1. Introduction

Traditionally, in global society, cultural, technological, and economic changes increasingly affect the competitiveness of organizations [

1,

2]. However, there are external factors generated by problems related to health and/or diseases, which are little visualized in organizations by decision makers. In this case, there was the emergence of the COVID-19 disease caused by the new coronavirus known as SARS-CoV-2. This pandemic has caused serious health problems, which have permeated all business sectors due to restrictions on mobility and the physical contact of people from its emergence to the present. Since 2020, the International Monetary Fund and the World Bank have reported serious economic problems (recession) in most regions due to COVID-19 and assert that it is one of the worst economic crises since the one manifested from 1930 in the United States of America. In addition, the pandemic has affected the Latin American and Caribbean (LAC) region more significantly; according to data from the World Bank [

3], COVID-19 has had a significant human cost, and its economic and social effects are being felt globally. To minimize these impacts, the World Bank [

3] has declared and launched a combination of new projects, the restructuring of existing projects with emergency components, and the use of our disaster financing instruments. According to data from [

4], the most serious problems that companies face are in supply chains and cash flows and in the impossibility of meeting the delivery dates of goods and services. In addition, a weak final demand for imported goods and services, an increase in risk aversion in financial markets, and a decrease in confidence in business can be seen. According to other relevant data of the OECD [

4], in LAC the COVID-19 crisis has been a very strong blow to micro and small companies (SMEs) that do not have the necessary resources to absorb the impact. Up to 2.7 million businesses in LAC are likely to close, most of them micro businesses, representing a loss of 8.5 million jobs.

Faced with these difficulties and adversities, companies have had to adapt to external changes for their survival, through resilience and innovation (creative thought processes). Therefore, resilient companies adopt and execute innovation-based strategies to face the challenges from a holistic perspective, starting from the theory of competitive organizational behavior (a strategic perspective of the individual behavior of the entrepreneur) [

5,

6], where the effectiveness of the strategy depends on managerial capacities and the level of adaptation to constant market changes [

7,

8,

9]. This is from a resource-based view (RBV) (a perspective of innovative capacity and financial resources focused on business reaction in order to compete locally and globally through the mix of tangible and intangible resources) [

10,

11]. Without a doubt, these strategic actions lead companies towards strong competitiveness and a substantial improvement in their financial performance. Therefore, our study aims to verify the main business strategies that affect the management of innovation and the financial results of SMEs in the Sonora region of Mexico. We define business strategy as a long-term plan to pursue specific performance advantages based on novel products, more efficient processes, or lower costs [

12]. In addition, we try to investigate the effects of electronic commerce (e-commerce) and home office transactions, which affect the innovation management and corporate performance of SMEs.

Open innovation (OI) is defined as the use of intentional inputs and outputs of knowledge to accelerate internal company innovation [

13], comprising multiple incoming and outgoing knowledge streams derived from purposeful interactions with others [

14]. Open innovation is spreading across industries around the world; collective intelligence stimulates companies’ open innovation, and companies improve their ability to innovate by integrating internal and external resources [

15]. The adoption of OI by an organization means that its innovation management process improves, and ideas, concepts, designs, products, services, etc., flow in and out of its boundaries [

16].

Open Innovation Communities (OICs) have become a crucial strategy for companies to bring together and engage geographically dispersed users to share knowledge and submit product-related ideas [

17]. As information technology (IT) has spread to all industries, dynamic, open innovation capabilities that enable companies to “sense” and “seize” exit opportunities have become crucial [

18], as the flows of information, technologies, and ideas are the basic elements of the innovation process [

19]. The open innovation model includes various channels, such as the home office or electronic commerce [

20]. While remote work used to be more a feature of multinational companies and open source communities, the pandemic forced millions of people across a wide range of industries to switch to working from home, literally overnight, prompting a struggle to adapt to remote collaboration [

21].

Currently, under a pandemic scenario, these actions are considered to be disruptive innovations that strengthen business competitiveness [

22]. The recent literature has scarcely studied the efficiency of business strategies and innovation management in SME-type companies, giving more space to large companies in the high-tech sector [

22,

23,

24,

25]. Therefore, this study is based on two complementary theories that help improve business competitiveness. On the one hand, there is the theory of competitive behavior where the entrepreneur makes strategic decisions through an approach based on leadership [

6,

10,

26], and on the other hand, there is the theory of resources and capabilities based on tangible and intangible elements that are transformed into innovative strategies to achieve competitive success [

6,

26]. Therefore, the behavioral and social phenomena that occur in the company are linked to business competencies for the execution of a competitive strategy based on resources and capabilities [

