The Ethics of Fractional-Reserve Banking System: A Private Property Rights Approach

Abstract

:1. Introduction

2. Literature Review

3. Ethical Framework

3.1. Ethics of Private Property

3.2. Ethics and Sustainability

4. An Ethical Approach to the Fractional-Reserve Banking System

- The economic analysis of the origin of money as an evolutionary institution helps identify the role of governments and bankers in the emergence of the FRBS and fiat money.

- Emphasizing the legal aspects of money production contrast, the main features of free-market and monopolistic monetary institutions, especially on legal inequality and sustainability issues.

- These findings connect with the ethics of the private property approach to identify how the FRBS fosters fiat inflation and business cycles in an economically unsustainable and ethically reprehensible process.

4.1. Breach of Private Property: Natural Money versus Paper Money

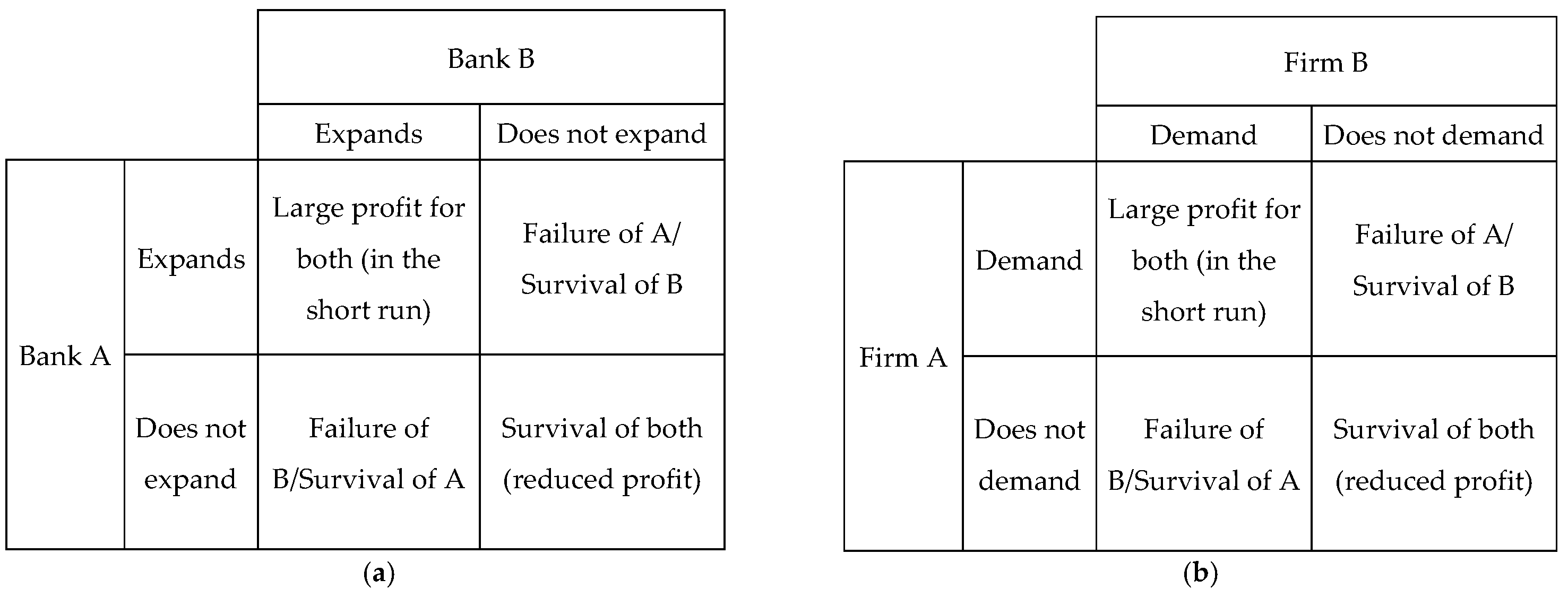

4.2. Legal Inequality: Market Economy versus Legal Monopoly

4.3. Dynamic Unsustainability: Inflation and Business Cycles

- Money supply increases.

- Money demand decreases.

- Both at the same time.

5. Discussion and Policy Implications

5.1. Theoretical Implications

- The economic argument indicated that FRBS means breaching private property rights, distorting the price system, and generating a discoordination of money supply and demand.

- The legal argument states that the FRBS arises from a legal monopoly granted by governments to profit from cheap credit, deficit spending, and, above all, the inflation tax.

