Gender Diversity in Boards of Directors: A Bibliometric Mapping

Abstract

1. Introduction

2. Literature Review

2.1. First Period (1994–2005)

2.2. Second Period (2006–2012)

2.3. Third Period (2013–2020)

3. Materials and Methods

4. Analysis

4.1. Citation Analysis

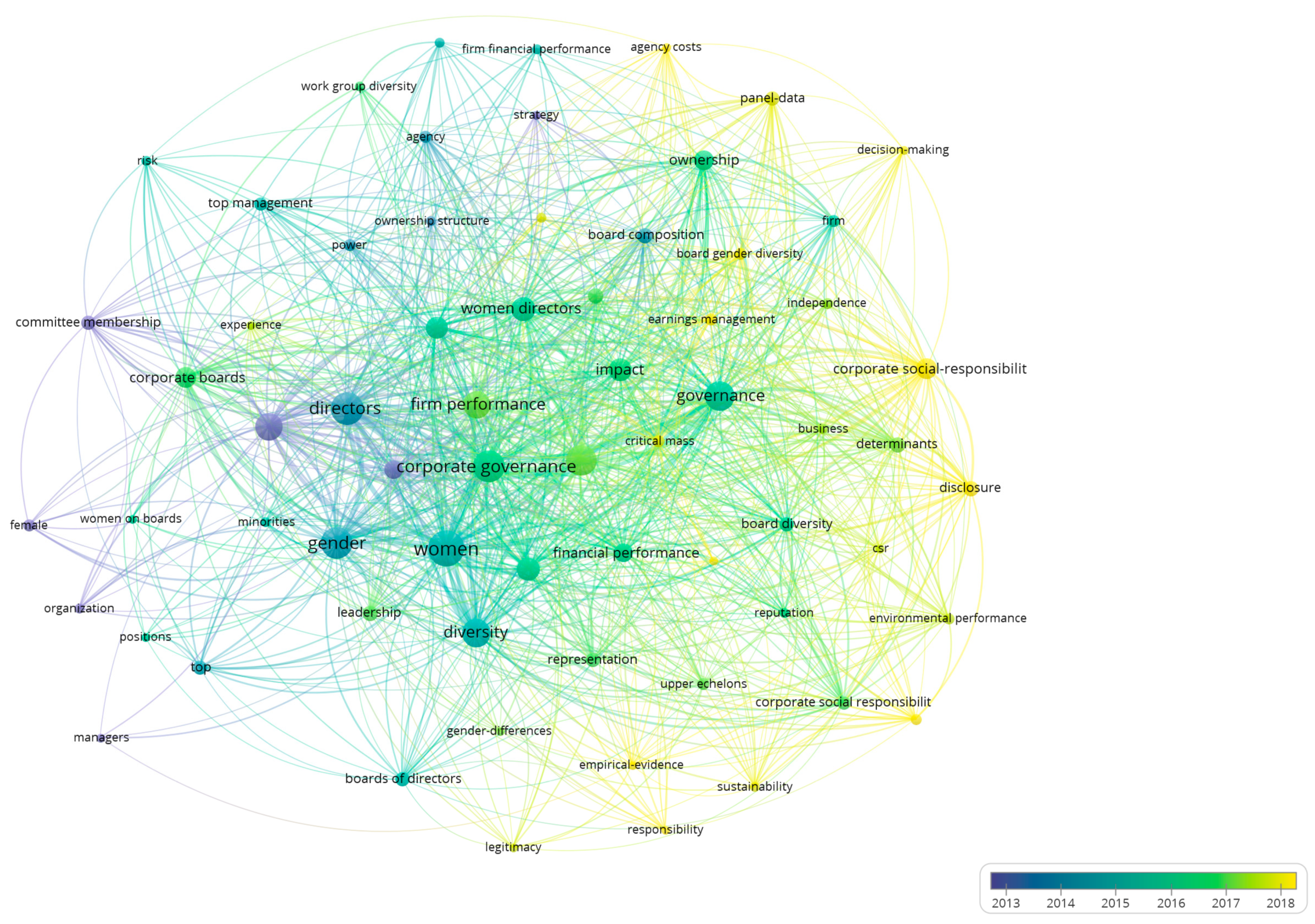

4.2. Keyword Analysis

