Unraveling the Roots of Income Polarization in Europe: A Divided Continent

Abstract

:1. Introduction

2. Literature Review

3. Data and Summary Statistics

4. Methodology

4.1. Polarization and Relative Distribution

4.2. RIF-Regression Model

5. Results

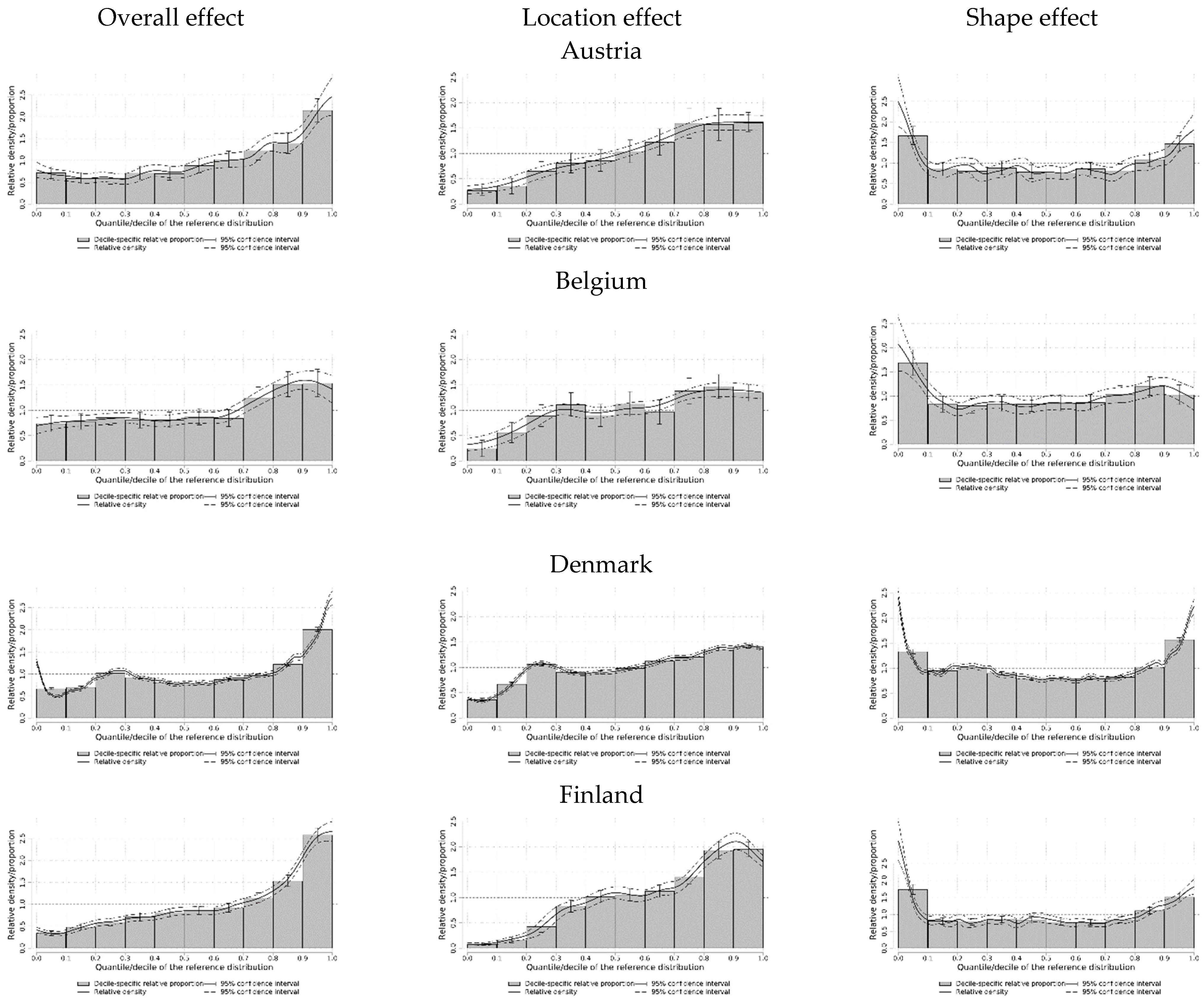

5.1. Relative Distribution Results

5.2. RIF-Regression Results

6. Discussion

7. Conclusions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| 1 | Luxembourg Income Study (LIS) Database, http://www.lisdatacenter.org (Accessed on 10 March 2023) (multiple countries; December 2022–January 2023). Luxembourg: LIS. |

| 2 | Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherland, Spain and United Kingdom. |

| 3 | “Disposable household income” is usually the preferred measure for income distribution analysis, as it is the income available to households to support their consumption expenditure and savings during the reference period (Canberra Group 2011). According to the LIS documentation (https://www.lisdatacenter.org/data-access/key-figures/methods/disposable/) Accessed on 10 March 2023, this measure includes income received from work, wealth and direct government benefits, such as retirement or unemployment benefits. The measure then subtracts direct taxes paid, such as income taxes. |

| 4 | Here, we limit ourselves to illustrating the basic concepts behind the use of the relative distribution method. Interested readers are referred to Handcock and Morris (1998, 1999) for a more detailed explication. |

| 5 | For a more specific observation of the use of RIF-regression applied to polarization indexes, see (Jann 2021). |

