Family Business and Transaction Exposure

Abstract

1. Introduction

It is sometimes argued that translation exposure is unimportant and that firms should not attempt to hedge this form of exchange rate risk. The reasoning underlying this view is that the exchange rate movement, relative to the currency of the home country, does not reduce the foreign currency profitability of the overseas investment. (P. 2)

2. Literature Review

3. Hypothesis Development

3.1. Transaction Exposure and the Foreign Environment

3.2. Transaction Exposure and Family-Business Affiliations

4. Methodology and Research Model

4.1. Data and Sample

4.2. Research Model

4.2.1. Dependent Variable (Level of Hedging)

4.2.2. Independent Variables

4.2.3. Control Variables

5. Analysis and Results

5.1. Descriptive Analysis

5.1.1. The Independent Variable—The Level of Hedging

5.1.2. The Dependent Variable—The Degree of Involvement in the Foreign Environment

5.1.3. The Dependent Variable—A Firm Being Affiliated to a Family Business

5.1.4. Control Variable—Firm Size

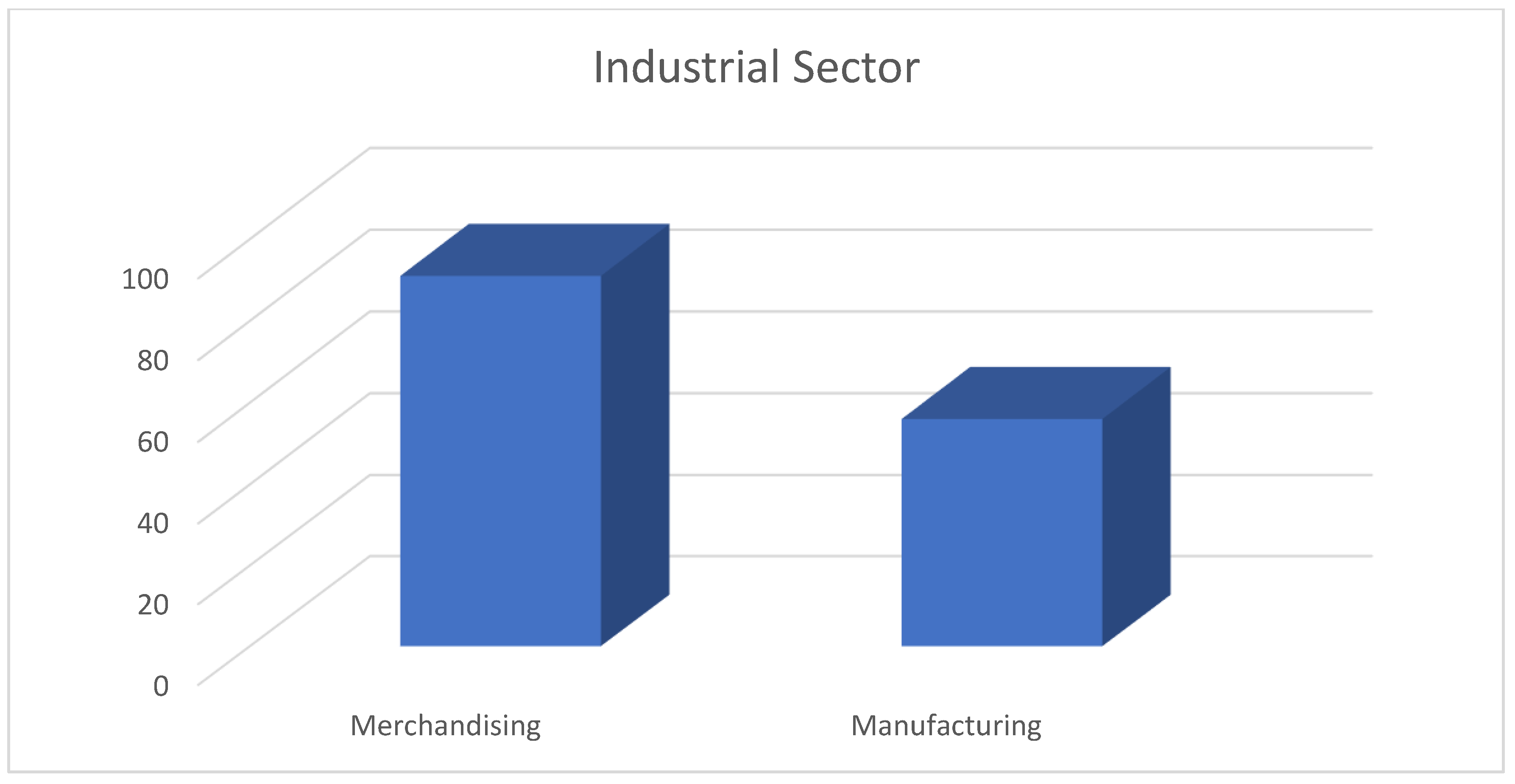

5.1.5. Control Variable—Nature of Business

5.2. Correlation Results

5.3. Hypothesis Testing

5.4. Robustness

6. Discussion and Conclusions, Implications, Limitations, and Further Studies

6.1. Discussion and Conclusions: Open Innovation of Family Business

6.2. Implications and Recommendations for Further Research

6.3. Limitations

Author Contributions

Funding

Conflicts of Interest

Appendix A. The Multicollinearity Test Results (VIF Values)

