Sources of Financial Development and Their Impact on FDI Inflow: A Panel Data Analysis of Middle-Income Economies

Abstract

1. Introduction

- To investigate the role of financial institutions’ development in determining the FDI inflow for the panel of middle-income economies.

- To explore the impact of the financial market’s development on FDI inflow for the panel of middle-income economies.

- To examine the impact of overall financial development on FDI inflow for the panel of middle-income economies.

- To evaluate the role of other macroeconomic and control variables, such as inflation rate, trade openness, and economic growth, in determining the FDI inflow for the panel of the target population.

- (i)

- What is the role of financial institutions’ development in determining the FDI inflow for the panel of middle-income economies?

- (ii)

- How does the financial market’s development impact the FDI inflow for the panel of middle-income economies?

- (iii)

- How does the overall financial development impact the FDI inflow for the panel of middle-income economies?

- (iv)

- How do other macroeconomic and control variables such as inflation rate, trade openness, and economic growth determine the FDI inflow for the panel of middle-income economies?

2. Methodology

3. Results

4. Discussion

5. Conclusions, Recommendations, and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abdouli, Mohamed, and Sami Hammami. 2020. Economic Growth, Environment, FDI Inflows, and Financial Development in Middle East Countries: Fresh Evidence from Simultaneous Equation Models. Journal of the Knowledge Economy 11: 479–511. [Google Scholar] [CrossRef]

- Abdullahi, Muhammad Mustapha, and Kabiru Ibrahim Maji. 2019. Renewable Energy, Regulation, Employment and Environmental Sustainability in Sub-Saharan Africa. Renewable Energy 9. [Google Scholar] [CrossRef]

- Acquah, Abraham Mensah, and Muazu Ibrahim. 2020. Foreign direct investment, economic growth and financial sector development in Africa. Journal of Sustainable Finance & Investment 10: 315–34. [Google Scholar] [CrossRef]

- Aghion, Philippe, Philippe Bacchetta, Romain Rancière, and Kenneth Rogoff. 2009. Exchange rate volatility and productivity growth: The role of financial development. Journal of Monetary Economics 56: 494–513. [Google Scholar] [CrossRef]

- Ahmed, Khalid, and Agha Jahanzeb. 2021. Does financial development spur environmental and energy-related innovation in Brazil? International Journal of Finance & Economics 26: 1706–23. [Google Scholar] [CrossRef]

- Akar, Basak Gul. 2016. The determinants of renewable energy consumption: An empirical analysis for the Balkans. European Scientific Journal 12: 594–607. [Google Scholar] [CrossRef]

- Akarsu, Gülsüm, and Nebile Korucu Gümüşoğlu. 2017. What Are the Main Determinants of Renewable Energy Consumption? A Panel Threshold Regression Approach. Anadolu Üniversitesi Sosyal Bilimler Dergisi 19: 1–22. [Google Scholar] [CrossRef]

- Alola, Andrew Adewale, Uju Violet Alola, and Seyi Saint Akadiri. 2019. Renewable energy consumption in Coastline Mediterranean Countries: Impact of environmental degradation and housing policy. Environmental Science and Pollution Research 26: 25789–801. [Google Scholar] [CrossRef] [PubMed]

- Ang, James B. 2009. Financial development and the FDI-growth nexus: The Malaysian experience. Applied Economics 41: 1595–601. [Google Scholar] [CrossRef]

- Arif, Ankasha, Misbah Sadiq, Malik Shahzad Shabbir, Ghulam Yahya, Aysha Zamir, and Lydia Bares Lopez. 2020. The role of globalization in financial development, trade openness and sustainable environmental -economic growth: Evidence from selected South Asian economies. Journal of Sustainable Finance & Investment, 1–18. [Google Scholar] [CrossRef]

- Asamoah, Lawrence Adu, Emmanuel Kwasi Mensah, and Eric Amoo Bondzie. 2019. Trade openness, FDI and economic growth in sub-Saharan Africa: Do institutions matter? Transnational Corporations Review 11: 65–79. [Google Scholar] [CrossRef]

- Asamoah, Michael Effah, Imhotep Paul Alagidede, and Frank Adu. 2022. Exchange rate uncertainty and foreign direct investment in Africa: Does financial development matter? Review of Development Economics 26: 878–98. [Google Scholar] [CrossRef]

- Asongu, Simplice A. 2014. Linkages between investment flows and financial development. African Journal of Economic and Management Studies 5: 269–99. [Google Scholar] [CrossRef]

- Asongu, Simplice, Uduak S. Akpan, and Salisu R. Isihak. 2018. Determinants of foreign direct investment in fast-growing economies: Evidence from the BRICS and MINT countries. Financial Innovation 4: 26. [Google Scholar] [CrossRef]

- Azad, A. K., M. G. Rasul, Mohammad Masud Kamal Khan, Anis Omri, M. M. K. Bhuiya, and M. A. Hazrat. 2014. Modelling of renewable energy economy in Australia. Energy Procedia 61: 1902–6. [Google Scholar] [CrossRef][Green Version]

- Azam, Muhammad, and Muhammad Haseeb. 2021. Determinants of foreign direct investment in BRICS- does renewable and non-renewable energy matter? Energy Strategy Reviews 35: 100638. [Google Scholar] [CrossRef]