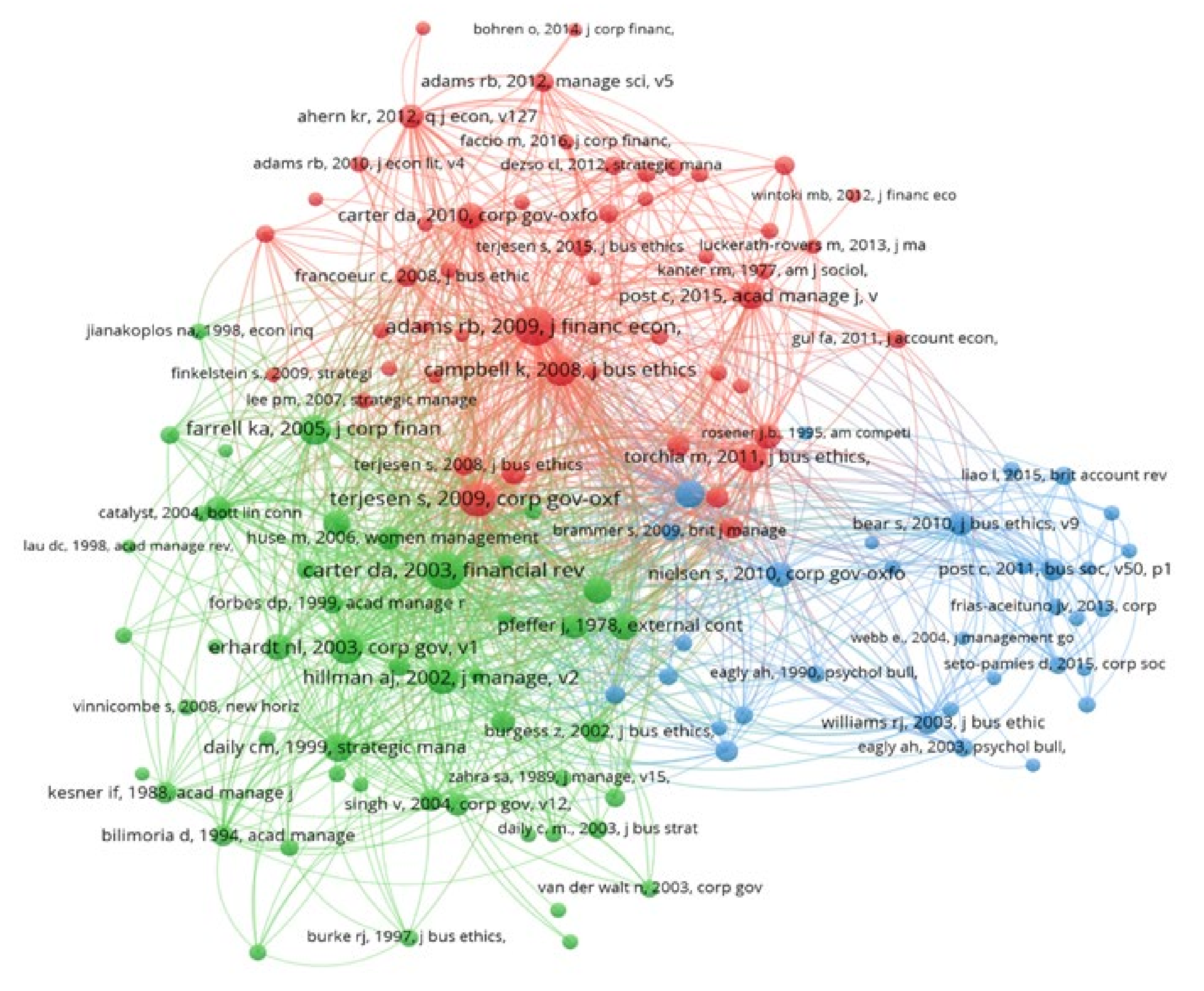

4.3. Co-Citation Analysis

5. Discussion

Gender Diversity and Open Innovation

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- European Institute for Gender Equality (EIGE). Gender Equality Index 2019 Work-Life Balance; European Union, Publications Office of the European Union: Luxembourg, 2019. [Google Scholar]

