Effective Venture Capital Market Development Concept

Abstract

1. Introduction

- define what VC market status that a government should help to achieve is;

- make a content analysis of the factors influencing VC activity and differentiate if necessary between factors related to developed VC markets and underdeveloped ones;

- propose a conceptual model for self-sustainable VC market development.

2. Literature Review

- Seed: Funding provided before the investee company has started mass production/distribution with the aim to complete research, product definition, or product design, also including market tests and creating prototypes. This funding will not be used to start mass production/distribution.

- Start-up: Funding provided to companies, once the product or service is fully developed, to start mass production/distribution and to cover initial marketing. Companies may be in the process of being set up or may have been in business for a shorter time but have not sold their product commercially yet. The destination of the capital would be mostly to cover capital expenditures and initial working capital.

- Later-stage financing: Financing provided for an operating company, which may or may not be profitable. Later-stage venture tends to be financing into companies already backed by VCs.

- there is balance of demand for such capital and supply;

- the market is capable of financing the riskiest companies: those in the earliest stages of their development and high-tech ventures (without tangible assets for collaterals and stable income), and it provides strong support for them;

- there is a sufficiently good quality pipeline of investible businesses for VCFs;

- the market has reached critical mass for further organic growth without public support.

2.1. How to Measure the Self-Sustainability Point?

2.2. How to Measure the Market Gap?

2.3. How Can a Country Activate VC Market?

3. Materials and Methods

- Content analysis of the literature:

- -

- regarding VC supply determinants

- -

- regarding VC demand determinants

- -

- regarding VCists and entrepreneurs matching determinants.

- Consolidation of the factors for supply, demand, and matching.

- Survey of VC market experts’ opinion regarding the importance of the factors in small countries with underdeveloped VC markets.

- Constructing a conceptual model for VC market activity development.

- VC fund managers representatives

- All VC fund managers registered or permanently active in Latvia were approached—in total 9. 8 from 9 provided answers to the questionnaire.

- Public agencies responsible for VC programs in Latvia/Baltics representatives

- Latvian public agency’s ALTUM representatives in charge of VC programs were approached. All three approached provided answers. Additionally, three representatives of EIF in charge of VC and Private Equity programs in Baltic States were approached. EIF is one of the most important players in the EU venture capital market managing European Commission VC programs [14]. All three representatives from EIF provided answers. The representative from the European Bank for Reconstruction and Development in charge of VC market programs in Baltic States approached did not provide the answers.

- Policymakers in charge of VC programs

- Representatives from the Latvian Finance Ministry and Ministry of Economics in charge of the country’s VC policy (three in total) did not fill the questionnaire. Latvian Bank representative involved in Capital Market development issues provided answers.

- Limited partners or investors in VC funds

- From few institutional investors in VC funds (five pension funds), four were approached. Three of them provided answers.