| Coefficients | |||||||

|---|---|---|---|---|---|---|---|

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | Collinearity Statistics | ||

| B | Std. Error | Beta | Tolerance | VIF | |||

| (Constant) | 1.131 | 0.772 | 1.465 | 0.145 | |||

| Industr | −0.392 | 0.390 | −0.151 | −1.007 | 0.316 | 0.249 | 4.015 |

| size | 0.072 | 0.042 | 0.147 | 1.743 | 0.084 | 0.784 | 1.275 |

| Fpurchas | 0.134 | 0.055 | 0.311 | 2.444 | 0.016 | 0.346 | 2.894 |

| Fsales | 0.128 | 0.055 | 0.248 | 2.345 | 0.020 | 0.499 | 2.003 |

| Fdebt | −0.013 | 0.056 | −0.018 | −0.239 | 0.812 | 0.942 | 1.061 |

| Listed | 0.127 | 0.353 | 0.047 | 0.361 | 0.718 | 0.326 | 3.067 |

| family | 0.684 | 0.227 | 0.266 | 3.008 | 0.003 | 0.719 | 1.392 |

Appendix B. Binary Logistic Regression

| Variables in the Equation | |||||||

|---|---|---|---|---|---|---|---|

| B | S.E. | Wald | df | Sig. | Exp(B) | ||

| Step 1 a | family | 2.188 | 0.456 | 23.018 | 1 | 0.000 | 8.914 |

| Constant | −2.005 | 0.403 | 24.810 | 1 | 0.000 | 0.135 | |

| Score | df | Sig. | |||

|---|---|---|---|---|---|

| Step 1 | Variables | Industr | 0.068 | 1 | 0.795 |

| size | 1.818 | 1 | 0.178 | ||

| Fpurchas | 0.768 | 1 | 0.381 | ||

| Fsales | 1.814 | 1 | 0.178 | ||

| Fdebt | 1.381 | 1 | 0.240 | ||

| Overall Statistics | 10.442 | 5 | 0.064 | ||

References

- Central Bank of Kuwait. 2020. Available online: https://www.cbk.gov.kw/en/monetary-policy/exchange-rate-policy (accessed on 10 March 2020).

- Eiteman, D.; Stonehill, A.; Moffett, M.H. Multinational Business Finance, 10th ed.; Addison-Wesley: London, UK, 2003. [Google Scholar]

- Shapiro, A. Multinational Financial Management, 6th ed.; Wiley: New York, NY, USA, 1999. [Google Scholar]

- Chow, E.H.; Lee, W.Y.; Solt, M.E. The economic exposure of US multinational firms. J. Financ. Res. 1997, 20, 191–210. [Google Scholar] [CrossRef]

- World Bank Data. 2018. Available online: https://tcdata360.worldbank.org/countries/KWT?indicator=1541&countries=BRA&viz=line_chart&years=1970,2018&country=KWT (accessed on 18 March 2020).

- Bartov, E.; Bodnar, G.M.; Kaul, A. Exchange rate variability and the riskiness of US multinational firms: Evidence from the breakdown of the Bretton Woods system. J. Financ. Econ. 1996, 42, 105–132. [Google Scholar] [CrossRef]

- Redhead, K. Exchange rate risk management—Part 2. Credit Control 2001, 22, 26. [Google Scholar]

- Grant, R.; Soenen, L. Strategic management of operating exposure. Eur. Manag. J. 2004, 22, 53–62. [Google Scholar] [CrossRef]

- Pramborg, B. Derivatives hedging, geographical diversification, and firm market value. J. Multinatl. Financ. Manag. 2004, 14, 117–133. [Google Scholar] [CrossRef]

- Hagelin, N.; Pramborg, B. Hedging foreign exchange exposure: Risk reduction from transaction and translation hedging. J. Int. Manag. Account. 2004, 15, 1–20. [Google Scholar] [CrossRef]

- Belk, P.; Glaum, M. The management of foreign exchange risk in UK multinationals: An empirical investigation. Account. Bus. Res. 1990, 21, 3–13. [Google Scholar] [CrossRef]

- Batten, J.; Mellor, R.; Wan, V. Foreign exchange risk management practices and products used by Australian firms. J. Int. Bus. Stud. 1993, 24, 557–573. [Google Scholar] [CrossRef]

- Fatimi, A.; Glaum, M. Risk management practices of German firms. Manag. Financ. 2000, 26, 1–16. [Google Scholar] [CrossRef]

- Kuwait Stock Exchange. 2020. Available online: https://www.boursakuwait.com.kw/market-participants/listed-companies (accessed on 15 March 2020).

