Abstract

This paper analyses the gender-, age- and educational attainment level-specific output–employment relationship and its dependence on foreign direct investment (FDI). The unbalanced panel covers 25 European Union countries’ data from 2000 to 2020. Empirical estimations are made using the pooled OLS estimator. The impact of FDI on gender-, age- and educational attainment level-specific output–employment elasticities is estimated by including the multiplicative terms between gross domestic product (GDP) and FDI in regression models. The main results indicate the positive impact of economic growth on employment, with the highest output–employment elasticities for males and youth regardless of gender. The estimation results also indicate limited abilities of economic growth to increase the employment of highly educated people and females older than 25 years regardless of their educational attainment level. Our results suggest that higher FDI level in the host countries is mostly associated with the decreasing employment reaction to economic growth. Although FDI is an important factor affecting the output–employment relationship, it does not help to solve the problem of unemployment in the EU, especially for youth.

1. Introduction

Economic growth leading to employment growth is a priority of every country and the European Union as a whole. A high level of employment indicates that the country’s labour resources are efficiently used, the country can reach its potential level of production and there is a low unemployment rate and a favourable social environment. A low employment rate or a high unemployment rate in a country indicates unused labour and other resources, economic and social problems such as growing poverty, income inequality, emigration and increasing budget deficit due to increased social benefits. A high employment rate is one of the main goals of macroeconomic policy. The Great Recession has had a different impact on employment and unemployment in countries around the world and encouraged increasing interest in research on employment (unemployment) reaction to economic fluctuations. The coronavirus crisis and the war in Ukraine, with its consequences on the labour market, have further increased the relevance of this topic. Despite the growing economies, the European Union has not reached the employment target which was a 75% employment rate (for people aged 20–64) in 2020. The gender gap in employment and the low employment rate of youth have also remained a serious problem in the European Union.

The results of studies on the economic growth–employment nexus (Seyfried 2007, 2014; Herman 2011; Furceri et al. 2012; Hartwig 2014; Richter and Witkowski 2014; Ezzahidi and El Alaoui 2014; Burggraeve et al. 2015; Dahal and Rai 2019; Thuku et al. 2019; Adegboye et al. 2019; Mkhize 2019; Ben-Salha and Zmami 2021; Mihajlović and Marjanović 2021; et al.) usually show the positive but heterogeneous impact of economic growth on employment. Authors have analysed the output–employment elasticities in individual countries (Seyfried 2007, 2014; Hartwig 2014; Ezzahidi and El Alaoui 2014; Burggraeve et al. 2015; Dahal and Rai 2019; Thuku et al. 2019) or regions (Furceri et al. 2012; Richter and Witkowski 2014; Adegboye et al. 2019; Mkhize 2019; Ben-Salha and Zmami 2021; Mihajlović and Marjanović 2021) but there is a scarcity of research conducted in the European Union as a whole (Herman 2011; Richter and Witkowski 2014; Burggraeve et al. 2015). Since European Union countries follow rather different employment strategies and targets, it is important to know whether economic growth in the European Union as a whole leads to employment growth or whether the growth not connected to jobs. It also allows us to understand if economic growth in the European Union is more associated with productivity or employment growth. European Union countries have a free labour movement, meaning that decreasing employment in one country could increase employment in another and otherwise. Trying to eliminate this effect, and to increase the efficiency of estimates, this study applies the panel estimation technique in 25 European Union (EU) countries which allows us to look at the European Union as a single market.

Authors have also determined the factors influencing heterogeneity of the output–employment relationship: specific economic characteristics of each country (Pattanaik and Nayak 2014; Slimane 2015; Burggraeve et al. 2015; El-Hamadi et al. 2017; Ali et al. 2018; Dahal and Rai 2019; Thuku et al. 2019; Mkhize 2019; Ben-Salha and Zmami 2021), institutional (Kapsos 2006; Furceri et al. 2012; Richter and Witkowski 2014; Ali et al. 2018; Ben-Salha and Zmami 2021), and demographic characteristics (Furceri et al. 2012; Anderson and Braunstein 2013; Pattanaik and Nayak 2014; Slimane 2015; Anderson 2016; Ben-Salha and Zmami 2021). Scientific literature emphasises that employment reaction to economic growth could vary across gender (Kapsos 2006; Anderson and Braunstein 2013; Anderson 2016; Adegboye et al. 2019) or age (Kapsos 2006; Adegboye et al. 2019), with most estimations indicating the higher responsiveness of employment to economic growth for females compared to males, and lower for youth compared to total male and female output–employment elasticities. The literature analysing the output–unemployment relationship also discusses possible heterogeneity across educational attainment levels (Askenazy et al. 2015; Kadiša et al. 2021), indicating lower unemployment reaction to economic fluctuations for highly educated people. Since we could not find any similar research in the context of the output–employment relationship, our research complements existing literature by analysing the gender-, age- and educational attainment level-specific output–employment elasticity in the European Union.

In the context of growing globalisation, FDI is widely discussed as a factor determining economic growth and employment separately. However, literature analysing the impact of FDI on the output–employment relationship is limited and requires further detailed analysis. The scientific literature emphasises that FDI could increase employment reaction to economic growth directly by inventing new jobs (Mucuk and Demirsel 2013) and indirectly by increasing the level of wages and increasing aggregate demand as well as demand for the labour force (Yousfi and Benziane 2020; Boumediene et al. 2021). The other point of view assumes that employment reaction to economic growth can decrease due to the FDI-driven higher labour productivity, FDI concentration in capital-intensive sectors, etc. (Golejewska 2001; Marelli et al. 2014). What impact FDI would have on the output–employment relationship depends on specific characteristics of countries, including the age, gender and educational attainment level of employees. The earlier empirical evidence does not provide consistent conclusions about the FDI’s impact on the output–employment relationship either. Therefore, this research not only complements limited empirical evidence on gender-, age- and educational attainment level-specific output–employment elasticity in the European Union but in addition, examines how this relationship depends on the FDI level in the host country.

Empirical results of this research show that 1% of economic growth would lead to an increase in employment by 0.30%, meaning that economic growth is associated with both productivity and employment growth in the EU. The main results suggest that employment reaction to economic growth decreases with age and economic growth has limited abilities to increase employment outcomes for highly educated people and women older than 25 years of age. Analysing the FDI’s impact on the heterogeneous output–employment relationship, we find that a higher FDI level in the host country is associated with lower employment reaction to economic growth in most of the analysed cases.

The rest of the paper is organised as follows: Section 2 summarises empirical evidence on the heterogenous output–employment relationship and discusses the impact of FDI on employment sensitivity to economic growth; Section 3 presents the applied methodology: the model, estimation strategy and data; Section 4 discusses the main results; Section 5 concludes the paper.

2. Literature Review

2.1. Output–Employment Relationship

The output–employment relationship analysis is the alternative of the so-called employment version of Okun law (International Monetary Fund 2010). Okun (1962) was the first who described the reverse relationship between output and unemployment based on the statistical data of the United States. The main idea of the Okun law is that 1% of economic growth is associated with a decrease in unemployment by 0.3 p.p. Although the relationship is known as a law, it is also criticised for its instability over time and heterogeneity across countries as they differ across the level of development and other macroeconomic characteristics. Since the relationship between output and unemployment is negative, the economic growth impact on employment is supposed to be positive (Mihajlović and Marjanović 2021). The output–employment analysis could be more valuable for researchers as the statistical data of employment are more detailed and allow analysis of the relationship between output and employment according to age, gender, education, part-time/full-time work, skilled/unskilled jobs, economic structure, etc. (Kapsos 2006).

While the relationship between economic growth and unemployment is measured by the Okun coefficient, the output–employment relationship is mainly defined as output–employment sensitivity (Seyfried 2014; Mihajlović and Marjanović 2021) or output–employment elasticity (Anderson 2016; Dauda and Ajeigbe 2021). According to Kapsos (2006) and Ezzahidi and El Alaoui (2014), output–employment elasticity shows how much employment growth is related to the 1% of economic growth. The most desirable level of output–employment elasticity ranges between 0 and 1 (Ghazali and Mouelhi 2018), indicating that economic growth is associated with both employment and labour productivity growth (Dahal and Rai 2019). The main results of empirical studies analysing the output–employment relationship are summarised in Table 1.

Table 1.

Empirical studies of the output–employment relationship.

The analysis of empirical studies (Seyfried 2007; Herman 2011; Furceri et al. 2012; Seyfried 2014; Hartwig 2014; Ezzahidi and El Alaoui 2014; Dahal and Rai 2019; Thuku et al. 2019; Adegboye et al. 2019; Mkhize 2019; Ben-Salha and Zmami 2021; Mihajlović and Marjanović 2021) shows that economic growth effect on employment in most of the cases is positive but heterogeneous. The output–employment elasticities range from being negative in Serbia, Belarus and Romania (Slimane 2015) or relatively small in countries such as Germany (Seyfried 2007), Greece, Ireland and Italy (Seyfried 2014), and regions such as Africa, Sub-Saharan Africa (Furceri et al. 2012), Europe and Central Asia (Richter and Witkowski 2014), to being higher than one in Spain (Seyfried 2014; Burggraeve et al. 2015). Some research shows that output–employment elasticities in the same country can vary across different periods, showing the tendencies of output–employment elasticities to become higher (Adegboye et al. 2019) or lower (Thuku et al. 2019). We can find only several studies where the impact of economic growth on employment is estimated for a group of European countries with output–employment elasticities equal to 0.32 in EU-10 (Richter and Witkowski 2014), 0.37 in European Union (Herman 2011) and 0.57 in Euro area (Burggraeve et al. 2015).

Some research also estimates how economic growth affects the employment of demographic groups differenced by gender and age (Kapsos 2006; Anderson and Braunstein 2013; Anderson 2016; Adegboye et al. 2019). Kapsos (2006) estimated that women’s output–employment elasticity was higher than men’s in all three periods in 160 studied economies, but the opposite result was found in Japan. The author also confirmed that the elasticity of youth employment was significantly lower than the overall employment elasticity. Anderson and Braunstein (2013) found that the intensity of gender-specific employment growth varies between countries and over time. The authors confirmed higher female employment reaction to output changes for the global and the OECD group samples in all analysed periods. Still, results were different in estimating gender-specific output–employment relationships in countries which do not belong to the OECD. The main findings showed that the output–employment elasticities of males and females do not significantly differ. The results of Anderson’s (2016) research also confirmed higher women’s employment elasticity than men’s in 80 countries. The same conclusions about the higher females’ employment sensitivity to economic growth were confirmed by Majid and Siegmann (2021) in the case of Pakistan. Adegboye et al.’s (2019) estimations show similar output–employment elasticities for both genders and lower employment reaction to economic growth for youth compared to other demographic groups. Differences in output–employment elasticities across age or gender can be related to their different education attainment level. Education is particularly important for the participation rate of women in the labour market (Fitzenberger et al. 2004) as it decreases the employment gap between women and men (Jaba et al. 2015) and increases employability (OECD 2013), which is very important for youth. Since some studies of the output–unemployment relationship confirm that education is an important factor in determining the heterogeneous output–unemployment relationship and showing that unemployment reaction to economic fluctuations is higher for less educated people (Askenazy et al. 2015; Kadiša et al. 2021), we cannot find similar research in the context of output–employment relationship.

As highlighted in the scientific literature, the heterogeneous output–employment relationship also may appear due to other factors such as different responses to employment in periods of economic recession and expansion (Burggraeve et al. 2015; Butkus et al. 2022), specific economic characteristics of each country (Pattanaik and Nayak 2014; Slimane 2015; Burggraeve et al. 2015; El-Hamadi et al. 2017; Ali et al. 2018; Dahal and Rai 2019; Thuku et al. 2019; Mkhize 2019; Ben-Salha and Zmami 2021), institutional (Kapsos 2006; Furceri et al. 2012; Richter and Witkowski 2014; Ali et al. 2018; Ben-Salha and Zmami 2021) and demographic factors (Furceri et al. 2012; Anderson and Braunstein 2013; Pattanaik and Nayak 2014; Slimane 2015; Anderson 2016; Ben-Salha and Zmami 2021; etc.). This research aims to analyse how one of the economic factors, foreign direct investment, affects gender-, age- and educational attainment level-specific employment reaction to economic growth.

2.2. FDI Impact on Output—Employment Relationship

The technological dissemination aspect of economic openness is usually assessed through the FDI which reflects the country’s financial openness. FDI is one of the factors determining the increase in labour productivity, integration into international supply chains, boosting export, innovation, job creation and spreading of know-how (OECD 2019). According to Hale and Xu (2016), FDI brings capital and technology to the targeted industries and companies, affecting labour demand and thus labour structure, employment, average productivity and wage level. The FDI’s impact on economic growth and employment separately is widely discussed. However, literature analysing the effect of FDI on the output–employment relationship is scarce. Following the literature which analyses the relationship between the FDI, economic growth and employment nexus, we assume that FDI could affect employment reaction to economic growth directly and indirectly. The scientific literature emphasises that the direct effect of FDI occurs when a foreign multinational company transfers its capital and creates jobs by company founding (Mucuk and Demirsel 2013). The indirect effect is observed when FDI firstly increases labour productivity growth and when it stimulates aggregate demand and demand for the labour force in local companies (Yousfi and Benziane 2020; Boumediene et al. 2021). This is the most common view, meaning that FDI would increase GDP and have positive effects on employment (Estrin 2017).

