1. Introduction

There has been tremendous progress since the concept of open innovation was introduced by Chesbrough [

1]. He defined open innovation as “the use of purposive inflows and outflows of knowledge to accelerate internal innovation, and expand the markets for external use of innovation, respectively. Open innovation is a paradigm that assumes that firms can and should use external ideas as well as internal ideas, and internal and external paths to market, as they look to advance their technology” [

2]. The adoption of open innovation has become imperative because it is impossible, or at least extremely difficult, to expect firms to possess all necessary resources. Expecting firms to possess all required resources so that their capabilities are always well fitted with the business environment is nearly impossible; in fact, this tends to be dangerous [

3].

Open innovation offers a number of advantages to firms. It facilitates firms to collaborate with various external parties to obtain knowledge [

1]. Open innovation can break down functional silos and facilitate various disciplines and sectors to work together. These collaborations can result in disruptive innovation for solving complex problems, which could not have been achieved with traditional ways [

4]. In addition, open innovation has been proven to help companies to overcome uncertain situations due to the emergence of new technologies. Through developing alliances, laggard firms from various industries can combine resources so that they can catch up with innovation leaders [

5]. With open innovation, companies can develop non-core knowledge and set up new partnerships [

6].

Through the use of open innovation, firms can acquire necessary resources beyond organizational boundaries [

7], which can subsequently be reconfigured with firms’ internal resources [

8]. To do this, firms require dynamic capabilities, which are defined as “the firm’s ability to integrate, build, and reconfigure internal and external competencies to address rapidly changing environment” [

9]. In addition, dynamic capabilities support firms to identify new opportunities, and to some extent, to acquire external knowledge to fill capability gaps. Moreover, capabilities facilitate firms to integrate external knowledge into the organization [

10]. To achieve this goal, companies can implement open innovation to obtain external resources and use dynamic capabilities to integrate them with internal resources [

10].

The majority of research in the fields of dynamic capabilities and open innovation is not carried out comprehensively; the two topics were largely analyzed separately, and mostly utilized large-sized companies as subjects. These studies are not able to obtain a strategic perspective covering both concepts, and therefore understanding regarding how and in what way the concepts create support for one another seems to be still lacking. This study attempts to address this knowledge gap by analyzing the mechanism of how both concepts interplay from a strategic perspective. Thus, the research questions proposed in this study are twofold. First, how do dynamic capabilities support firms to align resources, strategies and capabilities for pursuing open innovation? Second, how do activities in dynamic capabilities support different phases of open innovation?

This research uses a strategic perspective to examine how activities of dynamic capabilities influence firms’ open innovation phases through the reconfiguration of resources and knowledge; to our best knowledge, this is the first study addressing this issue. Here, we adopt a definition from the existing work of Go [

11] who defines the term as “looking at the whole business within the context of key factors, such as market opportunity, competitive advantage and resourcing”. The use of a strategic perspective enables researchers to analyze how activities of dynamic capabilities contribute to firms’ capabilities [

12]. Furthermore, this approach enables researchers to observe how the mechanisms of the three activities of dynamic capability, i.e., sensing, seizing and performing, make different contributions to the four phases of open innovation. Expectedly, the findings of this study can elucidate the complex interplays between activities of dynamic capabilities with phases in open innovation [

13].

Although there have been very limited studies addressing both concepts, i.e., [

8,

14], these works were carried out in large-sized firms characterized by knowledge and technology-intensive applications. The degree of technology application affects the practices of open innovation [

15]. Open innovation in large-sized firms and SMEs have similarities in some respects, but the practices of open innovation in large-sized firms cannot be applied directly to small companies. This is because the practices in SMEs are not scaled down from those in large-sized firms [

16,

17]. Additionally, open innovation provides a different degree of benefits between SMEs and large firms, where the former gain more than the latter [

16]. SMEs can move flexibly, are more willing to take risks, are faster in making decisions, and have more liquid resources that enable them to respond more quickly to market changes [

18]. Nevertheless, these privileges also cause some issues for SMEs. SMEs tend to focus on certain firms to collaborate with, particularly companies with similar sizes and characteristics situated in nearby geographic locations [

6]. For the reasons above, the use of SMEs as subjects will expand knowledge in the field of dynamic capabilities and open innovation.

This study is organized into six sections. In

Section 2, the literature review, we elaborate relevant existing theories as the foundation for our study. In

Section 3, we describe how we executed this study, along with several rationales for case study design. In

Section 4, we analyze empirical findings from the field, followed by a discussion with relevant literature in

Section 5. Last, we summarize our findings in the

Section 6 conclusion.