- Representatives of start-up community or serial entrepreneurs

4. Results

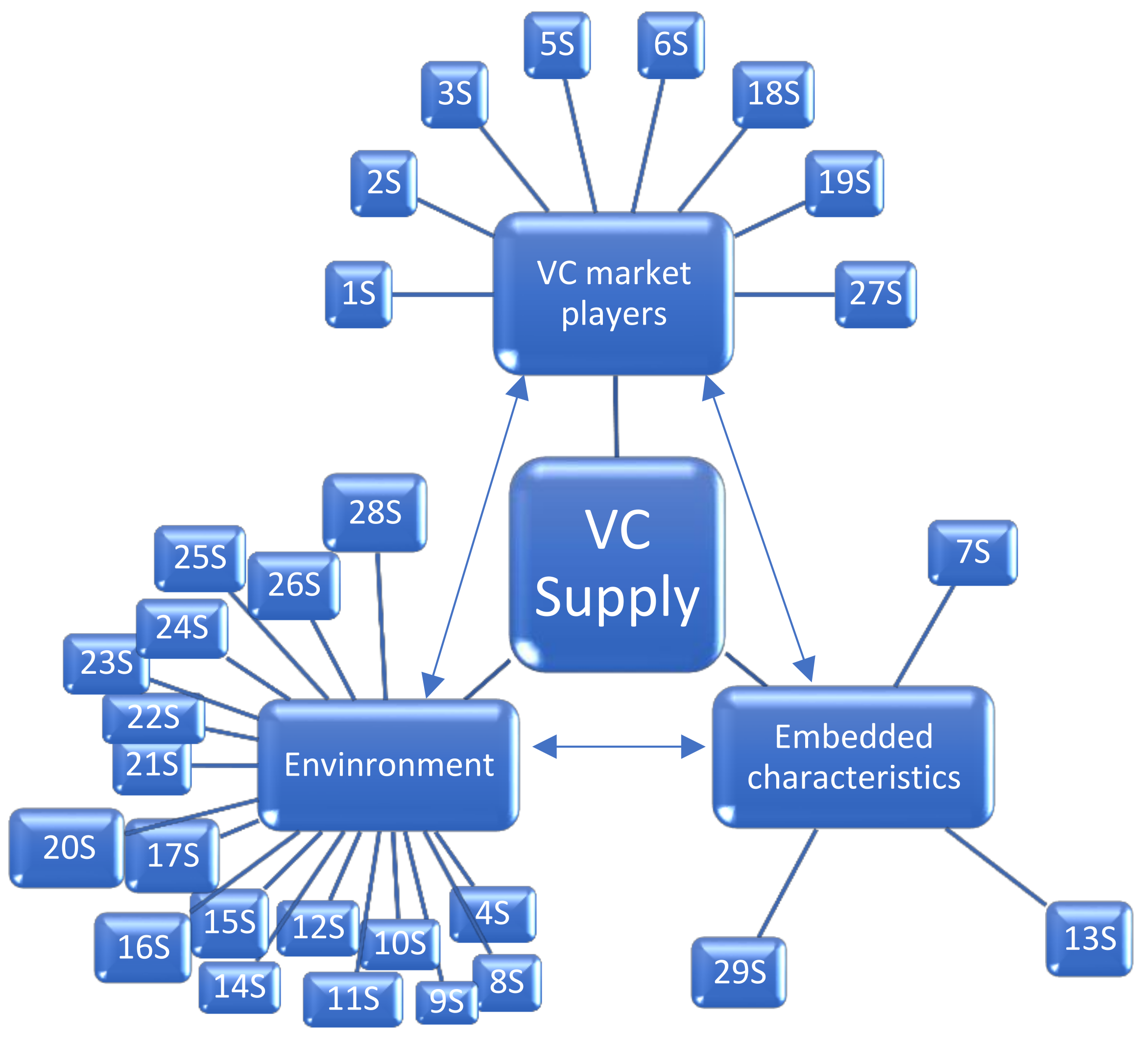

4.1. Content Analysis of the Literature Regarding Factors Influencing VC Supply

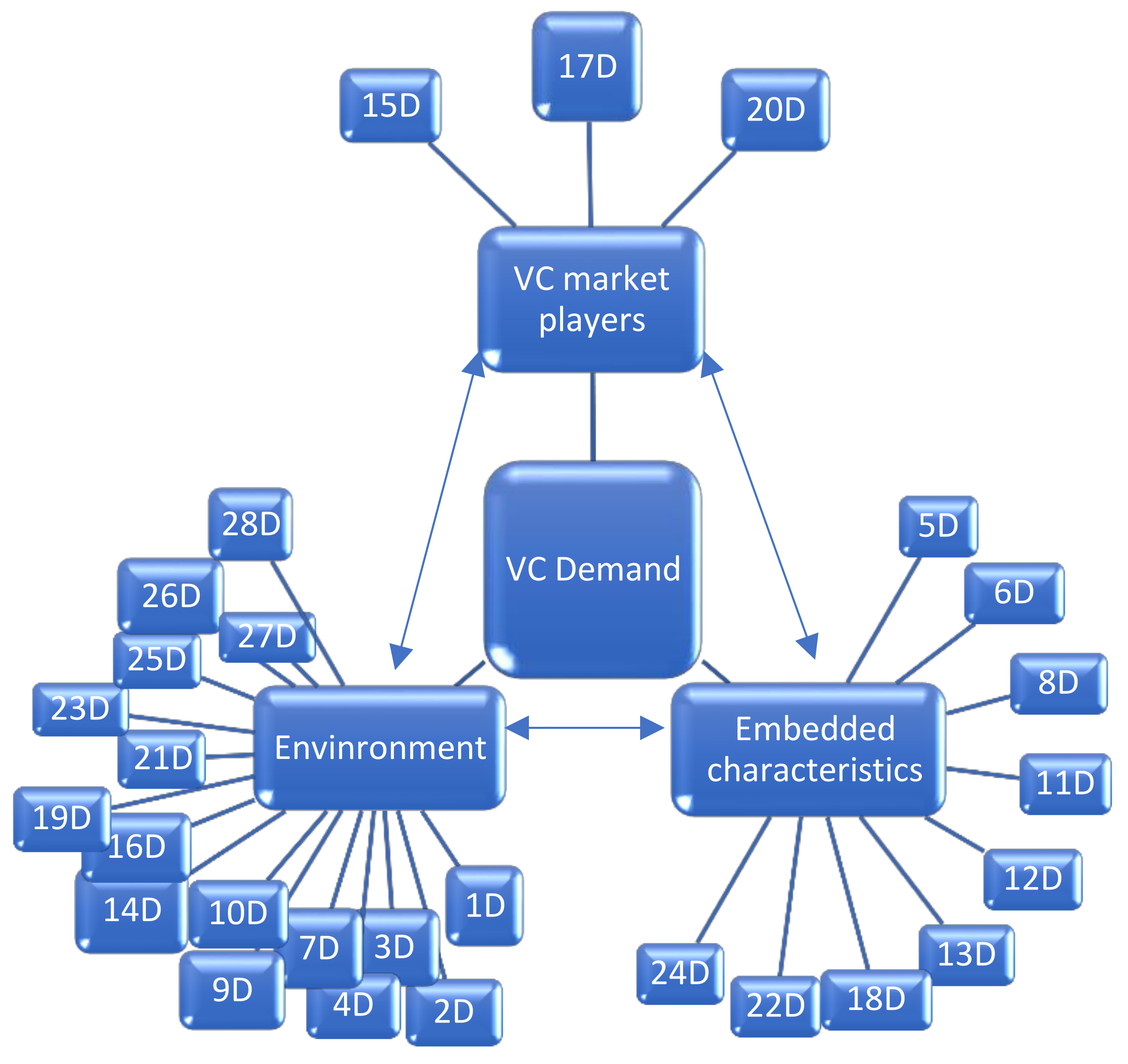

4.2. Content Analysis of the Literature Regarding Factors Influencing VC Demand

4.3. Content Analysis of the Literature Regarding Factors Influencing Venture Capitalists (VCists) and Entrepreneurs Matching Possibilities

4.4. The Consolidation of the Factors for Supply, Demand, and Matching

4.5. The Questionnaire for Experts

- to understand whether factors delivered from the studies are important in countries with underdeveloped VC markets and small internal markets (such as Latvia, for example);

- to determine to what degree each of them is important and what the correlations are between them.

