Fiscal Deficit and Its Impact on Economic Growth: Evidence from Bangladesh

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

4. Discussion and Results

4.1 Additional Discussion and Results

5. Conclusions

Appendix A

| Obs | Mean | Std. Dev. | |

|---|---|---|---|

| GDPGR | 13 | 5.75 | 0.93 |

| FD | 13 | 293692.5 | 206832.9 |

| GDPGR | FD | |

|---|---|---|

| GDPGR | 1 | |

| FD | 0.360 | 1 |

| Panel A: Dickey Fuller Test | |||||

| Z(t) | Test Statistics | 1% Critical Value | 5% Critical Value | 10% Critical Value | |

| GDPGR | −1.628 | −3.75 | −3.00 | −2.63 | |

| D.GDPGR | −3.148 | −3.75 | −3.00 | −2.63 | |

| FD | 3.355 | −3.75 | −3.00 | −2.63 | |

| Panel B: Phillips-Perron Test | |||||

| Test Statistics | 1% Critical Value | 5% Critical Value | 10% Critical Value | ||

| GDPGR | |||||

| Z(rho) | −6.872 | −17.200 | −12.500 | −10.200 | |

| Z(t) | −1.982 | −3.750 | −3.000 | −2.630 | |

| FD | |||||

| Z(rho) | 2.567 | −17.200 | −12.500 | −10.200 | |

| Z(t) | 4.499 | −3.750 | −3.000 | −2.630 | |

| D.GDPGR | |||||

| Z(rho) | −15.726 | −17.200 | −12.500 | −10.200 | |

| Z(t) | −3.852 | −3.750 | −3.000 | −2.630 | |

| D.FD | |||||

| Z(rho) | −3.382 | −17.200 | −12.500 | −10.200 | |

| Z(t) | −1.369 | −3.750 | −3.000 | −2.630 | |

| Panel C: KPSS Tests | |||||

| Lag Order | Test Statistic GDPGR | Test Statistic RFD | |||

| 0 | 0.103 | 0.313 | |||

| 1 | 0.072 | 0.189 | |||

| 2 | 0.069 | 0.155 | |||

| Test Statistics | 5% level is 0.146 | ||||

| 1% level is 0.216 | |||||

| Lag Order | Test statistic D.GDPGR | Test statistic D.RFD | |||

| 0 | 0.0483 | 0.0665 | |||

| 1 | 0.0475 | 0.0764 | |||

| 2 | 0.0559 | 0.134 | |||

| lag | LL | LR | df | p | FPE | AIC | HQIC | SBIC |

|---|---|---|---|---|---|---|---|---|

| 0 | −7.89036 | 0.422604 | 1.97564 | 1.92835 | 1.99755 | |||

| 1 | −7.57938 | 0.62195 | 1 | 0.430 | 0.495799 | 2.12875 | 2.03417 | 2.17258 |

| 2 | −3.44336 | 8.2721 * | 1 | 0.004 | 0.251695 | 1.43186 | 1.28999 | 1.4976 |

| 3 | −2.76117 | 1.3644 | 1 | 0.243 | 0.281176 | 1.50248 | 1.31332 | 1.59014 |

| 4 | −2.75633 | 0.00968 | 1 | 0.922 | 0.3781 | 1.72363 | 1.48718 | 1.8332 |

| Maximum Rank | Parms | LL | Eigenvalue | Trace Statistic | Critical Value 5% |

|---|---|---|---|---|---|

| Lambda Trace | |||||

| 0 | 6 | −141.16117 | 15.5272 | 15.41 | |

| 1 | 9 | −134.47017 | 0.70375 | 2.1452 * | 3.76 |

| 2 | 10 | −133.39756 | 0.17718 | ||

| Lambda Max | |||||

| 0 | 6 | −293.13178 | 13.382 | 14.07 | |

| 1 | 9 | −286.44078 | 0.70375 | 2.1452 | 3.76 |

| 2 | 10 | −285.36818 | 0.17718 | ||

| Coefficient | Standard Deviation | t-stat | p-value | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| D_GDPGR | |||||||||||

