1. Introduction

There is an enhanced global awareness about the impacts of climate change despite opposite calls from some neoliberal sceptics. The Intergovernmental Panel on Climate Change (IPCC) (

Boko et al. 2007) highlighted the relative sensitivity of emerging economies, specifically those hosting coastal systems and low-lying areas like Small Island Developing States (SIDS) to climate change variables and challenges. These challenges include submergence, coastal flooding, and coastal erosion that eventually and stealthfully add additional burdens to existing development concerns, including population growth, economic development and urbanisation. There are calls for strengthening local capacity for both infrastructural and economic viability (

Folke et al. 2002;

Berke et al. 1993;

Marsden and Smith 2005). Financing these much-required climate change mitigation projects entails high economic inputs that emerging economies generally struggle to meet. Discussions about the economic aspects of such challenges are limited in the literature. While

Haque (

1999) has warned about the indifference of conventional economic models being applied for environmental issues in the ongoing neoliberalism global village,

Wanner (

2015) analyses the proposal of green economies through measures that explain the intensification and commodification of nature. Because of ongoing neoliberalist transactions, emerging economies generally opt for loans and foreign aid from more robust economies, private banks or global institutions. While a loan provides for immediate economic relief and encourages investment in key specific projects, the borrower often does not encourage the implementation of a sustainable economic ecosystem to catalyse local societal empowerment. Foreign aid, on the other hand, is often encouraged by politicians that see quick funding to large infrastructural projects as aiding their political campaigns and advancement

De Renzio (

2016).

This inexorable vicious and economically unsustainable cycle of debts affects many small island developing states (SIDS) economies. Coupled with regional and global politics and burdened by increasing debts, cities and countries eventually find themselves forced to trade vital infrastructures as a means of debt repayment. One conspicuous example is evident in Sri Lanka. A debt-ridden Sri Lankan government was forced to lease out a strategic port for a 99-year tenure to China. Such a move changed the geopolitical profile of the region and has been interpreted as a negative sign by nearby nations, including India and Japan (

Abi-Habib 2018). This potentially problematic fate serves as a precedent for many other emerging country ports generally because China financed some 35 other ports through similar agreements, although not to the same extent as in Sri Lanka (

Abi-Habib 2018). This potential untenable situation for emerging countries opens avenues to consider other sources of finance.

There is, however, a gap in knowledge relating to how economic capacity building within emerging economies generally can, not only ensure a viable source of income to repay debts, but also aid in maintaining infrastructural robustness. This paper, therefore, through a review of literature, considers climate change mitigation plans from a political economy perspective and seeks to propose a framework interlinking governance and novel drivers for sustainable development through respective country urban heritage conservation and culture.

As developed countries already have the economic and physical infrastructures in place to sustain their activities, this paper focusses on the case of SIDS economies that are usually at a transitional, and important, phase in their development. This position, in their economic and cultural evolution, has regard to the capacity of their respective heritage conservation (not preservation) policies and activities to pro-actively contribute to a city’s economic renewal, revitalization and/or role in charting a city’s liveability and economic prosperity. This approach has been validated by many authors as being allied to the rise of cultural creative industries (CCI) in various parts of the world that have demonstrated how this underexploited economic dimension can aid and lead to successful urban regeneration initiatives (

M. Z. Allam 2018).

Building from this, the authors perceive that there is an urgent need to better appreciate the position and merit of urban heritage conservation (not ‘preservation’) as being a valuable driver that has been little harnessed in developing and SIDS economies to assist and enable economic and liveability growth and prosperity of their key city(ies). Implementing such may also offer the potency to include climate change mitigation measures within the heritage conservation activities and investments.

This paper thus proposes that economic resilience can achieve and support dimensions of urban heritage and culture conservation and enhancement, that economic resilience measures and strategies can catalytic for private investment in both the public and private domains, and that indirectly aid can assist in economically, socially and culturally uplifting entire neighbourhoods and/or precincts. The paper is not offered as an avenue available for all developing countries, but is crafted recognising the particular geographical and economic issues confronting emergent SIDS national economies and their tangible and/or intangible cultural heritage legacies. The authors propose a new economic model, supporting cultural dimensions that offers potential to better supporting quality sustainability initiatives and policies while attracting investment.

The paper is structured as follows:

Section 2 dwells into the background of the key issues prevent in this topic, and the subsequent

Section 3,

Section 4,

Section 5 and

Section 6 explore, through a literature review on the converging themes of climate change, economics and culture and heritage, including reviewing the veracity of several pertinent methodological approaches, with attention to SIDS countries.

Section 7 reviews the various models currently used in the financing of climate change mitigation strategies, with attention to SIDS countries.

Section 8 and

Section 9 propose a new methodological framework and strategy and discusses its applicability in various economic and regional contexts and, finally,

Section 10 concludes and offers avenues for further research.

2. Background

Emerging economies generally usually have low gross domestic products (GDPs), and are seen as being economically fragile by many authors and governments.

Todaro (

1992) shares that the majority of these economies are endowed with diverse natural resources that could be the subject of high economic returns that could assist in helping shape new economic profiles. Some countries have adopted new economic agendas, and these have been positive towards the aims of their economic growth aspirations. This can be seen through countries like Singapore, India and Malaysia that have improved their GDPs in record time (

Ministry of Foreign Affairs Singapore 2018). However, in contrast to these countries, other countries are often subsumed in their own challenges characterised by mismanagement, corruption, poverty, poor infrastructure development, little or no mechanisation and technological adoption, poor quality of education, unreliable institutions and a raft of cultural and behavioural aspects that value-bias and exacerbate positive economic landscapes (

Tridico 2010;

Todaro and Smith 2009).

In terms of economic opportunities, one space is the increasing potential offered through the agricultural sector that often generates sizeable employment opportunities and has stood as a foundational source of revenue for the financing of government projects.

Todaro and Smith (

2009) posit that asset-rich emerging economies, with resources such as ports, minerals, forests and wildlife, fail to implement supportive infrastructure and policies that would allow them to maximize the utilisation of such sectors for the benefit of their country’s economy. Thus, instead of encouraging the creation of in-country industries, and supporting local manufacturing sectors, the majority of products from different sectors are exported to developed countries in raw form, earning only a fraction of their total value, before returning as expensive products to purchase. Very little or no value-added processing is encouraged despite and few financial and legal incentives and structures are in place (

Todaro and Smith 2009). This leads to low income thresholds for the local workforce, and, ultimately, little is paid to the government in the form of taxes. For example, the manufacturing sector could aid in value adding by creating more employment opportunities, supporting service industries and activating infrastructure development (

Tridico 2010). Unfortunately, this sector is often downtrodden and overlooked by governments. This conclusion is evidenced that even though consumption, government spending, investment and net trade can add to stronger economy enabling, such measures are often not availed to encourage optimal manufacture performance on an urban scale or on a regional scale.

The ‘urban’ dimension is of particular interest in this analysis. For example, the urban aspect is of key importance because the world is witnessing a population boom along with unprecedented rates of urbanisation.

