1. Introduction

This paper presents an economic simulation model for the small island state of Barbados. With a focus on the medium to longer run future, the model seeks to represent a set of uncertain external factors that can significantly impact upon economic outcomes. These include demand for the country’s exports, tourism, and damage to capital stocks from tropical storms.

While the model is specific to Barbados, many small island developing states (SIDS) face similar challenges. They are highly dependent on export revenue and are therefore vulnerable to trade risks (

Streeten 1993;

Briguglio 1995;

McGillivray et al. 2011). Tourism is an important sector; the World Tourism Organization (

UNWTO 2012 Table 1.10) lists 29 SIDS for whom inbound tourist receipts exceeded half of the value of their exports of services, and 11 for whom tourist receipts exceeded half the value of both goods and services exports (out of a list of 35 for which data were available). Moreover, SIDS are vulnerable to climate impacts, particularly sea-level rise, but also damage from tropical storms (

Nurse et al. 2014). Thus, to a large degree, SIDS thrive to the extent that they can effectively respond to external changes. Historically, that has meant changes in foreign demand for the country’s products; in the future, it will increasingly include changes in the climate.

Given the importance of uncertain external factors, we followed a robust decision making (RDM) strategy (

Lempert and Kalra 2011). In RDM, the goal is to identify policies that are more likely than not to lead to good outcomes in a wide variety of possible futures, whether by mitigating negative outcomes or enhancing positive outcomes. This is, indeed, a well-established reason for building scenarios. As

Pierre Wack (

1985), a scenario pioneer, wrote in a classic paper, “Scenarios serve two main purposes. The first is protective: anticipating and understanding risk. The second is entrepreneurial: discovering strategic options of which you were previously unaware.” The robust decision-making strategy will also be familiar to policy makers in SIDS.

Demas (

2009; originally published in 1965) argued that one of the advantages of small size is “greater flexibility”, a point also made by

Kuznets (

1960), and SIDS deploy a variety of strategies and tactics to respond to external events.

The model presented in this paper combines an updated version of a macroeconomic model for Caribbean states (

Kemp-Benedict et al. 2018), a model of storm damage to capital stocks for Barbados (

Kemp-Benedict et al. 2019), and a tourism sector model based on an empirical model by

Laframboise et al. (

2014). To these, we added sub-models developed in this paper for global GDP growth, economic growth in tourism source markets, and payouts from the Caribbean Catastrophic Risk Insurance Facility (CCRIF).

The economic model follows the structuralist tradition in development economics. That tradition, which arguably grew from

Rosenstein-Rodan’s (

1943) classic paper, had a strong influence on development thinking (

Chenery 1975). It dominated Caribbean economic thought for decades through the work of Sir Arthur

Lewis (

1954),

William Demas (

2009),

Lloyd Best (

1968), and

Norman Girvan (

2006), among others. The stream of structuralism applied in this paper, which is compatible with Caribbean structuralism, is today developed and promoted by economists such as Lance Taylor, Jose Ocampo, Luis Carlos Bresser-Pereira, and their collaborators (

Taylor 1989;

Ocampo et al. 2009;

Bresser-Pereira et al. 2015). Structuralist models in this stream are demand-led, with firms investing in anticipation of future demand, while saving and the trade balance accommodate. Demand-led models are particularly appropriate for SIDS, where the domestic economy is strongly reliant on the export sector, which drives the rest of the economy through a multiplier process. The “structure” of structuralism refers both to productive structure of the economy as well social and institutional structures in which the economy is embedded (

Gibson 2003;

Ocampo et al. 2009).

The structuralism of Taylor and others can be contrasted with the neoclassical “new structural economics” (

Lin 2012). The new structural economics is concerned with the balance between the role of public and private actors in the economy, criticizing the “old structuralism” for its focus on public investment and planning. It emphasizes the role of markets in resource allocation, with the state playing a coordinating or facilitating role. The “structure” in new structural economics is the prevailing structure of factor endowments. While the new structural economics offers some potentially useful techniques, such as the “growth diagnostics” method of

Hausmann et al. (

2008), it tends to take the neoclassical conception of the market as given. Indeed,

Hausmann et al. (

2008, p. 327) claim that an economy that is underperforming and in need of reform is “by definition” plagued with market imperfections and distortions. As noted by

Felipe et al. (

2008), while the growth diagnostics approach might be useful in some situations, its scope is severely limited and must be applied cautiously. More broadly, the central analytical task of the new structural economics is to determine how the endowment structure must change in order to promote growth (

Lin 2012, p. 99). Such a study can provide insight when preparing a development strategy, but from the perspective of Taylor, Ocampo, and Bresser-Pereira’s structuralism, it is quite narrow and begs the question of what drives changes in the endowment structure.

The structuralist approach in this paper can be further contrasted with the balance-of-payments constrained growth theory of

Thirlwall (

1979,

2011).

Cimoli and Porcile (

2014) showed that Thirlwall’s model can be combined with the Kaldor-Verdoorn law and a Lewis-type subsistence labor model to generate a useful North–South model along structuralist lines. The model presented in this paper is not inconsistent with balance-of-payments constrained growth, but it views long-run trajectories as emerging from short-run dynamics. We therefore do not impose the balance of payments constraint but rather allow it to emerge as a tendency.

