Country Economic Security Monitoring Rapid Indicators System

Abstract

:1. Introduction

2. Literature Review

2.1. Economic Security Concept

2.2. Economic Security Monitoring

3. Methodology

3.1. Economic Security System Structure

- Legal framework:

- Russia’s economic security strategy for the period up to 2030;

- Russia’s national security strategy.

- Russia’s national interests in the economic sphere:

- Economy development and ensuring the country’s economic security;

- Creating personal development conditions and improvement of citizens’ life quality;

- Ensuring technological sovereignty;

- Russia’s entry into leading countries’ ranks in terms of gross domestic product.

- Economic security threats:

- Internal threats: economy’s state regulation inefficiency, lack of innovative development and interests balance violation in the economy developing most effective ways search;

- External threats: high volatility in world energy prices, significant fluctuations in the national currency exchange rate, capital outflow over its inflow excesses, increase in corporate debt, raw materials export overload and the economy’s significant dependence on imports.

- Economic security operational monitoring (ESOM) concept definition:

- 5.

- The main tasks of the ESOM:

- Reliable information collection, operational monitoring organization and search for reliable data on the state of the country’s economic security in dynamics;

- Country’s economic security analysis and assessment and results comparison with certain criteria;

- Filling and periodic updating ESOM databases in order to develop adequate mechanisms for neutralizing threats;

- Identification of forecasting threats and timely crisis phenomena “harbingers” in the country’s economy;

- Recommendations for authorities’ preparation at various hierarchy levels for the country’s economic security system operational management purpose.

3.2. Step-by-Step ESOM Procedure

- Monitoring problems statement, immanent tools and requirements definition.

- Necessary up-to-date information search. This stage includes the indicators system and its threshold levels choice. In this work, the system proposes a short-term indicators set with a one-month sample discretization, which is published in official statistical collections.

- Initial information on economic security indicators’ transformation. In addition to the main system, additional ones are used that are necessary for evaluation and precursors search.

- Index method implementation (Senchagov and Mityakov 2011), adapted by us for the ESOM problem. Converting indicators to a dimensionless form. After the transformation, indicators retain trends in their dynamics and vary within the same scale, which opens up the possibility for their analysis using radar charts

- Indicators’ interaction patterns analysis, both integral and generalized economic security indices.

3.3. Economic Security Rapid Indicators System

- The GDP physical volume index is calculated as the ratio of the current GDP volume to the GDP volume in the corresponding period of the previous year, multiplied by 100%. It is the country’s economic growth indicator.

- The industrial production index is an indicator for production volume analysis and is considered as the ratio of the current to the previous year periods’ production volume, multiplied by 100%. It is an indicator of the country’s industrial production level growth (fall).

- The fixed investment index is a relative indicator that characterizes the change in the volume of capital investments in the current period compared with the corresponding period of the previous year, multiplied by 100%. It represents the main factors of economic growth and technological development.

- The labor market tension coefficient indicates the number of unemployed people per one declared vacancy. In fact, it determines the total number ratio of the unemployed population to the number of vacancies, and is the country’s personnel security indicator.

- The index of real disposable money income is a relative indicator that characterizes the change in real disposable money income in the current period compared with the corresponding period of the previous year, multiplied by 100%. It is an important indicator that characterizes the country’s social sphere state.

- The retail turnover index is a relative indicator that characterizes the change in retail trade volume in the current period compared with the corresponding period of the previous year, multiplied by 100%. It is population consumer demand changes indicator, which is an important economic security indicator.

- Goods and services monthly imports coverage by gold and foreign exchange reserves shows how many months it takes to cover imports using gold and foreign exchange reserves. In other words, how long a country can pay for imports solely from reserves. It is the financial airbag of the state. It is accumulated in order to overcome crisis moments more easily, to stimulate the economy in difficult periods.

- The consumer price index is a classic inflation indicator. It shows the change in prices for consumer goods and services, fixed at a constant quantity, and properties purchased, used or paid for by the population in the current period compared with the corresponding period of the previous year, multiplied by 100%.