- Aziz, Omar G., and Anil V. Mishra. 2016. Determinants of FDI inflows to Arab economies. The Journal of International Trade & Economic Development 25: 325–56. [Google Scholar] [CrossRef]

- Bayar, Yilmaz, and Marius D. Gavriletea. 2018a. Foreign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and Causality. International Journal of Financial Studies 6: 55. [Google Scholar] [CrossRef]

- Bayar, Yilmaz, and Marius Dan Gavriletea. 2018b. Peace, terrorism and economic growth in Middle East and North African countries. Quality & Quantity 52: 2373–92. [Google Scholar] [CrossRef]

- Behrman, Jack N. 1972. The role of international companies in Latin American integration. The International Executive 14: 18–20. [Google Scholar] [CrossRef]

- Belaid, Fateh, Ahmed H Elsayed, and Fateh Belaid. 2019. What Drives Renewable Energy Production in MENA Region? Investigating the Roles of Political Stability, Governance and Financial Sector. Giza: Economic Research Forum (ERF). [Google Scholar]

- Boateng, Elliot, Mary Amponsah, and Collins Annor Baah. 2017. Complementarity effect of financial development and FDI on investment in Sub-Saharan Africa: A panel data analysis. African Development Review 29: 305–18. [Google Scholar] [CrossRef]

- Caglayan, Mustafa, Omar S. Dahi, and Firat Demir. 2013. Trade Flows, Exchange Rate Uncertainty, and Financial Depth: Evidence from 28 Emerging Countries. Southern Economic Journal 79: 905–27. [Google Scholar] [CrossRef]

- Camarero, Mariam, Laura Montolio, and Cecilio Tamarit. 2020. Determinants of FDI for Spanish regions: Evidence using stock data. Empirical Economics 59: 2779–820. [Google Scholar] [CrossRef]

- Canh, Nguyen Phuc, Nguyen Thanh Binh, Su Dinh Thanh, and Christophe Schinckus. 2020. Determinants of foreign direct investment inflows: The role of economic policy uncertainty. International Economics 161: 159–72. [Google Scholar] [CrossRef]

- Chen, Hao, Duncan O. Hongo, Max William Ssali, Maurice Simiyu Nyaranga, and Consolata Wairimu Nderitu. 2020. The Asymmetric Influence of Financial Development on Economic Growth in Kenya: Evidence From NARDL. SAGE Open 10: 2158244019894071. [Google Scholar] [CrossRef]

- Chen, Yulong. 2018. Factors influencing renewable energy consumption in China: An empirical analysis based on provincial panel data. Journal of Cleaner Production 174: 605–15. [Google Scholar] [CrossRef]

- Choong, Chee-Keong. 2012. Does domestic financial development enhance the linkages between foreign direct investment and economic growth? Empirical Economics 42: 819–34. [Google Scholar] [CrossRef]

- Collison, Phoebe, Louis Brennan, and Ruth Rios-Morales. 2017. Attracting Chinese foreign direct investment to small, developed economies: The case of Ireland. Thunderbird International Business Review 59: 401–19. [Google Scholar] [CrossRef]

- da Silva, Patrícia Pereira, Pedro André Cerqueira, and Wojolomi Ogbe. 2018. Determinants of renewable energy growth in Sub-Saharan Africa: Evidence from panel ARDL. Energy 156: 45–54. [Google Scholar] [CrossRef]

- Dal Bianco, Silvia, and Nguyen C. Loan. 2017. FDI Inflows, Price and Exchange Rate Volatility: New Empirical Evidence from Latin America. International Journal of Financial Studies 5. [Google Scholar] [CrossRef]

- Damette, Olivier, and Antonio C Marques. 2019. Renewable energy drivers: A panel cointegration approach. Applied Economics 51: 2793–806. [Google Scholar] [CrossRef]

- De Hoyos, Rafael E., and Vasilis Sarafidis. 2006. Testing for Cross-Sectional Dependence in Panel-Data Models. The Stata Journal 6: 482–96. [Google Scholar] [CrossRef]

- Desbordes, Rodolphe, and Shang-Jin Wei. 2017. The effects of financial development on foreign direct investment. Journal of Development Economics 127: 153–68. [Google Scholar] [CrossRef]

- Dimitrova, Anna, Tim Rogmans, and Dora Triki. 2020. Country-specific determinants of FDI inflows to the MENA region. Multinational Business Review 28: 1–38. [Google Scholar] [CrossRef]

- Eren, Baris Memduh, Nigar Taspinar, and Korhan K Gokmenoglu. 2019. The impact of financial development and economic growth on renewable energy consumption: Empirical analysis of India. Science of the Total Environment 663: 189–97. [Google Scholar] [CrossRef]

- Ergun, Selim Jürgen, Phebe Asantewaa Owusu, and Maria Fernanda Rivas. 2019. Determinants of renewable energy consumption in Africa. Environmental Science and Pollution Research 26: 15390–405. [Google Scholar] [CrossRef]

- Ersoy, İmre. 2011. The Impact of Financial Openness on Financial Development, Growth and Volatility in Turkey: Evidence From the ARDL Bounds Tests. Economic Research-Ekonomska Istraživanja 24: 33–44. [Google Scholar] [CrossRef]

- Fauzel, Sheereen. 2016. Modeling the relationship between FDI and financial development in small island economies: A PVAR approach. Theoretical Economics Letters 6: 367–75. [Google Scholar] [CrossRef]