- Adams, R.B.; Funk, P. Beyond the glass ceiling: Does gender matter? Manage. Sci. 2012, 58, 219–235. [Google Scholar] [CrossRef]

- Chizema, A.; Kamuriwo, D.S.; Shinozawa, Y. Women on corporate boards around the world: Triggers and barriers. Leadersh. Q. 2015, 26, 1051–1065. [Google Scholar] [CrossRef]

- Ayuso, V.M.; Robledo, I.S. Barreras que apuntalan el techo de cristal: Barreras que apuntalan el techo de cristal: Una revisión de sus causas en los consejos de administración de las empresas del IBEX 35. Inf. Comer. Española ICE Rev. Econ. 2016, 892, 123–135. [Google Scholar]

- Akpinar-Sposito, C. Career barriers for women executives and the glass ceiling syndrome: The case study comparison between french and turkish women executives. Procedia Soc. Behav. Sci. 2013. [CrossRef]

- Heredia, E.B.; Ramos, A.; Sarrió, M.; Candela, C. Más allá del “techo de cristal”. Diversidad de género. Rev. Minist. Trab. Asun. Soc. 2002, 40, 55–68. [Google Scholar]

- Broadbridge, A.; Mavin, S. Editorial (Beyond the glass ceiling and metaphors). Gend. Manag. 2016, 31, 502–513. [Google Scholar] [CrossRef]

- Quezada, R.G. Acceso de las mujeres a los cargos directivos: Universidades con techos de cristal. CS 2018, 24, 67–90. [Google Scholar] [CrossRef]

- Smith, G.I.; Main, B. Symbolic management and the glass cliff: Evidence from the boardroom careers of female and male directors. Br. J. Manag. 2018, 29, 136–155. [Google Scholar]

- Cook, A.; Glass, C. Above the glass ceiling: When are women and racial/ethnic minorities promoted to CEO? Strateg. Manag. J. 2014, 35, 1080–1089. [Google Scholar] [CrossRef]

- European Union. Proposal for a Directive of the European Parliament and of the Council on Improving the Gender Balance among Non-Executive Directors of Companies Listed on Stock Exchanges and Related Measures. 2012. Available online: https://ec.europa.eu/info/policies/justice-and-fundamental-rights/gender-equality (accessed on 24 December 2020).

- OECD. Recommendation of the Council on Gender Equality in Education; Employment and Entrepreneurship: Paris, French, 2013. [Google Scholar]

- Poletti-Hughes, J.; Briano-Turrent, G.C. Gender diversity on the board of directors and corporate risk: A behavioural agency theory perspective. Int. Rev. Financ. Anal. 2019, 62, 80–90. [Google Scholar] [CrossRef]

- Jurkus, A.F.; Park, J.C.; Woodard, L.S. Women in top management and agency costs. J. Bus. Res. 2011, 64, 180–186. [Google Scholar] [CrossRef]

- Nishii, L.H.; Gotte, A.; Raver, J.L. Upper Echelon Theory Revisited: The Relationship between Upper Echelon Diversity, the Adoption of Diversity Practices, and Organizational Performance (CAHRS Working Paper #07-04); Cornell University, School of Industrial and Labor Relations, Center for Advanced Human Resource Studies: Ithaca, NY, USA, 2007. [Google Scholar]

- Rodríguez-Fernández, M.; Gaspar-González, A.I.; Sánchez-Teba, E.M. Does diversity in top management teams contribute to organizational performance? The response of the IBEX 35 companies. Soc. Sci. 2020, 9, 36. [Google Scholar] [CrossRef]