The World Bank (

2010) predicts that over 70% of people will be living in cities and urban centres, especially in developed countries, by 2050. To sustain life in urban centres and cities, a continuous flow of resources, including energy, water, food and energy, is required (

Conke and Ferreira 2015;

Kennedy et al. 2008). This means an exponential surge in the need for human services and utilities. For example, energy consumption in cities will grow (

Kennedy et al. 2009) but, in turn, increase the discharge of dangerous emissions (

World Bank 2010). This exacerbates the negative emergence of greenhouses gases due to an over-reliance upon non-renewable energy generation, automobile dependence and through several high pollutant generating or highly energy reliant industries that take advantage of low pay rates and naïf in country legislative pollution control mechanisms. Although there has been globally an increase in efforts to shift towards renewable sources, some countries still favour and rely upon fossil fuels for their energy needs for their short and medium term economic growth projections (

UNCTAD 2017). This is because fossil fuels are cheaper, rely on government importation or in-country overt exploitation and, hence, governments control revenue collection associated with these non-renewable resources (

Cottrell et al. 2015;

Covert et al. 2018). An increasing urban population also means an increasing demand for food and potable water, thus straining an already over-stretched local agricultural sector.

In addition to the need for energy resources, there is a parallel increase in the generation of waste and the relational demand for effective waste management strategies. In most advanced economies, concerted efforts towards reducing, recycling and reusing wastes have been adopted (

Ministry of Foreign Affairs Singapore 2018;

Ali and Yusof 2018;

Ng et al. 2015), and their long-standing strategy of container-exporting waste to Asian developing countries including China has recently ceased. Nevertheless, in others, no effort is being undertaken and there is increasing evidence of waste despoliation in fresh and saline water bodies, on land, and in the air (

Yiougo et al. 2013). This is, however, an equal challenge for developing economies.

Compounding all these challenges, brought about by population increase and urbanisation, is the increasing real and daunting problem of climate change. Unfortunately, the consequences thereof are seen as gigantic, expensive and threatening to both local and global economies (

World Bank 2010;

OECD 2014a;

Hallegatte et al. 2013).

The most vulnerable economies to climate change are coastal economies, especially small island developing states (SIDS) (

World Bank 2010;

OECD 2014a). These economies are usually located on busy maritime routes and heavily reliant upon ports for their economic growth. According to

Neumann et al. (

2015), these cities have higher population growth and urbanisation rates than their hinterlands, and these trends will continue into the future. These trend statistics are influenced by infrastructural developments and the growth of supportive sectors that rely upon high revenues yielded from port activities.

Ports offer major jobs opportunities and remain a key sector in facilitating economic growth, even in arid countries (

Dwarakish and Salim 2015). For SIDS, climate change means sea-level rise risks, tsunami and infrequent severe wind storm risks, excessive flooding, heat waves, rising freshwater tables, major danger to loss of life and property, damage to port infrastructure, increases in prices of imported products, without even mentioning erosion and salt-infested metal and concrete fatigue. Climate change also results in a tangible part of a country’s GDP being channelled towards public expenditure on mitigation measures and short-term ‘band-aid’ adaptation activities. This can be perceived as an extra cost, but is also deemed important in supporting and protecting investments in the improvement of infrastructure as well as increasing a reliance upon food production technologies and food security measures (

Sahmatkesh and Karamouz 2017).

Negative impacts of climate change, such as flooding, have disastrous consequences upon urban fabrics. This includes the destruction and/or deterioration of buildings, properties and infrastructure, as well as the derision of cultural heritage legacies in favour of development imperatives. The burden of rebuilding this built environment fabric, thereby seeking to mitigate the further destruction of port infrastructure and the disruption of service-dependent neighbouring areas (and cultural heritage precincts and places) can sometimes be a major economic challenge for the public sector and normally falls upon the responsibility of each country’s national government (

OECD 2014a). Economic help is thus sought by developing economies in the form of financial support from developed countries as well as global financial institutions (

Schmidt-Traub and Sachs 2015). The notable challenge from this pattern of economic dependency is that of the proper utilisation of received funds, through Foreign Aid and loans, in accordance with the original brief the aid or loan were sought. Cases of corruption, fraud, embezzlement have led to misappropriation, derailment of processes, delay and sometimes, the recall of funds (

Ehlers 2014). Unfortunately, the terms and conditions of such loans are typically of a conventional banking nature and lack a fair evaluation of political backgrounds and contextualisation (

Schmidt-Traub and Sachs 2015). Thus, repayment efforts are often hampered and are sometimes absent.

Due to international propensity patterns of developing countries struggling with non-repayments, loans financiers are constantly reviewing their financing models making this sector unstable. For instance, in 2015, a new model was introduced called ‘Global Funds’ to service funding of countries burdened by Human Immunodeficiency Virus (HIV), tuberculosis and malaria. This model, a ‘pre-determined country allocation financing model’, also called the ‘result-based financing approach’, was perceived to allow the longitudinal financing of projects in countries that had repayment capacity evidence (

Eldridge and TeKolste 2016). This model was translated into the funding of both short and long-term projects.

Nevertheless, while excessive debt is perceived by countries internationally as an essential burden carried by emerging and SIDS country economies generally, and often is a result of predatory financing models adopted by some financiers. The Chinese model, for example, of, ‘Belt and Road Initiative’, has positively helped several emerging and SIDS country economies to fund infrastructural projects to permit them to tap into larger consumer global markets (

Schmidt-Traub and Sachs 2015). Nevertheless, with no stringent standards, and policy frameworks, some loans can arguable be classified as exploitative and possessing long-term dire economic and socio-political consequences when repayments are forfeited or defaulted (

Were 2018). Similarly, it takes time for most projects funded by foreign debt to collect revenue to break-even. Thus, SIDS’ city and country governments often turn to alternative financial sources for their repayments. In most cases, some countries struggle to justify loans. Some authors claim that substantial economic growth can and is being prevented due to the harsh repayment conditions from foreign aid and loans (

Payer 1975). With lesser financial support, there is even lesser opportunities for promoting resilience against the challenges brought forth by enhanced climate change.

3. Climate Change and the Need for Resilience and Economic Viability

Increasing human activities have had far-reaching impacts on the environment and its sustainability. One key outcome is climate change, which can be defined as an unprecedented extreme change in the Earth’s weather conditions. The most noticeable include increases in global temperatures, changes in wind patterns and variations in global precipitation (

UN Habitat 2015).

These changes have and are impacting the world greatly with notable consequences on both fauna and flora, and the Earth’s ecological systems at large. These changes have and are impacting country economies, human societies, terrestrial and aquatic ecosystems and on the larger scheme of geopolitics, mainstream political and corporate landscapes. Economically, there have been far-reaching consequences of climate change upon cities and coastal areas and landscapes.