- Gao, Runda, Glauco De Vita, Yun Luo, and Jason Begley. 2021. Determinants of FDI in producer services: Evidence from Chinese aggregate and sub-sectoral data. Journal of Economic Studies 48: 869–92. [Google Scholar] [CrossRef]

- Gitone, ISAAC. 2014. Determinants of Adoption of Renewable Energy in Kenya. Unpublished Research Project. Nairobi: University of Nairobi. [Google Scholar]

- Gopalan, Sasidaran, Ramkishen S. Rajan, and Luu Nguyen Trieu Duong. 2019. Roads to Prosperity? Determinants of FDI in China and ASEAN. The Chinese Economy 52: 318–41. [Google Scholar] [CrossRef]

- Henri, Njangang, Nembot Ndeffo Luc, and Nawo Larissa. 2019. The long-run and short-run effects of foreign direct investment on financial development in African countries. African Development Review 31: 216–29. [Google Scholar] [CrossRef]

- Hoang, Hong Hiep, Cong Minh Huynh, Nguyen Minh Huy Duong, and Ngoc Hoe Chau. 2021. Determinants of foreign direct investment in Southern Central Coast of Vietnam: A spatial econometric analysis. Economic Change and Restructuring 55: 285–310. [Google Scholar] [CrossRef]

- Islam, Mollah A., Muhammad A. Khan, József Popp, Wlodzimierz Sroka, and Judit Oláh. 2020. Financial Development and Foreign Direct Investment—The Moderating Role of Quality Institutions. Sustainability 12: 3556. [Google Scholar] [CrossRef]

- Khan, Hameed, and Umair Khan. 2019. Financial Development and FDI Inflows in China. Economics Discussion Papers, No 2019–54. Kiel: Kiel Institute for the World Econom, pp. 1–26. [Google Scholar]

- Khan, Muhammad Waris Ali, Shrikant Krupasindhu Panigrahi, Khamis Said Nasser Almuniri, Mujeeb Iqbal Soomro, Nayyar Hussain Mirjat, and Eisa Salim Alqaydi. 2019. Investigating the Dynamic Impact of CO2 Emissions and Economic Growth on Renewable Energy Production: Evidence from FMOLS and DOLS Tests. Processes 7: 496. [Google Scholar] [CrossRef]

- Kumari, Reenu, and Anil Kumar Sharma. 2017. Determinants of foreign direct investment in developing countries: A panel data study. International Journal of Emerging Markets 12: 658–82. [Google Scholar] [CrossRef]

- Kurtović, Safet, Nehat Maxhuni, Blerim Halili, and Sead Talović. 2020. The determinants of FDI location choice in the Western Balkan countries. Post-Communist Economies 32: 1089–110. [Google Scholar] [CrossRef]

- Lee, Chien-Chiang, Chi-Chuan Lee, and Chih-Yang Cheng. 2020. The impact of FDI on income inequality: Evidence from the perspective of financial development. International Journal of Finance & Economics 27: 137–57. [Google Scholar] [CrossRef]

- Lin, Shu, and Haichun Ye. 2011. The role of financial development in exchange rate regime choices. Journal of International Money and Finance 30: 641–59. [Google Scholar] [CrossRef]

- Malarvizhi, Chinnasamy Agamudai Nambhi, Yashar Zeynali, Abdullah Al Mamun, and Ghazali Bin Ahmad. 2018. Financial Development and Economic Growth in ASEAN-5 Countries. Global Business Review 20: 57–71. [Google Scholar] [CrossRef]

- Marques, António C., José A. Fuinhas, and José P. Manso. 2011. A quantile approach to identify factors promoting renewable energy in European countries. Environmental and Resource Economics 49: 351–66. [Google Scholar] [CrossRef]

- Maryam, Javeria, and Ashok Mittal. 2020. Foreign direct investment into BRICS: An empirical analysis. Transnational Corporations Review 12: 1–9. [Google Scholar] [CrossRef]

- Mehrara, Mohsen, Sadeq Rezaei, and Davoud Hamidi Razi. 2015. Determinants of renewable energy consumption among eco countries; based on Bayesian model averaging and weighted-average least square. International Letters of Social and Humanistic Sciences 54: 96–109. [Google Scholar] [CrossRef]

- Mengova, Evelina. 2019. What Determines Energy Production from Renewable Sources? Journal of Strategic Innovation and Sustainability 14: 83–100. [Google Scholar]

- Meyer, John W., and Brian Rowan. 1977. Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology 83: 340–363. [Google Scholar] [CrossRef]

- Mijiyawa, Abdoul’Ganiou. 2015. What drives foreign direct investment in Africa? An empirical investigation with panel data. African Development Review 27: 392–402. [Google Scholar] [CrossRef]

- Nasir, Muhammad Ali, Toan Luu Duc Huynh, and Huong Thi Xuan Tram. 2019. Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. Journal of Environmental Management 242: 131–41. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, Anh T. N., and Andrzej Cieślik. 2021. Determinants of foreign direct investment from Europe to Asia. The World Economy 44: 1842–58. [Google Scholar] [CrossRef]

- Nguyen, Canh Phuc, and Gabriel S. Lee. 2021. Uncertainty, financial development, and FDI inflows: Global evidence. Economic Modelling 99: 105473. [Google Scholar] [CrossRef]