References

- Alderson, Arthur S., and Kevin Doran. 2011. Global inequality, within-nation inequality, and the changing distribution of income in seven transitional and middle-income societies. In Inequality beyond Globalization: Economic Changes, Social Transformations, and the Dynamics of Inequality. Münster: LIT Verlag, pp. 183–200. [Google Scholar]

- Alderson, Arthur S., Jason Beckfield, and François Nielsen. 2005. Exactly How Has Income Inequality Changed? Patterns of Distributional Change in Core Societies. International Journal of Comparative Sociology 46: 405–23. [Google Scholar] [CrossRef]

- Araar, Abdelkrim. 2008. On the Decomposition of Polarization Indices: Illustrations with Chinese and Nigerian Household Surveys. CIRPEE Working Paper No. 08-06. Montréal: CIRPEE. [Google Scholar]

- Atkinson, Anthony B., and Andrea Brandolini. 2013. On the identification of the middle class. In Income Inequality: Economic Disparities and the Middle Class in Affluent Countries. Stanford: Stanford University Press, pp. 77–100. [Google Scholar]

- Awoyemi, T. T., and A. Araar. 2009. Explaining polarization and its dimensions in Nigeria: A DER decomposition approach. Paper presented at 14th Annual Conference on ‘Econometric Modelling for Africa’, Abuja, Nigeria, July 8–10; pp. 8–10. [Google Scholar]

- Borraz, Fernando, Nicolás González, and Maximo Rossi. 2013. Polarization and the middle class in Uruguay. Latin American Journal of Economics 50: 289–326. [Google Scholar] [CrossRef]

- Brzeziński, Michał. 2011. Statistical inference on changes in income polarization in Poland. Przegląd Statystyczny 58: 102–13. [Google Scholar]

- Brzeziński, Michal. 2013. Income Polarization and Economic Growth. National Bank of Poland Working Paper 147. Warsaw: National Bank of Poland. [Google Scholar]

- Canberra Group. 2011. Handbook on Household Income Statistics. Geneva: United Nations. [Google Scholar]

- Castro, José Villaverde. 2003. Regional Convergence, Polarisation and Mobility in the European Union, 1980–1996. Journal of European Integration 25: 73–86. [Google Scholar] [CrossRef]

- Chakravarty, Satya R., and Amita Majumder. 2001. Inequality, polarisation and welfare: Theory and applications. Australian Economic Papers 40: 1–13. [Google Scholar] [CrossRef]

- Clementi, Fabio, and Francesco Schettino. 2013. Income polarization in Brazil, 2001–2011: A distributional analysis using PNAD data. Economics Bulletin 33: 16. [Google Scholar] [CrossRef]

- Clementi, Fabio, and Francesco Schettino. 2015. Declining inequality in Brazil in the 2000s: What is hidden behind? Journal of International Development 27: 929–52. [Google Scholar] [CrossRef]

- Clementi, Fabio, Andrew L. Dabalen, Vasco Molini, and Francesco Schettino. 2015. When the Centre Cannot Hold: Patterns of Polarization in Nigeria. Review of Income and Wealth 63: 608–32. [Google Scholar] [CrossRef]

- Clementi, Fabio, Michele Fabiani, and Vasco Molini. 2019. The devil is in the detail: Growth, inequality and poverty reduction in Africa in the last two decades. Journal of African Economies 28: 408–34. [Google Scholar] [CrossRef]

- Clementi, Fabio, Michele Fabiani, and Vasco Molini. 2021. How polarized is sub-Saharan Africa? A look at the regional distribution of consumption expenditure in the 2000s. Oxford Economic Papers 73: 796–819. [Google Scholar] [CrossRef]

- Clementi, Fabio, Michele Fabiani, Vasco Molini, and Francesco Schettino. 2022a. Response to ‘Polarization and Poverty Reduction in Africa: The Devil Is in the Choice of Equivalence Relation’. Journal of African Economies 31: 176–79. [Google Scholar] [CrossRef]

- Clementi, Fabio, Michele Fabiani, Vasco Molini, and Rocco Zizzamia. 2022b. Are we really painting the devil on the walls? Polarization and its drivers in Sub-Saharan Africa in the past two decades. Journal of African Economies 31: 124–46. [Google Scholar] [CrossRef]

- Clementi, Fabio, Vasco Molini, and Francesco Schettino. 2017. All that Glitters is Not Gold: Polarization Amid Poverty Reduction in Ghana. World Development 102: 275–91. [Google Scholar] [CrossRef]

- Cowell, Frank A., and Maria-Pia Victoria-Feser. 1996. Robustness properties of inequality measures. Econometrica: Journal of the Econometric Society 64: 77–101. [Google Scholar] [CrossRef]

- de la Vega, Ma Casilda Lasso, and Ana Marta Urrutia. 2006. An alternative formulation of the Esteban-Gradín-Ray extended measure of polarization. Journal of Income Distribution 15: 42–54. [Google Scholar] [CrossRef]

