Abstract

Bank lending to SMEs plays a vital role in economic growth, contributing significantly to employment and GDP. Access to bank lending is crucial for small- and medium-sized enterprises (SMEs), as they contribute significantly to global employment and GDP. New financial technologies promise better bank operations, fewer costs, and enhanced credit supply to SMEs. However, there is still a lack of empirical findings on how these technologies can solve demand-side bank lending problems for small- and medium-sized firms. This study gathered data from a sample of 381 respondents, comprising CEOs, managers, officers, loan managers, IT consultants, and other relevant stakeholders. The findings indicate that the adoption of blockchain technologies, as well as the adoption of Big Data technologies encompassing cloud computing, data analytics, algorithms, and programming, along with the adoption of mobile banking technologies, have had a substantial positive impact on bank credit supplies for small- and medium-sized enterprises (SMEs) in Pakistan. This novel study contributes to existing knowledge in two ways. First, it provides knowledge to SMEs looking to adopt new technologies; second, it provides knowledge to a manager looking to finance the SMEs with information asymmetries. This research also provides key findings for researchers and policymakers.

1. Introduction

Bank lending to SMEs is essential for economic growth, as it produces 60–70% of total world employment and over 50% of world GDP (Fanta 2016). However, the International Finance Corporation (IFC) estimates that 65 million firms, or 40% of formal micro, small, and medium enterprises (MSMEs) in developing countries, have an unmet financing need of $5.2 trillion every year, which is equivalent to 1.4 times the current level of the global MSME lending. East Asia and the Pacific accounted for the global finance gap’s largest share (46%). Governments have taken several initiatives to improve financial access to SMEs across the Globe; however, banks are still reluctant to lend to incredibly informal SMEs.

There are several limitations that banks face while lending to SMEs, for instance, severe information asymmetries (Flögel and Beckamp 2020, p. 3), high financing costs (Bertrand and Klein 2021; Mirza et al. 2023; Liu et al. 2022; Rabbani et al. 2023; Rahid 2023; Zhang et al. 2022), lack of collateral, overestimation of the creditworthiness of borrowers (Berg et al. 2019), and unsound credit histories.

In recent years, the surge of FinTech has opened new possibilities for expanding access to credit for SMEs. FinTech companies leverage technology to streamline the lending process, making it easier and faster for SMEs to apply for and receive loans. Some big technology (BigTech) companies, such as Alibaba and Tencent in China, Mercado Credito in Argentina, Paytm in India, and Amazon Lending in the United States, have extended loans to millions of small borrowers (Cornelli et al. 2021; Yang et al. 2019). In China, each of the three leading virtual banks—MYbank (affiliated with Alibaba), WeBank (affiliated with Tencent), and XW Bank (affiliated with tech giant Xiaomi)—provides loans to millions of small firms annually, more than 80 percent of which have no credit history. Maybank Islamic is an excellent example of FinTech adoption technologies. Maybank is offering clean lending to SMEs in less than 30 min by making an online application either through an online platform or a mobile app.

The adoption of FinTech by commercial banks in Pakistan has been increasing in recent years, as banks look for ways to improve their efficiency, reach a wider customer base, and provide new services. Some of the most common FinTech solutions adopted by banks in Pakistan include mobile banking, online banking, and digital payment systems (Al Tarawneh et al. 2023; Basile et al. 2023). This has allowed banks to offer convenient and accessible services to their customers, regardless of their location. Additionally, the use of technology has helped to reduce the cost of delivering financial services and has increased the speed and accuracy of financial transactions (Al Tarawneh et al. 2023; Basile et al. 2023). However, the level of FinTech adoption by banks in Pakistan varies and is still limited in some areas. Nevertheless, the trend towards FinTech adoption is expected to continue as banks look to meet the changing needs of their customers and stay competitive in the market.

Despite high FinTech adoption in Pakistani commercial banks, bank lending to SMEs in Pakistan is only 17%, which is very low compared to other South Asian countries (Li et al. 2023; Rahid 2023). The State Bank of Pakistan has started many initiatives to increase bank lending to SMEs. However, banks still face challenges lending to informal SMEs due to a lack of collateral, severe information asymmetries, poor creditworthiness, and higher default rates manipulated lending contracts by loan officers. These factors may cause a low ratio of domestic-to-private-sector credit.

Past studies stressed that the application of FinTech reduces the dependence on professionals, shortens the management process, and reduces errors in business transfer, improving the efficiency of the borrower information assessment (Hendershott et al. 2021; Okine et al. 2023; Taylor et al. 2020)

For instance, according to Tantri (2020), FinTech can improve lending and profitability and reduce the default rate by outperforming loan officer predictions. Furthermore, credit-scoring models developed through Big Data and machine learning decrease individual officers’ discretion, thus significantly alleviating the risk of biased results and helping banks identify bad loans Malhotra et al. (2022) In addition, FinTech technologies (cloud computing and artificial intelligence) can quickly process many loan applications and better predict customer default dynamically in real time Cornelli et al. (2021).

Furthermore, FinTech (i.e., blockchain) can improve bank lending by sharing information and creating risk pools which will be helpful for SME lending (Rabbi et al. 2021). A model proposed by Wang et al. (2019, p. 7) suggested that by integrating blockchain into a combined scoring system, the lender can review corporate and lender information in real time. The use of blockchain will reduce costs and information asymmetries. Secondly, blockchain technology may help reduce the incentive of individual and corporate borrowers to manipulate and tamper with their information in the credit system. The tamper-proof and algorithmic execution characteristics of blockchain technology may also enhance the reliability of the conventional credit system and contractibility on contingencies that were difficult to contract traditionally (Chen et al. 2023).

To date, there is a notable gap in the existing literature regarding the adoption of FinTech, including blockchain, Big Data, and mobile banking, in small- and medium-sized enterprises (SMEs) and its impact on bank credit supplies in Pakistan. This study aims to address this gap by investigating how the adoption of FinTech, specifically blockchain technologies, Big Data adoption (encompassing cloud computing, data analytics, algorithms, and programming), and mobile banking technologies, can influence the availability and accessibility of bank credit for SMEs in the manufacturing sector of Pakistan.

