Abstract

Over the last three decades, Vietnam has undergone economic reforms and achieved rapid economic growth. However, the country is still facing numerous challenges linked to a relatively high share of employment in an informal economic sector, which could prevent Vietnam from escaping from the middle-income trap and becoming a high-income country. This research explores the effect of foreign direct investment (FDI) on job creation in the formal economic sector of Vietnam. A subnational dataset of 63 cities/provinces from 2006 to 2020 was analyzed using an instrumental variable two-stage least-squares fixed-effect model. The results show that FDI is an employment growth-enhancing factor in the formal economic sector. Specifically, FDI enterprises are found to be more capable than domestic enterprises in creating employment, and there is a positive employment spillover from the foreign to the domestic sector, although the magnitude of the effect remains small. Apart from FDI, firm agglomeration, capital resource productivity, and government support for sector development spur employment growth. Labor quality, profitability and foreign industrial agglomeration are identified to be determinants of FDI. Furthermore, the impact mechanism of FDI on the formal sector’s employment is further discussed using mindspongeconomics, the SM3D knowledge management system, and the culture tower.

1. Introduction

The renovation progress initiated in 1986 has transformed Vietnam from a centralized to a market economy. Various economic reforms have been implemented, resulting in high economic growth. High economic growth has brought the country from a low-income to a middle-income group. Like other developing countries, the coexistence of formal and informal sectors is widespread in Vietnam. The informal sector suffers low productivity due to obsolescent technologies, subsistent capital, and low-skilled labor. With access to broader capital, the implementation of advanced technologies, and highly skilled labor, the formal sector enjoys much higher productivity. The real challenge that Vietnam faces is the overwhelming share of employment in the informal sector. According to the General Statistics Office of Vietnam (2022), more than 68% of the labor force in Vietnam is working in informal jobs. Although the informal sector accounts for a large share of the labor force, economic growth is mostly driven by the formal sector, which accounts for more than 60% of GDP. This places the country in danger of a middle-income trap. To escape from the middle-income trap and raise people’s living standards, the government needs to restructure its economic sectors toward upsizing the formal sector and downsizing the informal sector. Expansion in the formal sector creates more jobs, and such employment growth in this sector would absorb the excess labor in agriculture and the informal sector, increasing labor productivity and enabling workers to earn a higher income. Employment generation in the formal sector is an urgent need for the country. One way to accomplish this goal is to rely on foreign direct investment (FDI) for its growth contribution. FDI attraction has long been crucial to Vietnam’s external economic affairs. According to the Ministry of Planning and Investment of Vietnam (2018), Vietnam received more than 2600 FDI projects from 129 countries and territories between 1988 and 2018, totaling USD 333 billion in registered investment capital, of which more than USD 183 billion (about 55% of the registered capital) was disbursed.

In general, it is believed that FDI has both direct and indirect effects on employment generation in host nations UNCTAD (1994). The direct effect is judged on the provision of jobs by foreign firms and the indirect effect works through productivity spillovers and multiplier effects in the local economy. The outcome of the direct effect of FDI on the level of employment depends on the mode of entry of FDI. Through “greenfield FDI,” foreign firms set up new plants and create new production facilities in host countries. In this scenario, foreign investment supplements domestic investment, and labor demand tends to rise. In addition, substantial employment growth is anticipated if this FDI is concentrated in labor-intensive industries. However, if FDI comes in the mode of the merger and acquisition of local firms, then the effect of FDI on employment would be very slight or even negative. In this situation, foreign investment substitutes for and crowds out domestic investment. If the foreign owners subsequently rationalize the firms, employment is even likely to decrease. Even worse, if FDI is concentrated in capital-intensive industries, by updating technologies and machines that are more efficient than the use of manpower, it would cause a considerable decline in demand for labor. On the other hand, Lipsey et al. (2010) insist that foreign-owned firms are relatively large, more productive, and have wider contacts and knowledge of world markets and better access to financing. These advantages could enhance foreign firms’ output and make them more capable of creating jobs than domestic firms. Therefore, the replacement of domestic firms by foreign firms does not damage employment but increases it.

FDI realizes its indirect effect on employment by creating business opportunities for domestic firms and enhancing the domestic firms’ level of productivity. With a physical presence in the host country, foreign firms establish backward linkages with domestic firms for input supplies. Expanding foreign firms’ output requires more input, which increases domestic firms’ business opportunities and boosts employment within the domestic economy. In addition, a positive relationship between FDI and the domestic firms’ level of productivity can be achieved in three ways: (a) demonstration effect, (b) technology transfer, and (c) labor turnover. FDI companies operating in the local market “demonstrate” modern technology to indigenous companies so that they may copy and effectively implement it (Blomström and Kokko 1998; Javorcik 2004). Further, foreign firms can directly transfer knowledge and technology to local suppliers to improve the productivity of the firms in the supply chains (Moran 2001). Workers employed and trained by foreign firms can spread the knowledge to benefit local firms once they change employment or start their own businesses Bhaumik et al. (2007). There is considerable evidence for the existence of technological and productivity spillovers from multinational enterprises (MNEs) to local firms (Pack and Saggi 2001; Balsvik 2011). FDI improves the domestic firms’ level of productivity. In a competitive labor market, profit-seeking firms employ labor up to the point where the marginal revenue product of labor equals the wage. An increase in productivity raises the marginal revenue product of labor, which now exceeds the existing wage, resulting in a positive marginal profit. Each firm tries to increase its total profit by hiring additional workers. As a result, market demand for labor increases, creating more jobs.

Despite extensive research on foreign direct investment (Massoud 2008; Abor and Harvey 2008; Nordin 2017; Saucedo et al. 2020; Thuy 2020; Azam et al. 2015; Gutiérrez-Portilla et al. 2019), the understanding of its impact on employment growth in the developing countries’ formal sector remains limited. For example, little is known about how FDI affects the transition of employment from the informal to the formal sector and what factors influence this process and how. This limitation can hinder policymaking and/or the quality of solutions to support economic growth to some degree. In addition, many developing countries are currently highly vulnerable to shocks from the China–U.S. trade war (Li et al. 2018), the COVID-19 pandemic (La et al. 2020), and the Russia–Ukraine conflict, etc. This makes it even more important to understand how to create and obtain better jobs to improve people’s livelihoods through the workforce transition pathway.