As it is expressed by Malik (2019), FDI is a factor that diverts the creation of new jobs from agriculture to other more productive sectors, meaning that FDI is closely related to productivity growth as well as output–employment elasticity. According to the methodology presented by Kapsos (2006), for a given amount of output growth, any increase in employment growth is associated with an equal and opposite decrease in labour productivity growth. From this point of view, FDI-driven productivity growth should lead the decreasing output–employment elasticity. The same situation is expected when FDI is concentrated in capital-intensive economic sectors or foreign companies tend to replace the labour force with capital. Otherwise, if FDI-driven productivity growth would lead to an increase in wages or aggregate demand (Lipsey and Sjöholm 2005), according to Onaran (2008), Jude and Silaghi (2016) and Malik (2019), we should expect the increase in employment in the host country. Golejewska (2001) emphasises that FDI increases the average wage level and competition, leading to the bankruptcies of some local companies and causing short-term unemployment problems due to the lack of a highly skilled labour force which is usually required by foreign companies. Additionally, FDI brings not only technology but also knowledge, new management and work techniques (Golejewska 2001; Marelli et al. 2014), which could increase labour productivity through workforce training without an additional labour force, meaning that output growth could not generate employment. Generally, the positive effect of FDI on employment is observed when the number of new jobs created by FDI exceeds the number of layoffs and job losses related to FDI (Gohou and Soumaré 2012). The research results of Jude and Silaghi (2016) show that new technologies are associated with increased labour productivity and decreased employment, while the creation of new foreign companies is related to employment growth in the European Union countries. The negative impact of FDI on output–employment growth was confirmed by Slimane (2015) in a panel of 90 countries which can be explained by the fact that openness expressed as FDI allows firms to access more productive, advanced goods and technology, consequently, the reaction of employment to economic growth is decreasing. As it is highlighted by Mendoza-Velázquez et al. (2021), the impact of FDI on employment depends on the technological environment, social progress, production conditions and competition in the host country.

The impact of FDI on the output–employment relationship could vary across gender and age. Foreign companies use more advanced and technical skills-intensive technologies than local companies and therefore require a higher-skilled, mostly male workforce (Banerjee and Veeramani 2015). On the other hand, there is an increasing emphasis on the positive effect of FDI impact on women’s employment, explained by their comparative advantage in labour-intensive (Tang and Zhang 2017) and non-skill-intensive sectors such as manufacturing (Siegmann 2007; Sherif et al. 2022) and services. The empirical estimations show that FDI in various countries could increase both low-skilled and high-skilled employment (Onaran 2008; Saucedo et al. 2020). Juhn et al. (2014) stated that automation and computerisation of jobs reduce the need for physical strength, which was once the main comparative advantage of men in the labour market. According to the Heckscher–Ohlin model, increased demand for goods and services and higher competition due to international trade increase the demand for cheaper, unskilled labour (Vacaflores 2011; Ngouhouo and Nchofoung 2021). As Siegmann (2007) and Sherif et al. (2022) point out, women’s work is less well-paid, so in certain highly competitive and labour-intensive industries, such as textiles and clothing, women have a higher relative demand than men. The research of Tang and Zhang (2017) and Kodama et al. (2018) shows that foreign capital companies prefer to employ women more than domestic companies, meaning that attracting foreign direct investment could help increase women’s employment reaction to economic growth. The same conclusions can be made about the FDI’s impact on youth employment reaction to economic growth. Young people lack work experience but learn quickly, adapt to changes and use new technologies more easily (Setyanti and Wahyudi 2021). Since young people are still in education, they are a cheaper labour force compared to older and more educated people, they could be a more attractive labour force to foreign companies.

Adegboye et al. (2019) analysed the impact of economic growth on male, female and youth employment in Sub-Saharan Africa, including FDI as one of the factors determining the heterogeneity of output–employment elasticities. The authors assumed that attracting FDI would lead to wage growth, thus affecting employment growth. The study’s results confirmed that attracting FDI is associated with a higher employment response to economic growth for all analysed demographic groups. Different conclusions were made by Anderson and Braunstein (2013), who found a negative FDI impact on the output–employment relationship for both genders. This is related to the fact that FDI tends to be more about capital-intensive than domestic investment—even in labour-intensive sectors. However, no statistically significant differences between genders were found. We also found several studies which analysed the impact of FDI on the output–unemployment relationship. Kadiša et al.’s (2021) study shows that FDI weakens the effect of economic growth on unemployment. The highest effect of inward FDI on the unemployment reaction to output growth was found for young and uneducated people, as FDI brings technologies that substitute the least skilled labour force. The smallest effect is observed for female and highly educated employed groups. Durech et al. (2014) did not find a statistically significant impact of FDI on the output—unemployment relationship in the Czech Republic and Slovakia.

The literature review showed that the relationship between the economic growth, employment and FDI nexus could vary across different demographic groups and their educational attainment level. In this study, we try to expand the existing literature and analyse gender-, age- and educational attainment level-specific output–employment relationship and how this relationship changes due to different levels of inward FDI in a country.

3. Methodology

This study follows the basic idea postulated in Okun’s (1962) seminal work on the relationship between production and unemployment in the United States. According to Okun’s law, economic growth should lead to a decrease in unemployment and an increase in employment. Studies, depending on the research aims, prefer to use the gap model (Ball et al. 2017; Butkus and Seputiene 2019; Louail and Riache 2019; Duran 2022) or a first differences model (Blázquez-Fernández et al. 2018; Goto and Bürgi 2021) for estimation of economic growth impact on unemployment. However, research on the output–employment relationship (Slimane 2015; Ali et al. 2018; Thuku et al. 2019; Mkhize 2019) usually follow the methodology represented by Kapsos (2006) and applies a log-linear specification to estimate the output–employment elasticities. Islam and Nazara (2000) explained that log-linear regression is more suitable for estimating output–employment elasticity compared to arithmetic elasticity coefficient, as it is applicable for panel data and cross-country comparisons. Since we aim to analyse how economic growth affects employment dynamics, we apply a first differenced version of Okun’s equation and use GDP and employment variables in their first differences. By differencing these variables, additionally, we eliminate the country-specific fixed effects from the model and expect to solve the problem of unobserved heterogeneity in the data.

Our research follows the studies of Slimane (2015), Maza (2022), etc., and consists of two phases. First, we analyse the impact of economic growth on employment growth using the equation given below (see Equation (1)):

where ΔlnEi,t is the log difference of the number of the employed population (measured as a thousand persons employed) between period t and t − 1 in a country i. ΔlnYi,t is the log difference of the output (measured as GDP at constant 2015 prices, million euro) between t and t − 1 in a country i. The parameter β measures output–employment elasticity, which we expect to be with a positive sign. α is the intercept, θt measures the time-varying effects, εi,t is defined as the idiosyncratic error.

Differently from the other output–employment research, we also analyse the gender-, age- and educational attainment level-specific output–employment relationship. For that purpose, we use the employment of different genders (total, male and female), ages (15–64, 15–24, 25–39, 40–64) and education attainment levels following the International Standard Classification of Education (ISCED). ISCED 0–2 includes less than primary, primary and lower secondary education; ISCED 3–4: upper secondary education and post-secondary non-tertiary education; ISCED 5–8: short-cycle tertiary education, bachelor’s, master’s, doctoral or equivalent level education.

In our research, we aim to expand the existing literature and analyse how the gender, age- and the educational attainment level-specific output–employment relationship depends on the FDI level in the host country. Our second step is to apply Equation (2), which is modified by including the multiplicative term between GDP growth and inward FDI (iFDI) level.

where ln(iFDIi,t) is the log of inward FDI stock level (measured as % of GDP) in country i at the period t. Other terms are the same as in Equation (1). Since we include the multiplicative term into the regression model, the output–employment relationship becomes conditional, i.e., mediated by iFDI level. For the correct interpretation of estimation results, we apply the equation suggested by Friedrich (1982). Equation (3) is used to estimate the conditional effect of economic growth on employment.

where

is a slope coefficient, that shows the conditional effect of economic growth on employment at the different iFDI levels. As Butkus et al. (2021) explained, not only the slopes but also the standard errors of the estimated slope coefficients become conditional and, in our case, vary according to the level of iFDI. Standard errors of the slope coefficients are estimated using Equation (4).

For the estimation of statistical significance, t values for the conditional output–employment relationship moderated by the iFDI level are calculated using Equation (5).

Following the previous research on the output–employment relationship (Furceri et al. 2012; Pattanaik and Nayak 2014; Richter and Witkowski 2014; Slimane 2015; Mkhize 2019), we use the pooled ordinary least square estimation. Heteroskedasticity and autocorrelation consistent (HAC) robust standard errors are included in regression models to avoid effects of serial correlation and heteroscedasticity in the error term. Data covers the unbalanced panel of 25 EU countries from 2000 to 2020. Two countries (Cyprus and Malta) were excluded from the sample due to extremely high iFDI levels. Data on GDP and employment were collected from Eurostat, on iFDI from UNCTAD (the United Nations Conference on Trade and Development) databases. Descriptive statistics of selected variables are presented in Appendix A.

4. Estimation Results and Discussion

This section summarises the estimation results of the research using the methodology presented above. Table 2 shows estimated gender-, age- and educational attainment level-specific output–employment elasticities based on Equation (1).

Table 2.

Economic growth impact on employment.

