The Role of Hydrocarbons in the Global Energy Agenda: The Focus on Liquefied Natural Gas

Abstract

:1. Introduction

2. Climate Change and Public Image of HCR as a Source of CO2 Emission

3. Alternative Energy Technologies. Problems and Prospects

3.1. Nuclear Energy Sector

3.2. Renewable Energy Sector

- RES are a group of primary energy resources that are considered inexhaustible for foreseeable future consumption. Moreover, they have an extensive geographical range to allow the creation and scaling of decentralized energy supply systems [63] and, as a result, avoid the problems related to the creation of centralized infrastructures.

- Theoretically, RES technologies are carbon-free, with some exceptions. Nevertheless, when considering them in view of the entire lifecycle, including the production and use of worn equipment, environmental issues become more controversial [64].

- Similar to HCR, some RES have non-uniform geographical distribution. Significant differentiation can be seen even in one country [65]. Resources of wind and solar energy show the most wide-spread distribution in the world, though they do have certain restrictions.

- Another issue is dependence on favourable weather conditions, prediction of which is a complex scientific task. The most predictable sources are biomass, geothermal energy and hydro-energy due to their low dependence (or independence) on changeable weather conditions. This issue also determines the complexity of energy transformation process control and maintenance of required levels of effectiveness [66].

- The third issue is related to the immaturity of most RES-based technologies, which affects energy generation cost. The most cost-intensive options are solar and oceanic energy plants, with the electricity cost being an order of magnitude higher than that of HCR. The most competitive are large-scale hydro and wind plants, the energy cost of which is only a few times higher than that of HCR. Additionally, a comparatively low production cost of energy can be obtained during the processing of biomass, including peat, due to the high rate of its reserve base replenishment [67]. Low competitiveness in terms of price necessitates seeking ways of defining the project’s potential based on theoretical prospects, rather than on the completeness of technologies and potential profitability [68].

- The fourth, and probably main, issue with RES is the accumulation and storage of energy. Today, many technologies have been developed in this area, but there are objective problems with their effectiveness and possible storage period [69]. In accordance with market needs, RES development is impossible without these key stages of energy generation [70].

3.3. Hydrogen Technologies

- Unlike HCR, hydrogen is a secondary energy resource since its production from the natural environment is hard to implement. Many concepts and technologies have been developed for generation of hydrogen [78], which can be provisionally divided into two groups: (1) based on RES, and (2) based on HCR. The first group uses thermochemical or biological processes. The second group uses HCR reforming and pyrolysis processes. The problem is that the majority of accessible technologies are not sufficiently tested for their industrial implementation.

- The cost of hydrogen production is quite high due to the initial stage of technology development and it does not allow competition with traditional HCR-based technologies. The study [79] includes a comparative analysis of 19 technologies for the production of hydrogen fuel. Based on this analysis, the authors drew several important conclusions in terms of the potential of the development of hydrocarbon resources. First of all, the reforming of the hydrocarbon feed has the highest energy efficiency among all of the options considered. Secondly, the exergy efficiency of hydrocarbon reforming is one of the highest (45–50%), with only biomass gasification being ahead of it (60%). Thirdly, it was shown that the cheapest hydrogen could also be obtained from the hydrocarbon feed, with a price of nearly 0.75 $/kg H2. The use of technologies such as water electrolysis will enable generation of hydrogen with a cost 1.5 times higher and more.

- 3.

- Transportation and storage processes are the foils of the hydrocarbon energy sector [82]. An increase in the efficiency of the processes is related to the solution of two key issues: the transformation of hydrogen into a form with higher density (for example, liquefaction), and an increase in the safety of tanks and delivery systems. In addition, while the first problem already has some practical solutions, the issues of safe hydrogen handling have not yet been studied. However, nearly 70 mln t are produced, presently, and as a rule is used during the processing of metals.

4. Hydrocarbon Resources. Focus on LNG

4.1. The Role of Hydrocarbons in the Energy Sector

- There is no system for the international regulation of processes connected with the development of the traditional oil and gas sector, whether by increasing the effectiveness of internal processes or by integration with associated industries.

- Rapid depletion of the raw materials base of easy-to-recover reserves and, as a result, higher operating and investment costs. By some estimates, the refilling of reserve volumes trails behind the volumes of produced oil and gas resources by 20%–30% [85], which will lead to industrial stagnation and destabilization of the raw-material and associated markets in the long term.

- 3.

- The comparatively low level of oil recovery at multiple fields. The average value of the global recovery ratio is around 20%–40% [87]. In some cases, such rates are connected with the possibility of reorientation to new “effortless” reservoirs; however, such policies may become impracticable soon.

- 4.

- 5.

- The lack of commonly accepted indicators for assessment of oil and gas companies’ performance based on sustainable development principles [91]. For example, it is evident that using nuclear energy resources must be regulated and controlled at an international level. Due to this, it is not quite clear why hi-tech oil and gas industries bearing huge technological and environmental risks are completely self-regulated.

