Learn from Whom? An Empirical Study of Enterprise Digital Mimetic Isomorphism under the Institutional Environment

Abstract

1. Introduction

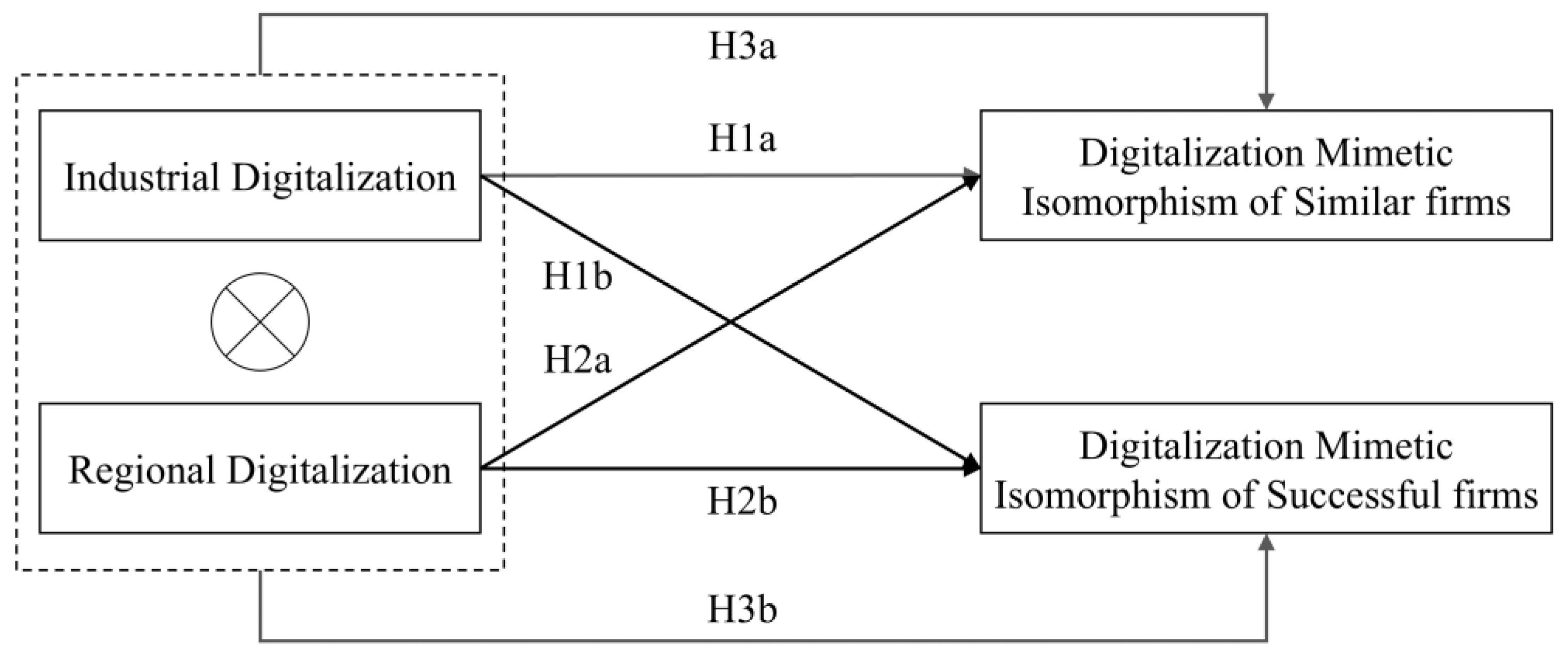

2. Theory and Hypothesis Development

2.1. New Institutional Theory and Mimetic Isomorphism

2.2. Industrial Digitalization and Digital Mimetic Isomorphism

2.3. Regional Digitalization and Digital Mimetic Isomorphism

2.4. Interactive Effect of Industrial Digitalization and Regional Digitalization on Digital Mimetic Isomorphism

3. Reseach Design

3.1. Sample and Data

3.2. Variables and Measures

3.3. Methodology

4. Results

4.1. Summary Statistics

4.2. Baseline Results

4.3. Robustness Checks

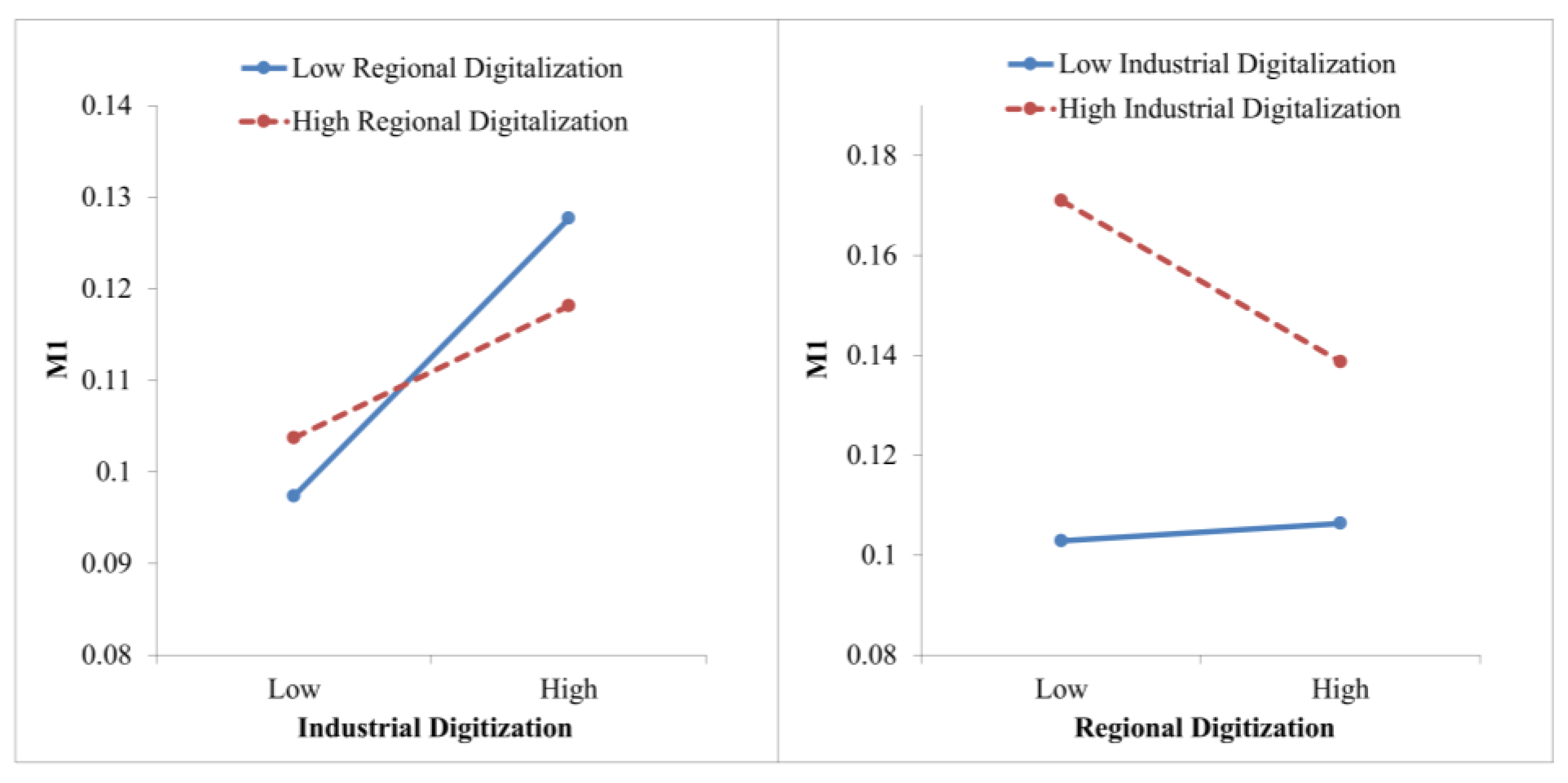

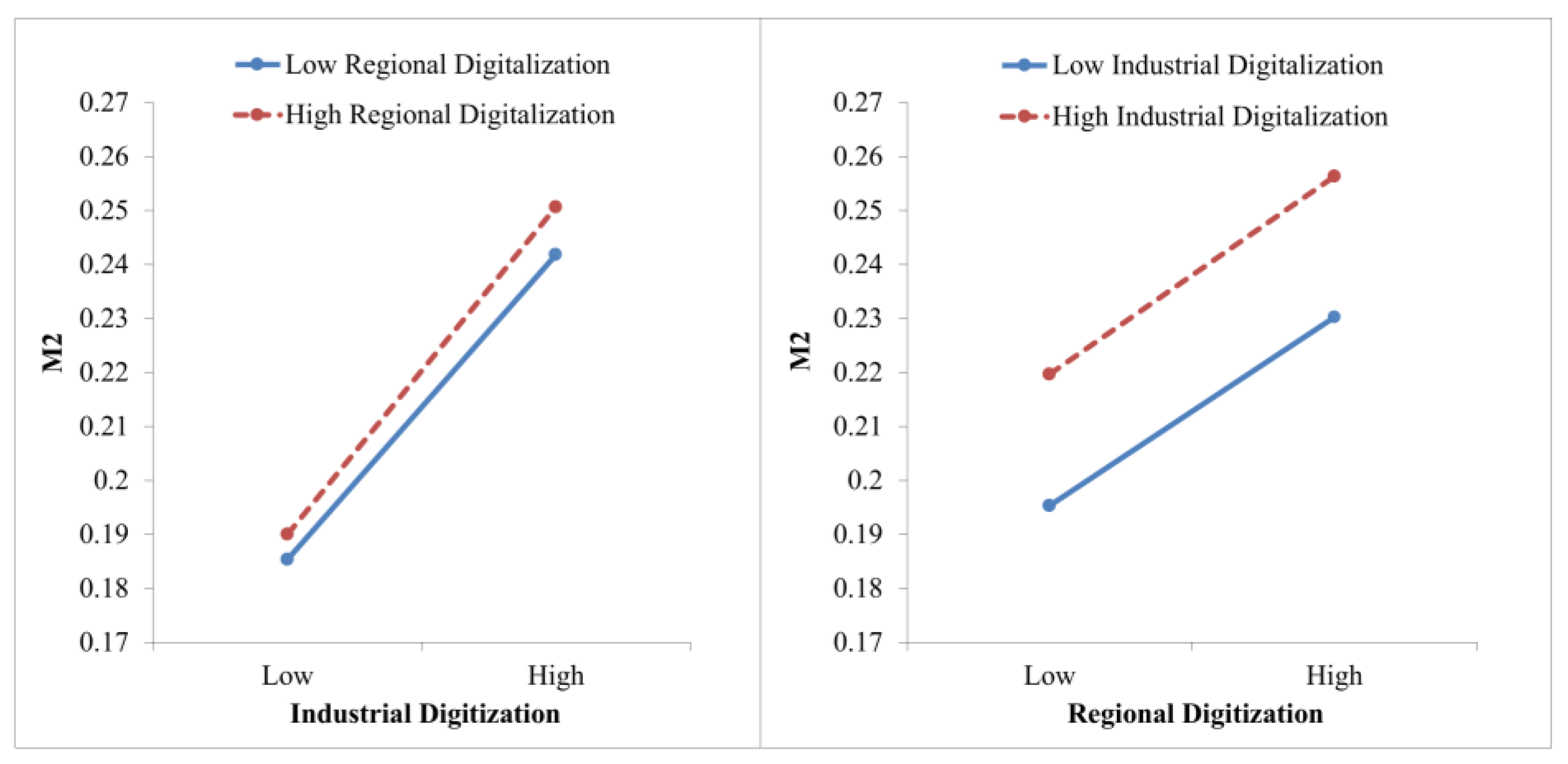

4.4. Interaction Effect Results

5. Discussion and Conclusions

5.1. Conclusions

5.2. Theoretical Contributions

5.3. Practical Implications

5.4. Limitations and Future Research

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | When the treatment variable refers to regional digitalization, the selected matching variable are firm size, firm age, seperation, ownership, CEO education, shareholding No. 1, asset return, and CEO tenure. Moreover, all results pass the matching balance test, signifying the significant value of the ATT. |

References

- Ando, Naoki. 2011. Isomorphism and foreign subsidiary staffing policies. Cross Cultural Management: An International Journal 18: 131–43. [Google Scholar] [CrossRef]

