Global Value Chains Participation during the COVID-19 Pandemic: A Dynamic Panel Approach

Abstract

:1. Introduction

2. Theoretical Background and Literature Review

3. Methodology

3.1. Data Description

3.2. Decomposing Gross Exports into Value-Added Terms

3.3. Measuring Global Value Chains’ Participation

3.4. Econometrics Model Specification

4. Empirical Results and Discussion

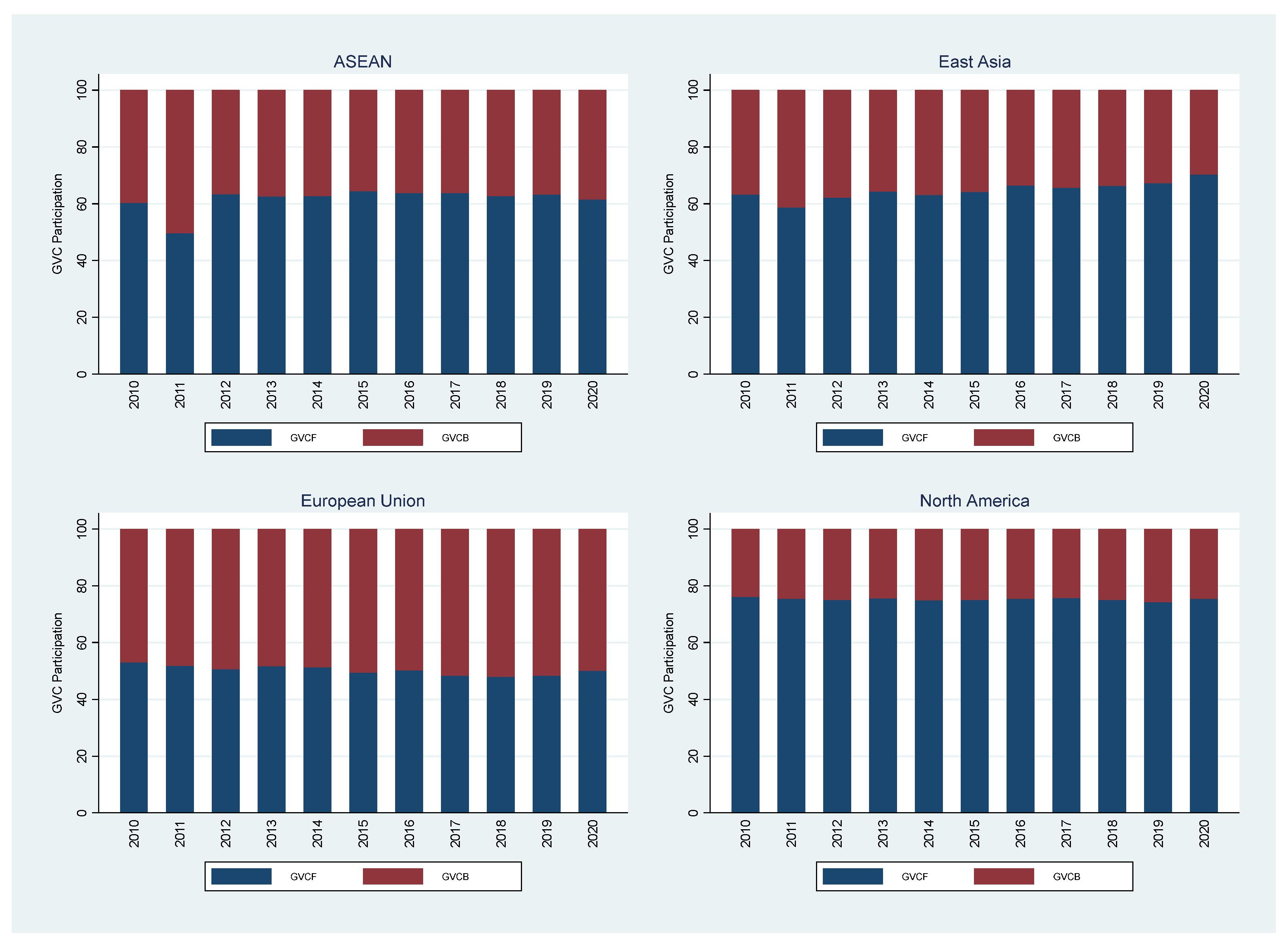

4.1. Descriptive Statistics

4.2. Panel Unit Root Test

4.3. Backward and Forward Linkage Global Value Chains Participation

4.4. The SYS-GMM Dynamic Panel Estimation

4.5. Robustness Test

5. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| No. | Group | Countries |

