4.1. The Tourists’ Sample Results

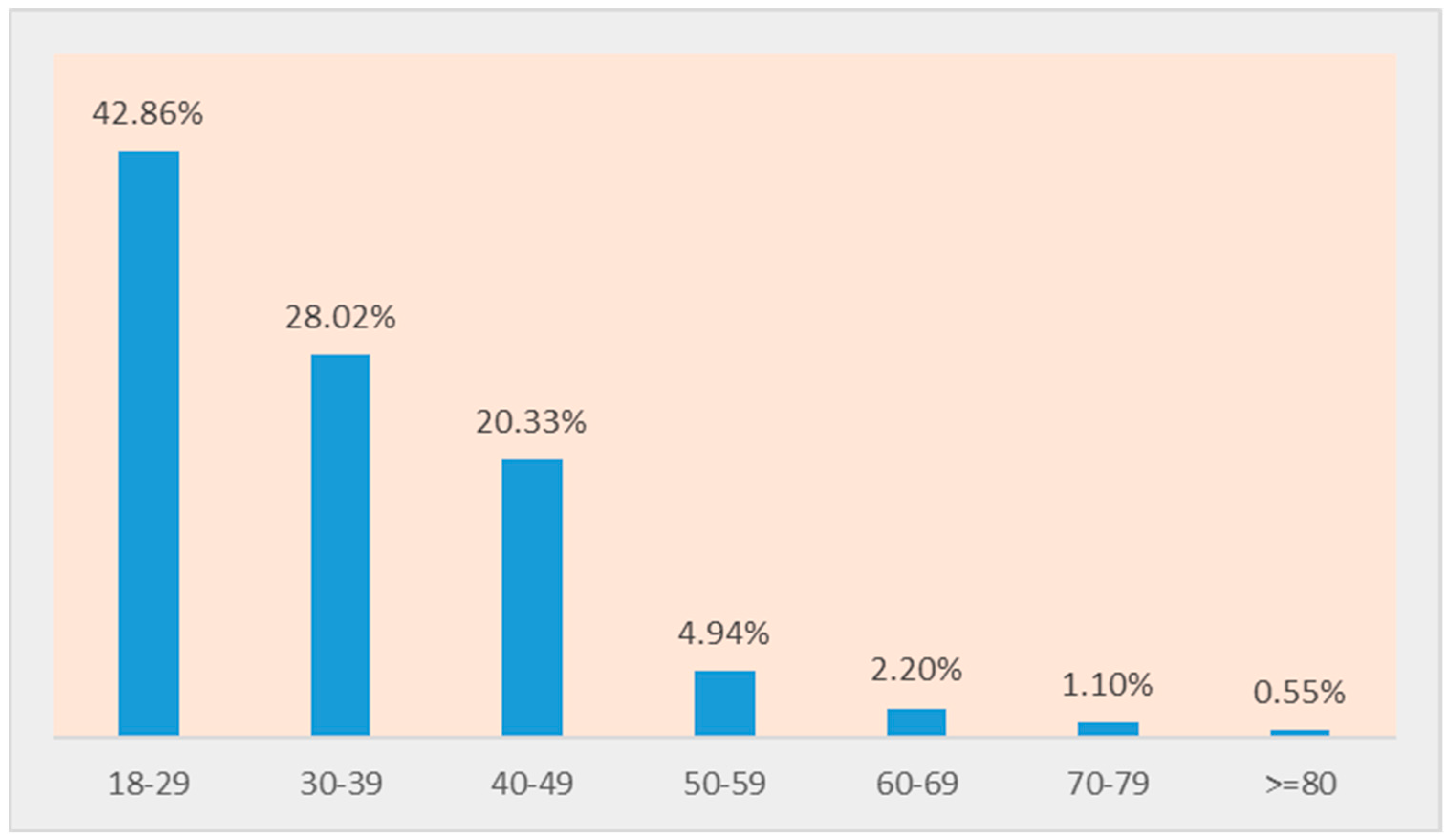

Beginning with the demographic characteristics of the tourist sample, 58% of the respondents were female and 42% were male. The sample is also adequately balanced with respect to age. The allocation of respondents to the various age group was as follows: “18–29” (43%), “30–39” (28%), “40–49” (20%) and “50–59 and older” (9%). This allocation is shown in

Figure 1.