- Nkoa, Bruno Emmanuel Ongo. 2018. Determinants of foreign direct investment in Africa: An analysis of the impact of financial development. Economics Bulletin 38: 221–33. [Google Scholar]

- Olorogun, Lukman A. 2021. The nexus between FDI inflows and economic development in Ghana: Empirical analysis from ARDL model. Journal for Global Business Advancement 14: 93–114. [Google Scholar] [CrossRef]

- Omri, Anis, and Duc Khuong Nguyen. 2014. On the determinants of renewable energy consumption: International evidence. Energy 72: 554–60. [Google Scholar] [CrossRef]

- Omri, Anis, Saida Daly, and Duc Khuong Nguyen. 2015. A robust analysis of the relationship between renewable energy consumption and its main drivers. Applied Economics 47: 2913–23. [Google Scholar] [CrossRef]

- Osei, Michael J., and Jaebeom Kim. 2020. Foreign direct investment and economic growth: Is more financial development better? Economic Modelling 93: 154–61. [Google Scholar] [CrossRef]

- Özmen, Erdal. 2007. Financial development, exchange rate regimes and the Feldstein–Horioka puzzle: Evidence from the MENA region. Applied Economics 39: 1133–38. [Google Scholar] [CrossRef]

- Papież, Monika, Sławomir Śmiech, and Katarzyna Frodyma. 2018. Determinants of renewable energy development in the EU countries. A 20-year perspective. Renewable and Sustainable Energy Reviews 91: 918–34. [Google Scholar] [CrossRef]

- Paul, Justin, and Pravin Jadhav. 2020. Institutional determinants of foreign direct investment inflows: Evidence from emerging markets. International Journal of Emerging Markets 15: 245–61. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2021. General diagnostic tests for cross-sectional dependence in panels. Empirical Economics 60: 13–50. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem, Yongcheol Shin, and Ron P. Smith. 1999. Pooled Mean Group Estimation of Dynamic Heterogeneous Panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Pradhan, Rudra P., Mak B. Arvin, John H. Hall, and Sara E. Bennett. 2018. Mobile telephony, economic growth, financial development, foreign direct investment, and imports of ICT goods: The case of the G-20 countries. Economia e Politica Industriale 45: 279–310. [Google Scholar] [CrossRef]

- Rafidi, Zac, and George Verikios. 2021. The Determinants of Foreign Direct Investment: A Review and Re-Analysis of Evidence from Australia. Australian Economic Review 55: 71–90. [Google Scholar] [CrossRef]

- Rjoub, Husam, Mehmet Aga, Ahmad Abu Alrub, and Murad Bein. 2017. Financial Reforms and Determinants of FDI: Evidence from Landlocked Countries in Sub-Saharan Africa. Economies 5: 1–12. [Google Scholar] [CrossRef]

- Sahin, Serkan, and Ilhan Ege. 2015. Financial Development and FDI in Greece and Neighbouring Countries: A Panel Data Analysis. Procedia Economics and Finance 24: 583–88. [Google Scholar] [CrossRef]

- Saini, Neha, and Monica Singhania. 2018. Determinants of FDI in developed and developing countries: A quantitative analysis using GMM. Journal of Economic Studies 45: 348–82. [Google Scholar] [CrossRef]

- Sarafidis, Vasilis, and Tom Wansbeek. 2012. Cross-Sectional Dependence in Panel Data Analysis. Econometric Reviews 31: 483–531. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Miroslav Mateev, Salah Abosedra, Muhammad Ali Nasir, and Zhilun Jiao. 2021. Determinants of FDI in France: Role of transport infrastructure, education, financial development and energy consumption. International Journal of Finance & Economics 26: 1351–74. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Thi Hong Van Hoang, Mantu Kumar Mahalik, and David Roubaud. 2017. Energy consumption, financial development and economic growth in India: New evidence from a nonlinear and asymmetric analysis. Energy Economics 63: 199–212. [Google Scholar] [CrossRef]

- Siddikee, Md Noman, and Mohammad Mafizur Rahman. 2020. Foreign Direct Investment, Financial Development, and Economic Growth Nexus in Bangladesh. The American Economist 66: 265–80. [Google Scholar] [CrossRef]

- Sirag, Abdalla, Samira SidAhmed, and Hamisu Sadi Ali. 2018. Financial development, FDI and economic growth: Evidence from Sudan. International Journal of Social Economics 45: 1236–49. [Google Scholar] [CrossRef]

- Smith, Francois. 2021. Uncertainty, Financial Development and FDI Inflows: France Evidence. Asian Business Research Journal 6: 7–13. [Google Scholar] [CrossRef]

- Taşdemir, Fatma. 2020. Endogenous thresholds for the determinants of FDI inflows: Evidence from the MENA countries. International Journal of Emerging Markets 17: 683–704. [Google Scholar] [CrossRef]

- Taylor, John B. 2000. Low inflation, pass-through, and the pricing power of firms. European Economic Review 44: 1389–408. [Google Scholar] [CrossRef]

- Vasyechko, Olga. 2012. A review of FDI theories: An application for transition economies. International Research Journal of Finance and Economics 89: 118–137. [Google Scholar]

- Yahya, Farzan, and Muhammad Rafiq. 2019. Unraveling the contemporary drivers of renewable energy consumption: Evidence from regime types. Environmental Progress & Sustainable Energy 38. [Google Scholar] [CrossRef]