- Anwar, Muhammad, Kayhan Tajeddini, and Rizwan Ullah. 2020. Entrepreneurial finance and new venture success—The moderating role of government support. Business Strategy & Development 3: 408–21. [Google Scholar] [CrossRef]

- Argote, Linda, and Ella Miron-Spektor. 2011. Organizational Learning: From Experience to Knowledge. Organization Science 22: 1123–37. [Google Scholar] [CrossRef]

- Brookes, Maureen, and Levent Altinay. 2017. Knowledge transfer and isomorphism in franchise networks. International Journal of Hospitality Management 62: 33–42. [Google Scholar] [CrossRef]

- Brunnermeier, Markus, Simon Rother, and Isabel Schnabel. 2020. Asset Price Bubbles and Systemic Risk. The Review of Financial Studies 33: 4272–317. [Google Scholar] [CrossRef]

- Cao, Shaopeng, Xin Cui, Jing Liao, Chunfeng Wang, and Shouyu Yao. 2024. A good neighbor, a found treasure: Do local neighbors affect corporate innovation? Journal of Product Innovation Management 4: 1–22. [Google Scholar] [CrossRef]

- Chalmers, Dominic, Russell Matthews, and Amy Hyslop. 2021. Blockchain as an external enabler of new venture ideas: Digital entrepreneurs and the disintermediation of the global music industry. Journal of Business Research 125: 577–91. [Google Scholar] [CrossRef]

- Chen, Limin, Jingya Liu, and Shilei Zhang. 2016. Influence of Mimetic lsomorphism on Firms’ lnternationalization Performance Relationship-An Empirical Study Based on Legitimacy Perspective in Institutional Theory. China Industrial Economics 9: 127–43. [Google Scholar] [CrossRef]