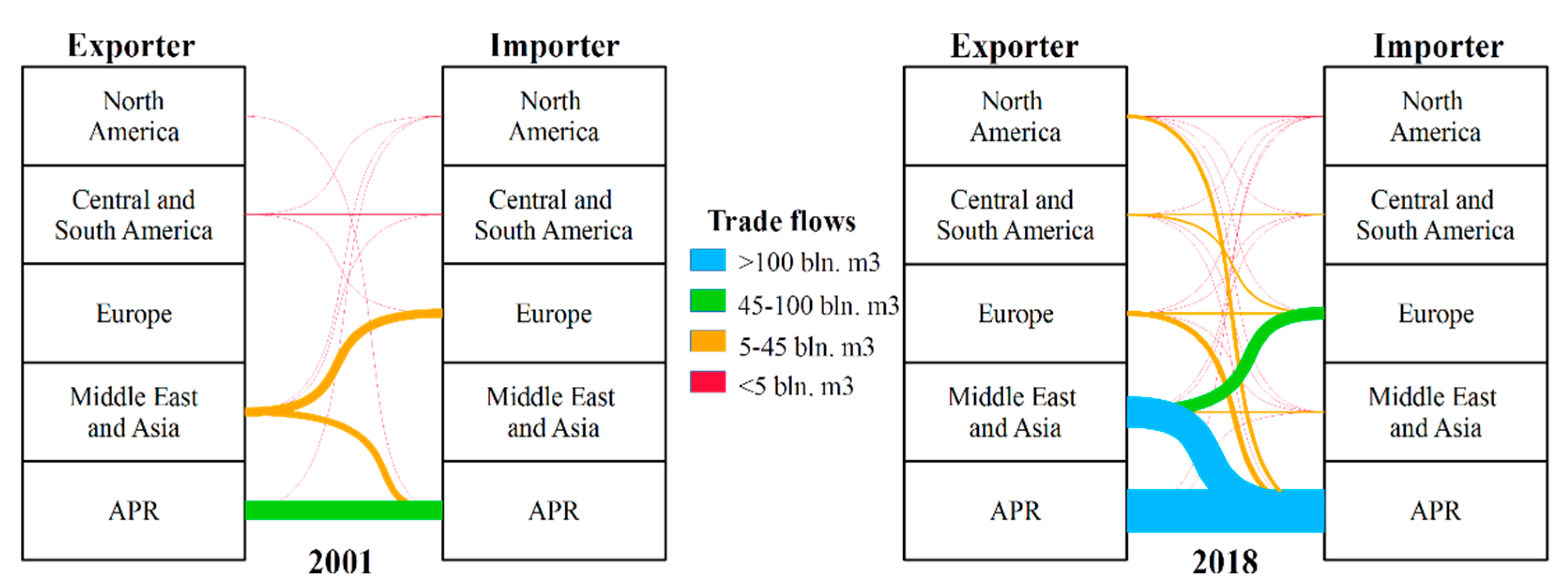

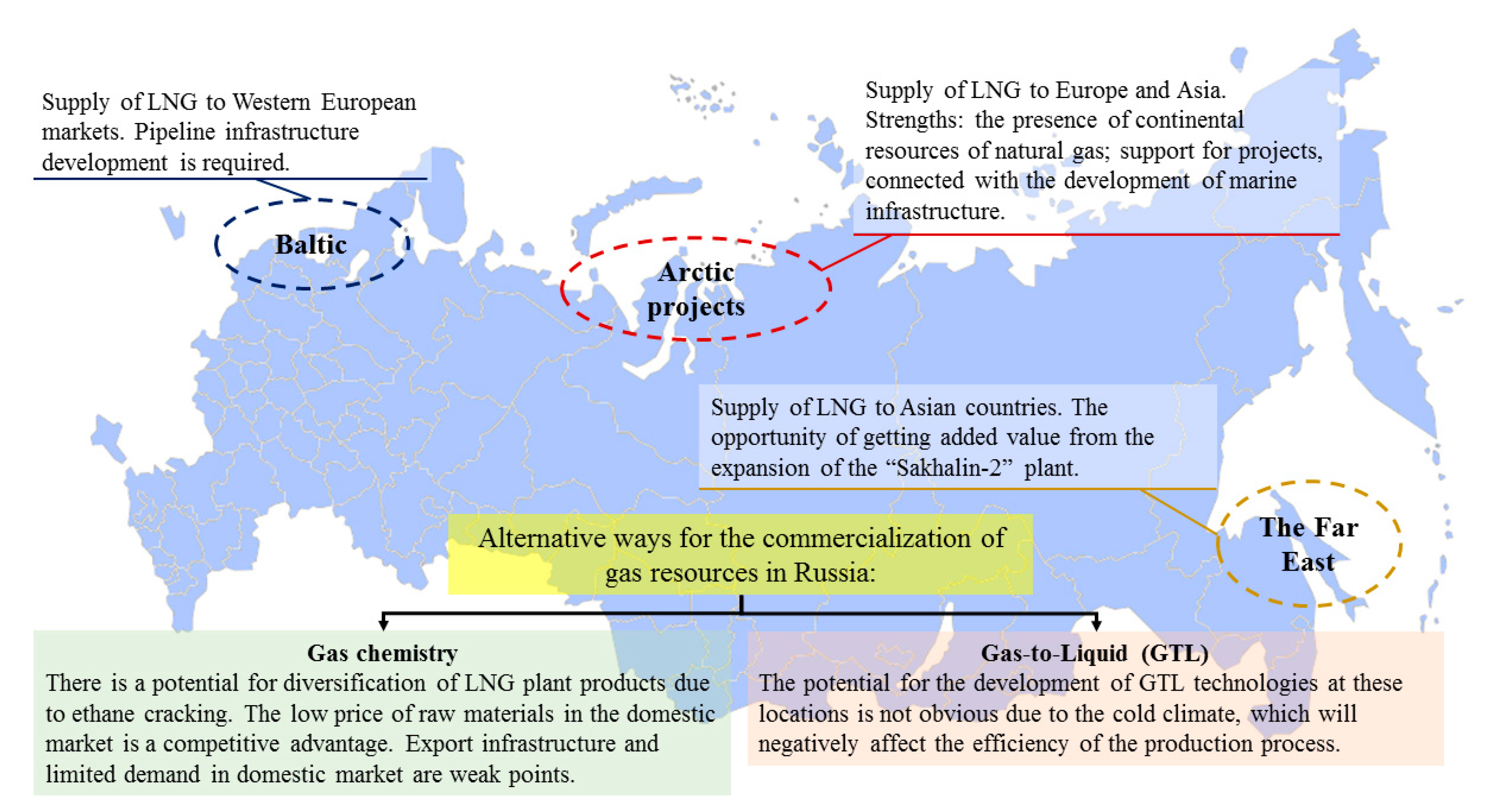

4.2. The Role of Russia in the Development of the LNG Industry

5. Conclusions and Discussion

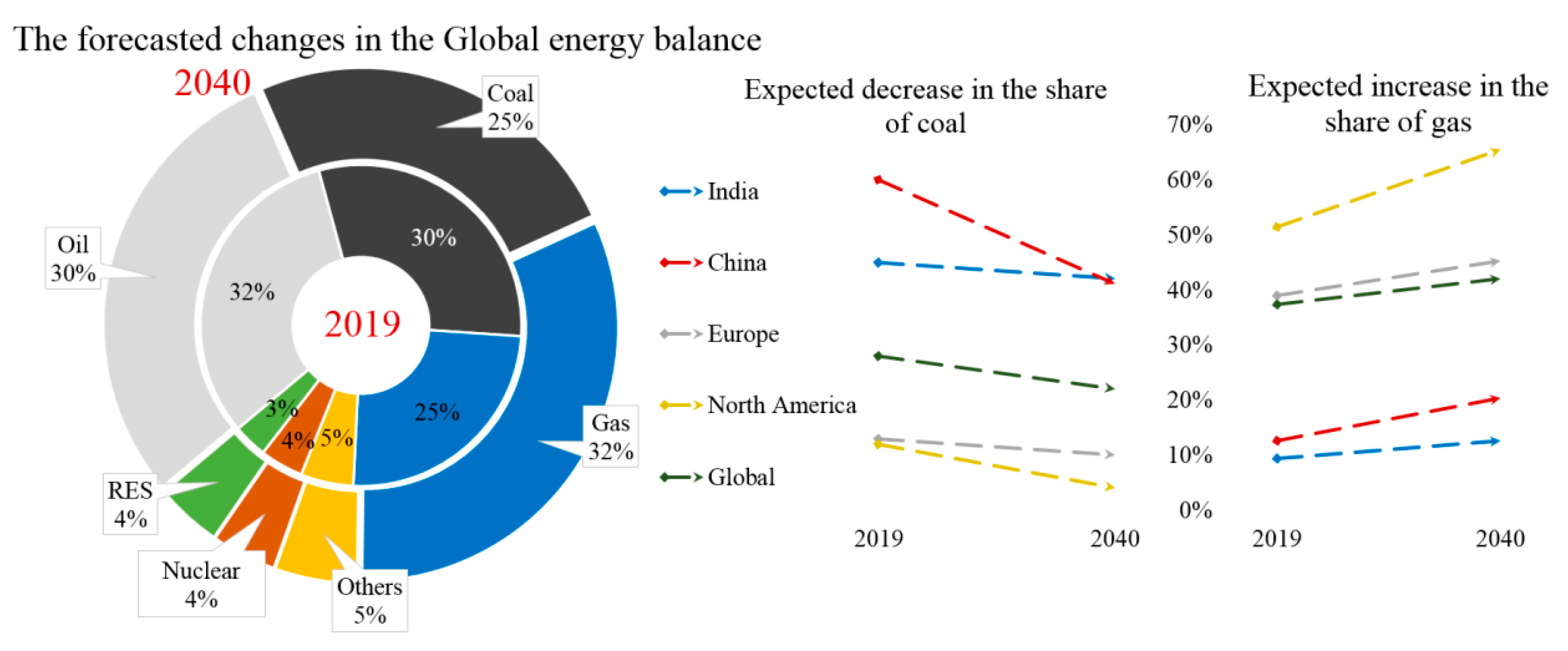

5.1. Global Energy Markets

- Today we face a paradoxical situation. International corporations and politicians calling for the need for an immediate transition from HCR to alternative energy technologies. However, the real activities of leading global economies show that they are not planning to decrease their footprint in the hydrocarbon energy sector and, moreover, they are expanding scientific and technical potential in geological surveying and the production of HCR.

- Environmental protection is one of the main barriers to sustainable development in the energy sector, which is unlikely to be eliminated within the next few decades due to our current level of technological development. The risk of climatic catastrophe is extremely high. At the same time, the lack of knowledge of the secondary theories of Global Warming mechanisms makes this issue even more complicated. On the one hand, we could have a chance to receive extra time to improve the environmental efficiency of our technologies. On the other hand, there is a risk that it is too late, and we will see the forecasted consequences much earlier than expected.

- The most promising alternative energy options include RES, nuclear energy, and hydrogen. Theoretically, each of these resources is able to solve the HCR environmental issue, but there are some concurrent critical disadvantages that prevent them from being a complete alternative in the observed future:

- -

- the majority of RES-based technologies will be non-competitive within the next ten to twenty years due to insufficient efficiency of energy conversion and storage processes;

- -

- the generation of nuclear energy is associated with significant risks of a mainly technical (environmental) nature, mitigation of which is impossible at present;

- -

- hydrogen itself is not an energy resource, as much as a method for storage and transportation of primary energy and its broad application requires a solution to safe-storage and transportation issues, a higher efficiency of production, the creation of new infrastructure and the development of market-interaction mechanisms.

