The Impact of Technological Innovation and Strategic CSR on Firm Value: Implication for Social Open Innovation

Abstract

:1. Introduction

2. Theoretical Background

2.1. Technological Innovation

2.2. Stakeholder Theory

2.2.1. Definition of Stakeholders

2.2.2. Types of Stakeholders

2.3. Corporate Social Responsibility (CSR)

2.3.1. Definition

2.3.2. Strategic CSR

3. Research Model and Method

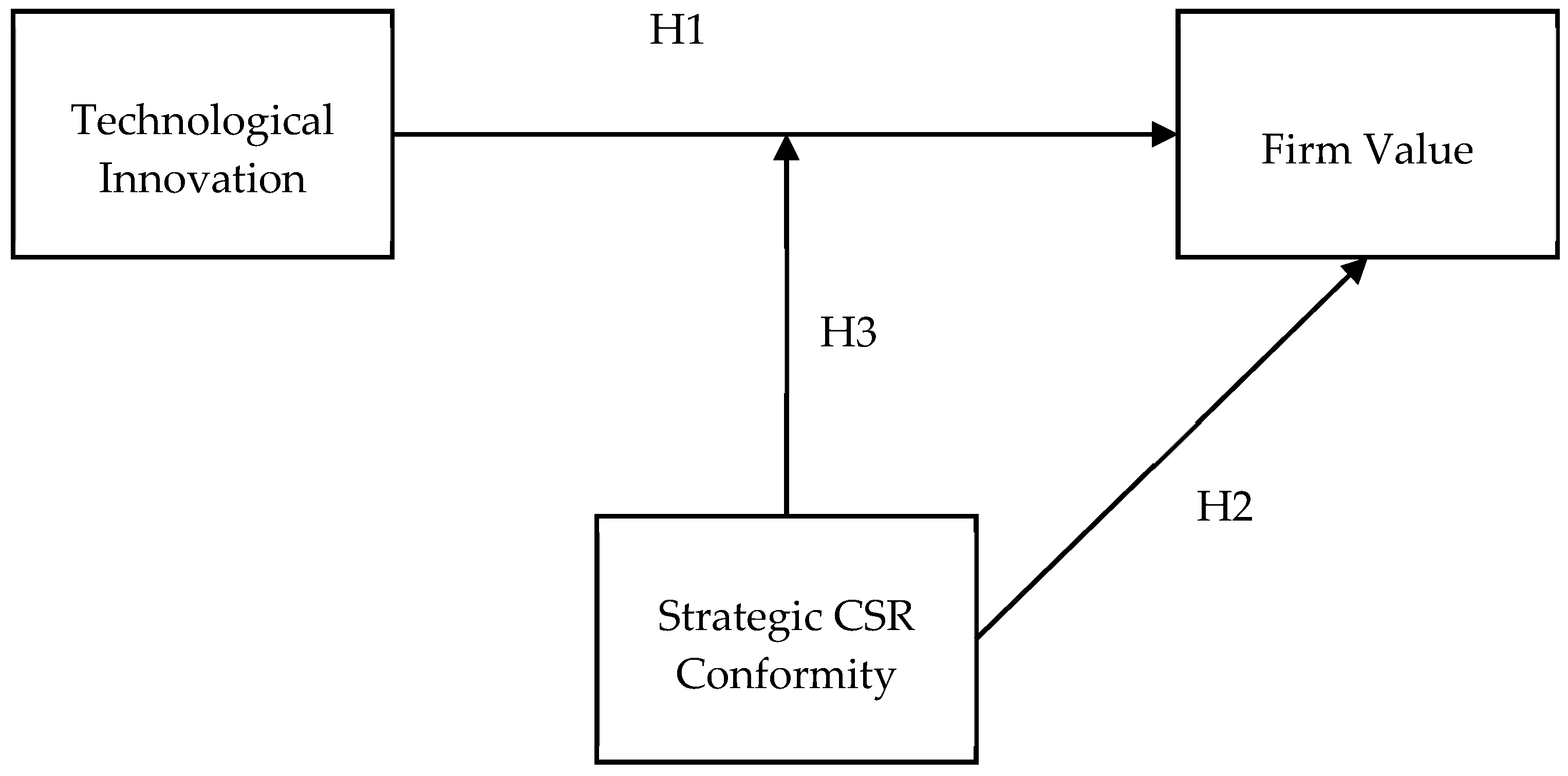

3.1. Research Model

3.1.1. Technological Innovation and Firm Value

- Hypothesis 1.A firm’s technological innovation activities have a positive effect on firm value.

3.1.2. Strategic CSR Conformity and Firm Value

- Hypothesis 2.A firm’s strategic CSR conformity has a positive effect on firm value.

