Beyond Borders: The Effects of Immigrants on Value-Added Trade

Abstract

1. Introduction

2. Literature Review

3. Empirical Model, Data, and Variables

3.1. The Empirical Model

3.2. The Variables, Data Sources, and Expected Signs

3.2.1. Dependent Variables

3.2.2. Explanatory Variables

3.3. Descriptive Statistics

4. Empirical Results

4.1. Immigrants and TiVA

4.2. The Control Factors

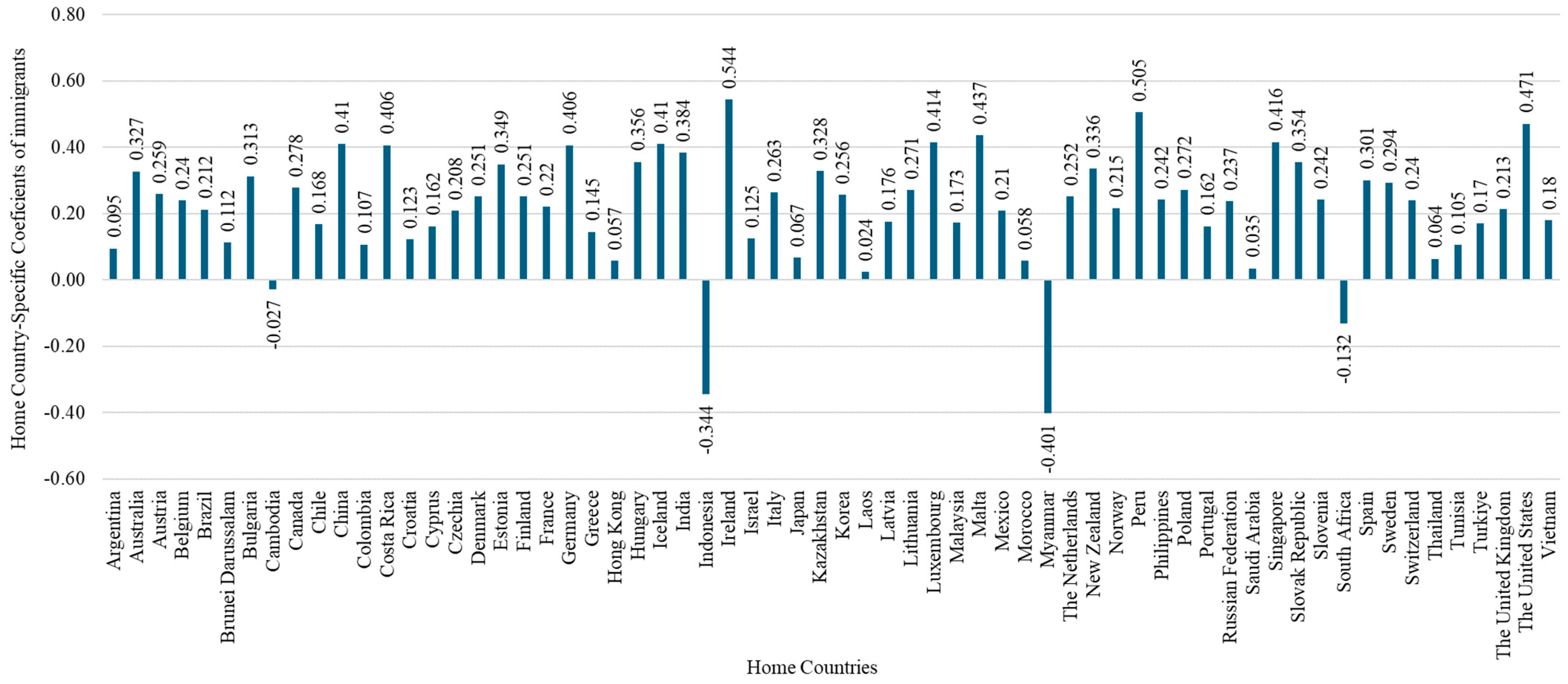

4.3. Heterogeneity in the Effects of Immigrants

4.4. Robustness Checks

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Trade in Value Added (TiVA) | Gross Imports and Exports | |||||

|---|---|---|---|---|---|---|

| (a) | (b) | (c) | (d) | (e) | (f) | |

| Variables | ltiva_tot | ltiva_agr | ltiva_mnf | ltiva_ser | log(gimp) | log(gexp) |

| Ln (Immig) | −0.965 *** | −0.953 *** | −0.649 *** | −1.372 *** | −0.0209 *** | −0.135 *** |

| (0.0864) | (0.100) | (0.0903) | (0.0870) | (0.0081) | (0.018) | |

| Ln (PCI1) | 3.412 *** | 4.203 *** | 3.244 *** | 3.471 *** | 3.599 *** | 0.339 |

| (0.102) | (0.118) | (0.107) | (0.103) | (0.115) | (0.288) | |

| Ln (Immig)#ln (PCI1) | 0.0348 *** | 0.0445 *** | 0.0477 *** | 0.0581 *** | −0.0357 ** | 0.359 *** |

