Exploring the Role of Islamic Fintech in Combating the Aftershocks of COVID-19: The Open Social Innovation of the Islamic Financial System

Abstract

1. Introduction and Research Question

- ▪

- Its services are asset backed which means derivative products such as, option, futures, swap etc. are prohibited.

- ▪

- It is based on a PLS (profit and loss sharing) method of doing business. The contracts like Musharaka (joint enterprise where partners contribute capital and share profits and losses) and Mudaraba (joint enterprise where only one partners contribute capital and share losses, the other partners work and share profits only) are popular because of this feature.

- ▪

- It is ethical as it affords importance to honesty, truthfulness, integrity, and respect for others. Islamic financial institutions not only have to follow the norms of the contract but also must follow Islamic law of transaction.

- ▪

- Islamic finance is subject to good governance as it governed by sharia; the principles of sharia are derived from the Holy Qur’an and Sunnah of Prophet Muhammad ﷺ. Islamic financial must adhere to principles of Qur’an and Sunnah to categories permissible (halal) otherwise it is declared (haram) [40,41].

- What is the unique role performed by Islamic Finance and Islamic Fintech in the post COVID-19 period?

- What are specific Islamic financial services that can be combined with the Fintech based innovative solutions and meet the needs of the COVID-19 affected Islamic finance customers?

- Is the proposed Islamic Fintech model useful in the short run, medium run, and long run to fight the economic aftereffects of the pandemic?

2. Literature Review and Research Framework

2.1. Significance of Islamic Finance and Islamic Fintech

- The sustainability of Islamic finance stems from the fact that Islamic finance is not confined to the Muslims or Muslim countries only; the deep appeal of Islamic finance goes beyond it and reached far to the non-Muslims and western countries also [62,63]. It is argued among the finance scholars and practitioners that sharia-based financial products and services bring impact beyond conventional market practices [52,64].

- The confidence in the sustainability of the Islamic financial system emerges from the fact that this system is well integrated with the tenets of well-conceived and consistent frameworks [65,66]. It is governed by the principles of sharia which is based on giving equal rights and obligation to the parties to uphold contractual arrangements [67,68].

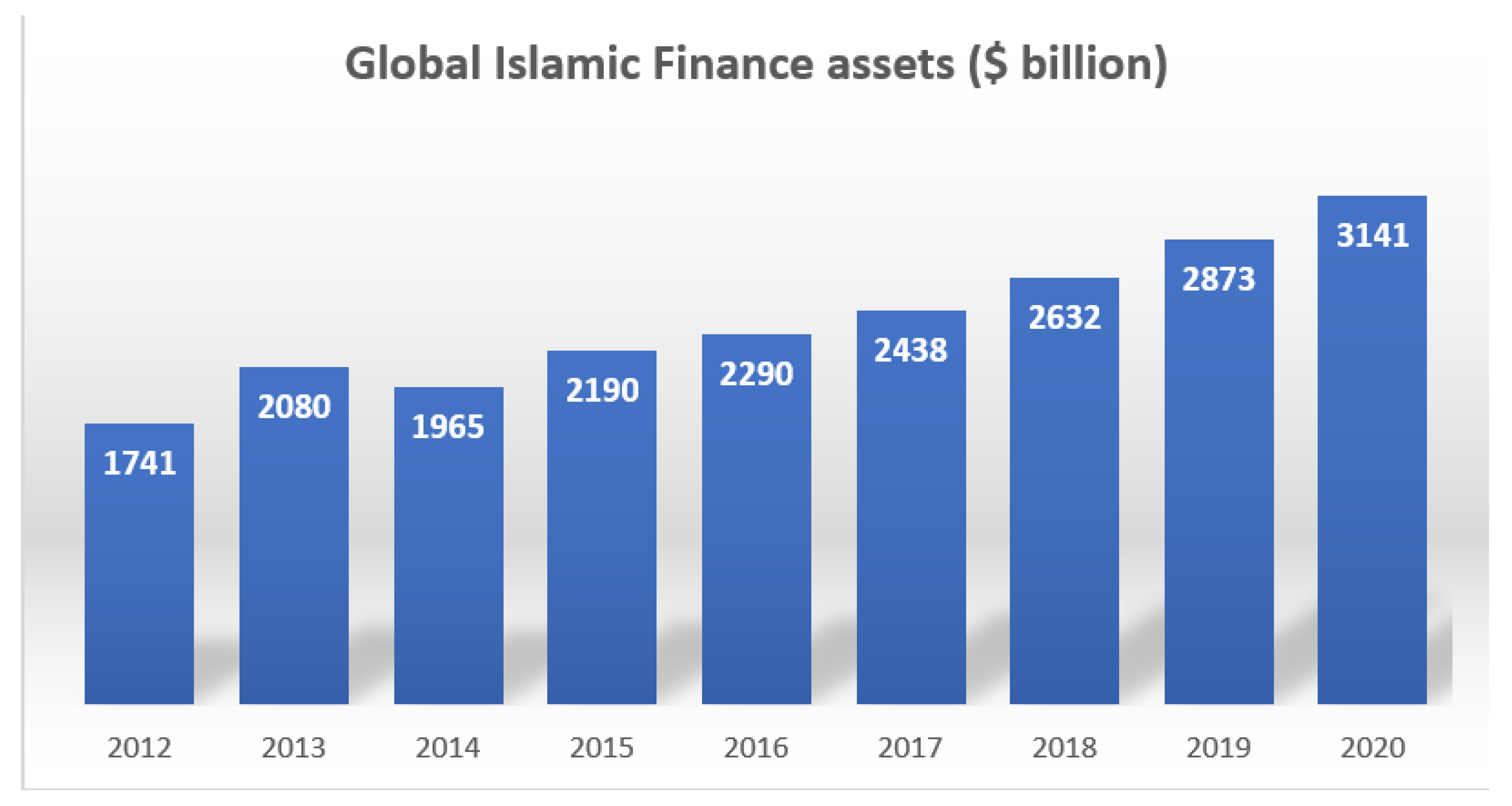

- Islamic finance and banking have been growing at an unprecedented pace since the inception of first Islamic bank in Dubai in 1975. Islamic finance and banking has achieved unprecedented growth in the last decade or so and it has also passed the test of time during the financial crisis of 2008 by being the most stable and sustainable financial system [9,69].