4. Analysis and Findings

The focus of this section is on a series of processes of making a large number of scattered and unstructured data so that linkages and structures between concepts can be clearly seen [

52]. First, we refined the data in cycling steps between emergent themes, concepts and constructs we obtained from the relevant literature. This stage was undertaken to ensure that “what we are finding has precedents, but also whether we have discovered new concepts” [

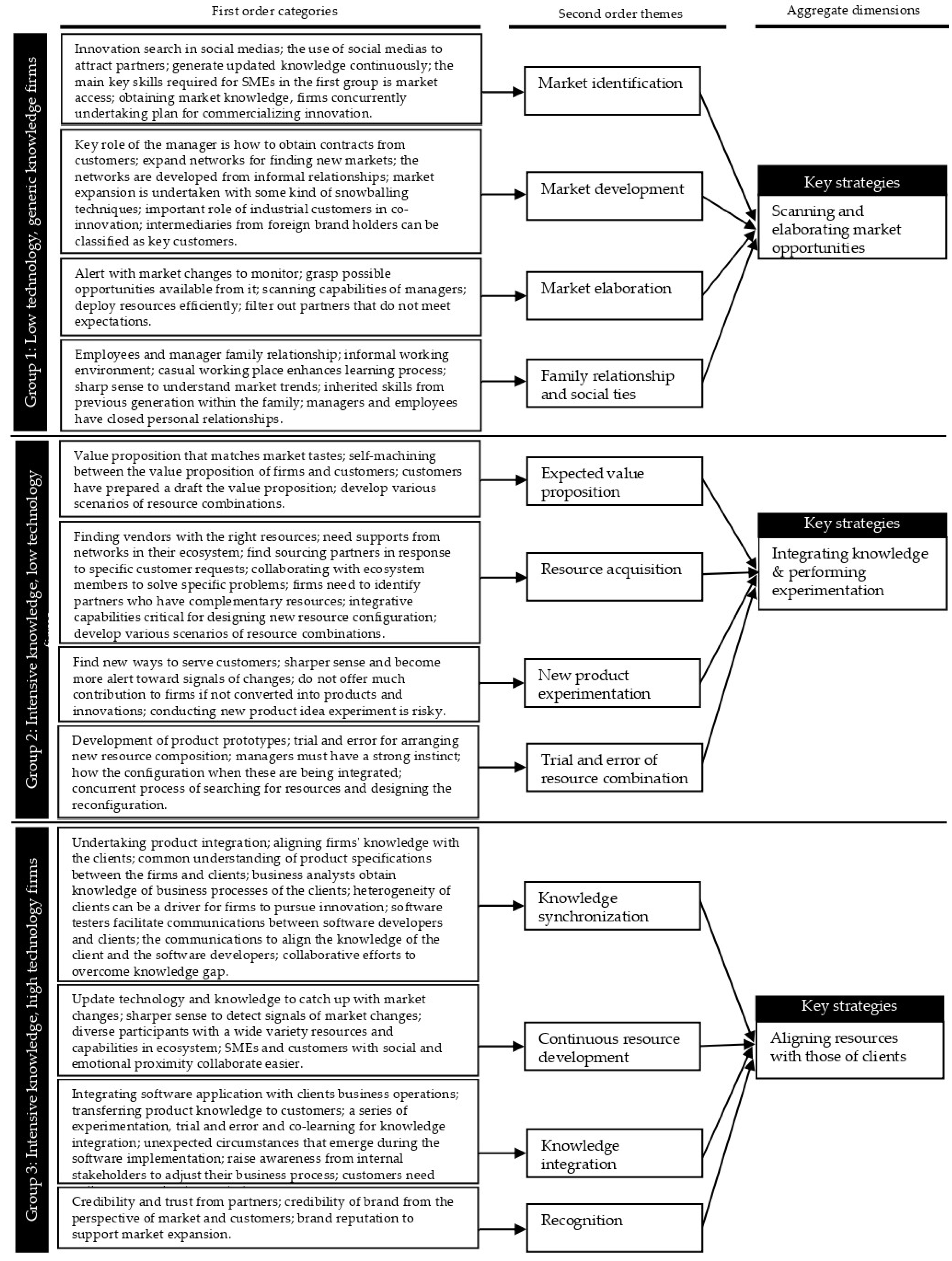

51]. We derived the first order themes demonstrating practices, which are connected to the dimensions of dynamic capabilities and open innovation. Emerging themes at this stage are assigned in the first-order and

italicized in the narrative text in this section.

Second, we conducted data reduction to identify within group similarities and differences [

47]. Similar themes in the first-order are combined into the same second-order. Finally, the second-order themes are integrated into an aggregate dimension, which constitutes the strategies of firms within each group. The data structure, presented in

Figure 1 helps researchers to communicate the analysis of the results with the audience visually and see how the data refinement process starts from raw data and categorizes it into code in several levels [

51].

4.1. Group 1: Generic Knowledge and Low Technology SMEs

During turbulent times due to the pandemic, digital technologies have provided tremendous support to case study firms for sensing and creating opportunities. SME managers in this group conduct innovation searches in social media to enable firms to identify and develop potential ideas for innovation. In addition, the use of social media to attract partners from various geographic locations is cost efficient. Displaying product samples on social media has made it easier for customers to evaluate whether the products they want are following their needs.

The search was also intended for obtaining new knowledge regarding what is trending in the market. As SME case studies are supported with limited resources, the managers should always be aware to generate updated knowledge continuously, which enables them to be more sensitive toward emerging opportunities.

The main skill required for SMEs in the first group is market access. To access the market, the sensing capabilities of managers help the firms to win market domains that are not identified by competitors. When conducting sensing activities, which are dominated by obtaining market knowledge, firms concurrently undertake plans for commercializing innovation. The firms do not have much interest to acquire new knowledge to create innovation, but rather they prefer not to accept orders in case they are unable to manufacture products.