3.1.3. Interaction between Technological Innovation and Conformity of Strategic CSR Activities

- Hypothesis 3.The interaction between technological innovation activities and strategic CSR conformity has a positive effect on firm value.

3.2. Research Method

3.2.1. Data Collection and Sample

3.2.2. Measurement of Variables

Technological Innovation

Firm Value

Strategic CSR Conformity

Control Variable

4. Analysis Results

5. Discussion: Strategic CSR and Social Open Innovation

6. Conclusions

6.1. Summary and Interpretation of Key Findings

6.2. Academic and Practical Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Demirel, P.; Mazzucato, M. Innovation and Firm Growth: Is R&D Worth It? Ind. Innov. 2012, 19, 45–62. [Google Scholar]

- Hagedoorn, J. Innovation and Entrepreneurship: Schumpeter Revisited, Industrial and Corporate Change; Oxford University Press: Oxford, UK, 1996; Volume 5, pp. 883–896. [Google Scholar]

- Belenzon, S.; Patacconi, A. Innovation and firm value: An investigation of the changing role of patents 1985–2007. Res. Policy 2013, 42, 1496–1510. [Google Scholar] [CrossRef]

- Kim, C.H. A Domestic Settlement Plan for Corporate Social Responsibility Management. Soc. Enterp. Stud. 2012, 5, 3–51. [Google Scholar]

- Chon, M.L.; Kim, C.S. The Effect of Sustaining Corporate Social Responsibility on Relationship between CSR and Financial Performance. Korean Account. Inf. Assoc. 2011, 29, 351–374. [Google Scholar]

- Knox, S.; Maklan, S. Corporate Social Responsibility: Moving Beyond Investment Towards Measuring Outcomes. Eur. Manag. J. 2004, 22, 508–516. [Google Scholar] [CrossRef] [Green Version]

- Rogers, M. The definition and measurement of innovation. Melb. Inst. Appl. Econ. Soc. Res. 1998, 10, 27. [Google Scholar]

- Marques, J.P. Closed versus open innovation: Evolution or combination? Int. J. Bus. Manag. 2014, 9, 196. [Google Scholar] [CrossRef] [Green Version]

- Battisti, G.; Stoneman, P. How Innovative are UK Firms? Evidence from the Fourth UK Community Innovation Survey on Synergies between Technological and Organizational Innovations. Br. J. Manag. 2010, 21, 187–206. [Google Scholar] [CrossRef] [Green Version]

- Kwon, S.J. The Effect of Product Innovation, Process Innovation, and Marketing Innovation on Innovation Capability and Knowledge Sharing of Ventures: Focusing on the Moderating Effect of Business Area. J. Korean Entrep. Soc. 2017, 12, 97–122. [Google Scholar] [CrossRef]

- Ansoff, I. Corporate Strategy; McGraw-Hill: New York, NY, USA, 1965. [Google Scholar]

- Fernando, S.; Lawrence, S. A Theoretical Framework for CSR Practices: Integrating Legitimacy Theory, Stakeholder Theory and Institutional Theory. J. Theor. Account. Res. 2014, 10, 149–178. [Google Scholar]

- Fadun, S.O. Corporate Social Responsibility (CSR) Practices and Stakeholders Expectations: The Nigerian Perspectives. Res. Bus. Manag. 2014, 1. [Google Scholar] [CrossRef] [Green Version]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Pitman: Boston, MA, USA, 1984. [Google Scholar]

- Windsor, D. Stakeholder Management in Multinational Enterprises. Proc. Int. Assoc. Bus. Soc. 1992, 3, 241–255. [Google Scholar] [CrossRef]

- Mitchell, R.K.; Agle, B.R.; Wood, D.J. Toward a Theory of Stakeholder Identification and Salience: Defining the Principle of Who and What Really Counts. Acad. Manag. Rev. 1997, 22, 853–886. [Google Scholar] [CrossRef]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Rauf, F.; Voinea, C.L.; Naveed, K.; Fratostiteanu, C. CSR Disclosure: Effects of Political Ties, Executive Turnover and Shareholder Equity. Evidence from China. Sustainability 2021, 13, 3623. [Google Scholar] [CrossRef]

- Kim, M.C.; Kim, Y.H. Corporate social responsibility and shareholder value of restaurant firms. Int. J. Hosp. Manag. 2014, 40, 120–129. [Google Scholar] [CrossRef]

- Kolk, A.; Pinkse, J. Towards strategic stakeholder management? Integrating perspectives on sustainability challenges such as corporate responses to climate change. Corporate Governance. Int. J. Bus. Soc. 2007, 7, 370–378. [Google Scholar]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Guthrie, J.; Petty, R.; Ricceri, F. The voluntary reporting of intellectual capital: Comparing evidence from Hong Kong and Australia. J. Intellect. Cap. 2006, 7, 54–271. [Google Scholar] [CrossRef]

