Exports- and Imports-Led Growth: Evidence from a Time Series Analysis, Case of Jordan

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data

3.2. Methodology

4. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Durbin–Watson | Jarque–Bera Normality Test | ARCH | |||

|---|---|---|---|---|---|

| Model | χ2 | p | F | p | |

| 1.8519 | 6.07 | 0.0481 | 0.10 | 0.7507 | |

| 1.9159 | 9.00 | 0.0111 | 0.96 | 0.3326 | |

| 1.8759 | 1.69 | 0.4287 | 0.02 | 0.8920 | |

| 1.9940 | 3.07 | 0.2157 | 0.39 | 0.5367 | |

| 1 | More Trade for More Jobs Identifying the Employment Potential of Jordan’s Exports, International Labour Organization, Amman Office, Jordan, 2019. |

| 2 | Department of Statistics Interactive Database: External Trade Functions 1994–2021, by Kind of Trade, Unit, Commodity Groups and Time. Detailed information is also available in Jordan’s Trade and Investment Information System (JTIIS), which is hosted on the DOS website. |

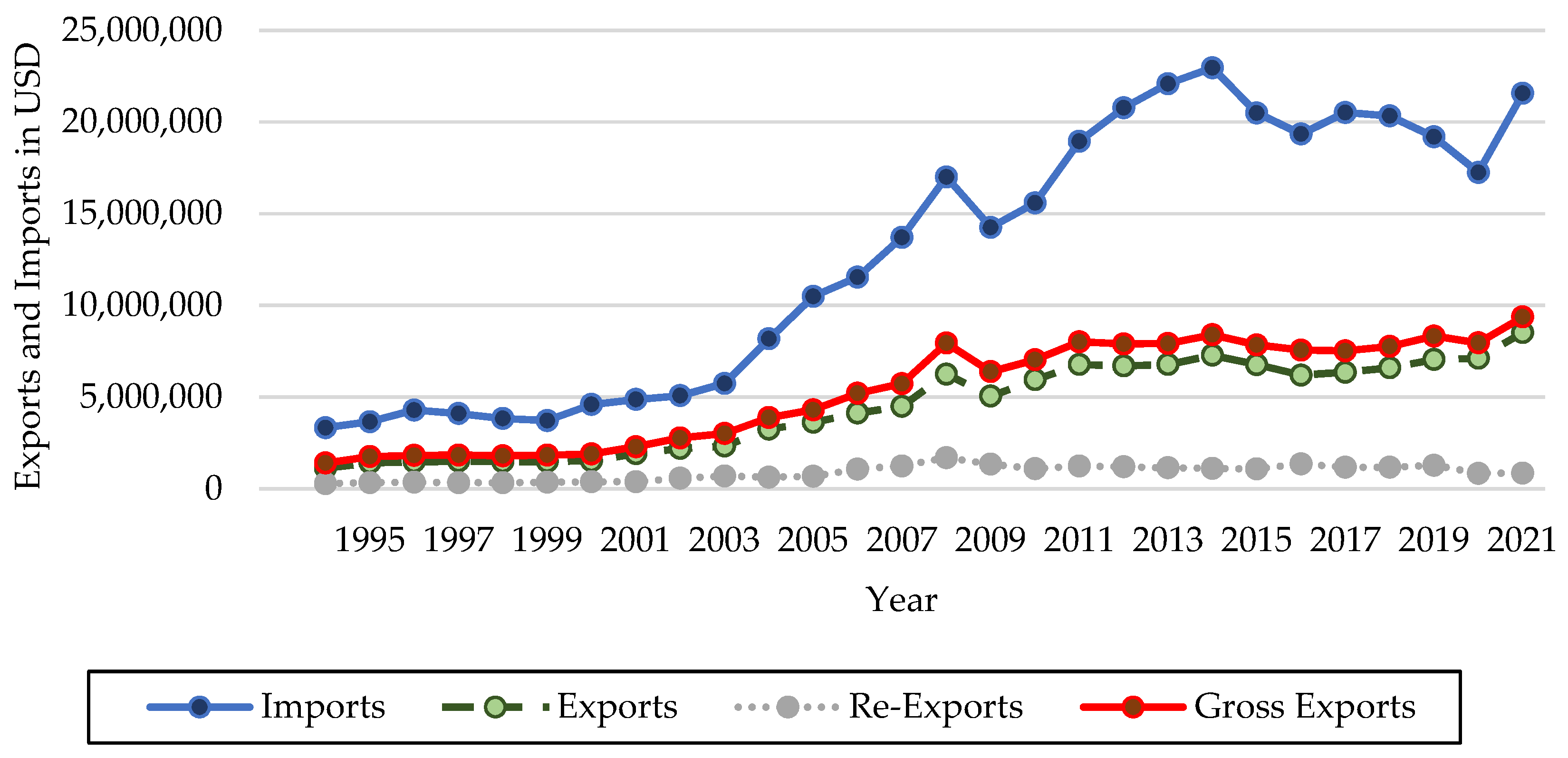

| 3 | Gross Exports is the sum or Exports and Re-exports. The data are compiled in broad conformity with international practice and in accordance with definitions recommended by the United Nations for foreign trade statistics, specifically in accordance with the International Merchandise Trade Statistics. |

