Selected Socio-Economic Aspects of the Last Two Economic Crises in Slovenia Assessed through a Three-Stage Territorial Model

Abstract

1. Introduction

2. Theoretical and Methodological Approach

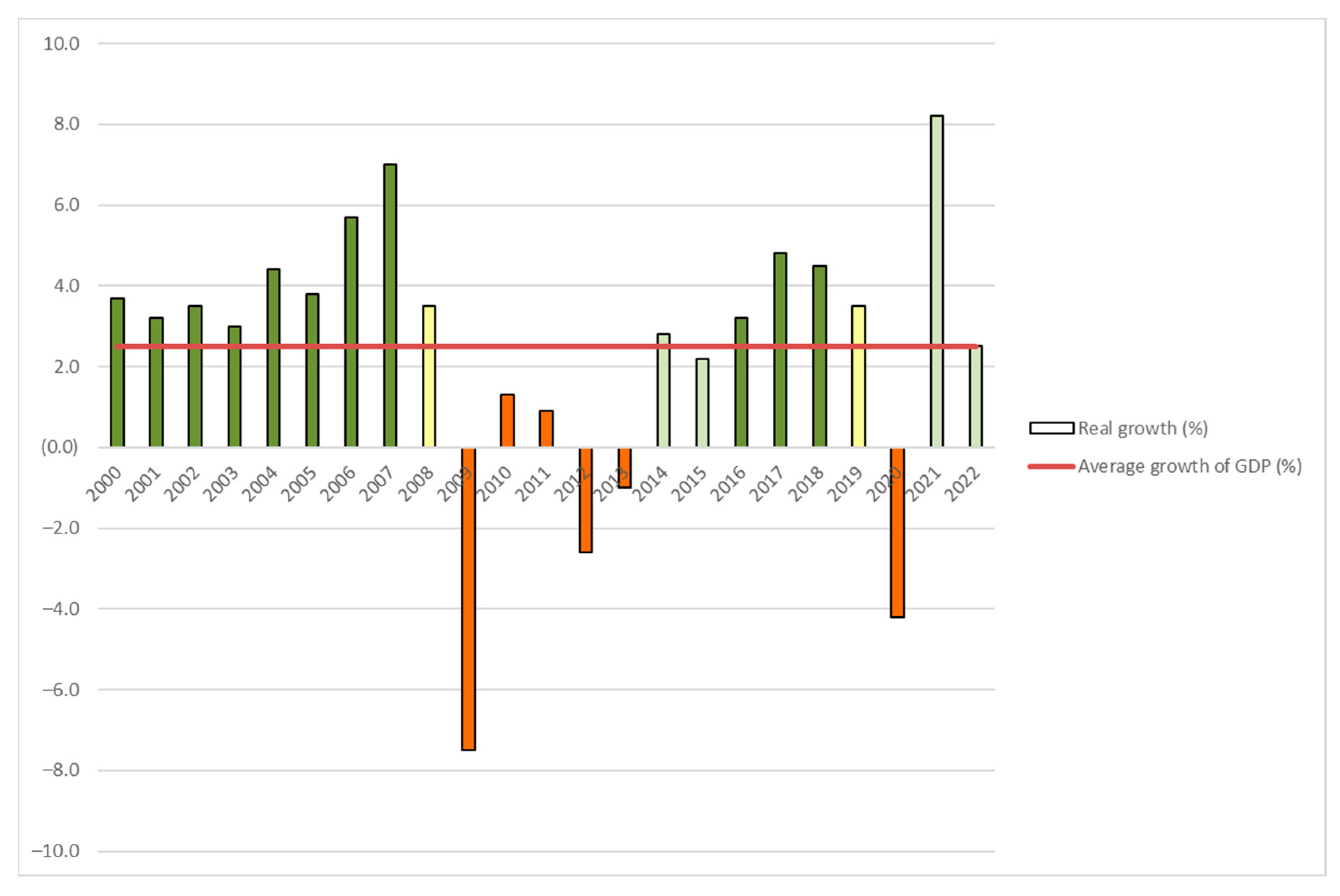

2.1. Defining Stages of Economic Cycles in Slovenia after 2000

2.2. Economic Crises in Slovenia after 2000: Previous Research

2.3. Developing a Three-Stage Territorial Model for Assessing Socio-Economic Aspects of the Economic Crises

2.4. Methods

3. Results

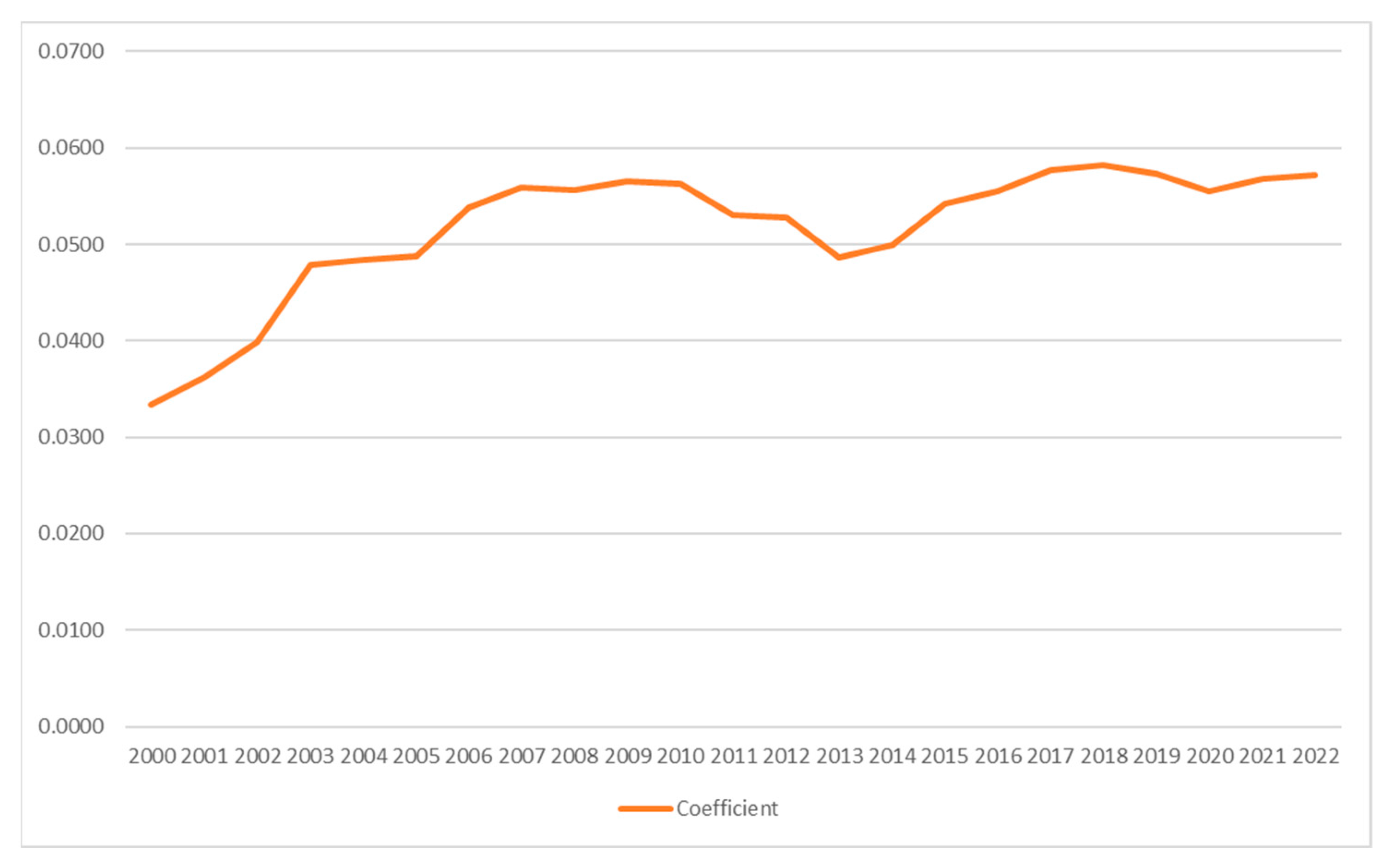

3.1. Socio-Economic Aspects of Economic Crises in Slovenia: Macro-Territorial Level

3.2. Socio-Economic Aspects of Economic Crises in Slovenia: Meso-Territorial Level

3.3. Socio-Economic Aspects of Economic Crises in Slovenia: Micro-Territorial Level

4. Discussion and Conclusions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

References

- Angelova, Mina, and Daniela Pastarmadzhieva. 2022. Global Crisis and Economic Crashes due to COVID-19 Pandemic (Comparative Research of the EU South-East Countries). AIP Conference Proceedings 2449: 070016. [Google Scholar] [CrossRef]

- Banerjee, Biswajit, and Manca Jesenko. 2014. Economic Growth and Regional Disparities in Slovenia. Regional Studies 49: 1722–45. [Google Scholar] [CrossRef]

