Abstract

The COVID-19 pandemic was a health, economic, and financial crisis. The aviation sector was one of the most severely hit. Despite the extensive literature on this, COVID-Finance has been focused on stock returns, neglecting what could be learnt from the spreads of airlines’ credit default swaps (CDSs). This would seem of the utmost importance, given the epicenter of the crisis within the credit market. In this paper, an in-depth analysis of airlines’ CDS spreads is conducted. It is found that they were severely hit, for all airlines studied. However, the results of the PSY test showed that speculative trading led the surge, as explosive roots were found in the spreads of all these aviation firms. The dramatic increase in CDS spreads has contributed to already high borrowing costs for airlines. Our results suggest that aviation bail outs have helped to mitigate spreads’ explosiveness. Monetary policy measures have also limited, albeit indirectly, the funding risk posed by the government bail outs. By the end of March 2021, spreads were no longer explosive, and were approaching, at highly heterogeneous paces, their pre-pandemic values. Notwithstanding, airlines’ stock prices have been notably resistant to recovery.

Keywords:

COVID-19; airlines; bail outs; competition law; credit default swaps; fiscal policy; monetary policy 1. Introduction

In this paper, we investigate the contours of COVID-19’s impact on the airline ecosystem. It is widely accepted that the aviation sector was one of the most severely hit by the crisis, particularly through major credit difficulties (Kotcharin et al. 2023). We provide the first assessment of the aviation pandemic crisis using spreads for airlines’ credit default swaps (CDS). These are credit insurance derivative contracts, protecting the buyer against events such as bankruptcy, debt restructuring, or default of the underlying reference entity (e.g., an airline). CDS quotes are usually spreads (in basis points). Rising CDS spreads are perceived as worsening credit conditions for such entities (Oliveira and Santos 2015). In our sample, we use spreads of CDS for each of the six most relevant airlines, per generated revenue, in the world (Forbes 2023): the four major US air carriers (Delta Airlines, American Airlines, United Airlines, and Southwest Airlines), and two of the major European groups (Air France–KLM and Deutsche Lufthansa AG). We use daily data for the core of the pandemic period (from September 2019, before the first reports of COVID-19, until late March of 2021, when vaccination was already under way). The research question—what can we learn from the contour of airlines’ CDS spreads during the COVID-19 pandemic?—entails several dimensions and is relevant to various stakeholders from the aviation crisis eco-system. Some of the conclusions involve assessing the CDS spreads’ responses to the fiscal policy efforts to assist airlines (bail outs), inferring whether there was speculative purchase of CDS (worsening airlines’ access to credit), differentiating the pandemic’s effects on CDS spreads between low-cost (LCCs) and full-service carriers (FSCs), and looking at the effects on spreads of social gatherings around festivities, etc.

This paper is organized as follows. The next section provides background to the research problem and extensively discusses the relevant literature. Section 3 presents the methodology and data. Section 4 presents the results. Section 5 discusses the results in connection with the research question and the research hypotheses. It shall also provide directions for future research. Section 6 concludes.

2. Background and Literature Review

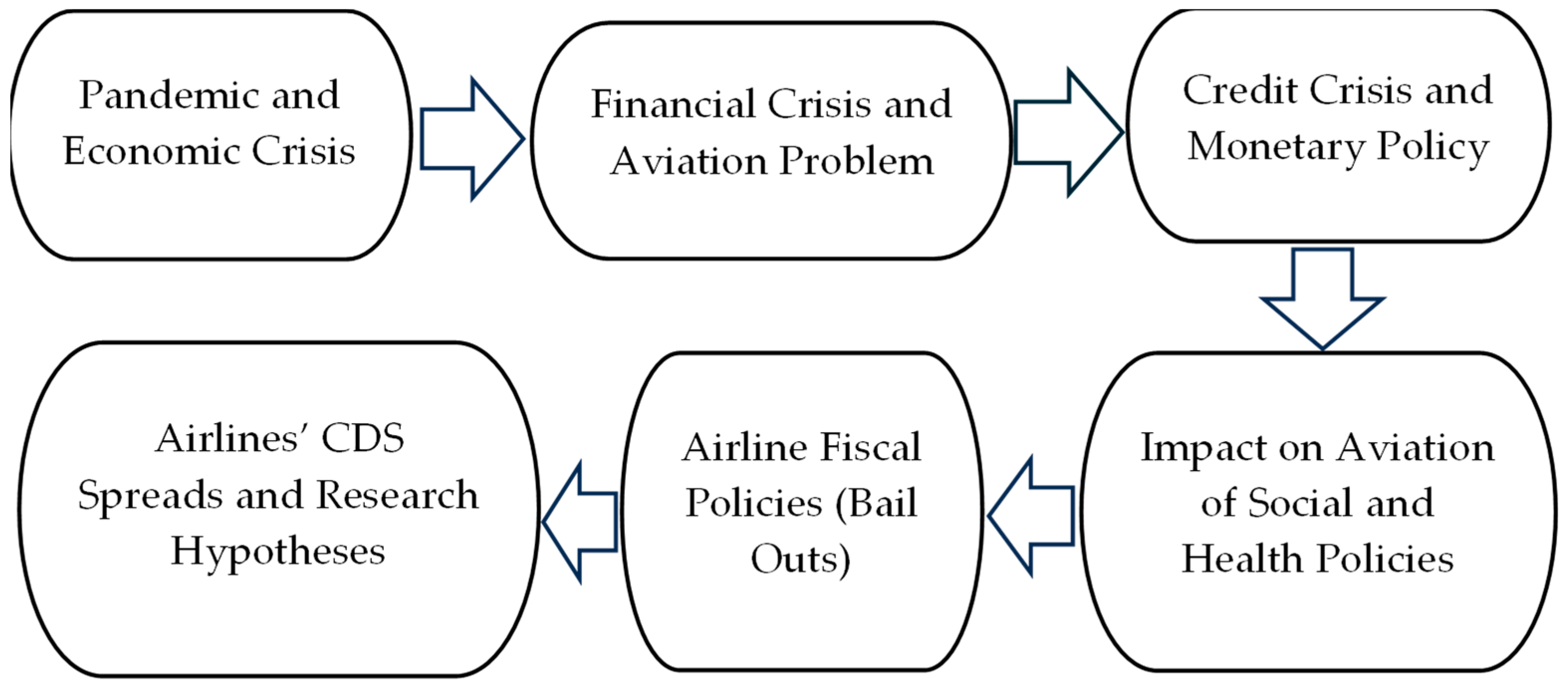

The flowchart in Figure 1 aims at providing a roadmap to this section, increasing conceptual liaison between the topics. The directional arrows do not always imply causality, but merely sequential steps in the reasoning.

Figure 1.

Background and structure of the literature review.

2.1. The Pandemic Context and the Research Problem

On 11 March 2020, the World Health Organization (WHO) issued a statement confirming that the COVID-19 outbreak had become a pandemic. The SARS-CoV-2 virus was rapidly perceived as highly contagious and easily transmissible. Extreme measures of social containment were taken worldwide. These entailed social distancing, school closing, workplace closing, cancelation of public events, restrictions on group gatherings, stay-at-home requirements, closing public transportation, restrictions on within-country mobility and on international voyages, testing policies, vaccination policies, contact tracing, facial coverings, information campaigns, protection of the elderly, etc. (Narayan et al. 2021). As argued by Liu et al. (2021), lockdowns, declines in consumer physical attendance, border shutdowns, social distancing, and other measures had a notorious negative economic impact on demand, productivity, and income. The pandemic quickly escalated to a major economic crisis and aviation was one of the most severely affected sectors (Kotcharin et al. 2023). Airlines faced both liquidity shortages and major difficulties in obtaining credit. The aviation crisis was such that government aid through bail outs was called for.

It is to be expected that airlines’ CDS spreads would be relevant during a period of serious borrowing difficulties and liquidity constraints. Should a credit event (see ISDA 2014) occur, the CDS buyer would receive from the protection seller the full amount of the value agreed in the contract. Notwithstanding, to the best of our knowledge, no study in the literature on finance and COVID-19 has focused on the signals derived from the evolution of airlines’ CDS spreads. Apergis et al. (2022) have provided the only paper in the literature that refers both to this credit derivative and to airlines. However, the authors focused on relating the CDS spreads of several US economic sectors to the evolution of the pandemic, in terms of daily new infections and daily COVID-19-related deaths. They did not focus on the airlines’ problem per se, nor on airline-targeted policies. They noticed that there was a heterogeneous response of CDS spreads across sectors, with restaurant chains and airline transportation being the most severely affected. In conclusion, despite the COVID-19 crisis being a time of major changes in airlines’ debt structure, a key debt restructuring tool and creditors’ protection financial instrument (CDS) has largely been ignored in the literature. Hence, the spreads’ capacity to provide market signals of airlines’ financial distress levels and information on the success of pandemic aviation policies have not been explored.

The relevance of our research question becomes more obvious not only with the identification of a gap in the literature, but also in a period where the pandemic was leading several airlines worldwide to either file for bankruptcy or for protection from creditors. Examples include Avianca Peru, the Ecuadorian airline TAME, LATAM airlines group and its subsidiaries in Chile, Argentina, Peru, Ecuador, and Colombia, the Chilean One Airlines, LIAT (headquartered in Antigua and Barbuda), Air Asia Japan, Hong Kong Dragon Airlines Limited (Cathay Dragon), Mexican airline Interjet, Thailand-based NokScoot, and Air Mauritius (Kotcharin et al. 2023).

2.2. COVID-19: From Economic and Financial Crisis to Aviation Problem

The COVID crisis has been deeply studied in the literature. It was an uncommon event, since, contrary to other natural disasters, it was a prolonged, multi-period crisis, with several waves that appeared to be almost synchronized across countries (Ludvigson et al. 2020). The first wave, in early 2020, led the International Monetary Fund (IMF) to predict a global contraction of 3% in that year (IMF 2020). Output in the UK suffered a dropdown of 9.9% in 2020. Unemployment rose to 15% in the USA in the 2nd quarter of 2020 (Federal Reserve of St. Louis 2023). The Japanese GDP diminished 4.8% in the same year. In conclusion, the pandemic proved to be more than a health crisis, but a true social and economic disaster (e.g., Apergis et al. 2022).

There are reports in the literature that point to sectoral differentiation of the impacts of the pandemic. Pagano et al. (2023) put forth the high-tech sector as an example of very high resilience, contrasting with the tourism sector, restaurant chains, and the travel sector. Choi (2020) added regional to sectoral differences when considering the impacts of the pandemic. Airlines, oil and gas, and consumer-facing industries were the most severely hit, both in the USA and in Europe. In contrast, the automotive industry was mostly affected in the USA, while the apparel and shoe industry was mostly affected in Europe.

Not surprisingly, the heavy economic losses suffered by nearly every industry were reflected on the stock markets (Padungsaksawasdi and Treepongkaruna 2021, 2023). The widespread negative reactions of financial markets to the pandemic have been well documented in the finance literature (see, inter alia, Baker et al. 2020; Ding et al. 2021; Fahlenbrach et al. 2021; Liu and Yamamoto 2022). Indeed, the most popular financial volatility index, the VIX, reached one of its highest historical values ever (66.04), in March 2020. In the same week, after the declaration of COVID-19 as a pandemic, the main US stock market index, the S&P500, had lost nearly 10%.

The bearish financial impact of the pandemic was also heterogeneous across sectors. The airline industry was one of the first and most harshly hit, not only in its daily activity but also in the stock market (e.g., Kotcharin et al. 2023). The negative impact of the COVID-19 outbreak on airline stocks has been documented by Kumari et al. (2022, 2023). Maneenop and Kotcharin (2020) refer to cumulative abnormal negative returns of 24.42% for airlines’ stocks in the week after the pandemic statement, clearly outpacing the fall in the S&P500 index.

Lee (2021) argued that the problem was not only that aviation was the hardest hit economic sector, but also the spillovers of that: airlines had been a key sector in the global economy, but their contribution to it halved between 2019 (USD 3.5 trillion) and 2020 (USD 1.8 trillion); global mobility fell as the total number of passengers transported dropped by 60% between those years, and demand for air cargo decreased by 10.6%. Lee (2021) also underlined the potential unemployment crisis; in 2019, the industry represented 3.6 million permanent jobs in the USA alone. Moreover, Lee (2021) observed that a major crisis in aviation had put global connectivity and global supply chains under serious threat of succumbing.

