Unraveling Ghana’s Resource Curse Hypothesis: Analyzing Natural Resources and Economic Growth with a Focus on Oil Exploration

Abstract

1. Introduction

2. Literature Review

2.1. Natural Resources, Economic Growth, and Resource Curse Hypothesis

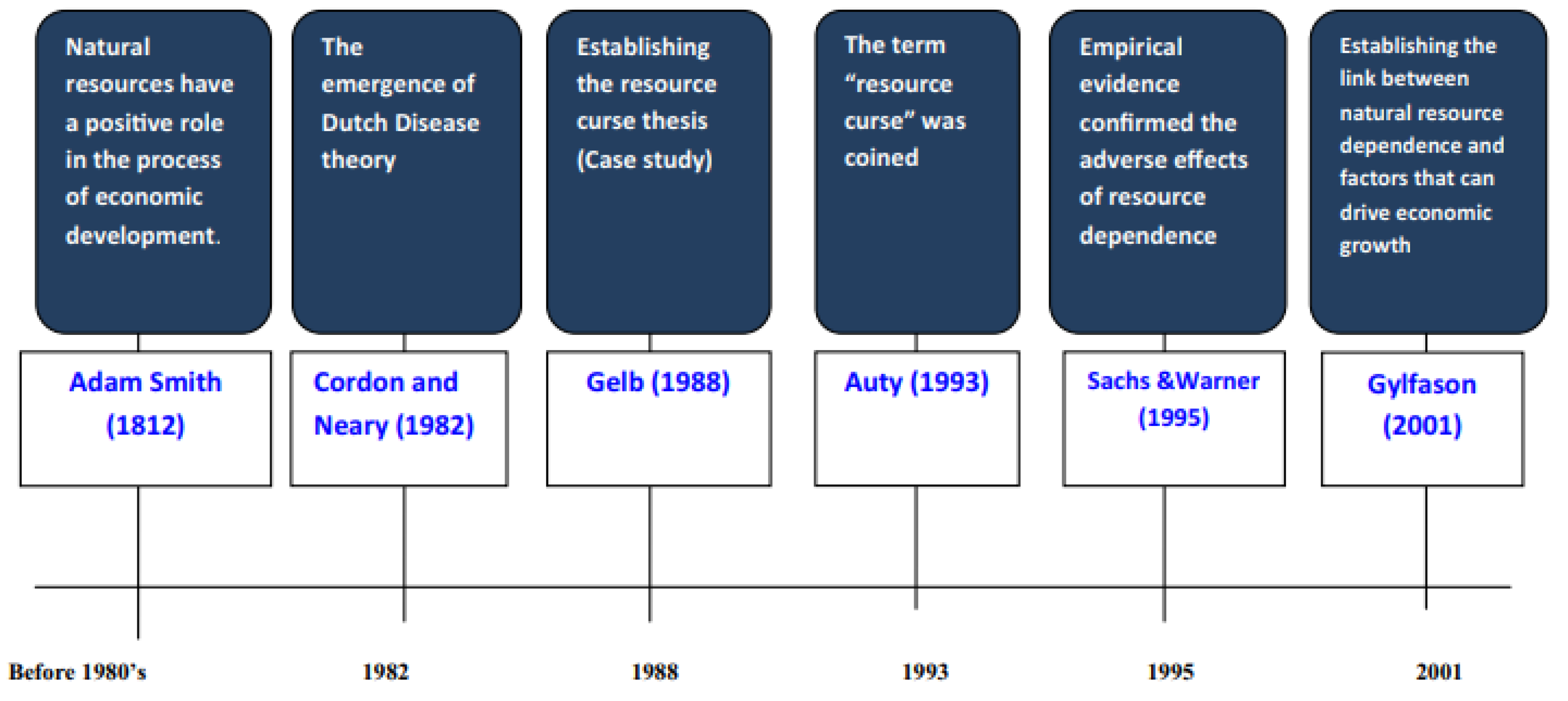

2.1.1. Short Notes of Evolution Timelines

2.1.2. What Happened after 2001?

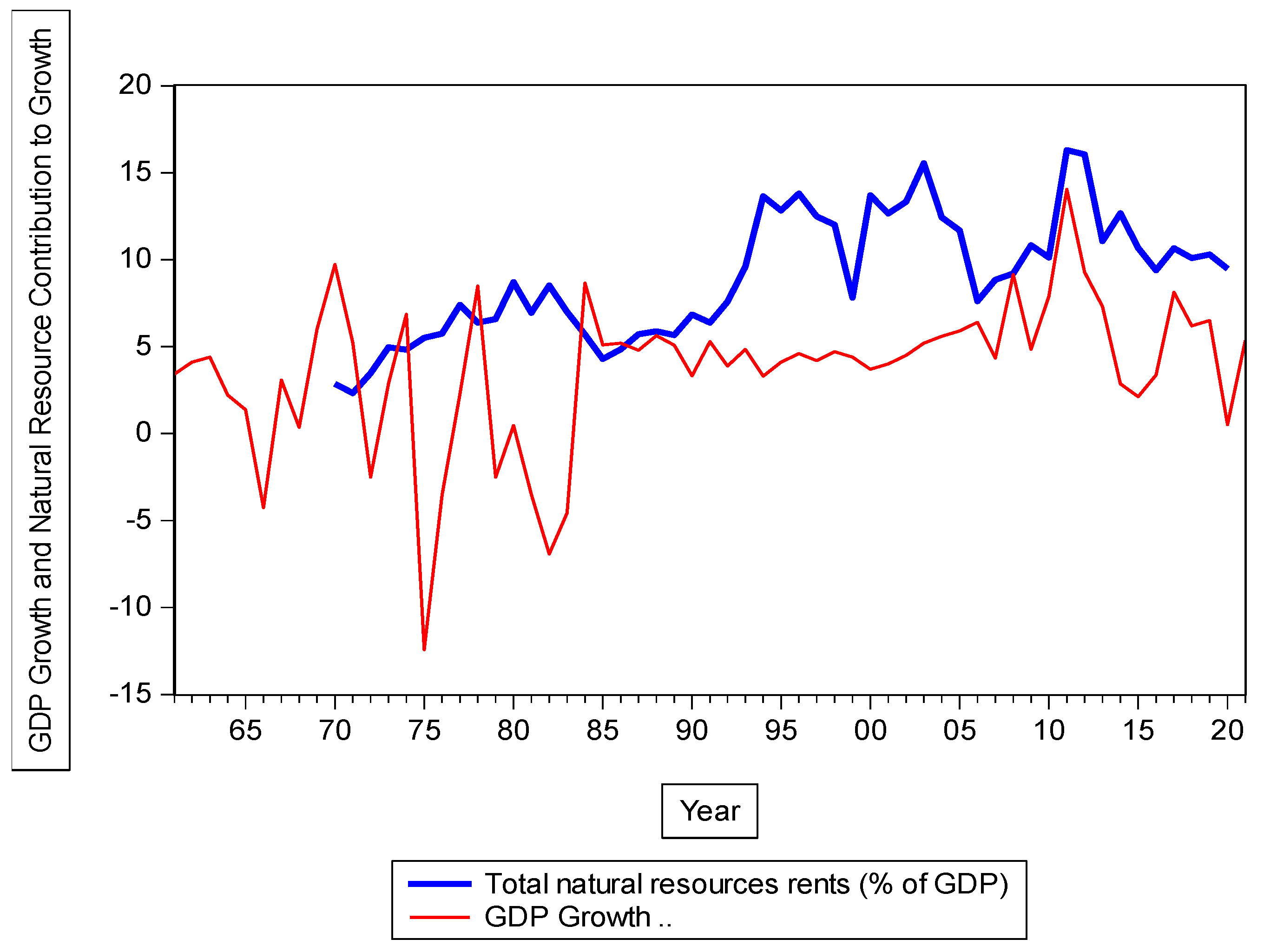