- Brozzi, Ricardo, Lucija Lapuh, Janez Nared, and Thomas Streifeneder. 2015. Towards more resilient economies in Alpine regions. Acta Geographica Slovenica 55: 339–50. [Google Scholar] [CrossRef]

- Burger, Aleš, and Matija Rojec. 2018. Importance of Crisis-Motivated Subsidization of Firms: The Case of Slovenia. Eastern European Economics 56: 122–48. [Google Scholar] [CrossRef]

- Burger, Anže. 2021. What can be learnt from the effectiveness of Slovenia’s anti-crisis state aid measures during the great recession: Application to the COVID-19 downturn. Teorija in Praksa 57: 990–1017. Available online: https://www.dlib.si/stream/URN:NBN:SI:doc-02FUHN2U/3edb31e9-8ba2-4835-8ed6-10c09b6934a9/PDF (accessed on 22 January 2024).

- Camagni, Roberto. 2009. Per un concetto di capitale territorial. In Crescita e Sviluppo Regionale: Strumenti, Sistemi, Azioni. Edited by Dino Borri and Ferlaino Fiorenzo. Milan: Franco Angeli, pp. 66–90. [Google Scholar]

- Christopherson, Susan, Jonathan Michie, and Peter Tyler. 2010. Regional resilience: Theoretical and empirical perspectives. Cambridge Journal of Regions, Economy and Society 3: 3–10. [Google Scholar] [CrossRef]

- Cuadrado-Roura, Juan R., Ron Martin, and Andrés Rodrígues-Pose. 2016. The economic crisis in Europe: Urban and regional consequences. Cambridge Journal of Regions, Economy and Society 9: 3–11. [Google Scholar] [CrossRef]

