Analysis of Factors Influencing Credit Access of Vietnamese Informal Labors in the Time of COVID-19 Pandemic

Abstract

:1. Introduction

2. Literature Review

3. Data and Methods

3.1. Data

3.2. Methods

4. Results and Discussion

4.1. Descriptive Statistics and Findings

4.2. Determinants of Access to Credit

4.3. Effects of Access to Credit on the Quality of Life Improvement

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Adewumi, Aderemi, and Ayo Akinyelu. 2017. A survey of machine-learning and nature-inspired based credit card fraud detection techniques. International Journal of System Assurance Engineering and Management 8: 937–53. [Google Scholar] [CrossRef]

- Agier, Isabelle, and Ariane Szafarz. 2013. Subjectivity in credit allocation to microentrepreneurs: Evidence from Brazil. Small Business Economics 41: 263–75. [Google Scholar] [CrossRef] [Green Version]

- Akudugu, Mamudu. 2012. Estimation of the Determinants of Credit Demand by Farmers and Supply by Rural Banks in Ghana’s Upper East Region. Asian Journal of Agriculture and Rural Development 2: 189–200. [Google Scholar]

- Anane, Isaac, Yue Zhang, and Fengying Nie. 2021. The Sources of Microfinance Capital and its Effects on Farmers access to Credit in Ghana. SVU-International Journal of Agricultural Science 3: 112–28. [Google Scholar] [CrossRef]

- Assogba, Perceval Noel, Sènakpon E. Haroll Kokoye, Rosaine N. Yegbemey, Jonas André Djenontin, Zacharie Tassou, Joanna Pardoe, and Jacob A. Yabi. 2017. Determinants of Credit Access by Smallholder Farmers in North-East Benin. Journal of Development and Agricultural 9: 210–16. [Google Scholar]

- Bin, Joachem Meh. 2021. Impact of Access to Credit on the Sustainability of Small and Medium Sized Enterprises in Cameroon. American Journal of Industrial and Business Management 11: 705–18. [Google Scholar] [CrossRef]

- Caiazza, Rosa, Erik Lehmann, and Henry Etzkowitz. 2021. An absorptive capacity—Based system view of COVID-19 in the small business economy. International Entrepreneurship and Manafement Journal 17: 1419–39. [Google Scholar] [CrossRef]

- Cameron, A. Colin, and Pravin K. Trivedi. 2005. Microeconometrics: Methods and Applications. New York: Cambridge University Press. [Google Scholar]

- Da, Van Huynh, Thuy Thi Kim Truong, Long Hai Duong, Nhan Trong Nguyen, Giang Vu Huong Dao, and Canh Ngoc Dao. 2021. The COVID-19 Pandemic and Its Impacts on Tourism Business in a Developing City: Insight from Vietnam. Economies 9: 172. [Google Scholar] [CrossRef]

- Diagne, Aliou. 1999. Determinants of Household Access to and Participation in Formal and Informal Credit Markets in Malawi. Discussion Paper 67. Washington, DC: International Food Policy Research Institute. [Google Scholar]

- Doan, Tinh, and Tran Quang Tuyen. 2015. Credit participation and constraints of the poor in Peri-urban Areas, Vietnam: A micro-econometric analysis of a household survey. Argumenta Oeconomica 1: 175–200. [Google Scholar] [CrossRef]

- Ferede, Kiros Habtu. 2012. Determinants of Rural Households Demand for and Access to Credit in Microfinance Institutions: The Case of Atamata Woreda–Ethiopia’ MA. Wageningen: Wageningen University Research. [Google Scholar]

- Garay, Annalyn Ramos. 2007. Credit Accesibility of Smallscale Farmers and Fisherfolk in the Philippines. Review of Development and Cooperation. Lincoln: University of Lincoln. [Google Scholar]

- He, Guangwen, and Lili Li. 2005. People’s Republic of China: Financial Demand Study of Farm Households in Longren/Guizhou of PRC. ADB Technical Assistance Consult’s Report. Project Number: 35412. Guiyang: ADB. [Google Scholar]

- Hua, Jinling, and Rajib Shaw. 2020. Corona Virus “infodemic” and emerging issues through a data lens: The case of china. International Journal of Environmental Research and Public Health 17: 2309. [Google Scholar] [CrossRef] [Green Version]

