Comparative Analysis of VAR and SVAR Models in Assessing Oil Price Shocks and Exchange Rate Transmission to Consumer Prices in South Africa

Abstract

1. Introduction

2. Literature Review

3. Methodology

3.1. Unit Root Tests (ADF and PP)

3.2. Model Specification

3.2.1. Modelling of Cointegration Test

3.2.2. Modelling of VAR and SVAR

3.3. Diagnostic Tests Applied

4. Results and Discussion

4.1. Discussion of Unit Root Test (ADF and PP) Results

4.2. Correlation Analysis

4.3. Discussion of Johansen Cointegration Test Results

4.4. Lag Selection

4.5. Justification of Not Differencing the Variables

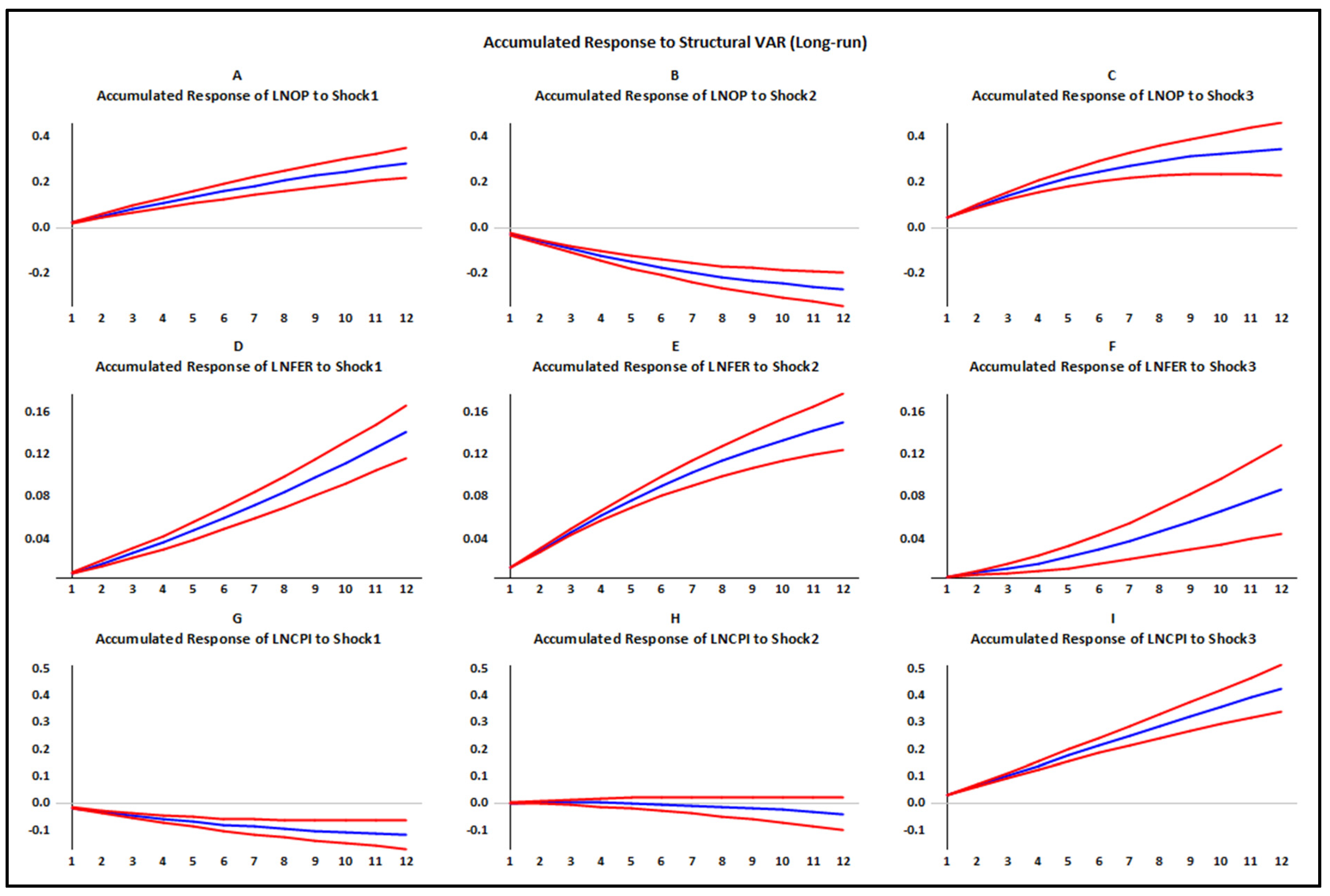

4.6. Empirical Results: Comparing VAR and SVAR

4.7. Diagnostic Test Results

5. Conclusions and Policy Recommendations

Limitations of the Study and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abildgren, K., Hansen, N. L., & Kuchler, A. (2018). Overoptimism and house price bubbles. Journal of Macroeconomics, 56, 1–14. [Google Scholar] [CrossRef]

- Abubakar, A. B., Karimu, S., & Mamman, S. O. (2024). Inflation effects of oil and gas prices in the UK: Symmetries and asymmetries. Utilities Policy, 90, 101803. [Google Scholar] [CrossRef]

- Abu-Bakar, M., & Masih, M. (2018). Is the oil price pass-through to domestic inflation symmetric or asymmetric? new evidence from India based on NARDL (MPRA Paper No. 87569). Munich Personal RePEc Archive. Available online: https://mpra.ub.uni-muenchen.de/87569/ (accessed on 1 November 2024).

- Adekunle, W., & Tiamiyu, A. (2018). Exchange rate pass-through to consumer prices in Nigeria: An asymmetric approach. Munich Personal RePEc Archive. [Google Scholar]

- Adom-Dankwa, A., Atsu, F., Gyamfi, E. N., & Amewu, G. (2024). Assessing the asymmetric interrelationships between sovereign bond yields and selected potential determinants: A case of frontier wamz economies. Heliyon, 10(19), e37995. [Google Scholar] [CrossRef] [PubMed]

- Aisen, A., Manguinhane, E., & Simione, F. F. (2021). An empirical assessment of the exchange rate pass-through in mozambique (Vol. 21, pp. 1–37). IMF Working Papers. International Monetary Fund. [Google Scholar] [CrossRef]

- Ajmi, A. N., Gupta, R., Babalos, V., & Hefer, R. (2015). Oil price and consumer price nexus in South Africa revisited: A novel asymmetric causality approach. Energy Exploration & Exploitation, 33(1), 63–73. [Google Scholar] [CrossRef]