| (0.0132) | (0.0153) | (0.0138) | (0.0133) | (0.0150) | (0.0373) | |

| Ln (PCI2) | 4.358 *** | 4.991 *** | 4.831 *** | 3.186 *** | 5.378 *** | 2.061 *** |

| (0.155) | (0.180) | (0.162) | (0.157) | (0.177) | (0.479) | |

| Ln (Immig)#ln (PCI2) | 0.273 *** | 0.272 *** | 0.198 *** | 0.346 *** | 0.0954 *** | −0.217 *** |

| (0.0242) | (0.0279) | (0.0253) | (0.0243) | (0.0275) | (0.0693) | |

| Ln (TRcost) | −0.399 *** | −0.453 *** | −0.455 *** | −0.305 *** | −0.450 *** | −1.219 *** |

| (0.0114) | (0.0133) | (0.0120) | (0.0115) | (0.0131) | (0.0465) | |

| Constant | −26.18 *** | −36.21 *** | −27.41 *** | −24.02 *** | −29.97 *** | −2.196 |

| (0.628) | (0.700) | (0.652) | (0.632) | (0.692) | (2.091) | |

| Random-effects components: | ||||||

| St. Dev. (Region) | −0.0500 | −0.146 | −0.0412 | −0.0504 | −0.121 | −0.696 *** |

| (0.220) | (0.224) | (0.223) | (0.218) | (0.228) | (0.223) | |

| St. Dev. (Immig) | −0.668 *** | −0.444 *** | −0.651 *** | −0.555 *** | −0.687 *** | −2.086 *** |

| (0.0250) | (0.0243) | (0.0254) | (0.0232) | (0.0253) | (0.145) | |

| St. Dev. (Panel) | 1.379 *** | 1.585 *** | 1.414 *** | 1.428 *** | 1.373 *** | 0.143 * |

| (0.0250) | (0.0245) | (0.0252) | (0.0241) | (0.0246) | (0.0762) | |

| St. Dev. (Residual) | −1.156 *** | −1.008 *** | −1.112 *** | −1.155 *** | −1.011 *** | 0.717 *** |

| (0.00433) | (0.00437) | (0.00432) | (0.00433) | (0.00430) | (0.00407) | |

| Log-likelihood | −17,650 | −22,517 | −19,183 | −17,708 | −22,143 | −71,547 |

| Chi-square (overall) | 36,049 | 36,436 | 31,839 | 33,841 | 27,956 | 5851 |

| AIC | 35,324.93 | 45,057.18 | 38,389.87 | 35,439.78 | 44,310.15 | 143,118.8 |

| BIC | 35,426.05 | 45,158.3 | 38491.0 | 35,540.9 | 44,411.27 | 143,219.6 |

| ICC (region- home) | 0.994 *** | 0.9946 *** | 0.9937 *** | 0.9945 *** | 0.9919 *** | 0.8733 *** |

| (0.003) | (0.0010) | (0.0010) | (0.0011) | (0.0013) | (0.0013) | |

| Observations | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 |

| Panel A: Multilevel Linear Model Estimation Results | ||||||

| Dep Variable: Value Added Gtrade (Logs) | Gross Exports and Imports | |||||

| (a) | (b) | (c) | (d) | (e) | (f) | |

| VARIABLES | Tiva_Total | Tiva_Agri | Tiva_Mnf | Tiva_Serv | Gr_Imp | Gr_Exp |

| Ln (Immig) | 0.103 *** | 0.122 *** | 0.0954 *** | 0.117 *** | 0.155 *** | 0.141 *** |

| (0.0024) | (0.0025) | (0.0024) | (0.0024) | (0.0029) | (0.0093) | |

| Ln (PCI1) | 1.784 *** | 1.859 *** | 1.759 *** | 1.890 *** | 2.065 *** | 0.959 *** |

| (0.0737) | (0.0782) | (0.0740) | (0.0751) | (0.0881) | (0.291) | |

| Ln (PCI2) | 1.470 *** | 1.565 *** | 1.601 *** | 0.559 *** | 2.787 *** | 1.084 * |

| (0.145) | (0.154) | (0.146) | (0.148) | (0.168) | (0.564) | |

| Ln (TRcost) | −1.529 *** | −1.521 *** | −1.579 *** | −1.424 *** | −1.801 *** | −1.850 *** |

| (0.0106) | (0.0112) | (0.0106) | (0.0108) | (0.0128) | (0.0405) | |

| Constant | −1.727 ** | −6.944 *** | −2.332 *** | −0.465 | −6.037 *** | 4.143 |

| (0.671) | (0.713) | (0.674) | (0.684) | (0.783) | (2.611) | |

| Observations | 31,769 | 31,769 | 31,769 | 31,769 | 31,769 | 31,769 |

| R−Squared (Within) | 0.566 | 0.551 | 0.571 | 0.540 | 0.564 | 0.122 |

| Log Likelihood | −26,718 | −28,623 | −26,865 | −27,331 | −35,856 | −66,807 |

| F−Statistic | 10,334 | 9701 | 10,549 | 9288 | 10,870 | 1063 |

| RMSE | 0.562 | 0.597 | 0.565 | 0.573 | 0.702 | 2.119 |

| Panel B: Multilevel PPML Estimation Results | ||||||

| Dep Variable: Value Added Trade (Levels) | Gross Exports and Imports | |||||

| VARIABLES | TOT | AGR | MNF | SER | IMP | EXP |

| Ln (Immig) | 0.203 *** | 0.299 *** | 0.193 *** | 0.222 *** | 0.257 *** | 0.292 *** |