Gasper et al. (

2011) share that the majority of cities and urban centres serve as economic ‘engines’ of their countries and regions, wherein a considerable share of their national GDP is derived from these areas. Cities host most of a country’s major businesses, financial institutions, tourist destinations, basic and advanced infrastructure, and are locations for major institutions. In addition, they also host an emerging middle-class whom contributes financially in the form of taxes (

Dobbs et al. 2012). For cities, climate change is an externality that causes energy supply disruptions, infrastructure stresses, scarcity of food and potable water, and disrupts projects in various means. All these changes impact upon fiscal policies and slow expansionary projects due to the re-routing of resources, both monetary and human capital, towards mitigation and reconstruction (

UN Habitat 2015;

Allam and Jones 2019).

Dafermos et al. (

2018) shares that climate change can affect fiscal policy in two ways. (1) Through the provision of transition risks and the provision for physical risks. Transition risk provision entails reviewing and allocating resources to help towards the transition from carbon-intensive assets, like non-renewable power plants, to low-carbon modes including alternative energies, green technologies and smart farming, amongst others (

Campiglio 2016). (2) Provision for physical risks entails budgetary allocations to address contingencies against possible disruptions.

Climate change also impacts upon human societies. It has been evidenced that reduced economic activities results from climate change because limited resources are committed to investments that impacts upon job opportunities. It also results in a reduced per capita income that affects purchasing power and the sustenance of healthy lifestyles (

Taylor et al. 2016). This may translate into human and wildlife psychological and mental stress, along with compromising human education quality that becomes more expensive and unaffordable, and, thus, societal inequities are a consequence (

Rezai et al. 2018). Such consequences and challenges envelope the human topics of poverty, morbidity, mortality rates, political and economic insecurity, migration and social strife, and equally occur in wildlife systems.

Schmidhuber and Tubiello (

2007) conclude that, in terms of food security, climate change has had significant negative impacts affecting its availability, stability, utilisation and access. According to the

World Food Programme (

2018), harsh and extreme weather conditions as a consequence of climate change affects the conditions under which different crops grow, thus, leading to a reduction numerically and in the quality of production. More importantly, the production of certain staple foods is at risk, thus exposing both country and global populations respectively to problems of food security, malnutrition, obesity, scarcity and related health problems (

FAO et al. 2018).

Waterman and Zeunert (

2018) conclude that food security is particularly susceptible to the consequences of climate change, and that a major change is required in international policy and land use planning practices to better address this challenge.

Though climate change poses threats to plants and animals, the liveability of humans and their ecosystems experiences similar threats.

Urban centres are increasingly experiencing issues, including flooding, especially in their marine and coastal areas and in SIDS. As a result, urban infrastructure, often costly and complex, has been at risk and subject to damage, deterioration, metal and concrete fatigue, and simply weathering that escalates in pace in tropical zones (

World Bank 2010). This is turn impacts upon the supply and transmittal of basic commodities and services, such as energy, water and food, into urban areas in terms of production cost, distribution, accessibility and availability. Major impacts upon power interruption from flooding was witnessed in cities like Toronto in Texas, Tallahassee in the Gulf of Mexico and Danville in California (

Potter 2018;

Westoll 2018;

DiChristopher 2018). These interruptions not only affected these coastal cities but also their hinterlands resulting in their individual and collective inability to produce and service enough food for local consumption and distribution to various catchment cities (

Ehlers 2014).

Allied to these issues is the international, and national, policy drive to ensure national food security for the survival of local communities.

Aung and Chang (

2014) assert that numerous programs, such as the Hazard Analysis Critical Control Points (HACCP) and the International Standardization Organization’s ISO-22000, have been introduced to ensure both safety and standards of food production. Both these programs and internal national policies have sought to respond to the demand for food consumer quality goods protection and security is increasing as well as a growing expectation for faster response times to address any impurity dilution or incidents in the complete food production chain. However, is this enough action, and will these initiatives have any affect in the face of exponential population growth rates occurring internationally as well as inside SIDS nations that lack quality arable land resources and rainfalls, as noted by

Waterman and Zeunert (

2018).

Despite the magnitude of these climate change challenges, mitigation strategies exist and there have been several successful precedents. Singapore, Malaysia and Tokyo, amongst others, are notable venues where mitigation strategies have been successful. Singapore, for example, has robust housing density plans and innovative environmental sustainability strategies that have witnessed it becoming one of the most liveable cities in the world (

The Economist Intelligence Unit 2018), embodied in its ‘green city’ epithet, despite the fact that it is a coastal city prone to similar effects of climate change (

Gaigné et al. 2012). Singapore’s strong economic growth policies also address stated commitment to climate change resilience actions (

Ministry of Foreign Affairs Singapore 2018). Singapore has also embraced a major green technologies policy to ensure a continuous ecological system flow of resources and their optimal use and growth (

Kennedy et al. 2008). These include technologies being employed in basic and vital urban infrastructure provision to secure minimal operations during disasters, and investments being performed with sustainability and resilience in mind with an aim to benefit both short and long-term goals.

As explained by

Mitchell and Harris (

2012), resilience means anticipation and adaptation to a looming consequence. For these reasons,

