Technological Capabilities, Open Innovation, and Eco-Innovation: Dynamic Capabilities to Increase Corporate Performance of SMEs

Abstract

:1. Introduction

2. Literature Review and Hypothesis Statement

2.1. TC, Open Innovation, Eco-Innovation, and Corporate Performance

2.2. Open Innovation, Eco-Innovation, and Corporate Performance

3. Materials and Methods

3.1. Sample

3.2. Characteristics of SMEs

3.3. Design and Validation of Data Collection Instrument

3.4. Measurement of Variables

3.4.1. Technological Capability (TC)

3.4.2. Open Innovation (OINN)

3.4.3. Eco-Innovation (EINN)

3.4.4. Corporate Performance (CPERF)

4. Results

4.1. Measurement Model

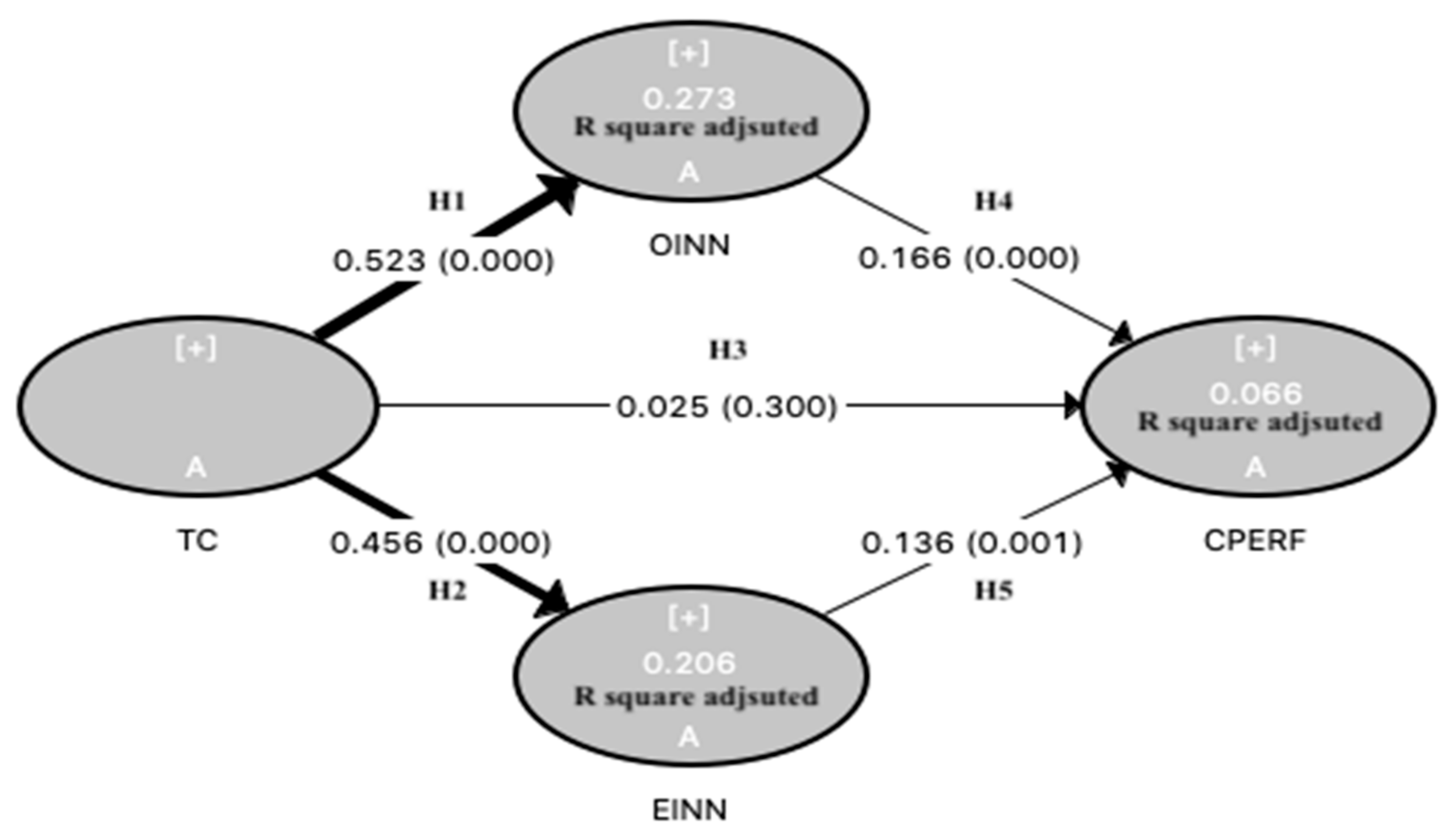

4.2. Structural Model

4.2.1. Indicators of Predictive Analysis of the Model

4.2.2. Measuring the Predictive Relevance of the Model

4.2.3. Multiple Mediation Analysis

4.2.4. Multi-Group Analysis

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. (Survey)

- Block I

- Activity sector: □ Trade

- Gender: □ Female □ Male

- Size of the company: □ Small (10–50 employees) □ Medium (51–200 employees)