|---|---|---|

| 1 | ASEAN | Indonesia, Malaysia, Philippines, Singapore, Thailand, Viet Nam, Brunei Darussalam, Lao PDR, Cambodia |

| 2 | East Asia | People’s Republic of China, Japan, Republic of Korea |

| 3 | EU | Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Germany, Denmark, Spain, Estonia, Finland, France, Greece, Croatia, Hungary, Ireland, Italy, Lithuania, Luxembourg, Latvia, Malta, Netherlands, Poland, Portugal, Romania, Slovak Republic, Slovenia, Sweden |

| 4 | NA | United States, Canada |

References

- Acemoglu, Daron, Simon Johnson, and James A. Robinson. 2005. Institutions as a Fundamental Cause of Long-Run Growth. Handbook of Economic Growth 1: 385–472. [Google Scholar] [CrossRef]

- Amendolagine, Vito, Andrea F. Presbitero, Roberta Rabellotti, and Marco Sanfilippo. 2019. Local Sourcing in Developing Countries: The Role of Foreign Direct Investments and Global Value Chains. World Development 113: 73–88. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another Look at the Instrumental Variables Estimation of Error Component Models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef] [Green Version]

- Arellano, Manuel, and Stephen Bond. 1991. Some Tests of Specification for Panel Data:Monte Carlo Evidence and an Application to Employment Equations. The Review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef] [Green Version]

- Asian Development Bank. 2015. Global Value Chains Indicators for International Production Sharing. Key Indicators for Asia and the Pacific 2015. Manila: Asian Development Bank, Available online: https://www.adb.org/sites/default/files/publication/175162/gvc.pdf (accessed on 9 March 2021).

- Asian Development Bank. 2019. The Evolution of Indonesia’s Participation in Global Value Chains. Manila: Asian Development Bank. [Google Scholar] [CrossRef] [Green Version]

- Athukorala, P. Chandra, and Nobuaki Yamashita. 2006. Production Fragmentation and Trade Integration: East Asia in Global Context. North American Journal of Economics and Finance 17: 233–56. [Google Scholar] [CrossRef] [Green Version]

- Baldwin, Richard, and Beatrice W. di Mauro. 2020. Economics in the Time of COVID-19. Edited by Baldwin and Beatrice Weder Di Mauro. A VoxEU.org eBook. London: CEPR Press, Available online: https://voxeu.org/article/economics-time-covid-19-new-ebook (accessed on 2 April 2021).

- Baltagi, Badi H. 2005. Econometric Analysis of Panel Data. Hoboken: John Wiley & Sons Ltd. [Google Scholar]

- Blundell, Richard, and Stephen Bond. 1998. Initial Conditions and Moment Restrictions in Dynamic Panel Data Models. Journal of Econometrics 87: 115–43. Available online: https://www.ucl.ac.uk/~uctp39a/Blundell-Bond-1998.pdf (accessed on 10 June 2021). [CrossRef] [Green Version]

- Borin, Alessandro, and Michele Mancini. 2019. Measuring What Matters in Global Value Chains and Value-Added Trade. WPS 8804. Available online: http://hdl.handle.net/10986/31533 (accessed on 25 November 2021).

- Danielle, S. Yu Krista, Kathleen B. Aviso, Joost R. Santos, and Raymond R. Tan. 2020. The Economic Impact of Lockdowns: A Persistent Inoperability Input-Output Approach. Economies 9: 109. [Google Scholar] [CrossRef]

- Felice, Giulia, and Lucia Tajoli. 2021. Trade Balances and Global Value Chains: Is There a Link? Structural Change and Economic Dynamics 59: 228–46. [Google Scholar] [CrossRef]

- Francois, Joseph, and Miriam Manchin. 2013. Institutions, Infrastructure, and Trade. World Development 46: 165–75. [Google Scholar] [CrossRef] [Green Version]

- Ge, Ying, David Dollar, and Xinding Yu. 2020. Institutions and Participation in Global Value Chains: Evidence from Belt and Road Initiative. China Economic Review 61: 101447. [Google Scholar] [CrossRef]

- Gereffi, Gary, and Joonkoo Lee. 2016. Economic and Social Upgrading in Global Value Chains and Industrial Clusters: Why Governance Matters. Journal of Business Ethics 133: 25–38. [Google Scholar] [CrossRef]

- Gereffi, Gary, John Humphrey, and Timothy Sturgeon. 2005. The Governance of Global Value Chains. Review of International Political Economy 12: 78–104. [Google Scholar] [CrossRef]