| _ce1 L1. | −0.554 | 0.136 | −4.060 | 0.000 | |||||||

| GDPGR LD. | 0.276 | 0.170 | 1.620 | 0.105 | |||||||

| FD LD. | 0.000 | 0.000 | −4.860 | 0.000 | |||||||

| _cons | −2.446 | 0.762 | −3.210 | 0.001 | |||||||

| D_FD | |||||||||||

| _ce1 L1. | −3998.416 | 13545.850 | −0.300 | 0.768 | |||||||

| GDPGR LD. | 14113.690 | 16862.940 | 0.840 | 0.403 | |||||||

| FD LD. | 0.536 | 0.430 | 1.250 | 0.213 | |||||||

| _cons | 0.000 | 75680.910 | 0.000 | 1.000 | |||||||

| Cointegrating equations | |||||||||||

| _ce1 | Parms | chi2 | p > chi2 | ||||||||

| 1 | 4.663 | 0.031 | |||||||||

| Identification: beta is exactly identified | |||||||||||

| Johansen normalization restriction imposed | |||||||||||

| _ce1 | beta | Coef. | Std.Err | Z | p > z | ||||||

| GDPGR | 1 | ||||||||||

| FD | −9.97 × 10−6 | 4.62 × 10−6 | −2.16 | 0.031 | |||||||

| _cons | −9.632928 | ||||||||||

| lag | chi2 | df | p−Value |

|---|---|---|---|

| 1 | 2.439 | 4 | 0.656 |

| 2 | 2.063 | 4 | 0.724 |

| Jarque-Bera test | ||||

| Equation | chi2 | df | p-Value | |

| D_GDPGR | 0.294 | 2 | 0.863 | |

| D_FD | 0.610 | 2 | 0.737 | |

| ALL | 0.904 | 4 | 0.924 | |

| Skewness test | ||||

| Equation | Skewness | chi2 | df | p-Value |

| D_GDPGR | −0.353 | 0.228 | 1 | 0.633 |

| D_FD | 0.080 | 0.012 | 1 | 0.914 |

| ALL | 0.240 | 2 | 0.887 | |

| Kurtosis test | ||||

| Equation | Kurtosis | chi2 | df | p-Value |

| D_GDPGR | 2.622 | 0.066 | 1 | 0.798 |

| D_FD | 1.858 | 0.598 | 1 | 0.439 |

| ALL | 0.664 | 2 | 0.718 | |

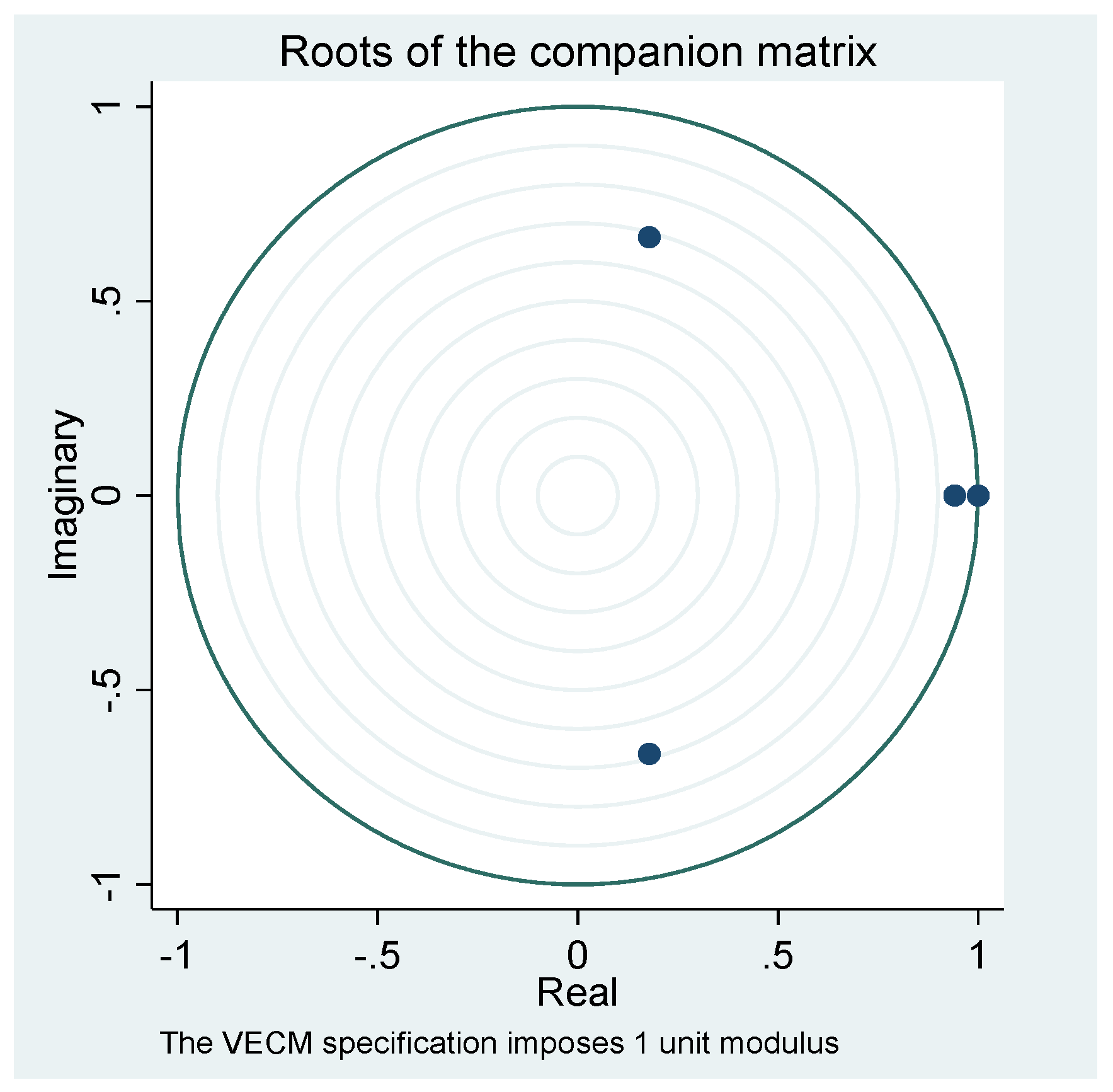