| 4 | (6.643 − 5.639)/5.639 × 100. |

| 5 | A Roadmap for Investment Promotion and Export Diversification: The Case of Jordan. Center for International Development at Harvard University (CID) Faculty—Working Paper Series: 374 (Hausmann et al. 2019). |

| 6 | Report by Mojahed Elsagheer from the Jordanian Ministry of Planning and International Cooperation, “Energy Situation in Jordan”, July 2013. |

| 7 | All exports and imports values are in USD. |

| 8 | World Bank list of economies, URL: https://data.worldbank.org/?locations=JO-XT | World Food Programme (WFP) Jordan Country Brief Published in May 2022 (accessed on 16 January 2023). |

| 9 | Population, total—Jordan. The World Bank Data, URL: https://data.worldbank.org/indicator/SP.POP.TOTL?locations=JO. |

| 10 | Ministry of Energy and Mineral Resources—Performance of Jordanian Mining Sector During 2014–2018, published in 2020. |

| 11 | The Observatory of Economic Complexity (OEC), Historical exports data (accessed on 14 December 2022). |

| 12 | Jordan—Country Commercial Guide, Market Overview by the International Trade Administration (ITA), December 2022. |

| 13 | Jordan’s Product Space, Part On, January 2017—The Jordan Strategy Forum (JSF). |

| 14 | Jordan and the WTO, URL: https://www.wto.org/english/thewto_e/countries_e/jordan_e.htm (accessed on 10 December 2022). |

| 15 | Jordan Free Trade Agreement, United States Trade Representative (USTR). URL: https://ustr.gov/trade-agreements/free-trade-agreements/jordan-fta (accessed on 9 December 2022). |

| 16 | The Jordanian Ministry of Industry, Trade and Supply—Foreign Trade Policy Directorate. URL: https://www.mit.gov.jo/EN/ListDetails/Departments/44/11 (accessed on 9 December 2022). |

| 17 | European Research Executive Agency “REA”: EU-Jordan Association Agreement—URL: https://ec.europa.eu/chafea/agri/en/content/eu-jordan-association-agreement (accessed on 9 December 2022). |

| 18 | The Jordan Time—Climate change to hit impoverished Jordanians the hardest, streamlining funding process vital to build resilience. By Mohammad Ghazal—September 2022. |

| 19 | Manufacturing Sector—Jordan’s Economic Vision Roadmap. The Jordan Strategy Forum (JSF) 2021. |

| 20 | World Bank Data—Exports and Imports of goods and services (% of GDP). |

| 21 | The World Bank—Stronger Open Trade Policies Enable Economic Growth for All 2018. URL: https://www.worldbank.org/en/results/2018/04/03/stronger-open-trade-policies-enables-economic-growth-for-all#:~:text=Countries%20that%20are%20open%20to,more%20affordable%20goods%20and%20services (accessed on 9 December 2022). |

| 22 | Output divided by the weighted geometric average of both labor and capital input. |

| 23 | Representing the relationship between input factors and the output. Knowing that the factors of production are land, labor, capital, and entrepreneurship. A New Class of Production Function Model and Its Application. Published by De Gruyter in 2016, Journal of Systems Science and Information. |

| 24 | OECD: Organisation for Economic Co-operation and Development. |

| 25 | BRICS: Brazil, Russia, India, China, and South Africa. |

References

- Abedini, Javad. 2008. The Greater Arab Free Trade Area (GAFTA): An Estimation of Its Trade Effects. Journal of Economic Integration 23: 848–72. [Google Scholar] [CrossRef]

- Abu Shihab, Ruba, Thikraiat Soufan, and Shatha Abdul-Khaliq. 2014. The Causal Relationship between Exports and Economic Growth in Jordan. Global Journal of Management and Business: (B) Economic & Commerce 14: 17–22. Available online: https://www.zuj.edu.jo/wp-content/staff-research/economic/dr.Thikraiat-Soufan/1.pdf (accessed on 1 January 2023).

