Impact of Monetary Policy on Private Investment: Evidence from Vietnam’s Provincial Data

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Background

2.2. Empirical Evidence

3. Private Investment and Monetary Policy Management in Vietnam

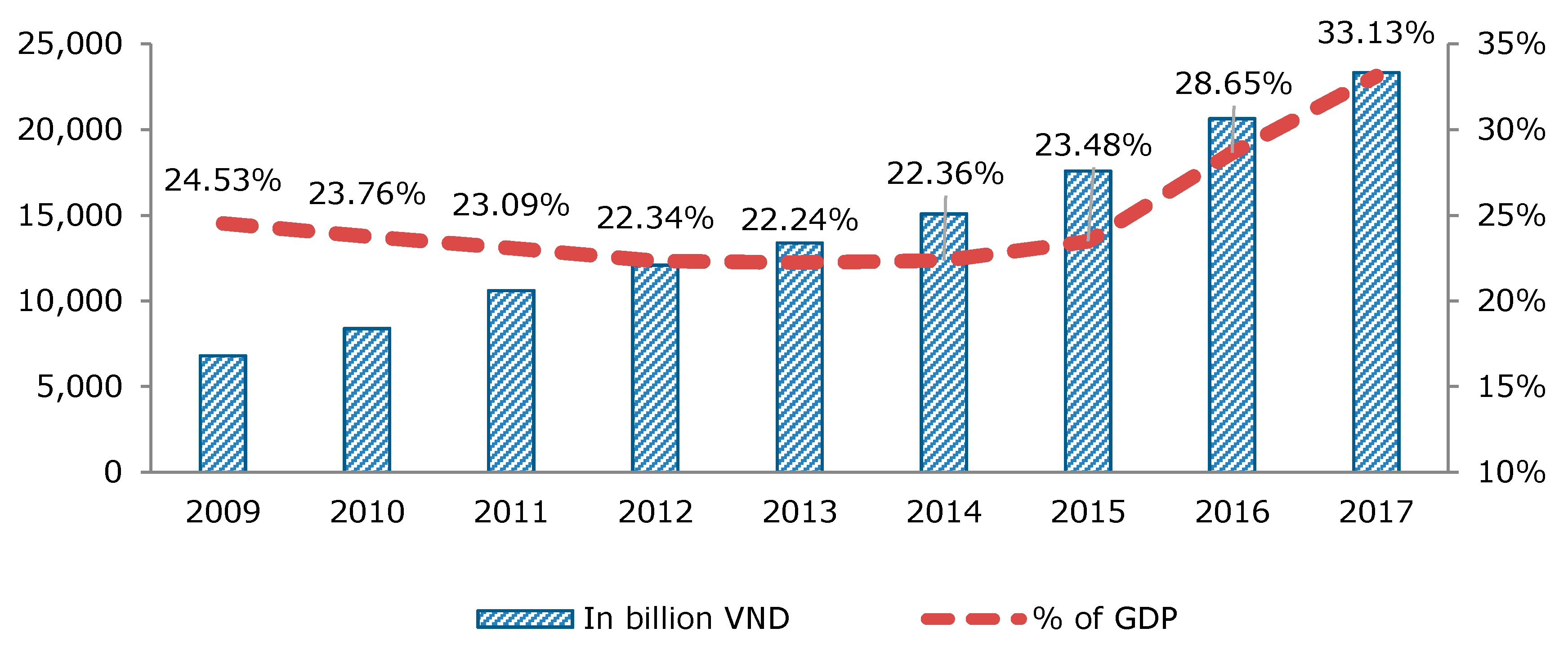

3.1. Private Investment in Vietnam

3.2. Monetary Policy Management in Vietnam

4. Methodology

4.1. Model

- –

- The lagged private equity (PrvI(−1)): Previous studies on the determinants of private investment reveal the profound influence of the lagged values of private investment. This suggests that the investment decisions of private firms are clearly dependent on the historical transaction information. Hence, we included the dependent variable at a one-year lag as an explanatory variable to capture the impact of the preceding year’s information on private investor’s decisions.