| Panel A: Unit Modulai Test. | ||||||

| Eigenvalue | Modulus | |||||

| 1 | 1 | |||||

| 0.9410217 | 0.941022 | |||||

| 0.1782671 | +0.6641845i | 0.687692 | ||||

| 0.1782671 | −0.6641845i | 0.687692 | ||||

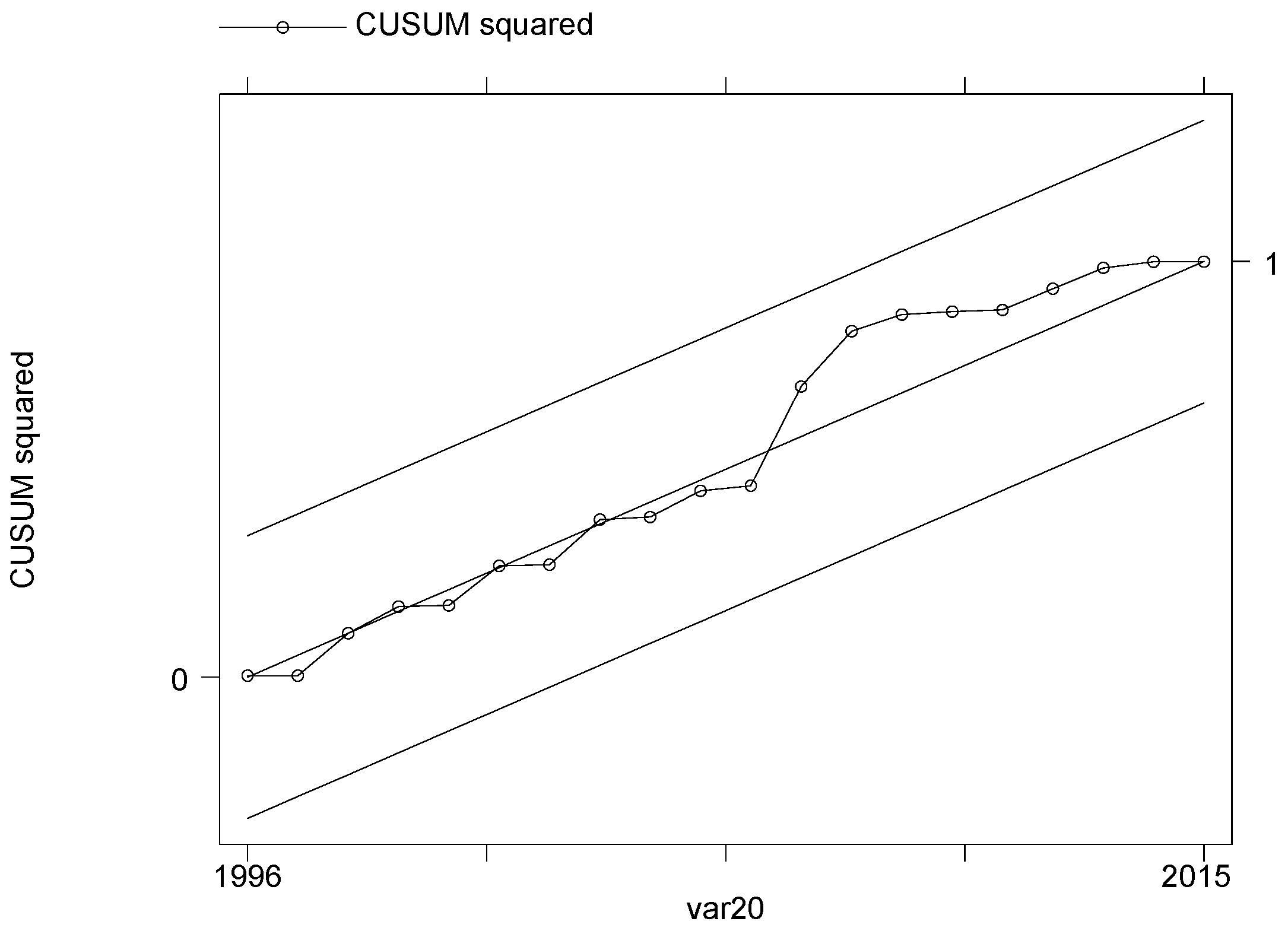

| Panel B: Cusum Tests | ||||||

| Variable Name | Test Statistics | Critical Value | ||||

| 1% | 5% | 10% | ||||

| D.RGDP | 0.457 | 1.143 | 0.948 | 0.850 | ||

| D.RFD | 0.893 | 1.143 | 0.948 | 0.850 | ||

| F-Stat | Prob > F | |

|---|---|---|

| Breusch-Pagan Test | 1.24 | 0.312 |

| The White Test | 1.46 | 0.278 |

| LM-statistics | Prob > chi2 | |

| Breusch-Pagan Test | 1.940 | 0.163 |

| The White Test | 2.930 | 0.231 |

Author Contributions

Conflicts of Interest

References

- Ali, Muhammad Mahboob, Anisul M. Islam, and Victoria J. Wise. 2011. The Great Recession of 2008: Impact on the Bangladeshi economy and international business implications. Thunderbird International Business Review 53: 263–276. [Google Scholar] [CrossRef]

- BBS (Bangladesh Bureau of Statistics). 2017. Bangladesh Economic Review. Dhaka: Bangladesh Bureau of Statistics. [Google Scholar]

- Barro, Robert J. 1981. Output effects of government purchases. Journal of Political Economy 89: 1086–121. [Google Scholar] [CrossRef]

- Barro, Robert J. 1987. Government spending, interest rates, prices, and budget deficits in The United Kingdom 1701–1918. Journal of Monetary Economics 20: 221–47. [Google Scholar] [CrossRef]

- Bhoir, Rakesh B., and Sanjay R. Dayre. 2015. Does India’s economic growth independent of fiscal deficit? The Business and Management Review 5: 189–92. [Google Scholar]

