Analysis of the Effect of Human Capital, Institutionality and Globalization on Economic Complexity: Comparison between Latin America and Countries with Greater Economic Diversification

Abstract

:1. Introduction

2. Related Work

2.1. Impact of Economic Complexity on Socioeconomic Variables

2.2. Determining Factors in Economic Complexity

3. Materials and Methods

- : and are not correlated, the random effects model, GLS is consistent and efficient, and the LSDV model is consistent and inefficient.

- : and are correlated, the random effects model, GLS is not consistent, and the LSDV model is consistent and inefficient.

- As a dependent variable, the economic complexity index measures the productive capacities and knowledge of each country, allowing more advanced production through the variety of exports and the degree of specialization of each exported product. On the one hand, it can take negative values when the productive structure of a country is simple, that is, it is based mainly on the export of raw materials, besides having an export basket that is not very diversified and too common with the rest of the countries in the foreign market. On the other hand, it can take positive and high values when exports have high added value, besides having a highly diversified basket of exportable products and exclusive production of goods and services in the international market.

- As an independent variable, the human capital index measures the number of future products that can be expected from children based on schooling through the combination of the quality and quantity of education.

- As a complementary variable, the globalization index measures globalization along the economic social political dimension of the countries of the world, i.e., the degree of economic integration in the world economy, the internationalization of personal contacts of its citizens, the access to the Internet, and the scope of its international political commitment.

- As a complementary variable, the government integrity index quantifies the capacity of the state to settle conflicts of interest and control systemic corruption through its institutions, where the score for this component is obtained by averaging the scores of factors such as the payment of bribes, transparency in government policies, absence of corruption, perception of corruption, and transparency of public administration.

4. Results

- High economic complexity countries that include economies with an economic complexity index for the year 2018 greater than 1.62.

- High-income countries that include economies with gross national income per capita greater than USD 12,535.

- Upper-middle-income countries that comprise economies of gross national income per capita between USD 4046 and USD 12,535.

- Lower-middle-income countries comprising economies with gross national income per capita between USD 1036 and USD 4046.

- The economic complexity index shows an average of −0.19, according to the Harvard Growth Lab. This is due to the fact that the region’s export is based on low-complexity activities, such as agriculture and mineral extraction. Other economies, such as Costa Rica, El Salvador, Nicaragua, Guatemala, and Honduras, have advanced in the development of textiles and machinery. In addition, Argentina, Uruguay, and Mexico have developed a production of more moderate complexity in the automotive industry, electronics, and chemistry. Less variability within the Latin American economies indicates the slow progress in innovation and diversification of their production.

- The human capital index shows an average of 0.43, i.e., a child born in Latin America will have an average of 43% labor productivity in the future if adequate education and health services are guaranteed. According to the United Nations Development Reports (2021), there is no significant variation at a general level between countries, making Latin America a region with uniform human capital.

- The globalization index shows an average of 0.61, which indicates an average level of cooperation in economic, political, and social integration. In the same way as the human capital index, there is no significant variability; however, it is much lower over time within each country.

- The government integrity index shows an average of 0.36, which indicates that, according to The Foundation Heritage, the levels of ethics and the rule of law are moderately low. Likewise, it has little capacity to prevent and manage conflicts of interest and corruption. The low variability between the data results in the low-institutionality characteristic of the region, in addition to the fact that little or nothing has been done to correct it over the years.

- The economic complexity index shows an average of 1.86 according to the Harvard Growth Lab. This is due to the fact that the export of the selected countries is based on activities of high and moderate complexity, such as the production of electrical and industrial machinery. Economies such as Germany, Japan, the Czech Republic, Slovenia, and Sweden have advanced in automotive production, in addition to the development of the pharmaceutical industry, electrical equipment, and travel and tourism products.

- The human capital index shows an average of 0.49, i.e., a child born in these economies will have an average of 49% labor productivity in the future if he/she is guaranteed adequate education and health service. According to the United Nations Development Reports (2021), there is no significant variation at a general level between the countries, making the economies of high economic complexity a group of countries with a uniform human capital.

- The globalization index shows an average of 0.81, which indicates a high level of cooperation in economic–political, and social integration. In the same way as the human capital index, there is no significant variability; however, it is decreased over time within each country.

- The government integrity index shows an average of 0.70, which indicates that the levels of ethics and rule of law are moderately high, which shows that they have a high capacity to prevent and manage conflicts of interest and corruption. The variability between the data makes the high level of institutionality characteristic of the group, in addition to the fact that it has varied little over the years.