| (0.0127) | (0.0153) | (0.0132) | (0.0118) | (0.0128) | (0.0162) | |

| Ln (PCI1) | 2.651 *** | 1.898 *** | 3.054 *** | 1.856 *** | 2.677 *** | 3.716 *** |

| (0.245) | (0.272) | (0.269) | (0.231) | (0.227) | (0.575) | |

| Ln (PCI2) | 2.802 *** | 2.041 *** | 3.032 *** | 2.606 *** | 3.597 *** | 2.009 * |

| (0.513) | (0.435) | (0.551) | (0.552) | (0.428) | (1.161) | |

| Ln (TRcost) | −0.750 *** | −0.719 *** | −0.797 *** | −0.603 *** | −0.864 *** | −0.821 *** |

| (0.0640) | (0.0768) | (0.0632) | (0.0671) | (0.0658) | (0.0688) | |

| Constant | −13.13 *** | −12.49 *** | −15.61 *** | −11.34 *** | −15.06 *** | −14.12 *** |

| (2.639) | (2.563) | (2.877) | (2.584) | (2.234) | (5.377) | |

| Observations | 31,769 | 31,769 | 31,769 | 31,769 | 31,769 | 31,769 |

| Psuedo R−Square | 0.918 | 0.861 | 0.921 | 0.913 | 0.940 | 0.783 |

| Log Likelihood | −3.719 × 106 | −85,740 | −2.813 × 106 | −898,260 | −1.440 × 107 | −2.770 × 107 |

| Chi−Square | 3075 | 7068 | 2678 | 3361 | 7055 | 1845 |

| RMSE | 0.566 | 0.561 | 0.567 | 0.561 | 0.505 | 0.976 |

| OECD Member Host Countries | |||

|---|---|---|---|

| Australia | Finland | Korea | Slovakia |

| Austria | France | Latvia | Slovenia |

| Belgium | Germany | Lithuania | Spain |

| Canada | Greece | Luxembourg | Sweden |

| Chile | Hungary | Mexico | Switzerland |

| Colombia | Iceland | Netherlands | Türkiye |

| Costa Rica | Ireland | New Zealand | United Kingdom |

| Czech Republic | Israel | Norway | United States |

| Denmark | Italy | Poland | |

| Estonia | Japan | Portugal | |

| 1 | |

| 2 | A separate survey by Hatzigeorgiou and Lodefalk (2021) also reports a consistent positive influence of immigrants on home–host country trade. |

| 3 | In ancillary estimations, the results of which can be obtained from the authors, we replace the trade cost measure with standard gravity model variables, including geodesic distance (a common proxy for transportation costs), economic remoteness (to represent multilateral resistance to trade), and dummy variables that identify whether countries are landlocked, have a prior colonial relationship, share a common border or language, or are parties to one or more trade agreement(s). The alternative specification is as follows:

|

| 4 | One of the key benefits of multilevel models over the linear high-dimensional fixed-effects (HDFE) approach is their ability to incorporate both fixed and random effects. This flexibility allows for modeling random variations across different levels of the hierarchy, improving the ability to generalize findings beyond the sampled data (Bell and Jones 2015). By incorporating random effects, multilevel models also offer better estimates of group-level effects, such as country-specific effects, while accounting for unobserved heterogeneity within groups (e.g., home countries in the same region). This can yield more reliable and comprehensive results (Browne et al. 2018). Multilevel models also provide enhanced interpretability, particularly in hierarchical settings. They allow for the separate estimation of within-group and between-group effects, offering clearer insights into relationships at different levels of analysis. This can be especially valuable for understanding the dynamics within and between different groups in a dataset, such as regions or institutions (Raudenbush and Bryk 2002). |

| 5 | For example, a tech manufacturer in the host (home) country might rely on specific semiconductor components from the immigrant’s home (host) country, enabling the efficient sourcing of components, integration into the manufacturing process, and the global export of the final product. |

| 6 | The World Bank (2019) posits that natural capital, and the availability of a skilled workforce are pivotal to a nation’s competitive edge. Limão and Venables (2001) highlight the importance of efficient transport networks and the transformative nature of ICT integration and accessibility in modern economies. McMillan et al. (2017) underscore the importance of structural economic shifts, while Robinson and Acemoglu (2012) stress the significance of institutional frameworks in shaping economic interaction and the central role of the private sector in growth dynamics, respectively. Thus, a country with a robust productive capacity can specialize in producing specific components or stages of production more efficiently and economically rather than manufacturing the entire product. |