2.3. COVID-19: Liquidity Crisis, Banking Crisis, and Monetary Policy

The economic impacts of the disease and of the containment and health policies, discussed earlier, clearly lowered the expected value of future cash flows for most firms. For this reason alone, the stock market should have been bearish in the pandemic period. Moreover, there was an increase in risk, as documented by the behavior of the VIX (see Section 2.2). Increased volatility meant additional uncertainty for families, with respect to future unemployment. A rise in precautionary savings, leading to consumption smoothing with lower present consumption, is a common response by families in such scenarios (Jordà et al. 2020). This further contributed to the bearish conditions in stock markets. Lockdowns and mobility restrictions had caused liquidity shortages, particularly in consumer-facing sectors (such as airlines). The lower present consumption expenditures by families, due to the prospects of future unemployment, further deepened the liquidity crisis. As expected, firms then sought liquidity by any means, namely by increasing withdrawals of money from their bank accounts.

Banks facing augmented withdrawals of money had a lower capacity to concede credit (Baum et al. 2021). This capacity was even further diminished by the increased risk of default on existing bank loans, both by firms (facing bankruptcy risk given the liquidity shortage) and by households (who might default on their loans in the event of unemployment). The lowering quality of the banks’ assets is documented in Bosio et al. (2020) and Didier et al. (2021). The reduced capacity to concede credit to households, firms, governments, and to the banking system itself increased financial frailty and threatened the stability of the financial system (Caglayan and Xu 2019; Oliveira and Santos 2022). High connectedness between banks, firms, governments, and families, accelerated the transmission of the crisis to other financial markets, namely debt markets (Barua and Barua 2020; Brei et al. 2020).

Despite the extensive literature on the financial effects of the pandemic, the focus in relation to aviation stocks has almost entirely been on high risk and low returns. However, when designing airlines’ bail-out policies, the concern was also the difficulty the industry was facing in obtaining funds through debt markets. Kotcharin et al. (2023) provide a rationale for this difficulty; considering that the decline in airlines’ stock prices was acting as a huge constraint on their ability to attract financiers, the firms were left with no credit collateral of high quality. Adding to this, rating agencies downgraded nearly all airline issuers, leaving most out of the investment grade (Fitch 2021). Unlike most previous financial crises, the bond market was at the epicenter of the COVID-19-induced crisis (Goldstein et al. 2021).

The outbreak of the COVID-19 pandemic, leading to increased uncertainty and fragility in the banking sector, put pressure on central banks to conduct expansionary monetary policies. The rationale was to keep interest rates low in the interbank market, and to guarantee sufficient liquidity to the banking system, at a time where the quality of the banks’ assets made it more difficult for banks to borrow from each other (Bernanke et al. 2005). In the Euro Area (EA), quantitative easing (QE) policies had already been put forth by the European Central Bank (ECB), since 2012. Notwithstanding, the coronavirus crisis led the ECB to launch the Pandemic Emergency Purchase Program (PEPP), with a total endowment of EUR 1850 billion (ECB 2023). It should be noted that the ECB was also preventing a new sovereign debt crisis, as government spending, in the pandemic years, was massively increasing. The PEPP was discontinued in March 2022.

The US Treasury also adopted a flexible approach to monetary policy, with the Federal Funds Rate being cut to the [0–0.25%] interval. On 15 March 2020, the Federal Reserve also announced a shift to QE, revealing the objective of buying USD 500 billion in treasuries and USD 200 million in government-guaranteed mortgage-backed securities (MBSs). The federal reserve began tapering its pace by the end of 2021 (Milstein and Wessel 2021). Bonaccolto et al. (2023) claim that these monetary policy measures effectively helped to ease the COVID-19 liquidity hardship1. Charalambakis et al. (2024) also conclude that the ease of credit approval had grown after accommodative monetary policies were put forth, in comparison with the early stages of the pandemic.

The success of the expansionary monetary policy did not imply easier access to credit for the aviation sector. Although there were some claims that by the end of the second quarter of 2022, airlines were reaching financial results equal to their pre-pandemic levels (Clarke 2023), this was far from being the general case. Aviation stock prices were certainly not recovering. Some Chinese airlines and some American airlines were showing early positive signs (Liao et al. 2022), but not only were these companies very few in number, also, they were all LCCs. LCCs had not been hit so severely by the outbreak of the pandemic as FSCs. In fact, the difference between the paths of LCCs and FSCs only reinforces the heterogeneous routes to recovery discussed in Sun et al. (2023). Notwithstanding, this is a point of contention; Jaroenjitrkam et al. (2023) argue that the negative impact of the pandemic was clearer in LCCs2. Sun et al. (2023) also refer to the outlier nature of early recoveries, looking beyond profitability, focusing on total numbers of passengers. Data for 2022 for that variable confirm that the aviation industry was still well behind pre-pandemic levels.

2.4. The Impact on Aviation of Social Containment, Public Health Policies and Economic Aid to Households

The bearish financial performance of aviation stock alone could constitute grounds for the need for some kind of policy intervention. Some authors suggested that the containment and health public policies would give a boost to the airline market. Chang et al. (2021), Narayan et al. (2021), and Kaczmarek et al. (2021), inter alia, argued in such a sense, noticing that social and public health measures were perceived as reducing the risk of contagion and the number of infected individuals. Thus, they would boost investors’ confidence. Notwithstanding, others (e.g., Ashraf 2020; Chen et al. 2020) argued in the opposite direction, since stringent policies, particularly in countries with smaller domestic markets, would adversely affect aviation stock prices. Kotcharin et al. (2023) criticized the studies put forth against containment measures: these had been conducted very early in the pandemic; most often, they made use of information from few countries. In fact, studies such as the research conducted by Sakawa and Watanabel (2023) used data from a single country. Kotcharin et al. (2023) built a large sample, from which they concluded that containment policies had a positive impact on airlines’ stock returns.

The vastly popular pandemic household debt relief and income support measures were criticized by Kotcharin et al. (2023), Capelle-Blancard and Desroziers (2020), Meng et al. (2021), and Sun et al. (2021). Their evidence suggested that people receiving such support tended to be less concerned with the virus, and more relaxed with respect to the pandemic in general, leading to an increase in infection cases. Hence, a negative relation between airlines’ stock performance and household aid policies was found. In a less critical tone, Zaremba et al. (2021) found no correlation between these measures and airlines’ stock returns.

2.5. Airline Targeted Fiscal Policies

As argued above, the dimension of the negative shock suffered by the aviation sector has led many governments worldwide to develop fiscal policies specifically tailored for it. Enormous public aid was provided, generating a de facto government bail out of the airline sector. Lee (2021) claimed this was a clear case of “too big to fail”. Kotcharin et al. (2023) provided a rationale for the bail out based on the decline in airline stock prices, since this was a huge constraint on these firms’ ability to summon capital. Moreover, as explained in Section 2.3, improved borrowing conditions due to expansionary monetary policy were not directly felt by the aviation sector.

Here, we describe the main bail-out policies, providing examples of particular interest. Our examples have been chosen with regard to the dimensions of the airline groups and the goals of this paper. As mentioned in the introduction to this paper, we study two of the most significant European groups: Air France–KLM and Deutsche Lufthansa AG. We also study the four main USA-based airlines (by number of enplaned passengers): American Airlines, Delta Airlines, United Airlines, and Southwest Airlines (Forbes 2023). The aviation companies we have just alluded to are also the six most relevant in the world in terms of generated revenue (Forbes 2023). Furthermore, they represent two of the most significant markets. They come from two advanced but distinct competition law frameworks. Finally, they include FSCs and one LCC. In fact, in terms of generated revenue, Southwest is the largest LCC in the USA and, indeed, the world.

Lee (2021) identified the four main bail-out policies targeting airlines:

- (A)

- loans and loan guarantees;

- (B)

- equity acquisition;

- (C)

- hybrid financing;

- (D)

- wage subsidies.

With respect to the first policy measure, one of the clearest issues the airline industry faced as result of the pandemic outbreak was the very rapid lowering of their credit ratings (see Section 2.3). As such, many governments had to find ways to extend loans specifically to airlines. These were often made through state-owned development banks (Lee 2021).

Loans and loan guarantees were a fundamental tool in the public assistance to the Air France–KLM group. Two governments were involved in the credit rescue operation: EUR 3.4 billion from the Netherlands (EUR 2.4 billion lent by a consortium of banks, and EUR 1 billion in a government loan), and EUR 7 billion from the French government, including a state guarantee on loans and a loan from the government, in its role as major shareholder of the Air France–KLM group (Lee 2021; Air France–KLM 2023).

It is important to note that the aid to Air France–KLM, given the EU jurisdiction on competition law, required the approval from the EC. This was obtained in light of the two arguments put forward by the company and both governments as follows: in the event of bankruptcy, there would be a major unemployment problem in these countries, and the Air France–KLM group was pivotal in terms of connectivity within Europe and in relation to the space outside the EU (European Commission 2020).

Nonetheless, the dispute on the compatibility of the Air France–KLM bail out with competition law remained in the EU General Court until early July 2024. On 20 December 2023, the court declared the 2020 EC decision null. However, on 10 July 2024, the EU General Court ruled in favor of an appeal against the first decision. The EC approval of the bail out in 2020 was declared valid (Lusa 2024).

With respect to equity acquisitions (policy B), the presence of the state in the capital structure of an airline group is not uncommon in Europe. In fact, Lee (2021) argued that by 2016, 57% of airlines worldwide were either fully or partially state-owned. Partial ownership of airlines by the state is assumed to correspond to 27 to 30% of all shares being publicly owned (ICAO 2016). Equity acquisition has rarely been used alone. In fact, it has most commonly been realized in the form of government usage of hybrid instruments (policy C). These are financial tools that combine features of equity instruments and debt instruments. Specific examples include debt-for-equity swaps and convertible bonds. Debt-for-equity swaps entail the issuance of equity to the firm’s creditor, so that the debt is discharged. Convertible bonds are debt securities, implying interest payments, but which can be converted to a predetermined number of shares.

Hybrid instruments have been particularly relevant in the context of the Deutsche Lufthansa AG bail out. The German Economic Stabilization Fund (WSF) was established by the German parliament on 27 March 2020. Aid to the Deutsche Lufthansa AG comprised both an increase in equity (the WSF purchased EUR 300M of new shares) and hybrid instruments. The new stock was such that the WSF would have a stake of 20% in the group. It was prepared to increase this to 25% plus one share in case of a hostile takeover against Deutsche Lufthansa AG. With respect to the hybrid, the WSF bought EUR 1 billion in convertible bonds and provided EUR 4.7 billion in debt-for-equity swaps.

To obtain approval from the EU’s Competition Commissary, Deutsche Lufthansa AG had to agree to some conditions. LCCs feared the market power of FSCs would further be enhanced by bail outs. The Lufthansa group agreed with a commitment to free some slots in its Frankfurt and Munich hubs3. Deutsche Lufthansa also agreed to share some of their resources in such hubs with smaller airlines.

The debate with respect to the compatibility of the Lufthansa government bail out with EU competition law also remained open in July 2024. In fact, the Irish LCC Ryanair filled a complaint with the EU General Court against Lufthansa’s bail out. Ryanair considered that Deutsche Lufthansa AG did not meet the requirements for a government bail out, even under the State Aid Temporary Framework adopted by the EU on 19 March 2020. The court ruled in favor of Ryanair on 10 March 2023. Lufthansa filed an appeal against the verdict, but early in July 2024, the EU General Court again declared null the government bail out to Lufthansa. The EC has subsequently declared it will fully investigate the eligibility of Lufthansa for state aid in 2020. Furthermore, the EC will also study alternative ways of recapitalizing the group and check for the possibility of Lufthansa having excess market power in other airports beyond Frankfurt and Munich (Veríssimo 2024).

Finally, bail outs in the form of wage subsidies (policy D) were heavily used in the USA. Established by the Corona Virus Aid, Relief, and Economic Security Act (CARES Act), the 4003 Loan Program gave permission to the Treasury Department to make loans, provide loan guarantees and other necessary investment to eligible business, and to provide liquidity related to losses incurred during the COVID-19 pandemic. Under this proviso, the US Department of the Treasury provided USD 25 billion in loans to passenger air carriers, repair station operations, cargo carriers, ticket operators, and other business critical to national security. The CARES Act required borrowers to maintain employment and wages at the levels of March 2020. Management compensations were restricted. Stock repurchases and dividend distributions were forbidden until loans had been repaid.

