The Impact of Uncertainty on Trade: The Case for a Small Port

Abstract

1. Introduction

2. News (US–China Trade War) and Its Impact on South-East Asian Trade

3. Review of the Selected Literature

3.1. Empirical Estimation Method and Data

3.2. Testing for Nonlinearity

3.3. Markov Regime-Switching Model

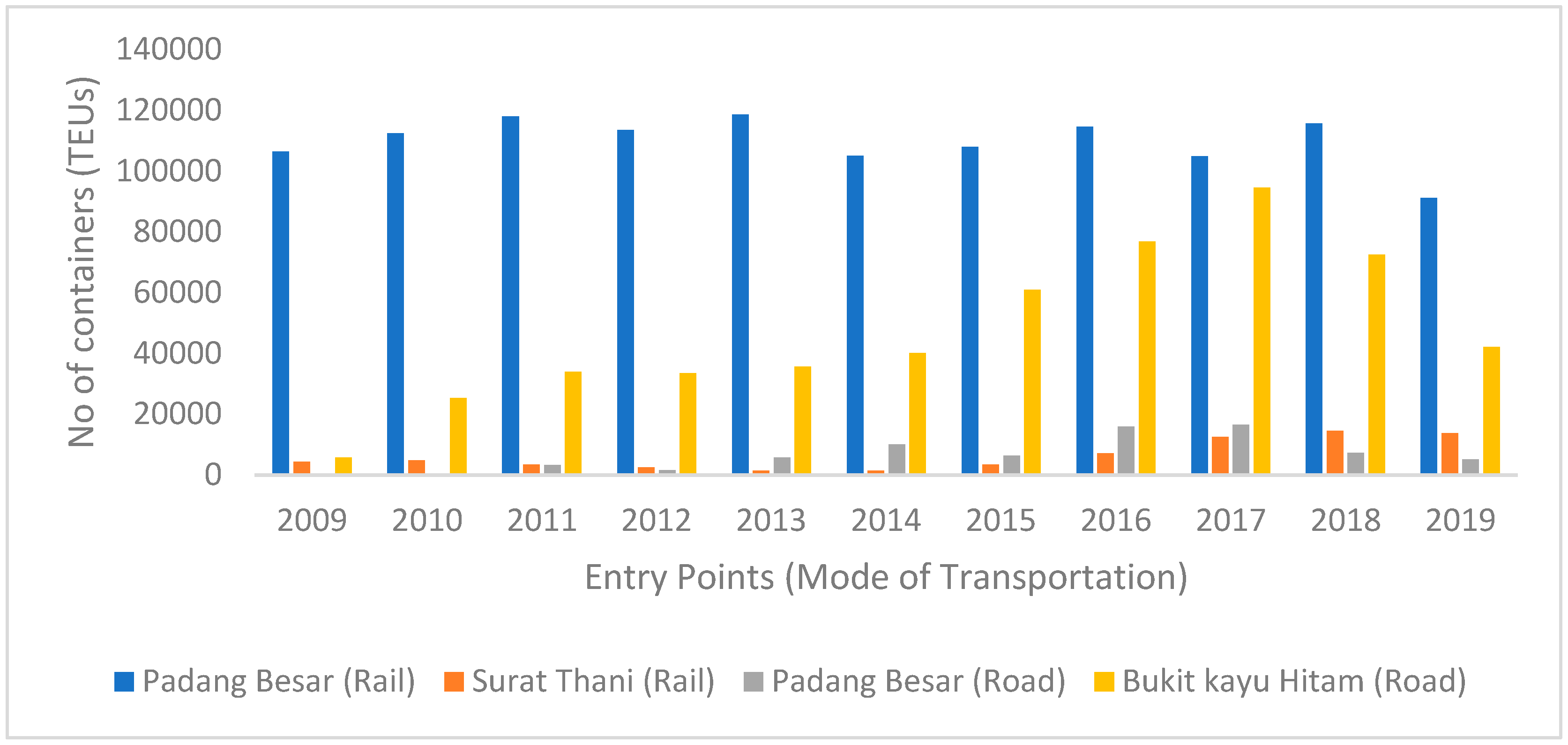

4. Data and Sources

4.1. Empirical Results and Discussion

Benchmark Results

4.2. Robustness Tests—Alternative Measures of Uncertainty

4.3. Robustness Tests—Alternative Measures of Policy Uncertainty in the Form of Geopolitical Risks

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Al-Thaqeb, Saud Asaad, and Barrak Ghanim Algharabali. 2019. Economic policy uncertainty: A literature review. Journal of Economic Asymmetries 20: e00133. [Google Scholar] [CrossRef]

- Ardia, David, Keven Bluteau, and Kris Boudt. 2019. Questioning the news about economic growth: Sparse forecasting using thousands of news-based sentiment values. International Journal of Forecasting 35: 1370–86. [Google Scholar] [CrossRef]