| 7 | It is important to note that the ad valorem tariff-equivalent trade cost estimates include the trade costs of all goods (some of which are not traded internationally); the estimates also vary greatly depending on underlying assumptions used for the elasticity of substitution; hence, such estimates should preferably be used for comparative exercise, to analyze changes in trade costs over time, or for technical analysis, such as in an econometric model of trade (UNESCAP 2021). |

| 8 | For example, a country pair that is one standard deviation above the mean might have more favorable initial conditions or inherent characteristics that increase their value-added trade. |

| 9 | For brevity, estimation results with the interaction terms from which the marginal effects presented in Table 3 are derived are presented in Appendix A Table A1. |

| 10 | One example is skilled Italian artisans migrating to the U.S. and contributing to the luxury goods sector, increasing the value added in American exports of designer products back to Italy or to other markets. |

| 11 | French immigrants in Japan, for example, may influence the Japanese demand for French luxury goods while also helping French winemakers tailor their products to the Japanese palate, thereby enhancing TiVA between the countries. |

| 12 | For instance, the tech industry in Silicon Valley has significantly benefited from immigrants’ contributions to software development and IT that have bolstered the value added to U.S. exports in these sectors (Saxenian 2006). |

| 13 | An example would be Vietnamese immigrants in Australia who increase TiVA by starting a seafood processing firm that exports high-quality seafood products to Vietnam. |

| 14 | Mexican U.S. immigrants may use their networks to help U.S. firms navigate the Mexican market for refined petroleum products, adding value to U.S. exports. |

| 15 | To address the concerns about potential reverse causality, we also estimate our models using a one-period lag of the immigrant stock variable. The results, presented in Appendix A Table A2, remain consistent and statistically significant, with minimal coefficient changes compared to our original estimations. |

| 16 | Appendix A Table A3 provides the list of OECD member host countries included in the present study. |

References

- Ahn, JaeBin, Mary Amiti, and David Weinstein. 2011. Trade finance and the great trade collapse. American Economic Review 101: 298–302. [Google Scholar] [CrossRef]

- Aleksynska, Mariya, and Giovanni Peri. 2014. Isolating the Network Effect of Immigrants on Trade. The World Economy 37: 434–55. [Google Scholar] [CrossRef]

- Anderson, James, and Eric van Wincoop. 2004. Trade costs. Journal of Economic Literature 42: 691–751. [Google Scholar] [CrossRef]

- Azoulay, Pierre, Benjamin F. Jones, J. Daniel Kim, and Javier Miranda. 2022. Immigration and entrepreneurship in the United States. American Economic Review: Insights 4: 71–88. [Google Scholar] [CrossRef]

- Baltagi, Badi, Peter Egger, and Michael Pfaffermayr. 2003. A generalized design for bilateral trade flow models. Economics Letters 80: 391–97. [Google Scholar] [CrossRef]

- Bandyopadhyay, Suranjan, Cletus Coughlin, and Howard Wall. 2008. Ethnic networks and US exports. Review of International Economics 16: 199–213. [Google Scholar] [CrossRef]

- Bastos, Paulo, and Joana Silva. 2012. Networks, firms, and trade. Journal of International Economics 87: 352–64. [Google Scholar] [CrossRef]

- Bell, Andrew, and Kelvin Jones. 2015. Explaining fixed effects: Random effects modeling of time-series cross-sectional and panel data. Political Science Research and Methods 3: 133–53. [Google Scholar] [CrossRef]

- Bove, Vittorio, and Leandro Elia. 2017. Migration, diversity, and economic growth. World Development 89: 227–39. [Google Scholar] [CrossRef]

- Browne, William, Harvey Goldstein, and Jon Rasbash. 2018. Multiple membership multiple classification (MMMC) models. Journal of the Royal Statistical Society: Series A (Statistics in Society) 161: 573–90. [Google Scholar] [CrossRef]

- Burchardi, Konrad, Thomas Chaney, and Tarek Hassan. 2019. Migrants, ancestors, and foreign investments. The Review of Economic Studies 86: 1448–86. [Google Scholar] [CrossRef]

- Chaney, Thomas. 2014. The Network Structure of International Trade. American Economic Review 104: 3600–34. Available online: http://www.jstor.org/stable/43495348 (accessed on 21 April 2024). [CrossRef]

- Combes, Pierre-Philippe, Miren Lafourcade, and Thierry Mayer. 2005. The trade-creating effects of business and social networks: Evidence from France. Journal of International Economics 66: 1–29. [Google Scholar] [CrossRef]

- Cuadros, Ana Cuadros, Josep Martín-Montaner, and Jordi Paniagua. 2016. Homeward bound FDI: Are migrants a bridge over troubled finance? Economic Modelling 58: 454–65. [Google Scholar] [CrossRef]

- Docquier, Frédéric, and Hillel Rapoport. 2012. Globalization, brain drain, and development. Journal of Economic Literature 50: 681–730. [Google Scholar] [CrossRef]

- Dunlevy, James. 2006. The influence of corruption and language on the pro-trade effect of immigrants: Evidence from the American states. Review of Economics and Statistics 88: 182–86. [Google Scholar] [CrossRef]