Additionally, the research aims to understand how FinTech can help overcome the challenges faced by SMEs in securing bank financing. By examining the adoption of various FinTech tools, the study seeks to provide empirical evidence on how these technologies can mitigate information asymmetries and other obstacles that hinder SMEs’ access to bank credit. The ultimate goal is to shed light on the potential benefits and implications of FinTech adoption for SMEs’ bank credit supplies, offering valuable insights for researchers, policymakers, and stakeholders interested in fostering economic growth and supporting the SME sector. Importantly, this study represents the first attempt to investigate this specific context.

To achieve the study’s objectives, data were collected and analyzed from 381 respondents, including owners, CEOs, credit managers, loan officers, and IT consultants in Pakistan. The findings of this research demonstrate that FinTech-based applications, such as Big Data, mobile money apps, and blockchain-driven bank operations, have significantly addressed information asymmetry issues and improved bank loan supplies for SMEs from private commercial banks. These findings contribute to the limited literature on FinTech adoption in SMEs in several ways.

Firstly, this empirical study provides new insights into the impact of FinTech adoption on bank credit supplies for SMEs in Pakistan, an area that has not been explored previously. Secondly, it offers valuable knowledge to SME owners, CEOs, managers, and bank managers on how SMEs can effectively meet their financing needs through the adoption of FinTech. Given the novelty of this research, its findings hold substantial significance for SMEs, bank managers, and policymakers seeking to address the financing needs of SMEs, particularly in the context of Pakistan. The findings offer guidance for SMEs in search of funding opportunities and assist banks in financing SMEs with lower default rates, ultimately benefiting both parties involved.

This study contributes to the existing literature by providing new insights into the impact of FinTech adoption on bank credit supplies in SMEs in Pakistan, a topic that has been underexplored. It also offers practical implications for SME owners, CEOs, managers, bank managers, and policymakers by shedding light on how FinTech can address SMEs’ financing needs. The findings of this study have the potential to support the growth and development of SMEs, making it a valuable contribution to the field.

The next section of this paper is composed of a review of the literature, the research methodology, the results, a discussion, and a conclusion.

2. Literature Review

The loan officer is a key individual who collects soft information from SMEs (Agarwal and Hauswald 2010; Flögel and Beckamp 2020). There are two distinct channels through which loan officers can convert soft information to hard information. This hard information can then predict the borrower’s credit score (Filomeni et al. 2021). Loan officers collect the soft information about the creditworthiness of the browsers and then translate this qualitative information into numerical scores precisely, as suggested by Liberti and Mian (2008). Furthermore, this qualitative information can be upgraded or downgraded to obtain the desired outcome and named as uncodified information. In other words, the loan officer can manipulate the soft information to obtain the desired results. This manipulation could be the leading cause of higher loan default rates, higher rejection rates for SMEs, and more information asymmetry problems (Berg et al. 2019).

New financial technologies such as blockchain and artificial intelligence made it almost impossible to alter the information and facilitate the lending decision more accurately and in an unbiased way (Garg et al. 2021; Rabbi et al. 2021; Rajnak and Puschmann 2020; Tantri 2021; Wang et al. 2019). The integration of new financial technologies, such as blockchain and artificial intelligence, has the potential to revolutionize the way financial services are provided. Blockchain provides a secure and transparent way of storing and sharing information, making it almost impossible to alter the information once it is recorded on the blockchain. This can enhance the trust and transparency of financial transactions and reduce the risk of fraud and counterfeiting. Artificial intelligence, on the other hand, can analyze vast amounts of data in a short amount of time and provide more accurate and unbiased lending decisions. This can help to reduce the risk of human error and bias in the lending process and ensure that credit is provided to the most deserving borrowers. Overall, the integration of new financial technologies such as blockchain and artificial intelligence has the potential to improve the efficiency, accuracy, and fairness of financial services, making it easier for individuals and businesses to access credit and other financial services. However, it is important to note that the widespread adoption of these technologies also requires regulatory support, as well as the development of clear and consistent regulations to ensure the security and privacy of financial transactions.

For instance, Sheng (2021)found that FinTech has significantly improved lending decisions in China. However, this study did not show any critical findings on how it can improve the credit supplies to SMEs when SMEs adopt FinTech.

Asymmetrical information is highly existing in the lending process to SMEs. This lack of communication creates a negative selection problem for loan officers. As a result, unfavorable choices will almost always become apparent before signing the loan agreement. The identification is challenging because banks generally cannot discriminate against borrowers based on the quality of their loans. However, Malhotra et al. (2022) found that new artificial intelligence adoption in banks may overcome this information asymmetry by collecting certain information (i.e., Big Data) about borrowers. AI can help to improve the credit supplies to small and medium enterprises by analyzing the large dataset (i.e., browsers’ payment history and default rate) and can open new economic gates for underserved SMEs. These findings are supported by Emeana et al. (2020) and Mhlanga (2021). Although these technologies can help improve borrowers’ credit scores, information collected by the loan officer is still relevant for making loan decisions for small and medium enterprises, especially the information opaque firm. However, the literature is silent on how FinTech adoption in SMEs may overcome credit supply problems to SMEs.

There are many works in the literature on FinTech and its implication for improving and assisting credit decisions (Tantri 2021). For instance, Tantri (2020, 2021) found that FinTech (i.e., machine learning) can better predict customer default rates than loan officers in India. Furthermore, the study found that the machine-learning algorithm can lend up to 60% more money at the same delinquent rate as loan officers or achieve a 33% lower delinquency rate at the same approval rate (Tantri 2021). However, in the context of the SME loan process and how FinTech can overcome information asymmetry problems of uncodified, information is still missing in the literature. The literature is silent on how FinTech adoption in SMEs may overcome credit supply problems to SMEs.

2.1. Theoretical Foundation

The theoretical foundation of this study is based on several key concepts and frameworks that are relevant to the research topic of bank credit supplies to small and medium enterprises (SMEs). These concepts provide the necessary theoretical basis for investigating the role of financial technologies, specifically blockchain and artificial intelligence, in improving lending decisions, mitigating information asymmetry, and enhancing credit supplies to SMEs. We performed an extensive review of the previous literature specifically focused on the banking sector, credit assessment, information asymmetry, and credit supplies to SMEs, as these areas provided valuable insights into the factors influencing the adoption of financial technologies (Awan et al. 2021; Kumar Bhardwaj et al. 2021; Salimon et al. 2023; Shahadat et al. 2023).