- Level of education: □ Basic studies □ University studies

- Type of company: □ Moral □ Physical

- Geographic location of the company: □ Sonora □ Baja California □ Sinaloa

- Block II

| 1: Completely Disagree, 5: Completely Agree | Authors (Researchers)/Factor Load | |||||

| Technological capability (TC): In the last 2 years your company: | 1 | 2 | 3 | 4 | 5 | [10,74,75] |

| TC1: Had information technology better than the competition | □ | □ | □ | □ | □ | 0.776 |

| TC2: Used technological tools to negotiate with suppliers | □ | □ | □ | □ | □ | 0.721 |

| TC3: Used software for intradepartmental communication | □ | □ | □ | □ | □ | 0.831 |

| TC4: Had qualified personnel to handle ICT | □ | □ | □ | □ | □ | 0.857 |

| TC5: Used ICT for decision-making | □ | □ | □ | □ | □ | 0.832 |

| Open innovation: In the last 2 years your company: | 1 | 2 | 3 | 4 | 5 | [6,7,103,104] |

| Inbound | ||||||

| OINN1: Participated in projects with other companies in the sector | □ | □ | □ | □ | □ | 0.853 |

| OINN2: Had direct participation of customers in improving products | □ | □ | □ | □ | □ | 0.819 |

| OINN3: Had participation of suppliers in improving innovation processes | □ | □ | □ | □ | □ | 0.858 |

| Outbound | ||||||

| OINN4: Had sales of licenses or registration of new brands | □ | □ | □ | □ | □ | 0.842 |

| OINN5: Had sales of intangible assets such as know-how | □ | □ | □ | □ | □ | 0.880 |

| OINN6: Developed new businesses with internal knowledge | □ | □ | □ | □ | □ | 0.873 |

| Eco-innovation: In the last 2 years your company has: | 1 | 2 | 3 | 4 | 5 | [76,77,105,106,107,108] |

| EINN1: Designed products that reduce the use of materials | □ | □ | □ | □ | □ | 0.856 |

| EINN2: Designed products with components for reuse or recycling | □ | □ | □ | □ | □ | 0.835 |

| EINN3: Designed products to avoid or reduce the use of hazardous materials | □ | □ | □ | □ | □ | 0.765 |

| INN4: Used production processes that minimize or reduce waste | □ | □ | □ | □ | □ | 0.814 |

| EINN5: Cooperated and linked with sustainable suppliers | □ | □ | □ | □ | □ | 0.853 |

| EINN6: Used processes and technologies focused on energy efficiency | □ | □ | □ | □ | □ | 0.855 |

| EINN7: Exchanged ideas for the design of green products with stakeholders (employees, customers, and suppliers) | □ | □ | □ | □ | □ | 0.829 |

| Corporate performance: In the last 3 years your company has achieved: | 1 | 2 | 3 | 4 | 5 | [16,78,79,109,110] |

| CPERF1: Increased profits (financial profits) | □ | □ | □ | □ | □ | 0.718 |

| CPERF2: Increased sales of products and services | □ | □ | □ | □ | □ | 0.752 |

| CPERF3: Increased contribution margin (costs + expenses, income) | □ | □ | □ | □ | □ | 0.758 |

| CPERF4: Increased market share in the sector | □ | □ | □ | □ | □ | 0.793 |

References

- Kanter, R.M. Innovation: The classic traps. Harv. Bus. Rev. 2006, 84, 72–83. [Google Scholar]

- Geissdoerfer, M.; Vladimirova, D.; Evans, S. Sustainable business model innovation: A review. J. Clean. Prod. 2018, 198, 401–416. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plan. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Scuotto, V.; Del Giudice, M.; Bresciani, S.; Meissner, D. Knowledge-driven preferences in informal inbound open innovation modes. An explorative view on small to medium enterprises. J. Knowl. Manag. 2017, 21, 640–655. [Google Scholar] [CrossRef]

- Zanjirchi, S.M.; Jalilian, N.; Mehrjardi, M.S. Open innovation: From technology exploitation to creation of superior performance. Asia Pac. J. Innov. Entrep. 2019, 13, 326–340. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business School Press: Brighton, MA, USA, 2006; ISBN 9781422102831. [Google Scholar]

- West, J.; Salter, A.; Vanhaverbeke, W.; Chesbrough, H. Open innovation: The next decade. Res. Policy 2014, 43, 805–811. [Google Scholar] [CrossRef]

- Tucci, C.L.; Chesbrough, H.; Piller, F.; West, J. When do firms undertake open, collaborative activities? Introduction to the special section on open innovation and open business models. Ind. Corp. Chang. 2016, 25, 283–288. [Google Scholar] [CrossRef]

- Zahra, S.A.; Nambisan, S. Entrepreneurship and strategic thinking in business ecosystems. Bus. Horiz. 2012, 55, 219–229. [Google Scholar] [CrossRef]

- Gërguri-Rashiti, S.; Ramadani, V.; Abazi-Alili, H.; Dana, L.P.; Ratten, V. ICT, Innovation and Firm Performance: The Transition Economies Context. Thunderbird Int. Bus. Rev. 2017, 59, 93–102. [Google Scholar] [CrossRef]

