1. Introduction

Entrepreneurship has been widely recognised as a key driver of economic growth. A large body of literature confirms the positive role of entrepreneurship in the economic performance of countries, regions, and cities (

Ács et al. 2008;

Audretsch et al. 2015;

Naudé 2013). Therefore, understanding, measuring, and promoting entrepreneurship, have become major areas of interest for researchers and policymakers (

Audretsch 2012;

Müller 2016). In this regard, the literature recognises that entrepreneurship is a complex, multidimensional phenomenon whose success depends on a set of interrelated factors and actors in a place: an ecosystem. Essentially, the term entrepreneurial ecosystem (EE) refers to “...a set of interdependent actors and factors coordinated in such a way that they enable productive entrepreneurship within a particular territory” (

Stam 2015, p. 1765). Therefore, the concept of the entrepreneurial ecosystem is one of the most comprehensive ways to understand and foster entrepreneurship (

Autio et al. 2018) and the EE concept has been remarkably beneficial for scholars and policymakers as it has contributed to gaining a comprehensive understanding of how entrepreneurship is produced and can be sustained in a place. Moreover, the concept of EE has attracted much attention from both policy and research, which can be seen in the rapid increase in publications over the last ten years (

Cavallo et al. 2019;

Malecki 2018). However, despite the increasing knowledge in this field, most studies in EE focus primarily on western, world-leading entrepreneurial ecosystems in the European Union or the United States (

Audretsch 2019;

Stam 2015), while there is much less information about EE in developing economies (

Cao and Shi 2021) and particularly in the context of Latin America (

Álvarez and Grazzi 2018). It is now well established from a variety of studies that having a clear picture of the characteristics and performance of national-level and regional-level EEs is crucial for effective entrepreneurship policymaking (

Ács et al. 2014;

Cho et al. 2022;

Lafuente et al. 2021;

Szerb et al. 2013).

The type and the way that entrepreneurship materialises in the European Union or China is different from how entrepreneurship occurs in South America, or anywhere else. Therefore, investigating the specific nature of EE in developing economies, such as those in South America, is of great value for both researchers and policymakers.

Researchers suggest that the entrepreneurial dynamics depend on the country’s level of economic development (

Wennekers et al. 2005). More specifically,

Ács et al. (

2017) indicate that entrepreneurship is more prevalent in richer countries. According to the Human Development Index (HDI), which measures factors such as life expectancy, education, and standard of living, the most developed economies in South America are Chile, Uruguay, and Argentina. Therefore, this study aims to characterise the entrepreneurial ecosystems in these three countries at the national and regional (subnational) levels employing the available literature and data from the Global Entrepreneurship Index—GEI and The Index of Dynamic Entrepreneurship—IDE. The structure of the paper is as follows. The central questions in this study ask how supportive are the entrepreneurial ecosystems in Chile, Uruguay, and Argentina? What are the strengths and weaknesses of these ecosystems? The structure of the paper is as follows. First, the existing literature on entrepreneurship and entrepreneurial ecosystems is introduced. Second, the methodology of the two indices employed in this study is described in detail. Third, the main results for the three selected countries are presented. Fourth, the main findings are discussed. The final section presents the conclusions, limitations, and directions for future research.

2. Literature Review

2.1. Entrepreneurship and Entrepreneurial Ecosystems

Entrepreneurship has been recognised as a promising mechanism to generate entrepreneur-led local and national economic growth for decades (

Carree and Thurik 2010;

S. Wennekers and Thurik 1999). However, defining, measuring, and fostering entrepreneurship is not a straightforward process. Entrepreneurship is a complex phenomenon that emerges in different ways and shapes in every location. In this way, it can be observed that there are multiple definitions of the term entrepreneurship within the literature (

Eisenmann 2013;

Kobia and Sikalieh 2010). Taking a closer look at the literature, one can see that there is no general agreement about a common definition of entrepreneurship (

Ahmand and Seymour 2008;

Chowdhury et al. 2015;

Prince et al. 2021). In this context, the literature shows that researchers aiming to measure entrepreneurship have chosen an indicator according to how they define entrepreneurship. In this regard, it can be observed that researchers usually specify entrepreneurship in line with its productive nature or the quality or quantity type (see

Chowdhury et al. 2019;

Xie et al. 2021). On the one hand, entrepreneurship refers to quantity (Kirznerian) entrepreneurship, on the other hand, it also implies quality (Schumpeterian) entrepreneurship. Quality entrepreneurship encompasses high-growth-oriented, innovative businesses run by creative entrepreneurs, while quantity-based entrepreneurship refers to business formation and density (

Szerb et al. 2019). Furthermore, the publication of the influential work of

Shane (

2003) and

Spilling (

1996) fostered an interest in visualising entrepreneurship as a complex multidimensional phenomenon that results from the systemic combination of several interrelated factors and actors in a place, a system.

2.2. EEs Conceptualisation

Within the literature, there are several definitions for entrepreneurial ecosystems. However, the key concept to define EE is that entrepreneurship does not take place in a vacuum—a whole host of factors determine how easy (or difficult) it is to start up. In this line, it is also important to notice that efficient entrepreneurial ecosystems are said to produce entrepreneurship as an output (

Stam and van de Ven 2021). Building on the concept of entrepreneurial ecosystems, several conceptual frameworks and subsequent indexes aiming to diagnose the state and quantify the performance of entrepreneurial ecosystems at the national or regional level have been developed.

Table 1 provides a summary of the most well-known models according to the literature.

From the summary table above, we can see that there are several definitions of EE. Each of the definitions highlight a different decisive set of components needed to form an ecosystem. However, although differences in the number and type of ecosystem elements exist among the selected EE models, there appears to be some agreement about what is important for entrepreneurial ecosystems to function. These include people, a population with entrepreneurial attitudes, abilities, and aspirations coupled with a supportive set of policies and regulations, finance, culture, infrastructure, human capital, networks, educational systems, market, and innovation platforms.

2.3. Geographical Scope of the Study

South America is the fourth-largest continent with a total area of around 17.84 million km

2 divided between 12 countries. The size of the economies of South American countries is diverse. By 2021, Brazil was the biggest economy with a GDP of around 1.6 trillion USD and Paraguay was the smallest economy in the region with a GDP of around 39.50 billion USD. According to the United Nations’ country classifications 2021, these three countries are considered developing economies. However, according to the country classification by income, Argentina is an upper-middle-income economy (GNI per capita

$4096 to

$12,695) while Chile and Uruguay are high-income economies (GNI per capita

$12,695 or more) (

The World Bank 2022). As observed from

Table 2, Argentina has the biggest economy in terms of GDP among the selected countries. However, pre-pandemic data shows that Argentina experienced a steady contraction in its economy and considerably high annual inflation between 2016 and 2019 while Chilean and Uruguayan economies were growing in the same period of time. The COVID-19 pandemic has had a significant impact on economies around the world and so it affected Argentina, Chile, and Uruguay. Among the main impacts on these countries’ economies is a relatively higher rate of unemployment. In 2020, the unemployment rate in Argentina reached 11.5%, 10.9% in Chile, and 10.3% in Uruguay which implies a relatively high increase as compared to pre-pandemic unemployment rates.

