The Impact of Over-the-Top Television Services on Pay-Television Subscription Services in South Africa

Abstract

:1. Introduction

2. Literature Review

2.1. Overview of Pay-TV Subscription Services in South Africa

2.2. Overview of OTT TV Services in South Africa

2.3. Theoretical Perspective

The Uses and Gratifications Theory

- Information—This refers to the need to obtain information online for self-education for various reasons, including entertainment. Therefore, for online TV content, this refers to consumers browsing different sites to obtain information or to find a specific programme to view at a specific time based on their preference and what is convenient to their lifestyle or needs.

- Convenience utility—OTT TV services are a convenient media source to search for content without being bound by geographical location, unlike with pay-TV subscription services; furthermore, information is sourced at any place and on any device.

- Entertainment—OTT TV services can be a source of entertainment for consumers. They kill time and aid in relaxation.

- Social interaction—This refers to users’ ability to interact with others and ease of access to online TV content. This, therefore, is an advantage, as consumers can interact with others and communicate their experiences of a specific programme in real-time; for instance, when a particular programme is airing, users can have hashtags on social platforms such as Twitter to discuss the programme.

- Demassification—Refers to users’ ability to select programmes or content from a wide variety of menus. One can argue that pay-TV services enable consumers to access a wide variety of content, similar to OTT TV services.

- Asynchroneity—Refers to users’ ability to control a message when it is received. Given that OTT TV services such as Netflix, Showmax, and Amazon Prime have a variety of programmes in their digital library and allow users to select programmes they wish to see at a time convenient to them, this then can predict users’ intentions to cut the cord with pay-TV service operators.

2.4. Impact of OTT TV Services on Pay-TV Operators

2.4.1. Cord-Cutting

Cord-Cutting by Demographic Population

- The older generation, including those who are not tech-savvy, are hesitant to cut the cord with pay-TV operators because of the fear of adapting to new technologies, including difficulties in learning new technologies [47].

- Millennials and Generation Z are highly likely to cut the cord as the cost of purchasing a TV set, including a setup box, is deemed a costly exercise compared with a portable laptop used for dual purposes. Young people do not have a steady income. With the continuous rise in subscription fees, these age groups tend to opt for OTT TV services convenient to their lifestyle and which they deem affordable [43]. This trend will continue to grow, especially with these age groups [7].

Reasons for Cord-Cutting

- Increase in subscription fees. As broadband data becomes affordable, consumers may re-evaluate the cost of a pay-TV subscription, considering the cost of broadband data which is used for multiple purposes.

- Ability to choose channels, including TV content of one’s choice. Pay-TV subscribers, in general, want to pay for what they use; therefore, availability of this option may indeed lead to cord-cutting.

- Convenience—the ability to consume TV content using any preferred device at any time. Consumers do not wish to be restricted to one choice of device and place to consume TV content.

- Consumption of TV content to satisfy personal needs and lifestyle. Although this may be fulfilling to consumers, it has setbacks, such as limited content available.

- From a cost–benefit analysis, pay-TV subscription services are perceived not to be worth the price. Moreover, considering the setup costs, including broadband data subscription and time available to consume content, it may not be beneficial. However, it is also arguable that pay-TV offers a variety of genres and content which spans sport, reality TV, documentaries, and news channels.

- Technology preferences based on the number of available devices at their disposal.

- The perceived advantages that OTT TV services have over pay-TV services such as the ability to consume television content using any device from more than one service provider, cost of subscription fees, including frustrations with old technology and the inability to obtain features available on OTT TV services [7].

- Poor customer service [49]. How consumers perceive customer service and their experience may indeed influence cord-cutting, despite the quality of content.

- implementing a multiscreen which enables consumers to access television everywhere and anywhere;

- obtaining exclusive rights to television content;

- having online packages which do not require a setup box. In South Africa, the MultiChoice Group that owns DStv announced a launched of a ‘dishless’ services which do not require a setup box, and this is called Showmax Pro [27].

- having cloud pay-TV accessible using smart TV sets; and

- offering consumers the option to select and pay for the channels they use [53].

2.4.2. Cord-Nevers

2.4.3. Cord-Shavers

2.4.4. Summary

- Sub-RQ 1—Are OTT TV services a substitute for or complementary to traditional pay-TV subscription services in South Africa?

- Sub-RQ 2—Do first-time subscribers favour OTT TV subscription services over pay-TV services in South Africa? If so, which OTT TV services do they favour for the first-time subscription?

3. Research Design and Methodology

3.1. Population and Sampling Strategy

3.2. Sampling Size

3.3. Data Collection and Analysis

3.4. Reliability and Validity

3.4.1. Reliability

3.4.2. Validity

4. Results and Discussions

4.1. Demographic Profiles

4.2. Sub-RQ 1—Are OTT TV Services a Substitute for or Complementary to Traditional Pay-TV Subscription Services in South Africa?