- The net capital outflow, a percentage compared with goods and services exports, is the difference between capital exports and imports in the country in the current period in relation to the export volume, multiplied by 100%. It shows what export earnings can be taken out of the country, maintaining an economic security level.

- External debt is an external public debt sum, and indicates the country’s ability to repay its debts. External public debt has long ceased to be Russia’s economic security problem and external corporate debt sum.

- The export volume index is calculated as the goods and services exports volume to the exports volume ratio, determined in the corresponding period of the previous year, multiplied by 100%. It shows the country’s potential export results.

- The import volume index is calculated as the goods and services imports volume to the imports volume ratio, determined in the corresponding period of the previous year, multiplied by 100%. It demonstrates the country’s necessary provision level for the production of external resources.

3.4. Economic Security Indicators’ Critical and Target Values

3.5. “Index Method” Implementation

3.5.1. Indicator Conversion to a Dimensionless Form

3.5.2. ESOM Indicators’ System Integral Indices Using Spheres and Economic Security Generalized Index Synthesis

3.6. Additional Indicators

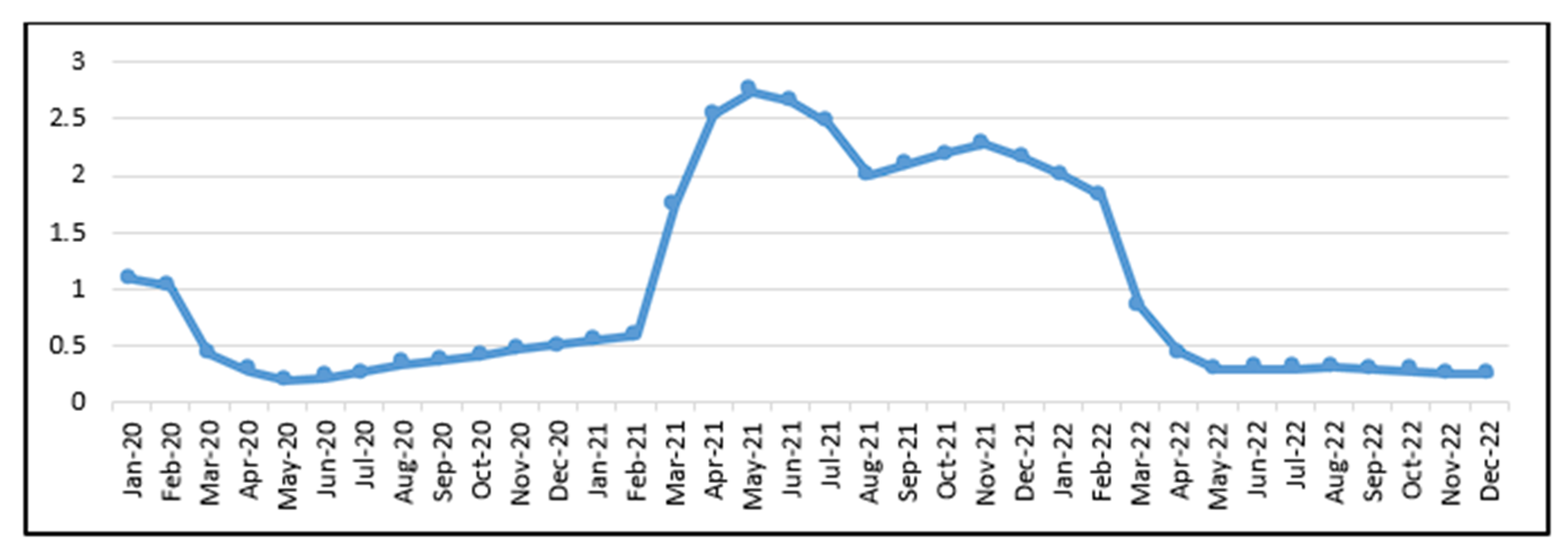

4. Results and Discussion

5. Conclusions

- Using the proposed operational monitoring methodology and the index method, we built an economic security generalized index for the 1997–2022 period. This made it possible to identify the characteristic features of each crisis, as well as confirm the RTS index’s usability as its harbinger.