We constructed a simulation model, which

Gibson (

2003) argues is a technique well suited to structuralist theory. We then ran the model using a mix of Monte Carlo and scenario approaches in keeping with the RDM methodology. In the terminology of

Knight (

1921), we considered some uncertainties to be quantifiable risks, while others were fundamental uncertainties. For the former, such as global GDP growth, we provided a stochastic model and ran it in Monte Carlo mode, drawing parameter values from a probability distribution. For the latter, such as future sea-surface temperature, we could not provide a stochastic model, and instead allowed for distinct alternatives. Once sea-surface temperature was given, we ran a stochastic model of storm damage, but the parameters themselves depended on a cascading set of uncertainties, some of them irreducible to probabilistic calculations (

Collins et al. 2013).

While the model is in development, initial results show that, even in the absence of climate change, fluctuations in export and tourism demand within historical bounds can lead to substantially different GDP and external debt trajectories. Such changes are largely out of the control of Barbadian authorities, thus there is need for robust strategies and policies to manage the impact of those fluctuations on the economy. Under a climate change scenario, it becomes even more challenging to manage external debt due to rebuilding costs, loss of productive capital, and the resulting increase in imports.

1.1. The Barbados Economy

The post-independence period of the Barbados economy is characterized by succeeding periods of growth and contraction. In the 1960s and the 1970s, annual average economic growth was 5%. During this period, the economy was driven primarily by agricultural production, particularly sugar cane. By 1980, the economy had diversified, with agriculture accounting for 9% of GDP, wholesale and retail trade 17%, general services 14%, manufacturing to 12%, and government services and tourism to 11% each. The economy in the 1980s was negatively impacted by the global recession, but by 1986, the economy again grew by 5% each year due to strong performances in the foreign exchange earning sectors of agriculture, tourism, and manufacturing (

Meditz and Hanratty 1987). In the early 1990s, the economy again was impacted by the external economic environment and entered an International Monetary Fund (IMF) program that sought to deliver balance of payment support. By 1993, the economy was recovering and continued to grow during the 1990s, driven by tourism and construction sectors.

1The post 2008 global recession period brought low or no growth to the small island economy. From 2008 to 2018, the annual average GDP growth rate was 0.1% (using data from the World Bank WDI and

Central Bank of Barbados 2018). Further, the country’s external debt increased to 150% of GDP, contributing to a fiscal deficit of 5% of GDP in 2016 (

Central Bank of Barbados 2018). This led to a sovereign debt default and the country signing onto a four year IMF Extended Fund Facility in 2018.

Barbados’ economy is heavily reliant on the tourism sector. Tourism directly accounts for 13% of GDP and indirectly for 40%. The sector also supports, directly and indirectly, around 40% of total employment on the island (

WTTC 2018). The tourism sector is the main foreign exchange earner, and in June 2019, it recorded 3.9% growth while all other sectors had contracted. This increase was due to increases in arrivals from the United Kingdom and the United States. However, cruise tourism fell by 1.9% due to rerouting of itineraries to original ports following disruptions form the 2017 hurricane season (

Central Bank of Barbados 2019). Given the island’s dependence on tourism for economic activity, the impacts of climate change—including stronger, more frequent hurricanes (

Granvorka and Strobl 2013), sea level rise (

Scott et al. 2012), loss of coral reefs (

Burke and Maidens 2004), and increasing droughts (

Cashman and Nagdee 2017)—have direct implications for the sector (

Moore 2010;

ECLAC 2011;

Cashman et al. 2012). Because of the sector’s economic importance, climate change holds indirect implications for the entire economy. This is true for many Caribbean countries, as the region is the most tourism dependent in the world (

Thomas 2015).

Barbados has played an active and prominent role in regional integration, being a founding member in 1973 of the Caribbean Community and Common Market (CARICOM). Barbados maintains a Cabinet position within CARICOM. In addition, through the Revised Treaty of Chaguaramas in 2001, Barbados led the establishment and the implementation of the CARICOM Single Market and Economy (CSME) up until 2008. Among its various benefits, the CSME allows its members the free movement of goods and services, the right of establishment, an external common tariff, and the free movement of capital and labor.

1.2. Barbados in a Changing Climate

Barbados is on the southern edge of the hurricane belt, thus most years it suffers little damage from tropical cyclones. Nevertheless, it is periodically struck, sometimes severely.

Kemp-Benedict et al. (

2019) estimate a strike probability for Barbados of just over one-third for storms in the Eastern Caribbean.

Climate models exhibit low skill in projecting tropical cyclone frequency and intensity (

Nurse et al. 2014, p. 1634), and give ambiguous results for Atlantic tropical storms (

Villarini and Vecchi 2012). With extremely wide variation, the trend is towards an increasing number of tropical storms through 2050, with no change beyond that. In this paper, we use a model developed by

Kemp-Benedict et al. (

2019) that relates storm intensity and frequency in the Eastern Caribbean to changes in sea-surface temperature (SST). In contrast to projections of tropical cyclones, climate models unambiguously suggest rising SST, whether at global scale, in the tropics, or in the North Atlantic (

Villarini and Vecchi 2012). Given the uncertain results on tropical cyclones from climate models, the model accepts a range of parameter values to allow for different climate scenarios.

1.3. The Caribbean Catastrophic Risk Insurance Facility (CCRIF)

The Caribbean Catastrophic Risk Insurance Facility (CCRIF) Segregated Portfolio Company (SPC) is a regional catastrophic risk pool mechanism. It was established in 2007 in response to the damage from hurricane Ivan in 2004. The purpose of the CCRIF is to cover damage to public infrastructure, whereas the focus for the model described in this paper is damage to private physical capital. As described below, the role of the CCRIF sub-model in our simulation model is to offset the need for external borrowing after a storm.