- In contrast to its conventional counterpart, Islamic finance focuses on social justice and equitable distribution of income [70].

- Islamic finance has social finance tools such as Qardh-Al-Hassan, Zakat, Awqaf, etc. which are more suited to the sustainable characteristics of a financial system [5].

2.2. Why Islamic Fintech industry?

2.3. The Role of Islamic Fintech in Open innovation and COVID-19

3. Research Framework, Methodology and Methods

Economic Impact of COVID-19 and the Role of Islamic Finance

- Zakat: Zakat is one of the five obligations made on Muslim Ummah after Shahadah (belief that there is none but Allah Almighty to worship), Salah (Muslims needs to pray five times a day), Sawm (It is obligatory for Muslims to fast during the holy month of Ramadan), and Hajj (an annual Islamic pilgrimage during the last month of Islamic (Zilhijjah) month in the holy city of Makkah), who meet certain criteria to donate 2.5% of its wealth each year for the social cause. It is believed that with the payment of Zakat, Muslims purify their yearly earnings [17]. The importance of Zakat in Islam can be understood from the fact that it has appeared 82 times in the Holy Qur’an along with the Salat (second obligation in Islam) [113]. Zakat has been made obligatory to serve a very specific purpose and avoidance of it attracts a very strong penalty. Zakat can play a huge role in a situation like the current pandemic where millions of people have lost their jobs and are on the verge of extreme poverty [5,16,17]. Zakat has a variety of applications as indicated in the Holy Qur’an also [114], but general consensus among Muslim scholars is that the best application of Zakat is the eradication of poverty [16]. It is the duty of a Muslim to help their Muslim brothers and sisters in the time of need and COVID-19 has badly affected the poor and daily wage laborers and the best of application of Zakat would be to help COVID-19 affected people [5,7,17].

- Qardh-Al-Hasan: Qardh-Al-Hasan is a form of benevolent loan which is provided by the lender to the borrower free of interest charge. In Islamic social finance, Qardh-Al-Hasan has a special mention as it is an interest free loan, without interest, markup, or share in profit in case of business loan and the borrower has flexibility regarding repayment. It is extended on a goodwill basis mainly to extend a helping hand to the poor and needy for the purpose of benevolence (kindness) [5]. The basic purpose of Islam is eradication of poverty by helping the poor and vulnerable and Qardh-Al-Hasan can prove to be a valuable financing tool for the vulnerable and COVID-19 affected poor [115,116]. Qardh-Al-Hasan has more significance in comparison to Zakat as it can be extended to any person no matter how rich a person is; on the other hand Zakat can be extended to the poor, needy, and eligible as per the rules of sharia. Qardh-Al-Hasan is the Islamic social finance tool used to reinforce to social harmony, integrity, cooperation, and the ethical principle of social justice. It can be used during and post COVID-19 to help and empower the poor and needy to please Allah Almighty [5].

- Social Sukuk: Social Sukuk is another Islamic social finance extremely important tool to fight the economic adversities of COVID-19 during and post COVID [117]. Social Sukuk is the new and innovative way to fund social services for redistribution of wealth and achievement of social justice [118,119]. Social Sukuk brings the social sector into the discourse of Islamic finance, which has largely been ignored compared to the private, business, and government sectors. Islamic Development Bank (IsDB) has issued a COVID-19 related Social Sukuk in the market showing the contribution of banks in the capital market to help COVID-19 affected people. The intention of issuing the social Sukuk is to minimize the economic damages caused due to COVID-19 and build resilience against future shocks. The IsDB Sukuk is serving as the starting point in the Islamic capital market as other Islamic financial institutions follow suit in the coming months and these Sukuk serve as a boost to the struggling industries due to COVID-19 [5,6].

- Islamic Microfinance: Islamic microfinance is a relatively new market in the Islamic finance market. Islamic microfinance is like the conventional microfinance, providing financial assistance to the people excluded from the traditional financial system with only difference being the sharia compliance of the financial services [120,121]. One of the objectives of microfinance as a concept itself is to provide valuable financial services to people and small and medium enterprises (SMEs) excluded from the mainstream financial system [122,123]. These individuals are either very poor or SMEs who cannot fulfill the extensive documentary formalities of the financial institutions [82]. Microfinance institutions, Islamic banks, governments, and other Islamic financial institutions can play a massive role and can make a big difference by providing a small amount of collateral free loans to the poor and COVID-19 affected SMEs [26,83].

4. Results and the Proposed Model

4.1. Short Run Emergency Support

4.2. Medium Term Recovery

4.3. Long Run Recovery and Resilience

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hellewell, J.; Abbott, S.; Gimma, A.; Bosse, N.I.; Jarvis, C.I.; Russell, T.W.; Munday, J.D.; Kucharski, A.J.; Edmunds, W.J.; Sun, F.; et al. Feasibility of controlling COVID-19 outbreaks by isolation of cases and contacts. Lancet Glob. Health 2020, 8, e488–e496. [Google Scholar] [CrossRef]

- Xu, S.; Li, Y. Beware of the second wave of COVID-19. Lancet 2020, 395, 1321–1322. [Google Scholar] [CrossRef]

- Dureab, F.; Al-Awlaqi, S.; Jahn, A. COVID-19 in Yemen: Preparedness measures in a fragile state. Lancet Public Health 2020, 5, e311. [Google Scholar] [CrossRef]

- Sachs, J.D.; Horton, R.; Bagenal, J.; Ben Amor, Y.; Karadag Caman, O.; Lafortune, G. The Lancet COVID-19 Commission. Lancet 2020, 396, 454–455. [Google Scholar] [CrossRef]

