Cryptocurrency Open Innovation Payment System: Comparative Analysis of Existing Cryptocurrencies

Abstract

1. Introduction

- The institutional one defines the financial system from the point of view of financial institutions and considers their functioning and relationships within the market;

- The monetary one considers the financial system from the side of providing the real economy with money, that is, it reveals this concept as a mechanism for providing the real economy with money;

- The distributive one characterizes the financial system from the point of view of the functions of distribution and transformation of capital or from the point of view of the mechanism of redistribution of funds depending on their excess or shortage;

- The functional one performs the function of a system that covers a network of financial markets, financial intermediaries, and other financial institutions that implement the financial plans of households, businesses, and public authorities; and

- In the system approach the relationship between the elements of the financial system and their impact on the functioning of the financial sector and the economy as a whole is considered [1].

2. Literature Review

3. Methods

4. Results

5. Discussion: Cryptocracy Open Innovation

- The possibility of linking the value of cryptocurrencies to specific assets, which ensures the reliability of the cryptocurrency, for example, the cost of electricity. This means that there are no real specific performance indicators that confirm the intrinsic value of the cryptocurrency. For example, the internal value of shares is determined by analyzing the financial condition of the issuer and its performance indicators (liquidity, profitability, property value, etc.) [46,47].

- The human factor. In the absence of oscillators and other indicators on the stock exchange in the crypto sector, investors tend to make trading mistakes, which negatively affects the stability of supply and demand and, accordingly, the cryptocurrency exchange rate.

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Vejačka, M. Basic Aspects of Cryptocurrencies. J. Econ. Bus. Financ. 2014, 2, 75–83. [Google Scholar]

- Saiedi, E.; Bronström, A.; Ruiz, F. Global drivers of the cryptocurrency infrastructure adoption. Small Bus. Econ. 2020. [Google Scholar] [CrossRef]

- Batrancea, L.; Batrancea, I.; Moscviciov, A. The analysis of entity’s liquidity—A means of evaluating cash flow. Int. J. Financ. Econ. 2009, 9, 92–98. [Google Scholar]

- Giudici, G.; Milne, A.; Vinogradov, D. Cryptocurrencies: Market analysis and perspectives. J. Ind. Bus. Econ. 2019, 47, 1–18. [Google Scholar] [CrossRef]

- Uematsu, Y.; Tanaka, S. High-dimensional Macroeconomic Forecasting and Variable Selection via Penalized Regression. Econom. J. 2017. [Google Scholar] [CrossRef]

- Tinbergen, J. Shaping the World Economy; Suggestions for an International Economic Policy; Twentieth Century Fund: New York, NY, USA, 1962; p. 113. [Google Scholar]

- Tasca, P.; Hayes, A.; Liu, S. The evolution of the Bitcoin economy: Extracting and analyzing the network of payment relationships. J. Risk Financ. 2018, 19, 94–126. [Google Scholar] [CrossRef]

- Swan, M. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Newton, MA, USA, 2015; p. 23. [Google Scholar]

- Singh Maini, S.; Govinda, K. Stock Market Prediction using Data Mining Techniques. In Proceedings of the IEEE 2017 International Conference on Intelligent Sustainable Systems (ICISS 2017), Tirupur, India, 7–8 December 2017. [Google Scholar]

- Silva, J.S.; Tenreyro, S. The log of gravity. Rev. Econ. Stat. 2006, 88, 641–658. [Google Scholar] [CrossRef]

- Shahrivari, S.; Jalili, S. Beyond Batch Processing: Towards Real-Time and Streaming Big Data. Computers 2014, 3, 117. [Google Scholar] [CrossRef]

- Remy, C.; Rym, B.; Matthieu, L. Tracking Bitcoin users activity using community detection on a network of weak signals. In Proceedings of the 6th International workshop on complex networks and their applications, Lyon, France, 29 November–1 December 2017; Springer: Berlin/Heidelberg, Germany, 2017; pp. 166–177. [Google Scholar]