- Czeczeli, Vivien, Pal Peter Kolozsi, Gabor Kutasi, and Adam Marton. 2020. Economic Exposure and Crisis Resilience in Exogenous Shock—The Short-Term Economic Impact of the COVID-19 Pandemic in the EU. Public Finance Quarterly = Pénzügyi Szemle 65: 321–47. [Google Scholar] [CrossRef]

- Damijan, Jože P. 2020. Economics of Corona Pandemic in Slovenia. Available online: https://library.fes.de/pdf-files/bueros/kroatien/16160.pdf (accessed on 16 March 2024).

- Deichmann, Joel I. 2021. Overview of Foreign Direct Investment in Former Yugoslavia and Related Scholarly Literature. In Foreign Direct Investments in the Successor States of Yugoslavia. Edited by Joel I. F. Deichmann. Cham: Springer Nature, pp. 1–21. [Google Scholar]

- DiPasquale, Giacomo, Mathew Gomies, and Jacier M. Rodriguez. 2021. Race and class patterns of income inequality during postrecession periods. Social Science Quarterly 102: 2812–23. [Google Scholar] [CrossRef]

- Direct Investment 2009. 2010. Available online: https://bankaslovenije.blob.core.windows.net/publication-files/nn_2009_en.pdf (accessed on 24 January 2024).

- Direct Investment 2022. 2023. Available online: https://bankaslovenije.blob.core.windows.net/publication-files/direct-investment-2022_final.pdf (accessed on 24 January 2024).