- In the case of high-income countries, indicates the existence of a negative and moderately low correlation, i.e., an increase in human capital reduces the complexity of exports, and the correlation is statistically significant at 1%.

- In the case of upper-middle-income countries, indicates the existence of a very low positive correlation, i.e., the increase in human capital increases economic complexity, although the correlation is not statistically significant.

- In the case of lower-middle-income countries, indicates the existence of a moderately low negative correlation, i.e., an increase in human capital reduces the complexity of exports, and the correlation is statistically significant at 1%

- In the case of countries with high economic complexity, indicates the existence of a positive and moderate correlation, i.e., an increase in human capital increases the complexity of exports, and the correlation is statistically significant at 1%.

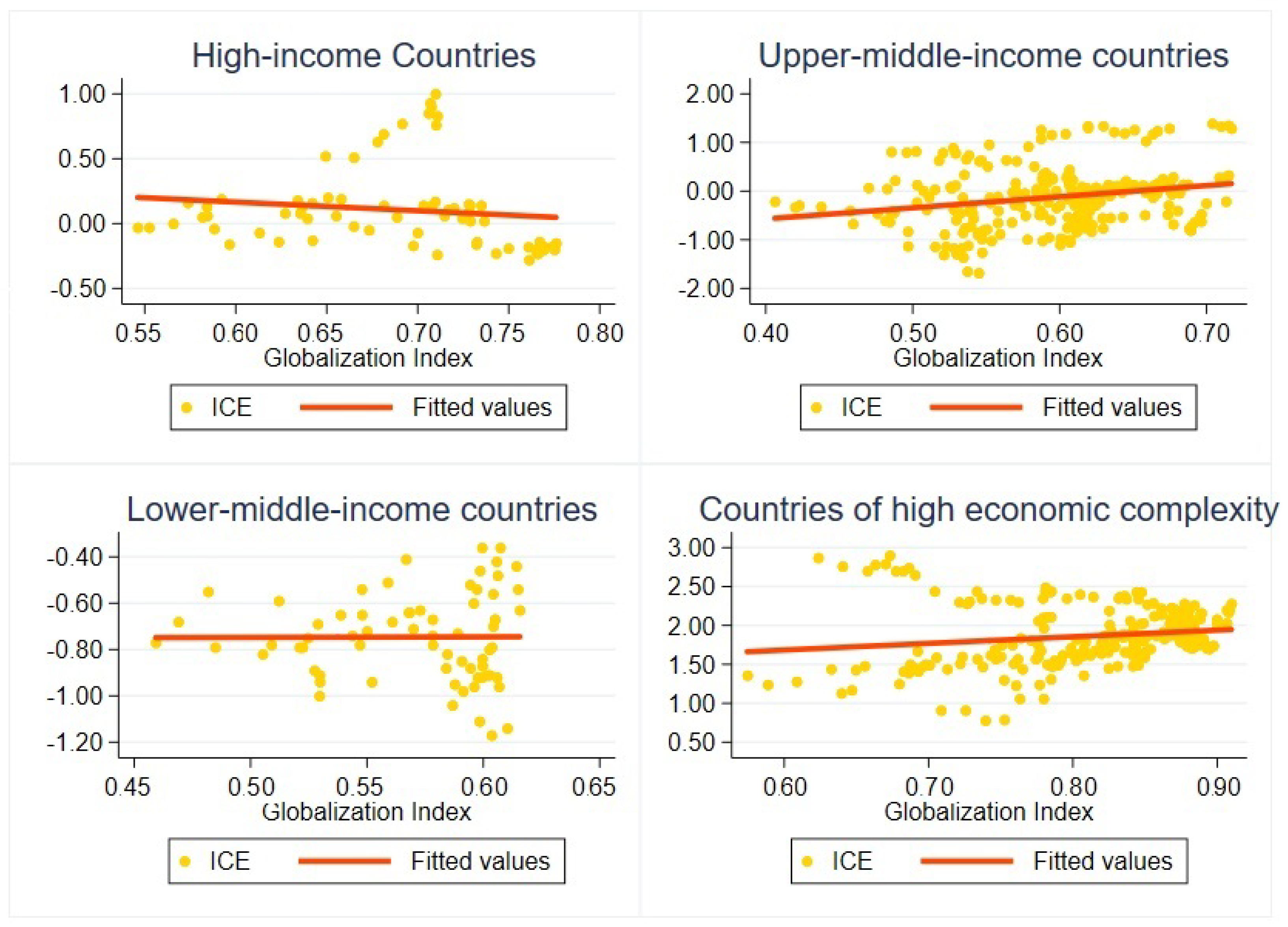

- In the case of high-income countries, indicates the existence of a negative and low correlation, i.e., an increase in the level of globalization reduces the complexity of exports, and the correlation is not statistically significant at 1%

- In the case of upper-middle-income countries, indicates the existence of a very low positive correlation, i.e., the increase in the level of globalization increases economic complexity, and the correlation is statistically significant at 1%

- In the case of lower-middle-income countries, indicates the non-existence of correlation, i.e., an increase or decrease in the level of globalization does not affect the complexity of exports.