- Salisu, Y.; Abu Bakar, L.J. Technological capability, relational capability and firms’ performance. Rev. Gestão 2019, 27, 79–99. [Google Scholar] [CrossRef] [Green Version]

- De Mori, C.; Batalha, M.O.; Alfranca, O. A model for measuring technology capability in the agrifood industry companies. Br. Food J. 2016, 118, 1422–1461. [Google Scholar] [CrossRef]

- Valdez-Juárez, L.E.; De Lema, D.G.P.; Maldonado-Guzmán, G. Management of knowledge, innovation and performance in SMEs. Interdiscip. J. Inf. Knowl. Manag. 2016, 11, 141–176. [Google Scholar] [CrossRef]

- Jean, R.J. The ambiguous relationship of ICT and organizational performance: A literature review. Crit. Perspect. Int. Bus. 2007, 3, 306–321. [Google Scholar] [CrossRef]

- Veronica, S.; Alexeis, G.P.; Valentina, C.; Elisa, G. Do stakeholder capabilities promote sustainable business innovation in small and medium-sized enterprises? Evidence from Italy. J. Bus. Res. 2019, 119, 131–141. [Google Scholar] [CrossRef]

- Nosratabadi, S.; Mosavi, A.; Shamshirband, S.; Zavadskas, E.K.; Rakotonirainy, A.; Chau, K.W. Sustainable Business Models: A Review. Sustainability 2019, 11, 1663. [Google Scholar] [CrossRef] [Green Version]

- Weerawardena, J.; Mavondo, F.T. Capabilities, innovation and competitive advantage. Ind. Mark. Manag. 2011, 40, 1220–1223. [Google Scholar] [CrossRef]

- Leitão, J.; Pereira, D.; de Brito, S. Inbound and Outbound Practices of Open Innovation and Eco-Innovation: Contrasting Bioeconomy and Non-Bioeconomy Firms. J. Open Innov. Technol. Mark. Complex. 2020, 6, 145. [Google Scholar] [CrossRef]

- Leitão, J.; de Brito, S.; Cubico, S. Eco-Innovation Influencers: Unveiling the Role of Lean Management Principles Adoption. Sustainability 2019, 11, 2225. [Google Scholar] [CrossRef] [Green Version]

- Kneipp, J.M.; Gomes, C.M.; Bichueti, R.S.; Frizzo, K.; Perlin, A.P. Sustainable innovation practices and their relationship with the performance of industrial companies. Rev. Gestão 2019, 26, 94–111. [Google Scholar] [CrossRef] [Green Version]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef] [Green Version]

- Salim, H.K.; Padfield, R.; Hansen, S.B.; Mohamad, S.E.; Yuzir, A.; Syayuti, K.; Tham, M.H.; Papargyropoulou, E. Global trends in environmental management system and ISO14001 research. J. Clean. Prod. 2018, 170, 645–653. [Google Scholar] [CrossRef] [Green Version]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef] [Green Version]

- Oduro, S. Examining open innovation practices in low-tech SMEs: Insights from an emerging market. J. Sci. Technol. Policy Manag. 2019, 10, 509–532. [Google Scholar] [CrossRef]

- Eze, S.C.; Chinedu-Eze, V.C.; Bello, A.O. Determinants of dynamic process of emerging ICT adoption in SMEs—Actor network theory perspective. J. Sci. Technol. Policy Manag. 2019, 10, 2–34. [Google Scholar] [CrossRef]

- Anderson, R.W.; Acur, N.; Corney, J. How do SMEs Use Open Innovation When Developing New Business Models? In Researching Open Innovation in SMEs; World Scientific: Singapore, 2018; pp. 179–209. [Google Scholar]

- Wonglimpiyarat, J. Challenges of SMEs innovation and entrepreneurial financing. World J. Entrep. Manag. Sustain. Dev. 2015, 11, 295–311. [Google Scholar] [CrossRef]

- Eggers, F. Masters of disasters? Challenges and opportunities for SMEs in times of crisis. J. Bus. Res. 2020, 116, 199–208. [Google Scholar] [CrossRef]

- Garcia, R.; Wigger, K.; Hermann, R.R. Challenges of creating and capturing value in open eco-innovation: Evidence from the maritime industry in Denmark. J. Clean. Prod. 2019, 220, 642–654. [Google Scholar] [CrossRef]

- Cheng, C.C.J.; Shiu, E.C. Leveraging open innovation strategies for fueling eco-innovation performance in dynamic environments. Sustain. Account. Manag. Policy J. 2020, 11, 1245–1270. [Google Scholar] [CrossRef]

- Salim, N.; Ab Rahman, M.N.; Abd Wahab, D. A systematic literature review of internal capabilities for enhancing eco-innovation performance of manufacturing firms. J. Clean. Prod. 2019, 209, 1445–1460. [Google Scholar] [CrossRef]

- Badir, Y.F.; Frank, B.; Bogers, M. Employee-level open innovation in emerging markets: Linking internal, external, and managerial resources. J. Acad. Mark. Sci. 2020, 48, 891–913. [Google Scholar] [CrossRef] [Green Version]