- Detailed analysis of the dynamics of the last two economic crises was carried out using both individual and integral indices and Russia’s economic security generalized index.

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abalkin, Leonid Ivanovich. 1994. Economic security of Russia: Threats and their reflection. Questions of Economics 12: 4–13. [Google Scholar]

- Andrianova, Elena Gelevna, Sergey Anatolievich Golovin, Sergey Viktorovich Zykov, Sergey Alexandrovich Lesko, and Ekaterina Romanovna Chukalina. 2020. Review of modern models and methods of analysis of time series of dynamics of processes in social, economic and socio-technical systems. Russian Technological Journal 8: 7–45. [Google Scholar] [CrossRef]

- Averina, Irina Sergeevna, and Marina Eduardovna Buyanova. 2019. Development of an information-analytical system for monitoring challenges and threats to the economic security of the region. Fundamental Research 9: 5–10. [Google Scholar]

- Barsukova, Marina Vyacheslavna, Anastasia Vladimirovna Nikolaeva, Tatyana Vladimirovna Stolyarova, and Lyudmila Petrovna Fedorova. 2019. Monitoring Tools to Identify Threats to Economic Security Vestnik RUK. p. 3. Available online: https://cyberleninka.ru/article/n/instrumenty-monitoringa-po-vyyavleniyu-ugroz-ekonomicheskoy-bezopasnosti (accessed on 18 April 2023).

- Borio, Claudio E. V., and Philip William Lowe. 2022. Asset Prices Financial and Monetary Stability: Exploring the Nexus. BIS Working Paper 114. Available online: https://ssrn.com/abstract=846305 (accessed on 24 July 2023).

- Borrell, Josep. 2023. Economic Security: A New Horizon for EU Foreign and Security Policy. Available online: https://www.eeas.europa.eu/eeas/economic-security-new-horizon-eu-foreign-and-security-policy_en (accessed on 20 July 2023).

- Buzan, Barry. 1991. New Patterns of Global Security in the Twenty-First Century. International Affairs 67: 431–51. [Google Scholar] [CrossRef] [Green Version]

- Coulombe, Philippe Goulet, Maxime Leroux, Dalibor Stevanovic, and Stéphane Surprenant. 2022. How Is Machine Learning Useful for Macroeconomic Forecasting? Journal of Applied Econometrics 37: 920–64. [Google Scholar] [CrossRef]

- Decree of the President of the Russian Federation No. 208. 2017. Economic Security Strategy of the Russian Federation for the Period up to 2030: Decree of the President of the Russian Federation of May 13, 2017 No. 208. Available online: http://www.consultant.ru/cons/cgi/online.cgi?req=doc&base=LAW&n=216629&fld=134&dst=1000000001,0&rnd=0.7295930030490538#0 (accessed on 15 April 2023).

- Grikietytė-Čebatavičienė, J. 2021. Financial Security Assessment in the European Union Countries. In Vilnius University Open Series. Vilnius: Vilnius University Press, pp. 13–19. [Google Scholar] [CrossRef]

- Hough, P. 2014. Understanding Global Security. London: Routledge. ISBN 978-1-135-04201-1. [Google Scholar]

- Hrybinenko, Olha, Olena Bulatova, and Olha Zakharova. 2020. Financial indicators in the system of economic security of the world countries. Ppaer presented at the International Scientific Conference “Business and Management 2020”, Vilnius, Lithuania, May 7–8; pp. 273–81. [Google Scholar]