- Kim, D.J. Effects Of External Activities Of Corporate Social Responsibility On Benefits Of Employees And Shareholders-Mainly From Stakeholders’ Perspective. J. Hum. Resour. Manag. Res. 2009, 16, 29–47. [Google Scholar]

- Votaw, D. Genius Became Rare: A Comment on the Doctrine of Social Responsibility Pt1. Calif. Manag. Rev. 1972, 28, 142–152. [Google Scholar]

- Carroll, A.B. A Three-Dimensional Conceptual Model of Corporate Performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Carroll, A.B.; Buchholtz, A.K. Business and Society. In Ethics and Stakeholder Management; South-Western: Cincinnati, OH, USA, 1996. [Google Scholar]

- Tian, Z.; Wang, R.; Yang, W. Consumer Responses to Corporate Social Responsibility (CSR) in China. J. Bus. Ethics 2011, 101, 197–212. [Google Scholar] [CrossRef]

- Bowen, H.R. Social Responsibilities of the Businessman; Harper and Row: NewYork, NY, USA, 1953. [Google Scholar]

- Rahman, H.; Ramos, I. Open Innovation in SMEs: From closed boundaries to networked paradigm. Issues Inf. Sci. Inf. Technol. 2010, 7, 471–487. [Google Scholar] [CrossRef]

- Heald, M. Management’s responsibility to society: The growth of an idea. Bus. Hist. Rev. 1957, 31, 375–384. [Google Scholar] [CrossRef]

- Kim, A.H.; Yoo, J.W. The Moderating Effect of Corporate Governance on the Relations between Corporate Social Responsibility and Corporate Value. Korean J. Bus. Adm. 2012, 26, 219–240. [Google Scholar]

- Byun, S.Y.; Kim, J.W. Strategic CSR and Corporate Performance in Korean and Japanese Corporations. Int. Bus. J. 2011, 22, 83–110. [Google Scholar]

- Lee, J.D.; Chung, Y.H. The Effect of Innovation Activities on Asymmetric cost Behavior. Korean Bus. Educ. Rev. 2018, 33, 259–273. [Google Scholar] [CrossRef]

- Mendes, A.M.; Santos, M.J. Strategic CSR: An integrative model for analysis. Soc. Responsib. J. 2016, 12, 363–381. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategic & Society: The Link Between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2006, 84, 56–68. [Google Scholar]

- Jang, J.K. The Relation between Corporate Social Responsibility and Firm Value. Korea Contents Soc. 2015, 15, 455–462. [Google Scholar] [CrossRef]

- Blowfield, M. Reasons to be cheerful? What we know about csr’s impact. Third World Q. 2007, 28, 683–695. [Google Scholar] [CrossRef]

- David, P.; Kline, S.; Dai, Y. Corporate social responsibility practices, corporate identity, and purchase intention: A dual-process model. J. Public Relat. Res. 2005, 17, 291–313. [Google Scholar] [CrossRef]

- Johnson, L.D.; Pazderka, B. Firm value and investment in R&D. Manag. Decis. Econ. 1993, 14, 15–24. [Google Scholar]

- Reinganum, J.F. Innovation and Industry Evolution. Q. J. Econ. 1985, 100, 81–99. [Google Scholar] [CrossRef] [Green Version]

- Min, B.S.; Smyth, R. How does leverage affect R&D intensity and how does R&D intensity impact on firm value in South Korea? Appl. Econ. 2016, 48, 5667–5675. [Google Scholar]

- Eng, L.L.; Shackell, M. The Implications of Long-Term Performance Plans and Institutional Ownership for Firms’ Research and Development (R&D) Investments. J. Account. Audit. Financ. 2001, 16, 117–139. [Google Scholar]

- Mitchell, G.R.; Hamilton, W.F. Managing R&D as A Strategic Option. Res. Technol. Manag. 1988, 31, 15–22. [Google Scholar]

- Kim, J.S.; Kim, S.C. Innovation and the Default Risk of Firms. Korean Manag. Rev. 2009, 38, 773–797. [Google Scholar]

- Bhatt, P.; Ahmad, A.J.; Roomi, M.A. Social innovation with open source software: User engagement and development challenges in India. Technovation 2016, 52, 28–39. [Google Scholar] [CrossRef]

- Ehie, I.C.; Olibe, K. The effect of R&D investment on firm value: An examination of US manufacturing and service industries. Int. J. Prod. Econ. 2010, 128, 127–135. [Google Scholar]