- Ahmad, Jaleel, and Andy C. C. Kwan. 1991. Causality between exports and economic growth: Empirical evidence from Africa. Economics Letters 37: 243–48. Available online: https://www.sciencedirect.com/science/article/abs/pii/016517659190218A (accessed on 1 January 2023).

- Ahmad, Jaleel, and Somchai Harnhirun. 1995. Unit roots and cointegration in estimating causality between exports and economic growth: Empirical evidence from the ASEAN countries. Economics Letters 49: 329–34. Available online: https://www.sciencedirect.com/science/article/abs/pii/0165176595006789 (accessed on 2 January 2023).

- Al-Yousif, Yousif Khalifa. 1997. Exports and economic growth: Some empirical evidence from the Arab Gulf countries. Applied Economics 29: 693–97. [Google Scholar] [CrossRef]

- Arteaga, Julio César, Mónica Liseth Cardozo, and Márcia Jucá T. Diniz. 2020. Exports to China and economic growth in Latin America, unequal effects within the region. International Economics 164: 1–17. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2005. Exports, Economic Growth and Causality in Korea. Applied Economics Letters 12: 693–96. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2006. Export-led growth and the Japanese economy: Evidence from VAR and directed acyclic graphs. Applied Economics 38: 593–602. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2007. Causality between exports, imports, and economic growth: Evidence from transition economies. Economics Letters 94: 389–95. [Google Scholar] [CrossRef]

- Awokuse, Titus O. 2008. Trade openness and economic growth: Is growth export-led or import-led? Applied Economics 40: 161–73. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, and Claire Economidou. 2009. Export led growth vs. growth led exports: LDCs experience. The Journal of Developing Areas 42: 179–212. Available online: https://muse.jhu.edu/article/253430 (accessed on 9 December 2022). [CrossRef]

- Bahmani-Oskooee, Mohsen, and Maharouf Oyolola. 2007. Export growth and output growth: An application of bounds testing approach. Journal of Economics and Finance 31: 1–11. Available online: https://link.springer.com/article/10.1007/BF02751507 (accessed on 9 December 2022). [CrossRef]

- Balassa, Bela. 1978. Exports and Economic Growth: Further Evidence. Journal of Development Economics 5: 181–89. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Christian Lundblad. 2011. Financial Openness and Productivity. World Development 39: 1–19. [Google Scholar] [CrossRef]

- Bhagwati, Jagdish N. 1988. Export-Promoting Trade Strategy: Issues and Evidence. The World Bank Research Observer 3: 27–57. [Google Scholar] [CrossRef]

- Bhagwati, Jagdish N. 1989. Protectionism. Cambridge: The MIT Press. Available online: https://mitpress.mit.edu/9780262521505/protectionism/ (accessed on 12 December 2022).

- Brooks, Chris. 2014. Introductory Econometrics for Finance. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef]

- Clerides, Sofronis K., Saul Lach, and James R. Tybout. 1998. Is Learning-by-Exporting Important? Micro-Dynamic Evidence from Colombia, Mexico and Morocco. The Quarterly Journal of Economics 113: 903–47. Available online: https://www.jstor.org/stable/2586877 (accessed on 9 December 2022). [CrossRef]

- Coe, David T., and Elhanan Helpman. 1995. International R&D spillovers. European Economic Review 39: 859–87. [Google Scholar] [CrossRef]

- Darrat, Ali F. 1986. Trade and Development: The Asian Experience. Cato Journal 6: 695–99. Available online: https://www.cato.org/cato-journal/fall-1986/trade-development-asian-experience (accessed on 20 December 2022).

- Debbarmaa, Jahira, Yongrok Choia, Fan Yangb, and Hyoungsuk Lee. 2022. Exports as a new paradigm to connect business and information technology for sustainable development. Journal of Innovation & Knowledge 7: 100233. [Google Scholar] [CrossRef]

- Dhawan, Urvashi, and Bagala Biswal. 1999. Re-examining export-led growth hypothesis: A multivariate cointegration analysis for India. Applied Economics 31: 525–30. [Google Scholar] [CrossRef]

- Dodaro, Santo. 1993. Exports and growth: A reconsideration of causality. The Journal of Developing Areas 27: 227–44. Available online: https://www.jstor.org/stable/4192203 (accessed on 20 December 2022).

- Dreger, Christian, and Dierk Herzer. 2013. A further examination of the export-led growth hypothesis. Empirical Economics 45: 39–60. Available online: https://link.springer.com/article/10.1007/s00181-012-0602-4 (accessed on 21 December 2022). [CrossRef]

- Edwards, Sebastian. 1993. Openness, Trade Liberalization, and Growth in Developing Countries. Journal of Economic Literature 31: 1358–93. Available online: https://www.jstor.org/stable/2728244 (accessed on 21 December 2022).