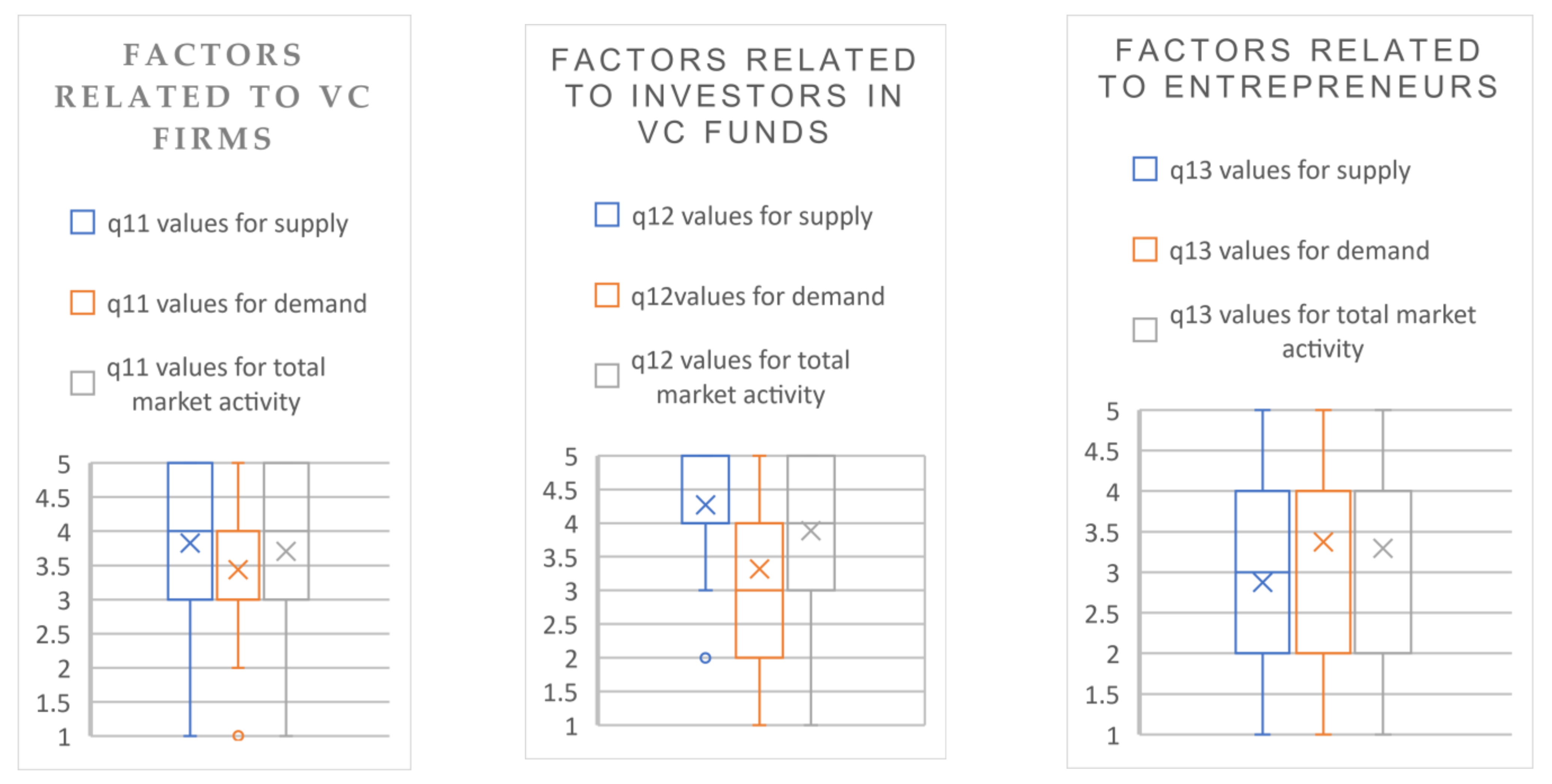

4.5.1. Metagroup “VC Market Players”

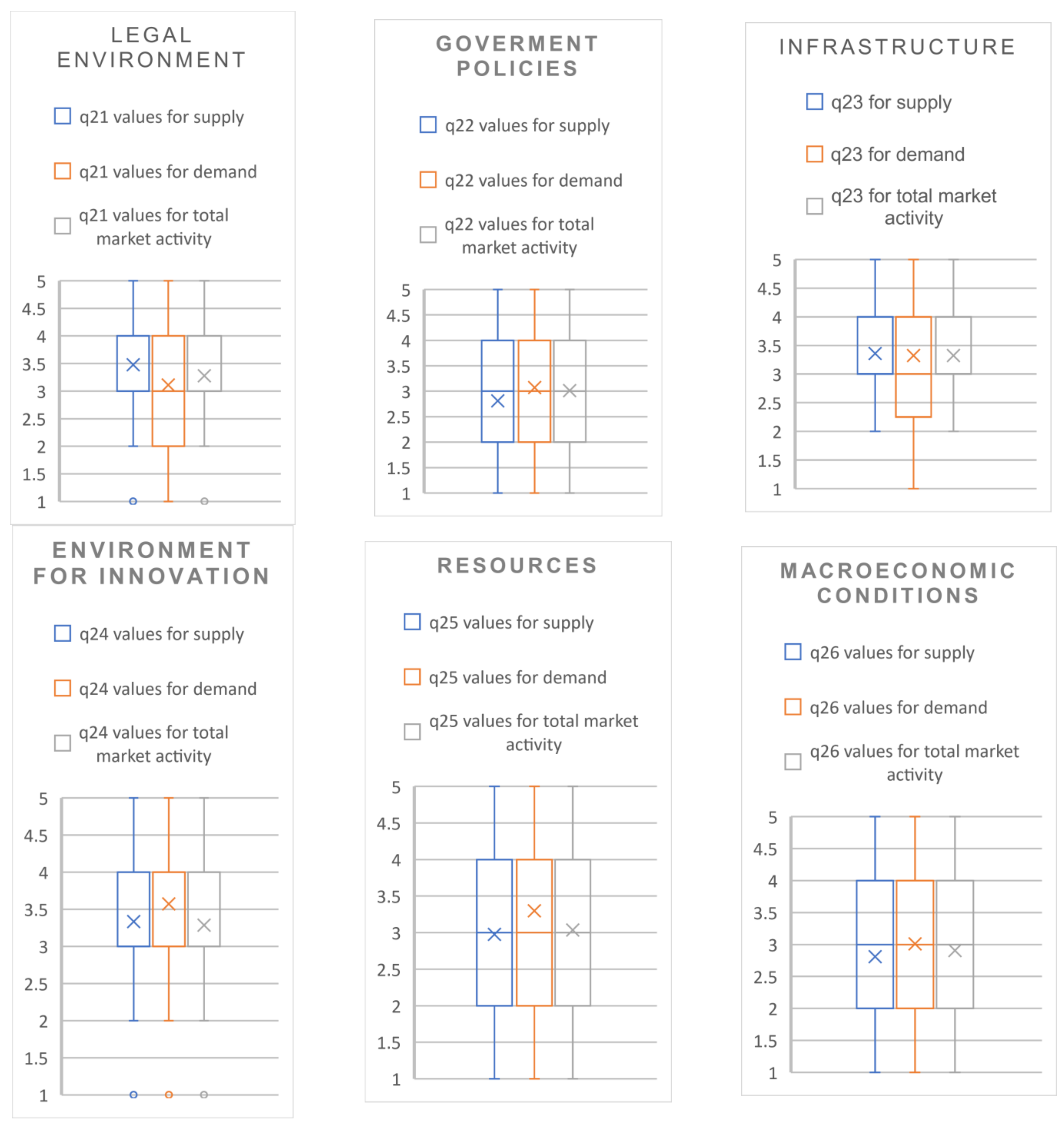

4.5.2. Metagroup “Environment”

4.5.3. Metagroup “Embedded Characteristics”

4.5.4. Model of VC Market Activity Development Dimensions

5. Discussion

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Andrieu, A.P.; Groh, G. Entrepreneurs’ financing choice between independent and bank-affiliated venture capital firms. J. Corp. Financ. 2012, 18, 1143–1167. [Google Scholar] [CrossRef]

- Cassar, G. The financing of business start-ups. J. Bus. Ventur. 2004, 19, 261–283. [Google Scholar] [CrossRef]

- Lerner, J.; Moore, D.; Shepherd, S. A study of New Zealand’ s Venture Capital Market and Implications for Public Policy. 2005. Available online: www.lecg.com (accessed on 15 March 2021).

- Hellmann, M.; Puri, T. Venture capital and the professionalization of start-up firms: Empirical evidence. J. Financ. 2002, 57, 169–197. Available online: http://leeds-faculty.colorado.edu/Bhagat/VC-ProfessionalizationStartup.pdf (accessed on 15 March 2021). [CrossRef]

- Demirel, P.; Danisman, G.O. Eco-innovation and firm growth in the circular economy: Evidence from European small- and medium-sized enterprises. Bus. Strat. Environ. 2019, 28, 1608–1618. [Google Scholar] [CrossRef]

- Pinkow, F.; Iversen, J. Strategic Objectives of Corporate Venture Capital as a Tool for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 157. [Google Scholar] [CrossRef]

- Lerner, J.; Nanda, R. Venture Capital’s Role in Financing Innovation: What We Know and How Much We Still Need to Learn. J. Econ. Perspect. 2020, 34, 237–261. [Google Scholar] [CrossRef]

- Bertoni, F.; Marti, J.; Reverte, C. The impact of government-supported participative loans on the growth of entrepreneurial ventures. Res. Policy 2019, 48, 371–384. [Google Scholar] [CrossRef]

- Lerner, J. The future of public efforts to boost entrepreneurship and venture capital. Small Bus. Econ. 2010, 35, 255–264. [Google Scholar] [CrossRef]

- Bilbao-Osorio, B.; Burkhardt, K.; Correia, A.; Deiss, R.; Lally, D.; Martino, R.; Rueckert, E.; Senczyszyn, D.; Criscuolo, C.; Veugelers, R.; et al. Science, Research and Innovation Performance of the EU 2018 Strengthening the Foundations for Europe’s Future European Commission Directorate-General for Research and Innovation Directorate A—Policy Development and Coordination. 2018. Available online: https://op.europa.eu/en/publication-detail/-/publication/16907d0f-1d05-11e8-ac73-01aa75ed71a1/language-en (accessed on 15 March 2021).

- Aulakh, S.; Thorpe, L.; BIS Equity Finance Programmes Qualitative Reviews of: A) UKHTF and b) The Bridges Fund. Ekogen Report to the Department for Business Innovation and Skills. 2011. Available online: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/32220/11-1009-bis-equity-finance-qualitative-reviews-ukhtf-bridges.pdf (accessed on 15 March 2021).

- Grilli, L.; Mrkajic, B.; Latifi, G. Venture capital in Europe: Social capital, formal institutions and mediation effects. Small Bus. Econ. 2018, 51, 393–410. [Google Scholar] [CrossRef]

- European Commission. An SME Strategy for a Sustainable and Digital Europe; European Commission: Brussels, Belgium, 2020. [Google Scholar]

- European Court of Auditors. Centrally Managed EU Interventions for Venture Capital: In Need of More Direction. 2019. Available online: https://www.eca.europa.eu/en/Pages/DocItem.aspx?did=51616 (accessed on 15 March 2021).

- Hellmann, T.; Thiele, V. Fostering Entrepreneurship: Promoting Founding or Funding? Manag. Sci. 2019, 65, 2502–2521. [Google Scholar] [CrossRef]

- Harding, R. Plugging the knowledge gap: An international comparison of the role for policy in the venture capital market. Ventur. Cap. 2002, 4, 59–76. [Google Scholar] [CrossRef]

- Romain, A.; de la Potterie, B.V. The Determinants of Venture Capital: A Panel Data Analysis of 16 OECD Countries; Universite Libre de Bruxelles: Brussels, Belgium, 2004. [Google Scholar]

- Cipollone, A.; Giordani, P.E. Market frictions in entrepreneurial innovation: Theory and evidence. J. Econ. Behav. Organ. 2019, 163, 297–331. [Google Scholar] [CrossRef]

- Bertoni, F.; D’Adda, D.; Grilli, L. Self-selection of entrepreneurial firms in thin venture capital markets: Theory and empirical evidence. Strat. Entrep. J. 2019, 13, 47–74. [Google Scholar] [CrossRef]

- Wishlade, F.; Michie, R.; Familiari, G.; Schneiderwind, P.; Resch, A. Ex-Post Evaluation of Cohesion Policy Programmes 2007-13, Focusing on the European Regional Development Fund (ERDF) and Cohesion Fund (CF); Publications Office of the European Union: Luxembourg, 2016. [Google Scholar]

- Invest Europe. Private Equity Activity 2020. 2021. Available online: www.investeurope.eu (accessed on 20 May 2021).

- Giraudo, E.; Giudici, G.; Grilli, L. Entrepreneurship policy and the financing of young innovative companies: Evidence from the Italian Startup Act. Res. Policy 2019, 48, 103801. [Google Scholar] [CrossRef]

- Owen, R.; Mason, C. Emerging trends in government venture capital policies in smaller peripheral economies: Lessons from Finland, New Zealand, and Estonia. Strat. Chang. 2019, 28, 83–93. [Google Scholar] [CrossRef]

- Matisone, A.; Lace, N. The Impact of Public Interventions on Self-Sustainable Venture Capital Market Development in Latvia from the Perspective of VC Fund Managers. J. Open Innov. Technol. Mark. Complex. 2020, 6, 53. [Google Scholar] [CrossRef]

- Hyman, D.N. Public Finance: A Contemporary Application of Theory to Policy; Cengage Learning: Boston, MA, USA, 2010. [Google Scholar]

- Williamson, O.E. The New Institutional Economics: Taking Stock, Looking Ahead. J. Econ. Lit. 2000, 38, 595–613. [Google Scholar] [CrossRef]

- Boocock, M.; Woods, G. The evaluation criteria used by venture capitalists: Evidence from a UK venture fund. Int. Small Bus. J. 1997, 16, 36–57. [Google Scholar] [CrossRef]

- Ibrahim, D.M. Public or Private Venture Capital? Washingt. LAW Rev. 2019, 94, 1137–1174. Available online: https://digitalcommons.law.uw.edu/cgi/viewcontent.cgi?article=5077amp;=amp;context=wlramp;=amp;sei-redir=1amp;referer=https%253A%252F%252Fscholar.google.com%252Fscholar%253Fq%253Drelated%253AOWFTF994u20J%253Ascholar.google.com%252F%2526scioq%253DIbrahim%252C%252BD.%252B (accessed on 15 February 2021). [CrossRef]

- Baldock, R.; Mason, C. Establishing a new UK finance escalator for innovative SMEs: The roles of the Enterprise Capital Funds and Angel Co-Investment Fund. Ventur. Cap. 2015, 17, 59–86. [Google Scholar] [CrossRef]

- Da Rin, M.; Nicodano, G.; Sembenelli, A. Public policy and the creation of active venture capital markets. J. Public Econ. 2006, 9, 1699–1723. [Google Scholar] [CrossRef]

- Parhankangas, A. The economic impact of venture capital. In Handbook of Research on Venture Capital: Volume 2; Edward Elgar Pub: Cheltenham, UK, 2012; pp. 124–158. [Google Scholar]

- Invest Europe. Investing in Europe: Private Equity Activity 2019. 2020. Available online: https://www.investeurope.eu/search/?q=Private+Equity+Activity+2019 (accessed on 15 March 2021).