- –

- Monetary policy (MP)’s effect, captured by broad money (M2), credit to the private sector (CR), interest rate (IR) and exchange rate (ER) (Handa 2009; Horngren 1995). The inclusion of the exchange rate variable as a monetary policy instrument in the research model could be explained as follows. Under the Law on the State Bank of Vietnam 2010, official instruments used for implementing the national monetary policy include re-financing, interest rates, exchange rates, reserve requirements, open market operations and other measures as prescribed by the Vietnamese government. As regards the transmission mechanism, a change in the exchange rate would cause the trade balance to change, thereby affecting private investment activities. Meanwhile, adjustments to the broad money, domestic credit and interest rate may have a direct impact on investment capital flows and prospects of private firms with a lag (says, 1–3 months).

- –

- Public investment (PubI) and foreign direct investment (FDI), proxies for local investment activities (Agu 2015; Akkina and Celebi 2002; Farla et al. 2016; Khan 2011; Oshikoya 1994), in which: (i) Public investment was measured as the value of public investment relative to the local GDP. The previous literature on public investment’s effect on private investment yielded mixed results, i.e., in both positive and negative ways. On the one hand, public investment development may hinder private investment from gaining access to bank credit (the so-called “crowding-out” effect). On the other hand, public investment could also benefit the private investment through provision of social infrastructure systems. (ii) Foreign direct investment is measured as the percentage of foreign direct investment to the local GDP. Analogous to public investment, foreign direct investment’s effect on private investment could be deemed a double-edged sword. Aside from the benefits deriving from technology transfer or market development orientation, foreign investors may pose certain risk to the private sector through heating up competition to dominate the domestic market.

- –

- Other local economic factors, namely economic growth (Gdpg), trade openness (Trade), inflation (Inflat), infrastructure development (Infras), labor force (Labor) and human capital (HuC). They have been proved empirically to have an impact on both the input and output of an enterprise’s business activities, thereby affecting its investment capital flows (Ahmed and Miller 2000; Carrasco 1998; Cavallo and Daude 2011; Erden and Holcombe 2005; Ghura and Goodwin 2000; Gjini and Kukeli 2012). Quantitatively, we used the annual growth rate of the local real GDP as an economic growth measure; the value of trade relative to the local GDP as a trade openness measure; the annual growth rate of the local consumer price index (CPI) as an inflation measure; the annual growth rate of the local landline subscribers as an infrastructure development measure; the annual growth rate of the local employed aged 15 and over as a labor force measure; and the annual growth of the number of students in local vocational secondary schools as a human capital measure.

4.2. Data

4.3. Estimation Approach

5. Empirical Results

5.1. Summary Statistics

5.2. Analysis of Results

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Agrawal, G., and M. A. Khan. 2011. Impact of FDI on GDP: A comparative study of China and India. International Journal of Business and Management 6: 71–79. [Google Scholar] [CrossRef] [Green Version]

- Agu, O. C. 2015. Determinants of Private Investment in Nigeria an Econometric Analysis. International Journal of Economics, Commerce and Management 3: 1–14. [Google Scholar]

- Ahmed, H., and S. M. Miller. 2000. Crowding-out and crowding-in effects of the components of government expenditure. Contemporary Economic Policy 18: 124–33. [Google Scholar] [CrossRef]

- Akkina, K. R., and M. A. Celebi. 2002. The determinants of private fixed investment and the relationship between public and private capital accumulation in Turkey. The Pakistan Development Review 41: 243–54. [Google Scholar] [CrossRef] [Green Version]

- Alawneh, A. M., T. M. Al-Fawwaz, and G. N. Shawaqfeh. 2015. The Impact of the Fiscal and Quantitative Monetary Policies on the Domestic and Foreign Direct Investment in Jordan: An Empirical Study. International Journal of Academic Research in Accounting Finance and Management Sciences 5: 1–10. [Google Scholar] [CrossRef]