This study aims to advance our understanding of the factors that influence employment in Vietnam’s formal economy, especially the role of foreign direct investment (FDI). We use a two-stage least-squares fixed-effects model with instrumental variables to estimate our model. More importantly, we take into account the employment transformation mechanism in discussing the empirical results in the light of macroeconomic growth model, mindspongeconomics (Vuong 2023; Khuc 2022), and the SM3D knowledge management system (Vuong et al. 2022). Our paper is expected to contribute to the literature on economic development associated with employment and FDI in Vietnam and other developing countries.

The rest of the paper is organized as follows: Section 2 presents the literature review on employment and FDI. Section 3 provides model specification, data, and methodology. Results and discussion are presented in Section 4. Section 5 presents further verification of the results, and finally Section 6 contains the conclusion and implications.

2. Literature Review

Numerous studies evaluate the connection between FDI and employment in host countries, and the findings reveal mixed results. Several empirical studies find that FDI and job growth in host countries are positively correlated. Using data on aggregate FDI inflows and formal sector employment covering a 34-year period from 1970 to 2003 in Fiji, Jayaraman and Singh (2007) found a unidirectional long-run causality running from foreign direct investment to employment. A positive impact of FDI on manufacturing employment is evidenced in the study by Nunnenkamp and Bremont (2007) for Mexico in 1994–2006. There is no difference in the FDI effect between white- and blue-collar employment; however, the positive effect on blue-collar employment decreases with the increasing skill intensity of manufacturing industries. Abor and Harvey (2008), in their study on the effect of FDI on employment in Ghana, reported that FDI has a statistically significant and positive effect on the economy’s employment level. Based on firm-level data from the Chinese manufacturing sector during the period 1998–2004, Karlsson et al. (2009) examined both the direct and indirect employment effects of FDI. Their results showed that FDI has a positive direct effect on employment growth as well as a positive indirect effect on job creation in domestic-owned firms via spillovers. In their study of manufacturing firms in Indonesia during 1975–2005, Lipsey et al. (2010) concluded that foreign firms experienced faster employment growth than domestic firms. Similarly, the study by Foster-McGregor et al. (2013) at the manufacturing firm level in 19 sub-Saharan African countries over the period 2010–2011 also found that foreign-owned firms pay higher average wages, employ more workers than their domestic counterparts, and generate positive human capital effects. In contrast, Akcoraoglu and Acikgoz (2011) found a negative relationship between FDI and employment in Turkey from 1990 to 2010. They argued that the majority of FDI flows to Turkey are in the form of foreign acquisitions and mergers rather than greenfield investments. In their study of Vietnam during the period 2011 to 2015, Nguyen et al. (2020) reported that FDI has a negative impact on employment in Vietnam, and the magnitude of the effect is larger on the employment of skilled labor than on aggregate labor.

There are also studies that claim no or insignificant impact of FDI on employment creation. In the study of Egypt in the period 1974–2005, Massoud (2008) found an insignificant effect of FDI on employment. However, the author claimed that the employment effects of FDI depend on the mode of FDI entry. When greenfield FDI interacts with human capital and exports, employment is positively impacted; however, mergers and acquisitions are proven to have a direct negative impact on employment. Aktar et al. (2009) concluded that FDI did not contribute to the reduction in the unemployment rate in Turkey over the period 2000 to 2007. Nordin (2017) investigated the impact of FDI on employment in Malaysia for the period of 2000 to 2010 among five sectors: agriculture, mining and quarrying, manufacturing, construction, and services. The results show that FDI has no clear impact on employment in Malaysia. Table 1 below summarizes related literature on the impact of FDI on employment.

Table 1.

Summary of the literature on impact of FDI on employment.

In summary, while there has been much research on the impact of foreign direct investment (FDI) on employment, there is less research on the impact of FDI on employment in the formal economic sector. However, it could be seen that existing studies provide helpful insights into the theory of employment associated with FDI. These studies help shape the development of our model and analysis, which is presented in the following sections.