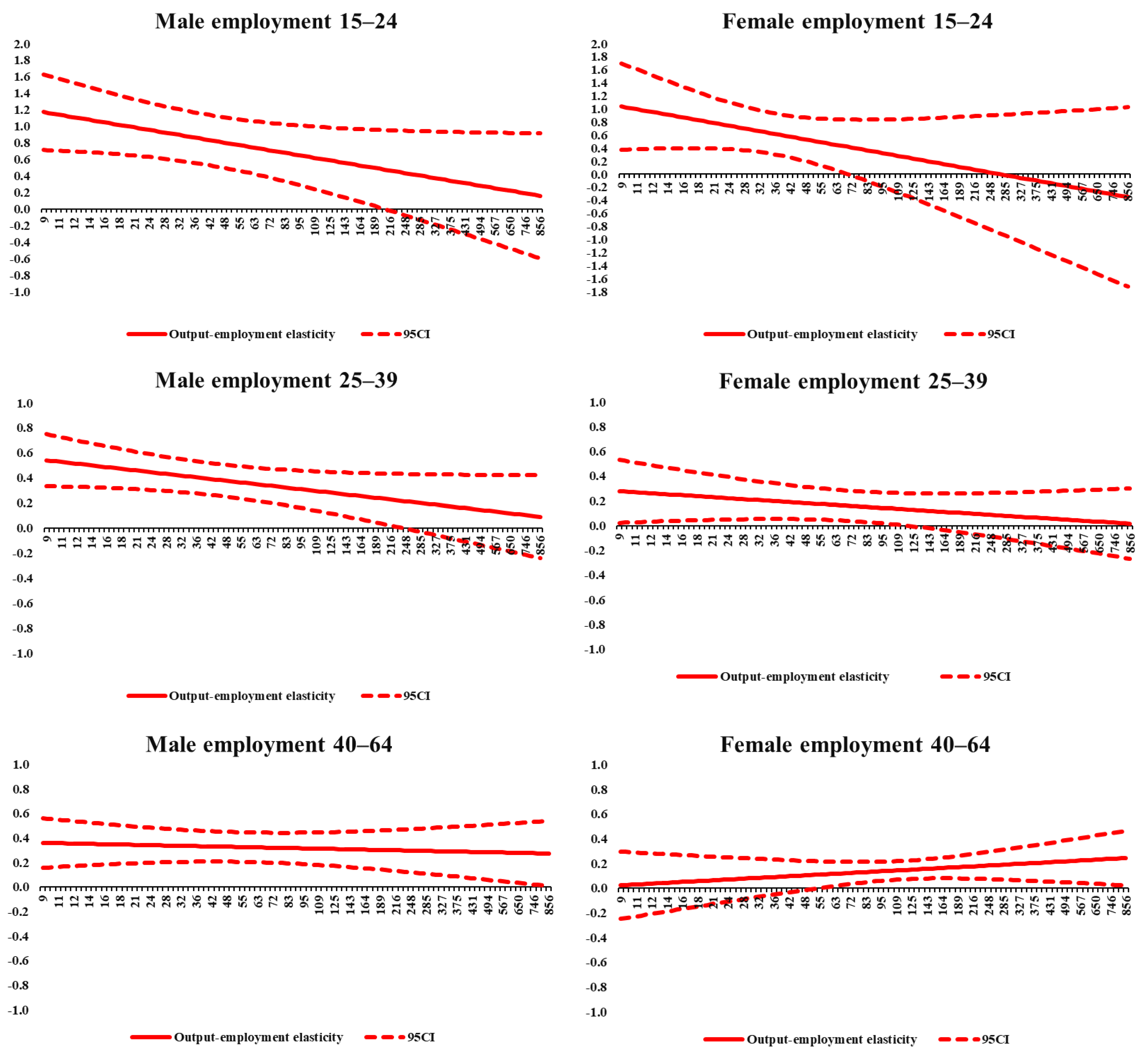

Analysing the effect of economic growth on employment generation, we find that economic growth significantly increases total, male and female employment in all age groups. Our estimations show that 1% of economic growth tends to increase employment by 0.30 % in 25 EU countries. Such a coefficient is similar to the one postulated in the seminal Okun (1962) output–unemployment research. Similar output–employment elasticities are found in previous research conducted by Richter and Witkowski (2014) in the EU-10 countries (0.32), Burggraeve et al. (2015) in individual countries such as Germany (0.30) and Italy (0.32), by Hartwig (2014) in Switzerland (0.31), etc. The highest output–employment elasticities are estimated for males compared with total and female employment and for youth regardless of gender. According to estimation results (see Table 2), an increase in GDP by 1% is associated with an employment increase of 0.66% for youth, 0.77% for young males and 0.52% for young females. Our results are in contrast with previous research (Kapsos 2006; Anderson and Braunstein 2013; Anderson 2016; Majid and Siegmann 2021), where higher output–employment elasticities are identified for females. However, part of the results are in line with others, who find the highest responsiveness of unemployment to economic fluctuations for youth (Hutengs and Stadtmann 2014; Blázquez-Fernández et al. 2018; Ahn et al. 2019; Liotti 2021; Butkus et al. 2020) and for males compared to females (Dixon et al. 2017).

There are several possible reasons determining higher youth employment sensitivity to economic growth. Young people usually do not have the work experience or education that older workers have, their salary is lower, so are their dismissal costs, and they more often work on short-term contracts or prefer seasonal jobs (Dunsch 2015; Dietrich and Möller 2016; Ball et al. 2017). Higher employment reaction to the economic growth of males compared with females can be explained by the low female participation rate in the labour market due to maternity leave and other domestic obligations (Lewandowska-Gwarda 2018; Ahn et al. 2019) or men’s work in cyclically sensitive sectors such as manufacturing and construction (Kim and Park 2019; Liotti 2021). Generally, as Hutengs and Stadtmann (2014), we can state that the ability of economic growth to generate job opportunities decreases with a person’s age.

Employment reaction to economic growth also varies across different levels of educational attainment. Our estimations show that economic growth has limited abilities to increase the employment of highly educated people. These results are in line with Askenazy et al. (2015) in the research on EU-15 employment/unemployment reaction to economic growth or Butkus et al. (2020) in the research on the output–unemployment relationship in the EU. Differently, we find that the reaction of employment to economic growth is more robust for uneducated young and middle-aged males or young males with secondary and upper secondary education. According to Butkus et al. (2020), highly educated employees are more valuable to companies due to their knowledge and experience, so their employment reaction to economic fluctuations is lower compared with those less educated. Economic growth in 25 EU countries also has a positive and statistically significant impact on the employment of young females with secondary and upper secondary education. Thus, the abilities of economic growth to increase the employment of females older than 25 years remain limited.

