Inter-Sectoral Economic Linkages in the Mining Industries of Botswana and Tanzania: Analysis Using Partial Hypothetical Extraction Method

Abstract

:1. Introduction

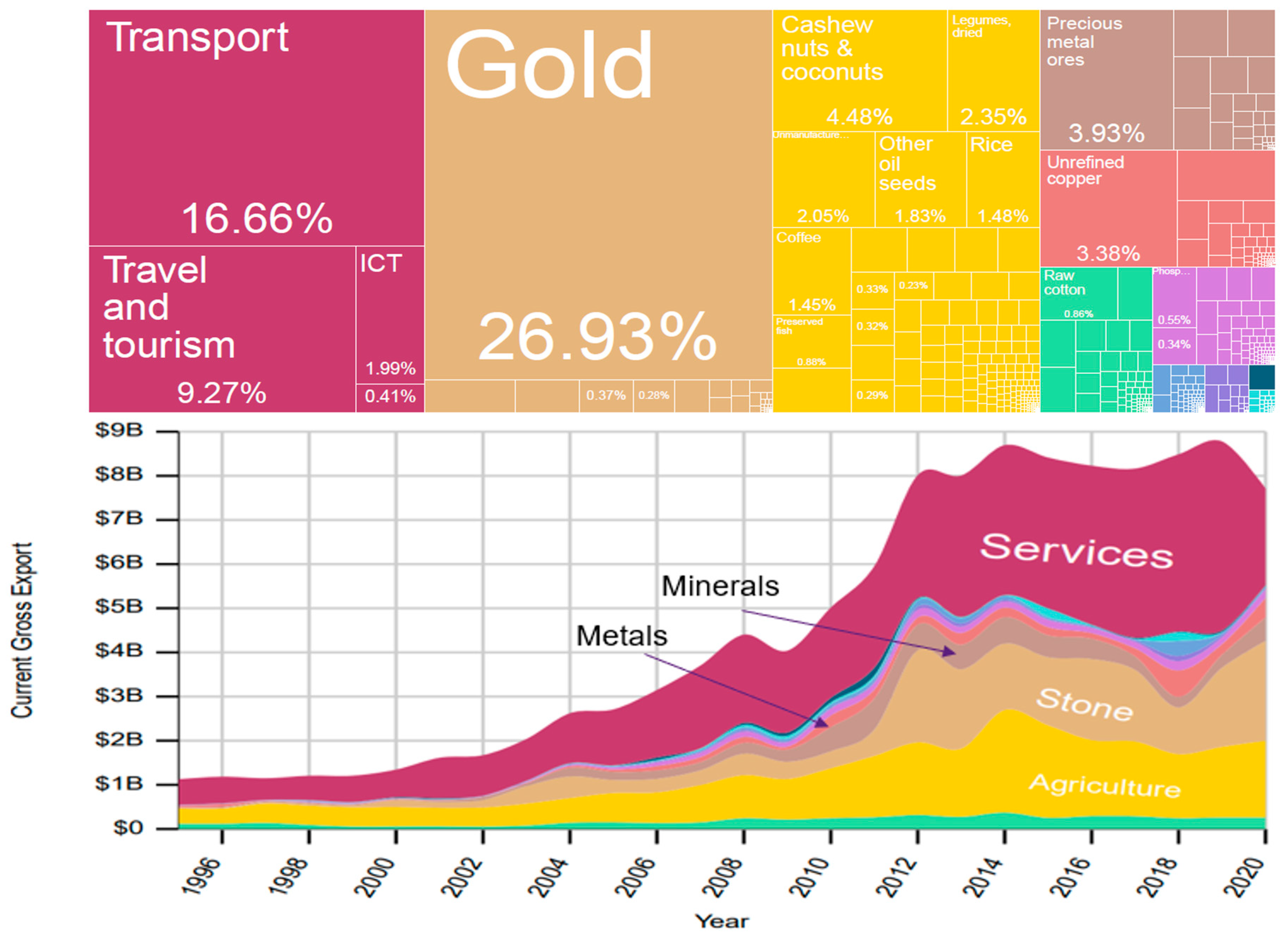

2. Mining and the Economies of Tanzania and Botswana

3. Methodology

3.1. HEM Model to Measure Inter-Sectoral Linkages

3.2. Data Description

4. Results and Discussions

4.1. Tanzania

4.1.1. Manufacturing Sectors

4.1.2. Construction Sector

4.1.3. Service Sectors

4.2. Botswana

4.2.1. Manufacturing Sectors

4.2.2. Service Sectors

5. Potential for Economic Diversification

5.1. Mineral Utilisation for Physical Infrastructure

5.2. Leveraging to Develop Local Businesses

6. Concluding Remarks

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Code | Economic Sectors | |

| 1 | A01 | Agriculture |

| 2 | A02 | Fishing |

| 3 | D | Mining and Quarrying |

| 4 | E01 | Food & Beverages |

| 5 | E02 | Textiles and Wearing Apparel |

| 6 | E03 | Wood and Paper |

| 7 | E04 | Petroleum, Chemical and Non-Metallic Mineral Products |

| 8 | E05 | Metal Products |

| 9 | E06 | Electrical and Machinery |

| 10 | E07 | Transport Equipment |

| 11 | E08 | Other Manufacturing |

| 12 | E09 | Recycling |

| 13 | F | Electricity, Gas and Water |

| 14 | G | Construction |

| 15 | H01 | Maintenance and Repair |

| 16 | H02 | Wholesale Trade |

| 17 | H03 | Retail Trade |

| 18 | H04 | Hotels and Restaurants |

| 19 | I | Transport |

| 20 | J01 | Post and Telecommunications |

| 21 | J02 | Financial Intermediation and Business Activities |

| 22 | J03 | Public Administration |

| 23 | J04 | Education, Health and Other Services |

| 24 | J05 | Private Households |

| 25 | J06 | Others |

References