3. Model Specification, Data, and Methodology

3.1. Conceptual Framework

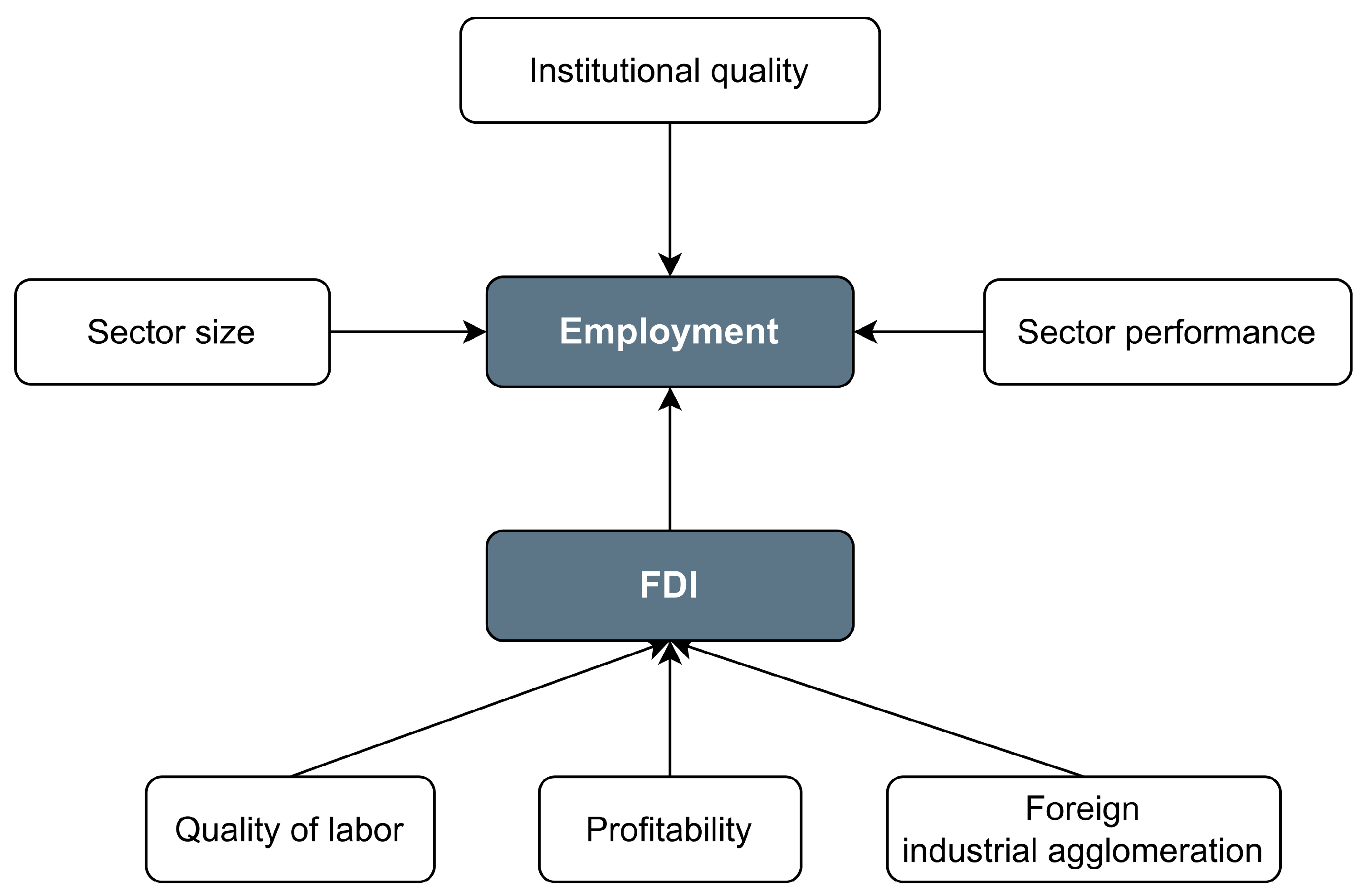

In this study, we proposed and adopted the conceptual framework of the employment model (Figure 1). The model has four blocks of inputs determining employment growth in the sector, which are institutional quality, sector size, sector performance, and FDI. According to the classical labor theory, demand for labor is derived from the quantity of output produced. How much output that a sector produces depends on the sector size. When number of firms rises, the size of the sector increases, leading to the expansion of the sector’s production capacity. More output produced requires more labor use. The relation of sector performance and employment can be understood via the productivity channel. In the production process, firms use their budgets for the hiring and purchase of inputs that are used to produce outputs. Good business performance results in more output generated from each dollar of budget. This implies higher productivity for inputs, and, according to the classical labor theory, higher labor productivity induces firms to demand for more labor. The role of institutional quality in employment is clear. Provision of government supports for sector development facilitates sector growth and business performance, leading the way to the increased employment.

Figure 1.

Framework for FDI-based employment model. Modified from Abor and Harvey (2008).

How FDI affects employment is well discussed in the literature. However, FDI is determined by various factors. First, in microeconomics theory, profits play an important role in creating incentives for business and entrepreneurs in a market economy. Profits send a signal for industry expansion when more firms are induced to enter, while losses send a signal for industry contraction when firms are leaving the market. Profitability is considered as a driving force for profit-seeking FDI. Second, from the traditional viewpoint, due to the advantages of cheap labor cost, FDI favors countries with an abundance of labor. However, rapid waves of new technological advances have reduced the labor content and increased the knowledge content of production (Pfeffermann and Madarassy (1992)). As multinational corporations have gradually shifted from low-cost and low-skilled labor-intensive industries towards more capital and knowledge intensive industries, the availability of a high-quality workforce in the host countries has become a decisive factor for FDI. Third, having knowledge about local business environments is essential for foreign firms. As Tan and Meyer (2011) argued, when the perceptions of local institutions are weak, potential foreign investors may rely on incumbent foreign firms in the domestic markets to judge the prevalent business environment. A larger number of FDI firms in a given location indicates a good business environment and thus increased likelihood that foreign investors will enter. Foreign industrial agglomeration acts as an FDI determinant factor.

3.2. Regression Model

Based on the literature and theoretical framework presented in Section 2 and Section 3.1, we have constructed an empirical model of employment. As suggested by Arellano and Bond (1991), the lagged dependent variable is included as a regressor in the model to account for both short-term and long-term autoregressive effects of employment. The regression equation is written as below:

where subscript i stands for province, and t denotes time (in years).

Employment (EMP): This variable is measured as the natural logarithm of the number of employees. The number of employees is the total number of workers enterprises employ and pay wages or salaries (data from the General Statistics Office of Vietnam).

Firm agglomeration (FAG): This variable is used as a proxy for the sector size. The variable is calculated as the natural logarithm of enterprise density, which is the ratio of the total number of enterprises to the total population. The density of enterprises displays the number of enterprises per 1000 people (data from the General Statistics Office of Vietnam).

Capital resource productivity (CRP): This variable is used as a proxy for the sector performance, which measures how much output that each unit of capital resources can generate. The variable is calculated by taking the natural logarithm of the ratio of sector’s output and its capital resources. The most precise data for the sector’s output is total net turnover, defined as the amount of money businesses earn from the sale of goods and services, investment property, and other revenue minus deductions (taxes, trade discounts, sales discounts, and goods sales returns) during the reporting period. Capital resources are the entire capital formed from equity and liabilities of the enterprises (data from the General Statistics Office of Vietnam).

Sector development support (GOS): This variable is used as a proxy for institutional quality. The variable is measured as the index of private sector development services, a measure of provincial services for private sector trade promotion, provision of regulatory information to firms, business partner matchmaking, and technological services for firms. The index values vary from 0.00 to 1.00, and a higher score means higher support provided for sector development (data from Vietnam Chamber of Commerce and Industry—VCCI and USAID).

FDI intensity (FDI): this variable presents the relative size of FDI in the entire sector. We measure this variable by calculating the ratio of FDI capital resources and total capital resources. As Huang (2001) argued, the absolute size of foreign capital does not show the position of FDI in a country. Instead, the ratio of foreign capital and total capital stock displays the FDI position. The higher the FDI intensity, the more FDI in the sector (data from the General Statistics Office of Vietnam).

There are two types of industrial agglomeration, which are domestic and foreign firms. As Dũng et al. (2018) argued, the nature of the two types of industrial agglomeration is different. Following the work by Dao and Ngo (2022), we focus on the employment creation effect of the interaction of FDI on these two types of industrial agglomeration.