- D’Ambrosio, Conchita. 2001. Household Characteristics and the Distribution of Income in Italy: An Application of Social Distance Measures. Review of Income and Wealth 47: 43–64. [Google Scholar] [CrossRef]

- D’Ambrosio, Conchita, and Edward N. Wolff. 2001. Is Wealth Becoming More Polarized in the United States? Jerome Levy Economics Institute of Bard College Working Paper 330. Annandale-On-Hudson: Jerome Levy Economics Institute of Bard College. [Google Scholar]

- Deutsch, Joseph, Jacques Silber, and Gaston Yalonetzky. 2014. On Bi-Polarization and The Middle Class in L atin A merica: A Look A t the First Decade of the Twenty-First Century. Review of Income and Wealth 60: S332–S352. [Google Scholar] [CrossRef]

- Deutsch, Joseph, Meital Hanoka, and Jacques Silber. 2007. On the Link Between the Concepts of Kurtosisand Bipolarization. Economics Bulletin 4: 1–6. [Google Scholar]

- Duclos, Jean-Yves, Joan Esteban, and Debraj Ray. 2004. Polarization: Concepts, measurement, estimation. Econometrica 72: 1737–72. [Google Scholar] [CrossRef]

- Easterly, William. 2001. The Middle Class Consensus and Economic Development. Journal of Economic Growth 6: 317–35. [Google Scholar] [CrossRef]

- Essama-Nssah, Boniface, and Peter J. Lambert. 2012. Chapter 6 Influence Functions for Policy Impact Analysis. In Inequality, Mobility and Segregation: Essays in Honor of Jacques Silber. Bentley: Emerald Group Publishing Limited, pp. 135–59. [Google Scholar]

- Esteban, Joan, Carlos Gradín, and Debraj Ray. 2007. An extension of a measure of polarization, with an application to the income distribution of five OECD countries. The Journal of Economic Inequality 5: 1–19. [Google Scholar] [CrossRef]

- Esteban, Joan-Maria, and Debraj Ray. 1994. On the Measurement of Polarization. Econometrica: Journal of the Econometric Society 62: 819–51. [Google Scholar] [CrossRef]

- Esteban, Joan-Maria, and Debraj Ray. 1999. Conflict and distribution. Journal of Economic Theory 87: 379–415. [Google Scholar] [CrossRef]

- Esteban, Joan-Maria, and Debraj Ray. 2008. Polarization, fractionalization and conflict. Journal of Peace Research 45: 163–82. [Google Scholar] [CrossRef]

- Esteban, Joan-Maria, and Debraj Ray. 2011. Linking conflict to inequality and polarization. American Economic Review 101: 1345–74. [Google Scholar] [CrossRef]

- Ezcurra, Roberto. 2009. Does Income Polarization Affect Economic Growth? the Case of the European Regions. Regional Studies 43: 267–85. [Google Scholar] [CrossRef]

- Firpo, Sergio, Nicole M. Fortin, and Thomas Lemieux. 2009. Unconditional Quantile Regressions. Econometrica 77: 953–73. [Google Scholar]

- Firpo, Sergio P., Nicole M. Fortin, and Thomas Lemieux. 2018. Decomposing Wage Distributions Using Recentered Inuence Function Regressions. Econometrics 6: 28. [Google Scholar] [CrossRef]

- Foster, James E., and Michael C. Wolfson. 1992. Polarization and the Decline of the Middle Class: Canada and the US. Working Paper 31. Oxford: Oxford Poverty & Human Development Initiative. Available online: https://ophi.org.uk/working-paper-number-31/ (accessed on 10 March 2023).

- Foster, James E., and Michael C. Wolfson. 2010. Polarization and the Decline of the Middle Class: Canada and the US. The Journal of Economic Inequality 8: 247–73. [Google Scholar] [CrossRef]

- Gasparini, Leonardo, Matias Horenstein, Ezequiel Molina, and Sergio Olivieri. 2008. Income polarization in Latin America: Patterns and links with institutions and conflict. Oxford Development Studies 36: 461–84. [Google Scholar] [CrossRef]

- Gigliarano, Chiara, and Karl Mosler. 2009. Constructing indices of multivariate polarization. The Journal of Economic Inequality 7: 435–60. [Google Scholar] [CrossRef]

- Gradín, Carlos. 2000. Polarization by Sub-Populations in Spain, 1973–1991. Review of Income and Wealth 46: 457–74. [Google Scholar] [CrossRef]

- Handcock, Mark S., and Martina Morris. 1998. Relative Distribution Methods. Sociological Methodology 28: 53–97. [Google Scholar] [CrossRef]

- Handcock, Mark S., and Martina Morris. 1999. Relative Distribution Methods in the Social Sciences. New York: Springer. [Google Scholar]

- Hussain, Mohammad Azhar. 2009. The sensitivity of income polarization: Time, length of accounting periods, equivalence scales, and income definitions. The Journal of Economic Inequality 7: 207–23. [Google Scholar] [CrossRef]

