1. Introduction

Decarbonizing the economy is one of the major challenges in most countries addressing climate change. Decarbonization can be achieved through an “energy transition”, which is the transition from the production and utilization of fossil fuels to cleaner and more sustainable sources of energy [

1]. According to UNEP’s Emissions Gap Report 2021 [

2], global GHG emissions dropped unprecedentedly by 5.4% in 2020 but are expected to bounce back in 2021 by 4.8% to pre-COVID levels at 59.1 Gt CO

2e in 2019, primarily dominated by fossil CO

2 emissions from energy and industry sectors. The report highlights the crucial role of decarbonizing the energy sector for a successful energy transition towards a low-carbon economy [

2].

Despite the potentially significant reduction of GHG emissions, decarbonizing the energy sector is challenged with environmental sustainability, energy security, economic stability, and social aspects [

3]. For instance, a global carbon tax might be a promising instrument to accelerate decarbonization. However, this instrument would be confronted by high capital requirements, the competition among energy sectors for decarbonization options, inconsistent environmental policies, as well as public acceptance of changes in energy usage [

3]. For developing countries, the additional layer of obstacles to energy transition includes competitive prices of fossil fuels, lack of financial resources and policy support, and unreliability of renewable sources of energy [

4].

Another set of challenges to energy transition is the occurrence of geopolitical and economic shocks. For instance, during the COVID-19 pandemic, various countries have reshaped their investment structure by increasing medical and health expenditures while withdrawing funds from renewable energy projects [

5,

6]. During the global financial crisis in 2008, stimulus plans for economic recovery resulted in large-scale funds flowing to fossil fuel industries, while reduction of public support for renewable energy in the form of subsidies and feed-in tariffs [

5,

7]. Meanwhile, Fischhendler et al. [

8] argued that geopolitical conflicts have a dual impact: some aspects discourage energy transition to renewables, while others boost them. On one end, investments in renewables flourish under conditions of armed conflict and in volatile geopolitical contexts by taking the advantages of renewable energy while downplaying the disadvantages of conflict environments. On the other end, violent conflicts deter investors, discourage domestic and international trade, and suppress the development of renewable energy infrastructures [

8]. Since countries use energy as a geopolitical weapon to protect their interests and ensure national security, geopolitical interests in the fossil fuels market change, making renewable energy sources appear more important in the international market [

9].

The impacts of geopolitical conflicts on energy transition have been discussed in previous studies. For instance, the Russia-Ukraine conflict affects the world economy through higher prices for energy and weaker confidence and financial markets as a result of strong international sanctions against Russia [

10]. While Ukraine is not a significant trading partner for any major economies, Russia has great exposure to the European Union, the United Kingdom, and other developing economies [

10]. Studies show that unexpected changes in geopolitical risks increase the volatility of oil prices [

11,

12]. Consequently, this increase in oil price uncertainty has huge impacts on developing economies, particularly those countries that are too dependent on imported fossil products [

4]. For instance, Cunado and Perez de Gracia [

13] found that oil prices have a significant effect on both economic activity and price indices, although the impact is limited to the short run, and more significant when oil price shocks are defined in local currencies. In another study, Murshed and Tanha [

14] found that movements in oil prices influence the renewable energy transition, which highlights the important policy implications in attaining energy security and environmental sustainability in the traditional imported crude oil-dependent countries. Yet, there has been no study that analyzes how extreme oil price uncertainties from geopolitical conflicts accelerate or slow down the energy transition towards a more sustainable economy.

This study addresses this gap by analyzing the decision dynamics in energy transition investments under uncertainties brought by geopolitical conflicts. Specifically, this research aims to calculate the value of an energy transition investment based on the cost savings from using fossil-based to renewable energy sources, estimate the value of flexibility to postpone the investment decision under uncertainty in geopolitical risks, analyze how various levers affect this flexibility value, and evaluate whether geopolitical conflicts accelerate or slow-down the energy transition. Using the case of the Philippines, an oil-importing country, this research applies both the traditional valuation method as well as the real options valuation to calculate the value and the flexibility to postpone the investment in the energy transition from fossil-based to renewable energy sources. This evaluates the optimal timing of investment under uncertainty in extreme oil prices as influenced by international conflicts such as the Russia-Ukraine war. Then, this study analyzes how changes in the explanatory variables affect investment decisions through sensitivity analysis. Finally, this study aims to provide recommendations on how an oil-importing country becomes energy self-sufficient and robust from economic and geopolitical shocks.