Two other demographic parameters that were recorded in the TQ are income and education. A percentage equal to 28% stated that they belonged to the income group from EUR 10,000–19,999, 19% stated they belonged to the income group “below 5000€”, 12% stated an income in the group of “20,000–29,999€”, 7.6% stated an income of “40,000€ and above” and 5.5% stated an income in the group, “30,000–39,999€”. Apparently, as also depicted in

Figure 2, the sample is sufficiently balanced in the income parameter.

Regarding the respondents’ education levels, 40% stated they had a bachelors’ degree, 35% stated they had a master’s degree, 15% stated they had graduated from high school, 6% stated they had received a Ph.D. and 3% indicated that they had graduated from other types of institutions, such as technical colleges.

The main part of the questionnaire gave important insights into how the tourists’ consumption behavior was before the energy crisis outbreak and how it has been adapted after the crisis. The mean length of stay at the destination was calculated to be 17 days. In a more detailed presentation, 28% of respondents stated they had a stay length of 1–10 days, 28% of 11–20 days, 13% of 21–30 days, 13% answered “don’t know” and 10% answered zero days. This allocation is shown in

Figure 3. The answers for 2023 are not significantly different from the previous years and this is the reason we do not present them in separate figures.

Besides the length of stay, it is important to investigate the variables that describe the intention to spend and most importantly the size of the tourist expenditure for 2023. Thirty percent of respondents answered they would spend EUR 800, which was 31% higher than what was stated in 2021 and 4% higher than what was stated in 2022. Moreover, 14% answered they would spend less than EUR 100, 12% stated they would spend in the range EUR 200–299, 10% would spend in the range of EUR 500–599, 8% would spend EUR 300–399, 8% would spend EUR 400–499, 7% would spend EUR 600–699, 6% would spend EUR 700–799 and 5% would spend EUR 100–199. These answers did not change significantly across the three studied years (2021, 2022 and 2023). The expenditure frequency is shown in

Figure 4.

As aforementioned, the respondents were asked not only about the size of their intended expenditure after the energy crisis (in comparison with the previous two years) but also about their overall holiday habits and consumption patterns and how these would change due to the energy crisis and the increased prices that it has inflicted on all economic sectors. A total of 41% of respondents answered that they expected no change at all, 15% answered they would shorten their stay at the destination, 11% answered they would change the structure and allocation of their expenses at the destination, 10% answered that they would change towards a cheaper destination, 8% would change to fewer or cheaper activities and entertainment opportunities at the destination, 5% would change the type of holiday, 4% did not know yet, 3% would change their holiday accommodation type, 2% would change the number of family members participating in holidays, 2% would change their eating-out habits and 2% would change their transportation mode at the destination into a chapter one. Another sector where tourists stated that there might be a change in their consumption pattern is in their transportation decisions to, from and at the destination. A total of 11% will use multiple types of transportation, 37% will use a car, 32% will use an airplane, 17% will use a ship, 5% will use a train, 4% will use a motorcycle or other, 4% answered they will not go on holiday at all and 18% stated that they had not decided at the time they were asked. Overall, as far as transportation choices before and after the energy crisis, we did not confirm any significant changes or differences from the past two studied years and the allocation of 2023 is shown in

Figure 5.

Other aspects of holidays that we investigated in terms of the effect that the increased energy prices might have on them were tourist eating-out habits and holiday activities. A total of 56% of respondents would select a tavern, 26% would select fast food, 26% would select take-out, 21% would select an a la carte restaurant, 12% would select a hotel restaurant and 4% would select the category “other”. The percentages of all eating out possibilities are lower for 2023 compared with previous years, whereas the category “other” has increased to about 32% (from around the 6.5% that it was in the previous two years). The increase in this category may be due to higher energy prices but it could also be due to the fact that the selection of a food place may be more flexible and more of last-minute decision, not necessarily one that a consumer takes a year earlier, particularly because of the uncertainty caused by ascending prices.