- Jann, Ben. 2021. Relative distribution analysis in Stata. The Stata Journal 21: 885–951. [Google Scholar] [CrossRef]

- Keefer, Philip, and Stephen Knack. 2002. Polarization, Politics and Property Rights: Links Between Inequality and Growth. Public Choice 111: 127–54. [Google Scholar] [CrossRef]

- Massari, Riccardo, Maria Grazia Pittau, and Roberto Zelli. 2009a. A Dwindling Middle Class? Italian Evidence in the 2000s. Journal of Economic Inequality 7: 333–50. [Google Scholar] [CrossRef]

- Massari, Riccardo, Maria Grazia Pittau, and Roberto Zelli. 2009b. Caos calmo: L’evoluzione dei redditi familiari in Italia. In L’Italia delle disuguaglianze. Edited by Lorenzo Cappellari, Paolo Naticchioni and Stefano Staffolani. Rome: Carocci editore, pp. 19–28. [Google Scholar]

- Milanovic, Branko. 2000. The median-voter hypothesis, income inequality, and income redistribution: An empirical test with the required data. European Journal of Political Economy 16: 367–410. [Google Scholar] [CrossRef]

- Molini, Vasco, and Pierella Paci. 2015. Poverty Reduction in Ghana—Progress and Challenges. Washington, DC: World Bank. [Google Scholar]

- Montalvo, José, and Marta Reynal-Querol. 2002. Why Ethnic Fractionalization? Polarization, Ethnic Conflict and Growth. UPF Economics and Business Working Paper No. 660. Barcelona: UPF Economics and Business. [Google Scholar]

- Motiram, Sripad, and Nayantara Sarma. 2014. Polarization, Inequality, and Growth: The Indian Experience. Oxford Development Studies 42: 297–318. [Google Scholar] [CrossRef]

- Nissanov, Zoya, and Maria Grazia Pittau. 2016. Measuring changes in the Russian middle class between 1992 and 2008: A nonparametric distributional analysis. Empirical Economics 50: 503–30. [Google Scholar] [CrossRef]

- Petrarca, Ilaria, and Roberto Ricciuti. 2016. Relative income distribution in six European countries. In Inequality after the 20th Century: Papers from the Sixth ECINEQ Meeting. Bingley: Emerald Group Publishing Limited, vol. 24, pp. 361–86. [Google Scholar]

- Pérez, Cristina Blanco, and Xavier Ramos. 2010. Polarization and Health. Review of Income and Wealth 56: 171–85. [Google Scholar] [CrossRef]

- Poggi, Ambra, and Jacques Silber. 2010. On polarization and mobility: A look at polarization in the wage–career profile in Italy. Review of Income and Wealth 56: 123–40. [Google Scholar] [CrossRef]

- Pressman, Steven. 2007. The Decline of the Middle Class: An International Perspective. Journal of Economic Issues 41: 181–200. [Google Scholar] [CrossRef]

- Ricci, Chiara Assunta, and Sergio Scicchitano. 2021. Decomposing changes in income polarization by population group: What happened during the crisis? Economia Politica 38: 235–59. [Google Scholar] [CrossRef]

- Rios-Avila, Fernando. 2020. Recentered influence functions (RIFs) in Stata: RIF regression and RIF decomposition. The Stata Journal 20: 51–94. [Google Scholar] [CrossRef]

- Wolfson, Michael C. 1994. When inequalities diverge. The American Economic Review 84: 353–58. [Google Scholar]

- Wolfson, Michael C. 1997. Divergent inequalities: Theory and empirical results. Review of Income and Wealth 43: 401–21. [Google Scholar] [CrossRef]

- Zhang, Xiaobo, and Ravi Kanbur. 2001. What Difference Do Polarisation Measures Make? An Application to China. Journal of Development Studies 37: 85–98. [Google Scholar] [CrossRef]

| Country | Year a | P10 | P25 | P50 | Mean | P75 | P90 | Gini | Fgt0 | FW |

|---|---|---|---|---|---|---|---|---|---|---|

| Austria | 2000 | 15,453.1 | 21,222.0 | 28,213.5 | 30,736.8 | 36,628.5 | 48,616.9 | 25.4 | 13.7 | 20.1 |

| 2019 | 17,059.0 | 25,105.6 | 34,097.5 | 37,783.3 | 46,174.6 | 61,489.0 | 27.4 | 15.4 | 21.7 | |

| Belgium | 2000 | 14,104.1 | 18,805.4 | 27,002.7 | 30,313.4 | 35,868.5 | 47,013.6 | 28.8 | 16.2 | 22.0 |

| 2017 | 15,335.6 | 21,104.6 | 30,880.9 | 32,847.5 | 40,884.2 | 51,391.1 | 26.0 | 18.4 | 22.1 | |

| Denmark | 2000 | 15,953.2 | 20,758.6 | 28,254.5 | 29,686.8 | 35,772.6 | 43,914.9 | 22.5 | 13.1 | 18.2 |