We applied a rigorous process of content analysis to categorize and extract the key factors from the identified literature. This involved systematically examining each study and identifying recurring themes, concepts, and factors that were consistently reported as being influential in the adoption of blockchain, Big Data analytics, and mobile banking technologies in the context of credit supplies to SMEs. We drew upon the Technology Adoption Theory, which posits that individuals or organizations are more likely to adopt a new technology if they perceive it to be useful or beneficial. The Technology Adoption Theory is based on the work of a number of researchers who have contributed to our understanding of technology adoption processes. Everett M. Rogers, who created the theory in his book “Diffusion of Innovations”, published in 1962, and Geoffrey Moore, who built on the notion in his book “Crossing the Chasm”, published in 1991, are notable contributors to the theory.

We aligned our factor extraction process with this theoretical framework, ensuring that the identified factors captured the perceived usefulness and benefits of adopting blockchain, Big Data analytics, and mobile banking technologies in the context of credit supplies to SMEs. We argue that banks may perceive blockchain technology as useful due to its potential to improve credit assessments, reduce adverse selection, and increase credit supply to SMEs (Nuryyev et al. 2020; Song et al. 2020; Zamani 2022). Previous studies by Zamani (2022), Nuryyev et al. (2020), Shahadat et al. (2023), and Salimon et al. (2023) examined the adoption and impact of financial technologies in the SMEs, particularly in relation to credit assessment, information asymmetry, and credit supply to SMEs. These studies provide empirical evidence and theoretical support for the hypothesized relationships between the adoption of blockchain, Big Data analytics, and mobile banking technologies and the increased credit supplies to SMEs.

According to the previous literature, the use of FinTech, such as blockchain and mobile banking technologies, has been found to have positive effects on financial intermediation, particularly in the banking sector. Similarly, studies such as those of Emeana et al. (2020) and Malhotra et al. (2022) have suggested that the adoption of FinTech by banks has reduced adverse selection, which is a situation where lenders cannot differentiate between good and bad borrowers, leading to higher default rates. Additionally, the social influence construct of the Technology Adoption Theory suggests that individuals or organizations may adopt a new technology due to the influence of others (Kumar Bhardwaj et al. 2021).

2.2. Hypothesis Development

Past studies argue that blockchain technology can increase transparency and reduce information asymmetry in lending, which can improve lenders’ ability to assess credit risk and reduce adverse selection. This, in turn, can lead to increased credit supply to SMEs (Liu et al. 2022). Furthermore, the researchers also argue that the use of blockchain technology can increase the efficiency of lending processes, reduce transaction costs, and improve the accuracy of credit assessments, all of which can increase credit supply to SMEs (Malhotra et al. 2022). Hence, this study’s first hypothesis () is that the adoption of blockchain by the staff of SMEs has significantly increased banks’ supplies to SMEs.

Furthermore, we also argue that the use of Big Data analytics technology by staff in SMEs is perceived as useful because it provides valuable insights into the financial health and performance of the business, making it more attractive to lenders. As a result, SMEs are more likely to adopt this technology to improve their chances of securing credit, which in turn, leads to an increase in credit supplies to these businesses. Therefore, this study’s second hypothesis () is that the adoption of Big Data analytics by the staff of SMEs has significantly increased credit supplies to SMEs.

Finally, the perceived ease of use construct of the Technology Adoption Theory suggests that individuals or organizations are more likely to adopt a new technology if they perceive it to be easy to use or understand (Nuryyev et al. 2020). Previous studies also stressed the importance of mobile banking technologies: mobile banking technologies can increase the accessibility of financial services, particularly in areas with limited physical access to banks (Schuetz and Venkatesh 2020). This can improve SMEs’ ability to access credit, which can lead to increased credit supply. Therefore, based on the above discussion, this study’s third hypothesis () is that by adopting mobile banking technologies, the staff of SMEs has significantly increased the credit supplies to SMEs. Conceptual framework of this research can be seen in Figure 1.

Figure 1.

Conceptual framework.

3. Research Methodology

The research methodology of this study is designed to investigate the factors influencing bank credit supplies to SMEs and understand the impact of financial technology adoption. To ensure the reliability and validity of the findings, a rigorous research approach was employed, including the selection of a suitable research population, a robust sampling process, and appropriate measurement sources.

3.1. Research Population and Sampling

The research population for this study comprises small and medium enterprises (SMEs) operating within a specific industry or geographical region. The population is defined based on criteria such as annual revenue, number of employees, and any other relevant factors that align with the research objectives (see Table 1). The sampling frame consists of a comprehensive list of SMEs obtained from the Pakistan Chamber of Commerce that meet the defined population criteria. The sampling process involves a systematic selection of SMEs from the sampling frame to form the study’s sample. Both random sampling and stratified sampling were employed.

Table 1.

Descriptive statics of respondents.

3.2. Data Collection Process

The investigation used self-administered questionnaire surveys as the method of data collection due to their efficiency and cost-effectiveness for gathering information from a diverse population across a larger geographic area. The questionnaire survey was directed at the 381 respondents (i.e., CEOs, owners, managers, credit officers, loan officers, regional CEOs, IT consultants, and FinTech experts) of SMEs, and a key-informant approach was used to acquire data from individuals who possess the most comprehensive knowledge of their organizations. The questionnaire survey was disseminated through two different methods, postal mail and electronic mail, based on the type of email address provided by the respondents. Those with personal email addresses received the survey via email, while those with general company email addresses received the survey via postal mail. This decision was made after a consultation with experts in the field and the Pakistan Small and Medium Enterprises Development Authority to ensure the best response rate. The target population included SMEs in the manufacturing, services, and trade sectors, which contribute 30% of the country’s GDP and 25% of its exports (Saleem 2008) The sample was selected purposively from the Chamber of Commerce and the Small and Medium Enterprises Development Authority. Therefore, this study followed (Cornelli et al. 2021; Schuetz and Venkatesh 2020; Sheng 2021) and used quantitatively measured variables based on collecting data from 381 respondents (i.e., CEOs, owners, managers, credit officers, loan officers, regional CEOs, IT consultants, and FinTech experts) from SMEs (i.e., manufacturing firms). When using standardized questions that were understood in the same manner by all participants, the quantitative approach yielded outstanding results. In addition, we used a convenience sampling method to sample SME staff with structured questionnaires from December 2021 to March 2022.