4. Discussion

The results in the analysis of the impacts of international conflicts on energy transition provide various points of discussion. The first part describes renewables as an energy transition strategy. The next point discusses the valuation result for NPV and ROV calculations. Then, the levers influencing NPV and ROV are presented. The last part highlights the impacts of an international conflict such as the Russia-Ukraine war on investment decisions in energy transition projects.

First, this study focused on investment in renewables as an energy transition strategy. The energy transition is the transition towards environmentally and economically sustainable energy technologies which help the world mitigate climate change [

55]. These technologies include renewables, energy storage, electrified transportation, energy-efficient built environment, hydrogen, nuclear, sustainable materials, and carbon capture and storage [

16]. From a developing country’s perspective, one of the major decarbonization strategies is the transition from fossil-based to a more sustainable energy generation using renewable sources. However, compared with industrialized countries, developing countries are challenged by competitive prices of fossil fuels, lack of financing mechanisms and policy framework, economic development, and skepticism on the reliability of renewables [

4,

56,

57]. It is therefore important to analyze how various factors affect decisions and accelerate investments in energy transition projects.

Second, from the traditional valuation method, the

NPV results in all scenarios analyzed are positive. This means that the energy transition project on renewables is feasible in the selected case country. This confirms the findings from previous studies [

58,

59,

60,

61] that investment in solar PV is a viable option for the energy transition. On the contrary, some cases [

62,

63] found negative

NPV for utility-scale and lower generation capacity solar PV. For instance, Assereto and Byrne [

62] found that without policy support, investing in utility-scale solar PV might only be profitable under the best-case scenario, when technology costs are low. Sheha et al. [

63] found that two out of ten studied were promising cases, one with a solar photovoltaic plant size of 200 MW and the other with 300 MW, while lower solar penetration had negative

NPVs. Meanwhile, this research considers a large-scale deployment of solar PV at a 1 GW generating capacity. The positive

NPV result can be explained by the advantage of economies of scale, in which the huge investment and other costs are distributed with a large-scale deployment of solar panels installed, and at the same time increases the cost-saving value from energy transition [

60].

Applying the real options approach, this study finds higher real option values than

NPV which imply a better decision to postpone the energy transition to more favorable investment conditions. This result supports previous findings [

62,

64,

65], which found values in delaying investments in utility-scale and residential solar PV. Investment in the energy transition is largely impacted by the uncertainties in costs and revenues, hence, the timing is relevant to consider when making investment decisions in huge projects, which require high initial capital [

64]. To maximize this flexibility value, an investor or project planner must respond to the six levers influencing the value of real options as shown in