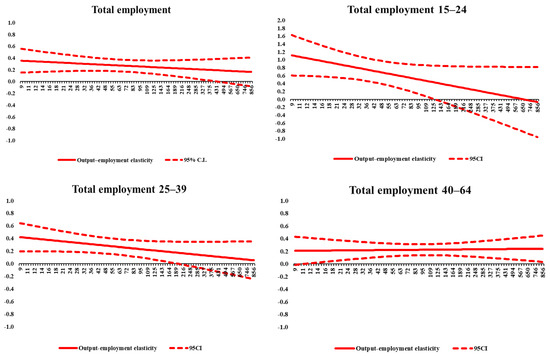

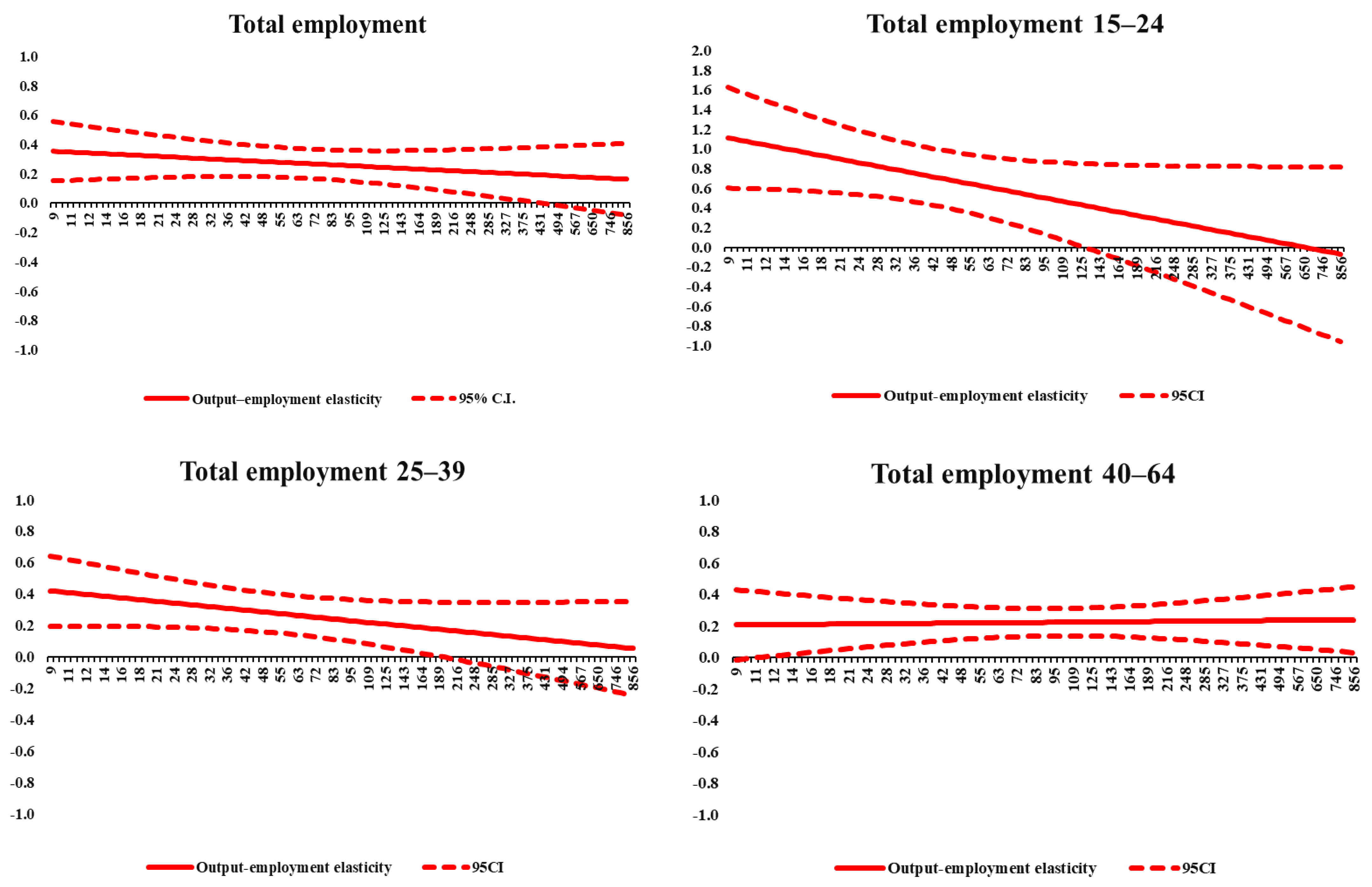

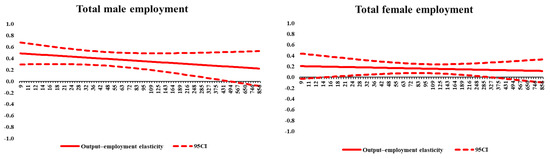

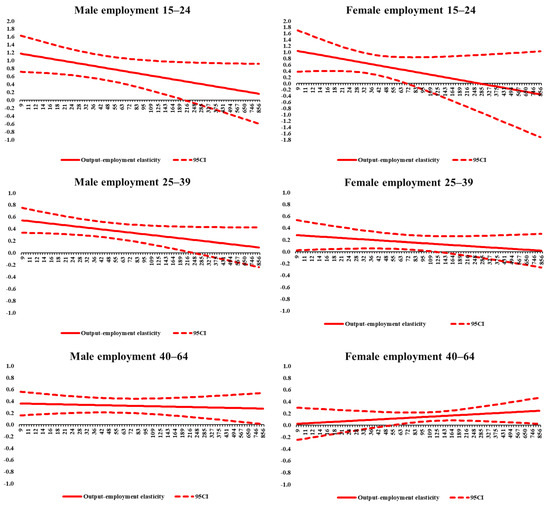

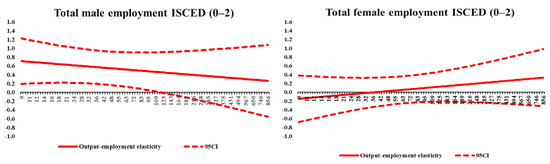

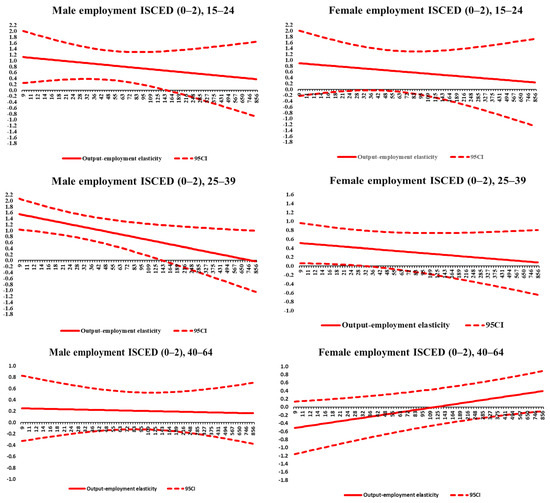

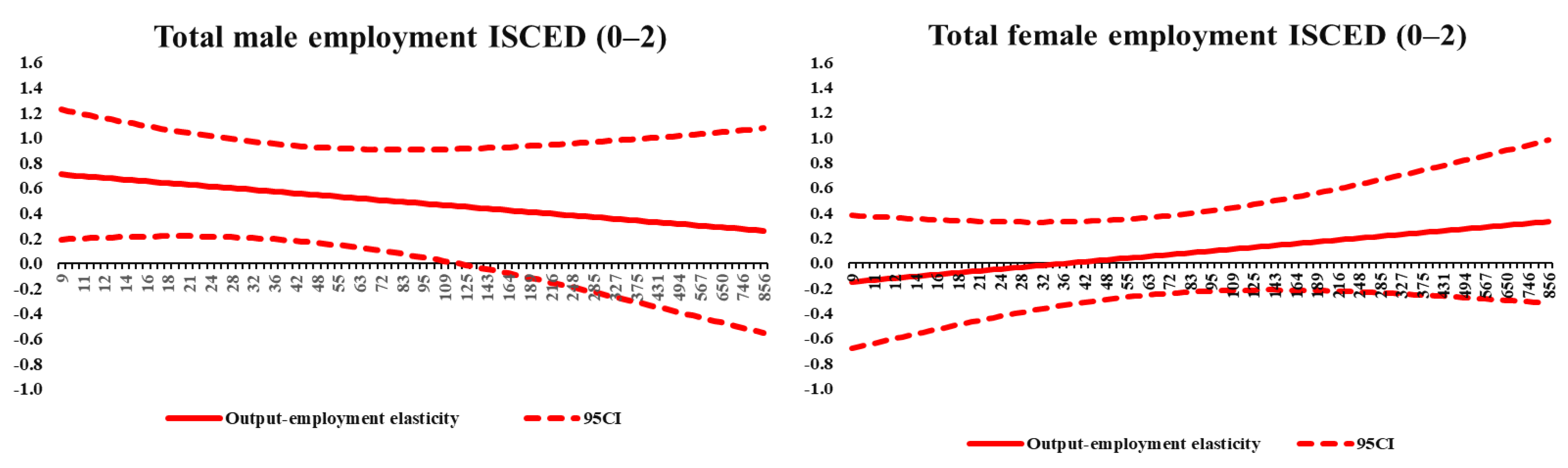

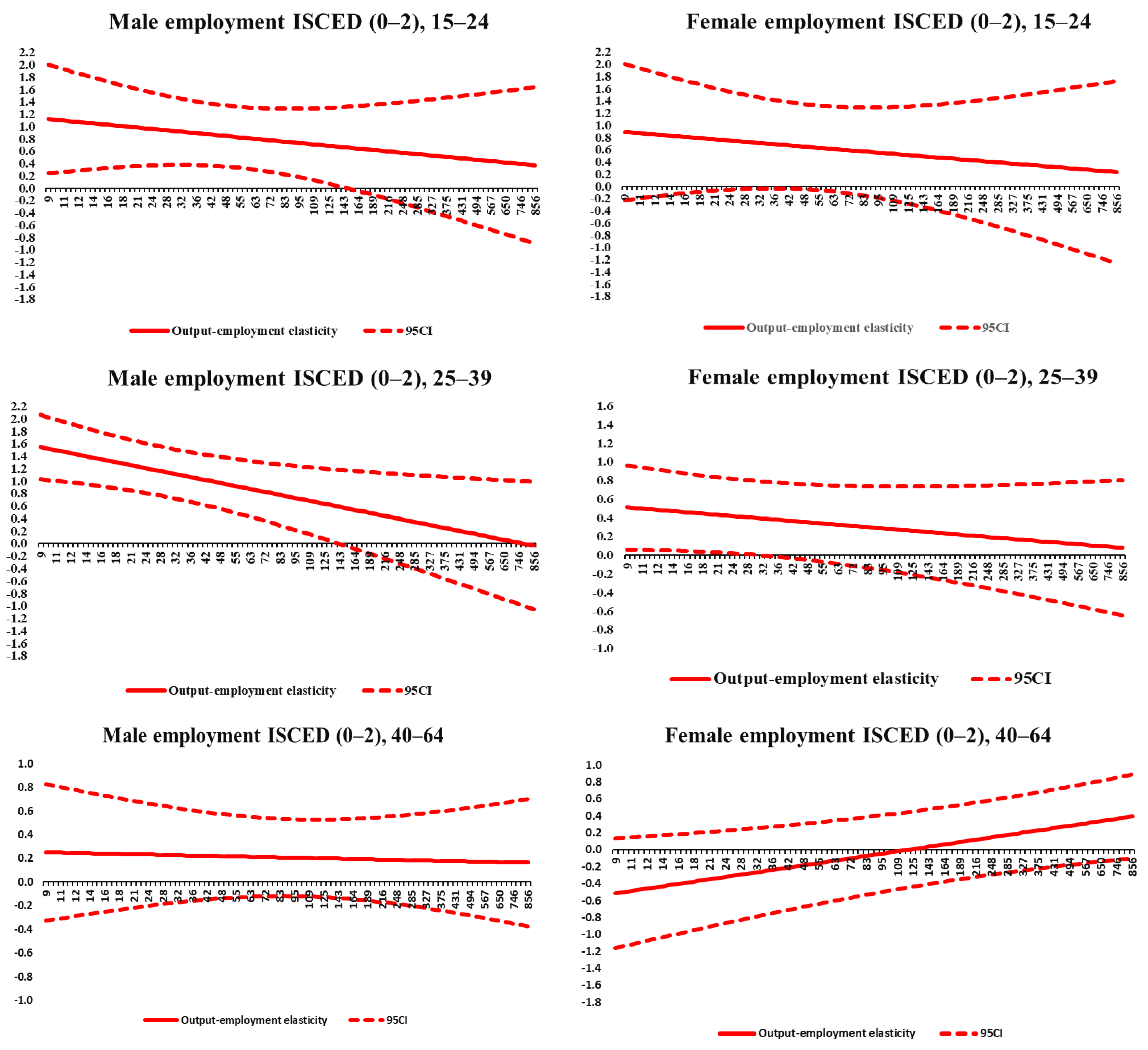

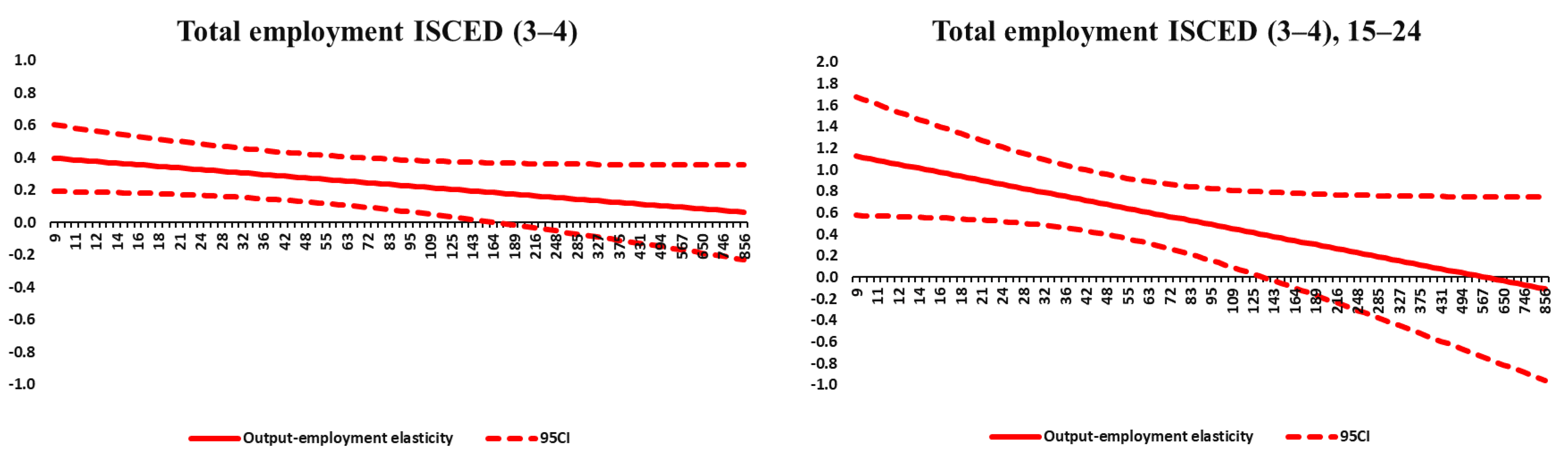

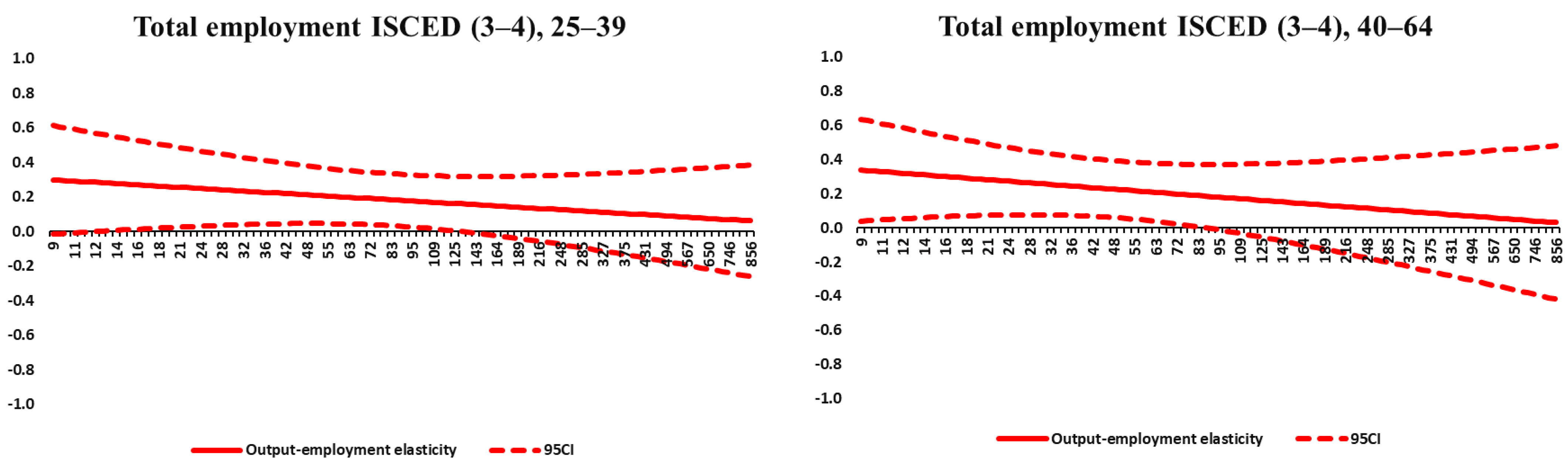

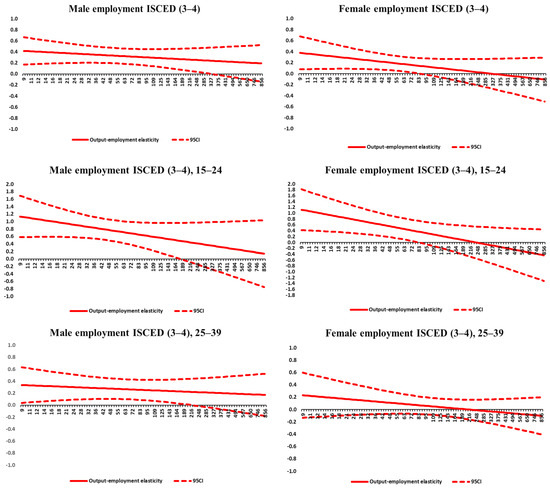

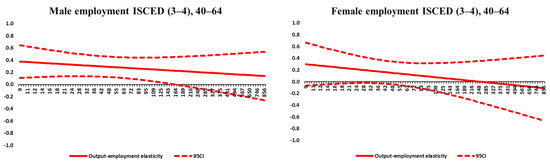

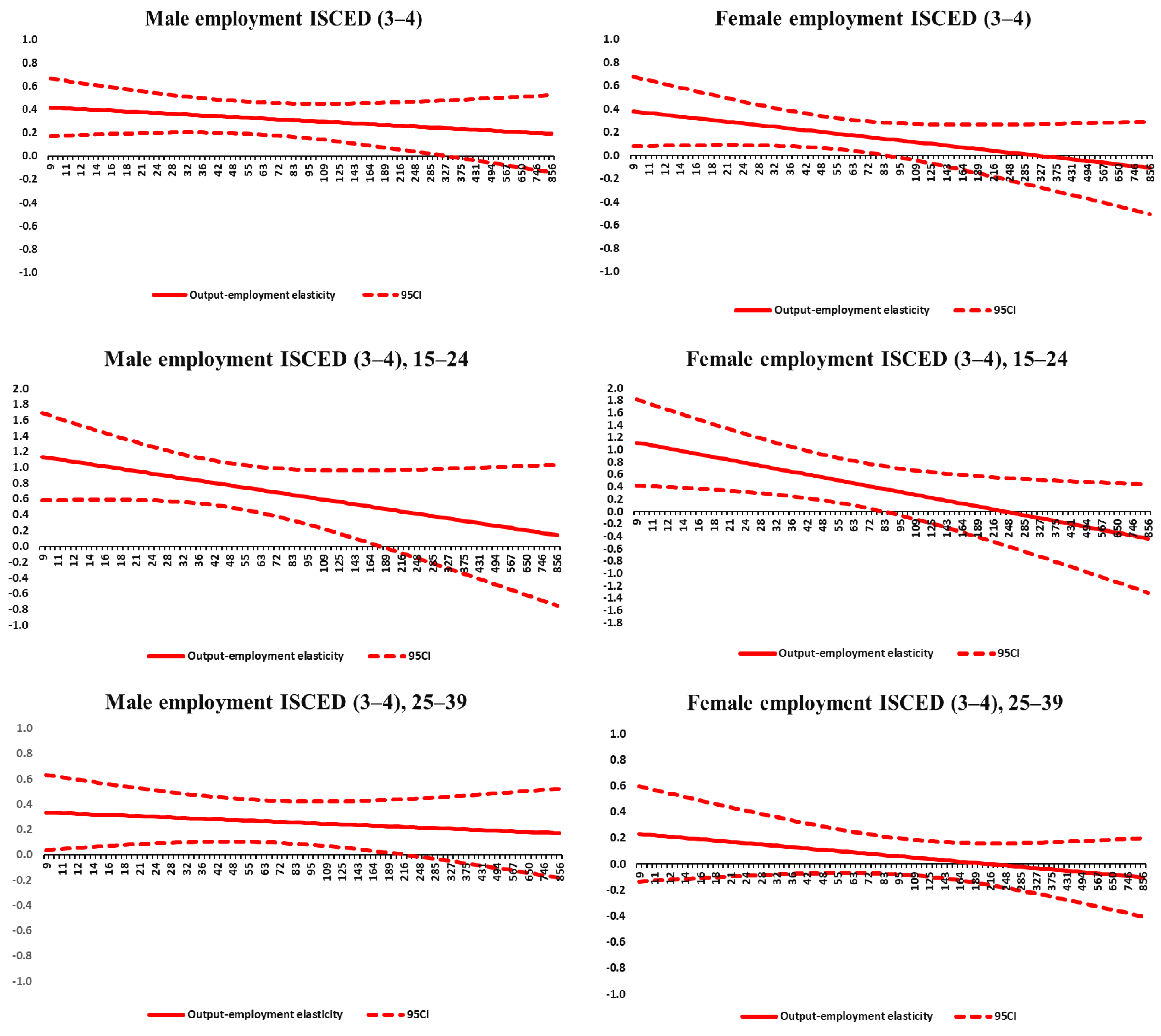

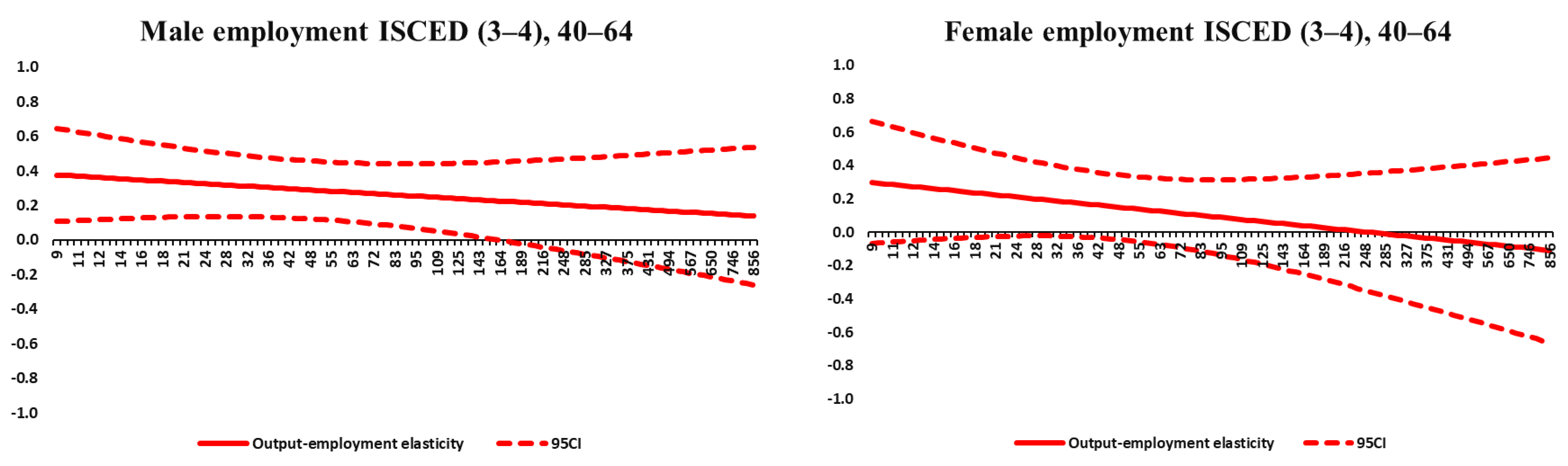

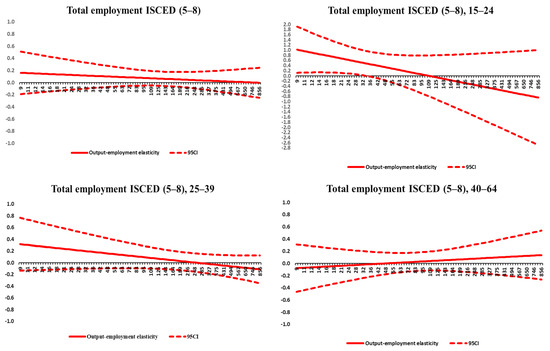