- Anastasia, O. C., S. I. Omade, and E. J. Osemen. 2011. Long run relationship between private investment and monetary policy in Nigeria. Journal of Finance and Accounting 2: 30–39. [Google Scholar]

- Ang, J. B. 2009. Private investment and financial sector policies in India and Malaysia. World Development 37: 1261–73. [Google Scholar] [CrossRef] [Green Version]

- Arellano, M., and O. Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef] [Green Version]

- Beck, T., and R. Levine. 2004. Stock markets, banks, and growth: Panel evidence. Journal of Banking & Finance 28: 423–42. [Google Scholar]

- Blundell, R., and S. Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef] [Green Version]

- Brima, S., and A. S. Brima. 2017. Monetary policy effect on private sector investment: Evidence from Sierra Leone. International Journal of Economics and Financial Issues 7: 476–88. [Google Scholar]

- Bui, Q. D., and D. A. Pham. 2016. On the choice of forecasting models for inflation: International experience (Lựa chọn mô hình dự báo lạm phát tại Ngân hàng Trung ương các nước và một số bài học kinh nghiệm). Vietnam Trade and Industry Review 3: 106–11. [Google Scholar]

- Cao, T. Y. N., and T. G. Le. 2015. Application of SVAR model to study monetary transmission channels and monetary policy implications in Vietnam (Ứng dụng mô hình SVAR nghiên cứu kênh truyền dẫn tiền tệ và gợi ý chính sách tiền tệ ở Việt Nam). Journal of Economics and Development 216: 37–47. [Google Scholar]

- Carrasco, M. 1998. Crowding out and government spending. University Avenue Undergraduate Journal of Economics 2: 1. [Google Scholar]

- Cavallo, E., and C. Daude. 2011. Public investment in developing countries: A blessing or a curse? Journal of Comparative Economics 39: 65–81. [Google Scholar] [CrossRef] [Green Version]

- Chu, L. K., and H. V. Chu. 2020. Is too much liquidity harmful to economic growth? The Quarterly Review of Economics and Finance 76: 230–42. [Google Scholar] [CrossRef]

- Dang, T. Q. A., D. A. Pham, and T. P. H. Le. 2019. Pass-through of exchange rate to domestic prices: An empirical study for Vietnam. In Price-setting Behaviour and Inflation Dynamics in SEACEN Member Economies and their Implications for Inflation, 80416-M. Edited by D. Finck and P. Tillmann. Kuala Lumpur: SEACEN Centre, pp. 323–49. [Google Scholar]

- Dang, T. T., and A. D. Pham. 2020. What make banks’ front-line staff more customer oriented? The role of interactional justice. International Journal of Bank Marketing 38: 777–98. [Google Scholar] [CrossRef]

- De Long, J. B., and L. H. Summers. 1991. Equipment investment and economic growth. The Quarterly Journal of Economics 106: 445–502. [Google Scholar] [CrossRef]

- Dinh, T. T. 2019. The linkage between public investment and private investment in economic development (Quan hệ giữa đầu tư công và đầu tư tư nhân trong phát triển kinh tế). Vietnam MOF’s Review of Finance. Available online: http://tapchitaichinh.vn/nghien-cuu-trao-doi/quan-he-giua-dau-tu-cong-va-dau-tu-tu-nhan-trong-phat-trien-kinh-te-305137.html (accessed on 13 August 2020).

- Duong, N. M. P., T. P. A. Vu, T. T. D. Do, and H. T. Nguyen. 2015. Impact of monetary policy on the stock market: Evidence in Vietnam (Tác động của chính sách tiền tệ đến thị trường chứng khoán: Bằng chứng tại Việt Nam). Development and Integration Review 25: 3–13. [Google Scholar]

- Emmons, W. R., and F. A. Schmid. 2004. Monetary policy actions and the incentive to invest. Federal Reserve Bank of St. Louis Working Paper Series (2004–018A): 1–14. [Google Scholar]