- Akofio-Sowah, N. A. (2009). Is there a link between exchange rate pass-through and the monetary regime: Evidence from sub-Saharan Africa and Latin America. International Advances in Economic Research, 15(3), 296–309. [Google Scholar] [CrossRef]

- Alba, J. D., Liu, J., Chia, W., & Park, D. (2020). Foreign output shock in small open economies: A welfare evaluation of monetary policy regimes. Economic Modelling, 86, 101–116. [Google Scholar] [CrossRef]

- Alex, D. (2021). Anchoring of Inflation Expectations in Large Emerging Economies. The Journal of Economic Asymmetries, 23, e00202. [Google Scholar] [CrossRef]

- Al Jabri, S., Mala, R., & Vespignani, J. (2022). Oil prices and fiscal policy in an oil-exporter country: Empirical evidence from Oman. Energy Economics, 111, 106103. [Google Scholar] [CrossRef]

- Antonova, A. (2023, October 4–5). State-dependent pricing and cost-push inflation in a production network economy (Working Paper). 2023 European Central Bank Conference on Monetary Policy: Bridging Science and Practice, Frankfurt am Main, Germany. [Google Scholar]

- Arefeva, A., & Arefyev, N. (2024). Playing by the Taylor rules or sticking to Friedman’s policy: A new approach to monetary policy identification. Economic Modelling, 143, 106966. [Google Scholar] [CrossRef]

- Aron, J., Farrell, G., Muellbauer, J., & Sinclair, P. (2014). Exchange rate pass-through to import prices, and monetary policy in South Africa. The Journal of Development Studies, 50(1), 144–164. [Google Scholar] [CrossRef]

- Arvanitopoulos, T., & Agnolucci, P. (2020). The long-term effect of renewable electricity on employment in the United Kingdom. Renewable and Sustainable Energy Reviews, 134, 110322. [Google Scholar] [CrossRef]

- Ascari, G., & Haber, T. (2021). Non-linearities, state-dependent prices and the transmission mechanism of monetary policy. The Economic Journal, 132(641), 37–57. [Google Scholar] [CrossRef]

- Asghar, N., & Naveed, T. A. (2015). Pass-through of world oil prices to inflation: A time series analysis of Pakistan. Pakistan Economic and Social Review, 53(2), 269–84. [Google Scholar]

- Ashley, R. A., & Verbrugge, R. J. (2009). To difference or not to difference: A Monte Carlo investigation of inference in vector autoregression models. International Journal of Data Analysis Techniques and Strategies, 1(3), 242–274. [Google Scholar] [CrossRef]

- Atems, B., Kapper, D., & Lam, E. (2015). Do exchange rates respond asymmetrically to shocks in the crude oil market? Energy Economics, 49, 227–238. [Google Scholar] [CrossRef]

- Baaziz, Y., Labidi, M., & Lahiani, A. (2013). Does the South African Reserve Bank follow a nonlinear interest rate reaction function? Economic Modelling, 35, 272–282. [Google Scholar] [CrossRef]

- Baffes, J., Kose, M. A., Ohnsorge, F., & Stocker, M. (2015). The great plunge in oil prices: Causes, consequences, and policy responses (World Bank Policy Research Working Paper 7424). World Bank Group. Available online: https://openknowledge.worldbank.org/handle/10986/22611 (accessed on 18 October 2024).

- Baharumshah, A. Z., Sirag, A., & Soon, S. (2017). Asymmetric exchange rate pass-through in an emerging market economy: The case of Mexico. Research in International Business and Finance, 41, 247–259. [Google Scholar] [CrossRef]

- Bai, J., & Ng, S. (2005). Tests for skewness, kurtosis, and normality for time series data. Journal of Business & Economic Statistics, 23(1), 49–60. [Google Scholar] [CrossRef]

- Ball, L., & Mankiw, N. G. (1994). A sticky-price manifesto. Carnegie-Rochester Conference Series on Public Policy, 41, 127–151. [Google Scholar] [CrossRef]

- Basher, S. A., Haug, A. A., & Sadorsky, P. (2012). Oil prices, exchange rates and emerging stock markets. Energy Economics, 34(1), 227–240. [Google Scholar] [CrossRef]

- Becklemans, L. (2005). Credit and monetary policy: An Australian SVAR (Research Discussion Paper 2005–06). Reserve Bank of Australia. [Google Scholar]

- Beckmann, J., Czudaj, R. L., & Arora, V. (2020). The relationship between oil prices and exchange rates: Revisiting theory and evidence. Energy Economics, 88, 104772. [Google Scholar] [CrossRef]

- Bems, R., Caselli, F., Grigoli, F., & Gruss, B. (2021). Expectations’ anchoring and inflation persistence. Journal of International Economics, 132, 103516. [Google Scholar] [CrossRef]

- Bernanke, B. S., & Mihov, I. (1995). Measuring monetary policy. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Bigerna, S. (2023). Energy price shocks, exchange rates and inflation nexus. Energy Economics, 128, 107156. [Google Scholar] [CrossRef]

- Bils, M., & Klenow, P. J. (2004). Some evidence on the importance of sticky prices. Journal of Political Economy, 112(5), 947–985. [Google Scholar] [CrossRef]

- Blanchard, O. J., & Quah, D. (1988). The dynamic effects of aggregate demand and supply disturbances. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Boughton, J. M. (1988). The monetary approach to exchange rates: What now remains? (No. 171). Princeton Essays in International Finance. [Google Scholar]

- Box, G. E. P., & Pierce, D. A. (1970). Distribution of residual autocorrelations in autoregressive-integrated moving average time series models. Journal of the American Statistical Association, 65(332), 1509–1526. [Google Scholar] [CrossRef]

- Breusch, T. S. (1978). Testing for autocorrelation in dynamic linear models. Australian Economic Papers, 17(31), 334–355. [Google Scholar] [CrossRef]

- Brini, R., Jemmali, H., & Farroukh, A. (2016, March 23–25). Macroeconomic impacts of oil price shocks on inflation and real exchange rate: Evidence from selected MENA countries. Paper presented at the 15th International Conference Middle East Economic Association (MEEA), Hammamet, Tunisia. [Google Scholar]

- Brischetto, A., & Voss, G. (2000). A structural vector autoregression model of monetary policy in Australia. Available online: https://www.rba.gov.au/publications/rdp/1999/pdf/rdp1999-11.pdf (accessed on 23 November 2024).