- Ashley, Richard A., and Douglas M. Patterson. 2006. Evaluating the Effectiveness of State-Switching Time Series Models for U.S. Real Output. Journal of Business & Economic Statistics 24: 266–77. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Rangan Gupta, and Mawuli Segnon. 2016. The role of economic policy uncertainty in predicting US recessions: A mixed-frequency Markov-switching vector autoregressive approach. Economics 10: 1–20. [Google Scholar] [CrossRef]

- Bouoiyour, Jamal, Refk Selmi, Shawkat Hammoudeh, and Mark E. Wohar. 2019. What are the categories of geopolitical risks that could drive oil prices higher? Acts or threats? Energy Economics 84: 104523. [Google Scholar] [CrossRef]

- Brandt, Michael W., and Lin Gao. 2019. Macro fundamentals or geopolitical events? A textual analysis of news events for crude oil. Journal of Empirical Finance 51: 64–94. [Google Scholar] [CrossRef]

- Broock, William A., José Alexandre Scheinkman, W. Davis Dechert, and Blake LeBaron. 1996. A test for independence based on the correlation dimension. Econometric Reviews 15: 197–235. [Google Scholar] [CrossRef]

- Broll, Udo, Soumyatanu Mukherjee, and Rudra Sensarma. 2020. Risk preferences estimation of exporting firms under exchange rate uncertainty. Scottish Journal of Political Economy 67: 126–36. [Google Scholar] [CrossRef]

- Caldara, Dario, and Matteo Iacoviello. 2022. Measuring geopolitical risk. American Economic Review 112: 1194–225. [Google Scholar] [CrossRef]

- Caldara, Dario, Matteo Iacoviello, Patrick Molligo, Andrea Prestipino, and Andrea Raffo. 2020. The economic effects of trade policy uncertainty. Journal of Monetary Economics 109: 38–59. [Google Scholar] [CrossRef]

- Chen, Shyh-Wei, and Chung-Hua Shen. 2007. Evidence of the duration-dependence from the stock markets in the Pacific Rim Economies. Applied Economics 39: 1461–74. [Google Scholar] [CrossRef]

- Cheng, Chak Hung Jack, and Ching-Wai Jeremy Chiu. 2018. How important are global geopolitical risks to emerging countries? International Economics 156: 305–25. [Google Scholar] [CrossRef]

- Crowley, Meredith, Ning Meng, and Huasheng Song. 2018. Tariff scares Trade policy uncertainty and foreign market entry by Chinese firms. Journal of International Economics 114: 96–115. [Google Scholar] [CrossRef]

- Dogah, K. E. 2021. Effect of trade and economic policy uncertainties on regional systemic risk: Evidence from ASEAN. Economic Modelling 104: 105625. [Google Scholar] [CrossRef]

- Gupta, Rangan, and Xiaojin Sun. 2020. Forecasting economic policy uncertainty of BRIC countries using Bayesian VARs. Economics Letters 186: 108677. [Google Scholar] [CrossRef]

- Gupta, Rangan, and Mark Wohar. 2017. Forecasting oil and stock returns with a Qual VAR using over 150years of data. Energy Economics 62: 181–86. [Google Scholar] [CrossRef]

- Gupta, Rangan, Giray Gozgor, Huseyin Kaya, and Ender Demir. 2019. Effects of geopolitical risks on trade flows: Evidence from the gravity model. Eurasian Economic Review 9: 515–30. [Google Scholar] [CrossRef]

- Grier, Kevin B., and Aaron D. Smallwood. 2013. Exchange rate shocks and trade: A multivariate GARCH-M approach. Journal of International Money and Finance 37: 282–305. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 57: 357–84. [Google Scholar] [CrossRef]

- Hill, Paula, Adriana Korczak, and Piotr Korczak. 2019. Political uncertainty exposure of individual companies: The case of the Brexit referendum. Journal of Banking & Finance 100: 58–76. [Google Scholar]

- Huang, Yun, and Paul Luk. 2020. Measuring economic policy uncertainty in China. China Economic Review 59: 101367. [Google Scholar] [CrossRef]

- Klaassen, Franc. 2004. Why is it so difficult to find an effect of exchange rate risk on trade? Journal of International Money and Finance 23: 817–39. [Google Scholar] [CrossRef]

- Kollias, Christos, Suzanna-Maria Paleologou, Panayiotis Tzeremes, and Nickolaos Tzeremes. 2017. Defence expenditure and economic growth in Latin American countries: Evidence from linear and nonlinear causality tests. Latin American Economic Review 26: 2. [Google Scholar] [CrossRef]

- Kristjánsdóttir, Helga, Sigurður Guðjónsson, and Guðmundur Kristján Óskarsson. 2022. Free Trade Agreement (FTA) with China and interaction between exports and imports. Baltic Journal of Economic Studies 8: 1–8. [Google Scholar] [CrossRef]

- Lee, Siu Ming. 2021. Performance Sustained during COVID-19 Highlights Strong Fundamentals in Penang’s Trade in Goods. Penang Institute Issues. June. Available online: https://penanginstitute.org/publications/issues/performance-sustained-during-covid-19-highlights-strong-fundamentals-in-penangs-trade-in-goods/ (accessed on 2 August 2021).