- Raza Rabbani, M.; Asad Mohd, A.M.; Rahiman, H.U.; Atif, M.; Zulfikar, Z.; Naseem, Y. The Response of Islamic Financial Service to the COVID-19 Pandemic: The Open Social Innovation of the Financial System. J. Open Innov. Technol. Mark. Complex. 2021, 7, 85. [Google Scholar] [CrossRef]

- Hassan, M.K.; Rabbani, M.R.; Abdullah, Y. Socioeconomic Impact of COVID-19 in MENA region and the Role of Islamic Finance. Int. J. Islam. Econ. Financ. 2021, 4, 51–78. [Google Scholar]

- Hassan, M.K.; Rabbani, M.R.; Ali, M.A. Challenges for the Islamic Finance and banking in post COVID era and the role of Fintech. J. Econ. Coop. Dev. 2020, 43, 93–116. [Google Scholar]

- Mooney, C.W., Jr. Fintech and secured transactions systems of the future. Law Contemp. Probl. 2018, 81, 1–20. [Google Scholar]

- Hassan, M.K. The Global Financial Crisis and Islamic Finance. SSRN Electron. J. 2011, 53, 551–564. [Google Scholar] [CrossRef]

- Hassan, M.K.; Sanchez, B.; Yu, J.S. Financial development and economic growth: New evidence from panel data. Q. Rev. Econ. Financ. 2011, 51, 88–104. [Google Scholar] [CrossRef]

- Ibrahim, M.H.; Shahid Ebrahim, M. Islamic Banking and Finance: Beyond Comparison and Investment Opportunities. Pac. Basin Financ. J. 2018, 52, 1–4. [Google Scholar] [CrossRef]

- Hassan, M.K.; Shaikh, S.A.; Kayhan, S. Introduction to Islamic Banking and Finance; World Scientific: Singapore, 2020. [Google Scholar]

- Ahmed, H.; Asutay, M.; Wilson, R. Reflecting on Islamic banking and financial crisis: Risks, reputation and stability. In Islamic Banking and Financial Crisis: Reputation, Stability and Risks; Edinburgh University Press: Edinburgh, UK; Durham University: Durham, UK, 2013; pp. 1–20. [Google Scholar]

- Montanaro, E. Islamic banking: A challenge for the Basel Capital Accord. In Islamic Banking and Finance in the European Union: A Challenge; Edward Elgar Publishing Ltd.: Cheltenham, UK; University of Siena: Siena, Italy, 2010; pp. 112–127. [Google Scholar]

- Atif, M.; Hassan, M.K.; Rabbani, M.R.; Khan, S. 6 Islamic FinTech. In COVID-19 and Islamic Social Finance: 91; Routledge: London, UK, 2021. [Google Scholar]

- Rabbani, M.R.; Khan, S.; Hassan, M.K.; Ali, M. 7 Artificial intelligence and Natural language processing (NLP) based FinTech model of Zakat for poverty alleviation and sustainable development for Muslims in India. In ICOVID-19 and Islamic Social Finance: 104; Routledge: London, UK, 2021. [Google Scholar]

- Mohammad, K.S.; Mustafa, Y. An Artificial Intelligence and NLP based Islamic FinTech Model Combining Zakat and Qardh-Al-Hasan for Countering the Adverse Impact of COVID 19 on SMEs and Individuals. Int. J. Econ. Bus. Adm. 2020, 8, 351–364. [Google Scholar]

- Dharani, M.; Hassan, M.K.; Paltrinieri, A. Faith-based norms and portfolio performance: Evidence from India. Glob. Financ. J. 2019, 41, 79–89. [Google Scholar] [CrossRef]

- Azmat, S.; Hassan, M.K.; Ghaffar, H.; Azad, A.S.M.S. State contingent banking and asset price bubbles: The case of Islamic banking industry. Glob. Financ. J. 2020, 100531. [Google Scholar] [CrossRef]

- Breidbach, C.F.; Keating, B.W.; Lim, C. Fintech: Research directions to explore the digital transformation of financial service systems. J. Serv. Theory Pract. 2019, 30, 79–102. [Google Scholar] [CrossRef]

- Cheng, M.; Qu, Y. Does bank FinTech reduce credit risk? Evidence from China. Pac. Basin Financ. J. 2020, 63, 101398. [Google Scholar] [CrossRef]

- Abou-Youssef, M.M.H.; Kortam, W.; Abou-Aish, E.; El-Bassiouny, N. Effects of religiosity on consumer attitudes toward Islamic banking in Egypt. Int. J. Bank Mark. 2015, 33, 786–807. [Google Scholar] [CrossRef]

- Chong, B.S.; Liu, M.H. Islamic banking: Interest-free or interest-based? Pac. Basin Financ. J. 2009, 17, 125–144. [Google Scholar] [CrossRef]

- Iqbal, M. Towards making ‘Islamic’ banking Islamic. In Risk and Regulation of Islamic Banking; Edward Elgar Publishing Ltd.: Cheltenham, UK; Islamic Economics Institute, King Abdul Aziz University: Jeddah, Saudi Arabia, 2014; pp. 71–104. [Google Scholar]

- Nawaz, S.S.; Hilmy, H.M.A.; Gunapalan, S. Islamic banking customers’ intention to use mobile banking services: A Sri Lankan study. J. Adv. Res. Dyn. Control Syst. 2020, 12, 1610–1626. [Google Scholar]

- Khan, S.; Rabbani, M.R. Chatbot as Islamic Finance Expert (CaIFE): When finance meets Artificial Intelligence. In Proceedings of the 2020 International Conference on Computational Linguistics and Natural Language Processing (CLNLP 2020), Seoul, Korea, 17–19 July 2020; pp. 1–5. [Google Scholar]

- Yussof, S.A.; Al-Harthy, A. Cryptocurrency as an Alternative Currency in Malaysia: Issues and Challenges. Islam Civilis. Renew. 2018, 9, 48–65. [Google Scholar] [CrossRef]

