China in Africa: An Examination of the Impact of China’s Loans on Growth in Selected African States

Abstract

:1. Introduction and Background of Study

2. Literature Review

2.1. Theoretical Literature

2.1.1. Financing Gap Theory (Two Gap Theory)

2.1.2. False Paradigm Theory

2.1.3. Debt Overhang Theory

2.1.4. Credit Rationing Effect

2.2. Empirical Literature

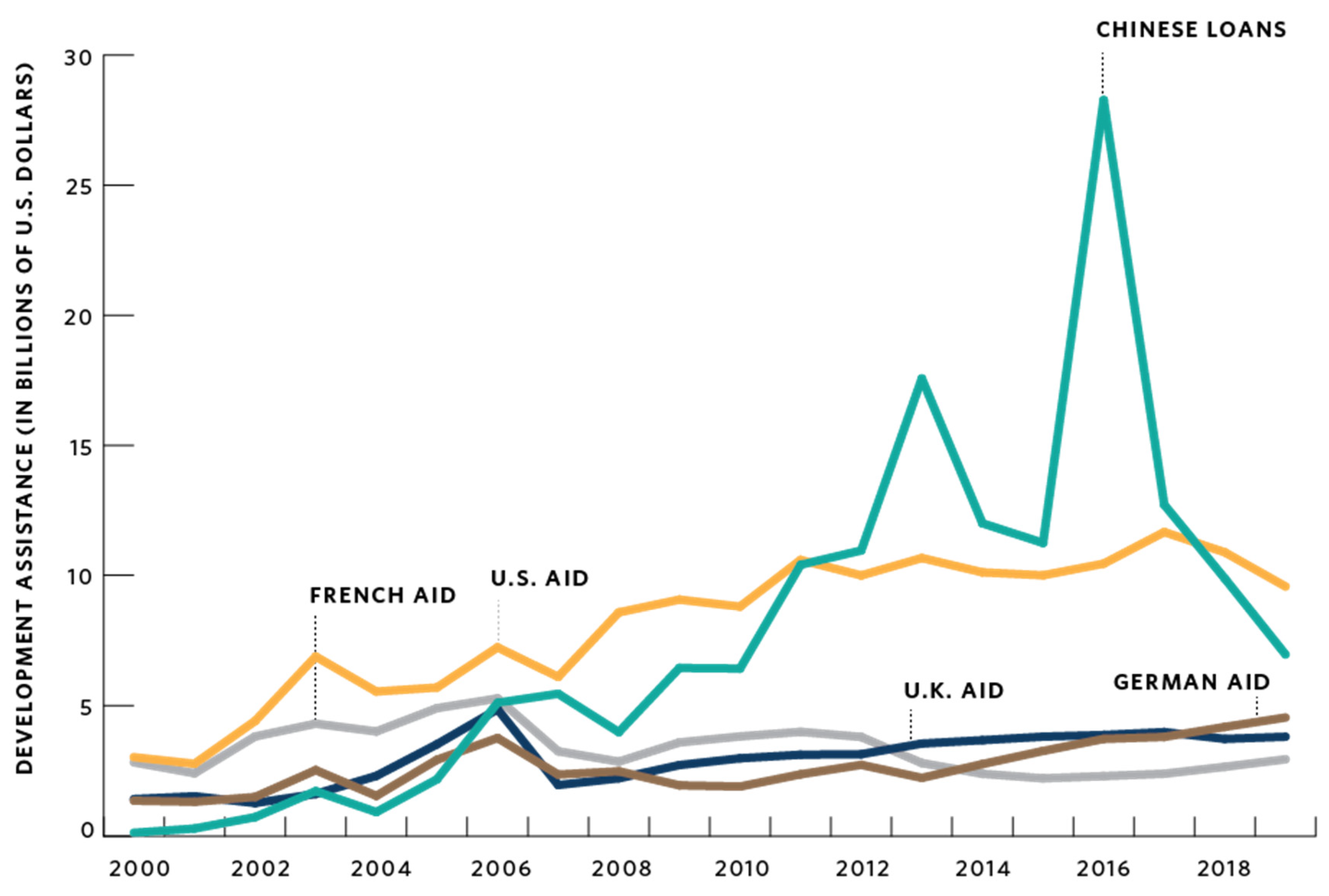

3. The Dynamics of the China–Africa Loans

3.1. Need for Infrastructure Funding in Africa

3.2. An Overview of Chinese Loans to Africa Since 2000

3.3. African Governments View about Their Relationship with China

3.4. Why Chinese Loans Are Preferred

3.5. Criticism of China’s Infrastructure Funding in Africa

3.5.1. Vanity Projects

3.5.2. Predatory Loans

3.5.3. Control and Dominance

3.5.4. Debt Trap Diplomacy

4. Methodology

4.1. Data Sources and Research Approach

4.2. Model Specification

4.3. Estimation Techniques

4.3.1. Unit Root Tests

4.3.2. Panel Cointegration Test

4.3.3. Panel ARDL

Mean Group (MG) Estimator

Pooled Mean Group (PMG) Model

Hausman Test

5. Presentation of Results

5.1. Descriptive Statistics

5.2. Stationarity Tests

5.3. Cointegration Tests

5.4. ARDL Results

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Acker, Kevin. 2021. Chinese Lending to Africa Slowed in 2019, But Don’t Rule Out a Revival. Available online: https://www.bu.edu/gdp/2021/04/12/chinese-lending-to-africa-slowed-in-2019-but-dont-rule-out-a-revival/ (accessed on 14 December 2021).

- African Development Bank (AfDB). 2019. Africa’s 3 Infrastructure: Great Potential But Little Impact On Inclusive Growth. Available online: https://www.afdb.org/fileadmin/uploads/afdb/Documents/Publications/2018AEO/African_Economic_Outlook_2018_-_EN_Chapter3.pdf (accessed on 12 February 2020).

- Afonso, António, and Christophe Rault. 2007. What Do We Really Know about Fiscal Sustainability in the Eu? A Panel Data Diagnostic. European Central Bank. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp820.pdf (accessed on 12 February 2020).

- African Times. 2018. China Pushes Back after German Media Questions Its African Interests. Available online: https://africatimes.com/2018/11/13/china-pushes-back-after-german-media-questions-its-african-interests/ (accessed on 12 February 2020).

- AfroBarometer. 2016. Here’s What Africans Think about China’s Influence in Their Countries. Available online: https://afrobarometer.org/blogs/heres-what-africans-think-about-chinas-influence-their-countries (accessed on 10 September 2020).

- Afrodad. 2019. The China-Zimbabwe Relations: Impact on Debt and Development in Zimbabwe. Available online: https://www.africaportal.org/publications/china-zimbabwe-relations-impact-debt-and-development-zimbabwe/ (accessed on 10 September 2020).

- Aliha, Payam, Tayat Sarmidi, Abhu Shaar, and Fhatim Said. 2017. Using Ardl Approach to Cointehration for Investigating the Relationship between Payment Technologies and Money Demand on A World Scale. Hellenic Association of Regional Scientists. Available online: http://www.rsijournal.eu/ARTICLES/December_2017/2.pdf (accessed on 16 November 2021).