- Briotti, Maria Gabriella. 2005. Economic Reactions to Public Finance Consolidation: A Survey of the Literature. ECB Occasional Paper No. 38. Frankfurt: European Central Bank (ECB). [Google Scholar]

- Rana, Ebney Ayaj, and Abu N. M. Wahid. 2016. Fiscal Deficit and Economic Growth in Bangladesh. A Time-Series Analysis. The American Economist 62: 31–42. [Google Scholar] [CrossRef]

- Edame, Greg Ekpung, and Okoiarikpo Benjamin Okoi. 2015. Fiscal Deficits and Economic Growth in Nigeria: A Chow Test Approach. International Journal of Economics and Financial Issues 5: 748–52. [Google Scholar]

- Engle, R.F., and C.W.J. Granger. 1987. Cointegration and Error Correction: Representation, Estimation and Testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Fatima, Goher, Ather Maqsood Ahmed, and Wali Ur Rehman. 2011. Fiscal Deficit and Economic Growth: An Analysis of Pakistan’s Economy. International Journal of Trade, Economics and Finance 2. [Google Scholar] [CrossRef]

- Haider, ASM Shakil, Sabrina Fatema Shaon, and M. Rezaul Kabir. 2016. Impact of Budget Deficit on Growth: An Empirical Case Study on Bangladesh. Available online: https://www.researchgate.net/publication/298971557 (accessed on 31 May 2017).

- Hassan, Md. Hashibul, and Ayesha Akhter. 2014. Budget Deficit and Economic Growth of Bangladesh: A VAR-VECM Approach. Janata Bank Journal of Money, Finance and Development. 1. Available online: https://ssrn.com/abstract=2661754 (accessed on 31 May 2017).