- Chen, Yujiao, Tiebo Song, and Jianbin Huang. 2022. Digital transformation of enterprises: Ls the company following peers in the same industry? Or in the same area? Research on decision process based on institutional theory. Studies in Science of Science 40: 1054–62. [Google Scholar] [CrossRef]

- Chen, Yujiao, Rui Li, and Tiebo Song. 2023. Does TMT internationalization promote corporate digital transformation? A study based on the cognitive process mechanism. Business Process Management Journal 29: 309–38. [Google Scholar] [CrossRef]

- Cheng, Zhuo, Arun Rai, Feng Tian, and Sean Xin Xu. 2021. Social Learning in Information Technology Investment: The Role of Board Interlocks. Management Science 67: 547–76. [Google Scholar] [CrossRef]

- Chi, Maomao, Dingling Ye, Junjing Wang, and Shanshan Zhai. 2020. How Can Chinese Small-and Medium-sized Manufacturing Enterprises lmprove the New Product Development (NPD) Performance? From the Perspective of Digital Empowerment. Nankai Business Review 23: 63–75. [Google Scholar]

- Correani, Alessia, Alfredo De Massis, Federico Frattini, Antonio Messeni Petruzzelli, and Angelo Natalicchio. 2020. Implementing a Digital Strategy: Learning from the Experience of Three Digital Transformation Projects. California Management Review 62: 37–56. [Google Scholar] [CrossRef]

- Dai, Xiang, and Shuangzhi Yang. 2022. Digital Empowerment, Source of Digital Input and Green Manufacturing. China Industrial Economics 9: 83–101. [Google Scholar] [CrossRef]

- DiMaggio, Paul J., and Walter W. Powell. 1983. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. American Sociological Review 48: 147–60. [Google Scholar] [CrossRef]