The CCRIF offers parametric insurance—that is, insurance following a trigger event rather than after an assessment of loss—for states in the Caribbean and, since 2015, Central America. This feature facilitates its inclusion in the present model, because it allows us to use simulated peak wind speeds as the parameter for the simulated payout. The payout model is described in a later section.

As with other risk pools, the aim of the facility is to support a group of countries facing a common risk with at least partially independent probabilities of loss. Compared with a conventional approach in which each country purchases insurance independently, the CCRIF SPC risk pool reduces countries’ premium costs by up to half of what they might pay on their own (

CCRIF 2018a).

Insurance products offered by CCRIF SPC are classified as both parametric, as defined above, and sovereign. The triggering events for the parametric insurance include tropical cyclones, earthquakes, and excess rainfall. The insurance is sovereign because the policy owners are the governments of the contributing states, and the insurance is meant to protect government budgets from disaster impacts. The CCRIF SPC offers coverage for losses caused by wind and storm surge caused by tropical cyclones (for one-in-10-years events), and by excess rainfall (from one-in-15-years events) (

Martinez-Diaz et al. 2019).

Barbados is a loyal customer of CCRIF SPC (

Martinez-Diaz et al. 2019). It has purchased insurance products from CCRIF SPC every year and has been covered against tropical cyclones and earthquakes since 2007 and excess rainfall since 2014. Barbados is also the country that has received the higher number of payouts (six out of 38 payouts from 2007 until 2018), all from tropical cyclones and excess rainfall events, receiving a total of US

$ 19.3 million (

CCRIF 2018b). All payouts to Barbados have gone from the CCRIF SPC to Barbados’ Consolidated Fund within 14 days after the event, providing liquidity to the governments and allowing them to respond quickly. Payouts have been administered by the Ministry of Public Works and used mainly for immediate post-event activities, including the repairing of public infrastructure such as roads and bridges and remedial work in low lying areas (

CCRIF 2018b). The funds are intended to cover immediate needs only, not all recovery-related costs. Thus, the size of the payouts is relatively small in comparison to the damage caused by covered events.

1.4. Exchange Rate Management in Barbados

Barbados has adopted a fiscal strategy for countering the depletion of foreign reserves, which are chronic in small open economies (

Worrell et al. 2003). That system has allowed the country to maintain its exchange rate peg at 2 BBD/USD since 1975, despite periodic pressures on foreign reserves. In this system, the central bank and the Ministry of Finance use a forecasting model to identify a target level for the fiscal balance consistent with the target exchange rate. Given the target, the Finance Ministry engages with spending ministries to decide how to achieve it. Adjustment may include both increased taxes and decreased government spending in order to increase domestic saving, requiring flexibility and acquiescence from both citizens and ministries. During a balance of payments crisis that began in 1991, Barbados expanded the system, establishing a body to oversee the process, the Joint Economic Group (JEG), and negotiating a “tripartite accord” with labor on wages, prices, and productivity.

For the purposes of the model presented in this paper, we do not seek to represent this complex process in any detail. Rather, we represent the outcome by relying on accounting relationships and a simple behavioral rule.

We begin with a standard economic balance, equating injections into the economy—purchases of consumption and investment goods

C and

I, income from exports,

X, government expenditure,

G, incoming personal remittances

R, and payouts from the CCRIF

Fpay—to their corresponding leakages—consumption expenditure (also equal to

C), saving

S, imports

M, taxes

T, remitted profits Π

r, and premium payments to the CCRIF

Fprem. In this section, we express all variables in nominal terms, thus the balance is

Consumer goods

C enter on both the injection and the leakage sides of the equation and cancel out; the textbook result. In Barbados as well as other small island economies, there is little capacity to produce investment goods, and we assume that all are imported. Imports then consist of investment goods

I, imported consumption goods

Mc, and intermediate imports for domestic production,

Mi. With these definitions, and rearranging to solve for imports of consumption goods, we can rewrite Equation (1) as

Most of the terms on the right-hand side of this equation are fully determined in the model. Exports are determined by global demand; intermediate imports by domestic production; remittance inflows from citizens or relatives living abroad by a factor applied to GDP; and remittance outflows to meet contractual obligations or remit profits by a factor applied to the capital stock. The remaining term is total domestic saving.

To determine a rule for total domestic saving, we note that, while in principle, foreign savings can complement domestic savings, in practice, they tend to substitute for them (

Bresser-Pereira et al. 2015, chp. 8). The mechanism operates through the exchange rate. Capital inflows represent a demand for the domestic currency, which causes it to appreciate, other things remaining equal. That drives wages and imports of consumption goods upward. The rising wage squeezes profits, which are only partially offset by the fall in the cost of intermediate imports. That depresses savings, and the balance of payments worsens.

Barbados’ strategy offsets the potential crowding out of domestic private savings by increasing public saving through the fiscal balance. For the purposes of the present model, where we do not explicitly represent government spending, we express this rule through a target domestic saving rate

sdtarg, which is then multiplied by GDP,

Y, giving an expression for imports of consumer goods

Mc. This gives an upper bound for the level of imports of consumer goods,

This constraint is maintained by adjusting the saving rate. It is possible for the right-hand side to become negative, in which case the upper bound is set to zero.