- Felbermayr, Gabriel, Stephan Hiller, and Daria Sala. 2010. Does immigration boost per capita income? Economics Letters 107: 177–79. [Google Scholar] [CrossRef]

- Flisi, Sara, and Marina Murat. 2011. The hub continent. Immigrant networks, emigrant diasporas and FDI. The Journal of Socio-Economics 40: 796–805. [Google Scholar] [CrossRef]

- Genc, Murat, Maasranga Gheasi, Peter Nijkamp, and Jacques Poot. 2012. The impact of immigration on international trade: A meta-analysis. In Migration Impact Assessment: New Horizons. Edited by Peter Nijkamp, Jacques Poot and Mediha Sahin. Cheltenham: Edward Elgar Publishing, pp. 301–37. [Google Scholar]

- Girma, Sourafel, and Zhihao Yu. 2002. The link between immigration and trade: Evidence from the United Kingdom. Weltwirtschaftliches Archiv 138: 115–30. [Google Scholar] [CrossRef]

- Gould, David. 1994. Immigrant links to the home country: Empirical implications for U.S. bilateral trade flows. The Review of Economics and Statistics 76: 302–16. [Google Scholar] [CrossRef]

- Hatzigeorgiou, Andreas. 2010. Migration as Trade Facilitation: Assessing the Links between International Trade and Migration. The World Economy 33: 2025–50. [Google Scholar] [CrossRef]

- Hatzigeorgiou, Andreas, and Magnus Lodefalk. 2021. A literature review of the nexus between migration and internationalization. The Journal of International Trade and Economic Development 30: 319–40. [Google Scholar] [CrossRef]

- Head, Keith, and John Ries. 1998. Immigration and trade creation: Econometric evidence from Canada. Canadian Journal of Economics/Revue Canadienne d’Économique 31: 47–62. [Google Scholar] [CrossRef]

- Herander, Mark, and Luz Saavedra. 2005. Exports and the structure of immigrant-based networks: The role of geographic proximity. The Review of Economics and Statistics 87: 323–35. [Google Scholar] [CrossRef]

- Hiller, Sanne. 2013. Does immigrant employment matter for export sales? Evidence from Denmark. Review of World Economics 149: 369–94. [Google Scholar] [CrossRef]

- Hummels, David. 2007. Transportation costs and international trade in the second era of globalization. The Journal of Economic Perspectives 21: 131–54. [Google Scholar] [CrossRef]

- Hunt, Jennifer, and Marjolaine Gauthier-Loiselle. 2010. How much does immigration boost innovation? American Economic Journal: Macroeconomics 2: 31–56. [Google Scholar] [CrossRef]

- Iranzo, Susana, and Giovanni Peri. 2009. Migration and trade: Theory with an application to the Eastern–Western European integration. Journal of International Economics 79: 1–19. [Google Scholar] [CrossRef]

- Irarrazabal, Andreas, Andreas Moxnes, and Luca David Opromolla. 2013. The margins of multinational production and the role of intrafirm trade. Journal of Political Economy 121: 74–126. [Google Scholar] [CrossRef]

- Johnson, Robert. 2018. Measuring global value chains. Annual Review of Economics 10: 207–36. [Google Scholar] [CrossRef]

- Kerr, Sari, William Kerr, Çağlar Özden, and Christopher Parsons. 2016. Global talent flows. Journal of Economic Perspectives 30: 83–106. [Google Scholar] [CrossRef]

- Kerr, William. 2023. U.S. High-Skilled Immigration, Innovation, and Entrepreneurship: Empirical Approaches and Evidence. NBER Working Paper No. 19377. Cambridge: National Bureau of Economic Research. Available online: https://econpapers.repec.org/repec:nbr:nberwo:19377 (accessed on 21 April 2024).

- Kerr, William, and William Lincoln. 2010. The supply side of innovation: H-1B visa reforms and US ethnic invention. Journal of Labor Economics 28: 473–508. [Google Scholar] [CrossRef]

- Kugler, Maurice, and Hillel Rapoport. 2011. Migration, FDI, and the Margins of Trade. International Journal of Manpower 32: 280–93. [Google Scholar]

- Limão, Nuno, and Anthony Venables. 2001. Infrastructure, geographical disadvantage, transport costs, and trade. The World Bank Economic Review 15: 451–79. [Google Scholar] [CrossRef]

- McMillan, Margaret, Dani Rodrik, and Claudia Sepulveda. 2017. Structural Change, Fundamentals, and Growth: A Framework and Case Studies. Washington, DC: International Food Policy Research Institute (IFPRI). Available online: https://ssrn.com/abstract=2964674 (accessed on 21 April 2024).