- ILO. 2020. COVID-19 and the World of Work, 5th ed. Geneva: International Labour Organization. [Google Scholar] [CrossRef]

- Kedir, Abi. 2003. Determinants of Access to Credit and Loan Amount: Household—Level Evidence. Urban Ethiopia’ International Conference on Development Studies July 11–12, 2003, Addis Ababa, Ethiopia Paper 64. Kalamazoo: Western Michigan University. [Google Scholar]

- Kumar, Anil, Suneel Sharma, and Mehregan Mahdavi. 2021. Machine Learning (ML) Technologies for Digital Credit Scoring in Rural Finance: A Literature Review. Risks 9: 192. [Google Scholar] [CrossRef]

- Langat, Robert Cherutyot. 2013. Determinants of Lending to Farmers by Commercial Banks in Kenya. Nairobi: University of Nairobi. [Google Scholar]

- Lassana, Touré, and Diop Ibrahima Thione. 2020. Analysis of Determinants of Access to Credit for Cotton Producers in Mali. South Asian Journal of Social Studies and Economics 6: 44–59. [Google Scholar] [CrossRef]

- Le, Linh K., and Duong V. Pham. 2011. Analysis of factors determining the amount of formal credit loans of farm households in An Giang. Banking Technology Magazine 60: 8–15. [Google Scholar]

- Lee, Han-Sol, Ekaterina A. Degtereva, and Alexander M. Zobov. 2021. The Impact of the COVID-19 Pandemic on Cross-Border Mergers and Acquisitions’ Determinants: New Empirical Evidence from Quasi-Poisson and Negative Binomial Regression Models. Economies 9: 184. [Google Scholar] [CrossRef]

- Li, Xia, Christopher Gan, and Baiding Hu. 2011. The welfare impact of microcredit on rural households in China. Journal of Behavioral and Experimental Economics (formerly The Journal of Socio-Economics) 40: 404–11. [Google Scholar] [CrossRef]

- Louviere, Jordan J., David A. Hensher, and Joffre D. Swait. 2002. Stated Choice Methods: Analysis and Application. Cambridge: Cambridge University Press, ISBN 0-521-78830-7. [Google Scholar]

- Nguyen, Anh Tuan, Tuyen Quang Tran, Huong Van Vu, and Dat Quoc Luu. 2018. Housing satisfaction and its correlates: A quantitative study among residents living in their own affordable apartments in urban Hanoi, Vietnam. International Journal of Urban Sustainable Development 10: 79–91. [Google Scholar] [CrossRef]

- Nguyen, Nhung, and Nhung Luu. 2013. Determinants of financing pattern and access to formal-informal credit: The case of small and medium sized enterprises in Viet Nam. Journal of Management Research 5: 240–59. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, Ninh, Nguyen T. Phương, and Nguyen P. Quan. 2019. Analysis of factors affecting the accessibility of official credit for households in Thua Thien Hue province. Journal of Science and Development 8: 844–52. [Google Scholar]

- Nouman, Muhammad, Muhammad Siddiqi, Syed Asim, and Zahid Hussain. 2013. Impact of Socio Economic Characteristics of Farmers on Access to Agricultural Credit. Sarhad Journal of Agriculture 29: 469–76. [Google Scholar]

- Pham, Binh, Anh Huynh, and Tran C. Tho. 2020. Factors affecting formal credit access of rice farmers in Nga Nam town, Soc Trang province. Journal of Scientific Research and Economic Development 8: 2020. [Google Scholar]

- Pham, Chuong Hong. 2020. Evaluation of COVID-19 Response Policies and Recommendations. Hanoi: National Economics University Publishing House. [Google Scholar]

- Rajneesh, Narula. 2020. Policy opportunities and challenges from the COVID-19 pandemic for economies with large informal sectors. Journal of International Business Policy 3: 302–10. [Google Scholar]

- Sayed, Adham, and Bing Peng. 2021. Pandemics and Income Inequality: A Historical Review. SN Business & Economics 1: 54. [Google Scholar]

- Sekyi, Samuel. 2017. Rural households’ credit access and loan amount in Wa Municipality, Ghana. International Journal of Economics and Financial Issues 7: 506–14. [Google Scholar]