Fiscal mechanisms operate slowly, thus the balance in Equation (3) may not be achieved in any given time period. Rather, realized domestic savings will fluctuate around the target level. The implementation in the model is described below in

Section 2: Methodology.

2. Methodology

As noted in the Introduction, the core of the model presented in this paper is a macroeconomic simulation model built along structuralist lines (

Taylor 1989;

Ocampo et al. 2009;

Bresser-Pereira 2012). The model is documented in a separate paper (

Kemp-Benedict et al. 2018). While we leave the details to that paper, we briefly describe the structure and the main assumptions below. Data requirements are summarized in the

Appendix A.

2.1. Dynamic Macroeconomic Model

The main calculations underlying the economic model are shown in

Figure 1. Consumption both fuels and is driven by GDP. Some of that consumption is in the form of imports, which are balanced against exports (net of remittances) to determine the change in the external debt. Trend GDP growth sets longer-run expectations for firms. In the short run, GDP growth in excess of growth in the capital stock indicates rising capital utilization and is taken by firms as a sign of rising demand and therefore a stimulus to investment. However, because investment goods are imported, investment expenditure contributes to the external debt.

2 That is assumed to increase the perceived risk of investment in the country by external investors, thus further investment is dampened when the debt-to-GDP ratio rises. Once investment is determined, it contributes to the capital stock.

At the highest level of abstraction, domestic economic activity in the model results from a multiplier applied to exports. While this is similar to “export base” theory (

North 1955), which enjoyed some popularity in the 1970s, the multiplier in the model is dynamic rather than static, as it is in export base models (

W. C. Lewis 1976). The dynamic multiplier is constructed by starting with a two-sector model—export-oriented and domestic—and through an input–output type analysis, deriving an effective one-sector model with the two-sector model parameters and exogenous prices embedded in it. The approach was inspired by the work of the Caribbean structuralists

Seers (

1964) and

Bruce and Girvan (

1972), who carried out a similar calculation for the special case of a petroleum exporter. Aside from the intuitive appeal of the multiplier, the attraction of this type of model is that output variables are at the level of the whole economy rather than the two sectors, which facilitates calibration when data are scarce.

The assumption of exogenous prices requires some justification. For small open economies, it is plausible to assume exogenous prices for tradeable goods. Yet, the same also appears to hold for non-tradeables.

Holder and Worrell (

1985) found, in a study that included Barbados, that the price of tradeables had a much stronger effect than either wage rates or bank lending rates on the price of non-tradeables.

In the model runs reported in this paper, we held structural parameters fixed at their calibrated values, thus changes in the multiplier are driven by relative price changes. In scenario exercises, it is possible to change structural parameters exogenously to allow for greater or lesser integration between the domestic and the export sectors, changing import propensity, different sector wage shares, and so on.

The model is implemented as a system dynamics model implemented in the modeling software Vensim DSS.

3 The model economy is normally out of equilibrium. As a structuralist model, it is demand driven; when demands depart from expectations, economic actors are assumed to act only after a delay. In economic modeling, this is normally referred to as adjustment following a shock. However, as the economy is strongly dependent on fluctuating external demand and climate events, it is effectively always being “shocked”. Admittedly, some of those shocks—such as global recessions or severe storms—are unusually large, a possibility that we incorporate into the model.

In this paper, we make four significant extensions to the model as documented in

Kemp-Benedict et al. (

2018). First, as described in the introduction, we simulate the outcome of the exchange rate management regime. Second, we construct a model for global GDP growth in order to drive export demand. Third, we construct a separate model for the tourism sector. Fourth, we apply a model for payouts from the CCRIF SCP.

2.2. The Exchange Rate Management Regime

Our strategy for simulating Barbados’ fiscal exchange rate management regime was described in the Introduction. We now say explicitly how it is implemented in the model. We first put Equation (3) in terms of real variables by explicitly giving prices,

In this expression,

e is the exchange rate,

P is the general price level,

Px and

Pm are the prices of exports and imports, and a star indicates a world price, denominated in US dollars.

Imports of consumption goods are a fraction of consumption above a basic level. Basic consumption, which is a fixed multiple

c0 of the population,

N, is assumed to be fully supplied by domestic producers at a price

Pd. Households target a desired level of saving

swdesired with a (price-dependent) import fraction

m. They then devote a fraction of their smoothed wage income

W in excess of basic consumption to desired imports of consumer goods,

If this exceeds the maximum level of imports consistent with the target saving rate, then the Central Bank and the Finance Ministry will intervene in order to raise total saving. In the model, this intervention is represented by a target level of consumer goods imports,

which corresponds to a target saving rate,

Because this is achieved through a fiscal mechanism and therefore operates after a delay, we assume that the actual saving rate tracks the target with a one-year smoothing time.

2.3. Demand Drivers

In this demand-led model, the main external sources of demand are for goods and services exports and domestic expenditure by tourists. We treat tourist revenue as export demand, although that demand is realized by in-country payments.

Income in tourist source countries is an explanatory factor for tourist arrivals (

Moore 2010). Due to global economic conditions, we expect the source countries’ GDP to move together to some degree. Similarly, we expect changes in export demand to reflect global economic conditions. To generate consistent external demand scenarios, we constructed a model for the world GDP growth rate,

gw, and used it as an explanatory variable for growth rates of export demand and income in tourist source countries.

