The Effect of Financial Market Capitalisation on Economic Growth and Unemployment in South Africa

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Data

3.2. Model Specification

3.3. Estimation Technique

3.3.1. Unit Root Test

3.3.2. Lag Structure Selection

3.3.3. Vector Error Correction Model

3.3.4. Impulse Response Function

3.3.5. Variance Decomposition

4. Results and Discussion

4.1. Unit Root Test

4.2. Lag Length Selection

4.3. Co-Integration Test

4.4. Diagnostic Test Results

4.5. Vector Error Correction Estimation Results

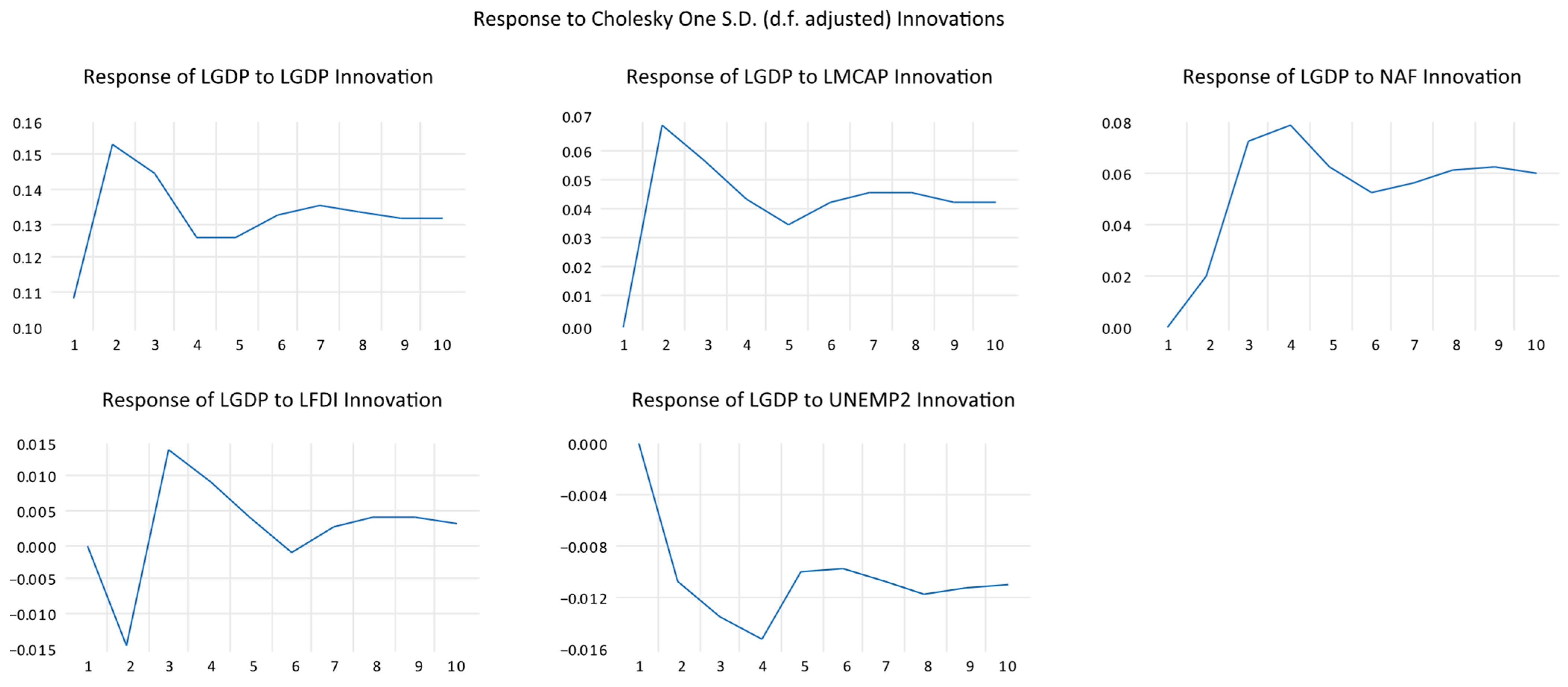

4.6. Impulse Response Function

4.7. Variance Decomposition Results and Analysis

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Akyüz, G. (2012). Bulanik VIKOR yöntemi ile tedarikçi seçimi. Atatürk Üniversitesi İktisadi ve İdari Bilimler Dergis, 26(1), 197–215. [Google Scholar]