10,

11,

27]. For several decades, and particularly in the current scenario, the behavior of SMEs has been the focus of study for researchers and experts in the business sciences. The business strategies deployed by SMEs to be more competitive require greater financial, technological, and managerial capacity to increase the innovation activities [

27,

28,

29]. These barriers are deeper in SMEs located in emerging or developing economies. This study responds to the current problems of family and non-family SMEs with these unique characteristics. The actions and business strategies that the directors of these SMEs are developing are based on ambidextrous innovation (radical, incremental, and open innovation) for health and financial sustainability [

29,

30]. With the above context, the study tries to answer the following questions: (1) what are the key elements of business strategy and innovation management that raise the economic indicators and corporate performance of SMEs? (2) What are the strategic factors of e-commerce and the home office that raise the management of innovation and the corporate performance of SMEs?

This article has been structured as follows: the first part presents the theoretical review, the empirical review, and the development of the hypotheses. Then, the methodology used and the sample and its characteristics are explained, and the variables under study are justified. Finally, the results, discussions, conclusions, and future lines of research are shown.

5. Discussion

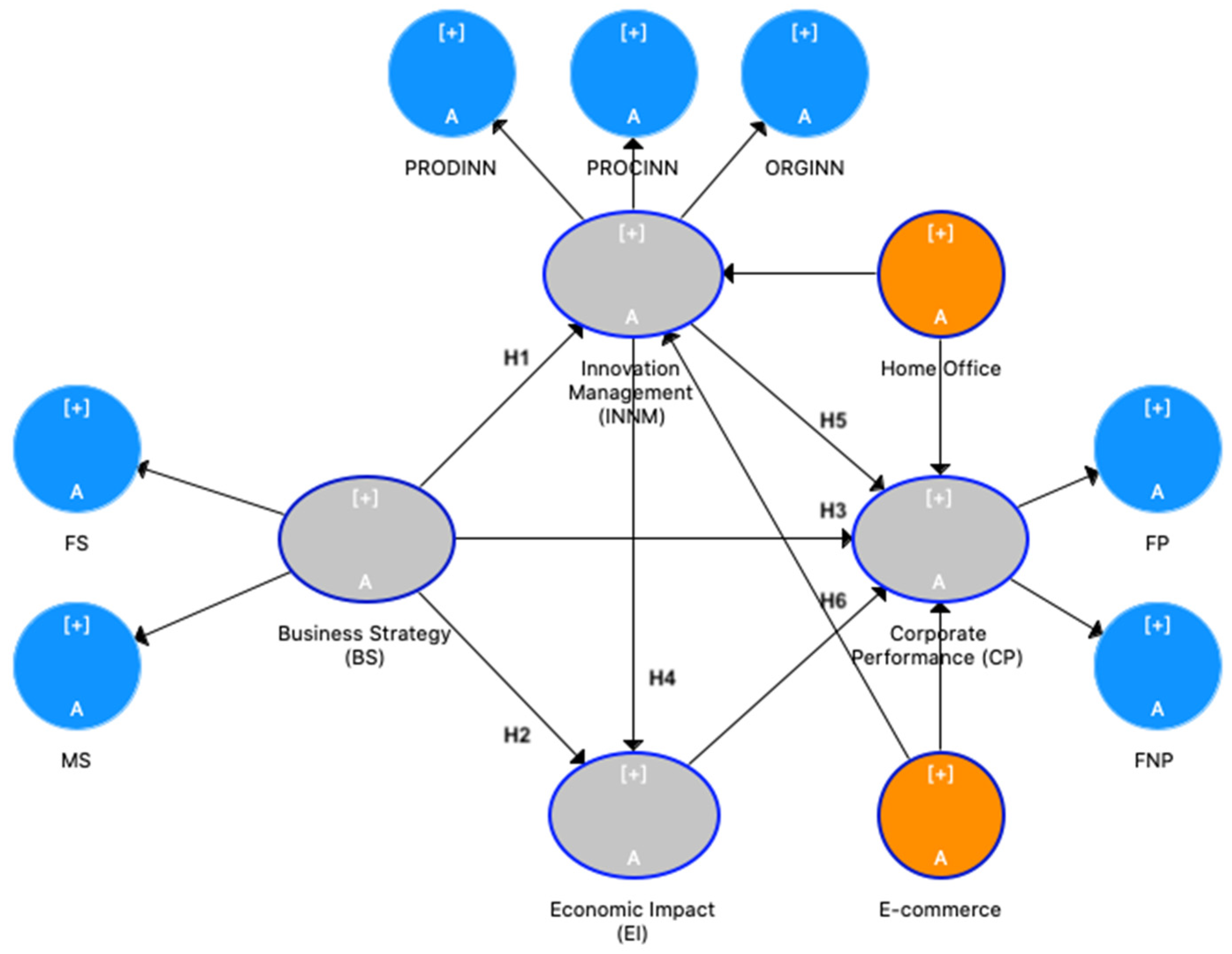

This section discusses the main findings of the research study based on the theory of competitive behavior and the theory based on resources and capabilities. In order to answer the objectives and questions of the investigation, the results derived from the verification of the hypotheses of the proposed theoretical model are described below.

