Framework for R&D&I Activities in the Steel Industry in Popularizing the Idea of Industry 4.0

Abstract

:1. Introduction

- What is the dynamics of changes in R&D expenditures of the Polish steel industry in 2010–2019 in comparison with the total industry in the country?

- What is the dynamics of changes in new product investments and business process innovations in the Polish steel industry in 2010–2019?

- What is the level (dynamics) of investment outlays in environmental innovations in the Polish steel industry in 2010–2019?

2. Theoretical Approach for Sectoral Analysis

3. R&D&I Framework for the Steel Sector in Industry 4.0 in Literature

4. Industrial Analyses of R&D&I Activity in the Polish Steel Industry

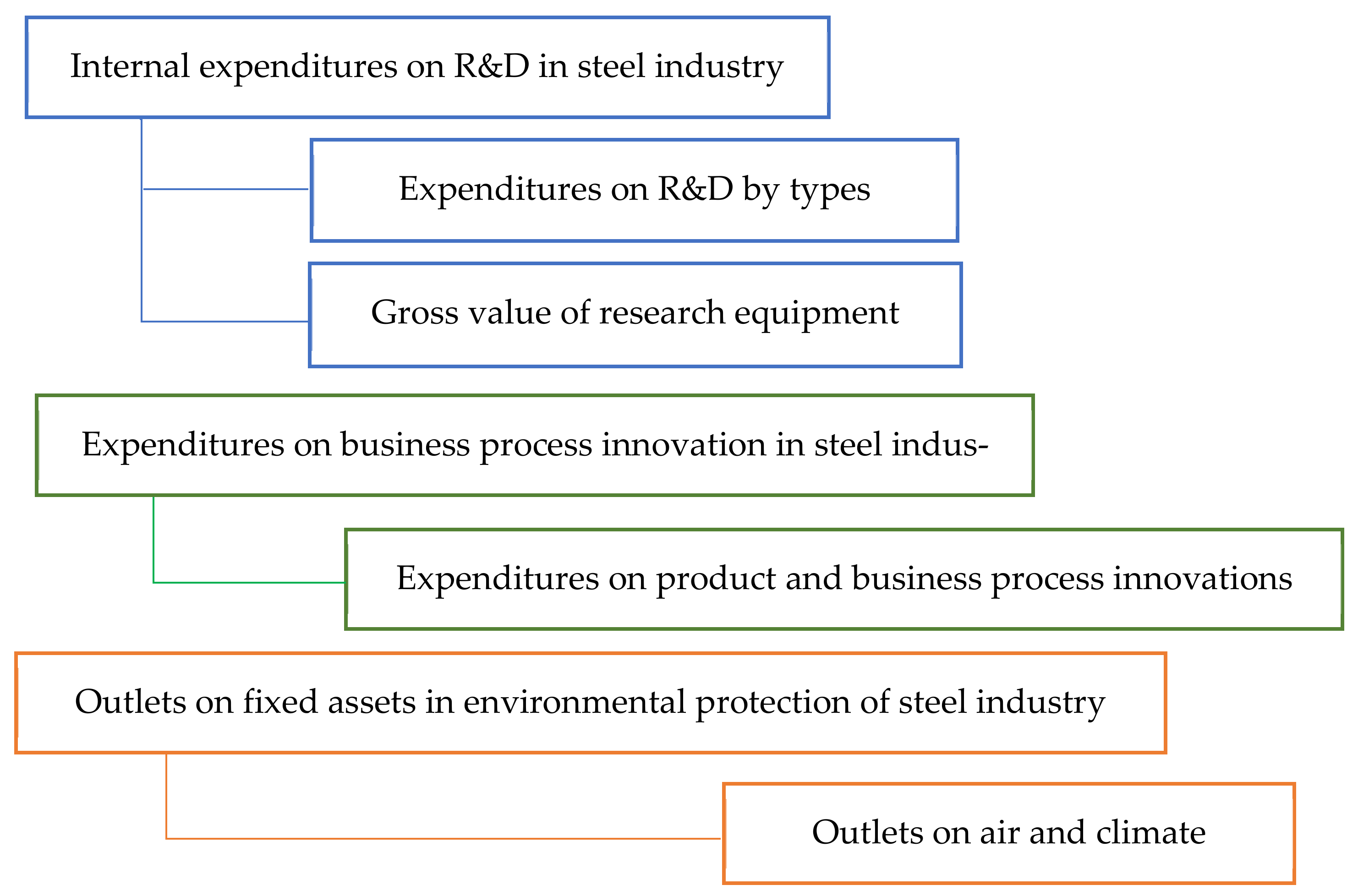

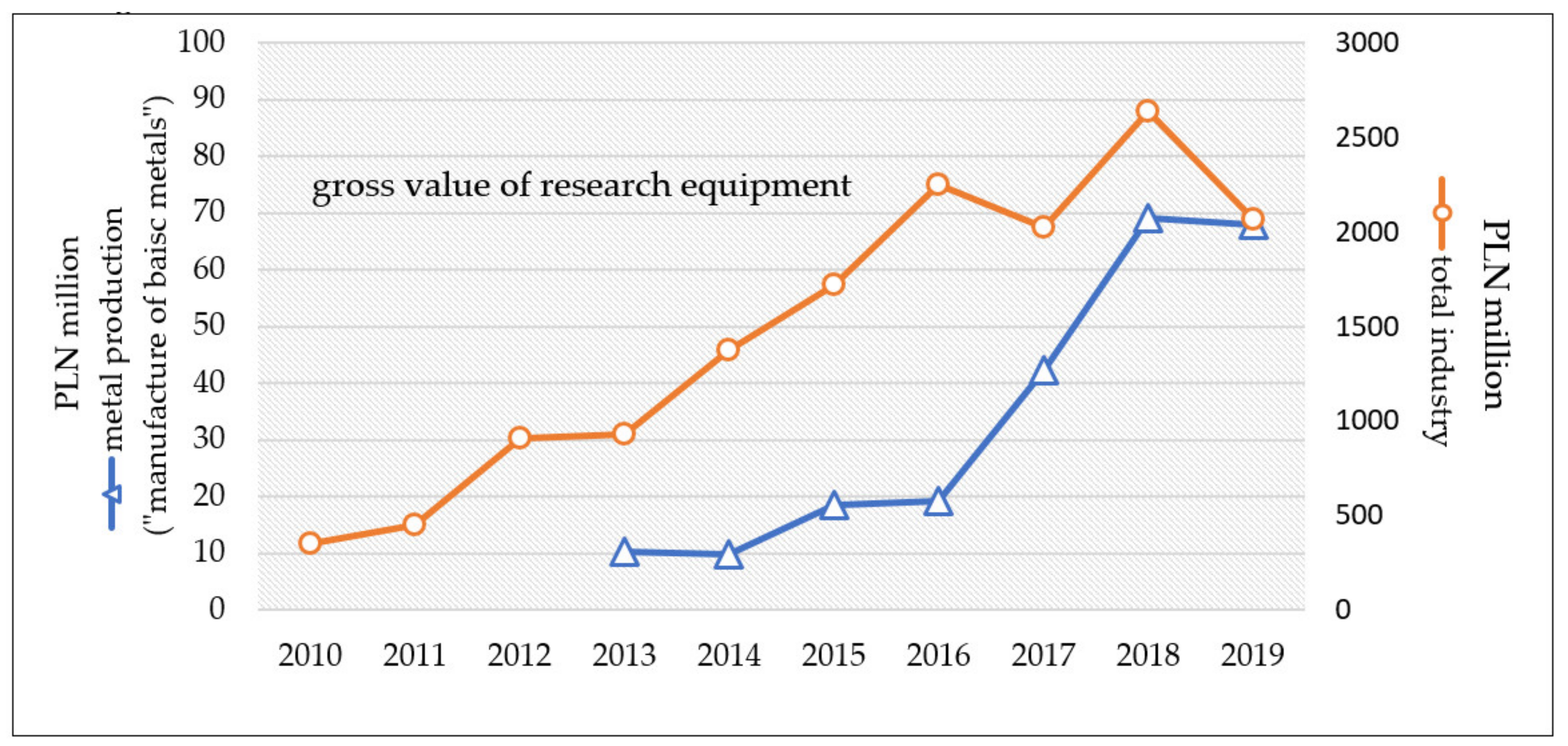

4.1. R&D Expenditure Dynamics of the Steel Industry in Poland

- DR&D—the indicator of the dynamics of the position ER&D

- ER&D (t)—the value in the current year (t)

- ER&D(t=2010)—the value in the base year (t = 2010)

4.2. Dynamics of Expenditures on New Products and Business Process Innovations in the Steel Industry in Poland

4.3. Dynamics of Investment Expenditures on Environmental Protection in the Steel Industry in Poland

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hamel, G. Leading the Revolution; Harvard Business School Press: Boston, MA, USA, 2000. [Google Scholar]

- Hermann, P. Evolution of strategic management: The need for new dominant designs. Int. J. Manag. Rev. 2005, 7, 111–130. [Google Scholar] [CrossRef]

- Nag, R.; Hambrick, D.C.; Chen, M. What is strategic management, really? Inductive derivation of a consensus definition of the field. Strateg. Manag. J. 2007, 28, 935–955. [Google Scholar] [CrossRef]

- Baranowski, M. (Ed.) Badania—Rozwój-Innowacje. In Wybrane Zagadnienia; Narodowe Centrum Badań i Rozwoju: Warsaw, Poland, 2017; p. 7. [Google Scholar]

- Steel Statistical Yearbook 2020 Concise Version, Table 1; World Steel Association: Brussels, Belgium, 2020; p. 2. Available online: https://worldsteel.org/wp-content/uploads/Steel-Statistical-Yearbook-2020-concise-version.pdf (accessed on 8 May 2022).

- Ahmad, I.; Mustafa, J. Competing in Quality in Steel Market: Role of Systematic R&D Framework. In Proceedings of the 1st National Conference on Metallurgy and Materials, Jamshoro, Pakistan, 25 March 2015. [Google Scholar]

- Promotion of Research & Development in Iron & Steel Sector. Journal of India, 12 February 2021. Available online: https://journalsofindia.com/promotion-of-research-development-in-iron-steel-sector/(accessed on 20 April 2022).