- Erden, L., and R. G. Holcombe. 2005. The effects of public investment on private investment in developing economies. Public Finance Review 33: 575–602. [Google Scholar] [CrossRef]

- Farla, K., D. De Crombrugghe, and B. Verspagen. 2016. Institutions, foreign direct investment, and domestic investment: crowding out or crowding in? World Development 88: 1–9. [Google Scholar] [CrossRef] [Green Version]

- Fu, Q., and X. Liu. 2015. Monetary policy and dynamic adjustment of corporate investment: A policy transmission channel perspective. China Journal of Accounting Research 8: 91–109. [Google Scholar] [CrossRef] [Green Version]

- Ghura, D., and B. Goodwin. 2000. Determinants of private investment: a cross-regional empirical investigation. Applied Economics 32: 1819–29. [Google Scholar] [CrossRef]

- Gjini, A., and A. Kukeli. 2012. Crowding-out effect of public investment on private investment: An empirical investigation. Journal of Business & Economics Research (JBER) 10: 269–76. [Google Scholar]

- Gujarati, D. N. 2003. Basic Econometrics, 4th ed. New York: McGraw Hill. [Google Scholar]

- Hailu, D. B., and F. Debele. 2015. The Effect of Monetary Policy on the Private Sector Investment in Ethiopia: ARDL Co-Integration Approach. Economics 4: 22–33. [Google Scholar] [CrossRef]

- Handa, J. 2009. Monetary Economics, 2nd ed. Quebec: McGill University. [Google Scholar]

- Hansen, L. P. 1982. Large sample properties of generalized method of moments estimators. Econometrica: Journal of the Econometric Society 50: 1029–54. [Google Scholar] [CrossRef]

- Hasan, I., P. Wachtel, and M. Zhou. 2009. Institutional development, financial deepening and economic growth: Evidence from China. Journal of Banking & Finance 33: 157–70. [Google Scholar]

- Horngren, L. 1995. Monetary policy in theory and practice. Sovereign Risk Banks Quarterly Review 3: 5–12. [Google Scholar]

- Khan, A. H. 1988. Macroeconomic policy and private investment in Pakistan. The Pakistan Development Review 27: 277–91. [Google Scholar] [CrossRef] [Green Version]

- Khan, M. S. 2011. The design and effects of monetary policy in Sub-Saharan African countries. Journal of African Economies 20: 16–35. [Google Scholar] [CrossRef]

- Maana, I., R. Owino, and N. Mutai. 2008. Domestic debt and its impact on the economy–The case of Kenya. Paper presented at 13th Annual African Econometric Society Conference, Pretoria, South Africa, July 9–11; vol. 40, pp. 346–598. [Google Scholar]

- Misati, R. N., and E. M. Nyamongo. 2011. Financial development and private investment in Sub-Saharan Africa. Journal of Economics and Business 63: 139–51. [Google Scholar] [CrossRef]

- Ndikumana, L. 2008. Can macroeconomic policy stimulate private investment in South Africa? New insights from aggregate and manufacturing sector-level evidence. Journal of International Development: The Journal of the Development Studies Association 20: 869–87. [Google Scholar] [CrossRef] [Green Version]

- Ndikumana, L. 2016. Implications of monetary policy for credit and investment in sub-Saharan African countries. Journal of African Development 18: 1–18. [Google Scholar]

- Nguyen, T. T. H., and D. T. Nguyen. 2010. Macroeconomic Determinants of Vietnam’s Inflation 2000–2010: Evidence and Analysis. Hanoi: Vietnam Centre for Economic and Policy Research, University of Economics and Business, Vietnam National University. [Google Scholar]

- Olweny, T., and M. Chiluwe. 2012. The effect of monetary policy on private sector investment in Kenya. Journal of Applied Finance and Banking 2: 239. [Google Scholar]

- Oshikoya, T. W. 1994. Macroeconomic determinants of domestic private investment in Africa: An empirical analysis. Economic Development and Cultural Change 42: 573–96. [Google Scholar] [CrossRef]