- Agostini, L.; Nosella, A. Inter-organizational relationships involving SMEs: A bibliographic investigation into the state of the art. Long Range Plann. 2018, 52, 1–31. [Google Scholar] [CrossRef]

- Miao, C.; Rutherford, M.W.; Pollack, J.M. An exploratory meta-analysis of the nomological network of bootstrapping in SMEs. J. Bus. Ventur. Insights 2017, 8, 1–8. [Google Scholar] [CrossRef]

- Abubakar, Y.A.; Hand, C.; Smallbone, D.; Saridakis, G. What specific modes of internationalization influence SME innovation in Sub-Saharan least developed countries (LDCs)? Technovation 2019, 79, 56–70. [Google Scholar] [CrossRef]

- Wang, Y.; Lo, H.-P.; Zhang, Q.; Xue, Y. How technological capability influences business performance: An integrated framework based on the contingency approach. J. Technol. Manag. China 2006, 1, 27–52. [Google Scholar] [CrossRef]

- Ulas, D. Digital Transformation Process and SMEs. In Proceedings of the Procedia Computer Science; Elsevier BV: Amsterdam, The Netherlands, 2019; Volume 158, pp. 662–671. [Google Scholar]

- Hassan, M.U.; Iqbal, Z.; Malik, M.; Ahmad, M.I. Exploring the role of technological developments and open innovation in the survival of SMEs: An empirical study of Pakistan. Int. J. Bus. Forecast. Mark. Intell. 2018, 4, 64–85. [Google Scholar] [CrossRef]

- Weber, D.M. The Impact of Information and Communication Technology on Intermediation, Outreach, and Decision Rights in the Microfinance Industry. Ph.D. Thesis, Arizona State University, Tempe, AZ, USA, 2012; p. 207. [Google Scholar]

- Civelek, F.; Kulkarni, R.; Fritz, K.-P.; Meyer, T.; Troulos, C.; Guenther, T.; Zimmermann, A. Open-Eco-Innovation for SMEs with Pan-European Key Enabling Technology Centres. Clean Technol. 2020, 2, 422–439. [Google Scholar] [CrossRef]

- Wehn, U.; Montalvo, C. Knowledge transfer dynamics and innovation: Behaviour, interactions and aggregated outcomes. J. Clean. Prod. 2018, 171, S56–S68. [Google Scholar] [CrossRef] [Green Version]

- Yu, Y.; Dong, X.Y.; Shen, K.N.; Khalifa, M.; Hao, J.X. Strategies, technologies, and organizational learning for developing organizational innovativeness in emerging economies. J. Bus. Res. 2013, 66, 2507–2514. [Google Scholar] [CrossRef]

- Sáez-Martínez, F.J.; Díaz-García, C.; Gonzalez-Moreno, A. Firm technological trajectory as a driver of eco-innovation in young small and medium-sized enterprises. J. Clean. Prod. 2016, 138, 28–37. [Google Scholar] [CrossRef]

- Kuo, T.C.; Smith, S. A systematic review of technologies involving eco-innovation for enterprises moving towards sustainability. J. Clean. Prod. 2018, 192, 207–220. [Google Scholar] [CrossRef]

- Halme, M.; Korpela, M. Responsible Innovation toward Sustainable Development in Small and Medium-Sized Enterprises: A Resource Perspective. Bus. Strateg. Environ. 2014, 23, 547–566. [Google Scholar] [CrossRef]

- Bagheri, M.; Mitchelmore, S.; Bamiatzi, V.; Nikolopoulos, K. Internationalization Orientation in SMEs: The Mediating Role of Technological Innovation. J. Int. Manag. 2019, 25, 121–139. [Google Scholar] [CrossRef]

- Chege, S.M.; Wang, D.; Suntu, S.L. Information Technology for Development Impact of Information Technology Innovation on Firm Performance in Kenya Impact of Information Technology Innovation on Firm Performance in Kenya; Taylor Francis Group: Abingdon, UK, 2020; Volume 26, pp. 316–345. [Google Scholar] [CrossRef]

- Azam, M.S. Diffusion of ICT and SME performance. Adv. Bus. Mark. Purch. 2015, 23A, 7–290. [Google Scholar] [CrossRef]

- Kumar, R.; Singh, R.K.; Dwivedi, Y.K. Application of industry 4.0 technologies in SMEs for ethical and sustainable operations: Analysis of challenges. J. Clean. Prod. 2020, 275, 124063. [Google Scholar] [CrossRef]

- Fernández-Portillo, A.; Almodóvar-González, M.; Hernández-Mogollón, R. Impact of ICT development on economic growth. A study of OECD European union countries. Technol. Soc. 2020, 63, 101420. [Google Scholar] [CrossRef]

- Cenamor, J.; Parida, V.; Wincent, J. How entrepreneurial SMEs compete through digital platforms: The roles of digital platform capability, network capability and ambidexterity. J. Bus. Res. 2019, 100, 196–206. [Google Scholar] [CrossRef]

- Keinz, P.; Marhold, K. Technological competence leveraging projects via intermediaries: Viable means to outbound open innovation and mediated capability building? Int. J. Proj. Manag. 2020. [Google Scholar] [CrossRef]