- Geczy, C.; Minton, B.; Schrand, C. Why firms use currency derivatives. J. Financ. 1997, 52, 1323–1354. [Google Scholar] [CrossRef]

- Graham, J.R.; Rogers, D.A. Do firms hedge in response to tax incentives? J. Financ. 2002, 57, 815–839. [Google Scholar] [CrossRef]

- Allayannis, G.; Ofek, E. Exchange rate exposure, hedging, and the use of foreign currency derivatives. J. Int. Money Financ. 2001, 20, 273–296. [Google Scholar] [CrossRef]

- Chiang, Y.C.; Hui-Ju, L.I.N. The use of foreign currency derivatives and foreign-denominated debts to reduce exposure to exchange rate fluctuations. Int. J. Manag. 2005, 22, 598. [Google Scholar]

- Judge, A. Hedging and the use of derivatives: Evidence from UK non-financial firms. SSRN Electron. J. 2002. [Google Scholar] [CrossRef]

- Bartram, S.M.; Brown, G.W.; Fehle, F.R. International evidence on financial derivatives usage. Financ. Manag. 2009, 38, 185–206. [Google Scholar] [CrossRef]

- Zhang, H. Effect of derivative accounting rules on corporate risk-management behavior. J. Account. Econ. 2009, 47, 244–264. [Google Scholar] [CrossRef]

- Allayannis, G.; Lel, U.; Miller, D.P. The use of foreign currency derivatives, corporate governance, and firm value around the world. J. Int. Econ. 2012, 87, 65–79. [Google Scholar] [CrossRef]

- Belghitar, Y.; Clark, E.; Mefteh, S. Foreign currency derivative use and shareholder value. Int. Rev. Financ. Anal. 2013, 29, 283–293. [Google Scholar] [CrossRef]

- Bae, S.C.; Kim, H.S.; Kwon, T.H. Currency derivatives for hedging: New evidence on determinants, firm risk, and performance. J. Futur. Mark. 2018, 38, 446–467. [Google Scholar] [CrossRef]

- Shehata, N.F. Assessment of corporate governance disclosure in the GCC countries using the UNCTAD ISAR benchmark. J. Dev. Areas 2016, 50, 453–460. [Google Scholar] [CrossRef]

- Al-Qahtani, A.K. The development of accounting regulation in the GCC: Western hegemony or recognition of peculiarity? Manag. Audit. J. 2005, 20, 217–226. [Google Scholar] [CrossRef]

- Saidi, N.H. Corporate Governance in MENA Countries: Improving Transparency and Disclosure; No. 113238; The Lebanese Transparency Association: Baadba, Lebanon, 2004; pp. 1–129. [Google Scholar]

- Gulf News. Better Governed Stae-Owned Enterprises to Drive Gulf Growth. 2017. Available online: https://gulfnews.com/business/banking/better-governed-state-owned-enterprises-to-drive-gulf-growth-1.1006936 (accessed on 25 January 2017).

- Jorion, P. The exchange rate exposure of US multinationals. J. Bus. 1990, 63, 331–345. [Google Scholar] [CrossRef]

- Bradley, K.; Moles, P. The effect of exchange rate movements on non-financial UK firms. Int. Bus. Rev. 2001, 10, 51–69. [Google Scholar] [CrossRef]

- Allayannis, G.; Weston, J. The use of foreign currency derivatives and firm market value. Rev. Financ. Stud. 2001, 14, 243–276. [Google Scholar] [CrossRef]

- Chan, K.F.; Gan, C.; McGraw, P.A. A hedging strategy for New Zealand’s exporters in transaction exposure to currency risk. Multinatl. Financ. J. 2003, 7, 25–54. [Google Scholar] [CrossRef]

- Guay, W.; Kothari, S.P. How much do firms hedge with derivatives? J. Financ. Econ. 2003, 70, 423–461. [Google Scholar] [CrossRef]

- Jin, Y.; Jorion, P. Firm value and hedging: Evidence from US oil and gas producers. J. Financ. 2006, 61, 893–919. [Google Scholar] [CrossRef]

- Karoui, A. The correlation between FX rate volatility and stock exchange returns volatility: An emerging markets overview. SSRN Electron. J. 2006. [Google Scholar] [CrossRef]

- Dominguez, K.M.; Tesar, L.L. Exchange rate exposure. J. Int. Econ. 2006, 68, 188–218. [Google Scholar] [CrossRef]

- Bartram, S.M.; Brown, G.W.; Conrad, J. The effects of derivatives on firm risk and value. J. Financ. Quant. Anal. 2011, 46, 967–999. [Google Scholar] [CrossRef]

- Gómez-González, J.E.; León Rincón, C.E.; Leiton Rodríguez, K.J. Does the use of foreign currency derivatives affect firms’ market value? Evidence from Colombia. Emerg. Mark. Financ. Trade 2012, 48, 50–66. [Google Scholar] [CrossRef]

- Kang, S.; Kim, S.; Lee, J.W. Reexamining the exchange rate exposure puzzle by classifying exchange rate risks into two types. Glob. Econ. Rev. 2016, 45, 116–133. [Google Scholar] [CrossRef]

- Cheng, R.Y.S.; Chu, E.Y.; Song, S.I.; Lai, T.S. Impacts of Foreign Currency Exposure on Malaysia’s Firm Value: Firm Value, Hedging and Corporate Governance Perspectives. Glob. Bus. Manag. Res. 2017, 9, 206–220. [Google Scholar]

- Parlapiano, F.; Alexeev, V.; Dungey, M. Exchange rate risk exposure and the value of European firms. Eur. J. Financ. 2017, 23, 111–129. [Google Scholar] [CrossRef]