- USGS. 2016 Minerals Yearbook: Africa. U.S. Geological Survey. 2021. Available online: https://d9-wret.s3.us-west-2.amazonaws.com/assets/palladium/production/atoms/files/myb3-2016-africa-sum.pdf (accessed on 16 April 2022).

- Ericsson, M.; Löf, O. Mining’s contribution to national economies between 1996 and 2016. Miner. Econ. 2019, 32, 223–250. [Google Scholar] [CrossRef] [Green Version]

- Harvard University. Atlas of Economic Complexity. 2023. Available online: https://atlas.cid.harvard.edu/what-is-the-atlas (accessed on 16 March 2023).

- Izvorski, I.; Coulibaly, S.; Doumbia, D. Reinvigorating Growth in Resource-Rich Sub-Saharan Africa. World Bank Group. 2018. Available online: http://documents.worldbank.org/curated/en/617451536237967588/Reinvigorating-Growth-in-Resource-Rich-Sub-Saharan-Africa, (accessed on 22 July 2021).

- The World Bank. World Development Indicators. 2023. Available online: https://databank.worldbank.org/source/world-development-indicators#, (accessed on 20 March 2023).

- Usman, Z.; Landry, D. Economic Diversification in Africa: How and Why It Matters, Carnegie Endowment for International Peace. 2021. Available online: https://www.semanticscholar.org/paper/Economic-Diversification-in-Africa%3A-How-and-Why-It-Usman-Landry/8b87207299b8fa3631d30739527b5d59915b0018 (accessed on 3 May 2022).

- Chang, H.-J.; Lebdioui, A. From Fiscal Stabilization to Economic Diversification: A Developmental Approach to Managing Resource Revenues. 2020. Available online: https://www.wider.unu.edu/publication/fiscal-stabilization-economic-diversification (accessed on 14 May 2022).

- World Bank. Africa’s Pulse, No. 27, April 2023: Leveraging Resource Wealth During the Low Carbon Transition; World Bank: Washington, DC, USA, 2023; Available online: http://hdl.handle.net/10986/39615 (accessed on 1 May 2023).

