Methodological Aspects of a Comprehensive Analysis of the Fixed Capital of Machine Building Enterprises

Abstract

:1. Introduction

- An active part, including the means of labor directly involved in the production process (machines, equipment, monitoring equipment, etc.);

- A passive part, providing production conditions and fulfilling auxiliary functions (buildings, facilities, communications, etc.).

2. Methodology

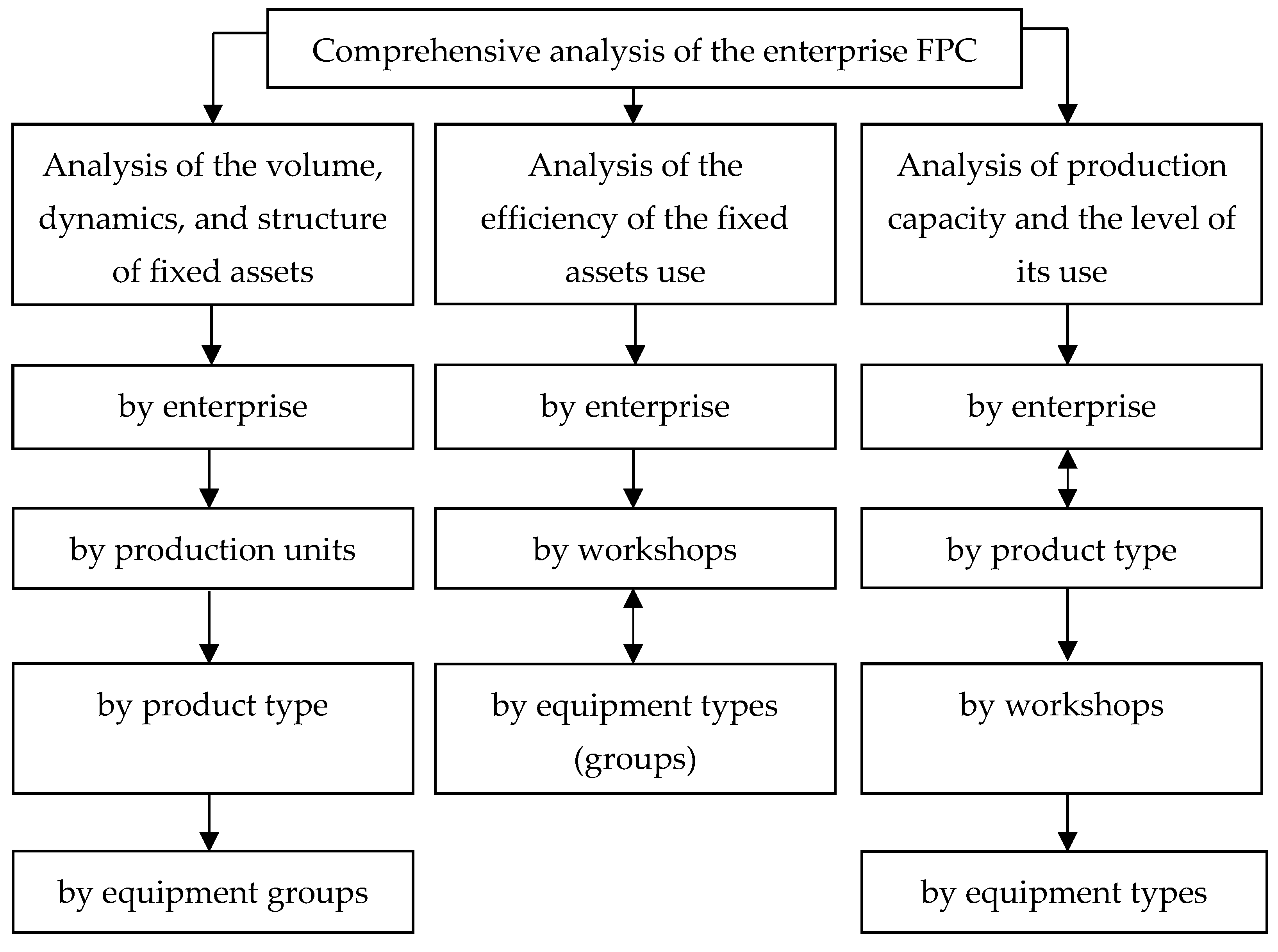

- Analysis of the volume, dynamics, and structure of the fixed assets, which gives an idea of the size of the enterprise, the level of development of its technological base, and the rationality of the distribution of funds between the individual components of the FPC (Zheltenkov et al. 2017);

- Analysis of the efficiency of the FPC use, which shows the impact from the use of the fixed assets of the enterprise, the level of reserves formed for objective and subjective reasons, and the possibility of increasing the rationality of its use (Poelueva and Soldatkina 2019);

- Analysis of production capacity and the level of its use, which gives an idea of the performance of the enterprise as a whole, the possibilities of quantitative growth for certain types of products, as well as participation in the competition by increasing the market share (Potolova 2019).