- Ruiz-Jiménez, J.M.; Fuentes-Fuentes, M.M.; Ruiz-Arroyo, M. Combination capability and innovation: The effects of gender diversity on top management teams in technology-based firms. J. Bus. Ethics 2016, 135, 503–515. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2010, 84, 523–538. [Google Scholar] [CrossRef] [PubMed]

- Moreno-Gómez, J.; Lafuente, E.; Vaillant, Y. Gender diversity in the board, women’s leadership and business performance. Gend. Manag. 2018, 33, 104–122. [Google Scholar] [CrossRef]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef]

- Berezinets, I.V.; Garanina, T.A.; Ilina, Y.B. Social capital of women directors and financial performance of a company: Empirical study. Russ. Manage. J. 2018, 16, 337–370. [Google Scholar] [CrossRef]

- Usman, M.; Farooq, M.U.; Zhang, J.; Makki, M.A.M.; Khan, M.K. Female directors and the cost of debt: Does gender diversity in the boardroom matter to lenders? Manag. Audit. J. 2019, 34, 374–392. [Google Scholar] [CrossRef]

- Setó-Pamies, D. The relationship between women directors and corporate social responsibility. Corp. Soc. Responsib. Environ. Manag. 2015, 22, 334–345. [Google Scholar] [CrossRef]

- Cook, A.; Ingersoll, A.R.; Glass, C. Gender gaps at the top: Does board composition affect executive compensation? Hum. Relat. 2019, 72, 1292–1314. [Google Scholar] [CrossRef]

- Seierstad, C.; Kirton, G. Having it all? Women in high commitment careers and work-life balance in Norway. Gend. Work. Organ. 2015, 22, 390–404. [Google Scholar] [CrossRef]

- De Cabo, R.; Terjesen, S.; Escot, L.; Gimeno, R. Do ‘soft law’ board gender quotas work? Evidence from a natural experiment. Eur. Manag. J. 2019, 37, 611–624. [Google Scholar] [CrossRef]

- Bilimoria, D.; Piderit, S. Board committee membership, effects of sex-based bias. Acad. Manag. J. 1994, 37, 1453–1477. [Google Scholar] [CrossRef]

- Sheridan, A.; Milgate, G. Accessing board positions: A comparison of female and male board members’ views. Corp. Gov. 2005, 13, 847–855. [Google Scholar] [CrossRef]

- Daily, C.M.; Certo, S.T.; Dalton, D.R. A decade of corporate women: Some progress in the boardroom, none in the executive suite. Strateg. Manag. J. 1999, 20, 93–100. [Google Scholar] [CrossRef]

- Campbell, K.; Minguez-Vera, A. Female board appointments and firm valuation: Short and long-term effects. J. Manag. Gov. 2010, 14, 37–59. [Google Scholar] [CrossRef]

- Elstad, B.; Ladegard, G. Women on corporate boards: Key influencers or tokens? J. Manag. Gov. 2012, 16, 595–615. [Google Scholar] [CrossRef]

- Wynarczyk, P. An Investigation into the Participation of Women in Industrial Research and Development (R&D) in the North East of England; Emerald group: Bingley, UK, 2010. [Google Scholar]

- Erynne, L.; Bernardi, R.; Bosco, S. Recognition for sustained corporate social responsibility: Female directors make a difference. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 27–36. [Google Scholar] [CrossRef]

- Gago, R.F.; García, L.C.; Nieto, M. Corporate social responsibility, board of directors, and firm performance: An analysis of their relationships. Rev. Mang. Sci. 2016, 10, 85–104. [Google Scholar] [CrossRef]

- Orazalin, N.; Baydauletov, M. Corporate social responsibility strategy and corporate environmental and social performance: The moderating role of board gender diversity. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1664–1676. [Google Scholar] [CrossRef]

- Colakoglu, N.; Eryilmaz, M.; Ferrero, J.M. Is board diversity an antecedent of corporate social responsibility performance in firms? A research on the 500 biggest Turkish companies. Soc. Responsib. J. 2020. [CrossRef]