- Baig, Khan, and Gilal Qayyum. 2018. Do Natural Disasters Cause Economic Growth? An Ardl Bound Testing Approach. Studies in Business and Economics 13: 5–20. [Google Scholar] [CrossRef] [Green Version]

- Baker McKenzie. 2018. Funding Africa’s Infrastructure Gap. Available online: https://www.polity.org.za/article/funding-africas-infrastructure-gap-2019-05-24 (accessed on 16 November 2021).

- Bavier, Joe. 2019. Don’t Expect Debt Relief, United States Warns Africa. Available online: https://www.reuters.com/article/us-usa-africa-idUSKCN1TP144 (accessed on 5 July 2021).

- Bavier, Joe, and Christian Shepherd. 2018. Despite Debt Woes, Africa Still Sees China as Best Bet for Financing. Available online: https://www.reuters.com/article/us-China–Africa-idUSKCN1LF2RM (accessed on 10 November 2020).

- BBC. 2018. Mamamah Airport: Sierra Leone Cancels China-Funded Project. Available online: https://www.bbc.com/news/world-africa-45809810 (accessed on 13 September 2020).

- BDlive. 2018. Africa’s Infrastructure Gaps Are an Investment Opportunity Waiting to Happen. Available online: https://www.businesslive.co.za/bd/opinion/2018-11-09-africas-infrastructure-gaps-are-an-investment-opportunity-waiting-to-happen/ (accessed on 13 September 2020).

- Bizimungu, Julius. 2020. Let’s Not Ask What Can Be Done for Africa, Kagame Tells Europe. Available online: https://www.newtimes.co.rw/news/lets-not-ask-what-can-be-done-africa-kagame-tells-europe (accessed on 16 November 2021).

- Bland, Dan. 2018. Why Djibouti Is Home to China’s First Foreign Military Base. Available online: https://smallwarsjournal.com/blog/why-djibouti-home-chinas-first-foreign-military-base (accessed on 11 September 2021).

- Bombrowski, Katja. 2017. Chinese Foreign Policy: Silk Road Across the Indian Ocean. Available online: https://Www.Dandc.Eu/En/Article/China-Building-Trade-Related-Infrastructure-Africa (accessed on 17 October 2021).

- Bräutigam, Deborah. 2018. U.S. Politicians Get China In Africa All Wrong. Available online: https://www.washingtonpost.com/news/theworldpost/wp/2018/04/12/China–Africa/ (accessed on 11 September 2021).

- Bräutigam, Deborah. 2019. Deborah Brautigam: No Evidence of Chinese Debt Traps in Africa. Available online: https://chinaafricaproject.com/podcasts/podcast-china-debt-trap-africa-deborah-brautigam/ (accessed on 5 August 2021).

- Bräutigam, Deborah. 2020. Chinese Debt Relief: Fact and Fiction. Available online: https://thediplomat.com/2020/04/chinese-debt-relief-fact-and-fiction/ (accessed on 5 August 2021).

- Button, Kennet, and Junyang Yuan. 2013. Airfreight transport and economic development: An examination of causality. Urban Studies 50: 329–40. Available online: https://www.jstor.org/stable/26144208 (accessed on 5 August 2021). [CrossRef]

- Calderón, César, and Luis Servén. 2003. The output cost of Latin America’s infrastructure gap. In The Limits of Stabilization: Infrastructure, Public Deficits, and Growth in Latin America. Edited by William Easterly and Luis Servén. Washington, DC: Stanford University Press, pp. 95–119. [Google Scholar]

- Calderón, César, and Rodrigo Fuentes. 2013. Government Debt and Economic Growth. Available online: https://publications.iadb.org/publications/english/document/Government-Debt-and-Economic-Growth.pdf (accessed on 13 June 2020).

- Campos, Zanda. 2018. The Economic Cost of Poor Infrastructure. Available online: https://www.africanfinanceandtech.com/single-post/2018/02/28/The-Economic-Cost-of-Poor-Infrastructure (accessed on 13 June 2020).

- Carmignani, Fabrizio, and Abdur Chowdhury. 2010. Why Are Natural Resources a Curse in Africa, But Not Elsewhere? Available online: http://www.uq.edu.au/economics/abstract/406.pdf (accessed on 20 August 2020).

- Cascais, Antonio. 2018. Africa’s Leaders Race to China summit to Talk Cooperation. Available online: https://www.dw.com/en/africas-leaders-race-to-china-summit-to-talk-cooperation/a-45301681 (accessed on 20 August 2020).

- Chaudhury, Dipanjan Roy. 2021. Africa’s Rising Debt: Chinese Loans to Continent Exceeds $140 Billion. Available online: https://economictimes.indiatimes.com/news/international/world-news/africas-rising-debt-chinese-loans-to-continent-exceeds-140-billion/articleshow/86444602.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst (accessed on 13 December 2021).

- Chen, Dingding, and Katrin Kinzelbach. 2015. Democracy promotion and China: Blocker or bystander? Democratization 22: 400–18. [Google Scholar] [CrossRef]

- Chenery, Hollis, and Allan Strout. 1966. Foreign assistance and economic development. American Economic Review 56: 678–733. [Google Scholar]

- Chimbelu, Chiponda. 2019. Making Chinese investment in African ports work despite risks. Deutsche Welle. Available online: https://www.dw.com/en/making-chinese-investment-in-african-ports-work-despite-risks/a-49282176 (accessed on 16 August 2021).

- Chin, Mui-Yin, Sheue-Li Ong, Chew-Keong Wai, and Yee-Qin Kon. 2021. The role of infrastructure on economic growth in belt and road participating countries. Journal of Chinese Economic and Foreign Trade Studies 14: 169–86. [Google Scholar] [CrossRef]

- Chindengwike, James Daniel, and Arnold Kira. 2021. The Impact of Foreign Debts on Economic Growth in Tanzania: Evidence from 1988–2020. Available online: https://www.researchgate.net/publication/350709550_The_Impact_of_Foreign_Debts_on_Economic_Growth_in_Tanzania_Evidence_from_2000-2019 (accessed on 14 January 2022).

- Clements, Benedict, Rina Bhattacharya, and Toan Nguyen. 2005. Can Debt Relief Boost Growth in Poor Countries? Economic Issues. Washington, DC: International Monetary Fund, Available online: https://www.imf.org/External/Pubs/FT/issues/issues34/ (accessed on 13 September 2020).

- Dahir, Abdi. 2019. The “Debt-Trap” Narrative around Chinese Loans Shows Africa’s Weak Economic Diplomacy. Available online: https://qz.com/africa/1542644/china-debt-trap-talk-shows-africas-weak-economic-position/ (accessed on 28 November 2021).

- De Rugy, Veronique, and Jack Salmon. 2013. Debt and Growth: A Decade of Studies. Available online: https://www.mercatus.org/publications/government-spending/debt-and-growth-decade-studies (accessed on 6 July 2020).