- Hassan, Morsheda, Raja Nassar, and Chang Liu. 2014. Effect of government deficit spending on the GDP in the United States. Journal of Economics & Economic Education Research 15: 103–12. [Google Scholar]

- Hirschman, Albert O. 1969. The Strategy of Economic Development. In Accelerating Investment in Developing Economies. Edited by A. N. Agarwal and S. P. Singh. London: London Oxford Press. [Google Scholar]

- Hussain, Mohammed Ershad, and Mahfuzul Haque. 2017. Empirical Analysis of the Relationship between Money Supply and Per Capita GDP Growth Rate in Bangladesh. Journal of Advances in Economics and Finance (JAEF) 2: 54–66. [Google Scholar] [CrossRef]

- Hussain, Mohammed Ershad, and Mahfuzul Haque. 2016. Foreign Direct Investment, Export and Economic Growth: An Empirical Analysis for Bangladesh. Economies 4. Available online: https://www.mdpi.com/2227-7099/4/2/7/pdf (accessed on 31 May 2017). [CrossRef]

- Jarque, Carlos M., and Anil K. Bera. 1980. Efficient Tests for Normality, Homo-scedasticity and Serial Independence of Regression Residuals. Economic Letters 6: 255–59. [Google Scholar] [CrossRef]

- Johansen, Soren, and Katarina Juselius. 1990. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Krugman, Paul. 2012. End This Depression Now. New York and London: W. W. Norton and Company. [Google Scholar]

- Martin, Ricardo, and Mohsen Fardmanesh. 1990. Fiscal Variables and Growth: A Cross-Sectional Analysis. Public Choice 64: 239–51. [Google Scholar] [CrossRef]

- Cinar, Mehmet, İlhan Eroğlu, and Baki Demirel. 2014. Examining the Role of Budget Deficit Policies in Economic Growth from a Keynesian Perspective. International Journal of Economics and Finance 6. [Google Scholar] [CrossRef]

- Mohanty, Ranjan Kumar. 2012. Fiscal Deficit-Economic Growth Nexus in India: A Cointegration analysis. Ph.D. Dissertation, Centre for Economic Studies & Planning, School of Social Sciences, Jawaharlal Nehru University, New Delhi, India. [Google Scholar]

- Navaratnam, Ravinthirakumaran, and Kesavarajah Mayandy. 2016. Causal nexus between fiscal deficit and economic growth: Empirical evidence from South Asia. International Journal for Innovation Education and Research 8: 1–19. [Google Scholar]

- Nayab, Humera. 2015. The Relationship between Budget Deficit and Economic Growth of Pakistan. Journal of Economics and Sustainable Development 6: 85–90. [Google Scholar]

- Odhiambo, Simeo Okelo, G. Momanyi, Othuon Lucas, and Fredrick O. Alia. 2013. The Relationship between Fiscal Deficits and Economic Growth in Kenya: An Empirical Investigation. Greener Journal of Social Sciences 3: 306–23. [Google Scholar]

- Pesaran, M. Hashem, Yongcheol Shin, and Ron P. Smith. 1999. Pooled mean group estimator of dynamic heterogeneous panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Ramu, Anantha M. R., and K. Gayithri. 2016. Fiscal Deficit Composition and Economic Growth Relation in India: A Time Series Econometric Analysis. ISEC Working Paper 367. München: Munich University Library. [Google Scholar]

- Shojai, Siamack. 1999. Budget Deficits and Debt: A Global Perspective. New York: Praeger. [Google Scholar]

- Taylor, Lance, Christian R. Proano, Laura de Carvalho, and Nelson Barbosa. 2012. Fiscal deficits, economic growth and government debt in the USA. Cambridge Journal of Economics 36: 189–204. [Google Scholar] [CrossRef]

- Vamvoukas, George A. 2000. Short- and Long-run effects of Budget Deficits on Interest Rates. Spoudai 50: 58–73. [Google Scholar]

- World Bank. 2017. Bangladesh Development Update 2017. Dhaka, Bangladesh: World Bank. Available online: https://openknowledge.worldbank.org/handle/10986/26642 (accessed on 21 September 2017).

| 1 | |

| 2 | |

| 3 | According to World Bank’s report “Bangladesh economy remained strong and resilient despite external and internal challenges. Bangladesh is among the top 12 developing countries with a population of over 20 million, who achieved 6 plus percent growth in 2016. By any standards, Bangladesh economy has done well. Bangladesh needs to focus on a growth agenda centered on sustainable and inclusive growth. Overall fiscal deficit was contained at 3.6 percent of GDP, despite low tax collections due to political disruptions, and a shift towards low duty commodity import. NBR revenue collection fell short, at Tk. 1208.2 billion in FY15 compared to Tk. 1497.2 billion target. The Annual Development Program (ADP) implementation lags behind with an out turn of Taka 685 billion, though improved from last year. Domestic financing of budget deficit increased to 1.4 percent of GDP in FY15 from 1.1 percent in FY14. This came entirely from 93 percent increase in non-bank borrowing”. Source: https://www.worldbank.org/en/news/feature/2016/04/30/bangladesh-development-update-bangladesh-economy-requires-focus-on-sustainable-and-inclusive-growth-moving-forward |