- Melitz, Jacques. 2008. Language and foreign trade. European Economic Review 52: 667–99. [Google Scholar] [CrossRef]

- Miroudot, Sébastien, and Charles Cadestin. 2017. Services in Global Value Chains: From Inputs to Value-Creating Activities. OECD Trade Policy Papers No. 197. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Mitaritonna, Caroline, Gianluca Orefice, and Giovanni Peri. 2017. Immigrants and firms’ outcomes: Evidence from France. European Economic Review 96: 62–82. [Google Scholar] [CrossRef]

- Novy, Dennis. 2013. Gravity redux: Measuring international trade costs with panel data. Economic Inquiry 51: 101–21. [Google Scholar] [CrossRef]

- Organization for Economic Cooperation and Development (OECD). 2021. OECD Data Explorer. Available online: https://data-explorer.oecd.org/ (accessed on 21 April 2024).

- Ottaviano, Gianmarco, Giovanni Peri, and Greg Wright. 2018. Immigration, trade and productivity in services: Evidence from U.K. firms. Journal of International Economics 112: 88–108. [Google Scholar] [CrossRef]

- Parsons, Christopher, and Pierre-Louis Vézina. 2018. Migrant networks and trade: The Vietnamese boat people as a natural experiment. The Economic Journal 128: F210–F234. [Google Scholar] [CrossRef]

- Peri, Giovanni, and Franscisco Requena-Silvente. 2010. The trade creation effect of immigrants: Evidence from the remarkable case of Spain. Canadian Journal of Economics 43: 1433–59. [Google Scholar] [CrossRef]

- Portugal-Perez, Alberto, and John Wilson. 2012. Export performance and trade facilitation reform: Hard and soft infrastructure. World Development 40: 1295–307. [Google Scholar] [CrossRef]

- Rauch, James. 1999. Networks versus markets in international trade. Journal of International Economics 48: 7–35. [Google Scholar] [CrossRef]

- Rauch, James. 2001. Business and social networks in international trade. Journal of Economic Literature 39: 1177–203. [Google Scholar] [CrossRef]

- Rauch, James, and Vitor Trindade. 2002. Ethnic Chinese Networks in International Trade. Review of Economics and Statistics 84: 116–30. Available online: https://www.jstor.org/stable/3211742 (accessed on 21 April 2024). [CrossRef]

- Raudenbush, Stephen, and Anthony Bryk. 2002. Hierarchical Linear Models: Applications and Data Analysis Methods, 2nd ed. Thousand Oaks: Sage Publications. [Google Scholar]

- Robinson, James, and Daron Acemoglu. 2012. Why Nations Fail: The Origins of Power, Prosperity, and Poverty. New York: Crown Business. Available online: http://www.tinyurl.com/y57yqpy8 (accessed on 21 April 2024).

- Saxenian, AnnaLee. 2006. International Mobility of Engineers and the Rise of Entrepreneurship in the Periphery. WIDER Research Paper 2006-142. Helsinki: United Nations University World Institute for Development Economics Research. Available online: https://hdl.handle.net/10419/63430 (accessed on 21 April 2024).

- Timmer, Marcel, Erik Dietzenbacher, Bart Los, Robert Stehrer, and Gaaitzen J. de Vries. 2015. An illustrated user guide to the World Input-Output Database: The case of global automotive production. Review of International Economics 23: 575–605. [Google Scholar] [CrossRef]

- United Nations Conference on Trade and Development (UNCTAD). 2021. Productive Capacities Index. UNCTADstat. Available online: https://unctadstat.unctad.org/datacentre/dataviewer/US.PCI (accessed on 13 August 2024).

- United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP). 2021. Trade Cost Database: User Note. Available online: https://www.unescap.org/sites/default/d8files/Trade%20Cost%20Database%20-%20User%20note.pdf (accessed on 13 August 2024).

- Wagner, Don, Keith Head, and John Ries. 2002. Immigration and the trade of provinces. Scottish Journal of Political Economy 49: 507–25. [Google Scholar] [CrossRef]

- World Bank. 2019. World Development Report 2019: The Changing Nature of Work. Washington, DC: World Bank Publications. Available online: https://www.worldbank.org/en/publication/wdr2019 (accessed on 21 April 2024).

- World Bank. 2021. Ad Valorem Equivalent of Non-Tariff Measures. World Bank Data Catalog. Available online: https://datacatalog.worldbank.org/search/dataset/0040437 (accessed on 21 April 2024).

- Zhou, Ying, and Sajid Anwar. 2022. Immigrant Diversity, Institutional Quality, and GVC Position. Sustainability 14: 2129. [Google Scholar] [CrossRef]

| Mean | Std. Dev. | |

|---|---|---|

| Trade flow measures: | ||

| Gross exports of host country i to home country j (millions, USD) | 69.60398 | 334.5786 |

| Gross imports of host country i from home country j (millions, USD) | 1874.258 | 8706.77 |

| Value-added trade (TiVA): value added from home country i that is included in the exports of host country j | ||

| Total (millions, USD) | 876.5885 | 2789.897 |

| Manufactures (millions, USD) | 649.3937 | 2248.778 |

| Agriculture (millions, USD) | 10.5588 | 42.60521 |

| Service (millions, USD) | 200.3528 | 655.2618 |

| Immigrant population: number of individuals from home country i that reside in host country j | ||