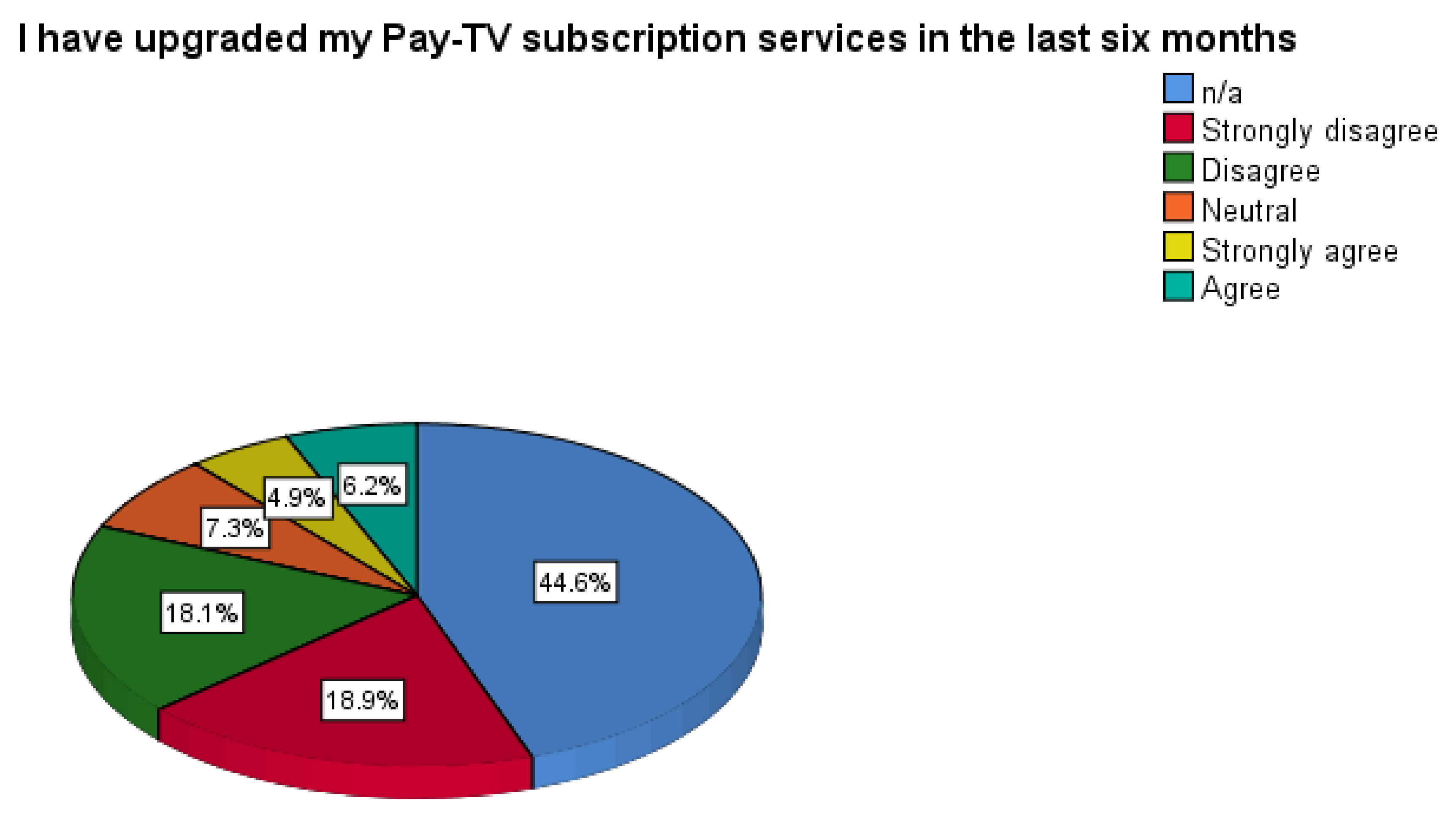

4.2.1. Respondents Who Have Upgraded Pay-TV Subscription

4.2.2. Cord-Cutters

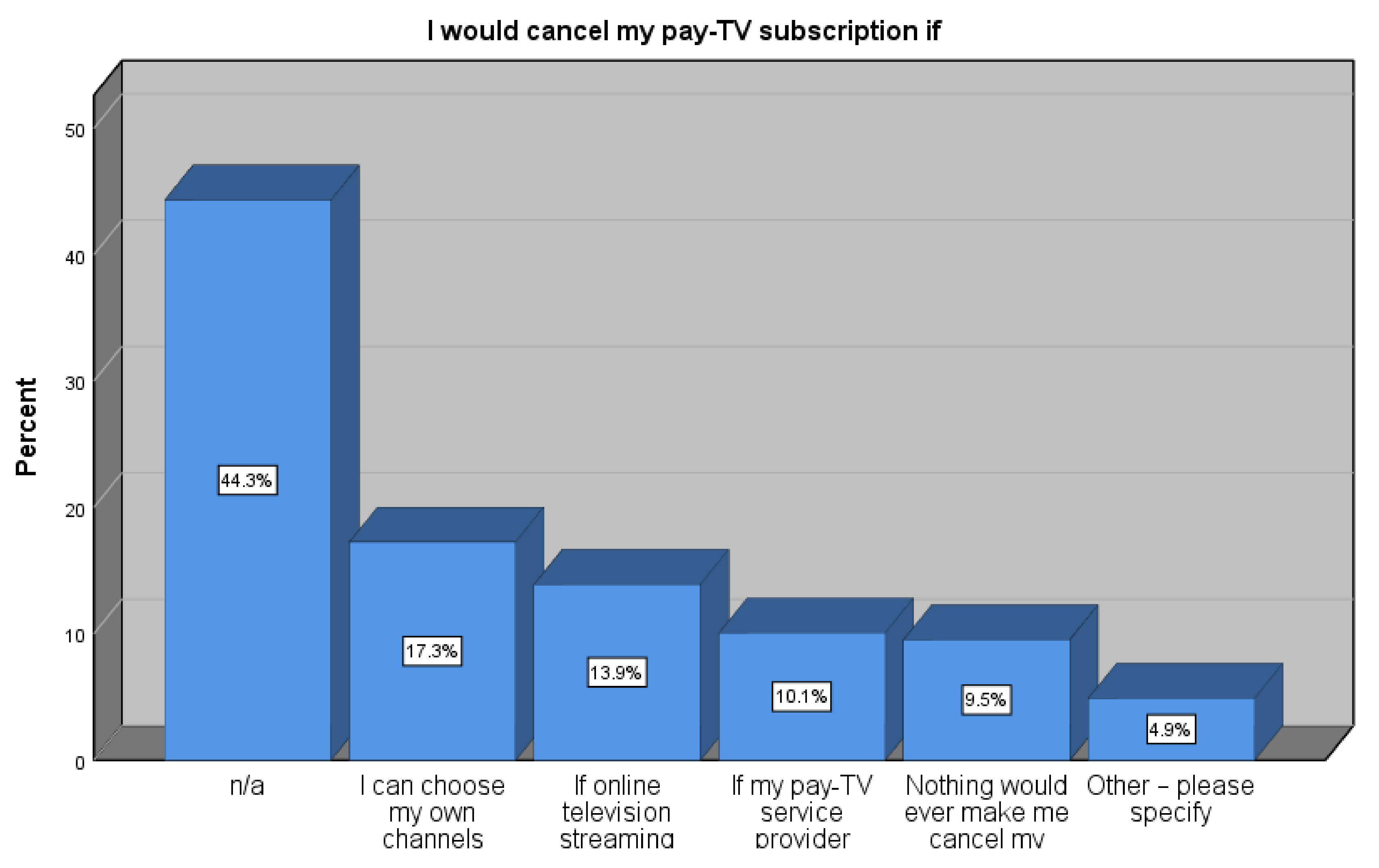

Reason for Future Cancellation Consideration

4.2.3. Cord-Shavers

4.2.4. Cord-Stacking

4.3. Sub-RQ 2—Do First-Time Subscribers Favour OTT TV Subscription Services over Pay-TV Services in South Africa? If So, Which OTT TV Services Do They Favour for the First-Time Subscription?