In open-ended questions with respect to the financial impact inflicted on respondents, 20% answered that they experienced no impact from the higher energy prices, whereas 80% stated they experienced various negative consequences. A total of 3% stated that they became unable to save money, 3% stated they had experienced a loss of income, 31% stated that their expenses had increased, 20% stated that they were negatively impacted and 21% identified themselves as having to cope with a severe financial impact (

Figure 6).

As a result of the new economic situation after the energy crisis, respondents were asked about the consumption of items/habits they were going to forgo. A total of 64% said that they would be cutting down on clothing, shoes and accessories, 70% would cut down on furniture, appliances and decoration, 25% would cut down on personal care products, 35% would cut down on entertainment products, 41% would cut down on gym and sport memberships, 20% would cut down on vacation and trips and 1% would cut down on others.

The increased energy prices were also found to affect energy saving attitudes at home. A total of 92% of respondents answered that they actively applied energy saving actions at home. A total of 35% of respondents stated they used energy saving or A+ appliances, 64% that they had installed LED lamps, 20% stated that they would refrain from using high-energy-consuming appliances, 10% would use solar panels for hot water production and 9% would use other energy saving solutions such as cooking methods with reduced energy consumption, smart plugs, motion sensors lights, etc.

Quantitative Analysis in the Tourists’ Sample

Before starting the regression analysis, we performed a descriptive analysis and correlation. We identified high (>0.75) and significant correlations between tourism expenditure in 2022 and tourism expenditure in 2023, tourism expenditure in 2021 and tourism expenditure in 2022, the length of stay in 2022 and the length of stay in 2023 and eating out patterns in 2021 and eating out patterns in 2022. Additionally, other correlation patterns were found between income and education and income and tourism expenditure. Next, we estimated various models with multiple regression in the form

but have kept only the one that gave significant and meaningful results; we have named this model as “the tourist’s model” (

Table 1), which is structured as follows:

Tourist Expenditure 2023 = f(income, length of stay 2023, length of stay 2021, tourism expenditure 2021, tourism expenditure 2022, COVID-19)

All variables are significant with an absolute value of the t statistic higher than 2. The dependent variable entitled “tourist expenditure 2023” describes the tourist situation after the energy crisis. We expect that the tourist, due to the higher energy prices, will have lower disposable income. This translates into tourists only being able to afford cheaper destinations, cheaper accommodation and food and/or shorter stays at the destination. We observe a positive relationship between the tourist’s income and the tourist’s expenditure that will be experienced in 2023 (at the time of the questionnaire completion, 2023 was the future time).

Foremost, we observed a negative relationship between the length of stay in 2021 (the past—before the energy crisis) and the intended tourism expenditure in 2023. This shows that the participants stated that their future (after the energy crisis) will not be the same as their past (before the energy crisis). These two magnitudes appear to have a significant inverse relationship. Put differently, tourists who took holidays for more days in 202 will tend to spend less (expenditure) for their holidays in 2023. This shows a clear change in expenditure patterns between the states “before the crisis” and “after the crisis”. This situation is not confirmed between the total number of vacation days taken in 2022 and the expenditure in 2023. This may be due to the fact that 2022 was the year of the energy crisis taking place and there was already an adaptation in the total number of holidays.

Conversely to the total number of vacation days, there are two magnitudes that are positively related to the tourist expenditure in 2023. These are the tourist expenditure in 2021 and the tourist expenditure in 2022. The coefficient for the 2021 variable is lower than for the coefficient in 2022; this unveils a stronger relationship between the present (the year 2022, which is the year when the energy crisis started) and the future (year 2023—after the crisis) than between the present and the past (year 2021, before the energy crisis). This also shows a decaying effect between the expenditure of the past and the expenditure in the future. In general, the information we received shows that the year the crisis started, (2022) will not be much different, in terms of tourist expenditure, than the future (2023).