- The global resource potential of the oil and gas industry as a whole is able to ensure the sustainable development of the world economy under the conditions of a better investment climate and the formation of an international regulation system for the sector. Here, special attention must be paid to ensuring good conditions for the development of hard-to-recover reserves in terms of geological and environmental factors.

- The vector for the development of oil and coal sector has shifted towards integration with the chemical industry to enable the diversification of sectoral enterprises activities, but their role in the energy sector will not be reduced within the next few decades.

- LNG production is the independent sector of the gas industry with the highest expansion potential in the long run. First of all, this can be attributed to the environmental and economical properties of LNG, which enable its consideration as a “win–win” solution for energy supply to satisfy even the strict requirements of European Union. Moreover, the flexibility of LNG logistic chains compared to pipelines is a very important factor.

5.2. The Role of Russia in the Development of the LNG Industry

Funding

Conflicts of Interest

References

- Lieder, M.; Rashid, A. Towards circular economy implementation: A comprehensive review in context of manufacturing industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Kan, A. General characteristics of waste management: A review. Energy Educ. Sci. Technol. Part A-Energy Sci. Res. 2009, 23, 55–69. [Google Scholar]

- Riaz, A.; Zahedi, G.; Klemeš, J.J. A review of cleaner production methods for the manufacture of methanol. J. Clean. Prod. 2013, 57, 19–37. [Google Scholar] [CrossRef]

- Loiseau, E.; Saikku, L.; Antikainen, R.; Droste, N.; Hansjürgens, B.; Pitkänen, K.; Leskinen, P.; Kuikman, P.; Thomsen, M. Green economy and related concepts: An overview. J. Clean. Prod. 2016, 139, 361–371. [Google Scholar] [CrossRef]

- Van der Ploeg, F.; Withagen, C. Global Warming and the Green Paradox: A Review of Adverse Effects of Climate Policies. Rev. Environ. Econ. Policy 2015, 9, 285–303. [Google Scholar] [CrossRef]

- Abas, N.; Kalair, A.; Khan, N. Review of fossil fuels and future energy technologies. Futures 2015, 69, 31–49. [Google Scholar] [CrossRef]

- Chu, S.; Majumdar, A. Opportunities and challenges for a sustainable energy future. Nature 2012, 488, 294–303. [Google Scholar] [CrossRef]

- INEOS Group website. Open Letter to the European Commission President Jean-Claude Juncker. Available online: https://www.ineos.com/news/ineos-group/letter-to-the-european-commission-president-jean-claude-juncker/ (accessed on 12 February 2019).