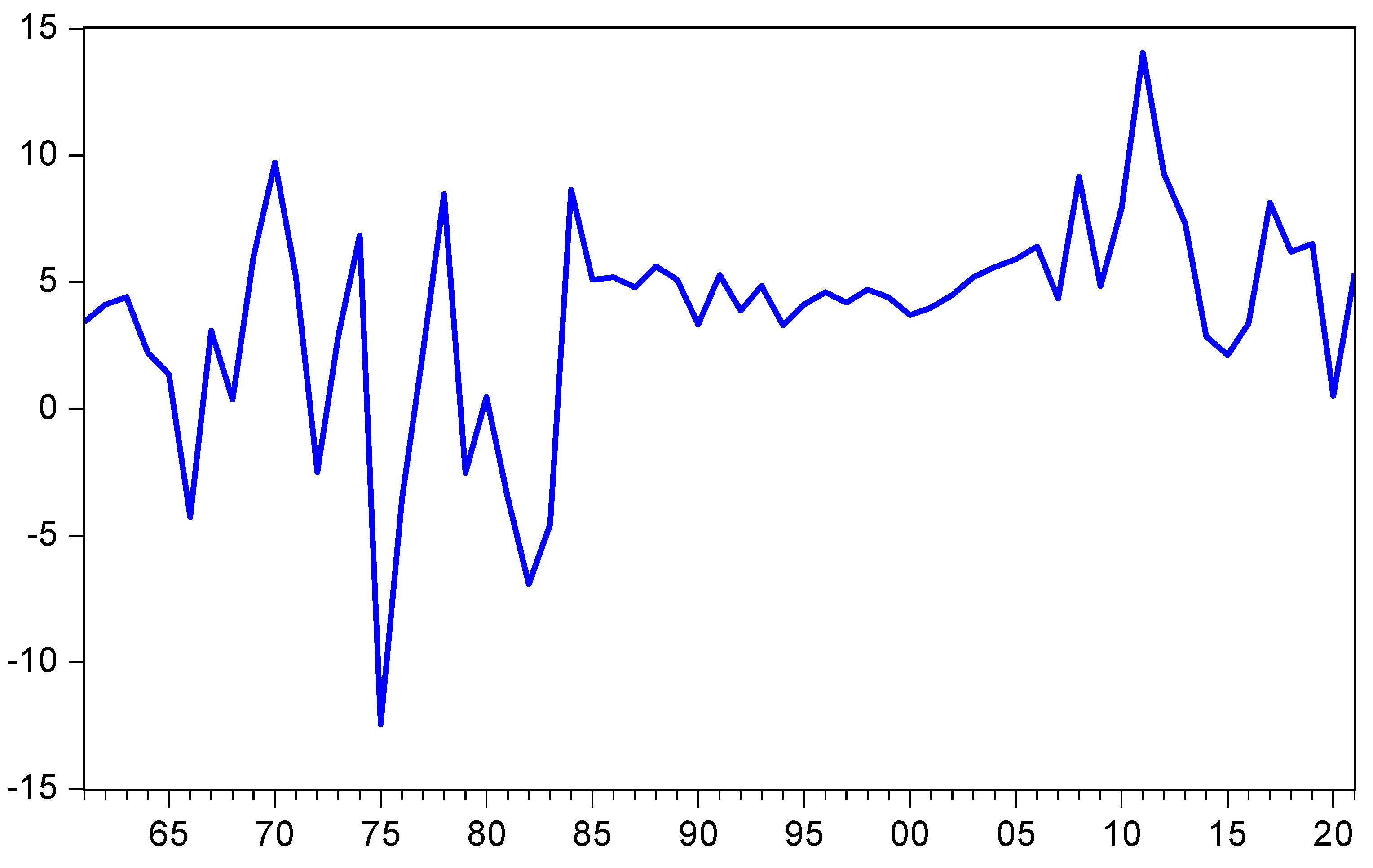

2.2. The Ghanaian Economy

3. Methodology

3.1. Model Specification

3.2. Times Series Estimation Techniques

- (a)

- (b)

- and finite fourth-order cumulants

- (c)

- for all , where

3.3. Measures of Natural Resources

Control Variable

3.4. Source of Data

4. Results and Analysis

4.1. Diagnostic Test

Unit Root

4.2. Results and Discussions

- lnOil (Oil Production):

- 2.