- Husainova, Ekaterina Aleksandrovna, Liliya Ravilevna Urazbakhtina, Nina Anatolyevna Serkina, and Olga Vladimirovna Filina. 2019. Monitoring Tools of Regional Economic Security. E3S Web of Conferences 124: 05009. [Google Scholar] [CrossRef] [Green Version]

- Ignatov, Augustin. 2019. Analysis of the dynamics of the European economic security in the conditions of a changing socio-economic environment. New Medit 18: 15–56. [Google Scholar] [CrossRef] [Green Version]

- Interfax. 2019. The Ministry of Economic Development Has Determined Macro Indicators Values That Are Critical for Russian Federation Security. JSC “Interfax”. 2019. Available online: https://www.interfax.ru/business/656619 (accessed on 31 July 2023).

- Kahler, Martin. 2004. Economic Security in an Era of Globalization: Definition and Provision. The Pacific Review 17: 485–502. [Google Scholar] [CrossRef]

- Kozicki, Bartosz, Marcin Gornikiewicz, and Marzena Walkowiak. 2020. The Impact of COVID-19 Pandemic on the Economic Security of Russia and European Countries. European Research Studies Journal 23: 324–32. [Google Scholar] [CrossRef]

- Krivorotov, Vadim Vasilyevich, Alexey Vladimirovich Kalina, and Irina Stepanovna Belik. 2019. Threshold values of indicators for diagnosing the economic security of the Russian Federation at the present stage. UrFU Bulletin Series: Economics and Management 18: 892–910. [Google Scholar] [CrossRef]

- Kuklin, Alexander Anatolyevich, Natalia Leonidovna Nikulina, Gennady Pavlovich Bystrai, Alexey Sergeevich Naidenov, and Boris Alengordovich Korobitsyn. 2013. Diagnostics of threats and risks of economic security of the region. Risk Analysis Problems 10: 80–91. [Google Scholar]

- Kuznetsov, Nikolay Vladimirovich. 2019. Three-level architecture of the system of analysis and monitoring of the socio-economic security of the country. Theory and Practice of Social Development 12: 55–58. [Google Scholar]

- Lessmann, Christian. 2013. Regional Inequality and Internal Conflict. CESifo Working Paper No. 4112. 35p. Available online: https://www.cesifo.org/DocDL/cesifo1_wp4112.pdf (accessed on 31 July 2023).

- Manyaeva, Vera Alexandrovna, Svetlana Ivanovna Sotskova, and Olga Alexandrovna Naumova. 2019. Development Of Methods For Monitoring Economic Security Of An Economic Entity. In Global Challenges and Prospects of the Modern Economic Development. Edited by V. Mantulenko. Volume 57. European Proceedings of Social and Behavioural Sciences. Hong Kong: Future Academy, pp. 1158–68. [Google Scholar] [CrossRef]

- McCormick, David H., Charles E. Luftig, and James M. Cunningham. 2020. Economic Might, National Security, and the Future of American Statecraft. Texas National Security Review 3: 50–75. [Google Scholar] [CrossRef]

- Medvedenko, O. V. 2020. Economic security indicators and their threshold values that determine the emergence of threats to the development of destructive entrepreneurship in Russia. Journal of Economy and Business 11: 148–55. [Google Scholar] [CrossRef]

- Meijnders, Minke, and Martens Merel. 2019. Economic Security Methodology and Approach. Wassenaar: Netherlands Institute of International Relations. Available online: https://www.readkong.com/page/economic-security-clingendael-institute-4925937 (accessed on 25 July 2023).