- Durand, Rodolphe, and Pierre-Antoine Kremp. 2016. Classical Deviation: Organizational and Individual Status as Antecedents of Conformity. Academy of Management Journal 59: 65–89. [Google Scholar] [CrossRef]

- Francis, John, Cong Cong Zheng, and Ananda Mukherji. 2009. An Institutional Perspective on Foreign Direct Investment: A Multi-level Framework. Management International Review 49: 565–83. [Google Scholar] [CrossRef]

- Giachetti, C. Claudio, and Salvatore Torrisi. 2018. Following or Running Away from the Market Leader? The Influences of Environmental Uncertainty and Market Leadership. European Management Review 15: 445–63. [Google Scholar] [CrossRef]

- Gobble, MaryAnne M. 2018. Digital Strategy and Digital Transformation. Research-Technology Management 61: 66–71. [Google Scholar] [CrossRef]

- Goldfarb, Avi, and Catherine Tucker. 2019. Digital Economics. Journal of Economic Literature 57: 3–43. [Google Scholar] [CrossRef]

- Greenwood, Royston, Amalia Magán Díaz, Stan Xiao Li, and José Céspedes Lorente. 2010. The Multiplicity of Institutional Logics and the Heterogeneity of Organizational Responses. Organization Science 21: 521–39. [Google Scholar] [CrossRef]

- Greve, Henrich R. 2009. Bigger and safer: The diffusion of competitive advantage. Strategic Management Journal 30: 1–23. [Google Scholar] [CrossRef]

- Han, Shin-Kap. 1994. Mimetic Isomorphism and Its Effect on the Audit Services Market. Social Forces 73: 637–64. [Google Scholar] [CrossRef]

- Hansen, Rina, and Kien Sia Siew. 2015. Hummel’s Digital Transformation Toward Omnichannel Retailing: Key Lessons Learned. MIS Quarterly Executive 14: 51–66. [Google Scholar]

- Hartmann, Dominik, Miguel R. Guevara, Cristian Jara-Figueroa, Manuel Aristarán, and César A. Hidalgo. 2017. Linking Economic Complexity, Institutions, and Income Inequality. World Development 93: 75–93. [Google Scholar] [CrossRef]

- Haunschild, R. Pamela, and Anne S. Miner. 1997. Modes of Interorganizational Imitation: The Effects of Outcome Salience and Uncertainty. Administrative Science Quarterly 42: 472–500. [Google Scholar] [CrossRef]

- Haveman, Heather A. 1993. Follow the Leader: Mimetic Isomorphism and Entry Into New Markets. Administrative Science Quarterly 38: 593. [Google Scholar] [CrossRef]

- Heugens, Pursey P. M. A. R., and Michel W. Lander. 2009. Structure! Agency! (And Other Quarrels): A Meta-Analysis of Institutional Theories of Organization. Academy of Management Journal 52: 61–85. [Google Scholar] [CrossRef]

- Hidalgo, César A., Bailey Klinger, Albert-Laszlo Barabási, and Romeu Hausmann. 2007. The Product Space Conditions the Development of Nations. Science 317: 482–87. [Google Scholar] [CrossRef]

- Hinings, Bob, Thomas Gegenhuber, and Royston Greenwood. 2018. Digital innovation and transformation: An institutional perspective. Information and Organization 28: 52–61. [Google Scholar] [CrossRef]

- Huang, Jimmy, Ola Henfridsson, Martin J. Liu, and Sue Newell. 2017. Growing on Steroids: Rapidly Scaling the User Base of Digital Ventures Through Digital Innovaton. MIS Quarterly 41: 301–14. [Google Scholar] [CrossRef]

- Jiménez-Jiménez, Daniel, and Raquel Sanz-Valle. 2011. Innovation, organizational learning, and performance. Journal of Business Research 64: 408–17. [Google Scholar] [CrossRef]

- Kern, Philipp, and Howard Gospel. 2023. The effects of strategy and institutions on value creation and appropriation in firms: A longitudinal study of three telecom companies. Strategic Management Journal 44: 343–66. [Google Scholar] [CrossRef]

- Kesidou, Effie, James H. Love, Serdal Ozusaglam, and Chee Yew Wong. 2023. Changing the geographic scope of collaboration: Implications for product innovation novelty and commercialization. Journal of Product Innovation Management 40: 859–81. [Google Scholar] [CrossRef]

- Khin, Sabai, and Theresa Cf Ho. 2018. Digital technology, digital capability and organizational performance: A mediating role of digital innovation. International Journal of Innovation Science 11: 177–95. [Google Scholar] [CrossRef]

- Kolomeitsev, Sergei, Kristie J. N. Moergen, Jason W. Ridge, Dan L. Worrell, and Scott Kuban. 2024. Peer Response to Regulatory Enforcement: Lobbying by Non-Sanctioned Firms. Journal of Management, 1–24. [Google Scholar] [CrossRef]

- Kostova, Tatiana, and Srilata Zaheer. 1999. Organizational Legitimacy Under Conditions of Complexity: The Case of the Multinational Enterprise. Academy of Management Review 24: 64–81. [Google Scholar] [CrossRef]

- Lai, Kee-Hung, Christina W. Y. Wong, and T. C. Edwin Cheng. 2006. Institutional isomorphism and the adoption of information technology for supply chain management. Computers in Industry 57: 93–98. [Google Scholar] [CrossRef]