- Other Natural Resource Variables:

4.3. Hypothesis Testing—Further Explanations Using Principal Component Analysis

5. Conclusions

6. Policy Implication

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Full Name of Variable | Short Form |

|---|---|

| Real GDP Growth rate | lnRGDP |

| Agriculture as a percentage of GDP | lnAgric |

| Total Arable Land in Hectors | lnArable |

| Cocoa Production (annually) | lnCocoa |

| Oil Production (annually) | lnOil |

| Gold Production (annually) | lnGold |

| Bauxite Production (annually) | lnBau |

| Diamond Production (annually) | LnDia |

| Mangenese Production (annually) | lnMang |

| Other Control Variable | |

| Gross Fixed Capital Formation | lnCap |

| Total labor | lnLab |

| Inflation | lnInfla |

| Domestic Credit to private sector as a percentage of GDP as a proxy for financial development | lnFD |

| Foreign Direct Investment as a percentage of GDP | lnFDI |

| Trade as a percentage | lnOpen |

| Government Expenditure as a percentage of GDP | lnGovsize |

| External Debt Stocks | lnExds |

| Natural log on variable | Ln() |

| Variables | Obs | Mean | Std.Dev. | Min | Max | Skew. | Kurt. |

|---|---|---|---|---|---|---|---|

| lnOil | 37 | 10.308 | 0.582 | 9.1 | 11.385 | 0.122 | 2.141 |

| lnGold | 31 | 14.63 | 0.495 | 13.166 | 15.383 | −0.877 | 3.931 |

| lnDiam | 31 | 12.992 | 1.067 | 10.138 | 14.51 | −1.282 | 3.887 |

| lnBaux | 31 | 13.335 | 0.407 | 12.732 | 14.206 | 0.357 | 2.056 |

| lnMang | 31 | 13.77 | 0.908 | 11.993 | 15.499 | −0.222 | 2.174 |

| lnCocoa | 59 | 13.316 | 0.472 | 12.41 | 14.171 | 0.108 | 2.146 |

| lnAgric | 62 | 3.607 | 0.343 | 2.852 | 4.106 | −0.73 | 2.563 |

| lnArable | 58 | 14.82 | 0.403 | 14.346 | 15.367 | 0.113 | 1.39 |

| lnFD | 61 | 1.995 | 0.669 | 0.433 | 2.894 | −0.497 | 2.328 |

| lnExds | 51 | 3.829 | 0.572 | 2.805 | 4.938 | 0.257 | 2.008 |

| lnFDI | 49 | 0.214 | 1.502 | −3.094 | 2.248 | −0.528 | 2.225 |

| lnCap | 48 | 2.738 | 0.442 | 1.325 | 3.367 | −0.746 | 3.448 |

| lnLab | 32 | 16.065 | 0.23 | 15.671 | 16.433 | −0.058 | 1.789 |

| lnOpen | 62 | 3.865 | 0.591 | 1.844 | 4.754 | −1.149 | 4.535 |

| lnRGDP | 62 | 23.559 | 0.654 | 22.759 | 24.915 | 0.72 | 2.18 |

| lnInfla | 60 | 2.988 | 0.799 | 0.663 | 4.813 | −0.41 | 3.645 |

| lnGovsize | 62 | 2.342 | 0.236 | 1.768 | 2.819 | −0.347 | 2.489 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | (15) | (16) | (17) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) lnOil | 1.000 | ||||||||||||||||

| (2) lnGold | 0.594 | 1.000 | |||||||||||||||

| (3) lnDiam | 0.039 | −0.049 | 1.000 | ||||||||||||||

| (4) lnBaux | 0.621 | 0.616 | 0.094 | 1.000 | |||||||||||||

| (5) lnMang | 0.616 | 0.685 | 0.048 | 0.629 | 1.000 | ||||||||||||

| (6) lnCocoa | 0.590 | 0.789 | −0.111 | 0.695 | 0.837 | 1.000 | |||||||||||

| (7) lnAgric | −0.603 | −0.780 | 0.210 | −0.656 | −0.673 | −0.804 | 1.000 | ||||||||||

| (8) lnArable | 0.609 | 0.923 | −0.084 | 0.689 | 0.798 | 0.864 | −0.786 | 1.000 | |||||||||

| (9) lnFD | 0.604 | 0.927 | −0.102 | 0.593 | 0.788 | 0.839 | −0.727 | 0.967 | 1.000 | ||||||||

| (10) lnExds | −0.389 | −0.447 | 0.068 | −0.553 | −0.616 | −0.632 | 0.667 | −0.569 | −0.471 | 1.000 | |||||||

| (11) lnFDI | 0.464 | 0.788 | −0.218 | 0.485 | 0.517 | 0.694 | −0.774 | 0.707 | 0.701 | −0.642 | 1.000 | ||||||

| (12) lnCap | 0.322 | 0.091 | 0.282 | 0.161 | 0.026 | 0.061 | −0.033 | 0.000 | 0.054 | 0.408 | −0.100 | 1.000 | |||||

| (13) lnlab | 0.682 | 0.880 | −0.186 | 0.728 | 0.839 | 0.931 | −0.913 | 0.933 | 0.899 | −0.690 | 0.772 | 0.011 | 1.000 | ||||

| (14) lnOpen | 0.125 | 0.550 | −0.036 | 0.033 | 0.271 | 0.279 | −0.067 | 0.497 | 0.592 | 0.294 | 0.210 | 0.312 | 0.266 | 1.000 | |||

| (15) lnRGDP | 0.667 | 0.839 | −0.219 | 0.692 | 0.805 | 0.911 | −0.948 | 0.891 | 0.849 | −0.692 | 0.758 | −0.000 | 0.989 | 0.183 | 1.000 | ||

| (16) lnInfla | 0.015 | −0.071 | 0.428 | 0.073 | −0.074 | −0.187 | 0.043 | −0.173 | −0.272 | 0.047 | −0.043 | 0.336 | −0.162 | −0.122 | −0.166 | 1.000 | |

| (17) lnGovsize | −0.660 | −0.452 | 0.083 | −0.647 | −0.418 | −0.382 | 0.522 | −0.562 | −0.455 | 0.528 | −0.424 | 0.147 | −0.560 | 0.127 | −0.546 | 0.001 | 1.000 |

References

- Acquah-Andoh, Elijah, Denis M. Gyeyir, David M. Aanye, and Augustine Ifelebuegu. 2018. Oil and Gas Production and the Growth of Ghana’s Economy: An Initial Assessment. International Journal of Economics & Financial Research 4: 303–12. [Google Scholar]

- Adabor, Opoku. 2023. Averting the ‘Resource Curse Phenomenon’ through Government Effectiveness. Evidence from Ghana’s Natural Gas Production. Management of Environmental Quality: An International Journal 34: 159–76. [Google Scholar] [CrossRef]

