Abstract

This study investigates the impact of central bank digital currencies (CBDCs) on monetary policy flexibility, the effective lower bound (ELB), and negative interest rate policies (NIRPs), specifically in the case of the digital euro (DE). Through a combination of theoretical modeling and empirical analysis, including two extensive surveys among EU participants, we explore whether CBDCs can change the ELB and affect consumer preferences in favor of the digital euro over physical cash. Our findings indicate that the introduction of the DE could potentially move the ELB from its current value of around −1.30% by approximately 0.25%. If agents had the possibility to move their deposits into both cash and DE, they would convert approximately 52% of the converted amount into cash and the rest into CBDCs. However, over a 10 year period, the situation would shift in favor of the DE, with a share of 63%. Both findings show that NIRPs will be more limited in the case of the introduction of CBDCs (DE). These facts must be considered both when deciding whether to introduce a CBDC (DE) and after its eventual introduction in the case of NIRP application.

1. Introduction

With the rapid evolution of financial technologies, central bank digital currencies (CBDCs) have emerged as transformative instruments reshaping monetary policy (MP) worldwide. A CBDC, a digital form of sovereign currency, offers the promise of enhanced financial inclusion, efficiency, and transparency (Panetta 2021). However, offering a second form of central bank money besides cash might have implications for MP and the so-called effective lower bound (ELB, or zero lower bound (ZLB) in the case of a 0% interest threshold for MP), as it might restrict the effectiveness of MP in a negative interest rate policy (NIRP) environment (Meaning et al. 2021).

The ELB is one of the key concepts in monetary economics (Yellen 2018). It denotes the threshold where further reductions in nominal interest rates fail to stimulate economic activity because economic agents always have the option to convert deposits to cash to avoid negative interest rates (NIRs). Exchanging, transporting, and holding cash comes at certain costs, that are to some extent higher than the losses due to NIR, therefore the ELB is not at zero but at a certain level below. However, the introduction of CBDCs can offer another alternative that will be seen by agents as less costly and risky compared to cash. Agents may begin to prefer holding CBDCs, even if they do not convert deposits to cash at a given value of NIR. This preference moves the ELB value closer to zero. Choosing the right CBDC design is, from that point of view, crucial. For example, issuing a widely available and unrestricted non-remunerated CBDC could signal the end of NIRPs, as it gives economic agents a much easier option than cash, to avoid NIR (Bindseil 2022). Thus, the implementation of CBDCs should be carefully examined as they could potentially have extreme effects on MP, financial stability, and economic growth. The article suggests that the choice of whether to convert deposits into cash or CBDCs depends on costs, security, privacy, and overall preferences for each asset. This research aims to answer the following research questions:

RQ 1: To what extent do the suggested factors (costs, security, privacy, and overall preferences) determine the demand for CBDCs and the distribution between cash and CBDC in the case of NIRPs?

RQ 2: How does the implementation of CBDCs affect the ELB under the assumption that the suggested factors influence the distribution between cash and CBDCs?

The article investigates these questions in the case of the eurozone (see Section 4.2 for details). It is organized as follows. First, we perform a review of the literature regarding the level of the ELB in countries that have experienced NIRPs in the past. In Section 3, a theoretical model is developed to evaluate the influence of the suggested factors relevant to the economic agent’s decision whether to choose cash or CBDCs in times of NIRPs. Then, two surveys are conducted to gain a better understanding of the current sentiment about the relevance of the identified factors that influence the distribution of cash in relation to CBDCs. Both surveys aim to evaluate the level of the ELB for cash and CBDCs to provide a better basis for the simulations in the subsequent step. The surveys are described in Section 4, and their results are presented in Section 5. The values of the shares, i.e., how much money households convert to cash and CBDCs in the case of NIRPs, are calculated in Section 6. Monte Carlo simulations are performed in Section 7 to predict the development of the ELB for the eurozone over the next ten years under the condition that the digital euro is established and its use spreads. Our findings are discussed in Section 8. The research is concluded in Section 9.

2. Literature Review

It is common sense among economists (e.g., Franta 2021) that the real lower bound is not at zero, as the zero lower bound (ZLB) concept suggests. The exact interest rate at which the real ELB could be is an ongoing discussion among economists. Several central banks, including those in the euro area, Switzerland, Sweden, Denmark, and Japan, have moved their policy rates into negative territory in recent years following the global financial crisis (GFC). This policy was adopted from 2014 onwards to counter deflationary risks and boost persistently weak growth following the GFC (see, e.g., Czudaj 2020; Wawrosz and Traksel 2023, for details). This experience can provide insights into where the real ELB on interest rates may lie in practice.

Evidence from Switzerland suggests that its ELB is below −0.75%. The Swiss National Bank cut its policy rate to −0.75% in January 2015. Bech and Malkhozov (2016) find that Swiss money markets have continued to function well, with short-term market rates remaining close to the policy rate. There is little evidence of disruption in key funding markets like repos.

In Sweden, the Riksbank cut its repo rate to −0.50% in February 2015 and left it in negative territory until 2019. Erikson and Vestin (2021) argue that while the pass-through to deposit rates have been limited, the overall transmission mechanism has remained intact. The exchange rate channel continued to function at an interest rate set by the Riksbank between 2015 and 2019 (Erikson and Vestin 2021). Andersson and Jonung (2020) analyzed the effects of the NIRP period between 2015 and 2019 and pointed out that, while focusing on consumer inflation and the flattening of the Phillips curve, the Swedish central bank had to take extreme measures the effects of which outweighed the benefits for Swedish society. Because there was no noticeable exchange of deposits into other means of payment on a broader base, it can be assumed that the real ELB in Sweden lies comfortably below −0.50%.

Denmark’s central bank lowered its key policy rate to −0.75% in late 2015. Analysis by the central bank finds no evidence of changes in the use of banknotes and coins or abnormal redemptions from money market funds, indicating that there are only limited side effects from negative rates to that point. Additionally, the pass-through to money market rates has remained intact. Though negative interest rates have not been passed through to private households to their full extent, there is no evidence that the sum denominated in the form of banknotes and coins in circulation was significantly affected by the NIRP. Thus, it can be concluded that this is evidence of an ELB in Denmark below −0.75% (Jensen and Spange 2015).

In the eurozone, the ECB reduced the rate on the deposit facility (i.e., the rate that banks can use to make overnight deposits with the Eurosystem) to −0.10% in June 2014. It was further reduced four times until September 2019, when it reached the lowest value of −0.50%, which was held until August 2020 when it was increased to 0%. It has been increased several times since then and is positive at the time of writing this article (spring 2024). The NIRP of the ECB did not cause any major disruptions (Altavilla et al. 2022). Thus, this experience also points to an ELB below the −0.50% level.

Finally, the Bank of Japan has adopted a −0.10% policy rate. Early steps into negative territory have proceeded without noticeable signs of market impairment (Witmer and Yang 2016). This tentative experience suggests Japan’s ELB is below −0.10%, though more observation is needed as rates go further negative. The Czech National Bank calculated the threshold for the short-term nominal interest rate in a corridor of −2% to −0.4%, with the mean at approximately −1% (Kolcunová and Havránek 2018). Though the ELB has not been tested with negative interest rates, Witmer and Yang (2016) estimated it to be around −0.5%.

In summary, empirical results for the ELB across various countries and regions provide evidence that the ELB is below the current NIR adopted previously in these jurisdictions. However, as we already indicated, the value of the ELB can change if a CBDC is introduced, depending on human behavior. A framework of how agents make their choices is suggested in Section 3.

3. Utility Maximization at the ELB

If a CBDC is available, people have a second form of CB money which they can use to convert their deposits in times of NIRPs. Their preference on whether to convert depends on the expected yield from the assets, in our case deposits, cash, or a CBDC. Inspired by Armelius et al. (2018), the expected asset yield (y) consists of the average of an expected risk-free short-term nominal interest rate (i) over the asset (A), its maturity (n), and a premium (). This yield can be expressed as:

The formula consists of two parts. The first part calculates the average of the expected yield (y) of the asset (A) for (n) future periods, when ( is the expected yield in period (t + k), while (k) varies from 1 to (n), inclusively. The second part represents an asset-specific premium (P) at a certain point in time (t) over the period (n) and accounts for the aggregate advantages and disadvantages of the asset (A). This premium is specific to the considered asset and encompasses factors such as costs, security, privacy, or overall preferences associated with the asset. Importantly, the expected yield can become due to a negative value of the premium negative. Even in times of positive interest rates, an aggregated negative premium (e.g., via a strong negative preference for an asset) can outweigh a positive interest rate, and vice versa.

Considering the following assets—deposits, cash, and CBDC, it can generally be assumed that the agent (J) is indifferent using any asset if the expected yield over the same period is the same for all assets.

In the classic ELB theory, only deposit rates and cash are considered. Other forms of assets cannot usually be used as a general medium of exchange compared to cash or CBDCs, due to their lower liquidity. Bank deposits have certain advantages compared to cash and usually come with bank services that might have a value for the deposit holder. Also, deposits are relatively secure and convenient to handle one-time and recurring expenses. Compared to cash, these perceived advantages might add to a positive premium () for an agent who is able to offset the NIR imposed on her/his deposit to a certain extent. This is the reason why the empirics show that the real ELB presumably lies in the negative territory and not at 0%, as the ZLB theory suggests. While negative interest rates cannot be imposed on cash (though the remuneration of cash was suggested by several economists like Silvio Gesell in the past (Gessell 1891), exchanging, holding, and securing cash comes at certain costs. When a CBDC is added to the equation, and assuming that there are no further disadvantages imposed on cash, the is always the floor for an agent’s decision to convert money either into cash or a CBDC. If a CBDC has certain advantages which lead to a higher compared to , then the overall goes up if at least one agent decides to convert a certain amount from his deposit rather into a CBDC than into cash once the ELB is reached, which causes the change in the CB’s balance sheet and potentially MP implications.

Continuing from the previous point, let us assume a scenario in a NIRP environment when the nominal interest rate is already at the ELB. In such times, an agent (J) has already made the decision to convert his/her deposits to avoid costs imposed on them, thus deposits are no longer considered as an option. The agents distribute their deposits affected by NIR between cash and a CBDC based on the values of utility from holding cash () versus CBDC (). The share of the wealth converted in cash is denominated as and the share of the wealth converted in CBDCs as It must be emphasized that an agent can also prefer converting wealth only into cash or only into CBDCs, so both the values of and lie between 0 and 1, including extreme values.

The agent’s decision is influenced by subjective preferences and the relative utilities of the assets. They try to maximize their total utility, which can be expressed as:

The utility functions ( and () are defined based on the factors relevant to the household, which could include the suggested factors for the premiums: costs, security, privacy, and further overall preferences. The baseline design suggested for the digital euro (European Commission 2023) and other CBDCs expects that CBDCs will be non-interest-bearing for daily expenses, hence = is assumed. Currently, when only cash exists, α = 1. If an agent starts to prefer CBDCs as a result of its higher premium, the distribution between cash and CBDCs changes in favor of CBDCs. The premium (P) depends on factors that can vary individually from agent to agent. It is suggested that the individual (PJ) of an agent (J) is determined by the following factor weights :

- : factor weight ( for the costs (C) for exchanging, holding, storing, transporting, and insuring the assets (A) (cash or CBDCs) of agent (J).

- : factor weight ( for perceived risks or security (R) involved with exchanging and holding the asset (A) (cash or CBDCs) of agent (J). These risks can involve risks such as security risks, theft, hacking, or system failure, thus affecting the trustworthiness of (A) overall.

- : factor weight ( for transparency (T) or privacy and anonymity of a transaction in the according asset (A) of agent (J). It is important for some users to be able to perform transactions fully anonymously, thus, transactions that are potentially fully transparent to the authorities will be seen negatively.

- : factor weight ( for overall preferences (P) for the asset (A) (cash or CBDCs) of agent (J). It includes general attitudes or predispositions towards CBDCs or cash that are not directly tied to the other weighting factors of costs, security, or transparency. They can consist of financial goals and psychological comfort and also of convenience, payment acceptance, reputation, technological affinity, or trust. Other aspects included in the factor are mentioned at the beginning of Section 4.

- These weights for the factors represent the relative importance (adding all up to 1 or 100% of the premium (P), respectively) of each factor. The weight values can shift based on societal trends, policy changes, and evolving user priorities. Also, if economic conditions change (e.g., inflation, new banking regulations), the weight given to the costs factor could shift. Importantly, it is assumed that an agent has the same value of the weight for each factor, independent of which asset they apply. The weights represent the importance of each factor; therefore, it must be the same, regardless of the assets.

However, the score for each factor might be different for each asset, for example, due to different transaction costs for CBDCs or cash, or due to different levels of security for either asset holdings. These factor scores can be expressed as:

= score for the factor of costs for either asset.

= score for the factor of perceived risk for either asset.

= score for the factor of transparency for either asset.

= score for the factor of overall preferences for either asset.

Thus, can be described as the weighted average of the factors:

Hence, for cash and CBDCs, two expressions for the premiums result:

and

To reflect the fact that the factor scores and weights might change over time, e.g., when interest rates move further into the negative area, a dynamic component (t) to the equation is added. The formula changes as follows:

The dynamic nature of the factor weights and factor scores now allows the model to adapt to different economic scenarios, providing a more accurate prediction of preferences under varying conditions. Expression (7) can now reflect, e.g., that users might tolerate NIR going from 0 to −0.25% in one period but might make a different decision when it further declines to −0.5% in the next period. Making the factor score dynamic to express that, for instance, costs might change over time, does not make the weight obsolete, because the agent (J) might also change the relative weight importances , influencing the premium for an asset accordingly.