FDI * FFAG: This variable indicates the joint effect of FDI intensity and foreign industrial agglomeration. The foreign industrial agglomeration is measured as the natural logarithm of the number of foreign enterprises per 1000 inhabitants (data from the General Statistics Office of Vietnam).

FDI * DFAG: This variable indicates the joint effect of FDI intensity and domestic industrial agglomeration. The natural logarithm of the number of domestic enterprises per 1000 people is used to calculate the domestic industrial agglomeration (data from the General Statistics Office of Vietnam).

FDI determinant variables

Profitability (PRF): This variable is the profit rate, which is calculated as the ratio of total profit before taxes to total capital resources. Total profit before taxes is the amount of money earned by a company from its business, financial, and other activities. The profit rate represents the amount of profit made per unit of capital resources (data from the General Statistics Office of Vietnam).

Quality of labor (LBQ): A proxy for quality of labor is the labor training index, which indicates the initiatives taken by provincial authorities to support local employees’ development of their skills and knowledge in order to satisfy the employment needs of businesses. The index has a maximum value of 1.00, and a higher value means higher efforts provided for local labor training (data from Vietnam Chamber of Commerce and Industry—VCCI and USAID data).

Foreign industrial agglomeration (FFAG): This variable is measured as the natural logarithm of the number of foreign enterprises per 1000 inhabitants (data from the General Statistics Office of Vietnam). The detailed information on variables used in the models is presented in Table S1.

3.3. Model Validation

Since FDI is affected by other factors, there is a potential endogeneity problem in the model. An instrumental variable two-stage least-squares fixed-effect model is chosen for estimation. The estimated results are valid and accepted when the model passes the two tests, which are the endogeneity test and the overidentification test of all instruments.

3.4. Data

The study aims to investigate the impact of FDI on employment growth in the formal economic sector using province-level data from 63 cities/provinces in Vietnam. We selected Vietnam as a case study for at least two main reasons. Firstly, Vietnam’s economic growth rate is among the fastest in the world, and particularly the country also has plans to become a developed, high-income country by 2050 (The Government of Vietnam (2022)). This creates a great and urgent need to shift workers from the informal sector, which has low productivity, to the formal sector, which has higher productivity. Secondly, Vietnam’s economy is closely linked to the contributions of foreign direct investment (FDI) enterprises during its rapid development over the past two decades. Currently, the FDI sector generates an average of nearly 20.0% of the country’s GDP, employs nearly 5 million workers, and produces 42% of the total profit of the business sector BBT (2023). This study encompasses the years 2006 through 2020. The chosen study period is primarily determined by the availability of data. All registered local and foreign businesses engaged in the production of products and services compose the formal economic sector. There are both state-owned and private domestic enterprises. The kind of ownership is determined by the national or local government’s registered capital contribution. State-owned firms have a government share greater than 50%, whereas non-state enterprises have a government share less than 50%. Foreign firms comprise 100% foreign ownership and partnerships with domestic investors. Data are derived from several surveys on business performance released by the General Statistics Office of Vietnam and the Provincial Competitiveness Index (PCI), which was produced jointly by the Vietnam Chamber of Commerce and Industry (VCCI) and USAID.

4. Results and Discussion

Table 2 provides the regression results. As can be seen in this table, starting with the persistent behavior of the lag effect, the estimated coefficient for the lag of employment is positive and statistically significant (β = 0.75, p-value < 0.01). This value implies that 1% growth in employment in the previous year will translate to an increase of 0.75% employment growth in this year.

Table 2.

Effect of FDI on employment in the formal economic sector in Vietnam.

There is a positive relation between sector size and employment growth with a positive effect on employment of firm agglomeration (β = 0.16, p-value < 0.01). The impact of firm agglomeration on employment is twofold. The direct effect is straightforward. As the size of the sector increases, the expansion of production results in larger employment. While the direct effect of sector size on employment is clear, the indirect effect works through the impact on firm productivity. When more firms are located in a given geographical area, each firm can gain the benefit of external economies of scale—the unit cost of production in a firm declines as the scale of production by all firms increases. This gain arises through input sharing, market pooling, and knowledge spillovers. This idea was originally initiated in the work of Marshall (1890) and supported in various empirical studies (Tan and Meyer 2011; Bouncken and Kraus 2013; Gabriele et al. 2013). Increases in firms’ productivity foster output growth, which in turn raises the level of employment.

Capital resource productivity has a positive effect on employment (β = 0.05, p-value < 0.1). In the production process, capital resources are used to hire and purchase various types of inputs to produce output. A higher capital resource productivity means each unit of capital resources can generate more output or the use of all inputs is more effective and efficient. Among them is labor input. An increase in productivity of labor input leads to higher profits for firms and induces them to employ more labor.

Sector development support positively affects employment (β = 0.06, p-value < 0.05). The government’s sector development assistance includes a variety of business support services. Private sector trade promotion initiatives and business partner matching help companies find new business development prospects. The sector’s output expands, and so does the demand for labor. Through the creation of business parks and industrial zones, local governments help to form cluster industries. Industrial zones and parks serve as a pool to attract a large number of specialized workers. In addition, when local governments assist private firms in acquiring and using new technologies, they indirectly stimulate the level of investment in the business sector as firms invest in new technologies. Increases in the stock of physical capital and level of technologies raise labor productivity, which in turn encourages firms to provide more jobs for skilled workers.

There is a strong positive effect of FDI intensity on employment generation in the sector (β = 1.97, p-value < 0.01). The degree of FDI intensity represents the relative proportion of FDI capital resources and, consequently, the position of FDI companies in the overall sector. The greater the FDI intensity, the greater the presence of FDI firms in the sector, which has a positive influence on the industry’s employment growth. This finding provides robust evidence supporting the view of the existence of a positive relation between FDI and employment growth in the host countries (Abor and Harvey 2008; Jayaraman and Singh 2007; Nunnenkamp and Bremont 2007; Karlsson et al. 2009). Our finding is, however, contrary to Nguyen et al. (2020), who claimed a negative impact of FDI on employment in Vietnam. In their argument, the ratio of net M&A to greenfield investments is moderate, and foreign investors, when buying Vietnamese firms, cut a large number of personnel. We would argue that it may not work this way. By using more advanced technologies and exercising superior managerial skills, foreign firms are more productive than domestic firms. They would enjoy higher labor productivity and thus demand more labor than their domestic counterparts. Relatively large foreign firms have better access to financing, wider contacts, and knowledge of world markets, leading to a larger scale of production and a higher demand for labor. Evidently, in Vietnam, the majority of the FDI sector’s output is for exports. According to the General Statistic Office of Vietnam, the volume of FDI exported goods grew at an average annual rate of 17.5% in the period from 2006 to 2020, making the share of the FDI export in the total export value of the country increase dramatically, from 58% in 2006 to more than 72.3% in 2020.