In the USA, aviation-related businesses received subsidies under terms such as not laying off or involuntarily furloughing workers until the end of September 2020. The Payroll Support Program (PSP), a part of CARES Act, provided assistance to passenger air carriers for the continuation of payment of employee wages. Created in 2020, it was reupped twice in 2021 (Wallace 2022). To provide the most relevant examples: American Airlines Inc. received USD 7.5 billion, and United Airlines Holding received USD 7.491 billion (Lee 2021), Delta Airlines received USD 5.4 billion (Karp 2020), and Southwest Airlines received USD 7 billion (Wallace 2022).

It is estimated that the Treasury was paying too much per employee (300,000 USD while even for flight attendants, the median wage was 68,000 USD per year). The premium was used by executives to prevent bankruptcy and to boost share prices, ultimately benefiting shareholders. The presence of stock options in managers’ payment structures implied they would also be benefitting themselves. This would infringe the spirit of the restrictions in the CARES Act. In short, both in Europe and in the USA, the debate about airlines’ COVID-19 bail outs is not settled.

2.6. Credit Default Swaps

Traditionally, CDS markets were mostly related to corporate reference entities. Sovereign CDSs came a distant second. For a long time, CDSs were mostly used to hedge buyers’ creditor positions in bonds markets. The protection buyer made only periodic fixed payments during the contract lifetime (Oliveira and Santos 2015). However, CDS usage for trading by investors who do not possess the relevant bonds has been increasing since 2005 (Bannier et al. 2014). Uncovered or naked CDS buyers expect spreads to increase. In such cases, they would profit from selling.

CDSs are highly leveraged insurance derivatives. Compared with the bonds market, investment in CDSs is cheaper, fostering momentum trading and explosive spreads. Such naked traders mostly buy CDSs referring to entities whose credit quality is expected to worsen (as was the case with airlines after the onset of the pandemic). If such expectation persists for some time, CDS spreads may rise explosively, due to herding behavior and the fact that spreads do not have an upper bound (arbitrage between the CDS and bond markets is unfeasible (Palladini and Portes 2011)). A distressed firm’s creditor, when facing sharply rising CDS spreads, interprets this as a sign of higher default probability for the bonds he holds. As such, spreads’ explosive increase also leads credit to the reference entity to become more difficult. Creditors of distressed entities (e.g., airlines during the pandemic) might also feel motivated to buy insurance protection, further fostering the rise in CDS spreads.

Evidence of excess reactions or explosiveness of CDS spreads is large (Andritzky and Singh 2006; Coudert and Gex 2010). Chiarella et al. (2015) showed that, for financially distressed entities, trading momentum is critical in determining CDS spreads. The problem for distressed firms is aggravated by the fact that sharp rises in such spreads Granger cause rises in bond yields (e.g., Damette and Frouté 2010). In our example of interest, not only would airlines find borrowing more difficult, but the borrowing costs would also increase, as airlines’ bond yields would also be rising.

This paper improves on the literature by providing a first rigorous assessment on whether the extreme anxiety of the COVID-19-based airline crisis translated only to normal fears related to the credit quality of these firms, or whether in fact there were also excess reactions. To do so, we take advantage of the test for multiple market explosiveness episodes developed by Phillips et al. (2015a, 2015b). The literature on these derivatives had had a major problem with the precise definition of an exuberance episode. Coudert and Gex (2010), inter alia, referred to a surge in the spreads of GM and Ford that propagated to the industry. Notwithstanding, there was no threshold for them to identify a “surge”. Andritzky and Singh (2006) showed that huge increases in CDS spreads might occur, although the meaning of “huge increase” is unclear. As explored in the methodology section, the test proposed by Phillips et al. (2015a, 2015b) is invaluable in solving this lack of rigor. Explosiveness can be tested; if present, it should be interpreted as a surge or exuberance episode, since fundamentals can hardly account for such a rhythm of growth in an economic or financial variable.

Moreover, the success of the COVID-19 airline bail outs has never been assessed using the evolution of the firms’ CDS spreads. Given that the bond market was at the epicenter of the COVID-19-induced financial crisis (Goldstein et al. 2021), studying the evolution of airlines’ CDS spreads appears to be of the utmost interest.

Furthermore, although sovereign credit quality is not the focus of this paper, it should be pointed out that the possibility of a new sovereign debt crisis might be studied using sovereign CDSs (Zhai et al. 2022). Jinjarak et al. (2020) showed that the spreads of European sovereign CDSs during the pandemic were larger than expected, with the difference attributed to short-term crisis panic due to COVID-19 and to policy reactions, namely the expansionary fiscal policies studied in Section 2.5. A comment on this is made when discussing these paper’s results in Section 5, below. The QE monetary policy might have prevented another sovereign debt crisis, particularly with the PEPP.

2.7. Research Hypotheses Emerging from the Literature

Focusing on this papers’ research question, we formulated the following research hypotheses. These also emerged naturally from the literature we have discussed.

H1:

Spreads of airlines’ CDSs were not neutral in response to the pandemic crisis. Instead, the pandemic was a convoluted period for such credit derivatives.

H2:

The possibility of leveraged uncovered purchase of these derivatives led to excess reaction in these spreads.

H3:

CDS behavior confirms that airlines would experience high, or impossible, borrowing costs, namely in the bonds market.

H4:

CDS markets anticipated the WHO declaration of the pandemic.

H5:

Dates of increased social gatherings negatively impacted airlines’ CDSs, either due to updated lower discounted cash flows incorporating travelling restrictions, or, in the absence of such restrictions, due to the growth in the numbers of infected people resulting from such dates.

H6:

The CDS market should confirm the heterogeneous resilience of airlines, with LCCs suffering less. Heterogeneous resilience should also imply that CDSs for some aviation groups will converge back to pre-COVID-19 values at a faster pace than others.

H7:

The fiscal policy assistance to airlines (bail outs) mitigated the explosiveness of their CDS spreads.

H8:

Monetary policy aid (QE) also lowered borrowing costs for airlines, at least preventing the bail outs from leading to a new sovereign debt crisis.

3. Methodology and Data

Research hypotheses H1–H8 are related to exuberance episodes in airlines’ CDS spreads. Therefore, understanding the procedure that allows testing for explosive roots and consistent time stamping of the exuberance episodes is critical. The Phillips et al. (2015a, 2015b) method is explained in detail in Section 3.1. Section 3.2 describes the data in our sample.

3.1. Testing for Explosiveness

Phillips et al. (2015a, 2015b) suggested a double-recursive, right-tailed alternative unit root test that has become the standard test for exuberance or explosiveness. This is a test for explosive roots in financial time series, based on augmented Dickey–Fuller (ADF) regression. With ,

where is the relevant series. The null hypothesis, , refers to the unit root case, as in the ADF test. However, the alternative refers to an explosive root . Thus, this is a right-tailed unit root test, as the alternative is right-sided.

For a recursive test, the researcher needs an initial window size, . Equation (1) is estimated recursively, with the first observation as the starting point. Let , with , be the fractional size of the sample for samples starting at . The corresponding ADF test statistic is . As increases, the sequence of observed test statistics, , is created. Phillips et al. (2011) had previously suggested that a test for multiple bubbles might be based on this sequence. The SADF test statistic would be as follows:

Rejection of the null, and, thus, a conclusion in favour of the occurrence of explosive behaviour, would happen if the observed SADF statistic were bigger than the right critical value. Phillips et al. (2015a) cope with the possibility of multiple in-sample bubbles by nesting the SADF test in a loop, allowing the starting point to vary: . The generalized SADF statistic (GSADF) is therefore the biggest ADF statistic in the double recursion:

The asymptotic distributions of the SADF and the GSADF test statistics depend on a nuisance parameter: . For practitioners, Phillips et al. (2015a) suggest the heuristic rule:

Phillips et al. (2015a) recommend Monte Carlo simulations to obtain critical values at conventional significance levels. Furthermore, the authors developed a backwards strategy to obtain the GSADF statistic, with the purpose of consistently estimating the dates for the beginning and the ending of multiple exuberance episodes. The backwards SADF test (BSADF) statistic is given as follows:

The GSADF test starts with the repeated implementation of the backwards sup ADF test. The test statistic is as follows:

Phillips et al. (2015a) claim there is no rationale or fundamental in finding explosive roots. As such, when these exist in financial time series, they are a sign of bubble-type behavior. That is, if explosive roots are found in stock prices, for example, that would be unrelated to fundamentals and related instead to a common belief that the prices would keep increasing. This type of herding behavior is particularly easy with highly leveraged derivatives, where, quite often, not even the expenditure of buying the underlying asset is required. In the CDS market, as discussed in Section 2.6, the clear threshold to conclude that traders are buying for speculative motives can thus be put at the level of finding explosive behavior in spreads through the Phillips et al. (2015a, 2015b) test. Cervera and Figuerola-Ferretti (2024) provide a discussion on this.

3.2. Sample

All the data used in this paper were retrieved from Refinitiv Eikon, under an academic license. Our sample comprised daily CDS spreads (end-of-day quotes for 5-year-maturity CDSs), for the period between 16 September 2019 and 29 March 2021: a total of 367 observations per airline (2202 observations on aggregate). We collected data for each of the world’s six most relevant airlines. The choice of the airlines in the sample is explained in Section 2.5. We chose to work with 5-year-maturity CDSs since these represent the most common option in the literature.

The sample period was chosen so that it contained both a pre-pandemic period, the early news of the disease, the outbreak of the pandemic, the Thanksgiving, Christmas, and New Year festivities of 2020, and the beginning of the vaccination period. For details on the COVID-19 timeline, see CDC (2023).

Finally, it should also be pointed out that we chose to start as early as September 2019 in order to provide the Phillips et al. (2015a) procedure with sufficient observations. As indicated by the heuristic rule in Equation (4), with 367 observations for each series, a trimming factor of 0.103959 is recommended to ensure that the initial estimation is feasible, so that the GSADF and the SADF test statistics may be obtained. For the implementation of the test, we followed the authors’ recommended suggestion of obtaining the critical values through Monte Carlo simulation. An add-on for the right-tailed unit root test is available for Eviews. The double-recursive nature of the GSADF test statistic and the need to iterate 1000 times to obtain critical values for each possible series mad the procedure time-consuming (about 6 h of computational time for each series, using an i-7 processor, with 16 GB of RAM and 4.7 GhZ).

As an overview of our data, Table 1 provides some summary descriptive statistics. Both the standard error and the interval size indicated that each of the six series had significant variability. This suggested that the sample might contain several episodes, which would be of relevance to test our research hypotheses.

Table 1.

CDS Spreads—Descriptive Statistics.

4. Results

Table 2, Table 3 and Table 4 report the results of the GSADF test for the six aviation companies. Table 2 refers to the European airlines (the Air France–KLM group and the Deutsche Lufthansa AG group). Table 3 reports results for the world’s biggest LCC (Southwest Airlines) and for the world’s biggest airline in terms of generated revenue: Delta Airlines (Forbes 2023). Both are USA-based. Finally, Table 4 reports results for the GSADF test for the second and third biggest airlines in the world in terms of generated revenue: American and United Airlines, respectively (Forbes 2023).

Table 2.

GSADF test results for Air France–KLM and Lufthansa.

Table 3.

GSADF test results for Delta and Southwest.

Table 4.

GSADF test results for American and United Airlines.

The three tables are organized according to the same structure. The left panel reflects results for one airline, and the right panel for another. For each airline, we then provide the observed GSADF test statistic, as obtained according to Section 3.2, and the 1% critical value of the simulated distribution of the test statistic given by Equation (6). Since the alternative hypothesis in each test is right-sided, the rejection of the null implies conclusion in favor of the existence of explosive or exuberant behavior in the relevant CDS spreads. Rejection occurs whenever the observed test statistic is bigger than the critical value. In the event of rejection, for a given firm, the test statistic is marked in the relevant table and panel with a * if rejection occurs only at 10%, ** if rejection occurs at 5% (but not at 1%), and *** if rejection occurs at 1%.

Table 2 informs us that the observed test statistics, for both European airline groups, were such that the null hypotheses (, in the corresponding version of the auxiliary regression matching Equation (1)) was rejected in favor of the explosive root alternative. For the Air France–KLM group, the observed test statistic was 11.48416, which was bigger than the simulation-based 1% critical value of 2.924427. As such, rejection of the null of a unit root in favor of the alternative of the existence of explosiveness occurred even at the 1% significance level. For the Deutsche Lufthansa AG group, the observed test statistic was 17.46319. In this case, the simulation-based 1% critical value was also smaller than the observed test statistic. Rejection of the null, even at the 1% significance level, in favor of the alternative of explosiveness in the CDS spreads was obtained for Lufthansa as well.