Attempting an autoregression using data from the World Bank World Development Indicators for 1980–2018 yielded residuals that deviated strongly from normality due to the global recessions in the early 1980s, the early 1990s, the early 2000s, and the Global Financial Crisis (p = 0.013 with the Shapiro–Wilk test). We therefore represented the world GDP growth rate by separating recessions from normal conditions. We used an autoregressive model for normal conditions and a mixed Poisson-exponential model for recessions. We constructed a modified time series by setting the world growth rates in 1982, 1991, 2001, and 2009 to 3.15%/year, which is the mean value with those years removed. Carrying out the autoregression in R using the Yule-Walker algorithm and choosing the optimal order using the Akaike Information Criterion (AIC) measure gave an order one model. The residuals for the modified time series were acceptably normal (p = 0.865 with the Shapiro–Wilk test). We modeled the occurrence of recessions as a Poisson process with an annual probability of recession of 10% (four recessions over 39 years) and the depth of the recession as a truncated exponentially distributed variable with a mean depth below trend of 2.6%/year and a maximum depth of 10.0%/year.

Most tourists to Barbados arrive from the UK (over 35%), the US (about 25%), other CARICOM countries (about 15%), and Canada (about 12%). We assume all tourists come from these four source markets. For the model runs in this paper, we represent CARICOM by the World Bank’s “Caribbean Small States” group (CSS).

4 For each country and the CSS, we modeled the GDP growth rate of source country or region

s as a stochastic process,

In this equation,

σs is the standard deviation of the residuals of the fitted model, and

B is a standardized normal random variate. The model structure is a compromise. For each of the three countries (UK, US, and Canada), each coefficient (aside from the constant) is significant at least at the 10% level. For the CSS group, the coefficient on the lagged world GDP growth rate is not significant but is retained to maintain the same structure across tourism source markets. Given the non-normality of the residuals for world GDP, we ran the Shapiro–Wilk test as a check, which gave acceptable results (US:

p = 0.208; UK:

p = 0.838; Canada:

p = 0.157; CSS:

p = 0.340).

For the growth rate of export demand (excluding tourism revenue), we found that it can be reasonably modeled as depending solely on the instantaneous value of the world GDP growth rate. The constant term was insignificant and small, thus we ran the regression with the intercept set to zero. Using a notation similar to that above, the export growth model is,

The coefficient bX0 is very nearly equal to one (0.943), thus trend growth in demand for Barabados’ exports follows growth in the global economy very closely. However, the deviations are large, with σX = 9.7%/year. The Shapiro–Wilk test statistic for the residuals is consistent with normality (p = 0.877).

2.4. The Tourism Sector

Tourist revenue is calculated for tourist season, which is taken to be the first quarter of each year. As noted earlier, the revenue is treated as part of exports. A number of tourism models are available, including ones by

Moore (

2010) and

Laframboise et al. (

2014). Moore makes use of a tourism climate index (TCI) proposed by

Mieczkowski (

1985). This is a compelling approach, because climate indices, whether TCI or more recent alternatives (

de Freitas et al. 2008;

Mailly et al. 2014), include climate-related variables that can be drawn from climate models. Moreover, local indices can in some cases be computed from indices at coarser resolution using statistical downscaling techniques (

Casanueva et al. 2014). However, aside from unresolved challenges in making long-run projections of climate tourism indices (

Dubois et al. 2016), implementing a climate index would require a finer time resolution than the quarterly time step we assumed in our model. We therefore adopted one of the models tested by

Laframboise et al. (

2014). Specifically, we chose the model for tourism expenditure in which tourism-weighted GDP per capita is the income proxy (Table II.2 in Laframboise et al.). We depart from that paper, however, by using the tourism-weighted GDP growth rate rather than GDP per capita.

Besides tourism-weighted GDP growth in source markets

gsource, the model of

Laframboise et al. (

2014) depends on a hurricane dummy,

h, the tourism-weighted real exchange rate

esource, and the number of airlines serving Barbados,

A. Using a “hat” to indicate a growth rate and denoting tourist income by

Xtour, the model is,

Of these variables,

gsource is computed using the model described in the previous section,

esource is computed using an exogenously specified exchange rate

e, the computed price level in Barbados, and price indices in source countries, and

A is given exogenously. The hurricane dummy

h is computed using a storm damage model documented in

Kemp-Benedict et al. (

2019), as described in the next section.

2.5. Climate Impacts

The storm damage model of

Kemp-Benedict et al. (

2019) simulates hurricane events by running the simulation model in Monte Carlo mode using a probabilistic model. Because hurricanes in Barbados are comparatively rare, hurricane arrivals in Barbados are computed as a strike probability (estimated to be 36%) multiplied by the probability of arrival in the Eastern Caribbean as a whole, which is represented by a generalized extreme value (GEV) distribution. Peak wind speed in a given year is treated as an independent draw from the distribution, which is characterized by location, scale, and shape parameters. Historically, the peak wind speed recorded in Barbados has been on average about three quarters of the peak wind speed for the Eastern Caribbean as a whole, thus after fitting the GEV to data for the Eastern Caribbean, we adjusted the location and the scale parameters by that factor.

Under climate change, the distribution of storm arrivals and intensities is not stationary, thus the parameter values of the GEV distribution are expected to change. Testing a nonstationary model with global sea-surface temperature (SST) as a covariate showed a significant relationship for the location parameter. In the simulation models, climate scenarios are therefore specified by a trajectory for SST, which drives the location parameter in the GEV, thereby driving up average peak wind speed.