The coefficients on the interaction terms of FDI intensity and industrial agglomeration are statistically significant. The interaction of FDI intensity and foreign industrial agglomeration shows a positive effect on employment (β = 0.44, p-value < 0.01), whereas the joint effect of FDI intensity and domestic industrial agglomeration is negative (β = −0.59, p-value < 0.01). A plausible interpretation for this is that foreign firms may create business spillovers to domestic firms. Through the backward linkages that foreign firms establish with domestic firms, output expansion in foreign firms requires more input from domestic firms and thus increases the business opportunity for domestic firms, raising their employment level. A higher FDI intensity interacting with more foreign firms results in a larger business spillover and thus positively impacts employment growth. Unlike foreign firms, a larger density of domestic firms means higher competition among them for the business created by foreign firms. High competition would induce domestic firms to spend more resources to lobby. The loss of output due to the wasted resources gives way to the loss of employment opportunities. Thus, the joint effect of FDI intensity and the density of domestic enterprises on employment is negative. This is in line with the work of Dao and Ngo (2022), who found a positive effect of the interaction of FDI and foreign industrial agglomeration on output growth, while the growth effect of the interaction of FDI and domestic industrial agglomeration is negative.

Finally, regarding FDI determinants, foreign firms are more attracted to the formal economic sector when they can earn higher profits (β = 0.002, p-value < 0.01) and are supplied by the local workforce with higher labor quality (β = 0.035, p-value < 0.05). A larger proportion of incumbent foreign firms in the sector sends the signal of a good prevalent business environment (β = 0.02, p-value < 0.01), which attracts business from potential foreign investors in the sector.

The impact mechanism of FDI on the formal sector’s employment can be further explained using mindspongeconomics (Vuong 2023; Khuc 2022) and the SM3D knowledge management system (Vuong et al. 2022; Nguyen et al. 2023). This mechanism is a long process of workers’ learning and decision-making associated with core values and information from the living environment. To be specific, workers are typically motivated by economic benefit, one of the most important core values of the workers’ decision-making mechanism (Khuc 2022). If the compensation offered by FDI firms is higher, workers are more likely to apply for FDI jobs. Because FDI firms require their employees to have a certain level of skills and training, and because they frequently have a highly disciplined and professional working environment/process, they help transform and improve workforce quality from workers’ mindsets to capacity associated with knowledge, skills, and attitude. In light of the culture tower (Khuc 2021), it is FDI that helps nurture and facilitate industrial culture, which refers to the high level of perceptions, practices, and creativity. It is noted that this culture gradually formed through disciplined and professional working processes over a sufficient period of time (Vuong et al. 2022). When FDI companies enter a country, they bring with them their own industrial culture. This can help to gradually raise the standards of industrial culture in the country in the long run.

5. Further Analysis

In the previous section, it is evident that FDI is an employment growth-enhancing factor in the formal economic sector. In this section, we try to explain how FDI can play this role. FDI being the driving force for employment creation, two implications need to follow. First, FDI enterprises should be more capable of creating jobs than domestic enterprises. Second, the FDI sector ought to create a beneficial effect on employment in the domestic sector. When FDI capital resources rise, they not only encourage the foreign companies to offer more jobs but also the local companies to do the same, which leads to an increase in employment in the entire sector. To check for the robustness of these hypotheses, the domestic and the FDI sectors are treated separately in the study. Each sector’s capacity to create jobs may be calculated as the percentage increase in jobs corresponding to a percentage increase in the sector’s capital resources. The formula for this measurement is called employment elasticity, which is

where is the elasticity of employment with respect to the capital resources, K is the size of the capital resources, and L is the number of jobs. According to the employment elasticity formula, a 1% increase in capital resources will result in an % rise in jobs. The sector that has a better capacity to create jobs has a higher elasticity value. Moreover, the employment of one sector is included in the employment function of another sector to account for the potential for intersectoral employment spillovers (i.e., the impact each sector has on the employment of another sector). This idea originated from Feder (1982), who examined how exports affect economic growth. The employment functions for two sectors are assumed to take the form:

where and are the number of employees and the amount of capital resources available in the domestic sector, respectively, and and are the number of employees and the amount of capital resources available in the FDI sector, respectively.

The growth equations for the two sectors are derived by using the natural logarithm on both sides of the employment function as follows:

These equations demonstrate that each sector’s employment growth is influenced by the expansion of that sector’s capital resources and the development of employment in other sectors. and indicate the employment elasticity of capital resources in the domestic sector and the FDI sector, respectively. and indicate the employment spillover effect that each sector has on another. A positive sign of implies a complementary effect in which the growth of employment in one sector would foster an increase in employment of another sector. In the opposite manner, a negative sign of implies a substitution effect in which the growth of employment in one sector would crowd out employment in another sector.

The two simultaneous equations are constructed as follows based on Equations (5) and (6):

where subscript i stands for province and t stands for time (in years). To account for the lag effect’s persistent behavior, the dependent variables’ lags are used as regressors in the model. We illustrate variables in Equations (7) and (8) below.

- Domestic sector’s employment (): the natural logarithm of the domestic sector’s employment. The available data for employment in the formal domestic sector are the number of employees in this sector.

- FDI sector’s employment (): the natural logarithm of the FDI sector’s employment. The available data for employment in the formal domestic sector are the number of employees in this sector.

- Domestic sector’s capital resources (): the natural logarithm of the domestic sector’s capital resources.

- FDI sector’s capital resources (): the natural logarithm of the FDI sector’s capital resources.