Three components comprised the questionnaire. The first section of the questionnaire consisted of five demographic questions and a cover letter that provided the participants with an explanation of the constructs, as well as the goal of the study. The remaining portion included self-developed questions on using blockchain technology (five items) and bank loans to SMEs (five items). According to the advice of professionals in the fields of management and FinTech, notably blockchain technology, we created the questionnaires and validated them. We used a Likert scale from 1 (strongly disagree) to 5 to evaluate the surveys. The questionnaire was distributed through the shared Google Doc, WhatsApp, and LinkedIn. The next section of the paper describes the detailed analysis.

4. Data Analysis

4.1. Pretest

Before managing the survey at a large scale, a pretest technique was used to evaluate the quality of the questionnaire. This technique helps the scholars decrease the uncertainty and reduce the redundancy in the survey constructs. Commonly, this method comprises probing the survey constructs carefully and performing a prelude analysis on the representative pilot data. Before collecting data, we perform various techniques to refine the survey constructs further. For instance, the questionnaire constructs were first adapted from the earlier literature and then discussed with the faculty members who have expertise in the relevant field. The adapted scale undergoes a careful and critical evaluation to enhance the content validity of the questionnaire. Thus, adapted items convey the exact meaning that we want to measure. After we developed satisfactory survey items, further refinement was conducted. Eighty respondents (i.e., CEOs, owners, managers, credit officers, loan officers, regional CEOs, IT consultants, and FinTech experts) were invited to participate in the one-on-one meeting and asked to analyze the language of the constructs in the questionnaires carefully. As a result, questionnaire items were developed, and minor changes were made after obtaining overall feedback. Finally, we tested the questionnaire to overcome the conflict of which of the alternative items was better. This pretesting process enhances the content validity of the survey items and provides a rigorously tested scale for practitioners and academicians. The subsequent section describes the findings of the pilot study.

4.2. Pilot Testing

To assess the validity of the proposed model, we pilot-tested the survey item before collecting the data on a large scale. It is essential to check the validity and reliability of the proposed constructs in pilot testing. Since the sample frame involves working people, collecting a large data size for pilot testing was difficult. However, a convenient sample of full-time students will be sufficient to ensure the contents’ validity. Our key intention was to confirm the reliability of the items used in the study. We developed the online survey items, and respondents were contacted by sharing survey links. Out of 400 respondents, a total of 381 correct responses were received. The collected data were tested by using SmartPLS software to ensure the acceptable limit of reliabilities. We found that the entire construct displayed pretty good results, and the reliabilities were above the acceptable range, for example, of alpha > 0.7 with many above 0.9. Similarly, factor loadings were > 0.70, with many above 0.90. Table 2 presents the pilot testing results.

Table 2.

Results of pilot test.

Overall, the pretest analysis increased the confidence in the developed constructs before testing with a full sample. After the pilot test, we collected the data for the whole sample, and the below section describes the results obtained from the complete sample.

4.3. Reliability and Convergent Validity

The construct used in this study underwent the testing process, and we examined the convergent validity and reliability through the measure of the Cronbach’s alpha, factor loadings, and average variance extracted (AVE) (Hair et al. 1998). We conducted a CFA to test the validity of the items and found that all the constructs exhibited the recommended a level of reliability (Cronbach’s alpha > 0.70). The factor loading for each construct item was found to be above the acceptable limit, i.e., factor loadings > 0.60. Finally, the AVE of each construct exhibited that each construct value is above the recommended cutoff limit, i.e., AVE > 0.50. An AVE greater than 0.50 implies that the latent factor explains at least 50% of the variance among the items (See Table 3).

Table 3.

Construct reliability and validity.