- Sato, K.; Shimizu, J. International use of the renminbi for invoice currency and exchange risk management: Evidence from the Japanese firm-level data. N. Am. J. Econ. Financ. 2018, 46, 286–301. [Google Scholar] [CrossRef]

- Sikarwar, E. Exchange rate fluctuations and firm value: Impact of global financial crisis. J. Econ. Stud. 2018, 45, 1145–1158. [Google Scholar] [CrossRef]

- Andrikopoulos, A.; Dassiou, X.; Zheng, M. Exchange-rate exposure and Brexit: The case of FTSE, DAX and IBEX. Int. Rev. Financ. Anal. 2020, 68, 101437. [Google Scholar] [CrossRef]

- Bodnar, G.; Gebhardt, G. Derivatives usage in risk management by US and German non-financial firms: A comparative survey. J. Int. Manag. Account. 1999, 10, 153–187. [Google Scholar] [CrossRef]

- Glaum, M. The determinants of selective exchange risk management, evidence from German non-financial corporations. J. Appl. Corp. Financ. 2002, 14, 108–121. [Google Scholar] [CrossRef]

- Salifu, Z.; Osei, K.A.; Adjasi, C.K. Foreign exchange risk exposure of listed companies in Ghana. J. Risk Financ. 2007, 8, 380–393. [Google Scholar] [CrossRef]

- Lane, P.R.; Shambaugh, J.C. The long or short of it: Determinants of foreign currency exposure in external balance sheets. J. Int. Econ. 2010, 80, 33–44. [Google Scholar] [CrossRef]

- Clark, E.; Mefteh, S. Asymmetric foreign currency exposures and derivatives use: Evidence from France. J. Int. Financ. Manag. Account. 2011, 22, 27–45. [Google Scholar] [CrossRef]

- Yip, W.H.; Nguyen, H. Exchange rate exposure and the use of foreign currency derivatives in the Australian resources sector. J. Multinatl. Financ. Manag. 2012, 22, 151–167. [Google Scholar] [CrossRef]

- Ito, T.; Koibuchi, S.; Sato, K.; Shimizu, J. Exchange rate exposure and risk management: The case of Japanese exporting firms. J. Jpn. Int. Econ. 2016, 41, 17–29. [Google Scholar] [CrossRef]

- Šimáková, J. The impact of exchange rate movements on firm value in Visegrad countries. Acta Univ. Agric. Silvic. Mendel. Brun. 2017, 65, 2105–2111. [Google Scholar] [CrossRef]

- Harris, T.S.; Rajgopal, S. Foreign currency: Accounting, communication and management of risks. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Thorbecke, W. The exposure of US manufacturing industries to exchange rates. Int. Rev. Econ. Financ. 2018, 58, 538–549. [Google Scholar] [CrossRef]

- Glen, J.; Jorion, P. Currency hedging for international portfolios. J. Financ. 1993, 48, 1865–1886. [Google Scholar] [CrossRef]

- Berkman, H.; Bradbury, M. Empirical evidence on the corporate use of derivatives. Financ. Manag. 1996, 25, 5–13. [Google Scholar] [CrossRef]

- Morey, M.M.; Simpson, M.W. To hedge or not to hedge: The performance of simple strategies for hedging foreign exchange risk. J. Multinatl. Financ. Manag. 2001, 11, 213–223. [Google Scholar] [CrossRef]

- Lioui, A.; Poncet, P. Optimal currency risk hedging. J. Int. Money Financ. 2002, 21, 241–264. [Google Scholar] [CrossRef]

- Moosa, I. Is there a need for hedging exposure to foreign exchange risk. Appl. Financ. Econ. 2004, 14, 279–283. [Google Scholar] [CrossRef]

- Benson, K.; Faff, A. The relationship between exchange rate exposure, currency risk management and performance of international equity funds. Pac. -Basin Financ. J. 2004, 12, 333–357. [Google Scholar] [CrossRef]

- Huffman, S.P.; Makar, S.D. The effectiveness of currency-hedging techniques over multiple return horizon for foreign-denominated debt issuers. J. Multinatl. Financ. Manag. 2004, 14, 105–115. [Google Scholar] [CrossRef]

- Bodnar, G.M.; Consolandi, C.; Gabbi, G.; Jaiswal-Dale, A. A Survey on Risk Management and Usage of Derivatives by Non-Financial Italian Firms; CAREFIN Research Paper No. 7/08; CAREFIN: Milan, Italy, 2008. [Google Scholar]

- Anand, M.; Kaushik, K.P. Currency derivatives: A survey of Indian firms. IIMB Manag. Rev. 2008, 20, 324–339. [Google Scholar]

- Al-Shboul, M.; Alison, S. The effects of the use of corporate derivatives on the foreign exchange rate exposure. J. Account. Bus. Manag. 2009, 16, 72–92. [Google Scholar]

- Vivel-Búa, M.; Otero-González, L.; Fernández-López, S.; Durán-Santomil, P. Why hedge currency exposure with foreign currency debt? Acad. Rev. Latinoam. Adm. 2013, 26, 258–289. [Google Scholar] [CrossRef]