- Brooks, C. (2019). Introductory econometrics for finance (4th ed.). Cambridge University Press. [Google Scholar]

- Burbidge, J., & Harrison, A. (1984). Testing for the effects of oil-price rises using vector autoregressions. International Economic Review, 25(2), 459–484. [Google Scholar] [CrossRef]

- Caselli, F., & Roitman, A. (2016). Non-linear exchange rate pass-through in emerging markets (Vol. 16, pp. 1–36). IMF Working Papers. International Monetary Fund. [Google Scholar] [CrossRef]

- Cavalcanti, T., & Jalles, J. T. (2013). Macroeconomic effects of oil price shocks in Brazil and in the United States. Applied Energy, 104, 475–486. [Google Scholar] [CrossRef]

- Charteris, A., & Kallinterakis, V. (2021). Feedback trading in retail-dominated assets: Evidence from the gold bullion coin market. International Review of Financial Analysis, 75, 101727. [Google Scholar] [CrossRef]

- Chebbi, A. (2019). How to enlarge the fiscal space and gain efficiency when adopting automatic fuel pricing mechanisms? The Tunisian case. The Quarterly Review of Economics and Finance, 73, 34–43. [Google Scholar] [CrossRef]

- Chen, S. (2009). Oil price pass-through into inflation. Energy Economics, 31(1), 126–133. [Google Scholar] [CrossRef]

- Chen, S., & Chen, H. (2007). Oil prices and real exchange rates. Energy Economics, 29(3), 390–404. [Google Scholar] [CrossRef]

- Chen, Y., Dong, S., Qian, S., & Chung, K. (2024). Impact of oil price volatility and economic policy uncertainty on business investment—Insights from the energy sector. Heliyon, 10(5), e26533. [Google Scholar] [CrossRef]

- Chen, Y., Raza, K., & Alharthi, M. (2023). The nexus between remittances, education, and energy consumption: Evidence from developing countries. Energy Strategy Reviews, 46, 101069. [Google Scholar] [CrossRef]

- Cheng, P., & You, Y. (2024). U.S. monetary policy spillovers to emerging market countries: Responses to cost-push and natural rate shocks. Economic Modelling, 143, 106971. [Google Scholar] [CrossRef]

- Chin, L., Azali, M., & Matthews, K. G. (2007). The monetary approach to exchange rate determination for Malaysia. Applied Financial Economics Letters, 3(2), 91–94. [Google Scholar] [CrossRef]

- Chinn, M. D. (1991). Some linear and nonlinear thoughts on exchange rates. Journal of International Money and Finance, 10, 214–230. [Google Scholar] [CrossRef]

- Choi, S., Furceri, D., Loungani, P., Mishra, S., & Poplawski-Ribeiro, M. (2018). Oil prices and inflation dynamics: Evidence from advanced and developing economies. Journal of International Money and Finance, 82, 71–96. [Google Scholar] [CrossRef]

- Chou, K.-W., & Tseng, Y.-H. (2011). Pass-through of oil prices to CPI inflation in Taiwan. International Research Journal of Finance and Economics, 69, 73–83. [Google Scholar]

- Chundama, S. (2022). Do oil price shocks affect exchange rates in oil-importing countries: A case of the Zambian economy using the SVAR approach. International Journal For Multidisciplinary Research, 4(5), 1–12. [Google Scholar] [CrossRef]

- Clarida, R., Galí, J., & Gertler, M. (1999). The science of monetary policy: A new keynesian perspective. Journal of Economic Literature, 37(4), 1661–1707. [Google Scholar] [CrossRef]

- Cologni, A., & Manera, M. (2008). Oil prices, inflation and interest rates in a structural cointegrated VAR model for the G-7 countries. Energy Economics, 30(3), 856–888. [Google Scholar] [CrossRef]

- Crespo-Cuaresma, J., Fidrmuc, J., & MacDonald, R. (2005). The monetary approach to exchange rates in the CEECs. The Economics of Transition, 13(2), 395–416. [Google Scholar] [CrossRef]

- Csomós, G. (2013). The command and control centers of the United States (2006/2012): An analysis of industry sectors influencing the position of cities. Geoforum, 50, 241–251. [Google Scholar] [CrossRef]

- Daboussi, O. M., & Thameur, N. (2014). Inflation targeting and exchange rate pass-through: A comparative study in emerging markets. International Journal of Innovation and Applied Studies, 9(1), 317–324. [Google Scholar]

- De Abreu Lourenco, R., & Gruen, D. (1995). Price stickiness and inflation. Research Discussion Paper 9502. Reserve Bank of Australia. [Google Scholar]

- DeJong, D. N., & Husted, S. (1993). Towards a reconciliation of the empirical evidence on the monetary approach to exchange rate determination. The Review of Economics and Statistics, 75(1), 123–128. [Google Scholar] [CrossRef]

- Diaz, E. M., Cunado, J., & de Gracia, F. P. (2024). Global drivers of inflation: The role of supply chain disruptions and commodity price shocks. Economic Modelling, 140, 106860. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366), 427–431. [Google Scholar] [CrossRef]

- Duke, O. O., Adenuga, A. O., Olusegun, T. S., & Odu, A. T. (2023). Oligopoly and exchange rate dynamics in Nigeria. Scientific African. [Google Scholar] [CrossRef]

- Dungey, M., & Pagan, A. (2000). A Structural VAR Model of the Australian Economy. Economic Record, 76(235), 321–342. [Google Scholar] [CrossRef]

- Dungey, M., & Vehbi, T. (2015). The influences of international output shocks from the US and China on ASEAN economies. Journal of Asian Economics, 39, 59–71. [Google Scholar] [CrossRef]

- Du Plessis, S., Smit, B., & Sturzenegger, F. (2007). The cyclicality of monetary and fiscal policy in South Africa since 1994. The South African Journal of Economics, 75, 391–411. [Google Scholar] [CrossRef]

- Edwards, S. (2006). The relationship between exchange rates and inflation targeting revisited. NBER Working Paper 12163. National Bureau of Economic Research. Available online: https://www.nber.org/papers/w12163 (accessed on 25 November 2024).