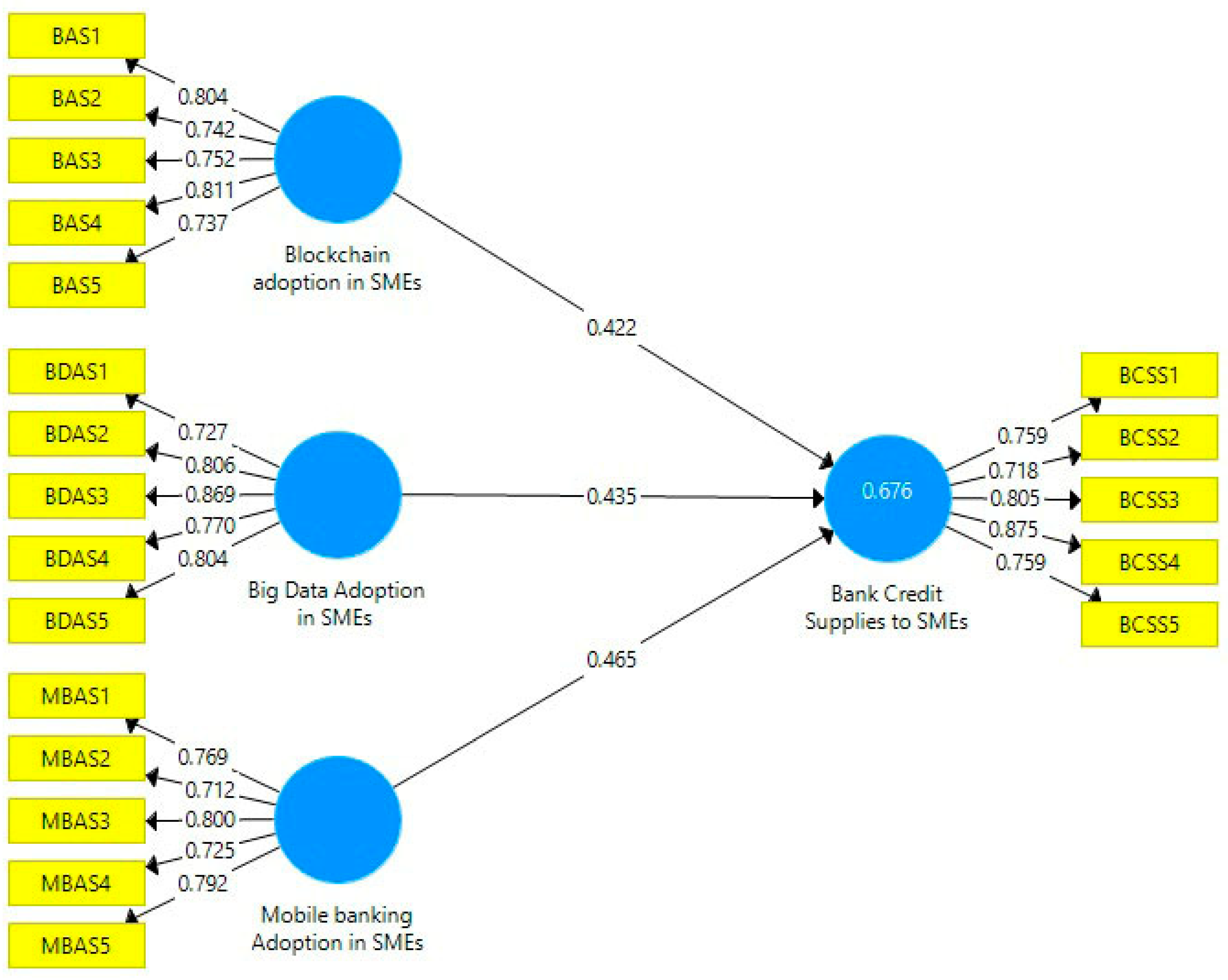

The CFA was conducted using SmartPLS to study whether the measures of the study show factor loadings higher than 0.7 (Hair et al. 1998). The Cronbach’s alphas of the corresponding constructs were all greater than the 0.70 threshold. CR and AVE both achieved a satisfactory level. Thus, this demonstrated that all instruments for the constructs were reliable. Furthermore, all values are above the recommended level, indicating a lack of cross-loading issues, except for one item from excessive cognitive use. Thus, this item was excluded from the construct (see Figure 2).

Figure 2.

Results of the PLS algorithm.

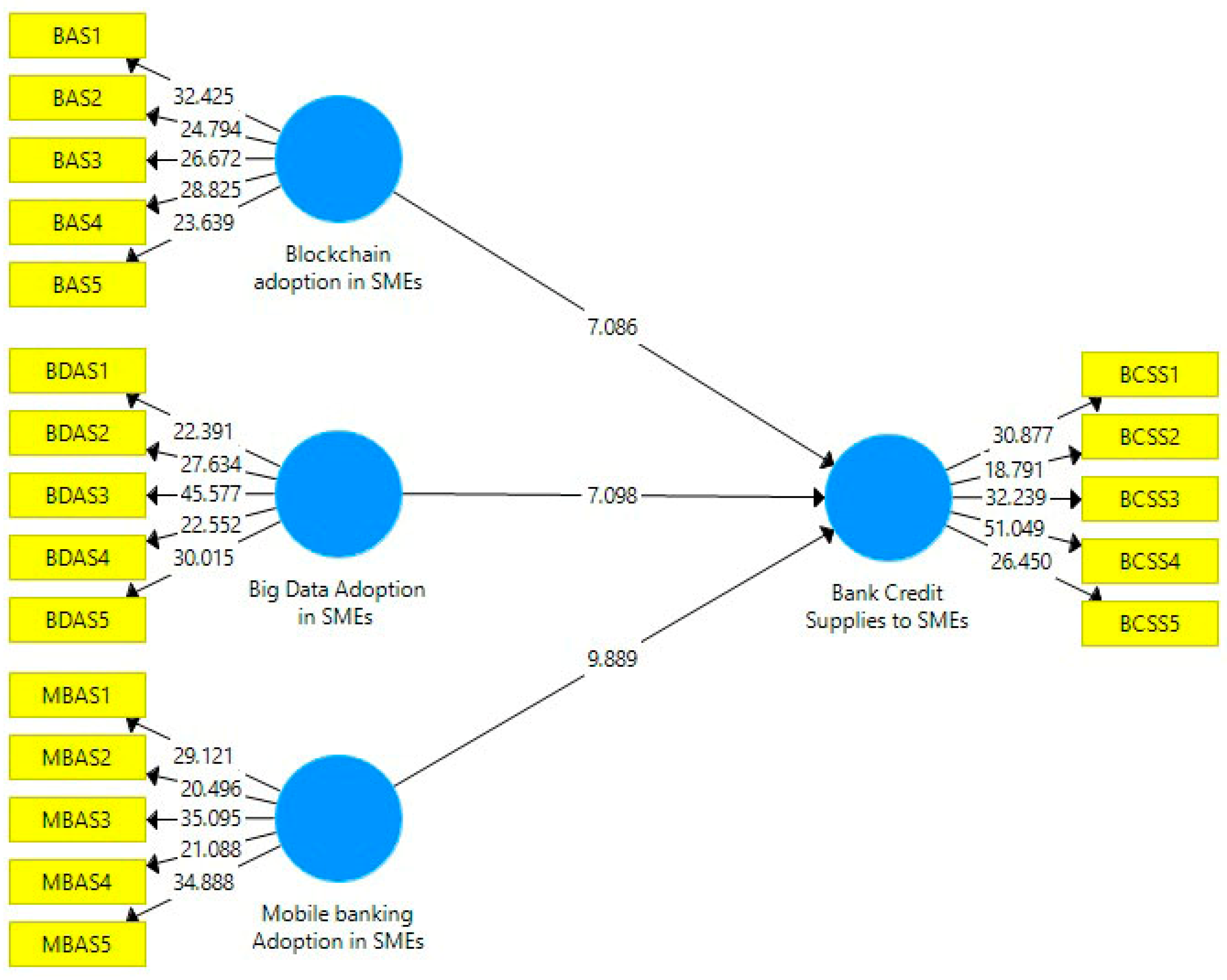

4.4. Discriminant Validity

In addition to convergent validity, we also determined the discriminant validity of our proposed constructs in multiple ways. First, we examined the square root of average variance extracted (AVE) for each construct used in our study. The results show that each construct’s AVE is greater than the inter-construct correlations. An AVE > inter-construct correlations showed that there is no issue of discriminant validity. The inter-construct correlation matrix is present in Table 4, indicating that each construct’s AVE is higher than the respective variable correlation. In the second method, we examined the cross-loading among the constructs and found that all values are above the suggested level, signifying the lack of a cross-loading problem (see Table 5). There was no severe issue of cross-loading found. Hence, we can conclude that there is a considerable level of discriminant validity (see Figure 3).