- Statistics Botswana. 2022 Population and Housing Census. 2023. Available online: https://www.statsbots.org.bw/census-2022 (accessed on 20 June 2023).

- De Vries, G.; Timmer, M.; de Vries, K. Structural Transformation in Africa: Static Gains, Dynamic Losses. J. Dev. Stud. 2015, 51, 674–688. [Google Scholar] [CrossRef]

- Weldegiorgis, F.S.; Dietsche, E.; Franks, D.M. Building mining’s economic linkages: A critical review of local content policy theory. Resour. Policy 2021, 74, 102312. [Google Scholar] [CrossRef]

- URT. The Mineral Policy of Tanzania, Ministry of Energy and Minerals. 2009. Available online: https://www.madini.go.tz/media/Mineral_Policy_of_Tanzania_2009_sw.pdf (accessed on 12 August 2020).

- BOT; TIC; NBS. Tanzania Investment Report. Joint Report by Bank of Tanzania (BOT), Tanzania Investment Centre (TIC), National Bureau of Statistics (NBS). 2018. Available online: https://www.bot.go.tz/Publications/Other/Tanzania%20Investment/en/2020021122482325204.pdf (accessed on 4 June 2021).

- Statistica. Mining Industry in Tanzania—Statistics & Facts. 2022. Available online: https://www.statista.com/topics/9027/mining-industry-in-tanzania/#topicHeader__wrapper (accessed on 22 June 2022).

- Scurfield, T. Tanzania Strikes a Better Balance with Its Mining Fiscal Regime. 2020. Available online: https://resourcegovernance.org/blog/tanzania-strikes-better-balance-mining-fiscal-regime (accessed on 13 May 2022).

- Mining Commission. Government Revenue Collection from the Mineral Sector. The United Republic of Tanzania. 2022. Available online: https://www.tumemadini.go.tz/pages/government-revenue-from-mineral-sector (accessed on 21 June 2023).

- Roe, A. Tanzania: From Mining to Oil and Gas; WIDER Working Paper, No. 2016/79; The United Nations University World Institute for Development Economics Research (UNU-WIDER): Helsinki, Finland, 2016; ISBN 978-92-9256-122-2. [Google Scholar] [CrossRef]

- De Vries, G.; Arfelt, L.; Drees, D.; Godemann, M.; Hamilton, C.; Jessen-Thiesen, B.; Kaya, A.I.; Kruse, H.; Mensah, E.; Woltjer, P. The Economic Transformation Database (ETD): Content, Sources, and Methods; Technical Note; UNU-WIDER: Helsinki, Finland, 2021. [Google Scholar] [CrossRef]

- URT. The Mining Act, 2010 [Principal Legislation], Revised Edition of 2018, Chapter 123. The Government of the United Republic of Tanzania. 2018. Available online: https://www.leat.or.tz/files/202206140809THE-MINING-ACT-2010-CAP-123-R.E.2018.pdf (accessed on 29 July 2020).

- Roe, A. Tanzania—From Mining to Oil and Gas: Structural Change or Just Big Numbers? WIDER Working Paper 2017/175; UNU-WIDER: Helsinki, Finland, 2017. [Google Scholar] [CrossRef] [Green Version]

- Yunis, J.; Aliakbari, E. Fraser Institute Annual Survey of Mining Companies 2021. 2022. Available online: https://www.fraserinstitute.org/sites/default/files/annual-survey-of-mining-companies-2021.pdf (accessed on 6 June 2023).

- International Trade Administration. Botswana—Country Commercial Guide: Mining and Minerals. 2021. Available online: https://www.trade.gov/country-commercial-guides/botswana-mining-minerals (accessed on 13 May 2022).

- Barczikay, T.; Biedermann, Z.; Szalai, L. An investigation of a partial Dutch disease in Botswana. Resour. Policy 2020, 67, 101665. [Google Scholar] [CrossRef]

- Hillbom, E.; Bolt, J. Botswana—A Modern Economic History: An African Diamond in the Rough. Palgrave Macmillan. 2018. Available online: https://link.springer.com/book/10.1007/978-3-319-73144-5 (accessed on 13 July 2022).