- Salma Al Azizah, U.; Choirin, M. Financial Innovation on Zakat Distribution and Economic Growth. In Proceedings of the 2nd International Conference of Zakat (ICONZ) Proceeding, DKI Jakarta, Indonesia, 14 February 2019. [Google Scholar]

- Alam, N.; Gupta, L.; Zameni, A. Fintech and Islamic Finance: Digitalization, Development and Disruption; Springer International Publishing: Berlin/Heidelberg, Germany; Henley Business School, University of Reading Malaysia: Iskandar Puteri, Malaysia, 2019. [Google Scholar]

- Nastiti, N.D.; Kasri, R.A. The role of banking regulation in the development of Islamic banking financing in Indonesia. Int. J. Islam. Middle East. Financ. Manag. 2019, 12, 643–662. [Google Scholar] [CrossRef]

- Kammoun, S.; Loukil, S.; Loukil, Y.B.R. The impact of fintech on economic performance and financial stability in mena zone. In Impact of Financial Technology (FinTech) on Islamic Finance and Financial Stability; IGI Global; IHEC, CODECI, University of Sfax: Sfax, Tunisia, 2019; pp. 253–275. [Google Scholar]

- Abdullah, E.M.E.; Rahman, A.A.; Rahim, R.A. Adoption of financial technology (Fintech) in mutual fund/unit trust investment among Malaysians: Unified Theory of Acceptance and Use of Technology (UTAUT). Int. J. Eng. Technol. 2018, 7, 110–118. [Google Scholar] [CrossRef]

- Baber, H. FinTech, Crowdfunding and Customer Retention in Islamic Banks. Vision 2020, 24, 260–268. [Google Scholar] [CrossRef]

- Khan, S.; Rabbani, M.R. Artificial Intelligence and NLP based Chatbot as Islamic Banking and Finance Expert. In Proceedings of the 2020 International Conference on Computational Linguistics and Natural Language Processing (CLNLP 2020), Seoul, Korea, 17–19 July 2020; pp. 20–22. [Google Scholar]

- Hasan, R.; Hassan, M.K.; Aliyu, S. Fintech and Islamic Finance: Literature Review and Research Agenda. Int. J. Islam. Econ. Financ. 2020, 1, 75–94. [Google Scholar] [CrossRef]

- Irum, S.; Rehana, K.; Imran, S.C. Fintech and Islamic Finance-challenges and Opportunities. Rev. Econ. Dev. Stud. 2019, 5, 581–590. [Google Scholar] [CrossRef]

- Alam, N.; Gupta, L.; Shanmugam, B. Islamic Finance: A Practical Perspective; Palgrave Springer: London, UK, 2017. [Google Scholar]

- Mohammadkhani, J.; Khalili, F. The effects of risk and return on islamic banking. Int. J. Econ. Perspect. 2017, 11, 411–425. [Google Scholar]

- Döpke, J.; Tegtmeier, L. Global risk factors in the returns of listed private equity. Stud. Econ. Financ. 2018, 35, 340–360. [Google Scholar] [CrossRef]

- Rabbani, M.R. COVID-19 and its impact on supply chain financing and the role of Islamic Fintech: Evidence from GCC countries. Int. J. Agil. Syst. Manag. 2021, in press. [Google Scholar]

- Hassan, M.K.; Rabbani, M.R.; Atif, M.; Shaikh, S. Shariah Indices and Implied Volatilities of S&P, Oil and Gold. Eurasian Econ. Rev. Spec. Issue 2021, in press. [Google Scholar]

- Lawal, I.M.; Imam, U.B. Islamic Finance; A Tool For Realizing Sustainable Development Goals (SDG) In Nigeria. Int. J. Innov. Res. Adv. Stud. 2016, 3, 10–17. [Google Scholar]

- Gundogdu, A.S. An Inquiry into Islamic Finance from the Perspective of Sustainable Development Goals. Eur. J. Sustain. Dev. 2018, 7, 381–390. [Google Scholar] [CrossRef]

- Zhuang, Y.; Chang, X.; Lee, Y. Board composition and corporate social responsibility performance: Evidence from Chinese public firms. Sustainability 2018, 10, 2752. [Google Scholar] [CrossRef]

- Karim, S.; Manab, N.A.; Ismail, R.B. Assessing the governance mechanisms, corporate social responsibility and performance: The moderating effect of board independence. Glob. Bus. Rev. 2020, 0972150920917773. Available online: https://www.researchgate.net/profile/Sitara-Karim/publication/340584081_Assessing_the_Governance_Mechanisms_Corporate_Social_Responsibility_and_Performance_The_Moderating_Effect_of_Board_Independence/links/60867a83881fa114b42b4a1d/Assessing-the-Governance-Mechanisms-Corporate-Social-Responsibility-and-Performance-The-Moderating-Effect-of-Board-Independence.pdf (accessed on 11 March 2016). [CrossRef]

- Karim, S.; Manab, N.A.; Ismail, R. The Interaction Effect of Independent Boards on Corporate Governance-Corporate Social Responsibility (CG-CSR) and Performance Nexus. Asian Acad. Manag. J. 2020, 25, 25. [Google Scholar] [CrossRef]

- Sarea, A.; Bin-Nashwan, S.A. Guide to giving during the COVID-19 pandemic: The moderating role of religious belief on donor attitude. Int. J. Ethics Syst. 2020, 37, 90–104. [Google Scholar] [CrossRef]

- Khan, S.; Hassan, M.K.; Rabbani, M.R. An Artificial Intelligence-based Islamic FinTech model on Qardh-Al-Hasan for COVID 19 affected SMEs. In Islamic Perspective for Sustainable Financial System; Istanbul University Press: Istanbul, Turkey, 2021. [Google Scholar]

- Damak, M.; Roy, D.; Mensah, S. Islamic Finance 2020–2021: COVID-19 Offers an Opportunity for Transformative Developments; 2020. Available online: https://www.spglobal.com/ratings/en/research/articles/200615-islamic-finance-2020-2021-covid-19-offers-an-opportunity-for-transformative-developments-11533355 (accessed on 11 March 2016).