- Lee, Seung Hoon, and Yong Suk Lee. 2018. Political influence and trade uncertainty: Evidence from sanction threats and impositions. Economics Bulletin 38: 367–72. [Google Scholar]

- Li, Mangmang, Yuqiang Cao, Meiting Lu, and Hongjian Wang. 2021. Political uncertainty and allocation of decision rights among business groups: Evidence from the replacement of municipal officials. Pacific-Basin Finance Journal 67: 101541. [Google Scholar] [CrossRef]

- Lin, Hualing, Qiubi Sun, and Sheng-Qun Chen. 2020. Reducing exchange rate risks in international trade: A hybrid forecasting approach of CEEMDAN and multilayer LSTM. Sustainability 12: 2451. [Google Scholar] [CrossRef]

- Malaysia External Trade Development Corporation. 2020. Trade Performance: June 2020 and January–June 2020. Available online: file:///D:/Downloads/PR202006_Eng%20(2).pdf (accessed on 23 February 2021).

- Manela, Asaf, and Alan Moreira. 2017. News implied volatility and disaster concerns. Journal of Financial Economics 123: 137–62. [Google Scholar] [CrossRef]

- Penang Port Sdn. Bhd. (PPSB). 2020. Data Aliran Keluar Masuk Kontena 2000–2020. Pulau Pinang, Malaysia: Penang Port Sdn. Bhd., unpublished. [Google Scholar]

- Perée, Eric, and Alfred Steinherr. 1989. Exchange rate uncertainty and foreign trade. European Economic Review 33: 1241–64. [Google Scholar] [CrossRef]

- Reboredo, Juan C. 2010. Nonlinear effects of oil shocks on stock returns: A Markov-switching approach. Applied Economics 42: 3735–44. [Google Scholar] [CrossRef]

- The Edge. 2019. Malaysian Furniture Exports to the US Seen Growing 20% Annually. July 17. Available online: https://www.theedgemarkets.com/article/malaysian-furniture-exports-us-seen-growing-20-annually (accessed on 27 January 2021).

- World Economic Outlook (WEO). 2020. A Crisis Like No Other, an Uncertain Recovery. Washington: IMF. [Google Scholar]

- Wolfers, Justin, and Eric Zitzewitz. 2009. Using Markets to Inform Policy: The Case of the Iraq War. Economica 76: 225–50. [Google Scholar] [CrossRef]

- Yang, Cai, Zibo Niu, and Wang Gao. 2022. The time-varying effects of trade policy uncertainty and geopolitical risks shocks on the commodity market prices: Evidence from the TVP-VAR-SV approach. Resources Policy 76: 102600. [Google Scholar] [CrossRef]

| Markets | Export Growth | Import Growth | ||

|---|---|---|---|---|

| Pre-Trade Conflict | Ongoing Trade Conflict * | Pre-Trade Conflict | Ongoing Trade Conflict | |

| July 2017–June 2018 % Growth | July 2018–June 2019 % Growth | July 2017–June 2018 % Growth | July 2018–June 2019 % Growth | |

| Vietnam * | 5.9 | 21.1 | −13.8 | 17.3 |

| Singapore | 21.3 | 19.4 | 13.7 | 17.3 |

| Taiwan * | 7.7 | 14.7 | 1.0 | 20.3 |

| Thailand | 8.6 | 10.5 | 2.5 | 19.0 |

| Malaysia | 11.1 | 2.1 | 6.8 | 7.4 |

| China | 11.6 | 1.0 | 12.4 | −18.7 |

| Export Growth | Import Growth | |||

|---|---|---|---|---|

| Pre-Trade Conflict | Ongoing Trade Conflict | Pre-Trade Conflict | Ongoing Trade Conflict | |

| July 2017–June 2018 % Growth | July 2018–June 2019 % Growth | July 2017–June 2018 % Growth | July 2018–June 2019 % Growth | |