3. Method

This study combines data from two well-known ecosystem measurement tools: The Global Entrepreneurship Index and the Index of Dynamic Entrepreneurship—IDE. In this way, by analysing the performance of EEs from two complementary perspectives, we aim to provide a comprehensive picture of national-level EEs in Argentina, Chile, and Uruguay. Each of these indices’ methodology is summarised in the following section.

3.1. The Global Entrepreneurship Index

The Global Entrepreneurship Index (GEI) has been designed based on the concept of National Systems of Entrepreneurship which refers to the “dynamic, institutionally embedded interaction between entrepreneurial attitudes, ability, and aspirations, by individuals, which drives the allocation of resources through the creation and operation of new ventures” (

Ács et al. 2014, p. 479). The GEI is a four-level composite indicator that consists of 28 variables, 14 pillars, 3 sub-indices, and 1 super index. The GEI recognises that entrepreneurship is a phenomenon driven by both individual-level entrepreneurial behaviour and contextual (e.g., physical, socio-economic, and political environment) factors. For this reason, the GEI employs individual and institutional data for variable calculation. The Entrepreneurial Attitudes (ATT) sub-index measures the perception of a country or region’s population about entrepreneurship. This sub-index shows the extent to which entrepreneurship is a socially accepted and desirable occupation. Entrepreneurial abilities (ABT) measure the capacity and skills of the entrepreneurs to start up and how the institutional context enables these start-up opportunities. Finally, entrepreneurial aspirations (ASP) capture the potential of entrepreneurs to innovate and grow and how the institutional context supports such high growth possibilities (

Ács et al. 2014).

The GEI has been recalculated for more than a decade for more than 130 countries. The GEI is the only available measurement that considers both the individual and institutional aspects of EE. Individual data for GEI calculations comes from the Global Entrepreneurship Monitor (GEM) Adult Population Survey. The GEM is a consortium of national country teams, generally involved with top academic institutions, that carries out continuous survey-based research on entrepreneurship and entrepreneurship ecosystems around the world. The GEM collects annual data through the Adult Population Survey (APS) which is a survey administered by GEM National Teams to a representative national sample of at least 2000 respondents. The APS looks at the population’s entrepreneurial behaviour and attitudes and it contains a large set of questions aiming to measure the characteristics, motivations, and ambitions of individuals starting businesses, as well as social attitudes towards entrepreneurship. As displayed in

Table 3, each of the GEI 14 pillars is calculated, including both individual data and institutional data from different sources.

3.2. The Index of Dynamic Entrepreneurship—IDE

The Index of Dynamic Entrepreneurship (IDE) is a composite index that measures the quality of the systemic conditions of a country to support dynamic entrepreneurship by evaluating the performance of the following 10 dimensions: social conditions, entrepreneurial human capital, culture, educational system, demand conditions, Science, Technology, and Innovation Platforms (STI) platforms, business structure, social capital, policies and regulations, and financing. The IDE is constructed following the recommendation from the Organisation for Economic Co-operation and Development (OECD) for constructing indexes. The IDE aims to capture the dynamic and innovative aspects of entrepreneurship, and to provide a comprehensive picture of the entrepreneurial ecosystem in an economy. It is designed to be a valuable tool for policymakers, researchers, and practitioners, who can use the results to identify areas for improvement and to make informed decisions about how to support and promote entrepreneurship. The IDE is typically constructed based on the normalisation of more than 40 variables obtained from recognised databases, official statistics, surveys, and expert assessments from the Gem National Experts Survey (NES) as presented in

Table 4. The GEM gathers relevant data that allows an interpretation of the characteristics of the entrepreneurial environment in a country through the GEM-NES survey. This survey is the largest and most comprehensive study of entrepreneurship in the world, collecting data from over 100 economies. The NES collects information about 12 entrepreneurship Framework Conditions (EFCs), which are relevant to entrepreneurship, from at least 36 experts in each of these aspects in each country using a self-administered questionnaire.