- Sossou, Comlan Hervé, Gildas Adjovi, Thomas Dogot, and Philippe Lebailly. 2017. Analysis of the Determinants of Access to Credit for Agricultural Holdings in Benin. Cotonou: National Institute of Agricultural Research of Benin (INRAB), p. 15. [Google Scholar]

- Twumasi, Martinson Ankrah, Yuansheng Jiang, and Monica Owusu Acheampong. 2020. Determinants of agriculture participation among tertiary institution youths in Ghana. Journal of Agricultural Extension and Rural Development 11: 56–66. [Google Scholar]

- Twumasi, Martinson Ankrah, Yuansheng Jiang, Evans B. Ntiamoah, Selorm Akaba, Kwabena N. Darfor, and Linda K. Boateng. 2020. Access to Credit and Farmland Abandonment Nexus: The Case of Rural Ghana. Hoboken: Wiley. [Google Scholar] [CrossRef]

- West, David. 2000. Neural network credit scoring models. Computers & Operations Research 27: 1131–52. [Google Scholar]

| Variables | Definition |

|---|---|

| Dependent variables | |

| Access to credit | Access to credit (1 = yes, 0 = no) |

| Quality of life | Improving quality of life, 1 = much of an improvement, 2 = slight Improvement, 3 = no improvement, 4 = decrease |

| Explanatory variables | |

| Household characteristics | |

| Gender | Respondent gender (1 = male; 0 = female) |

| Age | Informal labor’s actual age (years) |

| Education | Actual schooling years |

| Ethnicity | Whether respondent is Kinh (1 = yes; 0 = no) |

| Family size | Number of household members (people) |

| Marital status | Get married (1 = married, 0 = otherwise) |

| Collateral | Have a collateral security (1 = yes, 0 = no) |

| Area | Live in urban and rural areas (1 = urban, 0 = rural) |

| Credit characteristics | |

| Source of credit | Organization supply (1 = banks, 2 = associations, 3 = local credit fun) |

| Size of credit | The amount of money borrowed |

| Credit debt | Unpaid credit loans (1 = if all loans have been paid, 0 = all loans have not been paid) |