Table 3 reports the GSADF test information for the series of spreads for Delta Airlines and Southwest Airlines. In both cases, the null hypothesis was rejected in favor of the existence of explosive roots. For Delta Airlines, the observed test statistic was 14.45049, which was bigger than the simulation-based 1% critical value reported. As such, rejection of the null in favor of the alternative of the existence of explosiveness occurred even at the 1% significance level. For Southwest Airlines, the observed test statistic was 17.46319. As such, the simulation-based 1% critical value was also smaller than the observed test statistic. We rejected the null, even at the 1% significance level, in favor of the alternative of explosiveness in Southwest’s spreads.

Table 4 contains the results of the GSADF test for American Airlines and United Airlines. As with the previous tables, the results led to the rejection of the unit root null hypothesis in favor of the alternative of the existence of explosiveness in CDS spreads. For American Airlines, the observed test statistic was 9.160579, and for United Airlines, it was 10.94848. In both cases, the observed value for the GSADF statistic was bigger than the simulation-based 1% critical value. Therefore, rejection of the null occurred at the 1% significance level for both firms.

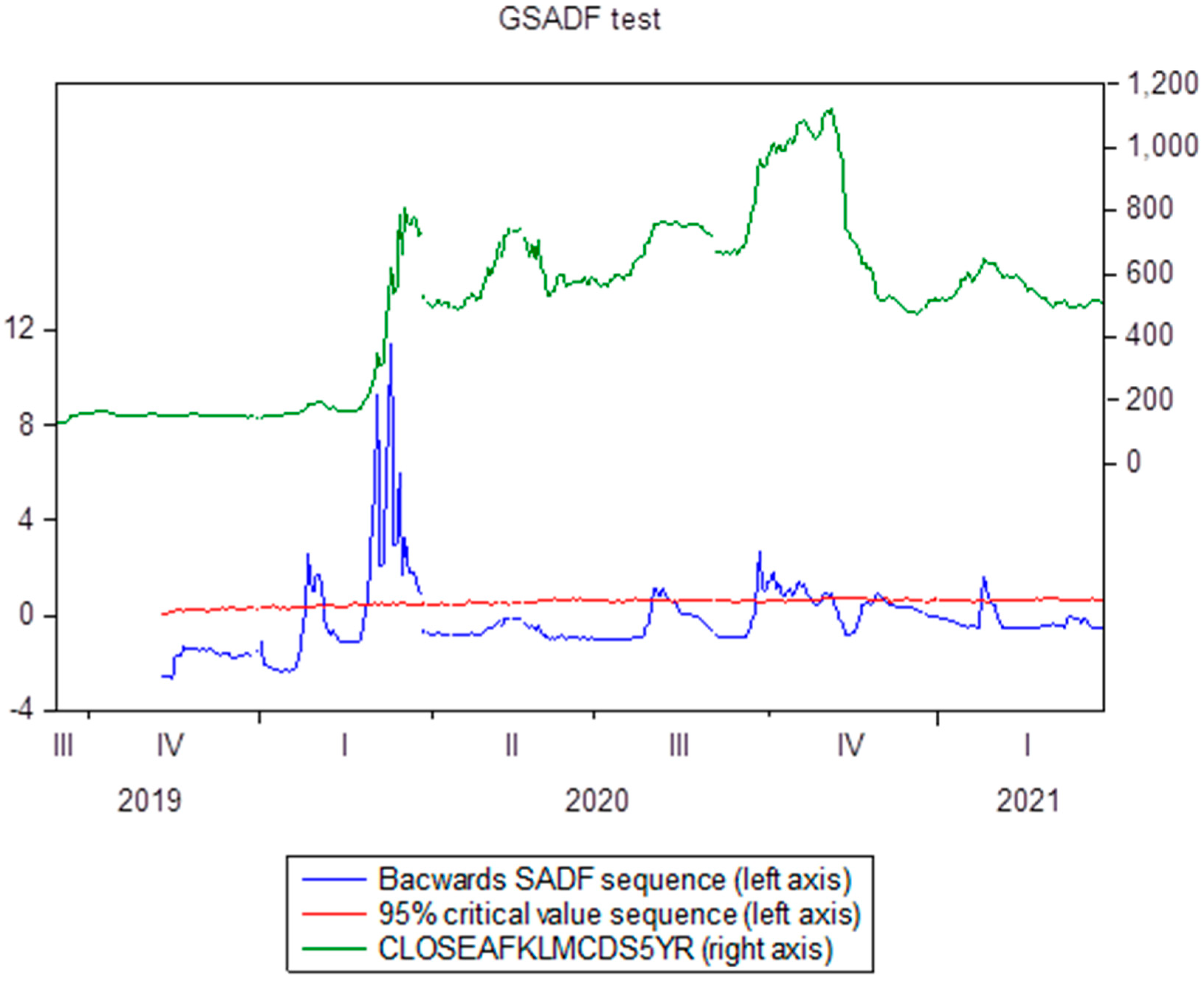

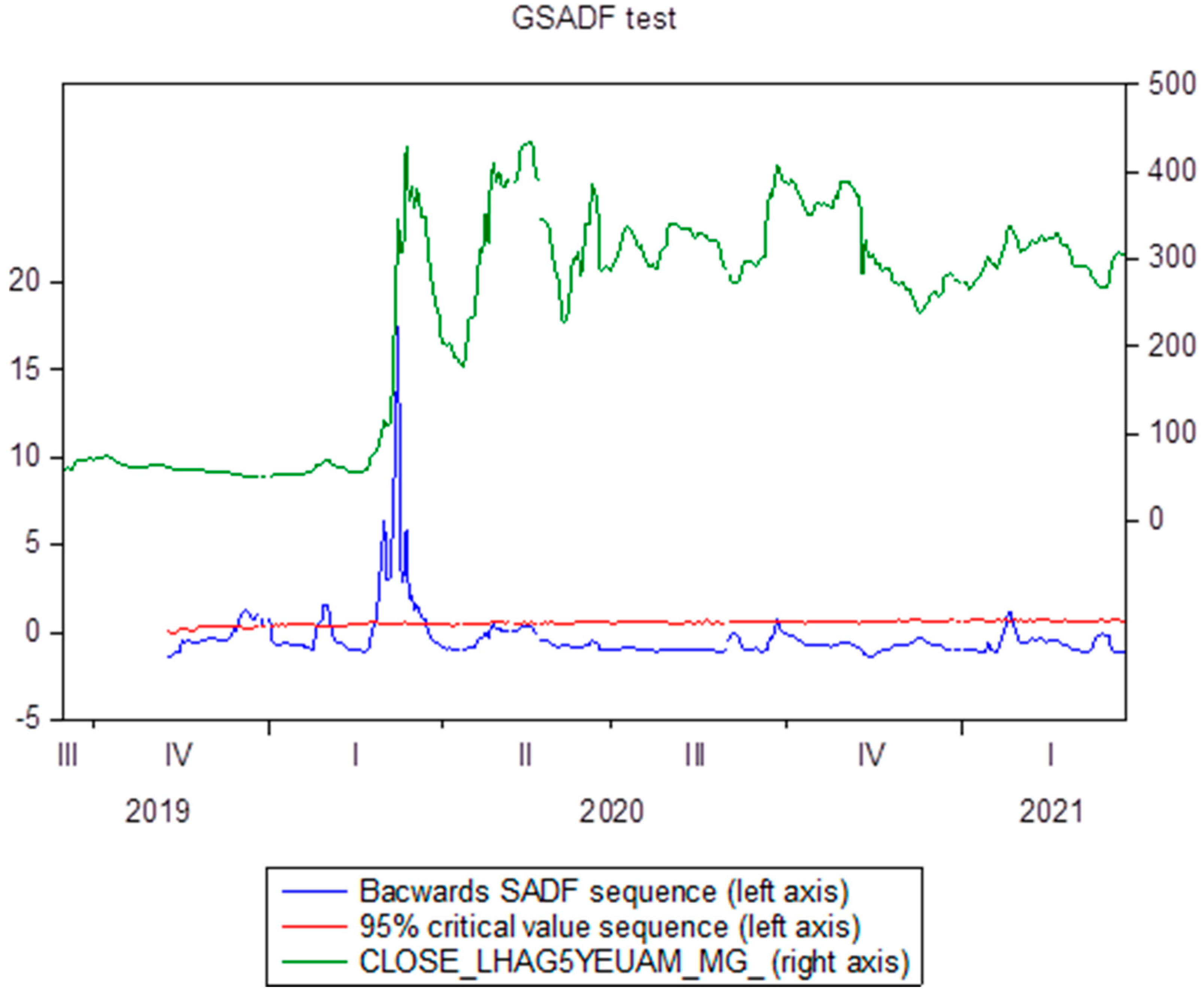

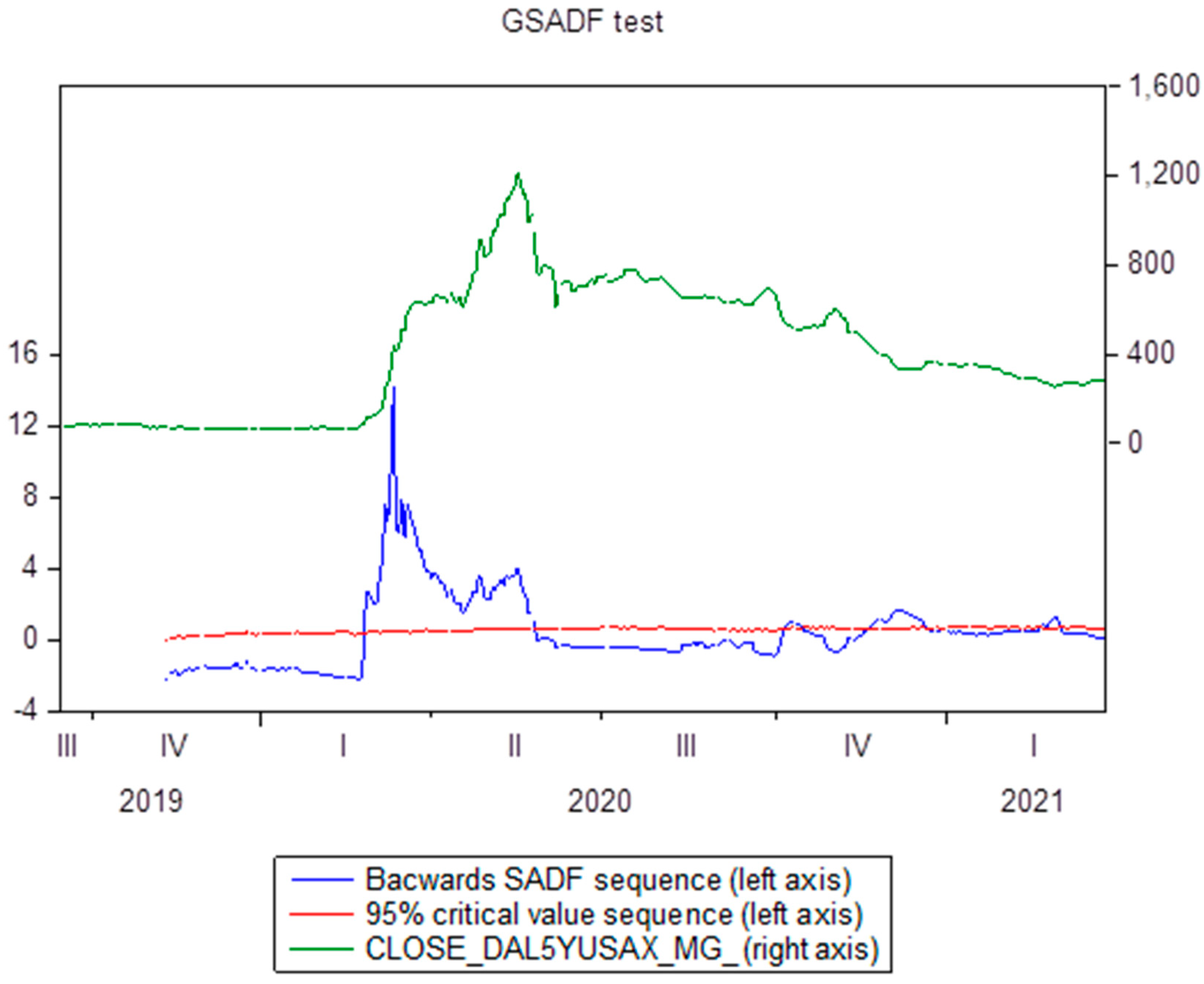

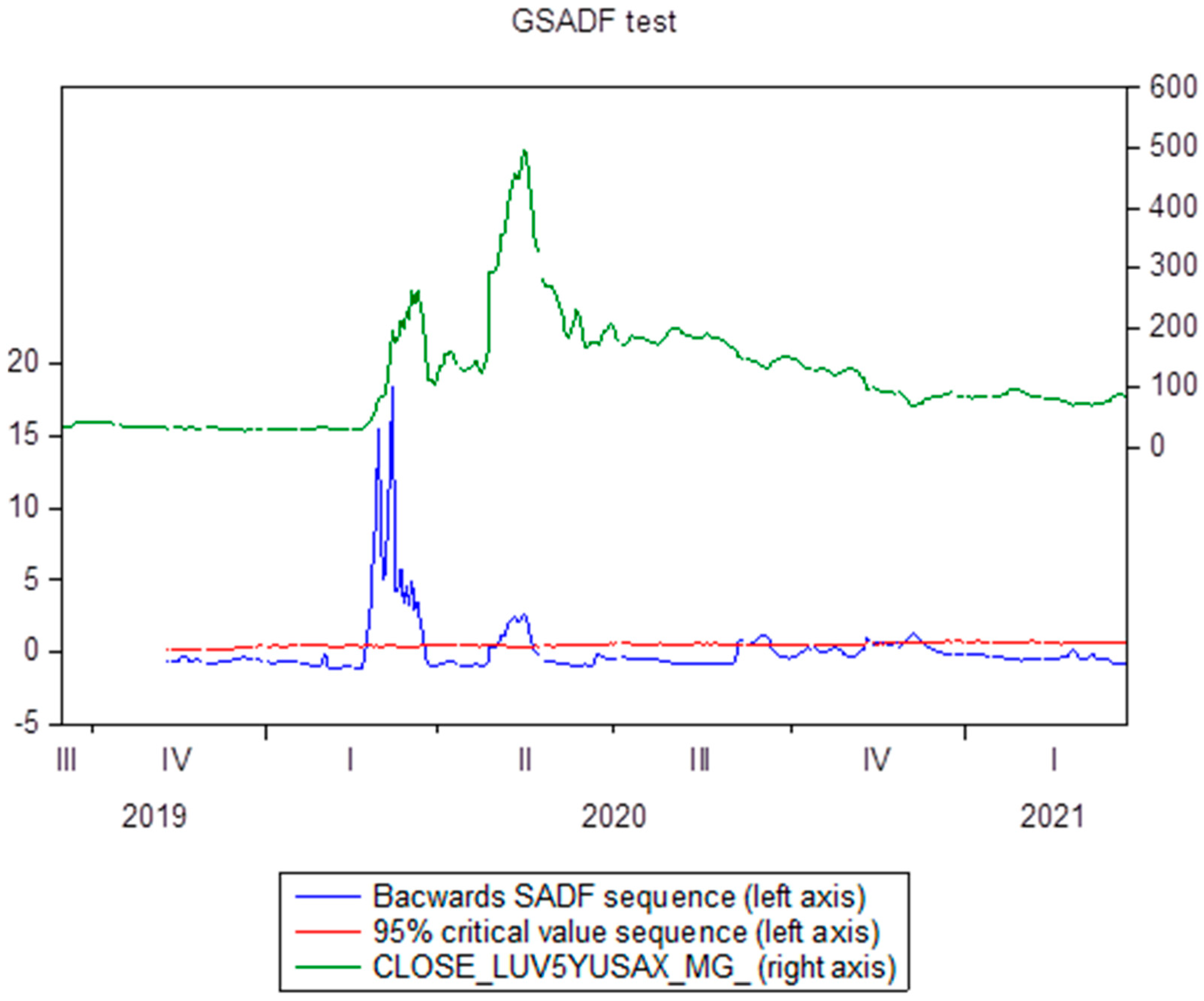

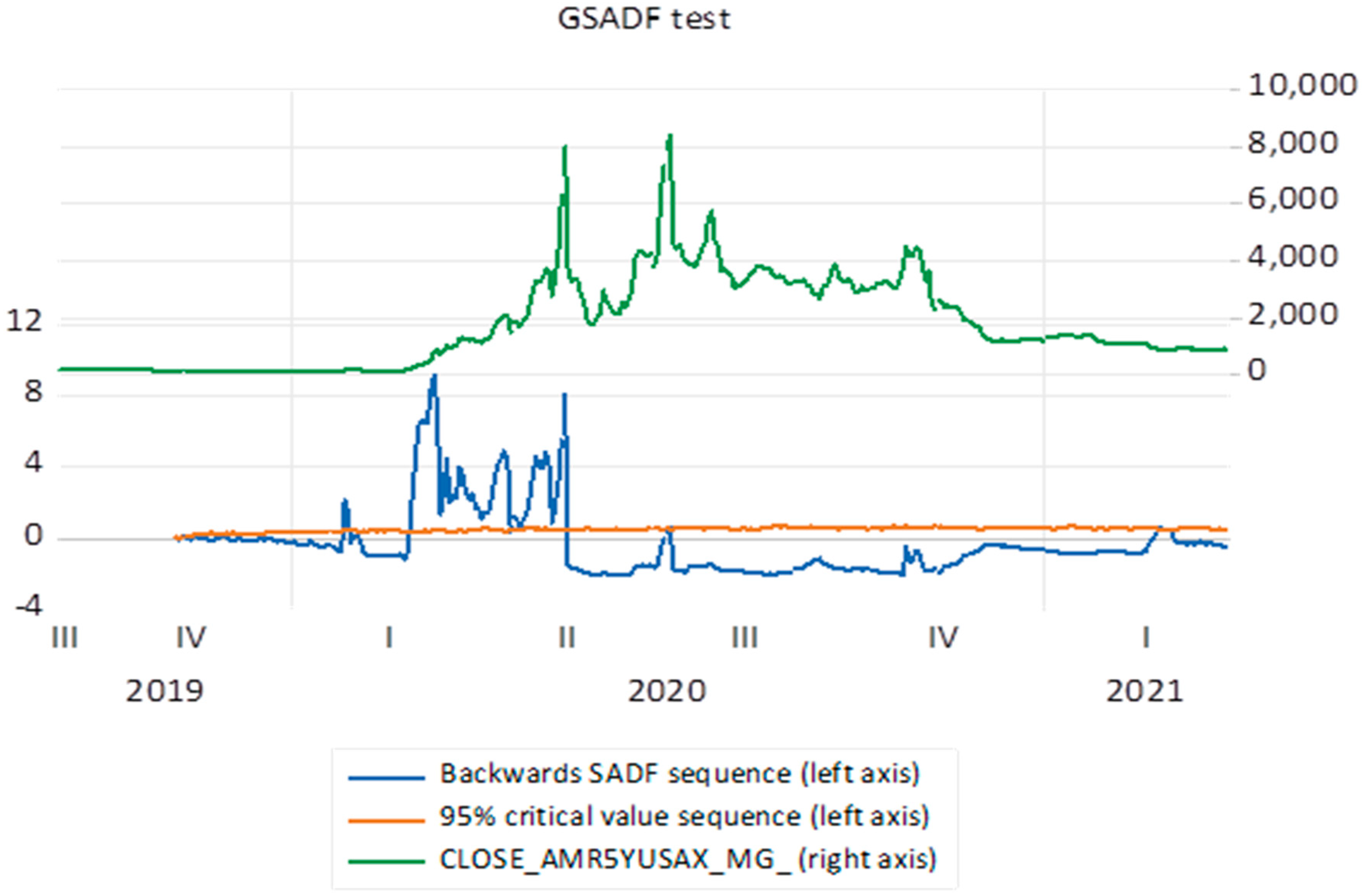

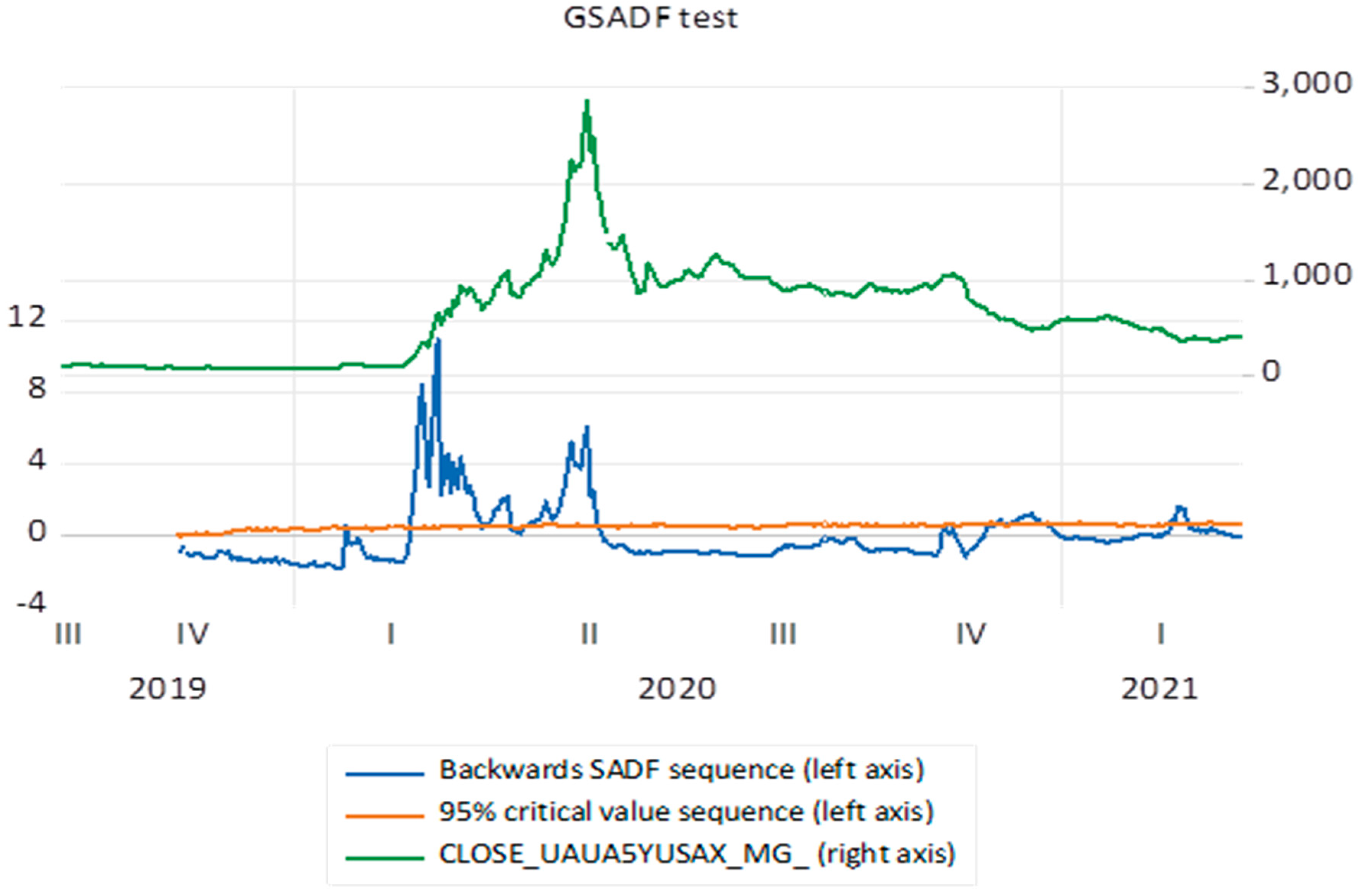

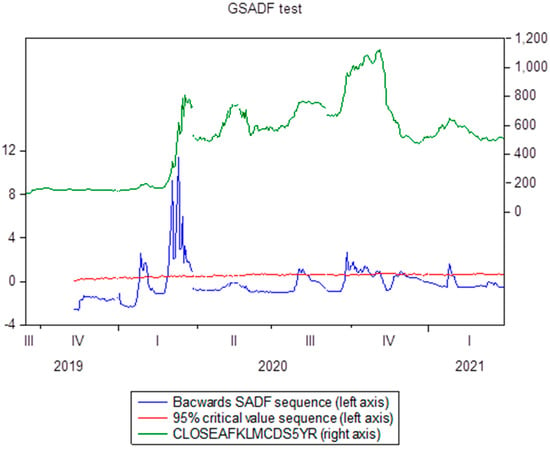

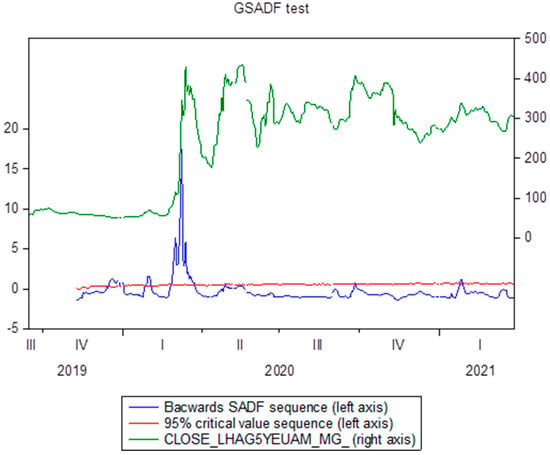

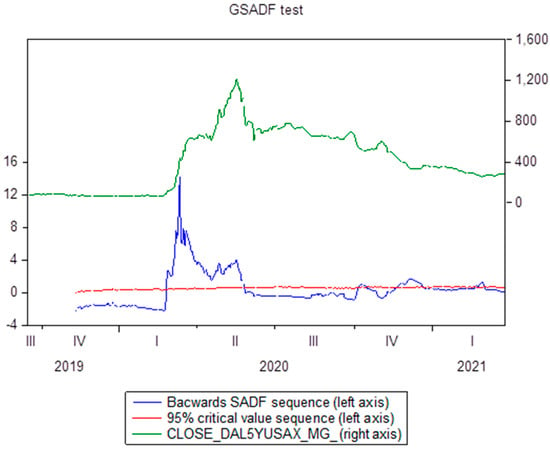

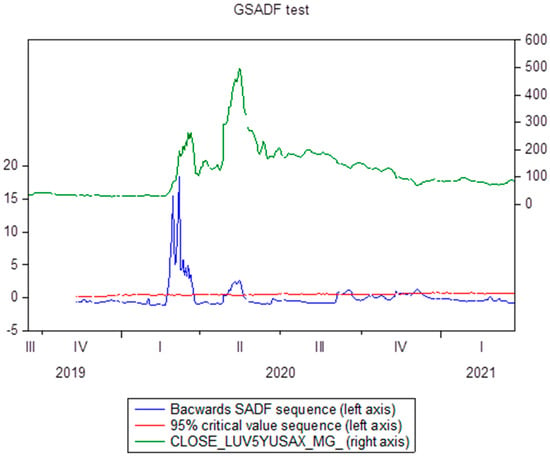

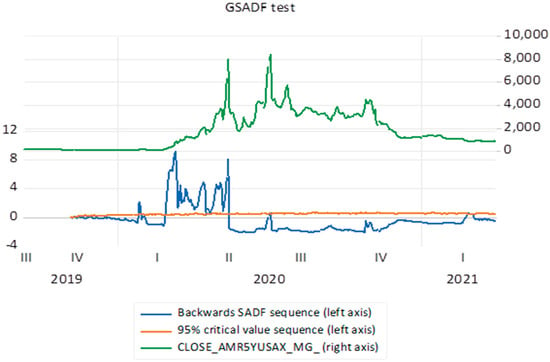

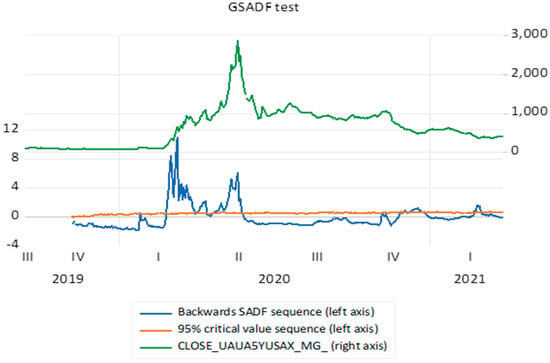

Figure 2, Figure 3, Figure 4, Figure 5, Figure 6 and Figure 7 are those obtained as a test output in Eviews when implementing the Phillips et al. (2015a, 2015b) test for each of the six daily CDS spread series. Each figure contains three lines: the green line represents the spread for the relevant airline in the sample period; the red line represents the simulated 95% quantile of the test statistic at each moment in time, which is a sequence of 5% significance critical values; the blue line represents the backwards SADF values for the relevant airline and for the sample period. It should also be noted that the horizontal line represents the sample period, duly corrected for the need to use the first 0.103959T observations due to recursions (as explained in Section 3.1). The right axis is to be used when reading the value of the spread, and the left axis is to be used when reading the values of the BSADF. Most importantly, according to Phillips et al. (2015a, 2015b), periods of explosive roots exist whenever the blue line is above the red one. As discussed in Section 3, the procedure allows for multiple bubbles or explosive events. The Phillips et al. (2015a, 2015b) method allowed us to consistently timestamp the exuberance episodes or bubble periods.

Figure 2.

Air France–KLM outputs for the Phillips et al. (2015a, 2015b) procedure.

Figure 3.

Deutsche Lufthansa AG outputs for the Phillips et al. (2015a, 2015b) procedure.

Figure 4.

Delta Airlines outputs for the Phillips et al. (2015a, 2015b) procedure.

Figure 5.

Southwest Airlines outputs for the Phillips et al. (2015a, 2015b) procedure.

Figure 6.

American Airlines outputs for the Phillips et al. (2015a, 2015b) procedure.

Figure 7.

United Airlines outputs for the Phillips et al. (2015a, 2015b) procedure.