- Dolenc, Primož, Andraž Grum, and Suzana Laporšek. 2012. The effect of financial/economic crisis on firm performance in Slovenia—A micro level, difference-in-differences approach. Montenegrin Journal of Economics 8: 207–22. [Google Scholar]

- Domonkos, Tomáš, Filip Ostrihoň, and Brian König. 2021. Hurdling through the great recession: Winners and losers among post-communist EU countries in pro-poor growth. Empirical Economics 60: 893–918. [Google Scholar] [CrossRef]

- Drobne, Samo, and Marija Bogataj. 2013. Vpliv recesije na parametre kakovosti regionalnih središč in njihovo privlačnost. Revija za univerzalno odličnost 2: 25–42. Available online: https://www.fos-unm.si/media/pdf/ruo_2013_22_drobne_bogataj1.pdf (accessed on 16 March 2024).

- Economic Crisis: Resilience of Regions. 2014. ESPON ECR2. Final Report. Cardiff: ESPON & Cardiff University. [Google Scholar]

- Farčnik, Daša, and Polona Domadenik. 2019. Vpliv gospodarskih razmer na zaposlovanje diplomantov. Economic and Business Review for Central and South-Eastern Europe 21: 43–50. [Google Scholar] [CrossRef]

- Feldmann, Magnus. 2017. Crisis and opportunity: Varieties of capitalism and varieties of crisis responses in Estonia and Slovenia. European Journal of Industrial Relations 23: 33–46. [Google Scholar] [CrossRef]

- Fratesi, Ugo, and Giovanni Perucca. 2018. Territorail capital and resilience of European regions. The Annals of Regional Science 60: 241–64. [Google Scholar] [CrossRef]

- Functionally Derelict Areas Database of Slovenia. 2017. Functionally Derelict Areas Database of Slovenia. Ljubljana: Ministry of Economic Development and Technology. [Google Scholar]

- Functionally Derelict Areas Database of Slovenia. 2023. Functionally Derelict Areas Database of Slovenia. Ljubljana: Department of Geography Faculty of Arts University of Ljubljana. [Google Scholar]

- Görgün, Selen, and Seher Nur Sülkü. 2020. 2008 Global Krizinin Gelişmekte Olan Ülkeler Arasındaki Yayılımının Mekânsal Ekonometrik Analizi. Ekonomik Yaklaşım 31: 301–40. [Google Scholar] [CrossRef]

- Hočevar, Marko. 2022. A paradigmatic shift? Economic crises and labour market policies on the EU’s (semi-)periphery. Teorija in Praksa 4: 945–68. Available online: https://www.fdv.uni-lj.si/docs/default-source/tip/paradigmatska-sprememba-gospodarske-krize-in-politike-trga-dela-na-(pol)periferiji-eu.pdf?sfvrsn=0 (accessed on 22 January 2024). [CrossRef]

- Holgersen, Stale. 2014. Urban Responses to The Economic Crisis: Confirmation of Urban Policies as Crisis Management in Malmö. International Journal of Urban and Regional Research 38: 285–301. [Google Scholar] [CrossRef]

- Horvat, Tatjana, Veronika Šart, Gorazd Justinek, and Vito Bobek. 2021. Analysis of the financing of local communities in Slovenia in times of economic downturn and crises. Lex Localis 19: 751–80. [Google Scholar] [CrossRef]

- Jovanović, Vladimir, Carić Marko, and Jovanović Marija. 2013. Impact of economy instability on trade bilance of Balkan countries comparative analyse. Metalurgia International 18: 80–82. [Google Scholar]

- Kruskal-Wallis H Test Using SPSS Statistics. 2024. Available online: https://statistics.laerd.com/spss-tutorials/kruskal-wallis-h-test-using-spss-statistics.php (accessed on 9 July 2024).

- Krzak, Maciej, Poniatowski Grzegorz, and Wasik Katarzyna. 2014. Measuring Financial Stress and Economic Sensitivity in CEE Countries. CASE Network Reports, No. 117. Available online: https://www.econstor.eu/bitstream/10419/119878/1/777773236.pdf (accessed on 13 March 2024).