- Sandbag Climate Campaign CIC. Available online: https://ember-climate.org/carbon-price-viewer/ (accessed on 12 February 2019).

- Asmelash, H. The G7’s Pledge to End Fossil Fuel Subsidies by 2025: Mere Rhetoric or a Sign of Post-Paris Momentum? Eur. Soc. Int. Law (Esil) Reflect. 2016, 5, 1–7. [Google Scholar] [CrossRef]

- Whitley, S.; Chen, H.; Doukas, A.; Gençsü, I.; Gerasimchuk, I.; Touchette, Y.; Worrall, L. G7 Fossil Fuel Subsidy Scorecard; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2018; Available online: https://prod-edxapp.edx-cdn.org/assets/courseware/v1/0333e0d130fe95a336116caa1de2c98d/asset-v1:SDGAcademyX+CA001+1T2019+type@asset+block/6.R_Whitley__S__Chen__H__Doukas__A__et_al.__2018__G7_fossil_fuel_subsidy_scorecard._ODI_Report._London-_Overseas_Development_Institute.pdf (accessed on 12 February 2019).

- Burrows, L.; Kotani, I.; Zorlu, P.; Popp, R.; Patuleia, A.; Littlecott, C. G7 Coal Scorecard–Fifth Edition Coal Finance Heads for the Exit. 2019. Available online: https://www.jstor.org/stable/pdf/resrep21850.pdf (accessed on 12 February 2019).

- Department of Energy website. DOE Announces $3.8 Million Investment in New Methane Gas Hydrate Research. Available online: https://www.energy.gov/fe/articles/doe-announces-38-million-investment-new-methane-gas-hydrate-research (accessed on 12 September 2016).

- Maggio, G.; Cacciola, G. When will oil, natural gas, and coal peak? Fuel 2012, 98, 111–123. [Google Scholar] [CrossRef]

- Mohr, S.H.; Wang, J.; Ellem, G.; Ward, J.; Giurco, D. Projection of world fossil fuels by country. Fuel 2015, 141, 120–135. [Google Scholar] [CrossRef]

- Wang, J.; Feng, L.; Tang, X.; Bentley, Y.; Höök, M. The implications of fossil fuel supply constraints on climate change projections: A supply-side analysis. Futures 2017, 86, 58–72. [Google Scholar] [CrossRef]

- Dale, S. New economics of oil. ONE J. 2015, 1, 365. [Google Scholar]

- Makhovikov, A.B.; Katuntsov, E.V.; Kosarev, O.V.; Tsvetkov, P.S. Digital transformation in oil and gas extraction. In Proceedings of the Innovation-Based Development of the Mineral Resources Sector: Challenges and Prospects-11th conference of the Russian-German Raw Materials, Potsdam, Germany, 7–8 November 2018; pp. 531–538. [Google Scholar]

- Hoffert, M.I.; Caldeira, K.; Benford, G.; Criswell, D.R.; Green, C.; Herzog, H.; Jain, A.K.; Kheshgi, H.S.; Lackner, K.S.; Lewis, J.S.; et al. Advanced Technology Paths to Global Climate Stability: Energy for a Greenhouse Planet. Science 2002, 298, 981–987. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Masson-Delmotte, V.; Zhai, P.; Pörtner, H.O.; Roberts, D.; Skea, J.; Shukla, P.R.; Pirani, A.; Moufouma-Okia, W.; Péan, C.; Pidcock, R.; et al. Global warming of 1.5 C. In An IPCC Special Report on the Impacts of Global Warming of. 2018 October 8; IPCC: Geneva, Switzerland, 2018. [Google Scholar]

- Rogelj, J.; Den Elzen, M.; Höhne, N.; Fransen, T.; Fekete, H.; Winkler, H.; Schaeffer, R.; Sha, F.; Riahi, K.; Meinshausen, M. Paris Agreement climate proposals need a boost to keep warming well below 2 C. Nature 2016, 534, 631–639. [Google Scholar] [CrossRef] [Green Version]

- Steffen, W.; Rockström, J.; Richardson, K.; Lenton, T.M.; Folke, C.; Liverman, D.; Summerhayes, C.P.; Barnosky, A.D.; Cornell, S.E.; Crucifix, M.; et al. Trajectories of the Earth System in the Anthropocene. Proc. Natl. Acad. Sci. USA 2018, 115, 8252–8259. [Google Scholar] [CrossRef] [Green Version]

- Lenton, T.M.; Held, H.; Kriegler, E.; Hall, J.W.; Lucht, W.; Rahmstorf, S.; Schellnhuber, H.J. Tipping elements in the Earth’s climate system. Proc. Natl. Acad. Sci. USA 2008, 105, 1786–1793. [Google Scholar] [CrossRef] [Green Version]

- Schellnhuber, H.J.; Rahmstorf, S.; Winkelmann, R. Why the right climate target was agreed in Paris. Nat. Clim. Chang. 2016, 6, 649. [Google Scholar] [CrossRef]

- Jiang, X.; Guan, D. Determinants of global CO2 emissions growth. Appl. Energy 2016, 184, 1132–1141. [Google Scholar] [CrossRef] [Green Version]

- Sovacool, B.K. What are we doing here? Analyzing fifteen years of energy scholarship and proposing a social science research agenda. Energy Res. Soc. Sci. 2014, 1, 1–29. [Google Scholar] [CrossRef]

- Sundqvist, T. What causes the disparity of electricity externality estimates? Energy Policy 2004, 32, 1753–1766. [Google Scholar] [CrossRef]