- Hamada, N. Strategy on Research & Development at Nippon Steel Corporation; Nippon Steel Technical Report No. 101; November 2012; Available online: https://www.nipponsteel.com/en/tech/report/nsc/pdf/NSTR101-06_review.pdf (accessed on 20 April 2022).

- Erboz, G. How To Define Industry 4.0: Main Pillars of Industry 4.0. In Proceedings of the Managerial Trends in the Development of Enterprises in Globalization Era at Slovak University of Agriculture, Nitra, Slovakia, 1–2 November 2017. [Google Scholar]

- Peters, H. Application of Industry 4.0 concepts at steel production from an applied research perspective. In Proceedings of the 17th IFAC Symposium on Control, Optimization, and Automation in Mining, Mineral and Metal Processing, Vienna, Austria, 31 August–2 September 2016; Available online: https://tc.ifac-control.org/6/2/files/symposia/vienna-2016/mmm2016_keynotes_peters.PowerPoint-Präsentation (accessed on 13 March 2022).

- World Steel in Figures; Word Steel Association: Brussels, Belgium, 2021; Available online: https://worldsteel.org/wp-content/uploads/2021-World-Steel-in-Figures.pdf (accessed on 5 May 2022).

- Gajdzik, B.; Wolniak, R. Influence of the COVID-19 Crisis on Steel Production in Poland Compared to the Financial Crisis of 2009 and to Boom Periods in the Market. Resources 2021, 10, 4. [Google Scholar] [CrossRef]

- Bigliardi, B.; Filippelli, S. Sustainability and Open Innovation: Main Themes and Research Trajectories. Sustainability 2022, 14, 6763. [Google Scholar] [CrossRef]

- Chesbrough, H.; Vanhaverbeke, W.; West, J. Open Innovation. New Imp. Creat. Profit. Technol. 2006, 1, 285–307. [Google Scholar]

- Chesbrough, H. Open Innovation: Where We’ve Been and Where We’re Going. Res.-Technol. Manag. 2012, 55, 20–27. [Google Scholar] [CrossRef]

- Naqshbandi, M.M.; Jasimuddin, S.M. The Linkage between Open Innovation, Absorptive Capacity and Managerial Ties: A Cross-Country Perspective. J. Innov. Knowl. 2022, 7, 100167. [Google Scholar] [CrossRef]

- Lee, S.; Park, G.; Yoon, B.; Park, J. Open Innovation in SMEs—An Intermediated Network Model. Res. Policy 2010, 39, 290–300. [Google Scholar] [CrossRef]

- Hossain, M. A Review of Literature on Open Innovation in Small and Medium-Sized Enterprises. J. Glob. Entrep. Res. 2015, 5, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Hossain, M.; Kauranen, I. Open Innovation in SMEs: A Systematic Literature Review. J. Strategy Manag. 2016, 9, 58–73. [Google Scholar] [CrossRef]