The original model was built for annual hurricane events and was run at a yearly time step. In the model described in this paper, which is run at a quarterly time step, hurricanes appear only during “hurricane season”, which is taken to be the third quarter of each year. Firms anticipate climate damage when they make new investments, balancing current adaptation expenditures against future rebuilding costs. They do this in a typical engineering cost-minimization exercise that compares capitalized investment expenditure to discounted expected damages. However, they may not correctly anticipate future climate. In this paper, we assume that they do not, and continue to assume historical climate when making new investments.

5The climate damage model applied in this paper is inspired by the treatment of extreme events in engineering studies, where the aim is to build infrastructure that can withstand all but the most infrequent and damaging events. Under stationary conditions, a popular parameter is the return period. Under nonstationary conditions, the concept of a return period becomes problematic (

Read and Vogel 2015). Nevertheless, given its intuitive appeal, changes in return period were used in the IPCC Special Report on Extreme Events (SREX) to illustrate the impacts of climate change (

IPCC and Field 2012). This engineering approach can be contrasted with the highly aggregate “damage function” approach used in some prominent integrated assessment models (IAMs), such as DICE (

Nordhaus 1993,

2017) and FUND (

Anthoff and Tol 2012). In such models, greenhouse gas concentration in the atmosphere or global temperature determines economic losses. Losses are typically given as a fraction of GDP, although in some cases they represent loss of fixed capital (

Fankhauser and Tol 2005;

Rezai et al. 2013;

Piontek et al. 2018). In the model described in this paper, we used global sea surface temperature to compute a (stochastic) peak wind speed, which then determines losses to capital stocks of different vintages. Thus, the overall logic is the same as in the IAMs—a global climate parameter drives economic losses—but we simulated the decision process and used a physically-motivated storm model to calculate damages.

While we did not explicitly consider public infrastructure, we did take into account the impact of CCRIF premiums and payouts on the current account. We assumed a series of fixed premium payments in US dollars. Following a

World Bank (

2007) background document to the creation of the CCRIF, we simulated payouts as rising from zero below an “attachment” wind speed and plateauing at a maximum payout

Fpaymax above an “exhaustion” wind speed. For the simulations, we chose the attachment wind speed to be the lower limit for a tropical storm,

wTS, and the exhaustion wind speed to be the lower limit for a category five hurricane,

wCAT5. Between those limits, the payout increased as the fractional distance between the attachment and the exhaustion wind speeds raised to the power of a damage exponent

β. That is,

We note that, because the CCRIF only covers damage to public infrastructure, it is not a large correction to total damage expenditure in the model.

We further took into account loss in global GDP due to climate change using the damage function from the DICE integrated assessment model. The effects were essentially negligible, which might not have been the case if the damage function allowed for a higher probability of catastrophic damage (

Weitzman 2009,

2011;

Ackerman and Stanton 2012). The DICE damage function depends on atmospheric temperature rather than SST. Following historical patterns based on ordinary least squares (OLS) regression of the global temperature anomaly on the SST anomaly using data from National Oceanic and Atmospheric Administration (NOAA), we found that the annual rise in global temperatures is about 12.5% higher than the annual rise in SST. We applied that dependence to our SST assumption and used the damage function from DICE-2016R (

Nordhaus 2017).

3. Results

In this section, we present some key results from runs of the model. We ran the model to 2080, a common choice for a future year in climate scenario projections. We ran two scenarios, one with a historical climate and the second with a warming climate. We ran the model under each scenario 1000 times, using the same pseudo-random number sequence in each case.

First, we consider the scenario without climate change. Key economic variables are shown in

Figure 2. As shown in the figure, in the average case, GDP rises in line with historical rates but with the possibility of much slower or faster growth depending on global economic conditions and variability in export demand. The debt-to-GDP ratio initially rises in all variants, as in

Kemp-Benedict et al. (

2018). However, it subsequently declines—without triggering the exchange rate stabilization mechanism—to gradually return close to zero in the average case.