We used the two simultaneous equations to further examine the impacts of FDI on employment in the formal economic sector. Data from the General Statistics Office of Vietnam are also used in this model. Since the independent variable in one equation is the dependent variable in another equation, the model has an endogeneity issue. As a result, undertaking the estimate for the two concurrent regression equations using the GMM and the three-stage least-squares approach is advised.

Table 3 presents two key results of the regression model. First, employment elasticity with respect to capital resources in the foreign sectors (β = 0.161, p-value < 0.01) is higher than that in the domestic sector (β = 0.034, p-value < 0.01). This means that a 1% increase in capital resources leads to a 0.161% increase in employment in the foreign sector, while the number is only 0.034% in the domestic sector. This indicates that foreign enterprises are more capable of creating jobs than domestic enterprises. This finding is in line with several studies in the literature. Lipsey et al. (2010) claimed that foreign manufacturing firms experienced faster employment growth than domestic manufacturing firms in Indonesia. Studying manufacturing firms in sub-Saharan African countries, Foster-McGregor et al. (2013) also found evidence that foreign firms employ more workers than domestic firms. One possible interpretation for this is that foreign enterprises are more productive than their domestic counterparts. As a result, labor productivity in foreign enterprises is higher than in domestic firms, which leads to a higher demand for labor.

Table 3.

Subsector employment creation capability and employment spillover.

Second, with a positive coefficient value (β = 0.006, p-value < 0.01), a positive employment spillover effect exists from the FDI sector to the domestic sector. The expansion in employment in the FDI sector induces more employment creation in the domestic sector. This implies that the FDI sector creates business opportunities for the domestic sector, especially the supporting industries that supply inputs for foreign firms. However, the magnitude of the spillover effect is quite small. This confirms the finding of Jenkins (2006), who studied the impact of FDI on the employment level in Vietnam. As the author argued, the linkages between foreign and domestic firms are weak, and imports provide the majority of foreign firms’ inputs, so foreign firms create few business opportunities, and the spillover effect is minimal. The difference in technological level between domestic and international businesses is one of the causes of the weak linkages. Most Vietnamese businesses are small to medium-sized and have a low degree of technology. The demands placed on modern and sophisticated technology items by each detail and component are difficult for local small and medium-sized businesses to satisfy (Thuy 2020). The low absorptive capacity of Vietnamese businesses also serves as a barrier to the supply of positive externalities (Nguyen and Diez 2019). The variables that contribute to the inadequate absorptive capacity include low R&D expenditure, fewer innovation incentives, a shortage of qualified labor, limited use of quality management systems, and a resistance to change in mindset. In contrast, a negative employment creation spillover effect from the domestic sector to the FDI sector (β = −0.048, p-value < 0.05) is found. This result shows that domestic enterprises do not help increase but, on the contrary, compete with FDI enterprises in attracting labor.

Based on the empirical results and in-depth discussion presented above, our study offers many contributions. First, our study contributes to advancing understanding of the employment model associated with FDI. Specifically, our work concretely presents clear evidence on the impacts of FDI on the formal sector’s employment and offers in-depth justifications of how FDI facilitates the workforce transformation in Vietnam in the light of mindspongeconomics, the SM3D knowledge management theory, and the culture tower. It is noted that FDI associated with economic trade liberalization is the key to development for all participating nations. Foreign direct investment can drive economic growth because it can help improve investment capital, human quality, and technology, which ultimately help increase productivity. It should be noted that Vietnam’s goal is to develop high-quality human resources to meet its economic development needs. By 2050, the country plans to be a developed, high-income nation. In this regard, the study not only confirms and advances the FDI-based economic growth model in the past and present but also helps shape the economic development pathway for Vietnam in years to come. Second, the study proves the usefulness of the advanced econometric method coupled with a set of knowledge management theories for analyzing panel data. In other words, our study complements the advanced method for understanding the effects of FDI on employment and the economy using a dynamic panel regression model coupled with a GMM estimator. This is very helpful for economists as the topic may be further investigated by extending and/or updating the data over time.

6. Conclusions and Policy Implications

This study aims to investigate the impact of FDI on employment growth in the formal economic sector in Vietnam. Using the instrumental variable two-stage least-squares fixed-effect estimation for a subnational dataset of 63 cities/provinces from 2006 to 2020, the study results in noticeable findings that make a valuable contribution to the knowledge of FDI and employment growth relation in developing countries.

First, the study shows a positive effect of FDI on employment growth in the formal economic sector in Vietnam. The contribution of FDI to employment growth mainly comes from the higher capability in jobs created by foreign firms compared to domestic firms. The employment elasticity in the foreign sector is found to be much higher than that in the domestic sector. This is because foreign enterprises are more productive than their domestic counterparts. On the one hand, this result suggests that the government should be ready to provide favorable measures to further attract FDI inflows. On the other hand, the finding suggests that more efforts are needed to train local workers and new skills to meet the employment requirements of FDI enterprises. In this regard, it is paramount to grasp the trends in industries of FDI in the future in order to have time in advance to equip local workers with the needed occupational skills.

Second, the study shows a limited employment spillover effect created by FDI due to the weak linkages and large disparities between foreign and domestic enterprises. In light of mindspongeconomics, the culture tower and the SM3D knowledge management systems, this result suggests that domestic firms should be prepared to change their attitudes, be ready to implement new managerial skills and management systems, and be committed to constantly updating their technological level. More resources should be allocated toward activities that foster innovation and creativity. This disciplined process should be maintained for the long term, which would help improve the quality of domestic supporting industries to meet the requirement of foreign enterprises.

Third, the study found a positive effect of firm agglomeration, capital resource productivity, and government support for sector development on employment generation. This calls for the improvement in policies aiming at the development of the formal economic sector covering a wide range of factors, including favorable tax structures, the creation of a conducive business environment, and effective labor training.

Finally, our study indicates and highlights the crucial role of the government (i.e., development state) in assisting both domestic and FDI companies. These supports should include but not be limited to the provision of information for business partner matchmaking, the acquisition and use of new technologies and tax incentives, and formal institutions (law, regulations, and public services), especially investment taxes. Policies should also be considered that encourage foreign enterprises to use domestically produced inputs instead of imported ones. As the world enters a period of volatility, uncertainty, complexity, and ambiguity (VUCA), and the Vietnam economy is highly vulnerable to changes due to its high degree of economic openness, this study poses the need to improve employment policies for overcoming and/or mitigating potential shocks in the future.