- The ethical argument pointed to income redistribution through FRBS in favor of governments, central banks, and newly created money-receiving industries and against the rest of society that must pay the costs of fiat inflation and politically induced business cycles.

5.2. Policy Implications

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aghion, Philippe, Céline Antonin, and Simon Bunel. 2021. The Power of Creative Destruction. New York: Harvard University Press. [Google Scholar]

- Albinowski, Maciej. 2022. The role of fractional-reserve banking in amplifying credit booms: Evidence from panel data. Review of Austrian Economics 35: 63–88. [Google Scholar] [CrossRef]

- Arena, Richard. 1999. The Hayek/Keynes controversy in the light of modern business cycle theory. History of Economic Ideas 7: 227–53. [Google Scholar]

- Bagus, Philipp, and David Howden. 2012. The continuing continuum problem of deposits and loans. Journal of Business Ethics 106: 295–300. [Google Scholar] [CrossRef]

- Bagus, Philipp, and David Howden. 2016. The economic and legal significance of “full” deposit availability. European Journal of Law and Economics 41: 243–54. [Google Scholar] [CrossRef]

- Bagus, Philipp, David Howden, and Amadeus Gabriel. 2014a. Causes and consequences of inflation. Business and Society Review 119: 497–517. [Google Scholar] [CrossRef]

- Bagus, Philipp, David Howden, and Amadeus Gabriel. 2017. The hubris of hybrids. Journal of Business Ethics 145: 373–82. [Google Scholar] [CrossRef]

- Bagus, Philipp, David Howden, and Jesús Huerta de Soto. 2018. Entrepreneurial Error Does Not Equal Market Failure. Journal of Business Ethics 149: 433–41. [Google Scholar] [CrossRef]

- Bagus, Philipp, David Howden, and Walter Block. 2013. Deposits, loans, and banking: Clarifying the debate. American Journal of Economics and Sociology 72: 627–44. [Google Scholar] [CrossRef]

- Bagus, Philipp, Juan Ramón Rallo, and Miguel A. Alonso-Neira. 2014b. A free-market bailout alternative? European Journal of Law and Economics 37: 405–19. [Google Scholar] [CrossRef]

- Bernholz, Peter. 2003. Monetary Regimes and Inflation: History, Economic and Political Relationships. Cheltenham: Edward Elgar. [Google Scholar]

- Bibow, Jorg. 2002. Keynes on central banking and the structure of monetary policy. History of Political Economy 34: 749–87. [Google Scholar] [CrossRef]

- Block, Walter, and Laura Davidson. 2011. The case against fiduciary media: Ethics is the key. Journal of Business Ethics 98: 505–11. [Google Scholar] [CrossRef]

- Boettke, Peter J. 1997. Where did economics go wrong? Modern economics as a flight from reality. Critical Review 11: 11–64. [Google Scholar] [CrossRef]

- Boettke, Peter J., and Patrick Newman. 2017. The consequences of Keynes. Journal of Markets and Morality 20: 155–64. [Google Scholar] [CrossRef]

- Bolton, Patrick, and Mathias Dewatripont. 2004. Contract Theory. Cambridge: The MIT Press. [Google Scholar]

- Bylund, Per L., and Mark D. Packard. 2022. Subjective value in entrepreneurship. Small Business Economics 58: 1243–60. [Google Scholar] [CrossRef]

- Clapham, Sir John Harold. 1970. The Bank of England: A History, 1694–1914. Cambridge: Cambridge University Press. [Google Scholar]

- Cochran, John P., and Steven T. Call. 1998. The role of fractional-reserve banking and financial intermediation in the money supply process: Keynes and the Austrians. Quarterly Journal of Austrian Economics 1: 29–40. [Google Scholar] [CrossRef]

- Cortés Conde, Roberto. 2003. La crisis argentina de 2001–2002. Cuadernos de Economía 40: 762–67. [Google Scholar] [CrossRef]

- Dalziel, Paul. 2002. The triumph of Keynes: What now for monetary policy research? Journal of Post Keynesian Economics 24: 511–27. [Google Scholar] [CrossRef]

- Dosi, Giovanni, Giorgio Fagiolo, and Andrea Roventini. 2010. Schumpeter meeting Keynes: A policy-friendly model of endogenous growth and business cycles. Journal of Economic Dynamics and Control 34: 1748–67. [Google Scholar] [CrossRef]

- Espinosa, Víctor I. 2023a. Principios Modernos de Economía del Desarrollo: Teoría y Práctica. Madrid: Unión Editorial. [Google Scholar]