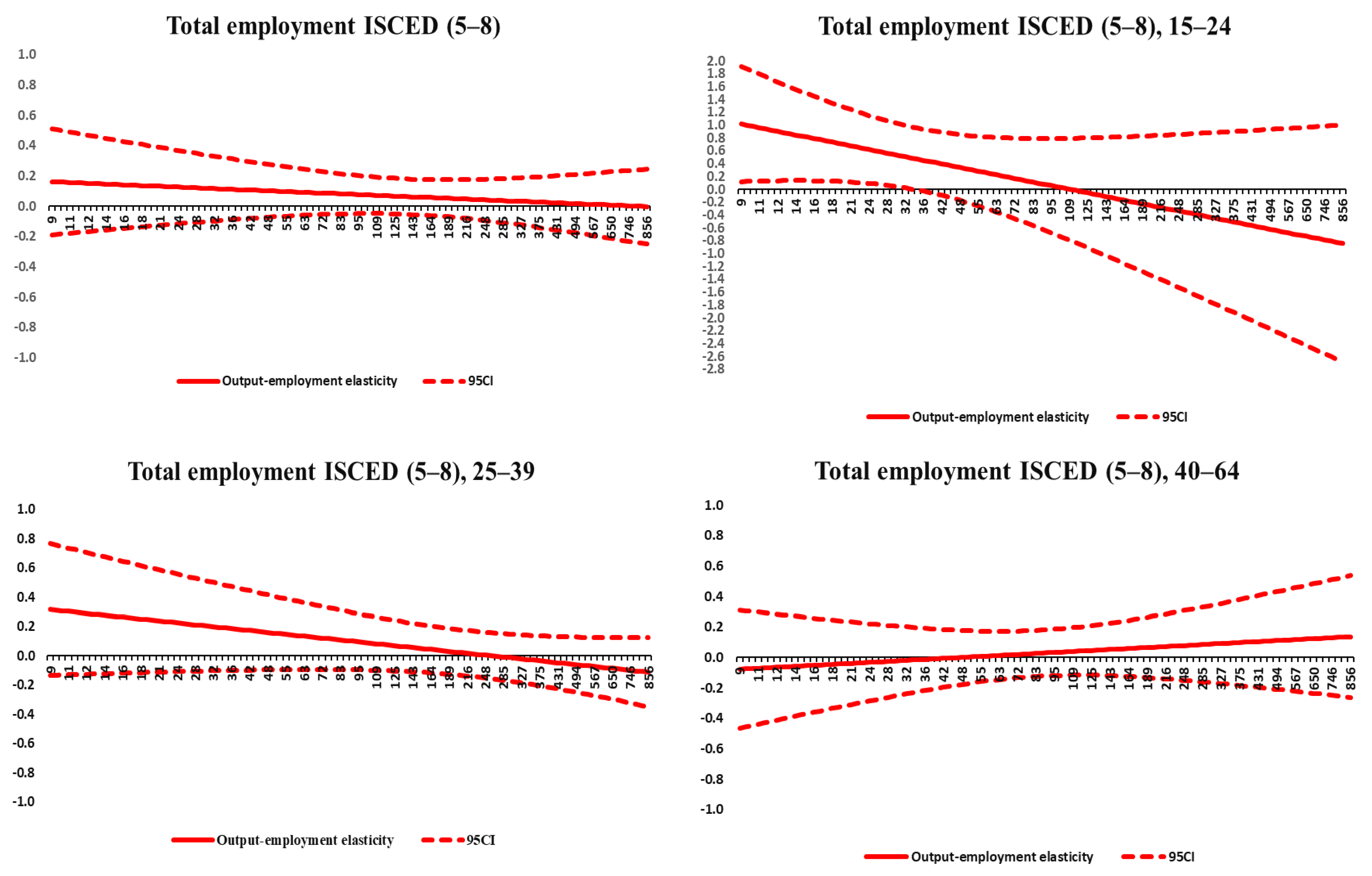

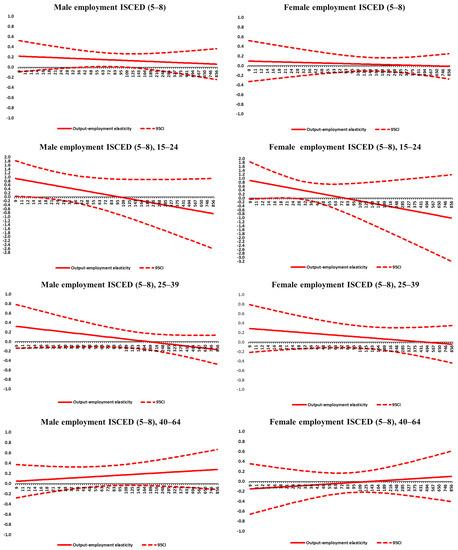

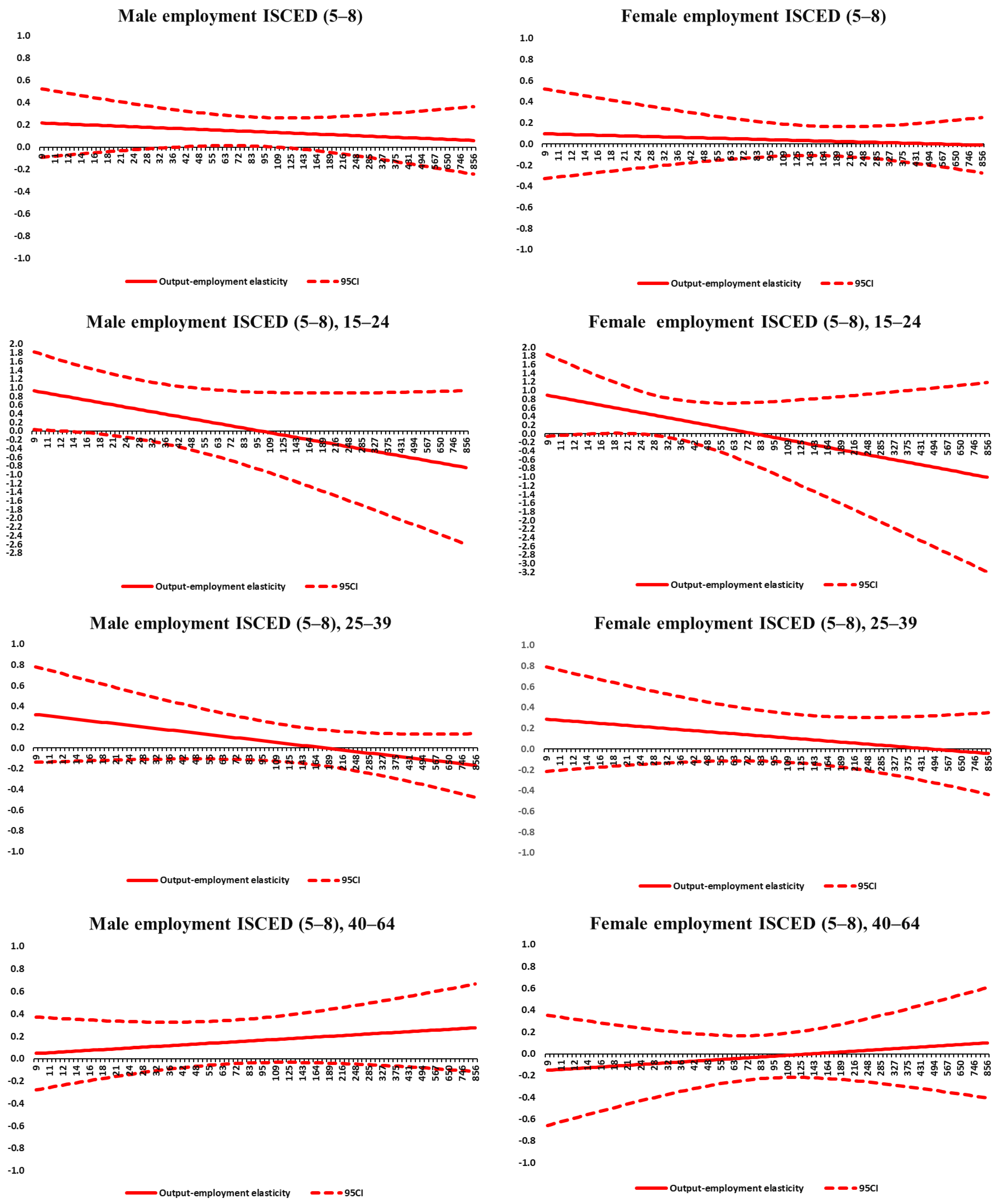

In our study, we also analyse how iFDI is changing the effect of economic growth on employment generation. Estimation results of iFDI impact on the output–employment relationship are presented in Table 3. To understand the conditional effect of iFDI on the output–employment relationship, conditional output–employment elasticities and confidence intervals were estimated (Appendix B).

Table 3.

Estimation results of inward FDI impact on the output–employment relationship based on Equation (2).