Furthermore, to incorporate the fact that the factors might have a non-linear relationship with each other, the formula is further modified to integrate non-linear functions. For example, costs for holding either asset could increase disproportionately as holding more cash becomes more expensive per unit to secure or transport the money or, in the case of a tiered CBDC, the costs are zero up to a certain threshold with further holdings beyond this free tier being remunerated. Also, preferences could increase disproportionately with knowledge, etc. To reflect this possibility, a function is implemented which could be linear or nonlinear, respectively:

with , and being linear or nonlinear functions (e.g., linear, logarithmic, or exponential) describing the relationship between the weights and factor weights .

Inserting the premium (8) in (3), the following expression for distributing between cash and CBDCs results:

It is worth mentioning that a part of (P) consists of fixed costs for the effort of exchanging deposits into a certain amount of cash or CBDCs. Hence, an economic agent (J) will tolerate nominal interest rates below his or her individual (ELBJ) if they expect them to occur only for a brief period because bearing the exchanging costs for saving NIR for a short period might not pay off. In addition, the costs involved with exchanging and holding cash are individual costs (storage, insurance, transport, exchange), whereas the costs for exchanging and holding CBDCs (cyber-security, digital infrastructure) are expected to be incorporated by institutions such as the CB and might not be fully forwarded to (PJ).

It can be concluded that determining (P) can be quite challenging as this factor can be complex and depends on individual perception of the weight factors and scores. Notably, the resulting weight from different advantages and disadvantages could differ, yet the resulting value for (P) could still be identical for both assets. It is possible and even likely that, for instance, security or privacy get a higher scored weight factor for one asset while convenience and fungibility get a higher scored weight factor for the other asset.

The decision will hinge on which set of premiums aligns more closely with the household‘s needs, preferences, and circumstances. For instance, a household that values privacy and has limited digital access might prefer cash, while one that values convenience and digital security might lean towards CBDCs. The choice may also be influenced by the broader economic and technological environment, such as the prevalence of digital infrastructure, the stability of the financial system, and regulatory frameworks governing payment options.

As of today, no country has experienced a NIRP with CBDCs already implemented. Additionally, there is a lack of literature from other researchers examining this topic. As interest rate policy goes through cycles, there is a chance that CBDCs will already be implemented when a central bank of a major economy decides on uncommon monetary policy measures. As it was outlined, the introduction of CBDCs might influence the level of the ELB, but the extent to which the new central bank’s means of payment can influence a potential shift of the ELB is yet unclear. In the next step, two surveys are conducted and analyzed to shed light on the sentiment of economic agents and their tolerance level for NIR in the case when a CBDC, specifically DE, is introduced.

4. Materials and Methods

From a private household‘s perspective, the utility derived from choosing between cash and CBDCs (when interest rates on both assets are equally zero) would depend on how the non-interest-rate-related attributes of each asset, depicted by the premium (P), align with the household‘s lifestyle, values, and practical needs. It can also be affected by other factors such as the household‘s income level, wealth, the amount of debt, and so on. Especially for lower-income households, this decision is less about financial optimization, as they can be subjects of financial stress, and more about the real possibilities and practicality they have in daily life. The overall preferences factor includes all these aspects.

4.1. Survey Objective

The primary objective of the surveys is to explore individuals’ attitudes towards the potential introduction of CBDCs and their potential responses to NIR. The aim is to obtain a better understanding of the sentiment regarding the implementation of CBDCs and to evaluate the factor weights and scores, depicted in Section 3, that can influence the individual utility functions. The results shall help to evaluate whether the introduction of CBDCs can influence the ELB in a NIRP environment, as this might have an impact on monetary policy that needs to be considered.

4.2. Survey Design and Assumptions

This research conducted two surveys among a relevant population. Since NIRPs are a crucial part of the surveys, we decided to realize them among a population that has experienced NIRPs in the past. Also, the participants should be citizens from a relevant economy. It was suggested to perform the survey in a G20 economy because the G20 represents approximately 80% of the global GDP. Also, CBDCs should be an actual and relevant topic, so the participants should be from an economy that is at least in the development phase for the implementation of CBDCs. All these criteria are fulfilled by the Eurozone only; thus, it was decided to perform the survey among citizens of the EU. The research was divided into two surveys for two reasons. First, to avoid bias due to fatigue of the participants from a survey that is too long to keep their attention. Second, to approach the crucial question about the ELB in two different settings. The first survey (Survey I) mainly aims to explore the current sentiment about a potential implementation of CBDCs in the EU, while the second, much shorter, survey (Survey II) concentrates specifically on evaluating the qualities of the two payment forms, cash and CBDCs, as well as the levels of and .

Certain assumptions were made prior to conducting the surveys. For the succeeding consideration and the questionnaire, the suggestion for a baseline design for the digital euro will be used, thus it is assumed that a CBDC will be free of charge to natural persons within the EU, highlighting its non-remunerated nature as a public good. Limits on individual holdings of the DE are planned to mitigate potential impacts on monetary policy and financial stability, though setting these limits is not yet determined. Also, it has been indicated that the DE will not bear interest. Hence, it will be treated equally to physical banknotes, though future scenarios might lead to a reevaluation of this stance (European Commission 2023).

Moreover, when designing the questionnaires, one of the initial assumptions was that the respondents do not need any prior knowledge about CBDCs. Though both surveys provide a basic explanation of what CBDCs and the DE are, it can be assumed that the respondents have different interpretations of the questions based on their prior knowledge. However, some fundamental aspects of CBDCs or the DE were clarified in the survey introduction, such as differences with cryptocurrencies. Also, this research assumes that various external factors, such as technological advancements, regulatory changes, and global economic conditions, can influence individuals’ opinions and factors. For instance, a different intensity of the discussion about the DE in the media of participants’ country could alter public sentiment towards the DE and CBDCs in general, hence influencing . Also, changes in monetary policy could affect tolerance towards NIR (Bordo and Levin 2017). Moreover, it cannot be ruled out that the participants who are asked to measure their tolerance to NIRPs in a hypothetical situation may respond differently compared to actually being in a NIRP environment. Additionally, by ensuring anonymity and not collecting personal data, the surveys aim to elicit honest and accurate responses from the participants.

The participants for the surveys were acquired from a diverse pool of EU citizens. The questionnaires are designed to capture the perspectives of individuals with varying levels of familiarity with CBDCs and different financial circumstances. Prior to distributing the surveys, a number of pre-tests were conducted with smaller groups of participants to assess the clarity and comprehensibility of the questions, as well as to identify any potential issues related to the survey structure or the topic. Survey I was split up into 54 separate surveys to exactly match the population distribution regarding the number of citizens and the percentage of female and male residents for each of the 27 countries. It consisted of three main sections: (1) removal of cash and introduction of CBDCs, (2) impact of NIR on bank accounts or CBDCs, and (3) personal questions to gather demographic information1.

Survey I participants were excluded from Survey II, which was conducted with exactly half the number of respondents compared to Survey I. Thus, the second survey included 525 participants, reflecting the corresponding EU population distribution. Survey II was conducted with fewer groups because, according to the population distribution of the EU, further dividing the participants into group sizes according to the population would have led to groups that would have been too small to be representative. While the first survey consisted of 54 different single surveys, the second survey consisted of 20 groups (see Appendix A for the distribution for Surveys I and II). Survey II participants were asked to rate the importance of factor weights and the corresponding scores for costs, security, risk, and overall preferences on a scale of 1 to 10. They were also asked a multiple-choice question regarding the ELB, along with basic demographic questions2.

5. Results for Survey I and Survey II

In the following Section 5.1 and Section 5.2, the results of two independent surveys concerning the factor weights and factor scores as well as the individual ELB are described3.

5.1. Descriptive Results for Survey I

A total of 1050 respondents participated in this survey. The geographic distribution of the participants matches exactly the proportions of populations and male-to-female distribution of all 27 countries (see Statista 2023 for details).

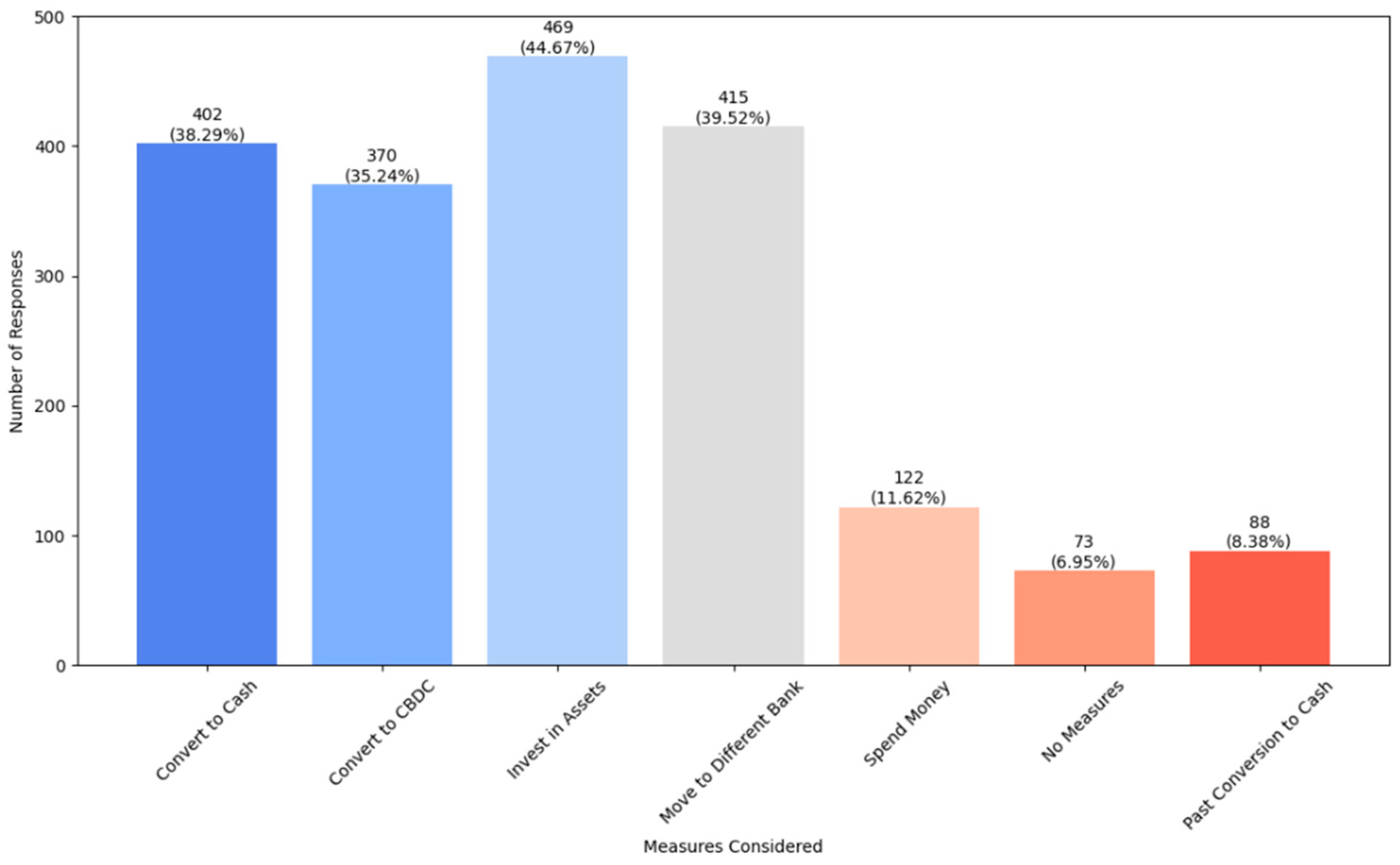

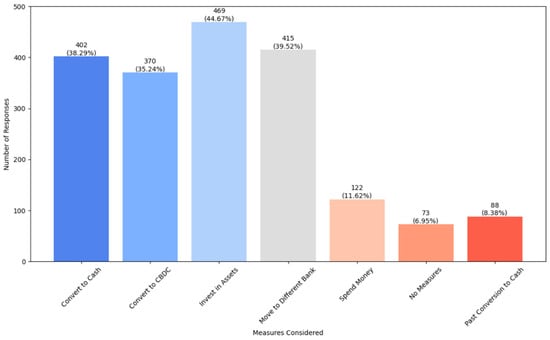

In question 2.1, participants were asked what measures they would take to avoid NIR under the assumption that a CBDC is available. Multiple answers were possible with an option not to choose any measures at all. The most favored strategies (Figure 1) include investing in other assets, chosen by approximately 44.7% of respondents, and moving funds to a bank with lower negative interest rates, selected by about 39.5%. Additionally, 38.3% of participants would convert deposits to cash, and a slightly smaller portion of the respondents, at 35.3%, would convert them into CBDCs. Interestingly, 12.3% of the participants would consider converting into both cash and CBDCs, while 26% would only consider cash and not CBDCs, and 23% would only consider converting deposits into CBDCs and not into cash in times of NIRPs (all other options set aside).

Figure 1.