| 2016 | 17,606.8 | 22,771.4 | 31,255.8 | 34,168.6 | 41,277.4 | 52,309.4 | 25.5 | 12.8 | 20.5 | |

| Finland | 2000 | 12,605.8 | 16,324.7 | 22,272.2 | 24,495.9 | 28,995.4 | 36,976.2 | 25.3 | 12.7 | 20.0 |

| 2016 | 15,827.0 | 20,916.9 | 28,139.0 | 31,381.4 | 37,410.7 | 48,046.0 | 25.8 | 12.6 | 20.4 | |

| France | 2000 | 12,744.5 | 17,415.9 | 24,065.7 | 27,858.2 | 33,224.6 | 46,376.4 | 29.4 | 14.9 | 23.6 |

| 2018 | 13,815.4 | 19,275.9 | 26,970.8 | 31,095.5 | 36,605.6 | 50,458.9 | 30.2 | 16.0 | 23.0 | |

| Germany | 2000 | 15,184.2 | 20,825.9 | 27,538.6 | 30,606.1 | 36,915.0 | 48,383.3 | 25.9 | 12.5 | 20.7 |

| 2019 | 15,291.0 | 22,182.4 | 31,483.6 | 35,222.0 | 42,200.6 | 56,566.9 | 29.3 | 17.2 | 22.8 | |

| Ireland | 2000 | 9322.0 | 14,279.8 | 22,236.7 | 25,007.8 | 31,176.6 | 41,731.6 | 31.3 | 22.5 | 26.4 |

| 2019 | 16,008.1 | 21,494.2 | 30,308.7 | 34,853.2 | 42,441.0 | 55,680.9 | 28.7 | 15.5 | 23.8 | |

| Italy | 2000 | 8945.6 | 13,425.4 | 20,400.7 | 23,793.6 | 29,665.8 | 40,105.7 | 33.4 | 20.1 | 28.2 |

| 2016 | 8206.8 | 12,741.7 | 19,503.7 | 22,359.3 | 28,518.8 | 39,064.8 | 33.9 | 21.1 | 29.1 | |

| Luxembourg | 2000 | 21,288.6 | 27,628.0 | 37,282.0 | 42,403.1 | 51,239.9 | 69,413.8 | 26.2 | 12.3 | 22.8 |

| 2019 | 21,967.5 | 30,451.9 | 43,198.6 | 49,813.8 | 61,648.5 | 82,427.8 | 29.6 | 16.4 | 25.5 | |

| Netherland | 1999 | 15,596.0 | 20,104.8 | 26,656.0 | 28,670.3 | 34,764.7 | 43,537.3 | 23.1 | 11.1 | 19.0 |

| 2018 | 16,802.5 | 22,378.2 | 30,833.0 | 34,284.5 | 41,330.4 | 53,688.4 | 27.0 | 13.8 | 21.6 | |

| Spain | 2000 | 9857.0 | 14,486.5 | 22,246.8 | 26,265.5 | 32,556.0 | 46,205.8 | 33.7 | 20.8 | 29.2 |

| 2016 | 8852.7 | 14,606.6 | 23,047.6 | 26,407.8 | 34,173.7 | 46,516.1 | 34.1 | 22.6 | 29.6 | |

| United Kingdom | 2000 | 10,543.7 | 14,622.7 | 22,152.3 | 27,690.4 | 32,969.3 | 47,166.8 | 35.7 | 20.3 | 29.5 |

| 2020 | 14,228.5 | 19,148.3 | 27,222.5 | 31,741.7 | 38,876.6 | 54,271.9 | 30.5 | 15.5 | 25.8 |