4. Results

4.1. Entrepreneurial Activity

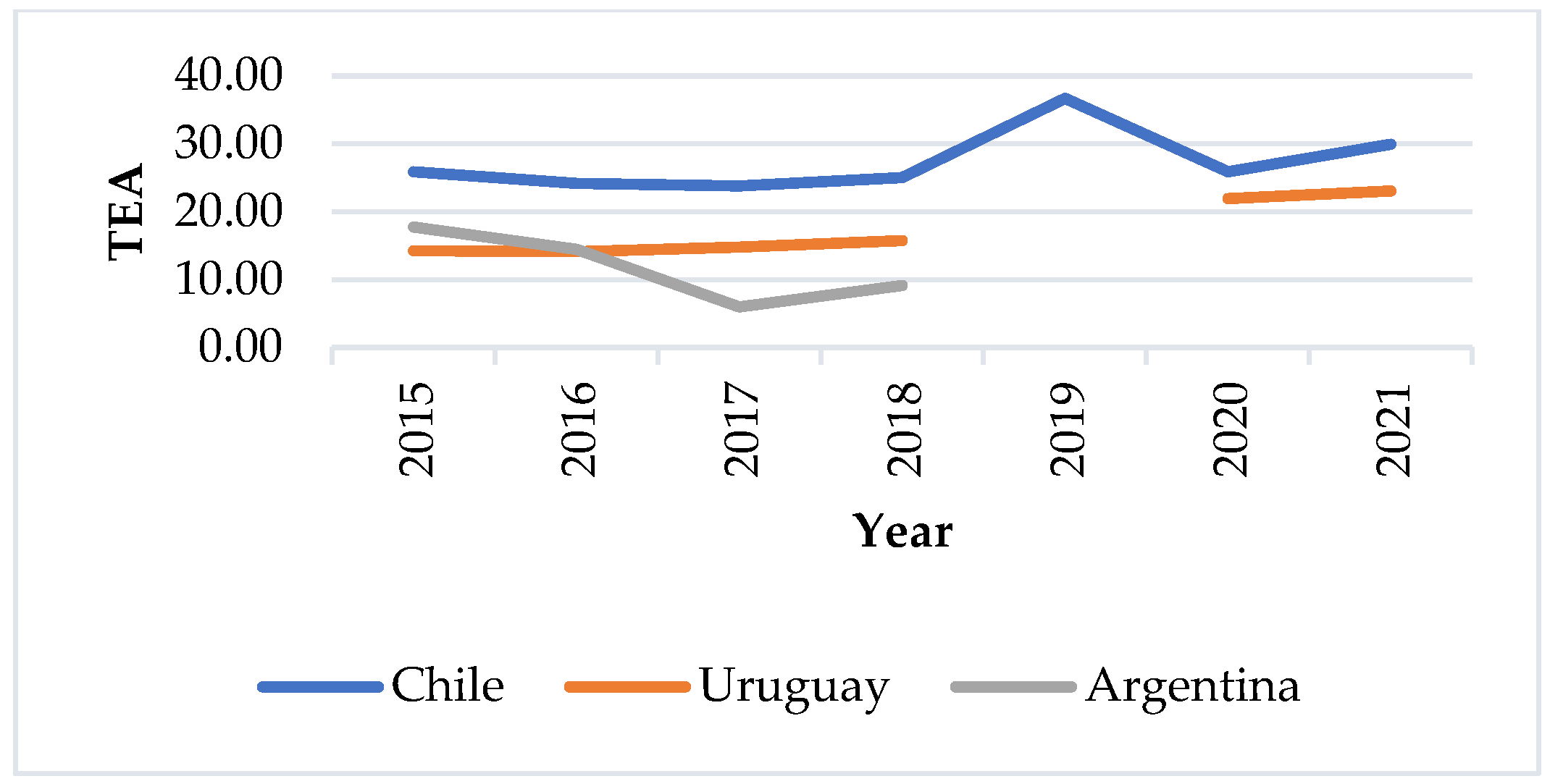

Total early-stage Entrepreneurial Activity (TEA) has been employed in this section to quantify the levels of entrepreneurial activity in Chile, Uruguay, and Argentina. TEA is defined as the percentage of the 18–64-year-old regional population who are either nascent entrepreneurs or an owner-manager of a new business (

GEM 2022). TEA accounts for every kind of entrepreneur in different production sectors, it includes self-employed people, creative, and imitative entrepreneurs. Scholars suggest that both, “everyday” and creative kinds of entrepreneurs are relevant for economic growth in developing economies. Therefore, TEA seems to be informative about entrepreneurial activity in the South American context, where all are developing countries.

Historically, developed countries such as the U.S., Switzerland, and Spain have shown levels of TEA between 5% and 20%. However, it is important to note that there are no high, low, or “optimal” TEA rates as this indicator only reflects the prevalence of entrepreneurship in a country. In this context, having a high quantity of entrepreneurial firms in a country is not a synonym for economic growth, job creation, or increased productivity (

Mueller 2007;

Nightingale and Coad 2014). As presented in

Figure 1, the rate of TEA has stayed historically high in Chile (over 24%) and reached a peak of around 36.7% in 2019. The observed rates of TEA in Uruguay reveal the existence of an increasing number of entrepreneurs in this economy going from 14.28% in 2015 to 23.06% in 2021. Argentina, on the other hand, shows a dramatic decrease in the rates of TEA since 2016. Yet, in 2018, 9.11% of the Argentinian 18–64-year-old regional population was either a nascent entrepreneur or owner-manager of a business.

4.2. National Entrepreneurial Ecosystems in Argentina, Chile, and Uruguay

4.2.1. The Global Entrepreneurship Index

As shown in

Figure 2, since 2014, Chile has remained the best-performing ecosystem as compared to Argentina and Uruguay. The score difference between Chile and Uruguay and Argentina is considerable as we can see that, historically, Chile’s average GEI scores are around 58 points while Argentina and Uruguay have historically stayed under 40 points. This shows that these two economies are not progressing towards catching up with Chile. Nevertheless, although Chile performs relatively well in the South American context, catching up with world-leading ecosystems such as the United States (which leads the world in entrepreneurship just ahead of Switzerland and Canada) is still a huge challenge for Chile.

A closer look at the GEI pillar level shows that overall, the profiles of the EEs in these three countries are “spiky” where some pillars perform at a good level while others significantly underperform (

Figure 3). Considering that a healthy ecosystem is a balanced one (

Ács et al. 2014), this type of configuration implies that several bottlenecks are a priority to address to improve the performance of the system. More specifically, we observe that Chile exhibits strengths in product innovation and risk acceptance while the Chilean ecosystem weaknesses are in process innovation and competition. Uruguay exhibits a distinct set of strengths and weaknesses. Uruguay shows strength in networking and technology absorption with its most important weaknesses in internationalisation and risk capital. As for Argentina, it exhibits particular strength in start-up skills and technology absorption. The Argentinian entrepreneurial ecosystem suffers from clear bottlenecks in risk acceptance and internationalisation.

4.2.2. The Index of Dynamic Entrepreneurship—IDE

The scores for the Index of Dynamic Entrepreneurship—IDE are calculated yearly for more than 40 economies globally. This data allows us to rank the participant countries based on the quality of their ecosystem and see the relative position of each economy (

Table 5). Globally, Chile ranks in the middle position (21 out of 40). In the context of South America, Chile is at the top with an IDE score of 34.45. Uruguay and Argentina with IDE scores of 30.9 and 30.07, respectively, remain in a “lower middle” position surpassed by Brazil but substantially over Colombia, Peru, and Ecuador. Importantly, what we can see from a global perspective is that although Chile, Uruguay, and Argentina perform relatively well in the South American region context, catching up with the top-performing ecosystems, such as the U.S. or Canada, remains a great challenge.

A closer view of the ten dimensions of the IDE (

Figure 4) shows that Chile exhibits strengths in policies and regulations and demand conditions while the Chilean ecosystems’ weaknesses are in STI platforms and business structure. Uruguay exhibits a similar set of strengths and weaknesses. Uruguay also shows strength in policies and regulations and demand conditions and its most important weaknesses in STI platforms. Argentina also exhibits an ecosystem with favourable policies and regulations and weak STI platforms.

4.3. Regional Entrepreneurial Ecosystems in Argentina, Chile, and Uruguay

National-level measurements of entrepreneurial ecosystems are informative and provide a clear perspective of entrepreneurship; however, there is a growing call for understanding entrepreneurship at the regional level due to the various regional forces influencing entrepreneurship (

Audretsch et al. 2012;

Del Monte et al. 2020;

Fritsch et al. 2021;

Fritsch and Storey 2014;

Szerb et al. 2015). High-quality research about regional, and sub-national entrepreneurship and entrepreneurial ecosystems in South American countries are scarce. Particularly, the field of entrepreneurship in non-central regions of emerging Latin American economies remains underdeveloped (

Villegas-Mateos 2020). However, some work published in local academic journals can be accessed, and it provides a general overview of the entrepreneurial characteristics of some regions within each country.