Measures to avoid negative interest rates (SI, question 2.1). (Source: own).

However, spending money to avoid holding deposits is less preferred, with only about 11.6% choosing this option. Remarkably, a minimal segment of just 7% of respondents indicated that they would not take any specific measures. When asked in question 2.2 whether participants had previously exchanged deposits into cash (obviously, CBDCs were not available in the past) to avoid NIR, 8.4% confirmed they had taken such measures.

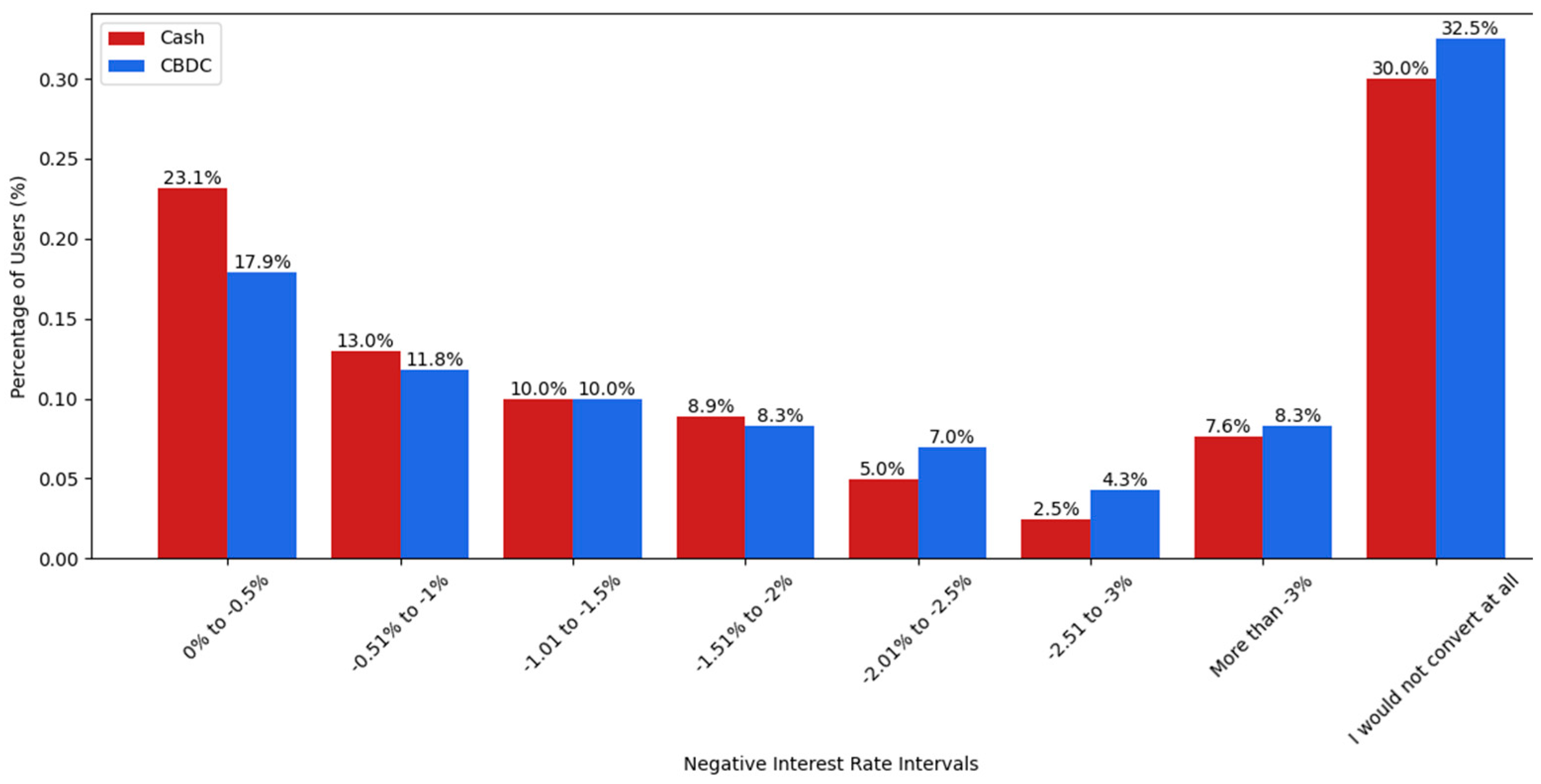

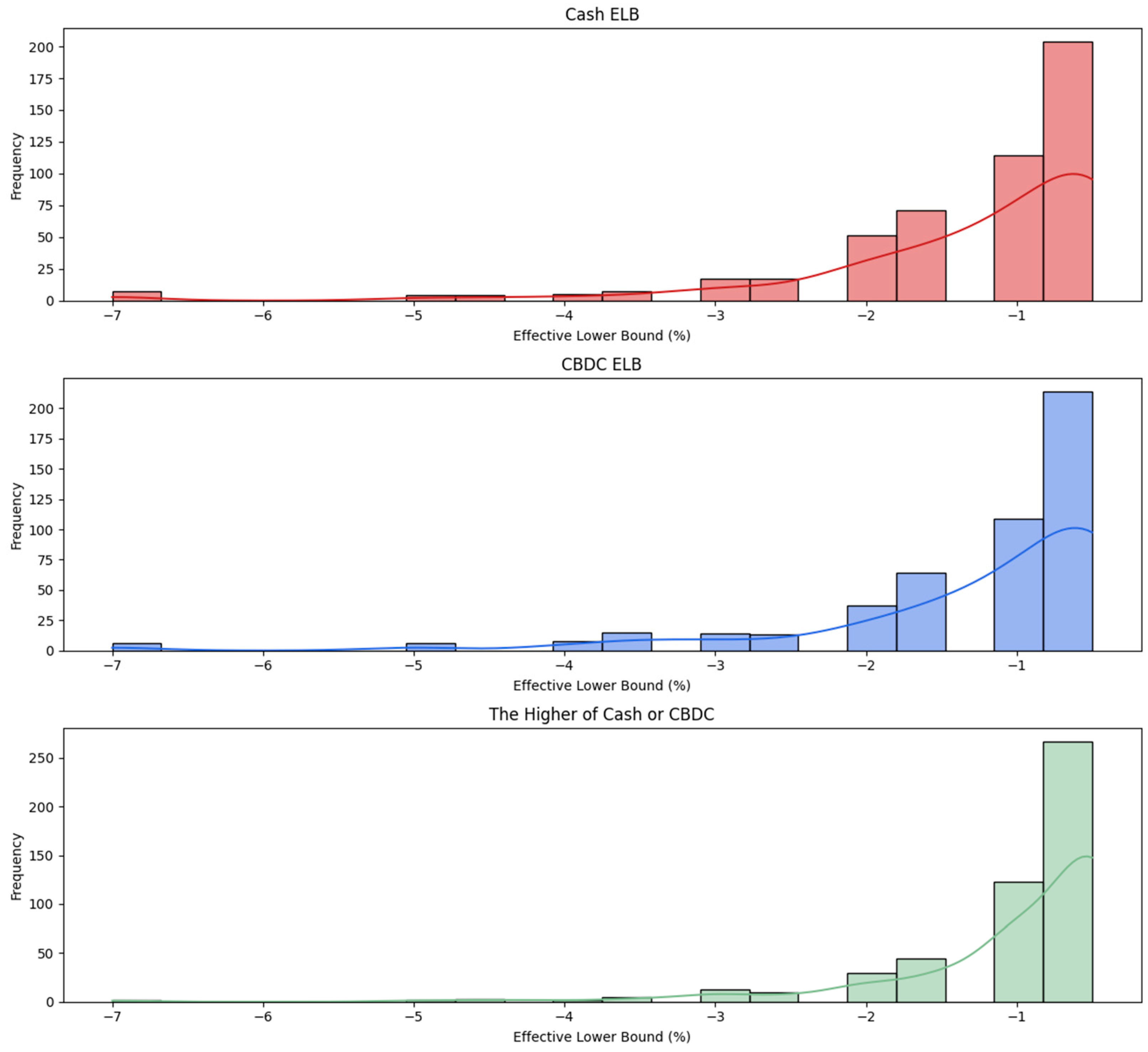

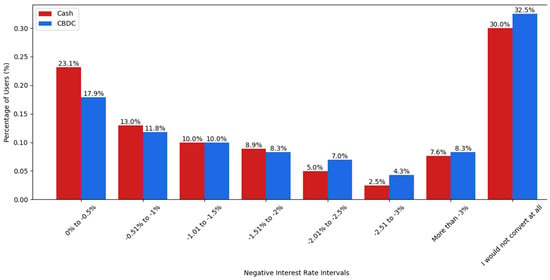

In question 2.4, the participants were asked about a threshold when they would start converting their deposits into either cash or CBDCs when NIR would be applied on their deposits. Multiple answers were possible. Because it was not mandatory to pick an option, there were less than 1050 responses for each, cash and CBDCs, available for the analysis.

Depicted by the bar-graph in Figure 2, it can be concluded that more than 83.5% of the respondents chose to convert into cash or CBDCs when interest rates fall. The number of conversions below zero happen with a declining rate towards the “more than −3%” mark. A total of 30% of the respondents chose not to convert into cash, while being open to convert into CBDCs.

Figure 2.

Negative interest differentials of individual cash-ELB and CBDC-ELB (question 2.4). (Source: own).

In contrast, 32.5% chose not to convert into CBDCs, while being open to convert into cash. Approximately 16.5% of the respondents chose not to convert their deposits at all, neither into CBDCs nor into cash, regardless of how negative interest rates would be. To look at weighted averages of the interest rates, the middle value of the evenly distributed interest rate differentials was taken. For the bracket of <−3%, an interest rate of −4.5% is assumed. For calculating the weighted averages, which are equal to the ELBs for the three options (participants being open to cash only, CBDCs only, or being open to cash and CBDCs), those participants that would not consider the respective option were excluded. For instance, in the case of calculation of the ELB both for cash and CBDCs (, the 16.5% that would not consider converting their deposits into cash or CBDCs at all were excluded. The weighted average for the interest rate for cash is at −1.37%4. This can be considered the actual ELB for cash ( for those who would consider converting into cash or CBDCs. Calculated by the same method, the weighted average interest rate for lies at −1.56%, slightly lower than the .

However, in general, it can be assumed that participants would choose rationally and convert into the option which they assume is more favorable for them. Thus, it seems appropriate to calculate the weighted average interest rate if the respondents always choose the least negative option. For example, if a participant chose that they would convert at −1.5% into cash and at −0.5% into CBDCs, it is assumed that they would convert into CBDCs when interest rates approach −0.5%, and not have any deposits left to convert when interest rates go further into the negative territory. Thus, the in this example can be considered irrelevant. So, assuming that participants only convert into either cash or CBDCs, and chose the cheaper solution, would bring the up to −1.11%. Hence, after adding CBDCs to the system, the ELB would move up by 0.26% compared to the situation where only cash is available as a remedy to NIR. Notably, an ELB shift of 0.26% is an extreme position, implying that agents act rationally and exchange everything at the respective ELB only into either cash or CBDCs. Also, it neglects that those participants who chose at the time of the survey not to convert at all into either option—regardless of how far the negative interest falls—might change their mind at a certain negative interest rate and start converting despite their original decision.

The participants were asked in question 2.7 about their distribution between cash and CBDCs in times of a banking crisis. Figure 3 shows that respondents preferred cash over CBDCs, though most participants opted for a combination of cash and CBDCs.

Figure 3.

Distribution of cash versus CBDCs in times of a banking crisis (SI, question 2.7). (Source: own).