- Adelman, Irma, and Cynthia Taft Morris. 1978. Growth and Improverishment in the Middle of the Nineteenth Century. World Development 6: 245–73. [Google Scholar] [CrossRef]

- Adu, George. 2012. Studies on Economic Growth and Inflation. Uppsala: Pub.epsilon.slu.se, vol. 2012, p. 14. [Google Scholar]

- Alam, Md Shabbir, Tomiwa Sunday Adebayo, Radwa Radwan Said, Naushad Alam, Cosimo Magazzino, and Uzma Khan. 2022. Asymmetric impacts of natural gas consumption on renewable energy and economic growth in Kingdom of Saudi Arabia and the United Arab Emirates. Energy & Environment. [Google Scholar] [CrossRef]

- Alexeev, Michael, and Robert Conrad. 2009. The Elusive Curse of Oil. The Review of Economics and Statistics 91: 586–98. [Google Scholar] [CrossRef]

- Amundsen, Inge. 2014. Drowning in Oil: Angola’s Institutions and the ‘Resource Curse’. Comparative Politics 46: 169–89. [Google Scholar] [CrossRef]

- Andrade, Saraly, and Joaquin Morales. 2007. Institute for Advanced Development Studies. Available online: https://econpapers.repec.org/paper/advwpaper/200711.htm (accessed on 4 September 2023).

- An, Min, Ping Xie, Weijun He, Bei Wang, Jin Huang, and Ribesh Khanal. 2022. Spatiotemporal Change of Ecologic Environment Quality and Human Interaction Factors in Three Gorges Ecologic Economic Corridor, Based on RSEI. Ecological Indicators 141: 109090. [Google Scholar] [CrossRef]

- Asumadu, George, Daniel Ofori, John Agyei, and Ali Yahuza Bawa. 2021. Ghana’s Oil Discovery and Natural Resource Curse Nexus. Modern Economy 12: 1959–71. [Google Scholar] [CrossRef]

- Auty, Richard. 2002. Sustaining Development in Mineral Economies: The Resource Curse Thesis. London: Routledge. [Google Scholar]

- Badeeb, Ramez Abubakr, Hooi Hooi Lean, and Jeremy Clark. 2017. The Evolution of the Natural Resource Curse Thesis: A Critical Literature Survey. Resources Policy 51: 123–34. [Google Scholar] [CrossRef]

- Baloch, Muhammad Awais, Nasir Mahmood, and Jian Wu Zhang. 2019. Effect of Natural Resources, Renewable Energy and Economic Development on CO2 Emissions in BRICS Countries. Science of the Total Environment 678: 632–38. [Google Scholar]

- Barro, Robert J. 1997. Determinants of Economic Growth: A Cross-Country Empirical Study. In Lionel Robbins Lectures. Cambridge: MIT Press. [Google Scholar]

- Bhattacharyya, Sambit, and Paul Collier. 2014. Public Capital in Resource Rich Economies: Is There a Curse? Oxford Economic Papers 66: 1–24. [Google Scholar] [CrossRef]

- Blanco, Luisa, and Robin Grier. 2012. Natural Resource Dependence and the Accumulation of Physical and Human Capital in Latin America. Resources Policy 37: 281–95. [Google Scholar] [CrossRef]

- Boakye, Richard. 2020. Assessment of the Effects of Illegal Small-Scale Mining on Cocoa Farming and Livelihood Birim North District. Ph.D. thesis, University of Cape Coast Repository, Cape Coast, Ghana. [Google Scholar]

- Bodea, Cristina, Masaaki Higashijima, and Raju Jan Singh. 2016. Oil and Civil Conflict: Can Public Spending Have a Mitigation Effect? World Development 78: 1–12. [Google Scholar] [CrossRef]

- Bond, Stephen R., and Adeel Malik. 2009. Natural Resources, Export Structure, and Investment. Oxford Economic Papers 61: 675–702. [Google Scholar] [CrossRef]

- Boos, Adrian, and Karin Holm-Müller. 2013. The Relationship between the Resource Curse and Genuine Savings: Empirical Evidence. Journal of Sustainable Development 6: 59. [Google Scholar] [CrossRef]

- Bornhorst, Fabian, Sanjeev Gupta, and John Thornton. 2008. Natural Resource Endowments, Governance, and the Domestic Revenue Effort: Evidence from a Panel of Countries, International Monetary Fund Working Paper WP/08/170. Available online: https://www.imf.org/external/pubs/ft/wp/2008/wp08170.pdf (accessed on 4 September 2023).

- Boyce, John R., and J. C. Herbert Emery. 2011. Is a Negative Correlation between Resource Abundance and Growth Sufficient Evidence That There Is a ‘Resource Curse’? Resources Policy 36: 1–13. [Google Scholar] [CrossRef]

- Brooks, Taggert Jonathan. 1999. Currency Depreciation and the Trade Balance: An Elasticity Approach and Test of the Marshall-Lerner Condition for Bilateral Trade between the United States and the G-7. A Dissertation Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy Economics. Milwaukee: The University of Wisconsin. [Google Scholar]

- Busse, Matthias, and Steffen Gröning. 2013. The Resource Curse Revisited: Governance and Natural Resources. Public Choice 154: 1–20. [Google Scholar] [CrossRef]

- Canuto, Otaviano, and Matheus Cavallari. 2012. Natural Capital and the Resource Curse. World Bank, Economic Premise. Number 83. Available online: www.worldbank.org/economicpremise (accessed on 4 September 2023).