The key role of the managers is how to obtain contracts from customers to ensure the sustainability of the firms’ operations. Only managers have access to communicate with customers from overseas. On the other hand, these customers do not trust everyone from the SMEs except the managers, as expressed below:

“There are no tips on how to reach the foreign market. What I’ve got is just acquaintances, there is no formal procedure. I’ve never applied [i.e., submitted proposal] to government bodies or others for exporting products”

(Manager, HandicratCo).

Due to the generic nature of the products, firms in this group aggressively attempt to expand networks for finding new markets. The majority of the networks are developed from informal relationships with acquaintances, family or past experiences. Existing customers are the source for developing the networks. These customers are often willing to provide recommendations so that the managers can contact friends of the current customers. So, market expansion is undertaken with some kind of snowballing technique.

SMEs in the first group expect to receive orders from industrial customers. These customers not only order products on a large scale but also become partners in co-innovation. They have market information resulting from their market research, and the information is valuable for the case study firms to pursue innovation.

Due to the important role of industrial customers in co-innovation and their large transaction value, the firms categorize them as key customers. In addition to industrial customers, other parties can be classified as key customers and can be intermediaries from foreign brand holders. These intermediaries are fragile because they can easily switch to other SMEs if firms are unable to meet their expectations. This is because there is not any unique knowledge and technology from the firms in the eyes of intermediaries.

Industrial customers and intermediaries have different roles in the innovation process and different levels of involvement in new product development. Intermediaries have more limited roles in the innovation process in comparison to industrial customers as described by a manager below:

“Intermediaries are from abroad, [they] do not give us much room for innovation. They will only talk with us about how to make products, but not the design. They already have it. We can ask what if we produce this product this way, or we make products using other techniques, or slightly different materials.”

(Owner, LeatherFashionCo).

Meanwhile, industrial customers design and market their products so that there is more room for altering new product designs as described below:

“Industrial customers are the most attractive. They’re willing to talk about how to design products that can sell well. They are also open to talking about the product price. They have to know how much the production costs will be if the design is like this, or like that.”

(Owner, LeatherFashionCo).

SMEs must be alert to market changes to monitor and grasp possible opportunities available to them. Unfortunately, these responsibilities are embedded in the managers only, not distributed to individuals throughout the organization. Thus, the justification for whether it is necessary or not to innovate lies in the hands of the managers.

Using the scanning capabilities, managers can identify which ideas are good and which are not for innovation. In addition, at the sensing stage, the case study firms can predict roughly who can be partners to generate synergies, and which partners are less suitable to work with. Strong scanning capabilities enable firms to deploy resources efficiently and filter out partners that do not meet expectations.

Most personnel of both SMEs in this group have a family relationship with the managers. This relationship, combined with a casual working environment and strong social ties between the owner and employees of SMEs, have enabled the firms to become solid organizations that are eager to make unfamiliar decisions. In addition, the informal working environment proliferated in this SME group enhances the learning process.

Managers are required to have a sharp sense to understand market trends, and this skill is inherited from the previous generation within the family. Limited resource availability encouraged case study firms to portray what is going to happen in the future and how to allocate resources in the most beneficial options. In such circumstances, managers typically looked at experience and combined it with intuition to make decisions.

Although the managers and employees have close personal relationships, sometimes an awkward situation occurs between them. As an example, the reallocation of resources from a workstation with a low work load to another sometimes has to be done using coercive power, as expressed below:

“We are friends [i.e., owner and employees], that’s true. But when it comes with work, it means money. There’s no longer hesitation or shyness to say that you must do something. Otherwise, your profitability will be harmed.”

(Supervisor, HandicraftCo).

4.2. Group 2: Knowledge Intensive and Low-Technology SMEs

SMEs in this group run their business with a small team consisting of architects and interior designers that focuses on the planning of property development, particularly private houses. In this group, new product developments are undertaken as responses to customers’ orders or auctions. All products are designed bespoke to customers’ orders. Due to their small size, the firms often seek partners, e.g., raw material vendors, civil engineering, mechanical and electrical consultants, etc., to turn their designs into products. To increase the chance of obtaining orders from customers or winning tenders from clients, firms in this group need to develop products with a value proposition that matches market tastes.

The customers contacted these firms because there is a set of expectations they want to obtain. In other words, the customers have conducted some sort of self-machining between the value proposition of the SMEs and the expected value they will receive, as explained below:

“Customers usually see many pictures on Instagram, Facebook, or showrooms. Then, they think about which one seems most suitable and then they come over and talk. Usually, our customers are like that. They don’t come to us suddenly and say, I want you to design our interior, no…not that way.”

(Manager, InteriorDesignCo).

Similarly, the manager of another case company expressed as follows:

“We have our character, our uniqueness, our focus in our field. The way we make products is unique; there is something that distinguishes them from other people’s works.”

(Principal architect, ArchitectCo).

From the statement above, it can be said that firms will find it easier to design products if customers have a certain degree of knowledge and a certain degree of clarity regarding what value proposition they want. Customers who are still struggling to define their value proposition will make architects and designers experience difficulties to serve them. Firms expect that customers have prepared a draft of the value proposition as expressed under the following conditions:

“If they don’t know what they want, their preferences, or what the design theme is, then the idea of making a product will only jump from one theme to another without a definite ending point. It is very exhausting from our side as the architects.”

(Junior architect, ArchitectCo).