- Yun, J.J.; Won, D.; Park, K. Dynamics from open innovation to evolutionary change. J. Open Innov. Technol. Mark. Complex. 2016, 2, 7–22. [Google Scholar] [CrossRef]

- Reid, F.; Harrigan, M. An Analysis of Anonymity in the Bitcoin System. Security and Privacy in Social Networks; Springer: Berlin/Heidelberg, Germany, 2013; pp. 197–223. [Google Scholar]

- Puri, V. Decrypting Bitcoin Prices and Adoption Rates Using Google Search. CMC Senior Theses, Claremont McKenna College, Claremont, CA, USA, 2016. Paper 1418. p. 27. Available online: http://scholarship.claremont.edu/cmc_theses (accessed on 12 March 2021).

- Neudecker, T.; Hartenstein, H. Could network information facilitate address clustering in Bitcoin? In Proceedings of the 21st International Conference on Financial Cryptography and Data Security, Sliema, Malta, 3–7 April 2017; Springer: Cham, Switzerland, 2017; pp. 155–169. [Google Scholar]

- Hedge, M.S.; Krishna, G.; Srinath, R. An Ensemble Stock Predictor and Recommender System. In Proceedings of the IEEE 2018 International Conference on Advances in Computing, Communications and Informatics (ICACCI 2018), Bangalore, India, 19–22 September 2018. [Google Scholar]

- Manning, C.D.; Raghavan, P.; Schütze, H. Introduction to Information Retrieval; Cambridge University Press: New York, NY, USA, 2008; p. 123. [Google Scholar]

- Lohrmann, C.; Luukka, P. Classification of intraday S&P500 returns with a Random Forest. Int. J. Forecast. 2018, 35. [Google Scholar] [CrossRef]

- Lischke, M.; Fabian, B. Analyzing the Bitcoin network: The first four years. Future Internet 2016, 8, 7. [Google Scholar] [CrossRef]

- Li, J.; Cheng, K.; Wang, S.; Morstatter, F.; Trevino, R.P.; Tang, J.; Liu, H. Feature Selection: A Data Perspective. arXiv 2016, arXiv:1601.07996. [Google Scholar] [CrossRef]

- Lewer, J.J.; Van den Berg, H. A gravity model of immigration. Econ. Lett. 2008, 99, 164–167. [Google Scholar] [CrossRef]

- Lahmiri, S.; Bekiros, S. Cryptocurrency forecasting with deep learning chaotic neural networks. Chaos Solitons Fractals 2019, 118, 35–40. [Google Scholar] [CrossRef]

- Kroll, J.A.; Davey, I.C.; Felten, E.W. The economics of Bitcoin mining, or Bitcoin in the presence of adversaries. In Proceedings of the 12th Workshop on the Economics of Information Security (WEIS 2013), Washington, DC, USA, 11–12 June 2013; p. 11. [Google Scholar]

- Kristoufek, L. What Are the Main Drivers of the Bitcoin Price? Evidence from Wavelet Coherence Analysis. PLoS ONE 2015, 10, e0123923. [Google Scholar] [CrossRef]

- Kristoufek, L. BitCoin meets Google Trends and Wikipedia: Quantifying the relationship between phenomena of the Internet era. Sci. Rep. 2013, 3, 3415. [Google Scholar] [CrossRef] [PubMed]

- Krauss, C.; Do, X.A.; Huck, N. Deep neural networks, gradient-boosted trees, random forests: Statistical arbitrage on the S&P. Eur. J. Oper. Res. 2017, 259. [Google Scholar] [CrossRef]

- Krause, M. Bitcoin: Implications for the Developing World. CMC Senior Theses, Claremont McKenna College, Claremont, CA, USA, 2016. Paper 1261. p. 75. [Google Scholar]

- Koshy, D.; Koshy, P.; McDaniel, P. An analysis of anonymity in Bitcoin using p2p network traffic. In Proceedings of the 18th International Conference on Financial Cryptography and Data Security, Christ Church, Barbados, 3–7 March 2014; Springer: Berlin/Heidelberg, Germany, 2014; pp. 469–485. [Google Scholar]