- Armour, J.; Cumming, D. The legislative road to Silicon Valley. Oxf. Econ. Pap. 2006, 58, 596–635. [Google Scholar] [CrossRef]

- Groh, A.P.; Wallmeroth, J. Determinants of venture capital investments in emerging markets. Emerg. Mark. Rev. 2016, 29, 104–132. [Google Scholar] [CrossRef]

- Li, Y.; Zahra, S.A. Formal institutions, culture, and venture capital activity: A cross-country analysis. J. Bus. Ventur. 2012, 27, 95–111. [Google Scholar] [CrossRef]

- Gompers, J.; Lerner, P.A. What drives venture capital fundraising? Natl. Bur. Econ. Res. 1998, 1998, w6906. [Google Scholar]

- Kraemer-eis, H.; Lang, F. Guidelines for SME Access to Finance Market Assessments. 2014. Available online: http://www.eif.org/news_centre/publications/eif_wp_22_gafma_april14_fv.pdf (accessed on 20 May 2021).

- Jeng, L.A.; Wells, P.C. The determinants of venture capital funding: Evidence across countries. J. Corp. Finance 2000, 6, 241–289. [Google Scholar] [CrossRef]

- Johansson, J.; Malmström, M.; Wincent, J.; Parida, V. How individual cognitions overshadow regulations and group norms: A study of government venture capital decisions. Small Bus. Econ. 2021, 56, 857–876. [Google Scholar] [CrossRef]

- Gantenbein, P.; Kind, A.; Volonté, C. Individualism and Venture Capital: A Cross-Country Study. Manag. Int. Rev. 2019, 59, 741–777. [Google Scholar] [CrossRef]

- Alperovych, Y.; Groh, A.; Quas, A. Bridging the equity gap for young innovative companies: The design of effective government venture capital fund programs. Res. Policy 2020, 49, 104051. [Google Scholar] [CrossRef]

- Lerner, J. Government Incentives for Entrepreneurship. In Government Incentives for Entrepreneurship. Working Paper 26884; National Bureau of Economic Research: Boston, MA, USA, 2020. [Google Scholar] [CrossRef]

- Wilson, K.E.; Silva, F. Policies for Seed and Early Stage Finance. In OECD Science, Technology and Industry Policy Papers; OECD: Paris, France, 2013. [Google Scholar] [CrossRef]

- Matisone, A.; Lace, N. Entrepreneurs’ and Venture Capitalists’ openness for cooperation: Barriers and drivers. In Proceedings of the IMCIC 2019—10th International Multi-Conference on Complexity, Informatics and Cybernetics, Orlando, FL, USA, 12–15 March 2019; Volume 1. [Google Scholar]

- Williamson, O.E. Transaction Cost Economics: How It Works; Where It is Headed. De Econ. 1998, 146, 23–58. [Google Scholar] [CrossRef]

- Yin, R.K. Qualitative Research from Start to Finish, 2nd ed.; The Guilford Press: New York, NY, USA, 2016. [Google Scholar]

- Lerner, J.; Leamon, A.; Garcia-Robles, S. Best Practice in Creating a Venture Capital Ecosystem. 2015, p. 100. Available online: http://www.ttaturkey.org/upload/articles-useful-links/Best_Practices_Creating_VC_Ecosystem.pdf (accessed on 15 March 2021).

- Migendt, M.; Polzin, F.; Schock, F.; A Täube, F.; Von Flotow, P. Beyond venture capital: An exploratory study of the finance-innovation-policy nexus in cleantech. Ind. Corp. Chang. 2017, 26, 973–996. [Google Scholar] [CrossRef]

- Baldock, R. An assessment of the business impacts of the UK’s Enterprise Capital Funds. Environ. Plan. C Gov. Policy 2016, 34, 1556–1581. [Google Scholar] [CrossRef]

- Prohorovs, A. Attraction of investments into venture capital and private equity funds of Latvi. Econ. Sci. Rural. Dev. Conf. Proc. 2013, 30, 1–9. [Google Scholar]

- Conti, A.; Thursby, M.; Thursby, J. Patents as signals for startup financing. J. Ind. Econ. 2013, 61, 592–622. [Google Scholar] [CrossRef]

- Hochberg, Y.V.; Serrano, C.J.; Ziedonis, R.H. Patent collateral, investor commitment, and the market for venture lending. J. Financ. Econ. 2018, 130, 74–94. [Google Scholar] [CrossRef]

- Alsos, G.A.; Ljunggren, E. The role of gender in entrepreneur–investor relationships: A signaling theory approach. Entrep. Theory Pract. 2017, 41, 567–590. [Google Scholar] [CrossRef]

- Coleman, J.; Cotei, S.; Farhat, C. The debt-equity financing decisions of US startup firms. J. Econ. Financ. 2016, 40, 1. [Google Scholar] [CrossRef]

- Hoppmann, J.; Vermeer, B. The double impact of institutions: Institutional spillovers and entrepreneurial activity in the solar photovoltaic industry. J. Bus. Ventur. 2020, 35, 105960. [Google Scholar] [CrossRef]

- Liu, T.; Cao, B.; Johan, J.; Leng, S. The real effect of liquidity provision on entrepreneurial financing: Evidence from a natural experiment in China. Eur. J. Financ. 2019, 25, 568–593. [Google Scholar] [CrossRef]

- Juha, S.; Kari, V. Development Trajectory of An Innovation-Based Environmental Technology Start-Up. Int. J. Innov. Econ. Dev. 2017, 3, 99–112. [Google Scholar] [CrossRef][Green Version]

- Jin, S.; Lee, K. The Government R&D Funding and Management Performance: The Mediating Effect of Technology Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 94. [Google Scholar] [CrossRef]

- Parker, S.C. The Economics of Self-Employment and Entrepreneurship; Cambridge University Press (CUP): Cambridge, UK, 2004. [Google Scholar]

- Audretsch, D.B.; Carree, M.A.; Thurik, A.R. Does Entrepreneurship Reduce Unemployment; Tinbergen Institute Discussion Paper No. 01-074/3; Tinbergen Institute: Amsterdam, The Netherlands, 2002; Available online: http://hdl.handle.net/10419/85927%0AStandard-Nutzungsbedingungen: (accessed on 5 March 2021).

- Harrison, R. Crossing the chasm: The role of co-investment funds in strengthening the regional business angel ecosystem. Small Enterp. Res. 2018, 25, 3–22. [Google Scholar] [CrossRef]

- Harrison, R.T.; Yohanna, B.; Pierrakis, Y. Internationalisation and localisation: Foreign venture capital investments in the United Kingdom. Local Econ. J. Local Econ. Policy Unit 2020, 35, 230–256. [Google Scholar] [CrossRef]

- Weigand, C. Beyond the finance paradigm: The entrepreneurial logic of financial resource acquisition from an effectuation perspective. J. Entrep. Ventur. 2019, 11, 440–460. [Google Scholar] [CrossRef]

- Lerner, J. Boulevard of Broken Dreams. Why Public Efforts to Boost Entrepreneurship and Venture Capital Have Failed-and What to Do about It; Princeton University Press: New York, NY, USA, 2009. [Google Scholar]

- Standaert, T.; Manigart, S. Government as fund-of-fund and VC fund sponsors: Effect on employment in portfolio companies. Small Bus. Econ. 2018, 50, 357–373. [Google Scholar] [CrossRef]

- Ning, Y.; Xu, G.; Long, Z. What drives the venture capital investments in China? Chin. Manag. Stud. 2019, 13, 574–602. [Google Scholar] [CrossRef]

- Prohorovs, A.; Pavlyuk, D. Analysis of Economic Factors Influencing Venture Capital Investment in European Countries. Soc. Res. 2013, 4, 33. [Google Scholar]