- González, Javier, and Przemyslaw Kowalski. 2017. Global Value Chain Participation in Southeast Asia: Trade and Related Policy Implications. In Production Networks in Southeast Asia. Edited by Lili Yan Ing and Fukunari Kimura. New York: Routledge. [Google Scholar]

- Gordon, Robert J. 2014. Macroeconomics. London: Pearson Education Limited. [Google Scholar]

- Guan, Dabo, Daoping Wang, Stephane Hallegatte, Steven J. Davis, Jingwen Huo, Shuping Li, Yangchun Bai, Tianyang Lei, Qianyu Xue, D’Maris Coffman, and et al. 2020. Global Supply-Chain Effects of COVID-19 Control Measures. Nature Human Behaviour 4: 577–87. Available online: https://www.nature.com/articles/s41562-020-0896-8 (accessed on 22 November 2021). [CrossRef] [PubMed]

- Hao, Yu, Hua Liao, and Yi-Ming Wei. 2015. Is China’s Carbon Reduction Target Allocation Reasonable? An Analysis Based on Carbon Intensity Convergence. Applied Energy 142: 229–39. [Google Scholar] [CrossRef]

- Hubbard, R. Glenn, Anthony P. O’Brien, and Matthew Rafferty. 2014. Macroeconomics. Harlow: Pearson Education, Inc. [Google Scholar]

- Hummels, David, Jun Ishii, and Kei-Mu Yi. 2001. The Nature and Growth of Vertical Specialization in World Trade. Journal of International Economics 54: 75–96. [Google Scholar] [CrossRef]

- Inomata, Sitoshi. 2017. Analytical Frameworks for Global Value Chains: An Overview. In Global Value Chain Development Report 2017: Measuring and Analyzing the Impact of GVCs on Economic Development. Washington, DC: The World Bank Group, pp. 15–35. [Google Scholar]

- Ivanov, Dmitry. 2020. Predicting the Impacts of Epidemic Outbreaks on Global Supply Chains: A Simulation-Based Analysis on the Coronavirus Outbreak (COVID-19/SARS-CoV-2) Case. Transportation Research Part E: Logistics and Transportation Review 136: 101922. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, Aart Kraay, and Massimo Mastruzzi. 2010. The Worldwide Governance Indicators: Methodology and Analytical Issues 5430. Washington, DC: The World Bank. [Google Scholar]

- Kazunobu, Hayakawa, and Mukunoki Hiroshi. 2021. The Impact of COVID-19 on International Trade: Evidence from the First Shock. Journal of the Japanese and International Economies 60: 101135. [Google Scholar] [CrossRef]

- Kee, Hiau Looi, and Heiwai Tang. 2016. Domestic Value Added in Exports: Theory and Firm Evidence from China. American Economic Review 106: 1402–36. [Google Scholar] [CrossRef] [Green Version]

- Kersan-Škabic, Ines, and Alen Belullo. 2021. The Characteristics of Regional Value Chains in the Sector of Chemicals and Pharmaceutical Products in the EU. Economies 9: 167. [Google Scholar] [CrossRef]

- Koch, Philipp. 2020. Economic Complexity and Growth: Can Value-Added Exports Better Explain the Link? Economics Letters 198: 109682. [Google Scholar] [CrossRef]

- Koopman, Robert, Zhi Wang, and Shang-Jin Wei. 2014. Tracing Value-Added and Double Counting in Gross Exports. American Economic Review 104: 459–94. [Google Scholar] [CrossRef] [Green Version]

- Leontief, Wassily W. 1936. Quantitative Input and Output Relations in the Economic System of the United States. Review of Economics and Statistics 18: 105–25. Available online: https://orion.math.iastate.edu/driessel/15Models/1936_Input_Output.pdf (accessed on 21 November 2020). [CrossRef] [Green Version]

- Levchenko, Andrei A. 2007. Institutional Quality and International Trade. Review of Economic Studies 74: 791–819. [Google Scholar] [CrossRef]

- Los, Bart, Marcel P. Timmer, and Gaaitzen J. de Vries. 2015. How Global Are Global Value Chains? A New Approach to Measure International Fragmentation. Journal of Regional Science 55: 66–92. [Google Scholar] [CrossRef]

- Mandras, Giovanni, and Simone Salotti. 2020. An Input–Output Analysis of Sectoral Specialization and Trade Integration of the Western Balkans Economies. Economies 8: 93. [Google Scholar] [CrossRef]

- Mouanda, Gilhaimé M., and Jiong Gong. 2019. Determinants of Global Value Chains Participation for Landlocked Countries. International Journal of Social Science and Economic Research 4: 3265–93. [Google Scholar]