- Pham, A. D. 2020. Application of Inflation Forecasting Models to Central Bank’s Monetary Policy Implementation: The Case of Vietnam (Ứng dụng mô hình dự báo lạm phát trong điều hành chính sách tiền tệ tại Việt Nam). Ph.D. thesis, Vietnam Banking Academy, Hanoi, Vietnam. [Google Scholar]

- Pham, A. D., and A. T. P. Hoang. 2019. Does female representation on board improve firm performance? A case study of non-financial corporations in Vietnam. In Beyond Traditional Probabilistic Methods in Economics. Edited by V. Kreinovich, N. Thach, N. Trung and D. Van Thanh. ECONVN 2019. Studies in Computational Intelligence. Cham: Springer, vol. 809, pp. 497–509. [Google Scholar]

- Pham, A. D., H. Pham, and K. C. Ly. 2019. Double taxation treaties as a catalyst for trade developments: A comparative study of Vietnam’s relations with ASEAN and EU member states. Journal of Risk and Financial Management 12: 172. [Google Scholar] [CrossRef] [Green Version]

- Pham, T. A. 2015. Applying SVAR model to analyze the exchange rate pass-through effects in Vietnam (Ứng dụng mô hình SVAR trong phân tích hiệu ứng chuyển của tỷ giá hối đoái ở Việt Nam). Journal of Economics and Development 220: 48–58. [Google Scholar]

- Pham, T. A. 2016. Monetary Policies and The Macroeconomic Performance of Vietnam. Ph.D. thesis, Queensland University of Technology, Queensland, Australia. [Google Scholar]

- Roodman, D. 2009. A note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics 71: 135–58. [Google Scholar] [CrossRef]

- Sakr, K. 1993. Determinants of Private Investment in Pakistan. Washington: IMF Working Paper. [Google Scholar]

- Syed, S. H., and M. T. Majeed. 2007. Public Policy and Private Investment in Pakistan. MPRA Paper, 57675. Munich: University Library of Munich. [Google Scholar]

- To, N. H. 2013. Settling Non-Performing Loans during the Restructuring Process of Vietnamese Commercial Banks (Xử lý nợ xấu trong quá trình tái cấu trúc các ngân hàng thương mại Việt Nam). Ministerial-level Research Project, DTNH.20/2012. Hanoi: Vietnam Banking Academy. [Google Scholar]

- Tran, N. T., and H. T. Nguyen. 2013. The transmission mechanism of monetary policy in Vietnam: An SVAR model approach (Cơ chế truyền dẫn chính sách tiền tệ ở Việt Nam tiếp cận theo mô hình SVAR). Development and Integration Review 10: 8–16. [Google Scholar]

- Vo, X. V., and P. C. Nguyen. 2017. Monetary policy transmission in Vietnam: Evidence from a VAR approach. Australian Economic Papers 56: 27–38. [Google Scholar] [CrossRef]

- Wai, U. T., and C. H. Wong. 1982. Determinants of private investment in developing countries. Journal of Development Studies 19: 19–36. [Google Scholar] [CrossRef]

- Windmeijer, F. 2005. A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics 126: 25–51. [Google Scholar] [CrossRef]

- World Bank. 2003. Determinants of Private Sector Growth in Ethiopia’s Urban Industry: The Role of Investment Climate. World Bank in Collaboration with the Ethiopian Research Institute (EDRI). Addis Ababa: World Bank Ethiopia. [Google Scholar]

| 1 | On the first tier, Vietnam is split into 58 provinces and 5 municipalities under the central government. Municipalities are centrally-controlled cities and have special status equal to the provinces. Our panel, thus, consisted of a total of 63 (first tier) provinces and cities. |

| Year | GDP Growth (% yoy) | Inflation (% yoy) | M2 (% of GDP) | Credit to Private Sector (% of GDP) | Real Lending Interest Rate (%) | Exchange Rate (VND per USD) |