- Kohavi, R.; John, G. Wrappers for feature selection. Artif. Intell. 1997, 97, 273–324. [Google Scholar] [CrossRef]

- Kenji, K.; Rendell, L. A practical approach to feature selection. In Proceedings of the 9th International Workshop on Machine Learning, Aberdeen, UK, 1–3 July 1992; pp. 368–377. [Google Scholar]

- Kenda, K.; Kažič, B.; Novak, E.; Mladenić, D. Streaming Data Fusion for the Internet of Things. Sensors 2019, 19, 1955. [Google Scholar] [CrossRef] [PubMed]

- Kang, Q.; Zhou, H.; Kang, Y. An Asynchronous Advantage Actor-Critic Reinforcement Learning Method for Stock Selection and Portfolio Management. In Proceedings of the 2nd International Conference on Big Data Research, Seattle, WA, USA, 10–13 December 2018; pp. 141–145. [Google Scholar]

- Jiao, Y.; Jakubowicz, J. Predicting Stock Movement Direction with Machine Learning: An Extensive Study on S&P 500 Stocks. In Proceedings of the 2017 IEEE International Conference on Big Data (IEEE BigData 2017), Boston, MA, USA, 11–14 December 2017. [Google Scholar]

- Guo, T.; Antulov-Fantulin, N. Predicting short-term Bitcoin price fluctuations from buy and sell orders. arXiv 2018. [Google Scholar]

- Goldberger, A.S. The Interpretation and Estimation of Cobb-Douglas Functions. Econometrica 1968, 36, 464. [Google Scholar] [CrossRef]

- An, J.; Mikhaylov, A. Russian energy projects in South Africa. J. Energy South. Afr. 2020, 31, 58–64. [Google Scholar] [CrossRef]

- An, J.; Mikhaylov, A.; Richter, U.H. Trade war effects: Evidence from sectors of energy and resources in Africa. Heliyon 2020, 6, e05693. [Google Scholar] [CrossRef] [PubMed]

- Denisova, V.; Mikhaylov, A.; Lopatin, E. Blockchain infrastructure and growth of global power consumption. Int. J. Energy Econ. Policy 2019, 9, 22–29. [Google Scholar] [CrossRef]

- Dooyum, U.D.; Mikhaylov, A.; Varyash, I. Energy security concept in Russia and South Korea. Int. J. Energy Econ. Policy 2020, 10, 102–107. [Google Scholar] [CrossRef]

- Lee, M.; Yun, J.J.; Pyka, A.; Won, D.; Kodama, F.; Schiuma, G.; Park, H.; Jeon, J.; Park, K.; Jung, K.; et al. How to Respond to the Fourth Industrial Revolution, or the Second Information Technology Revolution? Dynamic New Combinations between Technology, Market, and Society through Open Innovation. J. Open Innov. Technol. Mark. Complex. 2018, 4, 21. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z. Micro- and Macro-Dynamics of Open Innovation with a Quadruple-Helix Model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Wagner, R. The Invention of Culture; University of Chicago Press: Chicago, IL, USA, 2016. [Google Scholar]

- Swidler, A. Culture in Action: Symbols and Strategies. Am. Sociol. Rev. 1986, 51, 273. [Google Scholar] [CrossRef]

- Bhabha, H.K. The Location of Culture; Routledge: Abingdon, UK, 2012. [Google Scholar]

- Grant, A.M.; Mayer, D.M. Good soldiers and good actors: Prosocial and impression management motives as interactive pre-dictors of affiliative citizenship behaviors. J. Appl. Psychol. 2009, 94, 900–912. [Google Scholar] [CrossRef]

- Marion, T.; Fixson, S. The Innovation Navigator: Transforming Your Organization in the Era of Digital Design and Collaborative Culture; University of Toronto Press: Toronto, ON, Canada, 2018. [Google Scholar]

- Coyle, D. The Culture Code: The Secrets of Highly Successful Groups; Bantam: New York, NY, USA, 2018. [Google Scholar]

- Murphy, P.J.; Cooke, R.A.; Lopez, Y. Firm culture and performance: Intensity’s effects and limits. Manag. Decis. 2013, 51, 661–679. [Google Scholar] [CrossRef]