We fully acknowledge that the study has some limitations. The first limitation is that the study has not yet taken into account the more specific employment created by FDI, which may limit the understanding of which sectors are most or least affected by FDI. Next, FDI is a driving force for economic growth, and Vietnam is pursuing a green and circular economy (Nguyen and Nguyen 2019), yet green FDI has not been examined in the study. The final limitation is the limited connection of our study’s findings to other research, which should be further improved in future work.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/economies11110266/s1, Table S1: Summary of variables used in model (1); Table S2: Summary of variables used in model (7,8).

Author Contributions

Conceptualization, T.B.T.D.; methodology, T.B.T.D.; software, T.B.T.D.; validation, V.Q.K. and M.C.D.; formal analysis, V.Q.K. and M.C.D.; data curation, T.L.C.; writing—original draft preparation, T.B.T.D., V.Q.K., M.C.D. and T.L.C.; writing—review and editing, T.B.T.D., V.Q.K., M.C.D. and T.L.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

All data used in the study are available from the author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abor, Joshua, and Simon K. Harvey. 2008. Foreign Direct Investment and Employment: Host Country Experience. Macroeconomics and Finance in Emerging Market Economies 1: 213–25. [Google Scholar] [CrossRef]

- Akcoraoglu, Alpaslan, and Senay Acikgoz. 2011. Employment, International Trade and Foreign Direct Investment: Time Series Evidence from Turkey. International Research Journal of Finance and Economics 76: 89–101. [Google Scholar]

- Aktar, İsmail, Nedret Demirci, and Latif Öztürk. 2009. Can Unemployment Be Cured by Economic Growth and Foreign Direct Investment in TURKEY? International Research Journal of Finance and Economics 1: 203–11. [Google Scholar]

- Arellano, Manuel, and Stephen Bond. 1991. Some Test of Spesification for Data Panel: Monte Carlo Evidence and an Aplication of Employment Equations. Source: The Review of Economic Studies 58: 277–97. [Google Scholar]

- Azam, Muhammad, Saleem Khan, Zalina Binti Zainal, Namasivayam Karuppiah, and Farah Khan. 2015. Foreign Direct Investment and Human Capital: Evidence from Developing Countries. Investment Management and Financial Innovations 12: 155–62. [Google Scholar]

- Balsvik, Ragnhild. 2011. Is Labor Mobility a Channel for Spillovers from Multinationals? Evidence from Norwegian Manufacturing. Review of Economics and Statistics 93: 285–97. [Google Scholar] [CrossRef]

- BBT Vietnam’s Foreign Direct Investment Powers Economy into the Future. 2023. Available online: https://special.vietnamplus.vn/2023/02/10/vietnams-foreign-direct-investment-powers-economy-into-the-future/#:~:text=Data from the Ministry of,GDP of the whole economy (accessed on 11 October 2023).

- Bhaumik, Sumon Kumar, Saul Estrin, and Klaus E. Meyer. 2007. Determinants of Employment Growth at MNEs: Evidence from Egypt, India, South Africa and Vietnam. Comparative Economic Studies 49: 61–80. [Google Scholar] [CrossRef]

- Blomström, Magnus, and Ari Kokko. 1998. Multinational Corporations and Spillovers. Journal of Economic Surveys 12: 247–77. [Google Scholar] [CrossRef]

- Bouncken, Ricarda B., and Sascha Kraus. 2013. Innovation in Knowledge-Intensive Industries: The Double-Edged Sword of Coopetition. Journal of Business Research 66: 2060–70. [Google Scholar] [CrossRef]

- Dao, Thi Bich Thuy, and Vi Dung Ngo. 2022. Does Foreign Direct Investment Stimulate the Output Growth of the Formal Economic Sector in Vietnam: A Subnational-Level Analysis. International Journal of Emerging Markets. ahead-of-print. [Google Scholar] [CrossRef]

- Dũng, Ngô Vi, Đào Thị Bích Thủy, and Nguyễn Ngọc Thắng. 2018. Economic and non-economic determinants of FDI inflows in Vietnam: A sub-national analysis. Post-Communist Economies 30: 693–712. [Google Scholar] [CrossRef]

- Feder, Gershon. 1982. On Exports and Economic Growth. Journal of Development Economics 12: 59–73. [Google Scholar] [CrossRef]

- Foster-McGregor, Neil, Anders Isaksson, and Florian Kaulich. 2013. Foreign Ownership and Labour Markets in Sub-Saharan African Firms. Working Paper 99. Wien: The Vienna Institute for International Economic Studies. [Google Scholar]

- Gabriele, Roberto, Diego Giuliani, Marco Corsino, and Giuseppe Espa. 2013. Reassessing the Spatial Determinants of the Growth of Italian SMEs. DEM Discussion Papers. Department of Economics and Management. Available online: https://ideas.repec.org/p/trn/utwpem/2013-06.html (accessed on 10 October 2023).

- Gutiérrez-Portilla, Paula, Adolfo Maza, and José Villaverde. 2019. A Spatial Approach to the FDI-Growth Nexus in Spain: Dealing with the Headquarters Effect. International Business Review 28: 101597. [Google Scholar] [CrossRef]

- Huang, Yasheng. 2001. The Benefits of FDI in a Transitional Economy: The Case of China. Paris: OECD. [Google Scholar]

- Javorcik, Beata Smarzynska. 2004. Does Foreign Direct Investment Increase the Productivity of Domestic Firms? In Search of Spillovers through Backward Linkages. American Economic Review 94: 605–27. [Google Scholar] [CrossRef]

- Jayaraman, Tiru K., and Baljeet Singh. 2007. Impact of Foreign Direct Investment on Employment in Pacific Island Countries: An Empirical Study of Fiji. Economia Internazionale/International Economics 60: 57–74. [Google Scholar]

- Jenkins, Rhys. 2006. Globalization, FDI and Employment in Viet Nam. Transnational Corporations 15: 115–42. [Google Scholar]

- Karlsson, Sune, Nannan Lundin, Fredrik Sjöholm, and Ping He. 2009. Foreign Firms and Chinese Employment. World Economy 32: 178–201. [Google Scholar] [CrossRef]

- Khuc, Van Quy. 2021. Culture Tower. Available online: https://ssrn.com/abstract=4559667 (accessed on 10 October 2023).