- Edwards, Sebastian. 1998. Openness, Productivity and Growth: What Do We Really Know? The Economic Journal 108: 383–98. Available online: https://www.jstor.org/stable/2565567 (accessed on 21 December 2022). [CrossRef]

- Engle, Robert. 2001. GARCH 101: The use of ARCH/GARCH Models in Applied Econometrics. Journal of Economic Perspectives 15: 157–68. Available online: https://www.jstor.org/stable/2696523 (accessed on 21 December 2022). [CrossRef]

- Fajana, Olufemi. 1979. Trade and growth: The Nigerian experience. World Development 7: 73–78. [Google Scholar] [CrossRef]

- Feder, Gershon. 1983. On exports and economic growth. Journal of Development Economics 12: 59–73. [Google Scholar] [CrossRef]

- Foster, Neil. 2006. Exports, growth and threshold effects in Africa. The Journal of Development Studies 42: 1056–74. [Google Scholar] [CrossRef]

- Fratzscher, Marcel, and Matthieu Bussiere. 2004. Financial Openness and Growth: Short-Run Gain, Long-Run Pain? European Central Bank Working Paper. No. 348. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp348.pdf (accessed on 22 December 2022).

- Ghatak, Subrata, Chris Milner, and Utku Utkulu. 1997. Exports, export composition and growth: Cointegration and causality evidence for Malaysia. Applied Economics 29: 213–23. [Google Scholar] [CrossRef]

- Hagemejer, Jan, and Jakub Mućk. 2019. Export-led growth and its determinants: Evidence from Central and Eastern European countries. The World Economy 42: 1994–2025. [Google Scholar] [CrossRef]

- Hanson, Philip. 1982. The end of import-led growth? Some observations on Soviet, Polish, and Hungarian experience in the 1970s. Journal of Comparative Economics 6: 130–47. [Google Scholar] [CrossRef]

- Hausmann, Ricardo, Tim O’Brien, Miguel Angel Santos, Ana Grisanti, and Jorge Tapia. 2019. Jordan: The Elements of a Growth Strategy. Center for International Development (CID) at Harvard University Working Papers. No. 346. Available online: https://growthlab.cid.harvard.edu/files/growthlab/files/2019-02-28-cid-wp-346-jordan-growth-strategy-revised.pdf (accessed on 22 December 2022).

- Helpman, Elhanan, and Paul Krugman. 1987. Market Structure and Foreign Trade. Increasing Returns, Imperfect Competition, and the International Economy. Cambridge: The MIT Press. Available online: https://mitpress.mit.edu/9780262580878/market-structure-and-foreign-trade/ (accessed on 22 December 2022).

- Hye, Qazi Muhammad Adnan, and Houda Bel Haj Boubaker. 2011. Exports, Imports and Economic Growth: An Empirical Analysis of Tunisia. The IUP Journal of Monetary Economics 9: 6–21. [Google Scholar]

- Hye, Qazi Muhammad Adnan, Shahida Wizarat, and Wee-Yeap Lau. 2013. Trade-led growth hypothesis: An empirical analysis of South Asian countries. Economic Modelling 35: 654–60. [Google Scholar] [CrossRef]

- International Monetary Fund (IMF). 2001. Global Trade Liberalization and the Developing Countries. November. Available online: https://www.imf.org/external/np/exr/ib/2001/110801.htm#i (accessed on 7 January 2023).

- International Monetary Fund (IMF). 2004. Jordan: Selected Issues and Statistical Appendix. IMF Country Report No. 04/121. Available online: https://www.elibrary.imf.org/view/journals/002/2004/121/002.2004.issue-121-en.xml (accessed on 1 January 2023).

- Islam, Faridul, Qazi Muhammad Adnan Hye, and Muhammad Shahbaz. 2012. Import-economic growth nexus: ARDL approach to cointegration. Journal of Chinese Economic and Foreign Trade Studies 5: 194–214. Available online: https://www.emerald.com/insight/content/doi/10.1108/17544401211263964/full/html (accessed on 2 January 2023). [CrossRef]

- Islam, Muhammed N. 1998. Export expansion and economic growth: Testing for cointegration and causality. Applied Economics 30: 415–25. [Google Scholar] [CrossRef]

- Jarque, Carlos M., and Anil K. Bera. 1980. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters 6: 255–59. [Google Scholar] [CrossRef]

- Jin, Jang C., and Eden S. H. Yu. 1996. Export-led growth and the US economy: Another look. Applied Economics Letters 3: 341–44. [Google Scholar] [CrossRef]

- Ju, Jiandong, Li Wu, and Li Zeng. 2010. The Impact of Trade Liberalization on the Trade Balance in Developing Countries. International Monetary Fund (IMF). Available online: https://www.elibrary.imf.org/view/journals/024/2010/002/article-A006-en.xml (accessed on 2 January 2023).