| Country | Index a | Value | LB b | UB c | p-Value d |

|---|---|---|---|---|---|

| Austria | MRP | 0.150 | 0.113 | 0.187 | 0.000 |

| LRP | 0.161 | 0.099 | 0.222 | 0.000 | |

| URP | 0.139 | 0.091 | 0.188 | 0.000 | |

| Belgium | MRP | 0.102 | 0.065 | 0.139 | 0.000 |

| LRP | 0.148 | 0.084 | 0.212 | 0.000 | |

| URP | 0.056 | 0.003 | 0.109 | 0.036 | |

| Denmark | MRP | 0.127 | 0.120 | 0.134 | 0.000 |

| LRP | 0.101 | 0.089 | 0.113 | 0.000 | |

| URP | 0.153 | 0.143 | 0.163 | 0.000 | |

| Finland | MRP | 0.155 | 0.134 | 0.177 | 0.000 |

| LRP | 0.157 | 0.117 | 0.197 | 0.000 | |

| URP | 0.153 | 0.126 | 0.181 | 0.000 | |

| France | MRP | 0.065 | 0.055 | 0.075 | 0.000 |

| LRP | 0.105 | 0.089 | 0.121 | 0.000 | |

| URP | 0.026 | 0.014 | 0.038 | 0.000 | |

| Germany | MRP | 0.148 | 0.127 | 0.168 | 0.000 |

| LRP | 0.213 | 0.178 | 0.247 | 0.000 | |

| URP | 0.082 | 0.054 | 0.111 | 0.000 | |

| Ireland | MRP | 0.120 | 0.070 | 0.170 | 0.000 |

| LRP | 0.090 | 0.001 | 0.180 | 0.047 | |

| URP | 0.150 | 0.088 | 0.211 | 0.000 | |

| Italy | MRP | −0.005 | −0.038 | 0.028 | 0.772 |

| LRP | 0.007 | −0.054 | 0.068 | 0.823 | |

| URP | −0.017 | −0.058 | 0.024 | 0.416 | |

| Luxembourg | MRP | 0.178 | 0.130 | 0.227 | 0.000 |

| LRP | 0.234 | 0.146 | 0.321 | 0.000 | |

| URP | 0.122 | 0.065 | 0.179 | 0.000 | |

| Netherland | MRP | 0.167 | 0.141 | 0.193 | 0.000 |

| LRP | 0.188 | 0.143 | 0.232 | 0.000 | |

| URP | 0.146 | 0.111 | 0.181 | 0.000 | |

| Spain | MRP | 0.045 | 0.016 | 0.075 | 0.002 |

| LRP | 0.081 | 0.030 | 0.132 | 0.002 | |

| URP | 0.010 | −0.025 | 0.046 | 0.569 | |

| United Kingdom | MRP | 0.058 | 0.030 | 0.085 | 0.000 |

| LRP | 0.083 | 0.035 | 0.132 | 0.001 | |

| URP | 0.032 | 0.002 | 0.061 | 0.031 |

| Austria | Belgium | Denmark | Finland | France | Germany | Ireland | Italy | Luxembourg | Netherland | Spain | U.K. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sector | ||||||||||||

| Not employed | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Agriculture | 0.090 ** (0.040) | 0.095 ** (0.039) | 0.926 *** (0.247) | 0.171 *** (0.050) | 0.029 (0.173) | −0.217 (0.214) | 0.047 * (0.025) | 0.131 *** (0.043) | 0.021 (0.053) | 0.195 *** (0.061) | 0.078 * (0.041) | 0.088 (0.313) |

| Industry | 0.004 (0.018) | −0.002 (0.014) | 0.656 *** (0.084) | 0.066 ** (0.029) | −0.327 *** (0.072) | −0.062 (0.043) | 0.005 (0.013) | 0.000 (0.033) | 0.008 (0.016) | −0.096 *** (0.028) | −0.034 * (0.020) | 0.360 *** (0.059) |

| Services | 0.002 (0.012) | −0.015 (0.010) | 0.672 *** (0.050) | 0.033 (0.022) | −0.306 *** (0.057) | −0.021 (0.029) | 0.008 (0.009) | −0.010 (0.024) | 0.025 ** (0.012) | −0.049 *** (0.016) | −0.021 (0.016) | 0.218 *** (0.042) |

| Education | ||||||||||||

| Low | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Medium | −0.001 (0.013) | −0.019 * (0.009) | −0.242 *** (0.050) | −0.057 ** (0.024) | 0.230 *** (0.052) | −0.150 *** (0.035) | 0.039 *** (0.010) | 0.098 *** (0.019) | 0.015 (0.010) | −0.020 (0.016) | 0.099 *** (0.016) | 0.064 (0.047) |

| High | 0.080 *** (0.017) | 0.053 *** (0.009) | 1.127 *** (0.057) | 0.200 *** (0.025) | 2.229 *** (0.062) | 0.209 *** (0.039) | 0.106 *** (0.009) | 0.358 *** (0.034) | 0.096 *** (0.011) | 0.176 *** (0.017) | 0.309 *** (0.015) | 0.469 *** (0.043) |

| Country of birth | ||||||||||||

| Born in the country | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | ||

| Born outside the country | −0.014 (0.013) | 0.017 *** (0.010) | 0.335 *** (0.061) | 0.039 (0.033) | −0.055 *** (0.009) | −0.173 *** (0.040) | −0.016 * (0.009) | 0.074 *** (0.023) | −0.020 (0.020) | −0.041 (0.0549) | ||

| Area | ||||||||||||

| Cities | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | ||||

| Towns and suburbs | −0.008 (0.012) | −0.021 *** (0.008) | −0.650 *** (0.052) | −0.108 *** (0.021) | −0.461 *** (0.076) | −0.024 ** (0.010) | −0.022 (0.013) | −0.057 *** (0.015) | ||||

| Rural areas | −0.031 ** (0.012) | −0.034 *** (0.011) | −0.609 *** (0.081) | −0.117 *** (0.022) | −0.570 *** (0.087) | −0.041 *** (0.008) | −0.017 (0.013) | −0.102 *** (0.013) | ||||

| Age | 0.001 *** (0.000) | −0.000 (0.000) | 0.009 *** (0.001) | 0.001 (0.001) | 0.010 *** (0.001) | −0.003 *** (0.001) | 0.001 *** (0.000) | 0.000 (0.000) | 0.001 ** (0.000) | 0.000 (0.000) | 0.001 * (0.000) | 0.000 (0.001) |