4.3.1. Cord-Nevers

Favoured OTT TV Services by Cord-Nevers

Reasons Influencing Cord-Nevers to Favour OTT TV over Pay-TV Subscription Services

4.4. General Findings

5. Conclusions and Recommendations

6. Limitations and Future Research

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Scale Mean if Item Deleted | Scale Variance if Item Deleted | Corrected Item—Total Correlation | Squared Multiple Correlation | Cronbach’s Alpha if Item Deleted | |

|---|---|---|---|---|---|

| I have upgraded my Pay-TV subscription services in the last six months. | 6.85 | 48.698 | 0.767 | 0.622 | 0.910 |

| I have cancelled my pay-TV subscription services in favour of OTT TV subscription | 7.00 | 50.656 | 0.802 | 0.698 | 0.908 |

| I have downgraded my premium pay-TV subscription for a lower-priced package in favour of OTT TV services | 6.80 | 48.264 | 0.779 | 0.679 | 0.908 |

| I have combined my pay-TV with OTT TV subscription | 6.39 | 43.798 | 0.774 | 0.638 | 0.912 |

| Which OTT TV services have you combined your pay-TV subscription with? | 6.51 | 45.689 | 0.812 | 0.708 | 0.903 |

| I would cancel my pay-TV subscription if | 6.73 | 47.727 | 0.776 | 0.642 | 0.908 |

References

- Chen, Y.-N.K. Competitions among OTT TV platforms and traditional television in Taiwan: A niche analysis. In Proceedings of the 14th International Telecommunications Society (ITS) Asia-Pacific Regional Conference: “Mapping ICT into Transformation for the Next Information Society”, 24–27 June 2017; International Telecommunications Society (ITS): Kyoto, Japan, 2017; pp. 1–25. Available online: http://hdl.handle.net/10419/168477 (accessed on 14 March 2020).

- Kim, M.S.; Kim, E.; Hwang, S.; Kim, J.; Kim, S. Willingness to pay for over-the-top services in China and Korea. Telecommun. Policy 2017, 41, 197–207. [Google Scholar] [CrossRef]

- Kannisto, K. The Motivations for Netflix to Vertically Integrate its Business Model: Why Netflix Began the Production of Netflix. Bachelor’s Thesis, Aalto University, Espoo, Finland, 2019. Available online: www.aalto.fi (accessed on 14 March 2020).

- BusinessTech. Netflix Has an Unfair Advantage over DStv: Multichoice CEO; BusinessTech: Gauteng, South Africa, 2018. [Google Scholar]

- ICASA. Draft findings document: Inquiry into subscription television broadcasting services. Gov. Gaz. 2019, 42391, 1–189. [Google Scholar]

- ICASA. MultiChoice Submission on Discussion Document Inquiry into Subscription TV Broadcasting Services. ICASA 2019. Available online: https://www.icasa.org.za/legislation-and-regulations/multichoice-submission-on-discussion-document-inquiry-into-subscription-tv-broadcasting-services (accessed on 18 December 2019).

- Tefertiller, A. Media substitution in cable cord-cutting: The adoption of web-streaming television. J. Broadcast Electron. Media 2018, 62, 390–407. [Google Scholar] [CrossRef]

- Kearney. OTT Streaming in the Limelight: Four Trends and Predictions for the Media Industry. Available online: https://www.es.kearney.com/communications-media-technology/ott-streaming-in-the-limelight-four-trends-and-predictions-for-the-media-industry (accessed on 31 July 2020).

- Park, S.; Kwon, Y. Research on the relationship between the growth of OTT service market and the change in the structure of the Pay-TV market. In Proceedings of the 30th European Conference of the International Telecommunications Society (ITS): “Towards a Connected and Automated Society”, Helsinki, Finland, 16–19 June 2020; International Telecommunications Society (ITS): Helsinki, Finland, 2019. Available online: https://www.econstor.eu/bitstream/10419/205203/1/Park-Kwon.pdf (accessed on 16 April 2020).

- De Villiers, J. Almost a Third of South African Households Now Own Their Own Cars—While 90% have Electric Stoves. Business Insider SA. 2019. Available online: https://www.businessinsider.co.za/general-household-survey-2018-south-african-households-third-own-cars-electrical-stoves-2019-5 (accessed on 23 February 2020).

- Stats, S.A. Mid-year Population Estimates. 2019. Available online: http://www.statssa.gov.za/publications/P0302/MYPE2019Presentation_final_forSG26_07staticPop_1.pdf (accessed on 14 June 2020).

- eMedia Holdings. Broadcasting—eMedia Holdings. 2020. Available online: http://www.emediaholdings.co.za/broadcasting/ (accessed on 16 February 2020).

- Mulyana, A. Media and cultural preference: Watching activity on pay television. Int. J. Commun. Res. 2019, 9, 53–58. [Google Scholar]

- Statista. Video Streaming (SVoD)—South Africa. Available online: https://www.statista.com/outlook/206/112/video-streaming--svod-/south-africa#market-users (accessed on 24 January 2020).

- MultiChoice. Our History. 2020. Available online: https://www.multichoice.com/about-us/our-history/ (accessed on 16 February 2020).

- ICASA. Subscription Broadcasting Services Market Inquiry. 2019. Available online: https://www.icasa.org.za/legislation-and-regulations/inquiries/subscription-broadcasting-services-market-inquiry (accessed on 18 December 2019).

- StarSat. Who We Are. Available online: http://starsat.co.za/about/ (accessed on 16 February 2020).

- Gilbert, P. How Data Bundle Prices Changed over Five Years. ITWeb 2018. Available online: https://www.itweb.co.za/content/LPwQ5MlyKoOqNgkj (accessed on 23 February 2020).

- Prior, B. Past, Present, and Future of Fibre Prices in South Africa. MyBroadBand 2019. Available online: https://mybroadband.co.za/news/fibre/311493-past-present-and-future-of-fibre-prices-in-south-africa.html (accessed on 23 February 2020).

- Omarjee, L. MTN, Vodacom to Slash Data Prices or Face Prosecution; All Providers Must Give Free Data Daily—Competition Watchdog. Fin 2019. Available online: https://www.fin24.com/Companies/mtn-vodacom-to-slash-prices-or-face-prosecution-all-providers-must-give-free-data-daily-competition-watchdog-20191202-2 (accessed on 23 February 2020).

- Mungadze, S. MTN to Drop Its Data Prices ‘Soon’. ITWeb 2020. Available online: https://www.itweb.co.za/content/kLgB1Me8npo759N4 (accessed on 10 April 2020).

- Netflix. Netflix—Overview—Profile. 2020. Available online: https://www.netflixinvestor.com/ir-overview/profile/default.aspx (accessed on 23 February 2020).

- SimilarWeb. Top TV Movies and Streaming Websites in South Africa. 2020. Available online: https://www.similarweb.com/top-websites/south-africa/category/arts-and-entertainment/tv-movies-and-streaming (accessed on 16 April 2020).

- MultiChoice. Companies and Brands. 2020. Available online: https://www.multichoice.com/companies-brands/ (accessed on 23 February 2020).

- BusinessTech. Showmax Subscribers vs Netflix in South Africa. BusinessTech 2019. Available online: https://businesstech.co.za/news/media/297640/showmax-subscribers-vs-netflix-in-south-africa/ (accessed on 23 February 2020).

- Showmax. How Does Showmax Work? Showmax 2018. Available online: https://stories.showmax.com/how-does-showmax-work/ (accessed on 12 April 2020).

- McLeod, D. Showmax Pro, with live sport, launched in South Africa at R449/month. TechCentral 2020. Available online: https://techcentral.co.za/showmax-pro-with-live-sport-launched-in-south-africa-at-r449-month/100569/ (accessed on 20 August 2020).