In the first block, we present the results of H1, H2, and H3. The findings show that business strategies (financial and market) have not been differentiating elements and/or actions to increase the competitiveness of SMEs. The results show that the business strategy does not have significant effects on the management of innovation and the economic indicators of SMEs. Frequently, companies in the time of pandemic have been focusing on other types of actions that allow them to obtain results in a short time and fighting for survival in competitive markets [

38,

131]. In addition, we observe that business strategy has a small significant but negative effect on corporate performance; therefore, it can be inferred that SMEs are currently adopting innovative strategies such as the use of technology for their market strategies and, in addition, are suffering from a serious financial health problem [

66,

67]. These findings are aligned with the postulates of the theory of competitive behavior when adopting business strategies to face the external impacts derived from the economic crisis generated by the COVID-19 pandemic [

6,

11]. On the other hand, the managerial skills and financial capacities of the companies have strong barriers that prevent SMEs from obtaining organizational and financial benefits, which allows us to associate these findings with the theory of business resources and capabilities [

10,

49,

108]. The literature on competitive behavior has argued that competitive success leads to the financial profitability of companies. In addition, the RBV shows that companies that execute effective financial and market strategies are mainly able to do so due to the amount of tangible and intangible resources they possess, leading them to a competitive advantage and towards more lasting economic success [

6,

132]. Therefore, the lower the financial capacity of the company, the lower the impact on the adoption of market strategies and innovation practices and economic indicators [

68]; these problems affect competitiveness and limit the expansion to other markets [

69]. One of the reasons why a significant relationship between financial and market strategies with innovation has not been found may be due to the financial limitation or capacity and the organizational uncertainty of SMEs [

70]. The findings reported by Didonet and Díaz-Villavicencio [

42] are similar to our results, confirming that the market strategies focused on learning from customers, suppliers, and competitors help detect opportunities and improve innovation management and increase organizational results in SMEs. However, these adversities sometimes encourage SME managers to be more creative and, of course, to promote innovation with greater emphasis [

71]. Our findings are in this same direction, highlighting that the risks, organizational uncertainty, and financial insecurity have become more acute in SMEs due to the effects of the COVID-19 pandemic [

72]. The efforts of SMEs to maintain financial health and develop innovative marketing strategies have led them to a critical and significant competitive organizational wear, to the point of only surviving and covering operating expenses, which seriously affects financial returns [

133,

134].

In the second block, the results of H4 and H5 are described and present significant and positive effects. These findings allow us to infer that SMEs in this region are in a very strong competitive struggle, and for this, they are generating new ways of working and improving their internal processes to improve innovation management [

2,

34]. The results allow us to infer that the innovation management has a positive and significant effect on the economic indicators; therefore, the innovation practices that SMEs are generating, in their products, processes, and management, are causing a balanced financial health. Even though in Mexico there are few financial incentives to face the global economic crisis, the organizations called SMEs are supporting this onslaught of the COVID-19 pandemic. In addition, the management of innovation is an elementary factor to continue in the competitive fight because they have managed to maintain a reasonable number of sales and economic benefits that allow them to comply with their obligations [

82,

84]. These findings are in line with the theory of resources and capabilities, given that those responsible for managing SMEs are applying their creativity and innovation capacities to face market changes, which at present have gone from being physical markets to virtual markets [

10,

82,

135]. The study carried out by Lendel et al. [

28] highlights the importance of adopting and executing a management model and process for organizational innovation. This requires a high commitment from the employees and managers of the companies, which leads them towards competitive improvement and a more sustainable performance. Our findings are similar to those of the studies by Liu and Yoo [

81], which report that intangible resources and strategic direction play a determining role in the innovative performance and financial performance of SMEs. In addition, Caballero-Morales [

84] reveals that SMEs in the time of the COVID-19 pandemic were more creative and managed to develop new forms of marketing and improve and adapt products to the needs of consumers, all of which allowed them to remain in the market and obtain acceptable economic results to stabilize their operations. In addition, Lee’s [

25] studies reveal that ambidextrous innovation (incremental and disruptive) in SMEs is in their daily lives due to current market demands moving towards the digital age.