5.2. Descriptive Results for Survey II

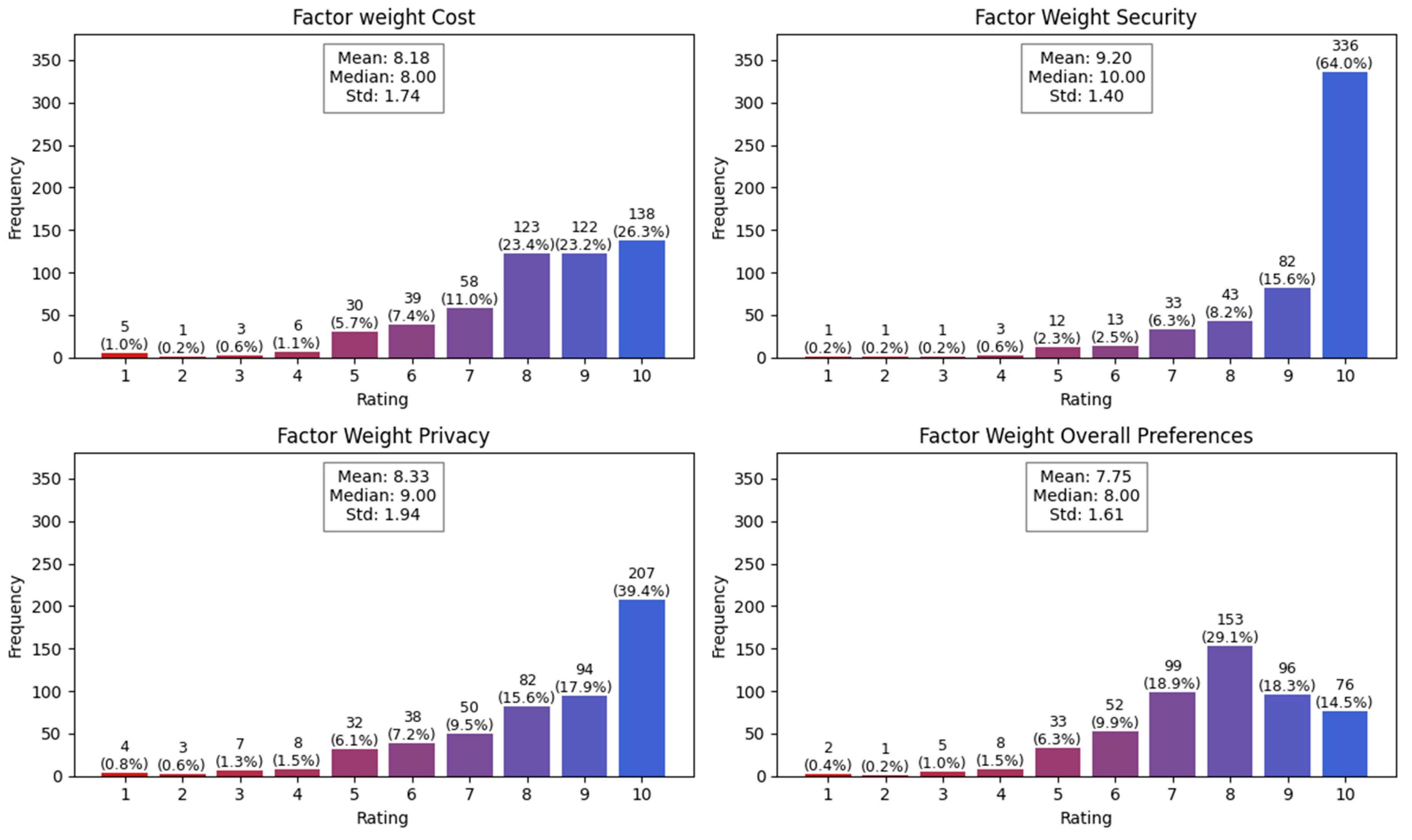

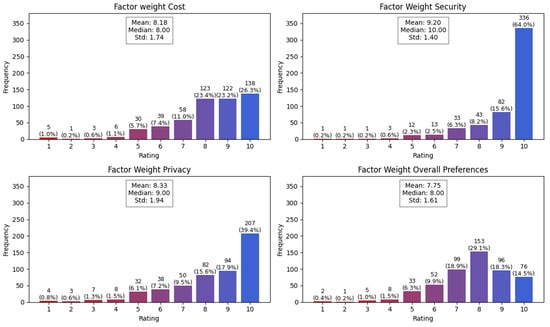

The second survey specifically targeted the factor weights and factor scores discussed previously. After the explanatory introduction, the participants were asked in question 1.1 how important the attributes costs, security (risk perception), privacy (transparency), and overall preferences are, when considering a form of payment or storage of value. They were asked to rate each quality on a scale from 1 to 10.

As seen in Figure 4, all factors received rather strong ratings. The rating for costs indicates strong consideration of costs in payment preferences. The mean score was 8.18, with a standard deviation of 1.74, suggesting a consensus among participants on the importance of costs. The security factor was the most highly rated factor with a mean of 9.20 and a standard deviation of 1.40. This highlights that security is important for either payment form.

Figure 4.

Factor weights for costs, security, privacy, and overall preferences (SII, question 1.1). (Source: own).

Privacy (transparency) also held importance, with a mean score of 8.33 and a standard deviation of 1.94. The distribution showed a slight skew towards higher ratings, indicating a strong preference for privacy in financial transactions.

The factor “overall preferences” had a mean of 7.75 and a standard deviation of 1.61. While still important, it shows a wider spread of opinions compared to other factors. In conclusion, it can be stated that security is the most critical factor, followed closely by privacy and costs, while overall preferences are less important for the respondents.

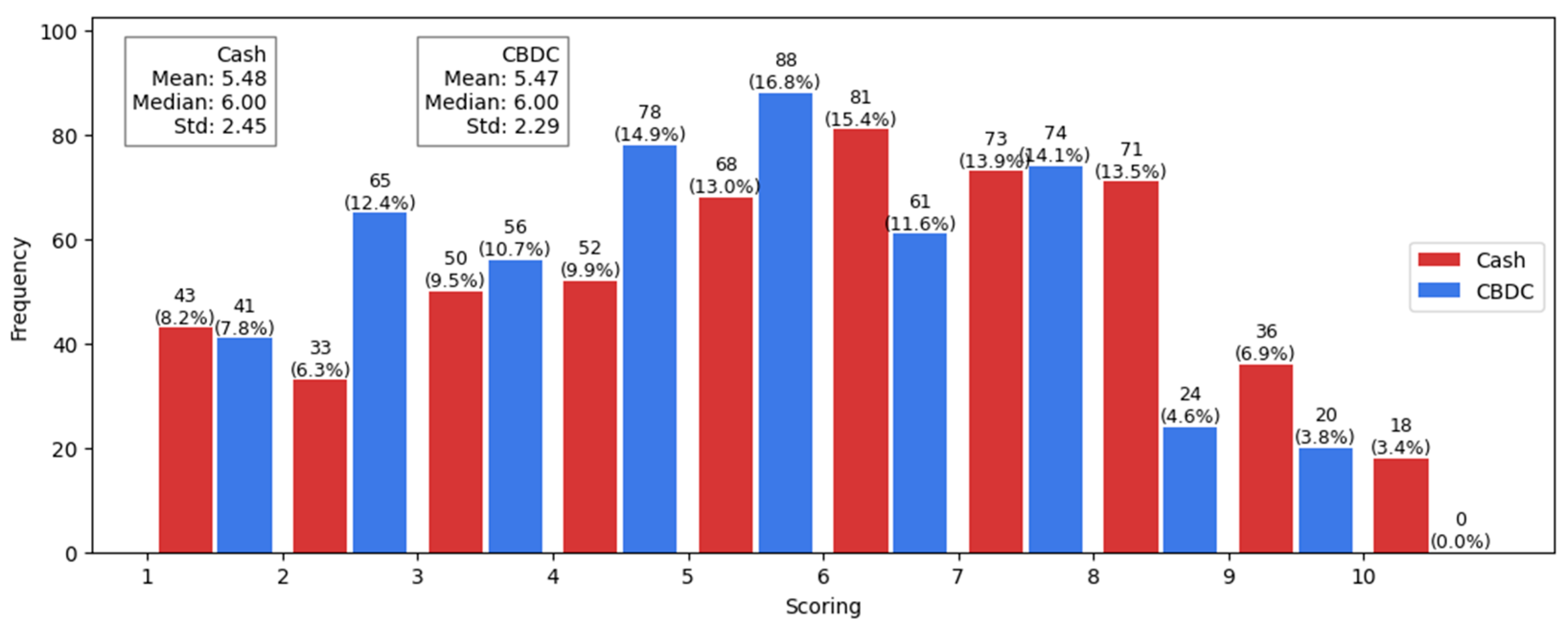

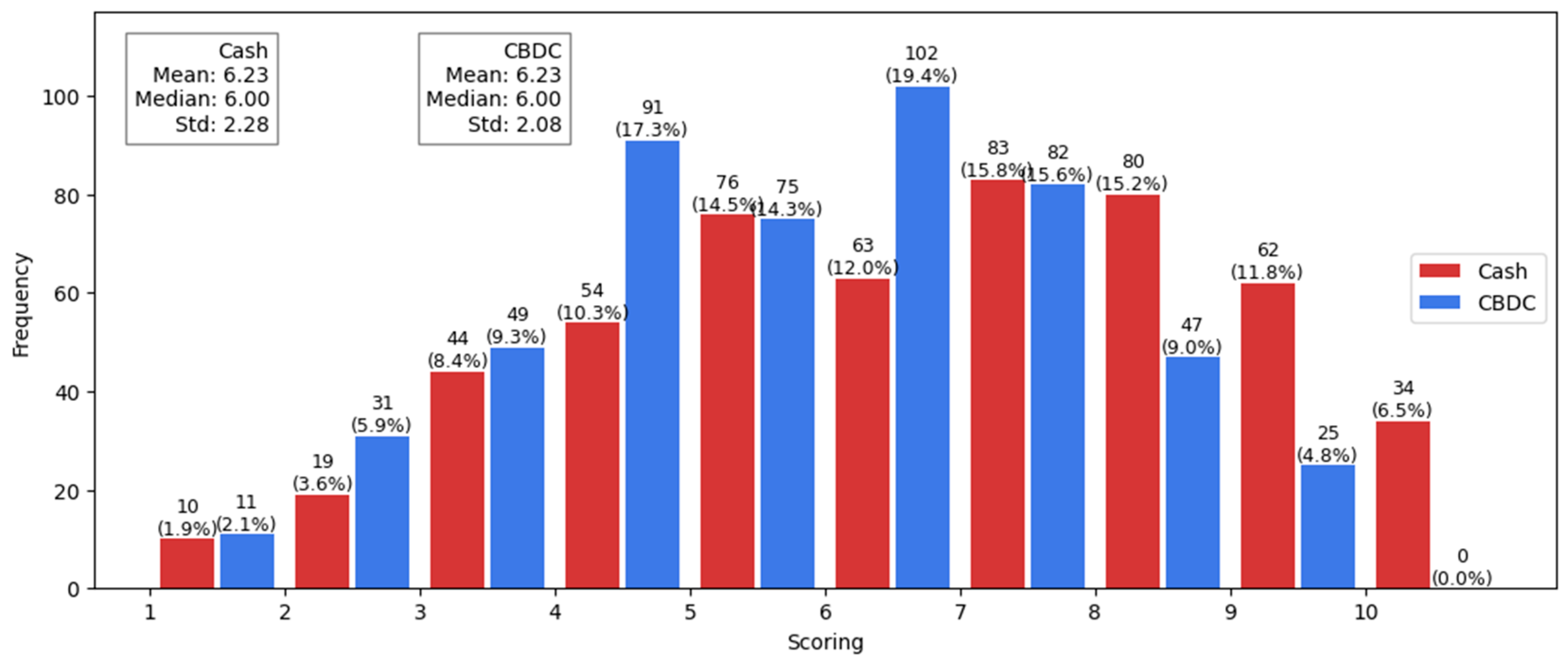

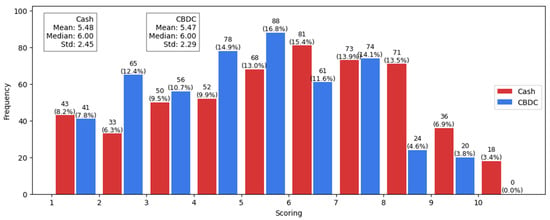

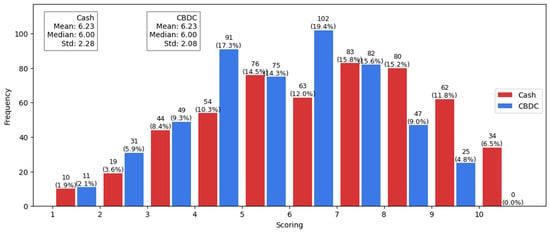

In question 1.2, the participants were asked to score the qualities of cash and CBDCs regarding costs efficiency, perceived security and privacy aspects, and the overall preferences, resulting from convenience of payments and knowledge about the payment form. The scores for the costs and security factors (see Figure 5 and Figure 6) showed comparable results, depicting no strong preference for one payment form over the other. In the case of costs, participants rated cash and CBDCs similarly, with cash scoring a mean of 5.48 and CBDCs scoring 5.47. This similarity suggests a neutral perception of both forms regarding cost-effectiveness.

Figure 5.

Factor score for costs (SII, question 1.2). (Source: own).

Figure 6.

Factor score for security (SII, question 1.2). (Source: own).

Similarly, the security scores were close, with cash and CBDCs scoring a mean of 6.23 (see Figure 6). These ratings indicate a comparable level of confidence in the security aspects of both cash and CBDCs.