- In the case of countries with high economic complexity, indicates the existence of a low positive correlation, i.e., the increase in the level of globalization increases the complexity of exports, and the correlation is not statistically significant at 1%.

- In the case of high-income countries, indicates the existence of a negative and moderately high correlation, i.e., an increase in government integrity reduces the complexity of exports, and the correlation is statistically significant at 1%.

- In the case of upper-middle-income countries, indicates the existence of a low positive correlation, i.e., the increase in government integrity increases economic complexity, and the correlation is statistically significant at 1%.

- In the case of lower-middle-income countries, indicates the existence of a low negative correlation, i.e., an increase in institutionality reduces the complexity of exports, and the correlation is not statistically significant at 1%.

- In the case of countries with high economic complexity, indicates the existence of a positive and moderate correlation, i.e., the increase in human capital increases the complexity of exports, and the correlation is statistically significant at 1%.

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Alejo, Javier, Gabriel Montes-Rojas, and Walter Sosa-Escudero. 2018. Testing for serial correlation in hierarchical linear models. Journal of Multivariate Analysis 165: 101–16. [Google Scholar] [CrossRef] [Green Version]

- Antonietti, Roberto, and Chiara Franco. 2021. From fdi to economic complexity: A panel granger causality analysis. Structural Change and Economic Dynamics 56: 225–39. [Google Scholar] [CrossRef]

- Arif, Imran. 2021. Productive knowledge, economic sophistication, and labor share. World Development 139: 105303. [Google Scholar] [CrossRef]

- Bahar, Dany, Hillel Rapoport, and Riccardo Turati. 2022. Birthplace diversity and economic complexity: Cross-country evidence. Research Policy 51: 103991. [Google Scholar] [CrossRef]

- Bandeira Morais, Margarida, J. Swart, and J. A. Jordaan. 2018. Economic complexity and inequality: Does productive structure affect regional wage differentials in Brazil? USE Working Paper Series 18: 1–19. [Google Scholar]

- Ferraz, Diogo, Herick Fernando Moralles, Jessica Suárez Campoli, Fabíola Cristina Ribeiro de Oliveira, and Daisy Aparecida do Nascimento Rebelatto. 2018. Economic complexity and human development: Dea performance measurement in asia and latin america. Gestão & Produção 25: 839–53. [Google Scholar]

- Giordano, Paolo, Rosario Campos, Cloe Ortiz de Mendívil, Kathia Michalczewsky, and Jesica De Angelis. 2018. Trade and Integration Monitor 2018: Flying to Quality: Export Sophistication as an Engine of Growth. New York: Inter-American Development Bank. [Google Scholar]

- Greene, William H. 2003. Econometric Analysis. Hoboken: Pearson Education India. [Google Scholar]

- Güneri, Barbaros, and A. Yasemin Yalta. 2021. Does economic complexity reduce output volatility in developing countries? Bulletin of Economic Research 73: 411–31. [Google Scholar] [CrossRef]

- Hartmann, Dominik, Miguel R. Guevara, Cristian Jara-Figueroa, Manuel Aristarán, and César A Hidalgo. 2017. Linking economic complexity, institutions, and income inequality. World Development 93: 75–93. [Google Scholar] [CrossRef] [Green Version]

- Harvad Growth Lab. Atlas of Economic Complexity. 2020. Atlas of Economic Complexity. Available online: https://atlas.cid.harvard.edu/what-is-the-atlas (accessed on 15 July 2023).