- Islamic Development Bank Group. The Covid-19 Crisis and Islamic Finance; 2020. Available online: https://www.isdb.org/pub/reports/2020/the-covid-19-crisis-and-islamic-finance-response-of-the-islamic-development-bank-group (accessed on 11 March 2016).

- Sherif, M. The impact of Coronavirus (COVID-19) outbreak on faith-based investments: An original analysis. J. Behav. Exp. Financ. 2020, 28, 100403. [Google Scholar] [CrossRef]

- Hamidi, M.L.; Worthington, A.C. Islamic social banking: The way forward perbankan sosial Islam: Langkah kehadapan? J. Ekon. Malays. 2018, 52, 195–207. [Google Scholar]

- Akoum, I.; Haron, A. Islamic banking: Towards a model of corporate governance. J. Glob. Bus. Adv. 2011, 4, 317–335. [Google Scholar] [CrossRef]

- Porzio, C.; Starita, M.G. Islamic banking contracts and the risk profile of Islamic banks. In Islamic Finance in Europe: Towards a Plural Financial System; Edward Elgar Publishing: Cheltenham, UK; Parthenope University of Napoli: Napoli, Italy, 2013; pp. 79–95. [Google Scholar]

- Venardos, A.M. Current Issues in Islamic Banking and Finance; World Scientific Publishing: London, UK, 2010. [Google Scholar]

- Khorshid, A. Islamic Insurance: A Modern Approach to Islamic Banking; Routledge Curzon Taylor & Francis Group: Abingdon, UK, 2004. [Google Scholar]

- Ariff, M. Islamic Banking. Asian-Pac. Econ. Lit. 1988, 2, 48–64. [Google Scholar] [CrossRef]

- Lewis, M.K. Principles of Islamic corporate governance. In Handbook on Islam and Economic Life; Edward Elgar Publishing Ltd.: Cheltenham, UK; University of South Australia Business School: Adelaide, SA, Australia, 2014; pp. 243–267. [Google Scholar]

- Louhichi, A.; Boujelbene, Y. Bank capital, lending and financing behaviour of dual banking systems. J. Multinatl. Financ. Manag. 2017, 41, 61–79. [Google Scholar] [CrossRef]

- Louhichi, A.; Louati, S.; Boujelbene, Y. Market-power, stability and risk-taking: An analysis surrounding the riba-free banking. Rev. Account. Financ. 2019, 18, 2–24. [Google Scholar] [CrossRef]

- DinarStandard. State of the Global Islamic Economy Report 2020/21; 2020. Available online: https://www.icricinternational.org/state-of-the-global-islamic-economy-2020-21-report-is-published/ (accessed on 11 March 2016).

- Noor, M.A.N.M.; Ahmad, N.H.B. The Determinants of Islamic Banks’ Efficiency Changes: Empirical Evidence from the World Banking Sectors. Glob. Bus. Rev. 2012, 13, 179–200. [Google Scholar] [CrossRef]

- Mkadmi, J.E.; Halioui, K. Impact of Islamic and conventional corporate governance mechanisms on financial performance of Islamic Banks: Evidence from Malaysia. In Ethical and Social Perspectives on Global Business Interaction in Emerging Markets; IGI Global; University of Gafsa: Gafsa, Tunisia, 2016; pp. 186–203. [Google Scholar]

- Hanim Tafri, F.; Abdul Rahman, R.; Omar, N. Empirical evidence on the risk management tools practised in Islamic and conventional banks. Qual. Res. Financ. Mark. 2011, 3, 86–104. [Google Scholar] [CrossRef]

- Ozdincer, B.; Yuce, A. Stakeholder Returns of Islamic Banks Versus Conventional Banks. Emerg. Mark. Financ. Trade 2018, 54, 3330–3350. [Google Scholar] [CrossRef]

- Azrak, T.; Saiti, B.; Kutan, A.; Engku Ali, E.R.A. Does information disclosure reduce stock price volatility? A comparison of Islamic and conventional banks in Gulf countries. Int. J. Emerg. Mark. 2020. [Google Scholar] [CrossRef]

- Belkhir, M.; Grira, J.; Hassan, M.K.; Soumaré, I. Islamic banks and political risk: International evidence. Q. Rev. Econ. Financ. 2019, 74, 39–55. [Google Scholar] [CrossRef]

- Merdad, H.; Hassan, M.K. Islamic Mutual Funds’ Performance in Saudi Arabia. In Contemporary Islamic Finance: Innovations, Applications, and Best Practices; 2013. Available online: https://onlinelibrary.wiley.com/doi/book/10.1002/9781118653814#page=300 (accessed on 11 March 2016).

- Alam, M.; Rabbani, M.R.; Tausif, M.R.; Abey, J. Banks’ Performance and Economic Growth in India: A Panel Cointegration Analysis. Economies 2021, 9, 38. [Google Scholar] [CrossRef]

- Alhomaidi, A.; Hassan, M.K.; Zirek, D.; Alhassan, A. Does an Islamic label cause stock price comovements and commonality in liquidity? Appl. Econ. 2018, 50, 1–14. [Google Scholar] [CrossRef]

- Wakil, N.A.B.A.; Saleh, M. The Role of Islamic Finance Institution To Enhance Halal Industry: Issues and Challenges. In Proceedings of the First International Conference On Islamic Development Studies 2019, ICIDS 2019, Bandar Lampung, Indonesia, 10 September 2019. [Google Scholar]

- Ahmad, S.; Rahim Abdul Rahman, A. The efficiency of Islamic and conventional commercial banks in Malaysia. Int. J. Islam. Middle East. Financ. Manag. 2012, 5, 241–263. [Google Scholar] [CrossRef]