- Gelb. Economic Diversification in Resource Rich Countries. 2010. Available online: https://www.imf.org/external/np/seminars/eng/2010/afrfin/pdf/gelb2.pdf (accessed on 23 June 2021).

- USGS. 2016 Minerals Yearbook: Botswana. U.S. Geological Survey. 2021. Available online: https://www.usgs.gov/media/files/mineral-industry-botswana-2016-pdf (accessed on 30 July 2022).

- United Nations Conference on Trade and Development. UNCTAD ICT Policy Review and National E-commerce Strategy for Botswana; United Nations: Geneva, Switzerland, 2021. [Google Scholar] [CrossRef]

- Paelinck, J.; De Caevel, J.; Degueldre, J. Quantitative analysis of some phenomena of the polarized regional de-velopment: Essay on statistic simulation of propagation paths. Bibl. L’inst. Sci. Écon. 1965, 7, 341–387. [Google Scholar]

- Duarte, R.; Sánchez-Chóliz, J.; Bielsa, J. Water use in the Spanish economy: An input–output approach. Ecol. Econ. 2002, 43, 71–85. [Google Scholar] [CrossRef]

- Cella, G. The Input-Output Measurement of Interindustry Linkages. Oxf. Bull. Econ. Stat. 1984, 46, 73–84. [Google Scholar] [CrossRef]

- Dietzenbacher, E.; Lahr, M.L. Expanding extractions. Econ. Syst. Res. 2013, 25, 341–360. [Google Scholar] [CrossRef]

- Temurshoev, U.; Oosterhaven, J. Analytical and Empirical Comparison of Policy-Relevant Key Sector Measures. Spat. Econ. Anal. 2014, 9, 284–308. [Google Scholar] [CrossRef] [Green Version]

- Dietzenbacher, E.; van der Linden, J.A. Sectoral and Spatial Linkages in the EC Production Structure. J. Reg. Sci. 1997, 37, 235–257. [Google Scholar] [CrossRef]

- Miller, R.E.; Lahr, M.L. A taxonomy of extractions. Contrib. Econ. Anal. 2001, 249, 407–441. [Google Scholar]

- Hirschman, A.O. The Strategy of Economic Development, 1st ed.; Yale University Press: New Haven, CT, USA, 1958. [Google Scholar]

- Worldmrio. The Eora Global Supply Chain Database. 2022. Available online: https://worldmrio.com/ (accessed on 12 September 2022).

- Lenzen, M.; Moran, D.; Kanemoto, K.; Geschke, A. Building Eora: A Global Multi-Region Input–Output Database at High Country And Sector Resolution. Econ. Syst. Res. 2013, 25, 20–49. [Google Scholar] [CrossRef]

- Timmer, M.P.; Dietzenbacher, E.; Los, B.; Stehrer, R.; de Vries, G.J. An Illustrated User Guide to the World Input-Output Database: The Case of Global Automotive Production. Rev. Int. Econ. 2015, 23, 575–605. [Google Scholar] [CrossRef]

- Bishoge, O.K.; Zhang, L.; Mushi, W.G.; Suntu, S.L.; Gregory, G. An overview of the natural gas sector in Tanza-nia-Achievements and challenges. J. Appl. Adv. Res. 2018, 3, 108–118. [Google Scholar] [CrossRef] [Green Version]

- USGS. 2017–2018 Minerals Yearbook: Tanzania. U.S. Geological Survey. 2022. Available online: https://pubs.usgs.gov/myb/vol3/2017-18/myb3-2017-18-tanzania.pdf (accessed on 14 December 2022).

- Gray, H. The Political Economy of the Steel Sector in Tanzania: Power Relations and Patterns of Decline and Growth over Time. Working Paper 036. Centre of African Studies. 2021. Available online: https://ace.soas.ac.uk/publication/the-political-economy-of-the-steel-sector-in-tanzania-power-relations-and-patterns-of-decline-and-growth-over-time/ (accessed on 9 September 2021).