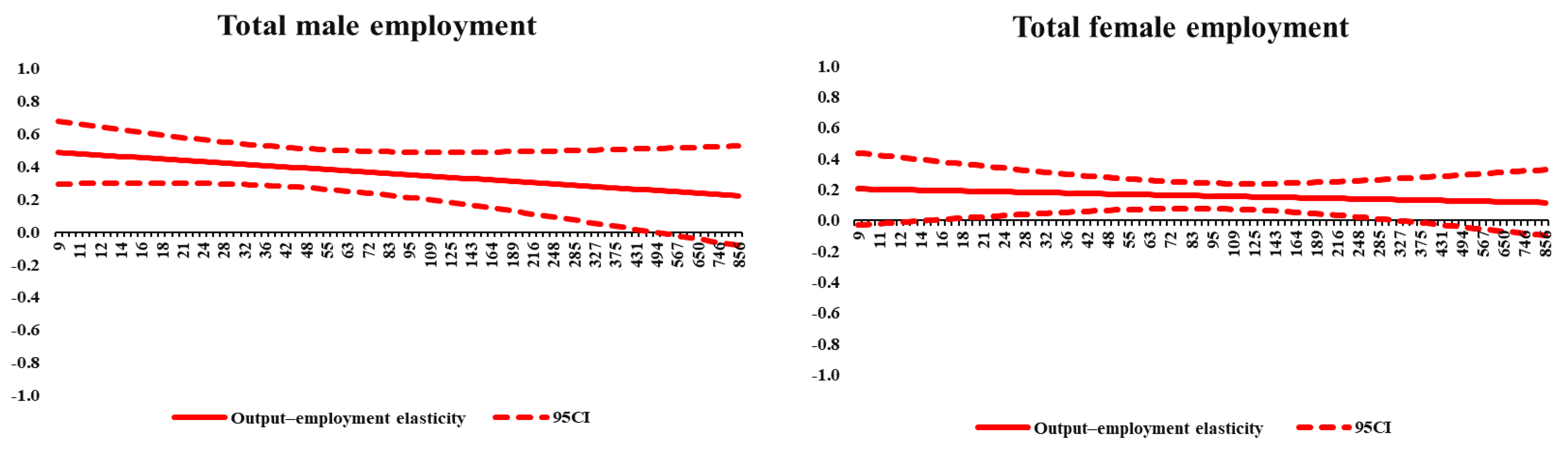

According to estimation results made regardless of educational attainment level (Figure A1), we find that iFDI has a weak but negative impact on the output–employment relationship. It means that the inflow of FDI into the country weakens possibilities for growth to increase employment. When the iFDI level is higher than 451% of GDP, economic growth effect on employment becomes insignificant. These results are in line with Anderson and Braunstein (2013), Slimane (2015) and Kadiša et al. (2021), who also identified a negative FDI impact on economic growth and the employment/unemployment relationship. Reflecting on our estimation results, we can state that a higher iFDI level in 25 EU countries is associated with increased labour productivity more than with job creation. The negative impact of FDI on the output–employment relationship is usually related to the implementation of new technologies, which allows for increasing labour productivity without additional labour force or bankruptcies of local companies due to increased competition (Jude and Silaghi 2016; Malik 2019).

As we are analysing the iFDI impact on the gender-specific output–employment relationship (Figure A2), we can state that both male and female employment reaction to economic growth is weakly affected. Economic growth has a statistically significant impact on female employment growth when iFDI ranges between 15% of GDP to 312% of GDP, while the output–employment relationship for males is statistically significant until the iFDI level reaches 494% of GDP. Estimated conditional output–employment elasticities differentiated by age (Figure A1 and Figure A2) show that iFDI has the highest impact on youth employment. Although in most of the analysed cases, iFDI decreases employment reaction to economic growth, we find that iFDI has a positive impact on 40–64 year old female employment reaction to economic growth, which is statistically significant when the iFDI level is higher than 55% of GDP. First of all, as it was explained by Tang and Bethencourt (2017) and Kodama et al. (2018), foreign companies more often employ women compared to local companies. Secondly, a positive iFDI impact on a female output–employment result can be related to a higher concentration of women in labour-intensive economic sectors or their lower salaries compared with men (Siegmann 2007; Tang and Bethencourt 2017; Sherif et al. 2022).

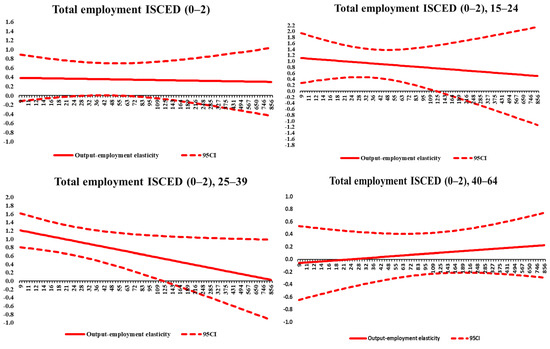

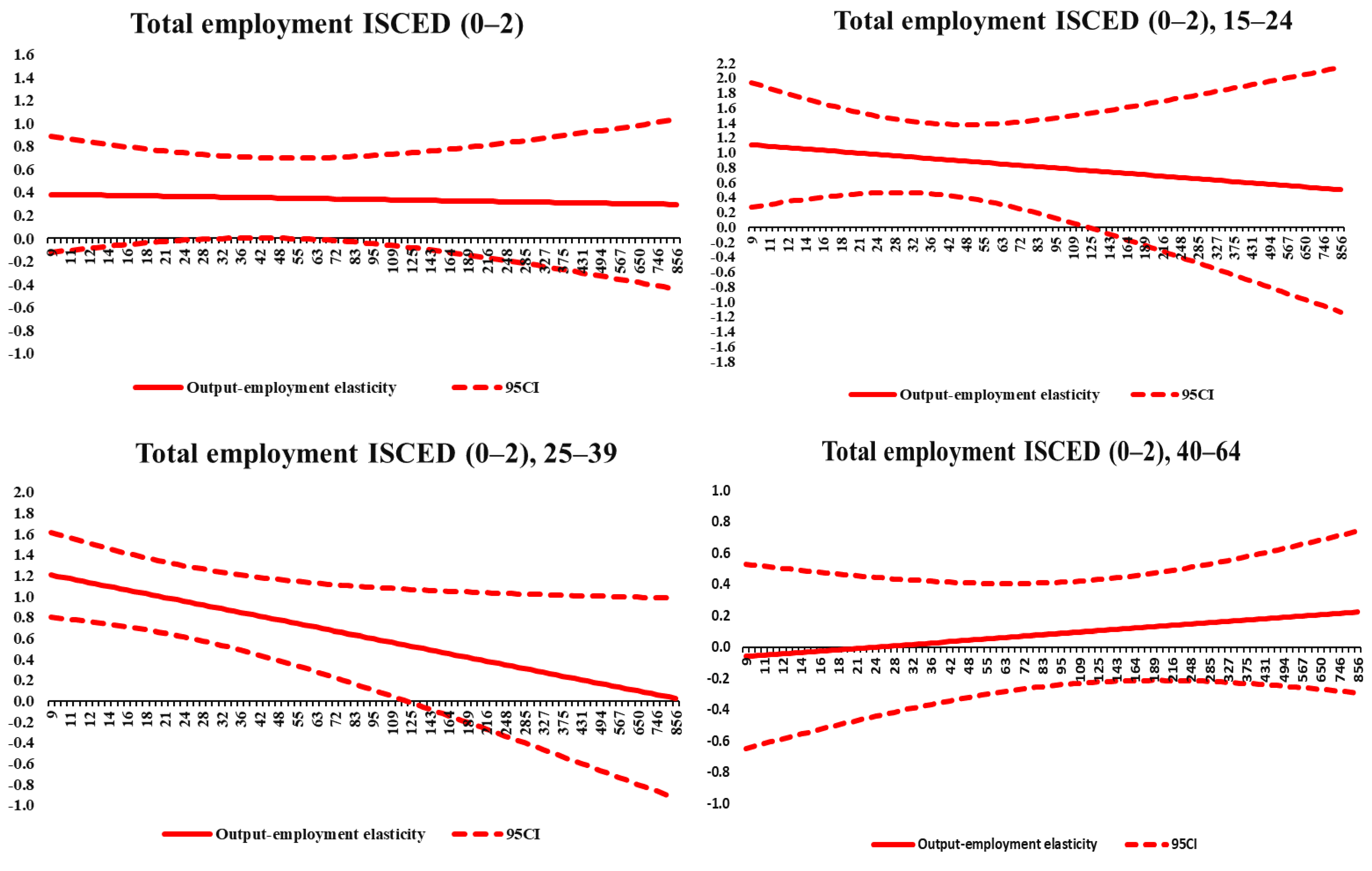

When we analyse the impact of iFDI on the output–employment relationship in terms of educational attainment level (see Figure A3, Figure A4, Figure A5, Figure A6, Figure A7 and Figure A8), we find that iFDI has the highest negative impact on the employment of highly educated (ISCED5–8) youth. However, this impact is statistically significant when the iFDI level is relatively small (lower than 33% of GDP). Our estimations also show that iFDI decreases employment reaction to economic growth for all those who have upper secondary and post-secondary non-tertiary education regardless of gender or age. It also significantly decreases the output–employment elasticities of youth regardless of their education, meaning that the attraction of iFDI does not help to solve the problem of the high youth unemployment rate in European Union countries. As it was mentioned by Banerjee and Veeramani (2015), foreign companies tend to use more advanced technologies that require higher qualifications, specific skills, and experience, which young people usually do not have.

Despite a higher level of iFDI being associated with decreased output–employment elasticity of uneducated and highly educated young or middle-aged people, surprisingly, it tends to increase output–employment elasticity of 40–64 year old uneducated and highly educated females or highly educated males. As mentioned above, the higher demand for the uneducated 40–64 year old female labour be explained by their concentration in labour-intensive sectors that do not require special skills, their lower salaries compared with men and higher experience compared with uneducated youth. The positive impact of iFDI on highly 40–64 year old educated male and female employment reaction to economic growth can be explained by higher experience and special skills useful for successful foreign companies’ integration, the appliance of new technologies and working methods, employee training, etc. Although our estimation results show some abilities of iFDI to increase output–employment elasticities of 40–64 year old uneducated and highly educated females or highly educated males, in our case, this relationship remains statistically insignificant at any level of iFDI.

5. Conclusions

The research on economic growth’s impact on employment/unemployment has gained importance since The Great Recession and now has increased relevance due to the coronavirus crisis, the war in Ukraine and its consequences. The gender gap in employment and the low employment rate of youth is a serious problem in the European Union that requires detailed analysis. This paper aims to expand the existing literature in several ways. Differently from the other output–employment researchers, we analysed the impact of economic growth on gender-, age- and educational attainment level-specific output–employment relationship. While other researchers usually tend to analyse the impact of FDI on economic growth or employment separately, we analysed how the gender-, age- and educational attainment level-specific output–employment relationship depends on the different levels of FDI in the host country. Since other research concentrates on individual countries and we did not find any similar research considering FDI impact on gender-, age- and educational attainment level-specific output–employment relationship in the European Union, our study was designed in the context of 25 EU countries.

Our results confirm that economic growth significantly increases the employment of total, male and female employment in all age groups, regardless of their educational attainment level. Comparing the reaction of employment to the economic growth according to gender, we found higher output–employment elasticity for men, compared to the total and female employment response to economic growth. Age-specific output–employment elasticity estimations show that youth employment elasticity is higher compared to other age cohorts. Additionally, empirical results suggest that employment reaction to economic growth decreases with age. Since other output–employment research confirms the higher employment reaction to economic growth for females and for the youth cohort, our estimations are more in line with output–unemployment studies. Estimations based on the different levels of educational attainment show that the employment of uneducated young and middle-aged males or young males with secondary and upper secondary education reacts significantly to output changes. However, economic growth has limited ability to create jobs for highly educated people.

Analysis of FDI impact on the output–employment relationship regardless of educational attainment level shows that FDI has a weak but negative impact, meaning that it reduces the employment reaction to economic growth. A relatively high level of FDI has an insignificant impact on the output–employment relationship, suggesting that a higher FDI level increases labour productivity more than employment growth. Our results also show that the employment reactions of males and females to economic growth are weakly influenced by FDI. The highest but negative impact of FDI was recorded for youth employment, meaning that the attraction of FDI does not help to solve the problem of the high youth unemployment rate in the EU. Additionally, we found little evidence of FDI increasing the employment reaction to economic growth for females older than 40 years. In terms of educational attainment, we find that FDI has the highest negative impact on the employment of highly educated youth. Although our estimations are made in the context EU, the methodology used for the estimations allows for adapting the empirical results for individual countries depending on their FDI level.