- Eprianti, N.; Zia Firdaus, N.; Himayasari, N.D. Effectiveness financing through peer to peer financial technology at smmb (small and medium micro business) in Indonesia. Hamdard Islam. 2020, 43, 850–860. [Google Scholar]

- Almuhammadi, A. An overview of mobile payments, fintech, and digital wallet in Saudi Arabia. In Proceedings of the 7th International Conference on Computing for Sustainable Global Development, INDIACom 2020, New Delhi, India, 12–14 March 2020; Institute of Electrical and Electronics Engineers Inc.: Jeddah, Saudi Arabia, 2020; pp. 271–278. [Google Scholar]

- Zain, N.R.M.; Hassan, R.; Ismail, A. Enhancing islamic banking and finance in southeast asia through the application of artificial intelligence: An exploration of banking’s best practices. In Impact of Financial Technology (FinTech) on Islamic Finance and Financial Stability; IGI Global; IIUM Institute of Islamic Banking and Finance, International Islamic University Malaysia: Selangor, Malaysia, 2019; pp. 36–53. [Google Scholar]

- Asif, J.; Vaqar, A.; Bakhrul, K.A. The Social Safety Nets and Poverty Alleviation in Pakistan: An Evaluation of Livelihood Enhancement and Protection Programme. Br. Int. Humanit. Soc. Sci. J. 2021, 3, 21–36. [Google Scholar]

- Karim, S.; Rabbani, M.R.; Khan, M.A. Determining the key factors of corporate leverage in Malaysian service sector firms using dynamic modeling. J. Econ. Coop. Dev. 2021, in press. [Google Scholar]

- Radwan, M.; Calandra, D.; Koumbarakis, P. Takaful Industry and Blockchain: Challenges and Opportunities for Costs ’ Reduction in Islamic Insurance Companies. Eur. J. Islam. Financ. 2020, 1–6. [Google Scholar] [CrossRef]

- Khan, S.; Rabbani, M.R. In Depth Analysis of Blockchain, Cryptocurrency and Sharia Compliance. Int. J. Bus. Innov. Res. 2020, 1, 1. [Google Scholar] [CrossRef]

- Moh’d Ali, M.A.; Basahr, A.; Rabbani, M.R.; Abdulla, Y. Transforming Business Decision Making with Internet of Things (IoT) and Machine Learning (ML). In Proceedings of the 2020 International Conference on Decision Aid Sciences and Application (DASA), Online, 8–9 November 2020; IEEE: New York, NY, USA, 2020; pp. 674–679. [Google Scholar]

- Rabbani, M.R.; Abdulla, Y.; Basahr, A.; Khan, S.; Moh’d Ali, M.A. Embracing of Fintech in Islamic Finance in the post COVID era. In Proceedings of the 2020 International Conference on Decision Aid Sciences and Application (DASA), Online, 8–9 November 2020; IEEE: New York, NY, USA, 2020; pp. 1230–1234. [Google Scholar]

- Sun, H.; Rabbani, M.R.; Sial, M.S.; Yu, S.; Filipe, J.A.; Cherian, J. Identifying big data’s opportunities, challenges, and implications in finance. Mathematics 2020, 8, 1738. [Google Scholar] [CrossRef]

- Khan, S.; Al-Dmour, A.; Bali, V.; Rabbani, M.R.; Thirunavukkarasu, K. Cloud computing based futuristic educational model for virtual learning. J. Stat. Manag. Syst. 2021, 24, 357–385. [Google Scholar]

- Nasir, F.; Saeedi, M. ‘RegTech’ as a Solution for Compliance Challenge: A Review Article. J. Adv. Res. Dyn. Control Syst. 2019, 11, 912–919. [Google Scholar] [CrossRef]

- Kurum, E. RegTech solutions and AML compliance: What future for financial crime? J. Financ. Crime 2020. [Google Scholar] [CrossRef]

- Kunhibava, S.; Ling, S.T.Y.; Ruslan, M.K. Sustainable Financing and Enhancing the Role of Islamic Banks in Malaysia. Arab Law Q. 2018, 32, 129–157. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M.; Mat Isa, M.P.B.M. The nexus of sustainability practices and financial performance: From the perspective of Islamic banking. J. Clean. Prod. 2019, 228, 703–717. [Google Scholar] [CrossRef]

- World Bank. Leveraging Islamic Fintech to Improve Financial Inclusion; 2020. Available online: http://hdl.handle.net/10986/34520 (accessed on 11 March 2016).

- Mulgan, G. The Process of Social Innovation. Innov. Technol. Gov. Glob. 2006, 1, 145–162. [Google Scholar] [CrossRef]

- Mosteanu, N.R.; Faccia, A. Fintech Frontiers in Quantum Computing, Fractals, and Blockchain Distributed Ledger: Paradigm Shifts and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 1–19. [Google Scholar]

- Abad-Segura, E.; González-Zamar, M.-D.; López-Meneses, E.; Vázquez-Cano, E. Financial Technology: Review of trends, approaches and management. Mathematics 2020, 8, 951. [Google Scholar] [CrossRef]

- Poon, J.; Chow, Y.W.; Ewers, M.; Ramli, R. The role of skills in Islamic financial innovation: Evidence from Bahrain and Malaysia. J. Open Innov. Technol. Mark. Complex. 2020, 6, 47. [Google Scholar] [CrossRef]

- Till, B.M.; Peters, A.W.; Afshar, S.; Meara, J.G. From blockchain technology to global health equity: Can cryptocurrencies finance universal health coverage. BMJ Glob. Health 2017, 2, e000570. [Google Scholar] [CrossRef]

- Goo, J.J.; Heo, J.-Y. The impact of the regulatory sandbox on the fintech industry, with a discussion on the relation between regulatory sandboxes and open innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 43. [Google Scholar] [CrossRef]

- Al Nawayseh, M.K. Fintech in COVID-19 and beyond: What factors are affecting customers’ choice of fintech applications? J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar] [CrossRef]