- Berger, A. Milankovitch theory and climate. Rev. Geophys. 1988, 26, 624–657. [Google Scholar] [CrossRef] [Green Version]

- Hays, J.D.; Imbrie, J.; Shackleton, N.J. Variations in the Earth’s orbit: Pacemaker of the ice ages. Science 1976, 194, 1121–1132. [Google Scholar] [CrossRef] [PubMed]

- Fischer, T.P.; Arellano, S.; Carn, S.; Aiuppa, A.; Galle, B.; Allard, P.; Lopez, T.; Shinohara, H.; Kelly, P.; Werner, C.; et al. The emissions of CO2 and other volatiles from the world’s subaerial volcanoes. Sci. Rep. 2019, 9, 1–11. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Guo, M.; Li, J.; Xu, J.; Wang, X.; He, H.; Wu, L. CO2 emissions from the 2010 Russian wildfires using GOSAT data. Environ. Pollut. 2017, 226, 60–68. [Google Scholar] [CrossRef] [PubMed]

- Shvidenko, A.Z.; Shchepashchenko, D.G.; Vaganov, E.A.; Sukhinin, A.I.; Maksyutov, S.S.; McCallum, I.; Lakyda, I.P. Impact of wildfire in Russia between 1998–2010 on ecosystems and the global carbon budget. Dokl. Earth Sci. 2011, 441, 1678–1682. [Google Scholar] [CrossRef]

- Page, S.E.; Siegert, F.; Rieley, J.O.; Boehm, H.D.V.; Jaya, A.; Limin, S. The amount of carbon released from peat and forest fires in Indonesia during 1997. Nature 2002, 420, 61–65. [Google Scholar] [CrossRef]

- Hooijer, A.; Page, S.; Canadell, J.G.; Silvius, M.; Kwadijk, J.; Wosten, H.; Jauhiainen, J. Current and future CO2 emissions from drained peatlands in Southeast Asia. Biogeosciences 2010, 7, 1505–1514. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.T.A.; Jiang, H.; Dasgupta, R.; Torres, M. A Framework for Understanding Whole-Earth Carbon Cycling. In Deep Carbon: Past to Present; Cambridge University Press: Cambridge, UK, 2019; pp. 313–357. [Google Scholar]

- Petrescu, A.M.R.; Van Beek, L.P.H.; Van Huissteden, J.; Prigent, C.; Sachs, T.; Corradi, C.A.R.; Dolman, A.J. Modeling regional to global CH4 emissions of boreal and arctic wetlands. Global Biogeochemical Cycles 2010, 24. [Google Scholar] [CrossRef] [Green Version]

- Zhang, B.; Zhao, X.; Wu, X.; Han, M.; Guan, C.H.; Song, S. Consumption-Based Accounting of Global Anthropogenic CH4 Emissions. Earth’s Future 2018, 6, 1349–1363. [Google Scholar] [CrossRef]

- Tian, W.; Wu, X.; Zhao, X.; Ma, R.; Zhang, B. Quantifying global CH4 and N2O footprints. J. Environ. Manag. 2019, 251, 109566. [Google Scholar] [CrossRef]

- Bloom, A.A.; Bowman, K.W.; Lee, M.; Turner, A.J.; Schroeder, R.; Worden, J.R.; Weidner, R.; McDonald, K.C.; Jacob, D.J. A global wetland methane emissions and uncertainty dataset for atmospheric chemical transport models (WetCHARTs version 1.0). Geosci. Model Dev. 2017, 10. [Google Scholar] [CrossRef] [Green Version]

- Canadell, J.G.; Le Quéré, C.; Raupach, M.R.; Field, C.B.; Buitenhuis, E.T.; Ciais, P.; Conway, T.J.; Gillett, N.P.; Houghton, R.A.; Marland, G. Contributions to accelerating atmospheric CO2 growth from economic activity, carbon intensity, and efficiency of natural sinks. Proc. Natl. Acad. Sci. USA 2007, 104, 18866–18870. [Google Scholar] [CrossRef] [Green Version]

- Steffen, W.; Broadgate, W.; Deutsch, L.; Gaffney, O.; Ludwig, C. The trajectory of the Anthropocene: The great acceleration. Anthr. Rev. 2015, 2, 81–98. [Google Scholar] [CrossRef]

- Fouquet, R. Path dependence in energy systems and economic development. Nat. Energy 2016, 1, 1–5. [Google Scholar]

- Capros, P.; Tasios, N.; De Vita, A.; Mantzos, L.; Paroussos, L. Transformations of the energy system in the context of the decarbonisation of the EU economy in the time horizon to 2050. Energy Strategy Rev. 2012, 1, 85–96. [Google Scholar] [CrossRef]

- Brundtland, G.; Khalid, M.; Agnelli, S.; Al-Athel, S.A.; Chidzero, B.; Fadika, L.M.; Hauff, V.; Lang, I.; Ma, S.; Marino de Botero, M.; et al. Our Common Future: The World Commission on Environment and Development; Oxford University Press: London, UK, 1987. [Google Scholar]

- Glavič, P.; Lukman, R. Review of sustainability terms and their definitions. J. Clean. Prod. 2007, 15, 1875–1885. [Google Scholar] [CrossRef]

- Vijayaraghavan, A.; Dornfeld, D. Automated energy monitoring of machine tools. Cirp Ann. 2010, 59, 21–24. [Google Scholar] [CrossRef] [Green Version]

- Yoon, H.S.; Kim, E.S.; Kim, M.S.; Lee, J.Y.; Lee, G.B.; Ahn, S.H. Towards greener machine tools–A review on energy saving strategies and technologies. Renew. Sustain. Energy Rev. 2015, 48, 870–891. [Google Scholar] [CrossRef]

- Kobos, P.H.; Malczynski, L.A.; La Tonya, N.W.; Borns, D.J.; Klise, G.T. Timing is everything: A technology transition framework for regulatory and market readiness levels. Technol. Forecast. Soc. Chang. 2018, 137, 211–225. [Google Scholar] [CrossRef]

- Schmidt, T.S.; Sewerin, S. Technology as a driver of climate and energy politics. Nat. Energy 2017, 2, 17084. [Google Scholar] [CrossRef]