In the last block (third), the result of H6 is described. The findings revealed that the economic impact had a small positive and significant effect on the corporate performance of SMEs in this region. These results allow us to infer that these companies, through the competitive behavior and business capacities of their managers, have managed to maintain a balanced financial health (level of debt, liquidity, and economic solvency), managing to cover operating expenses and costs [

135,

136]. These strategies have allowed the SMEs to invest in innovative actions (improvement in products, processes, and management) to strengthen their marketing processes through new sales channels, such as the use of digital platforms and social networks, actions that have allowed them to keep current customers and reach new customers in order to increase their sales and financial performance [

22,

61,

87]. These findings align with competitive behavior theory and resource-based theory. Our findings have a certain degree of similarity with the studies developed by Chiu et al. [

88], where it is argued that SMEs in most regions are at financial risk and have high levels of debt, which limits them from obtaining a surplus in their operations. On the other hand, Bongomin [

86] showed that SMEs in underdeveloped regions develop unsound financial strategies, and there is a poor culture of financial health, which leads them to achieve unprofitable and sustainable economic indicators.

In addition to the main hypotheses of the model, two control variables were analyzed in order to strengthen the investigation. The findings revealed that e-commerce has been an innovative strategy for SMEs in this region to improve their innovation practices and corporate performance. Recent studies have shown that during COVID-19, SMEs adopted and applied technological innovation through the improvement of their marketing and sales processes through digital platforms and social networks [

25,

137]. On the other hand, as part of the innovative strategies that SMEs are implementing, the home office is an action that is allowing adaptation to new ways of working. These activities and strategic actions are leading companies to improve their innovation management processes and above all to face current global challenges [

138,

139].

The COVID-19 crisis may forever change the way we do business and may mark a quantum leap in work-life balance. This is true not only in the context of the established companies but also for entrepreneurs [

140]. Many of the most challenging problems could benefit from the solutions of others in different parts of the world [

23]; this is the power of the convergence of technologies, people, and organizations that work together for a purpose [

25]. The convergence of ideas from different entities provides new energy for innovation. Previously unlikely partnerships are just one example of society coming together to face a common adversary [

140] and companies have already realized that they should not work alone; so, everyone has already established alliances, collaborations or alliances with others [

141]. Remote innovators rely on different types of information, i.e., technological or scientific information that is less time-sensitive than market-related information [

142].

Therefore, the adoption of dynamic open innovation practices represents an organizational and financial challenge for companies [

13]. Big data about society and markets will provide a new combination of technology and markets that crosses the boundaries of companies [

20]. Remote work and telecommuting can motivate open innovation and the construction of new business models by introducing new information about markets and society. Companies can accurately combine customer input while allowing them to be more closely involved in the design process and product-cycle management [

143].

Finally, in this section we have also considered it very important to discuss the results of the multigroup analysis included in the study. For this purpose, the categorical variable (family businesses and non-family businesses) was included, to verify its effects in the proposed theoretical model. The results have revealed that the managers of non-family businesses are the ones who have paid the greatest attention to the implementation of innovative strategies to minimize the effects of the global economic crisis [

144]. The literature on efficiency in strategic decision making and risk taking in family business and non-family business SMEs has divergent conclusions [

145]. It is important to state that the results of the multigroup analysis shed light that showed that family businesses and non-family businesses have suffered the blows of the COVID-19 pandemic. We can see this in the non-significant results of financial strategies and the financial strategies of the market innovation and corporate performance of the SMEs analyzed. In this study, we have considered two substantial strategic actions as part of open innovation (e-commerce and home office). The study on open innovation strategies in family business and non-family business SMEs is completely divergent [

146]. Some views maintain that non-family businesses invest more resources and develop a greater capacity for innovation than family businesses [

146,

147]. Therefore, non-family businesses have a greater propensity and ease towards open innovation, which makes them look like companies that are more collaborative with the outside world and more open to capturing knowledge. These actions allow these types of companies to raise their innovative practices that impact financial performance [

148]. These postulates are related to our findings from the multigroup analysis.

6. Conclusions

This section summarizes the findings of the study through a series of theoretical and practical conclusions and implications.