Although there are different approaches and definitions to sub-national regionalisation among South American countries, all countries have established two types of regions: the great natural, geographical regions and the smaller administrative sub-national units (provinces, departments, regions, or states). Great natural regions are composed of various smaller administrative units, namely, departments or provinces within a country. Great subnational regions are smaller than a country but bigger than the country’s administrative units; therefore, they are rather similar to the Nomenclature of Territorial Units for Statistics (NUTS 2) level regions of the EU classification. In this way, departments or provinces within a country are alike NUTS 3 level.

Argentina

Argentina is subdivided into 23 provinces and one autonomous city, Buenos Aires, which is the capital city. Argentina has five geographical regions. The Northwest (NOA) region is predominantly mountainous and includes five provinces. The Northeast (NEA) region includes four provinces, Cuyo Region four provinces, the Central region four provinces, and Patagonia six provinces. Argentinian Central Region is the most populated (64.5% of the country’s population), most educated, and less poor region. Argentine production is mainly concentrated in the Central region with a share of more than 70% of the country’s gross product.

4.4. Regional Entrepreneurship in Argentina

One of the most informative studies of regional entrepreneurship in Argentina is the Report for Cities for Entrepreneurship developed and published by PRODEM in 2018. This study employs the Index of Conditions for Entrepreneurship in Cities (ICEC-Prodem), supplemented with secondary information to characterise the entrepreneurial ecosystem in 25 Argentinian regions. They assessed cities’ performance in three main pillars: local entrepreneurial human capital, the space for opportunities (demand, IT availability, networks), and local policies that could promote or hinder entrepreneurship (social capital, finance availability, governmental regulations). The ICEC-Prodem indicator is a complex indicator built from 96 variables grouped into 28 sub-indices that belong to 9 dimensions of analysis.

The study reports that, overall, entrepreneurial human capital and financing are usually the most common limitations for Argentinian cities. These have been identified in most cases as the main opportunities for improvement. However, this reality is not the same in all cases. In addition, it coexists with very different realities in terms of social capital and institutional development. Regarding entrepreneurial human capital, there are different situations. For example, there are cities where there is some development of entrepreneurial education in higher-level institutions but not at the secondary level. In other cases, higher education institutions do not exist. In some cities, there are business role models, but they are not duly disseminated while in other cases there is an absence of business role models and unfavourable local culture at the same time. In this context, one of the recommendations is the use of existing assets and infrastructure to promote the development of entrepreneurial human capital. In places where educational infrastructure does not exist or is very limited, the feasibility of investing to build such assets or the possibility of establishing alliances with extra-local actors that help advance in this direction should be evaluated. It is also key to complement the usual focus on entrepreneurial projects to integrate young companies that include, for example, the children of entrepreneurs. This can potentially contribute to the preservation and renewal of existing family businesses in cities. Finally, it is recommended that each city must “scan” the existing actors and assets in the territorial environment and consider possibilities of working together with surrounding cities. An ecosystem is a pool of actors, activities, and resources that, hand in hand with institutions, rules, and incentives, give life to the functioning of the factors that affect the entrepreneurial process.

An important study of the EEs based on innovation in the city of Buenos Aires in 2019 shows that despite the unfavorable socio-political context of the country the development of entrepreneurship based on innovation in terms of federal public policy has not prevented the growth and consolidation of a vibrant and productive ecosystem. In this context, the influence and support of the local government of the Autonomous City of Buenos Aires have been a key articulator of the dynamics in the ecosystem. More specifically the authors highlight that Buenos Aires’ ecosystem is particularly strong in networking. The results from the Social Network Analysis identified at least 299 actors in the Buenos Aires ecosystem who actively interact with each other through 542 collaboration networks (

Tedesco et al. 2020a).

4.4.1. Chile

Chile is divided into 16 administrative regions grouped into three major regions: Norte (North, Great North), Zona Centro (Central zone), and Zona Sur (South zone). The North region is mainly a dry, arid, and semiarid region that includes five administrative regions. Zona Centro includes eight regions and is home to much of the Chilean population. This region includes the three largest metropolitan areas—Santiago, Valparaíso, and Concepción. The climate in Zona Centro is temperate, Mediterranean-type. The Southern Zone includes three administrative units, and it has the country’s most lakes. The Southernmost Zone covers all of Chilean Patagonia. This region is partly forested and partly grassy, where sheep farming has been established with some degree of success, but the greater part of this extreme southern territory is mountainous, cold, wet, and inhospitable.

4.4.2. Regional Entrepreneurship in Chile

Amorós et al. (

2013) provide one of the earliest studies exploring the features of the entrepreneurial framework conditions that support entrepreneurship in core and periphery regions in Chile. In their study, the authors collected information about the perception of the regional entrepreneurial framework conditions from 695 entrepreneurship experts from eight regions in Chile. The results showed gaps in terms of access to financing and better infrastructure among central and peripheral regions. Overall, the Santiago metropolitan zone enjoys relatively better conditions in terms of physical infrastructure, and thus, there is a need for more and better infrastructure in the peripheral regions to facilitate entrepreneurial activities. Along the same line, the work of

Villegas-Mateos (

2020) provides a similar study of the nature of Chilean central and non-central regional Entrepreneurial Ecosystems (EEs). Based on experts’ perceptions of Entrepreneurial Ecosystems (EEs) this study shows that, overall, the financial support and physical infrastructure conditions are perceived to be more favourable in central regions, whereas the general government policies and entrepreneurial education at primary and secondary levels are perceived to be better developed in non-central regions.

From a different perspective,

Oyarzo et al. (

2020) estimated the spatial distribution of business start-ups in Chile drawing on data about municipal business start-up rates. The authors have been able to show that the far south region concentrates on high start-up rates. These patterns have remained relatively constant over time (2005–2015) constituting an initial indication of persistence in business start-up rates. In the Northern region, the distribution of entrepreneurship is heterogeneous. While the municipalities of Iquique, Antofagasta, and Calama show high levels of entrepreneurship (darker areas), municipalities such as Putre, Colchane, Pica, and María Elena display the lowest rates of business start-ups. Central-southern Chile, where the Metropolitan Region, Valparaíso, Libertador Bernardo O’Higgins, and Maule Regions belong, has a concentration of municipalities with high rates of entrepreneurship in the Metropolitan Region while there are groups of municipalities with low rates in the Regions of Biobío and Araucanía, which are the least economically developed and more rural areas of the country.

