| 7 | Feldspars and related minerals | 383.8 | Increasing | 42.7 | Mainly domestic | Y | Y | - |

| 8 | Foundry sand | 64.6 | Stable | 0 | Domestic | Y | Y | - |

| 9 | Glass sand | 69.8 | Increasing | 0.9 | Domestic | Y | Y | - |

| 10 | Gypsum and anhydrite | 49.6 | Increasing | 1.7 | Domestic | Y | Y | Y 5 |

| 11 | Kaolin | 72.3 | Stable | 44.2 | Mainly domestic | Y | Y | - |

| 12 | Magnesite, raw | <10 | Strongly increasing | 4.0 | Domestic | Y | Y | - |

| 13 | Magnesite, calcined, dead-burned and fused | >200 | Increasing | 100 | Scarce | N | N | - |

| 14 | Phosphorus | 136.1 | Increasing | 100 | Scarce | N | N | - |

| 15 | Phosphate rock | 434.4 | Variable | 100 | Scarce | N | N | - |

| 16 | Potash salts | 938.2 | Increasing | 96.0 | Scarce | Y | Y | - |

| 17 | Salt (rock salt and brine) | 295.7 | Variable | 17.6 | Mainly domestic | Y | Y | - |

| 18 | Sand and gravel aggregates | 1596.8 | Variable | 1.0 | Domestic | Y | Y | - |

| 19 | Sulfur, elemental | 222.5 | Stable | 5.3 | Domestic | Y 6 | Y | - |

| 20 | Talc and steatite | 42.8 | Increasing | 100 | Scarce | N | N | - |

| No. | Mineral | Level of Consumption 2009–2018 | Trend 2009–2018 | Expected Future Trend until 2040 | Main Users |

|---|---|---|---|---|---|

| Fuels | |||||

| 1 | Coking coal | 9.9–13.5 Mtpy | Stable consumption | Stable consumption (after 2040 possible decline) | Production of coke for steelworks and for households |

| 2 | Crude oil | 20.6–27.8 Mtpy | Increase >5%/y | Some increase 2–3%/y until 2030, then stable or decrease | Oil products, petrochemical products |

| 3 | Natural gas | 12.8–17.2 billion m3py | Increase >5%/y | Further increase 3–5%/y (after 2040 stable or decrease) | Nitrogen fertilizers, electricity and heat generation, glassworks, cement plants, households heating |

| Metallic minerals | |||||

| 4 | Copper | 203–296 ktpy | Increase ca. 2%/y | Increase up to 4–5%/y | Copper wires, sheets, strips, pipes, rods, Cu alloys |

| 5 | Lead | 75–193 ktpy | Increase >10%/y | Increase 5–8%/y | Acid-lead batteries, Pb oxide |

| 6 | Nickel | 0.7–3.6 ktpy | Very variable, increasing in general | Some further increase | Stainless steel, Ni alloys |

| 7 | Titanium ores and concentrates | 81–105 ktpy | Stable, slightly variable | Stable, slightly variable | Titanium white |

| 8 | Zinc | 47–145 ktpy | Increase >5%/y, but variable | Increase >5%/y | Steel galvanization, Zn alloys, Zn compounds |

| Industrial minerals | |||||

| 9 | Ball clays and refractory clays | 367–693 ktpy | Increase >8%/y | Increase 2–4%/y | Ceramic tiles, refractories, ceramic sanitaryware |

| 10 | Dimension stone | 1549–2772 ktpy | Very variable, increasing in general | Some further increase | Dimension stone for buildings and tombstones, road stone |

| 11 | Dolomite, industrial | 1824–3373 ktpy | Very variable, increasing in general | Some further increase | Glass, ceramics, refractories, steelworks, fillers, fertilizers |

| 12 | Feldspars and related minerals2 | 745–1,095 ktpy | Increase 4–5%/y | Increase 2–3%/y | Ceramic tiles, glass, ceramic sanitaryware |

| 13 | Foundry sand | 720–920 ktpy | Stable | Stable or small increase | Foundries, dry mortars |

| 14 | Glass sand | 1646–2213 ktpy | Increase 4–5%/y | Increase 2–3%/y | Glass |

| 15 | Gypsum and anhydrite | 3511–4362 ktpy | Increase 2–3%/y | Increase 1–2%/y | Gypsum plasterboards, gypsum binders, cement |

| 16 | Kaolin | 214–287 ktpy | Stable, slightly variable | Stable, slightly variable | Ceramic tiles, ceramic sanitaryware, paper, rubber, paints |