Table 4.

Factor loadings and reliabilities.

Table 5.

Square of correlation between latent variables.

Figure 3.

The results of bootstrapping.

4.5. Measurement and Structural Model

To examine the measurement and structural model fit, we connected all items on their respective construct, and we simultaneously tested each with a single method factor. Finally, all the items were correlated to test the measurement model.

4.6. Hypotheses Testing

Before discussing the proposed hypothesized relationship, the results of the control variables are presented. We controlled certain variables in our proposed research model with the logic that stressors (i.e., age and gender) might influence the dependent variables (i.e., bank credit supplies to SMEs) and, hence, should be controlled for performance. The findings from the structural model validate this argument. However, except for several friends, we did not find support for any control variables.

4.7. Discussion of Results

H1.

Blockchain adoption in SMEs by its staff positively influences bank credit supplies to SMEs.

Consistent with prior research (Garg et al. 2021; Rabbi et al. 2021; Rajnak and Puschmann 2020; Tantri 2021; Wang et al. 2019), the results demonstrate a significant positive effect of blockchain adoption on bank credit supplies to SMEs (β = 0.422, p < 0.001). Blockchain technology offers secure and transparent information storage, reducing the risk of fraud and enhancing trust in financial transactions. This increased trust enables banks to have greater confidence in extending credit to SMEs adopting blockchain, as indicated by the positive coefficient.

H2.

Big Data adoption in SMEs by its staff positively influences bank credit supplies to SMEs.

The findings confirm the positive influence of Big Data adoption on bank credit supplies to SMEs (β = 0.435, p < 0.001), consistent with previous studies (Tantri 2020). Big Data analytics provides valuable insights into SMEs’ creditworthiness by analyzing large datasets, such as payment history and default rates. By leveraging these insights, banks can make more accurate lending decisions, reducing information asymmetry and increasing the likelihood of credit availability for SMEs.

H3.

Mobile banking adoption in SMEs by its staff positively influences bank credit supplies to SMEs.

The results reveal a significant positive effect of mobile banking adoption on bank credit supplies to SMEs (β = 0.465, p < 0.001). This finding is in line with previous research (Agarwal and Hauswald 2010; Flögel and Beckamp 2020), which highlights the role of loan officers in collecting soft information from SMEs. Mobile banking facilitates efficient financial management and communication between SMEs and banks, enabling faster and more accurate credit assessments. By adopting mobile banking, SMEs enhance their accessibility to credit, supported by the positive coefficient observed.

In summary, the results from the structural analysis yield (see Table 6) support for H1, H2, and H3. The results indicate that blockchain adoption in SMEs (H1: β = 0.422, p < 0.001), Big Data adoption in SMEs (H2: β = 0.435, p < 0.001), and mobile banking adoption in SMEs (H3: β = 0.465, p < 0.001) are a significant predictor of bank credit supplies to SMEs. Therefore, our structural analysis supports H1 and H2, which are fully supported. The results suggest that the three variables, blockchain adoption, Big Data adoption, and mobile banking adoption, are significant predictors of bank credit supplies to SMEs.

Table 6.

Hypothesis testing results.

The results show that all three hypotheses are supported, suggesting that the adoption of these technologies positively influences bank credit supplies to SMEs (see Table 6). These findings have important implications for policymakers and stakeholders who are interested in promoting SME growth and development. By encouraging SMEs to adopt these technologies, policymakers can increase their access to credit and thereby enhance their ability to grow and contribute to the economy.

5. Conclusions

Bank lending to SMEs plays a vital role in economic growth, contributing significantly to employment and GDP. The emergence of new financial technologies holds the promise of improving bank operations, reducing costs, and enhancing credit supply to SMEs. However, there is a dearth of empirical findings on how these technologies can address the supply-side challenges of bank lending for small- and medium-sized firms. This study collected data from 381 managers, including CEOs, owners, credit officers, loan officers, regional CEOs, IT consultants, and FinTech experts, and found that the adoption of blockchain technologies, Big Data, and mobile banking has significantly enhanced bank credit supplies for SMEs in Pakistan.

The results confirm that the variables of blockchain adoption, Big Data adoption, and mobile banking adoption are significant predictors of bank credit supplies to SMEs. Specifically, the findings demonstrate that the adoption of blockchain technology (H1) has a positive effect on bank credit supplies to SMEs (β = 0.422, p < 0.001), indicating that SMEs adopting blockchain are more likely to receive credit from banks. Similarly, the results indicate that Big Data adoption (H2) positively influences bank credit supplies to SMEs (β = 0.435, p < 0.001), suggesting that SMEs adopting Big Data technology have improved access to credit. Furthermore, the findings show that mobile banking adoption (H3) has a positive effect on bank credit supplies to SMEs (β = 0.465, p < 0.001), indicating that SMEs adopting mobile banking technology are more likely to receive credit from banks. These results support all three hypotheses, suggesting that the adoption of these technologies positively influences bank credit supplies to SMEs.

Implications

Managerial implications: This study provides valuable practical knowledge for SMEs considering the adoption of new technologies. It equips them with insights on how blockchain, Big Data, and mobile banking adoptions can enhance their chances of obtaining credit from banks. Additionally, the findings offer guidance to bank managers dealing with information asymmetries, enabling them to identify less risky borrowers and make informed lending decisions. The research also provides key findings for researchers and policymakers, shedding light on the potential of FinTech in promoting SME financing.

Theoretical implications: This study contributes to theoretical development by expanding the existing literature on how FinTech can reduce information asymmetries and enhance private bank credit supplies to SMEs in Pakistan. It presents a comprehensive model that analyzes the impact of blockchain, Big Data, and mobile banking adoption on bank credit supplies to SMEs. Theoretical frameworks can be refined and expanded based on these empirical findings, deepening our understanding of the role of technology in SME financing.