- Lai, Xiaobing, and Shujing Yue. 2022. Do Pilot Smart Cities Promote Corporate Digital Transformation? An Empirical Study Based on a Quasi-natural Experiment. Foreign Economics & Management 44: 117–33. [Google Scholar] [CrossRef]

- Li, Chengguang, and K. Praveen Parboteeah. 2015. The effect of culture on the responsiveness of firms to mimetic forces: Imitative foreign joint venture entries into China, 1985–2003. Journal of World Business 50: 465–76. [Google Scholar] [CrossRef]

- Li, Xinchun, Wenping Ye, and Hang Zhu. 2016. Trapped in or Free from the Cage: The Relationship between Regional Guanxi Culture and Guanxi Strategy of Entrepreneurial Firms. Journal of Management World 10: 88–102. [Google Scholar] [CrossRef]

- Lieberman, Marvin B., and Shigeru Asaba. 2006. Why Do Firms Imitate Each Other? Academy of Management Review 31: 366–85. [Google Scholar] [CrossRef]

- Liu, Guanyu, Jiaqi Liu, Ping Gao, Jiang Yu, and Zhengning Pu. 2024. Understanding mechanisms of digital transformation in state-owned enterprises in China: An institutional perspective. Technological Forecasting and Social Change 202: 123288. [Google Scholar] [CrossRef]

- Liu, Yong, Nan Wang, and Juanjuan Zhao. 2018. Relationships between isomorphic pressures and carbon management imitation behavior of firms. Resources, Conservation and Recycling 138: 24–31. [Google Scholar] [CrossRef]

- Luo, Jianqiang, and Qianwen Jiang. 2022. Priority evolution of product and service innovation under digital transformation-Based on the case of Haier smart home. Studies In Science of Science 40: 1710–20. [Google Scholar] [CrossRef]

- Martínez-Noya, Andrea, and Esteban García-Canal. 2021. Innovation performance feedback and technological alliance portfolio diversity: The moderating role of firms’ R&D intensity. Research Policy 50: 104321. [Google Scholar] [CrossRef]

- Mizruchi, Mark S., and Lisa C. Fein. 1999. The Social Construction of Organizational Knowledge: A Study of the Uses of Coercive, Mimetic, and Normative Isomorphism. Administrative Science Quarterly 44: 653–83. [Google Scholar] [CrossRef]

- Ni, Jiacheng, Qian Gu, and Huajing Li. 2023. The Later, the Slower, the Better? A Study on the Relationship Between lterative lnnovation and Entrepreneurial Outcomes of Digital Startups. Nankai Business Review 8: 1–22. Available online: http://kns.cnki.net/kcms/detail/12.1288.F.20230831.0915.002.html (accessed on 31 August 2023).

- Nie, Jun, Xin Jian, Juanjuan Xu, Nuo Xu, Tangyang Jiang, and Yang Yu. 2024. The Effect of Corporate Social Responsibility Practices on Digital Transformation in China: A Resource-Based View. Economic Analysis and Policy 82: 1–15. [Google Scholar] [CrossRef]

- Oh, Won-Yong, and Vincent L. Barker. 2018. Not All Ties Are Equal: CEO Outside Directorships and Strategic Imitation in R&D Investment. Journal of Management 44: 1312–37. [Google Scholar] [CrossRef]

- Ozturk, Ayse, S. Tamer Cavusgil, and O. Cem Ozturk. 2021. Consumption convergence across countries: Measurement, antecedents, and consequences. Journal of International Business Studies 52: 105–20. [Google Scholar] [CrossRef]

- Palmer, Donald A., P. Devereaux Jennings, and Xueguang Zhou. 1993. Late Adoption of the Multidivisional Form by Large U.S. Corporations: Institutional, Political, and Economic Accounts. Administrative Science Quarterly 38: 100–31. [Google Scholar] [CrossRef]

- Petersen, Mitchell A. 2009. Estimating Standard Errors in Finance Panel Data Sets: Comparing Approaches. The Review of Financial Studies 22: 435–80. [Google Scholar] [CrossRef]

- Posen, Hart E., Jan-Michael Ross, Brian Wu, Stefano Benigni, and Zhi Cao. 2023. Reconceptualizing Imitation: Implications for Dynamic Capabilities, Innovation, and Competitive Advantage. Academy of Management Annals 17: 74–112. [Google Scholar] [CrossRef]

- Posen, Hart E., Jeho Lee, and Sangyoon Yi. 2013. The power of imperfect imitation. Strategic Management Journal 34: 149–64. [Google Scholar] [CrossRef]

- Quinton, Sarah, Ana Canhoto, Sebastian Molinillo, Rebecca Pera, and Tribikram Budhathoki. 2018. Conceptualising a digital orientation: Antecedents of supporting SME performance in the digital economy. Journal of Strategic Marketing 26: 427–39. [Google Scholar] [CrossRef]

- Rahmati, Pouya, Ali Tafti, J. Christopher Westland, and Cesar Hidalgo. 2021. When All Products Are Digital: Complexity and Intangible Value in the Ecosystem of Digitizing Firm. MIS Quarterly 45: 1025–58. [Google Scholar] [CrossRef]

- Saesen, Julie, Corinna Vera Hedwig Schmidt, and Steffen Strese. 2024. The more, the better: The influence of overconfident CEOs on their firms’ digital orientation. Journal of Business Research 183: 114809. [Google Scholar] [CrossRef]