- Rong, Z.; Xiao, S. Innovation-Related Diversification and Firm Value. Eur. Financ. Manag. 2017, 23, 475–518. [Google Scholar] [CrossRef]

- Hirschey, M.; Weygandt, J.J. Amortization policy for advertising and research and development expenditures. J. Account. Res. 1985, 23, 326–335. [Google Scholar] [CrossRef]

- Seo, R.J.; Kim, J.S. Technology Innovation, Market Share and Firm Value in the Panel of Korean Manufacturing Firms. J. Ind. Econ. Bus. 2011, 24, 3211–3226. [Google Scholar]

- Flammer, C.; Bansal, P. Does A Long-Term Orientation Create Value? Evidence From A Regression Discontinuity. Strateg. Manag. J. 1990, 38, 1827–1847. [Google Scholar] [CrossRef]

- Guping, C.; Safdar, S.M.; Wan, P.; Badulescu, A.; Badulescu, D.; Vianna Brugni, T. Do Board Gender Diversity and Non-Executive Directors Affect CSR Reporting? Insight from Agency Theory Perspective. Sustainability 2020, 12, 8597. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Agency Theory: An Assessment and Review. Acad. Manag. Rev. 1989, 14, 57–74. [Google Scholar] [CrossRef]

- Wiese, A.; Toporowski, W. CSR failures in food supply chains—An agency perspective. Br. Food J. 2013, 115, 92–107. [Google Scholar] [CrossRef]

- Li, F.; Li, T.; Minor, D.A. Test of Agency Theory: CEO Power, Firm Value, and Corporate Social Responsibility. Int. J. Manag. Financ. 2016, 12, 611–628. [Google Scholar] [CrossRef]

- Milton, S. Some observations on CSR and Strategic Management. Bp. Manag. Rev. 2010, 41, 59–67. [Google Scholar] [CrossRef]

- Hillman, A.J.; Keim, G.D. Shareholder value, stakeholder management, and social issues: What’s the bottom line. Strateg. Manag. J. 2001, 22, 125–139. [Google Scholar] [CrossRef]

- Gassmann, O.; Enkel, E.; Chesbrough, H. The future of open innovation. R&D Manag. 2010, 40, 213–221. [Google Scholar]

- Hoskisson, R.E.; Hitt, M.A.; Wan, W.P.; Yiu, D. Theory and research in strategic management: Swings of a pendulum. J. Manag. 1999, 25, 417–456. [Google Scholar] [CrossRef]

- Dahlsrud, A. How corporate social responsibility is defined: An analysis of 37 definitions. Corp. Soc. Responsib. Environ. Manag. 2008, 15, 1–13. [Google Scholar] [CrossRef]

- Ozdora-Aksak, E.; Atakan-Duman, S. Gaining legitimacy through CSR: An analysis of Turkey’s 30 largest corporations. Bus. Ethics Eur. Rev. 2016, 25, 238–257. [Google Scholar] [CrossRef] [Green Version]

- Guo, Z.; Hou, S.; Li, Q. Corporate Social Responsibility and Firm Value: The Moderating Effects of Financial Flexibility and R&D Investment. Sustainability 2020, 12, 8452. [Google Scholar]

- Hu, Y.; Chen, S.; Shao, Y.; Gao, S. CSR and Firm Value: Evidence from China. Sustainability 2018, 10, 4597. [Google Scholar] [CrossRef] [Green Version]

- Barnea, A.; Rubin, A. Corporate Social Responsibility as a Conflict Between Shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Harjoto, M.; Laksmana, I. The Impact of Corporate Social Responsibility on Risk Taking and Firm Value. J. Bus. Ethics 2018, 151, 353–373. [Google Scholar] [CrossRef]

- Chung, C.Y.; Jung, S.; Young, J. Do CSR Activities Increase Firm Value? Evidence from the Korean Market. Sustainability 2018, 10, 3164. [Google Scholar] [CrossRef]

- Jeon, I.S.; Seol, Y.Y.; Kim, C.K. The Relevance of Corporate Social Responsibility and Corporate Value. Korean Bus. Educ. Rev. 2012, 27, 361–387. [Google Scholar]

- Magelssen, C. Allocation of property rights and technological innovation within firms. Strateg. Manag. J. 2020, 41, 758–787. [Google Scholar] [CrossRef]

- Deegan, C.; Rankin, M.; Voght, P. Firms’ Disclosure Reactions to Major Social Incidents: Australian Evidence. Account. Forum 2000, 24, 101–130. [Google Scholar] [CrossRef]