4.4.3. Uruguay

Uruguay is a small country located in the Southern Cone region of South America. Its total land area is 176,215 km2. Uruguay is the most urbanised country in South America with over 96% of its population living in urban areas. The country has a high standard of living, with well-developed infrastructure and a strong economy, which has contributed to its high level of urbanisation. The country is divided into 19 administrative departments grouped into two major regions: Montevideo and Interior. Montevideo covers an area of 530 km2 (0.3% of the total national territory) and holds approximately 40% of the total population.

4.4.4. Regional Entrepreneurship in Uruguay

Calispa-Aguilar (

2022) provides a recent analysis of 10 sub-national level ecosystems within Colombia (5), Ecuador (3), and Uruguay (2). In the study, the author calculates a regional EE index employing an adaptation of the Global Entrepreneurship Index (GEI) methodology which was originally designed to measure EE at the national level. Interestingly, the author also calculated differentiated regional EEs scores for some of the regions’ urban and rural areas. In this way, this study characterised a total of 22 ecosystems: 10 general, 6 urban, and 6 rural regional ecosystems within these three selected countries. We found this study highly relevant because this is so far, the only study that measures regional ecosystems among South American countries employing the same metric. In this study, the author provides GEI scores for the Uruguayan regions of Montevideo and the Interior and the rural and urban areas of the Interior region separately.

According to the study, in 2018, in Uruguay, the Montevideo region was the best-performing region, while “Interior Rural” ranked in the lowest position. Montevideo’s best-performing pillar is technology absorption while its weakest pillars are internationalisation and risk capital. The Interior rural region’s strength is high opportunity perception while this region’s weaknesses are low-risk capital and low capacity for technology absorption and internationalisation. These findings show a great gap in terms of technology absorption capacity between Montevideo and the Interior region. The leading position of the Montevideo ecosystem has been already highlighted in the literature. For instance,

Tedesco et al. (

2020b) analysed the features of EE in Montevideo employing Social Network Analysis and found that the quality of networks is a key determinant of the quality of Montevideo’s ecosystem. Interestingly, the authors identified at least 198 actors in Montevideo’s ecosystem who actively interact with each other through 751 collaboration networks. Importantly, researchers agree on the essential role of the Uruguayan National Research and Innovation Agency (ANII) in providing effective public support to innovation in Uruguayan firms. There is important evidence that beneficiary firms of ANNII’s innovation promotion programs show a larger probability of successfully introducing new products and processes (

Bukstein et al. 2018;

Messina and Castro 2019).

5. Discussion

In sum, the GEI and the IDE scores presented here provide an overview of the national-level EEs in Argentina, Chile, and Uruguay from two perspectives. These two measurements corroborate that Chile is the most well-developed entrepreneurial ecosystem in South America. In this line,

Espinoza et al. (

2019) argue that this result is the outcome of the continuous implementation of public policies based on a systemic vision of the promotion of entrepreneurship. Several programs to consolidate start-ups were launched in 1997 in Chile leading to an increasing number of incubators, the establishment of new networks of angel investors, and corporate entrepreneurship promotion. Furthermore, these results are sound with practical evidence that shows that Chile has taken entrepreneurship development as a priority since 2012. High-impact measures such as strengthening the Chilean Production Development Corporation (in Spanish: Corporación de Fomento de la Producción) and launching great prominent start-up programs such as Capital Semilla (seed capital), Start-up Chile by CORFU or “PAR Chile Apoya Mujer” for supporting companies led by women have helped to position Chilean EE as one of the most well developed in South America.

Durán (

2022) corroborates the key role of the Chilean government in supporting an ideal business environment for Chilean and foreign start-ups. However, the author suggests that recent political instability, especially the discussion of the possibility of a new Constitution might influence the country’s future of entrepreneurship.

Similarly, Uruguay has a growing entrepreneurial ecosystem with several initiatives aimed at fostering entrepreneurship and innovation. The government has been supportive of the development of this ecosystem and has implemented policies to provide funding, mentorship, and other resources to entrepreneurs. Among the most important institutions that promote entrepreneurs in Uruguay are the National Research and Innovation Agency (ANII), The National Youth Institute (INJU), the Technological Laboratory of Uruguay (LATU), The Ministry of Social Development (MIDES), and several other regional institutions such as business chambers operating alongside all Uruguayan departments or the “Portal Uruguay emprendedor” initiative. In recent years, the country has seen a significant increase in the number of start-ups, particularly in the technology sector where there was an important increase in IT exports from Uruguay. In particular, the growth of the tech sector has been driven by several factors, including the country’s highly educated workforce and the availability of funding and mentorship opportunities (

American University’s Center for Latin American and Latino Studies 2022).

The indicators employed in this study show that the entrepreneurial ecosystem in Argentina underperforms compared to Uruguay and Chile. Despite having a large and well-educated population, the country has struggled with economic instability and high inflation, which have limited the growth of the entrepreneurial sector (

Blanke et al. 2022). However, in recent years, there has been a slight increase in the number of start-ups and entrepreneurial initiatives in the country (

Argentinian Ministry of Economy 2022). The government has taken steps to support the development of the ecosystem, such as providing funding for start-ups and promoting innovation. Among the most important government initiatives to strengthen Argentinian EEs are the “emprendimiento argentino” “fondo expansión” “fondo aceleración” or “PAC emprendedores” programs which provide funding to Scientific or Technological-Based Entrepreneurship and entrepreneurship with impact whose objective is to strengthen value chains and that contribute to the country’s productive development (

Argentinian Ministry of Economy 2023). The technology sector has been a particular area of growth in the entrepreneurial ecosystem, with the rise of fintech, e-commerce, and other tech-focused start-ups (

Alzahrani and Daim 2019;

Sánchez et al. 2020). Additionally, the country has a strong culture of innovation and entrepreneurship, which has encouraged many young people to start their businesses. In conclusion, while the entrepreneurial ecosystem in Argentina has faced challenges, it has shown a lot of promise and potential for growth in the future. The country’s supportive policies and resources for entrepreneurs, along with the growth of the technology sector and the country’s strong entrepreneurial culture, make it an attractive destination for entrepreneurs and investors alike.

The second section of this study focused on synthesising and discussing the available data on the regional (sub-national level) of these three selected countries. One of the most relevant findings in this regard was that while there are several studies and data about the national-level ecosystem conditions for these countries less literature and data are available about the regional-level features. This might imply a lack of a clear understanding of regional entrepreneurship at the regional level. From the collected literature we observe greater research interest in the regions where the capital cities are while less attention is paid to smaller less populated regions. Furthermore, findings from this section showed that regional EEs have their characteristics and performance. We observed that the literature on regional EEs identifies in more detail the aspects that affect entrepreneurship locally. Smaller locations, such as provinces or cities might require different policy solutions to foster entrepreneurship. While the country-level data evidence more general aspects that are important for entrepreneurship (such as political stability or taxation), regionally defined aspects such as local actors from the public and private sectors and the presence of local academic institutions might be more relevant for the success of particular locations (

Birollo 2022). Consequently, we assert that data from studies at the regional (subnational) level might be more informative for efficient entrepreneurship policy design than national-level data. Regional studies provide policymakers with specific insights on how to arrange the environmental conditions for individuals to start and grow a business in a determined location.