- Kassinis, G.; Panayiotou, A.; Dimou, A.; Katsifaraki, G. Gender and enviromental sustainability: A longitudinal analysis. Corp. Soc. Responsib. Environ. Manag. 2016, 23, 399–412. [Google Scholar] [CrossRef]

- Hernández-Nicolás, C.M.; Martín-Ugedo, J.F.; Mínguez-Vera, A. The influence of gender on financial decisions: Evidence from small start-up firms in Spain. Ekon. Manag. 2015, 18, 93–107. [Google Scholar] [CrossRef]

- Dang, A.R.; Houanti, L.; Ammari, A.; Lê, N.T. Is there a ‘business case’ for board gender diversity within French listed SMEs. Appl. Econ. Lett. 2018, 25, 980–983. [Google Scholar] [CrossRef]

- Arzubiaga, U.; Iturralde, T.; Maseda, A.; Kotlar, J. Entrepreneurial orientation and firm performance in family SMEs: The moderating effects of family, women, and strategic involvement in the board of directors. Int. Entrep. Manag. J. 2018, 14, 217–244. [Google Scholar] [CrossRef]

- Post, C.; Byron, K. Women on boards and firm financial performance: A meta-analysis. Acad. Manag. J. 2015, 58, 1546–1571. [Google Scholar] [CrossRef]

- Lückerath-Rovers, M. Women on boards and firm performance. J. Manag. Gov. 2013, 17, 491–509. [Google Scholar] [CrossRef]

- Stumbitz, B.; Lewis, S.; Rouse, J. Maternity management in SMEs: A transdisciplinary review and research agenda. Int. J. Manag. Rev. 2018, 20, 500–522. [Google Scholar] [CrossRef]

- Mongeon, P.; Paul-Hus, A. The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics 2016, 106, 213–228. [Google Scholar] [CrossRef]

- Cortés, J. Web of Science: Termómetro de la producción internacional de conocimiento: Ventajas y limitaciones. Cult. Científica Tecnológica 2015, 5, 5–15. [Google Scholar]

- Clarivate Analytics. Available online: http://clarivate.libguides.com/webofscienceplatform/coverage (accessed on 20 April 2020).

- Waltman, L.; Van Eck, N.; Noyons, E.C.M. A unified approach to mapping and clustering of bibliometric networks. J. Informetr. 2010, 4, 629–635. [Google Scholar] [CrossRef]

- Sánchez, M.V.G.; Cancino, J.L.T. Los mapas bibliométricos o mapas de la ciencia: Una herramienta útil para desarrollar estudios métricos de información. Bibl. Univ. 2013, 16, 95–108. [Google Scholar] [CrossRef]

- Fabregat-Aibar, L.; Barberà-Mariné, M.; Terceño, A.; Pié, L. A bibliometric and visualization analysis of Socially responsible funds. Sustainability 2019, 11, 2526. [Google Scholar] [CrossRef]

- Erhardt, N.; Werbel, J.; Shrader, C. Board of director diversity and firm financial performance. Corp. Gov. 2003, 11, 102–111. [Google Scholar] [CrossRef]

- Carter, D.; D’Souza, F.; Simkins, B.; Simpson, G. The gender and ethnic diversity of US boards and board committees and firm financial performance. Corp. Gov. 2010, 18, 396–414. [Google Scholar] [CrossRef]

- Hillman, A.J.; Shropshire, C.; Cannella, A.A., Jr. Organizational predictors of women on corporate boards. Acad. Manag. J. 2007, 50, 941–952. [Google Scholar] [CrossRef]

- Nielsen, S.; Huse, M. The contribution of women on boards of directors: Going beyond the surface. Corp. Gov. 2010, 18, 136–148. [Google Scholar] [CrossRef]

- Hillman, A.J.; Cannella, A.A.; Harris, I.C. Women and racial minorities in the boardroom: How do directors differ? J. Manag. 2002, 28, 747–763. [Google Scholar] [CrossRef]