- Deephouse, D.L. To be different, or to be the same? It’s a question (and theory) of strategic balance. Strateg. Manag. J. 1999, 20, 147–166. [Google Scholar] [CrossRef]

- Lim, M.S.; Kim, C.Y.; Yoo, J.W. How Strategic Conformity Interacts with Innovation: An Empirical Study on Korean Manufacturing Firms from the Perspective of Optimal Distinctiveness. J. Open Innov. Technol. Mark. Complex. 2020, 6, 121. [Google Scholar] [CrossRef]

- Zhao, E.Y.; Fisher, G.; Lounsbury, M. Optimal distinctiveness: Broadening the interface between institutional theory and strategic management. Strateg. Manag. J. 2017, 38, 93–113. [Google Scholar] [CrossRef]

- Branco, M.C.; Rodrigues, L.L. Corporate Social Responsibility and Resource-Based Perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Hart, S.L. A Natural-Resource-Based View of The Firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef] [Green Version]

- Porter, M.E.; Kramer, M.R. The competitive advantage of corporate philanthropy. Harv. Bus. Rev. 2002, 80, 56–68. [Google Scholar] [PubMed]

- Porter, M.E.; Kramer, M.R. Corporate philanthropy: Taking the high ground. Foundation strategy group. 2003. Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=20671 (accessed on 11 September 2022).

- Gallego-Álvarez, I.; Prado-Lorenzo, J.M.; García-Sánchez, I.M. Corporate social responsibility and innovation: A resource-based theory. Manag. Decis. 2011, 49, 1709–1727. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Academy of Management. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Mishra, D.R. Post-innovation CSR Performance and Firm Value. J. Bus. Ethics 2017, 140, 285–306. [Google Scholar] [CrossRef]

- Panwar, R.; Paul, K.; Nybakk, E.; Hansen, E.; Thompson, D. The legitimacy of CSR actions of publicly traded companies versus family-owned companies: JBE. J. Bus. Ethics 2014, 125, 481–496. [Google Scholar] [CrossRef]

- Withisuphakorn, P.; Jiraporn, P. The effect of firm maturity on corporate social responsibility (CSR): Do older firms invest more in CSR? Appl. Econ. Lett. 2016, 23, 298–301. [Google Scholar] [CrossRef]

- Finkelstein, S.; Hambrick, D.C. Top-Management-Team Tenure and Organizational Outcomes: The Moderating Role of Managerial Discretion. Adm. Sci. Q. 1990, 35, 484–503. [Google Scholar] [CrossRef]

- Fagerberg, J.; Mowery, D.C.; Nelson, R.R. Innovation, 4th ed.; Oxford University Press: Oxford, UK, 2005. [Google Scholar]

- Servaes, H.; Tamayo, A. The Impact of Corporate Social Responsibility on Firm Value: The Role of Customer Awareness. Manag. Sci. 2013, 59, 1045–1061. [Google Scholar] [CrossRef] [Green Version]

- Gilbert, R.; Newbery, D. Preemptive patenting and the persistence of monopoly. Am. Econ. Rev. 1982, 72, 514–526. [Google Scholar]

- D’Amato, A.; Falivena, C. Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 909–924. [Google Scholar] [CrossRef]

- Na, Y.; Hong, S.H. An Empirical Analysis on Value Relevance of Corporate Social Responsibility Activities by Firm Size. Korean Account. J. 2011, 20, 125–160. [Google Scholar]

- Ryu, D.W.; Ryu, D.J.; Hwang, J.H. Corporate Social Responsibility: Investment or Expense? Korean Manag. Rev. 2017, 46, 1127–1155. [Google Scholar] [CrossRef]

- Branch, B. Research and development Activity and Profitability-A Distributed Lag Analysis. J. Political Econ. 1974, 82, 999–1011. [Google Scholar] [CrossRef]

- Sougiannis, T. The Accounting Based Valuation of Corporate R&D. Account. Rev. 1994, 69, 44–68. [Google Scholar]

- Chesbrough, H.; Vanhaverbeke, W.; West, J. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2006; Volume 1. [Google Scholar]

- Bae, Y.; Chang, H. Efficiency and effectiveness between open and closed innovation: Empirical evidence in South Korean manufacturers. Technol. Anal. Strateg. Manag. 2012, 24, 967–980. [Google Scholar] [CrossRef]

- Dionisio, M.; de Vargas, E.R. Corporate social innovation: A systematic literature review. Int. Bus. Rev. 2020, 29, 101641. [Google Scholar] [CrossRef]

- Eichler, G.M.; Schwarz, E.J. What sustainable development goals do social innovations address? A systematic review and content analysis of social innovation literature. Sustainability 2019, 11, 522. [Google Scholar] [CrossRef] [Green Version]