- Martin, R.; Berndt, C.; Klagge, B.; Sunley, P. Spatial Proximity Effects and Regional Equity Gaps in the Venture Capital Market: Evidence from Germany and the United Kingdom. Environ. Plan. A Econ. Space 2005, 37, 1207–1231. [Google Scholar] [CrossRef]

- Zaborovskaia, O.; Nadezhina, O.; Avduevskaya, E. The Impact of Digitalization on the Formation of Human Capital at the Regional Level. J. Open Innov. Technol. Mark. Complex. 2020, 6, 184. [Google Scholar] [CrossRef]

| Term to Characterize VC Market | Explanation | Authors |

|---|---|---|

| Effective | Works efficiently to fund innovative, high-growth companies, and there is balance of demand for such capital and supply for it | Harding (2002) [16] |

| Self-sustaining | Has reached critical mass after which the sector could develop on its own without governmental support | Lerner et al. (2005) [3]; Hellmann and Thiele (2019) [15] |

| Vibrant/viable | The market activity has reached a tangible portion of country’s GDPs | Grilli et al. (2018) [12] |

| Robust | Similar to one that exists in the United States | Ibrahim (2019) [28] |

| Works as optimal finance escalator and sufficient pipeline | Providing finance possibilities for all enterprises potentially eligible for VC in any of their development stages, especially for early-stage innovative SMEs, and creating a sufficiently good quality pipeline of investible businesses | Baldock and Mason (2015) [29] |

| Active | VC markets provide strong support for early stage and high-tech ventures, which is evidenced by high ’innovation ratios,’ defined to be the ratio of early stage (or high-tech) investments to total venture investments | Da Rin et al. (2006) [30] |

| Maturing | Having confidence amongst investors and entrepreneurs about the market and its further development. Having well-managed and successful private VCF managers and a base of local institutional investors in VCFs. The market gaps are closed, and the market is segmenting to cater for specific demands. | Lerner et al. (2005) [3] |

| VC Market Activity Measurement | Frequency of Use | Authors (Non-Comprehensive List) |

|---|---|---|

| Total amount of VC investments as a portion of GDP (%) | Most frequent measurement | Armour et at. (2006) [33]; Grilli et al. (2018) [12]; Groh et al. (2016) [34], Lerner et al. (2005) [3], Romain et al. (2004) [17] and others |

| Total amount of VC investments per capita (EUR) | Moderate | Li et al. (2012) [35]; Gompers et al. (1998) [36]; Da Rin et al. (2005) [30] and others |

| Total number of VC investments per capita | Moderate | Li Y. et al. (2012) [35]; Gompers et al. (1998) [36] and others |

| Group of the Respondents | Number of the Representatives Approached (% from the Group Members Related to LV) | Number of the Representatives Who Filled the Survey |

|---|---|---|

| Latvian VCFs managers | 9 (100% of registered and active VCFs in LV) | 8 (89% of approached) |

| Public agencies responsible for VC programs in LV (Altum, EIF, EBRD) | 7 (100%) | 6 (86% of approached) |

| Policymakers in charge of VC programs in LV | 4 (100%) | 1 (25% of approached) |

| Institutional LPs in Latvian VCFs | 4 (80%) | 3 (75% of approached) |

| Representatives of LV start-up community | 7 (100% of main institutions involved in shaping Latvian start-up ecosystem) | 4 (57% of approached) |

| No | Categories | Frequency | |

|---|---|---|---|

| Mature Markets | Underdeveloped Markets | ||

| 1S | VC firms’ experience | 3 | 1 |

| 2S | Number of VC firms in a market | 2 | |

| 3S | Investment returns | 5 | |

| 4S | Policy for investments in VC funds | 3 | |

| 5S | Foreign VC investments | 2 | |

| 6S | Co-investment/Syndication possibilities | 7 | 1 |

| 7S | Proximity from core economic regions | 1 | |

| 8S | Domestic ecosystem | 3 | 2 |

| 9S | Technical/research university density and student rate | 2 | |

| 10S | Transaction costs | 2 | |

| 11S | Limitations of VC funds | 1 | 1 |

| 12S | Legal environment | 4 | 1 |

| 13S | Local custom for VC | 3 | |

| 14S | Exit possibilities | 4 | 1 |

| 15S | Macroeconomic conditions | 4 | 1 |

| 16S | Technology innovations | 1 | |

| 17S | Alternative investment for LPs opportunities | 1 | |

| 18S | The number of early-stage innovative entrepreneurs seekingVC | 1 | 2 |

| 19S | Successful entrepreneurs from prior generations | 3 | |

| 20S | Alternative IPO and listing regulation for SMEs | 2 | 3 |

| 21S | Possibility to obtain additional financing for next rounds/further grow | 3 | |

| 22S | Governmental policies and regulations for particular kind of investments | 1 | 1 |

| 23S | Demand for new products | 3 | |

| 24S | Governmental funding | 5 | |

| 25S | Governmental programs encouraging investors | 3 | 1 |

| 26S | Public support for early stage | 3 | |

| 27S | Base of investors in VC funds | 1 | |

| 28S | Capital market development | 2 | |

| 29S | Informal or intangible institutions | 1 | |

| No | Categories | Frequency | |

|---|---|---|---|

| Mature Markets | Unmatured Markets | ||

| 1D | Encouraging entrepreneurship | 5 | 2 |

| 2D | Capital market development | 3 | |

| 3D | Government subsidies/incentives for RD/specific technologies | 8 | |

| 4D | Domestic ecosystem | 3 | |

| 5D | Entrepreneurial risk tolerance | 3 | 2 |

| 6D | Awareness about VC | 1 | 4 |

| 7D | Legal norms | 5 | |

| 8D | Proximity from core economic regions/partners | 3 | |

| 9D | Demand for particular products/technologies | 8 | |

| 10D | Macroeconomic conditions | 3 | |

| 11D | Diversity of human and social capital | 2 | |

| 12D | Informal or intangible institutions | 3 | |

| 13D | Formal institutions | 3 | |

| 14D | Similarity between domestic and foreign policy incentives | 2 | |

| 15D | Local availability of VC | 10 | |

| 16D | Encouraging/supporting technology transfer of researchers | 3 | |

| 17D | Characteristics of prospective VC investors | 3 | |

| 18D | Readiness to partner | 1 | 1 |

| 19D | Government business support measures in general | 2 | |

| 20D | Business angel development | 1 | |

| 21D | Other capital availability | 2 | |

| 22D | Entrepreneurs’ preferences for particular funding | 2 | 1 |

| 23D | Local universities | 3 | |

| 24D | Local human capital | 5 | |

| 25D | Infrastructure | 2 | |

| 26D | Outsourcing public services | 1 | |

| 27D | Local success stories | 1 | |

| 28D | Local major industries | 1 | |

| 29D | Research facilities | 1 | |

| No | Categories | Frequency | |

|---|---|---|---|

| Mature Markets | Unmatured Markets | ||

| 1 | General awareness and perception of VC | 2 | 8 |

| 2 | Firm characteristics | 9 | 3 |

| 3 | Cultural obstacles | 4 | 3 |

| 4 | Communication | 17 | 2 |

| 5 | VC’s characteristics | 24 | 1 |

| 6 | Resources to attract VC | 4 | |

| 7 | Availability of other funding | 8 | |

| 8 | Entrepreneur’s characteristics | 6 | 3 |

| 9 | Trade-off | 13 | |

| 10 | Economic factors | 5 | |

| 11 | Business environment | 5 | 1 |

| Cronbach’s Alpha | N of Items |

|---|---|

| 0.990 | 365 |

| No | q11 Factors Related to VC Firms | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q11_1 | High total amount of available capital from VC firms in a market | 4.32 | 1 | 5 | 1.06 | 3.37 | 2 | 5 | 1.07 | 4.05 | 2 | 5 | 1.03 |

| q11_2 | High competition between VC firms in a market | 3.84 | 2 | 5 | 1.07 | 3.68 | 2 | 5 | 1.11 | 4.16 | 2 | 5 | 0.96 |

| q11_3 | Existence of VC firms in all stages in a market | 3.95 | 2 | 5 | 0.91 | 3.68 | 2 | 5 | 0.95 | 4.11 | 3 | 5 | 0.74 |

| q11_4 | Specialization of VC firms | 2.95 | 1 | 4 | 0.97 | 3.16 | 1 | 5 | 1.12 | 3.05 | 1 | 5 | 0.91 |

| q11_5 | Existence of local VC firms in a market | 4.11 | 2 | 5 | 1.10 | 3.58 | 2 | 5 | 1.02 | 3.74 | 2 | 5 | 1.10 |