- Stulz, R. Optimal hedging policies. J. Financ. Quant. Anal. 1984, 19, 127–140. [Google Scholar] [CrossRef]

- Smith, C.; Stulz, R. The determinants of firm’s hedging policy. J. Financ. 1985, 20, 391–405. [Google Scholar]

- Froot, K.; Scharfstein, D.; Stein, J.C. Risk management: Coordinating corporate investment and financing policies. J. Financ. 1993, 48, 1629–1658. [Google Scholar] [CrossRef]

- Casprini, E.; De Massis, A.; Di Minin, A.; Frattini, F.; Piccalnga, A. How Family Firms Execute Open Innovation Strategies: The Loccioni Case. J. Knowl. Manag. 2007, 21, 1459–1485. [Google Scholar] [CrossRef]

- De Massis, A.; Frattini, F.; Lichtenthaler, U. Research on Technological Innovation in Family Firms: Present Debates and Future Directions. Fam. Bus. Rev. 2013, 26, 10–31. [Google Scholar] [CrossRef]

- Alberti, F.G.; Ferrario, S.; Papa, F.; Pizzurno, E. Search breadth, open innovation and family firms: Evidences in Italian mid–high tech SMEs. Int. J. Technol. Intell. Plan. 2014, 10, 29–48. [Google Scholar] [CrossRef]

- Van de Vrande, V.; de Jong, J.P.; Vanhaverbeke, W.; De Rochemont, M. Open innovation in SMEs: Trends, motives and management challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef]

- Chiaroni, D.; Chiesa, V.; Frattini, F. Unravelling the process from Closed to Open Innovation: Evidence from mature, asset-intensive industries. RD Manag. 2010, 40, 222–245. [Google Scholar] [CrossRef]

- Yun, J.J.; Jeong, E.; Lee, Y.; Kim, K. The Effect of Open Innovation on Technology Value and Technology Transfer: A Comparative Analysis of the Automotive, Robotics, and Aviation Industries of Korea. Sustainability 2018, 10, 2459. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Yun, J.J.; Lee, M.; Park, K.; Zhao, X. Open Innovation and Serial Entrepreneurs. Sustainability 2019, 11, 5055. [Google Scholar] [CrossRef]

- Kim, C.Y.; Lim, M.S.; Yoo, J.W. Ambidexterity in External Knowledge Search Strategies and Innovation Performance: Mediating Role of Balanced Innovation and Moderating Role of Absorptive Capacity. Sustainability 2019, 11, 5111. [Google Scholar] [CrossRef]

- Yun, J.J.; Park, K.; Gaudio, G.D.; Corte, V.D. Open innovation ecosystems of restaurants: Geographical economics of successful restaurants from three cities. Eur. Plan. Stud. 2020, 1–20. [Google Scholar] [CrossRef]

- Mohapatra, S.M. A comparison of exchange rate exposure between manufacturing vis-à-vis service sector firms in India. Econ. Pap. 2017, 36, 75–85. [Google Scholar] [CrossRef]

- Wahab, A.A.; Rahim, R.A.; Janor, H. Role of foreign exchange exposure in determining hedging oractises in Malaysia. Int. J. Econ. Manag. 2019, 13, 79–91. [Google Scholar]

- Solakoglu, M.N. Exchange rate exposure and firm-specific factors. J. Econ. Soc. Res. 2005, 7, 36–46. [Google Scholar]

- Nimer, K. Exchange Rate Risk Management in the Developing Countries: The Case of Jordan. Ph.D. Thesis, Manchester Metropolitan University, Manchester, UK, 2005. [Google Scholar]

- Tanha, H.; Dempsey, M. Derivatives usage in emerging markets following the GFC: Evidence from the GCC countries. Emerg. Mark. Financ. Trade 2017, 53, 170–179. [Google Scholar] [CrossRef]

- Flood, E.; Lessard, D. On the measurement of operating exposure to exchange rates: A conceptual approach. J. Financ. Manag. 1986, 15, 25–36. [Google Scholar] [CrossRef]

- Booth, L.; Rotenberg, W. Assessing foreign exchange exposure: Theory and application using Canadian firms. J. Int. Financ. Manag. Account. 1990, 2, 1–22. [Google Scholar] [CrossRef]

- Doukas, J.A.; Hall, P.H.; Lang, L.H. Exchange rate exposure at the firm and industry level. Financ. Mark. Inst. Instrum. 2003, 12, 291–346. [Google Scholar] [CrossRef]

- Chow, E.H.; Chen, H.L. The determinants of foreign exchange rate exposure: Evidence on Japanese firms. Pac. -Basin Financ. J. 1998, 6, 153–174. [Google Scholar] [CrossRef]

- Shin, H.; Soenen, L. Exposure to currency risk by US multinational corporations. J. Multinatl. Financ. Manag. 1999, 9, 195–207. [Google Scholar] [CrossRef]

- Mahadevan, S. An empirical analysis of foreign exchange exposure of CNX 100 companies. Int. J. Financ. Manag. 2017, 7, 1–9. [Google Scholar] [CrossRef]

- Bradley, K.; Moles, P. Managing strategic exchange rate exposures: Evidence from UK firms. Manag. Financ. 2002, 28, 28–42. [Google Scholar] [CrossRef]