After the value desired by the customer is clear, the manager analyzes what knowledge and resource gaps are needed in the product development process. If there is a knowledge gap, then the firms interact with the business ecosystem in which the firms operate to obtain the required knowledge and develop various scenarios of knowledge integration.

During the process of new product development, to meet highly diversified orders from clients, the most important point for SMEs is finding vendors with the appropriate resources to be configured with internal resources. To enable new resource configuration, SMEs in this group need the ability to seize external resources and to obtain them, firms need support from networks in their ecosystem. This is because a variety of designs and highly customized orders require resources scattered across different partners in the business ecosystem. Firms spend considerably high amounts to find partners, before moving on to delivering innovation to customers.

Customized designs often require unique product materials or new knowledge, e.g., analysis of concrete strength, a harmony of color and shape, the use of state-of-the-art materials, etc., which are not always available internally. Digital technologies have enabled SMEs in this group to organize collaborations among ecosystem members to solve their specific problems. The need to interact with partners from the ecosystem to overcome the knowledge and resource gap is stated as follows:

“Rendering civil engineering tests such as strength or stability tests, we use vendors. And so do material suppliers; at the present day the choices of materials are very diverse… we need to speak with them [vendors].”

(Junior architect, ArchitectCo).

These shortcomings drive case study firms to find partners and exploit their knowledge and resources. To achieve this goal, firms need to identify partners who have complementary resources, including material suppliers, civil engineering consultants, rendering firms, legal consultants, and environment analysts, etc.

Once the partners have been identified, SMEs need to mobilize external knowledge and resources to then be orchestrated with internal resources. At this point, integrative capabilities are critical for designing new resource configurations once the SMEs have found suitable partners. In the process of integrating internal and external knowledge, managers often rely on experience and accumulated knowledge from the past, as well as social networks. The need for partners by a manager in this group is described as follows:

“You can ask all architects. No architect can be great at everything. No architect is Superman. They definitely have to ask for a favor from others, whether it’s civil engineers or even junior architects.”

(Principal architect, ArchitectCo).

During the process of knowledge integration, SME managers slightly disobeyed rationality and put more emphasize on creativity. At this integration stage, firms must be careful because there is some potential for knowledge leakage to the partners. For this reason, firms in this group tend to share non-core knowledge and conduct selective knowledge sharing with external partners.

The SMEs in this group experience several challenges as well as benefits from participation in a business ecosystem. The firms have to update technology and knowledge with participants in the ecosystem and find new ways to serve customers; otherwise, the firms will be left out. Joining the ecosystem encourages firms to have a sharper sense and become more alert toward signals of changes. Furthermore, joining the ecosystem enables firms to view the business environment from a wider-angle view and broaden information sources beyond organizational boundaries. There has been a large amount of information obtained from partners in the ecosystem, which could not have been obtained without participating in it.

Ideas obtained from the ecosystem do not offer much contributions to firms if not converted into products and innovations, and these efforts need collaborations between firms and customers. To realize these aims, SMEs have to do product experimentation by testing various product ideas. Conducting new product idea experimentation is risky and involves a certain amount of cost, but firms will miss opportunities if they are not willingly doing it, as described below:

“Not all clients’ wants are good; sometimes [their wants are] ambitious, have too many flowery dreams, but if [their wants are] implemented, the results will be disappointing. If that’s the case, we [as architects] are subject to blame. But if we don’t follow what they say, they claim we are not listening. It’s a dilemmatic [situation] you know.”

(Principal architect, ArchitectCo).

During the development of product prototypes, clients are offered several alternative product designs with different concepts. Each product concept requires different resources, such as the availability of raw materials, choice of suppliers, maintenance costs, construction time and costs. Trial and error for configuring new resource composition are carried out to develop product designs with these various concepts. Communications with vendors and partners are conducted to arrange, modify, or combine resources so that the new configuration becomes more relevant to customized customer needs. An abundant number of resource options combined with difficulties in interpreting customer desires have made the resource combination process complex, as one staff member noted:

“We had meetings for hours just to decide the color of tiles for the living room floor. Every day people will be there, it’s a big decision. There are many color choices [so that decision becomes difficult]. Just one color can be interpreted in so many ways.”

(Owner, InteriorDesignCo).

To cope with the difficulties of interpreting customer wants and capturing the value desired by customers, managers must have a strong instinct about what market opportunities will arise. Architecture magazines, talk shows, recent works of influential architects, and exhibitions are some sources of information for figuring out future product design trends. Websites devoted to architecture and interior design are good references as well; some examples of these are archify.com, archdaily.com and apartmenttherapy.com. From here, managers arrange in advance what resources will be needed to seize incoming opportunities. Even if these firms attempt to obtain the resources from external parties, they must be concerned regarding how the configuration is integrated with internal resources. For ensuring successful external knowledge integration, the process of searching for external resources and designing reconfiguration runs concurrently rather than sequentially.

4.3. Group 3: Knowledge and Technology Intensive SMEs

When the SMEs in the third group implement software, the firms not only undertake product integration with the business process of the clients but also align knowledge with theirs. To enable knowledge integration, SMEs as software developers and clients as users must have a common understanding of product specifications. In this stage, business analysts play a major role. Business analysts who are assigned to obtain an overview of the business processes of the clients must provide information regarding the logical relationships between activities in the organization. The information is used as the basis for designing the software.