Figure 2 refers to the 5-year-maturity CDS for the Air France–KLM group. The main exuberance period in this sample occurred between 26 February and 26 March 2020. There was also explosive behavior between 24 January and 30 January 2020. It is also possible to detect explosiveness between 28 July and 6 August 2020, between 24 September and 2 November, and between 26 January 2021 and 29 January 2021. The sample quotes for the spreads varied between 133.28, at the beginning of the sample, and 1124.077. The final in-sample spread, corresponding to 29 March 2021, was 503.787. Comments on the relevance and meaningfulness of these dates and values are provided in Section 5 of this paper. In that section, we also discuss the evolution of the spread during the sample period, bearing in mind, among other things, the type of aid given by the French and the Dutch governments to the Air France–KLM group (discussed in Section 2.5).

In Table 2, we concluded in favor of the existence of an explosive root in the spreads for 5-year-maturity CDSs concerning Lufthansa. Figure 3 confirms this, allowing us to conclude that the main explosiveness period was the one between 26 February 2020 and 20 March of that year. An earlier episode of explosiveness had occurred in the period between 24 January 2020 and 4 February of that year. From 22 to 27 January 2021 there was also explosiveness in Lufthansa’s CDS spreads. The CDS quotes for Deutsche Lufthansa AG varied from 60.11 at the beginning of the sample to 433.918. The last in-sample spread was 305.744. The relevance of these findings is discussed in the next section.

Figure 4 refers to the results for Delta Airlines, the world’s leading airline in terms of generated revenue (Forbes 2023). The 5-year-maturity CDS spreads for this reference entity exhibited explosive episodes. The most prolonged of these covered the period between 25 February 2020 and 26 May of the same year. Most interestingly, for reasons that are discussed in the next section, there was a period of explosiveness in the spreads between 20 November and 23 December 2020. Exuberance was also timestamped by the Phillips et al. (2015a, 2015b) procedure for the week from 1 to 8 March 2021. The minimum spread observed in that period was 70.5, at the beginning of the sample. The maximum quote was achieved at 1211.102. The last in-sample observation was 183.553.

In Figure 5, the results for the world’s largest LCC are displayed. For reasons discussed in Section 5, the estimated time intervals where exuberant behavior was meaningful were from 21 February to 26 March, from 29 April to 18 May, and from 27 November to 9 December. All these dates refer to 2020. For reasons explained in Section 5, one should maintain the flexibility, given the proximity of the first explosive episodes, to consider the possibility that these might have been a single episode with a discontinuity. During the sample period, the spreads for Southwest varied between 34.224 at the beginning and a maximum of 496.375. The quote for the last in-sample spread was 87.543. The evolution of Southwest’s spread is most relevant and is addressed in the discussion section.

Figure 6 and Figure 7, respectively, refer to the results for American Airlines Inc. and for United Airlines Holdings. With respect to the major exuberance episode, for American Airlines, this was estimated to occur in the period from 21 February 2020 to 27 May of that year, and for United Airlines, in the period from 25 February to 19 May 2020. The first in-sample CDS spread for American Airlines was 184.25 and the last was 919.312. Between these two dates, a maximum of 8402 was achieved. United Airlines had 97.5 and 416.624 as the first and last observations for the sample period. A maximum of 2877.888 was achieved in May 2020. Furthermore, it should be noted that neither United nor American Airlines exhibited an explosive episode from mid-November to mid/late December of 2020, contrary to what we found for Delta and for Southwest.

5. Discussion

The results presented in the previous section allow us to debate the research question addressed in this paper, in relation to the aviation CDS spreads’ behavior for some of the world’s most relevant air carriers during the pandemic period. The discussion is organized using as references the research hypotheses H1–H8 stated in Section 2.7. Relevant results from the literature review are also summoned for comparison whenever possible.