Limitations and Future Directions: While this study provides valuable insights, it is not without limitations. Firstly, the variables were measured at a single point in time, suggesting the need for future research to employ longitudinal techniques for a more comprehensive analysis. Additionally, while this study focused on the supply side of credit, exploring the demand-side factors would provide a more holistic understanding of SME financing. Future studies should consider investigating both supply and demand aspects to yield more generalized results.

Recommendations for Future Research: To further advance knowledge in this area, it is recommended to create a new section dedicated to the limitations and suggestions for future research. This section should highlight the need for longitudinal studies, delve into the demand-side factors of credit, and explore other potential technological innovations that may impact SME financing. Furthermore, providing detailed recommendations for future work and outlining specific avenues for research will contribute to the continued development of theory and practice in this field.

By addressing these limitations and focusing on future research directions, scholars can build upon this study’s findings and contribute to the ongoing advancement.

Author Contributions

Writing—original draft preparation, S.U.R.; supervision, M.A.-S.; methodology P.B.W.; data curation, E.L.; Validation, Z.S., Software; visualization, I.A.A.-A.; M.S.; Writing—review & and editing M.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Center Advancing Financial Equity and funded by Institutefame.org (under the Financing the Race Grant).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data is available on demand.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Agarwal, Sumit, and Robert Hauswald. 2010. Distance and private information in lending. The Review of Financial Studies 23: 2757–88. [Google Scholar] [CrossRef]

- Al Tarawneh, Mo’men Awad, Thi Phuong Lan Nguyen, David Gun Fie Yong, and Magiswary A/P Dorasamy. 2023. Determinant of M-Banking Usage and Adoption among Millennials. Sustainability 15: 8216. [Google Scholar] [CrossRef]

- Awan, Usama, Saqib Shamim, Zaheer Khan, Najam Ul Zia, Syed Muhammad Shariq, and Muhammad Naveed Khan. 2021. Big data analytics capability and decision-making: The role of data-driven insight on circular economy performance. Technological Forecasting and Social Change 168: 120766. [Google Scholar] [CrossRef]

- Basile, Luigi Jesus, Nunzia Carbonara, Roberta Pellegrino, and Umberto Panniello. 2023. Business intelligence in the healthcare industry: The utilization of a data-driven approach to support clinical decision making. Technovation 120: 102482. [Google Scholar] [CrossRef]

- Berg, Tobias, Manju Puri, and Jörg Rocholl. 2019. Loan Officer Incentives, Internal Rating Models, and Default Rates. European Finance Review 24: 529–78. [Google Scholar] [CrossRef]

- Bertrand, Jérémie, and Paul-Olivier Klein. 2021. Creditor information registries and relationship lending. International Review of Law and Economics 65: 105966. [Google Scholar] [CrossRef]

- Chen, Gengxuan, Qinmin Jia, and Hao Ling. 2023. Rethinking the Rise of Global Central Bank Digital Currencies: A Policy Perspective. Contemporary Social Sciences 2023: 1. [Google Scholar]

- Cornelli, Giulio, Jon Frost, Leonardo Gambacorta, Raghavendra Rau, Robert Wardrop, and Tania Ziegler. 2021. Fintech and big tech credit: What explains the rise of digital lending? CESifo Forum 22: 30–34. [Google Scholar]

- Emeana, Ezinne M., Liz Trenchard, and Katharina Dehnen-Schmutz. 2020. The Revolution of Mobile Phone-Enabled Services for Agricultural Development (m-Agri Services) in Africa: The Challenges for Sustainability. Sustainability 12: 485. [Google Scholar] [CrossRef]

- Fanta, Ashenafi Beyene. 2016. Complementarity between Relationship Lending and Collateral in SME Access to Bank Credit: Evidence from Ethiopia. Journal of African Business 17: 308–18. [Google Scholar] [CrossRef]

- Filomeni, Stefano, Gregory F. Udell, and Alberto Zazzaro. 2021. Hardening soft information: Does organizational distance matter? The European Journal of Finance 27: 897–927. [Google Scholar] [CrossRef]

- Flögel, Franz, and Marius Beckamp. 2020. Will FinTech make regional banks superfluous for small firm finance? Observations from soft information-based lending in Germany. Economic Notes 49: 12159. [Google Scholar] [CrossRef]

- Garg, Poonam, Bhumika Gupta, Ajay Kumar Chauhan, Uthayasankar Sivarajah, Shivam Gupta, and Sachin Modgil. 2021. Measuring the perceived benefits of implementing blockchain technology in the banking sector. Technological Forecasting and Social Change 163: 120407. [Google Scholar] [CrossRef]

- Hair, Joseph F., Rolph E. Anderson, Roland L. Tatham, and W.C. Black. 1998. Multivariate Data Analysis. Englewood Cliff: Prentice Hall. [Google Scholar]

- Hendershott, Terrence, Xiaoquan (Michael) Zhang, J. Leon Zhao, and Zhiqiang (Eric) Zheng. 2021. FinTech as a game changer: Overview of research frontiers. Information Systems Research 32: 1–17. [Google Scholar] [CrossRef]

- Kumar Bhardwaj, Amit, Arunesh Garg, and Yuvraj Gajpal. 2021. Determinants of Blockchain Technology Adoption in Supply Chains by Small and Medium Enterprises (SMEs) in India. Mathematical Problems in Engineering 2021: 1–14. [Google Scholar] [CrossRef]

- Li, Chunling, Nosherwan Khaliq, Leslie Chinove, Usama Khaliq, Mirzat Ullah, Zoltán Lakner, and József Popp. 2023. Perceived transaction cost and its antecedents associated with fintech users’ intention: Evidence from Pakistan. Heliyon 9: e15140. [Google Scholar] [CrossRef] [PubMed]

- Liberti, Jose M., and Atif R. Mian. 2008. Estimating the Effect of Hierarchies on Information Use. The Review of Financial Studies 22: 4057–90. [Google Scholar] [CrossRef]

- Liu, Nian, Xinhua Gu, and Chun Kwok Lei. 2022. The equilibrium effects of digital technology on banking, production, and employment. Finance Research Letters 49: 103196. [Google Scholar] [CrossRef]