- Devermont, Jude, and Catherine Chiang. 2019. Assessing the Risks of Chinese Investments in Sub Saharan African Ports. Available online: https://www.csis.org/analysis/assessing-risks-chinese-investments-sub-saharan-african-ports (accessed on 12 March 2021).

- Dey, Sima Rani, and Mohamad Tareque. 2020. External debt and growth: Role of stable macroeconomic policies. Journal of Economics Finance and Administrative Science 25: 185–204. [Google Scholar] [CrossRef]

- Donnelly, Lynley. 2018. Africa’s Debt to China Is Complicated. Available online: https://mg.co.za/article/2018-09-14-00-africas-debt-to-china-is-complicated (accessed on 18 May 2021).

- Dollar, David. 2019. Understanding China’s Belt And Road Infrastructure Projects In Africa. Available online: https://www.brookings.edu/wp-content/uploads/2019/09/FP_20190930_china_bri_dollar.pdf (accessed on 6 July 2020).

- Du Plesis, Carien. 2021. A Cautious Shift in Africa-China Relations. Available online: https://www.businesslive.co.za/fm/features/africa/2021-12-16-a-cautious-shift-in-africa-china-relations// (accessed on 10 December 2021).

- Easterly, William. 1999. The Ghost of Financing Gap: Testing the Growth Model Used in the International Financial Institutions. Journal of Development Economics 60: 423–38. [Google Scholar] [CrossRef]

- Edinger, Hannah, and Jean-Pierre Labuschagne. 2019. If You Want to Prosper, Consider Building Roads: China’s Role in African Infrastructure and Capital Projects. Available online: https://www2.deloitte.com/content/dam/insights/us/articles/za22330_consider-building-roads/DI_If-you-want-to-prosper-consider-building-roads.pdf (accessed on 22 November 2021).

- Edo, Samson. 2002. The external debt problem in Africa: A comparative study of Nigeria and Morocco. Africa Development Review 14: 221–36. [Google Scholar] [CrossRef]

- Efendi, Nathan. 2001. External Debt and Growth of Developing Countries. Ph.D. Thesis, University of Oklahoma, Norman, OK, USA. [Google Scholar]

- Ehizuelen, Mitchell Michael. 2021. China’s Infrastructure Financing and the Role of Infrastructure in Awakening African Economies. Journal of Comparative Asian Development 18: 1–25. [Google Scholar] [CrossRef]

- Ejigayehu, Dereje Abera. 2013. The Effect of External Debt on Economic Growth—A Panel Data Analysis on the Relationship between External Debt and Economic Growth. Available online: http://www.diva-portal.org/smash/get/diva2:664110/FULLTEXT01.pdf (accessed on 5 October 2020).

- Eleanor, Albert. 2017. China in Africa. Available online: https://www.cfr.org/backgrounder/China–Africa (accessed on 10 March 2021).

- Embassy of Ethiopia in Brussels. 2019. Ethiopia Contracts Two Companies to Complete Nile Dam Construction. Available online: https://ethiopianembassy.be/2019/02/21/ethiopia-contracts-two-companies-to-complete-nile-dam-construction/ (accessed on 22 November 2021).

- Engle, Robert, and Granger Clive. 1987. Cointegration and Error Correction Representation, Estimation and Testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Eysse, Benitta, and Deutshe Welle. 2018. Double Debt Risk for African Countries that Turn to China. Available online: https://mg.co.za/article/2018-07-26-double-debt-risk-for-african-countries-that-turn-to-china (accessed on 5 March 2020).

- Fabricius, Peter. 2021. Is the ‘Silk Road’ Unravelling? Available online: https://issafrica.org/iss-today/is-the-silk-road-unravelling (accessed on 18 January 2022).

- Faga, Laureen. 2019. New China–Africa Paper Calls on West to Tone down the BRI Drama. Available online: https://africatimes.com/2019/09/30/new-China–Africa-paper-calls-on-west-to-tone-down-the-bri-drama/ (accessed on 10 February 2021).

- Fedderke, Johannes, Peter Perkins, and John Luiz. 2006. Infrastructural investment in long-run economic growth: South Africa 1875–2001. World Development 34: 1037–59. [Google Scholar] [CrossRef]

- Feng, Emily, and David Pilling. 2019. The Other Side of Chinese Investment in Africa. Available online: https://www.ft.com/content/9f5736d8-14e1-11e9-a581-4ff78404524e (accessed on 22 March 2021).

- Fifield, Anna. 2018. China Pledges $60 Billion in Aid and Loans to Africa, No ‘Political Conditions Attached’. Available online: https://www.washingtonpost.com/world/china-pledges-60-billion-in-aid-and-loans-to-africa-no-strings-attached/2018/09/03/a446af2a-af88-11e8-a810-4d6b627c3d5d_story.html (accessed on 12 May 2020).

- French, Howard. 2021. Is a Belated Western Rival to China’s Belt and Road Too Late? Available online: https://www.worldpoliticsreview.com/articles/29533/with-the-belt-and-road-china-is-way-ahead-of-the-west-on-public-goods (accessed on 10 December 2021).

- Goetz, Andrew. 2011. The global economic crisis, investment in transport infrastructure, and economic development. In Transportation and Economic Development Challenges. Edited by Kenneth Button. Cheltenham: Edward Elgar Publishing, pp. 41–71. [Google Scholar] [CrossRef]

- Goldsmith, Courtney. 2019. Is a New Debt Crisis Mounting in Africa? Available online: https://www.worldfinance.com/special-reports/is-a-new-debt-crisis-mounting-in-africa (accessed on 12 May 2020).

- Gondo, Gerald. 2019. Closing Africa’s Infrastructure Gap. Available online: https://www.fin24.com/Finweek/Investment/closing-africas-infrastructure-gap-20190514 (accessed on 22 November 2021).

- Gopaldas, Ronak. 2018. Lessons from Sri Lanka on China’s ‘Debt-Trap Diplomacy’. Available online: https://issafrica.org/amp/iss-today/lessons-from-sri-lanka-on-chinas-debt-trap-diplomacy (accessed on 13 September 2020).

- Gordon, Pirie. 2019. China Flexes Its Aviation Muscles in Africa. Available online: https://www.news.uct.ac.za/article/-2019-09-02-china-flexes-its-aviation-muscles-in-africa (accessed on 10 October 2021).

- Hackenesch, Christine. 2015. Not as bad as it seems: EU and US democracy promotion faces China in Africa. Democratization 22: 419–37. [Google Scholar] [CrossRef]

- Hameed, Andre, Hindaf Ashraf, and Mustafa Chaudhary. 2008. External debt and its impact on economic and business growth in Pakistan. International Research Journal of Finance and Economics 20: 132–40. [Google Scholar]

- Hanauer, Larry, and Lyle Morris. 2014. China in Africa: Implications of a Deepening Relationship. Available online: https://www.rand.org/pubs/research_briefs/RB9760.html (accessed on 10 March 2021).