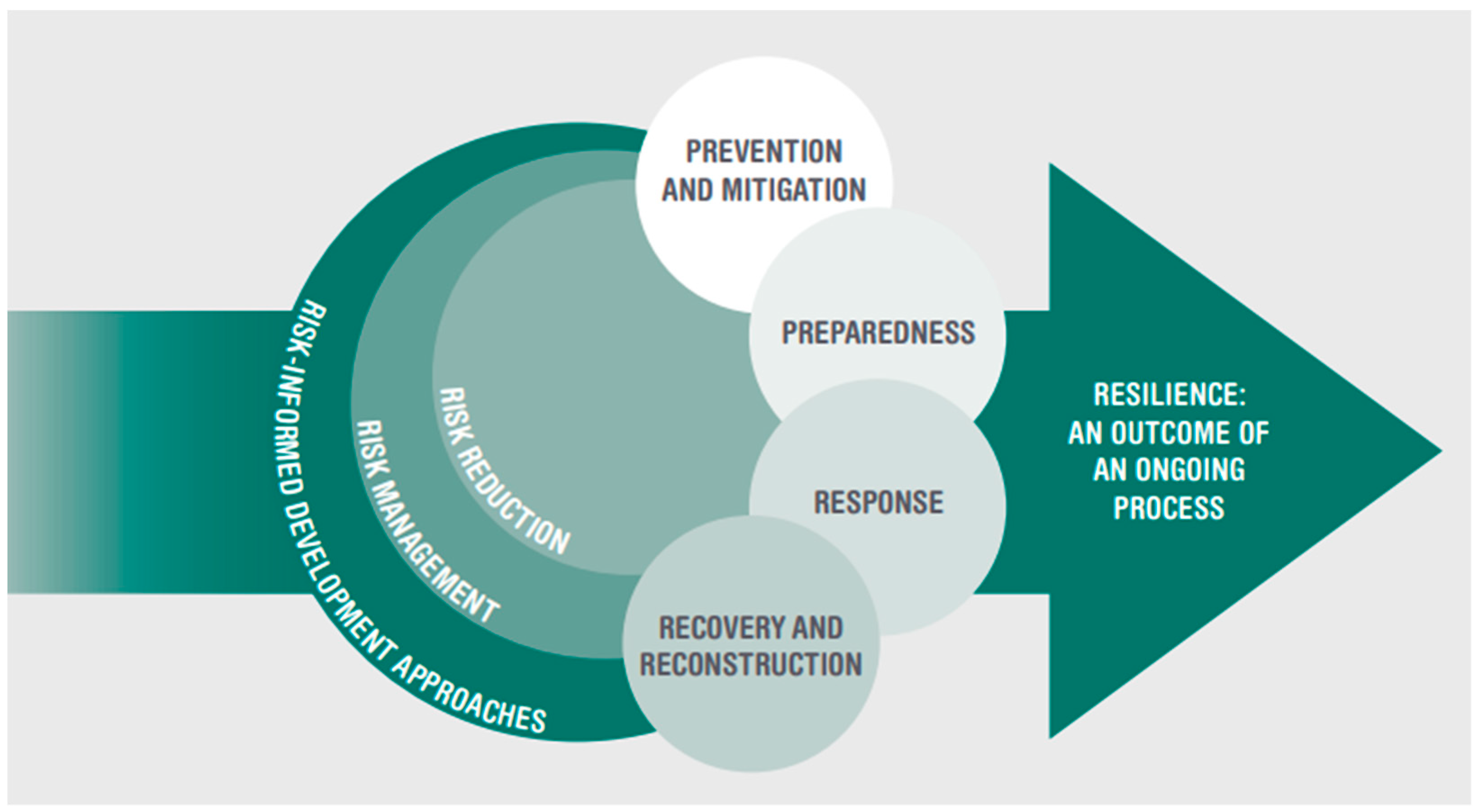

Kellett and Peters (

2014) argue that cities need to prepare beforehand to respond, recover and reconstruct when risks related to climate change strikes and incidents, as depicted in

Figure 1 below.

Kellett and Peters (

2014) graphically demonstrate that resilience to climate change and development fall together as partners in sustainable development and can entail a high cost. An understanding of the economics of sustainable development thus offers more insights onto the role of financing such an endeavour.

Kellett and Peters (

2014) methodology offer a framework and strategy in which to test this proposed model because it incorporates social and cultural variables in its structure rather than the conventional economic or the conventional ‘three-legged stool model’ that compartmentalises the three dimensions that are necessary for humans to obtain a high quality of life. The latter argues that if a society or country is unstable if one of its economic, environmental, and social/cultural ‘legs’ is weak. However, this metaphor also, unfortunately, assumes that a nation’s economic, environmental, and social ‘legs’ look separate and equal. Such is not feasible in a SIDS context because of the weaknesses often in all of its three ‘legs’. Therefore, but taking a methodological approach that identifies the cultural heritage assets and legacies of a SIDS country, including both its tangible and intangible qualities and values, may offer a more creative platform for SIDS identification and characterisation as a human and climate change resilience strategy. The proposed framework below, in Figure 3 and

Section 7, expands upon this methodological strategy recognizing these negative and positive variables and patterns.

4. Sustainable Economics

In the wake of climate change and the realisation of the need for resilient cities,

Kellett and Peters (

2014) advocate for city preparedness to climate change through the implementation of the Sustainable Development Goals (SDGs). They perceive that these actions should be incorporated into sound and sustainable financing models that facilitate the attainment of these goals. Of course, these models should factor in trade-offs between risk mitigation and building resilience. That is, funds should allow for sufficient management of anticipated risks as well as the flourishing of economic activities in a sustainable fashion. In enabling this, there has been an increase in the number and diversity of financing models adopted over recent years.

In 2015, during the third ‘Financing for Development Conference’, a financing model formulated under the Addis Ababa Action Agenda, coined as the ‘Official Development Assistance’ (ODA), was proposed. This model was aimed towards helping communities and building resilient nations (

Watson and Kellett 2016). The model emphasised the need for investment in infrastructure so as to develop resilience and help countries to absorb economic shocks. At face value, the model seems appropriate and of importance in ensuring that countries, especially developing ones, are able to cope with the increasing challenges of climate change. Nevertheless, this model has been criticised by many authors for a number of reasons.

Watson and Kellett (

2016) assert the inability of the model to factor cases where unnecessary risks are accepted that are dangerously high, and where not all development projects can be characterised by infrastructure development. They also observe that most developing economies are prone to poor governance, mismanagement of resources, corruption and susceptibility to natural hazards and, therefore, can readily experience economic swings, unsustainable debts that can lead to a strained financial sector, thus deterring investment.

Kellett and Caravani (

2013) posit that a social and economic balance must be found to address the risk of benefiting middle-income economies at the expense of least developed economies.

The ODA superseded the Green Climate Fund devised by the United Nations Framework Convention on Climate Change (UNFCCC). The Fund was an outcome of the 2011 United Nations Climate Change Conference (COP 17) in Durban, South Africa (

IISD 2011). The Fund was established to support initiatives that would lead eventually to a paradigm shift to low-emissions and foster resilience. Unlike the ODA that emphasised infrastructure development, the Fund model placed an emphasis upon the use of green technologies to help reduce emissions in various sectors like energy, transport, housing, cities and industries (

Kofler and Netzer 2012). Theoretically, once this is achieved, resilience is deemed to occur in terms of improved livelihood, better healthy human environments, quality infrastructure and an increased and reliable supply of food and potable water, ultimately leading to a better ecosystem (

Green Climate Fund 2018).

Begashaw and Shah (

2017) explain that achieving sustainable development requires various forms of financing, whether from public and/or private funds. For this reason, they argue that sustainable development in Africa could benefit from funds sourced from its financial markets. They also advise that financing could be achieved through domestic resource mobilisation. Relying on donors and investors is another potent financing model that has, and continues to support, sustainable development, but this increases a dependency upon and furthers the gap towards self-sustainability. Funds received in the form of Foreign Direct Investments (FDI), grants and/or remittances have had significant economic benefits as they provide the means to finance sizeable projects deemed essential by developing countries.

According to the United Nations Conference on Trade and Development (

UNCTAD 2018), some banks are development-oriented and focus their efforts solely on development projects. The success of these models is measured by their effectiveness in risk assessment, management of complex projects and their track record in managing long-term assets. Numerous projects have benefited from this kind of support globally, despite their limited capital base.

The ‘result-based financing’ model under not-for-profit The Global Fund to Fight AIDS, Tuberculosis and Malaria is another financing model available for emerging economies (

Eldridge and TeKolste 2016). This model promotes accountability for applying countries, hence, reducing wastage, mismanagement and misappropriation. The health fund, aimed at helping countries combat TB, malaria and HIV, can be extended to other sustainable development goals for the financing of infrastructure, environment and food security. However, funds can also be steered by geopolitical factors and diverge from sustainable ideas as previously portrayed. Such highlights the need to plan long term with a cohesive view on global economic forces. Amidst the imbroglio of such challenges, there is a strong need to consider ‘in-house’ capacity building that would auto generate finances while also catering for sustainable development and resilience. One potential policy would be to consider two novel drivers for sustainable development: (i) Culture and (ii) urban heritage.