- Williamson, R. Exchange rate exposure and competitive: Evidence from the automotive industry. J. Financ. Econ. 2001, 59, 441–475. [Google Scholar] [CrossRef]

- Nguyen, H.; Faff, R. Can the use of foreign currency derivatives explain variations in foreign exchange exposure? Evidence from Australian companies. J. Multinatl. Financ. Manag. 2003, 13, 193–215. [Google Scholar] [CrossRef]

- Lin, L.; Lee, C.I. Unmasking the relationships between exchange rate exposure and its determinants: A more complete picture from quantile regressions. Rev. Pac. Basin Financ. Mark. Policies 2017, 20, 1750023. [Google Scholar] [CrossRef]

- Goswami, G.; Shrikhande, M.M. Economic exposure and debt financing choice. J. Multinatl. Financ. Manag. 2001, 11, 39–58. [Google Scholar] [CrossRef]

- Gelos, R. Foreign currency debt in emerging markets: Firm-level evidence from Mexico. Econ. Lett. 2003, 78, 323–327. [Google Scholar] [CrossRef]

- Kedia, S.; Mozumdar, A. Foreign currency denominated debt: An empirical investigation. J. Bus. 2003, 76, 521–546. [Google Scholar] [CrossRef]

- Elliott, W.B.; Huffman, S.P.; Makar, S.D. Foreign-denominated debt and foreign currency derivatives: Complements or substitutes in hedging foreign currency risk. J. Multinatl. Financ. Manag. 2003, 13, 123–139. [Google Scholar] [CrossRef]

- Júnior, J.L.R. Exchange rate exposure, foreign currency debt, and the use of derivatives: Evidence from Brazil. Emerg. Mark. Financ. Trade 2011, 47, 67–89. [Google Scholar] [CrossRef]

- Hodder, J.E. Exposure to exchange-rate movements. J. Int. Econ. 1982, 13, 375–386. [Google Scholar] [CrossRef]

- KPMG. GCC Family Business Survey 2017. 2018. Available online: https://assets.kpmg/content/dam/kpmg/bh/pdf/gcc-family-business-survey-2017.pdf (accessed on 9 February 2020).

- PWC. Middle East Family Business Survey 2019. Available online: https://www.pwc.com/m1/en/publications/middle-east-family-business-survey.html (accessed on 9 February 2020).

- Claessens, S.; Djankov, S.; Fan, J.P.H.; Lang, L.H.P. The Costs of Group Affiliation: Evidence from East Asia; World Bank: Washington, DC, USA, 2000. [Google Scholar]

- Patrick, H. Corporate governance, ownership structure and financial crisis: Experience of East Asian countries. In Proceedings of the KDIC International Financial Symposium, Seoul, Korea, 11 December 2001. [Google Scholar]

- Nimer, K.; Al-Oqda, S.; Al-Atar, A. Financial and institutional determinants of exchange rate risk management in the Jordanian firms. Al-Manara Res. Stud. 2010, 16, 45–82. [Google Scholar]

- Allayannis, G.; Brown, G.W.; Klapper, L.F. Exchange Rate Risk Management: Evidence from East Asia; No. 2606; World Bank: Washington, DC, USA, 2001. [Google Scholar]

- Reem, J.; Baek, C. Exchange rate exposure of Korean large firms before and after the global financial crisis of 2008. Int. J. Financ. 2014, 26, 40–55. [Google Scholar]

- Hagelin, N. Why firms hedge with currency derivatives: An examination of transaction and translation exposure. Appl. Financ. Econ. 2003, 13, 55–69. [Google Scholar] [CrossRef]

- Bodnar, G.M.; Gentry, W.M. Exchange rate exposure and industry characteristics: Evidence from Canada, Japan, and the USA. J. Int. Money Financ. 1993, 12, 29–45. [Google Scholar] [CrossRef]

- Di Iorio, A.; Faff, R. An analysis of asymmetry in foreign currency exposure of the Australian equities market. J. Multinatl. Financ. Manag. 2000, 10, 133–159. [Google Scholar] [CrossRef]

- Allayannis, G.; Ihrig, J.E. The effect of markups on the exchange rate exposure of stock returns. Int. Financ. Discuss. Pap. 2000. [Google Scholar] [CrossRef]

- Kiymaz, H. Estimation of foreign exchange exposure: An emerging market application. J. Multinatl. Financ. Manag. 2003, 13, 71–84. [Google Scholar] [CrossRef]

- Jayasinghe, P.; Tsui, A.K.; Zhang, Z. Exchange rate exposure of sectoral returns and volatilities: Further evidence from Japanese industrial sectors. Pac. Econ. Rev. 2014, 19, 216–236. [Google Scholar] [CrossRef]

- Al-Shboul, M.; Anwar, S. Foreign exchange rate exposure: Evidence from Canada. Rev. Financ. Econ. 2014, 23, 18–29. [Google Scholar] [CrossRef]

- Bergbrant, M.C.; Campbell, K.; Hunter, D.M. Firm-level competition and exchange rate exposure: Evidence from a global survey of firms. Financ. Manag. 2014, 43, 885–916. [Google Scholar] [CrossRef]