- DERBEL, H.; BOURAOUI, T.; DAMMAK, N. Can Islamic Finance Constitute A Solution to Crisis? Int. J. Econ. Financ. 2011, 3, 75–83. [Google Scholar] [CrossRef]

- Gozman, D.; Liebenau, J.; Mangan, J. The Innovation Mechanisms of Fintech Start-Ups: Insights from SWIFT’s Innotribe Competition. J. Manag. Inf. Syst. 2018, 35, 145–179. [Google Scholar] [CrossRef]

- Passi, L.F. An open banking ecosystem to survive the revised payment services directive: Connecting international banks and fintechs with the CBI globe platform. J. Paym. Strateg. Syst. 2018, 12, 335–345. [Google Scholar]

- Neuendorf, K.A.; Kumar, A. Content Analysis. 2015. Available online: https://academic.csuohio.edu/kneuendorf/vitae/Neuendorf&Kumar15.pdf (accessed on 11 March 2016).

- Scott, R.A.; Kosslyn, S.M. Emerging trends in the social and behavioral sciences: An interdisciplinary, searchable, and linkable resource. In Index Theologicus; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Massaro, M.; Secinaro, S.; Dal Mas, F.; Brescia, V.; Calandra, D. Industry 4.0 and circular economy: An exploratory analysis of academic and practitioners’ perspectives. Bus. Strateg. Environ. 2021, 30, 1213–1231. [Google Scholar] [CrossRef]

- Ramelli, S.; Wagner, A.F. Feverish stock price reactions to COVID-19. Rev. Corp. Financ. Stud. 2020, 9, 622–655. [Google Scholar] [CrossRef]

- Hepburn, C.; O’Callaghan, B.; Stern, N.; Stiglitz, J.; Zenghelis, D. Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change? Oxf. Rev. Econ. Policy 2020, 36, S359–S381. [Google Scholar] [CrossRef]

- World Bank. The COVID-19 Crisis Response: Supporting Tertiary Education for Continuity, Adaptation, and Innovation; World Bank: Bretton Woods, NH, USA, 2020. [Google Scholar]

- Malik, K.; Sharma, S.; Kaur, M. COVID-19 and the Indian Private Equity Industry: Time to Use the Dry Powder. Vision 2020, 24, 255–259. [Google Scholar] [CrossRef]

- Sharif, A.; Aloui, C.; Yarovaya, L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. Int. Rev. Financ. Anal. 2020, 70, 101496. [Google Scholar] [CrossRef]

- Ozili, P. COVID-19 in Africa: Socio-economic impact, policy response and opportunities. Int. J. Sociol. Soc. Policy 2020. [Google Scholar] [CrossRef]

- Bahrini, R.; Filfilan, A. Impact of the novel coronavirus on stock market returns: Evidence from GCC countries. Quant. Financ. Econ. 2020, 4, 640–652. [Google Scholar] [CrossRef]

- Machmuddah, Z.; Utomo, S.D.; Suhartono, E.; Ali, S.; Ghulam, W.A. Stock market reaction to COVID-19: Evidence in customer goods sector with the implication for open innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 99. [Google Scholar] [CrossRef]

- Ozili, P.K.; Arun, T. Spillover of COVID-19: Impact on the Global Economy. SSRN Electron. J. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3562570 (accessed on 11 March 2016).

- Priyono, A.; Moin, A.; Putri, V.N.A.O. Identifying digital transformation paths in the business model of smes during the covid-19 pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 104. [Google Scholar] [CrossRef]

- Salisu, A.A.; Ebuh, G.U.; Usman, N. Revisiting oil-stock nexus during COVID-19 pandemic: Some preliminary results. Int. Rev. Econ. Financ. 2020, 69, 280–294. [Google Scholar] [CrossRef]

- Tlemsani, I.; Matthews, R. Zakat and social capital: Thoughts on modernism, postmodernism, and faith. J. Manag. Spiritual. Relig. 2020. [Google Scholar] [CrossRef]

- Adnan, N.I.M.; Kashim, M.I.A.M.; Hamat, Z.; Adnan, H.M.; Adnan, N.I.M.; Sham, F.M. The potential for implementing microfinancing from the zakat fund in malaysia. Humanit. Soc. Sci. Rev. 2019, 7, 524–548. [Google Scholar]

- Selim, M.; Hassan, M.K. Qard-al-Hasan-based monetary policy and the role of the central bank as the lender of last resort. J. Islam. Account. Bus. Res. 2020, 11, 326–345. [Google Scholar] [CrossRef]

- Selim, M.; Hassan, M.K. Interest-free monetary policy and its impact on inflation and unemployment rates. ISRA Int. J. Islam. Financ. 2019, 11, 46–61. [Google Scholar] [CrossRef]

- Uddin, M.H.; Kabir, S.H.; Kabir Hassan, M.; Hossain, M.S.; Liu, J. Why do sukuks (Islamic bonds) need a different pricing model? Int. J. Financ. Econ. 2020. [Google Scholar] [CrossRef]

- Paltrinieri, A.; Hassan, M.K.; Bahoo, S.; Khan, A. A bibliometric review of sukuk literature. Int. Rev. Econ. Financ. 2020, 5, 7. [Google Scholar] [CrossRef]

- Hassan, M.K.; Paltrinieri, A.; Dreassi, A.; Miani, S.; Sclip, A. The determinants of co-movement dynamics between sukuk and conventional bonds. Q. Rev. Econ. Financ. 2018, 68, 73–84. [Google Scholar] [CrossRef]

- Ashraf, A.; Hassan, M.K.; III, W.J.H. Performance of microfinance institutions in Muslim countries. Humanomics 2014, 30, 162–182. [Google Scholar] [CrossRef]

- Adeyemi, A.A.; Hassan, M.K. Islamic microfinancing. In Handbook on Islam and Economic Life; Edward Elgar Publishing: Cheltenham, UK, 2014. [Google Scholar]