- World Bank; World Integrated Trade Solution. Botswana Iton or Steel; Expanded Metal Imports 2005–2016. 2015–2016. Available online: https://wits.worldbank.org/trade/comtrade/en/country/BWA/year/2016/tradeflow/Imports/partner/ALL/product/731450 (accessed on 13 December 2022).

- Baya, B.T.; Jangu, M.H. Environmental Consideration for Sustainable Industrialisation in Tanzania. 2017. Available online: https://www.studocu.com/row/document/university-of-dar-es-salaam/corporate-finance/sw-1576226406-environmental-consideration-for-industrialization-in-tanzania/40964675 (accessed on 10 August 2021).

- Misati, R.; Ngoka, K. Constraints on the Performance and Competitiveness of Tanzania’s Manufacturing Exports; WIDER Working Paper 35/2021; UNU-WIDER: Helsinki, Finland, 2021. [Google Scholar] [CrossRef]

- Kikwasi, G.J.; Escalante, C. The Construction Sector in Tanzania. In Mining for Change: Natural Re-sources and Industry in Africa; Page, J., Tarp, F., Eds.; Oxford University Press, United Nations University World Institute for Development Economics Research (UNU-WIDER): Helsinki, Finland, 2020. [Google Scholar] [CrossRef] [Green Version]

- Mjimba, V. The Nature and Determinants of Backward Linkages in Emerging Minerals Commodity Sectors: A Case Study of Gold Mining in Tanzania, Making the Most of Commodities (MMCP). Discussion Paper 7. 2011. Available online: http://hdl.handle.net/10625/51386 (accessed on 20 September 2020).

- Bank of Tanzania. Act Supplement—Banking and Financial Institutions Act. Cap 342. 2006. Available online: https://www.imolin.org/imolin/amlid/data/urt/document/banking_and_financial_institutions_act_cap_342__2006_.html (accessed on 23 July 2021).

- Koitsiwe, K.; Adachi, T. Linkages between mining and non-mining sectors in Botswana. Miner. Econ. 2016, 30, 95–105. [Google Scholar] [CrossRef]

- Charis, G.; Danha, G.; Muzenda, E.; Patel, B.; Mateescu, C. Waste to Energy Opportunities in Botswana: A Case Study Review. In Proceedings of the 7th International Renewable and Sustainable Energy Conference, Agadir, Morocco, 27–30 November 2019. [Google Scholar] [CrossRef]

- Tlhalefang, J. The Impact of Increased Efficiency in the Transport Sectors Energy Use: A Computable General Equi-librium Analysis for the Botswana Economy. Botsw. J. Econ. 2011, 8, 2–25. Available online: https://www.ajol.info/index.php/boje/article/view/72975 (accessed on 9 September 2021).

- International Trade Administration. Energy: Botswana Country Commercial Guide. International Trade Administration. U.S. Department of Commerce. 2022. Available online: https://www.trade.gov/country-commercial-guides/botswana-energy#:~:text=With%20212%20billion%20tons%20of,majority%20of%20the%20country’s%20electricity (accessed on 13 December 2022).

- Moffat, B. The banking environment in Botswana: An overview. Botsw. Notes Rec. 2009, 41, 95–103. Available online: https://www.jstor.org/stable/23237928, (accessed on 9 October 2021).

- Jefferis, K. Economic Accounting of Mineral Resources in Botswana, WAVES Partnership Botswana Program. 2016. Available online: https://www.wavespartnership.org/sites/waves/files/kc/Botswana%20Mineral%20Accounts%20Technical%20Report%202015_final.pdf (accessed on 30 June 2021).

- BITC. Soda Ash Production and Beneficiation: Investor Factsheet. Botswana Investment and Trade Centre. 2018. Available online: https://www.scribd.com/document/412648364/Botswana-SODA-ASH-pdf (accessed on 22 June 2021).