- Stulz, R. Rethinking risk management. J. Appl. Corp. Financ. 1996, 9, 8–24. [Google Scholar] [CrossRef]

- Bodnar, G.; Hayt, G.; Marston, R.C.; Smithson, C.W. Wharton survey of financial risk management by US non-financial firms. Financ. Manag. 1998, 27, 589–609. [Google Scholar] [CrossRef]

- Lily, J.; Bujang, I.; Karia, A.A.; Kogid, M. Exchange rate exposure revisited in Malaysia: A tale of two measures. Eurasian Bus. Rev. 2018, 8, 409–435. [Google Scholar] [CrossRef]

| Hedging Level | Nature of Business | Firm Size | FP/TP | FS/TS | FD/TD | Listed/Non-Listed | Family Business | |

|---|---|---|---|---|---|---|---|---|

| Valid | 147 | 147 | 147 | 147 | 147 | 147 | 147 | 147 |

| Missing | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Mean | 2.5646 | 1.3810 | 4.0952 | 6.7823 | 2.7143 | 2.2653 | 0.3265 | 0.5986 |

| Median | 2.00000 | 1.0000 | 3.0000 | 8.0000 | 1.0000 | 2.0000 | 0.0000 | 1.0000 |

| Std. deviation | 1.2663 | 0.4873 | 2.5731 | 2.9366 | 2.5423 | 1.7569 | 0.4706 | 0.4919 |

| Range | 3.00 | 1.00 | 10.00 | 9.00 | 9.00 | 8.00 | 1.00 | 1.00 |

| Minimum | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 1.00 | 0.00 | 0.00 |

| Maximum | 4.00 | 2.00 | 11.00 | 10.00 | 10.00 | 10.00 | 1.00 | 1.00 |

| Sum | 377.00 | 203.00 | 602.00 | 997.00 | 399.00 | 333.00 | 48.00 | 88.00 |

| Instruments | Always | Usually | Sometimes | Seldom | Never | N |

|---|---|---|---|---|---|---|

| Forward | 25 | 10 | 20 | 7 | 85 | 147 |

| Futures | 0 | 0 | 0 | 0 | 147 | 147 |

| Options | 0 | 0 | 0 | 0 | 147 | 147 |

| Short-term borrowing | 25 | 12 | 7 | 8 | 95 | 147 |

| Short-term deposit | 12 | 5 | 0 | 4 | 126 | 147 |

| Netting | 31 | 23 | 24 | 5 | 64 | 147 |

| Leading lagging | 35 | 18 | 20 | 17 | 57 | 147 |

| Matching | 20 | 16 | 28 | 8 | 75 | 147 |

| Currency basket | 57 | 18 | 8 | 3 | 61 | 147 |

| Pricing | 25 | 9 | 7 | 4 | 102 | 147 |

| Level of Hedging | Frequency | Percent (%) | Valid Percent (%) | Cumulative Percent |

|---|---|---|---|---|

| No response | 44 | 29.9 | 29.9 | 29.9 |

| Hedging—level 1 | 31 | 21.1 | 21.1 | 51.0 |

| Hedging—level 2 | 17 | 11.6 | 11.6 | 62.6 |

| Hedging—level 3 | 55 | 37.4 | 37.4 | 100.0 |

| Total | 147 | 100.0 | 100.0 |

| Industry | Size | FP/TP | FS/TS | FD/TD | Level H | Listed | F-Group | |

|---|---|---|---|---|---|---|---|---|

| Industry | 1 | |||||||

| Size | 0.353 ** 0.000 | 1 | ||||||

| FP/TP | −0.746 ** 0.000 | −0.263 ** 0.001 | 1 | |||||

| FS/TS | 0.585 ** 0.000 | 0.299 ** 0.000 | −0.655 ** 0.000 | 1 | ||||

| FD/TD | −0.167 * 0.043 | 0.005 0.952 | 0.149 * 0.071 | −0.117 0.157 | 1 | |||

| Level H | −0.240 0.003 | 0.116 0.162 | 0.311 ** 0.000 | −0.062 0.453 | 0.074 0.374 | 1 | ||

| Listed | 0.798 ** 0.000 | 0.212 * 0.010 | −0.647 ** 0.000 | 0.598 ** 0.000 | −0.106 0.203 | −0.185 * 0.025 | 1 | |

| F-group | −0.358 ** 0.000 | 0.074 0.375 | 0.461 ** 0.000 | −0.351 ** 0.000 | 0.203 * 0.014 | 0.366 ** 0.000 | −0.374 ** 0.000 | 1 |

| Model | Model Fitting Criteria | |||

|---|---|---|---|---|

| −2 Log-Likelihood | Chi-Square | DF | Sig | |

| Intercept Only Final | 373.620 | |||

| 304.800 | 68.820 | 21 | 0.000 | |

| Effect | Model Fitting Criteria | Likelihood Ratio Tests | ||

|---|---|---|---|---|

| −2 Log-Likelihood of Reduced Model | Chi-Square | DF | Sig | |

| Intercept | 308.925 | 4.125 | 3 | 0.248 |

| Nature of business | 307.014 | 2.215 | 3 | 0.529 |

| Size | 307.074 | 2.274 | 3 | 0.518 |

| FP/TP | 311.592 | 6.792 | 3 | 0.079 * |

| FS/TS | 312.364 | 7.564 | 3 | 0.056 * |

| FD/TD | 310.998 | 6.188 | 3 | 0.103 |

| Listed or non-listed | 306.076 | 1.276 | 3 | 0.735 |

| Member in family | 333.153 | 28.353 | 3 | 0.000 ** |

| 95% Confidence Interval for Exp (B) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Level of Hedging | B | Std Error | Wald | DF | Sig | Exp (B) | Lower Bound | Upper Bound | |