- Cavalcanti, Tiago V. de V., Kamiar Mohaddes, and Mehdi Raissi. 2011. Growth, Development and Natural Resources: New Evidence Using a Heterogeneous Panel Analysis. The Quarterly Review of Economics and Finance 51: 305–18. [Google Scholar] [CrossRef]

- Cockx, Lara, and Nathalie Francken. 2016. Natural Resources: A Curse on Education Spending? Energy Policy 92: 394–408. [Google Scholar] [CrossRef]

- Collier, Paul. 2007. Managing Commodity Booms: Lessons of International Experience. Nairobi: African Economic Research Consortium, Centre for the Study of African Economies, Department of Economics Oxford University. [Google Scholar]

- Davis, Graham A., and John E. Tilton. 2005. The Resource Curse. In Natural Resources Forum. Hoboken: Wiley Online Library, vol. 29, pp. 233–42. [Google Scholar]

- Debrah, Emmanuel, and Emmanuel Graham. 2015. Preventing the Oil Curse Situation in Ghana: The Role of Civil Society Organisations. Insight on Africa 7: 21–41. [Google Scholar] [CrossRef]

- Dietsche, Evelyn. 2012. Institutional Change and State Capacity in Mineral-Rich Countries-Social Policy in a Development Context. In Mineral Rents and the Financing of Social Policy: Opportunities and Challenges. Edited by Katja Hujo. Chp. 5. London: Palgrave Macmillan, pp. 122–52. [Google Scholar]

- Dietz, Simon, Eric Neumayer, and Indra De Soysa. 2007. Corruption, the Resource Curse and Genuine Saving. Environment and Development Economics 12: 33–53. [Google Scholar] [CrossRef]

- Dorm-Adzobu, Clement. 1982. Impact of Utilization of Natural Resources on Forest and Wooded Savanna Ecosystems in Rural Ghana. Environmental Conservation 9: 157–62. [Google Scholar] [CrossRef]

- Epo, Boniface Ngah, and Dief Reagen Nochi Faha. 2020. Natural Resources, Institutional Quality, and Economic Growth: An African Tale. The European Journal of Development Research 32: 99–128. [Google Scholar] [CrossRef]

- Eregha, Perekunah B., and Ekundayo Peter Mesagan. 2016. Oil Resource Abundance, Institutions and Growth: Evidence from Oil Producing African Countries. Journal of Policy Modeling 38: 603–19. [Google Scholar] [CrossRef]

- Erum, Naila, and Shahzad Hussain. 2019. Corruption, Natural Resources and Economic Growth: Evidence from OIC Countries. Resources Policy 63: 101429. [Google Scholar] [CrossRef]

- Faggian, Alessandra, Félix Modrego, and Philip McCann. 2019. Human Capital and Regional Development. In Handbook of Regional Growth and Development Theories. Cheltenham: Edward Elgar Publishing, pp. 149–71. [Google Scholar] [CrossRef]

- Fischer, Carolyn. 2010. Does Trade Help or Hinder the Conservation of Natural Resources? Chicago: The University of Chicago Press. [Google Scholar]

- Frankel, Jeffrey A. 2010. The Natural Resource Curse: A Survey. NBER Working Paper Series No. w15836. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Gerelmaa, Lkhagva, and Koji Kotani. 2016. Further Investigation of Natural Resources and Economic Growth: Do Natural Resources Depress Economic Growth? Resources Policy 50: 312–21. [Google Scholar] [CrossRef]

- Gylfason, Thorvaldur. 2000. Resources, Agriculture and Economic Growth in Economies in Transition (July 1, 2000). CERGE-EI Working Paper Series No. 157. Available online: https://ssrn.com/abstract=1535743 (accessed on 26 September 2020).

- Gylfason, Thorvaldur. 2001. Natural Resources, Education, and Economic Development. European Economic Review 45: 847–59. [Google Scholar] [CrossRef]

- Gylfason, Thorvaldur, and Gylfi Zoega. 2006. Natural Resources and Economic Growth: The Role of Investment. World Economy 29: 1091–115. [Google Scholar] [CrossRef]

- Hassan, Syed Tauseef, Enjun Xia, Noor Hashim Khan, and Sayed Mohsin Ali Shah. 2019. Economic Growth, Natural Resources, and Ecological Footprints: Evidence from Pakistan. Environmental Science and Pollution Research 26: 2929–38. [Google Scholar] [CrossRef]

- Humphreys, Macartan, Jeffrey D. Sachs, and Joseph E. Stiglitz. 2007. Introduction: What Is the Problem with Natural Resource Wealth. In Escaping the Resource Curse. New York: Columbia University Press, pp. 1–20. [Google Scholar]

- Huq, Mozammel M. 1989. The Economy of Ghana. London: Palgrave Macmillan. ISBN 978-1-137-60243-5. [Google Scholar] [CrossRef]

- Huq, Mozammel, and Michael Tribe. 2018. In The Economy of Ghana: 50 Years of Economic Development. London: Palgrave Macmillan. [Google Scholar]

- Iimi, Atsushi. 2007. Escaping from the Resource Curse: Evidence from Botswana and the Rest of the World. IMF Staff Papers 54: 663–99. [Google Scholar] [CrossRef]

- Institute of Statistical, Social and Economic Research (ISSER). 2010. State of the Ghanaian Economy. Accra: University of Ghana. [Google Scholar]

- James, Alex, and David Aadland. 2011. The Curse of Natural Resources: An Empirical Investigation of US Counties. Resource and Energy Economics 33: 440–53. [Google Scholar] [CrossRef]

- James, Alexander. 2015. The Resource Curse: A Statistical Mirage? Journal of Development Economics 114: 55–63. [Google Scholar] [CrossRef]

- Kamal, Mustafa, Muhammad Usman, Atif Jahanger, and Daniel Balsalobre-Lorente. 2021. Revisiting the Role of Fiscal Policy, Financial Development, and Foreign Direct Investment in Reducing Environmental Pollution during Globalization Mode: Evidence from Linear and Nonlinear Panel Data Approaches. Energies 14: 6968. [Google Scholar] [CrossRef]

- Kheifets, Igor, and Peter C. B. Phillips. 2019. Fully Modified Least Squares for Multicointegrated Systems. Journal of Econometrics 232: 300–19. [Google Scholar]

- Kwarteng, Kwaku Gayeman. 2022. Report of the Finance Committee on the Public Interest and Accountability Committee Report on the Management of Petroleum Revenues for the 2021 Financial Year. Accra: Parliament of Ghana. [Google Scholar]

- Laari, Martey. 2018. Assessing the Impacts of Illegal Small-Scale Mining (Galamsey) on Cocoa Farming and Rural Livelihood: The Case of Amenfi West District of Ghana. Accra: Ashesi University College. [Google Scholar]

- Lederman, Daniel, William Francis Maloney, and Luis Serven. 2005. Lessons from NAFTA: For Latin America and the Caribbean. Stanford: Stanford University Press. [Google Scholar]