| 17 | Magnesite | 52–133 ktpy | Increase >8%/y | Increase 2–4%/y | Fertilizers, Mg compounds |

| 18 | Potash salts (K-Mg salts) | 192–1118 ktpy | Increase >5%/y, but variable | Increase 1–2%/y | Fertilizers, K compounds |

| 19 | Sulfur | 322–569 ktpy | Stable, slightly variable | Stable, slightly variable | Sulfuric acid for fertilizers production, (rubber, paper, food) |

| No. | Minerals | Recognized Resources | Recognized Resources of Active Mines | Recognized Reserves of Active Mines | Average Mining Output 2009–2018 | Sufficiency of Reserves of Active Mines (years) | Tendencies of Mining Output | |

|---|---|---|---|---|---|---|---|---|

| Fuels | ||||||||

| 1 | Coking coal | kt | 21,056,540 | 11,009,640 | 1,286,540 | 11,849.5 | 108.6 (long) | Stable |

| 2 | Crude oil | kt | 23,957 | 22,154 | 13,017 | 817.2 | 15.9 | Stable |

| 3 | Natural gas | mln m3 | 142,160 | 90,556 | 42,269 | 5356.9 | 7.9 | Decreasing |

| Metallic minerals | ||||||||

| 4 | Copper | kt Cu | 48,722 | 30,400 | 23,741 | 473.4 | 50.1 | Decreasing |

| 5 | Lead | kt Pb | 4074 | 1749 | 75 | 70.4 | 1 | Variable |

| 6 | Nickel | kt Ni | 209 | - | - | - | - | - |

| 7 | Titanium ores | kt TiO2 | 97,700 | - | - | - | - | - |

| 8 | Zinc | kt Zn | 6222 | 1062 | 196 | 70.1 | 1 | Decreasing |

| Industrial minerals | ||||||||

| 9 | Ball clays and refractory clays | kt | 222,479 | 2294 | 2220 | 236.9 | 9.4 | Increasing |

| 10 | Crushed and dimension stone—for the production of crushed aggregates and dimension stone | kt | 11,935,411 | 6,276,450 | 3,495,790 | 66,530.5 | 52.5 | Increasing |

| 11 | Dolomite, industrial | kt | 508,947 | 214,298 | 131,193 | 3,034.5 | 43.2 | Increasing |

| 12 | Fedspars and related minerals 2 | kt | 152,320 | 16,256 | 5254 | 62.6 | 83.9 | Decreasing |

| 13 | Foundry sand | kt | 307,877 | 50,028 | 18,600 | 1172.5 | 15.9 | Decreasing |

| 14 | Glass sand | kt | 776,512 | 193,840 | 67,422 | 2,259.4 | 29.8 | Strongly increasing |

| 15 | Gypsum and anhydrite | kt | 255,230 | 83,329 | 67,686 | 1125.8 | 60.1 | Decreasing |

| 16 | Kaolin | kt | 272,241 | 54,015 | 45,976 | 276.1 | 166.5 | Increasing |

| 17 | Magnesite | kt | 15,904 | 3693 | 3693 | 83.6 | 44.2 | Strongly increasing |

| 18 | Potash salts (K-Mg salts) | kt | 704,998 | - | - | - | - | - |

| 19 | Sulfur | kt | 538,711 | 18,248 | 17,420 | 601.7 | 29.0 | Variable |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kot-Niewiadomska, A.; Galos, K.; Kamyk, J. Safeguarding of Key Minerals Deposits as a Basis of Sustainable Development of Polish Economy. Resources 2021, 10, 48. https://doi.org/10.3390/resources10050048

Kot-Niewiadomska A, Galos K, Kamyk J. Safeguarding of Key Minerals Deposits as a Basis of Sustainable Development of Polish Economy. Resources. 2021; 10(5):48. https://doi.org/10.3390/resources10050048

Chicago/Turabian StyleKot-Niewiadomska, Alicja, Krzysztof Galos, and Jarosław Kamyk. 2021. "Safeguarding of Key Minerals Deposits as a Basis of Sustainable Development of Polish Economy" Resources 10, no. 5: 48. https://doi.org/10.3390/resources10050048

APA StyleKot-Niewiadomska, A., Galos, K., & Kamyk, J. (2021). Safeguarding of Key Minerals Deposits as a Basis of Sustainable Development of Polish Economy. Resources, 10(5), 48. https://doi.org/10.3390/resources10050048