- Kušar, Simon. 2011. The Institutional Approach in Economic Geography: An Applicative view. Hrvatski Geografski Glasnik 73: 39–49. [Google Scholar] [CrossRef]

- Kušar, Simon. 2012. Selected spatial effects of the global financial and economic crisis in Ljubljana, Slovenia. Urbani Izziv 23: 112–20. [Google Scholar] [CrossRef]

- Kušar, Simon. 2021a. FDI in Slovenia. In Foreign Direct Investments in the Successor States of Yugoslavia. Edited by Joel I. F. Deichmann. Cham: Springer Nature Switzerland, pp. 79–107. [Google Scholar]

- Kušar, Simon. 2021b. Razvojne razlike med regijami v Sloveniji po letu 1971. In Regionalni razvoj včeraj, danes, jutri. Edited by Janez Nared, Polajnar Horvat Katarina and Razpotnik Visković Nika. Ljubljana: Založba ZRC, pp. 25–33. [Google Scholar]

- Kušar, Simon, Bobovnik Nejc, and Lampič Barbara. 2024. Poročilo o Regionalnem Razvoju 2018–22. Ljubljana: Filozofska fakulteta Univerze v Ljubljani. [Google Scholar]

- Lahovnik, Matej. 2022. Economic measures during the COVID-19 crisis: A case of Slovenia. Paper presented at The 10th International Scientific Conference “Finance, Economics and Tourism—FET 2022, Pula, Croatia, September 22–24. [Google Scholar]

- Lampič, Barbara, Kušar Simon, and Zavodnik Lamovšek Alma. 2017. A model of comprehensive assessment of derelict land as a support for sustainable spatial and development planning in Slovenia. Dela 48: 33–59. [Google Scholar] [CrossRef]

- Lapuh, Lucija. 2016. Ekonomskogeografsko vrednotenje prožnosti regij v času recesije. Ph.D. Thesis, University of Ljubljana, Ljubljana, Slovenia. [Google Scholar]

- Lapuh, Lucija. 2017. Teoretično in terminološko o konceptu prožnosti. Geografski Vestnik 89: 51–60. [Google Scholar] [CrossRef]

- Lesnik, Tomaž, Kračun Davorin, and Jagrič Timotej. 2014. Recession and tax compliance—The case of Slovenia. Engineering Economics 25: 130–40. [Google Scholar] [CrossRef][Green Version]

- Lo Cascio, Iolanda, Fabio Mazzola, Giuseppe Di Giacomo, and Rosalia Epifanio. 2013. Territorial Capital and the Economic Crisis: The Role of Spatial Effects. Available online: https://www.econstor.eu/bitstream/10419/124154/1/ERSA2013_01333.pdf (accessed on 16 April 2024).

- Makovec Brenčič, Maja, Gregor Pfajfar, and Matevž Rašković. 2012. Managing in a time of crisis: Marketing, HRM and innovation. Journal of Business and Industrial Marketing 276: 436–46. [Google Scholar] [CrossRef]

- Manyena, Siambabala Bernard. 2006. The concept of resilience revisited. Disasters 30: 433–50. [Google Scholar] [CrossRef] [PubMed]

- Markovič-Hribernik, Tanja, and Matej Tomec. 2015. Bad bank and other possible banks’ rescuing models—The case of Slovenia. Annals of the “Constantin Brâncuşi” University of Târgu Jiu, Economy Series, 128–41. [Google Scholar]

- Martin, Ron. 2012. Regional economic resilience, hysteresis and recessionary shocks. Journal of Economic Geography 12: 1–32. [Google Scholar] [CrossRef]

- Martin, Ron, and Peter Sunley. 2015. On the notion of regional economic resilience: Conceptualization and explanation. Journal of Economic Geography 15: 1–42. Available online: https://www.jstor.org/stable/26159656 (accessed on 16 April 2024). [CrossRef]

- Mazzola, Fabio, Rosalia Epifanio, Iolanda Lo Cascio, and Giuseppe Di Giacomo. 2012. Territorial Capital And The Great Recession: A Nuts-3 Analysis For Southern Italy. Available online: https://hdl.handle.net/10419/120616 (accessed on 16 April 2024).