- Smith, N.; Smith, V.; Verner, M. Do women in top management affect firm performance? A panel study of 2500 Danish firms. Int. J. Product. Perform. Manag. 2006, 55, 569–593. [Google Scholar] [CrossRef]

- Konrad, A.M.; Kramer, V.; Erkut, S. The impact of three or more women on corporate boards. Organ. Dyn. 2008, 37, 145–164. [Google Scholar] [CrossRef]

- Small, H. Co-Citation in the scientific literature: A new measure of the relationship between two documents. J. Am. Soc. Inform. Sci. 1973, 24, 265–269. [Google Scholar] [CrossRef]

- Small, H. Co-Citation in the scientific literature: A new measure of the relationship between two documents. Infor. Sci. 1974, 2, 28–31. [Google Scholar] [CrossRef]

- Carter, D.; Simkins, B.; Simpsons, G. Corporate governance, board diversity, and firm value. Financ. Rev. 2003, 38, 33–53. [Google Scholar] [CrossRef]

- Terjesen, S.; Sealy, R.; Singh, V. Women directors on corporate boards: A review and research agenda. Corp. Gov. 2009, 17, 320–337. [Google Scholar] [CrossRef]

- Campbell, K.; Mínguez-Vera, A. Gender diversity in the boardroom and firm financial performance. J. Bus. Ethics 2008, 83, 435–451. [Google Scholar] [CrossRef]

- Farrell, K.A.; Hersch, P.L. Additions to corporate boards: The effect of gender. J. Corp. Financ. 2005, 11, 85–106. [Google Scholar] [CrossRef]

- Jensen, M.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 19, 305–360. [Google Scholar] [CrossRef]

- Pfeffer, J. Organizational Design; AHM Publishing Corporation: Arlington Heights, IL, USA, 1978. [Google Scholar]

- Ellili, N. Ownership structure, financial policy and performance of the firm: US evidence. Int. J. Bus. Manag. 2011, 6, 80–93. [Google Scholar] [CrossRef][Green Version]

- Carroll, A.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Brammer, S.; Pavelin, S. Voluntary environmental disclosures by large UK companies. J. Bus. Financ. Account. 2006, 33, 1168–1188. [Google Scholar] [CrossRef]

- Kurucz, E.C.; Colbert, B.A.; Wheeler, D. The business case for corporate social responsibility. In The Oxford Handbook of Corporate Social Responsibility; Crane, A., McWilliams, A., Matten, D., Moon, J., Eds.; Oxford University Press: Oxford, UK, 2008; pp. 3–112. [Google Scholar]

- Ciocirlan, C.; Pettersson, C. Does workforce diversity matter in the fight against climate change? An analysis of fortune 500 companies. Corp. Soc. Responsib. Environ. Manag. 2012, 19, 47–62. [Google Scholar] [CrossRef]

- Cabeza-García, L.; Fernández-Gago, R.; Nieto, M. Do board gender diversity and director typology impact CSR reporting? Eur. Manag. Rev. 2018, 15, 559–575. [Google Scholar] [CrossRef]

- Fernandez-Feijoo, B.; Romero, S.; Ruiz-Blanco, S. Women on boards: Do they affect sustainability reporting? Corp. Soc. Responsib. Environ. Manag. 2014, 21, 351–364. [Google Scholar] [CrossRef]

- Rose, C. Does female board representation influence firm performance? The Danish evidence. Corp. Gov. 2007, 15, 404–413. [Google Scholar] [CrossRef]

- Francoeur, C.; Labelle, R.; Sinclair-Desgagné, B. Gender diversity in corporate governance and top management. J. Bus. Ethics 2008, 81, 83–95. [Google Scholar] [CrossRef]

- Ahern, K.R.; Dittmar, A.K. The changing of the boards: The impact on firm valuation of mandated female board representation. Q. J. Econ. 2012, 1277, 137–197. [Google Scholar] [CrossRef]