- Leite, Mr Carlos, and Jens Weidmann. 1999. Does Mother Nature Corrupt? Natural Resources, Corruption, and Economic Growth. Washington, DC: International Monetary Fund. [Google Scholar]

- Li, Kaodui, Hongxin Ying, Yi Ning, Xiangmiao Wang, Mohammed Musah, Muntasir Murshed, Morrison Alfred, Yanhong Chu, Han Xu, and Xinyi Yu. 2022. China’s 2060 Carbon-Neutrality Agenda: The Nexus between Energy Consumption and Environmental Quality. Environmental Science and Pollution Research 29: 55728–42. [Google Scholar] [CrossRef] [PubMed]

- Matti, Stephanie. 2010. Resources and Rent Seeking in the Democratic Republic of the Congo. Third World Quarterly 31: 401–13. [Google Scholar] [CrossRef]

- Mavrotas, George, Syed Mansoob Murshed, and Sebastian Torres. 2011. Natural Resource Dependence and Economic Performance in the 1970–2000 Period. Review of Development Economics 15: 124–38. [Google Scholar] [CrossRef]

- Miles, D. Anthony. 2017. A Taxonomy of Research Gaps: Identifying and Defining the Seven Research Gaps. In Doctoral Student Workshop: Finding Research Gaps-Research Methods and Strategies, Dallas, Texas. pp. 1–15. Available online: https://www.researchgate.net/publication/319244623_ARTICLE_Research_Methods_and_Strategies_Workshop_A_Taxonomy_of_Research_Gaps_Identifying_and_Defining_the_Seven_Research_Gaps (accessed on 4 September 2023).

- Ministry of Land and Natural Resources. 2021. Ghana Landscape Restoration And Small-Scale Mining Project - Resettlement Policy Framework and Process Framework, Ministry of Land and Natural Resourse Report. Available online: https://documents1.worldbank.org/curated/en/331271621860861862/pdf/Revised-Resettlement-Plan-Ghana-Landscape-Restoration-and-Small-Scale-Mining-Project-P171933.pdf (accessed on 4 September 2023).

- Moshiri, Saeed, and Sara Hayati. 2017. Natural Resources, Institutions Quality, and Economic Growth; a Cross-Country Analysis. Iranian Economic Review 21: 661–93. [Google Scholar]

- Moussa, Amr Ahmed. 2018. The Impact of Working Capital Management on Firms’ Performance and Value: Evidence from Egypt. Journal of Asset Management 19: 259–73. [Google Scholar] [CrossRef]

- Moyo, Dambisa. 2009a. Dead Aid: Why Aid Is Not Working and How There Is a Better Way for Africa. New York: Macmillan. [Google Scholar]

- Moyo, Dambisa. 2009b. Why Foreign Aid Is Hurting Africa. The Wall Street Journal 21: 1–5. [Google Scholar]

- Namahoro, Jean Pierre, Wu Qiaosheng, and Su Hui. 2023. Economic Growth, Natural Resource Rents, and Business Openness Nexus in Regions and Income Levels of Africa: Evidence from Recent Panel Estimators. In Mineral Economics. Springer, Raw Materials Group (RMG). Luleå: Luleå University of Technology, vol. 36, pp. 583–98. [Google Scholar]

- Olayungbo, D. O. 2019. Effects of Oil Export Revenue on Economic Growth in Nigeria: A Time Varying Analysis of Resource Curse. Resources Policy 64: 101469. [Google Scholar] [CrossRef]

- Osman, Najat, John Tennyson Afele, Eunice Nimo, David Ofoe Gorleku, Louisa Adomaa Ofori, and Akwasi Adutwum Abunyewa. 2022. Assessing the Impact of Illegal Small-Scale Mining (Galamsey) on Cocoa Farming and Farmer Livelihood: A Case Study in the Amansie West District of Ghana. Pelita Perkebunan (a Coffee and Cocoa Research Journal) 38: 70–82. [Google Scholar] [CrossRef]

- Papyrakis, Elissaios, and Reyer Gerlagh. 2004. The Resource Curse Hypothesis and Its Transmission Channels. Journal of Comparative Economics 32: 181–93. [Google Scholar] [CrossRef]

- Papyrakis, Elissaios, and Reyer Gerlagh. 2007. Resource Abundance and Economic Growth in the United States. European Economic Review 51: 1011–39. [Google Scholar] [CrossRef]

- Pelinescu, Elena. 2015. The Impact of Human Capital on Economic Growth. Procedia Economics and Finance 22: 184–90. [Google Scholar] [CrossRef]

- Pendergast, Shannon M., Judith A. Clarke, and G. Cornelis Van Kooten. 2011. Corruption, Development and the Curse of Natural Resources. Canadian Journal of Political Science/Revue Canadienne de Science Politique 44: 411–37. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2004. General Diagnostic Tests for Cross Section Dependence in Panels, IZA Discussion Paper No. 1240. Journal of Econometrics 69. Available online: https://ssrn.com/abstract=572504 (accessed on 4 September 2023).

- Phillips, Peter, and Bruce. E. Hansen. 1990. Statistical inference in instrumental variables regression with I (1) processes. The Review of Economic Studies 57: 99–125. [Google Scholar] [CrossRef]

- Phillips, Peter C. B. 1995a. Fully Modified Least Squares and Vector Autoregression. Econometrica: Journal of the Econometric Society, 1023–78. [Google Scholar]

- Phillips, Peter C. B. 1995b. Nonstationary Time Series and Cointegration. Journal of Applied Econometrics 10: 87–94. [Google Scholar] [CrossRef]

- Ross, Michael, Kai Kaiser, and Nimah Mazaheri. 2011. The “Resource Curse” in MENA? Political Transitions, Resource Wealth, Economic Shocks, and Conflict Risk. Policy Research Paper 5742. Washington, DC: The World Bank. [Google Scholar]

- Ross, Michael L. 2007. How Mineral-Rich States Can Reduce Inequality. Escaping the Resource Curse 23775: 237–55. [Google Scholar]

- Sachs, Jeffrey D., and Andrew M. Warner. 1999. Natural Resource Intensity and Economic Growth. Elgar: Development Policies in Natural Resource Economies, pp. 13–38. ISBN 1-84064-009-x.-1999. [Google Scholar]