First, it is concluded that the financial strategies and markets that SMEs are currently implementing are not actions that generate competitive advantage; improvements for the management of innovation are much less a determining factor in raising corporate performance. Therefore, this first conclusion provides an important contribution to the development of competitive behavior theory and resource-based theory. Deriving from these results, the study shows the following practical implications for the improvement of SME management: (1) it is recommended that companies migrate from the traditional business model to business models based on innovation [

2], and (2) it is recommended to focus the resources and capabilities in maintaining financial health and to invest in digital platforms for the commercialization and sale of goods and services [

149,

150].

Secondly, the results of the second block allow us to corroborate that the innovation management of SMEs during the COVID-19 pandemic has been decisive for their survival. These findings strengthen and strongly contribute to the development of the theory of resources and capabilities. Despite the fact that innovation management has significant effects on maintaining economic indicators and corporate performance, these results have allowed the following practical implications to be issued for the improvement of SME management: (1) it is important to invest in and adopt technology to automate production processes and commercialization processes [

54,

151]; (2) it is recommended to adopt new business models for commercialization and online sales through digital platforms, to improve e-commerce transactions [

152,

153]; and (3) strengthen alliances with other companies and with universities, research centers, and governments to improve the efficiency of innovation management [

154,

155].

The third block of the study has shown that the economic indicators presented by the SME have remained stable and have allowed a moderate influence on the results of the corporate performance. However, in the face of the COVID-19 situation, the challenges and the obstacles are strong for SMEs; so, it is important to question whether they will be able to continue withstanding the waves of the great tide called the global economic crisis. For this reason, the following practical implications are issued: (1) be financed through different methods, such as subsidies from government institutions, crowdlending, crowd factoring, and crowdfunding [

88,

156], and (2) SME managers are recommended to solidify their strategic plans (administrative, operational, and financial) [

2,

106].

The research provides an important contribution to the literature on competitive organizational behavior through the resources and capabilities deployed by SMEs. The originality and novelty of the study is reflected in analyzing the current state of SMEs in a country with an emerging and/or developing economy. The scarcity of this type of study in SMEs in this region highlights the relevance of strategic behavior analysis and innovation management as factors that trigger competitiveness and corporate performance [

151]. The literature that analyzes competitive organizational behavior through resources and business capabilities emphasizes the importance of financial resources and market strategies as key strategies to trigger innovation and raise financial performance. Our determinations inform us that a lower financial capacity and inefficient market strategy do not have significant effects on innovation and corporate performance. These results are consistent with the studies carried out by González-Velasco [

134] and Bodlaj et al. [

68] on financial restrictions and their effects on the performance of SMEs. The research carried out by Ullah et al. [

157] reports that financial strategies reinforce the postulates of the RBV theory, explaining that these actions are intangible resources that provide a higher value in the innovation and corporate performance of SMEs. In the context of our research, these results are in another direction. On the other hand, our study shows an important contribution to the literature on open innovation. The RBV has stated that SMEs are less inclined towards open innovation practices. However, it is important to note that SMEs that have fewer resources and entrepreneurial capabilities tend to be more creative and innovative. Our findings have confirmed this, with new marketing practices through technology being a key element in triggering innovation and corporate performance. Moreover, this is on the right path towards maximizing resources through the home office. These findings are similar and consistent with studies developed by [

21,

122,

158]. In this same direction, the study carried out by Nofiani et al. [

159] shows that SMEs are currently in a state plagued by uncertainty and must adapt to market situations and internal needs. To this end, they develop multiple balanced and combined ambidextrous strategies focused on innovation to sustain appropriate financial performance and survive in highly competitive markets [

160,

161]. The strategies of anticipation, adaptation to change, and cooperation (open innovation) to acquire external resources are adopted more frequently by the managers of SMEs in periods of economic recession [

29].

Finally, given that many investigations have limitations, in this section we describe some of the limitations that came up during the investigation. The first limitation is the sample explored in the study because it is from a single specific region; therefore, in the future, it is important to consider a sample from different regions and even from other countries to develop comparative analyses. The second limitation is the responses obtained in the study because they are the subjective opinions of the managers of the companies. In Mexico, it is very difficult to obtain hard data on the innovation and economic indicators of companies. Regarding the third and last limitation, we consider that in the future the SEM technique can be used, based on covariance. On the other hand, the main future lines that are revealed are to continue analyzing the behavior of the SME and complete the proposed model. We recommend incorporating constructs that allow evaluating and verifying the effect of open innovation and business resilience, to see their behavior and financial performance in SMEs. COVID-19 has enhanced the collaborative mindset of SMEs, driven by a ‘shared cause’ that revolves around urgency. This collaborative mentality does not seem to be temporary; it is likely that most SMEs will continue like this after the crisis as they have already understood the benefits of collaboration, and this will drive further the development of open innovation.