- Mihalič, Tanja. 2013. A green tourism barometer in the time of economic crisis—the concept and case of Slovenia. Tourism in Southern and Eastern Europe 2: 1–17. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2289243 (accessed on 16 April 2024).

- Mörec, Barbara, and Matevž Rašković. 2011. Overview and estimation of the 2008 financial and economic crisis ‘effect size’ on sme capital structures: Case of Slovenia. Ekonomska Istraživanja 24: 107–25. [Google Scholar] [CrossRef][Green Version]

- National Bureau of Economic Research. 2010. Business Cycle Dating Committee Announcement 20 September 2010. Available online: https://www.nber.org/news/business-cycle-dating-committee-announcement-september-20-2010 (accessed on 22 February 2024).

- Neck, Reinhard, Dimitri Blueschke, and Klaus Weyerstrass. 2011. Optimal macroeconomic policies in a financial and economic crisis: A case study for Slovenia. Empirica 38: 435–59. [Google Scholar] [CrossRef]

- Njegomir, Vladimir, Boris Marović, and Rado Maksimović. 2010. The economic crisis and the insurance industry: The evidence from the ex-Yugoslavia region. Economic Annals 54: 129–62. Available online: https://www.ekof.bg.ac.rs/wp-content/uploads/2014/06/185-2-2.pdf (accessed on 16 April 2024). [CrossRef]

- Oprea, Florin, Mihaela Onofrei, Dan Lupu, Georgeta Vintila, and Gigel Paraschiv. 2020. The determinants of economic resilience. The case of Eastern European regions. Sustainability 12: 4228. [Google Scholar] [CrossRef]

- Oravský, Robert, Peter Tóth, and Ana Bánociová. 2020. The Ability of Selected European Countries to Face the Impending Economic Crisis Caused by COVID-19 in the Context of the Global Economic Crisis of 2008. Risk Financial Management 13: 179. [Google Scholar] [CrossRef]

- Podvršič, Ana, Joachim Becker, Dora Piroska, Tomas Profant, and Vladan Hodulak. 2020. Mitigating the COVID-19 effect: Emergency economic policymaking in Central Europe. Working Paper 2020: 7. Available online: https://ssrn.com/abstract=3684990 (accessed on 16 April 2024).

- Ponikvar, Nina, Maks Tajnikar, and Bonča Petra Dočenović. 2013. A small EU country attempting to exit the economic crisis: Rediscovering the post Keynesian perspective on incomes and prices policy. Journal of Post Keynesian Economics 36: 153–74. Available online: http://hdl.handle.net/10.2753/PKE0160-3477360108 (accessed on 16 April 2024). [CrossRef]

- Potočan, Vojko, Matjaž Mulej, and Zlatko Nedelko. 2019. How economic crises affect employees’ attitudes towards socially responsible behaviour—Case of Slovenia. Journal of East European Management Studies Special Issue, 152–78. [Google Scholar] [CrossRef]

- Rašković, Matevž, and Barbara Mörec. 2012. Organizational change and corporate sustainability in an economic crisis: Evidence from Slovenia. Amfiteatru Economic 14: 522–36. Available online: http://www.amfiteatrueconomic.ro/temp/Article_1142.pdf (accessed on 16 April 2024).

- Rey, Sergio J., and Julie Le Gallo. 2009. Spatial analysis of economic convergence. In Palgrave Handbook of Econometrics. Edited by Terence C. Mills and Patterson Kerry. London: Palgrave Macmillan, pp. 1251–90. [Google Scholar] [CrossRef]

- Robert, Peter, Ellu Saar, and Margarita Kazjulja. 2020. Individual and institutional influences on EU labour market returns to education: A comparison of the effect of the 2008 economic crisis on eight EU countries. European Societies 22: 157–87. [Google Scholar] [CrossRef]

- Rodríguez-Pose, Andrés, and Nicholas Gill. 2004. Is there a global link between regional disparities and devolution? Environment and Planning A 36: 2097–117. [Google Scholar] [CrossRef]

- Sendi, Richard. 2010. Housing bubble burst or credit crunch effect? Urbani Izziv 21: 96–105. [Google Scholar] [CrossRef]