- Yimer, Addis. 2017. Macroeconomic, Political, and Institutional Determinants of FDI Inflows to Ethiopia: An ARDL Approach. In Studies on Economic Development and Growth in Selected African Countries. Edited by Almas Heshmati. Singapore: Springer Singapore, pp. 123–51. [Google Scholar]

- Yusuf, Hammed Agboola, Waliu Olawale Shittu, Saad Babatunde Akanbi, Habiba MohammedBello Umar, and Idris Abdulganiyu Abdulrahman. 2020. The role of foreign direct investment, financial development, democracy and political (in)stability on economic growth in West Africa. International Trade, Politics and Development 4: 27–46. [Google Scholar] [CrossRef]

- Yuxiang, Karl, and Zhongchang Chen. 2011. Resource abundance and financial development: Evidence from China. Resources Policy 36: 72–79. [Google Scholar] [CrossRef]

- Zeytoonnejad Mousavian, Seyed Reza, Seyyed Mehdi Mirdamadi, Seyed Jamal Farajallah Hosseini, and Maryam Omidi NajafAbadi. 2021. Determinants of foreign direct investment inflow to the agricultural sector: A panel-data analysis. Journal of Economic and Administrative Sciences. ahead-of-print. [Google Scholar] [CrossRef]

- Zhao, Hongxin. 2003. Country factor differentials as determinants of FDI flow to China. Thunderbird International Business Review 45: 149–69. [Google Scholar] [CrossRef]

| Sr # | Authors | Variables | Population | Period | Estimation Methods | Main Findings |

|---|---|---|---|---|---|---|

| 1 | Kumari and Sharma (2017) | Determinants of FDI | 20 countries | 1990–2012 | Static panel | Trade openness (positive and significant). |

| 2 | Rjoub et al. (2017) | Financial reforms and FDI determinants | Sub-Saharan countries | 1995–2013 | Static panel | Trade openness and GDP (positive and significant). |

| 3 | Yimer (2017) | Political, macroeconomic, and institutional factors of FDI | Ethiopia | 1970–2013 | ARDL | Trade openness (positive and significant). |

| 4 | Pradhan et al. (2018) | Financial development, FDI, and control variables | G-20 | 1990–2014 | Static ARDL | Financial development, economic growth (positive and significant). |

| 5 | Saini and Singhania (2018) | FDI determinants | 20 countries (developed and developing) | 2004–2013 | GMM | Trade openness and economic growth (positive and significant). |

| 6 | Sirag et al. (2018) | FDI, financial development, and economic growth | Sudan | 1970–2014 | OLS and DOLS | Financial development, economic growth (positive and significant). |

| 7 | Nasir et al. (2019) | FDI, financial development, economic growth, and climate | ASEAN region | 1982–2014 | Ols, DOLS, and FMOLS | Financial development (positive and significant). |

| 8 | Canh et al. (2020) | Uncertainty and FDI | 21 economies | 2003–2013 | 2 SLS panel estimation | Economic policy uncertainty (negative and significant). |

| 9 | Kurtović et al. (2020) | FDI determinants | Postcommunist economies | 2007–2017 | GMM | Economic growth (positive and significant). |

| 10 | Abdouli and Hammami (2020) | FDI, financial development, economic growth, and environment | Middle-East countries | 1980–2014 | Simultaneous equation models | Economic growth, financial development, and institutional quality (positive and significant). |

| 11 | Taşdemir (2020) | FDI determinants | MENA region | 1995–2017 | Static panel | Financial depth, and trade openness (positive and significant). |

| 12 | Shahbaz et al. (2021) | FDI determinants, financial development, transport infrastructure, education, and consumption | France | 1965–2017 | ARDL | Financial development (negative and significant). |

| 13 | Smith (2021) | FDI inflow, financial development, and uncertainty | France | 2014–2020 | ARDL | Financial development (positive and significant), and uncertainty, inflation (negative and significant). |

| 14 | Nguyen and Lee (2021) | FDI inflow, financial development, and uncertainty | Global | 1996–2017 | GMM | Financial development (positive and significant), and uncertainty and inflation (negative and significant). |

| 15 | Asamoah et al. (2022) | FDI, uncertainty, and financial development | 40 African countries | 1990–2018 | GMM | Financial development, exchange rate, and trade openness (positive, sig), uncertainty (negative, sig). |

| Type | Symbol | Variable Title | Measurements and (Data Source) | Data Availability | References |

|---|---|---|---|---|---|

| Outcome | FDII | Foreign direct investment | FDI net inflow as a percentage of GDP (WDI) | 1970–2020 | (Nguyen and Lee 2021) |