| Vietnam * | 53.7 | 23.2 | 23.9 | 13.1 |

| Malaysia | 19.0 | 4.4 | 15.1 | 1.7 |

| Taiwan * | 17.9 | −0.2 | 13.1 | 8.9 |

| Thailand | 13.7 | −6.6 | 11.4 | 3.8 |

| Singapore | 7.6 | −7.0 | 13.1 | 0.8 |

| USA | 9.7 | −20.0 | 9.4 | −3.2 |

| Mean | Maximum | Minimum | Std. Dev. | Observations | |

|---|---|---|---|---|---|

| BKH_ROAD | 4112.7740 | 10,556.0000 | 149.0000 | 2264.7630 | 137 |

| CHINA_EPU | 229.0956 | 852.0525 | 59.4412 | 157.2609 | 133 |

| CHINA_NEWS | 279.9389 | 970.8299 | 26.1441 | 230.9545 | 133 |

| CHINA_TPU | 155.4398 | 413.8014 | 83.5258 | 60.5949 | 138 |

| GEPU_CURRENT | 159.2704 | 425.6608 | 81.8783 | 65.5911 | 138 |

| GPR | 105.2298 | 370.4247 | 40.5062 | 56.1812 | 138 |

| GPR_CHI | 111.9746 | 251.2252 | 61.9459 | 32.3835 | 138 |

| GPR_MAL | 89.8874 | 271.0700 | 22.6284 | 35.6237 | 138 |

| GPR_THA | 94.4052 | 279.7898 | 35.7548 | 45.0354 | 138 |

| GPR_THR | 113.2368 | 408.9641 | 31.3702 | 64.7981 | 138 |

| JAP_TPU | 197.8658 | 699.9738 | 36.5727 | 143.9806 | 127 |

| PB_RAIL | 9282.0220 | 11,946.0000 | 649.0000 | 1338.5660 | 137 |

| PB_ROAD | 545.8467 | 1996.0000 | 0 | 531.4399 | 137 |

| ST_RAIL | 583.8832 | 2069.0000 | 0 | 516.7699 | 137 |

| TP_EMV | 0.0495 | 0.3540 | 0 | 0.0786 | 127 |

| US_EPU | 141.8978 | 284.1359 | 63.8773 | 44.7165 | 133 |

| US_TPU | 137.7891 | 1374.2800 | 10.5643 | 210.1710 | 127 |

| BKH_R | CHINA_E | CHINA_NWS | CHINA_TPU | GEPU_CURRENT | GPR | GPR_CHI | GPR_MAL | GPR_THA | GPR_THR | PB_RAIL | PB_ROAD | ST_RAIL | TP_EMV | US_EPU | US_TPU | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BKH_R | 1 | |||||||||||||||

| CHINA_EPU | 0.398 | 1 | ||||||||||||||

| CHINA_NEWS | 0.411 | 0.963 | 1 | |||||||||||||

| CHINA_TPU | 0.386 | 0.883 | 0.898 | 1 | ||||||||||||

| GEPU_CURRENT | 0.383 | 0.925 | 0.929 | 0.992 | 1 | |||||||||||

| GPR | 0.575 | 0.568 | 0.537 | 0.411 | 0.443 | 1 | ||||||||||

| CHINA GPR | 0.386 | 0.710 | 0.676 | 0.579 | 0.614 | 0.731 | 1 | |||||||||

| MALAYSIA GPR | −0.003 | −0.236 | −0.196 | −0.252 | −0.246 | 0.131 | −0.114 | 1 | ||||||||

| THAILAND GPR | −0.238 | −0.389 | −0.346 | −0.426 | −0.432 | −0.221 | −0.169 | 0.234 | 1 | |||||||

| PADANG BESAR RAIL | 0.568 | 0.590 | 0.555 | 0.434 | 0.467 | 0.996 | 0.755 | 0.095 | −0.233 | 1 | ||||||

| PADANG BESAR ROAD | 0.037 | 0.191 | 0.184 | 0.205 | 0.210 | 0.014 | 0.098 | −0.087 | −0.220 | 0.037 | 1 | |||||

| SURAT THANI_RAIL | 0.726 | 0.270 | 0.303 | 0.249 | 0.251 | 0.357 | 0.236 | 0.041 | 0.027 | 0.345 | −0.054 | 1 | ||||

| TP_EMV | 0.536 | 0.805 | 0.766 | 0.650 | 0.684 | 0.597 | 0.672 | −0.303 | −0.337 | 0.618 | 0.201 | 0.346 | 1 | |||

| US_EPU | 0.368 | 0.764 | 0.708 | 0.618 | 0.647 | 0.660 | 0.815 | −0.275 | −0.307 | 0.691 | 0.150 | 0.148 | 0.736 | 1 | ||

| US_TPU | 0.059 | 0.403 | 0.421 | 0.710 | 0.645 | 0.040 | 0.231 | −0.295 | −0.333 | 0.063 | 0.123 | −0.080 | 0.248 | 0.291 | 1 | |

| CHINA GPR | 0.316 | 0.831 | 0.770 | 0.735 | 0.759 | 0.630 | 0.751 | −0.211 | −0.323 | 0.663 | 0.149 | 0.126 | 0.699 | 0.878 | 0.416 | 1 |