| q11_6 | Existence of foreign VC firms in a market | 4.32 | 3 | 5 | 0.58 | 3.42 | 2 | 5 | 0.90 | 3.89 | 2 | 5 | 0.81 |

| q11_7 | Existence of publicly co-financed VC firms in a market | 4.26 | 2 | 5 | 0.87 | 3.05 | 2 | 5 | 1.08 | 3.79 | 2 | 5 | 1.13 |

| q11_8 | Existence of private VC firms in a market | 4.11 | 2 | 5 | 1.10 | 3.26 | 1 | 5 | 1.15 | 3.84 | 2 | 5 | 1.01 |

| q11_9 | High reputation of VC firms in a market | 3.58 | 1 | 5 | 1.30 | 3.58 | 1 | 5 | 1.22 | 3.63 | 1 | 5 | 1.26 |

| q11_10 | Existence of experienced VC firms in a market | 4.00 | 2 | 5 | 1.00 | 3.74 | 2 | 5 | 0.87 | 3.89 | 3 | 5 | 0.81 |

| q11_11 | Substantial added value from VC firms | 3.42 | 1 | 5 | 1.22 | 4.26 | 2 | 5 | 0.87 | 3.89 | 2 | 5 | 0.99 |

| q11_12 | High investment returns of VC firms | 4.63 | 4 | 5 | 0.50 | 2.79 | 1 | 5 | 1.27 | 4.00 | 1 | 5 | 1.05 |

| q11_13 | Successful growth of VC firms’ portfolio companies | 4.16 | 3 | 5 | 0.76 | 4.11 | 2 | 5 | 0.94 | 3.95 | 3 | 5 | 0.85 |

| q11_14 | Low risk profile of VC firms (financial instruments used by VC firms; investment strategies) | 3.21 | 1 | 5 | 0.92 | 2.21 | 1 | 4 | 0.98 | 2.63 | 1 | 4 | 1.01 |

| q11_15 | High risk profile of VC firms (financial instruments used by VC firms; investment strategies) | 3.16 | 1 | 4 | 0.83 | 3.47 | 1 | 5 | 1.07 | 3.37 | 2 | 4 | 0.76 |

| No | q12 Factors Related to Investors in VC Funds | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q12_1 | Diversified and robust institutional investor base | 4.47 | 2.00 | 5.00 | 0.84 | 2.89 | 1.00 | 5.00 | 1.41 | 3.95 | 2.00 | 5.00 | 0.97 |

| q12_2 | Existence of successful entrepreneurs from prior generations | 4.37 | 3.00 | 5.00 | 0.76 | 4.11 | 2.00 | 5.00 | 0.94 | 4.26 | 3.00 | 5.00 | 0.73 |

| q12_3 | High experience and capacity in VC investments of governmental agency responsible for public VC investments | 4.11 | 2.00 | 5.00 | 0.88 | 2.79 | 1.00 | 5.00 | 1.36 | 3.42 | 1.00 | 5.00 | 1.17 |

| No | q13 Factors Related to Entrepreneurs | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q13_1 | High number of entrepreneurs seeking VC | 4.00 | 1.00 | 5.00 | 1.11 | 4.32 | 2.00 | 5.00 | 1.06 | 4.26 | 2.00 | 5.00 | 0.87 |

| q13_2 | General awareness between entrepreneurs/potential entrepreneurs about VC | 3.05 | 1.00 | 5.00 | 1.35 | 3.89 | 2.00 | 5.00 | 1.10 | 3.79 | 1.00 | 5.00 | 1.23 |

| q13_3 | Awareness of the added value from VC between entrepreneurs/potential entrepreneurs | 2.74 | 1.00 | 5.00 | 1.33 | 4.05 | 2.00 | 5.00 | 1.08 | 3.74 | 1.00 | 5.00 | 1.28 |

| q13_4 | High risk tolerance and partnership acceptance and trust of entrepreneurs/potential entrepreneurs | 3.26 | 1.00 | 5.00 | 1.05 | 3.95 | 3.00 | 5.00 | 0.62 | 3.89 | 2.00 | 5.00 | 0.88 |

| q13_5 | Dominant gender of entrepreneurs/potential entrepreneurs–male | 1.47 | 1.00 | 3.00 | 0.70 | 1.53 | 1.00 | 3.00 | 0.70 | 1.53 | 1.00 | 3.00 | 0.70 |

| q13_6 | High net worth of entrepreneurs seeking VC | 2.26 | 1.00 | 4.00 | 0.99 | 2.68 | 1.00 | 4.00 | 1.06 | 2.58 | 1.00 | 5.00 | 1.12 |

| q13_7 | Previous experience in entrepreneurship of entrepreneurs/potential entrepreneurs | 3.68 | 1.00 | 5.00 | 1.42 | 3.53 | 1.00 | 5.00 | 0.96 | 3.53 | 1.00 | 5.00 | 1.12 |

| q13_8 | Technical or MBA education of entrepreneurs/potential entrepreneurs | 2.89 | 1.00 | 5.00 | 1.24 | 3.05 | 1.00 | 5.00 | 1.22 | 3.05 | 1.00 | 5.00 | 1.18 |

| No | q21 Legal Environment Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q21_1 | Internationally harmonized and stable regulation for securities, bankruptcy, labor, and tax | 4.21 | 3.00 | 5.00 | 0.71 | 3.21 | 1.00 | 5.00 | 1.08 | 3.79 | 3.00 | 5.00 | 0.71 |

| q21_2 | Reduction in labor regulation | 3.05 | 1.00 | 5.00 | 0.91 | 2.74 | 1.00 | 5.00 | 1.10 | 2.89 | 1.00 | 5.00 | 0.94 |

| q21_3 | Easiness to hire foreign employees | 3.37 | 1.00 | 5.00 | 0.90 | 3.21 | 1.00 | 5.00 | 1.03 | 3.16 | 1.00 | 5.00 | 1.01 |

| q21_4 | Flexible policies regarding risk evaluation and broad limits for investments in VC funds for investors in VC funds | 3.89 | 1.00 | 5.00 | 1.15 | 2.84 | 1.00 | 5.00 | 1.30 | 3.53 | 1.00 | 5.00 | 1.02 |

| q21_5 | Tax application on investors in VC funds not VC funds level | 3.89 | 1.00 | 5.00 | 1.15 | 2.42 | 1.00 | 4.00 | 1.26 | 3.32 | 1.00 | 5.00 | 1.11 |

| q21_6 | Broad limits for VC funds (size of the investment; geography; focus; lifespan of the fund; risk profile) | 4.11 | 2.00 | 5.00 | 0.99 | 2.89 | 1.00 | 5.00 | 1.33 | 3.47 | 1.00 | 5.00 | 1.17 |

| q21_7 | Entrepreneur friendly tax system | 3.47 | 1.00 | 5.00 | 1.07 | 3.74 | 2.00 | 5.00 | 0.99 | 3.42 | 2.00 | 5.00 | 1.07 |

| q21_8 | Little administrative burden for starting a business | 3.21 | 1.00 | 5.00 | 1.27 | 3.79 | 1.00 | 5.00 | 1.44 | 3.26 | 1.00 | 5.00 | 1.33 |

| q21_9 | Easiness for foreigners to start a business | 3.11 | 1.00 | 5.00 | 1.29 | 3.42 | 1.00 | 5.00 | 1.26 | 3.16 | 1.00 | 5.00 | 1.30 |

| q21_10 | Government policies and regulations beneficial for particular kind of investments (i.e., cleantech, sustainability) | 3.16 | 1.00 | 5.00 | 1.26 | 3.16 | 1.00 | 5.00 | 1.12 | 3.21 | 1.00 | 5.00 | 1.18 |

| No | q22 Goverment Policies Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q22_1 | Programs encouraging entrepreneurship | 2.95 | 1.00 | 4.00 | 1.13 | 3.79 | 2.00 | 5.00 | 0.79 | 3.37 | 1.00 | 5.00 | 1.12 |

| q22_2 | Programs raising awareness about financial instruments | 2.11 | 1.00 | 4.00 | 0.94 | 3.32 | 2.00 | 5.00 | 1.00 | 2.84 | 1.00 | 5.00 | 1.01 |

| q22_3 | Support for technology transfer and RD | 3.11 | 1.00 | 5.00 | 1.10 | 3.42 | 2.00 | 5.00 | 0.84 | 3.16 | 1.00 | 5.00 | 1.12 |

| q22_4 | Outsourcing of public services | 2.16 | 1.00 | 5.00 | 1.26 | 2.11 | 1.00 | 5.00 | 1.10 | 2.16 | 1.00 | 5.00 | 1.17 |