- Khuc, Van Quy. 2022. Mindspongeconomics. Available online: https://ssrn.com/abstract=4453917 (accessed on 10 October 2023).

- La, Viet-Phuong, Thanh-Hang Pham, Manh-Toan Ho, Minh-Hoang Nguyen, Khanh-Linh P. Nguyen, Thu-Trang Vuong, Hong-Kong T. Nguyen, Trung Tran, Quy Khuc, Manh-Tung Ho, and et al. 2020. Policy Response, Social Media and Science Journalism for the Sustainability of the Public Health System amid the COVID-19 Outbreak: The Vietnam Lessons. Sustainability 12: 27. [Google Scholar] [CrossRef]

- Li, Chunding, Chuantian He, and Chuangwei Lin. 2018. Economic Impacts of the Possible China–US Trade War. Emerging Markets Finance and Trade 54: 1557–77. [Google Scholar] [CrossRef]

- Lipsey, Robert E., Fredrik Sjöholm, and Jing Sun. 2010. Foreign Ownership and Employment Growth in Indonesian Manufacturing. NBER Working Paper Series 21: 23. [Google Scholar]

- Marshall, Alfred. 1890. Principles of Economics. London: Macmillan. [Google Scholar]

- Massoud, Nada. 2008. Assessing the Employment Effect of FDI Inflows to Egypt: Does the Mode of Entry Matter? Paper presented at International Conference on “The Unemployment Crisis in the Arab Countries”, Cairo, Egypt, March 17–18. [Google Scholar]

- Ministry of Planning and Investment of Vietnam Report on 30 Years of Attracting Foreign Investment. 2018. Available online: https://www1.mpi.gov.vn/en/Pages/tinbai.aspx?idTin=42201&idcm=133 (accessed on 10 October 2023).

- Moran, Theodore H. 2001. Parental Supervision: The New Paradigm for Foreign Direct Investment and Development. Washington, DC: Institute for International Economics. Available online: https://www.piie.com/bookstore/parental-supervision-new-paradigm-foreign-direct-investment-and-development (accessed on 10 October 2023).

- Nguyen, Thi Xuan Thu, and Javier Revilla Diez. 2019. Less than Expected—The Minor Role of Foreign Firms in Upgrading Domestic Suppliers—The Case of Vietnam. Research Policy 48: 1573–85. [Google Scholar] [CrossRef]

- Nguyen, Nguyen Hoanh, and Trong Hanh Nguyen. 2019. Implementing Circular Economy: International Experience and Policy Implications for Vietnam. VNU Journal of Science Economics and Business 35: 68–81. [Google Scholar] [CrossRef]

- Nguyen, Thai Quang, Tran Thi Kim Lien, Pham Phuong Linh, and Nguyen Thanh Duc. 2020. Impacts of Foreign Direct Investment Inflows on Employment in Vietnam. Institutions and Economies 12: 37–62. [Google Scholar]

- Nguyen, Minh-Hoang, Ruining Jin, Giang Hoang, Minh-Hieu Thi Nguyen, Phuong-Loan Nguyen, Tam-Tri Le, Viet-Phuong La, and Quan-Hoang Vuong. 2023. Examining Contributors to Vietnamese High School Students’ Digital Creativity under the Serendipity-3D Knowledge Management Framework. Thinking Skills and Creativity 49: 101350. [Google Scholar] [CrossRef]

- Nordin, Sabariah. 2017. Does FDI Influence Employment in Malaysia? Journal of Advanced Research in Business and Management Studies 8: 85–94. [Google Scholar]

- Nunnenkamp, Peter, and José Eduardo Alatorre Bremont. 2007. FDI in Mexico: An Empirical Assessment of Employment Effects. Working Paper. Kiel: Kiel Institute for the World Economy (IfW). [Google Scholar]

- Pack, Howard, and Kamal Saggi. 2001. Vertical Technology Transfer via International Outsourcing. Journal of Development Economics 65: 389–415. [Google Scholar] [CrossRef]

- Pfeffermann, Guy Pierre, and Andrea Madarassy. 1992. Trends in Private Investment in Developing Countries, 1993: Statistics for 1970-91. Washington, DC: World Bank, vol. 16, ISBN 0821313525. [Google Scholar]

- Saucedo, Eduardo, Teofilo Ozuna, and Hector Zamora. 2020. The Effect of FDI on Low and High-Skilled Employment and Wages in Mexico: A Study for the Manufacture and Service Sectors. Journal for Labour Market Research 54: 1–5. [Google Scholar] [CrossRef]

- Tan, Danchi, and Klaus Meyer. 2011. Country-of-Origin and Industry FDI Agglomeration of Foreign Investors in an Emerging Economy. Journal of International Business Studies 42: 98–114. [Google Scholar] [CrossRef]

- The Government of Vietnam. 2022. No. 138/NQ-CP: Resolution on National Master Planning for the Period of 2021–2030, with a Vision towards 2050. Available online: https://thuvienphapluat.vn/van-ban/EN/Xay-dung-Do-thi/Resolution-138-NQ-CP-2022-national-master-planning-for-the-period-of-2021-2030/544532/tieng-anh.aspx (accessed on 20 October 2023).

- Thuy, Dao Thi Bich. 2020. FDI and Employment Creation in the Enterprise Sector in Vietnam. VNU Journal of Science: Economics and Business 36: 81–91. [Google Scholar]

- UNCTAD. 1994. World Investment Report 1994: Transnational Corporations, Employment and the Workplace. New York and Geneva: United Nations. [Google Scholar]

- Vuong, Quan-Hoang. 2023. Mindsponge Theory. Berlin: De Gruyter. [Google Scholar]

- Vuong, Quan-Hoang, Tam-Tri Le, Viet-Phuong La, Huyen Thanh Thanh Nguyen, Manh-Toan Ho, Quy Van Khuc, and Minh-Hoang Nguyen. 2022. COVID-19 Vaccines Production and Societal Immunization under the Serendipity-3D Knowledge Management Theory and Conceptual Framework. Humanities and Social Sciences Communications 9: 22. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).