- Edwards, S. (2012). The federal reserve, emerging markets, and capital controls: A high frequency empirical investigation. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Elsayed, A. H., Hammoudeh, S., & Sousa, R. M. (2021). Inflation synchronization among the G7and China: The important role of oil inflation. Energy Economics, 100, 105332. [Google Scholar] [CrossRef]

- Enders, W. (2014). Applied econometric time series (4th ed.). Wiley. [Google Scholar]

- Faisal, F., Amin, M. Y., Haq, Z. U., Rahman, S. U., & Ali, A. (2023). Natural resources revenues, shadow economy and financial institutions depth: The way forward. Resources Policy, 85, 103849. [Google Scholar] [CrossRef]

- Fetai, B., Koku, P. S., Caushi, A., & Fetai, A. (2016). The relationship between exchange rate and inflation: The case of Western Balkans Countries. Pressacademia, 5(4), 360–364. [Google Scholar] [CrossRef]

- Fisher, L. A., & Huh, H. (2019). An IV framework for combining sign and long-run parametric restrictions in SVARs. Journal of Macroeconomics, 61, 103125. [Google Scholar] [CrossRef]

- Gao, J., An, Z., & Bai, X. (2019). A new representation method for probability distributions of multimodal and irregular data based on uniform mixture model. Annals of Operations Research, 311(1), 81–97. [Google Scholar] [CrossRef]

- Geng, M., Qian, Z., Jiang, H., Huang, B., Huang, S., Deng, B., Peng, Y., Xie, Y., Li, F., Zou, Y., Deng, Z., & Zeng, J. (2023). Assessing the impact of water-sediment factors on water quality to guide river-connected lake water environment improvement. Science of The Total Environment, 912, 168866. [Google Scholar] [CrossRef] [PubMed]

- Gidigbi, M. O., Babarinde, G. F., & Lawan, M. W. (2018). Inflation and exchange rate volatility pass-through in Nigeria. Journal of Management, Economics, and Industrial Organization, 2(3), 18–40. [Google Scholar] [CrossRef]

- Gonzalo, J., & Pitarakis, J. Y. (2002). Lag length estimation in large dimensional systems. Journal of Time Series Analysis, 23(4), 401–423. [Google Scholar] [CrossRef]

- Gujarati, D., & Porter, D. C. (2009). Basic Econometrics (5th ed.). McGraw Hill Inc. [Google Scholar]

- Gunasinghe, C., Selvanathan, E. A., Naranpanawa, A., & Forster, J. (2019). The impact of fiscal shocks on real GDP and income inequality: What do Australian data say? Journal of Policy Modeling, 42(2), 250–270. [Google Scholar] [CrossRef]

- Gupta, R., & Modise, M. P. (2013). Does the source of oil price shocks matter for South African stock returns? A structural VAR approach. Energy Economics, 40, 825–831. [Google Scholar] [CrossRef]

- Ha, J., Stocker, M. M., & Yilmazkuday, H. (2020). Inflation and exchange rate pass-through. Journal of International Money and Finance, 105, 102187. [Google Scholar] [CrossRef]

- Hamilton, J. D. (1994). Time series analysis. Walter de Gruyter GmbH. [Google Scholar] [CrossRef]

- Herzberg, V., Kapetanios, G., & Price, S. (2003). Import prices and exchange rate pass-through: Theory and evidence from the United Kingdom (Working Paper 182). Bank of England. [Google Scholar]

- Hoque, A., Chan, F., & Manzur, M. (2008). Efficiency of the foreign currency options market. Global Finance Journal, 19(2), 157–170. [Google Scholar] [CrossRef]

- Hui, E. C., Yu, K., & Ng, I. M. (2014). The dynamics of housing demand under a linked-exchange rate system. Habitat International, 44, 50–61. [Google Scholar] [CrossRef]

- Hussain, M., Zebende, G. F., Bashir, U., & Donghong, D. (2017). Oil price and exchange rate co-movements in Asian countries: Detrended cross-correlation approach. Physica A: Statistical Mechanics and its Applications, 465, 338–346. [Google Scholar] [CrossRef]

- Iddrisu, A., & Alagidede, I. P. (2020). Revisiting interest rate and lending channels of monetary policy transmission in the light of theoretical prescriptions. Central Bank Review, 20(4), 183–192. [Google Scholar] [CrossRef]

- Jaffri, A. A., Asjed, R., & Bashir, S. (2013). Passthrough of global inflation to domestic inflation: An empirical evidence for Pakistan. Journal of Managerial Sciences, 7, 105–111. [Google Scholar]

- Jarque, C. M., & Bera, A. K. (1987). A Test for Normality of Observations and Regression Residuals. International Statistical Review, 55(2), 163–172. [Google Scholar] [CrossRef]

- Javed, Z. H., Farooq, M., Hussain, M., Shezad, A., Iqbal, S., & Akram, S. (2011). Impact of cost-push and monetary factors on GDP deflator: Empirical evidence from the economy of Pakistan. International Journal of Financial Research, 2(1), 57–65. [Google Scholar] [CrossRef]

- Jimoh, A. (2004). The monetary approach to exchange rate determination: Evidence from Nigeria. Journal of Economic Cooperation, 25(2), 109–130. [Google Scholar]

- Jiranyakul, K. (2021). Crude oil price changes and inflation: Evidence for Asia and the pacific economies. SSRN Electronic Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3884186 (accessed on 12 November 2024). [CrossRef]

- Kabundi, A., & Mlachila, M. (2018). The role of monetary policy credibility in explaining the decline in exchange rate pass-through in South Africa. Economic Modelling, 79, 173–185. [Google Scholar] [CrossRef]

- Karoro, T. D., Aziakpono, M. J., & Cattaneo, N. (2009). Exchange rate pass-through to import prices in South Africa: Is there asymmetry? South African Journal of Economics, 77, 380–398. [Google Scholar] [CrossRef]

- Kassi, D. F., Rathnayake, D. N., Edjoukou, A. J. R., Gnangoin, Y. T., Louembe, P. A., Ding, N., & Sun, G. (2019). Asymmetry in exchange rate pass-through to consumer prices: New perspective from Sub-Saharan African countries. Economies, 7(1), 5. [Google Scholar] [CrossRef]

- Kayani, U. N., Aysan, A. F., Gul, A., Haider, S. A., & Ahmad, S. (2023). Unpacking the asymmetric impact of exchange rate volatility on trade flows: A study of selected developed and developing Asian economies. PLoS ONE, 18(10), e0291261. [Google Scholar] [CrossRef] [PubMed]

- Kemoe, L. (2024). Effect of exchange rate movements on inflation in Sub-Saharan Africa (IMF Working Paper 24/59). International Monetary Fund. Available online: https://www.imf.org/en/Publications/WP/Issues/2024/01/18/Effect-of-Exchange-Rate-Movements-on-Inflation-in-Sub-Saharan-Africa-540465 (accessed on 29 November 2024).