- Meyer, J.W.; Rowan, B. Institutionalized organizations: Formal structure as myth and ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef] [Green Version]

- Osburg, T. Social Innovation to Drive Corporate Sustainability. Social Innovation; Springer: Berlin/Heidelberg, Germany, 2013; Volume 3, pp. 13–22. [Google Scholar]

- Schmidthuber, L.; Piller, F.; Bogers, M.; Hilgers, D. Citizen participation in public administration: Investigating open government for social innovation. R&D Manag. 2019, 49, 343–355. [Google Scholar]

- Roszkowska-Sliz, M. Exploring the Link Between Strategic CSR and Open Innovation. In Proceedings of the ISPIM Innovation Symposium, The International Society for Professional Innovation Management (ISPIM), Dublin, Ireland, 8–11 June 2014; Volume 1, pp. 1–21. [Google Scholar]

- Enkel, E.; Gassmann, O.; Chesbrough, H. Open R&D and open innovation: Exploring the phenomenon. R&D Manag. 2009, 39, 311–316. [Google Scholar]

- Felin, T.; Zenger, T.R. Closed or open innovation? Problem solving and the governance choice. Res. Policy 2014, 43, 914–925. [Google Scholar] [CrossRef]

- Ghodbane, W. Corporate social responsibility and performance outcomes of high technology firms: Impacts on open innovation. J. Syst. Manag. Sci. 2009, 9, 29–38. [Google Scholar]

- Ayuso, S.; Rodríguez, M.Á.; García-Castro, R.; Ariño, M.Á. Does Stakeholder Engagement Promote Sustainable Innovation Orientation? Ind. Manag. Data Syst. 2011, 111, 1399–1417. [Google Scholar] [CrossRef]

- Luo, X.; Wang, H.; Raithel, S.; Zheng, Q. Corporate social performance, analyst stock recommendations, and firm future returns. Strateg. Manag. J. 2013, 36, 123–136. [Google Scholar] [CrossRef]

- Bresciani, S.; Camilleri, M.A.; Troise, C.; O’Regan, N. Creating value through open innovation approaches: Implications for corporate sustainability and responsibility. 2022. Available online: https://www.um.edu.mt/library/oar/handle/123456789/86697 (accessed on 11 September 2022).

- Holmes, S.; Smart, P. Exploring Open Innovation Practice in Firm-nonprofit Engagements: A Corporate Social Responsibility Perspective. R&D Manag. 2009, 39, 394–409. [Google Scholar]

- Unceta, A.; Castro-Spila, J.; Garcia Fronti, J. The three governances in social innovation. Innov. Eur. J. Soc. Sci. Res. 2017, 30, 406–420. [Google Scholar] [CrossRef]

- Yun, J.J.; Park, K.; Im, C.; Shin, C.; Zhao, X. Dynamics of social enterprises—Shift from social innovation to open innovation. Sci. Technol. Soc. 2017, 22, 425–439. [Google Scholar] [CrossRef]

- Alexy, O.; George, G.; Salter, A. From Sensing Shape to Shaping Sense: A Dynamic Model of Absorptive Capacity and Selective Revealing. Acad. Manag. Rev. 2013, 38, 270–291. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- ter Hoeven, C.L.; Verhoeven, J.W.M. “Sharing is caring”: Corporate social responsibility awareness explaining the relationship of information flow with affective commitment”. Corp. Commun. Int. J. 2013, 18, 264–279. [Google Scholar] [CrossRef]

- Baker, S.; Mehmood, A. Social innovation and the governance of sustainable places. Local Environ. 2015, 20, 321–334. [Google Scholar] [CrossRef]

- Chalmers, D. Social innovation: An exploration of the barriers faced by innovating organizations in the social economy. Local Econ. 2013, 28, 17–34. [Google Scholar] [CrossRef]

- Chesbrough, H.; Di Minin, A. Open social innovation. New Front. Open Innov. 2014, 16, 301–315. [Google Scholar]

- Lau, A.K.; Lo, W. Regional innovation system, absorptive capacity and innovation performance: An empirical study. Technol. Forecast. Soc. Change 2015, 92, 99–114. [Google Scholar] [CrossRef]

- Roszkowska-Menkes, M.T. Integrating strategic CSR and open innovation. Towards a conceptual framework. Soc. Responsib. J. 2018, 14. [Google Scholar] [CrossRef]

- Bosworth, D.; Rogers, M. Market Value, R&D and Intellectual Property: An Empirical Analysis of Large Australian Firms. Econ. Rec. 2001, 77, 323–337. [Google Scholar]

- Oliver, C. Sustainable competitive advantage: Combining institutional and resource-based views. Strategy Manag. J. 1997, 18, 697–713. [Google Scholar] [CrossRef]