- Alfaro, L., Chanda, A., Kalemli-Ozcan, S., & Sayek, S. (2004). FDI and economic growth: The role of local financial markets. Journal of International Economics, 64(1), 89–112. [Google Scholar] [CrossRef]

- Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. The Quarterly Journal of Economics, 120(2), 701–728. [Google Scholar]

- Atje, R., & Jovanovic, B. (1993). Stock markets and development. European Economic Review, 37(2–3), 632–640. [Google Scholar] [CrossRef]

- Ayadi, R., Arbak, E., Naceur, S. B., & De Groen, W. P. (2015). Financial development, bank efficiency, and economic growth across the mediterranean (pp. 219–233). Springer International Publishing. [Google Scholar]

- Arcand, J. L., Berkes, E., & Panizza, U. (2015). Too much finance? Journal of Economic Growth, 20, 105–148. [Google Scholar] [CrossRef]

- Arestis, P., Demetriades, P. O., & Luintel, K. B. (2001). Financial development and economic growth: The role of stock markets. Journal of Money, Credit and Banking, 16–41. [Google Scholar] [CrossRef]

- Barunik, J., & Kristoufek, L. (2010). On hurst exponent estimation under heavy-tailed distributions. Physica A: Statistical Mechanics and Its Applications, 389, 3844–3855. [Google Scholar] [CrossRef]

- Bolbol, A., Fatheldin, A., & Omran, M. (2005). Financial development, structure and economic growth: The case of Egypt, 1974–2002. Research in International Business Finance, 19, 171–194. [Google Scholar] [CrossRef]

- Brainard, W. C., & Tobin, J. (1968). Pitfalls in financial model building. The American Economic Review, 58(2), 99–122. [Google Scholar]

- Calderón, C., & Liu, L. (2003). The direction of causality between financial development and economic growth. Journal of Development Economics, 72(1), 321–334. [Google Scholar] [CrossRef]

- Cecchetti, S. G., & Kharroubi, E. (2012). Reassessing the impact of finance on growth. Available online: https://ssrn.com/abstract=2117753 (accessed on 15 October 2024).

- Chen, T. C., Kim, D. H., & Lin, S. C. (2021). Nonlinearity in the efects of fnancial development and fnancial structure on unemployment. Economic Systems, 45(1), 100766. [Google Scholar] [CrossRef]

- Chirila, V., Turturean, C., & Chirila, C. (2015). Volatility spillovers between eastern European and euro zone stock markets. Transformations in Business & Economics, 14, 464–477. [Google Scholar]

- Cobb, C. W., & Douglas, P. H. (1928). A theory of production. The American Economic, 18(1), 139–165. [Google Scholar]

- Cooray, A. (2009). The financial sector and economic growth. Economic Record, 85, S10–S21. [Google Scholar] [CrossRef]

- Cooray, A. (2010). Do stock markets lead to economic growth? Journal of Policy Modeling, 32(4), 448–460. [Google Scholar] [CrossRef]

- Didier, T., Levine, R., Montanes, R. L., & Schmukler, S. L. (2021). Capital market financing and firm growth. Journal of International Money and Finance, 118, 102459. [Google Scholar] [CrossRef]

- Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society, 49(4), 1057–1072. [Google Scholar] [CrossRef]

- Engle, R. F., & Granger, C. W. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica: Journal of the Econometric Society, 55(2), 251–276. [Google Scholar] [CrossRef]

- Fedderke, J. W. (2021). The South African–United States sovereign bond spread and its association with macroeconomic fundamentals. South African Journal of Economics, 89(4), 499–525. [Google Scholar] [CrossRef]

- Farida, Y., Hamidah, A., Sari, S. K., & Hakim, L. (2024). Modeling the farmer exchange rate in Indonesia using the vector error correction model method. MATRIK: Jurnal Manajemen, Teknik Informatika dan Rekayasa Komputer, 23(2), 309–322. [Google Scholar] [CrossRef]

- Goldsmith, D. W., Habing, H. J., & Field, G. B. (1969). Thermal properties of interstellar gas heated by cosmic rays. Astrophysical Journal, 158, 173. [Google Scholar] [CrossRef]

- Haibo, C., Manu, E., & Somuah, M. (2023). Examining finance-growth nexus: Empirical evidence from the sub-regional economies of Africa. SAGE Open, 13(1), 21582440231153117. [Google Scholar] [CrossRef]