In addition to this, the occurrence of COVID-19 is another fact that has changed the tourism industry. Although the pandemic crisis is beyond the scope of the current paper, we employed an instrumental variable named COVID-19 to describe the respondents’ attitudes towards the financial detriment COVID-19 brought to their tourism status. We found an inverse relationship between the financial detriment from COVID-19 and the tourist expenditure in 2023. This is well understood because the pandemic itself had already caused a different situation in all economic sectors, not least tourism, and this situation is newly augmented by the energy crisis. Our research results further quantify this accumulation of detriment and find that a 1% financial detriment caused by the pandemic reduces the tourist expenditure of 2023 by 0.1%. This might be a result of a cumulative financial burden from which tourists have not yet recovered (at least in the period that this survey was carried out).

Regarding accommodation type in the year before the energy crisis and in the year of the energy crisis, this variable has a qualitative meaning that relates to the choice of the prevalent accommodation type during each year with future tourist expenditure. This relationship is inverse for 2021 and of the same sign for 2022. Given that the prevalent accommodation type was a hotel in 2021, this means that for tourists who stayed in a hotel in 2021, their expenditure in 2023 will be reduced. Contrary to the accommodation type in 2022, the selection of the prevalent accommodation type does not entail a reduction in the tourist expenditure but an increase.

4.2. The Hoteliers’ Sample Results

This sub-section follows a similar structure for the analysis of hotelier sample as

Section 4.1 does for tourists. First of all, a descriptive analysis of the results is offered, followed by a regression analysis.

We begin the presentation of the hotelier sample with a selection of the most important demographic results. These results can explain the answers to other questions in the questionnaire. One result is about the education of hoteliers/managers: 46.15% of them had a degree in tourism/hospitality, 15% a degree in law, 15% in marketing and 24% of them had a degree in accounting or geotechnology. The education of hoteliers/managers is sometimes a signal for the problems the sector encounters. For example,

Menegaki (

2022) compared hoteliers’ and museum curators’ educational backgrounds and found a correlation in the hoteliers’ lower educational background and their poorer understanding and appreciation of new technologies in hotels.

In terms of the characteristics of the tourist accommodation: 38% are three-star hotels, 30% are four-star hotels, 15% are five-star hotels and 8% are two-star hotels. Regarding the main part of the research, which encompasses the answers of hoteliers to questions about the effects of increased energy prices on tourism demand, the following was found. An increase in tourism arrivals was noted for both years, 2022 and 2023, at 10% and 15%, respectively. An increase in tourism night stays in 2023 was stated to be ranging from 1–10% (by 54% of the hoteliers) or 11–50% (by 31% of the hoteliers). As far as the open question posed to hoteliers about the guest’s habit changes they expect in 2023, these answers were quite heterogeneous. A total of 54% of hoteliers expect higher demand for hotel goods and services. A total of 39% of hoteliers expect higher demand for excursions and transportation that will enable guests to go outside the hotel (apparently this is a result of COVID-19 lockdown restrictions). A total of 7.69% expect no changes, 15.38% expect an extension of the stay period, 7.69% expect that guests/tourists will tend to eat out more and 23.08% expect that guests/tourists will ask for everything to be perfect due to the higher prices being paid. This implies that hoteliers expect that guests will not understand that the increased cost is due to the price increase of an essential input to which little can be done on the part of hoteliers.

As far as the length of stay is concerned, this has a negative coefficient for the year 2022 and a positive for the year 2023. The inverse relationship between guest arrivals and the length of stay in 2022 shows that an increase in the length of stay in 2022 would mean a reduction in guest arrivals in 2023. This is meaningful because the year 2022 is the year that the energy crisis started. Thus, if tourists stayed longer in the destination, that would cost them a higher percentage of their income and the following year they might decide to offset this loss by reducing their travelling. On the other hand, the length of stay in 2023 does not appear to affect the guest arrivals in 2023.