6. Conclusions

This study aimed to characterise the entrepreneurial ecosystems in the three most developed economies in South America: Chile, Uruguay, and Argentina, and find out how supportive the entrepreneurial ecosystems in these countries are. To do so, we employed the available data from well-known entrepreneurship databases and relevant literature about regional entrepreneurship. Together the results from the GEI and the IDE suggest that these three countries have a relatively supportive ecosystem for productive entrepreneurship, but Chile outstands.

A closer look at the GEI pillars showed that the characteristics of the ecosystems in these three countries have different configurations of strengths and weaknesses. Specifically, the Chilean ecosystem’s main strength is product innovation which implies the high capacity of entrepreneurs to develop new products and a conductive institutional environment for technology transfer. The greatest ecosystem bottleneck for Chile is on process innovation which indicates a low capacity for the adoption of new technologies among entrepreneurs and weak cooperation of scientific institutions with the business sector. As for Uruguay, the main system strength is networking due to the presence of strong entrepreneurs’ relationships (i.e., a high percentage of the population that knows a person who started a business) and the effect of a high-level population agglomeration due to the high level of urbanisation in Uruguay. The most severe bottleneck for the Uruguayan system is internationalisation, which suggests the lack of firms’ exporting capacity coupled with low economic complexity. In Argentina, the main system strength is on start-up skills meaning that the Argentinian population is highly able to perceive entrepreneurship opportunities and at the same time they have sufficient education level to start-up. However, such opportunities cannot successfully materialise due to the high fear of failure linked to the high perception of country risk. Therefore, risk acceptance stands as the main bottleneck of the Argentinian ecosystem.

According to the IDE, the configuration of the Chilean, Uruguayan, and Argentinian ecosystems are overall different, showing a unique set of weak and strong pillars for each case. However, interestingly, these three countries’ best-performing, and most constraining pillars are the same. These three countries have a highly supportive frame of policies and regulations that include policies for opening and closing companies, contractual security, tax burden, general entrepreneurial support policies, and specific programs for dynamic entrepreneurship support. This aspect is corroborated by current literature that highlights the key role of government initiatives focused on strengthening entrepreneurial ecosystems. By contrast, the most constraining dimension of the ecosystem for these countries is the limited science, technology, and innovation (STI) platform. Low-performing STI platforms denote an overall insufficient spending in R&D, low incidence of researchers, restricted Science and Technology production, and weak university-company relations.

The analysis of ecosystems undertaken here adds to a growing body of literature on entrepreneurial ecosystems in developing economies. One of the strengths of this study is that it represents a comprehensive examination of both the national and regional level ecosystems within each of the selected countries. The insights presented in this study may be of assistance to researchers interested in understanding what the conditions are that foster and prevent entrepreneurship in Chile, Uruguay, and Argentina and which are the specific features of entrepreneurial ecosystems in these economies. Moreover, this information can also be used to develop targeted interventions aimed at designing context-sensitive entrepreneurship policy. In terms of future work, it would be interesting to repeat the research described here using a systematic literature review methodology to obtain more comprehensive, up-to-date literature on this research topic. Moreover, this study was limited to the empirical data provided by two sources (GEI and IDE), and therefore, the results and interpretations are within the conceptual scope of these indices’ methodology. Future research could employ other types of measurement tools to assess the status of EEs in these countries from a different perspective.

Author Contributions

Conceptualization, E.C., M.C.A., C.S.A., E.P.S., M.M.B., E.G.C., and J.C.M.; methodology, E.C., M.C.A.; formal analysis, E.C., M.C.A., C.S.A., E.P.S., M.M.B., E.G.C., and J.C.M.; investigation, E.C., M.C.A., C.S.A., E.P.S., M.M.B., E.G.C., and J.C.M.; resources, E.C., M.C.A., C.S.A., E.P.S., M.M.B., E.G.C., and J.C.M.; writing—original draft preparation, E.C., M.C.A.; writing—review and editing, E.C., M.C.A., C.S.A., E.P.S., M.M.B., E.G.C., and J.C.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ács, Zoltan, Sameeksha Desai, and Jolanda Hessels. 2008. Entrepreneurship, economic development and institutions. Small Business Economics 31: 219–34. [Google Scholar] [CrossRef] [Green Version]

- Ács, Zoltan, Erkko Autio, and László Szerb. 2014. National Systems of Entrepreneurship: Measurement issues and policy implications. Research Policy 43: 476–94. [Google Scholar] [CrossRef]

- Ács, Zoltan, László Szerb, and Erkko Autio. 2017. The Global Entrepreneurship Index. In Global Entrepreneurship and Development Index 2016. Washington, DC: Springer, pp. 19–37. [Google Scholar]

- Ács, Zoltan, László Szerb, Esteban Lafuente, and Ainsley Lloyd. 2018. The global entrepreneurship and development index. In Global Entrepreneurship and Development Index 2018. London: Springer International Publishing, pp. 21–37. [Google Scholar]

- Ács, Zoltan, László Szerb, Esteban Lafuente, and Gábor Márkus. 2019. The Global Entrepreneurship Index 2019. Washington, DC: The Global Entrepreneurship and Development Institute. [Google Scholar]

- Ahmand, Nadim, and Richard Seymour. 2008. Defining Entrepreneurial Activity: Definitions Supporting Frameworks for Data Collection. OECD Statistics Working Paper. Paris: OECD. [Google Scholar]

- Álvarez, Roberto, and Matteo Grazzi. 2018. Innovation and entrepreneurship in Latin America: What do we know? what would we like to know? Estudios de Economia 45: 157–71. [Google Scholar] [CrossRef] [Green Version]

- Alzahrani, Saeed, and Tugrul U. Daim. 2019. Analysis of the Cryptocurrency Adoption Decision: Literature Review. In Proceedings of the 2019 Portland International Conference on Management of Engineering and Technology (PICMET), Portland, OR, USA, August 25–29. [Google Scholar]

- American University’s Center for Latin American and Latino Studies. 2022. The Impact of United States Engagement with Uruguay: 2000–2020. In CLALS Working Paper Series No. 34 (Issue February). Washington, DC: American University’s Center for Latin American and Latino Studies. [Google Scholar] [CrossRef]

- Amorós, José Ernesto, Christian Felzensztein, and Eli Gimmon. 2013. Entrepreneurial opportunities in peripheral versus core regions in Chile. Small Business Economics 40: 119–39. [Google Scholar] [CrossRef]

- Argentinian Ministry of Economy. 2022. Más de 1,6 Millones de Empresas ya se Incorporaron al Registro MiPyME; Indistria y Desarrollo Productivo. Available online: https://www.argentina.gob.ar/noticias/mas-de-16-millones-de-empresas-ya-se-incorporaron-al-registro-mipyme (accessed on 10 January 2023).