Firstly, with respect to research hypothesis H1, we conclude that the markets for CDSs with airlines as reference entities have been severely affected by the pandemic. Results presented in the previous section showed that spreads for any of the airlines varied widely in the sample period. For the Air France–KLM group, the sample included a peak spread that was 843.4% of the lowest in-sample spread. For Deutsche Lufthansa AG, the peak spread was 721.87% of the minimum spread. With respect to the US firms considered, the peak CDS spread was 1718.9% of the minimum for Delta, 1450.4% for Southwest, 4560.1% for American Airlines, and 2951.7% for United Airlines. These results validate H1. This result is in line with the conclusions of Apergis et al. (2022), pointing to the sharp increase in spreads of corporate CDSs with the outbreak of COVID-19.

Regarding H2, we conclude that, for all six firms, momentum trading and speculative purchase of CDSs occurred. In Section 4, results for the GSADF test led to the rejection of the null hypothesis for all firms considered. In line with Phillips et al. (2015a, 2015b), explosive behavior is seen as a tantamount to exacerbated market reactions. We concur with, inter alia, Chiarella et al. (2015), who claimed that the highly leveraged nature of CDSs makes financially stressed reference entities quite prone to trading momentum and excess reactions. H2 is validated.

Regarding research hypothesis H3, the results in Section 4 concerning the existence of periods of explosive spreads for all six firms, and the literature discussed in Section 2.6 related to the leading role of the CDS market in relation to bonds market, suggest that explosive hedging costs have translated into additional difficulties in the credit markets for airlines. Again, CDSs’ highly leveraged nature, allowing faster responses than those of bonds markets, suggests that the sharp rise in their spreads Granger caused the decline in airlines bonds’ prices, hence the rise in their yields (e.g., Coudert and Gex 2010; Palladini and Portes 2011; Damette and Frouté 2010).

H4 is validated. Results in Section 4 point to the existence of a common feature in the six aviation groups. For each of the cases considered, there existed a major explosive episode starting some weeks before the WHO declared the existence of a pandemic. In fact, the start dates of such explosiveness were 26 February (for Air France–KLM), 21 February (for American Airlines), 25 February (for United), 26 February (for Deutsche Lufthansa AG), 21 February (for Southwest), and 25 February (for Delta). Even those whose spreads entered explosive territory later were nearly 2 weeks (14 days) ahead of the WHO statement. There had been increasingly concerning media news about COVID-19 since late December 2019. These stories were mostly related to the number of newly infected persons and the number of COVID-19-related deaths (CDC 2023). Apergis et al. (2022) claimed that such numbers appeared to drive CDS spreads across sectors in the USA. Kotcharin et al. (2023), as discussed in Section 2, reached similar conclusions with respect to airline stock returns. Our findings are in line with theirs: we conclude that all airlines studied experienced a major episode of spread explosiveness that started 2 to 3 weeks before the official WHO statement. From a behavioral perspective, the pattern of the VIX index, as referred to in Section 2 of this paper, points to fear and uncertainty playing a role. Airline bondholders might have been more prone to hedge their loans as the news was unfolding. It is also a fact that before the WHO statement, momentum trading investors had perceived from the news that there would be trading gains from buying naked airline CDSs.