The quality of stay is denoted by three variables in this model. One is the manager/hotelier specialization, the second is the number of hotel stars and the third is the environmentally friendly quality of the hotel. Guest arrivals in 2023 are higher when the manager/hotelier has a degree related to tourism studies and/or when the certified quality (through the star system) of the hotel is higher. This is understandable since it is more likely for a hotel to have a higher quality when the hotelier/manager has undertaken studies in tourism and hospitality and knows the needs of the tourism sector and how these can be best addressed. Moreover, the allocation of stars takes place through an independent certification organization and therefore the quality that those stars represent is beyond doubt. Contrary to previous findings, we observe that the environmentally friendly quality offered by the hotel is negatively related to guest arrivals in 2023. This finding requires further investigation but it could be attributed to the fact that the environmentally friendly practices stated by the participating hotels suffer from both poor quality and quantity. The coefficients of the variables guest expenditure 2022 and guest expenditure 2023 both have a negative sign, showing a negative relationship between each one of them and guest arrivals. Therefore, if guest expenditure in each of the two years increases, the guest arrivals in 2023 will fall. This makes sense because guest expenditure erodes the disposable income and thus tourists have less income to spend on new arrivals.

The rest of the answers in the HQ are as follows: On average, hoteliers state that tourism expenditure increased by 5% between 2021 and 2022 and they expect a further increase at 11% between 2022 and 2023. More than 50% of hoteliers admit that energy price increases will have a detrimental effect on their business. A total of 92% of hoteliers had noticed those increases already, and 15% of them spoke about service time restrictions that will be due to high energy costs that cannot be absorbed by the business in any other way but through cutting down personnel. Furthermore, the number of hotels that do not apply energy saving practices appears to have been reduced to 15% from the 25% in 2021. This improvement can be attributed to the increased energy prices that have caused a lot of concern to hoteliers and caused them to install awnings, solar panels, LED lights, etc.

Before going onto the results of the regression analysis, we performed data exploration with correlation analysis and found high (>0.75) and significant correlations in the hotelier sample between the educational attainment of managers and tourist arrivals, the quality of stars and eco-friendly practices and the number of guests and the length of stay. Next, we have set up the so-called hoteliers’ model, which is structured as follows: guest arrivals 2023 = f(length of stay 2022, length of stay 2023, tourism expenditure 2022, manager’s education, hotel quality in stars, environmentally friendly quality, specialization of studies for managers, guest expenditure 2022, guest expenditure 2023).

Each of the 13 participating hotels in the sample completed the questionnaire for three consecutive years, generating 36 observations. The independent variable in the hotelier sample was the number of guests arriving at the hotel (guest arrival). For the demand of a hotel’s services to be high, there must be various applicable microeconomic and macroeconomic parameters. Room prices and other hotel service prices must correspond to the quality and amenities that the hotel offers and consumer’s income, various market trends, etc. Given the information we had available from our HQ and our pursuit to unveil the effects of structural changes through the inflated energy prices after the energy crisis outbreak in 2022, we investigated guest arrivals as a function of the length of guest stay in 2021, the length of guest stay in 2022, the manager’s education, the hotel quality, the environmentally friendly practices of the hotel, the guest’s expenditure in 2022 and the guest’s expenditure in 2023. All variables were significant, with the absolute t statistic higher than 2, and the model has a high R-squared. The results from the hotelier sample are shown in

Table 2.

4.3. Discussion

The main goal in the current piece of research was to find out whether and in what ways the energy crisis has impacted the tourism industry, with a particular emphasis on tourists’ visits and spending habits and hoteliers’ judgements and estimations. After observing the answers to the direct questions that were asked in both groups in the survey questionnaires, it became clear that both parties (tourists and hoteliers) had been impacted to some degree by the higher energy prices after the energy crisis.