- Khodeir, A. (2012). Towards inflation targeting in Egypt: The relationship between exchange rate and inflation. South African Journal of Economic and Management Sciences, 15(3), 325–332. [Google Scholar] [CrossRef]

- Kiley, M. T. (2006). A quantitative comparison of sticky-price and sticky-information models of price setting. Journal of Money, Credit and Banking, 38, 101–125. [Google Scholar]

- Kim, H., Lin, Y., & Thompson, H. (2020). Exchange rate pass-through to consumer prices: The increasing role of energy prices. Open Economies Review, 32(2), 395–415. [Google Scholar] [CrossRef]

- Kim, I. K., Lee, J., & Im, H. (2024). Asymmetry and non-linearity in exchange rate pass-through: Evidence from scanner data. Journal of International Money and Finance, 149, 103193. [Google Scholar] [CrossRef]

- Kim, S., & Roubini, N. (2000). Exchange rate anomalies in the industrial countries: A solution with a structural VAR approach. Journal of Monetary Economics, 45(3), 561–586. [Google Scholar] [CrossRef]

- Kin, S., & Courage, M. (2014). The impact of oil prices on the exchange rate in South Africa. Journal of Economics, 5(2), 193–199. [Google Scholar] [CrossRef]

- Klein, N. (2012). Estimating the implicit inflation target of the South African Reserve Bank (Vol. 12, p. 1). IMF Working Papers. International Monetary Fund. [Google Scholar] [CrossRef]

- Krishnamurthy, A., & Vissing-Jorgensen, A. (2011). The effects of quantitative easing on interest rates: Channels and implications for policy. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Kudabayeva, L., Abubakirova, A., Zurbayeva, A., Mussaeva, G., & Chimgentbayeva, G. (2024). The Relationship between Oil Prices and Inflation in Oil İmporting Countries (1980–2022). International Journal of Energy Economics and Policy, 14(1), 359–364. [Google Scholar] [CrossRef]

- Kumo, W. L. (2015). Inflation targeting monetary policy, inflation volatility and economic growth in South Africa (Working Paper Series 216). African Development Bank. [Google Scholar]

- Kuttu, S., Aboagye, A. Q., & Bokpin, G. A. (2018). Evidence of time-varying conditional discrete jump dynamics in sub-Saharan African foreign exchange markets. Research in International Business and Finance, 46, 211–226. [Google Scholar] [CrossRef]

- Lacheheb, M., & Sirag, A. (2019). Oil price and inflation in Algeria: A nonlinear ARDL approach. The Quarterly Review of Economics and Finance, 73, 217–222. [Google Scholar] [CrossRef]

- Lado, E. P. Z. (2015). Test of relationship between exchange rate and inflation in South Sudan: Granger-causality approach. Economics, 4(2), 34–40. [Google Scholar] [CrossRef]

- Le Huy, C., & Ba, H. L. H. (2020). The monetary approach to exchange rate determination: Empirical observations from the Pacific Basin economies. Decision Science Letters, 9(3), 453–463. [Google Scholar] [CrossRef]

- Lily, J., Kogid, M., Nipo, D. T., & Lajuni, N. (2020). Oil price pass-through into inflation revisited in Malaysia: The role of asymmetry. Malaysian Journal of Business and Economics, 6(2), 1–14. [Google Scholar] [CrossRef]

- Loewald, C. (2022). Monetary policy and inflation in South Africa (Working Paper Series WP/22/12). South African Reserve Bank. [Google Scholar]

- Loría, E., Sánchez, A., & Salgado, U. (2010). New evidence on the monetary approach of exchange rate determination in Mexico 1994–2007: A cointegrated SVAR model. Journal of International Money and Finance, 29(3), 540–554. [Google Scholar] [CrossRef]

- Lütkepohl, H. (2005). New introduction to multiple time series analysis. Springer Nature. [Google Scholar] [CrossRef]

- Lüutkepohl, H., Saikkonen, P., & Trenkler, C. (2000). Maximum eigenvalue versus trace tests for the cointegrating rank of a VAR process (SFB 373 Discussion Paper 2000). Humboldt University Berlin. [Google Scholar]

- Madesha, W., Chidoko, C., & Zivanomoyo, J. (2013). Empirical test of the relationship between exchange rate and inflation in Zimbabwe. Journal of Economics and Sustainable Development, 4, 52–58. [Google Scholar]

- Magubane, K., & Nzimande, N. P. (2024). A structural vector autoregression exploration of South Africa’s monetary and macroprudential policy interactions. Economies, 12(10), 278. [Google Scholar] [CrossRef]

- Majenge, L., Mpungose, S., & Msomi, S. (2024). Econometric Analysis of South Africa’s Fiscal and Monetary Policy Effects on Economic Growth from 1980 to 2022. Economies, 12(9), 227. [Google Scholar] [CrossRef]

- Makrelov, K., Davies, R., & Harris, L. (2021). The impact of capital flow reversal shocks in South Africa: A stock- and flow-consistent analysis. International Review of Applied Economics, 35(3–4), 398–425. [Google Scholar] [CrossRef]

- Malec, K., Maitah, M., Rojik, S., Aragaw, A., & Fulnečková, P. R. (2024). Inflation, exchange rate, and economic growth in Ethiopia: A time series analysis. International Review of Economics & Finance, 96, 103561. [Google Scholar] [CrossRef]

- Malik, F., & Umar, Z. (2019). Dynamic connectedness of oil price shocks and exchange rates. Energy Economics, 84, 104501. [Google Scholar] [CrossRef]

- Mao, Z., Wang, H., & Bibi, S. (2023). Crude oil volatility spillover and stock market returns across the COVID-19 pandemic and post-pandemic periods: An empirical study of China, US, and India. Resources Policy, 88, 104333. [Google Scholar] [CrossRef]

- Marcelin, I., & Mathur, I. (2016). Financial sector development and dollarization in emerging economies. International Review of Financial Analysis, 46, 20–32. [Google Scholar] [CrossRef]

- Maveé, N., Perrelli, M. R., & Schimmelpfennig, M. A. (2016). Surprise, surprise: What drives the rand/U.S. dollar exchange rate volatility? (IMF Working Paper 16/205). International Monetary Fund. [Google Scholar]

- Mbatha, V. M., & Alovokpinhou, S. A. (2021). The structure of the South African stock market network during COVID-19 hard lockdown. Physica A: Statistical Mechanics and its Applications, 590, 126770. [Google Scholar] [CrossRef]

- McCallum, B. T. (1986). On “real” and “sticky-price” theories of the business cycle. Journal of Money, Credit and Banking, 18(4), 397–414. [Google Scholar] [CrossRef]