- Singh, S.K.; Gupta, S.; Busso, D.; Kamboj, S. Top management knowledge value, knowledge sharing practices, open innovation and organizational performance. J. Bus. Res. 2019. [Google Scholar] [CrossRef]

- Crema, M.; Verbano, C.; Venturini, K. Linking strategy with open innovation and performance in SMEs. Meas. Bus. Excell. 2014, 18, 14–27. [Google Scholar] [CrossRef]

- Zhang, J.A.; Walton, S. Eco-innovation and business performance: The moderating effects of environmental orientation and resource commitment in green-oriented SMEs. R D Manag. 2017, 47, E26–E39. [Google Scholar] [CrossRef]

- Costa, J.; Matias, J.C.O. Open Innovation 4.0 as an Enhancer of Sustainable Innovation Ecosystems. Sustainability 2020, 12, 8112. [Google Scholar] [CrossRef]

- Marin, G.; Marzucchi, A.; Zoboli, R. SMEs and barriers to Eco-innovation in the EU: Exploring different firm profiles. J. Evol. Econ. 2015, 25, 671–705. [Google Scholar] [CrossRef]

- Barbieri, R.; Santos, D.F.L. Sustainable business models and eco-innovation: A life cycle assessment. J. Clean. Prod. 2020, 266, 121954. [Google Scholar] [CrossRef]

- Economic Commission for Latin America and the Caribbean (CEPAL). Sectors and Companies Facing COVID-19: Emergency and Reactivation; CEPAL: Santiago, Chile, 2020. [Google Scholar]

- Global Entrepreneurship Monitor (GEM). Global Entrepreneurship Monitor 2019/2020 Global Report; GEM: London, UK, 2020; Volume 8. [Google Scholar]

- World Bank. World Bank World Development Indicators Database; World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Porto-Gomez, I.; Zabala-Iturriagagoitia, J.M.; Leydesdorff, L. Innovation systems in México: A matter of missing synergies. Technol. Forecast. Soc. Chang. 2019, 148, 119721. [Google Scholar] [CrossRef]

- López Mejia, M.; Gómez Martínez, A.; Sánchez Meléndez, M.D. Gestión De Las Pyme En México. Ante Los Nuevos Escenarios de Negocios y La Teoría de la Agencia. Estud. Adm. 2020, 27, 69–91. [Google Scholar] [CrossRef]

- Instituto Nacional de Geografía, Estadística e Informática (INEGI). Censos Económicos 2019; INEGI: Mexico City, Mexico, 2019. [Google Scholar]

- Bianchi, C.; Carneiro, J.; Wickramasekera, R. Internationalisation commitment of emerging market firms: A comparative study of Chile and Brazil. J. Small Bus. Enterp. Dev. 2018, 25, 201–221. [Google Scholar] [CrossRef]

- De Oliveira, R.T.; Verreynne, M.L.; Figueira, S.; Indulska, M.; Steen, J. How do institutional innovation systems affect open innovation? J. Small Bus. Manag. 2020, 1–45. [Google Scholar] [CrossRef]

- Gorrell, G.; Ford, N.; Madden, A.; Holdridge, P.; Eaglestone, B. Countering method bias in questionnaire-based user studies. J. Doc. 2011, 67, 507–524. [Google Scholar] [CrossRef] [Green Version]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.; Podsakoff, N.P. Common Method Bias in Behavioral Research: A Critical Review of the Literature and recommended remedies. J. Appl. Psychol. 2003, 88, 879–903. [Google Scholar] [CrossRef]

- Sarstedt, M.; Hair, J.F.; Cheah, J.H.; Becker, J.M.; Ringle, C.M. How to specify, estimate, and validate higher-order constructs in PLS-SEM. Australas. Mark. J. 2019, 27, 197–211. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Weijters, B.; Cabooter, E.; Schillewaert, N. The effect of rating scale format on response styles: The number of response categories and response category labels. Int. J. Res. Mark. 2010, 27, 236–247. [Google Scholar] [CrossRef]

- Sá, E.S.; de Pinho, J.C.M.R. Effect of entrepreneurial framework conditions on R&D transfer to new and growing firms: The case of European Union innovation-driven countries. Technol. Forecast. Soc. Chang. 2019, 141, 47–58. [Google Scholar] [CrossRef]

- Duncan, N.B. Capturing Flexibility of Information Technology Infrastructure: A Study of Resource Characteristics and Their Measure. J. Manag. Inf. Syst. 1995, 12, 37–57. [Google Scholar] [CrossRef]

- OECD. The Measurement of Scientific and Technological Activities. Manual de Oslo; European Commission: Madrid, Spain, 2006. [Google Scholar]

- Bocken, N.M.P.; Farracho, M.; Bosworth, R.; Kemp, R. The front-end of eco-innovation for eco-innovative small and medium sized companies. J. Eng. Technol. Manag. 2014, 31, 43–57. [Google Scholar] [CrossRef] [Green Version]

- Cheng, C.C.; Shiu, E.C. Validation of a proposed instrument for measuring eco-innovation: An implementation perspective. Technovation 2012, 32, 329–344. [Google Scholar] [CrossRef]