- Hansen, Henrik. 2001. The impact of aid and external debt on growth and investment: Insights from cross-country regression analysis. International Journal of Economics and Financial Issues 6: 271–78. [Google Scholar]

- Horn, Sebastian, Carmen M. Reinhart, and Christoph Trebesch. 2021. China’s overseas lending. Journal of International Economics. [Google Scholar] [CrossRef]

- Humphrey, Chris, and Michaelowa Michaelowa. 2019. China in Africa: Competition for Traditional Development Finance Institutions? Available online: https://www.sciencedirect.com/science/article/abs/pii/S0305750X19300725 (accessed on 10 March 2021).

- Hutson, Terence. 2018. Growing Chinese Influence on Africa’s Harbours. Available online: https://www.iol.co.za/mercury/network/growing-chinese-influence-on-africas-harbours-15956795 (accessed on 12 April 2020).

- IMF. 2012. The good, the bad, and the ugly: 100 Years of dealing with public debt overhangs. In World Economic Outlook—Coping with High Debt and Sluggish Growth. Washington, DC: International Monetary Fund. [Google Scholar]

- Janda, Karel, and Gregory Quarshie. 2017. Natural Resources, Oil and Economic Growth in Sub Saharan Africa. Available online: https://mpra.ub.uni-muenchen.de/76748/1/MPRA_paper_76748.pdf (accessed on 12 April 2020).

- Jayaram, Kartik, Omid Kassiri, and Irene Sun. 2017. THE closest Look Yet at Chinese Economic Engagement in Africa. Available online: https://www.mckinsey.com/featured-insights/middle-east-and-africa/the-closest-look-yet-at-chinese-economic-engagement-in-africa (accessed on 12 April 2020).

- Johansen, Soren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Gu, Jing, and Richard Carey. 2019. China’s Development Finance and African Infrastructure Development. Available online: https://oxford.universitypressscholarship.com/view/10.1093/oso/9780198830504.001.0001/oso-9780198830504-chapter-8 (accessed on 22 November 2021).

- Jones, Lee, and Shahar Hameiri. 2020. Debunking the Myth of ‘Debt-trap Diplomacy’ How Recipient Countries Shape China’s Belt and Road Initiative. Available online: https://www.chathamhouse.org/sites/default/files/2020-08-19-debunking-myth-debt-trap-diplomacy-jones-hameiri.pdf (accessed on 22 November 2021).

- Jouanjean, Marie-Agnes, and Dick Willem te Velde. 2013. The Role of Development Finance Institutions in Promoting Jobs and Structural Transformation. ODI Paper Prepared for DFID. London: Overseas Development Institute. [Google Scholar]

- Kargbo, Santigie. 2017. Foreign Direct Investment and Economic Growth in Africa. University of Cape Town. Available online: https://open.uct.ac.za/handle/11427/25308 (accessed on 13 September 2020).

- Kazeem, Yomi. 2020. The Truth about Africa’s “Debt Problem” with China. Available online: https://qz.com/africa/1915076/how-bad-is-africas-debt-to-china/ (accessed on 22 November 2021).

- Kelly, Jeremy. 2012. China Africa: Curing the Resource Curse with Infrastructure and Modernization. Sustainable Development Law and Policy 12: 35–41. [Google Scholar]

- Kodongo, Odongo, and Kalu Ojah. 2016. Does infrastructure really explain economic growth in Sub Saharan Africa? Review of Development Finance 6: 105–25. [Google Scholar] [CrossRef]

- Kufuor, John. 2021. Africa’s Smallholder Farmers Are the Linchpin to Economic Success. Available online: https://africabusinesscommunities.com/agribusiness/features/column-john-kufuor-africas-smallholder-farmers-are-the-linchpin-to-economic-success/ (accessed on 13 September 2020).

- Kwasi, Stellah. 2019. High Cost of Having China as Africa’s Partner of Choice. Available online: https://issafrica.org/iss-today/high-cost-of-having-china-as-africas-partner-of-choice (accessed on 10 December 2021).

- Lall, Somik. 1999. The role of public infrastructure investments in regional development: Experience of Indian states. Economic and Political Weekly 34: 717–25. [Google Scholar]

- Letsoalo, Matuma, Dineao Bendile, and Tebogo Tswane. 2018. China gifts SA with R370bn. Available online: https://mg.co.za/article/2018-09-14-00-china-gifts-sa-with-r370bn (accessed on 14 May 2021).

- Levy-Livermore, Amnon, and Khorshed Chowdhury. 1998. Handbook on Globalization of the World Economy. Cheltenham: Edward Elgar Publishing Limited. [Google Scholar]

- Li, Xiaojun. 2017. Does Conditionality Still Work? China’s Development Assistance and Democracy in Africa. Available online: https://link.springer.com/article/10.1007/s41111-017-0050-6 (accessed on 12 April 2020).

- Li, Xiaojun. 2018. China Is Offering ‘No Strings Attached Aid’ to Africa. Here’s What That Means. Available online: https://www.washingtonpost.com/news/monkey-cage/wp/2018/09/27/china-is-offering-no-strings-attached-aid-to-africa-heres-what-that-means/ (accessed on 7 May 2020).

- Lin-Sea, Lau, Ng Cheong-Fatt, and Chee-Kong Choong. 2019. Chapter 9—Panel Data Analysis (Stationarity, Cointegration, and Causality). Available online: https://www.sciencedirect.com/science/article/pii/B9780128167977000096 (accessed on 10 December 2021).

- Maddala, Gangadharrao Soundalyarao, and Shaowen Wu. 1999. A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test. Oxford Bulletin of Economics and Statistics 61: 631–52. [Google Scholar] [CrossRef]

- Madowo, Larry. 2018. Should Africa Be Wary of Chinese Debt? Available online: https://www.bbc.com/news/world-africa-45368092 (accessed on 12 April 2020).

- Maeko, Thando. 2021. China Says Accusations of Debt-Trap Diplomacy in Africa Are False. Available online: https://www.businesslive.co.za/bd/national/2021-12-08-china-says-accusations-of-debt-trap-diplomacy-in-africa-are-false/ (accessed on 11 November 2021).

- Makhoba, Bongomusa Prince, Irrshad Kaseeram, and Lorraine Greyling. 2021. Asymmetric and threshold effects of public debt on economic growth in SADC: A panel smooth transition regression analysis. African Journal of Economic and Management Studies. ahead-of-print. [Google Scholar] [CrossRef]

- Manes, Eran, Friedrich Schneider, and Anat Tchetchik. 2016. On the Boundaries of the Shadow Economy: An Empirical Investigation. Available online: http://ftp.iza.org/dp10067.pdf (accessed on 16 August 2021).

- Marais, Hannah, and Jean Pierre Labuschagne. 2019. China’s Role in African Infrastructure and Capital Projects. Available online: https://www2.deloitte.com/us/en/insights/industry/public-sector/china-investment-africa-infrastructure-development.html (accessed on 16 August 2021).

- Moore, Gyude. 2018. The Language of “Debt-Trap Diplomacy” Reflects Western Anxieties, Not African Realities. Available online: https://qz.com/1391770/the-anxious-chorus-around-chinese-debt-trap-diplomacy-doesnt-reflect-african-realities/ (accessed on 9 May 2020).