- Mendali, G., & Das, S. (2023). Asymmetric exchange rate pass-through in India: A non-linear ARDL approach. Foreign Trade Review, 59(3), 429–447. [Google Scholar] [CrossRef]

- Mensi, W. (2019). Global financial crisis and co-movements between oil prices and sector stock markets in Saudi Arabia: A VaR based wavelet. Borsa Istanbul Review, 19(1), 24–38. [Google Scholar] [CrossRef]

- Merrino, S. (2022). Monetary policy and wage inequality in South Africa. Emerging Markets Review, 53. [Google Scholar] [CrossRef]

- Mien, E. (2022). Impact of oil price and oil production on inflation in the CEMAC. Resources Policy, 79, 103010. [Google Scholar] [CrossRef]

- Monfort, B., & Peña, S. (2008). Inflation determinants in Paraguay: Cost push versus demand pull factors (Vol. 8, p. 1). IMF Working Papers. International Monetary Fund. [Google Scholar] [CrossRef]

- Msomi, S., & Ngalawa, H. (2024). The monetary model of exchange rate determination for South Africa. Economies, 12(8), 206. [Google Scholar] [CrossRef]

- Mukhtarov, S., Mammadov, J., & Ahmadov, F. (2019). The impact of oil prices on inflation: The case of Azerbaijan. International Journal of Energy Economics and Policy, 9(4), 97–102. [Google Scholar] [CrossRef]

- Mushendami, P. L., & Namakalu, H. (2016). Exchange rate pass-through to inflation in Namibia. Journal of Emerging Issues in Economics, Finance and Banking, 5, 1860–1873. [Google Scholar]

- Myers, R. J., Johnson, S. R., Helmar, M., & Baumes, H. (2018). Long-run and short-run relationships between oil prices, producer prices, and consumer prices: What can we learn from a permanent-transitory decomposition? The Quarterly Review of Economics and Finance, 67, 175–190. [Google Scholar] [CrossRef]

- Ng, S., & Perron, P. (2001). LAG length selection and the construction of unit root tests with good size and power. Econometrica, 69(6), 1519–1554. [Google Scholar] [CrossRef]

- Ngalawa, H., & Viegi, N. (2011). Dynamic effects of monetary policy shocks in Malawi. South African Journal of Economics, 79, 224–50. [Google Scholar] [CrossRef]

- Nhamo, G., & Chapungu, L. (2024). Prospects for a sustainable and climate-resilient African economy post-COVID-19. Global Environmental Change, 86, 102836. [Google Scholar] [CrossRef]

- Nusair, S. A., & Olson, D. (2018). The effects of oil price shocks on Asian exchange rates: Evidence from quantile regression analysis. Energy Economics, 78, 44–63. [Google Scholar] [CrossRef]

- Olaberría, E. (2014). US long term interest rates and capital flows to emerging economies (OECD Economics Department Working Papers, No. 1155). OECD Publishing. [Google Scholar] [CrossRef]

- Onatski, A., & Wang, C. (2018). Alternative Asymptotics for cointegration tests in large VARs. Econometrica, 86(4), 1465–1478. [Google Scholar] [CrossRef]

- Orlov, A. (2015). An assessment of proposed energy resource tax reform in Russia: A static general equilibrium analysis. Energy Economics, 50, 251–263. [Google Scholar] [CrossRef]

- Oseni, I. O. (2016). Exchange rate volatility and private consumption in Sub-Saharan African countries: A system-GMM dynamic panel analysis. Future Business Journal, 2(2), 103–115. [Google Scholar] [CrossRef]

- Özlale, Ü., & Pekkurnaz, D. (2010). Oil prices and current account: A structural analysis for the Turkish economy. Energy Policy, 38(8), 4489–4496. [Google Scholar] [CrossRef]

- Parsley, D. C. (2012). Exchange rate pass-through in South Africa: Panel evidence from individual goods and services. The Journal of Development Studies, 48(7), 832–846. [Google Scholar] [CrossRef]

- Phillips, P. C. B., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75, 335–346. [Google Scholar] [CrossRef]

- Piffanelli, S. (2001). The instrument of monetary policy for Germany: A structural VAR approach (DESA Discussion Paper No. 19). United Nations Department of Economic and Social Affairs. [Google Scholar]

- Primiceri, G. E. (2005). Time varying structural vector autoregressions and monetary policy. The Review of Economic Studies, 72(3), 821–852. [Google Scholar] [CrossRef]

- Proença, S., & Aubyn, M. S. (2013). Hybrid modeling to support energy-climate policy: Effects of feed-in tariffs to promote renewable energy in Portugal. Energy Economics, 38, 176–185. [Google Scholar] [CrossRef]

- Qiu, C., Colson, G., Escalante, C., & Wetzstein, M. (2012). Considering Macroeconomic Indicators in the Food before Fuel Nexus. Energy Economics, 34(6), 2021–2028. [Google Scholar] [CrossRef]

- Qiu, X., Qian, J., Wang, H., Tan, X., & Jin, Y. (2024). An attentive Copula-based spatio-temporal graph model for multivariate time-series forecasting. Applied Soft Computing, 154, 111324. [Google Scholar] [CrossRef]

- Rangasamy, L. (2017). The impact of petrol price movements on South African inflation. Journal of Energy in Southern Africa, 28(1), 120. [Google Scholar] [CrossRef]

- Razafimahefa, I. F. (2012). Exchange rate pass-through in sub-saharan African economies and its determinants (IMF Working Paper 12/141). International Monetary Fund. Available online: https://www.imf.org/external/pubs/ft/wp/2012/wp12141.pdf (accessed on 16 October 2024).

- Revelli, D. N. P. (2020). The exchange rate pass-through to inflation and its implications for monetary policy in Cameroon and Kenya (Working Paper). Available online: https://aercafrica.org/wp-content/uploads/2020/01/Research-Paper-392.pdf (accessed on 20 November 2024).