The majority of clients of SMEs in this group are firms struggling to digitize their business operations in response to the COVID-19 pandemic. The mindset of these firms has changed by becoming more open to cooperating with external parties. These mindset changes are a part of their efforts not only to survive the pandemic but also to prepare for generating innovation during the post pandemic period.

Clients’ heterogeneity affects the SMEs’ innovation capability. On the one hand, the heterogeneity of business processes of the clients has made the case study firms experience considerably complex software development processes. On the other hand, this heterogeneity can be a driver to enhance their innovation capability. Due to this uncertainty, SMEs as software developers attempt to avoid opportunistic behaviors from clients by encouraging them to sign contracts.

During the software development stage, the innovation process runs iteratively. Software testers facilitate communications between developers and clients during new software development and implementation. One of the purposes of communications is to align the knowledge of the client and the software developers. During knowledge alignment, there must be some knowledge gap between both parties, and for this reason, they must address this gap through collaboration.

Innovation is a moving target, and therefore case study firms need to update technology and knowledge when participants in the ecosystem find new ways to serve customers, as expressed by an informant below:

“At the beginning of the pandemic we were forced to learn about Facebook ads, many SMEs want to advertise on Facebook. We’ve never done that before, even worse, these people lack digital literacy so yes, it’s a bit full of drama…. we have to catch up with a recent update of market demand.”

(Manager, AppsCo).

One of the benefits of joining the ecosystem is that SMEs will have a sharper sense to detect signals of market changes. There are a lot of unexpected signals coming from various sources, which could not have been obtained if the firms did not participate in the ecosystem, as stated below:

“… many small businesses are starting to use Facebook, Instagram or trading platforms. But knowing that more and more small business need application software is from my former college friends, having chats here and there, and from a friend who just started his business.”

(Manager, AppsCo).

The case study firms engage in local communities of start-up firms and software developers. In the communities, these firms undertake knowledge exchange regarding how to take and give in a business ecosystem, which is made up of diverse participants with a wide variety of resources and capabilities. From the clients’ point of view, diversity offers many choices so they must be extra cautious to select which vendor to collaborate with because this decision cannot be reversed. On the contrary, the case study firms are also selective in selecting clients. Accepting unsuitable firms as clients to collaborate can incur excessive unexpected costs during product development. The SMEs and customers who have proximity in terms of social and emotional needs tend to be easier to develop a reciprocal relationship with.

The case study firms act not only as software developers but also as consultants during the application implementation. When implementing the software, they not only integrate software applications with clients’ business operations but also transfer product knowledge to customers. During this process, there are a series of experiments, trial and error and co-learning. The informal relationship between SMEs and clients supports creativity and problem-solving to overcome unexpected circumstances that emerge during the software implementation, as described below:

“We strive to be as detailed as possible to describe what it will look like after the application is implemented. Although the rough drawings are there, they are often going not as expected”

(Manager, SoftwareCo).

Innovations introduced by the case study firms are not always accepted by the clients. Sometimes customers feel worried if the resulting software applications being developed lack acceptance from people in clients’ organizations. To be implemented successfully, SMEs need to raise awareness from internal stakeholders to adjust their business process with the new software application products offered by the SMEs. To enable this, customers need the willingness to plug and play with the new knowledge offered by SMEs as software developers.

Case study firms require credibility and trust to gain acceptance from partners in the ecosystem. It should be emphasized here that credibility refers to the credibility of firms in the eyes of partners in the ecosystem, not the credibility of the brand from the perspective of the market or customers. The availability of resources, collaboration capabilities and knowledge transfer capabilities are more important than the brand reputation when firms attempt to find partners.

However, brand reputation facilitates firms to gain trust from clients, particularly when firms intend to pursue market expansion through collaboration. Market expansion is a critical issue for SMEs largely due to a limited number of clients. In such instances, brand reputation also helps firms when nurturing relationships with ecosystem participants. Communication with the participants in the ecosystem will help companies obtain updated market information for expansion.

5. Discussion: Pathways toward Aligning Resources, Strategies and Capabilities

Open innovation implemented in the SME case studies has supported firms to obtain necessary resources and develop capabilities for value creation following market demands [

13], and this study provides empirical evidence for this opinion. SMEs will be able to identify a capability gap, which can then be filled with open innovation. When firms should enter the market, how they must position new products and how they build capabilities are interrelated concepts [

53]. Strategy can be articulated as a filter because firms cannot deploy their limited resources to develop capabilities and harness all available opportunities [

12]. Without well-fitted capabilities, certain strategies cannot be realized.

In this section, we presented five themes explaining the interplays of resources, strategies and capabilities presented in

Table 2, and discussed further details in the

italicized text in the following subsection. We do not claim that there is a certain priority among the five emerging themes, i.e., which theme must come first before others. Rather, we argue that the themes interplay with one another in complex ways, forming a nested system. We do not recommend certain priorities among them, we suggest that the three groups of firms form a typology of pathways toward aligning resources, strategies and capabilities. Within each group, there is a certain pattern that can be followed as guidance for managers.