- Eloff, H. This Graph Shows How Streaming on Showmax Drastically Increases as the Coronavirus Pandemic Grows. Channel 2020. Available online: https://www.channel24.co.za/TV/News/this-graph-shows-how-streaming-on-showmax-drastically-increases-as-the-coronavirus-pandemic-grows-20200408 (accessed on 8 April 2020).

- Fingas, J. YouTube Premium and Music Have 20 Million Subscribers. Engadget 2020. Available online: https://www.engadget.com/2020/02/03/youtube-premium-and-music-20-million-subscribers/ (accessed on 23 February 2020).

- Van der Merwe, M. South African Generation Y Students’ Attitude towards On-Demand Streaming Services. Master’s Thesis, North-West University, Potchefstroom, South Africa, 2019. Available online: http://repository.nwu.ac.za/handle/10394/32296 (accessed on 24 October 2020).

- TechCentral. Amazon Prime Video launched in SA. TechCentral 2016. Available online: https://techcentral.co.za/amazon-prime-video-launched-in-sa/70712/ (accessed on 12 April 2020).

- Ferreira, T. Watching TV in South Africa in 2020 just Got a Whole Lot More Complicated. Channel 2020. Available online: https://www.news24.com/channel/tv/news/watching-tv-in-south-africa-in-2020-just-got-a-whole-lot-more-complicated-20200131 (accessed on 24 October 2020).

- Ferreira, T. Google launches YouTube Premium in South Africa but There’s a Catch. Channel 2019. Available online: https://www.channel24.co.za/Music/News/google-launches-youtube-premium-in-south-africa-but-theres-a-catch-20190314 (accessed on 23 February 2020).

- Schouw, L. “To Binge or not to Binge”—The Online Viewing Habits of Dutch Millennials. Master’s Thesis, Erasmus University, Rotterdam, The Netherlands, 2018. Available online: https://www.semanticscholar.org/paper/“To-binge-or-not-to-binge”-The-online-Viewing-of-Schouw/0352d31c56ab55fd3f56a220d829d1f6e2702567 (accessed on 24 October 2020).

- Hossain, M.; Kim, M.; Jahan, N. Can “Liking” Behavior Lead to Usage Intention on Facebook? Uses and Gratification Theory Perspective. Sustainability 2019, 11, 1166. [Google Scholar] [CrossRef] [Green Version]

- Katz, E.; Blumler, J.G.; Gurevitch, M. Uses and Gratifications Research. Public Opin. Q. 1973, 37, 509–523. [Google Scholar] [CrossRef]

- Kirui, E.K. The Impact of Media Digitization on Local Video Production: A Case of Nairobi County. Master’s Thesis, University of Nairobi, Nairobi, Kenya, 2017. [Google Scholar]

- Samani, M.C.; Guri, C.J. Revisiting Uses and Gratification Theory: A Study on Visitors to Annah Rais Homestay. J. Komun. Malays. J. Commun. 2019, 35, 206–221. [Google Scholar] [CrossRef] [Green Version]

- Shobiye, T.; Naidoo, G.M.; Rugbeer, H. Factors that Influence One’s Choice for Viewing Public Television in South Africa. Altern. Interdiscip. J. Study Arts. Humanit. S. Afr. 2018, 25, 394–424. [Google Scholar] [CrossRef]

- Gossmann, N. Millennials’ Motivation to Consume Sport Content Online. Master’s Thesis, University of Pretoria, Pretoria, South Africa, 2018. Available online: https://repository.up.ac.za/handle/2263/68846 (accessed on 24 October 2020).

- Massad, V.J. Understanding the cord-cutters: An adoption/self-efficacy approach. Int. J. Media Manag. 2018, 20, 216–237. [Google Scholar] [CrossRef]

- Kim, J.; Kim, S.; Nam, C. Competitive dynamics in the Korean video platform market: Traditional pay TV platforms vs. OTT platforms. Telemat. Inform. 2016, 33, 711–721. [Google Scholar] [CrossRef]

- Elias, J. The Transition Trend From Pay-TV to Streaming Platforms: The Influence of Decision-Making-Power and Age on Consumers’ Motivations; Universidade Católica Portuguesa: Lisbon, Portugal, 2019. [Google Scholar]

- Park, E. Business strategies of Korean TV players in the age of Over-The-Top (OTT) video service. Int. J. Commun. 2018, 12, 4646–4667. [Google Scholar]

- Bloomberg. How COVID-19 Is Changing Entertainment. MyBroadBand 2020. Available online: https://mybroadband.co.za/news/technology/351331-how-covid-19-is-changing-entertainment.html (accessed on 10 May 2020).

- Crawford, J. Cutting the cord—A marketing case: An examination of changing TV Viewership. Atl. Mark. J. 2016, 5, 137–150. [Google Scholar]

- Mckinley, J. Are online streaming services hurting traditional television and radio? UWire Text 2018. Available online: http://link.galegroup.com/apps/doc/A559275564/AONE?u=capetech&sid=AONE&xid=ff5ec1b5 (accessed on 11 June 2020).

- Christenson, C. Changing Times: An Examination Changing Video Entertainment Sources and Cable TV Companies Communicating with Customers. Master’s Thesis, Bowling Green State University, Bowling Green, OH, USA, 2017. Available online: https://scholarworks.bgsu.edu/ms_smc/5%0AThis (accessed on 11 June 2020).

- Lee, C.C.; Nagpal, P.; Ruane, S.G.; Lim, H.S. Factors Affecting Online Streaming Subscriptions. Commun. IIMA 2018, 16, 2. [Google Scholar]

- Premium Times. Nearly Two Million U.S. Households Cancel Cable, Satellite TV. Prem. Times 2020. Available online: https://www.premiumtimesng.com/news/top-news/392349-nearly-two-million-u-s-households-cancel-cable-satellite-tv.html (accessed on 12 May 2020).

- Park, E.-A. Why the networks can’t beat Netflix: Speculations on the US OTT services market. Digit. Policy Regul. Gov. 2017, 19, 21–39. [Google Scholar] [CrossRef]

- De Villiers, J. Multichoice Plans to Make 52 Local Movies the Next Year—And Saw Streaming Subscriber Double. Business Insider SA 2019. Available online: https://www.businessinsider.co.za/multichoice-netflix-showmax-dstv-dtsv-now-local-movies-streaming-service-naspers-2019-6 (accessed on 10 May 2020).

- Chulkov, D.; Nizovtsev, D. Bundling, cord-cutting and the death of TV as we know it. J. Int. Acad. Case Stud. 2015, 21, 7–14. [Google Scholar]

- Bronkhorst, Q. Here are All the DStv Price Increases for 2020. BusinessTech 2020. Available online: https://businesstech.co.za/news/media/374572/here-are-all-the-dstv-price-increases-for-2020/ (accessed on 10 May 2020).