5. Culture and Urban Heritage as Economically Resilient Drivers for Sustainable Development

Humans harbour a wide array of rich cultures that they identify with, voice and engage with, and what distinguishes them from other human groups (

Duxbury et al. 2016); thus, cultural identification and its consequential expression in place(s). Through various cultures, humans have managed to forge an identity through arts, literature, architecture, religion, science, language, philosophies, etc. To conserve and ensure the continuity of these cultures, they have been passed down from one generation to the next, hence gaining the nomenclature ‘cultural heritage’ and elevating their worthiness for conservation (

Africa Confidential 2018;

Hayes 2017). When these elements, together with other forms of heritage are integrated in the urbanization process, they form part of urban heritage. This can be viewed as the valued physical, spatial and virtual elements of the past that forms parts of the urban ecosystem. These elements may be cultural, natural, economic, political and economic in their ‘heritage’ and can become part of a city’s assets (

Hayes 2017;

Plaza 2006).

Urban heritage plays a vital role in the economic growth of a country. Its benefits include employment, tourism economies, increased property values and their curtilages surrounding historical elements and places, activation of specialized business and interpretative opportunities, advancement of infrastructure, public-private partnerships and a reduction of social inequalities (

Duxbury et al. 2016). To put these benefits into context, for example, in 2017, England received over £16.4 billion from heritage tourism, £9.6 billion from heritage repairs and maintenance of historical buildings and hosts more than 278,000 employees in this sector (

Hayes 2017). Similarly,

Figure 2 below shows employment opportunities in the heritage sectors in Europe for 2014.

Despite these benefits, urban heritage is facing numerous challenges ranging from urbanisation and globalisation, economic development, social, political and religious strife, population increase, change in land use, built fabric deterioration and climate change (

Throsby 2016).

The evolving trends in cities brought about by urbanisation have changed how cities are governed, planned and managed (

Veldpaus et al. 2013). The increasing demand for services, housing, greener spaces and infrastructure development are seen to override the need for urban heritage conservation, especially in emerging economies (

Throsby 2016;

Girard 2013). Such is more pronounced in SIDS economies due to their geographical isolation and numerically small tangible cultural fabric assets experiencing high climate change deterioration effects. Urban planners and city leaders are seen to support a modern architectural language often thought to support the needs for an increasing population; allowing for infrastructure expansion, to support businesses by attracting foreign direct investments and allowing for the integration of technologies in the cities. This perception is, however, seen as short-sighted and has been criticised by many researchers (

Allam 2012;

Allam et al. 2018;

Allam and Jones 2018;

Allam and Newman 2018b;

Siew and Allam 2017;

Salingaros 2013,

2018).

Duxbury et al. (

2016) argue that urban heritage has numerous positive benefits that modern cities can harness, and that heritage should be integrated into a city’s planning activities and policies. In support of this,

Bandarin (

2016) argues that recent trends of urban growth discourage the integration of culture leading to the deterioration of urban environments and increases in urban poverty and urban income inequality. Additionally, they argue that the conservation of cultural heritage can support the positive integration of local communities and thereby accelerate growth in terms of both economy and society.

A careful understanding about the potency of integrating societal dynamics between locals, migrants and tourists, and its role in heritage, is also warranted. A case in point is São Salvador da Bahia de Todos os Santos in Brazil, where it was witnessed that government policy oriented towards over emphasising tourism led to an exclusion of locals resulting in their relocation to other places (

Bandarin and Van Oers 2012;

Sant’Anna and Andrade 2016). Similarly, in China, such trends have witnessed out-migration of locals from areas near the World Heritage-listed ‘Historic Centre of Macao’ (Centro Histórico de Macau) due to inflated rental costs as a consequence of the heritage importance given to the site by listing. These challenges can only be overcome by balancing trade-offs between development and cultural heritage conservation policies and practices.

Cultural and historical heritage have indisputable contributions to urban development (

Girard 2013;

Bandarin and Van Oers 2012;

Sant’Anna and Andrade 2016), and they have the potential to spur sustainable tourism, increase employment opportunities and attract local investment (

Duxbury et al. 2016;

Bandarin 2016). They are often catalysts to alleviating the social and economic poverty dimensions of a city. Such can be integrated into effective planning activities where urban heritage is incorporated carefully to respond to a city’s need and, thus, may lead to the upgrading of housing, infrastructure and the (re-)establishment of businesses (

United Nations 2015;

UNESCO 2015). These efforts can greatly benefit local communities, whose living standards that can be aided and lifted through the resulting generated revenue and increased job opportunities.

Compact and culturally integrated development schemes can help in reducing carbon footprints, encouraging healthy living and may help in improving accessibility through infrastructure planning (

Kagan et al. 2018).

Mària and Salvadó (

2017) point out that gentrification of abandoned and/or under-utilised historical buildings have the potential to reduce construction costs that would normally be incurred if a new building was to be erected as a replacement (

UNESCO 2015;

Nocca 2017). Similarly, this strategy could help reduce urban sprawl and encourage land conservation (

Nocca 2017). These measures can improve economic growth in heritage precincts and places benefiting local governments and residents alike.

The Guggenheim Museum in Bilbao, Spain, is an example of how culture transformed a city through an innovative way of imbuing culture into the urban fabric. This transformation is now known by researchers as the ‘Guggenheim effect’. The effect was initiated when architect Frank Gehry proposed the establishment of the museum in an industrial city. This approach led to the creation of pockets of green spaces, and the conservation and conversion of existing factories into museums aiding its contextual setting as well as its global attractiveness. Such has attracted substantial revenue into the city of Bilbao and the Spanish national economy (

Del Olmo 2018). The revenue has predominately been derived from tourism activities in the city that has increased exponentially, as reported by

Plaza (

2006). The inflow of visitors spurred other business opportunities, especially for locals selling artefacts, offering hospitality and translation services, and offering library and cultural interpretative services, amongst many others (

Del Olmo 2018). To maintain the museum’s context attractive standards and environmental sustainability efforts were encouraged while Bilbao’s infrastructure framework was improved. Economic diversification and value addition efforts were also intensified overall benefiting the city, its residents and visitors (

Franklin 2016).

Bridging the gap between theory and knowledge for adopting cultural urban heritage as driver for sustainable development requires an understanding of the economic dimensions of such a process.

6. The Economics of Cultural Heritage

The economics of heritage is a vexed question of academic and applied practice research that offers little insights and agreement as to a reliable, valid, and replicable methodology. The majority of this research is linked to the built environment of a place, and not to the intangible aspects and values of a place, including its tourism benefits and detriments. Recognising this point, the Australian Productivity Commission (

Productivity Commission 2006) concluded that: “Current methods of identifying historic heritage places for statutory listing focus on the benefits expected to accrue to the community. Typically, there is little, if any, consideration of the costs imposed either on the owner or the community more generally.”