- Van de Vrande, V.; De Jong, J.P.; Vanhaverbeke, W.; De Rochemont, M. Open Innovation in SMEs: Trends, Motives and Management Challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef] [Green Version]

- Rangus, K.; Drnovšek, M. Open Innovation in Slovenia: A Comparative Analysis of Different Firm Sizes. Econ. Bus. Rev. 2013, 15, 1. [Google Scholar] [CrossRef]

- Venturelli, A.; Caputo, A.; Pizzi, S.; Valenza, G. A Dynamic Framework for Sustainable Open Innovation in the Food Industry. Br. Food J. 2022, 124, 1895–1911. [Google Scholar] [CrossRef]

- Rialti, R.; Marrucci, A.; Zollo, L.; Ciappei, C. Digital Technologies, Sustainable Open Innovation and Shared Value Creation: Evidence from an Italian Agritech Business. Br. Food J. 2022, 124, 1838–1856. [Google Scholar] [CrossRef]

- Ghassim, B.; Foss, L. Understanding the Micro-Foundations of Internal Capabilities for Open Innovation in the Minerals Industry: A Holistic Sustainability Perspective. Resour. Policy 2018, 74, 101271. [Google Scholar] [CrossRef]

- Roszkowska-Menkes, M.T. Integrating Strategic CSR and Open Innovation. Towards a Conceptual Framework. Soc. Responsib. J. 2018, 14, 950–966. [Google Scholar] [CrossRef]

- Behnam, S.; Cagliano, R.; Grijalvo, M. How Should Firms Reconcile Their Open Innovation Capabilities for Incorporating External Actors in Innovations Aimed at Sustainable Development? J. Clean. Prod. 2018, 170, 950–965. [Google Scholar] [CrossRef] [Green Version]

- Huang, H.-C.; Lai, M.-C.; Lin, L.-H.; Chen, C.-T. Overcoming Organizational Inertia to Strengthen Business Model Innovation: An Open Innovation Perspective. J. Organ. Chang. Manag. 2013, 26, 977–1002. [Google Scholar] [CrossRef]

- Jesus, G.M.K.; Jugend, D. How Can Open Innovation Contribute to Circular Economy Adoption? Insights from a Literature Review. Eur. J. Innov. Manag. 2021, 7, 25–34. [Google Scholar] [CrossRef]

- Frascati Manual 2002: Proposed Standard Practice for Surveys on Research and Experimental Development; Organisation for Economic Co-Operation and Development (OECD): Paris, France, 2002; p. 34.

- Schumpeter, J.A. The Theory of Economic Development. An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle; Harvard Economic Studies 46: Cambridge, MA, USA, 1934. [Google Scholar]

- Drucker, P.F. Managing for the Future; Routledge: London, UK, 1992; p. 299. [Google Scholar]

- Drucker, P. Innovation and Entrepreneurship; Harper: New York, NY, USA, 1985. [Google Scholar]

- Freeman, C. A Schumpeterian Renaissance? SPRU Electronic Working Paper Series, Paper no. 102; University of Sussex: Brighton, UK, 2003. [Google Scholar]

- Kim, W.C.; Mauborgne, R. Blue Ocean Strategy: How to Create Uncontested Market Space and Make the Competition Irrelevant; Harvard Business School: Boston, MA, USA, 2005. [Google Scholar]

- Eagar, R.; van Oene, F.; Boulton, C.; Roos, D.; Dekeyser, C. The Future of Innovation Management: The Next 10 Years; 2011; Available online: http://www.foresightfordevelopment.org/library/download-file/46-1368/54 (accessed on 20 April 2022).

- Som, O. Innovation without R&D: Heterogeneous Innovation Patterns of Non-R&D-Performing Firms in the German Manufacturing Industry; Springer Science & Business Media: Wiesbaden, Germany, 2012. [Google Scholar]

- Ostraszewska, Z.; Tylec, A. Nakłady wewnętrzne na działalność badawczo-rozwojową w Polsce i źródła jej finansowania w sektorze przedsiębiorstw. Zesz. Nauk. Politech. Częstochowskiej Zarządzanie 2016, 24, 30–42. Available online: http://www.zim.pcz.pl/znwz (accessed on 20 April 2022). [CrossRef]

- Dachs, B. Innovative Activities of Multinational Enterprises in Austria; Internationaler Verlag der Wissenschaften: Frankfurt am Main, Germany, 2009. [Google Scholar]

- OECD and Eurostat Paryż—Luksemburg. Meta infromacje. In Book Oslo, 4th ed.; Słownik-pojęć; Statistics Poland: Warsaw, Poland, 2018. Available online: https://stat.gov.pl/metainformacje/slownik-pojec/pojecia-stosowane-w-statystyce-publicznej/4257.pojecie.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry—Poland; Statistics Poland: Warsaw, Poland; Główny Urząd Statystyczny: Warsaw, Poland, 2021.

- Polish Statistical Classification of Environmental Protection and Facilities. Regulation of the Council of Ministers of 2 March 1999. Journal of Laws No 25, Item 218, Warsaw, Poland. Available online: https://sip.lex.pl/akty-prawne/dzu-dziennik-ustaw/polska-klasyfikacja-statystyczna-dotyczaca-dzialalnosci-i-urzadzen-16834089 (accessed on 20 April 2022).

- Statistical Classification of Economic Activities in the European Community—NACE Rev.2. PKD 1 January 2008. Regulation of the Council of Ministers, dated 24 December 2007. Journal of Laws No. 251, Item 1885, Warsaw, Poland. Available online: https://sip.lex.pl/akty-prawne/dzu-dziennik-ustaw/polska-klasyfikacja-dzialalnosci-pkd-17399246 (accessed on 20 April 2022).

- Kagermann, H.; Wahlster, W.; Helbig, J. (Eds.) Recommendations for Implementing the Strategic Initiative Industrie 4.0: Final Report of the INDUSTRIE 4.0; Working Group: Industrie 4.0: Mit dem Internet der Dinge auf dem Weg zur 4. Industriellen Revolution, VDI-Nachrichten, April 2011; Acatech-National Academy of Science and Engineering: München, Germany, 2011; Available online: http://forschungsunion.de/pdf/industrie_4_0_final_report.pdf (accessed on 20 April 2022).

- Davies, R. Industry 4.0 Digitalisation for Productivity and Growth; European Parliament PE 568.337; European Parliamentary Research Service: Brussels, Belgium, 2015; Volume 1, Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2015/568337/EPRS_BRI(2015)568337_EN.pdf (accessed on 23 April 2022).