- Sarker, Suprateek, Sutirtha Chatterjee, Xiao Xiao, and Amany Elbanna. 2019. The Sociotechnical Axis of Cohesion for the IS Discipline: Its Historical Legacy and its Continued Relevance. MIS Quarterly 43: 695–719. [Google Scholar] [CrossRef]

- Sarrina Li, Shu-Chu, and Chen-Yi Lee. 2010. Market uncertainty and mimetic isomorphism in the newspaper industry: A study of Taiwan’s mainstream newspapers from 1992 to 2003. Asian Journal of Communication 20: 367–84. [Google Scholar] [CrossRef]

- Shen, Kunrong, Jianwei Lin, and Yuanhai Fu. 2023. Network Infrastructure Construction, Information Accessibility and the lnnovation Boundaries of Enterprises. China Industrial Economics 1: 57–75. [Google Scholar] [CrossRef]

- Strang, David, and Sarah A. Soule. 1998. Diffusion in Organizations and Social Movements: From Hybrid Corn to Poison Pills. Annual Review of Sociology 24: 265–90. [Google Scholar] [CrossRef]

- Suchman, Mark C. 1995. Managing Legitimacy: Strategic and Institutional Approaches. Academy of Management Review 20: 571–610. [Google Scholar] [CrossRef]

- Tang, Chang, Yuanyuan Xu, Yu Hao, Haitao Wu, and Yan Xue. 2021. What is the role of telecommunications infrastructure construction in green technology innovation? A firm-level analysis for China. Energy Economics 103: 105576. [Google Scholar] [CrossRef]

- Tang, Jianyun, Mary Crossan, and W. Glenn Rowe. 2011. Dominant CEO, Deviant Strategy, and Extreme Performance: The Moderating Role of a Powerful Board. Journal of Management Studies 48: 1479–503. [Google Scholar] [CrossRef]

- Triplett, Jack E. 1999. The Solow Productivity Paradox: What do Computers do to Productivity? The Canadian Journal of Economics / Revue Canadienne d’Economique 32: 309–34. [Google Scholar] [CrossRef]

- Tseng, Jen-Jen, and Ping-Hung Chou. 2011. Mimetic isomorphism and its effect on merger and acquisition activities in Taiwanese financial industries. The Service Industries Journal 31: 1451–69. [Google Scholar] [CrossRef]

- Wei, Jiang, Jialing Liu, and Yang Liu. 2021. New Trends and Problems of Innovation Strategy Theory in the Context of New Organization. Journal of Management World 37: 182–97+13. [Google Scholar] [CrossRef]

- Wernsdorf, Kathrin, Markus Nagler, and Martin Watzinger. 2022. ICT, collaboration, and innovation: Evidence from BITNET. Journal of Public Economics 211: 104678. [Google Scholar] [CrossRef]

- Wu, Fei, Huizhi Hu, Huiyan Lin, and Xiaoyi Ren. 2021. Enterprise Digital Transformation and Capital Market Performance: Empirical Evidence from Stock Liquidity. Journal of Management World 37: 130–44+10. [Google Scholar] [CrossRef]

- Xie, Kang, Yao Wu, Jinghua Xiao, and Xuehua Liao. 2016. Strategic Risk Control in Organizational Change: A Multi-Case Study of Organizational Transformation towards Internet. Journal of Management World 2: 133–48. [Google Scholar] [CrossRef]

- Xu, Qiong, Xin Li, and Fei Guo. 2023. Digital transformation and environmental performance: Evidence from Chinese resource-based enterprises. Corporate Social Responsibility and Environmental Management 30: 1816–40. [Google Scholar] [CrossRef]

- Yang, Monica, and MaryAnne Hyland. 2012. Re-examining mimetic isomorphism: Similarity in mergers and acquisitions in the financial service industry. Management Decision 50: 1076–95. [Google Scholar] [CrossRef]

- Ye, Dan, Meifang Yao, Baoshan Ge, and Liyi Zhao. 2023. The Mechanism of Digital Technology Driving Digital lnnovation Performance in Non-lnternet Enterprises: The Moderating Effect of Organizational Legitimacy. Science & Technology Progress and Policy 40: 11–18. [Google Scholar] [CrossRef]

- Zhang, Jing A., Fiona Edgar, Alan Geare, and Conor O’Kane. 2016. The interactive effects of entrepreneurial orientation and capability-based HRM on firm performance: The mediating role of innovation ambidexterity. Industrial Marketing Management 59: 131–43. [Google Scholar] [CrossRef]

- Zhang, Yongshen, Xiaobo Li, and Mingqiang Xing. 2021. Enterprise Digital Transformation and Audit Pricing. Auditing Research 3: 62–71. [Google Scholar] [CrossRef]

- Zhao, Tao, Zhi Zhang, and Shangshen Liang. 2020. Digital Economy, Entrepreneurship, and High-Quality Economic Development: Empirical Evidence from Urban China. Journal of Management World 36: 65–76. [Google Scholar] [CrossRef]

- Zhou, Yaying, Young-Seok Ock, Ibrahim Alnafrah, and Abd Alwahed Dagestani. 2023. What Aspects Explain the Relationship between Digital Transformation and Financial Performance of Firms? Journal of Risk and Financial Management 16: 479. [Google Scholar] [CrossRef]