- Hausmann, Ricardo, César A. Hidalgo, Sebastián Bustos, Michele Coscia, and Alexander Simoes. 2014. The Atlas of Economic Complexity: Mapping Paths to Prosperity. Cambridge: MIT Press. [Google Scholar]

- Hidalgo, César A. 2021. Economic complexity theory and applications. Nature Reviews Physics 3: 92–113. [Google Scholar] [CrossRef]

- Hidalgo, César A., and Ricardo Hausmann. 2009. The building blocks of economic complexity. Proceedings of the National Academy of Sciences 106: 10570–75. [Google Scholar] [CrossRef]

- Lapatinas, Athanasios. 2016. Economic complexity and human development: A note. Economics Bulletin 36: 1441–52. [Google Scholar]

- Lapatinas, Athanasios. 2019. The effect of the internet on economic sophistication: An empirical analysis. Economics Letters 174: 35–38. [Google Scholar] [CrossRef]

- Lapatinas, Athanasios, and Anastasia Litina. 2019. Intelligence and economic sophistication. Empirical Economics 57: 1731–50. [Google Scholar] [CrossRef] [Green Version]

- Le Caous, Emilie, and Fenghueih Huarng. 2020. Economic complexity and the mediating effects of income inequality: Reaching sustainable development in developing countries. Sustainability 12: 2089. [Google Scholar] [CrossRef] [Green Version]

- Lee, Kang-Kook, and Trung V. Vu. 2020. Economic complexity, human capital and income inequality: A cross-country analysis. The Japanese Economic Review 71: 695–718. [Google Scholar] [CrossRef]

- Lenicov, Jorge, Anahi Viola, and Patricia Knoll. 2015. El Comercio Mundial. Principales Características y Tendencias. Available online: http://www.unsam.edu.ar/escuelas/economia/oem/pdf/Boletin-16.pdf (accessed on 15 July 2023).

- Morante Ana, Villamil Maria del Pilar, and Florez Hector. 2017. Framework for supporting the creation of marketing strategies. Information 20: 7371–7378. [Google Scholar]

- Nguyen, Canh Phuc, Christophe Schinckus, and Thanh Dinh Su. 2020. The drivers of economic complexity: International evidence from financial development and patents. International Economics 164: 140–50. [Google Scholar] [CrossRef]

- Ozsoy, Seren, Burcu Fazlioglu, and Sinan Esen. 2021. Do FDI and patents drive sophistication of exports? a panel data approach. Prague Economic Papers 2021: 216–44. [Google Scholar] [CrossRef]

- Sadeghi Pegah, Hamid Shahrestani, Kambiz Hojabr Kiani, and Taghi Torabi. 2020. Economic complexity, human capital, and fdi attraction: A cross country analysis. International Economics 164: 168–82. [Google Scholar] [CrossRef]

- Serajuddin, Umar, and Hamadeh Nada. 2020. New World Bank Country Classifications by Income Level: 2020–2021. Available online: https://blogs.worldbank.org/opendata/new-world-bank-country-classifications-income-level-2020-2021 (accessed on 15 July 2023).

- Sweet, Cassandra Mehlig, and Dalibor Sacha Eterovic Maggio. 2015. Do stronger intellectual property rights increase innovation? World Development 66: 665–77. [Google Scholar] [CrossRef] [Green Version]

- The Foundation Heritage. 2020. Index of Freedom Economics. Available online: https://www.heritage.org/index/ (accessed on 15 July 2023).

- United Nations Development Reports. 2021. Human Development Data. Available online: https://hdr.undp.org/data-center (accessed on 15 July 2023).

- Vaismoradi, Mojtaba, Hannele Turunen, and Terese Bondas. 2013. Content analysis and thematic analysis: Implications for conducting a qualitative descriptive study. Nursing & Health Sciences 15: 398–405. [Google Scholar]

- Vu, Trung V. 2020. Economic complexity and health outcomes: A global perspective. Social Science & Medicine 265: 113480. [Google Scholar]

- Vu, Trung V. 2021. Does Institutional Quality Foster Economic Complexity? The Fundamental Drivers of Productive Capabilities. Kiel: ZBW—Leibniz Information Centre for Economics. [Google Scholar] [CrossRef] [Green Version]

- Weiß, Johann, Andreas Sachs, and Heidrun Weinelt. 2018. 2018 Globalization Report: Who Benefits Most from Globalization? Gütersloh: Bertelsmann Stiftung. [Google Scholar]