| BDS Statistics | |||||

|---|---|---|---|---|---|

| m = 2 | m = 3 | m = 4 | m = 5 | m = 6 | |

| BUKIT KAYU HITAM—RAIL | 0.1274 *** | 0.2168 *** | 0.2857 *** | 0.3302 *** | 0.3562 *** |

| CHINA_EPU | 0.1503 *** | 0.2521 *** | 0.3177 *** | 0.3577 *** | 0.3829 *** |

| CHINA_NEWS | 0.1422 *** | 0.2406 *** | 0.3012 *** | 0.3381 *** | 0.3597 *** |

| CHINA_TPU | 0.1153 *** | 0.1912 *** | 0.2374 *** | 0.2665 *** | 0.2900 *** |

| GEPU_CURRENT | 0.1265 *** | 0.2099 *** | 0.2615 *** | 0.2953 *** | 0.3210 *** |

| GPR | 0.0807 *** | 0.1302 *** | 0.1646 *** | 0.1816 *** | 0.1859 *** |

| CHINA GPR | 0.1073 *** | 0.1771 *** | 0.2255 *** | 0.2599 *** | 0.2781 *** |

| MALAYSIA GPR | 0.0290 *** | 0.0536 *** | 0.0652 *** | 0.0683 *** | 0.0687 *** |

| THAILAND GPR | 0.0568 *** | 0.0904 *** | 0.1046 *** | 0.1109 *** | 0.1065 *** |

| GPR BROAD | 0.0853 | 0.1422 | 0.1718 | 0.1875 | 0.1941 |

| PADANG BESAR RAIL | 0.0004 | −0.0279 *** | −0.0275 ** | −0.0270 ** | −0.0265 ** |

| PADANG BESAR ROAD | 0.0965 *** | 0.1621 *** | 0.1971 *** | 0.2120 *** | 0.2216 *** |

| BUKIT KAYU HITAM ROAD | 0.1274 *** | 0.2168 *** | 0.2857 *** | 0.3302 *** | 0.3562 *** |

| SURAT THANI_RAIL | 0.1435 *** | 0.2523 *** | 0.3238 *** | 0.3719 *** | 0.4056 *** |

| TP_EMV | 0.1380 *** | 0.2314 *** | 0.2973 *** | 0.3400 *** | 0.3658 *** |

| US_EPU | 0.0397 *** | 0.0662 *** | 0.0759 *** | 0.0770 *** | 0.0703 *** |

| US_TPU | 0.1436 *** | 0.2417 *** | 0.3014 *** | 0.3382 *** | 0.3680 *** |

| Padang Besar—Rail | Surat Thani—Rail | |||||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 1 | Model 2 | Model 3 | Model 4 | |

| Regime 1—Low Uncertainty | ||||||||

| U | 1.6919 | 2.8161 | 4.6307 ** | 0.4909 | 1.4440 *** | 1.8938 | 2.4926 *** | 1.0208 *** |

| (3.0339) | (2.2905) | (1.9356) | (1.0764) | (0.1983) | (1.0082) | (0.4345) | (0.2828) | |

| 8060.641 *** | 9424.197 *** | 8784.645 *** | 8503.953 *** | 662.7572 *** | 983.7904 *** | −24.8764 | 230.6212 *** | |

| (1053.279) | (402.7895) | (317.6218) | (426.1973) | (88.2953 | (162.2668) | (63.527) | (28.6850) | |

| Regime 2—High Uncertainty | ||||||||

| U | 1.4885 ** | −4.9955 | −9.6512 ** | 0.8853 ** | 0.7628 ** | 0.7456 | 3.9532 *** | 0.4763 *** |

| (0.5921) | (4.6572) | (4.3145) | (0.5417) | (0.3530) | (0.6056) | (0.8200) | (0.1334) | |

| 9395.731 *** | 9316.373 *** | 8392.554 *** | 9648.486 *** | 156.3656 *** | 192.9191 ** | 520.6865 *** | 1074.410 *** | |

| (241.1602) | (597.3881) | (1316.605) | (200.1047) | (56.4154) | (83.5067) | (168.2427) | (65.6824) | |

| 6.7666 *** | 6.7967 *** | 6.9398 *** | 6.7978 *** | 5.2775 *** | 5.4888 *** | 5.4058 *** | 5.3638 *** | |

| (0.0951) | (0.0749) | (0.0692) | (0.0830) | (0.0647) | (0.0642) | (0.0632) | (0.0653) | |

| Transition Probabilities | ||||||||

| p11 | 1.4691 | 2.7301 *** | 3.7986 *** | 1.9245 ** | 3.3131 *** | 4.4144 *** | 4.6855 *** | 4.9167 *** |

| (1.5129) | (0.8499) | (0.7574) | (1.1585) | (0.8561) | (1.4490) | (1.0856) | (1.1963) | |

| P21 | −2.5124 *** | −2.3297 *** | -1.7261 | −2.5539 *** | −3.9883 *** | −4.9413 *** | −3.2978 *** | −4.2754 *** |

| (0.9200) | (0.7849) | (1.4972) | (0.8677) | (0.7708) | (1.2140) | (0.9168) | (1.4914) | |

| LL | −1105.926 | −1107.308 | −1156.810 | −1058.606 | −903.6399 | −924.4807 | −944.6841 | −867.3438 |

| AIC | 16.7357 | 16.7565 | 16.9899 | 16.7811 | 13.6938 | 14.007 | 13.8932 | 13.7691 |

| SC | 16.8878 | 16.9086 | 17.1391 | 16.9379 | 13.8459 | 14.1593 | 14.0424 | 13.9259 |

| HQC | 16.7975 | 16.8183 | 17.0505 | 16.8448 | 13.7556 | 14.0690 | 13.9538 | 13.8328 |

| Padang Besar—Road | Bukit Kayu Hitam—Road | |||||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 1 | Model 2 | Model 3 | Model 4 | |