- Gotsi, M.; Wilson, A.M. Corporate reputation management: Living the brand. Manag. Decis. 2001, 39, 99–104. [Google Scholar] [CrossRef]

| Type of Innovation | Concept | Representative Case | |

|---|---|---|---|

| Technological Innovation | Product innovation | When releasing a completely differentiated product with superior performance over existing products | MP3 players, ABS-braking systems |

| Process innovation | When introducing differentiated techniques and improvements in the manufacturing process and logistics method that are not currently in use | RFID, CAD | |

| Reference | Definition of Stakeholders |

|---|---|

| Stanford memo, 1963 | Define a group as a stakeholder in the case where a firm’s survival may be interrupted when there is no support from the group. |

| Rhenmen, 1964 | Define a stakeholder relationship when a firm relies on someone to achieve its personal goals or when the firm relies on someone to survive. |

| Ahlstedt & Jahnukainen, 1971 | Definition of participants in a firm that moves according to their interests and goals. |

| Freeman & Reed, 1983 | Broad meaning: defined as a group that can be influenced or affected by achieving an organization’s goals. Narrow meaning: defined as an organization that relies on sustainable survival. |

| Freeman & Gilbert, 1987 | Defined as a group that can be influenced or affected by a business. |

| Cornell & Shapiro, 1987 | Defined as claimants under contract. |

| Evan & Freeman, 1988 | Defined as a group that holds a stake in a firm or has the right to claim. |

| Alkhajaji, 1989 | Defined as responsible group. |

| Carroll, 1989 | Defined as a group with interests (legal or moral), rights, or shares in legal ownership of a firm’s property. |

| Thompson et al., 1991 | Defined as an individual or a group having a relationship with a firm. |

| Savage et al., 1991 | Defined as a group that is interested in and can influence a firm’s activities. |

| Hill & Jones, 1992 | Defined as a group of interchanges that can exercise legitimate claims against a firm, supply important resources to the firm, and benefit from meeting expectations. |

| Brenner, 1993 | Defined as an individual or a group having a legitimate and insignificant relationship with a firm, such as a transaction relationship, a relationship that influences and receives behavior, and a relationship linked to moral responsibility. |

| Langtry, 1994 | The case where a group may demand moral or legal claims and the firm is responsible for the happiness of the individual or group. |

| Wicks et al., 1994 | Defined as an individual or a group that interacts with a firm and gives meaning and justice to the firm. |

| Clarkson, 1994 | Defined as an individual or a group who may be put at risk or affected as a result of investing in a firm in capital, labor, finance, or something valuable. |

| Variables | AVG | SD | VIF | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. Firm value | 0.72 | 0.47 | ||||||||

| 2. Market share | 0.06 | 0.14 | 1.46 | 0.07 | ||||||

| 3. Sales operating profit ratio | 8.43 | 9.06 | 1.20 | 0.34 *** | 0.24 *** | |||||

| 4. Debt ratio | 73.4 | 53.1 | 1.13 | 0.15 * | 0.02 | −0.27 *** | ||||

| 5. Firm size | 6.69 | 1.27 | 1.35 | 0.09 | 0.41 *** | 0.14 | 0.03 | |||

| 6. Firm age | 3.35 | 1.02 | 1.10 | −0.15 * | 0.04 | −0.08 | −0.16 * | −0.02 | ||

| 7. Industry type | 0.66 | 0.47 | 1.42 | 0.25 *** | −0.23 ** | 0.07 | −0.09 | 0.07 | 0.04 | |

| 8 Technological innovation | 0.00 | 1.00 | 1.74 | 0.42 *** | −0.06 | 0.10 | −0.03 | 0.28 *** | −0.16 * | 0.46 *** |

| 9. Strategic CSR conformity | 0.00 | 1.00 | 1.26 | −0.09 * | −0.18 * | −0.14 * | 0.01 | −0.19 ** | 0.01 | 0.06 |

| Step | Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|---|

| β(t) | β(t) | β(t) | β(t) | ||

| 1 | Control Variables | ||||

| Market share | 0.156 (0.50) | 0.239 (0.82) | 0.248 (0.85) | 0.406 (1.40) | |

| Sales operating profit ratio | 0.019 *** (4.28) | 0.019 *** (4.44) | 0.019 *** (4.43) | 0.019 *** (4.46) | |

| Debt ratio | 0.002 ** (3.00) | 0.002 *** (3.27) | 0.002 *** (3.26) | 0.002 ** (3.23) | |

| Firm size | −0.004 (−0.13) | −0.042 (−1.31) | −0.042 (−1.28) | −0.039 (−1.24) | |