- Hofstede, G. Culture’s Consequences: Comparing Values, Behaviors, Institutions, and Organizations across Nations; Sage Publications: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- O’Rilly, C.; Chatman, J. Culture as social control: Corporations, culture, and commitment. Res. Organ. Behav. 1996, 18, 157–200. [Google Scholar]

- Hope, O.K. Firm-level disclosures and the relative roles of culture and legal origin. J. Int. Financ. Manag. Account. 2003, 14, 218–248. [Google Scholar] [CrossRef]

- Mello, J.E.; Stank, T.P. Linking firm culture and orientation to supply chain success. Int. J. Phys. Distrib. Logist. Manag. 2005, 35, 542–554. [Google Scholar] [CrossRef]

- Galbreath, J. Drivers of Corporate Social Responsibility: The Role of Formal Strategic Planning and Firm Culture. Br. J. Manag. 2010, 21, 511–525. [Google Scholar] [CrossRef]

- Ouchi, W.G.; Wilkins, A.L. Organizational culture. Annu. Rev. Sociol. 1985, 11, 457–483. [Google Scholar] [CrossRef]

- Hartog, D.N.; Verburg, R.M. High performance work systems, organisational culture and firm effectiveness. Hum. Resour. Manag. J. 2004, 14, 55–78. [Google Scholar] [CrossRef]

- Gura, D.; Mikhaylov, A.; Glushkov, S.; Zaikov, M.; Shaikh, Z.A. Model for estimating power dissipation along the interconnect length in single on-chip topology. Evol. Intell. 2020, s12065. [Google Scholar] [CrossRef]

- Mikhaylov, A. Pricing in Oil Market and Using Probit Model for Analysis of Stock Market Effects. Int. J. Energy Econ. Policy 2018, 8, 69–73. [Google Scholar]

- Mikhaylov, A. Volatility Spillover Effect between Stock and Exchange Rate in Oil Exporting Countries. Int. J. Energy Econ. Policy 2018, 8, 321–326. [Google Scholar]

- Mikhaylov, A. Oil and Gas Budget Revenues in Russia after Crisis in 2015. Int. J. Energy Econ. Policy 2019, 9, 375–380. [Google Scholar]

- Mikhaylov, A. Cryptocurrency Market Development: Hurst Method. Financ. Theory Pract. 2020, 24, 81–91. [Google Scholar] [CrossRef]

- Mikhaylov, A. Geothermal energy development in Iceland. Int. J. Energy Econ. Policy 2020, 10, 31–35. [Google Scholar] [CrossRef]

- Mikhaylov, A.; Moiseev, N.; Aleshin, K.; Burkhardt, T. Global climate change and greenhouse effect. Entrep. Sustain. Issues 2020, 7, 2897–2913. [Google Scholar] [CrossRef]

- Nie, D.; Panfilova, E.; Samusenkov, V.; Mikhaylov, A. E-Learning Financing Models in Russia for Sustainable Development. Sustainability 2020, 12, 4412. [Google Scholar] [CrossRef]

- Nyangarika, A.; Mikhaylov, A.; Tang, B.-J. Correlation of Oil Prices and Gross Domestic Product in Oil Producing Countries. Int. J. Energy Econ. Policy 2018, 8, 42–48. [Google Scholar]

- Nyangarika, A.; Mikhaylov, A.; Richter, U. Oil Price Factors: Forecasting on the Base of Modified Auto-regressive Integrated Moving Average Model. Int. J. Energy Econ. Policy 2019, 9, 149–160. [Google Scholar]

- Nyangarika, A.; Mikhaylov, A.; Richter, U. Influence Oil Price towards Economic Indicators in Russia. Int. J. Energy Econ. Policy 2019, 9, 123–130. [Google Scholar] [CrossRef]