- Jung, Woo S., and Peyton J. Marshall. 1985. Exports, growth and causality in developing countries. Journal of Development Economics 18: 1–12. [Google Scholar] [CrossRef]

- Kardoosh, Marwan A. 2019. Trade Liberalization in Jordan and Economic Diplomacy. A Story of Qualified Success. Konrad-Adenauer-Stiftung e.V. Available online: https://www.kas.de/en/web/jordanien/single-title/-/content/trade-liberalization-in-jordan-and-economic-diplomacy (accessed on 2 January 2023).

- Kavoussi, Rostam M. 1984. Export expansion and economic growth: Further empirical evidence. Journal of Development Economics 14: 241–50. [Google Scholar] [CrossRef]

- Khalafalla, Khalid Yousif, and Alan J. Webb. 2001. Export–led growth and structural change: Evidence from Malaysia. Applied Economics 33: 1703–15. [Google Scholar] [CrossRef]

- Khemka, Abhinav, Temesgen Kifle, and Bryan Morgan. 2018. Export-Led Growth in India: A Bounds Testing Approach. The Journal of Developing Areas 52: 1–14. [Google Scholar] [CrossRef]

- Kónya, László. 2006. Exports and growth: Granger causality analysis on OECD countries with a panel data approach. Economic Modelling 23: 978–92. [Google Scholar] [CrossRef]

- Kristjanpoller, Werner, and Josephine E. Olson. 2014. Economic Growth in Latin American Countries: Is It Based on Export-Led or Import-Led Growth? Emerging Markets Finance and Trade 50: 6–20. [Google Scholar] [CrossRef]

- Kwan, Andy C. C., John A. Cotsomitis, and Benjamin K. C. Kwok. 1999. Exports, economic growth and structural invariance: Evidence from some Asian NICs. Applied Economics 31: 493–98. [Google Scholar] [CrossRef]

- Lawrence, Robert Z., and David E. Weinstein. 1999. Trade and Growth: Import-Led or Export-Led? Evidence From Japan and Korea. National Bureau of Economic Research (NBER) Working Paper No. 7264. Available online: https://www.nber.org/papers/w7264 (accessed on 20 December 2022).

- Love, Jim, and Ramesh Chandra. 2005. Testing export-led growth in South Asia. Journal of Economic Studies 32: 132–45. [Google Scholar] [CrossRef]

- Lucas, Robert E., Jr. 1988. On the mechanics of economic development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Lütkepohl, Helmut. 1993. Testing for causation between two variables in higher-dimensional VAR models. In Studies in Applied Econometrics. Heidelberg: Physica-Verlag HD, pp. 75–91. [Google Scholar] [CrossRef]

- Mahadevan, Renuka, and Sandy Suardi. 2008. A dynamic analysis of the impact of uncertainty on import- and/or export-led growth: The experience of Japan and the Asian Tigers. Japan and the World Economy 20: 155–74. [Google Scholar] [CrossRef]

- Mah, Jai S. 2005. Export expansion, economic growth and causality in China. Applied Economics Letters 12: 105–7. [Google Scholar] [CrossRef]

- Mazumdar, Joy. 2001. Imported machinery and growth in LDCs. Journal of Development Economics 65: 209–24. [Google Scholar] [CrossRef]

- Medina-Smith, Emilio J. 2001. Is the export-led growth hypothesis valid for developing countries? A case study of Costa Rica. United Nations Publication: Trade Analysis Branch. University of Sussex, United Kingdom and Universidad de Carabobo, Venezuela Study Series No. 7. Available online: https://unctad.org/system/files/official-document/itcdtab8_en.pdf (accessed on 20 December 2022).

- Melitz, Marc J. 2003. The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. The Econometric Society 71: 1695–725. Available online: https://scholar.harvard.edu/files/melitz/files/aggprod_ecma.pdf (accessed on 20 December 2022). [CrossRef]

- Mishra, Vinod, Susan Sunila Sharma, and Russell Smyth. 2010. Is economic development in the Pacific island countries export led or import led? Pacific Economic Bulletin 25: 6–63. Available online: http://hdl.handle.net/1885/157962 (accessed on 21 December 2022).