|---|---|---|---|---|---|---|

| 2009 | 5.32 | 6.5 | 105.61 | 103.32 | 10.07 | 17,065 |

| 2010 | 6.78 | 11.8 | 114.85 | 114.72 | 13.14 | 18,612 |

| 2011 | 5.90 | 18.6 | 99.80 | 101.80 | 16.95 | 20,509 |

| 2012 | 5.03 | 6.81 | 106.47 | 94.83 | 13.47 | 20,828 |

| 2013 | 5.42 | 6.04 | 117.03 | 96.80 | 9.63 | 20,933 |

| 2014 | 5.98 | 1.84 | 127.55 | 100.31 | 8.16 | 21,148 |

| 2015 | 6.68 | 0.63 | 137.65 | 111.93 | 6.96 | 21,697 |

| 2016 | 6.21 | 4.74 | 146.37 | 123.82 | 6.96 | 22,716 |

| 2017 | 6.81 | 3.53 | 165.38 | 130.72 | 7.40 | 23,012 |

| Variables | Notation | Calculation |

|---|---|---|

| Dependent variable | ||

| Private investment | PrvI | Private investment (% of local GDP) |

| Explanatory variables | ||

| Lagged private investment | PrvI(−1) | One-year lagged private investment |

| (1) Monetary policy | MP | |

| Broad money | M2 | M2 (% of local GDP) |

| Credit to the private sector | CR | Credit to the private sector (% of local GDP) |

| Interest rate | IR | Lending interest rate, adjusted for inflation (%) |

| Exchange rate | ER | Exchange rate of VND vis-à-vis USD |

| (2) Investment activities | ||

| Public investment | PubI | Public investment (% of local GDP) |

| Foreign direct investment | FDI | Foreign direct investment, net inflows (% of local GDP) |

| (3) Local economic development | ||

| Economic growth | Ggdp | Annual growth rate of local real GDP (%) |

| Trade openness | Trade | Trade (% of local GDP) |

| Inflation | Inflat | Annual growth rate of local CPI (%) |

| Infrastructure development | Infras | Annual growth rate of local landline subscribers (%) |

| Labor force | Labour | Annual growth rate of local labor force aged 15 and over (%) |

| Human capital | HuC | Annual growth rate of local students in vocational secondary schools (%) |

| Variables | Obs. | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| PrvI | 567 | 23.01 | 9.18 | 1.14 | 71.41 |

| M2 | 567 | 111.47 | 13.42 | 93.66 | 137.65 |

| CR | 567 | 99.14 | 10.03 | 82.87 | 114.72 |

| IR | 567 | 1.85 | 3.95 | −5.62 | 7.32 |

| ER | 567 | 19,244 | 2117 | 16,105 | 21,697 |

| PubI | 567 | 20.29 | 17.52 | 2.73 | 180.68 |

| FDI | 567 | 5.74 | 13.13 | 0.00 | 150.83 |

| Gdpg | 567 | 9.34 | 10.68 | −31.60 | 148.20 |

| Trade | 567 | 111.26 | 350.30 | 0.07 | 4234.26 |

| Inflat | 567 | 11.17 | 13.49 | −9.08 | 142.89 |

| Infras | 567 | 4.13 | 86.10 | −100.00 | 1876.63 |

| Labour | 567 | 1.84 | 2.95 | −16.12 | 17.80 |

| HuC | 567 | 13.51 | 83.04 | −100.00 | 910.94 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. PrvI | 1 | ||||||||||||

| 2. M2 | 0.322 | 1 | |||||||||||

| 3. CR | 0.374 | −0.510 | 1 | ||||||||||

| 4. IR | 0.199 | 0.184 | −0.210 | 1 | |||||||||

| 5. ER | 0.223 | −0.730 | 0.721 | −0.281 | 1 | ||||||||

| 6. PubI | 0.148 | 0.344 | 0.350 | 0.198 | 0.341 | 1 | |||||||

| 7. FDI | −0.280 | −0.480 | 0.465 | −0.289 | 0.512 | 0.342 | 1 | ||||||

| 8. Gdpg | −0.113 | 0.516 | −0.354 | −0.181 | −0.486 | 0.455 | −0.349 | 1 | |||||