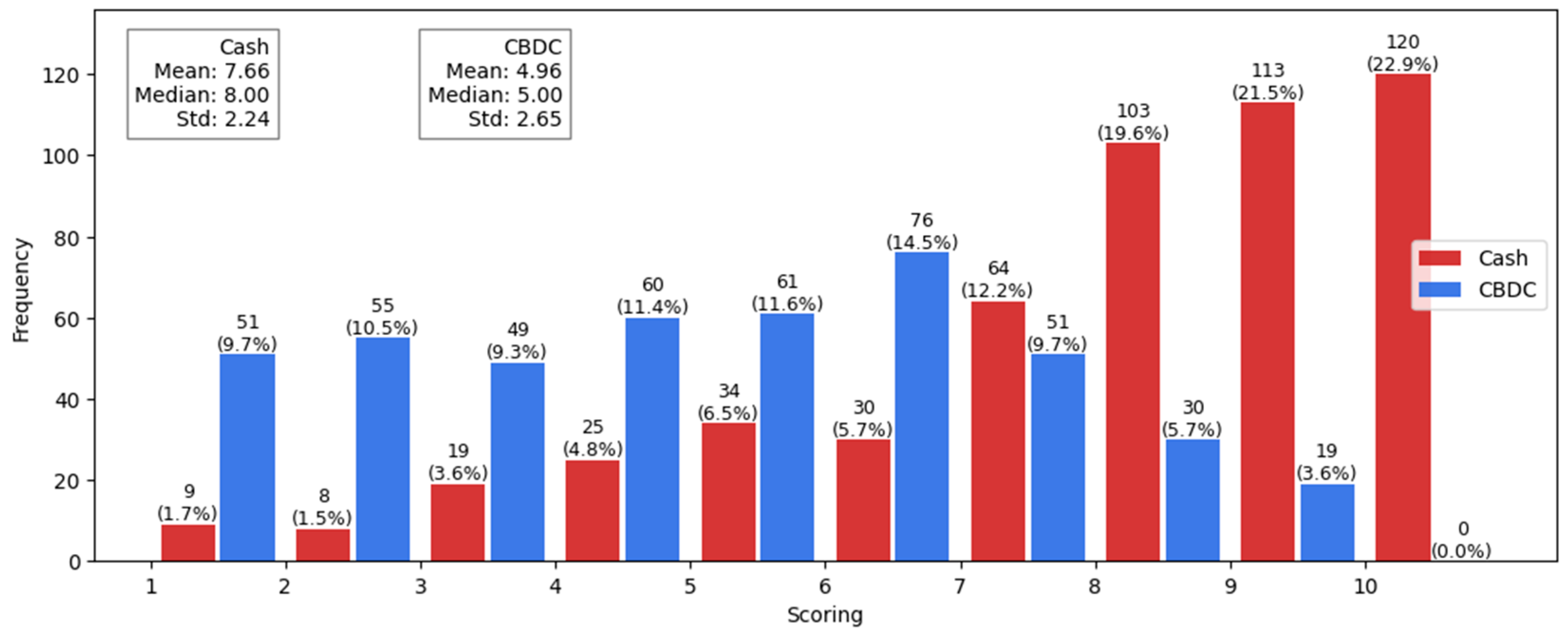

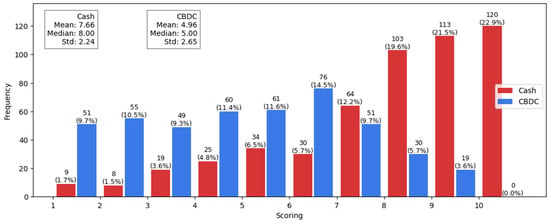

Privacy emerged as a factor where cash significantly outperformed CBDCs. The histogram in Figure 7 clearly shows that cash consistently scored higher than CBDCs, reflecting a strong preference for the privacy attributes of cash. The mean score for cash, with a value of 7.66, was significantly higher than that of CBDCs, with a value of 4.96, suggesting strong concerns about CBDCs regarding transparency.

Figure 7.

Factor score for privacy (SII, question 1.2). (Source: own).

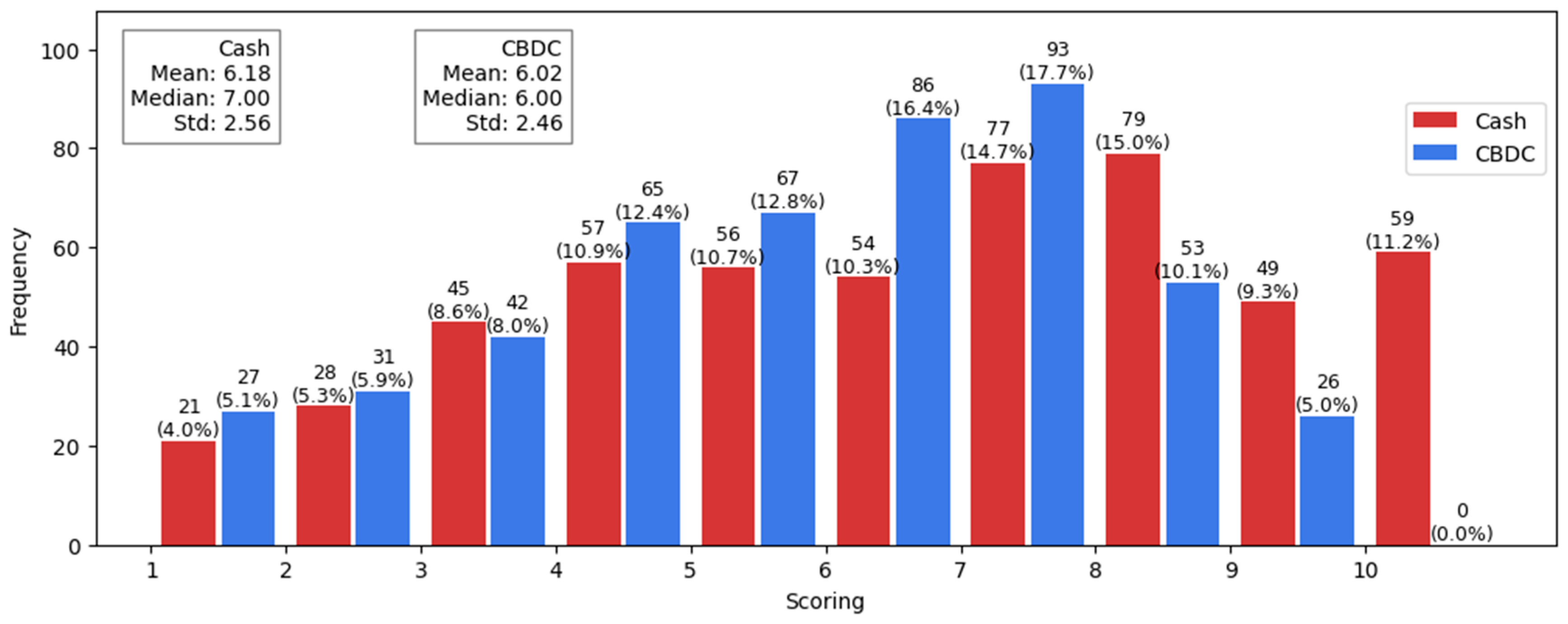

Overall preferences slightly leaned towards cash, with a mean score of 6.18 for cash and 6.02 for CBDC (see Figure 8). This indicates a marginal preference for cash when considering all factors not evaluated by costs, privacy, or security.

Figure 8.

Factor score for overall preferences (SII; question 1.2). (Source: own).

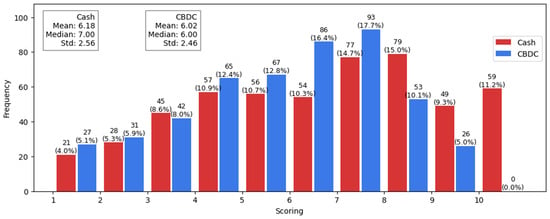

In the second section of Survey II, the participants were asked at what level of NIR they would consider moving their money out of the bank and converting it into either physical cash or the digital euro. This question is similar to question 2.4 in Survey I, with the difference that the increments for the interest rates were chosen differently. Out of the 525 responses for either cash or CBDCs, 7 chose “more than −5%” for cash, while 6 chose this option for CBDCs. This was replaced by a conservative −5.5% for both options for better analysis, and—together with the other options <−3% for Survey II—to match the proportional size for the <−3% group from Survey I. Participants also had the option to answer “I would not convert” for either payment form. A total of 24 respondents chose this option for cash, while 39 respondents chose that they would not convert at all for CBDCs. Leaving the respondents that chose not to convert into either option, the mean for the is at −1.27%, while the is slightly higher at −1.25% (see Figure 9 for details).

Figure 9.

The , the , and the (SII, question 2.1). (Source: own).

If it is assumed that the participants would convert into the option which is cheaper for them and minimize their costs in a NIRP environment, the moves up by 0.27% (this result is comparable to the result of question 2.4 of Survey I with 0.26%) to −1.00%. Also, the standard deviation decreases from 1.13% for cash and 1.14% for CBDCs to 0.86, due to the two options being available simultaneously.