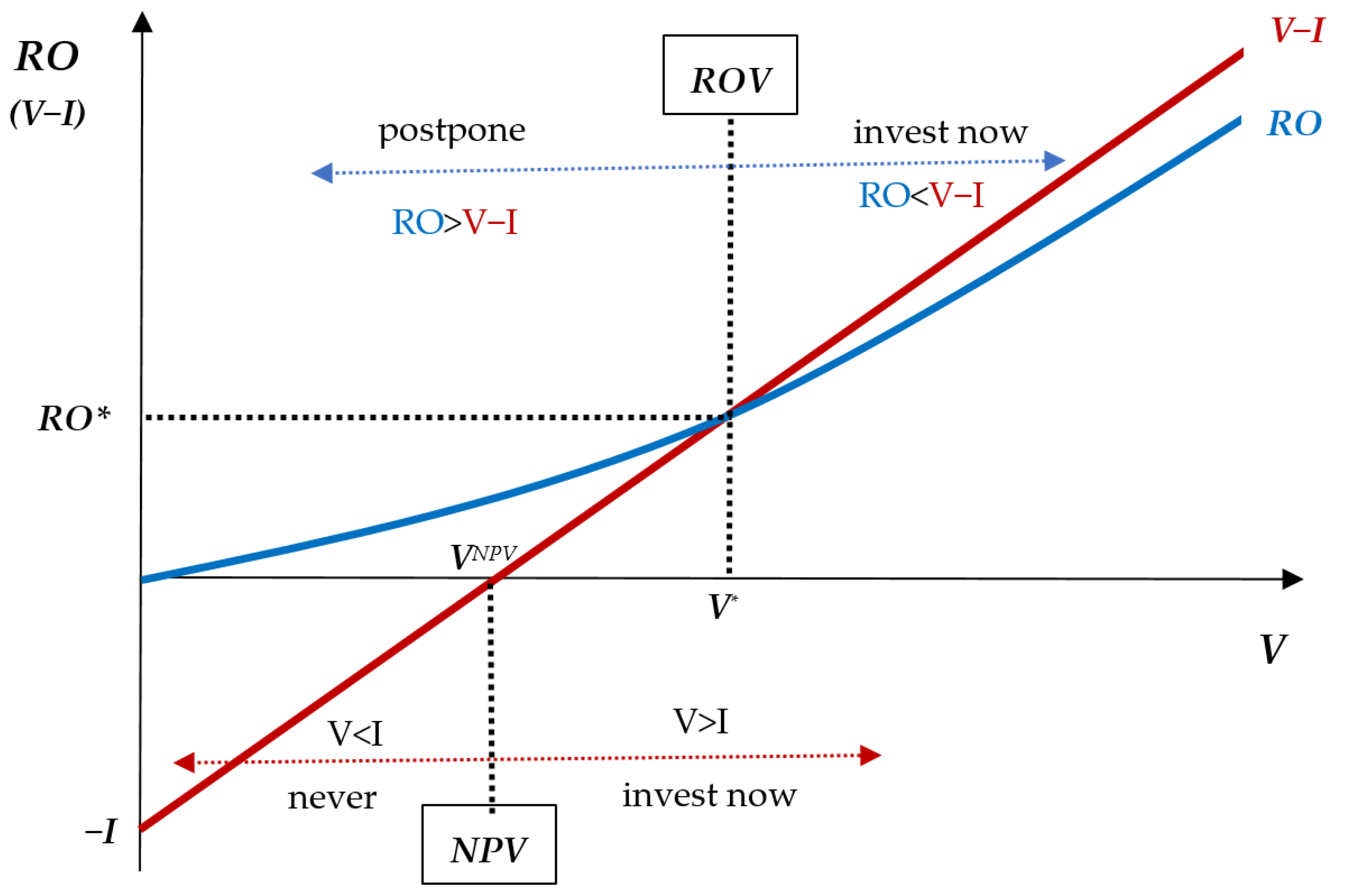

Figure 4.

The real options framework in this study identifies six drivers: the levers that influence NPV such as the investment cost (I) and the present value of expected cash flows (V); and the non-NPV levers such as the validity period of the option (T − t), risk-free interest rate (r), uncertainty in future cash flows (σ), and the opportunity cost of delaying investment (δ).

As shown in

Figure 4 and Sensitivity Analysis in

Table 7, the

V and

I affect both

NPV and

ROV in the opposite directions. For example, a reduction in the investment cost increases both the

NPV as well as

ROV, therefore, this lever does not lead to an earlier investment. Currently, the cost of solar PV is continuously declining due to technological innovations, competitive prices of solar PV and battery storage, and the learning effect [

66,

67]. With this trend, a firm has to wait longer to invest to the point when technology costs are low enough to make the investment more profitable [

62].

Another

NPV lever is the V which consists of costs and revenues from energy generation. According to the model in Equation (5), direct revenue is coming from the energy sales (electricity tariff and quantity of electricity generation) while the indirect revenue is the cost savings from the transition to renewable energy. Increasing the electricity generation from solar is less likely as this will incur higher investment costs. Moreover, increasing the tariff for solar PV, obviously, increases the value of both

NPV and

ROV. Since the

NPV is more than four times more sensitive than

ROV (see

Table 7), there would be a threshold of electricity price when investing immediately is a better option than waiting (

ROV <

NPV). This is confirmed in previous studies where increasing electricity tariffs results in earlier investment in energy transition projects [

60,

62].

The four non-NPV levers have different effects on

ROV. Note that these levers have no impact on

NPV with its inflexible (now or never) decision rule. The period of holding the option, risk-free interest rate, and uncertainty have positive impacts on

ROV. For instance, greater uncertainty in fuel prices raises the value of an option by increasing the value of flexibility. With the current Russia-Ukraine conflict, the uncertainty in oil prices may increase with Russia being one of the major players in the global oil market. As a consequence, a project planner tends to increase the uncertainty of expected returns in energy transition and then implement the project or back out, depending on changes in investment conditions. On the contrary, higher uncertainty increases the value of the real option, hence, prolonging the decision to implement the investment [

68,

69,

70].