- Gürkaynak, G.; Akgün, B.; Aydogan, Z. An analysis on the television broadcasting sector—The impact of OTT services: Are they complementary or substitutable? In The Second Academic Gift Book of ELIG Gürkaynak Attorneys-At Law on Selected Contemporary Competition Law Matters; Legal Yayıncılık, A.Ş: İstanbul, Turkey, 2019; pp. 281–338. Available online: https://ssrn.com/abstract=3396937 (accessed on 11 June 2020).

- MultiChoice. MultiChoice Group—FY20 Results. 2020. Available online: https://multichoice-reports.co.za/annuals/2020/pdf/results-presentation-final-final.pdf (accessed on 11 June 2020).

- Baumgartner, J. OTT Closes Penetration Gap With Pay TV. Multichannel News, 30 November 2015; Volume 36, p. 16. [Google Scholar]

- Enli, G.; Syvertsen, T. The end of television—Again! How TV is still influenced by cultural factors in the age of digital intermediaries. Media Commun. 2016, 4, 142–153. [Google Scholar] [CrossRef] [Green Version]

- Harris, S. Cord-Nevers Could Be Bigger Threat to TV than Cord-Cutters. CBC News. 2015. Available online: https://www.cbc.ca/news/business/cord-nevers-cord-cutters-tv-1.3308072 (accessed on 11 May 2020).

- eMarketer. US Adult Cord-Cutters and Cord-Nevers, 2018–2022 (Millions and % of Adult Population). eMarketer 2018. Available online: https://www.emarketer.com/chart/224703/us-adult-cord-cutters-cord-nevers-2018-2022-millions-of-adult-population (accessed on 11 May 2020).

- Evans, J. South Africa is Young and Female—Stats SA Report. News 2018. Available online: https://www.news24.com/SouthAfrica/News/south-africa-is-young-and-female-stats-sa-report-20180723 (accessed on 11 May 2020).

- Statista. South Africa: Youth Unemployment Rate from 1999 to 2019. 2020. Available online: https://www.statista.com/statistics/813010/youth-unemployment-rate-in-south-africa/ (accessed on 16 May 2020).

- Ofcom. Media Nations: UK. 2018. Available online: https://www.ofcom.org.uk/__data/assets/pdf_file/0014/116006/media-nations-2018-uk.pdf (accessed on 11 May 2020).

- Cooper, D.R.; Schindler, P.S. Business Research Methods, 12th ed.; McGraw-Hill/Irwin: New York, NY, USA, 2013; 692p. [Google Scholar]

- Malhotra, N.K. Marketing Research: An Applied Orientation, 6th ed; Pearson Education: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 5th ed.; Pearson Education: Harlow, UK, 2009. [Google Scholar]

- Clow, K.E.; James, K.E. Essentials for Marketing Research: Putting Research into Practice; Sage: Thousand Oaks, CA, USA, 2014. [Google Scholar]

- South Africa. Protection of Personal Information Act, No. 4 of 2013. Gov. Gaz. 2013, 581, 37067.

- Taherdoost, H. Sampling Methods in Research Methodology; How to Choose a Sampling Technique for Research. Int. J. Acad. Res. Manag. 2016, 5, 18–27. [Google Scholar] [CrossRef]

- Bryman, A.; Bell, E. Business Research Methods, 3rd ed.; Oxford University Press: New York; NY, USA, 2011. [Google Scholar]

- Statista. No. of Pay TV Households in South Africa 2016 to 2021. 2016. Available online: https://www.statista.com/statistics/505602/pay-tv-subscribers-south-africa/ (accessed on 24 January 2020).

- Tengeh, R.K.; Talom, F.S.G. Mobile Money as a Sustainable Alternative for SMEs in Less Developed Financial Markets. 2020. Available online: https://www.researchgate.net/publication/340463868_Mobile_money_as_a_sustainable_alternative_for_SMEs_in_less_developed_financial_markets (accessed on 8 July 2020).

- Oji, O.N.E.; Iwu, C.G.; Tengeh, R.K. Social media adoption challenges of small businesses: The case of restaurants in the Cape Metropole, South Africa. Afr. J. Hosp. Tour. Leis. 2017, 6, 1–12. [Google Scholar]

- Sarstedt, M.; Mooi, E. A Concise Guide to Market Research: The Process, Data, and Methods Using IBM SPSS Statistics, 3rd ed.; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Brace, I. Questionaire Design: How to Plan, Structure and Write Survey Material for Effective Market Research, 2nd ed.; Kogan Page: London, UK, 2008. [Google Scholar]

- Goforth, C. Using and Interpreting Cronbach’s Alpha. 2015. Available online: https://data.library.virginia.edu/using-and-interpreting-cronbachs-alpha/ (accessed on 8 July 2020).

- Survey Monkey. Using Skip Logic in a Survey. 2020. Available online: https://www.surveymonkey.com/mp/tour/skiplogic/?program=7013A000000mweBQAQ&utm_bu=CR&utm_campaign=71700000064157458&utm_adgroup=58700005704021376&utm_content=39700052007818772&utm_medium=cpc&utm_source=adwords&utm_term=p52007818772&utm_kxconfid=s4bvpi0ju& (accessed on 19 July 2020).

- BusinessTech. South Africans love TV: Stats SA. BusinessTech 2013. Available online: https://businesstech.co.za/news/trending/44899/south-africans-love-tv-stats-sa/ (accessed on 12 June 2020).

- Stats, S.A. How Unequal is South Africa? 2020. Available online: http://www.statssa.gov.za/?p=12930 (accessed on 21 June 2020).

- Daniels, R.H. Subscription Video on Demand: Viewing Preferences among New Zealand Audiences. Master’s Thesis, Auckland University of Technology, Auckland, The Netherlands, 2017. Available online: https://pdfs.semanticscholar.org/b36a/4f79a462b9c1f60a28053d44f2cd82d80a4d.pdf (accessed on 8 July 2020).

| OTT TV Service Provider | About |

|---|---|

| Netflix | Describes itself as a leading online streaming service provider with over 190 million subscribers across 190 countries globally [22]. Estimated to have over 400,000 subscribers since it officially launched in South Africa in 2016, and it is still experiencing continual growth [6]. According to SimilarWeb [23], Netflix ranks in third place for streaming in South Africa. |

| Showmax | An online video subscription service owned by the MultiChoice Group and launched in South Africa in 2015 in competition with global OTT TV services [24]. This OTT TV platform has an estimated subscriber base of 595,000 [25]. Like other OTT TV service providers, its services are accessible on a smart TV, tablet, smartphone, and laptop. Showmax offers international content and also produces local content. MultiChoice provides Showmax as a value-added benefit to its DStv Premium subscribers at no cost [26]. MultiChoice launched ShowmaxPro on 19 August 2020, which enables consumers to stream movies, including live sport on its platform as a standalone subscription on higher or standard definition quality [27]. Interestingly, during the national lockdown in South Africa owing to the COVID-19 pandemic, Showmax reported an increase in online streaming through its platform, depicting a change in customer viewership and increased consumption of content by consumers using OTT TV services [28]. |

| YouTube Premium | YouTube is a significant video application, ranked as the top website for TV movie viewing and streaming in South Africa [23]. YouTube has a broader reach, making it the most significant OTT TV player in South Africa, as broadcasters such as eTV and the SABC use its platform for streaming services. Its subscriber base is over 20 million subscribers globally, combined with music services offerings [29]. However, subscriber numbers in South Africa have not been made public. |