- Argentinian Ministry of Economy. 2023. Ecosistema Emprendedor; Industria y Desarrollo Productivo. Available online: https://www.argentina.gob.ar/produccion/ecosistema-emprendedor (accessed on 10 January 2023).

- Audretsch, David. 2012. Entrepreneurship research. Management Decision 50: 755–64. [Google Scholar] [CrossRef]

- Audretsch, David B. 2019. Have we oversold the Silicon Valley model of entrepreneurship? Small Business Economics 56: 849–56. [Google Scholar] [CrossRef] [Green Version]

- Audretsch, David B., Oliver Falck, Maryann P. Feldman, and Stephan Heblich. 2012. Local entrepreneurship in context. Regional Studies 46: 379–89. [Google Scholar] [CrossRef]

- Audretsch, David, Maksim Belitski, and Sameeksha Desai. 2015. Entrepreneurship and economic development in cities. Annals of Regional Science 55: 33–60. [Google Scholar] [CrossRef]

- Autio, Erkko, László Szerb, Eva Komlosi, and Monika Tiszberger. 2018. The European Index of Digital Entrepreneurship Systems. Luxembourg: Publications Office of the European Union. [Google Scholar] [CrossRef]

- Birollo, Gustavo. 2022. Entrepreneurship in Argentina. In Entrepreneurship in South America. Edited by Léo-Paul Dana, Christian Keen and Veland Ramadani. Cham: Springer, pp. 21–34. [Google Scholar]

- Blanke, Svenja, Kristina Birke, and Niklas Kutschka. 2022. How Argentina and Scandinavian Countries Are Dealing with Inflation. Available online: https://www.ips-journal.eu/topics/economy-and-ecology/how-argentina-and-scandinavian-countries-are-dealing-with-inflation-6133/ (accessed on 10 January 2023).

- Bukstein, Daniel, Elisa Hernández, and Ximena Usher. 2018. Impacto de los instrumentos de promoción de la innovación orientada al sector productivo: El caso de ANII en Uruguay. SciELO Chile 45: 271–99. [Google Scholar]

- Calispa-Aguilar, Evelyn. 2022. Regional systems of entrepreneurship in 2017–2018: An empirical study in selected regions of South America. Regional Statistics 12: 51–76. [Google Scholar] [CrossRef]

- Cao, Zhe, and Xianwei Shi. 2021. A systematic literature review of entrepreneurial ecosystems in advanced and emerging economies. Small Business Economics 57: 75–110. [Google Scholar] [CrossRef]

- Carree, Martin, and Roy Thurik. 2010. The Impact of Entrepreneurship on Economic Growth. In Handbook of Entrepreneurship Research, 5th ed. Edited by Zoltan Acs and David Audretsch. New York: Springer, pp. 557–94. [Google Scholar]

- Cavallo, Angelo, Antonio Ghezzi, and Raffaello Balocco. 2019. Entrepreneurial ecosystem research: Present debates and future directions. International Entrepreneurship and Management Journal 15: 1291–321. [Google Scholar] [CrossRef] [Green Version]

- Cho, Daniel Sunghwan, Paul Ryan, and Giulio Buciuni. 2022. Evolutionary entrepreneurial ecosystems: A research pathway. Small Business Economics 58: 1865–83. [Google Scholar] [CrossRef]

- Chowdhury, Farzana, David B. Audretsch, and Maksim Belitski. 2019. Institutions and Entrepreneurship Quality. Entrepreneurship: Theory and Practice 43: 51–81. [Google Scholar] [CrossRef] [Green Version]

- Chowdhury, Farzana, Siri Terjesen, and David Audretsch. 2015. Varieties of entrepreneurship: Institutional drivers across entrepreneurial activity and country. European Journal of Law and Economics 40: 121–48. [Google Scholar] [CrossRef]

- Del Monte, Alfredo, Sara Moccia, and Luca Pennacchio. 2020. Regional entrepreneurship and innovation: Historical roots and the impact on the growth of regions. Small Business Economics 58: 451–73. [Google Scholar] [CrossRef]

- Duran, Patricio. 2022. Entrepreneurship in Chile. In Entrepreneurship in South America. Edited by L. P. Dana, C. Keen and V. Ramadani. Cham: Springer, pp. 69–84. [Google Scholar] [CrossRef]

- Eisenmann, Thomas. 2013. Entrepreneurship: A Working Definition. Available online: https://hbr.org/2013/01/what-is-entrepreneurship (accessed on 10 January 2023).

- Espinoza, Claudia, Cristian Mardones, Katia Sáez, Pablo Catalán, and Cristian Mardones. 2019. Entrepreneurship and regional dynamics: The case of Chile. Entrepreneurship and Regional Development 9: 755–67. [Google Scholar] [CrossRef]

- Fritsch, Michael, Korneliusz Pylak, and Michael Wyrwich. 2021. Historical roots of entrepreneurship in different regional contexts—The case of Poland. Small Business Economics 58: 397–412. [Google Scholar] [CrossRef]

- Fritsch, Michael, and David J. Storey. 2014. Entrepreneurship in a Regional Context: Historical Roots, Recent Developments and Future Challenges. Regional Studies 48: 939–54. [Google Scholar] [CrossRef]

- GEM. 2022. Total Early-Stage Entrepreneurial Activity (TEA) Rate. Definitions. Available online: https://www.gemconsortium.org/wiki/1154 (accessed on 2 January 2023).

- GEM. 2023. Entrepreneurial Behaviour and Attitudes Data. Entrepreneurial Behaviour and Attitudes. Available online: https://www.gemconsortium.org/data (accessed on 2 January 2023).

- Isenberg, Daniel J. 2011. The Entrepreneurship Ecosystem Strategy as a New Paradigm for Economic Policy: Principles for Cultivating Entrepreneurships. Presentation at the Institute of International and European Affairs 1: 1–13. [Google Scholar]

- Kantis, Hugo, Juan Federico, and Sabrina Ibarra-García. 2021. IDE Index of Dynamic Entrepreneurship 2021. Available online: https://www.uruguayemprendedor.uy/uploads/recurso/e811c746b59fbd33536d5f16de0612de8a6f3302.pdf (accessed on 10 January 2023).