| q22_5 | Providing public funding for VC funds | 4.26 | 1.00 | 5.00 | 1.10 | 2.74 | 1.00 | 5.00 | 1.05 | 4.00 | 3.00 | 5.00 | 0.94 |

| q22_6 | Raising awareness about VC | 2.84 | 1.00 | 5.00 | 1.30 | 3.74 | 2.00 | 5.00 | 1.15 | 3.16 | 1.00 | 5.00 | 1.26 |

| q22_7 | Similarity between domestic and foreign policy | 2.63 | 1.00 | 5.00 | 1.38 | 2.47 | 1.00 | 5.00 | 1.31 | 2.47 | 1.00 | 5.00 | 1.26 |

| No | q23 Infrastructure Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q23_1 | Well-developed public infrastructure (transportation systems. communications) | 2.89 | 1.00 | 4.00 | 1.05 | 2.74 | 1.00 | 4.00 | 0.99 | 2.68 | 1.00 | 4.00 | 0.89 |

| q23_2 | High development of ICT industry | 4.00 | 3.00 | 5.00 | 0.82 | 4.21 | 2.00 | 5.00 | 0.85 | 4.05 | 2.00 | 5.00 | 0.85 |

| q23_3 | Existence of local business clusters. Well-developed industries | 3.63 | 1.00 | 5.00 | 1.21 | 3.79 | 1.00 | 5.00 | 1.03 | 3.74 | 1.00 | 5.00 | 1.05 |

| q23_4 | Existence and availability of research facilities | 3.53 | 1.00 | 5.00 | 1.07 | 3.74 | 2.00 | 5.00 | 1.05 | 3.58 | 2.00 | 5.00 | 1.07 |

| q23_5 | Existence of local technical universities | 3.58 | 1.00 | 5.00 | 1.07 | 3.68 | 2.00 | 5.00 | 0.95 | 3.63 | 2.00 | 5.00 | 1.01 |

| q23_6 | Active capital market providing exit possibilities | 3.95 | 1.00 | 5.00 | 1.31 | 3.16 | 1.00 | 5.00 | 1.17 | 3.74 | 1.00 | 5.00 | 1.33 |

| q23_7 | Absence of other available capital for entrepreneurs | 3.05 | 1.00 | 5.00 | 1.08 | 3.95 | 2.00 | 5.00 | 0.97 | 3.53 | 2.00 | 5.00 | 0.90 |

| q23_8 | Possibility toobtain additional funding for next rounds/further growth | 3.58 | 1.00 | 5.00 | 1.07 | 3.79 | 2.00 | 5.00 | 0.98 | 3.74 | 2.00 | 5.00 | 0.99 |

| q23_9 | Low transaction costs | 2.84 | 1.00 | 4.00 | 1.12 | 2.63 | 1.00 | 4.00 | 1.01 | 2.74 | 1.00 | 5.00 | 1.15 |

| q23_10 | Lack of other high-yield investments for investors in VC funds | 3.53 | 1.00 | 5.00 | 0.97 | 2.05 | 1.00 | 4.00 | 0.97 | 2.68 | 1.00 | 5.00 | 1.11 |

| q23_11 | Existence of alternative IPO and listing regulations for SMEs with less-stringent standards | 2.74 | 1.00 | 4.00 | 1.19 | 2.47 | 1.00 | 5.00 | 1.17 | 2.53 | 1.00 | 4.00 | 1.07 |

| q23_12 | Developed VC ecosystem with consultants and business angels | 4.16 | 3.00 | 5.00 | 0.83 | 4.05 | 3.00 | 5.00 | 0.91 | 3.89 | 3.00 | 5.00 | 0.88 |

| No | q24 Environment for Innovation Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q24_1 | High level of technology innovation | 3.89 | 1.00 | 5.00 | 0.99 | 4.16 | 3.00 | 5.00 | 0.69 | 3.79 | 2.00 | 5.00 | 0.79 |

| q24_2 | High level of demand for new products | 3.05 | 1.00 | 5.00 | 1.03 | 3.42 | 1.00 | 5.00 | 1.22 | 3.16 | 1.00 | 5.00 | 1.07 |

| q24_3 | High level of demand for particular products/technologies | 3.32 | 1.00 | 5.00 | 1.16 | 3.42 | 2.00 | 5.00 | 1.02 | 3.16 | 2.00 | 5.00 | 0.96 |

| q24_4 | High level of state R&D investments | 3.21 | 1.00 | 5.00 | 1.08 | 3.26 | 1.00 | 5.00 | 1.05 | 2.95 | 1.00 | 5.00 | 1.08 |

| No | q25 Resources Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q25_1 | High diversity of economically active persons (nationality, gender) | 2.74 | 1.00 | 5.00 | 1.37 | 2.84 | 1.00 | 5.00 | 1.17 | 2.63 | 1.00 | 5.00 | 1.26 |

| q25_2 | High student rate | 2.63 | 1.00 | 5.00 | 1.30 | 3.00 | 1.00 | 5.00 | 1.25 | 2.74 | 1.00 | 5.00 | 1.19 |

| q25_3 | Availability of technically skilled entrepreneurs and personnel | 3.68 | 1.00 | 5.00 | 1.11 | 4.00 | 3.00 | 5.00 | 0.82 | 3.84 | 1.00 | 5.00 | 1.17 |

| q25_4 | Availability of economically competent individuals | 3.05 | 1.00 | 5.00 | 1.22 | 3.42 | 1.00 | 5.00 | 1.17 | 3.11 | 1.00 | 5.00 | 1.33 |

| No | q26 Macroeconomic Conditions Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q26_1 | High GDP growth rate | 3.63 | 2.00 | 5.00 | 1.07 | 3.68 | 2.00 | 5.00 | 1.00 | 3.74 | 2.00 | 5.00 | 0.99 |

| q26_2 | High export level | 3.32 | 1.00 | 5.00 | 1.34 | 3.58 | 1.00 | 5.00 | 1.07 | 3.63 | 2.00 | 5.00 | 1.01 |

| q26_3 | High unemployment | 2.05 | 1.00 | 4.00 | 0.85 | 2.26 | 1.00 | 5.00 | 1.15 | 2.05 | 1.00 | 4.00 | 0.85 |

| q26_4 | High interest rates | 2.37 | 1.00 | 4.00 | 1.34 | 2.68 | 1.00 | 5.00 | 1.34 | 2.37 | 1.00 | 4.00 | 1.12 |