5.1. Strategies for Group 1: Scanning and Elaborating Market Opportunities

Due to the generic nature of the knowledge, it is difficult for firms in this group to win customers if they rely on knowledge alone. In addition, the generic nature of resources of these traditional SMEs has caused potential customers to select other firms using convenience consideration, without assigning certain criteria. Furthermore, the barrier to entry for potential competitors is low, due to the nature of knowledge and technology. In short, all firms in this group to some degree can be considered as just another company due to lack of knowledge uniqueness.

Suggested strategies for these firms to stand out from the crowd are actively

scanning and elaborating on market opportunities early to detect signals of change earlier. The capability to detect weak signals through active scanning is a critical point [

23]. This approach has also been evidenced in an existing work [

12] that pointed out that “the evaluative and inferential skill possessed by an organization and its management is important” to detect market trend signals. The capability of sensing changes in the environment can facilitate firms to generate deeper market knowledge, which is valuable for commercializing innovation [

12,

54]. Deciding as the first mover is risky but waiting could be more even dangerous due to the potential risk of losing [

55].

For this group,

external knowledge acquisition can be undertaken by obtaining ideas for innovation from the market and key customers, which can be classified into three groups: social media, industrial customers and intermediaries of foreign customers. Social media enable firms to scan and elaborate the market as well as expand networks in practical and cost-efficient ways. The role of social media for these purposes has been well documented in the literature [

56]. Industrial customers provide first-hand ideas for open innovation. What these customers order from the case study firms represent what the market wants. Their large-sized orders to some degree influence market trends. Intermediaries source products and distribute final products to foreign brand owners.

The ability to perform market scanning and elaboration depends on the relevant knowledge previously created [

21]. Therefore, current knowledge determines how much new knowledge can be acquired, integrates with existing knowledge, and makes use of it commercially. When undertaking co-innovation with partners,

firms can learn quickly due to the generic nature of knowledge to manufacture products. Even though the organization has not mobilized resources, they must do “sensing” on how to integrate and commercialize knowledge from open innovation [

10].

Sensing and seizing require different levels of resource allocation; as stated in the literature, “concerning competition for resources, sensing does not necessarily involve large commitments of resources“ [

12]. Scanning and elaborating on the environment are not costly activities; however, managers should invest a certain amount of time in these activities. Otherwise, firms will be left behind. Managers play a major role in obtaining market access, whereas integrating knowledge from external parties can be delegated to staff.

Once the firms have scanned and acquired customers successfully, firms are confident that they will be successful in the commercialization phase. Again, market access is a pivotal factor for this group. Obtaining knowledge leads to

a direct transition to the commercialization phase; meanwhile, the integrating phase does not receive much attention from firms. It can be said that the resource mobilizing process can be overlooked because of the generic nature of the knowledge and resources required, as indicated by the brighter color for integrating activities presented in

Figure 2. In the figure, the length of the arrows represents the duration of the activities, while the darkness of the arrows denotes their intensity. Mobilizing resources does not require much effort from the firms. Therefore, market access is a critical success factor for open innovation to occur. Thus, the key capabilities for open innovation firms in this group are

grasping emerging market opportunities and seizing them into commercialization. These must be done quickly, otherwise, the competitor will capture this opportunity. 5.2. Strategies for Group 2: Integrating Knowledge and Performing Product Experimentation

Suggested strategies for firms with high diversity and customized product design is

integrating knowledge and performing product experimentation. To realize these strategies, firms must strive to broaden the scope of obtaining complementary assets and partners for innovation. Companies will not be able, or at least will experience difficulties, to deliver value during innovation if they do not obtain complementary assets [

10].

These complementary assets are acquired by collaborating with participants in an ecosystem where the firms operate. Sometimes firms have to move far from their existing knowledge domain to broaden the scope of knowledge acquisition for creating more diversified value offerings. Similar to firms in the first group, most open innovation initiatives reside in the hands of managers who are also owners. The centralized natures of the open innovation initiatives have created some barriers for them to search for sources of innovations more broadly.

The case study firms must compromise between pursuing innovation and maintaining the uniqueness of products. In other words, firms are

striving to develop a unique product design that can be the identity of the firms, but at the same time meet the wants of customers. To enable this, firms need to develop capabilities that are relevant to the emerging business environment [

23]. Complementary assets acquired from partners vary greatly, and consequently, SMEs have a broad option of resource configurations. Meanwhile, the high heterogeneity of customer wants is partly caused by a lack of clarity regarding their wants. Customers with clearer value expectations tend to have a higher involvement in finding solutions and contribute more during the innovation process. These customers have certain qualities distinguishing them from those who are not ready to engage in collaborative innovation. Once the customers’ value has been identified, firms in this group adopt open innovation to leverage external resources.

The success of obtaining knowledge and integrating complementary assets determines whether open innovation will continue to commercialize. At a certain stage, customers might withdraw from the collaborative process whenever they feel they are not suitable for solutions offered by the firms. SMEs and customers have to agree on the adoption of the stage-gate-process in which at each stage of product development there is an opportunity for customers to resign. This stage-gate-process is one of the mitigations if collaboration does not work as expected so that higher losses can be avoided.

At the seizing stage, firms carry out a lot of experimentation regarding resource configurations to create product designs that best suit the customers’ wants. To minimize risk and failure costs, planning for resource configuration is undertaken with trial and error using a limited number of assets. Seizing capabilities are needed to mobilize knowledge from customers, suppliers and partners. How resources are allocated and dedicated is contingent on how the emerging opportunities and “existing position concerning the relevance of complementary assets.” [

12]. It should be emphasized here that the amount of resources mobilized at the seizing state is limited because these are used for product experimentation only.