| Immigrant stock | 36,085.39 | 288,064.1 |

| Productive capacity measures: | ||

| Overall productive capacity index, home country | 54.11173 | 9.552657 |

| Overall productive capacity index, host country | 60.01368 | 6.338487 |

| Bilateral trade costs: | ||

| Ad valorem tariff-equivalent bilateral trade costs (%), all goods | 150.8702 | 87.5284 |

| N = 33,754. |

| Trade in Value Added (TiVA) | Gross Imports and Exports | |||||

|---|---|---|---|---|---|---|

| (a) | (b) | (c) | (d) | (e) | (f) | |

| Variables | ltiva_tot | ltiva_agr | ltiva_mnf | ltiva_ser | log(gimp) | log(gexp) |

| Ln (Immig) | 0.220 *** | 0.267 *** | 0.187 *** | 0.286 *** | 0.230 *** | 0.397 *** |

| (0.0132) | (0.0161) | (0.0136) | (0.0144) | (0.0135) | (0.0107) | |

| Ln (PCI1) | 3.571 *** | 4.431 *** | 3.316 *** | 3.957 *** | 3.362 *** | 2.725 *** |

| (0.0428) | (0.0494) | (0.0447) | (0.0430) | (0.0483) | (0.146) | |

| Ln (PCI2) | 5.831 *** | 6.455 *** | 5.902 *** | 5.032 *** | 5.931 *** | 0.682 *** |

| (0.0689) | (0.0795) | (0.0719) | (0.0692) | (0.0783) | (0.208) | |

| Ln (TRcost) | −0.403 *** | −0.456 *** | −0.458 *** | −0.309 *** | −0.450 *** | −1.246 *** |

| (0.0115) | (0.0133) | (0.0120) | (0.0115) | (0.0131) | (0.0466) | |

| Constant | −32.95 *** | −43.23 *** | −32.16 *** | −33.68 *** | −31.30 *** | −5.854 *** |

| (0.390) | (0.408) | (0.401) | (0.391) | (0.406) | (1.013) | |

| Random-effects components: | ||||||

| St. Dev. (region) | 0.942 *** | 0.8556 *** | 0.9528 *** | 0.9374 *** | 0.8869 *** | 0.4724 ** |

| (0.203) | (0.159) | (0.201) | (0.204) | (0.228) | (0.222) | |

| St. Dev. (Immig) | 0.5127 *** | 0.6466 *** | 0.5189 *** | 0.5804 *** | 0.5031 *** | 0.1351 *** |

| (0.0249) | (0.0242) | (0.0254) | (0.0232) | (0.0252) | (0.0130) | |

| St. Dev. (panel) | 3.9354 *** | 4.9037 *** | 4.0592 *** | 4.1828 *** | 3.9393 *** | 1.1984 *** |

| (0.0250) | (0.0244) | (0.0252) | (0.0241) | (0.0245) | (0.0733) | |

| St. Dev. (residual) | 0.3160 *** | 0.3660 *** | 0.3298 *** | 0.3169 *** | 0.3642 *** | 2.0481 *** |

| (0.00433) | (0.00436) | (0.00432) | (0.00434) | (0.00429) | (0.00408) | |

| Log-likelihood | −17,746 | −22,593 | −19,226 | −17,901 | −22,149 | −71,594 |

| Chi-square (overall) | 35,635 | 36,070 | 31,680 | 33,035 | 27,930 | 5548 |

| AIC | 35,511.4 | 38,472.1 | 38,472.3 | 35,821 | 44,318.55 | 143,207.4 |

| BIC | 35,595.7 | 38,556.3 | 38,556.4 | 35,905.3 | 444,02.8 | 143,291.3 |

| ICC (region-home) | 0.9939 *** | 0.9946 *** | 0.9937 *** | 0.9945 *** | 0.9919 *** | 0.8232 *** |

| (0.0010) | (0.0010) | (0.0010) | (0.0011) | (0.0013) | (0.0013) | |

| Observations | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 |

| Trade in Value Added (TiVA) by Sector | Gross Exports and Imports | |||||

|---|---|---|---|---|---|---|

| (a) | (b) | (c) | (d) | (e) | (f) | |

| Variables | ltiva_tot | ltiva_agr | ltiva_mnf | ltiva_ser | log(gimp) | log(gexp) |

| Ln (Immig) | 0.208 *** | 0.255 *** | 0.178 *** | 0.271 *** | 0.227 *** | 0.407 *** |

| (0.0133) | (0.0161) | (0.0137) | (0.0143) | (0.0135) | (0.0106) | |

| Ln (PCI1) | 3.520 *** | 4.381 *** | 3.278 *** | 3.892 *** | 3.341 *** | 2.982 *** |

| (0.0431) | (0.0496) | (0.0451) | (0.0431) | (0.0487) | (0.147) | |

| Ln (PCI2) | 6.334 *** | 6.960 *** | 6.263 *** | 5.691 *** | 6.069 *** | 0.463 ** |

| (0.0783) | (0.0904) | (0.0820) | (0.0783) | (0.0892) | (0.220) | |

| Ln (TRcost) | −0.399 *** | −0.453 *** | −0.455 *** | −0.305 *** | −0.450 *** | −1.219 *** |