| Sex | ||||||||||||

| Male | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Female | 0.016 (0.010) | 0.002 (0.007) | 0.219 *** (0.048) | −0.074 *** (0.018) | −0.329 *** (0.049) | −0.066 *** (0.025) | −0.003 (0.007) | −0.053 *** (0.016) | −0.003 (0.009) | −0.040 *** (0.014) | −0.034 *** (0.012) | 0.155 *** (0.036) |

| N° Household members | −0.001 (0.004) | −0.000 (0.003) | −0.125 *** (0.020) | −0.053 *** (0.007) | −0.016 (0.019) | −0.050 *** (0.009) | −0.003 (0.002) | 0.019 ** (0.008) | −0.007 ** (0.003) | −0.014 *** (0.005) | 0.014 *** (0.004) | −0.067 *** (0.016) |

| Austria | Belgium | Denmark | Finland | France | Germany | Ireland | Italy | Luxembourg | Netherland | Spain | U.K. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sector | ||||||||||||

| Not employed | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Agriculture | 0.118 ** (0.059) | 0.123 (0.077) | 1.906 *** (0.427) | 0.267 *** (0.088) | −0.633 ** (0.298) | −0.477 (0.408) | 0.093 ** (0.042) | 0.167 ** (0.076) | −0.007 (0.095) | 0.236 ** (0.103) | 0.081 (0.076) | −0.193 (0.489) |

| Industry | 0.004 (0.030) | 0.022 (0.024) | 2.232 *** (0.151) | 0.152 *** (0.051) | −0.634 *** (0.122) | −0.080 (0.075) | 0.026 (0.024) | 0.061 (0.061) | 0.020 (0.032) | −0.095 * (0.051) | 0.019 (0.037) | 0.744 *** (0.105) |

| Services | −0.010 (0.020) | 0.012 (0.018) | 2.139 *** (0.090) | 0.046 (0.040) | −0.853 *** (0.096) | 0.008 (0.047) | 0.025 (0.016) | 0.055 (0.046) | 0.056 ** (0.023) | −0.068 ** (0.028) | −0.011 (0.029) | 0.311 *** (0.079) |

| Education | ||||||||||||

| Low | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Medium | −0.004 (0.024) | −0.001 (0.017) | 0.025 (0.096) | −0.067 (0.045) | 0.479 *** (0.097) | −0.196 *** (0.064) | 0.066 *** (0.019) | 0.152 *** (0.038) | 0.032 (0.020) | −0.055 * (0.029) | 0.166 *** (0.031) | 0.103 (0.088) |

| High | 0.063 ** (0.030) | 0.088 *** (0.017) | 2.069 *** (0.104) | 0.245 *** (0.045) | 2.401 *** (0.104) | 0.225 *** (0.068) | 0.145 *** (0.018) | 0.374 *** (0.054) | 0.158 *** (0.020) | 0.180 *** (0.029) | 0.390 *** (0.027) | 0.617 *** (0.079) |

| Country of birth | ||||||||||||

| Born in the country | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | ||

| Born outside the country | −0.019 (0.023) | −0.025 (0.019) | 0.354 *** (0.105) | 0.018 (0.059) | −0.092 *** (0.017) | −0.344 *** (0.075) | −0.056 *** (0.016) | 0.066 (0.040) | −0.097 ** (0.039) | −0.132 (0.098) | ||

| Area | ||||||||||||

| Cities | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | ||||

| Towns and suburbs | −0.010 (0.019) | −0.022 (0.015) | −0.464 *** (0.089) | −0.083 ** (0.038) | −0.638 *** (0.141) | −0.035 ** (0.017) | −0.028 (0.023) | −0.059 ** (0.028) | ||||

| Rural areas | −0.057 *** (0.019) | −0.037 * (0.020) | −0.192 *** (0.146) | −0.079 ** (0.040) | −0.780 *** (0.156) | −0.047 *** (0.015) | −0.013 (0.024) | −0.123 *** (0.026) | ||||

| Age | 0.000 (0.000) | −0.001 ** (0.000) | 0.000 (0.002) | −0.001 (0.001) | −0.004 * (0.002) | −0.005 *** (0.001) | 0.001 ** (0.000) | 0.000 (0.001) | 0.001 *** (0.001) | −0.003 *** (0.000) | 0.001 (0.001) | −0.001 (0.002) |

| Sex | ||||||||||||

| Male | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Female | 0.013 (0.016) | −0.014 (0.013) | 0.079 (0.088) | −0.077 ** (0.032) | −0.496 *** (0.086) | −0.047 (0.045) | 0.001 (0.013) | −0.040 (0.031) | 0.004 (0.017) | −0.089 *** (0.025) | −0.044 * (0.022) | −0.226 *** (0.066) |

| N° Household members | −0.002 (0.006) | 0.006 (0.005) | 0.114 *** (0.034) | −0.079 *** (0.012) | −0.045 (0.034) | −0.045 *** (0.016) | −0.005 (0.004) | 0.006 (0.014) | −0.011 (0.007) | −0.013 (0.009) | 0.029 *** (0.008) | −0.108 *** (0.029) |