Understandably conventional cost-benefit analyses of cultural heritage scenarios require not only the numerical quantification of intangible and tangible benefits of cultural heritage, but also consideration of costs in attaining, displaying, conserving and/or interpreting such. While the administrative costs of government intervention in cultural heritage are easy to mathematically reconcile, compliance, interpretative and maintenance costs are less clear. The latter are normally associated with and integral within the use of regulatory policy instruments (such as statutory listings, planning schemes, loans, master plans, etc.) including both explicit costs and/or implicit opportunity and development costs. Explicit costs arising by heritage listing/gazettal can include additional maintenance works guided by expert restorers and/or archaeologists, as well as a greater administrative burden for both the place owner/manager as well as the oversight governance entity. Opportunity costs usually include the potential developments of such places or properties that often need to be forgone or compromised to conserve a heritage property/place in its present form. Such costs need to be incurred by a community (as well as by private owners) as the opportunity forgone may have had wider social benefits such as conversion into a commercial site.

To confound this logic, the Australian indigenous peoples Gunditjmara of Budj Bim, a place recently elevated to World Heritage Listing, would dispute this Western interpretation as being irrelevant in their ‘economic’ appreciation of this place because they interpret such ‘economics’ not financially but culturally in terms of the ‘greater good for their society’ and their larger custodial responsibility fulfilment. Such dollar values cannot be calculated in their eyes nor in conventional Western cost-benefit models.

The significance and importance of cultural heritage lies in the benefits or values it generates. Most cultural heritage definitions, charters, criteria now use the term ‘values’ as capturing the tangible and intangible attributes of a place, whether they be scientific, historic, social, cultural and/or spiritual. These categories are typically, in Europe, sub-divided into “use” and “non-use” values, but are not in Australia, Canada, New Zealand and parts of Asia given the multiple layers of their cultural legacies. “Use values” are those benefits derived from the direct or indirect use of a heritage place and may include: financial benefits; aesthetic qualities; improved community image; and/or the opportunity to use the site for residential, commercial, tourism, recreation or social purposes. “Non-use values” includes the intangible benefits associated with the conservation of heritage. Such may include: existence value; the benefits associated with the knowledge that a heritage place has been conserved, even if a consumer does not intend to visit it themselves; and, an option value being the benefits derived from having the option to visit a heritage place in the future. A third, even further little-discussed value is the “bequest value” being the human psychological value to be gained from knowing that a heritage place may or can be bequeathed to its future generations, and, thus, continuing a legacy. The ‘future generations’ value argument is one exploited by greens/environmental groups in their arguments for the conservation of key environment assets; such as the Great Barrier Reef in Australia. Again, different cultural insights and perspectives in Australia, New Zealand, Canada and parts of Asia dispute these Western premises of economic quantification given their given the multiple layers of their cultural legacies. Thus, the research arena in this sub-realm is philosophically and mathematically very difficult, and one that the Productivity Commission above aptly understood.

Thus, conventional logic in this arena is flawed, and often very biased by the prevalence to defer to the tangible, a building as comprising the key commodity to value because it is static, not dynamic, can be excised from people, meanings, events and time.

The conventional Western interpretation is that government intervention in heritage economically lies in numerically in community-wide voice and demand for cultural heritage conservation. The less the voice, the more absent the heritage statement, the less the need to invest government monies into a venture that will return little to no economic return in the short or medium term, and may be more of a political expediency investment with no clear economic gain to be derived. Thus, the aesthetic quality of a building’s heritage façade, for example, can be of value to visitors, residents and itinerant passers-by as well as to the building’s owner. In economic terms, these benefits can be interpreted as positive externalities or “public goods”. Externalities are the collateral effects from a heritage conservation decision or marketplace transaction that affects the welfare of others, such as the conservation retention of a façade thereby conservation the aesthetics of a streetscape in accordance with good urban design principles. If collateral effects are of a (positive) beneficial nature, such as the community’s enjoyment of a privately-owned or publicly owned heritage property, it is said to be a positive externality. Witness, for example, the present public attention occurring in Singapore arising from the major renovation and restoration of the yet to be re-opened Raffles Hotel that is a heritage icon of this community, a ‘sacred tiger’ in this highly-charged economic landscape. Public goods thus possess community benefits that are non-excludable and non-rivalrous whereby no person can be excluded from their consumption of this place and consumption by one person will not reduce the consumption of this place by another. The existence, option and bequest values of cultural heritage thus additionally have public good characteristics.

The two most commonly used Western derived and applied evaluation techniques, that involve empirical approaches in assessing the economics of cultural heritage, are hedonic pricing and travel-cost.

Hedonic pricing is based upon the notion that the value of a market good is contributed to by a number of attributes that may include both market goods and non-market goods. Building pricing is the most commonly used proxy used in this method that is often used to guestimate the value of goods such as parks and reserves. Building prices may also be affected by adjoining or adjacent heritage properties, thus raising the sub-sub-topic of the vexed economic value of the curtilage of a recognized heritage place. Thus, the curtilage of Australia’s World Heritage-listed Sydney opera house is incalculable because the house is highly dependent upon its Sydney harbour water landscape and the two go hand-in-hand like an opera and its audience; they are inseparable tangibly and intangibly. A simple modelling of this could be stated as: Price = size + age + location + heritage attributes. By holding the other variables constant, the contribution of nearby heritage to building prices can be estimated. This is an implicit price, or measurement of willingness to pay, for heritage, dependent upon detailed data on building pricing pre- and post-conservation and its relevant attributes, and, therefore, be time-consuming, extremely conjectural and expensive in its undertaking. This approach has minimal merit in SIDS economies but has been little applied and tested to validate this observation. Additionally, such an approach is perhaps hampered by the fact that tangible building/place prices are in fact much less than what can be ascribed to the intangible value of a building/place. This is because of the nature of heritage tourism in SIDS places, like Malé in the Maldives or Port Louis in Mauritius, demonstrate vernacular cultural heritage and not icon (large highly-photographed structures) heritage that this technique is common applied to. Thus, the SIDS countries of the Maldives and Mauritius are images sold internationally by their beaches and tropical landscapes, and not by their World Heritage-listed places and/or landscapes.

The travel-cost method, that is often used to value tourism sites, like national parks, is dependent upon the consumer’s willingness to pay their travel costs to a given place. We know that many tourists travel to places simply because they have a ‘heritage’ label, or have been World Heritage-listed. Travel costs themselves, however, are not evidence of one’s willingness to pay travel and/or entry prices, but are often mathematically combined with statistics on the number of visitations per capita that thereupon may generate a demand curve for visitations to the place, from which the consumer surplus, or willingness to pay, can be estimated. This method assumes that the place is visitable, and that travel is undertaken for the sole purpose of visiting that place. This empirical technique’s application to heritage places is, therefore, limited to those places that frequently receive visitors, and even more so when applied to SIDS countries because cultural heritage places are very often the lowest determinant to SIDS visitation reasons, with the highest often being ‘beach, tropical island experience, etc.’. Thus, the SIDS countries of the Maldives and Mauritius are sold internationally by their beaches and tropical landscapes, and not by their airfare cheapness or family-friendly packages.