- Yumashev, A.; Ślusarczyk, B.; Kondrashev, S.; Mikhaylov, A. Global Indicators of Sustainable Development: Evaluation of the Influence of the Human Development Index on Consumption and Quality of Energy. Energies 2020, 13, 2768. [Google Scholar] [CrossRef]

| Characteristics | Decentralized System | Centralized System |

|---|---|---|

| Transaction confirmation | It takes place using power technology | Controls the system management, which is an independent party [14] |

| Scalability | Problems of bandwidth expansion, frequent emission limitations | High throughput and expansion capabilities of the system [15] |

| Stability | The heterogeneity of the technical equipment of the system participants makes it unpredictable and unstable | Standardized control system hardware and software improves the stability and speed of the system |

| Risk of Attack 51% | The smaller the system, the greater the possibility of capturing control by a group of miners with a share greater than 51% [16] | NA |

| Privacy | No need for personal data [17] | NA |

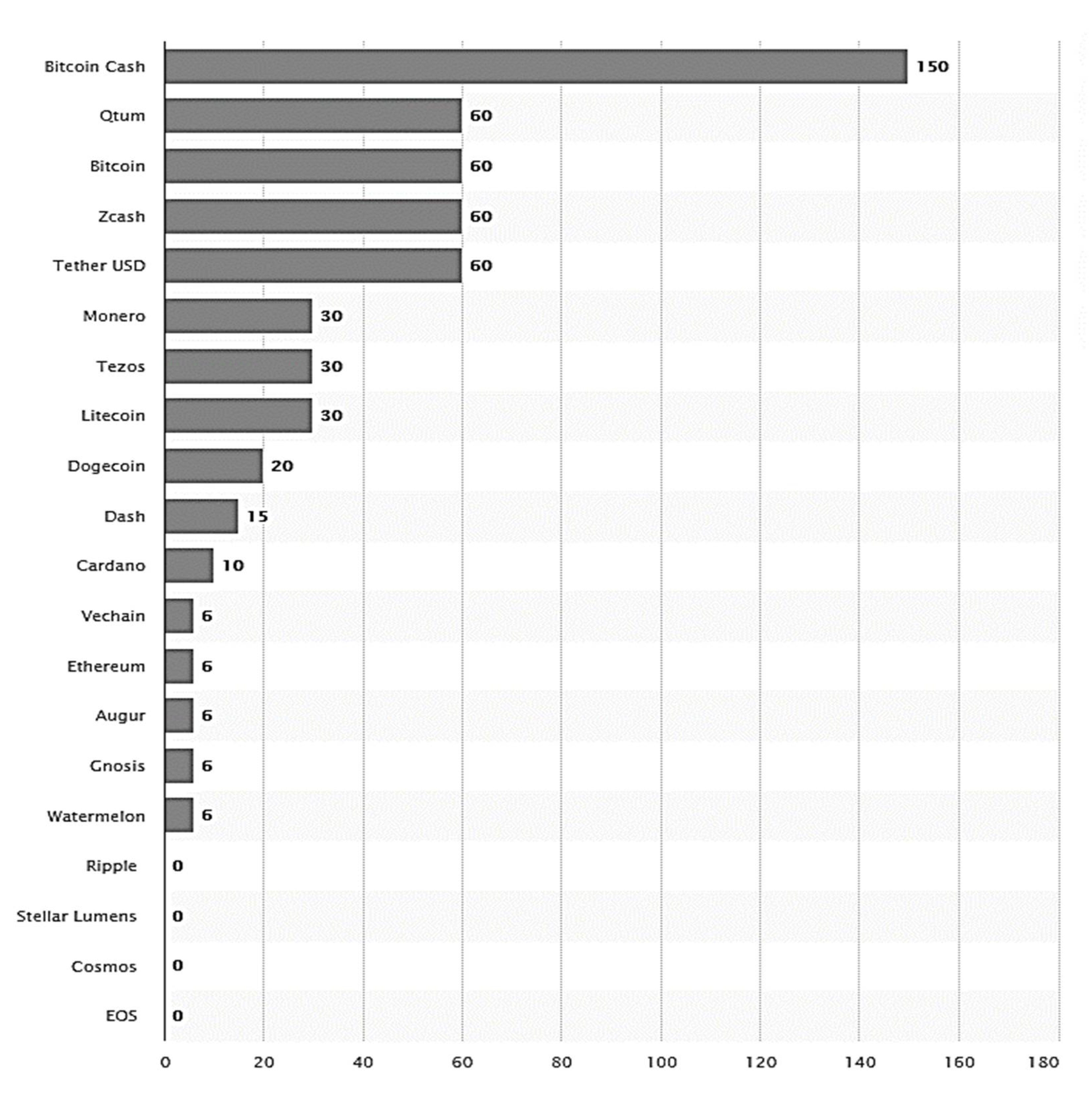

| Regression Model | F |

|---|---|

| Bitcoin Cash | 6.47 |

| Qtum | 2.64 |

| Bitcoin | 1.36 |

| Zcash | 3.06 |

| Tether | 2.68 |

| Monero | 0.005 |

| Tezos | 5.48 |