- Prete, D. Del, Giorgia Giovannetti, and Enrico Marvasi. 2018. Global Value Chains: New Evidence for North Africa. International Economics 153: 42–54. [Google Scholar] [CrossRef] [Green Version]

- Qin, Meng, Xiuyan Liu, and Xiaoxue Zhou. 2020. COVID-19 Shock and Global Value Chains: Is There a Substitute for China? Emerging Markets Finance and Trade 56: 3588–98. [Google Scholar] [CrossRef]

- Strange, Roger. 2020. The 2020 COVID 19 Pandemic and Global Value Chains. Journal of Industrial and Business Economics 47: 455–65. [Google Scholar] [CrossRef]

- Vidya, C. T., and K. P. Prabheesh. 2020. Implications of COVID-19 Pandemic on the Global Trade Networks. Emerging Markets Finance and Trade 56: 2408–21. [Google Scholar] [CrossRef]

- Wang, Zhi, Shang-jin Wei, and Kunfu Zhu. 2018. Quantifying International Production Sharing at the Bilateral and Sector Levels. NBER Working Paper. Cambridge: National Bureau of Economic Research 19677, Revised February 2018. Available online: https://www.nber.org/papers/w19677 (accessed on 5 March 2020).

- Widodo, Tri. 2008. Dynamic Changes in Comparative Advantage: Japan’s ‘Flying Geese’ Model and Its Implications for China. Journal of Chinese Economic and Foreign Trade Studies 1: 200–13. [Google Scholar] [CrossRef]

- Zergawu, Y. Zewdu, Yabibal M. Walle, and José M. G. Gómez. 2020. The Joint Impact of Infrastructure and Institutions on Economic Growth. Journal of Institutional Economics 16: 481–502. [Google Scholar] [CrossRef] [Green Version]

| Variables | Description | Measurement | Expectation | Source |

|---|---|---|---|---|

| GVCB | Backward Linkage Global Value Chains Participation | Share of Foreign Value Added (FVA) to gross export (ratio) | - | MRIO, Computed by Authors, 2010–2020 |

| GVCF | Forward Linkage Global Value Chains Participation | Share of Domestic Value Added (DVA) to gross export (ratio) | - | MRIO, Computed by Authors, 2010–2020 |

| COVID | COVID-19 pandemic | Dummy COVID-19 pandemic (1 = 2019–2020, 0 = otherwise) | Negative | - |

| GDP | Gross Domestic Product per capita (Log) | GDP divided by population (constant 2015 US dollars) | Positive | World Development Indicators World Bank, 2010–2020 |

| GOV | Government Effectiveness | Index lies between −2.5 and 2.5 | Positive | World Governance Indicators (WGI), 2010–2020 |

| RULE | Rule of Law | Index lies between −2.5 and 2.5 | Positive | WGI, 2010–2020 |

| No. | Category | Formula | Term Description |

|---|---|---|---|

| 1 | DDC | Double-counted DVA is used to produce final use and intermediate commodity exports. | |

| 2 | FVA_FIN | FVA from the importer (r) and third country (t) embodied in final exports. | |

| 3 | FVA_INT | FVA from the importer (r) and a third country (t) contained in intermediate exports, which are then used by r to produce its consumption. | |

| 4 | FDC | Double-counted FVA in home economy’s exports production. |

| No. | Category | Formula | Term Description |

|---|---|---|---|

| 1 | DVA_INT | DVA in intermediate exports used by the direct importer (r) to produce local final products. | |

| 2 | DVA_INTrex | DVA embedded in its intermediate exports used by the direct importer r to produce exports and ultimately absorbed by other countries except for the source country s. | |

| 3 | RDV_G | Returned DVA from the direct importer (r) and third country (t), and produced final products. |