Similarly, extending the opportunity’s duration (

T − t) raises the real option’s value because it increases the total uncertainty of the project. Moreover, any expected increase in the interest rate raises the value of the real option because it reduces the present value of the exercise price [

4]. Among the four non-NPV levers, the opportunity cost δ seems to stand out with higher sensitivity. The δ can be described as the cost incurred to preserve the option or the opportunity lost from waiting to implement a project. When this value is increased, the present value of expected cash flows will decrease, and eventually the real option value. Hence, an investor in the energy transition will consider this opportunity cost and make a decision to invest earlier as postponement will incur losses [

60].

Lastly, this study found the impacts of international conflicts on increasing both the

NPV and

ROV. The result for

NPV is quite obvious as conflicts, such as the Russia-Ukraine war, may result in extreme oil prices. Along with the rise in crude oil consumption, the occurrence of geopolitical and economic events including war in oil-producing countries, terrorist attacks, etc., drives the risk of high crude oil prices [

71,

72], which are described as jumps in this study. Additionally, the Poisson jumps in energy transition may result from the possible discovery of new material, a significant improvement in the production process, a change in PV technology, or the installation of a nearby PV panel manufacturing facility [

73]. With extreme oil prices or jumps, energy transition technologies become more competitive, hence, accelerating the investment in the transition. On the contrary, higher oil prices also increase the present value of future savings from the transition, resulting in higher real option values. Therefore, international conflicts further delay the investment in energy transition, using the real options rule, as the value of flexibility to postpone the project also increases. This confirms a previous study that geopolitical shocks have negative effects on energy transition, particularly in energy production from renewable energy sources [

9]. Additionally, considering both regular random fluctuations and occurrences of major shocks in real options valuation suggests a postponement of the decision in the energy transition project but not abandonment [

74]. Given the market uncertainty brought by international conflict, a decision-maker could gain a significant advantage from waiting to decide on energy transition later with better (though never complete) information.

5. Conclusions

This research examined how various factors accelerate the energy transition towards achieving the global climate targets. While this topic has been extensively discussed in previous studies, this paper contributes to the literature by (a) analyzing the impacts of an international conflict, such as the Russia-Ukraine war, on the timing of energy transition, (b) describing the occurrence of extreme prices by combining geometric Brownian motion model with Poisson jumps, and (c) exploring the effects of various real option levers on the timing and value of energy transition from the perspective of a developing country. Using the real options approach with the Black-Scholes-Merton model, this study analyzed the value of flexibility and the optimal timing to invest in the energy transition.

Applying the proposed model using the case of the Philippines, the results found that energy transition is a viable investment with positive NPV, considering the cost savings of the transition from fossil-based to renewable energy sources. The value of the flexibility (ROV) to postpone the investment is higher than the value of investing immediately (NPV), hence, the implementation of energy transition could be delayed. In terms of the NPV and ROV levers, lower investment cost and greater values of future cash flows, risk-free interest rate, period of holding the option, and the volatility of cash flows increase the value of the project, however, prolonging the timing of investment. Considering the opportunity cost of waiting, lowers the option value, hence accelerating the implementation of the energy transition. Meanwhile, the Russia-Ukraine war, which may result in extreme oil prices, increases both the NPV and ROV, hence further delaying the energy transition.

To accelerate the energy transition, particularly in developing countries, the findings in this study provide several policy implications based on the presented real option levers. First is the policy aimed at reducing the impacts of various market, geopolitical, and economic shocks. Second, the value of free operating cash flows from energy transition may be increased by increasing electricity tariffs and subsidizing the deployment of renewable energy technologies while decreasing the tariffs and de-subsidizing energy generation from fossil fuels. Finally, the government must also provide a better investment environment and financing schemes for energy transition projects. The government must encourage the development of more sustainable sources of energy and allow free-market competition to further decrease the investment cost in the energy transition by technology learning.

The main limitations of this study include the simplification of the project valuation using the Black-Scholes model, the availability of actual data on the effect of the Russia-Ukraine war on oil prices as described using geometric Brownian motion with Poisson jumps, and limiting the scope to an oil-importing developing country. Future studies may consider more complicated real options models such as Monte Carlo simulations, lattices, and dynamic programming to capture the complications of the extreme oil prices with other uncertainties. It would also be interesting to apply the model to oil-rich countries that are in the energy transition towards more environment-friendly and sustainable economies.