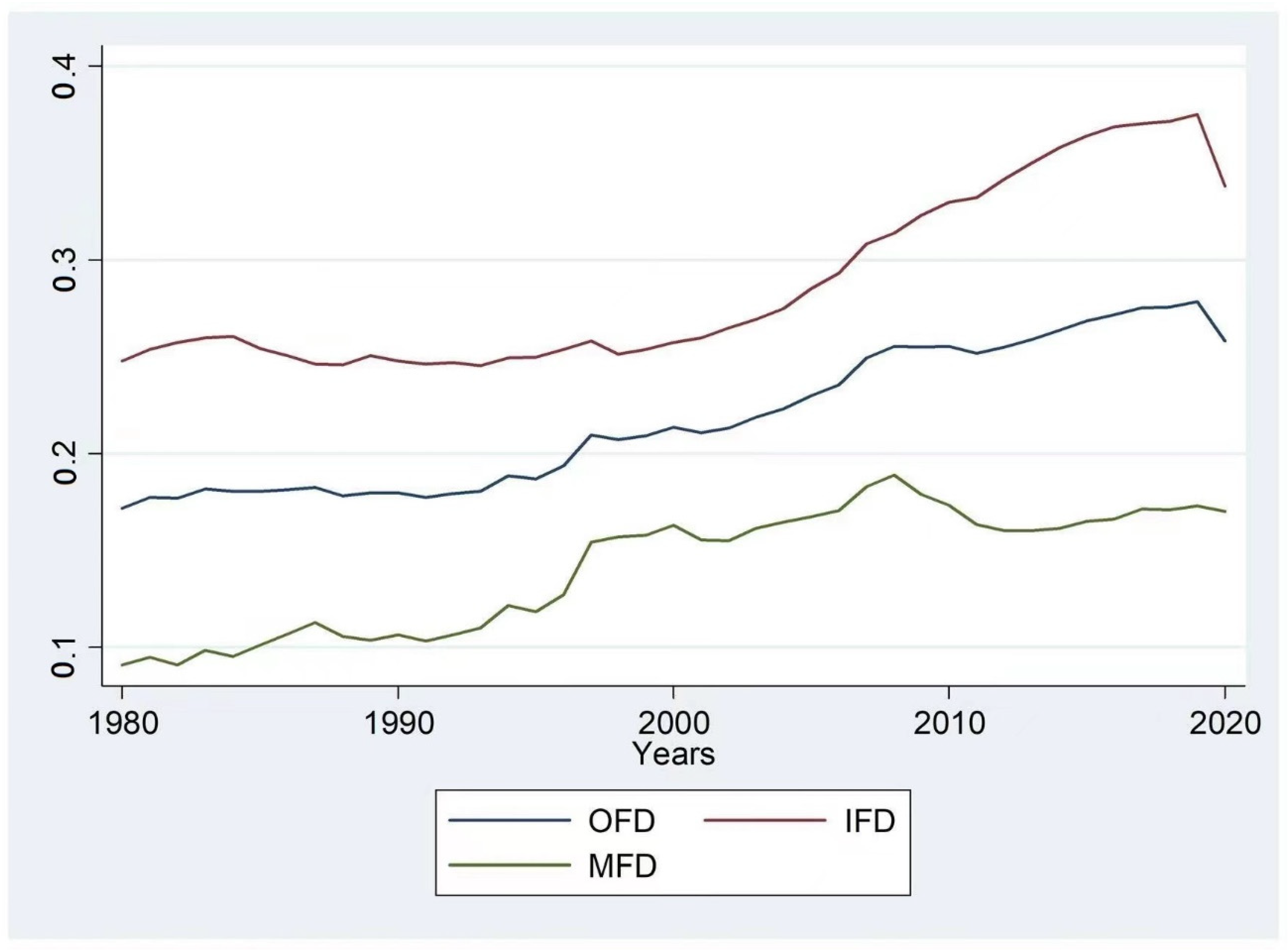

| Input | FIND OFD FID MFD | Financial development

| Overall financial development index (FD-IMF) Financial institution index (FD-IMF) Financial market index (FD-IMF) | 1980–2020 | (Rjoub et al. 2017; Shahbaz et al. 2017; Bayar and Gavriletea 2018a; Malarvizhi et al. 2018; Nguyen and Lee 2021). |

| Control | INFR | Inflation rate | Inflation with GDP deflator as an annual percentage (WDI) | 1960–2020 | (Azam and Haseeb 2021; Nguyen and Lee 2021). |

| TOP | Trade openness | Trade as a percentage of GDP (WDI) | 1960–2020 | (Azam and Haseeb 2021; Nguyen and Lee 2021). | |

| RGR | Economic growth | The growth rate of real GDP at an annual percentage (WDI) | 1960–2020 | (Azam and Haseeb 2021; Nguyen and Lee 2021) |