| 4 | |

| 5 | According to a report published by World Bank (2017), ”The Bangladesh economy is weathering persistent global uncertainties relatively well. Growth remained resilient, aided recently by recovery in exports and private investments. Inflation has decelerated benefitting from soft international commodity prices and prudent macroeconomic management. The outlook for Bangladesh’s main export destinations is projected to improve, although downside risks remain elevated”. |

| 6 | Bangladesh Bureau of Statistics (BBS) is only the national Statistical institution responsible for collecting, compiling and disseminating statistical data of all the sectors of the Bangladesh economy to meet and provide the data-needs of the users and other stake holders like national level planners and other agencies of the Government. The role of the BBS in providing necessary statistics for preparing the various national plans and policies for the overall development of the country is very significant. |

| 7 | World Bank Development Indicators is the primary World Bank collection of development indicators, compiled from officially-recognized international sources. It presents the most current and accurate global development data available, and includes national, regional and global estimates. |

| 8 | Briotti (2005) reviews the theoretical and empirical literature that has investigated the conditions under which a contractionary fiscal policy is effective in reducing debt and deficit, but does not have a negative effect on growth. The author concludes that the theoretical impact of fiscal policy on aggregate demand and economic activity depends largely on the conceptual framework considered and its assumptions about the world. Empirical studies based on macro-econometric model simulations find evidence that fiscal consolidations lead initially to production losses, while they can result in a higher output in the medium term. Empirical studies focusing on episodes of changes in fiscal policies provide in turn evidence that under certain circumstances austerity measures may have an expansionary impact on the economy. |

| Obs. | Mean | Std. Dev. | |

|---|---|---|---|

| RGDP | 23 | 3132.125 | 2098.388 |

| RFD | 23 | −140.491 | 100.771 |

| RGDP | RFD | |

|---|---|---|

| RGDP | 1 | |

| RFD | −0.9804 | 1 |

| Test Statistics | 1% Critical | 5% Critical | 10% Critical | |||

|---|---|---|---|---|---|---|

| Panel A: Dickey–Fuller Tests | ||||||

| RGDP | ||||||

| Z(t) | 1.39 | −3.75 | −3.00 | −2.63 | ||

| D.RGDP | ||||||

| Z(t) | −4.49 | −3.75 | −3.00 | −2.63 | ||

| RFD | ||||||

| Z(t) | 1.50 | −3.75 | −3.00 | −2.63 | ||

| D.RFD | ||||||

| Z(t) | −4.29 | −3.75 | −3.00 | −2.63 | ||

| Panel B: Phillips–Perron Tests | ||||||

| RGDP | ||||||

| Z(rho) | −7.29 | −17.20 | −12.50 | −10.20 | ||

| Z(t) | −2.13 | −3.75 | −3.00 | −2.63 | ||

| D.RGDP | ||||||

| Z(rho) | −19.32 | −17.20 | −12.50 | −10.20 | ||

| Z(t) | −5.17 | −3.75 | −3.00 | −2.63 | ||

| RFD | ||||||

| Z(rho) | 4.39 | −17.20 | −12.50 | −10.20 | ||

| Z(t) | 5.90 | −3.75 | −3.00 | −2.63 | ||

| D.RFD | ||||||

| Z(rho) | −19.76 | −17.20 | −12.50 | −10.20 | ||

| Z(t) | −3.86 | −3.75 | −3.00 | −2.63 | ||

| Panel C: KPSS Tests | ||||||

| Lag Order | Test Statistic RGDP | Test Statistic RFD | ||||

| 0 | 0.070 | 0.457 | ||||

| 1 | 0.058 | 0.274 | ||||

| 2 | 0.065 | 0.213 | ||||

| Test Statistics | 5% level is 0.146 | |||||

| 1% level is 0.216 | ||||||

| Lag Order | Test Statistic D.RGDP | Test Statistic D.RFD | ||||

| 0 | 0.042 | 0.088 | ||||

| 1 | 0.047 | 0.138 | ||||

| 2 | 0.074 | 0.142 | ||||

| Lag | LL | LR | df | p | FPE | AIC | HQIC | SBIC |

|---|---|---|---|---|---|---|---|---|

| 0 | −255.785 | 2.10 × 109 | 2.71 × 101 | 2.72 × 101 | 2.72 × 101 | |||

| 1 | −229.764 | 52.041 | 4 | 0.000 | 2.10 × 108 | 24.8173 | 24.8678 | 25.1156 |

| 2 | −228.21 | 3.1081 | 4 | 0.540 | 2.70 × 108 | 2.51 × 101 | 2.52 × 101 | 2.56 × 101 |