| Austria | Belgium | Denmark | Finland | France | Germany | Ireland | Italy | Luxembourg | Netherland | Spain | U.K. | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sector | ||||||||||||

| Not employed | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Agriculture | 0.062 (0.054) | 0.067 * (0.040) | −0.054 (0.353) | 0.075 (0.068) | 0.692 *** (0.191) | 0.041 (0.163) | 0.000 (0.033) | 0.094 ** (0.041) | 0.049 (0.046) | 0.154 * (0.084) | 0.075 * (0.043) | 0.371 (0.232) |

| Industry | 0.005 (0.026) | −0.027 (0.019) | −0.920 *** (0.119) | −0.020 (0.035) | −0.019 (0.089) | −0.044 (0.058) | −0.015 (0.018) | −0.062 (0.040) | −0.002 (0.014) | −0.097 ** (0.043) | −0.088 *** (0.027) | −0.023 (0.072) |

| Services | 0.014 (0.015) | −0.043 *** (0.012) | −0.794 *** (0.067) | 0.019 (0.025) | 0.240 *** (0.064) | −0.051 (0.044) | −0.008 (0.011) | −0.077 *** (0.024) | −0.004 (0.012) | −0.030 (0.021) | −0.031 (0.019) | 0.125 *** (0.042) |

| Education | ||||||||||||

| Low | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Medium | 0.002 (0.015) | −0.037 *** (0.012) | −0.510 *** (0.067) | −0.048 * (0.027) | −0.019 (0.058) | −0.104 ** (0.052) | 0.012 (0.012) | 0.044 ** (0.022) | −0.001 (0.010) | 0.015 (0.021) | 0.032 (0.020) | 0.025 (0.052) |

| High | 0.097 *** (0.021) | −0.017 (0.012) | 0.186 ** (0.078) | 0.155 *** (0.029) | 2.057 *** (0.073) | 0.193 *** (0.058) | 0.066 *** (0.011) | 0.342 *** (0.036) | 0.034 *** (0.012) | 0.171 *** (0.023) | 0.229 *** (0.019) | 0.322 *** (0.048) |

| Country of birth | ||||||||||||

| Born in the country | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | ||

| Born outside the country | −0.010 (0.016) | 0.061 *** (0.012) | 0.317 *** (0.067) | 0.060 (0.045) | −0.017 * (0.010) | −0.001 (0.031) | 0.022 * (0.011) | 0.082 *** (0.026) | 0.056 ** (0.023) | 0.050 (0.056) | ||

| Area | ||||||||||||

| Cities | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | ||||

| Towns and suburbs | −0.007 (0.017) | −0.020 * (0.011) | −0.836 *** (0.072) | −0.134 *** (0.025) | −0.284 *** (0.085) | −0.014 (0.012) | −0.016 (0.015) | −0.055 *** (0.019) | ||||

| Rural areas | −0.005 (0.016) | −0.031 ** (0.015) | −1.025 *** (0.115) | −0.156 *** (0.026) | −0.360 *** (0.107) | −0.035 *** (0.010) | −0.021 (0.015) | −0.082 *** (0.018) | ||||

| Age | 0.001 *** (0.001) | 0.001 * (0.001) | 0.019 *** (0.001) | 0.002 *** (0.001) | 0.025 *** (0.001) | −0.001 (0.001) | 0.001 * (0.000) | 0.001 ** (0.001) | 0.000 (0.000) | 0.002 *** (0.001) | 0.001 ** (0.000) | 0.001 (0.001) |

| Sex | ||||||||||||

| Male | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) | (base) |

| Female | 0.018 (0.012) | 0.019 * (0.011) | 0.359 *** (0.068) | −0.071 *** (0.021) | −0.162 *** (0.050) | −0.086 ** (0.035) | −0.006 (0.009) | −0.066 *** (0.020) | −0.010 (0.011) | 0.008 (0.018) | −0.025 (0.016) | −0.084 ** (0.039) |

| N° Household members | −0.000 (0.005) | −0.008 * (0.004) | −0.364 *** (0.028) | −0.026 *** (0.009) | 0.012 (0.022) | −0.055 *** (0.014) | −0.001 (0.003) | 0.033 *** (0.008) | −0.003 (0.003) | −0.016 ** (0.006) | −0.001 (0.006) | −0.027 (0.016) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fabiani, M. Unraveling the Roots of Income Polarization in Europe: A Divided Continent. Economies 2023, 11, 217. https://doi.org/10.3390/economies11080217

Fabiani M. Unraveling the Roots of Income Polarization in Europe: A Divided Continent. Economies. 2023; 11(8):217. https://doi.org/10.3390/economies11080217

Chicago/Turabian StyleFabiani, Michele. 2023. "Unraveling the Roots of Income Polarization in Europe: A Divided Continent" Economies 11, no. 8: 217. https://doi.org/10.3390/economies11080217

APA StyleFabiani, M. (2023). Unraveling the Roots of Income Polarization in Europe: A Divided Continent. Economies, 11(8), 217. https://doi.org/10.3390/economies11080217