- Zimmerman, Monica A., and Gerald J. Zeitz. 2002. Beyond Survival: Achieving New Venture Growth by Building Legitimacy. Academy of Management Review 27: 414–31. [Google Scholar] [CrossRef]

| Variables | Description | Source |

|---|---|---|

| Dependent variables | ||

| M1 | The level of digital mimetic isomorphism of similar firms | CCER |

| M2 | The level of digital mimetic isomorphism of successful firms | CCER |

| Independent variables | ||

| Indd | Industrial digitalization, complete dependency degree in input–output table calculations. | IOTs |

| Regd | Regional digitalization, the values obtained by applying principal component analysis for dimensionality reduction on the five aforementioned indicators | Statistical Yearbook et al. |

| Control variables | ||

| Herfindahl index | Squared sum of each company’s market share within an industry | CSMAR |

| Firm size | Natural logarithm of the sum of total assets plus one | CSMAR |

| Leverage ratio | Total debts divided by total assets | CSMAR |

| Cash holdings | Cash and cash equivalents divided by total assets | CSMAR |

| Asset return | Net profit divided by total assets | CSMAR |

| Revenue growth | The growth rate of the operating revenue | CSMAR |

| Firm age | Natural logarithm of the sum of the listed age plus one | CSMAR |

| Ownership | The dummy variable takes a value of 1 if the actual controller of the company is state-owned, and 0 otherwise | CSMAR |

| Board size | Natural logarithm of the number of board members | CSMAR |

| Shareholding No.1 | Natural logarithm of the ratio of shareholding held by the largest shareholder plus one | CSMAR |

| Separation | Natural logarithm of the control rights ratio minus ownership rights ratio plus one | CSMAR |

| CEO age | Natural logarithm of CEO age | CSMAR |

| CEO education | Values from 5 to 1: doctorate, master’s degree, bachelor’s degree, associate’s degree, and technical diploma or other qualifications | CSMAR |

| CEO tenure | Natural logarithm of the age of a CEO during their tenure (denoted in months) plus one | CSMAR |

| Variables | Mean | S.D. | Median | Min | Max | VIF |

|---|---|---|---|---|---|---|

| M1 | 0.209 | 0.230 | 0.097 | 0.000 | 0.721 | |

| M2 | 0.105 | 0.076 | 0.096 | 0.000 | 0.250 | |

| Indd | 0.086 | 0.132 | 0.032 | 0.006 | 0.593 | 1.09 |

| Regd | 0.200 | 0.080 | 0.188 | 0.065 | 0.417 | 1.08 |

| Herfindahl index | 0.091 | 0.090 | 0.065 | 0.014 | 0.555 | 1.02 |

| Firm size | 22.300 | 1.377 | 22.100 | 19.620 | 26.630 | 1.36 |

| Leverage ratio | 0.441 | 0.213 | 0.430 | 0.060 | 0.960 | 2.87 |

| Cash holdings | 0.173 | 0.121 | 0.141 | 0.011 | 0.601 | 1.07 |

| Asset return | 0.030 | 0.074 | 0.034 | -0.362 | 0.201 | 2.90 |

| Revenue growth | 0.185 | 0.604 | 0.089 | -0.661 | 4.429 | 1.00 |

| Firm age | 2.932 | 0.312 | 2.996 | 1.946 | 3.497 | 1.11 |

| Ownership | 0.364 | 0.481 | 0.000 | 0.000 | 1.000 | 1.37 |

| Board size | 2.126 | 0.202 | 2.197 | 1.609 | 2.708 | 1.15 |

| Shareholding No. 1 | 3.468 | 0.449 | 3.495 | 1.162 | 4.511 | 1.13 |

| Separation | 0.972 | 1.210 | 0.000 | 0.000 | 4.013 | 1.06 |

| CEO age | 3.901 | 0.136 | 3.912 | 3.497 | 4.190 | 1.10 |

| CEO education | 3.186 | 1.295 | 4.000 | 0.000 | 5.000 | 1.03 |

| CEO tenure | 3.512 | 1.070 | 3.714 | 0.000 | 5.460 | 1.09 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| M1 | M2 | M1 | M2 | |