| Mean | Std | Kurtosis | Skewness | Min | Max | N | |

|---|---|---|---|---|---|---|---|

| FDI inflow | 2.04 | 0.53 | 2.41 | 0.60 | −9.77 | 15.59 | 2173 |

| OFD | 0.22 | 0.14 | 1.12 | 1.25 | 0.03 | 0.74 | 2173 |

| IFD | 0.29 | 0.13 | 1.18 | 1.12 | 0.04 | 0.76 | 2173 |

| MFD | 0.14 | 0.17 | 0.71 | 1.26 | 0.00 | 0.74 | 2173 |

| INFR | 14.16 | 3.23 | 4.27 | 1.20 | −3.20 | 96.15 | 2173 |

| TOP | 66.72 | 40.07 | 1.26 | 0.86 | 0.00 | 274.97 | 2173 |

| RGR | 3.11 | 4.19 | 6.16 | −0.22 | −26.34 | 34.86 | 2173 |

| FDII | OFD | FID | FMD | INFR | TOP | RGR | |

|---|---|---|---|---|---|---|---|

| FDII | 1 | ||||||

| OFD | 0.0697 | 1 | |||||

| 0.0012 | |||||||

| IFD | 0.0982 | 0.8606 | 1 | ||||

| 0.0000 | 0.0000 | ||||||

| MFD | 0.0051 | 0.8025 | 0.4866 | 1 | |||

| 0.8132 | 0.000 | 0.000 | |||||

| INF | −0.2037 | −0.0992 | −0.1573 | −0.0221 | 1 | ||

| 0.0000 | 0.0000 | 0.0000 | 0.3023 | ||||

| TOP | 0.3072 | 0.0372 | 0.0935 | 0.0474 | −0.2698 | 1 | |

| 0.0000 | 0.0828 | 0.0000 | 0.0273 | 0.0000 | |||

| RGR | 0.0435 | 0.0172 | 0.0156 | 0.0151 | 0.0182 | −0.0098 | 1 |

| 0.0424 | 0.4225 | 0.4677 | 0.4824 | 0.3968 | 0.6479 |

| Test | Test Statistics | p-Value | Decision |

|---|---|---|---|

| Pesaran | 24.84 | 0.000 | No cross-sectional dependence |

| Frees | 4.076 | 0.000 | No cross-sectional dependence |

| Friedman | 244.943 | 0.000 | No cross-sectional dependence |

| Variables | At Levels | At First Difference | ||||

|---|---|---|---|---|---|---|

| Levin–Lin–Chu | Im–Pesaran–Shin | Breitung | Levin–Lin–Chu | Im–Pesaran-Shin | Breitung | |