| 3 | −226.236 | 3.9496 | 4 | 0.413 | 3.50 × 108 | 2.53 × 101 | 2.54 × 101 | 2.60 × 101 |

| 4 | −212.793 | 26.885 | 4 | 0.000 | 1.40 × 108 | 2.43 × 101 | 2.44 × 101 | 2.52 × 101 |

| Maximum Rank | Parms | LL | Eigenvalue | Trace Statistic | Critical Value 5% |

|---|---|---|---|---|---|

| Panel A: Lambda Trace Statistics | |||||

| 0 | 4 | −136.97855 | 20.3449 | 12.53 | |

| 1 | 7 | −126.82926 | 0.61963 | 0.0464 | 3.84 |

| 2 | 8 | −126.80609 | 0.0022 | ||

| Panel B: Lambda Max Statistics | |||||

| 0 | 4 | −114.66567 | 21.2573 | 11.44 | |

| 1 | 7 | −104.03703 | 0.67333 | 0.0259 | 3.84 |

| 2 | 8 | −104.02407 | 0.00136 | ||

| Coef. | Std. Err. | z | p > z | ||||

|---|---|---|---|---|---|---|---|

| D_RGDP | |||||||

| _ce1 L1. | 0.584 | 0.356 | 1.640 | 0.100 | |||

| RGDP LD. | −0.685 | 0.400 | −1.710 | 0.087 | |||

| RFD LD. | −10.776 | 5.932 | −1.820 | 0.069 | |||

| _cons | 1.590 | 237.428 | 0.010 | 0.995 | |||

| D_RFD | |||||||

| _ce1 L1. | −0.057 | 0.019 | −3.030 | 0.002 | |||

| RGDP LD. | 0.031 | 0.021 | 1.450 | 0.148 | |||

| RFD LD. | 0.389 | 0.314 | 1.240 | 0.215 | |||

| _cons | 16.315 | 12.551 | 1.300 | 0.194 | |||

| Cointegration Equation | |||||||

| _ce1 | Params | chi2 | p > chi2 | ||||

| 1 | 126.969 | 0.00 | |||||

| Identification: beta is exactly identified Johansen normalized restrictions imposed | |||||||