- Kobia, Margaret, and Damary Sikalieh. 2010. Towards a search for the meaning of entrepreneurship. Journal of European Industrial Training 34: 110–27. [Google Scholar] [CrossRef]

- Lafuente, Esteban, Zoltán J. Ács, and László Szerb. 2021. A composite indicator analysis for optimizing entrepreneurial ecosystems. Research Policy 51: 104379. [Google Scholar] [CrossRef]

- Malecki, Edward J. 2018. Entrepreneurship and entrepreneurial ecosystems. Geography Compass 12: 1–21. [Google Scholar] [CrossRef] [Green Version]

- Messina, María del Carmen, and Ricardo Castro. 2019. Ecosistema emprendedor Uruguayo—Situación Actual. In Emprendimiento e Innovación: Oportunidades para Todos. Edited by Ezequiel Herruzo-Gómez, Brizeida Hernández-Sánchez, Giuseppina Cardella and José Sánchez-García. Madrid: Dykinson. [Google Scholar]

- Mueller, Pamela. 2007. Exploiting entrepreneurial opportunities: The impact of entrepreneurship on growth. Small Business Economics 28: 355–62. [Google Scholar] [CrossRef]

- Müller, Sabine. 2016. A progress review of entrepreneurship and regional development: What are the remaining gaps? European Planning Studies 24: 1133–1158. [Google Scholar] [CrossRef]

- Naudé, Wim. 2013. Entrepreneurship and Economic Development: Theory, Evidence and Policy. IZA Discussion Paper 7507: 1–20. [Google Scholar] [CrossRef]

- Nightingale, Paul, and Alex Coad. 2014. Muppets and gazelles: Political and methodological biases in entrepreneurship research. Industrial and Corporate Change 23: 113–43. [Google Scholar] [CrossRef] [Green Version]

- Oyarzo, Mauricio, Gianni Romaní, Miguel Atienza, and Marcelo Lufín. 2020. Spatio-temporal dynamics in municipal rates of business start-ups in Chile. Entrepreneurship and Regional Development 32: 677–705. [Google Scholar] [CrossRef]

- Prince, Sam, Stephen Chapman, and Peter Cassey. 2021. The definition of entrepreneurship: Is it less complex than we think? International Journal of Entrepreneurial Behaviour and Research 27: 26–47. [Google Scholar] [CrossRef]

- Prodem. 2020. IDE Methodological Annex; PRODEM. Available online: https://prodem.ungs.edu.ar/wp-content/uploads/2020/11/anexo-2014_actualizaci%C3%B3n.pdf (accessed on 2 January 2023).

- Sánchez, Marisa, Pamela Zalba, and Juan Zoppis. 2020. Evolution of Fintechs in Argentina. Dimensión Empresarial 18: 1–13. [Google Scholar] [CrossRef]

- Shane, Scott. 2003. A general theory of entrepreneurship: The individual-opportunity nexus. In A General Theory Of Entrepreneurship: The Individual-Opportunity Nexus. Cheltenham: Edward Elgar Publishing. [Google Scholar] [CrossRef]

- Spilling, Olav. 1996. The entrepreneurial system: On entrepreneurship in the context of a mega-event. Journal of Business Research 36: 91–103. [Google Scholar] [CrossRef]

- Stam, Erik. 2015. Entrepreneurial Ecosystems and Regional Policy: A Sympathetic Critique. European Planning Studies 23: 1759–69. [Google Scholar] [CrossRef] [Green Version]

- Stam, Erik, and Andrew van de Ven. 2021. Entrepreneurial ecosystem elements. Small Business Economics 56: 809–32. [Google Scholar] [CrossRef] [Green Version]

- Stangler, Dane, and Jordan Bell-Masterson. 2015. Measuring Entrepreneurial Ecosystem. CSSRN 2580336, March 16. [Google Scholar]

- Szerb, László, Zoltan J. Acs, Erkko Autio, Raquel Ortega-Argilés, and Éva Komlósi. 2013. REDI: The Regional Entrepreneurship and Development Index—Measuring Regional Entrepreneurship Final Report (Issue November). Available online: https://op.europa.eu/en/publication-detail/-/publication/afc2a25c-d650-4be0-85cc-621ac9bab53c/language-en (accessed on 3 January 2023).

- Szerb, László, Zoltan J. Ács, Raquel Ortega-Argilles, and Eva Komlósi. 2015. The Entrepreneurial Ecosystem: The Regional Entrepreneurship and Development Index. SSRN Electronic Journal 2012: 1–30. [Google Scholar] [CrossRef]

- Szerb, László, Esteban Lafuente, K. Horváth, and Balázs Páger. 2019. The relevance of quantity and quality entrepreneurship for regional performance: The moderating role of the entrepreneurial ecosystem. Regional Studies 53: 1308–20. [Google Scholar] [CrossRef] [Green Version]

- Tedesco, M., T. Serrano, V. Sánchez, F. Ramos, and E. Hoffecker. 2020a. Ecosistemas de Emprendimiento Basados en Innovación en Iberoamérica: Resumen Ejecutivo Ciudad de Autónoma de Buenos Aires. Cambridge: MIT D-Lab. [Google Scholar]

- Tedesco, M., T. Serrano, V. Sánchez, F. Ramos, and E. Hoffecker. 2020b. Ecosistemas de Emprendimiento Basados en Innovación en Iberoamérica: Resumen Ejecutivo Ciudad de Montevideo. Cambridge: MIT D-Lab. [Google Scholar]

- The Global Entrepreneurship and Development Institute. 2023. Datasets. Global Entrepreneurship Research Data. Available online: https://thegedi.org/datasets/ (accessed on 3 January 2023).

- The World Bank. 2022. World Bank Country and Lending Groups. Washington, DC: The World Bank. [Google Scholar]

- The World Bank. 2023. World Bank Open Data. Available online: https://data.worldbank.org/ (accessed on 3 January 2023).

- Villegas-Mateos, Allan. 2020. Regional entrepreneurial ecosystems in Chile: Comparative lessons. Journal of Entrepreneurship in Emerging Economies 13: 39–63. [Google Scholar] [CrossRef]

- Wennekers, Sander, and Roy Thurik. 1999. Wennekers and Thurik—Linking entrepreneurship and economic growth. Small Business Economics 13: 27–55. [Google Scholar] [CrossRef]

- Wennekers, Sander, André Van Wennekers, Roy Thurik, and Paul Reynolds. 2005. Nascent entrepreneurship and the level of economic development. Small Business Economics 24: 293–309. [Google Scholar] [CrossRef] [Green Version]

- Xie, Zhimin, Xia Wang, Lingmin Xie, and Kaifeng Duan. 2021. Entrepreneurial ecosystem and the quality and quantity of regional entrepreneurship: A configurational approach. Journal of Business Research 128: 499–509. [Google Scholar] [CrossRef]

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).