- Lee, J.; Bagheri, B.; Kao, H. Research Letters: A Cyber-Physical Systems architecture for Industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Liu, Y.; Peng, Y.; Wang, B.; Yao, S.; Liu, Z. Review on cyber-physical systems. IEEE/CAA J. Autom. Sin. 2017, 4, 27–40. [Google Scholar] [CrossRef]

- Lee, J. Smart Factory Systems. Inform. Spektrum 2015, 38, 230–235. [Google Scholar] [CrossRef]

- Kang, H.S.; Lee, J.Y.; Choi, S.; Kim, H.; Park, J.H.; Son, J.Y.; Kim, B.H.; Noh, S.D. Smart Manufacturing: Past Research, Present Findings, and Future Directions. Int. J. Precis. Eng. Manuf.-Green Technol. 2016, 3, 111–128. [Google Scholar] [CrossRef]

- Lu, Y.; Ju, F. Smart Manufacturing Systems based on Cyber-physical Manufacturing Services (CPMS). IFAC Int. Fed. Autom. Control. Pap. Online 50-1 2017, 50, 15883–15889. [Google Scholar] [CrossRef]

- Zhong, R.Y.; Xu, X.; Klotz, E.; Newman, S.T. Intelligent Manufacturing in the Context of Industry 4.0. Engineering 2017, 3, 613–630. [Google Scholar] [CrossRef]

- Sommer, D.; Bhandari, K.R. Internationalization of R&D and Innovation Performance in the Pharma Industry. J. Intern. Manag. 2022, 28, 100927. [Google Scholar]

- Turek, I. Współpraca między organizacjami w zarządzaniu pracami badawczo-rozwojowymi. Studia Ekonomiczne. Zesz. Nauk. Uniw. Ekon. W Katowicach 2015, 225, 213–221. [Google Scholar]

- Chen, Y.-T.; Sun, E.W.; Chang, M.-F.; Lin, Y.-B. Pragmatic real-time logistics management with traffic IoT infrastructure: Big data predictive analytics of freight travel time for Logistics 4.0. Int. J. Prod. Econ. 2021, 238, 108157. [Google Scholar] [CrossRef]

- Mourtzis, D.; Vlachou, E. A cloud-based cyber-physical system for adaptive shop-floor scheduling and condition-based maintenance. J. Manuf. Syst. 2018, 47, 179–198. [Google Scholar] [CrossRef]

- Delic, M.; Eyers, D.R. The effect of additive manufacturing adoption on supply chain flexibility and performance: An empirical analysis from the automotive industry. Int. J. Prod. Econ. 2020, 228, 107689. [Google Scholar] [CrossRef]

- Bai, C.; Dallasega, P.; Orzes, G.; Sarkis, J. Industry 4.0 technologies assessment: A sustainability perspective. Int. J. Prod. Econ. 2020, 229, 107776. [Google Scholar] [CrossRef]

- Narula, S.; Puppala, H.; Kumar, A.; Frederico, G.F.; Dwivedy, M.; Prakash, S.; Talwar, V. Applicability of Industry 4.0 technologies in the adoption of global reporting initiative standards for achieving sustainability. J. Clean. Prod. 2021, 305, 127141. [Google Scholar] [CrossRef]

- Ching, T.; Lau, S.Y.; Ghobakhloo, M.; Fathi, M.; Liang, M.S. The Application of Industry 4.0 Technological Constituents for Sustainable Manufacturing: A Content-Centric Review. Sustainability 2022, 14, 432. [Google Scholar]

- Bayat, P.; Daraei, M.; Rahimikia, A. Designing of an open innovation model in science and technology parks. J. Innova. Entrepreneur 2022, 11, 4. [Google Scholar] [CrossRef]

- Mubarak, M.F.; Tiwari, S.; Petraite, M.; Mubarik, M.; Raja, R.Z. How Industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. Int. J. 2021, 32, 1477–7835. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A. Open for innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Henkel, J. Selective revealing in open innovation processes: The case of embedded Linux. Res. Policy 2006, 35, 953–969. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z. Micro- and Macro-Dynamics of Open Innovation with a Quadruple-Helix Model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef] [Green Version]

- Saebi, T.; Foss, N.J. Business models for open innovation: Matching heterogeneous open innovation strategies with business model dimensions. Eur. Manag. J. 2015, 33, 201–213. [Google Scholar] [CrossRef] [Green Version]

- Chesbrough, H. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Chesbrough, H.W. The era of open innovation. Manag. Innov. Change 2006, 127, 34–41. [Google Scholar]

- Petraite, M. Developing Innovation Culture in the Baltics: Organizational Challenges in a Time of Transition, Managing Innovation in a Global and Digital World; Springer Gabler: Wiesbaden, Germany, 2020; pp. 83–99. [Google Scholar]

- Turoń, K.; Kubik, A. Business Innovations in the New Mobility Market during the COVID-19 with the Possibility of Open Business Model Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 195. [Google Scholar] [CrossRef]

- Yang, J.Y.; Roh, T. Open for green innovation: From the perspective of green process and green consumer innovation. Sustainability 2019, 11, 3234. [Google Scholar] [CrossRef] [Green Version]

- Worrell, E. Energy Efficiency Improvement and Cost Saving Opportunities for the US Iron and Steel Industry an ENERGY STAR (R) Guide for Energy and Plant Managers; Lawrence Berkeley National Laboratory: Berkeley, CA, USA, 2011.

- De Beer, J.; Worrell, E.; Blok, K. Future technologies for energy-efficient iron and steel making. Annu. Rev. Energy Environ. 1998, 23, 123–205. [Google Scholar] [CrossRef]

- ESTEP AISBL. Clean Steel Partnership Strategic Research and Innovation Agenda (SRIA) October 2021/November 2021, Brussels. Available online: https://www.estep.eu/assets/CleanSteelMembersection/CSP-SRIA-Oct2021-clean.pdf (accessed on 29 April 2022).

- EC. The European Green Deal Sets out How to Make Europe the First Climate-Neutral Continent by 2050, Boosting the Economy, Improving People’s Health and Quality of Life, Caring for Nature, and Leaving No One Behind. 11 December 2019, Brussels. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_19_6691 (accessed on 27 April 2022).

- Low Carbon Roadmap: Pathways to a CO2-Neutral European Steel Industry; EUROFER: Brussels, Belgium, 2019.