Particularly, more than 90% of hoteliers/hotel managers reported negative effects on their businesses, whereas 80% of the consumer participants (tourists) reported a variety of repercussions on their financial situation. Additionally, it is anticipated and already observed that, with regard to the hospitality industry, the average guest expenditure per stay in 2023 was stated to be higher than what it was in 2022, the year the energy crisis began. This expenditure increase can be attributed to either a shortening in the number of vacation days or to the general inflation and inflationary pressures on commodity prices that have inevitably affected the tourism sector.

For the tourists themselves, however, it appears there is little change in their expenditure between the studied periods. Additionally, the inflationary pressures were a result of the both COVID-19 pandemic, which brought economies to a production halt and caused shortages in many inputs and final products, and the Russian–Ukrainian war, which worsened the situation and sharpened the subsequent energy crisis.

Another point worth mentioning in the hospitality sector is the fact that, given how heavily the Greek tourism industry depends on inbound tourism, variations in the elasticity of consumption, preferences and patterns of consumption can have an impact on the fundamental characteristics of travel. These are the duration of the vacation, the expenditure amount, the synthesis of the tourism consumption basket, etc. When these characteristics reflect on the profitability of the tourism industry, these factors are quite important.

At the time the surveys were conducted, namely in the year 2022, the future period was assumed to be the year 2023. Thus, for the upcoming tourism season of 2023, hotel managers anticipated (based on the survey results) an increase in the number of guests (a 50% growth on average compared with the 2022 season), an increase in the number of days spent by guests in 2023 (growth equal to 225% compared with year 2022) and an increase in the amount of money spent by guests in 2023 (growth equal to 120%). These projections are encouraging for the recovery of Greek tourism from shocks and future growth.

Based on our survey results, a percentage equal to 90% of the survey participants anticipate taking a vacation in 2023. In addition to this, 13% of the participants who stated that they would take a vacation did not know how many days they would be staying at the destination. The expenditure of visitors in 2023 remained at the same levels as the previous years, providing evidence that the holiday budget (for the majority of participants) was not declining but stayed the same, even though 80% of the respondents stated they had experienced a variety of financial impacts because of the energy crisis and general inflationary environment. This is one of the most important indicators suggesting the resilience (if not growth) of the tourism sector. Additionally, 80% of the participants answered that they would not miss out on their vacation due to this inflationary environment.

Besides the aforementioned findings, which reveal the resilience of the tourism sector, 92% of the respondents also indicated that they utilize some sort of energy-saving strategy or practice at home in order to lower their expenses and/or for other environmental protection reasons. Thus, this reveals that participants, in terms of energy use, behave efficiently at home, and they appear to rationalize their consumption and expenditure at home, whereas also not changing their tourism travel pattern, frequency and habits.

Furthermore, it is worthwhile mentioning the common elements that the two questionnaires investigated and making some comparisons. For instance, the number of days of vacation is one of the common questions posed to both the tourists and the hoteliers. The tourists were asked to make an estimation for themselves and the hoteliers were asked to make an estimation about the intentions of their customers. The change between the three studied years, 2021, 2022 and 2023, was less sharp in the tourist sample. The deviation in the estimation of the hotelier sample may be attributed to the higher content of local customers. Almost 80% of participants in the tourist sample were national tourists, so the trends for international tourists are underrepresented and hence cannot be reflected in this piece of research. Another group of questions comprise the eating-out habits of tourists, the excursions they take in nearby places and the total effect of COVID-19 on their travel behavior. Both questionnaire results showed an increase in eating out and excursions, so the inflationary pressures of the energy price increase do not appear to be a reason for contraction. With respect to the COVID-19 questions, both groups of respondents stated that they expected a further relaxation of protective measures that would increase their travel behavior.

Finally, “tourism expenditure” is the subject of the third common bundle of questions in the two questionnaires. The average increase in guest spending per stay was anticipated to increase by about 120% in 2022 and 2023 as stated by hoteliers/managers. However, the participants in the tourists’ questionnaire generated a much more conservative answer of 4% about the tourism expenditure increase.