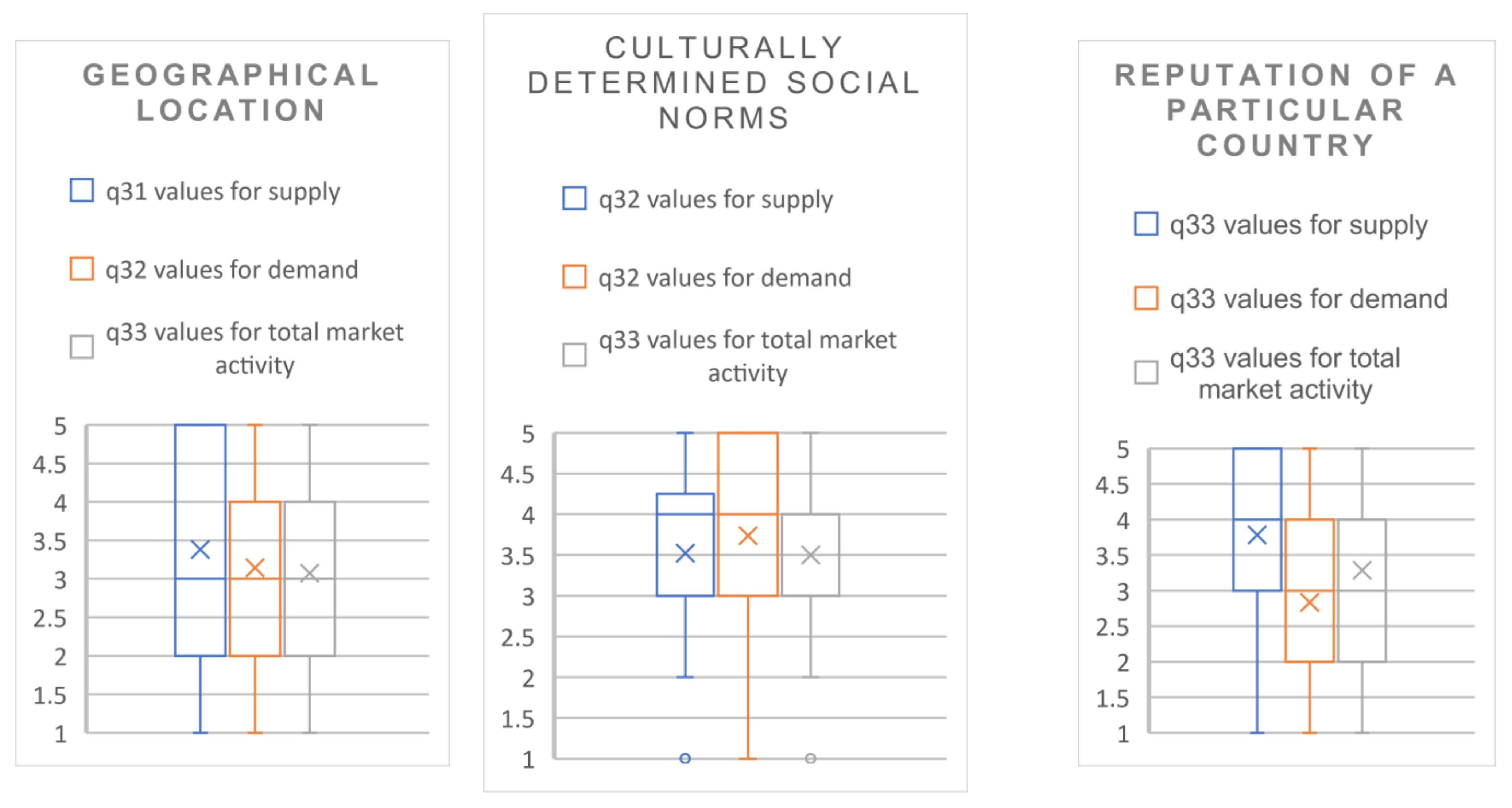

| No | q31 Geographical Location Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q31_1 | Close location of a particular place to the country’s core economical regions | 3.21 | 1.00 | 5.00 | 1.47 | 3.00 | 1.00 | 5.00 | 1.15 | 2.95 | 1.00 | 5.00 | 1.27 |

| q31_2 | Close location to the countries with high VC activity | 3.74 | 2.00 | 5.00 | 1.05 | 3.26 | 1.00 | 5.00 | 1.19 | 3.21 | 2.00 | 5.00 | 1.08 |

| No | q32 Culturally Determined Social Norms Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q32_1 | High level of risk and uncertainty toleration | 3.63 | 1.00 | 5.00 | 1.26 | 3.95 | 2.00 | 5.00 | 1.08 | 3.63 | 2.00 | 5.00 | 1.12 |

| q32_2 | Tendency towards cooperation and trust | 3.58 | 1.00 | 5.00 | 1.35 | 3.58 | 1.00 | 5.00 | 1.22 | 3.53 | 1.00 | 5.00 | 1.22 |

| No | q33 Reputation of a Particular Country Subfactors | Factor’s Influence on the VC Supply | Factor’s Influence on the VC Demand | Factor’s Influence on the Total VC Market Activity | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | Mean | Min | Max | Std. Dev. | ||

| q33_1 | Public image of a particular country | 3.95 | 1.00 | 5.00 | 1.03 | 3.11 | 1.00 | 5.00 | 0.99 | 3.37 | 1.00 | 5.00 | 1.01 |

| q33_2 | Lack of restrictions/warnings from international organizations | 3.74 | 2.00 | 5.00 | 1.05 | 2.58 | 1.00 | 4.00 | 0.96 | 3.21 | 1.00 | 5.00 | 1.23 |

| Meta-Factors’ Group—VC Market Players | |

| Factors Group—q11 Factors Related to VC Firms | |

| q11_12 | High investment returns of VC firms |

| q11_6 | Existence of foreign VC firms in a market |

| q11_1 | High total amount of available capital from VC firms in a market |

| q11_7 | Existence of publicly co-financed VC firms in a market |

| q11_11 | Substantial added value from VC firms |

| q11_2 | High competition between VC firms in a market |

| q11_13 | Successful growth of VC firms’ portfolio companies |

| q11_8 | Existence of private VC firms in a market |

| q11_3 | Existence of VC firms in all stages in a market |

| q11_5 | Existence of local VC firms in a market |

| q11_10 | Existence of experienced VC firms in a market |

| q11_9 | High reputation of VC firms in a market |

| q11_15 | High risk profile of VC firms (financial instruments used by VC firms; investment strategies) |

| q11_4 | Specialization of VC firms |

| q11_14 | Low risk profile of VC firms (financial instruments used by VC firms; investment strategies) |

| Factors group—q12 Factors related to investors in VC funds | |

| q12_1 | Diversified and robust institutional investor base |

| q12_2 | Existence of successful entrepreneurs from prior generations |

| q12_3 | High experience and capacity in VC investments of governmental agency responsible for public VC investments |

| Factors group—q13 Factors related to entrepreneurs | |

| q13_1 | High number of entrepreneurs seeking VC |

| q13_3 | Awareness of the added value from VC between entrepreneurs/potential entrepreneurs |

| q13_4 | High risk tolerance and partnership acceptance and trust of entrepreneurs/potential entrepreneurs |

| q13_2 | General awareness between entrepreneurs/potential entrepreneurs about VC |

| q13_7 | Previous experience in entrepreneurship of entrepreneurs/potential entrepreneurs |

| q13_8 | Technical or MBA education of entrepreneurs/potential entrepreneurs |

| Meta-factors’ group—Environment | |

| Factors group—q21 Legal environment | |

| q21_1 | Internationally harmonized and stable regulation for securities, bankruptcy, labor, and tax |

| q21_6 | Broad limits for VC funds (size of the investment; geography; focus; lifespan of the fund; risk profile) |

| q21_4 | Flexible policies regarding risk evaluation and broad limits for investments in VC funds for investors in VC funds |

| q21_5 | Tax application on investors in VC funds not VC funds level |

| q21_8 | Little administrative burden for starting a business |

| q21_7 | Entrepreneur friendly tax system |

| q21_2 | Reduction in labor regulation |

| q21_9 | Easiness for foreigners to start a business |

| q21_3 | Easiness to hire foreign employees |

| q21_10 | Government policies and regulations beneficial for particular kind of investments (i.e., cleantech; sustainability) |

| Factors group—q22 Government policies | |

| q22_5 | Providing public funding for VC funds |

| q22_1 | Programs encouraging entrepreneurship |

| q22_6 | Raising awareness about VC |

| q22_3 | Support for technology transfer and RD |

| q22_2 | Programs raising awareness about financial instruments |

| Factors group—q23 Infrastructure | |

| q23_2 | High development of ICT industry |

| q23_12 | Developed VC ecosystem with consultants and business angels |

| q23_7 | Absence of other available capital for entrepreneurs |

| q23_6 | Active capital market providing exit possibilities |

| q23_3 | Existence of local business clusters, well-developed industries |

| q23_8 | Possibility to obtain additional funding for next rounds/further growth |

| q23_4 | Existence and availability of research facilities |

| q23_5 | Existence of local technical universities |

| q23_10 | Lack of other high-yield investments for investors in VC funds |

| Factors group—q24 Environment for innovation | |

| q24_1 | High level of technology innovation |

| q24_2 | High level of demand for new products |

| q24_3 | High level of demand for particular products/technologies |

| q24_4 | High level of state R&D investments |

| Factors group—q25 Resources | |

| q25_3 | Availability of technically skilled entrepreneurs and personnel |

| q25_4 | Availability of economically competent individuals |

| q25_2 | High student rate |

| Factors group—q26 Macroeconomic conditions | |

| q26_1 | High GDP growth rate |

| q26_2 | High export level |

| Meta-factor group—Embedded characteristics | |

| Factors group—q31 Geographical location | |

| q31_2 | Close location to the countries with high VC activity |

| q31_1 | Close location of a particular place to the country’s core economical regions |

| Factor group—q32 Culturally determined social norms | |

| q32_1 | High level of risk and uncertainty toleration |

| q32_2 | Tendency towards cooperation and trust |

| Factor group—q33 Reputation of a particular country | |

| q33_1 | Public image of a particular country |

| q33_2 | Lack of restrictions/warnings from international organizations |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Matisone, A.; Lace, N. Effective Venture Capital Market Development Concept. J. Open Innov. Technol. Mark. Complex. 2021, 7, 218. https://doi.org/10.3390/joitmc7040218

Matisone A, Lace N. Effective Venture Capital Market Development Concept. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(4):218. https://doi.org/10.3390/joitmc7040218

Chicago/Turabian StyleMatisone, Anita, and Natalja Lace. 2021. "Effective Venture Capital Market Development Concept" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 4: 218. https://doi.org/10.3390/joitmc7040218

APA StyleMatisone, A., & Lace, N. (2021). Effective Venture Capital Market Development Concept. Journal of Open Innovation: Technology, Market, and Complexity, 7(4), 218. https://doi.org/10.3390/joitmc7040218