- Nielsen, S.; Huse, M. Women directors’ contribution to board decision-making and strategic involvement: The role of equality perception. Eur. Manag. Rev. 2010, 7, 16–29. [Google Scholar] [CrossRef]

- Rossi, F.; Hu, C.; Foley, M. Women in the boardroom and corporate decisions of Italian listed companies Does the “critical mass” matter? Manag. Decis. 2017, 55, 1578–1595. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A.; Pavelin, S. Corporate reputation and women on the board. Br. J. Manag. 2009, 20, 17–29. [Google Scholar] [CrossRef]

- Ruiz-Jiménez, J.M.; Fuentes-Fuentes, M. Management capabilities, innovation, and gender diversity in the top management team: An empirical analysis in technology-based SMEs. BRQ 2016, 19, 107–121. [Google Scholar] [CrossRef]

- Mirza, N.I.; Malik, Q.A.; Mahmood, C.K. The value of board diversity in the relationship of corporate governance and investment decisions of pakistani firms. J. Open Innov. Technol. Mark. Complex 2020, 6, 146. [Google Scholar] [CrossRef]

- Sabharwal, M. From glass ceiling to glass cliff: Women in senior executive service. J. Public Adm. Res. Theory 2015, 25, 399–426. [Google Scholar] [CrossRef]

- Hurley, D.; Choudhary, A. Role of gender and corporate risk taking. Int. J. Bus. Soc. 2020, 20, 383–399. [Google Scholar] [CrossRef]

- Tingbani, I.; Chithambo, L.; Tauringana, V.; Papanikolaou, N. Board gender diversity, environmental committee and greenhouse gas voluntary disclosures. Bus. Strategy Environ. 2020. [CrossRef]

- Malovics, G.; Cretan, R.; Mereine-Berki, B.; Toth, J. Socio-Environmental justice, participatory development, and empowerment of segregated urban Roma: Lessons from Szeged, Hungary. Cities 2019, 91, 137–145. [Google Scholar] [CrossRef]

- Berki, B.M.; Málovics, G.; Toth, J.; Creţan, R. The role of social capital and interpersonal relations in the alleviation of extreme poverty and spatial segregation of Romani people in Szeged. J. Urban Reg. Anal. 2017, 9, 33–50. [Google Scholar]

| Authors | Title | Journal | Year Public. | Total Cites | Average per Year |

|---|---|---|---|---|---|

| Erhardt, Werbeland and Shrade [50] | Board of director diversity and firm financial performance | Corporate Governance: An International Review | 2003 | 503 | 27.94 |

| Carter, D’Souza, Simkins and Simpson [51] | The Gender and Ethnic Diversity of US Boards and Board Committees and Firm Financial Performance | Corporate Governance: An International Review | 2010 | 370 | 33.64 |

| Hillman, Shropshire and Cannella [52] | Organizational predictors of women on corporate boards | Academy of Management Journal | 2007 | 304 | 21.71 |

| Nielsen and Huse [53] | The Contribution of Women on Boards of Directors: Going beyond the Surface | Corporate Governance: An International Review | 2010 | 269 | 24.45 |

| Post and Byron [41] | Women on boards and firm financial performance: A meta-analysis | Academy of Management Journal | 2015 | 264 | 44 |

| Hillman, Cannella and Harris [54] | Women and racial minorities in the boardroom: How do directors differ? | Journal of Management | 2002 | 259 | 13.63 |

| Smith, Smith and Verner [55] | Do women in top management affect firm performance? A panel study of 2500 Danish firms | International Journal of Productivity and Performance Management | 2006 | 250 | 16.67 |

| Konrad, Kramer and Erkut [56] | Critical mass: The impact of three or more women on corporate boards | Organizational Dynamics | 2008 | 2012 | 16.31 |

| Adams and Funk [2] | Beyond the Glass Ceiling: Does Gender Matter? | Management Science | 2012 | 207 | 23 |