- Mohaddes, Kamiar, and Mehdi Raissi. 2011. Oil Prices, External Income, and Growth: Lessons from Jordan. International Monetary Fund (IMF) Working Paper No. 11/291. Washington, DC: IMF. [Google Scholar]

- Narayan, Paresh Kumar, Seema Narayan, Biman Chand Prasad, and Arti Prasad. 2007. Export-led growth hypothesis: Evidence from Papua New Guinea and Fiji. Journal of Economic Studies 34: 341–51. [Google Scholar] [CrossRef]

- Nishimizu, Mieko, and Sherman Robinson. 1984. Trade policies and productivity change in semi-industrialized countries. Journal of Development Economics 16: 177–206. [Google Scholar] [CrossRef]

- Onafowora, Olugbenga A., Oluwole Owoye, and Akorlie A. Nyatepe-Coo. 1996. Trade policy, export performance and economic growth: Evidence from sub-Saharan Africa. The Journal of International Trade and Economic Development 5: 341–60. [Google Scholar] [CrossRef]

- Oxley, Les. 1993. Cointegration, causality and export-led growth in Portugal. Economics Letters 43: 163–66. [Google Scholar] [CrossRef]

- Panta, Humnath, Mitra Lal Devkota, and Dhruba Banjade. 2022. Exports and Imports-Led Growth: Evidence from a Small Developing Economy. Journal of Risk and Financial Management 15: 11. [Google Scholar] [CrossRef]

- Quinn, Dennis, Martin Schindler, and A. Maria Toyoda. 2011. Assessing Measures of Financial Openness and Integration. IMF Economic Review 59: 488–522. [Google Scholar] [CrossRef]

- Ramachandran, S. 2004. Jordan Economic Development in the 1990s and World Bank Assistance. Report No. 821031. Washington, DC: World Bank Group. Available online: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/774801468271825681/jordan-economic-development-in-the-1990s-and-world-bank-assistance (accessed on 20 December 2022).

- Rani, Ritu, and Naresh Kumar. 2018. Is There an Export- or Import-led Growth in BRICS Countries? An Empirical Investigation. Jindal Journal of Business Research 7: 13–23. [Google Scholar] [CrossRef]

- Reppas, Panayiotis A., and Dimitris K. Christopoulos. 2005. The export-output growth nexus: Evidence from African and Asian countries. Journal of Policy Modeling 27: 929–40. [Google Scholar] [CrossRef]

- Sachs, Jeffrey D., Andrew Warner, Anders Åslund, and Stanley Fischer. 1995. Economic Reform and the Process of Global Integration. Brookings Papers on Economic Activity 1995: 1–118. [Google Scholar] [CrossRef]

- Shan, Jordan, and Fiona Sun. 1999. Export-led growth and the US economy: Some further testing. Applied Economics Letters 6: 169–72. [Google Scholar] [CrossRef]

- Siliverstovs, Boriss, and Dierk Herzer. 2006. Export-led growth hypothesis: Evidence for Chile. Applied Economics Letters 13: 319–24. [Google Scholar] [CrossRef]

- Sims, Christopher A. 1980. Macroeconomics and Reality. Econometrica 48: 1–48. [Google Scholar] [CrossRef]

- SNAP. 2014. Jordan Baseline Information. The Syria Needs Analysis Project. ACAPS and MapAction. Available online: https://www.acaps.org/sites/acaps/files/products/files/16_jordan_baseline_information.pdf (accessed on 28 December 2022).

- Stallings, Barbara. 2001. Globalization and Liberalization: The Impact on Developing Countries. “CEPAL—SERIE Macroeconomía del desarrollo No 4”. United Nations Publication, Economic Development Division, LC/L.1571-P. Available online: https://hdl.handle.net/11362/5427 (accessed on 28 December 2022).

- Syal, Huma Nawaz. 2007. The Role of Trade Liberalization in Economic Growth Theories, Evidence, and Challenges. Strategic Studies 27: 50–72. Available online: http://www.jstor.org/stable/45242406 (accessed on 29 December 2022).

- Thornton, John. 1996. Cointegration, causality and export-led growth in Mexico 1895–1992. Economics Letters 50: 413–16. [Google Scholar] [CrossRef]

- Tyler, William G. 1981. Growth and export expansion in developing countries: Some empirical evidence. Journal of Development Economics 9: 121–30. [Google Scholar] [CrossRef]

- UNDP. 2013. Human Development Report 2013—The Rise of the South: Human Progress in a Diverse World. United Nations Development Programme (UNDP). Available online: https://www.undp.org/egypt/publications/human-development-report-2013-rise-south-human-progress-diverse-world (accessed on 4 January 2023).

- van IJzerloo, Jeroen. 2016. Jordan’s economy remains in jeopardy. RaboResearch—Economic Research. Available online: https://economics.rabobank.com/publications/2016/may/jordans-economy-remains-in-jeopardy/ (accessed on 4 January 2023).