- Rogge, K.S.; Reichardt, K. Policy mixes for sustainability transitions: An extended concept and framework for analysis. Res. Policy 2016, 45, 1620–1635. [Google Scholar] [CrossRef]

- Meadowcroft, J. What about the politics? Sustainable development, transition management, and long term energy transitions. Policy Sci. 2009, 42, 323. [Google Scholar] [CrossRef]

- Abergel, T.; Brown, A.; Cazzola, P.; Dockweiler, S.; Dulac, J.; Fernandez Pales, A.; West, K. Energy Technology Perspectives 2017: Catalysing Energy Technology Transformations; OECD: Paris, France, 2017. [Google Scholar]

- Abergel, T.; Brown, A.; Cazzola, P.; Dockweiler, S.; Dulac, J.; Pales, A.F.; Gorner, M.; Malischek, R.; Masanet, E.R.; McCulloch, S.; et al. Energy technology perspectives 2017: Catalysing energy technology transformations. 2017. Available online: https://www.cleanenergyministerial.org/sites/default/files/2018-07/English-ETP-2017.pdf (accessed on 12 February 2019).

- IRENA. Global Energy Transformation: A Roadmap to 2050; IRENA: Abu Dhabi, UAE, 2019. [Google Scholar]

- Ram, M.; Child, M.; Aghahosseini, A.; Bogdanov, D.; Lohrmann, A.; Breyer, C. A comparative analysis of electricity generation costs from renewable, fossil fuel and nuclear sources in G20 countries for the period 2015-2030. J. Clean. Prod. 2018, 199, 687–704. [Google Scholar] [CrossRef]

- Saito, S. Role of nuclear energy to a future society of shortage of e nergy resources and global warming. J. Nucl. Mater. 2010, 398, 1–9. [Google Scholar] [CrossRef]

- International Atomic Energy Agency. Nuclear Power Reactors in the World; Reference Data Series No. 2; IAEA: Vienna, Austria, 2019. [Google Scholar]

- IEA. Nuclear Power in a Clean Energy System; IEA: Paris, France, 2019; Available online: https://www.iea.org/reports/nuclear-power-in-a-clean-energy-system (accessed on 12 February 2019).

- Lovering, J.R.; Yip, A.; Nordhaus, T. Historical construction costs of global nuclear power reactors. Energy Policy 2016, 91, 371–382. [Google Scholar] [CrossRef] [Green Version]

- Dittmar, M. Nuclear energy: Status and future limitations. Energy 2012, 37, 35–40. [Google Scholar] [CrossRef]

- Hossain, M.K.; Taher, M.A.; Das, M.K. Understanding Accelerator Driven System (ADS) Based Green Nuclear Energy: A Review. World J. Nucl. Sci. Technol. 2015, 5, 287. [Google Scholar] [CrossRef] [Green Version]

- Ojovan, M.I.; Lee, W.E.; Kalmykov, S.N. An Introduction to Nuclear Waste Immobilization; Elsevier: Amsterdam, The Netherland, 2019. [Google Scholar]

- Yaqoot, M.; Diwan, P.; Kandpal, T.C. Review of barriers to the dissemination of decentralized renewable energy systems. Renew. Sustain. Energy Rev. 2016, 58, 477–490. [Google Scholar] [CrossRef]

- Asdrubali, F.; Baldinelli, G.; D’Alessandro, F.; Scrucca, F. Life cycle assessment of electricity production from renewable energies: Review and results harmonization. Renew. Sustain. Energy Rev. 2015, 42, 1113–1122. [Google Scholar] [CrossRef]

- Cherepovitsyn, A.; Tcvetkov, P. Overview of the prospects for developing a renewable energy in Russia. In 2017 International Conference on Green Energy and Applications (ICGEA); IEEE: Piscataway, NJ, USA, 2017; pp. 113–117. [Google Scholar]

- Dincer, I.; Acar, C. A review on clean energy solutions for better sustainability. Int. J. Energy Res. 2015, 39, 585–606. [Google Scholar] [CrossRef]

- Tcvetkov, P.S. The history, present status and future prospects of the Russian fuel peat industry. Mires Peat 2017, 19, 1–12. [Google Scholar] [CrossRef]

- Tan, R.R.; Aviso, K.B.; Ng, D.K.S. Optimization models for financing innovations in green energy technologies. Renew. Sustain. Energy Rev. 2019, 113, 109258. [Google Scholar] [CrossRef]

- Sabihuddin, S.; Kiprakis, A.E.; Mueller, M. A numerical and graphical review of energy storage technologies. Energies 2015, 8, 172–216. [Google Scholar] [CrossRef]

- Argyrou, M.C.; Christodoulides, P.; Kalogirou, S.A. Energy storage for electricity generation and related processes: Technologies appraisal and grid scale applications. Renew. Sustain. Energy Rev. 2018, 94, 804–821. [Google Scholar] [CrossRef]

- Dutton, J.; Pilsner, L. Delivering Climate Neutrality: Accelerating Eu Decarbonisation with Research and Innovation Funding. 2019. Available online: https://www.jstor.org/stable/pdf/resrep21732.pdf (accessed on 12 February 2019).

- Cabré, M.M.; Gallagher, K.P.; Li, Z. Renewable Energy: The Trillion Dollar Opportunity for Chinese Overseas Investment. China World Econ. 2018, 26, 27–49. [Google Scholar] [CrossRef]

- Murdock, H.E.; Gibb, D.; André, T.; Appavou, F.; Brown, A.; Epp, B.; Kondev, B.; McCrone, A.; Musolino, E.; Ranalder, L.; et al. Renewables 2019 Global Status Report. Available online: https://www.ren21.net/wp-content/uploads/2019/05/gsr_2019_perspectives_en.pdf (accessed on 12 February 2019).