- Loorbach, D.; Wijsman, K. Business transition management: Exploring a new role for business in sustainability transitions. J. Clean. Prod. 2013, 45, 20–28. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Ortiz-de-Mandojana, N. Green Innovation and Financial Performance. Organ. Environ. 2013, 26, 365–385. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. Testing measurement invariance of composites using partial least squares. Int. Mark. Rev. 2016, 33, 405–431. [Google Scholar] [CrossRef]

- Henseler, J.; Dijkstra, T.K.; Sarstedt, M.; Ringle, C.M.; Diamantopoulos, A.; Straub, D.W.; Ketchen, D.J.; Hair, J.F.; Hult, G.T.M.; Calantone, R.J. Common Beliefs and Reality about PLS. Organ. Res. Methods 2014, 17, 182–209. [Google Scholar] [CrossRef] [Green Version]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. (JMR) 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modeling. In Methodology for Business and Management. Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates Publishers: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Falk, R.; Miller, N. A Primer for Soft Modeling; University of Akron Press: Akron, OH, USA, 1992. [Google Scholar]

- Cohen, J. Set Correlation and Contingency Tables. Appl. Psychol. Meas. 1988, 12, 425–434. [Google Scholar] [CrossRef]

- Hu, L.; Bentler, P.M. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Struct. Equ. Model. A Multidiscip. J. 1999, 6, 1–55. [Google Scholar] [CrossRef]

- Chin, W.W.; Dibbern, J. Handbook of Partial Least Squares; Springer: Berlin/Heidelberg, Germany, 2010; ISBN 978-3-540-32825-4. [Google Scholar]

- Nitzl, C.; Roldan, J.L.; Cepeda, G. Mediation analysis in partial least squares path modelling, Helping researchers discuss more sophisticated models. Ind. Manag. Data Syst. 2016, 116, 1849–1864. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM). Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar] [CrossRef]

- Carrión, G.C.; Nitzl, C.; Roldán, J.L. Mediation Analyses in Partial Least Squares Structural Equation Modeling: Guidelines and Empirical Examples. In Partial Least Squares Path Modeling; Springer International Publishing: Cham, Switerland, 2017; pp. 173–195. [Google Scholar]

- Hair, J.F., Jr.; Sarstedt, M.; Ringle, C.M.; Gudergan, S.P. Advanced Issues in Partial Least Squares Structural Equation Modeling; SAGE: Thousand Oaks, CA, USA, 2017; ISBN 1483377385, 9781483377384. [Google Scholar]

- International Organization for Standardization (ISO). ISO 14001:2015: Environmental Management Systems: A Practical Guide for SMEs; ISO: Geneva, Switzerland, 2017. [Google Scholar]

- Ullah, B.; Wei, Z.; Xie, F. ISO certification, financial constraints, and firm performance in Latin American and Caribbean countries. Glob. Financ. J. 2014, 25, 203–228. [Google Scholar] [CrossRef]

- Piyathanavong, V.; Garza-Reyes, J.A.; Kumar, V.; Maldonado-Guzmán, G.; Mangla, S.K. The adoption of operational environmental sustainability approaches in the Thai manufacturing sector. J. Clean. Prod. 2019, 220, 507–528. [Google Scholar] [CrossRef]

- Grazzi, M.; Sasso, S.; Kemp, R. A Conceptual Framework to Measure Green Innovation in Latin America and the Caribbean; Inter-American Development Ban: Washington, DC, USA, 2019. [Google Scholar] [CrossRef]

- González-Moreno, Á.; Triguero, Á.; Sáez-Martínez, F.J. Many or trusted partners for eco-innovation? The influence of breadth and depth of firms’ knowledge network in the food sector. Technol. Forecast. Soc. Chang. 2019, 147, 51–62. [Google Scholar] [CrossRef]

- Cainelli, G.; De Marchi, V.; Grandinetti, R. Does the development of environmental innovation require different resources? Evidence from Spanish manufacturing firms. J. Clean. Prod. 2015, 94, 211–220. [Google Scholar] [CrossRef]

- Usman, M.; Vanhaverbeke, W. How start-ups successfully organize and manage open innovation with large companies. Eur. J. Innov. Manag. 2017, 20, 171–186. [Google Scholar] [CrossRef]

- Zimmermann, H.-D.; Pucihar, A. Open Innovation, Open Data and New Business Models. Sci. Organ. 2015, 449–458. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Park, K. Sustainability Condition of Open Innovation: Dynamic Growth of Alibaba from SME to Large Enterprise. Sustainability 2020, 12, 4379. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Belitski, M. The missing pillar: The creativity theory of knowledge spillover entrepreneurship. Small Bus. Econ. 2013, 41, 819–836. [Google Scholar] [CrossRef]

- Jugend, D.; Fiorini, P.D.C.; Armellini, F.; Ferrari, A.G. Public support for innovation: A systematic review of the literature and implications for open innovation. Technol. Forecast. Soc. Chang. 2020, 156, 119985. [Google Scholar] [CrossRef]