| Regime 1—Low Uncertainty | ||||||||

| U | 1.3848 | 0.0291 | 0.9969 ** | 0.4846 *** | 4.4860 *** | −6.9153 | 5.1380 | 3.0098 *** |

| (0.9852) | (0.7323) | (0.5042) | (0.1453) | (0.7825) | (4.0047) | (5.0471) | (0.6875) | |

| 1026.369 ** | 320.8186 *** | 164.4022 | 247.2118 *** | 1860.872 *** | 7093.293 *** | 5869.038 *** | 2393.372 *** | |

| (219.4071) | (112.3924) | (86.0782) | (40.8256) | (205.7368) | (631.9894) | (815.3219) | (161.6400) | |

| Regime 2—High Uncertainty | ||||||||

| U | 0.7534 *** | −2.3039 | −0.9770 | −0.7551 | 3.6169 | 0.0891 | 15.0113 *** | 0.9273 |

| (0.1749) | (1.4663) | (1.3664 | (0.4723) | (2.0992) | (3.7514) | (1.9860) | (1.1155) | |

| 136.1150 ** | 1656.345 *** | 1492.807 *** | 1435.324 *** | 5798.258 *** | 2433.166 *** | 676.7385 ** | 6532.997 *** | |

| (53.5060) | (213.4814) | (229.7346) | (92.4823) | (551.6591) | (536.8640) | (330.8139) | (280.0799) | |

| 5.6443 *** | 5.7620 *** | 5.7343 *** | 5.7216 *** | 7.0762 *** | 7.1886 *** | 7.1106 *** | 7.1287 *** | |

| (0.0784) | (0.0718) | (0.0678) | (0.0694) | (0.0638) | (0.0637) | (0.0627) | (0.0656) | |

| Transition Probabilities | ||||||||

| p11 | 1.6802 *** | 3.5817 *** | 3.5503 *** | 3.3873 *** | 4.7421 *** | 4.7922 *** | 3.4957 *** | 4.6724 *** |

| (0.5497) | (0.6857) | (0.6433) | (0.6366) | (1.0758) | (1.295) | (0.8920) | (1.0798) | |

| P21 | −3.0292 *** | −2.1521 *** | −2.1017 *** | −2.0636 *** | −3.4811 *** | −4.9145 *** | −4.7247 *** | −3.4692 *** |

| (0.5564) | (0.6525) | (0.6209) | (0.6081) | (0.895) | (1.2426) | (1.0759) | (0.8928) | |

| LL | −967.1459 | −973.1707 | −999.7684 | −926.6911 | −1138.720 | −1150.461 | −1177.385 | −1093.834 |

| AIC | 14.6488 | 14.7394 | −14.6973 | 14.7038 | 17.2288 | 17.4054 | 17.2902 | 17.3359 |

| SC | 14.8009 | 14.8915 | 14.8465 | 14.8605 | 17.3810 | 17.5575 | 17.4394 | 17.4927 |

| HQC | 14.7106 | 14.8012 | 14.7579 | 14.7674 | 17.2906 | 17.4672 | 17.3509 | 17.3996 |

| Padang Besar—Rail | Surat Thani—Rail | |||||

|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 1 | Model 2 | Model 3 | |

| Regime 1—Low Uncertainty | ||||||

| U | 3.5773 | −9.7101 ** | 1541.396 | 1.0808 *** | 3.5642 *** | 3400.241 *** |

| (2.2570) | (4.0940) | (2034.298) | (0.1372) | (0.7320) | (274.5706) | |

| 6796.501 *** | 8441.454 *** | 8457.844 *** | 717.7123 *** | 551.3818 *** | 225.1071 *** | |

| (992.7506) | (1262.841) | (352.2116) | (81.1444) | (160.6190) | (22.0985) | |

| Regime 2—High Uncertainty | ||||||

| U | 1.0254 ** | 4.1762 ** | 3362.042 ** | 0.6035 *** | 2.3803 *** | 3384.961 *** |

| (0.4053) | (1.7400) | (1528.91) | (0.15174) | (0.4475) | (563.7616) | |

| 9306.299 *** | 8839.431 *** | 9600.749 *** | 173.9174 *** | −13.4535 *** | 928.4792 *** | |

| (150.2391) | (296.0143) | (178.9183) | (32.6840) | (64.1527) | (80.1067) | |

| 6.7593 *** | 6.9369 *** | 6.7877 *** | 5.2276 *** | 5.3951 *** | 5.2113 *** | |

| (0.0855) | (1.4362) | (0.0807) | (0.0672) | (0.0663) | (0.0824) | |

| Transition Probabilities | ||||||

| p11 | 0.4290 | 1.7108 | 1.9466 ** | 2.7312 *** | 3.2008 *** | 2.9472 *** |

| (0.9024) | (1.4362) | (0.9727) | (0.6979) | (0.9390) | (0.5221) | |

| P21 | −2.7368 *** | −3.7796 *** | −2.6454 *** | −3.5636 *** | −4.5421 *** | −1.3652 |

| (0.7695) | (0.7569) | (0.8316) | (0.6410) | (1.1376) | (0.6276) | |

| Log−likelihood | −1106.040 | −1156.511 | −1057.506 | −902.8396 | −943.5132 | −870.2932 |