- Espinosa, Víctor I. 2023b. The perils of lax economic policy: The case of Chile during the COVID-19 pandemic. Review of Austrian Economics, 1–18. [Google Scholar] [CrossRef]

- Espinosa, Víctor I., Miguel A. Alonso Neira, and Jesús Huerta de Soto. 2021. Principles of sustainable economic growth and development: A call to action in a post-COVID-19 world. Sustainability 13: 13126. [Google Scholar] [CrossRef]

- Fahey, Denis. 1944. Money Manipulation and Social Order. Dublin: Browne & Nolan. [Google Scholar]

- Friedman, Milton. 1986. The resource cost of irredeemable paper money. Journal of Political Economy 94: 642–47. [Google Scholar] [CrossRef]

- Friedman, Milton, and Anna J. Schwartz. 1986. Has government any role in money? Journal of Monetary Economics 17: 37–62. [Google Scholar] [CrossRef]

- Garrison, Roger W. 2001. Time and Money: The Macroeconomics of Capital Structure. London: Routledge. [Google Scholar]

- Garrison, Roger W. 2006. From Keynes to Hayek: The marvel of thriving macroeconomies. Review of Austrian Economics 19: 5–15. [Google Scholar] [CrossRef]

- Haberler, Gottfried. 1936. Mr. Keynes’ theory of the “multiplier”. Journal of Economics 7: 299–305. [Google Scholar]

- Harris, William Vernon. 2008. The Monetary Systems of the Greeks and Romans. New York: Oxford University Press. [Google Scholar]

- Hayek, Friedrich A. 1945. The use of knowledge in society. American Economic Review 35: 519–30. [Google Scholar]

- Hayek, Friedrich A. 1984. Money, Capital, and Fluctuations: Early Essays. London: Routledge. [Google Scholar]

- Hodgson, Geoffrey M. 2006. What are institutions? Journal of Economic Issues 40: 1–25. [Google Scholar] [CrossRef]

- Hodgson, Geoffrey M. 2019. Evolutionary Economics: Its Nature and Future. Cambridge: Cambridge University Press. [Google Scholar]

- Hogan, Thomas L., and Lawrence H. White. 2021. Hayek, Cassel, and the origins of the great depression. Journal of Economic Behavior & Organization 181: 241–51. [Google Scholar]

- Holt, Frank L. 2021. When Money Talks: A History of Coins and Numismatics. New York: Oxford University Press. [Google Scholar]

- Hoppe, Hans-Hermann. 1993. Economics and Ethics of Private Property. Boston: Kluwer Academic Publishers. [Google Scholar]

- Huerta de Soto, Jesús. 2010. Socialism, Economic Calculation and Entrepreneurship. Northampton: Edward Elgar. [Google Scholar]

- Huerta de Soto, Jesús. 2020. Money, Bank Credit, and Economic Cycles. Auburn: The Mises Institute Press. [Google Scholar]

- Hülsmann, Jörg G. 1998. Toward a general theory of error cycles. Quarterly Journal of Austrian Economics 1: 1–23. [Google Scholar] [CrossRef]

- Hülsmann, Jörg G. 2003. Has fractional-reserve banking really passed the market test? Independent Review 7: 399–422. [Google Scholar]

- Hülsmann, Jörg G. 2008. The Ethics of Money Production. Auburn: The Mises Institute Press. [Google Scholar]

- Kirzner, Israel M. 1989. Discovery, Capitalism, and Distributive Justice. New York: Basil Blackwell. [Google Scholar]

- Kirzner, Israel. M. 2017. The entrepreneurial market process—An exposition. Southern Economic Journal 83: 855–68. [Google Scholar] [CrossRef]

- Lachmann, Ludwig M. 1973. Macro-Economic Thinking and the Market Economy: An Essay on the Neglect of the Micro-Foundations and Its Consequences. London: Institute of Economic Affairs. [Google Scholar]

- Lavoie, Marc, and Mario Seccareccia. 2004. Central Banking in the Modern World: Alternative Perspectives. Northhampton: Edward Elgar. [Google Scholar]

- Menger, Carl. 1892. On the origin of money. Economic Journal 2: 239–55. [Google Scholar] [CrossRef]

- Menger, Carl. 1976. Principles of Economics. New York: New York University Press. [Google Scholar]

- Moreno-Casas, Vicente, and Philipp Bagus. 2021. The ethics of care and the tragedy of the commons. International Review of Economics 68: 405–22. [Google Scholar] [CrossRef]