- Sachs, Jeffrey D., and Andrew Warner. 1995. Natural Resource Abundance and Economic Growth. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Sala-i-Martin, Xavier, and Arvind Subramanian. 2013. Addressing the Natural Resource Curse: An Illustration from Nigeria. Journal of African Economies 22: 570–615. [Google Scholar] [CrossRef]

- Satti, Saqlain Latif, Abdul Farooq, Nanthakumar Loganathan, and Muhammad Shahbaz. 2014. Empirical Evidence on the Resource Curse Hypothesis in Oil Abundant Economy. Economic Modelling 42: 421–29. [Google Scholar] [CrossRef]

- Schweinsberg, Martin, Michael Feldman, Nicola Staub, Olmo R. van den Akker, Robbie CM van Aert, Marcel ALM Van Assen, Yang Liu, Tim Althoff, Jeffrey Heer, and Alex Kale. 2021. Same Data, Different Conclusions: Radical Dispersion in Empirical Results When Independent Analysts Operationalize and Test the Same Hypothesis. Organizational Behavior and Human Decision Processes 165: 228–49. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, Khalid Ahmed, Aviral Kumar Tiwari, and Zhilun Jiao. 2019. Resource Curse Hypothesis and Role of Oil Prices in USA. Resources Policy 64: 101514. [Google Scholar] [CrossRef]

- Shobande, Olatunji Abdul. 2022. Does FDI Promote the Resource Curse in Nigeria? Journal of Risk and Financial Management 15: 415. [Google Scholar] [CrossRef]

- Srivastava, Sanjay, and Pawlowska Agata Ewa. 2020. Ghana: Balancing Economic Growth and Depletion of Resources. Available online: https://blogs.worldbank.org/africacan/ghana-balancing-economic-growth-and-depletion-resources (accessed on 26 September 2020).

- Stijns, Jean-Philippe. 2006. Natural Resource Abundance and Human Capital Accumulation. World Development 34: 1060–83. [Google Scholar] [CrossRef]

- Taneja, Sanjay, Mukul Bhatnagar, Pawan Kumar, and Ramona Rupeika-Apoga. 2023. India’s Total Natural Resource Rents (NRR) and GDP: An Augmented Autoregressive Distributed Lag (ARDL) Bound Test. Journal of Risk and Financial Management 16: 91. [Google Scholar] [CrossRef]

- Teixeira, Aurora AC, and Anabela SS Queirós. 2016. Economic Growth, Human Capital and Structural Change: A Dynamic Panel Data Analysis. Research Policy 45: 1636–48. [Google Scholar] [CrossRef]

- Tiba, Sofien. 2019. Exploring the Nexus between Oil Availability and Economic Growth: Insights from Non-Linear Model. Environmental Modeling & Assessment 24: 691–702. [Google Scholar]

- United Nations. 2022. Food and Agriculture Organization of the United Nations. Available online: https://www.fao.org/faostat/en/#data (accessed on 17 March 2023).

- Usman, Muhammad, Daniel Balsalobre-Lorente, Atif Jahanger, and Paiman Ahmad. 2023. Are Mercosur Economies Going Green or Going Away? An Empirical Investigation of the Association between Technological Innovations, Energy Use, Natural Resources and GHG Emissions. Gondwana Research 113: 53–70. [Google Scholar] [CrossRef]

- Van Der Ploeg, Frederick, and Steven Poelhekke. 2019. The Impact of Natural Resources: Survey of Recent Quantitative Evidence. In Why Does Development Fail in Resource Rich Economies. London: Routledge, pp. 31–42. [Google Scholar]

- Wedam, Emmanuel, F. Dugasseh Akowuge, and F. Asante. 2014. Costly Mistakes, Declining Fortunes; at Whose Detriment: An Assessment of Cocoa Cultivation in Ghana. Journal of Environment and Earth Science 4: 55–69. [Google Scholar]

- World Bank. 2022. World Development Indicator, 2022. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 14 March 2023).

- Yilanci, Veli, N. Ceren Turkmen, and Muhammad Ibrahim Shah. 2022. An Empirical Investigation of Resource Curse Hypothesis for Cobalt. Resources Policy 78: 102843. [Google Scholar] [CrossRef]

- Ze, Fu, Wence Yu, Anis Ali, Sanil S. Hishan, Iskandar Muda, and Khurshid Khudoykulov. 2023. Influence of Natural Resources, ICT, and Financial Globalization on Economic Growth: Evidence from G10 Countries. Resources Policy 81: 103254. [Google Scholar] [CrossRef]

| Variables | Expected Sign |

|---|---|

| Financial Development | + |

| Total Government expenditure | +/− |

| Openness | +/− |

| Inflation | − |

| Foreign Direct Investment | + |

| External Debt | − |

| Natural Resource | + |

| PART A | PART B | ||||

|---|---|---|---|---|---|

| Series | ADF (Probability) | PP (Probability) | Series | ADF (Probability) | PP (Probability) |