| 9. Trade | −0.244 | −0.488 | 0.317 | −0.318 | 0.462 | 0.185 | 0.459 | 0.182 | 1 | ||||

| 10. Inflat | −0.209 | 0.120 | 0.079 | 0.238 | −0.105 | 0.244 | −0.125 | −0.033 | −0.015 | 1 | |||

| 11. Infras | 0.488 | 0.108 | 0.213 | 0.211 | 0.302 | 0.314 | 0.102 | 0.276 | 0.102 | 0.119 | 1 | ||

| 12. Labour | 0.223 | 0.187 | 0.101 | 0.115 | 0.140 | 0.146 | 0.237 | 0.145 | 0.086 | 0.220 | 0.250 | 1 | |

| 13. HuC | 0.300 | 0.210 | 0.157 | 0.220 | 0.187 | 0.085 | 0.311 | 0.167 | 0.120 | 0.168 | 0.172 | 0.247 | 1 |

| Regressors | Equation (2a) | Equation (2b) | Equation (2c) | Equation (2d) |

|---|---|---|---|---|

| PrvI(−1) | 0.930 *** (0.205) | 0.847 *** (0.180) | 0.912 *** (0.300) | 0.853 *** (0.220) |

| M2 | 0.057 *** (0.024) | |||

| CR | 0.914 *** (0.105) | |||

| IR | 0.197 *** (0.001) | |||

| ER | −2.586 (0.160) | |||

| PubI | 0.007 (0.002) | 0.017 (0.001) | 0.005 (0.004) | 0.003 (0.001) |

| FDI | −0.025 * (0.130) | −0.010 (0.010) | −0.029 ** (0.010) | −0.015 (0.003) |

| Gdpg | −0.074 *** (0.224) | −0.088 *** (0.112) | 0.063 ** (0.105) | −0.064 * (0.022) |

| Trade | −0.001 (0.020) | −0.008 (0.014) | −0.006 ** (0.211) | −0.001 (0.036) |

| Inflat | −0.012 (0.001) | −0.023 (0.101) | −0.064 (0.024) | −0.070 (0.108) |

| Infras | 0.001 (0.019) | 0.001 (0.102) | 0.019 (0.001) | 0.001 (0.002) |

| Labour | −0.009 (0.014) | 0.039 (0.102) | −0.005 (0.003) | 0.014 (0.015) |

| HuC | 0.007 (0.120) | −0.001 (0.011) | 0.008 (0.002) | 0.005 (0.103) |

| Cons. | −3.962 (2.110) | −4.879 (3.445) | 2.358 (2.041) | 29.838 (4.667) |

| Obs. | 494 | 488 | 478 | 465 |

| AR(2) test (p-value) | 0.187 | 0.193 | 0.216 | 0.193 |

| Hansen test (p-value) | 0.603 | 0.395 | 0.391 | 0.162 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dang, T.T.; Pham, A.D.; Tran, D.N. Impact of Monetary Policy on Private Investment: Evidence from Vietnam’s Provincial Data. Economies 2020, 8, 70. https://doi.org/10.3390/economies8030070

Dang TT, Pham AD, Tran DN. Impact of Monetary Policy on Private Investment: Evidence from Vietnam’s Provincial Data. Economies. 2020; 8(3):70. https://doi.org/10.3390/economies8030070

Chicago/Turabian StyleDang, Thuy T., Anh D. Pham, and Diem N. Tran. 2020. "Impact of Monetary Policy on Private Investment: Evidence from Vietnam’s Provincial Data" Economies 8, no. 3: 70. https://doi.org/10.3390/economies8030070

APA StyleDang, T. T., Pham, A. D., & Tran, D. N. (2020). Impact of Monetary Policy on Private Investment: Evidence from Vietnam’s Provincial Data. Economies, 8(3), 70. https://doi.org/10.3390/economies8030070