| Litecoin | 3.06 |

| Dogecoin | 0.82 |

| Dash | 1.97 |

| Cardano | 3.70 |

| Vechain | 0.01 |

| Ethereum | 1.43 |

| Augur | 0.04 |

| Gnosis | 0.93 |

| Watermelon | 0.97 |

| Ripple | 1.70 |

| Stellar Lumens | 0.51 |

| Cosmos | 0.43 |

| EOS | 0.14 |

| Visa | 4.33 |

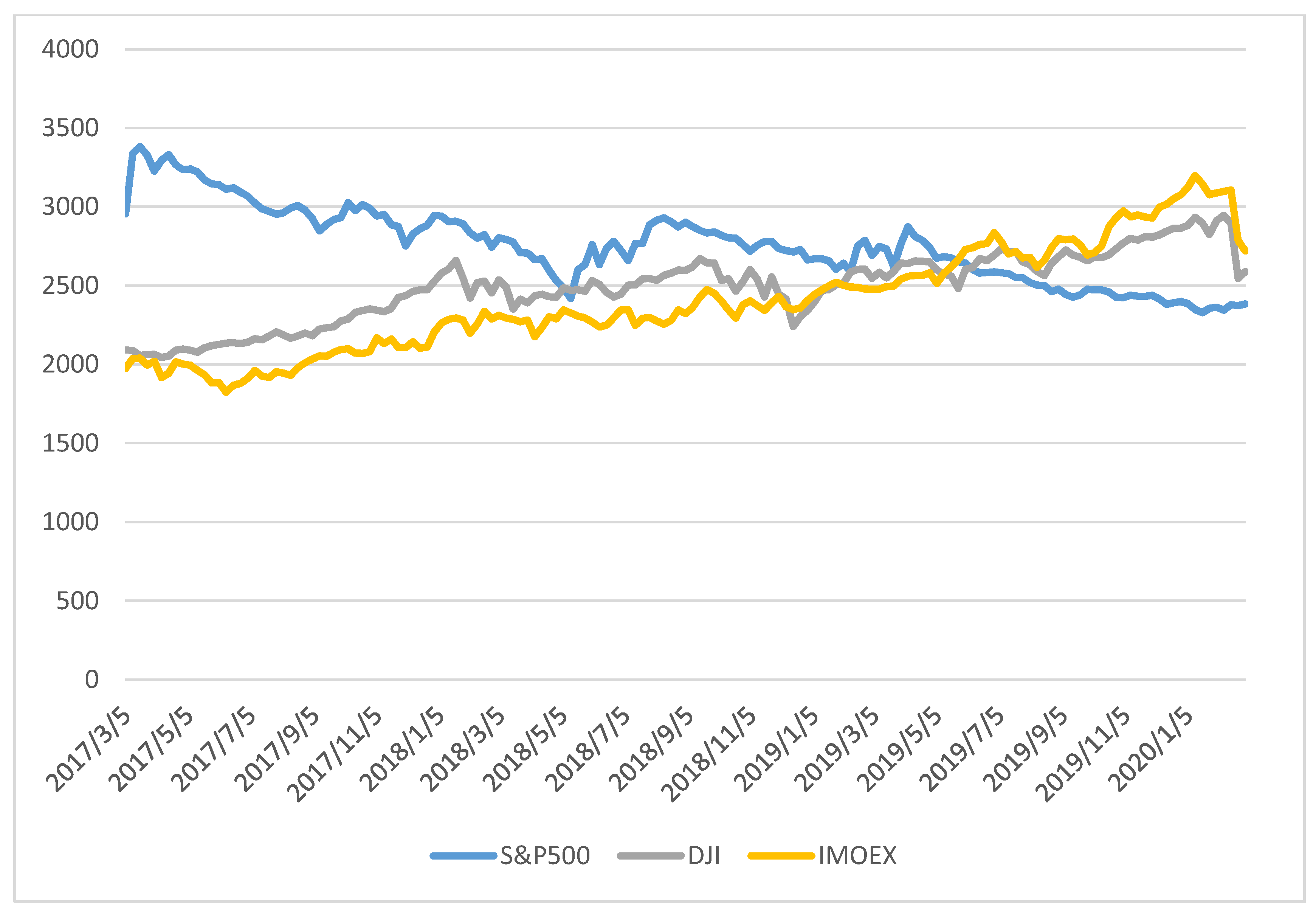

| Bitcoin | S&P500 | DJI | IMOEX | |

|---|---|---|---|---|

| Bitcoin | 1 | |||

| S&P500 | 0.53008 | 1 | ||

| DJI | 0.607055 | 0.84014 | 1 | |

| IMOEX | 0.439451 | 0.87806 | 0.911365 | 1 |

| Explained Variables | Number of Transactions Added to the Mempool per Second | Number of Terahashes per Second in the Last 24 h | Average Time for which a Transaction Including in the Extracted Block and the Public Register |

|---|---|---|---|

| Bitcoin cash | 0.03 | 0.02 | −0.05 |

| Bitcoin | 0.02 | 0.02 | −0.01 |

| Ethereum | 0.16 | 0.23 | −0.14 |

| Ripple | 0.03 | 0.04 | −0.02 |

| Bitcoin | 0.02 | 0.04 | −0.06 |

| Stellar | 0.03 | 0.07 | −0.05 |

| Litecoin | 0.08 | 0.16 | −0.08 |

| Monero | 0.01 | 0.08 | −0.07 |

| IOTA | 0.01 | 0.05 | −0.03 |

| Dash | 0.05 | 0.08 | −0.05 |

| Cosmos | 0.06 | 0.05 | −0.03 |

| EOS | 0.01 | 0.01 | −0.01 |

| Significance level | 0.05 | 0.05 | 0.05 |

| Observations | 1.825 | 1.825 | 1.825 |