- Remus, R.; Aguado Monsonet, M.; Roudier, S.; Delgado Sancho, L. JRC reference report. In Best Available Techniques (BAT) Reference Document for Iron and Steel Production; This Document is Published by the European Commission Pursuant to Article 13(6) of the Directive European Union; Publications Office of the European Union: Luxembourg, 2013. [Google Scholar]

- Protopopov, E.; Feyler, S. Analysis of current state and prospects of steel production development. In IOP Conference Series: Materials Science and Engineering, 2016; IOP Publishing: Bristol, UK, 2001. [Google Scholar]

- Industrial Emissions Directive 2010/75/EU—IDEAS/RePEc. Document for Iron and Steel Production: Industrial Emissions Directive 2010/75/EU: Brussels, Belgium; Publications Office of the European Union: Luxembourg, 2010. [Google Scholar]

- Anderson, S.; Metius, G.E.; Mcclelland, J.M. Future green steelmaking technologies. Electr. Furn. Conf. 2002, 60, 175–194. [Google Scholar]

- Transforming Our World: The 2030 Agenda for Sustainable Development. Available online: https://sustainabledevelopment.un.org/post2015/transformingourworld/publication (accessed on 20 April 2022).

- Acemoglu, D.; Akcigit, U.; Bloom, N.; Kerr, W. Innovation, Reallocation and Growth. NBER Work. Pap. 2013, 108, 18993. [Google Scholar]

- World Steel Association. Sustainable Steel: Policy and Indicators 2015; World Steel Association: Brussels, Belgium, 2015; Available online: http://www.worldsteel.org/publications/ (accessed on 20 April 2022).

- Peters, K.; Malfa, E.; Colla, V. The European steel technology platform’s strategic research agenda: A further step for the steel as backbone of EU resource and energy intense industry sustainability. La Metall. Ital. 2019, 111, 5–17. [Google Scholar]

- Proposal for Clean Steel Partnership under the Horizon Europe Programme. In Proposal for a European Partnership under Horizon Europe Clean Steel—Low Carbon Steelmaking (Version 15 July 2020); ESTEP AISBL: Brussels, Belgium, 2020.

- Adams, W.; Dirlam, J. Big Steel, Invention, and Innovation. Q. J. Econ. 1966, 80, 167–189. [Google Scholar] [CrossRef]

- Taghipour, A.; Akkalatham, W.; Eaknarajindawat, N.; Stefanakis, A.I. The impact of government policies and steel recycling companies’ performance on sustainable management in a circular economy. Res. Policy 2022, 77, 102663. [Google Scholar] [CrossRef]

- De Carvalho, A.; Sekiguchi, N. The structure of steel exports: Changes in specialisation and the role of innovation. In OECD Science, Technology and Industry Working Papers; No. 2015/07; OECD Publishing: Paris, France, 2015. [Google Scholar] [CrossRef]

- Emi, T. Steelmaking Technology for the Last 100 Years: Toward Highly Efficient Mass Production Systems for High Quality Steels”. ISIJ Int. 2015, 55, 36–66. [Google Scholar] [CrossRef] [Green Version]

- World and US Production of DRI and HBI; American Metal Market; AMM: New York, NY, USA, 2013; Available online: http://www.amm.com/EventAssets/25/5847/elements/AMM_DRI_MM_2013_PDF_Report_1D_opt.pdf (accessed on 20 April 2022).

- Kagermann, H. Change Through Digitization—Value Creation in the Age of Industry 4.0. In Management of Permanent Change; Springer: Berlin/Heidelberg, Germany, 2015. [Google Scholar]

- Gajdzik, B.; Wolniak, R. Digitalisation and Innovation in the Steel Industry in Poland—Selected Tools of ICT in an Analysis of Statistical Data and a Case Study. Energies 2021, 14, 3034. [Google Scholar] [CrossRef]

- Gajdzik, B.; Wolniak, R. Transitioning of Steel Producers to the Steelworks 4.0—Literature Review with Case Studies. Energies 2021, 14, 4109. [Google Scholar] [CrossRef]

- Peters, H. How Could Industry 4.0 Transform the Steel Industry? Future Steel Forum; Steel Times International: Warsaw, Poland, 14–15 June 2017. [Google Scholar]

- Silva, F.; de Carvalho, A. Research and Development, Innovation and Productivity Growth in the Steel Sector; DSTI/SU/SC(2015)5/FINAL Organisation de Coopération et de Développement Économiques Organisation for Economic Co-operation and Development: Paris, France, 29 March 2016. [Google Scholar]

- Zonta, T.; Costa, C.A.; Righi, R.R.; Lima, J.M.; Trindade, E.S.; Li, P.G. Predictive maintenance in the Industry 4.0: A systematic literature review. Comput. Ind. Eng. 2020, 150, 106889. [Google Scholar] [CrossRef]

- Wagner, T.; Herrmann, C.; Thiede, S. Industry 4.0 Impacts on Lean Production systems—Elsevier, 50th CIRP Conference of manufacturing Systems. Precedia CIRP 2017, 63, 125–131. [Google Scholar] [CrossRef]

- Kagechika, H. Recent progress and future trends in the research and development of steel. NKK Tech. Rev. 2003, 88, 6–9. [Google Scholar]

- D’Costa, A. The Global Restructuring of the Steel Industry: Innovations, Institutions and Industrial Change. In Routledge Studies in International Business and the World Economy; Taylor & Francis: Oxford, UK, 2003. [Google Scholar]

- The 2021 EU Industrial R&D Investment Scoreboard; Publications Office of the European Union: Luxembourg, 2021.

- Delivering on the UN’s Sustainable Development Goals—A Comprehensive Approach, Staff Working Document SWD(2020) 400 Final of 18 November 2020. Available online: https://ec.europa.eu/info/sites/default/files/delivering_on_uns_sustainable_development_goals_factsheet_en.pdf (accessed on 12 July 2022).

- The 2021 EU Industrial R&D Investment Scoreboard; European Commission, JRC/DG R&I: Warsaw, Poland, 2021.

- Statistical Yearbook of Industry 2012; Statistics Poland: Warsaw, Poland, 2012. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2012,5,6.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2013; Statistics Poland: Warsaw, Poland, 2013. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2013,5,7.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2014; Statistics Poland: Warsaw, Poland, 2014. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2014,5,8.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2015; Statistics Poland: Warsaw, Poland, 2015. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2015,5,9.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2016; Statistics Poland: Warsaw, Poland, 2016. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2016,5,10.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2017; Statistics Poland: Warsaw, Poland, 2017. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2017,5,11.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2018; Statistics Poland: Warsaw, Poland, 2018. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2018,5,12.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2019; Statistics Poland: Warsaw, Poland, 2019. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2019,5,13.html (accessed on 20 April 2022).