| FDI inflow | −1.49 | −1.98 | −1.30 | −4.21 *** | −4.11 *** | −5.14 *** |

| OFD | −1.84 | −1.50 | 0.04 | −5.19 *** | −5.93 *** | −4.16 *** |

| FID | −3.04 ** | −2.79 * | −0.46 | −4.85 *** | −3.35 *** | −3.14 ** |

| FMD | −2.29 | −2.93 | 0.32 | −4.82 *** | −5.81 *** | −8.96 *** |

| INF | −5.99 *** | −13.17 *** | −9.53 *** | −8.40 *** | −26.12 *** | −23.13 *** |

| TOP | −2.62 * | −0.95 | −2.48 * | −7.87 *** | −5.94 *** | −15.05 *** |

| RGR | −5.84 *** | −2.74 * | −1.78 | −7.94 *** | −3.47 *** | −4.96 *** |

| Countries | FDII | FD | FI | FM | INF | TOP | GRT |

|---|---|---|---|---|---|---|---|

| Algeria | 1 | 2 | 2 | 1 | 1 | 3 | 4 |

| Bangladesh | 3 | 2 | 2 | 1 | 1 | 1 | 0 |

| Bolivia | 1 | 1 | 1 | 1 | 2 | 1 | 3 |

| Botswana | 1 | 4 | 4 | 1 | 1 | 1 | 3 |

| Brazil | 1 | 3 | 3 | 1 | 3 | 1 | 3 |

| Cameroon | 2 | 4 | 4 | 1 | 0 | 1 | 0 |

| Colombia | 1 | 1 | 1 | 2 | 2 | 1 | 4 |

| Congo, Rep. | 1 | 1 | 1 | 1 | 0 | 2 | 0 |

| Costa Rica | 2 | 1 | 1 | 1 | 3 | 2 | 3 |

| Côte d’Ivoire | 1 | 1 | 1 | 4 | 0 | 1 | 1 |

| Dominican Republic | 2 | 1 | 1 | 1 | 3 | 4 | 0 |

| Ecuador | 2 | 4 | 4 | 1 | 2 | 1 | 0 |

| Egypt, Arab Rep. | 1 | 1 | 3 | 1 | 1 | 2 | 0 |

| El Salvador | 2 | 2 | 2 | 2 | 1 | 1 | 3 |

| Eswatini | 2 | 2 | 3 | 1 | 2 | 1 | 1 |

| Fiji | 2 | 1 | 1 | 1 | 1 | 1 | 0 |

| Gabon | 0 | 1 | 1 | 1 | 1 | 3 | 0 |

| Ghana | 1 | 4 | 1 | 3 | 1 | 1 | 1 |

| Guatemala | 1 | 1 | 1 | 1 | 3 | 1 | 1 |

| Guyana | 1 | 2 | 2 | 1 | 1 | 1 | 1 |

| Honduras | 3 | 3 | 1 | 1 | 1 | 2 | 1 |

| India | 3 | 2 | 1 | 1 | 1 | 1 | 0 |

| Indonesia | 4 | 3 | 1 | 2 | 1 | 1 | 1 |

| Iran, Islamic Rep. | 1 | 1 | 1 | 2 | 4 | 3 | 0 |

| Iraq | 2 | 3 | 1 | 1 | 1 | 2 | 0 |

| Jamaica | 2 | 1 | 1 | 4 | 4 | 1 | 2 |

| Jordan | 2 | 1 | 1 | 1 | 1 | 2 | 0 |

| Kenya | 4 | 1 | 2 | 1 | 1 | 1 | 0 |

| Malaysia | 0 | 3 | 3 | 2 | 0 | 2 | 1 |

| Mauritania | 2 | 1 | 1 | 1 | 2 | 3 | 2 |

| Mauritius | 1 | 2 | 1 | 2 | 4 | 2 | 1 |

| Mexico | 3 | 3 | 1 | 2 | 2 | 1 | 1 |

| Morocco | 2 | 1 | 1 | 1 | 3 | 1 | 0 |

| Myanmar | 1 | 1 | 1 | 4 | 1 | 4 | 0 |

| Nicaragua | 2 | 2 | 2 | 1 | 1 | 1 | 0 |

| Nigeria | 2 | 4 | 4 | 1 | 1 | 1 | 1 |

| Pakistan | 1 | 4 | 3 | 4 | 1 | 1 | 0 |

| Panama | 1 | 2 | 2 | 1 | 1 | 2 | 1 |

| Papua New Guinea | 1 | 1 | 4 | 2 | 0 | 1 | 2 |

| Paraguay | 2 | 1 | 1 | 3 | 2 | 1 | 0 |

| Peru | 1 | 1 | 2 | 1 | 3 | 4 | 1 |

| Philippines | 1 | 1 | 4 | 3 | 4 | 2 | 2 |

| Senegal | 2 | 2 | 1 | 3 | 1 | 2 | 0 |

| Solomon Islands | 1 | 3 | 3 | 4 | 3 | 1 | 2 |

| South Africa | 3 | 1 | 4 | 1 | 2 | 1 | 2 |

| Sri Lanka | 1 | 1 | 1 | 1 | 0 | 1 | 0 |

| Sudan | 2 | 2 | 2 | 1 | 1 | 1 | 2 |

| Suriname | 3 | 2 | 2 | 1 | 1 | 1 | 1 |

| Syrian Arab Republic | 3 | 1 | 1 | 1 | 1 | 1 | 1 |

| Thailand | 1 | 1 | 4 | 1 | 1 | 1 | 0 |

| Tunisia | 1 | 3 | 1 | 3 | 2 | 1 | 3 |

| Turkey | 3 | 1 | 1 | 1 | 1 | 1 | 0 |

| Zambia | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Mode | 1 | 1 | 1 | 1 | 1 | 1 | 0 |

| Pedroni Test | Statistic | Westerlund Test | Statistic | |

|---|---|---|---|---|

| Panel | Group | |||

| v | 0.2241 | Gt | −3.100 *** | |

| Rho | −5.139 *** | −3.145 *** | Ga | −5.884 *** |

| t | −15.43 *** | −16.18 *** | Pt | −19.573 *** |

| Adf | −10.99 *** | −9.375 *** | Pa | −5.343 *** |

| Pooled Mean Group | Mean Group | Dynamic Fixed Effect | |

|---|---|---|---|

| Long run | |||

| OFD | 0.147 | −8.715 | 0.683 |

| (0.393) | (31.78) | (0.748) | |

| IFD | 0.269 | 7.834 | 0.275 |

| (0.307) | (30.50) | (0.624) | |

| MFD | 0.451 *** | 0.940 | 0.442 ** |

| (0.116) | (2.092) | (0.198) | |

| INF | −0.0311 | −0.201 ** | −0.152 ** |

| (0.0444) | (0.0808) | (0.0750) | |

| TOP | 0.665 *** | 1.247 *** | 0.557 *** |

| (0.131) | (0.412) | (0.141) | |

| RGR | 0.0139 * | 0.0429 * | 0.0275 * |

| (0.0455) | (0.0682) | (0.0895) | |

| Short run | |||

| EC | −0.431 *** | −0.741 *** | −0.392 *** |

| (0.0294) | (0.0358) | (0.0174) | |

| 22.83 | 34.43 | 0.0467 | |

| (20.37) | (25.37) | (0.583) | |

| 25.23 | 36.23 | 0.190 | |

| (19.40) | (23.95) | (0.521) | |

| 2.680 | 1.777 | 0.233 | |

| (2.503) | (3.140) | (0.158) | |

| −0.0526 ** | −0.0479 ** | −0.00348 ** | |

| (0.0279) | (0.0270) | (0.0012) | |

| 0.655 * | 0.227 | 0.0608 * | |

| (0.269) | (0.289) | (0.0389) | |

| 0.0317 | 0.0169 | 0.0355 ** | |

| (0.0265) | (0.0322) | (0.0178) | |

| Constant | −0.191 ** | −4.885 | 0.168 *** |

| (0.0754) | (11.95) | (0.0325) | |

| Hausman test (MG and PMG) | 3.72 (0.7142) | ||

| Hausman test (DFE and PMG) | 14.27 ** (0.0267) | ||

| Observations | 2120 | 2120 | 2120 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Haque, M.A.; Biqiong, Z.; Arshad, M.U. Sources of Financial Development and Their Impact on FDI Inflow: A Panel Data Analysis of Middle-Income Economies. Economies 2022, 10, 182. https://doi.org/10.3390/economies10080182

Haque MA, Biqiong Z, Arshad MU. Sources of Financial Development and Their Impact on FDI Inflow: A Panel Data Analysis of Middle-Income Economies. Economies. 2022; 10(8):182. https://doi.org/10.3390/economies10080182

Chicago/Turabian StyleHaque, Mohammad Anamul, Zhang Biqiong, and Muhammad Usman Arshad. 2022. "Sources of Financial Development and Their Impact on FDI Inflow: A Panel Data Analysis of Middle-Income Economies" Economies 10, no. 8: 182. https://doi.org/10.3390/economies10080182

APA StyleHaque, M. A., Biqiong, Z., & Arshad, M. U. (2022). Sources of Financial Development and Their Impact on FDI Inflow: A Panel Data Analysis of Middle-Income Economies. Economies, 10(8), 182. https://doi.org/10.3390/economies10080182