- Jones-Evans, D.; Gkikas, A.; Rhisiart, M.; MacKenzie, N.G. Measuring open innovation in SMEs. In Researching Open Innovation in SMEs; World Scientific Publishing Co. Pte. Ltd.: Singapore, 2018; pp. 399–427. ISBN 9789813230972. [Google Scholar]

- Van de Vrande, V.; de Jong, J.P.J.; Vanhaverbeke, W.; de Rochemont, M. Open innovation in SMEs: Trends, motives and management challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef] [Green Version]

- Pigosso, D.C.A.; Schmiegelow, A.; Andersen, M.M. Measuring the Readiness of SMEs for Eco-Innovation and Industrial Symbiosis: Development of a Screening Tool. Sustainabiity 2018, 10, 2861. [Google Scholar] [CrossRef] [Green Version]

- Klewitz, J.; Zeyen, A.; Hansen, E.G. Intermediaries driving eco-innovation in SMEs: A qualitative investigation. Eur. J. Innov. Manag. 2012, 15, 442–467. [Google Scholar] [CrossRef] [Green Version]

- De Jesus Pacheco, D.A.; Carla, S.; Jung, C.F.; Ribeiro, J.L.D.; Navas, H.V.G.; Cruz-Machado, V.A. Eco-innovation determinants in manufacturing SMEs: Systematic review and research directions. J. Clean. Prod. 2017, 142, 2277–2287. [Google Scholar] [CrossRef]

- García-Granero, E.M.; Piedra-Muñoz, L.; Galdeano-Gómez, E. Measuring eco-innovation dimensions: The role of environmental corporate culture and commercial orientation. Res. Policy 2020, 49, 104028. [Google Scholar] [CrossRef]

- Quinn, R.E.; Rohrbaugh, J. A Spatial Model of Effectiveness Criteria: Towards a Competing Values Approach to Organizational Analysis A Spatial Model of Effectiveness Criteria: Towards a Competing Values Approach to Organizational Analysis. Manag. Sci. 2011, 29, 363–377. [Google Scholar] [CrossRef] [Green Version]

- Neely, A.D.; Adams, M.K.C. The Performance Prism: The Scorecard for Measuring and Managing Business Success Classification of Noisy Data: A Data Mining Challenge View Project; Pearson Education: London, UK, 2002; ISBN 0273653342. [Google Scholar]

| Type of Company | Male | Female | Total |

|---|---|---|---|

| Legal person | 174 | 104 | 278 |

| % | 25.40% | 15.20% | 40.60% |

| Natural person | 233 | 173 | 406 |

| % | 34.10% | 25.30% | 59.40% |

| Total | 407 | 277 | 684 |

| % | 59.50% | 40.50% | 100.00% |

| Manager’s Experience | Manager’s Education | ||||

|---|---|---|---|---|---|

| Type of Company | Little Experience | Sufficient Experience | Wide Experience | Basic | University |

| Legal person | 211 | 65 | 2 | 104 | 174 |

| % | 30.80% | 9.50% | 0.30% | 15.20% | 25.40% |

| Natural person | 319 | 85 | 2 | 214 | 192 |

| % | 46.60% | 12.40% | 0.30% | 31.30% | 28.10% |

| Total | 530 | 150 | 4 | 318 | 366 |

| Manager’s Education | Manager’s Experience | ||||

|---|---|---|---|---|---|

| Gender | Basics | University | Little Experience | Sufficient Experience | Wide Experience |

| Female | 154 | 123 | 231 | 46 | 0 |

| % | 22.50% | 18.00% | 33.80% | 6.70% | 0.00% |

| Male | 164 | 243 | 299 | 104 | 4 |

| % | 24.00% | 35.50% | 43.70% | 15.20% | 0.60% |

| Total | 318 | 366 | 530 | 150 | 4 |

| Construct | Cronbach’s Alpha | rho_ A | Composite Reliability |

|---|---|---|---|

| TC | 0.863 | 0.864 | 0.902 |

| OINN | 0.879 | 0.880 | 0.908 |

| Outbound | 0.832 | 0.832 | 0.899 |

| Inbound | 0.797 | 0.800 | 0.881 |

| EINN | 0.925 | 0.925 | 0.939 |

| CPERF | 0.750 | 0.753 | 0.842 |

| Construct | AVE | TC | OINN | EINN | CPERF |

|---|---|---|---|---|---|

| CTs | 0.648 | 0.805 | |||

| OINN | 0.623 | 0.523 | 0.790 | ||

| EINN | 0.690 | 0.456 | 0.344 | 0.830 | |

| CPERF | 0.571 | 0.174 | 0.336 | 0.204 | 0.756 |

| Hypothesis | Path Coefficient | SD | T Value | p-Value | f2 | Variance Explained: R2 | Result |

|---|---|---|---|---|---|---|---|

| H1: TC → OINN | 0.523 *** | 0.032 | 16.337 | 0.000 | 0.377 | 27.4% | Supported |

| H2: TC → EINN | 0.456 *** | 0.035 | 12.880 | 0.000 | 0.262 | 20.8% | Supported |

| H3: TC → CPERF | 0.025 | 0.046 | 0.532 | 0.302 | 0.005 | 0.4% | Unsupported |

| H4: OINN → CPERF | 0.166*** | 0.043 | 3.848 | 0.000 | 0.025 | 3.8% | Supported |