- Statistical Yearbook of Industry 2020; Statistics Poland: Warsaw, Poland, 2020. Available online: https://stat.gov.pl/obszary-tematyczne/roczniki-statystyczne/roczniki-statystyczne/rocznik-statystyczny-przemyslu-2020,5,14.html (accessed on 20 April 2022).

- Kosztyán, Z.T.; Katona, A.I.; Kuppens, K.; Kisgyörgy-Pál, M.; Nachbagauer, A.; Csizmadia, T. Exploring the structures and design effects of EU-funded R&D&I project portfolios. Technol. Forecast. Soc. Change 2022, 180, 121687. [Google Scholar]

- Sorli-Alcantud, A. European R&D funding. The framework programmes and the next generation EU. Dyna 2022, 97, 111–113. [Google Scholar]

- Regueiro-Picallo, M.; Rojo-López, G.; Puertas, J. A-CITEEC: A strategic research consortium for R&D&I and transfer of results in civil engineering and building. Int. J. Sustain. High. Educ. 2020, 21, 1297–1310. [Google Scholar]

- Taverna, A. R+D+I in cybersecurity = Prevention and resilience of critical infrastructures. In Proceedings of the 2020 IEEE Congreso Bienal de Argentina, ARGENCON 2020–2020 IEEE Biennial Congress of Argentina, ARGENCON 2020, Resistencia, Argentina, 1–4 December 2020; p. 9505339. [Google Scholar]

- Collado-Ruano, J.; Ojeda, M.N.; Malo, M.O.; Amino, D.S. Education, arts and interculturality: Documentary cinema as a communicative language and innovative technology for learning the R+D+I methodology. Texto Livre 2020, 13, 376–393. [Google Scholar] [CrossRef]

- European Commission. A Clean Planet for All: A European Strategic Long-Term Vision for a Prosperous, Modern, Competitive and Climate Neutral Company; Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee, the Committee of the Regions and the European Investment Bank; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- European Steel. The Wind of Change. Energy in Future Steelmaking. In Steel in the Energy Market Applications; Greening European Steel; European Commission: Luxembourg, 2018; Available online: https://op.europa.eu/o/opportal-service/download-handler?identifier=fb63033e-2671-11e8-ac73-01aa75ed71a1&format=pdf&language=en&productionSystem=cellar&part= (accessed on 20 April 2022).

- Steel Institute VDEh. Update of the Steel Roadmap for Low Carbon Europe 2050. In Part I: Technical Assessment of Steelmaking Routes; Eurofer: Brussels, Belgium, 2019; Available online: https://www.eurofer.eu/assets/publications/archive/archive-of-older-eurofer-documents/2013-Roadmap.pdf (accessed on 20 April 2022).

- Horizon Europe. Available online: https://ec.europa.eu/info/research-and-innovation/funding/funding-opportunities/funding-programmes-and-open-calls/horizon-europe_en#european-partnerships-in-horizon-europe (accessed on 20 April 2022).

- Zsolt, D.M.; Mazza, J.; Midões, C. European Union Cohesion Project Characteristics and Regional Economic Growth; Bruegel Working Paper No. 2021/02; Bruegel: Brussels, Belgium, 2021. [Google Scholar]

- Salas-Ruiz, J. Research management system, technological development and innovation (R+D+I) and formative research model: Engineering case—UCV, 2020. In Proceedings of the LACCEI International Multi-Conference for Engineering, Education and Technology, Boca Raton, FL, USA, 27–31 July 2020. [Google Scholar]

- Ruff, M.; Woschank, M. Industry 4.0 as an Enabler of Servitization in the Plant Engineering Business: Literature Review and Development of a Conceptual Research Model. Proced. Comput. Sci. 2022, 200, 833–842. [Google Scholar] [CrossRef]

- Lopez, S.; Yepes, V. Impact of R&D&I on the Performance of Spanish Construction Companies. Adv. Civ. Eng. 2020, 2020, 7835231. [Google Scholar]

- Cristhian De Castro Cuevas, O.; Armando Sanchez Martin, A.; Carolina Martinez Ballesteros, J.; Gerardo Clavijo Vargas, A.; Andres Poloche Arango, M. Organizational Model Proposal for the Creation of University-Industry Relationship and Coworking R+D+I, Organizational Model Proposal for the Creation of University-Industry Relationship and Coworking R+D+I. In Proceedings of the Congreso Internacional de Innovacion y Tendencias en Ingenieria, CONIITI 2019–Conference Proceedings, Bogotá, Colombia, 2–4 October 2019; p. 8960703. [Google Scholar]

- De Filippo, D.; Sandoval-Hamón, L.A.; Casani, F.; Sanz-Casado, E. Spanish Universities’ sustainability performance and sustainability-related R & D+I. Sustainability 2019, 11, 5570. [Google Scholar]

- Accenturestategy. Steel Demand Beyond 2030—Forecast Scenario; OECD: Paris, France, 2017. [Google Scholar]

- Montero, G.A. The App U.D.C.A closer to R&D&I. Rev. U.D.C.A Actual. Divulg. Cient. 2021, 24, e2172. [Google Scholar]

- De Paula, G.M. Nota Técnica do Sistema Produtivo Insumos Básicos e Foco Setorial Siderurgia. Relatório do Projeto Indústria 2027: Riscos e Oportunidades Para o Brasil Diante de Inovações Disruptivas; IE-UFRJ: Campinas, Brazil, 2017.

- Daroń, M.; Górska, M. Management Premises and Barriers in the Metal Industry in Poland in the Context of Innovative Activity. Sustainability 2019, 11, 6761. [Google Scholar] [CrossRef] [Green Version]

- Axelson, M.; Oberthür, S.; Nilsson, L.J. Emission reduction strategies in the EU steel industry: Implications for business model innovation. J. Ind. Ecol. 2021, 25, 390–402. [Google Scholar] [CrossRef]

- Stroud, D.; Evans, C.; Weinel, M. Innovating for energy efficiency: Digital gamification in the European steel industry. Eur. J. Ind. Relat. 2020, 26, 419–437. [Google Scholar] [CrossRef]

- Lee, K.; Ki, J.H. Rise of latecomers and catch-up cycles in the world steel industry. Res. Policy 2017, 46, 365–375. [Google Scholar] [CrossRef]

- Nakamura, T.; Ohashi, H. Intra-plant diffusion of new technology: Role of productivity in the study of steel refining furnaces. Res. Policy 2012, 41, 770–779. [Google Scholar] [CrossRef]

- Muscio, A.; Ciffolilli, A. What drives the capacity to integrate Industry 4.0 technologies? Evidence from European R&D projects. Econ. Innov. New Technol. 2020, 29, 169–183. [Google Scholar]

- Mozart, S.M.; de Paula, G.M.; Botelho, M.R. Technological Innovations and Industry 4.0 in the Steel Industry: Diffusion, Market Structure and Intra-Sectoral Heterogeneity. Rev. Bras. De Inovação 2021, 20, e021006. [Google Scholar] [CrossRef]

- Pinkham, M. Digital Technologies increase momentum. Metal Market Magazine, June 2018; 59–68. Available online: https://epub.pubservice.com/publications/MB/AM/20180601/2/index.html(accessed on 20 April 2022).