- Malhotra, Diksha, Poonam Saini, and Awadhesh Kumar Singh. 2022. How blockchain can automate KYC: Systematic review. Wireless Personal Communications 122: 1987–2021. [Google Scholar] [CrossRef]

- Mhlanga, David. 2021. Financial Inclusion in Emerging Economies: The Application of Machine Learning and Artificial Intelligence in Credit Risk Assessment. International Journal of Financial Studies 9: 39. [Google Scholar] [CrossRef]

- Mirza, Nawazish, Ayesha Afzal, Muhammad Umar, and Marinko Skare. 2023. The impact of green lending on banking performance: Evidence from SME credit portfolios in the BRIC. Economic Analysis and Policy 77: 843–50. [Google Scholar] [CrossRef]

- Nuryyev, Guych, Yu-Ping Wang, Jennet Achyldurdyyeva, Bih-Shiaw Jaw, Yi-Shien Yeh, Hsien-Tang Lin, and Li-Fan Wu. 2020. Blockchain Technology Adoption Behavior and Sustainability of the Business in Tourism and Hospitality SMEs: An Empirical Study. Sustainability 12: 1256. [Google Scholar] [CrossRef]

- Okine, Agnes Naa Dedei, Yao Li, Isaac Edem Djimesah, Hongjiang Zhao, Kenneth Wilson Adjei Budu, Elijah Duah, and Kingsford Kissi Mireku. 2023. Analyzing crowdfunding adoption from a technology acceptance perspective. Technological Forecasting and Social Change 192: 122582. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Shahnawaz Khan, and Mohammad Atif. 2023. Machine learning-based P2P lending Islamic Fintech model for small and medium enterprises in Bahrain. International Journal of Business Innovation and Research 30: 565–79. [Google Scholar] [CrossRef]

- Rabbi, Md., Prince Mahmud Hradoy, Mainul Islam, Hsibul Islam, Mst. Yesmine Akter, and Milon Biswas. 2021. BLS: Bank Loan Sanction Using Blockchain Authenticity, Transparency and Reliability. Paper presented at 2021 International Conference on Electronics, Communications and Information Technology (ICECIT), Khulna, Bangladesh, September 14–16. [Google Scholar]

- Rahid, Abu Obida. 2023. SME Financing of Commercial Banks in Bangladesh: Policy Directions Based on SME Loan Borrowers’ View. International Journal of Small and Medium Enterprises 6: 1–8. [Google Scholar] [CrossRef]

- Rajnak, Viktoria, and Thomas Puschmann. 2020. The impact of blockchain on business models in banking. Information Systems and E-Business Management 19: 809–61. [Google Scholar] [CrossRef]

- Saleem, Shahid. 2008. Saleem Smeda SME Policy Paper 2007—A Critical Review, SSRN. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1092050 (accessed on 5 June 2023).

- Salimon, Maruf Gbadebo, Olanrewaju Kareem, Sany Sanuri Mohd Mokhtar, Olayemi Abdullateef Aliyu, Jibril Adewale Bamgbade, and Adekunle Qudus Adeleke. 2023. Malaysian SMEs m-commerce adoption: TAM 3, UTAUT 2 and TOE approach. Journal of Science and Technology Policy Management 14: 98–126. [Google Scholar] [CrossRef]

- Schuetz, Sebastian, and Viswanath Venkatesh. 2020. Blockchain, adoption, and financial inclusion in India: Research opportunities. International Journal of Information Management 52: 101936. [Google Scholar] [CrossRef]

- Shahadat, M. M. Hussain, Md. Nekmahmud, Pejman Ebrahimi, and Maria Fekete-Farkas. 2023. Digital Technology Adoption in SMEs: What Technological, Environmental and Organizational Factors Influence SMEs’ ICT Adoption in Emerging Countries? Global Business Review, 09721509221137199. [Google Scholar] [CrossRef]

- Sheng, Tianxiang. 2021. The effect of fintech on banks’ credit provision to SMEs: Evidence from China. Finance Research Letters 39: 101558. [Google Scholar] [CrossRef]

- Song, Ziheng, Greer Mellon, and Zihan Shen. 2020. Relationship between racial bias exposure, financial literacy, and entrepreneurial intention: An empirical investigation. Journal of Artificial Intelligence and Machine Learning in Management 4: 42–55. [Google Scholar]

- Tantri, Prasanna. 2020. Creditors’ Rights and Strategic Default: Evidence from India. The Journal of Law and Economics 63: 411–47. [Google Scholar] [CrossRef]

- Tantri, Prasanna. 2021. Fintech for the Poor: Financial Intermediation Without Discrimination. European Finance Review 25: 561–93. [Google Scholar] [CrossRef]

- Taylor, Charles, Aquiles A. Almansi, and Aurora Ferrari. 2020. Prudential Regulatory and Supervisory Practices for Fintech: Payments, Credit and Deposits. Available online: https://documents1.worldbank.org/curated/en/954851578602363164/pdf/Prudential-Regulatory-and-Supervisory-Practices-for-Fintech-Payments-Credit-and-Deposits.pdf (accessed on 5 June 2023).

- Wang, Rui, Zhangxi Lin, and Hang Luo. 2019. Blockchain, bank credit and SME financing. Quality & Quantity 53: 1127–40. [Google Scholar] [CrossRef]

- Yang, Zhenni, Christopher Gan, and Zhaohua Li. 2019. Role of bank regulation on bank performance: Evidence from Asia-Pacific commercial banks. Journal of Risk and Financial Management 12: 131. [Google Scholar] [CrossRef]

- Zamani, Seyedeh Zahra. 2022. Small and Medium Enterprises (SMEs) facing an evolving technological era: A systematic literature review on the adoption of technologies in SMEs. European Journal of Innovation Management 25: 735–57. [Google Scholar] [CrossRef]

- Zhang, Wen, Shaoshan Yan, Jian Li, Xin Tian, and Taketoshi Yoshida. 2022. Credit risk prediction of SMEs in supply chain finance by fusing demographic and behavioral data. Transportation Research. Part E, Logistics and Transportation Review 158: 102611. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).