Meanwhile, when firms are at the commercializing stage, i.e., when building public facilities, private or office buildings,

mobilizing resources occurs on a large scale.

Integration and commercialization are performed simultaneously, as depicted in

Figure 2 with the dark grey and black colors. Resource mobilization and external knowledge integration occur on a large scale along with commercialization. At the commercialization stage, canceling resource mobilization will cost a lot of money; there is nearly no way to recover.

The new configuration of resources might not necessarily be realized although the partners have complementary assets. The firms need integrative capabilities so that these complementary assets can be utilized for building new capabilities. Therefore, the implementation of sensing and seizing will make it easier for firms to collaborate with external partners and commercialize innovations. Resource mobilization simplifies the reconfiguration of new resources and commercialization of the resulting innovation. Thus, firms in this group must possess capabilities, such as the following: develop a new configuration of resources with external complementary assets and commercialize the innovation afterwards.

5.3. Strategies for Group 3: Aligning Knowledge from Customers with That of the Firms

Key strategies for firms in group three are

aligning knowledge from customers with that of the firm, which mostly requires sensing and seizing activities. The early stage of application software development does not incur significant costs in comparison to the total production cost. For this reason, companies need to allocate more resources for this early stage such that the total production cost can be significantly reduced. This is conducted during the sensing stage. The pivotal role of the alignment has been noted in the literature, as an example [

12] “resource/asset alignment and coalignment issues are important in the context of innovation, but they are quite different from portfolio balance issues.”

To obtain external knowledge, firms in this group intensify knowledge acquisition from current customers in iterative ways and then incorporate it with internal knowledge. The firms must explore new product developments so that the software being developed is following the specifications of customer needs. At the same time, commercialization occurs during software deployment into the client’s business operations. It is important to highlight that the innovation process during exploration is limited to serving current customers, without considering market trends. This strategy is indeed effective for generating income but at the expense of the firms becoming less updated with external changes.

In the early stages of application software development, the firms carried out a lot of sensing and seizing activities. These are intended to obtain a detailed portrait of the client’s business operations before the early stages of product development began. At this point, SMEs and clients also analyze the composition and configuration of resources after the software application has been deployed into the client’s organization, for example, who should be rotated, which functions should be removed, or what works or can be eliminated. Such a condition requires a path of change because the clients should rearrange how their internal resources are reconfigured and business processes in the organization are reorganized. All of these activities require resource mobilization and to some extent business transformation of the clients. During the software application deployment, commercialization occurs. Unsuccessful deployment of the products means unsuccessful commercialization. This co-innovation process requires

iterative collaborations between the firms and clients until the software is successfully deployed into clients’ business operations. Thus,

organizational transformation and innovation commercialization occur in iterative ways and simultaneously, as depicted in

Figure 2.

During the software deployment process, the SME case studies attempt to interconnect several clients’ requirements to be organized by the SMEs. Coordinated by the software testers and tester leads, the firms conduct a series of running tests with clients to test the prototype software application before finalizing it. The firms and clients interact intensively to ensure that the software application meets the specification of customers. In case there are some changes in business processes to suit the application software, this adjustment is also consulted with the software developers. Thus, the critical point for firms in this group is the capability to organize co-innovation with partners in iterative ways between stages of open innovation.

6. New Insights and Knowledge Contribution

The current study opens up fundamental perspectives by explicating the mechanism by which firms integrate each element of dynamic capabilities with those of open innovation. This work explicates how the elements of dynamic capabilities and open innovation blend into one another; those elements reinforce one another. Firms must attempt to achieve an optimum level, or at least an acceptable level, regarding the practices of dynamic capabilities that must be emphasized and in what stage of open innovation. As an example, when firms emphasize opportunity seeking, they must mobilize resources with the use of dynamic capabilities; these must be accompanied with sufficient integration of knowledge and commercialization of innovation, which are part of open innovation. Too much emphasis on either dynamic capability or open innovation will lead to inefficiency due to excessive unnecessary activities.

Inbound and outbound innovation have caused different challenges for firms, while simultaneously conducting both will result in even greater challenges, and this study offers new insights for managing them. This research demonstrates that concurrent inbound and outbound innovation do not only need firms to synchronize the knowledge and resources of firms with partners but also, more importantly, there must be alignment between internal resources, strategies and capabilities within the firms. All resources must be devoted toward the arrangement of acquiring external resources, which subsequently utilized them for supporting strategies and developing capabilities. Thus, integrative capabilities with external partners and alignment capabilities within the firms are imperative for firms.

Success in integrating activities derived from dynamic capability and open innovation have opened doors of opportunities for scholars. The integration of external resources allows firms to develop new capabilities and, whenever needed, the firms can adjust their strategies. Supported with knowledge and resource integration, firms can create new value, or renew their current business model. This point has not received much attention from previous studies and could be a starting point for research avenue in the future.