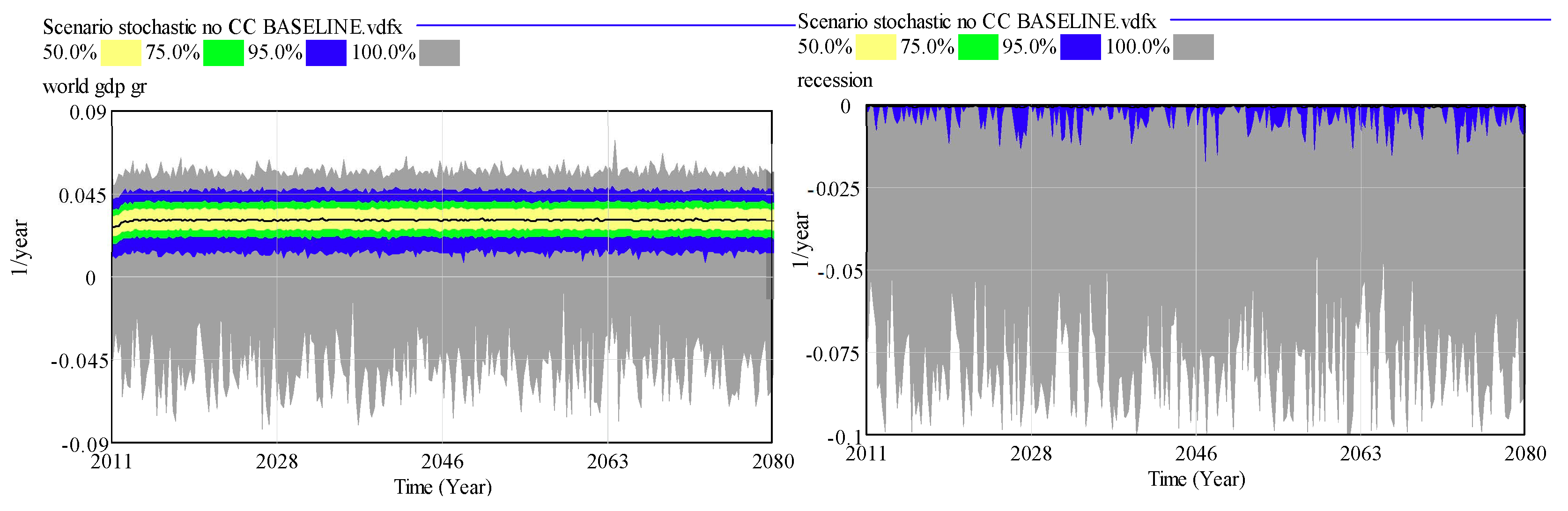

In the baseline scenario, we assume that the global trends from 1985 to the present continue into the future. This leads to a steady mean growth rate of about 3%/year, as shown in

Figure 3. However, the growth distribution is decidedly asymmetric because of the Poisson-exponential recession model. Recessions are shown in the second panel of

Figure 3, where they are most likely to be absent or small but may, in some circumstances, lead to a large fall in the global GDP growth rate.

Selected model outputs for a single model run, which includes climate change, are shown in

Figure 4. The cost of climate damage rises over time, as shown in graph (a). Rebuilding takes time, leading to the sharp rise and the smooth decay of loss and damage expenditure. Rebuilding also requires imports of capital goods, which are reflected in graph (b). Climate damage combined with fluctuations in world GDP, shown in graph (c), affect tourist expenditure in graph (d). The multiplier effect from export demand can be seen in graph (e). As shown in the graph, exports make up a large component of GDP, but it is dominated by an indirect component that is driven by export demand through a (dynamic) multiplier. Employment in the export sector and demand for domestic intermediate goods drives the domestic economy. The assumption that households decide their consumption based on smoothed wage income rather than instantaneous wage income results in smaller variations in GDP than in export demand, while basic consumption declines in importance as wages grow. The gap between imports and exports drives external debt, which varies as a share of GDP, as shown in graph (f).

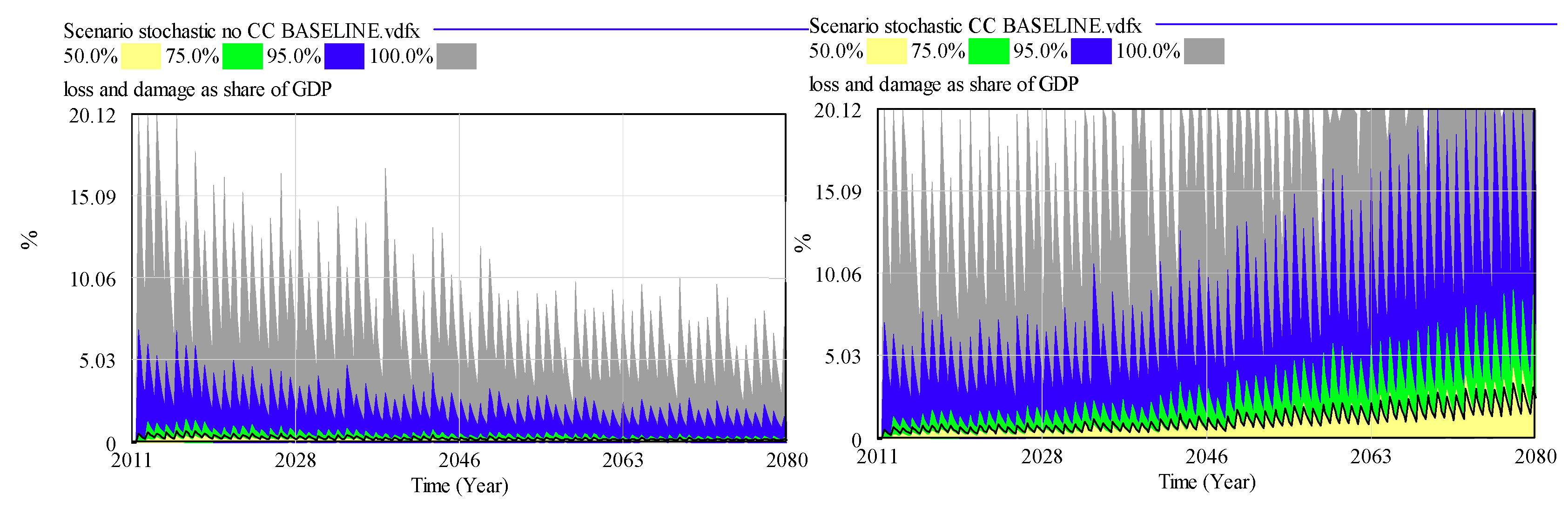

The effect of the storm damage model can be seen when comparing the scenario with climate change to that without. Under climate change, rebuilding costs rise substantially, as shown in

Figure 5. The saw-tooth pattern in the figure arises from hurricane damage occurring during the hurricane season, while, as noted above, rebuilding takes time.

As storm damage increases, payouts from the CCRIF also increase, as shown in

Figure 6. The average payout remains well below the cap (assumed to be 20 million USD). However, the 95% probability level eventually exceeds the cap.