| Indd | 0.087 *** | 0.054 *** | ||

| (59.57) | (244.83) | |||

| Regd | 0.012 *** | 0.032 *** | ||

| (5.03) | (44.00) | |||

| Herfindahl index | −0.173 *** | 0.031 *** | −0.185 *** | 0.019 *** |

| (−53.96) | (91.73) | (−64.81) | (27.07) | |

| Firm size | −0.003 *** | −0.000 *** | −0.003 *** | −0.001 *** |

| (−27.60) | (−3.33) | (−12.19) | (−7.32) | |

| Leverage ratio | 0.001 ** | −0.011 *** | 0.002 *** | −0.011 *** |

| (2.39) | (−47.96) | (5.70) | (−32.63) | |

| Cash holdings | 0.022 *** | −0.093 *** | 0.035 *** | −0.091 *** |

| (15.38) | (−276.94) | (27.89) | (−110.80) | |

| Asset return | 0.013 *** | −0.087 *** | 0.017 *** | −0.088 *** |

| (5.91) | (−138.28) | (10.63) | (−97.83) | |

| Revenue growth | −0.000 | 0.000 | −0.000 | 0.000 |

| (−0.45) | (1.28) | (−0.42) | (1.41) | |

| Firm age | 0.003 *** | 0.008 *** | −0.009 *** | 0.006 *** |

| (3.41) | (70.25) | (−12.69) | (40.69) | |

| Ownership | 0.006 *** | 0.021 *** | 0.005 *** | 0.021 *** |

| (7.99) | (154.46) | (7.36) | (100.04) | |

| Board size | −0.002 * | −0.014 *** | −0.002 *** | −0.015 *** |

| (−1.80) | (−65.27) | (−2.81) | (−52.82) | |

| Shareholding No.1 | 0.018 *** | −0.019 *** | 0.015 *** | −0.020 *** |

| (41.55) | (−285.93) | (28.43) | (−171.35) | |

| Separation | −0.001 *** | 0.001 *** | −0.001 *** | 0.001 *** |

| (−7.65) | (23.34) | (−6.63) | (12.07) | |

| CEO age | 0.037 *** | −0.014 *** | 0.030 *** | −0.015 *** |

| (31.97) | (−84.98) | (26.32) | (−37.56) | |

| CEO education | −0.002 *** | 0.000 *** | −0.001 *** | 0.000 *** |

| (−15.88) | (11.62) | (−10.80) | (8.19) | |

| CEO tenure | −0.002 *** | −0.002 *** | −0.002 *** | −0.002 *** |

| (−12.46) | (−31.81) | (−15.87) | (−25.87) | |

| Constant | 0.051 *** | 0.257 *** | 0.113 *** | 0.282 *** |

| (9.79) | (180.07) | (17.54) | (112.25) | |

| Year effect | Yes | Yes | Yes | Yes |

| Observations | 11,577 | 11,577 | 11,577 | 11,577 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| M1 | M2 | M1 | M2 | |

| Indd | 0.003 *** | 0.003 *** | ||

| (86.80) | (68.47) | |||

| Regd | 0.115 *** | 0.009 *** | ||

| (180.32) | (10.59) | |||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −0.122 *** | 0.293 *** | −0.099 *** | 0.298 *** |

| (−72.81) | (153.56) | (−69.62) | (115.29) | |

| Year effect | Yes | Yes | Yes | Yes |

| Observations | 13,130 | 13,130 | 13,130 | 13,130 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| M1 | M2 | M1 | M2 | |

| Indd | 0.081 *** | 0.050 *** | ||

| (34.45) | (214.24) | |||

| Regd | 0.030 *** | 0.025 *** | ||

| (16.91) | (81.73) | |||

| Controls | Yes | Yes | Yes | Yes |

| Constant | 0.033 *** | 0.244 *** | 0.059 *** | 0.266 *** |

| (5.85) | (134.73) | (9.61) | (158.57) | |

| Year effect | Yes | Yes | Yes | Yes |

| Observations | 8689 | 8689 | 8689 | 8689 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| M1 | M2 | M1 | M2 | |

| Indd | 0.056 *** | 0.070 *** | ||

| (38.30) | (525.07) | |||

| Regd | 0.044 *** | 0.023 *** | ||

| (29.23) | (42.16) | |||

| Controls | Yes | Yes | Yes | Yes |

| Constant | 0.039 *** | 0.232 *** | 0.018 *** | 0.348 *** |

| (7.14) | (181.45) | (5.34) | (137.11) | |

| Year effect | Yes | Yes | Yes | Yes |

| Observations | 9641 | 9641 | 9516 | 9516 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| M1 | M2 | M1 | M2 | |

| Indd | 0.075 * | 0.047 * | ||

| (0.044) | (1.85) | |||

| Regd | 0.061 * | 0.032 ** | ||

| (1.87) | (2.33) | |||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −0.109 | 0.285 *** | −0.058 | 0.304 *** |

| (0.173) | (10.98) | (−0.41) | (13.62) | |

| Observations | 10,916 | 10,916 | 10,916 | 10,916 |

| Variables | (1) | (2) |

|---|---|---|

| M1 | M2 | |

| Indd × Regd | −0.155 *** | 0.218 *** |

| (−13.90) | (36.70) | |

| Indd | 0.093 *** | 0.044 *** |

| (58.12) | (75.82) | |

| Regd | −0.003 | 0.019 *** |

| (−1.21) | (31.40) | |

| Controls | Yes | Yes |

| Constant | 0.048 *** | 0.262 *** |

| (6.57) | (100.67) | |

| Year effect | Yes | Yes |

| Observations | 11,577 | 11,577 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Y.; Ma, H.; Zhou, T. Learn from Whom? An Empirical Study of Enterprise Digital Mimetic Isomorphism under the Institutional Environment. Economies 2024, 12, 243. https://doi.org/10.3390/economies12090243

Chen Y, Ma H, Zhou T. Learn from Whom? An Empirical Study of Enterprise Digital Mimetic Isomorphism under the Institutional Environment. Economies. 2024; 12(9):243. https://doi.org/10.3390/economies12090243

Chicago/Turabian StyleChen, Ying, Haiyan Ma, and Tianyi Zhou. 2024. "Learn from Whom? An Empirical Study of Enterprise Digital Mimetic Isomorphism under the Institutional Environment" Economies 12, no. 9: 243. https://doi.org/10.3390/economies12090243

APA StyleChen, Y., Ma, H., & Zhou, T. (2024). Learn from Whom? An Empirical Study of Enterprise Digital Mimetic Isomorphism under the Institutional Environment. Economies, 12(9), 243. https://doi.org/10.3390/economies12090243