- Moore, Gyude. 2021. Chinese Lending Decline Leaves Africa with Huge Infrastructure Gap. Available online: https://african.business/2021/05/trade-investment/chinese-lending-decline-leaves-huge-infrastructure-gap/ (accessed on 16 August 2021).

- Moramudall, Umeshi. 2019. Is Sri Lanka Really a Victim of China’s ‘Debt Trap’? Sri Lanka’s Debt Crisis and Chinese Loans—Separating Myth from Reality. Available online: https://thediplomat.com/2019/05/is-sri-lanka-really-a-victim-of-chinas-debt-trap/ (accessed on 16 August 2021).

- Mourdoukoutas, Panos. 2019. What China Wants from Africa? Everything. Available online: https://www.forbes.com/sites/panosmourdoukoutas/2019/05/04/what-china-wants-from-africa-everything/#40f4d261758b (accessed on 23 October 2021).

- Munda, Constant. 2021. China Signals Cuts in Loans to Africa after Reduction of Financing Pledge. Available online: https://www.businessdailyafrica.com/bd/economy/china-signals-cuts-in-loans-to-africa-3638058 (accessed on 10 December 2021).

- Mushataq, Saba, and Danish Siddiqui. 2017. Effect of interest rate on bank deposits: Evidences from Islamic and non-Islamic economies. Future Business Journal 3: 1–8. [Google Scholar] [CrossRef]

- Mustapha, Shakira, and Annalisa Prizzon. 2018. Africa’s Rising Debt: How to Avoid a New Crisis. Available online: https://www.odi.org/publications/11221-africas-rising-debt-how-avoid-new-crisis (accessed on 12 July 2020).

- Ndjokou, Itchoko Motande Mondjeli, and Pierre Christian Tsopmo. 2017. The effects on economic growth of natural resources in Sub-Saharan Africa: Does the quality of institutions matters? Economics Bulletin 37: 248–63. [Google Scholar]

- Ndoricimpa, Arcade. 2020. Threshold effects of public debt on economic growth in Africa: A new evidence. Journal of Economics and Development 22: 187–207. [Google Scholar] [CrossRef]

- Nermin, Yasara. 2021. The Causal Relationship Between Foreign Debt and Economic Growth: Evidence from Commonwealth Independent States. Foreign Trade Review 56: 415–29. [Google Scholar] [CrossRef]

- Nyabiage, Jevans. 2020. Low-Interest Rate Loans from China Are Attractive to African Countries, Says Senegalese President. Available online: https://www.scmp.com/news/china/diplomacy/article/3106353/low-interest-rate-loans-china-are-attractive-african-countries (accessed on 16 August 2021).

- Nyabiage, Jevans. 2021. Blind Dumping over’: Chinese Lenders in Africa Focus on Stronger Economies. Available online: https://www.scmp.com/news/china/diplomacy/article/3127608/blind-dumping-over-chinese-lenders-africa-focus-stronger (accessed on 16 August 2021).

- Olamide, Ebenezer Gbenga, and Andrew Maredza. 2021. Pre-COVID-19 evaluation of external debt, corruption and economic growth in South Africa. Review of Economics and Political Science. [Google Scholar] [CrossRef]

- Olander, Eric. 2019. Museveni is Now China’s Most Forceful Advocate in Africa. Available online: https://chinaafricaproject.com/2019/10/10/museveni-is-now-chinas-most-forceful-advocate-in-africa/ (accessed on 22 November 2021).

- Olander, Eric. 2020. China to Cut Back Lending to Africa in the Post-COVID-19 Era. Available online: https://www.theafricareport.com/52806/china-to-cut-back-lending-to-africa-in-the-post-covid-19-era/ (accessed on 10 December 2021).

- Olingo, Allan. 2021. Africa: China Loan Binge Starts to Bite—The U.S, EU Hope to Gain From Fallout. Available online: https://allafrica.com/stories/202111270015.html (accessed on 10 December 2021).

- Olukayode, Maku. 2009. Does government spending spur economic growth in Nigeria. Journal of Economics and Social Science 23: 167–84. Available online: https://mpra.ub.uni-muenchen.de/id/eprint/17941 (accessed on 13 September 2020).

- Owusu-Manu, Degraft, Adam Braimah Jehur, David John Edwards, Frank Boateng, and George Asumadu. 2019. The impact of infrastructure development on economic growth in sub-Saharan Africa with special focus on Ghana. Journal of Financial Management of Property and Construction 24: 253–73. [Google Scholar] [CrossRef]

- Oyebanjo, Olawale. 2017. Determinants of Economic Growth in Sub-Saharan Africa: Decomposition of Exports and Imports. Available online: https://open.uct.ac.za/bitstream/handle/11427/27475/thesis_com_2017_oyebanjo_olawale.pdf?sequence=1 (accessed on 4 June 2020).

- Pandey, Ashutosh. 2019. China: A Loan Shark or the Good Samaritan? Available online: https://www.dw.com/en/china-a-loan-shark-or-the-good-samaritan/a-48671742 (accessed on 4 June 2020).

- Park, Yoon Jung, and Lina Benabdallah. 2021. U.S. Policymakers often Criticize Chinese Investment in Africa. The Research Tells a More Complicated Story. Available online: https://www.washingtonpost.com/politics/2021/02/19/us-policymakers-often-criticize-chinese-investment-africa-research-tells-more-complicated-story/ (accessed on 10 December 2021).

- Patino, Cecilia Maria, and Juliana Carvahlo Ferreira. 2018. Inclusion and exclusion criteria in research studies: Definitions and why they matter. Jornal Brasileiro de Pneumologia 44: 84. [Google Scholar] [CrossRef] [Green Version]

- Pedroni, Peter. 2004. Panel Cointegration: Asymptotic and Finite Sample Properties of Pooled Time Series Tests with an Application to the PPP Hypothesis. Econometric Theory 20: 597–625. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, Hashem, and Ron Smith. 1995. Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics 68: 79–113. [Google Scholar] [CrossRef]

- Pesaran, Hashem, Yongcheol Shin, and Ron Smith. 1999. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Perkins, Peter, Johanne Fedderke, and John Luiz. 2005. An Analysis of Economic Infrastructure Investment in South Africa. South African Journal of Economics 73: 211–28. [Google Scholar] [CrossRef] [Green Version]

- Peterson Institute for International Economics. 2021. How China Lends: A Rare Look into 100 Debt Contracts with Foreign Governments. Available online: https://www.cgdev.org/publication/how-china-lends-rare-look-into-100-debt-contracts-foreign-governments (accessed on 10 December 2021).

- Phakathi, Bekezela. 2018. Terms of Eskom’s China Loan Private, Says Cyril Ramaphosa. Available online: https://www.businesslive.co.za/bd/national/2018-09-12-terms-of-eskoms-china-loan-private-says-cyril-ramaphosa/ (accessed on 16 August 2021).

- Pilling, David, and Kathrine Hille. 2021. China Cuts Finance Pledge to Africa Amid Growing Debt Concerns. Available online: https://www.ft.com/content/b7bd253a-766d-41b0-923e-9f6701176916 (accessed on 10 December 2021).