H5 refers to festive seasons, usually implying family gatherings. In the pandemic case, public health authorities were concerned with the Thanksgiving–Christmas period of 2020. Considering only the US firms, both Delta Airlines and Southwest Airlines went through explosive CDS spread episodes in that period. As noted in Section 4, for Southwest, this happened between 27 November and 9 December. Section 4 also refers to an explosive spreads episode for Delta Airlines between 20 November and 23 December. Regarding the European airlines in the sample, CDS spreads did increase from late November to Christmas, just not so explosively, for Deutsche Lufthansa AG and the Air France–KLM group. Evidence is mixed, since neither American Airlines nor United Airlines showed a significant spread growth in the festive season of 2020. Nonetheless, with these results, we lean towards validating H5, as four out of the six firms’ spreads behaved according to its predictions. Our findings are in line with those of Kotcharin et al. (2023) and Apergis et al. (2022).

Research hypothesis H6 contains two sub-hypotheses: heterogeneous resilience of airlines, with some recovering to pre-pandemic levels more quickly than others; within that heterogeneity of recovery paces, LCCs behave better than FSCs. Results from Section 4 reveal that Southwest Airlines outperformed the other firms. Although, as seen in Section 4, it experienced explosive roots in CDS spreads with the COVID-19 outbreak, it largely recovered within the sample period. The last in-sample observation was 255.79% of the first for Southwest, a smaller ratio than 508.64% (Lufthansa), 498.95% (American Airlines), 427.31% (United), 377.99% (Air France–KLM), or even 263.19% (Delta). In short, this metric corroborates the view that the LCC had the lowest CDS spread as a ratio of its pre-pandemic level, in relative terms, by 29 March 2021. This result is in line with what was argued in the literature review: Gillen and Lall (2003) consider that the more flexible structure of LCCs makes it easier for them to recover from crisis events; Liao et al. (2022) suggested a similar direction. These values also corroborate the first sub-hypothesis: the differences between the ratios of the five FSCs considered here suggest these airlines were at different points within their recovery to the in-sample pre-pandemic spread. H6 is validated.

H7 can be translated to the following: did the major explosiveness finish for each airline only after the announcement of the formal bail outs? Regarding the European firms, it is fundamental to notice that the State Aid Temporary Framework was adopted by the EC on 19 March 2020 (European Commission 2022). The bail outs of the Air France–KLM group and Deutsche Lufthansa AG were approved by the EC using the extensions covered by the Temporary Framework (European Commission 2024). Evidence from Section 4 shows that the CDS spreads’ major explosiveness episodes ended on 26 March 2020 for Air France–KLM and on 20 March for Deutsche Lufthansa AG. Regarding the US airlines, the CARES Act was signed into law by the US President on 27 March, after passing the Senate vote on 25 and the House of Representatives on 26 March (US Treasury 2023). In Section 4, we noted that CDS spreads ceased to behave explosively on 19 May for United Airlines, 26 May for Delta, and 27 May for American Airlines. In these three cases, the spreads’ explosiveness was mitigated only after the conditions for the bail out were settled. The first exuberance episode for Southwest finished on the day the House of Representatives passed the CARES Act, 26 March. Figure 5 illustrates that Southwest’s major explosiveness period was not continuous (see discussion in Section 4), ending on 18 May. It would still be so after the conditions for a bail out existed. H7 is validated.

One might assess the success of COVID-QE policies by several metrics, but only indirectly can one see the impact on the aviation sector. Governments funding aviation-targeted fiscal policies would not run into bankruptcy, deploying a sovereign debt crisis. Monetary policy was successful, but that does not validate H8. In fact, easier borrowing for the economy does not imply easier bank credit conceded to airlines. Assistance in the form of bail outs would be more relevant, but the problem then might be governments running out of funds (Zhai et al. 2022). As discussed in Section 2.6, Jinjarak et al. (2020) noted that sovereign CDS spreads were higher than expected in the EU during the pandemic. They attributed this result precisely to expansionary fiscal policies. Notwithstanding, the fact remains that no sovereign debt crisis occurred in the COVID-19 years, and governments did bail out airlines. The explanation for this capacity, in Europe and in the US, must comprise the liquidity governments received from the QE programs.

Albeit beyond the scope of this paper, the authors think that a brief comment on the evolution of other financial indicators might be relevant, to provide a perspective on the post-COVID-19 situation of these firms. It has been found that, for most of the airlines studied here, a deleveraging effort has been under way. This may improve future credit markets’ confidence in the six airlines and lower their CDS spreads. Nonetheless, equity investors have not recovered confidence; no firm has fully recovered to pre-pandemic levels in the stock market. Delta Airlines is likely to be the only one close to this goal. We trust that these statements may well be supported by the following information (the values are retrieved from Refinitiv Eikon, except when otherwise indicated). In Table 5, “pre-pandemic” refers to the choice of 10 February 2020 as a reference date (simply a convention to facilitate comparisons). With the research in Table 5, we expect to gain a deeper insight into the post-pandemic financial situation of these firms.

Table 5.

Evolution of other financial indicators.

In short, in the 5 years between 22 July 2019 and 22 July 2024, the aviation stock market was clearly bearish. Air France–KLM experienced a loss of 81.87% in stock value, American Airlines a loss of 67.68%, United a loss of 48.64%, Southwest a loss of 46.83%, Lufthansa a loss of 46.61% and Delta Airlines a loss of 28.04%. It is not a goal of this paper to focus on these numbers, but highlight that at the equity markets level, the recovery from the pandemic is yet to occur.

A more in-depth analysis should be made for Deutsche Lufthansa AG, given the EU General Court decision of July 2024 (see discussion in Section 2.5). Since the first decision in favor of Ryanair, on 10 May 2023, stocks prices have followed a clear downward trend (from EUR 9.16 on the day of the court’s first decision to EUR 5.84 per share on 8 July 2024, the date of the Court’s final ruling, again in favor of Ryanair). The EC goal of finding ways to recapitalize the firm as the government abandons its shareholder position would seem more difficult in such a bearish market. However, the firm’s position in the recapitalization process is not so bad if one looks at the five-pillar strategic framework developed by Arrigo et al. (2023). Using data for 2019, the authors concluded that the firm had managed to maintain a strong position in its domestic market (market share of 43.9% with respect to overall traffic). This was a sign of a strong geostrategy pillar, as it pointed to a consolidated position in national hubs, limiting the ability of new firms to compete there (Arrigo et al. 2023). Furthermore, Lufthansa had been following a hybridization strategy, namely by assuming full control of Eurowings, a point-to-point LSC for short-haul flights between European cities. Thus, Lufthansa has benefited from the enhanced flexibility of its business diversification strategy. With respect to the aggregation block of the Arrigo et al. (2023) model, Deutsche Lufthansa AG owns about 240 subsidiaries and is a member of Star Alliance. It has commercial joint ventures (e.g., code share agreements) with Air Canada, United Airlines, Singapore Airlines, etc. Long-haul flights are clearly in the growth plan of the firm, ensuring it pursues the strategic pillar of cost optimization by exploring economies of scale and scope. In short, in the year before the pandemic outbreak, the German flag carrier met all the success criteria that Arrigo et al. (2023) identified in their multi-case study of European airlines. Thus, Lufthansa’s recapitalization, if the government is to withdraw considering the General Court’s decision, is likely to be successful. There is a clear contrast between the assessment of Lufthansa in the light of the five-pillars model and that of, for example, Alitalia, a firm that underwent a recapitalization experience. To refer to only two strategic weaknesses of Alitalia, the market share of LSCs in Italy was 55% in 2019, contrasting with Alitalia’s 14% (Arrigo et al. 2023); Alitalia’s annual percentage of long-haul seat kilometers was 37%, in contrast with the average of 68.4% for other European carriers. Clearly, Alitalia’s fleet was not prepared for a strategic change exploring cost optimization through long-haul flights. The airline ceased operations in 2021, but more than the pandemic, the lack of a sound strategy seems to have dictated that outcome.

The results we have analyzed in this section suggest both the limitations of our study and pointers for future research. Albeit pioneering, our study has some limitations, mostly because we have looked at only six air carriers. Furthermore, our airlines were chosen due to their relevance in terms of revenue generated. As such, for future research, we plan firstly to analyze a larger sample, including airlines from other parts of the world (e.g., Singapore, Australia, other European groups). We would also like to include medium-sized airlines, instead of only those generating the highest revenue. Another extension of this study is to consider other aviation partners beyond airlines (e.g., airports; airplane manufacturers). Adding to this, another research path will be to check for connectedness (Diebold and Yilmaz 2023) between CDS spreads and other financial indices. Furthermore, we would also like to filter out the credit default probabilities implied by CDS spreads, and to check whether they are related to fundamentals (in similar way to how Oliveira and Santos (2018) assessed sovereign CDSs). In the previous paragraph, we have conducted a small assessment of the airlines’ equity markets, and it seems firms are struggling badly with their equity prices, failing to even come close to pre-pandemic levels. A deeper analysis, looking at the firms’ financial reports and sector data, is necessary to properly explain this. Finally, a topic of future research should be the consequences of decisions such as the one just announced by the EU General Court, considering the 2020 government aid to Deutsche Lufthansa AG to be null. Studying strategies to recapitalize airlines when the government is withdrawing their capital but equity markets are heavily bearish for the sector is also a fundamental research topic.

6. Conclusions

In conclusion, the eight research hypotheses posed in Section 2.7 have been validated. These hypotheses were, however, derivations of this paper’s fundamental research question: what can we learn about the contour of airlines’ COVID-19 crisis from the behavior of their CDS spreads? We trust that we have shown that the literature indeed had a major gap, since, in a crisis with an epicenter at the debt market, one of the main indicators of firms’ credit quality (their CDS spreads) was being ignored. We have shown the relevance of looking into these to understand the COVID-19 crisis in aviation. We have learnt that spreads indeed rose sharply in the early stages of the crisis, with heterogenous velocities of subsequent recovery. H1 taught us that the CDS spreads of airlines were far from neutral in response to the pandemic. H2 showed that there were explosive roots in the CDS spreads of all the firms considered. If there was a liquidity and credit constraint for airlines, we have learnt that the behavior of CDS spreads in the early stages of the pandemic aggravated it, confirming H3. Moreover, we have learnt that CDS markets for airlines were forward-looking during the COVID-19 crisis (H4), and that dates associated with breaks in the social distancing rules were associated with an increase in the spreads (H5). We have also confirmed that, as the literature suggested, the LCC in our sample suffered less in the CDS market than the FSCs. Among the FSCs, although a downward trend in spreads existed, after the major explosiveness episode, the velocities of recovery were highly heterogeneous, confirming H6. We also conclude that for no airline did CDS spreads recover to non-explosive behavior before the legal and policy framework for government bail outs to airlines had been put forward (H7). Fiscal measures were critical for the behavior of airlines’ CDS spreads, with monetary policy changes being relevant to guarantee governments could pursue such fiscal policies (H8).

Author Contributions

Conceptualization, V.C., C.S. and M.A.O.; Methodology, C.S. and M.A.O.; software, M.A.O.; validation, V.C., M.A.O. and C.S.; formal analysis, M.A.O. and C.S.; investigation, M.A.O. and C.S.; resources, C.S. and M.A.O.; data curation, V.C.; writing—original draft preparation, M.A.O. and C.S.; writing—review and editing, V.C., M.A.O. and C.S.; visualization, M.A.O.; supervision, C.S.; project administration, M.A.O. and C.S.; funding acquisition, M.A.O. and C.S. All authors have read and agreed to the published version of the manuscript.

Funding

NECE is supported by national funds through FCT—Fundação para a Ciência e a Tecnologia, I.P. by project reference UIDB/04630/2020 and DOI identifier: 10.54499/UIDB/04630/2020; CeBER’s research is funded by national funds through FCT—Fundação para a Ciência e a Tecnologia, I.P., through project UIDB/05037/2020 with DOI 10.54499/UIDB/05037/2020.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is available upon request.

Acknowledgments

The authors would like to thank the anonymous referees, for their most valuable insights, suggestions and criticisms. They have added value to our paper. We would also wish to thank Andreas Papatheodorou for sharing his expertise in the aviation eco-system, in multiple conversations over the years.

Conflicts of Interest

The authors declare no conflicts of interest.