- Hlongwane, J. T., & Sheefeni, J. P. S. (2023). Financial markets shocks and monetary policy in South Africa: A bayesian var approach. Journal of Public Administration, Finance and Law, 11, 152. [Google Scholar] [CrossRef]

- Kapingura, F. M. (2013). Finance and economic growth nexus: Complementarityand substitutability between the banking sector andfinancial markets in Africa, using South Africa as a case. Journal of Economics and International Finance, 5(7), 273–286. [Google Scholar] [CrossRef]

- Karwowski, E., Fine, B., & Ashman, A. (2018). Introduction to the special section “Financialisation in South Africa”. Competition & Change, 22(4), 383–387. [Google Scholar]

- Karwowski, E., & Stockhammer, E. (2017). Financialisation in emerging economies: A systematic overview and comparison with Anglo-Saxon economies. Economic and Political Studies, 5(1), 60–86. [Google Scholar] [CrossRef]

- Khalid, W., Akalpler, E., Khan, S., & Shah, N. H. (2021). The relationship between unemployment and economic growth in South Africa: VAR Analysis. Forman Journal of Economic Studies, 17(1), 1–32. [Google Scholar] [CrossRef]

- Khetsi, Q. S., & Mongale, I. P. (2015). The impact of capital markets on the economic growth in South Africa. Journal of Governance and Regulation, 4(1), 154–163. [Google Scholar] [CrossRef]

- King, R. G., & Levine, R. (1993a). Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics, 108(3), 717–737. [Google Scholar] [CrossRef]

- King, R. G., & Levine, R. (1993b). Financial intermediation and economic development (Vol. 15689). Cambridge University Press. [Google Scholar]

- Law, S. H., & Singh, N. (2014). Does too much finance harm economic growth? Journal of Banking & Finance, 41, 36–44. [Google Scholar]

- Levine, R., & Zervos, S. (1998). Stock markets, banks, and economic growth. The American Economic Review, 83(3), 537–558. [Google Scholar]

- Lütkepohl, H. (1993). Testing for causation between two variables in higher-dimensional VAR models. In Studies in applied econometrics (pp. 75–91). Physica-Verlag HD. [Google Scholar]

- Lütkepohl, H. (2005). New introduction to multiple time series analysis. Springers Science & Business Media. [Google Scholar]

- Mabeba, M. (2023). Financialisation and economic growth Nexus in South Africa. Journal of Economics and Financial Analysis, 7(1), 61–78. [Google Scholar]

- Mabeba, M. (2024). The Effect of financial market depth on economic growth in developing countries with large financial sectors. Social Science Studies, 4(2), 66–81. [Google Scholar] [CrossRef]

- Mankiw, N. G., Romer, D., & Weil, D. (1992). A contribution to the empirics of economic growth. The Quarterly Journal of Economics, 107(2), 407–437. [Google Scholar] [CrossRef]

- Minier, J. (2003). Are small stock markets different? Journal of Monetary Economics, 50, 1593–1602. [Google Scholar] [CrossRef]

- McKinnon, R. I. (1973). The value-added tax and the liberalization of foreign trade in developing economies: A comment. Journal of Economic Literature, 11(2), 520–524. [Google Scholar]

- Nyasha, S., Odhiambo, N. M., & Magombeyi, M. (2021). The impact of stock market development on unemployment: Empirical evidence from South Africa. Journal of Economics and Business, 71(1–2), 92–110. [Google Scholar]

- Popov, A. (2018). Evidence on finance and economic growth (pp. 63–104). Edward Elgar Publishing. [Google Scholar]

- Pradhan, R. P., & Bagchi, T. P. (2013). Effect of transportation infrastructure on economic growth in India: The VECM approach. Research in Transportation Economics, 38(1), 139–148. [Google Scholar] [CrossRef]

- Prochniak, M., & Wasiak, K. (2017). The impact of the financial system on economic growth in the context of the global crisis: Empirical evidence for the EU and OECD countries. Empirica, 44, 295–337. [Google Scholar] [CrossRef]

- Samargandi, N., Fidrmuc, J., & Ghosh, S. (2015). Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income countries. World Development, 68, 66–81. [Google Scholar] [CrossRef]

- Schumpeter, J. A. (1912). Theory of economic development. Routledge. [Google Scholar]

- Shaddady, A. (2023). Unveiling the dynamics of financial institutions and markets in shaping economic prosperity in MENA. International Journal of Financial Studies, 11(4), 148. [Google Scholar] [CrossRef]