- Prentice, Alessandra, and Karin Strohecker. 2021. Database Reveals Secrets of China’s Loans to Developing Nations, Says Study. Available online: https://www.reuters.com/article/uk-china-emerging-debt-idUSKBN2BN14H (accessed on 10 December 2021).

- Preuss, Helmo. 2021. China Helps African Countries with Debt Relief. Available online: https://www.iol.co.za/the-star/opinion-analysis/china-helps-african-countries-with-debt-relief-9ca82ad5-bcd1-4a74-909a-6e88a99e1696 (accessed on 10 December 2021).

- Procopio, Maddalena. 2020. The International Politics Around Africa’s Debt. Available online: https://www.ispionline.it/it/pubblicazione/international-politics-around-africas-debt-27020 (accessed on 10 December 2021).

- Ranade, Prabha Shastri. 2009. Infrastructure Development and Its Environmental Impact: Study of Konkan Railway. Available online: https://books.google.co.za/books/about/Infrastructure_Development_and_Its_Envir.html?id=cGSKjaym3TcC&redir_esc=y (accessed on 17 November 2020).

- Rehman, Abdul. 2019. The nexus of electricity access, population growth, economic growth in Pakistan and projection through 2040: An ARDL to co-integration approach. International Journal of Energy Sector Management 13. [Google Scholar] [CrossRef]

- Rogovic, Mark, and David Robinson. 2018. Moody’s—Chinese lending to Sub Saharan Africa Can Support Growth, But Brings Risks. Available online: https://www.moodys.com/research/Moodys-Chinese-lending-to-Sub-Saharan-Africa-can-support-growth--PR_391736 (accessed on 17 November 2020).

- Rosen, Jonathan. 2018. ‘China Must Be Stopped’: Zambia Debates the Threat of Debt-Trap Diplomacy. Available online: https://www.worldpoliticsreview.com/insights/27027/china-must-be-stopped-zambia-debates-the-threat-of-debt-trap-diplomacy (accessed on 17 November 2020).

- Rostek-Buetti, Andreas. 2019. China’s Loan Policy under Scrutiny. Available online: https://www.dw.com/en/chinas-loan-policy-under-scrutiny/a-47118123 (accessed on 12 April 2020).

- Roy, Birmal, Satyaki Sarkar, Nikhil Ranjan Mandal, and Shashikant Pandey. 2014. Impact of infrastructure availabilitybon level of industrial development in Jharkhand, India: A district level analysis. International Journal of Technological Learning, Innovation and Development 7: 93–123. [Google Scholar] [CrossRef]

- Sachs, Jeffrey. 1989. Developing Country Debt and the World Economy. National Bureau of Economic Research. Chicago: The University of Chicago. [Google Scholar]

- Sahoo, Pravaka, and Dash Kumar. 2012. Economic growth in South Asia: Role of infrastructure. Journal of International Trade and Economic Development 21: 217–52. [Google Scholar] [CrossRef]

- Sahoo, Pravakar, Dash Kumar, and Nataraj Geethanjali. 2010. Infrastructure Development and Economic Growth in China. Institute of Development Economies, Discussion Paper Number 261. Available online: https://ideas.repec.org/p/jet/dpaper/dpaper261.html (accessed on 3 November 2020).

- Sakyl, Daniel, and John Egyir. 2017. Effects of Trade and FDI on Economic Growth in Africa: An Empirical Investigation. Available online: https://www.tandfonline.com/doi/abs/10.1080/19186444.2017.1326717 (accessed on 15 May 2020).

- Samargandi, Nahla, Jan Fidrmuc, and Sugata Ghosh. 2013. Is the Relationship between Financial Development and Economic Growth Monotonic for Middle Income Countries? Available online: https://www.brunel.ac.uk/economics-and-finance/research/pdf/1321.pdf (accessed on 10 May 2020).

- Sautman, Barry. 2019. The Truth about Sri Lanka’s Hambantota Port, Chinese ‘Debt Traps’ and ‘Asset Seizures’. Available online: https://www.scmp.com/comment/insight-opinion/article/3008799/truth-about-sri-lankas-hambantota-port-chinese-debt-traps (accessed on 10 May 2020).

- Savvides, Andreas. 1992. Investment Slowdown in Developing Countries During the 1980s: Debt Overhang or Foreign Capital Inflows. Kyklos Cilt 45: 363–78. [Google Scholar] [CrossRef]

- Shi, Yingying, Shen Guo, and Puyang Sun. 2017. The role of infrastructure in China’s regional economic growth. Journal of Asian Economics 49: 26–41. [Google Scholar] [CrossRef]

- Soule, Folashade. 2019. How African Governments Should Negotiate Better Infrastructure Deals with China. Available online: https://qz.com/africa/1515229/african-governments-should-do-better-china-infrastructure-deals/ (accessed on 12 July 2020).

- Stein, Peter, and Emil Uddhammar. 2021. China in Africa: The Role of Trade, Investments, and Loans Amidst Shifting Geopolitical Ambitions. Available online: https://www.orfonline.org/research/china-in-africa/ (accessed on 13 December 2021).

- Stones, Adrian, and Yigal Chazan. 2020. New “Debt Trap” Concerns over China Lending to Africa. Available online: https://www.geopoliticalmonitor.com/new-debt-trap-concerns-over-china-lending-to-africa/ (accessed on 10 December 2021).

- Strange, Austin, Bradley Parks, Michael Tierney, Andreas Fuchs, Axel Dreher, and Vijaya Ramachandran. 2013. China’s Development Finance to Africa: A Media-Based Approach to Data Collection. Available online: https://www.files.ethz.ch/isn/163944/chinese-development-finance-africa_0.pdf (accessed on 3 November 2020).

- Su, Xiaochen. 2017. Why Chinese Infrastructure Loans in Africa Represent a Brand-New Type of Neocolonialism. Available online: https://thediplomat.com/2017/06/why-chinese-infrastructural-loans-in-africa-represent-a-brand-new-type-of-neocolonialism/ (accessed on 12 November 2020).

- Subacchi, Paola. 2021. China’s Debt Grip on Africa. Available online: https://www.project-syndicate.org/commentary/covid19-africa-debt-relief-china-by-paola-subacchi-2021-01 (accessed on 22 November 2021).

- Sun, Yun. 2020. China and Africa’s Debt: Yes to Relief, No to Blanket Forgiveness. Available online: https://www.brookings.edu/blog/africa-in-focus/2020/04/20/china-and-africas-debt-yes-to-relief-no-to-blanket-forgiveness/ (accessed on 22 November 2021).

- Sulaiman, Chindio. 2020. The Impact of Wood Fuel Energy on Economic Growth in Sub-Saharan Africa: Dynamic Macro-Panel Approach. Sustainability 12: 3280. [Google Scholar] [CrossRef] [Green Version]

- UN. 2015. Financing Africa’s Infrastructure Development. Available online: https://www.un.org/en/africa/osaa/pdf/policybriefs/2015_financing_infrastructure.pdf (accessed on 20 May 2020).