| AIC | 16.7374 | 16.9855 | 16.7638 | 13.6818 | 13.8761 | 13.8156 |

| SC | 16.8895 | 17.1347 | 16.9206 | 13.8339 | 14.0253 | 13.9724 |

| HQC | 16.7992 | 17.0461 | 16.8275 | 13.7436 | 13.9367 | 13.8793 |

| Regime 1—Low Uncertainty | ||||||

| U | 0.2591 | −0.7644 | −478.5957 | 3.0844 *** | 5.2747 | 10056.19 *** |

| (0.3975) | (1.3178) | (1907.178) | (0.5007) | (4.8018) | (2065.812) | |

| 1247.904 *** | 1459.173 *** | 1351.451 *** | 2035.29 *** | 5841.575 *** | 2355.932 *** | |

| (136.0817) | (223.8122) | (96.6075) | (184.6058) | (786.2650) | (157.7376) | |

| Regime 2—High Uncertainty | ||||||

| U | 0.4789 *** | 1.0393 ** | 1599.957 *** | 0.4844 | 14.0891 *** | 4153.947 |

| (0.1269) | (0.4597) | (359.5000) | (1.3508) | (1.8095) | (2593.197) | |

| 181.8851 *** | 152.5176 | 226.8441 *** | 6531.349 *** | 761.1131 ** | 6436.281 *** | |

| (49.9344) | (81.3232) | (38.8021) | (467.0315) | (312.0361) | (256.3048) | |

| 5.6925 *** | 5.7290 *** | 5.6946 *** | 7.0823 *** | 7.1003 *** | 7.1065 *** | |

| (0.0728) | (0.0677) | (0.0695) | (0.0638) | (0.0627) | (0.0656) | |

| Transition Probabilities | ||||||

| p11 | 2.0114 *** | 2.0963 *** | 2.0712 *** | 4.7229 *** | 3.4910 *** | 4.6732 *** |

| (0.6298) | (0.6182) | (0.6040) | (1.0762) | (0.8926) | (1.0792) | |

| P21 | −3.3646 *** | −3.5371 *** | −3.3960 *** | −3.4854 *** | −4.7245 *** | −3.4517 *** |

| (0.6604) | (0.6404) | (0.6273) | (0.8943) | (1.0759) | (0.8951) | |

| Log−likelihood | −967.5098 | −999.2767 | −924.2396 | −1139.609 | −1176.053 | −1091.035 |

| AIC | 14.6542 | 14.6901 | 14.6651 | 17.2422 | 17.2708 | 17.2918 |

| SC | 14.8064 | 14.8393 | 14.8219 | 17.3943 | 17.4200 | 17.4486 |

| HQC | 14.7161 | 14.7508 | 14.7288 | 173040 | 17.3314 | 17.3555 |

| Padang Besar—Rail | Surat Thani—Rail | |||||||

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 1 | Model 2 | Model 3 | Model 4 | |

| Regime 1—Low Uncertainty | ||||||||

| U | 14.8811 | 107.4374 *** | 11.4715 | −0.0673 | 0.4847 | −3.9667 ** | 4.3748 *** | 3.6683 *** |

| (15.3455) | (21.7428) | (27.6069) | (2.4521) | (0.5604) | (1.6268) | (1.1088) | (0.9429) | |

| 3253.858 | −1664.528 | 6318.247 | 9453.659 *** | 319.8347 *** | 1514.241 *** | 589.3852 *** | 766.4135 *** | |

| (1906.433) | (1735.280) | (3459.406) | (261.8097) | (64.8436) | (123.2746) | (164.4627) | (123.3398) | |

| Regime 2—High Uncertainty | ||||||||

| U | −4.4634 | −4.2927 | 4.7010 | 304.6323 *** | −3.2913 *** | −0.1907 | −2.6127 | −1.2005 |

| (2.3880) | (2.4724) | (2.8374) | (79.5825) | (1.2256) | (0.7061) | (1.6422) | (1.1225) | |

| 9852.230 *** | 9887.763 *** | 8920.490 *** | −17741.13 *** | 1461.771 *** | 288.4942 *** | 516.0702 *** | 365.8604 *** | |

| (237.4110) | (243.1765) | (329.0029) | (6308.632) | (95.229) | (74.8273) | (159.5266) | (96.1773) | |

| 6.9331 *** | 6.8941 *** | 6.9319 *** | 6.8615 *** | 5.4967 *** | 5.5045 *** | 5.4637 *** | 5.4688 *** | |

| (0.0720) | (0.0634) | (0.0649) | (0.0653) | (0.0626) | (74.8273) | (0.0623) | (0.0623) | |

| Transition Probabilities | ||||||||

| p11 | 0.6351 | 1.8138 | 0.5256 | 3.5896 *** | 4.9771 *** | 4.6157 *** | 4.6758 *** | 4.6621 *** |

| (1.9444) | (1.0360) | (1.3485) | (0.6282) | (1.2180) | (1.3777) | (1.3526) | (1.3581) | |