| _ce1 | Beta | Coef. | Std. Err. | z | p > z | ||

| RGDP | 1.000 | ||||||

| RFD | 19.046 | 1.690 | 11.270 | 0.000 | |||

| _cons | 148.663 | ||||||

| Lag | chi2 | df | Prob > chi2 |

|---|---|---|---|

| 1 | 2.481 | 4 | 0.648 |

| 2 | 6.686 | 4 | 0.153 |

| Equation | Skewness | chi2 | df | Prob > chi2 |

|---|---|---|---|---|

| Jarque–Bera Test | ||||

| D_RGDP | 98.188 | 2 | 0.000 | |

| D_RFD | 0.152 | 2 | 0.927 | |

| ALL | 98.341 | 4 | 0.000 | |

| Skewness Test | ||||

| D_RGDP | 2.866 | 28.738 | 1 | 0.000 |

| D_RFD | −0.162 | 0.092 | 1 | 0.762 |

| ALL | 28.830 | 2.00 | 0 | |

| Kurtosis Test | ||||

| D_RGDP | 11.909 | 69.450 | 1 | 0.000 |

| D_RFD | 3.263 | 0.061 | 1 | 0.806 |

| ALL | 69.511 | 2 | 0 | |

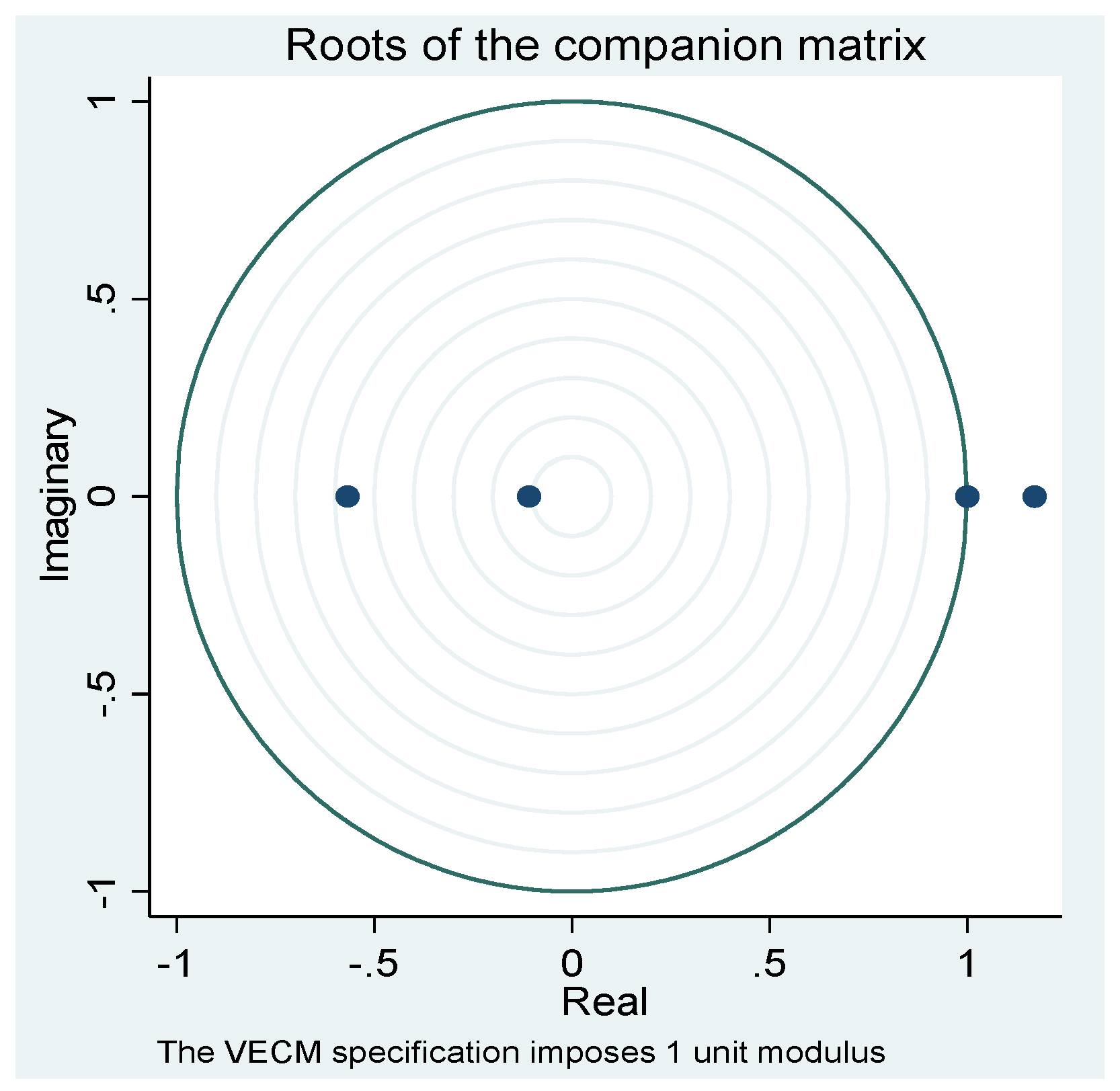

| Eigenvalue | Modulus | |

|---|---|---|

| 1 | 1 | |

| 0.6693922 | 0.669392 | |

| −0.2323502 | +0.2016746i | 0.307667 |

| −0.2323502 | −0.2016746i | 0.307667 |

| Variable Name | Test Statistics | Critical Value | ||

|---|---|---|---|---|

| 1% | 5% | 10% | ||

| D.GDPGR | 0.496 | 1.143 | 0.947 | 0.854 |

| D.FD | 0.754 | 1.143 | 0.947 | 0.854 |

| F-Stat | Prob > F | |

|---|---|---|

| Breusch–Pagan Test | F(1, 21) = 2.75 | 0.1119 |

| The White Test | F(2, 20) = 1.31 | 0.2915 |

| LM-Statistics | Chi-Square Critical Value of 5% Level of Significance | |

| Breusch–Pagan Test | 23 × 0.116 = 2.668 | 32.671 |

| The White Test | 23 × 0.116 = 2.668 | 33.924 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hussain, M.E.; Haque, M. Fiscal Deficit and Its Impact on Economic Growth: Evidence from Bangladesh. Economies 2017, 5, 37. https://doi.org/10.3390/economies5040037

Hussain ME, Haque M. Fiscal Deficit and Its Impact on Economic Growth: Evidence from Bangladesh. Economies. 2017; 5(4):37. https://doi.org/10.3390/economies5040037

Chicago/Turabian StyleHussain, Mohammed Ershad, and Mahfuzul Haque. 2017. "Fiscal Deficit and Its Impact on Economic Growth: Evidence from Bangladesh" Economies 5, no. 4: 37. https://doi.org/10.3390/economies5040037

APA StyleHussain, M. E., & Haque, M. (2017). Fiscal Deficit and Its Impact on Economic Growth: Evidence from Bangladesh. Economies, 5(4), 37. https://doi.org/10.3390/economies5040037