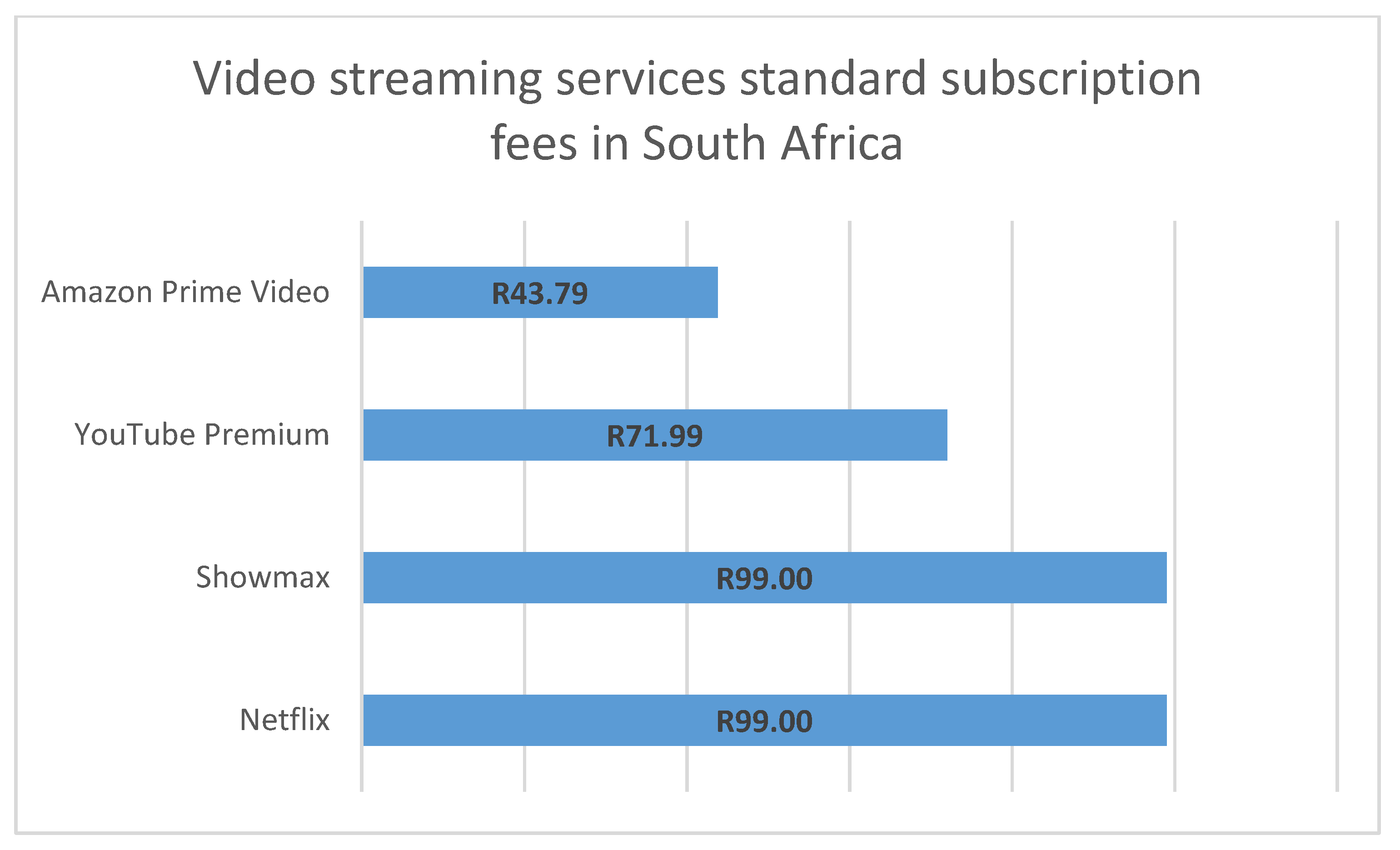

| Amazon Prime Video | A streaming service owned by Amazon, with over 2000 TV titles in its library. It was the first to offer its customers the ability to download content offline for later viewing. This is a data cost-saving, especially in South Africa, where broadband data is still unaffordable for the majority of the population. Its platform has over 100 million subscribers and is available in more than 200 countries worldwide [30]. Amazon Prime Video launched in South Africa in December 2016, and it offers online streaming video content to its subscribers for a minimal fee of ZAR 43.00 per month, and this makes it the lowest subscription fee compared with other OTT TV operators in South Africa, as depicted in Figure 1 [31]. |

| Confidence Level | 95% |

|---|---|

| Population proportion | 0.5 |

| Margin of error | 5% |

| Population size | 6,800,000.00 |

| Alpha | 0.03 |

| Z-score | 1.96 |

| Sample size | 384 |

| Cronbach’s Alpha | Cronbach’s Alpha Based on Standardised Items | N of Items |

|---|---|---|

| 0.922 | 0.926 | 6 |

| Frequency | Percent | Valid Percent | Cumulative Percent | |

|---|---|---|---|---|

| DStv | 216 | 55.2 | 55.2 | 55.2 |

| StarSat | 3 | 0.8 | 0.8 | 56.0 |

| I have free-to-air (FTA—SABC, eTV, OVHD, etc.) and OTT TV services | 43 | 11.0 | 11.0 | 67.0 |

| I only have OTT TV services (Netflix, Showmax, etc.) | 95 | 24.3 | 24.3 | 91.3 |

| I use free/paid mobile apps to consume TV content. | 34 | 8.7 | 8.7 | 100.0 |

| Total | 391 | 100.0 | 100.0 |

| Variable | Frequency | Percentage | |

|---|---|---|---|

| I identify as | Female | 122 | 31.2 |

| Male | 256 | 65.5 | |

| Gender fluid | 2 | 0.5 | |

| Non-binary | 4 | 1.0 | |

| Prefer not to say | 7 | 1.8 | |

| My age is | 18–24 | 51 | 13.0 |

| 25–34 | 67 | 17.1 | |

| 35–45 | 142 | 36.3 | |

| 46–54 | 79 | 20.2 | |

| 55+ | 52 | 13.3 | |

| My household income per month, including any additional jobs, but excluding government grants is | Less than ZAR 10,000.00 | 103 | 26.3 |