Even in these empirical methods, however, their methods only capture visitor values and for SIDS economies this data can be extremely deceptive as to the visitation motivations that are minimally linked to heritage buildings and are more linked to intangible landscapes and cultural celebrations and Western-perpetuated stereotype myths. Additionally, while tried and tested environmental preference techniques have the benefit of being based upon data from actual markets, their applicability to cultural heritage places is academically acknowledged by many authors as being limited in veracity, reliability and replicability. Additionally, the dearth of empirical methods also translates into their inability to robustly accommodate climate change adaptation and/or mitigation measures into their equations.

7. Models of Financing for Infrastructural Robustness and Preparedness for Emerging Economies

Infrastructure robustness is a measure for rating and ranking an economy. It can serve as a key in various economic sectors that can easily translate to both macro and microeconomic growth. However, what differentiates infrastructural robustness in different economies is the amount of resources directed toward infrastructure projects; in particular, the level of financial resources committed by a government towards that goal.

Ehlers (

2014) has noted that there are sufficient funds in global markets and the long-term interest rates attached to these funds are attractively low that can easily enable the financing of well-structured and designed infrastructure projects. The availability of these finances depends on different financial models adopted by respective governments and their capacity to meet their set contractual requirements. Parallel, it is worth noting that, conventionally, the financing of projects is undertaken through internal funding by governments drawing upon their own revenue bases and through domestic resource mobilisation, like the sale of government bonds, infrastructure assets (

Ehlers 2014;

Saha et al. 2017) and sovereign wealth funds (

World Bank Group 2014).

It is noteworthy that an economy touted as strong and growing has the capacity to internally support government investment in developmental projects. For example, due to their strong economic positions, countries such as India, China and members of the European Union have been able to finance their internal infrastructure development agendas. India proposed to spend approximately

$30 billion for infrastructure upgrades by 2015; China budgeted

$585 billion for development; and the European Union budgeted over

$200 billion for infrastructure financing by 2020 (

Deloitte 2013).

Further, stronger and well-run economies are able to attract foreign direct investment (FDI), which is a potent form of infrastructure financing.

Public-private partnerships (PPP) have a long story of success where the private sector complements government investment efforts by offering financial, expertise, innovation and professional support (

Ehlers 2014;

Farquharson et al. 2011). In addition, the Organisation for Economic Co-operation and Development (

OECD 2014b) posits that government capitalises on budgetary reliefs from these forms of partnerships. Thus, they are more able to optimise their macroeconomic constraints into internal loans. This form of financing is possible where strong political leaders encourage economic resilience oriented towards societal inclusion.

A notable example is Singapore. In Singapore the city-state government has partnered with the private sector to design and erect compact housing projects (

Ministry of Foreign Affairs Singapore 2018). PPP has also been a sought-after solution in countries with robust economies such as the United Arab Emirates (UAE). The City of Dubai in the UAE introduced a regulatory framework for PPPs aimed at enhancing economic robustness and stabilising economic risk management (

Dalley and Barton 2016;

Almarri 2015). In such cases, the private sector can be made to benefit from incentives, tax holidays and other governments support.

This has also been the case in Mauritius. During the adoption of the National Regeneration Scheme the Mauritius government sought to catalyse private investment in the public realm (

Allam et al. 2018;

Allam and Newman 2018a), recognising the need for careful consideration of key components while introducing PPP.

Thus, governments need to maintain a key role in PPPs even if it is simply a regulatory one. Moreover, key roles of each partner should be clearly articulated to maintain proper accountability.

Loans secured through internal borrowing or from external financial institutions or governments can also be the subject for the financing of infrastructures. There are numerous financial institutions, including banks (multilateral development banks (MDBs)) and insurance companies who have a mandate to finance and invest in development projects in different countries. This financing model is popular amongst many developing economies and has had mixed results in diverse economies. Some economies have grown and expanded from loans, while a sizeable number of them have failed. The latter includes examples in Sri Lanka and Zambia where both had to forfeit ownership of vital infrastructures to China due to debt default (

Africa Confidential 2018). Such instances highlight positive and negative issues related to this model, including vested interests and excessive demands. There also lies the challenge of project business structuring, where long wait times for economically viable breakeven points attracts relatively high initial costs (

Ehlers 2014;

OECD 2014b). Therefore, this model requires pro-active measures and sound planning of debt service. Otherwise, economies are shouldered with repayment burdens that sometimes lead to default.

In some cases, countries can also benefit from grants from financial institutions and governments. Though not popular, this infrastructure financing model is often offered to economies that suddenly have to deal with and recover from extreme environmental or socio-political conditions like prolonged civil strife, destructive calamities, like earthquakes, flooding and diseases, amongst others (

The World Bank 2017). A summary and typology of the various funding models are listed in

Table 1.

As demonstrated in the above discussion and

Table 1, it can be seen that none of the above models, and others as surveyed in the literature, do not focus essentially upon the inherent cultural and historical identity of cities as a potential source of finance for sustainable development. To this end, this article proposes a new urban rejuvenating framework drawing upon the main pillars culture and urban heritage.

8. Proposed Methodological Framework and Strategy

Recognising the foregoing discussions, the following methodological framework (

Figure 3) is proposed to cater to capacity building while maximising throughput on urban and cultural heritage in vulnerable economies. It is proposed that the dimensions of culture and urban heritage are used as catalysts for attracting investment which can then be placed in infrastructures required by a city.

An accompanying process (

Figure 4) is proposed in the form of an urban regeneration process model with urban and cultural heritage as its main dimensions. This model was inspired by

Allam and Newman (

2018a), a model that was successfully applied in Mauritius. Specific attributes of these two dimensions of a city need to be identified and investors, preferably local through to PPP, are invited to submit an expression of interest detailing their business model and related plans. Economic predication, in terms of employability rate and profit, needs to be substantiated accompanied with a rigorous market strategy explaining the segmentation, targeting and positioning aspects of the culture/urban heritage-based business strategy. The governing bodies are then invited to evaluate the viability of this project(s) and once this project has been approved, the implementation phase can begin. It is to be noted that governing bodies must provide some discretion for the smooth implementation of a selected project(s). This could be through fiscal and non-fiscal incentives that will be conspicuous enough to attract investors (

Allam and Jones 2019).

Allam et al. (

2018), in examining Mauritius, providing further evidence that this can be achieved through appropriate governance structures.

Where such a project is postulated under this process, it can lead to a substantial increase in the employment rate while attracting FDI and thereupon generate income for infrastructural maintenance and sustainable development. It is to be noted that a project framework needs to be tailored for each and every city because political and economic dimensions and variable may vary. One project approach is through focus group investigations of key stakeholders within the cultural, urban heritage and political environment and context of a city.

Through this Process, governing bodies are made to control the overall economic and environment context through fiscal and non-fiscal incentives. As postulated by

García (

2004), there is a need to ensure capital investment and building schemes that may need to involve all strata of a community to avoid top-down predominance in decision-making. García further argues that in order to build further upon this governance dimension, a cultural investment should be made more oriented towards maximising cultural and urban heritage development for local consumption and export.