Due to the need to rebuild damaged capital stocks, the average external debt-to-GDP ratio in the scenario with climate change remains above zero, despite payout from the CCIF (see

Figure 7). The initial trajectories are very similar, but under increasing climate change, the curve reverses and begins to rise.

4. Discussion

The model described in this paper is intended for policy analysis. Given the high external uncertainties facing SIDS, including Barbados, it follows a robust decision making (RDM) strategy (

Lempert and Kalra 2011). Uncertainty is taken as a given, and policies are sought that help to manage, rather than eliminate, that uncertainty. The major policy lesson the model provides at present is that climate change is a major external uncertainty that should be built into planning decisions. While not a new recommendation (

Nurse and Moore 2005), the country-specific features of the model can help to fill some of the gaps that have hindered adaptation planning in the Caribbean (

Taylor et al. 2012). Specifically, the model shows that, under a changing climate, it can become more difficult to manage the external debt, as shown in

Figure 7. The model runs that produced the figure assumed that future construction standards were guided by historical climate. As discussed in

Kemp-Benedict et al. (

2019), the model allows for standards to change in response to expected climate change. If an expectation of stronger and more frequent storms were incorporated into planning, then damage costs would be lower but would be partially offset by higher adaptation costs.

For RDM, a useful model must represent: (1) relevant external uncertainties; (2) impacts of external events; and (3) current and future autonomous and policy-induced responses to those impacts. With this goal in view, the model presented here falls short of a full policy model. It is in continual development, and we discuss some possible extensions below. We also plan to update the dataset and recalibrate the model.

6 Nevertheless, in its current state, it shows some of its potential. The purpose of a policy-oriented simulation model is to gain insight. Non-stochastic uncertainty can be captured through scenarios, as shown by running the model with and without climate change. As shown in

Figure 7, climate change impacts upon policy-relevant indicators, which suggests the need for counter-measures. Stochastic risk can be illustrated either by showing statistics for a large number of model runs (as in

Figure 7) or by showing individual trajectories (as in

Figure 4). Both types of output can be used in a planning process. The individual trajectories can be interpreted in real-world terms: a series of global recessions in the next couple of decades slows progress on reducing the debt; a series of storms negatively affects tourist revenue and GDP and drives up the debt; and the combination of severe storms with a global recession towards the end of the simulation coincides with a rapid increase in debt. Such individual model runs can be used in participatory “what-if” exercises to ask how policymakers might respond to a series of events.

At present, the model represents uncertainties in demand for exports and tourism, and for one type of storm damage: wind. These could be further developed. Regarding tourism, the highly aggregate model of

Laframboise et al. (

2014) was suitable for our simulation model in its current stage of development, but a more disaggregated model, such as that of

Moore (

2010), would allow a more complex set of behavioral responses. Of particular interest are substitution effects in major source markets, whether within the Caribbean or closer to the source country. Drivers for substitution could include: climate mitigation efforts that raise the cost of air travel (

ECLAC 2011), although that may not have a substantial effect (

Pentelow and Scott 2011); wariness about the potential for hurricanes (

Forster et al. 2012); and behavioral changes such as “flight shame”

7 (e.g., see

Cashman et al. 2012).

The climate damage sub-model focuses entirely on wind damage to productive capital. It could be extended to include damage to the residential housing stock and public infrastructure. Further climate events could include storm surge, flooding, and drought. The last of these is a particular concern at the moment. The country has been experiencing an extended drought, with impacts on both agriculture and tourism.

The behavioral responses in the model could be expanded to include adaptive responses to observed climate impacts. For example, a storm in the Eastern Caribbean, whether it strikes Barbados or not, could influence tourist decisions. Locally, the perceived strike probability might fall below the true level after a series of years in which storms miss Barbados and rise above that level in the aftermath of a strike.

Behavior is further shaped and budgets are affected by insurance. In the present model, only the CCRIF is represented. Following

Kemp-Benedict et al. (

2019), firms are assumed to carry out their cost–benefit analysis of climate adaptation with the expectation that they will pay for damages out of their own funds, with no insurance and no government assistance. Insurance, whether private or public, would change that calculation. Were the model extended to include climate damage to the residential housing stock, then a mechanism such as the (lapsed) catastrophe fund could come into play.

8 Setting and enforcing effective building standards would help to limit the amount that must be paid, while increasing construction costs.

Potentially, an extended version of the model presented in this paper could inform the construction of “resilience bonds” (

Vaijhala and Rhodes 2018). These are bonds to finance adaptive investment, in contrast to either catastrophic insurance or “catastrophe bonds”, which cover damages after disaster. The income and the expenditure from those bonds would affect macroeconomic balances while reducing the damage costs arising from climate events.

While the model in this paper was developed specifically for Barbados, many small island developing states (SIDS) face similar challenges. Whether they are tourist destinations reliant on marine resources (the “Blue Economy”: see

Smith-Godfrey 2016) or exporters of small manufactures, they are vulnerable to changes in the climate and the demand for their exports. Each island state will have its unique institutional and social structures, but the broad economic structure of an export-oriented sector providing employment and revenue for the rest of the economy is to a large extent dictated by the physical realities of a small island economy (

Demas 2009). Moreover, SIDS share a common set of climate threats: storms, loss of coral reefs, sea-level rise, and changing precipitation patterns. The model described in this paper can therefore be adapted for use in other SIDS.