- Zhu, Shengjun, Changda Yu, and Canfei He. 2020. Export structures, income inequality and urban-rural divide in china. Applied Geography 115: 102150. [Google Scholar] [CrossRef]

| Variable | Type | Notation | Unit of Measurement | Data Source | Description |

|---|---|---|---|---|---|

| Economic Complexity Index | Dependent variable | ICE | Index. Less than 0 = less economic diversification Greater than 0 = greater economic diversification | Atlas of Economic Complexity Harvad Growth Lab (2020) | It measures the average knowledge of the activities present in a society |

| Human Capital Index | Independent variable | ICH | Index. 0 = lowest 1 = highest | Human Development Data United Nations Development Reports (2021) | It measures the present value of all future benefits that a person expects to earn from their job until they stop working. |

| Globalization Index | Complementary Variable | IGE | Index. Close to 0 = less economic integration Close to 100 = greater economic, social and political integration | Swiss Economic Institute Sadeghi et al. (2020) | Measures the economic, political, and social connectivity, integration, and interdependence of countries |

| Government Integrity Index | Complementary Variable | IIG | Index. Close to 0 = less government integrity Close to 100 = higher government integrity | Index the Freedom Economics The Foundation Heritage (2020) | It measures the quality of the Rule of Law, together with the transparency and size of the State. |

| High Income | Upper Middle Income | Lower Middle Income | High Economic Complexity |

|---|---|---|---|

| Chile | Argentina | Bolivia | Austria |

| Uruguay | Brazil | El Salvador | Switzerland |

| Colombia | Honduras | Czech Republic | |

| Costa Rica | Nicaragua | Germany | |

| Ecuador | Venezuela | Hungary | |

| Guatemala | Japan | ||

| Mexico | South Korea | ||

| Panama | Singapore | ||

| Paraguay | Slovenia | ||

| Peru | Sweden |

| Variable | Mean | Standard Deviation | Min | Max | Observations | |

|---|---|---|---|---|---|---|

| Economic Complexity Index | General | −0.19 | 0.58 | −1.68 | 1.39 | N = 391 |

| Among | 0.56 | −0.92 | 1.16 | n = 17 | ||

| Within | 0.22 | −1.16 | 0.57 | T = 23 | ||

| Human Capital Index | General | 0.43 | 0.04 | 0.33 | 0.5 | N = 391 |

| Among | 0.03 | 0.37 | 0.48 | n = 17 | ||

| Within | 0.02 | 0.39 | 0.47 | T = 23 | ||

| Globalization Index | General | 0.61 | 0.07 | 0.41 | 0.78 | N = 391 |

| Among | 0.05 | 0.55 | 0.73 | n = 17 | ||

| Within | 0.04 | 0.46 | 0.7 | T = 23 | ||

| Government Integrity Index | General | 0.36 | 0.15 | 0.08 | 0.79 | N = 391 |

| Among | 0.13 | 0.2 | 0.7 | n = 17 | ||

| Within | 0.06 | 0.12 | 0.73 | T = 23 | ||

| Variable | Mean | Standard Deviation | Min | Max | Observations | |

|---|---|---|---|---|---|---|

| Economic Complexity Index | General | 1.86 | 0.39 | 0.78 | 2.9 | N = 230 |

| Among | 0.35 | 1.39 | 2.54 | n = 10 | ||

| Within | 0.19 | 1.25 | 2.35 | T = 23 | ||

| Human Capital Index | General | 0.49 | 0.03 | 0.42 | 0.54 | N = 230 |

| Among | 0.02 | 0.47 | 0.53 | n = 10 | ||

| Within | 0.02 | 0.44 | 0.52 | T = 23 | ||

| Globalization Index | General | 0.81 | 0.07 | 0.57 | 0.91 | N = 230 |

| Among | 0.06 | 0.71 | 0.88 | n = 10 | ||

| Within | 0.04 | 0.64 | 0.88 | T = 23 | ||

| Government Integrity Index | General | 0.7 | 0.18 | 0.3 | 0.95 | N = 230 |

| Among | 0.18 | 0.47 | 0.92 | n = 10 | ||

| Within | 0.05 | 0.44 | 0.9 | T = 23 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rivera, B.; Leon, M.; Cornejo, G.; Florez, H. Analysis of the Effect of Human Capital, Institutionality and Globalization on Economic Complexity: Comparison between Latin America and Countries with Greater Economic Diversification. Economies 2023, 11, 204. https://doi.org/10.3390/economies11080204

Rivera B, Leon M, Cornejo G, Florez H. Analysis of the Effect of Human Capital, Institutionality and Globalization on Economic Complexity: Comparison between Latin America and Countries with Greater Economic Diversification. Economies. 2023; 11(8):204. https://doi.org/10.3390/economies11080204

Chicago/Turabian StyleRivera, Bryan, Marcelo Leon, Gino Cornejo, and Hector Florez. 2023. "Analysis of the Effect of Human Capital, Institutionality and Globalization on Economic Complexity: Comparison between Latin America and Countries with Greater Economic Diversification" Economies 11, no. 8: 204. https://doi.org/10.3390/economies11080204