| Level-1 | Intercept | −0.343 | 2.030 | 0.029 | 1 | 0.866 | |||

| Nature | −1.306 | 1.018 | 1.647 | 1 | 0.199 | 0.271 | 0.037 | 1.991 | |

| Size | 0.027 | 0.120 | 0.051 | 1 | 0.821 | 1.028 | 0.812 | 1.301 | |

| FP/TP | 0.099 | 0.148 | 0.453 | 1 | 0.501 | 1.105 | 0.827 | 1.476 | |

| FS/TS | 0.251 | 0.161 | 2.442 | 1 | 0.118 | 1.286 | 0.938 | 1.762 | |

| FD/TD | 0.245 | 0.163 | 2.279 | 1 | 0.131 | 1.278 | 0.929 | 1.758 | |

| Listed | −0.695 | 0.984 | 0.498 | 1 | 0.480 | 0.499 | 0.073 | 3.436 | |

| Family | 0.215 | 0.594 | 0.132 | 1 | 0.717 | 1.240 | 0.387 | 3.975 | |

| Level-2 | Intercept | −2.735 | 2.426 | 1.271 | 1 | 0.260 | |||

| Nature | −0.984 | 1.200 | 0.673 | 1 | 0.412 | 0.374 | 0.036 | 3.925 | |

| Size | 0.087 | 0.142 | 0.374 | 1 | 0.541 | 1.091 | 0.826 | 1.441 | |

| FP/TP | 0.299 | 0.179 | 2.782 | 1 | 0.095 | 1.348 | 0.949 | 1.916 | |

| FS/TS | 0.161 | 0.168 | 0.914 | 1 | 0.339 | 1.174 | 0.845 | 1.632 | |

| FD/TD | 0.391 | 0.201 | 3.799 | 1 | 0.051 | 1.479 | 0.998 | 2.191 | |

| Listed | 0.715 | 1.218 | 0.345 | 1 | 0.557 | 2.044 | 0.188 | 22.255 | |

| Family | −1.754 | 0.816 | 4.622 | 1 | 0.032 | 0.173 | 0.053 | 0.856 | |

| Level-3 | Intercept | −3.416 | 2.022 | 2.855 | 1 | 0.091 | |||

| Nature | −1.224 | 1.072 | 1.305 | 1 | 0.253 | 0.294 | 0.036 | 2.402 | |

| Size | 0.142 | 0.109 | 1.706 | 1 | 0.192 | 1.153 | 0.931 | 1.426 | |

| FP/TP | 0.317 | 0.142 | 4.997 | 1 | 0.025 | 1.373 | 1.040 | 1.812 | |

| FS/TS | 0.401 | 0.158 | 6.436 | 1 | 0.011 | 1.493 | 1.095 | 2.034 | |

| FD/TD | 0.049 | 0.159 | 0.095 | 1 | 0.758 | 1.050 | 0.769 | 1.434 | |

| Listed | 0.153 | 1.014 | 0.023 | 1 | 0.880 | 1.165 | 0.160 | 8.505 | |

| Family | 2.044 | 0.629 | 10.593 | 1 | 0.001 | 7.718 | 2.247 | 26.503 | |

| Predicted | |||||

|---|---|---|---|---|---|

| No Response | Hedge—Level 1 | Hedge—Level 2 | Hedge—Level 3 | Percent Correct | |

| No response | 29 | 1 | 0 | 14 | 65.9% |

| Hedge—Level 1 | 7 | 7 | 3 | 14 | 22.6% |

| Hedge—Level 2 | 6 | 1 | 6 | 4 | 35.3% |

| Hedge—Level 3 | 7 | 3 | 2 | 43 | 78.2% |

| Overall Percentage | 33% | 8.2% | 7.5% | 51% | 57.8% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nimer, K.; Nassar, M.; Ghazaleh, N.A.; Ramadan, A. Family Business and Transaction Exposure. J. Open Innov. Technol. Mark. Complex. 2020, 6, 129. https://doi.org/10.3390/joitmc6040129

Nimer K, Nassar M, Ghazaleh NA, Ramadan A. Family Business and Transaction Exposure. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):129. https://doi.org/10.3390/joitmc6040129

Chicago/Turabian StyleNimer, Khalil, Mahmoud Nassar, Naser Abu Ghazaleh, and Abdulhadi Ramadan. 2020. "Family Business and Transaction Exposure" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 129. https://doi.org/10.3390/joitmc6040129

APA StyleNimer, K., Nassar, M., Ghazaleh, N. A., & Ramadan, A. (2020). Family Business and Transaction Exposure. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 129. https://doi.org/10.3390/joitmc6040129