- Harvey, R.G. From diamonds to coal? Critical reflections on Botswana’s economic future. Extr. Ind. Soc. 2015, 2, 827–839. [Google Scholar] [CrossRef]

- Mining Commission. Minerals Available in Tanzania. 2018. Available online: https://www.tumemadini.go.tz/pages/minerals-available-in-tanzania (accessed on 15 March 2022).

- Msami, J.; Wangwe, S. 8 Industrial Development in Tanzania. In Manufacturing Transformation: Comparative Studies of Industrial Development in Africa and Emerging Asia; Newman, C., Page, J., Rand, J., Shimeles, A., Söderbom, M., Tarp, F., Eds.; Oxford University Press: Oxford, UK, 2016; p. 155. [Google Scholar]

- Robi, A. Tanzania: Dangote Plans to Raise Cement Output By 30pc. Tanzania Daily News. 2021. Available online: https://allafrica.com/stories/202111040342.html (accessed on 10 January 2023).

- Jacob, T. When good intentions turn bad: The unintended consequences of the 2016 Tanzanian coal import ban. Extr. Ind. Soc. 2019, 7, 337–340. [Google Scholar] [CrossRef]

- Brink, J.V.D.; Szirmai, A. The Tanzanian scrap recycling cycle. Technovation 2002, 22, 187–197. [Google Scholar] [CrossRef]

- Izatt, R.M.; Hagelüken, C. Recycling and sustainable utilization of precious and specialty metals. In Metal Sustainability: Global Challenges, Consequences, and Prospects; John Wiley & Sons: Hoboken, NJ, USA, 2016; pp. 1–22. [Google Scholar] [CrossRef]

- Madenge. Tanzania Mining—The Best Prospect Sector. The United Republic of Tanzania. 2021. Available online: https://unitedrepublicoftanzania.com/economy-of-tanzania/minerals-in-tanzania-mining/tanzania-mining-the-best-prospect-sector/ (accessed on 20 July 2022).

- URT. The Mining (Local Content) Amendments Regulations to the Mining Act Cap 123 (2018). The Government of the United Republic of Tanzania. 2019. Available online: https://www.madini.go.tz/media/MINING-LOCAL-CONTENT-REGULATIONS-2018.pdf (accessed on 13 July 2020).

- Porée, N.; Maasdorp, G.; Oosthuizen, J. Strengthening of Economic and Trade Related Capacities and Competences in SADC; GIZ—Deutsche Gesellschaft für Internationale Zusammenarbeit: Bonn, Germany, 2012; Available online: https://www.gfa-group.de/projects/Strengthening_economic_and_trade_capacities_in_SADC_3939223.html (accessed on 18 March 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Weldegiorgis, F.S.; Dietsche, E.; Ahmad, S. Inter-Sectoral Economic Linkages in the Mining Industries of Botswana and Tanzania: Analysis Using Partial Hypothetical Extraction Method. Resources 2023, 12, 78. https://doi.org/10.3390/resources12070078

Weldegiorgis FS, Dietsche E, Ahmad S. Inter-Sectoral Economic Linkages in the Mining Industries of Botswana and Tanzania: Analysis Using Partial Hypothetical Extraction Method. Resources. 2023; 12(7):78. https://doi.org/10.3390/resources12070078

Chicago/Turabian StyleWeldegiorgis, Fitsum Semere, Evelyn Dietsche, and Shabbir Ahmad. 2023. "Inter-Sectoral Economic Linkages in the Mining Industries of Botswana and Tanzania: Analysis Using Partial Hypothetical Extraction Method" Resources 12, no. 7: 78. https://doi.org/10.3390/resources12070078

APA StyleWeldegiorgis, F. S., Dietsche, E., & Ahmad, S. (2023). Inter-Sectoral Economic Linkages in the Mining Industries of Botswana and Tanzania: Analysis Using Partial Hypothetical Extraction Method. Resources, 12(7), 78. https://doi.org/10.3390/resources12070078