- Kemeny, T. Does foreign direct investment drive technological upgrading? World Dev. 2010, 38, 1543–1554. [Google Scholar] [CrossRef]

- Gielen, D.; Boshell, F.; Saygin, D.; Bazilian, M.D.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Abdalla, A.M.; Hossain, S.; Nisfindy, O.B.; Azad, A.T.; Dawood, M.; Azad, A.K. Hydrogen production, storage, transportation and key challenges with applications: A review. Energy Convers. Manag. 2018, 165, 602–627. [Google Scholar] [CrossRef]

- Hosseini, S.E.; Wahid, M.A. Hydrogen from solar energy, a clean energy carrier from a sustainable source of energy. Int. J. Energy Res. 2020, 4, 4110–4131. [Google Scholar] [CrossRef]

- Cetinkaya, E.; Dincer, I.; Naterer, G.F. Life cycle assessment of various hydrogen production methods. Int. J. Hydrog. Energy 2012, 37, 2071–2080. [Google Scholar] [CrossRef]

- Dincer, I.; Acar, C. Review and evaluation of hydrogen production methods for better sustainability. Int. J. Hydrog. Energy 2015, 1109, 4–11111. [Google Scholar] [CrossRef]

- Nikolaidis, P.; Poullikkas, A. A comparative overview of hydrogen production processes. Renew. Sustain. Energy Rev. 2017, 67, 597–611. [Google Scholar] [CrossRef]

- Acar, C.; Beskese, A.; Temur, G.T. Sustainability analysis of different hydrogen production options using hesitant fuzzy AHP. Int. J. Hydrog. Energy 2018, 43, 18059–18076. [Google Scholar] [CrossRef]

- MA, J.; LIU, S.; ZHOU, W.; PAN, X. Comparison of Hydrogen Transportation Methods for Hydrogen Refueling Station. J. Tongji Univ. (Nat. Sci. ) 2008, 5, 615–619. [Google Scholar]

- Acar, C.; Dincer, I. Review and evaluation of hydrogen production options for better environment. J. Clean. Prod. 2019, 218, 835–849. [Google Scholar] [CrossRef]

- Royal Dutch Shell plc. Shell LNG Outlook 2020. 2020. Available online: https://www.shell.com/energy-and-innovation/natural-gas/liquefied-natural-gas-lng/lng-outlook-2020.html#iframe=L3dlYmFwcHMvTE5HX291dGxvb2sv (accessed on 12 February 2019).

- Litvinenko, V.S.; Kozlov, A.V.; Stepanov, V.A. Hydrocarbon potential of the Ural–African transcontinental oil and gas belt. J. Pet. Explor. Prod. Technol. 2017, 7, 1–9. [Google Scholar] [CrossRef] [Green Version]

- Tullo, A.H. C&EN’s Global Top 50 chemical companies of 2018. Chem. Eng. News 2019, 30–35. Available online: https://cen.acs.org/content/dam/cen/97/30/WEB/globaltop50-2018.pdf (accessed on 12 February 2019).

- Muggeridge, A.; Cockin, A.; Webb, K.; Frampton, H.; Collins, I.; Moulds, T.; Salino, P. Recovery rates, enhanced oil recovery and technological limits. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2014, 372, 20120320. [Google Scholar] [CrossRef] [Green Version]

- Exxon Mobil Financial Operating Review. 2018. Available online: https://corporate.exxonmobil.com/-/media/Global/Files/annual-report/2018-Financial-and-Operating-Review.pdf (accessed on 12 February 2019).

- Litvinenko, V.S.; Sergeev, I.B. Innovations as a Factor in the Development of the Natural Resources Sector. Stud. Russ. Econ. Dev. 2019, 30, 637–645. [Google Scholar] [CrossRef]

- Cherepovitsyn, A.; Lipina, S.; Evseeva, O. Innovative approach to the development of mineral raw materials of the arctic zone of the Russian federation. Zap. Gorn. Inst. /J. Min. Inst. 2018, 232, 438. [Google Scholar] [CrossRef]

- Cherepovitsyn, A.; Ilinova, A.; Evseeva, O. Stakeholders management of carbon sequestration project in the state-business-society system. Zap. Gorn. Inst. /J. Min. Inst. 2019, 240, 731. [Google Scholar] [CrossRef] [Green Version]

- Nugent, D.; Sovacool, B.K. Assessing the lifecycle greenhouse gas emissions from solar PV and wind energy: A critical meta-survey. Energy Policy 2014, 65, 229–244. [Google Scholar] [CrossRef]

- Tcvetkov, P.; Cherepovitsyn, A.; Makhovikov, A. Economic assessment of heat and power generation from small-scale liquefied natural gas in Russia. Energy Rep. 2020, 6, 391–402. [Google Scholar] [CrossRef]

- VYGON. Consulting Global LNG Market: Illusory Glut. 2018. Available online: https://vygon.consulting/upload/iblock/486/vygon_consulting_lng_world_balance_en_executive_summary.pdf (accessed on 12 February 2019).

- Dudley, B. BP Statistical Review of World Energy 2019; British Petroleum: London, UK, 2019. [Google Scholar]

- Dudley, B. BP Statistical Review of World Energy 2020; British Petroleum: London, UK, 2020. [Google Scholar]

- Savcenko, K.; Hornby, G. The future of European gas after Groningen. S&P Global Platts. 2020. Available online: https://www.spglobal.com/platts/plattscontent/_assets/_files/en/specialreports/naturalgas/groningen-european-gas-report.pdf (accessed on 12 February 2019).

- Howell, N.; Pereira, R. LNG in Europe. Current Trends, the European LNG Landscape and Country Focus. Gaffney, Cline Associates. Available online: https://www.europeangashub.com/wp-content/uploads/2019/10/DM-_6044045-v1-Article_LNG_in_Europe_HOWELL_PEREIRA.pdf (accessed on 12 February 2019).

- IGU. Global Gas Report 2019; International Gas Union: Barcelona, Spain, 2019; Available online: https://www.wgc2021.org/wp-content/uploads/2019/04/LNG2019-IGU-World-LNG-report2019.pdf (accessed on 12 February 2019).

- GIIGNL. The LNG Industry. Annual Report 2019. Available online: https://giignl.org/sites/default/files/PUBLIC_AREA/Publications/giignl_annual_report_2019-compressed.pdf (accessed on 12 February 2019).

- Belova, M.; Kolbikova, E.; Timonin, I. Russia’s place ona global LNG map. OilGas J. 2019, 74–81. Available online: https://vygon.consulting/upload/iblock/3c6/OGJR_2019_04_small.pdf (accessed on 12 February 2019).