| R10,000.00–R17,000.00 | 75 | 19.2 | |

| R18,000.00–R22,000.00 | 48 | 12.3 | |

| R23,000.00–R32,000.00 | 49 | 12.5 | |

| R33,000.00+ | 87 | 22.3 | |

| My province of residence | Eastern Cape | 33 | 8.4 |

| Free State | 22 | 5.6 | |

| Gauteng | 86 | 22.0 | |

| Kwa-Zulu Natal | 32 | 8.2 | |

| Limpopo | 9 | 2.3 | |

| Mpumalanga | 18 | 4.6 | |

| North West | 19 | 4.9 | |

| Northern Cape | 9 | 2.3 | |

| Western Cape | 163 | 41.7 |

| I Have Cancelled My Pay-TV Subscription Services in Favour of OTT TV Subscription. | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| n/a | Strongly Disagree | Disagree | Neutral | Strongly Agree | Agree | |||

| My age is | 18–24 | 35 | 7 | 6 | 1 | 0 | 1 | 50 |

| 25–34 | 28 | 14 | 16 | 4 | 2 | 3 | 67 | |

| 35–45 | 59 | 26 | 34 | 14 | 1 | 6 | 140 | |

| 46–54 | 32 | 15 | 19 | 8 | 1 | 4 | 79 | |

| 55+ | 17 | 13 | 13 | 4 | 2 | 1 | 50 | |

| Total | 171 | 75 | 88 | 31 | 6 | 15 | 386 | |

| I Have Cancelled My Pay-TV Subscription Services in Favour of OTT TV Subscription. | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| n/a | Strongly Disagree | Disagree | Neutral | Strongly Agree | Agree | |||

| My household income per month, including any additional jobs, but excluding government grants is | Less than R10,000.00 | 51 | 12 | 20 | 11 | 2 | 5 | 101 |

| R10,000.00–R17,000.00 | 33 | 13 | 13 | 6 | 3 | 7 | 75 | |

| R18,000.00–R22,000.00 | 23 | 10 | 12 | 2 | 0 | 1 | 48 | |

| R23,000.00–R32,000.00 | 18 | 11 | 11 | 8 | 0 | 0 | 48 | |

| R33,000.00+ | 31 | 25 | 24 | 3 | 1 | 1 | 85 | |

| Total | 156 | 71 | 80 | 30 | 6 | 14 | 357 | |

| I Have Cancelled My Pay-TV Subscription Services in Favour of OTT TV Subscription. | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| n/a | Strongly Disagree | Disagree | Neutral | Strongly Agree | Agree | |||

| My province of residence | Eastern Cape | 14 | 7 | 8 | 2 | 0 | 1 | 32 |

| Free State | 12 | 5 | 1 | 2 | 1 | 0 | 21 | |

| Gauteng | 47 | 15 | 16 | 7 | 1 | 0 | 86 | |

| KwaZulu- Natal | 16 | 6 | 3 | 3 | 0 | 4 | 32 | |

| Limpopo | 3 | 5 | 0 | 0 | 1 | 0 | 9 | |

| Mpumalanga | 7 | 3 | 3 | 1 | 1 | 1 | 16 | |

| North West | 8 | 7 | 1 | 2 | 0 | 0 | 18 | |

| Northern Cape | 5 | 0 | 3 | 0 | 0 | 1 | 9 | |

| Western Cape | 59 | 27 | 53 | 14 | 2 | 8 | 163 | |

| Total | 171 | 75 | 88 | 31 | 6 | 15 | 386 | |

| I Identify as | Total | ||||||

|---|---|---|---|---|---|---|---|

| Female | Male | Gender Fluid | Non-Binary | Prefer Not to Say | |||

| I have cancelled my pay-TV subscription services in favour of OTT TV subscription | n/a | 37 | 124 | 0 | 4 | 6 | 171 |

| Strongly disagree | 36 | 36 | 2 | 0 | 1 | 75 | |

| Disagree | 32 | 56 | 0 | 0 | 0 | 88 | |

| Neutral | 11 | 20 | 0 | 0 | 0 | 31 | |

| Strongly agree | 0 | 6 | 0 | 0 | 0 | 6 | |

| Agree | 6 | 9 | 0 | 0 | 0 | 15 | |

| Total | 122 | 251 | 2 | 4 | 7 | 386 | |

| “Should the area I stay in have a stable and established internet infrastructure, there is a strong possibility of cancelling the pay-tv subscription.” |

| “If for some reason, I would lose my job.” |

| “If another competitor with strong content comes along and if subscription would be more than R1000.” |

| “If they cancel or stop my favourite TV programmes.” |

| “We get poor content.” |

| “Should the area I stay in have a stable and established internet infrastructure, there is a strong possibility of cancelling the pay-tv subscription.” |

| I Identify as | Total | ||||||

|---|---|---|---|---|---|---|---|

| Female | Male | Gender Fluid | Non-Binary | Prefer Not to Say | |||

| I have downgraded my premium pay-TV subscription for a lower-priced package in favour of OTT TV services | n/a | 37 | 125 | 0 | 4 | 6 | 172 |

| Strongly disagree | 20 | 39 | 0 | 0 | 1 | 60 | |

| Disagree | 34 | 42 | 0 | 0 | 0 | 76 | |

| Neutral | 14 | 16 | 0 | 0 | 0 | 30 | |

| Strongly agree | 14 | 17 | 2 | 0 | 0 | 33 | |

| Agree | 2 | 14 | 0 | 0 | 0 | 16 | |

| Total | 121 | 253 | 2 | 4 | 7 | 387 | |

| My Household Income Per Month, Including any Additional Jobs, but Excluding Government Grants Is | Total | ||||||

|---|---|---|---|---|---|---|---|

| Less than R10,000.00 | R10,000.00–R17,000.00 | R18,000.00–R22,000.00 | R23,000.00–R32,000.00 | R33,000.00+ | |||

| I have combined my pay-TV with OTT TV subscription | n/a | 51 | 33 | 23 | 18 | 32 | 157 |

| Strongly disagree | 13 | 6 | 5 | 5 | 6 | 35 | |

| Disagree | 17 | 11 | 8 | 14 | 8 | 58 | |

| Neutral | 8 | 4 | 1 | 1 | 5 | 19 | |

| Strongly agree | 5 | 5 | 6 | 7 | 17 | 40 | |

| Agree | 6 | 14 | 5 | 3 | 19 | 47 | |

| Total | 100 | 73 | 48 | 48 | 87 | 356 | |

| My Age Is | Total | ||||||

|---|---|---|---|---|---|---|---|

| 18–24 | 25–34 | 35–45 | 46–54 | 55+ | |||

| I have combined my pay-TV with OTT TV subscription | n/a | 36 | 28 | 59 | 32 | 17 | 172 |

| Strongly disagree | 4 | 5 | 13 | 6 | 8 | 36 | |

| Disagree | 1 | 12 | 18 | 18 | 11 | 60 | |

| Neutral | 3 | 4 | 9 | 5 | 3 | 24 | |

| Strongly agree | 5 | 6 | 17 | 10 | 3 | 41 | |

| Agree | 2 | 11 | 23 | 7 | 8 | 51 | |

| Total | 51 | 66 | 139 | 78 | 50 | 384 | |

| My Province of Residence | Total | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Eastern Cape | Free State | Gauteng | KwaZulu-Natal | Limpopo | Mpumalanga | North West | Northern Cape | Western Cape | |||