- Rey, H. (2015). Dilemma not trilemma: The global financial cycle and monetary policy independence. National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Rezitis, A. N. (2015). The relationship between agricultural commodity prices, crude oil prices and US dollar exchange rates: A panel VAR approach and causality analysis. International Review of Applied Economics, 29(3), 403–434. [Google Scholar] [CrossRef]

- Romaniello, D., & Stirati, A. (2024). A review of cost-push inflation theories: From the classical-keynesian to the modern post-Keynesian approach. Journal of Post Keynesian Economics. forthcoming. [Google Scholar]

- Roudari, S., Mensi, W., Al Kharusi, S., & Ahmadian-Yazdi, F. (2023). Impacts of oil shocks on stock markets in Norway and Japan: Does monetary policy’s effectiveness matter? International Economics, 173, 343–358. [Google Scholar] [CrossRef]

- Saidu, M., Naseem, N., Law, S., & Yasmin, B. (2021). Exploring the asymmetric effect of oil price on exchange rate: Evidence from the top six African net oil importers. Energy Reports, 7, 8238–8257. [Google Scholar] [CrossRef]

- Salvucci, V., & Tarp, F. (2024). Crises, prices, and poverty—An analysis based on the Mozambican household budget surveys 1996/97–2019/20. Food Policy, 125, 102651. [Google Scholar] [CrossRef]

- Samunderu, E., & Murahwa, Y. T. (2021). Return based risk measures for non-normally distributed returns: An alternative modelling approach. Journal of Risk and Financial Management, 14(11), 540. [Google Scholar] [CrossRef]

- Sasaki, Y., Yoshida, Y., & Otsubo, P. K. (2022). Exchange rate pass-through to Japanese prices: Import prices, producer prices, and the core CPI. Journal of International Money and Finance, 123, 102599. [Google Scholar] [CrossRef]

- Savoie-Chabot, L., & Khan, M. (2015). Exchange rate pass-through to consumer prices: Theory and recent evidence (Discussion Paper 2015-9). Bank of Canada. [Google Scholar]

- Schwarzer, J. A. (2018). Retrospectives: Cost-push and demand-pull inflation: Milton Friedman and the “cruel dilemma. Journal of Economic Perspectives, 32(1), 195–210. [Google Scholar] [CrossRef]

- Shahrabi, J., Hadavandi, E., & Asadi, S. (2013). Developing a hybrid intelligent model for forecasting problems: Case study of tourism demand time series. Knowledge-Based Systems, 43, 112–122. [Google Scholar] [CrossRef]

- Simpson, M. W., Ramchander, S., & Chaudhry, M. (2005). The impact of macroeconomic surprises on spot and forward foreign exchange markets. Journal of International Money and Finance, 24(5), 693–718. [Google Scholar] [CrossRef]

- Sims, C. A. (1980). Macroeconomics and Reality. Econometrica, 48(1), 1. [Google Scholar] [CrossRef]

- Sims, C. A. (1992). Interpreting the macroeconomic time series facts. European Economic Review, 36(5), 975–1000. [Google Scholar] [CrossRef]

- Sims, C. A., Stock, J. H., & Watson, M. W. (1990). Inference in linear time series models with some unit roots. Econometrica, 58(1), 113. [Google Scholar] [CrossRef]

- Solaymani, S., & Kari, F. (2013). Environmental and economic effects of high petroleum prices on transport sector. Energy, 60, 435–441. [Google Scholar] [CrossRef]

- Song, H., & Witt, S. F. (2006). Forecasting international tourist flows to Macau. Tourism Management, 27(2), 214–224. [Google Scholar] [CrossRef]

- Stock, J. H., & Watson, M. W. (2001). Vector autoregressions. Journal of Economic Perspectives, 15(4), 101–115. [Google Scholar] [CrossRef]

- Sui, L., & Sun, L. (2016). Spillover effects between exchange rates and stock prices: Evidence from BRICS around the recent global financial crisis. Research in International Business and Finance, 36, 459–471. [Google Scholar] [CrossRef]

- Sun, Y., & Gao, J. (2023). Natural resource endowment and its lmpact on ecological efficiency. Resources Policy, 87, 104272. [Google Scholar] [CrossRef]

- Takhtamanova, Y. (2024). Understanding changes in exchange rate pass-through. Journal of Macroeconomics, 32, 1118–1130. [Google Scholar] [CrossRef]

- Taylor, J. B. (1994). The inflation/output variability trade-off revisited. In J. C. Fuhrer (Ed.), Goals, guidelines, and constraints facing monetary policymakers (pp. 21–38). Federal Reserve Bank of Boston. [Google Scholar]

- Tiberti, L., Maisonnave, H., Chitiga, M., & Mabugu, R. (2018). Reforming grants to tackle child poverty: An integrated macro-micro approach. World Development, 112, 272–281. [Google Scholar] [CrossRef]

- Tiwari, A. K., Cunado, J., Hatemi-J, A., & Gupta, R. (2019). Oil price-inflation pass-through in the United States over 1871 to 2018: A wavelet coherency analysis. Structural Change and Economic Dynamics, 50, 51–55. [Google Scholar] [CrossRef]

- Toni, M. (2024). An analysis of the relationship between oil prices and inflation in oil-dependent economies: With special reference to Oman. Journal of Energy Economics, 1(1), 1–9. [Google Scholar] [CrossRef]

- Tule, M. K., Salisu, A. A., & Ebuh, G. U. (2019). A test for inflation persistence in Nigeria using fractional integration & fractional cointegration techniques. Economic Modelling, 87, 225–237. [Google Scholar] [CrossRef]

- Uhlig, H. (2005). What are the effects of monetary policy on output? Results from an agnostic identification procedure. Journal of Monetary Economics, 52(2), 381–419. [Google Scholar] [CrossRef]

- Usupbeyli, A., & Ucak, S. (2020). The effects of exchange rates on CPI and PPI. Business and Economics Research Journal, 11, 323–334. [Google Scholar] [CrossRef]

- Uz Akdogan, I., & Dalan Bildir, M. (2009). Monetary approach to exchange rate determination: The case of Argentina, Brazil, Taiwan and Turkey, 1986–2006. Applied Econometrics and International Development, 9, 77–92. [Google Scholar]

- Volkan, A., Saatçioğlu, C., & Korap, L. (2007). Impact of exchange rate changes on domestic inflation: The Turkish experience (Discussion Paper 2007/6). Turkish Economic Association. [Google Scholar]

- Wang, Q., & Wang, S. (2020). Preventing carbon emission retaliatory rebound post-COVID-19 requires expanding free trade and improving energy efficiency. Science of The Total Environment, 746, 141158. [Google Scholar] [CrossRef] [PubMed]

- Wang, S., & Yang, L. (2024). Mineral resource extraction and resource sustainability: Policy initiatives for agriculture, economy, energy, and the environment. Resources Policy, 89, 104657. [Google Scholar] [CrossRef]

- Wang, Y. (2024). Crude oil prices, exchange rates, and monetary policy in Canada. SSRN Online Journal. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4925438 (accessed on 23 November 2024).