| Firm age | −0.043 (1.13) | −0.013 (−0.34) | −0.012 (−0.33) | −0.009 (−0.24) | |

| Industry type (high-tech/low-tech) | 0.268 ** (3.19) | 0.107 (1.22) | 0.102 (1.14) | 0.122 (1.40) | |

| 2 | Main effect variables | ||||

| Technological innovation | 0.178 *** (4.20) | 0.182 *** (4.15) | 0.138 ** (3.02) | ||

| Strategic CSR conformity | 0.013 (0.34) | 0.048 (1.23) | |||

| 3 | Interaction | ||||

| Technological innovation * Strategic CSR conformity | −0.071 ** (−2.71) | ||||

| Model | |||||

| R² | 0.24 | 0.34 | 0.34 | 0.38 | |

| Adjusted R² | 0.20 | 0.30 | 0.29 | 0.33 | |

| F value | 6.54*** | 8.90*** | 7.75*** | 8.07*** |

| Step | Variables | Model 1 | Model 2 | Model 3 |

|---|---|---|---|---|

| β(t) | β(t) | β(t) | ||

| 1 | Control Variables | |||

| Market share | 0.205 (0.31) | −0.040 (−0.06) | −0.006 (−0.00) | |

| Sales operating profit ratio | 0.019 *** (3.41) | 0.019 *** (3.38) | 0.018 *** (3.31) | |

| Debt ratio | 0.003 ** (2.96) | 0.002 *** (2.97) | 0.003 ** (2.96) | |

| Firm size | −0.085 (−1.76) | −0.102 (−2.14) | −0.103* (−2.13) | |

| Firm age | −0.49 (−0.94) | −0.033 (−0.63) | −0.036 (−0.67) | |

| Industry type | 0.252 (2.56) | 0.165 (1.55) | 0.165 (1.53) | |

| 2 | Main effect Variables | |||

| Technological innovation | 0.101 (1.43) | 0.114 (1.31) | ||

| Strategic CSR conformity | 0.110 (1.70) | 0.101 (1.39) | ||

| 3 | Interaction | |||

| Technological innovation * strategic CSR conformity | −0.029 (−0.26) | |||

| Model | ||||

| R² | 0.29 | 0.34 | 0.34 | |

| Adjusted R² | 0.23 | 0.26 | 0.25 | |

| F value | 4.84 *** | 4.50 *** | 3.95 *** |

| Step | Variables | Model 1 | Model 2 | Model 3 |

|---|---|---|---|---|

| β(t) | β(t) | β(t) | ||

| 1 | Control Variables | |||

| Market share | 0.053 (0.13) | 0.183 (0.50) | 0.330 (0.93) | |

| Sales operating profit ratio | 0.016 (1.88) | 0.016 * (2.07) | 0.016 * (2.18) | |

| Debt ratio | 0.002 (1.16) | 0.002 (1.20) | 0.001 (0.98) | |

| Firm size | 0.036 (0.67) | −0.008 (−0.17) | 0.005 (0.10) | |

| Firm age | −0.039 (−0.65) | −0.009 (−0.17) | 0.020 (0.37) | |

| Industry type | 0.293 (0.08) | −0.006 (−0.03) | 0.018 (0.10) | |

| 2 | Main effect Variables | |||

| Technological innovation | 0.214 ** (3.30) | 0.123 (1.66) | ||

| Strategic CSR conformity | 0.005 (0.08) | 0.063 (1.08) | ||

| 3 | Interaction | |||

| Technological innovation * strategic CSR conformity | −0.085 * (−2.27) | |||

| Model | ||||

| R² | 0.20 | 0.39 | 0.45 | |

| Adjusted R² | 0.09 | 0.27 | 0.34 | |

| F value | 1.85 | 3.36** | 3.85 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choi, S.; Yoo, J. The Impact of Technological Innovation and Strategic CSR on Firm Value: Implication for Social Open Innovation. J. Open Innov. Technol. Mark. Complex. 2022, 8, 188. https://doi.org/10.3390/joitmc8040188

Choi S, Yoo J. The Impact of Technological Innovation and Strategic CSR on Firm Value: Implication for Social Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(4):188. https://doi.org/10.3390/joitmc8040188

Chicago/Turabian StyleChoi, Soohwan, and Jaewook Yoo. 2022. "The Impact of Technological Innovation and Strategic CSR on Firm Value: Implication for Social Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 4: 188. https://doi.org/10.3390/joitmc8040188

APA StyleChoi, S., & Yoo, J. (2022). The Impact of Technological Innovation and Strategic CSR on Firm Value: Implication for Social Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8(4), 188. https://doi.org/10.3390/joitmc8040188