| Daily, Certo and Dalton [29] | A decade of corporate women: Some progress in the boardroom, none in the executive suite | Strategic Management Journal | 1999 | 172 | 7.82 |

| Rank | Keyword | Number of Times Used by Academics | Rank | Keyword | Number of Times Used by Academics |

|---|---|---|---|---|---|

| 1 | Women | 60 | 9 | Impact | 26 |

| 2 | Directors | 58 | 10 | Women directors | 24 |

| 3 | Gender diversity | 48 | 11 | Corporate Social Responsibility | 21 |

| 4 | Governance | 44 | 12 | Board of directors | 20 |

| 5 | Gender | 42 | 13 | Financial performance | 17 |

| 6 | Performance | 38 | 14 | Determinants | 14 |

| 7 | Firm performance | 34 | 15 | Top | 12 |

| 8 | Management | 28 | - | - | - |

| Ranking | Author/s (Year) | Number of Cites | Total Connection Force |

|---|---|---|---|

| 1 | Adams and Ferreira (2009) [20] | 74 | 1421 |

| 2 | Carter et al. (2003) [59] | 72 | 1424 |

| 3 | Terjesen et al. (2009) [60] | 61 | 1129 |

| 4 | Erhardt et al. (2003) [50] | 49 | 1008 |

| 5 | Campbell and Mínguez-Vera (2008) [61] | 47 | 982 |

| 6 | Hillman et al. (2002) [54] | 47 | 971 |

| 7 | Farrell Hersch (2005) [62] | 44 | 812 |

| 8 | Daily et al. (1999) [29] | 40 | 710 |

| 9 | Jensen (1976) [63] | 38 | 727 |

| 10 | Pfeffer (1978) [64] | 37 | 718 |

| Co-citation Map (Red Cluster) | Keyword Map (Green Cluster) |

|---|---|

| “Corporate governance, board diversity, and firm value” Carter et al., 2003 [59] “Women in the boardroom and their impact on governance and performance” Adams and Ferreira, 2009 [20] “Does female board representation influence firm performance? The Danish evidence” Rose, 2007 [72] | Firm Performance |

| “Gender diversity in corporate governance and top management” Francoeur et al., 2008 [73] | Corporate Governance |

| “Women in the boardroom and their impact on governance and performance” Adams and Ferreira, 2009 [20] “The changing of the boards: The impact on firm valuation of mandated female board” Ahern and Dittmar, 2012 [74] | Impact |

| “Board of director diversity and firm financial performance” Erhardt et al., 2003 [50] | Board Gender Diversity |

| “Women directors’ contribution to board decision-making and strategic involvement: The role of equality perception” Nielsen and Huse, 2010 [75] | Decision Making |

| “Board of director diversity and firm financial performance” Erhardt et al., 2003 [50] “Gender diversity in the Boardroom and firm financial performance” Campbell and Mínguez-Vera, 2008 [61] “Women on boards and firm financial Performance: A meta-analysis” Post et al., 2015 [41] | Financial Performance |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sánchez-Teba, E.M.; Benítez-Márquez, M.D.; Porras-Alcalá, P. Gender Diversity in Boards of Directors: A Bibliometric Mapping. J. Open Innov. Technol. Mark. Complex. 2021, 7, 12. https://doi.org/10.3390/joitmc7010012

Sánchez-Teba EM, Benítez-Márquez MD, Porras-Alcalá P. Gender Diversity in Boards of Directors: A Bibliometric Mapping. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):12. https://doi.org/10.3390/joitmc7010012

Chicago/Turabian StyleSánchez-Teba, Eva María, María Dolores Benítez-Márquez, and Paloma Porras-Alcalá. 2021. "Gender Diversity in Boards of Directors: A Bibliometric Mapping" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 12. https://doi.org/10.3390/joitmc7010012

APA StyleSánchez-Teba, E. M., Benítez-Márquez, M. D., & Porras-Alcalá, P. (2021). Gender Diversity in Boards of Directors: A Bibliometric Mapping. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 12. https://doi.org/10.3390/joitmc7010012