| Group | Statistics | GVCF | GVCB | GDP | GOV | RULE |

|---|---|---|---|---|---|---|

| ASEAN | Mean | 0.46 | 0.29 | 8.62 | 0.35 | −0.02 |

| SD | 0.16 | 0.13 | 1.24 | 0.89 | 0.84 | |

| Maximum | 0.85 | 0.56 | 11.02 | 2.34 | 1.88 | |

| Minimum | 0.21 | 0.08 | 6.79 | −0.94 | −1.12 | |

| East Asia | Mean | 0.43 | 0.24 | 9.90 | 1.04 | 0.73 |

| SD | 0.05 | 0.09 | 0.68 | 0.58 | 0.80 | |

| Maximum | 0.52 | 0.40 | 10.50 | 1.82 | 1.60 | |

| Minimum | 0.35 | 0.13 | 8.64 | 0.004 | −0.54 | |

| EU | Mean | 0.40 | 0.39 | 10.12 | 1.09 | 1.10 |

| SD | 0.08 | 0.11 | 0.64 | 0.56 | 0.60 | |

| Maximum | 0.72 | 0.73 | 11.56 | 2.05 | 2.10 | |

| Minimum | 0.16 | 0.16 | 8.74 | 0.15 | −0.11 | |

| NA | Mean | 0.56 | 0.18 | 10.81 | 1.63 | 1.67 |

| SD | 0.04 | 0.06 | 0.14 | 0.15 | 0.13 | |

| Maximum | 0.70 | 0.26 | 11.02 | 1.85 | 1.89 | |

| Minimum | 0.51 | 0.11 | 10.63 | 1.32 | 1.37 | |

| Full Sample | Mean | 0.42 | 0.35 | 9.81 | 0.95 | 0.86 |

| SD | 0.11 | 0.13 | 1.03 | 0.72 | 0.83 | |

| Maximum | 0.85 | 0.73 | 11.56 | 2.34 | 2.10 | |

| Minimum | 0.16 | 0.08 | 6.79 | −0.94 | −1.12 |

| Variables | T Statistics | p-Value |

|---|---|---|

| GVCF | −39.5926 | 0.0000 |

| GVCB | −39.2365 | 0.0000 |

| GDP | −2.1474 | 0.0159 |

| GOV | −6.0623 | 0.0000 |

| RULE | −6.7004 | 0.0000 |

| Variables | GVCF | GVCB |

|---|---|---|

| (1) | (2) | |

| Dep Var (−1) | 0.353 *** | 0.068 *** |

| (0.010) | (0.114) | |

| COVID-19 | −0.006 *** | −0.011 *** |

| (0.0008) | (0.001) | |

| GDP | 0.178 *** | 0.050 *** |

| (0.037) | (0.006) | |

| GOV | 0.089 *** | 0.041 *** |

| (0.002) | (0.006) | |

| RULE | 0.040 *** | 0.024 *** |

| (0.006) | (0.003) | |

| Constant | 0.361 *** | −0.242 *** |

| (0.089) | (0.051) | |

| No. of observations | 328 | 369 |

| No. of countries | 41 | 41 |

| Hansen test, p-value | 36.33; 0.134 | 34.00; 0.325 |

| AB–AR(1); p-value | −1.33; 0.184 | −2.00; 0.045 |

| AB–AR(2); p-value | 0.63; 0.530 | −1.02; 0.307 |

| Variables | GVCF | GVCB |

|---|---|---|

| (3) | (4) | |

| Dep Var (−1) | 0.355 *** | 0.057 *** |

| (0.012) | (0.008) | |

| COVID shocks | −0.059 *** | −0.082 *** |

| (0.006) | (0.005) | |

| GDP | 0.223 *** | 0.216 *** |

| (0.046) | (0.038) | |

| GOV | 0.084 *** | 0.070 *** |

| (0.003) | (0.008) | |

| RULE | 0.030 *** | 0.028 *** |

| (0.006) | (0.005) | |

| Constant | 0.367 *** | 0.276 *** |

| (0.099) | (0.060) | |

| No. of observations | 328 | 410 |

| No. of countries | 41 | 41 |

| Hansen test, p-value | 35.10; 0.167 | 37.15; 0.244 |

| AB–AR(1); p-value | −1.27; 0.203 | −2.43; 0.015 |

| AB–AR(2); p-value | 0.61; 0.545 | −1.69; 0.092 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wuri, J.; Widodo, T.; Hardi, A.S. Global Value Chains Participation during the COVID-19 Pandemic: A Dynamic Panel Approach. Economies 2022, 10, 121. https://doi.org/10.3390/economies10050121

Wuri J, Widodo T, Hardi AS. Global Value Chains Participation during the COVID-19 Pandemic: A Dynamic Panel Approach. Economies. 2022; 10(5):121. https://doi.org/10.3390/economies10050121

Chicago/Turabian StyleWuri, Josephine, Tri Widodo, and Amirullah Setya Hardi. 2022. "Global Value Chains Participation during the COVID-19 Pandemic: A Dynamic Panel Approach" Economies 10, no. 5: 121. https://doi.org/10.3390/economies10050121

APA StyleWuri, J., Widodo, T., & Hardi, A. S. (2022). Global Value Chains Participation during the COVID-19 Pandemic: A Dynamic Panel Approach. Economies, 10(5), 121. https://doi.org/10.3390/economies10050121