Another new insight of this study is that firms must have a certain level of resources and capabilities to implement open innovation, and subsequently integrate it into the resource base of the firms. Limited resource availability will restrict the options for firms to match with external resources, but firms can overcome this constraint with a disruptive approach with a consequence of bearing a higher risk. Once firms have reached a certain level of resource availability, it will be easy for them to accelerate the development of acquiring complementary external resources for developing capabilities and pursuing innovations. All of these concepts interact with one another in complex ways, forming a nested system

We have shed light on the duration differences for each level of activity, the capabilities that must be emphasized, and how firms must move from an activity into the next activity in open innovation. This implies that the level of importance of the activities in open innovation is not always equal, and therefore managers must adopt a contingency approach. In each activity, we have identified a number of crucial decisions that guide managers to integrate both concepts, including the external knowledge acquisition process, co-innovation process with partners, and risk mitigation during co-innovation.

From a macro perspective, this research sheds light on how dynamic capabilities support firms to co-evolve with the support partners within the ecosystem. It is apparent from current study that limited resources have encouraged SMEs to be more open, behave altruistically and be willing to contribute to ecosystems, which is in accordance with the idea put forward by Yun [

57]. These behaviors assist firms to reduce the imbalance between SMEs, as open economic actors, and large companies, which mostly tend to pursue closed innovation [

58]. The use of dynamic capabilities encourages the acceleration of the development of open innovation dynamics in each cluster [

59] so that the collective efforts of these ecosystem actors can counterbalance the capabilities of large companies.

7. Conclusions

Using a dynamic capability perspective, this study aims to analyze the strategy to integrate external resources into the open innovation process in SMEs. Openness is the means of defining ways in which an organization develops, maintains and uses every innovation capability, which can be drawn from anywhere in or outside the traditional organizational boundaries. From the empirical evidence, we identified a typology of pathways for aligning resources, strategies and capabilities.

In addition, we revealed that each group of firms uses a different mechanism for integrating dynamic capabilities into open innovation with a different emphasis. The three groups of firms explain the differences in terms of which activities of dynamic capabilities are applied in what phases of open innovation. In addition to this, the mechanism used by the three groups of case study companies has varying degrees of emphasis among the four phases of open innovation. Firms that fall into the first group, mostly used generic knowledge and low technology; the relevance of open innovation is the lowest compared to the other two groups in this group; this is because all knowledge used in this group of firms is general knowledge which mostly could become public goods. Obtaining knowledge through scanning and elaborating on the market is a pivotal point in the sensing stage.

For the second group, consisting of firms employing intensive knowledge and low technology, networks and ecosystem engagement determine how resources are mobilized, the configuration is organized, and knowledge integration is carried out. The critical point for this group is mobilizing and integrating complementary resources from partners with internal resources. In open innovation, these processes occur in the integration and commercialization phases.

In the meantime, firms with intensive knowledge and high technology classified in the third group must collaborate with clients to perform resource alignments. During the resource alignments, there are co-innovation activities between the clients and the firms as the software developer to ensure that the new product meets the specifications of the customers. Under these circumstances, the process of innovation must be undertaken iteratively, and therefore the interaction phase in open innovation is very pivotal. Performing activities are critical to devoting all necessary resources to deploy the software application.

In summary, this study identifies that different types of capabilities affect different phases of open innovation. Different collaboration goals have different impacts—i.e., market scanning, finding complementary assets, and aligning knowledge with customers, —on open innovation. In short, not all types of collaboration have an identical impact on every stage of open innovation. The key learning point from this study is that companies can take advantage of dynamic capabilities to implement open innovation through iterative and reciprocal processes, rather than linear and sequential processes.

The findings of this study provide a number of theoretical implications. The empirical findings in this study provide a new understanding of how dynamic capabilities strengthen open innovation. This study is the first research integrating dynamic capabilities into the open innovation process with elements of both concepts as the focus of analysis, and more importantly, it considers the four phases of open innovation. In addition, this study strengthens the contingency perspective of dynamic capabilities by showing the three groups of SMEs emphasize an approach for integrating dynamic capabilities and open innovation.

This study offers new insight in that the concept of open innovation has caused the boundaries between production and consumption to become blurred. This is because customers engage with producers during the value-creation process through co-innovation activities. In addition, we have identified the duration differences for each level of activities in open innovation, what capabilities must be emphasized, and how firms must move from an activity into the next activity in open innovation. This implies that the level of importance of the activities in open innovation is not always equal; managers must adopt a contingency approach. In each activity, we have identified a number of crucial decisions that guide managers to integrate both concepts including external knowledge acquisition process, a co-innovation process with partners, and risk mitigation during co-innovation.

In the practical field, the findings of this study imply that managers must understand environmental changes quickly, and quickly grasp emerging opportunities by orchestrating internal and external resources. Due to dynamic changes in the business environment, we suggest that the typology of pathways proposed in this study not be adopted as is, but rather managers should perform replication logic because of context differences. In our perspective, the typology is similar to a journey requiring continuous adjustment rather than a formula regarding how to race and reach the finish line early. This research used qualitative study and the main advantage is that it uses detailed data, but due to the expense, it cannot reach a large number of subjects. Future research can further investigate the results of this study using the survey method so that a large number of subjects are covered and generalizability can be confirmed. In particular, future research can investigate whether, or at least to what extent, the typology developed in the study is relevant in practice. If the findings confirm the typology, it will strengthen our proposed theory. On the contrary, if it is not supported, it will open the door to develop new theories so that the cycle of knowledge development continues.