- Shaw, E. S. (1973). Financial deepening in economic development. Oxford University Press. [Google Scholar]

- Shravani, & Sharma, S. K. (2020). Scrutinising causal relationship between stock market development and economic growth: Case of India. International Journal of Indian Culture and Business Management, 20(4), 429–443. [Google Scholar] [CrossRef]

- Solow, R. M. (1956). A contribution to the theory of economic growth. The Quarterly Journal of Economics, 70(1), 65–94. [Google Scholar] [CrossRef]

- Southall, R. (1981). Economic imperialism in theory and practice: The case of South African gold mining finance. The Journal of Modern African Studies, 19(2), 337–339. [Google Scholar] [CrossRef]

- Usman, M., Fatin, D. F., Barusman, M. Y. S., & Elfaki, F. A. (2017). Application of vector error correction model (VECM) and impulse response function for analysis data index of farmers’ terms of trade. Indian Journal of Science and Technology, 10(19), 1–14. [Google Scholar] [CrossRef]

- Vrieze, S. I. (2012). Model selection and psychological theory: A discussion of the differences between the Akaike information criterion (AIC) and the Bayesian information criterion (BIC). Psychological Methods, 17(2), 228. [Google Scholar] [CrossRef]

- Wait, C., Ruzive, T., & le Roux, P. (2017). The influence of financial market development on economic growth in BRICS countries. International Journal of Management and Economics, 53(1), 7–24. [Google Scholar] [CrossRef]

- Winker, P., & Maringer, D. (2005). The convergence of optimization based estimators: Theory and application to a GARCH-model (Discussion paper, No. 2005, 004E). Universität Erfurt, Staatswissenschaftliche Fakultät. [Google Scholar]

- Zhao, R. (2019). Technology and economic growth: From Robert Solow to Paul Romer. Human Behavior and Emerging Technologies, 1(1), 62–65. [Google Scholar] [CrossRef]

- Zhou, S., & Dev, D. T. (2020). The impact of shadow banking on economic growth: Evidence from cross country data (2006–2018). Journal of International Commerce, Economics and Policy, 11(03), 2050010. [Google Scholar] [CrossRef]

| Variables | Abreviation | Data Source |

|---|---|---|

| Gross domestic product per capita | GDP | World Bank |

| Market capitalisation | MCAP | World Bank |

| Unemployment | UNEM | South African Reserve Bank |

| Net acquisition of financial assets | NAT | World Bank |

| Foreign direct investment | FDI | World Bank |

| Variable | Augmented Dickey–Fuller (ADF) | Order of Integration | |||||

|---|---|---|---|---|---|---|---|

| Level | First Difference | ||||||

| Critical Value | T Statistic | Probability | Critical Value | T Statistic | Probability | ||

| LGDP | −2.954021 | −1.281401 | 0.6264 | −2.957110 | −4.334510 | 0.0018 | I(1) *** |

| MCAP | −2.963972 | −0.250961 | 0.88789 | −2.998064 | −2.992981 | 0.0505 | I(1) *** |

| NAF | −2.963972 | −1.839944 | 0.3549 | −2.963972 | −7.701176 | 0.0000 | I(1) *** |

| LFDI | −2.957110 | −2.714428 | 0.0827 | 2.960411 | −8.306229 | 0.0000 | I(1) *** |

| UNEMPL | −2.991878 | −0.9990438 | 0.7689 | −2.998064 | −5.970719 | 0.0000 | I(1) *** |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −145.2136 | NA | 0.046781 | 11.12694 | 11.36690 | 11.119829 |

| 1 | −75.26812 * | 108.8041 * | 0.001740 * | 7.797639 * | 9.237458 * | 8.225772 * |

| 2 | −51.61542 | 28.03283 | 0.002379 | 7.897439 | 10.53711 | 8.682350 |

| Hypothised No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob |

|---|---|---|---|---|

| None * | 0.636908 | 85.24195 | 76.97277 | 0.0102 |

| At most 1 * | 0.597392 | 57.88824 | 54.07904 | 0.0220 |

| At most 2 | 0.496907 | 33.32383 | 35.19275 | 0.0785 |

| At most 3 | 0.357167 | 14.77535 | 20.26184 | 0.2395 |

| At most | 0.100004 | 2.844849 | 9.164546 | 0.6101 |

| Hypothised No. of CE(s) | Eigenvalue | Max-Eigen Statistic | 0.05 Critical Value | Prob |