- Nikonenko, U.; Shtets, T.; Kalinin, A.; Dorosh, I.; Sokolik, L. Assessing the Policy of Attracting Investments in the Main Sectors of the Economy in the Context of Introducing Aspects of Industry 4.0. Int. J. Sustain. Dev. Plan. 2022, 17, 497–505. [Google Scholar] [CrossRef]

- Abdullah, F.M.; Saleh, M.; Al-Ahmari, A.M.; Anwar, S. The Impact of Industry 4.0 Technologies on Manufacturing Strategies: Proposition of Technology-Integrated Selection. IEEE Access 2022, 10, 21574–21583. [Google Scholar] [CrossRef]

- Zanella, R.M.; Frazzon, E.M.; Uhlmann, I.R. Social Manufacturing: From the theory to the practice. Braz. J. Oper. Prod. Manag. 2022, 19, e20221241. [Google Scholar]

- Dieste, M.; Sauer, P.C.; Orzes, G. Organizational tensions in industry 4.0 implementation: A paradox theory approach. Int. J. Prod. Econ. 2022, 251, 108532. [Google Scholar] [CrossRef]

- David, L.O.; Nwulu, N.I.; Aigbavboa, C.O.; Adepoju, O.O. Integrating fourth industrial revolution (4IR) technologies into the water, energy & food nexus for sustainable security: A bibliometric analysis. J. Clean. Prod. 2022, 363, 132522. [Google Scholar]

- Zeng, J.; Pagàn-Castaño, E.; Ribeiro-Navarrete, S. Merits of Intercity Innovation Cooperation of Environment-friendly Patents for Environmental Regulation Efficiency. Technol. Forecast. Soc. Change 2022, 180, 121404. [Google Scholar] [CrossRef]

- Wang, L.; Jing, S.; Deng, F. The impact of business environment optimization on firm’s innovation efficiency. Xitong Gongcheng Lilun Yu Shijian/Syst. Eng. Theory Pract. 2022, 42, 1601–1615. [Google Scholar]

- Gajdzik, B. Comprehensive classification of environmental aspects in a manufacturing enterprise. Metalurgija 2012, 51, 541–544. [Google Scholar]

- Wang, Y.; Qi, G. Sustainable Knowledge Contribution in Open Innovation Platforms: An Absorptive Capacity Perspective on Network Effects. Sustainability 2022, 14, 6536. [Google Scholar] [CrossRef]

- Arvanti, E.N.; Dima, A.; Stylios, C.D. A New Step-by-Step Model for Implementing Open Innovation. Sustainability 2022, 14, 6017. [Google Scholar] [CrossRef]

- Tao, A.; Qi, Q.; Da, D.; Boamah, V.; Tang, D. Game Analysis of the Open-Source Innovation Benefits of Two Enterprises from the Perspective of Product Homogenization and the Enterprise Strength Gap. Sustainability 2022, 14, 5572. [Google Scholar] [CrossRef]

- Baban, C.F.; Baban, M.; Rangone, A. Outcomes of Industry–University Collaboration in Open Innovation: An Exploratory Investigation of Their Antecedents’ Impact Based on a PLS-SEM and Soft Computing Approach. Mathematics 2022, 10, 931. [Google Scholar] [CrossRef]

- Yun, J.J.; Liu, Z.; Jeong, E.; Kim, S.; Kim, K. The Difference in Open Innovation between Open Access and Closed Access, According to the Change of Collective Intelligence and Knowledge Amount. Sustainability 2022, 14, 2574. [Google Scholar] [CrossRef]

- Gajdzik, B.; Sroka, W. Analytic study of the capital restructuring processes in metallurgical enterprises around the world and in Poland. Metalurgija 2012, 51, 265–268. [Google Scholar]

| 1. Government budget for R&D activities of industry | The amount of expenditures allocated by the government to R&D within the country, budgeted as all items related to R&D and then estimated in terms of financial resources. |

| 2. Internal expenditures on R&D activities | Expenditures incurred during the reporting year on R&D work carried out in the reporting unit, regardless of the source of funds; this includes current expenditure as well as capital expenditure on fixed assets related to R&D activities, but excludes the depreciation of the company assets. |

| (a) Current outlays on R&D activities | Personnel expenses, non-durable objects and energy, costs of consumption of materials, costs of business trip, costs of external services (other than on R&D activities), other current costs connected with R&D excluding the depreciation of fixed assets and VAT taxes. |

| - expenditures on staff | Gross salaries with wage surcharges. |

| (b) Investment outlays on R&D activities | Expenditure on new fixed assets used in R&D activity, including purchase of used fixed assets and purchasing of investment equipment. |

| 3. Gross value of scientific and research equipment | Value of research equipment: measuring or laboratory equipment. |

| 1. Expenditures on innovative activities | Amount of expenditures (from various sources) on innovative work, i.e., on product and business process innovations in the reporting year. |

| (a) expenditures on R &D activities | R&D expenditure (value/amount) in the reporting year. |

| (b) on purchase of knowledge | Amount of expenditures on the purchase of knowledge from external sources and computer software in the reporting year. |

| (c) on investment (capital expenditure) | Amount of expenditures on buildings, land, technical equipment, machinery, and tools and transport in the reporting year. |

| (d) on staff and marketing | Expenditures on staff training and expenditures on marketing activities related to new products in the reporting year. |

| 1. Expenditures on fixed assets for environmental protection | Amount of expenditure on fixed assets which can be used for the protection of all environmental components in the reporting year. |

| (a) expenditures on air protection | Amount of expenditure on fixed measures to protect air and climate in the reporting year. |