| LNRGDP | 1.0000 | 1.0000 | D(LNRGDP) | 0.0001 *** | 0.0001 *** |

| LNOPEN | 0.4952 | 0.4455 | D(LNOPEN) | 0.0000 *** | 0.0000 *** |

| LNOIL | 0.1496 | 0.2650 | D(LNOIL) | 0.0000 *** | 0.0001 *** |

| LNMANG | 0.7315 | 0.7014 | D(LNMANG) | 0.0011 ** | 0.0014 ** |

| LNLAB | 0.0090 ** | 0.0523 | D(LNLAB) | 0.0085 ** | 0.0085 ** |

| LNINFLA | 0.0055 ** | 0.0102 | D(LNINFLA) | 0.0000 *** | 0.0000 *** |

| LNGOVSIZE | 0.0464 * | 0.0341 | D(LNGOVSIZE) | 0.0000 *** | 0.0000 *** |

| LNGOLD | 0.0093 ** | 0.0064 ** | D(LNGOLD) | 0.0000 *** | 0.0000 *** |

| LNFDI | 0.5537 | 0.5651 | D(LNFDI) | 0.0000 *** | 0.0000 *** |

| LNFD | 0.6756 | 0.6480 | D(LNFD) | 0.0000 *** | 0.0000 *** |

| LNEXDS | 0.4457 | 0.3536 | D(LNEXDS) | 0.0000 *** | 0.0000 *** |

| LNDIA | 0.9425 | 0.9706 | D(LNDIA) | 0.0006 *** | 0.0008 ** |

| LNCOCOA | 0.7551 | 0.8239 | D(LNCOCOA) | 0.0000 *** | 0.0000 *** |

| LNCAP | 0.0045 | 0.0049 ** | D(LNCAP) | 0.0000 *** | 0.0000 *** |

| LNBAU | 0.5554 | 0.7193 | D(LNBAU) | 0.0001 *** | 0.0000 *** |

| LNARABLE | 0.9647 | 0.9485 | D(LNARABLE) | 0.0000 *** | 0.0000 *** |

| LNAGRIC | 0.9923 | 0.9493 | D(LNAGRIC) | 0.0000 *** | 0.0000 *** |

| Variables | Coefficients | |||

|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | |

| Indicators of Abundance of Resources | ||||

| lnAgric | 0.2441 *** | 0.3380 *** | 0.3866 *** | |

| lnArable | 0.3848 | 0.2134 * | 0.0981 *** | |

| lnCocoa | −0.0602 | 0.0378 ** | 0.0207 ** | |

| lnOil | 0.0112 ** | 0.0005 | −0.0124 | |

| lnGold | 0.0530 ** | 0.0415 * | ||

| lnBau | −0.1096 * | −0.1017 | −0.0142 ** | |

| LnDia | 0.0094 ** | 0.0186 | 0.0204 | |

| lnMang | −0.0068 | −0.0128 | 0.3925 ** | |

| Other Control Variable | ||||

| lnCap | 0.0106 ** | 0.0192 * | 0.0105 ** | 0.0568 ** |

| lnLab | 0.4992 *** | 0.4302 *** | 0.0716 *** | 0.9999 *** |

| lnInfla | −0.0132** | −0.0368 ** | −0.0059 | 0.0001 |

| lnFD | −0.1126** | −0.1236 * | −0.0021 | 0.0629 |

| lnFDI | 0.1452** | 0.3547 ** | 0.2575 *** | 0.0245 ** |

| lnOpen | −0.1954 *** | 0.0096 | −0.2002 ** | −0.1572 ** |

| lnGovsize | −0.1018 | −0.0058 * | 0.0180 | 0.0815 |

| lnExds | −0.0694 *** | −0.050 ** | −0.0723 ** | −0.0395 ** |

| Constant | −1.5282 *** | −1.0269 *** | −1.687 *** | −4.6028 |

| Variables | Coefficient | Prob. |

|---|---|---|

| Composite Indicators | ||

| P1 | 0.0214 | 0.049 |

| P2 | 0.0318 | 0.002 |

| P3 | 0.0951 | 0.010 |

| P4 | 0.0125 | 0.040 |

| Control Variables | ||

| lnCap | 0.0015 | 0.001 |

| lnLab | 0.3145 | 0.000 |

| lnInfla | −0.0014 | 0.032 |

| lnFD | −0.0054 | 0.041 |

| lnFDI | 0.0029 | 0.005 |

| lnOpen | 0.0245 | 0.009 |

| lnGovsize | −0.0235 | 0.038 |

| lnExds | −0.0458 | 0.017 |

| Constant | 3.5146 | 0.000 |

| Component | Eigenvalue | Difference | Proportion | Cumulative | |||||

|---|---|---|---|---|---|---|---|---|---|

| Number of Obs = 26 | Comp1 | 5.272 | 4.179 | 0.659 | 0.659 | ||||

| Number of Comp = 8 | Comp2 | 1.093 | 0.576 | 0.137 | 0.796 | ||||

| Trace = 8 | Comp3 | 0.517 | 0.141 | 0.065 | 0.860 | ||||

| Rho = 1.000 | Comp4 | 0.377 | 0.025 | 0.047 | 0.907 | ||||

| Comp5 | 0.352 | 0.128 | 0.044 | 0.952 | |||||

| Comp6 | 0.224 | 0.110 | 0.028 | 0.979 | |||||

| Comp7 | 0.114 | 0.063 | 0.014 | 0.994 | |||||

| Comp8 | 0.051 | . | 0.006 | 1.000 | |||||

| Variable | Comp1 | Comp2 | Comp3 | Comp4 | Comp5 | Comp6 | Comp7 | Comp8 | Unexplained |

| lnoil | 0.327 | 0.162 | 0.782 | 0.475 | −0.102 | 0.047 | 0.124 | −0.045 | 0 |

| lngold | 0.389 | −0.042 | 0.291 | 0.548 | −0.171 | 0.251 | −0.053 | 0.590 | 0 |

| India | −0.027 | 0.933 | 0.223 | 0.033 | −0.141 | −0.220 | 0.069 | −0.071 | 0 |

| lnbau | 0.349 | 0.204 | −0.416 | −0.799 | 0.086 | 0.261 | −0.113 | 0.102 | 0 |

| lnmang | 0.377 | 0.113 | 0.183 | 0.291 | 0.677 | 0.013 | −0.476 | 0.203 | 0 |

| lncocoa | 0.403 | −0.073 | 0.210 | −0.037 | 0.311 | −0.110 | 0.821 | 0.055 | 0 |

| lnagric | −0.483 | 0.198 | 0.022 | 0.149 | 0.223 | 0.825 | 0.227 | 0.102 | 0 |

| lnarable | 0.410 | −0.051 | 0.276 | 0.071 | −0.178 | 0.354 | −0.107 | −0.761 | 0 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Baafi, J.A. Unraveling Ghana’s Resource Curse Hypothesis: Analyzing Natural Resources and Economic Growth with a Focus on Oil Exploration. Economies 2024, 12, 79. https://doi.org/10.3390/economies12040079

Baafi JA. Unraveling Ghana’s Resource Curse Hypothesis: Analyzing Natural Resources and Economic Growth with a Focus on Oil Exploration. Economies. 2024; 12(4):79. https://doi.org/10.3390/economies12040079

Chicago/Turabian StyleBaafi, Joseph Antwi. 2024. "Unraveling Ghana’s Resource Curse Hypothesis: Analyzing Natural Resources and Economic Growth with a Focus on Oil Exploration" Economies 12, no. 4: 79. https://doi.org/10.3390/economies12040079

APA StyleBaafi, J. A. (2024). Unraveling Ghana’s Resource Curse Hypothesis: Analyzing Natural Resources and Economic Growth with a Focus on Oil Exploration. Economies, 12(4), 79. https://doi.org/10.3390/economies12040079