- Wei, Y., & Guo, X. (2023). Exogenous oil supply shocks and global agricultural commodity prices. SSRN Online Journal. [Google Scholar] [CrossRef]

- Woo, W. T. (1985). The monetary approach to exchange rate determination under rational expectations: The dollar-deutschmark rate. Journal of International Economics, 18(1–2), 1–16. [Google Scholar] [CrossRef]

- World Bank. (2023). Safety first: The economic cost of crime in South Africa (14th ed.). South Africa economic update. World Bank. [Google Scholar]

- Yang, J., & Koondhar, M. A. (2024). Impact of mineral based social equity on unearthing inequities: A longitudinal analysis of environmental and social equity of mineral exploitation in the global south. Journal of Environmental Management, 365, 121492. [Google Scholar] [CrossRef] [PubMed]

- Yazdanbakhsh, O., Zhou, Y., & Dick, S. (2017). An intelligent system for livestock disease surveillance. Information Sciences, 378, 26–47. [Google Scholar] [CrossRef]

- Zhang, F., Wang, Q., & Li, R. (2024). Linking natural resource abundance and green growth: The role of energy transition. Resources Policy, 91, 104898. [Google Scholar] [CrossRef]

- Zoundi, Z. (2024). Wells or welfare? Macroeconomic implications of the Canadian oil subsidy. Economic Modelling, 139, 106794. [Google Scholar] [CrossRef]

| Levels | First Difference | ||||

|---|---|---|---|---|---|

| Variables | Test | Intercept | Intercept and Trend | Intercept | Intercept and Trend |

| lnOP (logged oil prices) | ADF | 0.28 | 0.35 | 0.00 | 0.00 |

| PP | 0.23 | 0.29 | 0.00 | 0.00 | |

| lnFER (logged Foreign exchange rate) | ADF | 0.90 | 0.05 | 0.00 | 0.00 |

| PP | 0.93 | 0.17 | 0.00 | 0.00 | |

| lnCPI (logged Consumer Price Index) | ADF | 0.22 | 0.67 | 0.00 | 0.00 |

| PP | 0.15 | 0.55 | 0.00 | 0.00 | |

| Correlation Probability | lnOP | lnFER | lnCPI |

|---|---|---|---|

| lnOP (logged oil prices) | 1.00 | ||

| --- | |||

| lnFER (logged Foreign exchange rate) | 0.40 | 1.00 | |

| (0.00) | --- | ||

| lnCPI (logged Consumer Price Index) | −0.19 | −0.13 | 1.00 |

| (0.01) | (0.08) | --- |

| Trace Test Outcomes | ||||

|---|---|---|---|---|

| Hypothesised no. of cointegrated equations | Eigenvalue | Trace Statistic | 0.05 critical value | p-value |

| None | 0.082954 | 25.68223 | 29.79707 | 0.1385 |

| At most 1 | 0.050605 | 10.52769 | 15.49471 | 0.2423 |

| At most 2 | 0.008194 | 1.439924 | 3.841466 | 0.2302 |

| Maximum Eigenvalue Outcomes | ||||

| Hypothesised no. of cointegrated equations | Eigenvalue | Max-Eigen Statistic | 0.05 critical value | p-value |

| None | 0.082954 | 15.15454 | 21.13162 | 0.2782 |

| At most 1 | 0.050605 | 9.087763 | 14.26460 | 0.2789 |

| At most 2 | 0.008194 | 1.439924 | 3.841466 | 0.2302 |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −56.20529 | NA | 0.000400 | 0.688434 | 0.743332 | 0.710707 |

| 1 | 784.4663 | 1642.242 | 2.52 × 10−8 | −8.982167 | −8.762574 * | −8.893072 * |

| 2 | 795.6057 | 21.37196 | 2.46 × 10−8 * | −9.007043 * | −8.622755 | −8.851127 |

| 3 | 802.9777 | 13.88693 | 2.51 × 10−8 | −8.988113 | −8.439132 | −8.765377 |

| 4 | 806.8514 | 7.161762 | 2.66 × 10−8 | −8.928505 | −8.214828 | −8.638948 |

| 5 | 812.9606 | 11.08177 | 2.76 × 10−8 | −8.894890 | −8.016520 | −8.538513 |

| 6 | 825.9191 | 23.05417 * | 2.63 × 10−8 | −8.940920 | −7.897855 | −8.517722 |

| 7 | 831.4771 | 9.694196 | 2.75 × 10−8 | −8.900897 | −7.693137 | −8.410878 |

| 8 | 833.4766 | 3.417737 | 2.99 × 10−8 | −8.819496 | −7.447042 | −8.262655 |

| Types of Test | Null Hypothesis | Model | T Statistic | Probability | Decision (i.e., Reject or Accept the Null Hypothesis) |

|---|---|---|---|---|---|

| Portmanteau Test for autocorrelations | No residual autocorrelations | VAR | 60.10 | 0.26 | Null hypothesis accepted |

| SVAR | 60.10 | 0.26 | Null hypothesis accepted | ||

| Serial correlation LM tests | No serial correlation | VAR | 9.12 | 0.43 | Null hypothesis accepted |

| SVAR | 9.12 | 0.43 | Null hypothesis accepted | ||

| Normality test (Jarque-Bera) | Residuals are multivariate normal | VAR | 434.80 | 0.00 | Null hypothesis rejected |

| SVAR | 339.69 | 0.00 | Null hypothesis rejected |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Majenge, L.; Mpungose, S.; Msomi, S. Comparative Analysis of VAR and SVAR Models in Assessing Oil Price Shocks and Exchange Rate Transmission to Consumer Prices in South Africa. Econometrics 2025, 13, 8. https://doi.org/10.3390/econometrics13010008

Majenge L, Mpungose S, Msomi S. Comparative Analysis of VAR and SVAR Models in Assessing Oil Price Shocks and Exchange Rate Transmission to Consumer Prices in South Africa. Econometrics. 2025; 13(1):8. https://doi.org/10.3390/econometrics13010008

Chicago/Turabian StyleMajenge, Luyanda, Sakhile Mpungose, and Simiso Msomi. 2025. "Comparative Analysis of VAR and SVAR Models in Assessing Oil Price Shocks and Exchange Rate Transmission to Consumer Prices in South Africa" Econometrics 13, no. 1: 8. https://doi.org/10.3390/econometrics13010008

APA StyleMajenge, L., Mpungose, S., & Msomi, S. (2025). Comparative Analysis of VAR and SVAR Models in Assessing Oil Price Shocks and Exchange Rate Transmission to Consumer Prices in South Africa. Econometrics, 13(1), 8. https://doi.org/10.3390/econometrics13010008