- Moreno-Casas, Vicente, Victor I. Espinosa, and William Hongsong Wang. 2022. The political economy of complexity: The case of cyber-communism. Journal of Economic Behavior & Organization 204: 566–80. [Google Scholar]

- Newman, Patrick. 2020. Modern monetary theory: An Austrian interpretation of recrudescent Keynesianism. Atlantic Economic Journal 48: 23–31. [Google Scholar] [CrossRef]

- Pittaluga, Giovanni B., Elena Seghezza, and Pierluigi Morelli. 2021. The political economy of hyperinflation in Venezuela. Public Choice 186: 337–50. [Google Scholar] [CrossRef]

- Rady, Dina Abdel Moneim. 2012. Greece debt crisis: Causes, implications and policy options. Academy of Accounting and Financial Studies Journal 16: 87–96. [Google Scholar]

- Rothbard, Murray N. 1963. America’s Great Depression. New York: Van Nostrand. [Google Scholar]

- Rothbard, Murray N. 1988. The myth of free banking in Scotland. Review of Austrian Economics 2: 229–45. [Google Scholar] [CrossRef]

- Rothbard, Murray N. 1999. The origins of the Federal Reserve. Quarterly Journal of Austrian Economics 2: 3–51. [Google Scholar] [CrossRef]

- Rothbard, Murray N. 2002. For a New Liberty: The Libertarian Manifesto. Auburn: The Mises Institute Press. [Google Scholar]

- Salerno, Joseph T. 2010. Money, Sound and Unsound. Auburn: The Mises Institute Press. [Google Scholar]

- Sawyer, Malcolm. 2006. Inflation targeting and central bank independence: We are all Keynesians now! Or are we? Journal of Post Keynesian Economics 28: 639–52. [Google Scholar] [CrossRef]

- Selgin, George. 2020. Envisioning Monetary Freedom. Cato Journal 40: 509–25. [Google Scholar]

- Selgin, George A., and Lawrence H. White. 1994. How would the invisible hand handle money? Journal of Economic Literature 32: 1718–49. [Google Scholar]

- Taylor, John B. 2012. Monetary policy rules work and discretion doesn’t: A tale of two eras. Journal of Money, Credit and Banking 44: 1017–32. [Google Scholar] [CrossRef]

- Usher, Abbott P. 1943. The Early History of Deposit Banking in Mediterranean Europe. Cambridge: Harvard University Press. [Google Scholar]

- Van den Hauwe, Ludwig. 2006. The uneasy case for fractional-reserve free banking. Procesos de Mercado 3: 143–96. [Google Scholar]

- Van den Hauwe, Ludwig. 2016. Understanding financial instability: Minsky versus the Austrians. Journal des Économistes et des Études Humaines 22: 25–60. [Google Scholar] [CrossRef]

- Watson, Andrew M. 1967. Back to gold and silver. Economic History Review 20: 1–34. [Google Scholar]

- Whale, P. Barrett. 1944. A retrospective view of the Bank Charter Act of 1844. Economica 11: 109–11. [Google Scholar] [CrossRef]

- White, Lawrence H. 2023. Better Money: Gold, Fiat, or Bitcoin? New York: Cambridge University Press. [Google Scholar]

- Yeager, Leland B. 2010. Bank reserves: A dispute over words and classification. Review of Austrian Economics 23: 183–91. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Espinosa, V.I.; Alonso-Neira, M.A.; Huerta de Soto, J. The Ethics of Fractional-Reserve Banking System: A Private Property Rights Approach. Economies 2023, 11, 221. https://doi.org/10.3390/economies11090221

Espinosa VI, Alonso-Neira MA, Huerta de Soto J. The Ethics of Fractional-Reserve Banking System: A Private Property Rights Approach. Economies. 2023; 11(9):221. https://doi.org/10.3390/economies11090221

Chicago/Turabian StyleEspinosa, Víctor I., Miguel A. Alonso-Neira, and Jesús Huerta de Soto. 2023. "The Ethics of Fractional-Reserve Banking System: A Private Property Rights Approach" Economies 11, no. 9: 221. https://doi.org/10.3390/economies11090221

APA StyleEspinosa, V. I., Alonso-Neira, M. A., & Huerta de Soto, J. (2023). The Ethics of Fractional-Reserve Banking System: A Private Property Rights Approach. Economies, 11(9), 221. https://doi.org/10.3390/economies11090221