- Shutters, Shade T., Srinivasa S. Kandala, Fangwu Wei, and Ann P. Kinzig. 2021. Resilience of Urban Economic Structures Following the Great Recession. Sustainability 13: 2374. [Google Scholar] [CrossRef]

- Škare, Marinko, and Saša Stjepanović. 2016. Measuring Business Cycles: A Review. Contemporary Economics 10: 83–94. [Google Scholar] [CrossRef]

- Srakar, Andrej, and Miroslav Verbič. 2015. Dohodkovna neenakost v Sloveniji in gospodarska kriza. Teorija in Praksa 52: 538–68. Available online: https://www.fdv.uni-lj.si/docs/default-source/tip/3-15_srakar-verbic.pdf (accessed on 16 April 2024).

- Stanojević, Miroslav, and Matej Klarič. 2013. The impact of socio-economic shocks on social dialogue in Slovenia. Transfer: European Review of Labour and Research 19: 217–26. [Google Scholar] [CrossRef]

- Statistical Office of the Republic of Slovenia. 2024. Available online: https://pxweb.stat.si/SiStat/sl/Podrocja/Index/583/regionalni-pregled (accessed on 22 January 2024).

- Šubic, Petra. 2024. V Pomurju Raste nova Tovarna Avtodomov. Available online: https://www.finance.si/finance/v-pomurju-raste-nova-tovarna-avtodomov/a/285395 (accessed on 30 January 2024).

- Šušteršič, Janez. 2003. Tranzicija kot Politično Gospodarski Cikel (Post Mortem Analiza). Ljubljana: Fakulteta za družbene vede. [Google Scholar]

- Tambunan, Tullus. 2021. Development of Small Bussiness During Economic Crises: Evidence from Indonesia. In Cases on Small Business Economics and Development during Economic Crises. Edited by Simon Stephens. New York: IGI Global, pp. 1–26. [Google Scholar] [CrossRef]

- Verbič, Miroslav, Srakar Andrej, Majcen Boris, and Čok Mitja. 2016. Slovenian public finances through the financial crisis. Teorija in Praksa 53: 203–27. Available online: http://dk.fdv.uni-lj.si/db/pdfs/TiP2016_1_Verbic_etal.pdf (accessed on 16 April 2024).

- Vujadin, Nataša, Radomir Vujadin, and Ivan Piljan. 2013. Effect of Global Economic Crisis on Life Insurance Market-Countries of the Former Yugoslavia from 2008 to 2011. International Review 1: 59–73. [Google Scholar]

- Vujanović, Nina, Nebojša Stojčić, and Iraj Hashi. 2021. FDI spillovers and firm productivity during crisis: Empirical evidence from transition economies. Economic Systems 45: 1–16. [Google Scholar] [CrossRef]

- WIIW. 2019. Database on Foreign Direct Investments. Wien: Wiener Institut für Internationale Wirtschaftvergliche. [Google Scholar]

- Zarnowitz, Victor. 1992. Business Cycle Theory, History, Indicators and Forecasting. Chicago: The University of Chicago Press. [Google Scholar]

- Ženka, Jan, Jaroslav Rusnák, and Adam Červenka. 2024. Ekonomika základních potřeb a ekonomická odolnost českých a slovenských regionů v průběhu čtyř recesí. Geografie 129: 61–90. [Google Scholar] [CrossRef]

- Žnidaršič, Jasmina, Mojca Bernik, and Miha Marič. 2011. The Impact of the Economic Crisis on Youth Employment in Slovenia. Chinese Business Review 10: 701–13. [Google Scholar]

| Territorial Level | Field of Economic-Geographical Research | Application in the Paper |

|---|---|---|

| Macro level | Economic dynamics, unemployment rates, differences in the intensity of consequences, changing relations between countries and regions, polarization (national level of the research) | Analysis of basic economic indicators on the national level (GDP, level of unemployment, national debt, number of companies), development compared to EU, FDI dynamics, interregional disparities |

| Meso level | Changes in economic strength and socio-economic structure of regions, regional resilience (regional level of the research) | Analysis of basic economic indicators on the regional (NUTS 3) level, resilience of regions, quality of life in regions |