- Vohra, Rubina. 2001. Export and economic growth: Further time series evidence from less-developed countries. International Advances in Economic Research 7: 345–50. [Google Scholar] [CrossRef]

- Warred, Taleb Awad. 2014. The potential economic impact of Aid for Trade in the MENA region: Case of Jordan. In Connecting to Global Markets. Challenges and Opportunities: Case Studies Presented by WTO Chair-Holders. Edited by Marion Jansen, Mustapha Sadni Jallab and Maarten Smeets. Geneva: World Trade Organization (WTO), chp.13. pp. 219–34. Available online: https://www.wto.org/english/res_e/booksp_e/cmark_full_e.pdf (accessed on 7 January 2023).

- Were, Maureen. 2015. Differential effects of trade on economic growth and investment: A cross-country empirical investigation. Journal of African Trade 2: 71–85. [Google Scholar] [CrossRef]

- Wilk, M. B., and R. Gnanadesikan. 1968. Probability Plotting Methods for the Analysis of Data. Biometrika 55: 1–17. [Google Scholar] [CrossRef]

- Winters, L. Alan, Neil McCulloch, and Andrew McKay. 2004. Trade Liberalization and Poverty: The Evidence so Far. American Economic Association 42: 72–115. Available online: https://www.jstor.org/stable/3217037 (accessed on 7 January 2023). [CrossRef]

- WTO. 2008. Trade Policy Review Report: Jordan. Press Release: PRESS/TPRB/306. Available online: https://www.wto.org/english/tratop_e/tpr_e/tp306_e.htm (accessed on 12 January 2023).

- Zang, Wenyu, and Mark Baimbridge. 2012. Exports, imports and economic growth in South Korea and Japan: A tale of two economies. Applied Economics 44: 361–72. [Google Scholar] [CrossRef]

| Levels | First Differences | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| ADF | PP | ADF | PP | ||||||

| Lags | Tau | p | Tau | p | Tau | p | Tau | p | |

| GDP | 0 | −1.08 | 0.7140 | −1.08 | 0.7140 | −3.85 | 0.0003 | −3.85 | 0.0003 |

| 1 | −1.55 | 0.4980 | −1.26 | 0.6384 | −4.18 | <0.0001 | −3.91 | 0.0002 | |

| 2 | −0.90 | 0.7794 | −1.34 | 0.6042 | −4.69 | <0.0001 | −3.90 | 0.0002 | |

| 3 | −0.32 | 0.9136 | −1.34 | 0.6043 | −2.78 | 0.0065 | −3.70 | 0.0004 | |

| Exports | 0 | −2.15 | 0.2274 | −2.15 | 0.2274 | −5.17 | <0.0001 | −5.17 | <0.0001 |

| 1 | −2.10 | 0.2440 | −2.12 | 0.2371 | −4.11 | 0.0001 | −5.16 | <0.0001 | |

| 2 | −1.82 | 0.3643 | −2.12 | 0.2375 | −3.26 | 0.0017 | −5.13 | <0.0001 | |

| 3 | −1.30 | 0.6196 | −2.11 | 0.2407 | −3.76 | 0.0004 | −5.17 | <0.0001 | |

| Imports | 0 | −1.48 | 0.5335 | −1.48 | 0.5335 | −5.27 | <0.0001 | −5.27 | <0.0001 |

| 1 | −1.39 | 0.5768 | −1.57 | 0.4879 | −4.16 | <0.0001 | −5.27 | <0.0001 | |

| 2 | −1.32 | 0.6114 | −1.61 | 0.4681 | −3.37 | 0.0012 | −5.22 | <0.0001 | |

| 3 | −1.23 | 0.6525 | −1.66 | 0.4439 | −3.00 | 0.0035 | −5.23 | <0.0001 | |

| Capital | 0 | −1.93 | 0.3158 | −1.93 | 0.3158 | −5.92 | <0.0001 | −5.92 | <0.0001 |