| (0.0114) | (0.0133) | (0.0120) | (0.0115) | (0.0131) | (0.0465) | |

| Observations | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 |

| Panel A: HDFE Multilevel linear model estimation results | ||||||

| Dependent Variable: Value-Added Trade (Log) | Gross Exports and Imports | |||||

| (a) | (b) | (c) | (d) | (e) | (f) | |

| Variables | ltiva_tot | ltiva_agr | ltiva_mnf | ltiva_ser | log(gimp) | log(gexp) |

| Ln (Immig) | 0.104 *** | 0.121 *** | 0.0967 *** | 0.119 *** | 0.155 *** | 0.143 *** |

| (0.00237) | (0.00253) | (0.00238) | (0.00242) | (0.00296) | (0.00904) | |

| Ln (PCI1) | 1.848 *** | 1.902 *** | 1.851 *** | 1.907 *** | 2.065 *** | 1.092 *** |

| (0.0706) | (0.0755) | (0.0710) | (0.0722) | (0.0881) | (0.277) | |

| Ln (PCI2) | 1.616 *** | 1.864 *** | 1.927 *** | 0.386 *** | 2.787 *** | 1.250 ** |

| (0.135) | (0.144) | (0.135) | (0.138) | (0.168) | (0.518) | |

| Ln (TRcost) | −1.533 *** | −1.528 *** | −1.587 *** | −1.422 *** | −1.801 *** | −1.831 *** |

| (0.0103) | (0.0110) | (0.0103) | (0.0105) | (0.0128) | (0.0390) | |

| Constant | −2.597 *** | −8.332 *** | −4.032 *** | 0.111 | −6.037 *** | 2.818 |

| (0.628) | (0.670) | (0.630) | (0.641) | (0.783) | (2.422) | |

| Observations | 33,754 | 33,754 | 33,754 | 33,754 | 33,734 | 32,716 |

| R-squared (within) | 0.570 | 0.551 | 0.576 | 0.541 | 0.564 | 0.122 |

| Log-likelihood | −28,444 | −30,674 | −28,600 | −29,168 | −35,856 | −70,718 |

| F-statistic | 11,170 | 10,314 | 11,445 | 9928 | 10,870 | 1138 |

| RMSE | 0.563 | 0.601 | 0.566 | 0.575 | 0.702 | 2.105 |

| Panel B: Multilevel PPML estimation results | ||||||

| Dependent Variable: Value-Added Trade (Levels) | Gross Exports and Imports | |||||

| Variables | TOT | AGR | MNF | SER | IMP | EXP |

| Ln (Immig) | 0.206 *** | 0.298 *** | 0.196 *** | 0.223 *** | 0.260 *** | 0.289 *** |

| (0.0125) | (0.0152) | (0.0130) | (0.0117) | (0.0128) | (0.0162) | |

| Ln (PCI1) | 2.688 *** | 1.902 *** | 3.081 *** | 1.883 *** | 2.704 *** | 4.060 *** |

| (0.238) | (0.273) | (0.261) | (0.227) | (0.217) | (0.555) | |

| Ln (PCI2) | 2.958 *** | 2.137 *** | 3.173 *** | 2.910 *** | 3.474 *** | 1.678 |

| (0.494) | (0.410) | (0.528) | (0.509) | (0.410) | (1.160) | |

| Ln (TRcost) | −0.752 *** | −0.729 *** | −0.800 *** | −0.601 *** | −0.864 *** | −0.832 *** |

| (0.0639) | (0.0759) | (0.0632) | (0.0665) | (0.0659) | (0.0690) | |

| Constant | −13.96 *** | −12.86 *** | −16.32 *** | −12.74 *** | −14.70 *** | −14.07 *** |

| (2.549) | (2.524) | (2.771) | (2.430) | (2.152) | (5.324) | |

| Observations | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 | 33,754 |

| Pseudo R-square | 0.918 | 0.861 | 0.922 | 0.913 | 0.9409 | 0.7853 |

| Log-likelihood | −3.84 × 106 | −90,016 | −2.90 × 106 | −941,141 | −1.48 × 107 | −2.90 × 107 |

| Chi-square | 3315 | 7326 | 2879 | 3549 | 7480 | 1892 |

| RMSE | 0.566 | 0.565 | 0.566 | 0.564 | 0.503 | 0.974 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tadesse, B.; White, R. Beyond Borders: The Effects of Immigrants on Value-Added Trade. Economies 2024, 12, 222. https://doi.org/10.3390/economies12090222

Tadesse B, White R. Beyond Borders: The Effects of Immigrants on Value-Added Trade. Economies. 2024; 12(9):222. https://doi.org/10.3390/economies12090222

Chicago/Turabian StyleTadesse, Bedassa, and Roger White. 2024. "Beyond Borders: The Effects of Immigrants on Value-Added Trade" Economies 12, no. 9: 222. https://doi.org/10.3390/economies12090222

APA StyleTadesse, B., & White, R. (2024). Beyond Borders: The Effects of Immigrants on Value-Added Trade. Economies, 12(9), 222. https://doi.org/10.3390/economies12090222