- Sun, H.; Rabbani, M.R.; Ahmad, N.; Sial, M.S.; Cheng, G.; Zia-Ud-Din, M.; Fu, Q. CSR, Co-Creation and Green Consumer Loyalty: Are Green Banking Initiatives Important? A Moderated Mediation Approach from an Emerging Economy. Sustainability 2020, 12, 10688. [Google Scholar] [CrossRef]

- Jaziri, R.; Alanazi, A.S. Islamic Equity-Based Crowdfunding Regulatory Model: A Legal Analysis in Saudi Arabia. Eur. J. Soc. Sci. 2020, 48, 90–102. [Google Scholar]

- Hidayat, S.E. Islamic Economy in ASEAN Countries During the Covid 19 Era. ASEAN Stud. Cent. Univ. Medan Area Webinar 2020, 3, 90–102. [Google Scholar]

- Karim, S.; Manab, N.A.; Ismail, R.B. Legitimising the role of corporate boards and corporate social responsibility on the performance of Malaysian listed companies. Indian J. Corp. Gov. 2019, 12, 125–141. [Google Scholar] [CrossRef]

- Karim, S.; Manab, N.A.; Ismail, R.B. The dynamic impact of board composition on CSR practices and their mutual effect on organizational returns. J. Asia Bus. Stud. 2019, 14, 463–479. [Google Scholar] [CrossRef]

- Zauro, N.A.; Saad, R.A.J.; Ahmi, A.; Mohd Hussin, M.Y. Integration of Waqf towards enhancing financial inclusion and socio-economic justice in Nigeria. Int. J. Ethics Syst. 2020, 36, 491–505. [Google Scholar] [CrossRef]

- Singer, A. Soup and sadaqa: Charity in Islamic societies. Hist. Res. 2006, 79, 306–324. [Google Scholar] [CrossRef]

- Ross, D.M. Muslim Charity under Russian Rule: Waqf, Sadaqa, and Zakat in Imperial Russia. Islam. Law Soc. 2017, 24, 77–111. [Google Scholar] [CrossRef]

- Brookings, S.; Activity, E. UTC Your Use of the JSTOR Archive Ind; Olivier, J., Blanchard, W.D.N., Edmund, S., Eds.; 2006, pp. 89–158. Available online: http://www.jstor.org/stable/2534687 (accessed on 11 March 2016).

- Rabbani, M.R. The competitive structure and strategic positioning of commercial banks in Saudi Arabia. Int. J. Emerg. Technol. 2020, 11, 43–46. [Google Scholar]

- Hidayat, S.E.; Farooq, M.O.; Alim, E.A. Impacts of The COVID-19 Outbreak on Islamic Finance in The OIC Countries, 2020. Available online: https://knks.go.id/storage/upload/1591090473-b71788507b33ad61531b0705ed42b4269a8a994b.pdf (accessed on 11 March 2016).

- Rizwan, M.S.; Ahmad, G.; Ashraf, D. Systemic risk: The impact of COVID-19. Financ. Res. Lett. 2020, 36, 101682. [Google Scholar] [CrossRef] [PubMed]

- Song, L.; Zhou, Y. The COVID-19 Pandemic and Its Impact on the Global Economy: What Does It Take to Turn Crisis into Opportunity? China World Econ. 2020, 28, 1–25. [Google Scholar] [CrossRef]

- Martin, A.; Markhvida, M.; Hallegatte, S.; Walsh, B. Socio-economic impacts of COVID-19 on household consumption and poverty. Econ. Disasters Clim. Chang. 2020, 4, 453–479. [Google Scholar] [CrossRef] [PubMed]

| No. | Keywords | Articles Collected | Articles Finalized |

|---|---|---|---|

| 1. | Open Innovation | 54 | 23 |

| 2. | Social Innovation | 41 | 26 |

| 3. | Entrepreneurial Innovation | 25 | 10 |

| 4. | Islamic Fintech | 32 | 12 |

| 5. | Islamic Open Innovation | 09 | 04 |

| 6. | Islamic Social Innovation | 05 | 02 |

| 7. | COVID-19 and Islamic Fintech | 19 | 11 |

| 8. | Social Inclusion | 56 | 14 |

| 9. | Islamic Finance and COVID-19 | 23 | 13 |

| 10. | Islamic Financial System | 18 | 10 |

| Total | 282 | 125 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rabbani, M.R.; Bashar, A.; Nawaz, N.; Karim, S.; Ali, M.A.M.; Rahiman, H.U.; Alam, M.S. Exploring the Role of Islamic Fintech in Combating the Aftershocks of COVID-19: The Open Social Innovation of the Islamic Financial System. J. Open Innov. Technol. Mark. Complex. 2021, 7, 136. https://doi.org/10.3390/joitmc7020136

Rabbani MR, Bashar A, Nawaz N, Karim S, Ali MAM, Rahiman HU, Alam MS. Exploring the Role of Islamic Fintech in Combating the Aftershocks of COVID-19: The Open Social Innovation of the Islamic Financial System. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(2):136. https://doi.org/10.3390/joitmc7020136

Chicago/Turabian StyleRabbani, Mustafa Raza, Abu Bashar, Nishad Nawaz, Sitara Karim, Mahmood Asad Mohd. Ali, Habeeb Ur Rahiman, and Md. Shabbir Alam. 2021. "Exploring the Role of Islamic Fintech in Combating the Aftershocks of COVID-19: The Open Social Innovation of the Islamic Financial System" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 2: 136. https://doi.org/10.3390/joitmc7020136

APA StyleRabbani, M. R., Bashar, A., Nawaz, N., Karim, S., Ali, M. A. M., Rahiman, H. U., & Alam, M. S. (2021). Exploring the Role of Islamic Fintech in Combating the Aftershocks of COVID-19: The Open Social Innovation of the Islamic Financial System. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 136. https://doi.org/10.3390/joitmc7020136