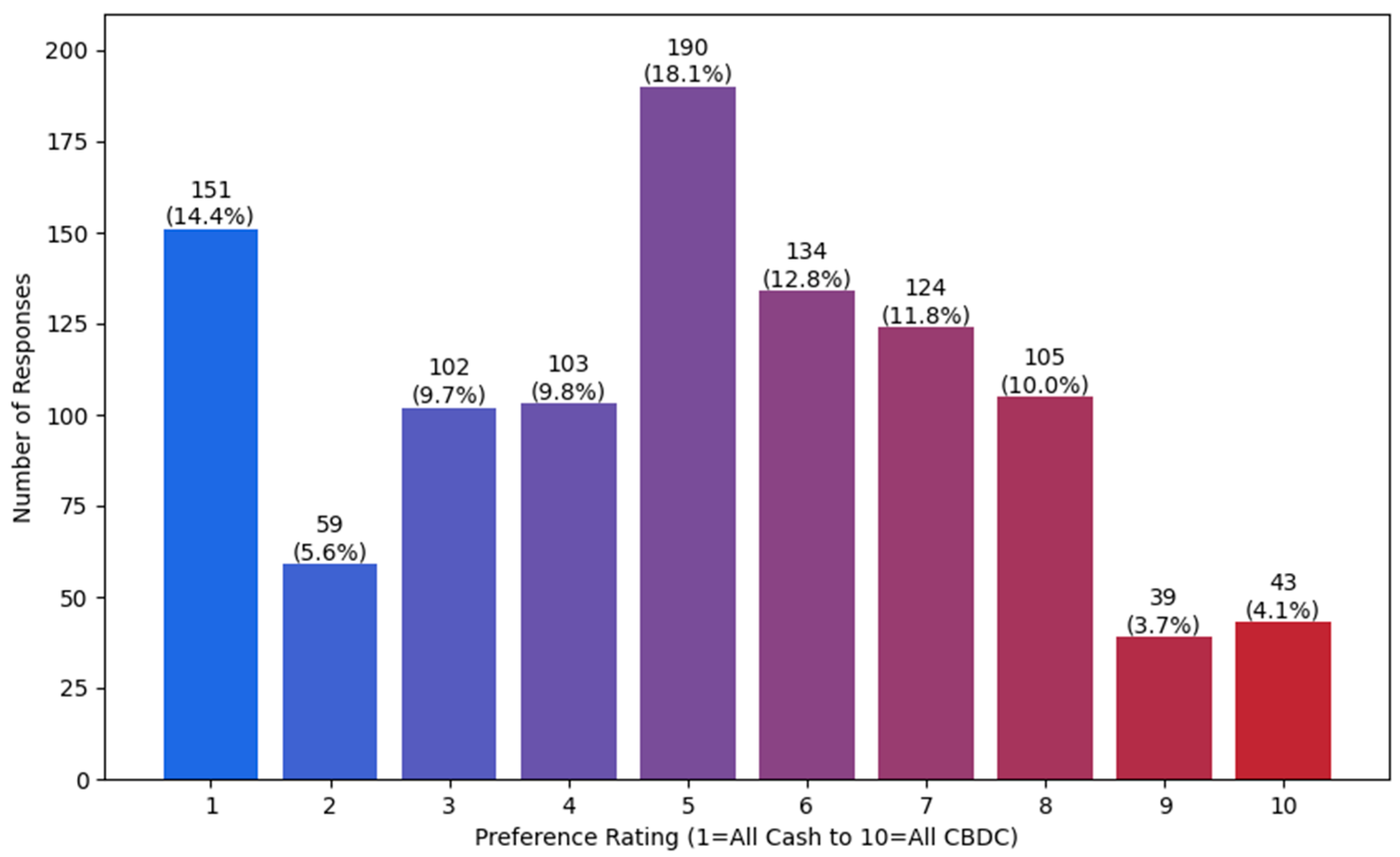

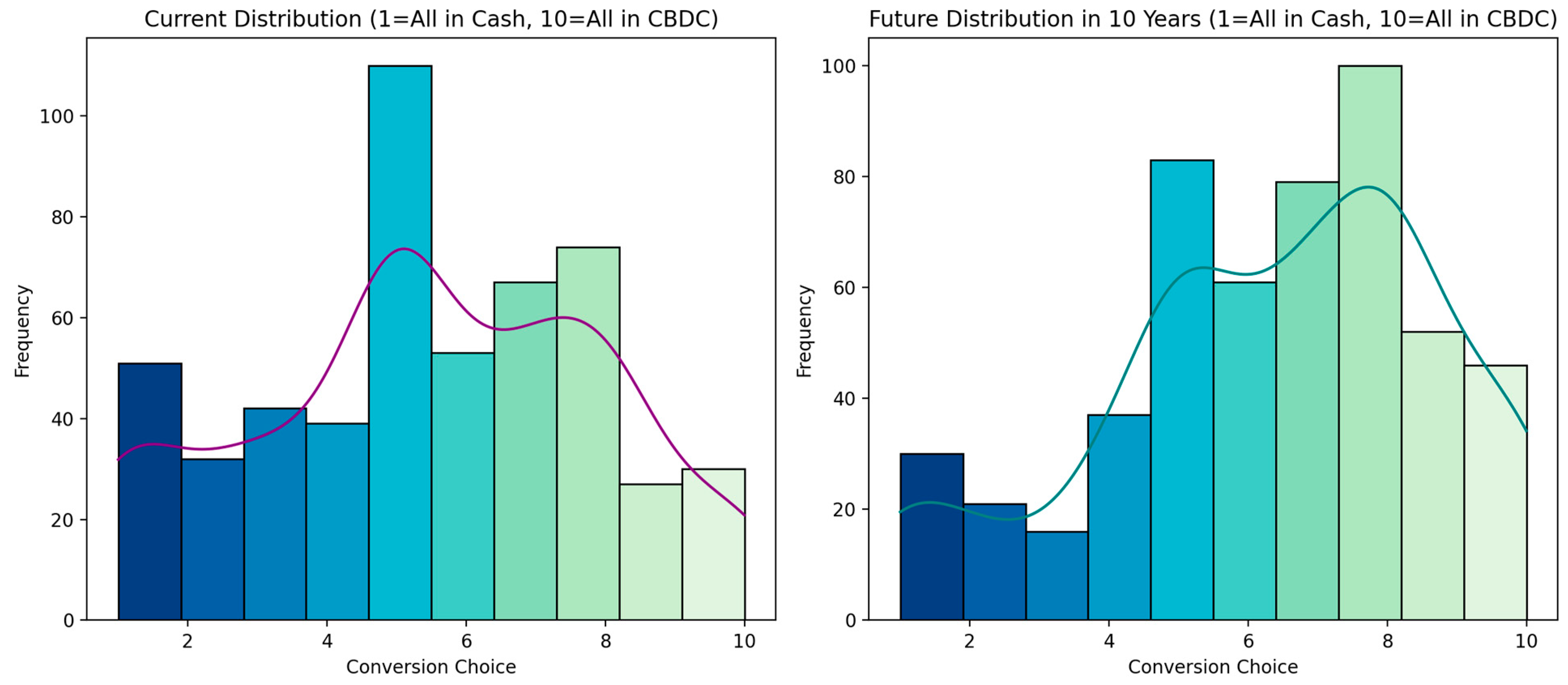

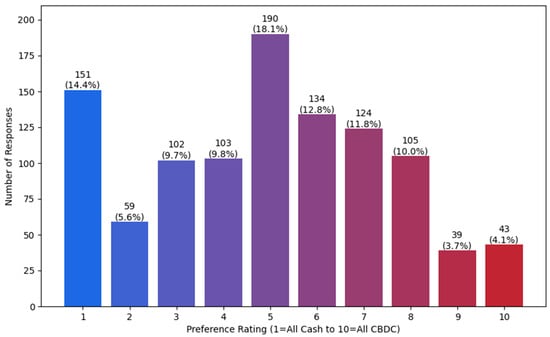

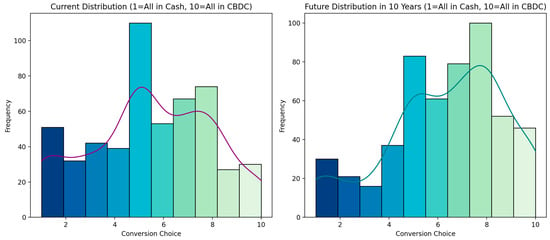

In question 2.2, the respondents were asked to pick a distribution in times of NIRPs between cash and CBDCs with options from “all cash” to “all CBDCs”, while in question 2.3, they were asked about their suggested distribution in times of NIRPs in 10 years in the future, under the assumption that CBDCs would be fully established at that time.

The current mean preference score for the use of CBDCs versus cash is 5.46 on a scale from 1 (all in cash) to 10 (all in CBDCs), with a standard deviation of 2.53. This indicates a relatively balanced preference between cash and CBDCs at present, with a slight inclination towards CBDCs. The kernel density estimations (KDE) in Figure 10, representing a smoothed estimation of the probability density for each data set, clearly show that participants will be more favorable towards CBDCs in the next decade than they are now. This can also be confirmed by the mean preference score shifting to 6.34 for the future considered period under the assumption that CBDCs are established by then and has gained in reputation.

Figure 10.

Distribution of cash and CBDCs during NIRPs now and in 10 years (SII, questions 2.2 and 2.3). (Source: own).

6. Distribution between Cash and CBDCs under NIRPs, Empiric Results and Simulation

In this section, the survey results are mapped on the distribution between cash ( and CBDCs according to the theoretical framework developed previously. The goal is to evaluate potential developments of factor weights and the corresponding factor scores over time, which—transmitted by a changing demand on cash and CBDCs—might lead to a shift in interest rate levels with potential influence on the MP.

As previously stated, the distribution between cash and CBDCs depends on the weights of factors and the factor scores that are relevant for deciding between cash and CBDCs. Hence, the survey results can be applied to obtain the distribution according to the following:

The results of the Survey I highlight that there is currently a strong preference for cash over the hypothetical use of CBDCs. This preference shifted when participants were offered CBDCs as an alternative for cash in times of NIRPs. The reasons set aside (which will be further discussed in Section 8), if CBDCs were available at the time of conducting the survey, this would have resulted in a strong (cash portion) and a weaker (1 − ), equivalent to the CBDC portion of the CB holdings from private households in times of positive interest rates.

In order to evaluate the distribution of between cash and CBDCs in times of NIR, the task can be approached from two different angles.

- A.

- Direct deduction of the distribution from the survey questions 2.1 in Survey I or 2.2 in Survey II.

- B.

- Calculate and via the normalized scored factor weights for both assets from questions 1.1. and 1.2. of Survey II.

6.1. Deducing the Cash and CBDC Distribution Directly

To calculate the distribution between cash and CBDCs under a NIRP regime according to the answers to question 2.1 and 2.2 in Survey II, it was decided to compare the results according to the following methods. First, the normalized means of the interest rates chosen for question 2.1 in Survey I, as well as question 2.2 in Survey II were used. Out of the 1050 responses, 38.29% of the participants chose cash in question 2.1 in Survey I, while 35.24% opted for CBDCs. Thus, the normalized mean preference5 is 52.07% for cash () and 47.93% () for CBDCs, respectively. Notably, in this question the participants also had the option to convert into other asset classes. Looking at the results from question 2.2 in Survey II, how respondents would distribute cash versus CBDCs in times of NIR—by calculating the means of the answers for and the and normalizing the results—a comparable distribution of 51.28% for cash () and 48.72% () for CBDCs is received.

To gain more confidence, a different method can be used to analyze the answers for question 2.2 in Survey II by scoring the responses for the and . This method has been chosen to evaluate the preferences for the payment methods in relation to each other by weighting the differences in the interest rates to a certain extent. The following scoring pattern was applied:

- Difference of 0%: score 5 for both.

- Difference up to 1%: score 6 for the less negative option, 4 for the more negative option.

- Difference up to 2%: score 7 for the less negative option, 3 for the more negative option.

- Difference up to 3%: score 8 for the less negative option, 2 for the more negative option.

- Difference above 3%: score 9 for the less negative option, 1 for the more negative option.

- “I would not convert at all” as one answer and any interest rate for the other answer: score 0 for “I would not convert at all” and 7 for the other option.

- “I would not convert at all” for both answers: score 0 for both.

Calculating the means for cash and CBDC scores and normalizing the results, a distribution of 50.67% for cash () and 49.33% () for CBDCs is received. Thus, for each of the analyses above, a similar result for the distribution of approximately 51% for cash and 49% for CBDCs is obtained.

6.2. Cash and CBDC Distribution by Normalized Scored Factor Weights

Assuming the validity of the results from 6.1, the distribution results from the analysis should be confirmed by a completely independent method of calculating the scored factor weights, resulting from answers to question 1.1 (factor weights) and 1.2 (factor scores) in Survey II. The following must be true (the non-linearity function is eliminated for simplicity reasons):

and

In question 1.1 of Survey II, the respondents were asked about the importance of costs, security, privacy (transparency), and overall preferences when making decisions regarding payment forms or storage of value (such as cash, bank deposits, or digital currencies like the digital euro). They were asked to rate each quality on a scale from 1 to 10. Calculating the mean for each factor weight, the following values were received:

As previously stated, the factor weights for costs, risk perception, transparency, and overall preferences are the same for cash and CBDCs, as agents evaluate the utility from, e.g., perceived risks or costs for them, the same, independent of the asset. Only the factor scores lead to a different or , respectively. Notably, the factor weights for the economic agents might change over time (for cash and CBDCs simultaneously), as, for example, the importance of risk aversion might increase in times of recession in relation to the importance of transparency.

In question 1.2 of Survey II, the participants were asked to score the same qualities for either payment form between 1 and 10. Calculating the mean for each score, the following values were obtained:

5.48 for costs, 5.47 for costs,

6.23 for security, 6.23 for security,

7.66 for transparency, 4.96 for transparency

6.18 for preferences, 6.02 for preferences.

Thus, for the

and

Upon normalizing the results, the values obtained are for cash and for CBDCs.

In question 2.3 in Survey II, the participants were asked what they anticipate for the distribution between cash and CBDCs in 10 years in a NIRP environment, assuming a CBDC is fully established by then. The respondents were asked to choose a distribution between 1 = all cash and 10 = all CBDCs. The results show that the respondents were inclined to be using more CBDCs than nowadays, with a cash portion of only 37% ( versus a CBDC portion of 63% . Comparing all results, the values in Table 1 are obtained:

Table 1.

Surveys I and II distributions between cash and CBDCs.

These results vary insignificantly from each other. It can be concluded, according to both independent surveys and approaching the question of the distribution between cash and CBDCs in times of NIRPs with different methods and independent questionnaires, that the distributions show an even picture with a slight advance for cash. Thus, from Surveys I and II, it can be seen that two outcomes would occur should CBDCs be implemented in a NIRP environment. First, the ELB would rise significantly, by approximately 0.25%, if economic agents had CBDCs as a second option alongside cash, both options had different weighted factors scores, and rational cost-effective decisions were assumed. Second, assuming that CBDCs would be established within a decade from now, the distribution between cash and CBDCs in times of NIR significantly changes in favor of CBDCs.

7. Monte Carlo Simulation of the ELB with CBDCs Implemented

The participants of both surveys were asked about the level of negative interest rates at which they would start converting their deposits into either cash or CBDCs. The results for question 2.4 in Survey I () showed that the lies at −1.37% while the lies at −1.56%. Assuming that agents behave rationally and are inclined to convert their deposits at the level that is the most cost-efficient for them individually, adding CBDCs as an option lifts the to −1.11%.

The results for Survey II (questions 2.1) indicated that the stood at −1.27%, while the alone was at −1.25%. Also, combining the two options and assuming rationality and most cost-effective individual choices, the increases by 0.27% to −1.00% when adding CBDCs as an alternative to cash.

In both surveys, the means for and did not differ significantly, considering that the participants could select options in 0.5% increments. Therefore the average of both surveys (see Table 2) was used.

Table 2.

Overview of the ELB interest rates of Surveys I and II.