| R2 | 0.914 | 0.828 | 0.747 |

| Adjusted R2 | 0.912 | 0.829 | 0.748 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Titov, V.; Uandykova, M.; Litvishko, O.; Kalmykova, T.; Prosekov, S.; Senjyu, T. Cryptocurrency Open Innovation Payment System: Comparative Analysis of Existing Cryptocurrencies. J. Open Innov. Technol. Mark. Complex. 2021, 7, 102. https://doi.org/10.3390/joitmc7010102

Titov V, Uandykova M, Litvishko O, Kalmykova T, Prosekov S, Senjyu T. Cryptocurrency Open Innovation Payment System: Comparative Analysis of Existing Cryptocurrencies. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):102. https://doi.org/10.3390/joitmc7010102

Chicago/Turabian StyleTitov, Valery, Mafura Uandykova, Oleg Litvishko, Tatyana Kalmykova, Sergey Prosekov, and Tomonobu Senjyu. 2021. "Cryptocurrency Open Innovation Payment System: Comparative Analysis of Existing Cryptocurrencies" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 102. https://doi.org/10.3390/joitmc7010102

APA StyleTitov, V., Uandykova, M., Litvishko, O., Kalmykova, T., Prosekov, S., & Senjyu, T. (2021). Cryptocurrency Open Innovation Payment System: Comparative Analysis of Existing Cryptocurrencies. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 102. https://doi.org/10.3390/joitmc7010102