| P21 | −3.8820 *** | −3.6955 *** | −3.7873 *** | −0.3852 | −4.6029 *** | −4.9908 *** | −5.0289 *** | −5.0205 *** |

| (0.7240) | (0.6209) | (0.6220) | (1.6568) | (1.3842) | (1.2122) | (1.200) *** | (1.2028) | |

| LL | −1157.316 | −1152.032 | −1158.895 | −1150.082 | −953.0087 | −953.8968 | −848.4135 | −949.1548 |

| AIC | 16.9973 | 16.9201 | 17.0203 | 16.8917 | 14.0147 | 14.0276 | 13.9476 | 13.9584 |

| SC | 17.1465 | 17.0693 | 17.1695 | 17.0409 | 14.1639 | 14.1768 | 14.0968 | 14.1076 |

| HQC | 17.0579 | 16.9808 | 17.0809 | 16.9523 | 14.0753 | 14.0883 | 14.0082 | 14.0190 |

| Regime 1—Low Uncertainty | ||||||||

| U | 0.1191 | −9.4019 ** | 3.5221 *** | 1.3719 | −6.9956 | −1.0767 *** | 18.830 *** | 11.4329 |

| (1.2239) | (3.9918) | (0.8601) | (2.7651) | (7.0164) | (4.9493) | (7.0112) | (7.5136) | |

| 1323.012 *** | 2274.775 *** | −82.4301 | 1208.596 *** | 7327.821 *** | 6143.562 *** | 4589.201 *** | 5509.893 *** | |

| (151.7525) | (410.3890) | (102.5792) | (269.0571) | (695.3123) | (456.8329) | (821.4908) | (830.4401) | |

| Regime 2—High Uncertainty | ||||||||

| U | −1.8106 ** | −0.1968 | 1.6797 | 3.3478 *** | −9.5735 *** | 3.8857 | 21.8218 *** | 16.7469 *** |

| (0.7640) | (0.8448) | (2.5606) | (0.7711) | (2.8751) | (4.8107) | (3.9429) | (3.6984) | |

| 480.2407 *** | 338.2866 *** | 1152.135 *** | −6.3977 | 3822.469 *** | 2078.717 *** | 487.7106 | 1353.502 *** | |

| (75.8017) | (78.6498) | (284.1437) | (80.8842) | (322.7585) | (469.4478) | (450.7068) | (366.2725) | |

| 7.7307 *** | 5.7371 *** | 5.6812 *** | 5.6799 *** | 7.1899 *** | 7.2115 *** | 7.1055 *** | 7.1533 *** | |

| (0.0687) | (0.0662) | (0.0669) | (0.0686) | (0.0632) | (0.0627) | (0.0635) | (0.0635) | |

| Transition Probabilities | ||||||||

| p11 | 2.1497 *** | 2.1192 *** | 3.4748 *** | 2.1087 *** | 3.3964 *** | 4.8563 *** | 3.3611 *** | 3.3567 *** |

| (0.6583) | (0.6065) | (0.6255) *** | (0.6249) | (0.8405) | (1.2821) | (0.8431) | (0.8445) | |

| P21 | −3.5895 *** | −3.5510 *** | −2.0528 *** | −3.5488 *** | −3.9954 *** | −4.9311 *** | −3.9700 *** | −3.9625 *** |

| (0.6583) *** | (0.6289) | (0.6066) | (0.6492) | (0.7680) | (1.2502) | (0.7704) | (0.7729) | |

| LL | −999.3483 | −999.8158 | −993.9712 | −992.9206 | −1190.386 | −1187.752 | −1179.965 | −1185.416 |

| AIC | 14.6912 | 14.6980 | 14.6127 | 14.5973 | −17.4800 | 17.4416 | 17.3279 | 17.4075 |

| SC | 14.8404 | 14.8472 | 14.7619 | 14.7465 | −17.6292 | 17.5908 | 17.4771 | 17.5567 |

| HQC | 14.7518 | 14.7586 | 14.6733 | 14.6580 | 17.5407 | 17.5022 | 17.3885 | 17.4681 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sidek, N.Z.M.; Kiranantawat, B.; Khaengkhan, M. The Impact of Uncertainty on Trade: The Case for a Small Port. Economies 2022, 10, 193. https://doi.org/10.3390/economies10080193

Sidek NZM, Kiranantawat B, Khaengkhan M. The Impact of Uncertainty on Trade: The Case for a Small Port. Economies. 2022; 10(8):193. https://doi.org/10.3390/economies10080193

Chicago/Turabian StyleSidek, Noor Zahirah Mohd, Bhuk Kiranantawat, and Martusorn Khaengkhan. 2022. "The Impact of Uncertainty on Trade: The Case for a Small Port" Economies 10, no. 8: 193. https://doi.org/10.3390/economies10080193

APA StyleSidek, N. Z. M., Kiranantawat, B., & Khaengkhan, M. (2022). The Impact of Uncertainty on Trade: The Case for a Small Port. Economies, 10(8), 193. https://doi.org/10.3390/economies10080193