| 1 | −1.98 | 0.2929 | −2.05 | 0.3640 | −4.25 | <0.0001 | −5.92 | <0.0001 | |

| 2 | −2.06 | 0.2606 | −2.12 | 0.2364 | −3.98 | 0.0002 | −5.92 | <0.0001 | |

| 3 | −1.80 | 0.3775 | −2.14 | 0.2294 | −3.70 | 0.0004 | −5.90 | <0.0001 | |

| H0: Rank = r | H1: Rank > r | Eigenvalue | Trace | p |

|---|---|---|---|---|

| 0 | 0 | 0.4374 | 46.7367 | 0.0624 |

| 1 | 1 | 0.2417 | 21.4297 | 0.3298 |

| 2 | 2 | 0.1500 | 9.2531 | 0.3425 |

| 3 | 3 | 0.0467 | 2.1031 | 0.1467 |

| k = 1 | k = 2 | k = 3 | k = 4 | k = 5 | |

|---|---|---|---|---|---|

| AICC | −427.19 | −1619.28 | −906.67 | −835.65 | −837.21 |

| HQC | −550.41 | −508.41 | −495.18 | −462.67 | −455.08 |

| AIC | −570.26 | −538.28 | −534.67 | −511.34 | −512.48 |

| BIC | −516.74 | −457.27 | −426.93 | −377.68 | −353.73 |

| FPEC | 0.0027 | 0.0043 | 0.0037 | 0.0053 | 0.0048 |

| Variable | β | SE | t | p | |

|---|---|---|---|---|---|

| Constant | 0.0135 | 0.0159 | 0.85 | 0.4010 | |

| 0.5571 | 0.1794 | 3.10 | 0.0035 * | ||

| −0.1237 | 0.1390 | −0.89 | 0.3792 | ||

| 0.1797 | 0.1845 | 0.97 | 0.3359 | ||

| −0.1594 | 0.1347 | −1.18 | 0.2438 | ||

| Constant | 0.0260 | 0.0201 | 1.29 | 0.2032 | |

| 0.4671 | 0.2267 | 2.06 | 0.0461 * | ||

| −0.0057 | 0.1757 | −0.03 | 0.9742 | ||

| −0.0717 | 0.2331 | −0.31 | 0.7601 | ||

| 0.1361 | 0.1702 | 0.80 | 0.4288 | ||

| Constant | 0.0062 | 0.0224 | 0.28 | 0.7833 | |

| 0.1806 | 0.2528 | 0.71 | 0.4792 | ||

| 0.2570 | 0.1959 | 1.31 | 0.1972 | ||

| −0.2003 | 0.2599 | −0.77 | 0.4456 | ||

| 0.1845 | 0.1898 | 0.97 | 0.3369 | ||

| Constant | −0.0061 | 0.0298 | −0.21 | 0.8385 | |

| 0.4197 | 0.3364 | 1.25 | 0.2197 | ||

| 0.1693 | 0.2607 | 0.65 | 0.5199 | ||

| −0.2439 | 0.3459 | −0.70 | 0.4850 | ||

| 0.0524 | 0.2526 | 0.21 | 0.8366 |

| Null Hypothesis (H0) | χ2 | df | p | Conclusion |

|---|---|---|---|---|

| Exports did not Grangerly cause GDP | 0.47 | 1 | 0.4923 | Not reject H0 |

| Imports did not Grangerly cause GDP | 0 | 1 | 0.9589 | Not reject H0 |

| Gross capital formation did not Grangerly cause GDP | 0.78 | 1 | 0.3757 | Not reject H0 |

| GDP did not Grangerly cause exports | 9.32 | 1 | 0.0023 | Reject H0 |

| Imports did not Grangerly cause exports | 2.21 | 1 | 0.1371 | Not reject H0 |

| Gross capital formation did not Grangerly cause exports | 5.17 | 1 | 0.0230 | Reject H0 |

| GDP did not Grangerly cause imports | 1.53 | 1 | 0.2167 | Not reject H0 |

| Exports did not Grangerly cause imports | 1.59 | 1 | 0.2078 | Not reject H0 |

| Gross capital formation did not Grangerly cause imports | 1.49 | 1 | 0.2218 | Not reject H0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Istaiteyeh, R.; Najem, F.; Saqfalhait, N. Exports- and Imports-Led Growth: Evidence from a Time Series Analysis, Case of Jordan. Economies 2023, 11, 135. https://doi.org/10.3390/economies11050135

Istaiteyeh R, Najem F, Saqfalhait N. Exports- and Imports-Led Growth: Evidence from a Time Series Analysis, Case of Jordan. Economies. 2023; 11(5):135. https://doi.org/10.3390/economies11050135

Chicago/Turabian StyleIstaiteyeh, Rasha, Farah Najem, and Nahil Saqfalhait. 2023. "Exports- and Imports-Led Growth: Evidence from a Time Series Analysis, Case of Jordan" Economies 11, no. 5: 135. https://doi.org/10.3390/economies11050135

APA StyleIstaiteyeh, R., Najem, F., & Saqfalhait, N. (2023). Exports- and Imports-Led Growth: Evidence from a Time Series Analysis, Case of Jordan. Economies, 11(5), 135. https://doi.org/10.3390/economies11050135