| - of which: purchase | types of modern fuel combustion technologies |

| (b) expenditures on water and wastewater management | waste water management and protection of waters of which outlays on municipal wastewater treatment, sewage system for the transport of wastewater and precipitation water, rotary system of water supply. |

| (c) expenditures on waste management, groundwater, surface water and protection of soils, | Amount of expenditures on fixed assets for waste management, soil and water protection the reporting year. |

| (d) expenditures on noise and vibration reduction | Amount of expenditures on fixed assets for the noise and vibration reduction in the reporting year. |

| Filed in Business Activity | Economic Entities in 2020 |

|---|---|

| 1. Manufacture of basic metals | 176 |

| 16 |

| 26 |

| 28 |

| 34 |

| 73 |

| Manufacture of Basic Metals | Total Industry | Manufacture of Basic Metals | Total Industry | Manufacture of Basic Metals | Total Industry | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | PLN mln | % | PLN mln | % | PLN mln | % | PLN mln | % | PLN mln | PLN mln | % |

| Internal Expenditure on R&D | Dynamics | Internal Expenditure on R&D | Dynamics | Internal Investment Expenditures on R&D | Dynamics | Internal Investment Expenditures on R&D | Dynamics | Research Equipment * | Research Equipment | Dynamics | |

| 2010 | 41.1 | base year | 1385 | base year | 20.2 | base year | 312.5 | base year | no data | 346.9 | base year |

| 2011 | 24.3 | −40.88 | 1779 | 28.45 | 5.8 | −71.29 | 412.2 | 31.90 | no data | 448.6 | 29.32 |

| 2012 | 29 | −29.44 | 2729.7 | 97.09 | 16.5 | −18.32 | 1151.7 | 268.54 | no data | 910.7 | 162.53 |

| 2013 | 47.1 | 14.60 | 3319.9 | 139.70 | 0 | −100.00 | 1125.7 | 260.22 | 10.3 | 929.7 | 168.00 |

| 2014 | 74.8 | 82.00 | 3630.5 | 162.13 | 3 | −85.15 | 1137.4 | 263.97 | 9.9 | 1375.8 | 296.60 |

| 2015 | 49 | 19.22 | 3926.1 | 183.47 | 14 | −30.69 | 1044.5 | 234.24 | 18.5 | 1719.3 | 395.62 |

| 2016 | 64.1 | 55.96 | 3921.8 | 183.16 | 41.1 | 103.47 | 935 | 199.20 | 19.2 | 2246 | 547.45 |

| 2017 | 117.5 | 185.89 | 5546.6 | 300.48 | 70 | 246.53 | 1832 | 486.24 | 42.3 | 2026.3 | 484.12 |

| 2018 | 267 | 549.64 | 7282.9 | 425.84 | 138.5 | 585.64 | 2686.2 | 759.58 | 69.2 | 2634 | 659.30 |

| 2019 | 270.2 | 557.42 | 7637.1 | 451.42 | 141 | 598.02 | 2269.8 | 626.34 | 67.8 | 2064.2 | 495.04 |

| Year | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | ||

| manufacture of basic metals | PLN mln | 420.8 | 666.8 | 471.7 | 663.4 | 709.6 | 740.9 | 852.6 | 812.5 | 1162.4 | 972.1 |

| dynamics * | % | basic year | 58.46 | 12.10 | 57.65 | 68.63 | 76.07 | 102.61 | 93.08 | 176.24 | 131.01 |

| total industry | PLN mln | 22,379 | 19,376.5 | 20,293.2 | 19,520.7 | 22,544.3 | 28,920.7 | 27,157.5 | 26,464.3 | 21,463.7 | 21,523.6 |

| dynamics * | % | basic year | −13.42 | −9.32 | −12.77 | 0.74 | 29.23 | 21.35 | 18.26 | −4.09 | −3.82 |

| Manufacture of Basic Metals | Industry Total | |||||||

|---|---|---|---|---|---|---|---|---|

| on Environmental Protection | Dynamics * | on Climate Protection | Dynamics * | on Environmental Protection | Dynamics * | on Climate Protection | Dynamics * | |

| Year | PLN mln | % | PLN mln | % | PLN mln | % | PLN mln | % |

| 2010 | 59.17 | basic year | 31.05 | basic year | 5586.40 | basic year | 2063.11 | basic year |

| 2011 | 136.80 | 131.19 | 122.10 | 293.19 | 5897.13 | 5.56 | 2970.25 | 43.97 |

| 2012 | 56.41 | −4.66 | 19.40 | −37.52 | 5258.09 | −5.88 | 2157.04 | 4.55 |

| 2013 | 61.98 | 4.75 | 37.96 | 22.25 | 6003.68 | 7.47 | 2339.64 | 13.40 |

| 2014 | 54.41 | −8.05 | 7.00 | −77.47 | 9417.31 | 68.58 | 4291.12 | 107.99 |

| 2015 | 49.03 | −17.15 | 16.92 | −45.52 | 9299.46 | 66.47 | 3813.13 | 84.82 |

| 2016 | 192.47 | 225.27 | 74.86 | 141.07 | 4290.58 | −23.20 | 2308.00 | 11.87 |

| 2017 | 179.76 | 203.80 | 154.09 | 396.23 | 4476.25 | −19.87 | 2107.58 | 2.16 |

| 2018 | 199.11 | 236.50 | 193.27 | 522.37 | 5242.15 | −6.16 | 2338.25 | 13.34 |

| 2019 | 100.95 | 70.60 | 88.85 | 186.11 | 6940.99 | 24.25 | 3211.39 | 55.66 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gajdzik, B.; Wolniak, R. Framework for R&D&I Activities in the Steel Industry in Popularizing the Idea of Industry 4.0. J. Open Innov. Technol. Mark. Complex. 2022, 8, 133. https://doi.org/10.3390/joitmc8030133

Gajdzik B, Wolniak R. Framework for R&D&I Activities in the Steel Industry in Popularizing the Idea of Industry 4.0. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(3):133. https://doi.org/10.3390/joitmc8030133

Chicago/Turabian StyleGajdzik, Bożena, and Radosław Wolniak. 2022. "Framework for R&D&I Activities in the Steel Industry in Popularizing the Idea of Industry 4.0" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 3: 133. https://doi.org/10.3390/joitmc8030133

APA StyleGajdzik, B., & Wolniak, R. (2022). Framework for R&D&I Activities in the Steel Industry in Popularizing the Idea of Industry 4.0. Journal of Open Innovation: Technology, Market, and Complexity, 8(3), 133. https://doi.org/10.3390/joitmc8030133