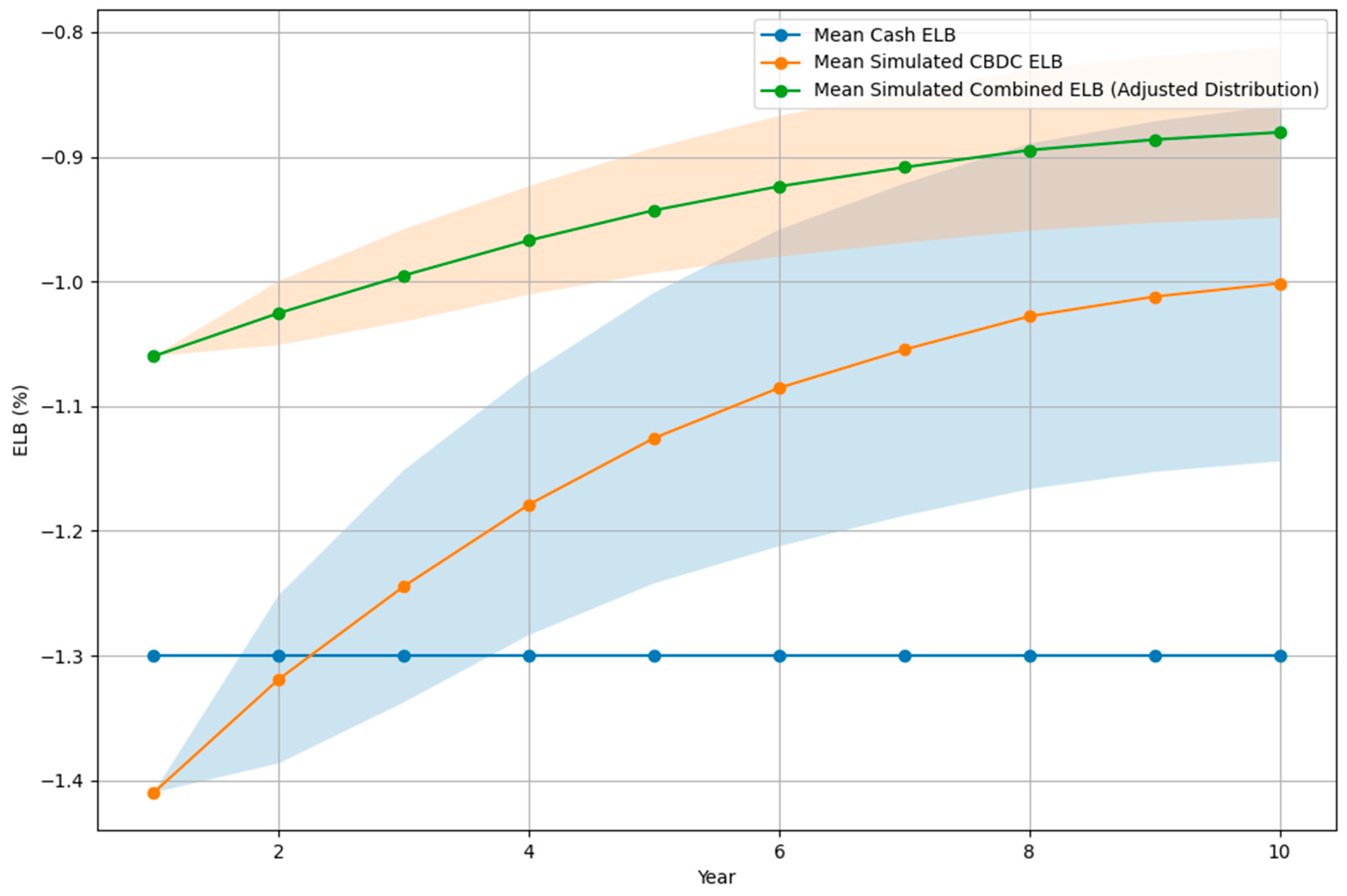

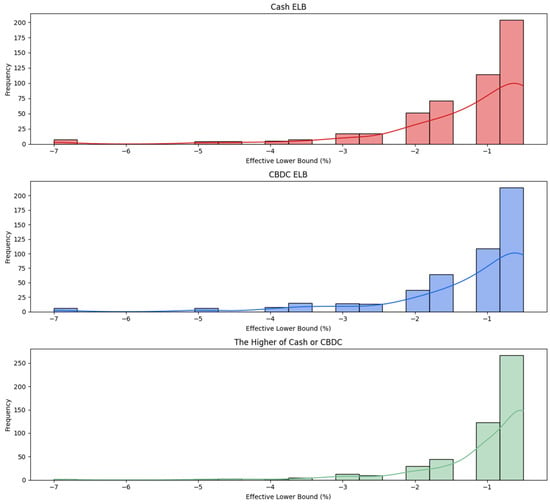

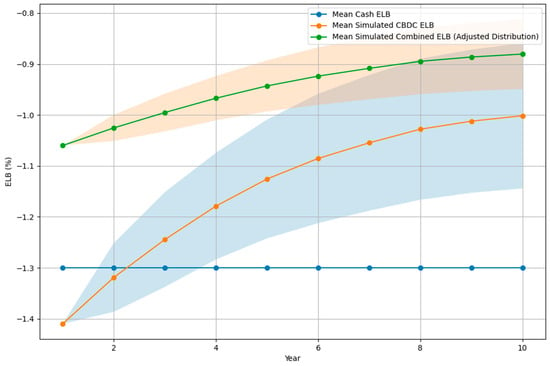

To get a better understanding of the dynamic interplay between user preferences for cash and CBDCs over time and its subsequent impact on the , a Monte Carlo simulation (MCS) framework to project the evolution of the over a ten-year period under uncertainties was developed. The MCS was constructed based on the following key assumptions:

- The remained constant over time. The average of Survey I + II results, with a value of −1.30%, was used.

- The starting point for was the average of Survey I + II, with a value of −1.41%.

- Each year, the increased (became less negative), with a decreasing probability over time7. A 70% probability of a 10% increase in the was assumed for the first year, with a linear decreasing probability for a 10% increase in subsequent years, making it less likely that the would increase in later years compared to each previous year. Higher percentages for an increase in the first year lead to higher levels of the ELB overall, assuming a stronger improvement in factor scores.

- The distribution for the starting point was the Survey II results of 52% cash versus 49% CBDCs.

- The endpoint for the distribution between cash and CBDCs in 10 years was 37% cash versus 63% CBDCs, according to the Survey II results. A linear development for the development of the distribution over 10 years was suggested.

A simulation with 100,000 iterations demonstrates a dynamic development of the combined ELB over the 10 year period. The starts at −1.06% and increases by 0.18% over time to −0.88%, reflecting the potential improvement in the .

The standard deviation of the outcomes, which is represented by the shaded area in the visualization in Figure 11, indicates the variability associated with the evolving ELB. Choosing more extreme assumptions of ±50% uncertainty in the distribution 37/63 (cash/CBDCs) in 10 years, or a higher uncertainty in the probability of the yearly increase in , as well as a higher or lower starting or endpoint of the yearly probabilistic increase, changes the simulation results but not the overall tendency.

Figure 11.

Monte Carlo simulation of dynamic development of the ELB over 10 years under dynamic uncertainty. (Source: own).

Additionally, changing the assumption for an increase in the first period has a high impact on the outcome. For example, assuming that the would have an extreme probability of increasing by 30% in the first year leads to a higher in year 10 of approximately −0.58% (ceteris paribus). However, even more extreme scenarios only lead to an increase in the without reaching the ZLB, due to the share of in the overall resulting .

8. Discussion of Research Findings

8.1. CBDC and the DE Demand and Adoption

Participants of Survey I were queried about their preference for cash versus the DE, and whether they would support the removal of cash. The results showed a preference for cash over the CBDC in times of NIRPs. This is in alignment with the results from Bearing Point, showing that cash remains the most popular payment method in Europe, though participants also endorse other digital payment forms. A strong majority of the respondents stated that they would not turn away from cash within the next five years (Bearing Point 2023). This was also confirmed by Survey II, which showed a 51/49 distribution for cash and the CBDC today and a 37/63 distribution for cash and the CBDC in a NIRP environment 10 years from now.

8.2. Concerns about CBDCs

The findings from Survey II, where participants rated the importance of the costs, security, privacy, and overall preferences factors on a scale from 1 to 10, show a clear correlation. The mean score for privacy (also referred to as transparency) was 8.33, with a standard deviation of 1.94, indicating that privacy is highly valued by participants. As emphasized by other researchers, addressing privacy concerns and data protection to enable public adoption of CBDCs is crucial (Bilotta and Botti 2021; Schianchi and Mantovi 2023).

Security also ranks as a top priority among economic agents as highlighted by various researchers (Aysan and Kayani 2021; Bilotta and Botti 2021; Kiff et al. 2020). Similarly, it was a top priority in Survey II, with the highest mean score of 9.20 and a standard deviation of 1.40.

In Survey II, the costs factor received a strong rating, evidenced by a mean score of 8.18 and a standard deviation of 1.74, suggesting that participants place considerable importance on the cost implications of payment methods and storage of value in general. Only a few sources, such as Keister and Sanches (2023), mention concerns that costs for accessing payment networks are a reason people use cash. Thus, the costs for CBDCs should be comparable to cash to facilitate adoption. Overall, the survey expresses high levels of concerns about government control, privacy, and security, as well as a moderate consideration for costs.

8.3. ELB Interest Rates under NIRPs

To date, no empiric results have yet existed about the or the . Therefore, the survey results can only be compared with the empirical data of the outlined in the literature research.

Survey I results indicated an of −1.37%, while Survey II showed −1.27%, and the average of Surveys I and II, −1.30, aligns closely with several estimates from other researchers. Witmer and Yang (2016), as well as De Fiore and Tristani (2018), approximate the ELB at around −1%. This also aligns with another empirical framework, such as the Czech National Bank‘s estimate of a corridor for the for between −2% and −0.4% (Kolcunová and Havránek 2018).

Experiences from other CBs, such as the Swiss National Bank and the Danish Central Bank, suggest less room for MP of around −0.75% (Jensen and Spange 2015). These are experienced values that have not triggered a noticeable conversion from deposits into cash. Hence, it can be assumed that the real will be more negative because these rates have not put the to the test yet (Bech and Malkhozov 2016). This is also valid for the experienced NIR of −0.5%, which has been implemented by the ECB and the Riksbank in Sweden (Altavilla et al. 2022; Erikson and Vestin 2021).

The experience of unconventional MP tools in a NIR environment in the euro area clearly disproves the idea of a ZLB and might make a reassessment of the level of the real necessary. With the restriction of a cash-only regime, the results from other researchers as well as results from this research suggest additional room for MP tools below NIR levels previously experienced. However, the introduction of the DE might lead to a change and could further influence the ELB. Assuming that the results from Surveys I and II have merit, giving market participants another option with CBDCs to escape NIR (assuming rational choices as well as cost-efficient behavior) leads to a less negative . This research suggests that introducing the DE could shift in the ELB towards more positive rates by 0.25%, providing the ECB with less MP flexibility. Furthermore, the shift could become more extreme over time if the DE becomes more established.

8.4. Distribution of Cash and CBDCs

In Survey II, the participants were asked how they would distribute cash versus CBDCs in times of NIRPs. To answer this question is particularly important because, for example, researcher Li (2023) stated that a higher demand for CBDCs would crowd out demand for cash and cash deposits between 4% and 52%, depending on whether CBDCs would be perceived as an alternative to cash or deposits, respectively. A certain crowding out effect is likely if agents are offered an alternative to cash, and this could also be confirmed by the survey results. Additionally, a model by Huynh et al. (2020), analyzing consumer choices for payment options in Canada, suggests that CBDCs would likely coexist with existing payment options but would crowd out cash to a certain extent.

The answers for question 2.4 in Survey I show that approximately 67.5% of the participants did not exclude the conversion into CBDCs when confronted with NIR. Furthermore, participants from Survey II confirmed in question 2.2 a certain crowding out for the demand for cash with a rather balanced distribution between cash and CBDCs. Notably, the number of participants in Survey I that chose not to convert under NIRPs in a cash-only regime of 315 (30%) diminished to 173 (16.5%) when given the opportunity to also convert into CBDCs instead of cash alone. Hence, the number of participants that chose not to convert in a NIRP environment decreased significantly when given the additional option to convert into CBDCs instead of cash only. Moreover, as the answers from question 2.2 and 2.3 in Survey II suggest, it is expected that the crowding out of cash would even increase if CBDCs were implemented and gained reputation over time.

8.5. Factor Weights and Factor Scores

The previously outlined theoretical framework details the interdependencies between certain weighted factors. Again, an equal interest rate of 0% for physical cash as well as for CBDCs is assumed. Consequently, the interest rate, as an influencing factor in the distribution between cash and CBDCs, can be neglected. In the literature (Blanchard 2020), the reasons for the ELB being below zero are predominately limited to cost differences between costs for deposit (including negative interest rates) and costs for exchanging and holding cash. The purported rise of the ELB when moving from to results not only from the lower costs involved with exchanging, transporting, and storing CBDCs compared to cash, as most standard literature for the ZLB and the ELB suggests. As can be seen from the survey results and the theoretical framework, costs is not the for only factor and the effect on the interest rate level from changing costs is not as strong as intuitively thought. Survey II results show that high factor weights for costs (mean 8.18), security (mean 9.20), and privacy (mean 8.33) align with Li’s findings that highlight that security and anonymity are most important for CBDC demand (Li 2023). Similarly, Huynh et al. (2020) also identified transaction costs, security, ease of use, and affordability as key attributes of payment methods. The researchers also concluded that security is the most significant attribute (Huynh et al. 2020). Additionally, the high privacy scores for cash, with a mean of 7.66 in Survey II, show cash far outperforming CBDCs, with a mean of 4.96. This aligns with studies from Huynh et al. or Li emphasizing anonymity’s importance for cash demand (Huynh et al. 2020; Li 2023). These findings could also be confirmed by Bijlsma et al. (2023). After researching the triggers for CBDC consumer adoption in the Netherlands, they also concluded that security and privacy protection are the key drivers for successfully implementing CBDCs.

Huynh et al. (2020) suggest, while analyzing consumer payment choices and the introduction of a CBDC in Canada, that CBDCs would have to be significantly better regarding factors such as costs, security, and user-friendliness to be successful. However, it can be argued that, while this research confirmed the importance of addressing these factors, CBDCs can still be successful even if they do not score higher than cash (or other payment forms) in all relevant product attributes. Thus, CBDCs can be successful even if they have lower scores in some factors compared to other payment forms, as long as the overall premium, determined by the weighted factor scores, remains competitive. Given the variation in economic agents’ preferences and their perception of the advantages and disadvantages of various assets, it is not a “winner takes it all” situation. Higher differences in premiums result in a higher market share for the payment form with the higher score. Moreover, the Monte Carlo simulation in Section 7 suggests that a further improvement in factor score for costs and overall preferences over time can lead to a further increase in the level and a higher share in the distribution between cash and CBDCs during NIRPs.

9. Conclusions

This research examines the potential impact of introducing CBDCs on the ELB in the case of the digital euro. We found, based on our survey realized in two questionnaires, that if NIRPs were introduced, and people had the opportunity to convert deposits both in cash and CBDCs (digital euro), the value of the ELB would move it closer to zero by approximately 0.25% and would lie between −1.00 and −1.11%. Agents would convert approximately 52% of their deposits into cash, and the remainder into CBDCs, considering factors such as costs of exchanging, holding, transporting, and insuring assets, perceived risks or security, transparency, privacy and anonymity, and overall preferences. This could potentially limit CB´s flexibility under NIRPs and diminish its efficiency. Our findings underscore the importance of carefully considering the broader implications of CBDCs on MP and economic stability before issuing them. In terms of policy recommendations, the results emphasize the importance of privacy and security in CBDC designs, suggesting that CBs evaluate appropriate anonymity thresholds and privacy-enhancing technologies.