| Micro level | Vacant dwellings, formation of brownfields, case studies of successful development approaches and resilient companies (individual/ location level of the research) | Vacant apartment buildings, business premises and construction sites, brownfields, an example of a resilient company |

| Year | FDI Stock Value (Million EUR) | FDI Stock Value (% of GDP) | FDI Inflow (Million EUR) |

|---|---|---|---|

| 2008 | 8598.0 | 22.7 | 831.8 |

| 2009 | 7827.8 | 21.6 | –342.5 |

| 2010 | 7982.9 | 22.0 | 79.5 |

| 2011 | 8880.1 | 24.1 | 782.2 |

| 2012 | 9248.6 | 25.6 | 264.1 |

| 2013 | 8896.5 | 24.5 | –113.9 |

| … | |||

| 2019 | 16,178.7 | 33.3 | 1306.8 |

| 2020 | 16,663.8 | 35.4 | 192.6 |

| NUTS 3 Region | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Mura | E | S | D | D | R | D | R | R | R |

| Drava | E | S | D | D | R | D | D | R | R |

| Carinthia | E | S | D | D | R | R | R | R | R |

| Savinja | E | E | D | R | R | D | D | R | R |

| Central Sava | E | S | D | D | D | D | D | D | D |

| Lower Sava | E | S | D | D | R | D | R | R | R |

| Southeast Slovenia | E | S | D | D | R | D | R | R | R |

| Central Slovenia | E | S | D | D | D | D | D | R | R |

| Upper Carniola | E | S | D | R | R | D | R | R | R |

| Littoral-Inner Carniola | E | S | D | D | D | D | R | E | E |

| Gorizia | E | S | D | D | D | D | D | R | R |

| Coastal-Carst | E | S | D | D | D | D | D | R | E |

| SLOVENIA | E | S | D | D | R | D | D | R | R |

| Category | Economic Crisis | COVID-19 Crisis |

|---|---|---|

| Intensity | Slovenia was one of the most affected countries in the EU | Decline smaller than the EU average |

| Length | Long-lasting crisis: it took five years to move to another stage of the economic cycle | It took only one year to move to another stage of the economic cycle |

| Recovery | Slow recovery: pre-crisis levels of economic strength compared to the EU average was reached only in 2021 | Recovery significantly stronger than in other EU member states |

| Unemployment | Level of unemployment doubled: from 7.3% in 2008 to 15.4% in 2014 | Not an issue; after the crisis it was lower than before the crisis |

| National debt | Strong increase of national debt | Small increase of national debt |

| Companies | Pressures on the survival of larger companies, but also success stories | Increase of the number of companies in all categories |

| FDI | Decrease of the value of FDI | No influence on FDI dynamics |

| Interregional disparities | Decrease of interregional disparities | Decrease of interregional disparities |

| Regional development | Diverse development trajectories of NUTS3 regions | Diverse development trajectories of NUTS3 regions |

| Brownfields | Formation of specific type of brownfields: abandoned construction sites | No influence on formation of brownfields |

| Quality of life | Overall decrease of the quality of life | Low influence on the quality of life |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kušar, S. Selected Socio-Economic Aspects of the Last Two Economic Crises in Slovenia Assessed through a Three-Stage Territorial Model. Economies 2024, 12, 189. https://doi.org/10.3390/economies12070189

Kušar S. Selected Socio-Economic Aspects of the Last Two Economic Crises in Slovenia Assessed through a Three-Stage Territorial Model. Economies. 2024; 12(7):189. https://doi.org/10.3390/economies12070189

Chicago/Turabian StyleKušar, Simon. 2024. "Selected Socio-Economic Aspects of the Last Two Economic Crises in Slovenia Assessed through a Three-Stage Territorial Model" Economies 12, no. 7: 189. https://doi.org/10.3390/economies12070189

APA StyleKušar, S. (2024). Selected Socio-Economic Aspects of the Last Two Economic Crises in Slovenia Assessed through a Three-Stage Territorial Model. Economies, 12(7), 189. https://doi.org/10.3390/economies12070189