Since all the countries are different considering their economic, social, demographic, institutional and other characteristics, we can also assume that the impact of FDI on the output–employment relationship is heterogeneous across countries. Our results show that FDI impact on gender-, age- and educational attainment level-specific output–employment relationship is associated with productivity growth more than with employment growth. For that reason, we considered expanding this research by splitting the sample into two different groups of countries by their productivity growth along with sectoral distribution of FDI. The methodology used for empirical estimations allowed us to analyse how the output–employment relationship depends on one macroeconomic variable. However, in the real world, several macroeconomic characteristics could influence the output–employment relationship at the same time. The scientific literature widely discusses the institutional environment as one of the important factors affecting the heterogeneous output–employment relationship, explaining that a more rigid labour market is associated with lower employment reactions to economic fluctuations. Since there is a lack of research analysing how the output–employment relationship depends on different levels of labour market regulation and foreign direct investment level at the same time, this field remains to be explored in our future research.

Author Contributions

Conceptualisation, L.D.-K., M.B. and K.M.; methodology, L.D.-K. and M.B.; formal analysis, L.D.-K.; resources, L.D.-K. and K.M.; data curation, L.D.-K.; writing—original draft preparation, L.D.-K., M.B. and K.M.; writing—review and editing, L.D.-K., M.B. and K.M.; visualization, L.D.-K.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Summary statistics of selected variables.

Table A1.

Summary statistics of selected variables.

| Education | Gender | Age | Mean | Min | Max | Standard Deviation |

|---|---|---|---|---|---|---|

| Employment Growth, Percentage Change | ||||||

| ISCED 0–8 | Total | 15–64 | 0.52 | −13.09 | 11.00 | 2.35 |

| 15–24 | −1.37 | −29.28 | 58.68 | 7.83 | ||

| 25–39 | −0.28 | −10.93 | 29.23 | 2.93 | ||

| 40–64 | 1.53 | −12.13 | 7.65 | 2.30 | ||

| Male | 15–64 | 0.34 | −17.18 | 13.34 | 2.67 | |

| 15–24 | −1.17 | −33.33 | 50.00 | 8.20 | ||

| 25–39 | −0.37 | −14.26 | 27.71 | 3.14 | ||

| 40–64 | 1.24 | −14.71 | 11.09 | 2.55 | ||

| Female | 15–64 | 0.76 | −8.96 | 10.50 | 2.36 | |

| 15–24 | −1.68 | −23.83 | 70.91 | 8.74 | ||

| 25–39 | −0.21 | −12.26 | 31.17 | 3.17 | ||

| 40–64 | 1.95 | −12.85 | 11.50 | 2.63 | ||

| ISCED 0–2 | Total | 15–64 | −2.64 | −27.57 | 39.47 | 7.07 |

| 15–24 | −2.91 | −57.58 | 75.56 | 14.34 | ||

| 25–39 | −2.87 | −33.76 | 89.64 | 10.51 | ||

| 40–64 | −2.33 | −37.50 | 45.61 | 7.99 | ||

| Male | 15–64 | −2.15 | −31.93 | 48.26 | 7.71 | |

| 15–24 | −2.57 | −50.00 | 57.63 | 14.51 | ||

| 25–39 | −2.17 | −32.20 | 105.92 | 11.62 | ||

| 40–64 | −1.77 | −40.44 | 58.88 | 9.16 | ||

| Female | 15–64 | −3.14 | −28.02 | 45.16 | 7.70 | |

| 15–24 | −2.37 | −51.85 | 157.14 | 19.54 | ||

| 25–39 | −3.69 | −49.06 | 66.33 | 12.77 | ||

| 40–64 | −2.76 | −42.05 | 65.48 | 9.24 | ||

| ISCED 3–4 | Total | 15–64 | 0.41 | −15.30 | 37.56 | 3.97 |

| 15–24 | −1.13 | −32.21 | 38.33 | 8.51 | ||

| 25–39 | −1.29 | −18.36 | 32.96 | 4.49 | ||

| 40–64 | 2.22 | −12.16 | 57.26 | 4.66 | ||

| Male | 15–64 | 0.50 | −16.92 | 31.51 | 4.03 | |

| 15–24 | −0.74 | −32.14 | 51.72 | 9.78 | ||

| 25–39 | −0.87 | −19.92 | 33.72 | 4.74 | ||

| 40–64 | 2.04 | −15.71 | 39.78 | 4.43 | ||

| Female | 15–64 | 0.31 | −16.72 | 44.72 | 4.43 | |

| 15–24 | −1.35 | −37.78 | 55.40 | 10.22 | ||

| 25–39 | −1.86 | −23.02 | 32.16 | 5.26 | ||

| 40–64 | 2.54 | −15.11 | 78.23 | 5.86 | ||

| ISCED 5–8 | Total | 15–64 | 3.69 | −41.42 | 69.54 | 6.01 |

| 15–24 | 3.48 | −56.67 | 310.17 | 22.68 | ||

| 25–39 | 3.3 | −36.12 | 71.43 | 6.86 | ||

| 40–64 | 4.24 | −48.81 | 67.86 | 6.41 | ||

| Male | 15–64 | 3.17 | −45.89 | 66.14 | 6.35 | |

| 15–24 | 4.84 | −57.69 | 514.93 | 33.48 | ||

| 25–39 | 3.10 | −43.69 | 67.82 | 7.47 | ||

| 40–64 | 3.42 | −50.43 | 63.64 | 7.01 | ||

| Female | 15–64 | 4.29 | −38.16 | 74.34 | 6.48 | |

| 15–24 | 3.09 | −50.00 | 228.99 | 21.59 | ||

| 25–39 | 3.69 | −30.47 | 76.12 | 7.38 | ||

| 40–64 | 5.27 | −47.66 | 78.05 | 7.26 | ||

| Inward foreign direct investment stock, % of GDP | 60.89 | 9.16 | 856.30 | 67.86 | ||

| Gross domestic product growth, percentage change | 2.03 | −14.84 | 25.18 | 3.82 | ||

Appendix B

Figure A1.

Inward FDI impact on age-specific output–employment relationship for all educational attainment levels combined. Note: the horizontal axis represents the iFDI level, %, vertical axis represents output–employment elasticity.

Figure A1.

Inward FDI impact on age-specific output–employment relationship for all educational attainment levels combined. Note: the horizontal axis represents the iFDI level, %, vertical axis represents output–employment elasticity.

Figure A2.

Inward FDI impact on gender- and age-specific output–employment relationship for all educational attainment levels combined. Note: the horizontal axis represents the iFDI level, %, vertical axis represents output–employment elasticity.

Figure A2.

Inward FDI impact on gender- and age-specific output–employment relationship for all educational attainment levels combined. Note: the horizontal axis represents the iFDI level, %, vertical axis represents output–employment elasticity.

Figure A3.

Inward FDI impact on age-specific output–employment relationship ISCED (0–2). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A3.

Inward FDI impact on age-specific output–employment relationship ISCED (0–2). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A4.

Inward FDI impact on gender- and age-specific output–employment relationship ISCED (0–2). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A4.

Inward FDI impact on gender- and age-specific output–employment relationship ISCED (0–2). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A5.

Inward FDI impact on age-specific output–employment relationship ISCED (3–4). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A5.

Inward FDI impact on age-specific output–employment relationship ISCED (3–4). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A6.

Inward FDI impact on gender- and age-specific output–employment relationship ISCED (3–4). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A6.

Inward FDI impact on gender- and age-specific output–employment relationship ISCED (3–4). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A7.

Inward FDI impact on age-specific output–employment relationship ISCED (5–8). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A7.

Inward FDI impact on age-specific output–employment relationship ISCED (5–8). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A8.

Inward FDI impact on gender- and age-specific output–employment relationship ISCED (5–8). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

Figure A8.

Inward FDI impact on gender- and age-specific output–employment relationship ISCED (5–8). Note: the horizontal axis represents the iFDI level, %, the vertical axis represents output–employment elasticity.

References

- Adegboye, Abidemi C., Monday I. Egharevba, and Joel Edafe. 2019. Economic regulation and employment intensity of output growth in Sub-Saharan Africa. In Governance for Structural Transformation in Africa. Cham: Palgrave Macmillan, pp. 101–43. [Google Scholar] [CrossRef]

- Ahn, JaeBin, Zidong An, John Bluedorn, Gabriele Ciminelli, Zsoka Kóczán, Davide Malacrino, Daniela Muhajand, and Patricia Neidlinger. 2019. Work in progress: Improving youth labor market outcomes in emerging market and developing economies. Staff Discussion Notes 19: 9–15. [Google Scholar] [CrossRef][Green Version]

- Ali, Abdelaaziz, Tayeb Ghazi, and Yassine Msadfa. 2018. Manufacturing Employment Elasticity and Its Drivers in Developing and Emerging Countries: Focus on Sub-Saharan Africa. OCP Policy Center Research Paper 17/03. Available online: https://www.africaportal.org/publications/manufacturing-employment-elasticity-and-its-drivers-developing-and-emerging-countries-focus-sub-saharan-africa/ (accessed on 7 July 2022).

- Anderson, Bret, and Elissa Braunstein. 2013. Economic growth and employment from 1990–2010: Explaining elasticities by gender. Review of Radical Political Economics 45: 269–77. [Google Scholar] [CrossRef]

- Anderson, Bret. 2016. Do Macroeconomic Structures and Policies Shape the Employment Intensity of Growth Differently for Women and Men? Journal of Economic Issues 50: 940–62. [Google Scholar] [CrossRef][Green Version]

- Askenazy, Philippe, Martin Chevalier, and Christine Erhel. 2015. Okun’s Laws Differentiated by Education. Document de Travail CEPREMAP 1514. Available online: https://www.cepremap.fr/depot/docweb/docweb1514.pdf (accessed on 7 July 2022).

- Ball, Laurence, Daniel Leigh, and Prakash Loungani. 2017. Okun’s law: Fit at 50? Journal of Money, Credit and Banking 49: 1413–41. [Google Scholar] [CrossRef]

- Banerjee, Purna, and Choorikkadan Veeramani. 2015. Trade Liberalisation and Women’s Employment Intensity: Analysis of India’s Manufacturing Industries. Indira Gandhi Institute of Development Research Working Paper, WP-2015-018. pp. 1–45. Available online: http://oii.igidr.ac.in:8080/xmlui/handle/2275/366 (accessed on 20 August 2022).

- Ben-Salha, Ousama, and Mourad Zmami. 2021. The effect of economic growth on employment in GCC countries. Scientific Annals of Economics and Business 68: 25–41. [Google Scholar] [CrossRef]

- Blázquez-Fernández, Carla, David Cantarero-Prieto, and Marta Pascual-Sáez. 2018. Okun’s Law in Selected European Countries (2005–2017): An Age and Gender Analysis. Economics and Sociology 11: 263–74. [Google Scholar] [CrossRef]

- Boumediene, Mohamed Amine, Mohamed Djellouli, and Mohamed Samir Benayad. 2021. The foreign direct investment and the employment in Maghreb countries: An econometric study by using the cointegration test and the panel models. Les cahiers du cread 37: 29–56. [Google Scholar]

- Burggraeve, Koen, Grégory de Walque, and Helene Zimmer. 2015. The relationship between economic growth and employment. Economic Review i: 32–52. [Google Scholar]

- Butkus, Mindaugas, Alma Maciulyte-Sniukiene, Renata Macaitiene, and Kristina Matuzeviciute. 2021. A New Approach to Examine Non-Linear and Mediated Growth and Convergence Outcomes of Cohesion Policy. Economies 9: 103. [Google Scholar] [CrossRef]

- Butkus, Mindaugas, and Janina Seputiene. 2019. The Output Gap and Youth Unemployment: An Analysis Based on Okun’s Law. Economies 7: 108. [Google Scholar] [CrossRef]

- Butkus, Mindaugas, Kristina Matuzeviciute, Dovile Rupliene, and Janina Seputiene. 2020. Does Unemployment Responsiveness to Output Change Depend on Age, Gender, Education, and the Phase of the Business Cycle? Economies 8: 98. [Google Scholar] [CrossRef]

- Butkus, Mindaugas, Laura Dargenytė-Kacilevičienė, Kristina Matuzevičiūtė, Dovilė Ruplienė, and Janina Šeputienė. 2022. Do Gender and Age Matter in Employment–Sectoral Growth Relationship Over the Recession and Expansion. Ekonomika 101: 38–51. [Google Scholar] [CrossRef]

- Dahal, Madhav Prasad, and Hemant Rai. 2019. Employment Intensity of Economic Growth: Evidence from Nepal. Economic Journal of Development Issues 27 & 28: 34–47. [Google Scholar] [CrossRef]

- Dauda, Rasaki, and Omowumi Ajeigbe. 2021. Sectoral Analysis of Employment Intensity of Growth in Nigeria. Global Business & Economics Anthology 1: 87–99. [Google Scholar] [CrossRef]

- Dietrich, Hans, and Joachim Möller. 2016. Youth unemployment in Europe—business cycle and institutional effects. International Economics and Economic Policy 13: 5–25. [Google Scholar] [CrossRef]

- Dixon, Robert, Guay Lim, and Jan C. Van Ours. 2017. Revisiting the Okun relationship. Applied Economics 49: 2749–65. [Google Scholar] [CrossRef][Green Version]

- Dunsch, Sophie. 2015. Okun’s law and youth unemployment in Germany and Poland. International Journal of Management and Economics 49: 34–57. [Google Scholar] [CrossRef]

- Duran, Hasan. 2022. Validity of Okun’s Law in a spatially dependent and cyclical asymmetric context. Panoeconomicus 69: 447–80. [Google Scholar] [CrossRef]

- Durech, Richard, Alexandru Minea, Lavinia Mustea, and Lubica Slusna. 2014. Regional evidence on Okun’s law in Czech Republic and Slovakia. Economic Modelling 42: 57–65. [Google Scholar] [CrossRef]

- El-Hamadi, Youssef, Abdeljabbar Abdouni, and Karima Bouaouz. 2017. The sectoral employment intensity of growth in Morocco: A pooled mean group approach. Applied Econometrics and International Development 17: 87–98. [Google Scholar]

- Estrin, Saul. 2017. Foreign direct investment and employment in transition economies. IZA World of Labour. [Google Scholar] [CrossRef]

- Ezzahidi, Elhadj, and Aicha El Alaoui. 2014. Economic Growth and Jobs Creation in Morocco: Overall and Sectors’ Analysis. MPRA Paper 57841. Available online: https://mpra.ub.uni-muenchen.de/id/eprint/57841 (accessed on 15 May 2022).