|---|---|---|---|---|

| None | 0.636908 | 27.35371 | 34.80587 | 0.2938 |

| At most 1 | 0.597392 | 24.56441 | 28.58808 | 0.1502 |

| At most 2 | 0.496907 | 18.54848 | 22.29962 | 0.1541 |

| At most 3 | 0.357167 | 11.93050 | 15.89210 | 0.1900 |

| At most | 0.100004 | 2.844849 | 9.164546 | 0.6101 |

| Test for | Test | p-Value | Conclusion |

|---|---|---|---|

| Normality | JB | 0.8036 | Accept Ho |

| Serial correlation | LM test | 0.6220 | Accept Ho |

| Heteroscedasticity | White (without cross terms) | 0.9656 | Accept Ho |

| LMCAP | NAF | LFDI | UNEMP | C | ECT |

|---|---|---|---|---|---|

| 0.320 *** | 0.093 *** | 0.130 *** | −0.027 *** | 2.310 | −0.429 *** |

| (0.051) | (0.036) | (0.052) | (0.009) | (0.165) | |

| [6.22084] | [2.546] | [2.499] | [−2.970] | [−2.591] |

| Variance Decomposition of LGDP | ||||||

| Period | S.E | LGDP | LMCAP | NAF | LFDI | UNEMP |

| 1 | 0.107865 | 100.0000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.200759 | 86.61338 | 11.63717 | 0.937810 | 0.524135 | 0.287503 |

| 3 | 0.264354 | 80.01541 | 11.16800 | 7.813115 | 0.574634 | 0.428845 |

| 4 | 0.306537 | 76.37457 | 10.29817 | 12.24280 | 0.513855 | 0.570600 |

| 5 | 0.33896 | 76.20792 | 9.469668 | 13.33590 | 0.432514 | 0.553999 |

| 6 | 0.369896 | 76.73976 | 9.233501 | 13.12688 | 0.363894 | 0.535970 |

| 7 | 0.400565 | 76.866636 | 9.171766 | 13.11825 | 0.314415 | 0.529206 |

| 8 | 0.429117 | 76.61841 | 9.102304 | 13.45787 | 0.283186 | 0.538234 |

| 9 | 0.455134 | 76.43970 | 8.969645 | 13.78828 | 0.260204 | 0.542174 |

| 10 | 0.479415 | 76.43970 | 8.865779 | 13.94507 | 0.238164 | 0.542176 |

| Variance Decomposition of LMCAP | ||||||

| Period | S.E | LGDP | LMCAP | NAF | LFDI | UNEMP |

| 1 | 0.280193 | 48.07265 | 51.92735 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.400637 | 48.15606 | 44.72264 | 1.3320458 | 5.726197 | 0.074646 |