| Paid money | A loan origination fee (million dong) |

| Interest | The interest rate charged to the borrower (%) |

| Variables | All | Urban | Rural | |||

|---|---|---|---|---|---|---|

| Mean/Share | SD | Mean/Share | SD | Mean/Share | SD | |

| Dependent variables | ||||||

| Access to credit | 21.42% | 23.57% | 17.33% | |||

| Quality of life | ||||||

| Much of an improvement | 36.83% | 36.24% | 36.22% | |||

| Slight improvement | 43.17% | 45.30% | 49.22% | |||

| No improvement | 10.37% | 8.71% | 7.97% | |||

| Decrease | 8.23% | 9.76% | 6.95% | |||

| Explanatory variables | ||||||

| Household characteristics | ||||||

| Gender | 51.92% | 57.84% | 55.29% | |||

| Age | 33.77 | 19.81 | 31.89 | 19.73 | 32.08 | 19.91 |

| Ethnicity | 81.83% | 82.56% | 76.78% | |||

| Education | 6.34 | 3.72 | 5.99 | 2.04 | 5.79 | 2.10 |

| Family size | 2.58 | 1.52 | 2.59 | 1.56 | 2.63 | 1.57 |

| Marital status | 69.40% | 77.83% | 74.34% | |||

| Credit characteristics | ||||||

| Collateral | 29.82% | 26.98% | 33.56% | |||

| Credit source | 2.64 | 0.82 | 2.65 | 0.81 | 2.64 | 0.83 |

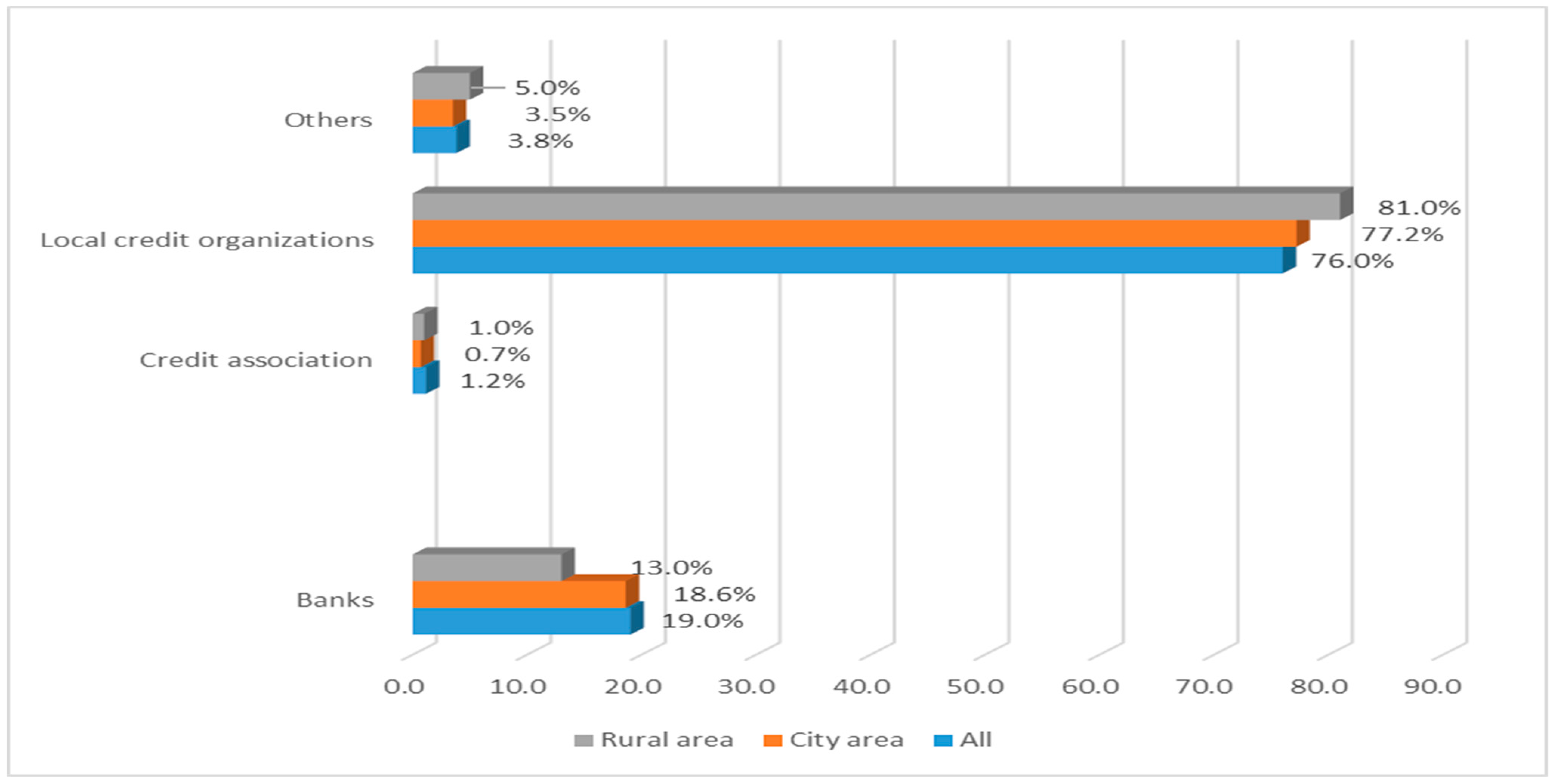

| Banks | 19.00% | 18.60% | 13.00% | |||

| Associations | 1.20% | 0.70% | 1.00% | |||

| Local credit fun | 76.00% | 77.20% | 81.00% | |||

| Credit size | 178,970.8 | 502,078.5 | 179,290.6 | 417,824.9 | 178,824.0 | 537,679.8 |

| Credit debt | 142,830.7 | 330,563.5 | 144,965.9 | 291,299.8 | 141,850.8 | 348,046.8 |

| Paid money | 84.74 | 559.21 | 149.25 | 843.93 | 55.13 | 360.86 |

| Interest | 2.95 | 4.15 | 2.44 | 3.53 | 3.19 | 4.41 |

| Number of observation | 963 | 577 | 387 | |||

| Variables | All | Urban | Rural | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Coefficient | SE | p-Value | Coefficient | SE | p-Value | Coefficient | SE | p-Value | |