- Mityakov, Eugeniy Sergeevich. 2018. Key elements of the methodology and tools for Russian regions economic security monitoring. Fundamental Research 8: 84–88. [Google Scholar]

- Mityakov, Eugeniy Sergeevich, Segey Nikolaevich Mityakov, and Natalya Alekseevna Romanova. 2013. Volga Federal District regions economic security. Economics of the Region 3: 81–91. [Google Scholar] [CrossRef]

- Mityakov, Segey Nikolaevich, and Eugeniy Sergeevich Mityakov. 2020. Machine learning in innovative processes problems research. Journal of Applied Research 4: 6–13. [Google Scholar]

- Mityakov, Segey Nikolaevich, and Eugeniy Sergeevich Mityakov. 2021. Analysis of Crisis Phenomena in the Russian Economy Using Fast Indicators of Economic Security. Studies on Russian Economic Development 3: 245–53. [Google Scholar] [CrossRef]

- Mityakov, Segey Nikolaevich, Eugeniy Sergeevich Mityakov, and Tatyana Aleksandrovna Fedoseeva. 2020. Economic security indicators municipality system as an integral element of economic security multi-level system. World of New Economics 14: 67–80. [Google Scholar]

- Mityakov, Segey Nikolaevich, Lilia Yuryevna Kataeva, Eugeniy Sergeevich Mityakov, and Seifullah Agaevich Ramazanov. 2019. Russia’s economic security operational monitoring. Innovative Development of the Economy 5: 213–23. [Google Scholar]

- Muratova, Shoista Norbovaevna. 2020. Analysis of Economic Security and Internal Market Protection Practices in European Union. Sciences of Europe 47: 24–28. [Google Scholar]

- Nanto, Dick Kazuyuki. 2011. Economics and National Security: Issues and Implications for U.S. Policy. Congressional Research Service. Available online: https://www.fas.org/sgp/crs/natsec/R41589.pdf (accessed on 15 April 2023).

- Posen, Adam, and Daniel Tarullo. 2017. Report of the Working Group on Economics and National Security//Princeton Project on National Security. Available online: http://www.princeton.edu/~ppns/conferences/reports/fall/ENS.pdf (accessed on 20 July 2023).

- Rechkalov, Alexander Vasilievich, Alexander Viktorovych Artyukhov, and Gennady Gryhorevich Kulikov. 2023. Logical-semantic definition of a production process digital twin. Russian Technological Journal 11: 70–80. [Google Scholar] [CrossRef]

- Rudakova, Tatiana Alekseevna, Inna Nikolaevna Sannikova, and Oksana Yurievna Rudakova. 2018. Economic security of the region: Essence, factors, monitoring tools. National Interests: Priorities and Security 14: 1072–91. [Google Scholar]

- Rudenko, M. N. 2019. Economic security monitoring of the region (on the Perm Territory example). Development and Security 3: 25–37. [Google Scholar]

- Samogin, Artem Sergeevich, and Vera Romanovna Galanova. 2021. French national security in the context of globalization: New challenges and ways to solve them in the modern doctrine. Matters of Russian and International Law 11-2A: 233–41. [Google Scholar]

- Satsuk, Tatiana Pavlovna, and Olga Vasilievna Koneva. 2022. Methodical approach to social sectors economic security assessing and monitoring. Innovative Development of the Economy 6: 259–65. [Google Scholar]

- Senchagov, Vyacheslav Konstatnynovych. 2010. Economy, Finance, Prices: Evolution, Transformation, Security. Monograph. Moscow: Ankil Publishing House. 1120p. [Google Scholar]

- Senchagov, Vyacheslav Konstatnynovych, ed. 2011. Modernization of the Financial Sector in Russia: Monograph. St. Petersburg: Nestor-Istoriya. 304p. [Google Scholar]

- Senchagov, Vyacheslav Konstatnynovych, and Segey Nikolaevich Mityakov. 2011. Using the index method to assess economic security level. Economic Security Academy Bulletin of the Russia’s Internal Affairs Ministry 5: 41–50. [Google Scholar]

- Senchagov, Vyacheslav Konstatnynovych, and Segey Nikolaevich Mityakov. 2013. Financial and economic crises of 1998 and 2008–2009 impact comparative analysis on Russia’s economic security indicators. Financial University Bulletin 6: 71–88. [Google Scholar]

- Senchagov, Vyacheslav Konstatnynovych, and Segey Nikolaevich Mityakov. 2016. Economic crises evaluation using short-term indexes and average economic security indexes of Russia. Studies on Russian Economic Development 27: 148–58. [Google Scholar]