- S&P Global Platts. 2019 Review and 2020 Outlook. 2019. Available online: https://www.spglobal.com/platts/plattscontent/_assets/_files/en/specialreports/oil/platts_2020_outlook_report.pdf (accessed on 12 February 2019).

- McKinsey. Global gas and LNG Outlook to 2035. 2018. Available online: https://www.mckinsey.com/solutions/energy-insights/global-gas-lng-outlook-to-2035/~/media/3C7FB7DF5E4A47E393AF0CDB080FAD08.ashx (accessed on 12 February 2019).

- Henderson, J.; Yermakov, V. Russian LNG: Becoming a Global Force. Working Paper; Oxford Institute for Energy Studies: Oxford, UK, 2019; 37 p. [Google Scholar] [CrossRef]

- Hashimoto, H. 2020 Gas Market Outlook. In 434th Forum on Research Works; The Institute of Energy Economics: Tokyo, Japan; Available online: https://globallnghub.com/wp-content/uploads/2020/01/8787.pdf (accessed on 23 December 2019).

- IEEJ. EPRINC The Future of Asian LNG 2018 (The Road to Nagoya); The Institute of Energy Economics: Tokyo, Japan, 2018; Available online: https://eneken.ieej.or.jp/data/8140.pdf (accessed on 12 February 2019).

- IGU. Global Gas Report 2018; International Gas Union: Barcelona, Spain, 2018; Available online: https://www.snam.it/export/sites/snam-rp/repository/file/gas_naturale/global-gas-report/global_gas_report_2018.pdf (accessed on 12 February 2019).

- Althouse Group. Overview of the gas processing industry in Russia. 2019. Available online: https://althausgroup.ru/wp-content/uploads/2019/10/Analiz-rynka-produktov-gazopererabotki.pdf (accessed on 12 February 2019). (In Russian).

- Bilfinger Tebodin. The Russian Chemical Market; Market study report; The Embassy of the Kingdom of the Netherlands; Bilfinger Tebodin: Moscow, Russia, 2018; Available online: https://www.pronline.ru/Handlers/ShowRelisesFile.ashx?relizid=6998&num=2 (accessed on 12 February 2019).

- VYGON Consulting. Gas Chemistry of Russia. Part 1. Methanol: So far only plans. 2019. Available online: https://vygon.consulting/upload/iblock/f22/vygon_consulting_russian_methanol_industry_development.pdf (accessed on 12 February 2019). (In Russian).

- Gautier, D.L.; Bird, K.J.; Charpentier, R.R.; Grantz, A.; Houseknecht, D.W.; Klett, T.R.; Sørensen, K. Assessment of undiscovered oil and gas in the Arctic. Science 2009, 324, 1175–1179. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Viacheslav, Z.; Alina, I. Problems of unconventional gas resources production in arctic zone-Russia. Espacios 2018, 39, 42. [Google Scholar]

- Brecha, R.J. Logistic curves, extraction costs and effective peak oil. Energy Policy 2012, 51, 586–597. [Google Scholar] [CrossRef]

- Litvinenko, V.; Trushko, V.; Dvoinikov, M. Method of construction of an offshore drilling platform on the shallow shelf of the Arctic seas. Russian Patent 2704451 С1, 28 October 2019. (In Russian). [Google Scholar]

- Bumpus, A.; Comello, S. Emerging clean energy technology investment trends. Nat. Clim. Chang. 2017, 7, 382–385. [Google Scholar] [CrossRef]

- Kivimaa, P.; Kern, F. Creative destruction or mere niche support? Innovation policy mixes for sustainability transitions. Res. Policy 2016, 45, 205–217. [Google Scholar] [CrossRef] [Green Version]

- Schmidt, T.S.; Sewerin, S. Measuring the temporal dynamics of policy mixes–An empirical analysis of renewable energy policy mixes’ balance and design features in nine countries. Res. Policy 2019, 48, 103557. [Google Scholar] [CrossRef]

- Pickl, M.J. The renewable energy strategies of oil majors–From oil to energy? Energy Strategy Rev. 2019, 26, 100370. [Google Scholar] [CrossRef]

- Sovacool, B.K. How long will it take? Conceptualizing the temporal dynamics of energy transitions. Energy Res. Soc. Sci. 2016, 13, 202–215. [Google Scholar] [CrossRef] [Green Version]

- Peters, G.P. The’best available science’to inform 1.5 C policy choices. Nat. Clim. Chang. 2016, 6, 646. [Google Scholar] [CrossRef] [Green Version]

| Indicator | EO14 | EO15 | EO16 | EO17 | EO18 | EO19 |

|---|---|---|---|---|---|---|

| Proportion of HCR as primary energy sources in 2025, incl.: | ||||||

| oil, % | 30 | 30 | 30 | 30 | 31 | 31 |

| gas, % | 24 | 25 | 24 | 24 | 25 | 24 |

| coal, % | 30 | 29 | 27 | 27 | 25 | 24 |

| Proportion of HCR as primary energy sources in 2035, incl.: | ||||||

| oil, % | 27 | 28 | 29 | 29 | 29 | 29 |

| gas, % | 26 | 27 | 26 | 25 | 27 | 26 |

| coal, % | 27 | 27 | 25 | 24 | 22 | 21 |

| Aggregate consumption of energy resources in 2035, bln toe | 17.6 | 17.5 | 17.3 | 17.2 | 17.1 | 17 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Litvinenko, V. The Role of Hydrocarbons in the Global Energy Agenda: The Focus on Liquefied Natural Gas. Resources 2020, 9, 59. https://doi.org/10.3390/resources9050059

Litvinenko V. The Role of Hydrocarbons in the Global Energy Agenda: The Focus on Liquefied Natural Gas. Resources. 2020; 9(5):59. https://doi.org/10.3390/resources9050059

Chicago/Turabian StyleLitvinenko, Vladimir. 2020. "The Role of Hydrocarbons in the Global Energy Agenda: The Focus on Liquefied Natural Gas" Resources 9, no. 5: 59. https://doi.org/10.3390/resources9050059

APA StyleLitvinenko, V. (2020). The Role of Hydrocarbons in the Global Energy Agenda: The Focus on Liquefied Natural Gas. Resources, 9(5), 59. https://doi.org/10.3390/resources9050059