| 3 | 0.488317 | 51.61910 | 42.39906 | 1.486315 | 4.299471 | 0.196051 |

| 4 | 0.566347 | 51.11453 | 42.28611 | 1.672848 | 4.761433 | 0.165083 |

| 5 | 0.33896 | 52.09944 | 41.47609 | 1.861536 | 4.36048 | 0.196883 |

| 6 | 0.690563 | 52.08391 | 41.36503 | 1.905878 | 4.456125 | 0.189057 |

| 7 | 0.744890 | 52.47720 | 41.03652 | 1.954715 | 4.331316 | 0.200248 |

| 8 | 0.796369 | 52.55077 | 40.94183 | 1.979716 | 4.329462 | 0.198222 |

| 9 | 0.844217 | 52.72466 | 40.78656 | 2.016256 | 4.270902 | 0.101617 |

| 10 | 00.88965 | 52.78768 | 40.70573 | 2.039479 | 4.255561 | 0.201549 |

| Variance Decomposition of NAF | ||||||

| Period | S.E | LGDP | LMCAP | NAF | LFDI | UNEMP |

| 1 | 1.016921 | 6.911954 | 4.869825 | 88.21822 | 0.000000 | 0.000000 |

| 2 | 1.394489 | 3.860799 | 5056793 | 83.50584 | 6.563675 | 1.012890 |

| 3 | 1.542191 | 5.113887 | 5.262818 | 75.07985 | 11.75863 | 2.784814 |

| 4 | 1.695611 | 8.238763 | 4.374488 | 67.07603 | 16.88542 | 3.425292 |

| 5 | 1.851300 | 10.42129 | 3.701796 | 64.99330 | 17.26108 | 3.622534 |

| 6 | 2.003905 | 10.73595 | 3.160731 | 64.86503 | 17.62399 | 3.614296 |

| 7 | 2.135008 | 10.92378 | 2.851103 | 64.28254 | 1815641 | 3.786167 |

| 8 | 2.253032 | 11.30772 | 2.582772 | 63.06404 | 19.09157 | 3.953895 |

| 9 | 2.366280 | 11.79903 | 2.347902 | 62.10861 | 19.66127 | 4.083193 |

| 10 | 2.477213 | 12.12960 | 2.14517 | 61.54178 | 20.03412 | 4.148789 |

| Variance Decomposition of LFDI | ||||||

| Period | S.E | LGDP | LMCAP | NAF | LFDI | UNEMP |

| 1 | 1.133192 | 0.022436 | 20.82554 | 0.215764 | 78.93626 | 0.000000 |

| 2 | 1.198430 | 0.032645 | 21.24033 | 1.673082 | 76.33360 | 0.720339 |

| 3 | 1.417138 | 1.435863 | 20.80305 | 2.221859 | 75.00265 | 0.536571 |

| 4 | 1.507475 | 1.801871 | 19.57603 | 2.520670 | 75.36758 | 0.733587 |

| 5 | 1.653128 | 2.058542 | 19.07029 | 2.153703 | 76.07114 | 0.646326 |

| 6 | 1.751730 | 2.054214 | 18.89089 | 2.077432 | 76.29473 | 0.682741 |

| 7 | 1.862560 | 2.141758 | 18.87023 | 2.045831 | 76.30554 | 0.636634 |

| 8 | 1.955303 | 2.232866 | 18.66250 | 2.088917 | 76.38136 | 0.634353 |

| 9 | 2.050935 | 2.324068 | 18.48585 | 2.052283 | 76.52053 | 0.617269 |

| 10 | 2.138765 | 2.138765 | 18.35026 | 2.020228 | 76.64352 | 0.614346 |

| Variance Decomposition of UNEMP | ||||||

| Period | S.E | LGDP | LMCAP | NAF | LFDI | UNEMP |

| 1 | 1.357130 | 0.007915 | 14.41271 | 1.311681 | 1.68596 | 82.58173 |

| 2 | 1.996680 | 18.24441 | 13.92267 | 0.632970 | 13.36263 | 53.83732 |

| 3 | 2.655809 | 26.18917 | 18.60502 | 0.463887 | 13.70252 | 41.03941 |

| 4 | 3.175198 | 28.95055 | 20.90336 | 0.810851 | 12.32841 | 37.00684 |

| 5 | 3.572362 | 29.50494 | 21.42007 | 1.459889 | 11.72587 | 35.88923 |

| 6 | 3.906353 | 29.90457 | 21.43992 | 1.581454 | 11.79662 | 35.27744 |

| 7 | 4.225326 | 30.43261 | 21.57184 | 1.487699 | 11.95576 | 34.55210 |

| 8 | 4.533344 | 30.90910 | 21.81311 | 1.429294 | 11.95085 | 33.89764 |

| 9 | 4.821081 | 31.21694 | 22.00555 | 1.445928 | 11.87424 | 33.45734 |

| 10 | 5.087891 | 31.41625 | 22.11025 | 1.475383 | 11.83263 | 33.16549 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ngcobo, W.A.; Zhou, S.; Pillay, S.S. The Effect of Financial Market Capitalisation on Economic Growth and Unemployment in South Africa. Economies 2025, 13, 57. https://doi.org/10.3390/economies13030057

Ngcobo WA, Zhou S, Pillay SS. The Effect of Financial Market Capitalisation on Economic Growth and Unemployment in South Africa. Economies. 2025; 13(3):57. https://doi.org/10.3390/economies13030057

Chicago/Turabian StyleNgcobo, Wandile Allan, Sheunesu Zhou, and Strinivasan S. Pillay. 2025. "The Effect of Financial Market Capitalisation on Economic Growth and Unemployment in South Africa" Economies 13, no. 3: 57. https://doi.org/10.3390/economies13030057

APA StyleNgcobo, W. A., Zhou, S., & Pillay, S. S. (2025). The Effect of Financial Market Capitalisation on Economic Growth and Unemployment in South Africa. Economies, 13(3), 57. https://doi.org/10.3390/economies13030057