However, it should be emphasized that this research is not without limitations alongside its contributions. First, the surveys targeted only private households in the EU. Opinions may further vary across geographic regions or emerging economies based on financial maturity. Second, common limitations regarding surveys apply, and intentions expressed by survey participants when asked about hypothetical situations often diverge from actual behavior when in the situation. Finally, the rapidly shifting CBDC landscape poses a challenge to the longevity of this study. Unforeseen developments or other design choices than those assumed in this study could alter the validity of the research results.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/economies12060143/s1.

Author Contributions

Conceptualization, M.P.; methodology M.P. and P.W.; validation, M.P.; formal analysis, M.P. and P.W.; investigation, M.P.; resources, M.P.; data curation, M.P.; writing—original draft preparation, M.P. and P.W.; writing—review and editing, P.W.; visualization, M.P.; supervision, P.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding. The surveys have been funded by the author Michael Pirgmann.

Informed Consent Statement

No applicable.

Data Availability Statement

Data from surveys can be obtained based on request from authors.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

According to the Eurostat 2022 numbers the following distribution was used to cluster the participants into country-related groups, separated by male and female:

Table A1.

EU population distribution in Survey I.

Table A1.

EU population distribution in Survey I.

| EU EUR | Currency | Total | Male | % Male | Female | % Female |

|---|---|---|---|---|---|---|

| Austria | EUR | 8,964,889 | 4,416,886 | 0.9914% | 4,548,003 | 1.0209% |

| Belgium | EUR | 11,554,767 | 5,700,474 | 1.2795% | 5,854,293 | 1.3141% |

| Croatia | EUR | 3,871,833 | 1,865,129 | 0.4187% | 2,006,704 | 0.4504% |

| Cyprus | EUR | 920,987 | 449,553 | 0.1009% | 471,434 | 0.1058% |

| Estonia | EUR | 1,331,824 | 633,426 | 0.1422% | 698,398 | 0.1568% |

| Finland | EUR | 5,533,793 | 2,733,808 | 0.6136% | 2,799,985 | 0.6285% |

| France | EUR | 67,871,925 | 32,835,985 | 7.3705% | 35,035,940 | 7.8643% |

| Germany | EUR | 83,237,124 | 41,066,785 | 9.2180% | 42,170,339 | 9.4657% |

| Greece | EUR | 10,482,487 | 5,125,977 | 1.1506% | 5,356,510 | 1.2023% |

| Ireland | EUR | 4,964,307 | 2,484,658 | 0.5577% | 2,479,649 | 0.5566% |

| Italy | EUR | 59,030,133 | 28,818,956 | 6.4688% | 30,211,177 | 6.7813% |

| Latvia | EUR | 1,893,223 | 875,225 | 0.1965% | 1,017,998 | 0.2285% |

| Lithuania | EUR | 2,810,761 | 1,304,965 | 0.2929% | 1,505,796 | 0.3380% |

| Luxembourg | EUR | 643,941 | 324,355 | 0.0728% | 319,586 | 0.0717% |

| Malta | EUR | 519,562 | 270,021 | 0.0606% | 249,541 | 0.0560% |

| Netherlands | EUR | 17,475,415 | 8,686,536 | 1.9498% | 8,788,879 | 1.9728% |

| Portugal | EUR | 10,343,066 | 4,920,220 | 1.1044% | 5,422,846 | 1.2172% |

| Slovakia | EUR | 5,449,270 | 2,665,376 | 0.5983% | 2,783,894 | 0.6249% |

| Slovenia | EUR | 2,108,977 | 1,059,938 | 0.2379% | 1,049,039 | 0.2355% |

| Spain | EUR | 47,400,798 | 23,248,611 | 5.2185% | 24,152,187 | 5.4213% |

| Totals: | 346,409,082 | 169,486,884 | 38.0435% | 176,922,198 | 39.7125% | |

| Non-EUR EU | ||||||

| Bulgaria | LEW | 6,519,789 | 3,136,262 | 0.7040% | 3,383,527 | 0.7595% |

| Czech Republic | CZK | 10,524,167 | 5,186,548 | 1.1642% | 5,337,619 | 1.1981% |

| Denmark | DKK | 5,840,045 | 2,904,857 | 0.6520% | 2,935,188 | 0.6588% |

| Hungary | HUF | 9,689,010 | 4,644,875 | 1.0426% | 5,044,135 | 1.1322% |

| Poland | PLN | 37,019,327 | 17,913,014 | 4.0208% | 19,106,313 | 4.2887% |

| Romania | RON | 19,053,815 | 9,245,544 | 2.0753% | 9,808,271 | 2.2016% |

| Sweden | SEK | 10,452,326 | 5,260,707 | 1.1808% | 5,191,619 | 1.1653% |

While the first survey consisted of 54 different single surveys, the second survey consisted of 20 groups with the following distribution:

Table A2.

Group distribution in Survey II.

Table A2.

Group distribution in Survey II.

| Country | Male | Female |

|---|---|---|

| Germany | 46 | 51 |

| France | 35 | 38 |

| Italy | 33 | 36 |

| Spain | 27 | 29 |

| Poland | 22 | 25 |

| Romania | 11 | 12 |

| Netherlands | 9 | 11 |

| Belgium | 6 | 7 |

| Greece | 5 | 7 |

| Rest of EU | 55 | 60 |

| Participants | 249 | 276 |

Notes

| 1 | Survey I questionnaire can be accessed at https://forms.gle/KXxNv6E1hR1tMb7d6 (accessed on 4 June 2023) (see Supplementary Materials). |

| 2 | Survey II questionnaire can be accessed at https://forms.gle/xPZn1sH4qzEaBX1v7 (accessed on 4 June 2023) (see Supplementary Materials). |

| 3 | The analysis of the remaining questions and the sentiment of the participants regarding the DE and the digital euro can be found at Pirgmann (2024). |

| 4 | The weighted average interest rate was calculated by taking the middle value of the interest rate differentials and assumed -4.5% for the interval of “more than −3%”. |

| 5 | The percentages are normalized by dividing each percentage by the total sum of all percentages, converting them into proportions of the whole. |

| 6 | The values were not weighted by the number of participants for Surveys I and II because it is more likely that the results for each survey are skewed by the questionnaire. Thus, the results were treated equally. |

| 7 | This seems a bit counterintuitive as one could think that the probability for the rise of the might increase over time as agents become more familiar with CBDCs, but the is not linearly correlated with the popularity of CBDCs, because as the increases, it takes disproportionally more advantages to move closer to zero, e.g., it takes less better scored factor weights for the to move from −1.5% to −1% than it takes from −1% to −0.5%. |

References

- Altavilla, Carlo, Lorenzo Burlon, Mariassunta Giannetti, and Sarah Holton. 2022. Is there a zero lower bound? The effects of negative policy rates on banks and firms. Journal of Financial Economics 144: 885–907. [Google Scholar] [CrossRef]

- Andersson, Fredrik N. G., and Lars Jonung. 2020. Lessons from the Swedish Experience with Negative Central Bank Rates. Cato Journal 40: 595–612. [Google Scholar]

- Armelius, Hanna, Paola Boel, Carl Andreas Claussen, and Marianne Nessén. 2018. The E-Krona and the Macroeconomy. Sveriges Riksbank Economic Review 3: 43–65. [Google Scholar]

- Aysan, Ahmet Faruk, and Farrukh Nawaz Kayani. 2021. China’s Transition to a Digital Currency: Does It Threaten Dollarization? SSRN Electronic Journal 2: 100023. [Google Scholar] [CrossRef]

- Bearing Point. 2023. Survey: Cash Is Number One in Europe|BearingPoint. Available online: https://www.bearingpoint.com/en/about-us/news-and-media/press-releases/survey-cash-is-number-one-in-europe/ (accessed on 13 January 2024).

- Bech, Morten L., and Aytek Malkhozov. 2016. How Have Central Banks Implemented Negative Policy Rates? Basel: Basel Committee on Banking Supervision. [Google Scholar]

- Bijlsma, Michiel, Carin van der Cruijsen, Nicole Jonker, and Jelmer Reijerink. 2021. What triggers consumer adoption of Central Bank Digital Currency? Journal of Financial Services Research 65: 1–40. [Google Scholar] [CrossRef]

- Bilotta, Nicola, and Fabrizio Botti. 2021. The (Near) Future of Central Bank Digital Currencies. Lausanne: Peter Lang AG. [Google Scholar] [CrossRef]

- Bindseil, Ulrich. 2022. Central Bank Digital Currencies in a World with Negative Nominal Interest Rates, Perspectives in Law, Business and Innovation. In The Future of Financial Systems in the Digital Age. Edited by Markus Heckel and Franz Waldenberger. Berlin/Heidelberg: Springer, pp. 75–88. [Google Scholar] [CrossRef]

- Blanchard, Olivier. 2020. Macroeconomics, 8th ed. London: Pearson. [Google Scholar]

- Bordo, Michael D., and Andrew T Levin. 2017. Central Bank Digital Currency and the Future of Monetary Policy. NBER Working Paper Series, Working Paper 23711; Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Czudaj, Robert L. 2020. Is the negative interest rate policy effective? Journal of Economic Behavior & Organization 174: 75–86. [Google Scholar] [CrossRef]

- De Fiore, Fiorella, and Oreste Tristani. 2018. (Un)Conventional Policy and the Effective Lower Bound. European Central Bank Working Paper Series, No. 2183; Frankfurt: European Central Bank. [Google Scholar] [CrossRef]

- Erikson, Henrik, and David Vestin. 2021. Pass-through of Negative Policy Rates. Stockholm: Sveriges RiksBank. [Google Scholar]

- European Commission. 2023. Regulation of the European Parliament and of the Council on the Establishment of the Digital Euro. Commission Staff Working Document. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52023PC0369 (accessed on 20 April 2024).

- Franta, Michal. 2021. The Likelihood of Effective Lower Bound Events. Macroeconomic Dynamics 25: 2058–79. [Google Scholar] [CrossRef]

- Gessell, Silvio. 1891. Die Reformation des Münzwesens als Brücke zum sozialen Staat. Buenos Aires: Selbstverlag. [Google Scholar]

- Huynh, Kim, Jozsef Molnar, Oleksandr Shcherbakov, and Qinghui Yu. 2020. Demand for Payment Services and Consumer Welfare: The Introduction of a Central Bank Digital Currency. Bank of Canada Staff Working Paper, No. 7. Ottawa: Bank of Canada. [Google Scholar]

- Jensen, Carina Moselund, and Morten Spange. 2015. Interest Rate Pass-Through and the Demand for Cash at Negative Interest Rates. Danmarks Nationalbank Monetary Review, 2nd Quarter. København: Danmarks Nationalbank. [Google Scholar]

- Keister, Todd, and Daniel Sanches. 2023. Should Central Banks Issue Digital Currency? The Review of Economic Studies 90: 404–31. [Google Scholar] [CrossRef]

- Kiff, John, Jihad Alwazir, Sonja Davidovic, Aquiles Farias, Ashraf Khan, Tanai Khiaonarong, and Majid Malaika. 2020. A Survey of Research on Retail Central Bank Digital Currency. IMF Working Papers 20. Washington, DC: International Monetary Fund. [Google Scholar] [CrossRef]

- Kolcunová, Dominika, and Tomáš Havránek. 2018. Estimating the Effective Lower Bound on the Czech National Bank’s Policy Rate. Czech National Bank Working Paper Series, 9/2018; Praha: Czech National Bank. [Google Scholar]

- Li, Jiaqi. 2023. Predicting the demand for central bank digital currency: A structural analysis with survey data. Journal of Monetary Economics 134: 73–85. [Google Scholar] [CrossRef]

- Meaning, Jack, Ben Dyson, James Barker, and Emily Clayton. 2021. Broadening narrow money: Monetary policy with a central bank digital currency. International Journal of Central Banking 17: 1–42. [Google Scholar] [CrossRef]

- Panetta, Fabio. 2021. Evolution or Revolution? The Impact of a Digital Euro on the Financial System. Frankfurt: European Central Bank. [Google Scholar]

- Pirgmann, Michael. 2024. The sentiment for the digital euro: European survey. Mladá Veda 12: 102–35. [Google Scholar]

- Schianchi, Augusto, and Andrea Mantovi. 2023. The Future Monetary System. In The Economics of Cryptocurrencies and Digital Money: A Monetary Framework with a Game Theory Approach. BIS Annual Economic Report. Cham: Springer International Publishing, pp. 117–43. [Google Scholar] [CrossRef]

- Statista. 2023. Estimated Population of Europe from 1950 to 2023, by Gender. Statista, November 21. [Google Scholar]

- Wawrosz, Petr, and Semen Traksel. 2023. Negative Interest Rates and Its Impact on GDP, FDI and Banks’ Financial Performance: The Cases of Switzerland and Sweden. International Journal of Financial Studies 11: 69. [Google Scholar] [CrossRef]

- Witmer, Jonathan, and Jing Yang. 2016. Estimating Canada’s Effective Lower Bound. Bank of Canada Review. Ottawa: Bank of Canada, pp. 3–14. [Google Scholar]

- Yellen, Janet. 2018. Comments on Monetary Policy at the Effective Lower Bound. Brookings Papers on Economic Activity 2018. Baltimore: The Johns Hopkins University Press, pp. 573–79. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).