- Starovoitov, Vladimir Gavrylovich, and Nikita Vladimirovich Starovoitov. 2019. Russian Federation economic security risk management system and monitoring: Federal level, first experience. Development and Security 4: 26–35. [Google Scholar]

- Suh, Jooyeoun, Jennifer Clark, and Jeff Hayes. 2018. Basic Economic Security in the United States: How Much Income Do Working Adults Need in Each State? Available online: https://iwpr.org/job-qualityincome-security/basic-economic-security-in-the-united-states/ (accessed on 15 July 2023).

- Tatarkin, Alexander Ivanovich, Olga Aleksandrovna Romanova, Alexander Anatolyevich Kuklin, and Vladimir Ivanovich Yakovlev. 1996. Economic security as an object of regional research. Questions of Economics 6: 78–80. [Google Scholar]

- Yuan, Guanghui, Fei Xie, and Huiling Tan. 2022. Construction of Economic Security Early Warning System Based on Cloud Computing and Data Mining. Computational Intelligence and Neuroscience 22: 2080840. [Google Scholar] [CrossRef]

| No. | Indicator Name | Critical Value | Target Value | Reference |

|---|---|---|---|---|

| Real economy sphere | ||||

| 1 | GDP physical volume index | 101.5% | 104% | http://www.gks.ru accessed on 17 April 2023 |

| 2 | Industrial production index | 100% | 106.5% | http://www.gks.ru accessed on 17 April 2023 |

| 3 | Fixed investment index | 100% | 105% | http://www.gks.ru accessed on 17 April 2023 |

| Social sphere | ||||

| 4 | Labor market tension coefficient | 3 ppl. | 1 ppl. | http://www.gks.ru accessed on 17 April 2023 |

| 5 | Real disposable money income index | 100% | 104% | http://www.gks.ru accessed on 17 April 2023 |

| 6 | Retail turnover index | 100% | 103.5% | http://www.gks.ru accessed on 17 April 2023 |

| Monetary and financial sphere | ||||

| 7 | Goods and services monthly imports’ coverage by gold and foreign exchange reserves | 3 month | 22 month | http://www.cbr.ru accessed on 19 April 2023 |

| 8 | Consumer price index, % | 113% | 104% | http://www.gks.ru accessed on 17 April 2023 |

| 9 | Net capital outflow, % compared with goods and services exports | 25% | 9% | http://www.cbr.ru accessed on 19 April 2023 |

| Foreign economic sphere | ||||

| 10 | External debt, % of GDP | 50% | 30% | http://www.cbr.ru accessed on 19 April 2023 |

| 11 | Export volume index | 102% | 106% | http://www.gks.ru accessed on 17 April 2023 |

| 12 | Import volume index | 102% | 106% | http://www.gks.ru accessed on 17 April 2023 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mityakov, S.N.; Mityakov, E.S.; Ladynin, A.I.; Nazarova, E.A. Country Economic Security Monitoring Rapid Indicators System. Economies 2023, 11, 208. https://doi.org/10.3390/economies11080208

Mityakov SN, Mityakov ES, Ladynin AI, Nazarova EA. Country Economic Security Monitoring Rapid Indicators System. Economies. 2023; 11(8):208. https://doi.org/10.3390/economies11080208

Chicago/Turabian StyleMityakov, Sergei N., Evgenii S. Mityakov, Andrey I. Ladynin, and Ekaterina A. Nazarova. 2023. "Country Economic Security Monitoring Rapid Indicators System" Economies 11, no. 8: 208. https://doi.org/10.3390/economies11080208

APA StyleMityakov, S. N., Mityakov, E. S., Ladynin, A. I., & Nazarova, E. A. (2023). Country Economic Security Monitoring Rapid Indicators System. Economies, 11(8), 208. https://doi.org/10.3390/economies11080208