Key indicators for these pillars need to be shortlisted and evaluated through inputs from stakeholders from both public and private sectors. This can be achieved through a focus group approach where strategic key stakeholders from both private and public sector discuss, propose and/or recommend what are the desired avenues for investment in conjunction with the crucial dimensions requiring urban regeneration (

Allam and Newman 2018a). These proposals and/or recommendations may then be drafted as key evaluation indicators. However, identification of key indicators for urban regeneration can be a quite complex discussion because any policy implemented can then and often extend beyond the designated geographical area of the project (

Coombes and Wong 1994). Further, as postulated by

Hemphill et al. (

2004) combining environmental and socio-economic issues increases the uncertainty of the indicators. There is need to integrate the sustainability indicators for an urban rejuvenation scheme at the right strata of a city. Such an approach ensures that the main aim of cultural heritage informed sustainable development is not forfeited at the expense of a neoliberalist goal of maximising profit.

9. Discussion

The review of the literature reveals that many emerging economies require economic help for economic stabilisation and resilience. This is accentuated by the demographic boom, which most cities in SIDS and emerging economies are witnessing, placing considerable stress upon their respective nation’s infrastructures.

Simon Kuznets has demonstrated that when a nation undergoes a shift in its economic practices—moving from agriculture to mechanization (linked strongly to a service economy under today’s understanding), the centre of a nation’s economy and focus will shift to its city or cities. Thus, it is of upmost paramount that economic mechanisms, proposed as solutions to address national challenges, in particular those linked to the environment that are shared by regions, are oriented at cities (

Anand and Kanbur 1993).

As discussed above, it has been established that the impacts of climate change have far-reaching negative impacts on the cities especially those located in coastal areas in SIDS and developing countries (

Dafermos et al. 2018). Factors such as flooding, heat waves, rising water tables and extreme winds have had negative impacts upon a city’s (or cities) infrastructure, many of which are in different stages of construction. It has been established that the destruction of these different types of infrastructures impacts heavily upon economic activities thereby increasing the burden of financing the reconstruction processes, and ultimately forcing national (and city) governments to opt for alternative (and often unsustainable) sources of financing (

Schmidt-Traub and Sachs 2015).

Unfortunately, though there are numerous forms of financing models, like internal funding and PPPs, these models lack the capacity to finance development projects that would allow SIDS and developing countries to flourish on both economic and social terms (

UNCTAD 2018). This is due to the fact that development projects are capital intensive and have long payback periods. It is, moreover, clear that the lack of capacity is due to the under-utilisation of available resources. Thus, national (and city) governments have limited capacity to domestic financial resources and coupled with similar limitations in their private sector that has different operational aims, may not be possible within the umbrella of national (and/or city) governmental processes and policies.

It has been established that the business environments in a sizeable number of emerging country and SIDS economies face excessive wastage, corruption, mismanagement and complex policies that are not favourable for FDIs that could otherwise assist national and/or city governments in their financing of key investment projects and in creating employment opportunities (

UNCTAD 2017). Therefore, most of these economies turn to external sources of financing in the form of loans from multi-lateral banks and countries like those offered by and through China, allied to its aggressive economic expansion policy. However, these financing models are tied to stringent conditions and interests. Though there have been some success stories in this arena (

Watson and Kellett 2016), there are numerically more cases of debt defaulters facing harsh consequences (

Africa Confidential 2018).

The above financing options are applicable to a significant number of emerging and SIDS economies because of their low GDPs, and this results in a constriction of revenue from local activities (

Todaro 1992). A majority of emerging and SIDS economies heavily rely upon their agricultural sector as their predominant source of employment and, thus, forms the backbone of their respective economy. This is true despite the majority of these emerging and SIDS economies having under-utilised resources, such as ports, historical and cultural heritage, and vibrant workforces. They also fail to capitalise on economic strategies structured towards value addition in trade and have unwillingly abandoned and destroyed their cultural heritage in favour of modern architectural designs and technologies without recognizing that they could benefit greatly by integrating these resources into their local planning activities, as evidenced in the case of the Guggenheim Museum in Bilbao (

Del Olmo 2018).

Economic resilience is reliant upon concerted, pro-active efforts that require societal inclusion. In addition to the natural and historical resources that cities of emerging and SIDS economies need to harness for them to encourage development, cities also require to ensure that their citizens, especially those connected to different cultures are included in development agendas (

Duxbury et al. 2016). The case of the Guggenheim, along with other cultural statistical figures relating to employment in England and Europe, reveals that there can be economic successes for cities that encourage culture and societal integration and participation in local governance (

Eurostat 2016).

As demonstrated in the proposed framework, there is an ongoing parallelism between the proposed approach and any other developments in a city. However, the inherent differences rest upon the capacity building of a culture and its urban heritage that is unique to that city. The introduction of any new technology or service to a city will undoubtedly affect the day-to-day running of a city’s businesses. To ensure a smooth dissemination through all levels of a city’s society, there is a need to consider and apply transition theories that can cater for the macro-, meso- and micro-levels of a city and ensure implementation through pathways of least resistance. The model of

Geels and Schot (

2007) provides avenues for this successfully to occur.

10. Conclusions

The funding of infrastructure linked to a city’s cultural heritage assets can be problematic for developing and SIDS countries because they do not have the capacity to tap into growing markets and to address climate change without the essential technical and intellectual equipment which are extremely costly. The funding of providing such infrastructure is commonly accessed through various means such as grants, loans and foreign aid. However, those grants, loans and/or aid often come at a substantive tangible and intangible cost and can place the entire national and city economies at risk when repayment conditions fail due to the incapacity of city and national authorities to structure revenue generating schemes. Moreover, current funding models often provided by lenders fail to empower local economy when investment is channelled linearly towards specific projects. This paper argues that a holistic approach needs to be taken, and that mutualisation of projects and investments needs to be sought, in enabling the construction and implementation of an infrastructure project. To empower the economy while benefiting to the urban fabric the authors propose an additional framework and an accompanying process that uses the dimensions of a city’s culture and urban heritage to generate revenue that can then be injected into essential infrastructures, whether it for climate change mitigation or other purposes. This can be achieved using fiscal incentivization mechanisms that would incidentally accelerate private investment in the public realm through the financing of vital infrastructure that can be oriented towards the support of cultural heritage and environmental improvement dimensions.

We would argue that further research is required to perform to calibrate, quantify and test the model in developing and SIDS countries, to further refine the process for its easy adoption in various regional contexts. Thus, such an approach will make it easier for policymakers looking at financing resilience strategies to address the goal of ensuring social inclusivity. Further research can be performed as to how the specific calibration of the model can be performed to a particular context and the impacts arising can be quantified economically. The latter can be sourced from the exploration of job creation data, capital investment patterns and revenue generation data for the public sector, and through measuring and evaluating the social dimensions of the project to explore how this is and/or can impact upon the liveability components of a city’s urban fabric.

While this proposal can have significant positive economic potential for areas rich in cultural heritage, its applicability may be tricky for areas that have suffered from modernist interventions, leading to the irreparable damage of the urban fabric. Thus, this proposal should be made applicable to selective urban areas and accompanied by strict, yet economically favourable, heritage conservation laws.