- UN. 2021. Small Island Developing States Need Urgent Support to Avoid Debt Defaults. Available online: https://unctad.org/news/small-island-developing-states-need-urgent-support-avoid-debt-defaults (accessed on 26 January 2022).

- Usman, Zainab. 2021. What Do We Know About Chinese Lending in Africa? Available online: https://carnegieendowment.org/2021/06/02/what-do-we-know-about-chinese-lending-in-africa-pub-84648 (accessed on 13 December 2021).

- Wade, Shepard. 2019. What China Is Really Up To In Africa. Available online: https://www.forbes.com/sites/wadeshepard/2019/10/03/what-china-is-really-up-to-in-africa/ (accessed on 20 May 2020).

- Wale, Ajetunmobi. 2018. China Pledges $60 Billion to Africa, Says ‘No Strings Attached’. Available online: https://www.africanliberty.org/2018/09/04/china-pledges-60-billion-to-africa-says-no-strings-attached/ (accessed on 11 June 2020).

- Wang, Chao, Ming Lim, Xinyi Zhang, Longfeng Zhao, and Paul Lee. 2020. Railway and road infrastructure in the Belt and Road Initiative countries: Estimating the impact of transport infrastructure on economic growth. Transportation Research Part A: Policy and Practice 134: 288–307. [Google Scholar] [CrossRef]

- Wei, Song. 2021. Decline in China’s Lending to Africa Doesn’t Tell Full Picture of Cooperation. Available online: https://www.globaltimes.cn/page/202103/1219995.shtml (accessed on 22 November 2021).

- Were, Anzetse. 2018. Debt Trap? Chinese Loans and Africa’s Development Options. South African Institute of International Affairs, Policy Insight, No. 66. Available online: https://saiia.org.za/research/debt-trap-chinese-loans-and-africas-development-options/ (accessed on 11 June 2020).

- Wheatley, Jonathan, Joseph Cotterill, and Neil Munshi. 2020. African Debt to China: A Major Drain on the Poorest Countries. Available online: https://www.ft.com/content/bd73a115-1988-43aa-8b2b-40a449da1235 (accessed on 3 March 2021).

- White, Edward. 2021. Hidden Debt’ on China’s Belt and Road Tops $385bn, Says New Study. Available online: https://www.ft.com/content/297beae8-7243-4d93-9fac-09e515e82972 (accessed on 13 December 2021).

- Wijeweera, Albert, Brain Dollery, and Palitha Pathberiya. 2005. Economic Growth and External Debt Servicing: A Cointegration Analysis of Sri Lanka. Working Paper Series in Economics; Armidale: School of Economics, University of New England, pp. 1442–2980. [Google Scholar]

- Will, Rachel. 2012. China’s Stadium Diplomacy. World Policy Journal 29: 36–44. Available online: http://www.worldpolicy.org/journal/summer2012/chinas-stadium-diplomacy (accessed on 22 October 2020). [CrossRef]

- Withnall, Adam. 2018. African Leaders Leave Beijing Forum Hailing ‘New World Order’ as China Offers $60bn Investment. Available online: https://www.independent.co.uk/news/world/asia/China–Africa-bejing-forum-investment-interest-free-loans-a8522376.html (accessed on 13 July 2020).

- World Bank. 2018. Reinvigorating Growth in Resource Rich Sub-Sharan Countries. Available online: https://documents1.worldbank.org/curated/en/617451536237967588/pdf/5-9-2018-17-9-2-SSAGrowthforweb.pdf (accessed on 11 June 2020).

- World Bank. 2009. Building Bridges China’s Growing Role as Infrastructure Financier for Sub-Saharan Africa. Available online: http://documents1.worldbank.org/curated/en/936991468023953753/pdf/480910PUB0Buil101OFFICIAL0USE0ONLY1.pdf (accessed on 10 October 2020).

- Zahonogo, Pam. 2016. Trade and Economic Growth in Developing Countries: Evidence from Sub-Saharan Africa. Available online: https://www.sciencedirect.com/science/article/pii/S2214851517300014 (accessed on 11 June 2020).

- Zalle, Ooumarou. 2018. Natural Resources and Economic Growth in Africa: The Role of Institutional Quality and Human Capital. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0301420718304033 (accessed on 11 June 2020).

- Zimbabwe Coalition of Debt and Development. 2021. The Spectre of Resource Backed Loans_Final Paper—Zimcodd. Available online: http://zimcodd.org/wp-content/uploads/2021/02/The-Bane-of-Resource-Backed-Loans-Implications-for-Debt-Sustainability.pdf (accessed on 22 November 2021).

| President Nyusi of Mozambique said that it is those who keep lecturing on the debt issue, not China, that caused the debt problem in Africa. |

| President Guelleh of Djibouti said that those criticizing the BRI have neither plans nor actions. Our confidence in the (Belt and Road Initiative) and trust in China and Africa-China cooperation will not waiver because of the groundless accusations. |

| Liberia’s Economy Minister Augustus Flomo was quoted as saying: “China is a very, very important partner for our development strategy”. |

| Namibian President Hage Geingob warned the US: “It assumes (US) Africans are children still,” Geingob said of the oft-repeated concerns in the West over China’s influence on the African continent. “They are not matured; they cannot deal with the world powers; they will be ill-treated and fooled as small kids. That’s what it implies”. |

| Uganda President Yoweri Museveni this week strongly defended his government’s decision to take large Chinese loans, pushing back against his critics by claiming that his government really does not have any other choice but to turn to China. |

| Rwanda’s President, Kagame’s argued that Europe has neglected Africa, with investments that flow back to Europe but “leave nothing on the ground in Africa.” “Instead of helping Africa it further impoverished the continent,” Kagame said. |

| South Africa’s President, Ramaphosa claimed that some people displayed a brazen prejudice against China as a financial partner for development, adding that if a Western organisation offered the same loan it would not be viewed with such scepticism. |

| Kenya’s President Uhuru Kenyatta remarked in a pre-summit interview with CGTN that, “I believe it has huge potential for a win–win situation for all who are involved, and that is why we are very keen as a country, and I believe also as a continent, to partner strongly with China”. |

| Ghanaian President Nana Akufo-Addo said his country wants to duplicate China’s success story. The President further stated that he was “inspired by this model, and are trying to replicate same”. |

| Zimbabwe’s President, Emmerson Mnangagwa hit out at critics of China in an interview on state TV. The Zimbabwean President was quoted as saying; “There is now a transition to a new world order and those who don’t see it are blind”. |

| Djibouti’s Finance Minister Ilyas Dawaleh: “Djibouti’s development needs all its friends and strategic partners. At the same time, no one can dictate to us who we should deal with.” |

| Financing Source | Advantages | Disadvantage |

|---|---|---|

| China | Low interest Long maturity and grace period National sovereignty Policy autonomy | Lack of transparency Closed financial loop |

| IFIs (IMF and World Bank) and the rest of the world | Interest rates depends on the country rating Financing or support targets inclusive economic growth | Conditions, such as quantitative performance Conditions increasingly touch sensitive economic policies |

| International Market (Eurobonds) | Less restrictive and conditions Huge sums are available | High costs Short or medium term maturity |