- Fitzenberger, Bernd, Reinhold Schnabel, and Gaby Wunderlich. 2004. The gender gap in labor market participation and employment: A cohort analysis for West Germany. Journal of Population Economics 17: 83–116. [Google Scholar] [CrossRef]

- Friedrich, Robert J. 1982. In defense of multiplicative terms in multiple regression equations. American Journal of Political Science 26: 797–833. [Google Scholar] [CrossRef]

- Furceri, Davide, Ernesto Crivelli, and Joël Toujas-Bernate. 2012. Can policies affect employment intensity of growth? A cross-country analysis. International Monetary Fund. [Google Scholar] [CrossRef]

- Ghazali, Monia, and Rim Mouelhi. 2018. The employment intensity of growth: Evidence from Tunisia. Journal of Economic Development 43: 85–117. [Google Scholar] [CrossRef]

- Gohou, Gaston, and Issouf Soumaré. 2012. Does foreign direct investment reduce poverty in Africa and are there regional differences? World Development 40: 75–95. [Google Scholar] [CrossRef]

- Golejewska, Anna. 2001. Foreign direct investment and employment in a host country: The case of polish manufacturing. Yearbook of Polish European Studies 5: 97–114. [Google Scholar]

- Goto, Eiji, and Constantin Bürgi. 2021. Sectoral Okun’s law and cross-country cyclical differences. Economic Modelling 94: 91–103. [Google Scholar] [CrossRef]

- Hale, Galina, and Mingzhi Xu. 2016. FDI Effects on the Labor Market of Host Countries. Federal Reserve Bank of San Francisco Working Paper Series 2016-25; San Francisco: Federal Reserve Bank of San Francisco, pp. 1–26. [Google Scholar] [CrossRef]

- Hartwig, Jochen. 2014. Testing Okun’s law with Swiss industry data. Applied Economics 46: 3581–90. [Google Scholar] [CrossRef][Green Version]

- Herman, Emilia. 2011. The impact of economic growth process on the employment in European Union countries. The Romanian Economic Journal 14: 47–67. [Google Scholar]

- Hutengs, Oliver, and Georg Stadtmann. 2014. Age-and gender-specific unemployment in Scandinavian countries: An analysis based on Okun’s law. Comparative Economic Studies 56: 567–80. [Google Scholar] [CrossRef]

- International Monetary Fund. 2010. Unemployment Dynamics in Recessions and Recoveries. In World Economic Outlook. Washington, DC: International Monetary Fund, chp. 3. [Google Scholar] [CrossRef]

- Islam, Iyanatul, and Suahasil Nazara. 2000. Estimating Employment Elasticity for the Indonesian Economy. Jakarta: International Labour Office. [Google Scholar]

- Jaba, Elisabeta, Ion Pârţachi, Boris Chistrugă, and Christiana Brigitte Balan. 2015. Gender employment gap in EU before and after the crisis. Procedia Economics and Finance 20: 326–33. [Google Scholar] [CrossRef]

- Jude, Cristina, and Monica Ioana Pop Silaghi. 2016. Employment effects of foreign direct investment: New evidence from Central and Eastern European countries. International Economics 145: 32–49. [Google Scholar] [CrossRef]

- Juhn, Chinhui, Gergely Ujhelyi, and Carolina Villegas-Sanchez. 2014. Men, women, and machines: How trade impacts gender inequality. Journal of Development Economics 106: 179–93. [Google Scholar] [CrossRef]

- Kadiša, Tomas, Butkus Mindaugas, and Aleksandravičienė Akvilė. 2021. Effect of Foreign direct investment on Growth-Unemployment Nexus. Socialiniai Tyrimai 44: 139–52. [Google Scholar] [CrossRef]

- Kapsos, Steven. 2006. The employment intensity of growth: Trends and macroeconomic determinants. In Labor Markets in Asia. London: Palgrave Macmillan, pp. 143–201. [Google Scholar]

- Kim, Myeong Jun, and Sung Y. Park. 2019. Do gender and age impact the time-varying Okun’s law? Evidence from South Korea. Pacific Economic Review 24: 672–85. [Google Scholar] [CrossRef]

- Kodama, Naomi, Beata S. Javorcik, and Yukiko Abe. 2018. Transplanting corporate culture across international borders: Foreign direct investment and female employment in Japan. The World Economy 41: 1148–65. [Google Scholar] [CrossRef]

- Lewandowska-Gwarda, Karolina. 2018. Female unemployment and its determinants in Poland in 2016 from the spatial perspective. Oeconomia Copernicana 9: 183–204. [Google Scholar] [CrossRef]

- Liotti, Giorgio. 2021. Labour Market Regulation and Youth Unemployment in the EU-28. Italian Economic Journal 8: 77–103. [Google Scholar] [CrossRef]

- Lipsey, Robert E., and Fredrik Sjöholm. 2005. The Impact of Inward FDI on Host Countries: Why Such Different Answers? Does Foreign Direct Investment Promote Development, 23–43. Available online: https://www.semanticscholar.org/paper/The-Impact-of-Inward-FDI-on-Host-Countries-%3A-Why-Lipsey-Sj%C3%B6holm/371137ace52174c04215d704ebe79f13a0ce59ff (accessed on 20 August 2022).

- Louail, Bilal, and Siham Riache. 2019. Asymmetry relationship between economic growth and unemployment rates in the Saudi economy: Application of Okun’s law during the period. International Journal of Advanced and Applied Sciences 6: 83–88. [Google Scholar] [CrossRef]

- Majid, Hadia, and Karin Astrid Siegmann. 2021. The Effects of Growth on Women’s Employment in Pakistan. Feminist Economics 27: 29–61. [Google Scholar] [CrossRef]

- Malik, Sanjaya Kumar. 2019. Foreign direct investment and employment in Indian manufacturing industries. The Indian Journal of Labour Economics 62: 621–37. [Google Scholar] [CrossRef]

- Marelli, Enrico, Laura Resmini, and Marcello Signorelli. 2014. The effects of inward FDI on regional employment in Europe. Romanian Journal of Regional Science 8: 1–23. [Google Scholar]

- Maza, Adolfo. 2022. Regional Differences in Okun’s Law and Explanatory Factors: Some Insights From Europe. International Regional Science Review 45: 555–80. [Google Scholar] [CrossRef]

- Mendoza-Velázquez, Alfonso, Alejandro Rondero-Garcia, and Luis David Conde-Cortés. 2021. Foreign Direct Investment and Employment Growth in the States of Mexico: Competitiveness and Social Progress. International Regional Science Review 44. [Google Scholar] [CrossRef]

- Mihajlović, Vladimir, and Gordana Marjanović. 2021. Challenges of the Output-Employment Growth Imbalance in Transition Economies. Naše Gospodarstvo/Our Economy 67: 1–9. [Google Scholar] [CrossRef]

- Mkhize, Njabulo Innocent. 2019. The sectoral employment intensity of growth in South Africa. Southern African Business Review 23: 1–24. [Google Scholar] [CrossRef]

- Mucuk, Mehmet, and M. Tahir Demirsel. 2013. The effect of foreign direct investments on unemployment: Evidence from panel data for seven developing countries. Journal of Business Economics and Finance 2: 53–66. [Google Scholar]

- Ngouhouo, Ibrahim, and Tii Njivukuh Nchofoung. 2021. Does trade openness affects employment in Cameroon? Foreign Trade Review 56: 105–16. [Google Scholar] [CrossRef]

- OECD. 2013. Education at a Glance 2013: OECD Indicators. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- OECD. 2019. FDI Qualities Indicators: Measuring the Sustainable Development Impacts of Investment, Paris. Available online: www.oecd.org/fr/investissement/fdi-qualities-indicators.html (accessed on 20 August 2022).

- Okun, Arthur M. 1962. Potential GNP: Its measurement and significance. American Statistical Association, Proceedings of the Business and Economics Section, 98–104. Available online: http://www.sciepub.com/reference/294493 (accessed on 20 August 2022).

- Onaran, Özlem. 2008. Jobless Growth in the central and Eastern European countries. Eastern European Economics 46: 90–115. [Google Scholar] [CrossRef]

- Pattanaik, Falguni, and Narayan Chandra Nayak. 2014. Macroeconomic Determinants of Employment Intensity of Growth in India. Margin. The Journal of Applied Economic Research 8: 137–54. [Google Scholar] [CrossRef]

- Richter, Kaspar, and Bartosz Witkowski. 2014. Does Growth Generate Jobs in Eastern Europe and Central Asia? World Bank Policy Research Working Paper 6759. Washington, DC: The World Bank, pp. 1–20. [Google Scholar] [CrossRef]

- Saucedo, Eduardo, Teofilo Ozuna, and Hector Zamora. 2020. The effect of FDI on low and high-skilled employment and wages in Mexico: A study for the manufacture and service sectors. Journal for Labour Market Research 54: 1–15. [Google Scholar] [CrossRef]

- Setyanti, Axellina Muara, and Setyo Tri Wahyudi. 2021. Foreign Direct Investment and Youth Employment Causality: Evidence From ASEAN-5 Countries. Jurnal Economia 17: 208–19. [Google Scholar] [CrossRef]

- Seyfried, William. 2007. A Cross-Country Analysis of the Employment Intensity of Economic Growth. Southwest Business & Economics Journal 16: 51–61. [Google Scholar]

- Seyfried, William. 2014. Examining the employment intensity of economic growth of the PIIGS. International Business & Economics Research Journal (IBER) 13: 593–98. [Google Scholar] [CrossRef][Green Version]

- Sherif, Reem, Charles Komla Delali Adjasi, and Michael Graham. 2022. Gender spillovers in foreign direct investments: An analysis of Namibia. Thunderbird International Business Review 64: 273–84. [Google Scholar] [CrossRef]

- Siegmann, Karin Astrid. 2007. Globalisation, Gender, and Equity: Effects of Foreign Direct Investment on Labour Markets in Rural Indonesia. Paper presented at German Development Economics Conference, Göttingen, Germany, vol. 30, pp. 113–30. Available online: http://hdl.handle.net/10419/19883 (accessed on 15 June 2022).

- Slimane, Sarra Ben. 2015. The relationship between growth and employment intensity: Evidence for developing countries. Asian Economic and Financial Review 5: 680–92. [Google Scholar] [CrossRef]

- Tang, Bo, and Carlos Bethencourt. 2017. Asymmetric unemployment-output tradeoff in the Eurozone. Journal of Policy Modeling 39: 461–81. [Google Scholar] [CrossRef]

- Tang, Heiway, and Yifan Zhang. 2017. Do Multinationals Transfer Culture? Evidence on Female Employment in China. CESifo Working Paper 6295. Munich: CESifo. [Google Scholar] [CrossRef]

- Thuku, Gideon Kiguru, Jacob Omolo, and Joseph Muniu. 2019. Employment Intensity of Output Growth in Kenya. Journal of Economics and Finance 10: 9–21. [Google Scholar]

- Vacaflores, Diego E. 2011. Was Latin America correct in relying in foreign direct investment to improve employment rates. Applied Econometrics and International Development 11: 101–22. [Google Scholar]

- Yousfi, Elhousseyn, and Radia Benziane. 2020. The impact of Foreign Direct Investment on Employment: Empirical Evidence from Algeria. Entrepriserelationship Review 9: 439–48. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).