| H5: EINN → CPERF | 0.136*** | 0.044 | 3.080 | 0.001 | 0.016 | 2.8% | Supported |

| Hypothesis | Path Coefficients | Percentile | Percentile | Bias Corrected 5% | Bias Corrected 95% |

|---|---|---|---|---|---|

| CI 5% | CI 95% | ||||

| H1: TC → OINN | 0.523 *** | 0.467 | 0.574 | 0.467 | 0.574 |

| H2: TC → EINN | 0.456 *** | 0.397 | 0.513 | 0.396 | 0.511 |

| H3: TC → CPERF | 0.025 | –0.051 | 0.103 | −0.051 | 0.101 |

| H4: OINN → CPERF | 0.166 *** | 0.095 | 0.240 | 0.093 | 0.235 |

| H5: EINN → CPERF | 0.136 *** | 0.065 | 0.208 | 0.064 | 0.209 |

| Bootstrap 90% | ||||||

|---|---|---|---|---|---|---|

| Path Coefficient | Percentile CI | Bias Corrected CI | VAF | |||

| H1 c’ | 0.025 nsig | −0.051 | 0.102 | –0.051 | –0.051 | |

| a1 | 0.523 sig | 0.470 | 0.572 | 0.471 | 0.472 | |

| a2 | 0.456 sig | 0.396 | 0.397 | 0.397 | 0.398 | |

| b1 | 0.166 sig | 0.094 | 0.239 | 0.093 | 0.092 | |

| b2 | 0.136 sig | 0.063 | 0.207 | 0.063 | 0.063 | |

| Point estimate | Percentile | Bias corrected | ||||

| H2 | 0.087 sig | 0.044 | 0.137 | 0.044 | 0.043 | 0.50 |

| H3 | 0.062 sig | 0.025 | 0.106 | 0.025 | 0.025 | 0.36 |

| Total indirect effect | 0.149 | 0.069 | 0.243 | 0.069 | 0.068 | 0.86 |

| Total effect | 0.174 | |||||

| VAF | 86% | |||||

| Constructs | Correlation | 5.0% | p-Value (Permutation) | Result |

|---|---|---|---|---|

| Corporate performance (CPERF) | 0.976 | 0.906 | 0.263 | Yes |

| Eco-Innovation (EINN) | 0.996 | 0.997 | 0.033 | No |

| Technological capability (TC) | 0.996 | 0.997 | 0.024 | No |

| Open innovation (OINN) | 1.000 | 1.000 | 0.105 | Yes |

| Hypothesis | Path (G1) | Path (G2) | t Value (G1) | t Value (G2) | p-Value (G1) | p-Value (G2) | Result |

|---|---|---|---|---|---|---|---|

| H1: TC → OINN | 0.506 | 0.521 | 5.260 | 15.214 | 0.000 | 0.000 | G1 < G2 |

| H2: TC → EINN | 0.388 | 0.460 | 4.952 | 12.149 | 0.000 | 0.000 | G1 < G2 |

| H3: TC → CPERF | 0.024 | 0.019 | 0.109 | 0.392 | 0.457 | 0.347 | G1 > G2 |

| H4: OINN → CPERF | 0.148 | 0.172 | 1.034 | 3.569 | 0.151 | 0.000 | G1 < G2 |

| H5: EINN → CPERF | 0.030 | 0.149 | 0.211 | 3.085 | 0.416 | 0.001 | G1 < G2 |

| Construct | R2 (G1) | R2 (G2) | 5.00% | 95.00% | p-Value (Permutation) |

|---|---|---|---|---|---|

| Corporate performance | –0.001 | 0.071 | –0.071 | 0.137 | 0.046 |

| Eco-innovation | 0.142 | 0.210 | –0.145 | 0.175 | 0.229 |

| Open innovation | 0.248 | 0.271 | –0.156 | 0.172 | 0.414 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Valdez-Juárez, L.E.; Castillo-Vergara, M. Technological Capabilities, Open Innovation, and Eco-Innovation: Dynamic Capabilities to Increase Corporate Performance of SMEs. J. Open Innov. Technol. Mark. Complex. 2021, 7, 8. https://doi.org/10.3390/joitmc7010008

Valdez-Juárez LE, Castillo-Vergara M. Technological Capabilities, Open Innovation, and Eco-Innovation: Dynamic Capabilities to Increase Corporate Performance of SMEs. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):8. https://doi.org/10.3390/joitmc7010008

Chicago/Turabian StyleValdez-Juárez, Luis Enrique, and Mauricio Castillo-Vergara. 2021. "Technological Capabilities, Open Innovation, and Eco-Innovation: Dynamic Capabilities to Increase Corporate Performance of SMEs" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 8. https://doi.org/10.3390/joitmc7010008

APA StyleValdez-Juárez, L. E., & Castillo-Vergara, M. (2021). Technological Capabilities, Open Innovation, and Eco-Innovation: Dynamic Capabilities to Increase Corporate Performance of SMEs. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 8. https://doi.org/10.3390/joitmc7010008