| Variable | Description and Unit of Measurement | Source |

|---|---|---|

| RR | Total natural resources rents are the sum of oil rents, natural gas rents, coal rents (hard and soft), mineral rents, and forest rents. | World Bank |

| L | Chinese Loans to African Governments. These loans are offered mainly by Exim Bank of China, China Development Bank. These provide approximately 80% of the loans, and they are also controlled by the Chinese government. The rest is provided by other small state controlled banks and private banks. | China–Africa Research Initiative |

| IMP | Total imports of goods and services. | World Bank |

| GDP | This is the Annual percentage growth rate of GDP (in PPP standards) at market prices based on constant local currency. | World Bank |

| FDI | Foreign direct investment refers to direct investment equity flows in the reporting economy. | World Bank |

| AGR | Agriculture, forestry, and fishing, value added (% of GDP) | World Bank |

| Descriptive Stats. | L | GDP | FDI | RR | IMP | AGR |

|---|---|---|---|---|---|---|

| Mean | 713.9333 | 228.9263 | 6.02375 | 3.11239 | 35.85939 | 6.291874 |

| Median | 4235.5000 | 145.0000 | 1.59318 | 4.62888 | 31.02384 | 2.92456 |

| Maximum | 5933.000 | 1032.000 | 1.946273 | 11.119465 | 107.94636 | 5.39756 |

| Minimum | 50.000 | 26.4000 | 7.23950 | 2.395806 | 34.0298 | 379467 |

| Std. Dev. | 845.2909 | 339.8948 | 1.56734 | 3.90548 | 21.8570 | 8.12065 |

| Skewness | 3.89759 | 1.51295 | 1.830486 | 2.798452 | 0.772397 | 2.27295 |

| Kurtosis | 26.1254 | 3.69322 | 17.02645 | 11.223859 | 3.56749 | 10.28539 |

| Jarque–Bera | 4466.640 | 68.66179 | 45.90455 | 43.6965 | 43.6392 | 117.9344 |

| Probability | 0.00432 | 0.00000 | 0.00000 | 0.00000 | 0.00000 | 0.0000 |

| Sum | 74.148 | 39146 | 2.3.1930 | 8.10346 | 345.46 | 2.41532 |

| Observations | 270 | 270 | 270 | 270 | 270 | 270 |

| Variable | LM, Pesaran and Shin Test | |

|---|---|---|

| Level | 1st Diff | |

| L | −2.26718 | 5.2372 |

| RR | −1.3956 | 7.3531 |

| IMP | 3.9382 * | - |

| FDI | 1.2190 | 5.5126 |

| AGR | 4.2391 * | - |

| GDP | 1.35128 | 4.2901 |

| Test Statistics | Statistic | Prob. | Statistic | Prob |

|---|---|---|---|---|

| Panel v-statistic | 0.82398 | 0.8672 | −2.75298 | 0.0000 |

| Panel rho-statistic | −2.8516 | 0.0000 | −2.91102 | 0.0000 |

| Panel PP-statistic | 3.45762 | 0.0000 | −2.13921 | 0.0298 |

| Panel ADF-statistic | −0.981751 | 0.6349 | −2.27201 | 0.0348 |

| Group Panel rho-statistic | 2.93416 | 0.0198 | - | - |

| Group PP-statistic | −3.86283 | 0.0212 | - | - |

| Group ADF-statistic | −3.22713 | 0.0000 | - | - |

| Hypothesised No of CEs | Fisher Statistic (from Trace Test) | Prob. | Fisher Statistic (from Max-Eigen Test) | Prob. |

|---|---|---|---|---|

| None | 0.000 | 1.0000 | 0.000 | 1.000 |

| At most 1 | 197.4 | 0.0000 | 153.9 | 0.0241 |

| At most 2 | 43.2 | 0.2741 | 18.3 | 0.7321 |

| Chi-Square | p-Value |

|---|---|

| 7.92 | 0.913 |

| PMG | MG | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob | Variable | Coefficient | t-Statistic | Prob |

| L | 2.140 | 2.2450 | 0.0263 | L | 2.333 | 2.4466 | 0.0155 |

| RR | −0.007 | −3.5756 | 0.0005 | RR | −0.0067 | −3.3521 | 0.0010 |

| LIMP | 2.344 | 7.2824 | 0.000 | IMP | 2.500 | 7.9096 | 0.0000 |

| LFDI | 0.0055 | 1.7351 | 0.0848 | FDI | 0.0047 | 1.5080 | 0.1336 |

| LAGR | −0.0047 | −1.2464 | 0.2146 | AGR | −0.0045 | −1.2069 | 0.2293 |

| PMG | MG | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob | Variable | Coefficient | t-Statistic | Prob |

| L | 0.3480 | 1.1059 | 0.2727 | L | 0.3206 | 1.1710 | 0.2458 |

| RR | 1.4216 | 1.1158 | 0.2684 | RR | 0.6569 | 1.5765 | 0.1196 |

| LIMP | 0.0363 | 4.7490 | 0.000 | IMP | 0.4424 | 20.5909 | 0.000 |

| LFDI | 2.0936 | 2.7305 | 0.0080 | FDI | 0.5773 | 12.959 | 0.0000 |

| LAGR | 0.4385 | 23.7795 | 0.0000 | AGR | 1.0368 | 0.8077 | 0.4221 |

| ECT | −0.3063 | −7.1117 | 0.0000 | ECT | −0.2058 | −7.1404 | 0.0000 |

| FMOLS | DOLS | ||||||

|---|---|---|---|---|---|---|---|

| Variable | Coefficient | t-Statistic | Prob | Variable | Coefficient | t-Statistic | Prob |

| L | 2.749 | 4.557 | 0.0000 | L | 0.870 | 4.3491 | 0.0000 |

| RR | 0.0078 | 0.0312 | 0.9751 | RR | 0.0566 | 0.5945 | 0.55534 |

| LIMP | 1.0783 | 6.2431 | 0.000 | IMP | 0.2605 | 2.2792 | 0.0245 |

| LFDI | 0.4542 | 1.9226 | 0.0570 | FDI | 0.0289 | −0.5820 | 0.5616 |

| LAGR | −0.6550 | −3.9428 | 0.0000 | AGR | 0.1242 | 5.1908 | 0.0000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mlambo, C. China in Africa: An Examination of the Impact of China’s Loans on Growth in Selected African States. Economies 2022, 10, 154. https://doi.org/10.3390/economies10070154

Mlambo C. China in Africa: An Examination of the Impact of China’s Loans on Growth in Selected African States. Economies. 2022; 10(7):154. https://doi.org/10.3390/economies10070154

Chicago/Turabian StyleMlambo, Courage. 2022. "China in Africa: An Examination of the Impact of China’s Loans on Growth in Selected African States" Economies 10, no. 7: 154. https://doi.org/10.3390/economies10070154

APA StyleMlambo, C. (2022). China in Africa: An Examination of the Impact of China’s Loans on Growth in Selected African States. Economies, 10(7), 154. https://doi.org/10.3390/economies10070154