| I have combined my pay-TV with OTT TV subscription | n/a | 14 | 12 | 47 | 16 | 3 | 8 | 8 | 5 | 59 | 172 |

| Strongly disagree | 3 | 1 | 6 | 4 | 1 | 1 | 2 | 1 | 17 | 36 | |

| Disagree | 6 | 0 | 11 | 1 | 1 | 2 | 1 | 1 | 37 | 60 | |

| Neutral | 1 | 2 | 2 | 2 | 1 | 3 | 1 | 0 | 12 | 24 | |

| Strongly agree | 3 | 4 | 10 | 5 | 3 | 2 | 4 | 1 | 9 | 41 | |

| Agree | 3 | 2 | 10 | 4 | 0 | 1 | 3 | 1 | 27 | 51 | |

| Total | 30 | 21 | 86 | 32 | 9 | 17 | 19 | 9 | 161 | 384 | |

| I Have Combined My Pay-TV with OTT TV Subscription. | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| n/a | Strongly Disagree | Disagree | Neutral | Strongly Agree | Agree | |||

| My monthly pay-TV subscription fee is | n/a | 172 | 0 | 0 | 0 | 0 | 0 | 172 |

| Entry package—less than R100.00/R1100.00 per annum | 0 | 3 | 8 | 1 | 6 | 4 | 22 | |

| Lower package—Less than R300.00/R3300.00 per annum | 0 | 6 | 8 | 3 | 4 | 2 | 23 | |

| Middle package—less than R400/R4400.00 per annum | 0 | 6 | 15 | 8 | 6 | 9 | 44 | |

| Premium package—R500.00+/R5500.00+ per annum | 0 | 21 | 29 | 12 | 25 | 36 | 123 | |

| Total | 172 | 36 | 60 | 24 | 41 | 51 | 384 | |

| I only Have OTT TV Services and Have Never Subscribed to Pay-TV. | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| n/a | Strongly Disagree | Disagree | Neutral | Strongly Agree | Agree | |||

| My age is | 18–24 | 25 | 2 | 5 | 0 | 17 | 1 | 50 |

| 25–34 | 48 | 6 | 5 | 2 | 1 | 5 | 67 | |

| 35–45 | 88 | 12 | 20 | 9 | 3 | 9 | 141 | |

| 46–54 | 52 | 5 | 7 | 8 | 2 | 4 | 78 | |

| 55+ | 40 | 4 | 4 | 2 | 1 | 0 | 51 | |

| Total | 253 | 29 | 41 | 21 | 24 | 19 | 387 | |

| I Identify as | Total | ||||||

|---|---|---|---|---|---|---|---|

| Female | Male | Gender Fluid | Non-Binary | Prefer Not to Say | |||

| I only have OTT TV services and have never subscribed to pay-TV. | n/a | 90 | 158 | 2 | 0 | 3 | 253 |

| Strongly disagree | 5 | 23 | 0 | 1 | 0 | 29 | |

| Disagree | 10 | 29 | 0 | 1 | 1 | 41 | |

| Neutral | 2 | 17 | 0 | 0 | 2 | 21 | |

| Strongly agree | 8 | 14 | 0 | 2 | 0 | 24 | |

| Agree | 6 | 12 | 0 | 0 | 1 | 19 | |

| Total | 121 | 253 | 2 | 4 | 7 | 387 | |

| I only Have OTT TV Services and Have Never Subscribed to Pay-TV. | Total | |||||||

|---|---|---|---|---|---|---|---|---|

| n/a | Strongly Disagree | Disagree | Neutral | Strongly Agree | Agree | |||

| My province of residence | Eastern Cape | 20 | 2 | 3 | 2 | 2 | 3 | 32 |

| Free State | 14 | 2 | 3 | 2 | 0 | 1 | 22 | |

| Gauteng | 50 | 7 | 7 | 6 | 13 | 3 | 86 | |

| KwaZulu-Natal | 19 | 1 | 5 | 3 | 1 | 2 | 31 | |

| Limpopo | 7 | 1 | 0 | 0 | 1 | 0 | 9 | |

| Mpumalanga | 11 | 3 | 4 | 0 | 0 | 0 | 18 | |

| North West | 13 | 2 | 0 | 2 | 1 | 1 | 19 | |

| Northern Cape | 6 | 1 | 0 | 0 | 1 | 1 | 9 | |

| Western Cape | 113 | 10 | 19 | 6 | 5 | 8 | 161 | |

| Total | 253 | 29 | 41 | 21 | 24 | 19 | 387 | |

| Hulu |

| Sling TV |

| Expat Vision UK |

| “I am using all of the services, as mentioned above.” |

| “Considering the price of data and subscription, I am still paying less. Also, I can use my laptop and data for multiple purposes compared to DStv, which needs a TV, decoder, etc.” |

| “DSTV plays the same movies and shows over and over again.” |

| “I move around a lot as a freelancer sometimes.” |

| “I never thought about subscribing to any pay-TV in the past.” |

| “Bad call service, unprofessional.” |

| I Subscribe to | Total | ||||||

|---|---|---|---|---|---|---|---|

| DStv | StarSat | I Have Free-to-Air (FTA—SABC, eTV, OVHD, etc) and OTT TV Services | I only Have OTT TV Services (Netflix, Showmax, etc) | I Use Free/Paid Mobile Apps to Consume TV Content | |||

| My household income per month, including any additional jobs, but excluding government grants is | Less than R10,000.00 | 51 | 1 | 16 | 18 | 17 | 103 |

| R10,000.00–R17,000.00 | 42 | 0 | 11 | 17 | 5 | 75 | |

| R18,000.00–R22,000.00 | 24 | 1 | 3 | 17 | 3 | 48 | |

| R23,000.00–R32,000.00 | 30 | 1 | 6 | 10 | 2 | 49 | |

| R33,000.00+ | 55 | 0 | 5 | 22 | 5 | 87 | |

| Total | 202 | 3 | 41 | 84 | 32 | 362 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Udoakpan, N.; Tengeh, R.K. The Impact of Over-the-Top Television Services on Pay-Television Subscription Services in South Africa. J. Open Innov. Technol. Mark. Complex. 2020, 6, 139. https://doi.org/10.3390/joitmc6040139

Udoakpan N, Tengeh RK. The Impact of Over-the-Top Television Services on Pay-Television Subscription Services in South Africa. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):139. https://doi.org/10.3390/joitmc6040139

Chicago/Turabian StyleUdoakpan, Nokuphiwa, and Robertson Khan Tengeh. 2020. "The Impact of Over-the-Top Television Services on Pay-Television Subscription Services in South Africa" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 139. https://doi.org/10.3390/joitmc6040139

APA StyleUdoakpan, N., & Tengeh, R. K. (2020). The Impact of Over-the-Top Television Services on Pay-Television Subscription Services in South Africa. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 139. https://doi.org/10.3390/joitmc6040139