| Gender | −0.14 | 0.68 | 0.03 | −0.07 | 0.06 | 0.02 | 0.04 | 0.78 | 0.00 |

| Age | −0.01 | 0.02 | 0.00 | −0.02 | 0.01 | 0.02 | −0.01 | 0.03 | 0.07 |

| Ethnicity | −1.63 | 0.69 | 0.01 | −0.11 | 0.11 | 0.03 | −1.20 | 0.76 | 0.03 |

| Education | 0.02 | 0.20 | 0.05 | 0.01 | 0.01 | 0.01 | 0.08 | 0.24 | 0.01 |

| Family size | −0.27 | 0.33 | 0.03 | −0.02 | 0.03 | 0.04 | −0.05 | 0.34 | 0.01 |

| Marital status | 0.93 | 1.01 | 0.09 | 0.04 | 0.08 | 0.06 | 1.05 | 1.13 | 0.08 |

| Collateral | 1.96 | 0.98 | 0.05 | 0.01 | 0.08 | 0.00 | 1.88 | 1.20 | 0.05 |

| Credit source | 0.01 | 0.29 | 0.01 | 0.01 | 0.03 | 0.01 | 0.07 | 0.33 | 0.02 |

| Credit size | 8.67 | 4.88 | 0.01 | 3.93 | 4.03 | 0.03 | 9.30 | 6.99 | 0.00 |

| Credit debt | 0.01 | 7.34 | 0.08 | 5.65 | 6.32 | 0.07 | 0.01 | 9.10 | 0.05 |

| Paid money | −0.01 | 0.01 | 0.00 | −0.01 | 0.01 | 0.04 | −0.01 | 0.01 | 0.02 |

| Interest | −0.03 | 0.09 | 0.02 | −0.01 | 0.01 | 0.01 | −0.02 | 0.08 | 0.03 |

| Constant | 0.07 | 2.10 | 0.03 | 0.29 | 0.19 | 0.03 | 0.16 | 0.22 | 0.03 |

| Number of observation | 963 | 577 | 387 | ||||||

| Variables | All | Urban | Rural | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Coefficient | SE | p-Value | Coefficient | SE | p-Value | Coefficient | SE | p-Value | |

| Credit access | 0.21 | 0.24 | 0.00 | 0.19 | 0.17 | 0.04 | 0.17 | 0.15 | 0.01 |

| Education | 0.26 | 0.21 | 0.00 | 0.16 | 0.08 | 0.02 | 0.31 | 0.31 | 0.00 |

| Collateral | 0.31 | 0.79 | 0.00 | 0.29 | 0.46 | 0.01 | 1.17 | 3.01 | 0.02 |

| Credit source | 0.09 | 0.25 | 0.00 | 0.34 | 0.16 | 0.02 | 0.11 | 0.30 | 0.01 |

| Credit size | 3.12 | 2.44 | 0.03 | 1.25 | 2.22 | 0.01 | 4.24 | 4.73 | 0.07 |

| Credit debt | 8.50 | 7.10 | 0.00 | −1.59 | 3.49 | 0/04 | 6.01 | 0.01 | 0.02 |

| Paid money | −0.01 | 0.06 | 0.00 | −0.01 | 0.01 | 0.04 | −0.04 | 0.02 | 0.03 |

| Interest | −0.25 | 0.14 | 0.00 | −0.11 | 0.06 | 0.01 | −0.20 | 0.24 | 0.05 |

| Number of observation | 963 | 577 | 387 | ||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vu, H.V.; Ho, H. Analysis of Factors Influencing Credit Access of Vietnamese Informal Labors in the Time of COVID-19 Pandemic. Economies 2022, 10, 8. https://doi.org/10.3390/economies10010008

Vu HV, Ho H. Analysis of Factors Influencing Credit Access of Vietnamese Informal Labors in the Time of COVID-19 Pandemic. Economies. 2022; 10(1):8. https://doi.org/10.3390/economies10010008

Chicago/Turabian StyleVu, Hung Van, and Huong Ho. 2022. "Analysis of Factors Influencing Credit Access of Vietnamese Informal Labors in the Time of COVID-19 Pandemic" Economies 10, no. 1: 8. https://doi.org/10.3390/economies10010008

APA StyleVu, H. V., & Ho, H. (2022). Analysis of Factors Influencing Credit Access of Vietnamese Informal Labors in the Time of COVID-19 Pandemic. Economies, 10(1), 8. https://doi.org/10.3390/economies10010008