Notes

| 1. | Whether such QE frameworks played a role in awakening inflation remains to be concluded. For more on monetary policy regime shifts and inflation see, inter alia, Oliveira and Santos (2010) and Santos and Oliveira (2010). |

| 2. | Evidence from the September 11 attack and the ensuing aviation crisis suggested that LCCs recovered more quickly than FSCs (Gillen and Lall 2003). |

| 3. | In total, 24 slots were freed by Deutsche Lufthansa AG from 2020 to 2024 (Veríssimo 2024). |

References

- Air France–KLM. 2023. Air France-KLM Capital: Shareholding Structure. Available online: https://www.airfranceklm.com/en/finance/air-france-klm-capital/shareholding-structure (accessed on 3 April 2024).

- Air France–KLM. 2024. Air France-KLM Group: Consolidated Financial Statements 2023. Paris: Air France–KLM Group. [Google Scholar]

- Airways. 2024. Southwest Airlines’ Q4/Full-Year 2023 Financial Results. Available online: https://www.airwaysmag.com/legacy-posts/southwest-q4-fy-2023-financial-results (accessed on 7 May 2024).

- Andritzky, Jochen, and Manmohan Singh. 2006. The Pricing of Credit Default Swaps During Distress. IMF Working Papers 06: 254. [Google Scholar] [CrossRef]

- Apergis, Nicholas, Dan Danuletiu, and Bing Xu. 2022. CDS spreads and COVID-19 pandemic. Journal of International Financial Markets Institutions & Money 76: 101433. [Google Scholar] [CrossRef]

- Arrigo, Ugo, Massimo Beccarello, and Giacomo Di Foggia. 2023. Strategic Response of European Airlines to Market Dynamics: A Comparative Analysis. Administrative Sciences 13: 255. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2020. Economic impact of government interventions during the COVID-19 pandemic: International evidence from financial markets. Journal of Behavioral and Experimental Finance 27: 100371. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies 10: 742–58. [Google Scholar] [CrossRef]

- Bannier, Christina E., Thomas Heidorn, and Heinz-Dieter Vogel. 2014. Characteristics and development of corporate and sovereign CDS. Journal of Risk Finance 15: 482–509. [Google Scholar] [CrossRef]

- Barua, Bipasha, and Suborna Barua. 2020. COVID-19 implications for banks: The case of an emerging economy with a weak financial system. SSRN Electronic Journal 3646961. [Google Scholar] [CrossRef]

- Baum, Christopher, Mustafa Caglayan, and Bing Xu. 2021. The impact of uncertainty on financial institutions: A cross-country study. International Journal of Finance and Economics 26: 3719–39. [Google Scholar] [CrossRef]

- Bernanke, Ben S., Jean Boivin, and Piotr Eliasz. 2005. Measuring monetary policy: A Factor Augmented Vector Autoregressive (FAVAR) approach. The Quarterly Journal of Economics 120: 387–422. [Google Scholar] [CrossRef]

- Bonaccolto, Giovanni, Nicola Borri, and Andrea Consiglio. 2023. Breakup and default risks in the great lockdown. Journal of Banking & Finance 147: 106308. [Google Scholar] [CrossRef]

- Bosio, Erica, Simeon Djankov, Filip Jolevski, and Rita Ramalho. 2020. Survival of Firms during Economic Crisis. World Bank Policy Research 9239. Available online: https://ssrn.com/abstract=3599546 (accessed on 7 May 2024).

- Brei, Michael, Blaise Gadanecz, and Aaron Mehrotra. 2020. SME lending and banking system stability: Some mechanisms at work. Emerging Markets Review 43: 100676. [Google Scholar] [CrossRef]

- Caglayan, Mustafa, and Bing Xu. 2019. Economic policy uncertainty effects on credit and stability of financial institutions. Bulletin of Economic Research 71: 342–47. [Google Scholar] [CrossRef]

- Capelle-Blancard, Gunther, and Adrien Desroziers. 2020. The stock market is not the economy? Insights from the COVID-19 crisis (June 16, 2020). CEPR Covid Economics 3638208. [Google Scholar] [CrossRef]

- CDC. 2023. CDC Museum COVID-19 Timeline. Available online: https://www.cdc.gov/museum/timeline/covid19.html (accessed on 20 April 2024).

- Cervera, Ignacio, and Isabel Figuerola-Ferretti. 2024. Credit risk and bubble behavior of credit default swaps in the corporate energy sector. International Review of Economics and Finance 89: 702–31. [Google Scholar] [CrossRef]

- Chang, Chun-Ping, Gen-Fu Feng, and Mingbo Zheng. 2021. Government fighting pandemic, stock market return and COVID-19 virus outbreak. Emerging Markets Finance and Trade 57: 2389–406. [Google Scholar] [CrossRef]

- Charalambakis, Evangelos, Federica Teppa, and Athanasios Tsiortas. 2024. Consumer participation in the credit market during the COVID-19 pandemic and beyond. Oxford Economic Papers, gpae019. [Google Scholar] [CrossRef]

- Chen, Ming-Hsiang, Ender Demir, Conrado Diego García-Goméz, and Adam Zaremba. 2020. The impact of policy responses to COVID-19 on U.S. travel and leisure companies. Annals of Tourism Research Empirical Insights 1: 100003. [Google Scholar] [CrossRef]

- Chiarella, Carl, Saskia ter Ellen, Xue-Zhong He, and Eliza Wu. 2015. Fear or fundamentals? Heterogeneous beliefs in the European sovereign CDS market. Journal of Empirical Finance 32: 19–34. [Google Scholar] [CrossRef]

- Choi, Sun-Yong. 2020. Industry volatility and economic uncertainty due to the COVID-19 pandemic: Evidence from wavelet coherence analysis. Finance Research Letters 37: 101783. [Google Scholar] [CrossRef]

- Clarke, Jamie. 2023. American Airlines Reports Q2 2022 Record Profit. Available online: https://aviationsourcenews.com/news/american-airlines-reports-q2-2022-record-profit/ (accessed on 10 December 2023).

- Companiesmarketcap. 2024. United Airlines Holdings—Total Debt. Available online: https://companiesmarketcap.com/united-airlines/total-debt/ (accessed on 11 May 2024).

- Coudert, Virginie, and Mathieu Gex. 2010. Contagion inside the Credit Default Swaps Market: The case of GM and Ford Crisis in 2005. International Financial Markets, Institutions and Money 20: 109–34. [Google Scholar] [CrossRef]

- Damette, Olivier, and Philippe Frouté. 2010. Is the crisis treatment exacerbating cautiousness or risk taking? Applied Financial Economics 20: 213–18. [Google Scholar] [CrossRef]

- Didier, Tatiana, Federico Huneeus, Mauricio Larrain, and Sergio L. Schmukler. 2021. Financing firms in hibernation during the COVID-19 pandemic. Journal of Financial Stability 53: 100837. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2023. On the past, present, and future of the Diebold–Yilmaz approach to dynamic network connectedness. Journal of Econometrics 234: 115–20. [Google Scholar] [CrossRef]

- Ding, Wenzhi, Ross Levine, Chen Lin, and Wensi Xie. 2021. Corporate Immunity to the COVID-19 Pandemic. Journal of Financial Economics 141: 802–30. [Google Scholar] [CrossRef]

- ECB. 2023. Pandemic emergency purchase programme (PEPP). In ECB Monetary Policy Instruments. Frankfurt: European Central Bank (ECB)—Eurosystem. Available online: https://www.ecb.europa.eu/mopo/implement/pepp/html/index.en.html (accessed on 20 February 2024).

- European Commission. 2020. State Aid: Commission Approves French Plans to Provide €7 Billion in Urgent Liquidity Support to Air France. Available online: https://ec.europa.eu/commission/presscorner/detail/en/IP_20_796 (accessed on 30 September 2023).

- European Commission. 2022. The State Aid Temporary Framework. Available online: https://competition-policy.ec.europa.eu/state-aid/coronavirus/temporary-framework_en (accessed on 10 October 2023).

- European Commission. 2024. Coronavirus Outbreak—List of Member State Measures Approved under Articles 107(2)b, 107(3)b and 107(3)c TFEU and under the State Aid Temporary Framework. Available online: https://competition-policy.ec.europa.eu/state-aid/coronavirus_en (accessed on 12 March 2024).

- Fahlenbrach, Rüdiger, Kevin Rageth, and René M. Stulz. 2021. How valuable is financial flexibility when revenue stops? Evidence from the COVID-19 crisis. Review of Financial Studies 34: 5474–521. [Google Scholar] [CrossRef]

- Federal Reserve of St. Louis. 2023. Unemployment Rate. FRED—Economic Data St. Louis FED. Available online: https://fred.stlouisfed.org/series/UNRATE (accessed on 22 October 2023).

- Finbox. 2024. Financial Leverage for Delta Air Lines Inc. Available online: https://finbox.com/NYSE:DAL/explorer/financial_leverage/ (accessed on 4 June 2024).

- Fitch. 2021. Few Airlines Remain IG after Coronavirus-Driven Downgrades. Available online: https://www.fitchratings.com/research/corporate-finance/few-airlines-remain-ig-after-coronavirus-driven-downgrades-26-01-2021 (accessed on 20 December 2023).

- Forbes. 2023. The Global 2000. Available online: https://www.forbes.com/lists/global2000/?sh=484495e05ac0 (accessed on 12 November 2023).

- Gillen, David, and Ashish Lall. 2003. International transmission of shocks in the airline industry. Journal of Air Transport Management 9: 37–49. [Google Scholar] [CrossRef]

- Goldstein, Itay, Ralph S. Koijen, and Holger M. Mueller. 2021. COVID-19 and its impact on financial markets and the real economy. The Review of Financial Studies 34: 5135–48. [Google Scholar] [CrossRef]

- GuruFocus. 2024. American Airlines Group Inc. Reports Record Revenue and Significant Debt Reduction in 2023. Available online: https://www.gurufocus.com/news/2179785/american-airlines-group-inc-reports-record-revenue-and-significant-debt-reduction-in-2023?r=caf6fe0e0db70d936033da5461e60141 (accessed on 30 January 2024).

- ICAO. 2016. List of Government-Owned and Privatized Airlines. Montreal: International Civil Aviation Organization (ICAO). Available online: https://www.icao.int/sustainability/SiteAssets/Pages/Eap_ER_Databases/FINAL_Airlines%20Privatization.pdf (accessed on 14 March 2024).

- IMF. 2020. World Economic Outlook—The Great Lockdown. Washington, DC: International Monetary Fund. [Google Scholar]

- ISDA. 2014. Credit Derivatives Definitions and Standard Reference Obligations—FAQ. New York City: International Swaps and Derivatives Association. [Google Scholar]

- Jaroenjitrkam, Anutchanat, Suntichai Kotcharin, and Sakkakon Maneenop. 2023. Corporate resilience to the COVID-19 pandemic: Evidence from the airline industry. The Asian Journal of Shipping and Logistics 39: 26–36. [Google Scholar] [CrossRef]

- Jinjarak, Yothin, Rashad Ahmed, Sameer Nair-Desai, Weining Xin, and Joshua Aizenman. 2020. Pandemic shocks and fiscal-monetary policies in the Eurozone: COVID-19 dominance during January–June 2020. National Bureau of Economic Research 4: 1557–80. [Google Scholar]

- Jordà, Òscar, Sanjay R. Singh, and Alan M. Taylor. 2020. Longer-Run Economic Consequences of Pandemics. In Federal Reserve Bank of San Francisco. Working Paper 2020-09. San Francisco: Federal Reserve Bank of San Francisco. [Google Scholar] [CrossRef]

- Kaczmarek, Tomasz, Katarzyna Perez, Ender Demir, and Adam Zaremba. 2021. How to survive a pandemic: The corporate resiliency of travel and leisure companies to the COVID-19 outbreak. Tourism Management 84: 104281. [Google Scholar] [CrossRef]

- Karp, Aaron. 2020. Delta Has Received $2.7 billion in US Federal Aid. Aviation Week Network, April 22. Available online: https://aviationweek.com/air-transport/airports-networks/delta-has-received-27-billion-us-federal-aid (accessed on 20 May 2024).

- Kotcharin, Suntichai, Sakkakon Maneenop, and Anutchanat Jaroenjitrkam. 2023. The impact of government policy responses on airline stock return during the COVID-19 crisis. Research in Transportation Economics 99: 101298. [Google Scholar] [CrossRef]