- ranking the renovation of fixed assets of the enterprise;

- development of measures to improve the structure of fixed assets;

- search for reserves to increase the efficiency of using fixed assets by type of product and areas of activity;

- forecasting the growth of manufactured products due to an increase in the efficiency of their use and (or) changes in the structure of fixed assets;

- increasing the profit and profitability of the enterprise due to the improvement of the equipment park and its renewal, etc.

- Specialization of the enterprise, i.e., the nomenclature of products and work performed;

- Production volumes (size of the enterprise);

- Level of production cooperation;

- Level of mechanization and automation;

- Location of the enterprise (in regard to sources of raw materials, fuel, heat and energy supply, etc.);

- Climatic conditions, etc.

- timely (planned) renewal and modernization of existing equipment;

- efficient use of production space through the rational arranging of the equipment;

- improving the structure of the equipment fleet with the help of new high-performance and accurate equipment and the means of mechanization and automation of the main and auxiliary production processes;

- use of standard projects in expanding production capacities;

- timely liquidation of unused equipment (sale or write-off on the expiry of the service life), etc.

- Determination of the general direction of change in the FPC value of the enterprise (increase, decrease, and relative constancy);

- Quantitative assessment of changes in the FPC (by the growth rate);

- Determination of the level of the FPC renewal (through the introduction and retirement of the fixed assets);

- Assessment of the level of the FPC depreciation and its regularity over time;

- General assessment of the FPC structure (improvement, deterioration, and relative constancy), as well as the change in the share of the most important components of its active part.

- Indicators of the intensive and extensive use of the FPC (in particular, equipment), which differ from each other in that the former assess their use on the basis of productivity, and the latter assess it on the basis of the time used;

- Integral indicators of the efficiency of the use of the FPC, defining the combination of all factors affecting the efficiency of its use.

3. Results and Discussion

- Both enterprises were actively increasing the volume of sales (Qs) in relation to the base year in the considered period of time and made identical revenue of 4200 million of RUB at the end of the period. This means that the activity of both enterprises can be assessed positively (+);

- However, the enterprise E1 had a higher growth rate of sales: 121.5% of sales occurred in the 1st year in relation to the base one and 120% in the 2nd year in relation to the 1st one. Therefore, according to this indicator, priority (+) can be given to the enterprise E1;

- The enterprise E2 has a lower average annual value of the fixed assets (Cfix) at the end of the period. However, taking into account the identical revenue, the positive trend of the change in Cfix (+) should be recognized for the enterprise E2;

- The enterprise E1 consistently increases Cfix (by 9% in general), and the enterprise E2 reduces it by 12%. This situation is rather difficult, since the increase in the fixed assets does not mean anything in terms of the efficiency of their use. However, (+) should be formally given to the enterprise E1;

- The number of personnel (NIPP) at the compared enterprises changes in different ways. At the enterprise E1, it decreases in general by 15% in relation to the base period, and at the enterprise E2, it increases by 15%. If the enterprise increases the production volumes while reducing the number of personnel, it indicates that it seeks to improve the efficiency of the use of labor resources, and in this case the positive trend (+) should be recognized for the enterprise E1;

- The enterprise E1 reached a higher value of the balance sheet profit (PRBS) at the end of the period (540 million of RUB compared to 350 million of RUB), which provides it with another advantage (+);

- The growth rate of the balance sheet profit of the enterprise E2 is also higher (127.1% and 150%, respectively, in the periods), which characterizes higher efficiency of its commercial activities (+).

- The value of the capital productivity (Cprod) of the enterprise E2 is higher both at the beginning and at the end of the period; therefore, its efficiency of the fixed assets use is also higher (+);

- The capital-labor ratio (Crat) is higher at the enterprise E1, which means the higher level of provision of the personnel with means of labor is a positive factor (+);

- The profitability of the FPC (Pfix) for the entire period is also higher at the enterprise E1;

- The depreciation of the fixed assets is lower at the enterprise E2, which gives it a certain advantage (+), since it means that its fixed assets are more operational;

- The share of the active part of the fixed assets is higher for the enterprise E2, which characterizes a more rational structure of the fixed assets (+);

- The rate of use of the enterprise production capacity at the enterprise E1 is higher during the entire considered period of time, which indicates the most efficient work of the enterprise and higher level of organization of production (+).

- level of complexity of the products;

- rate of growth of fixed assets;

- growth rates of the most promising equipment;

- rate of growth of workers;

- level of automation and mechanization of production;

- level of use of digital economy methods in the production process and many others.

- We selected indicators for comparison and determined their priority for a comprehensive assessment on the basis of the maximum number of points (10);

- The maximum value of the indicator for an enterprise was equated to the maximum number of points, if a higher value of the indicator corresponded to higher efficiency. If the minimum value of the indicator corresponded to higher efficiency, it was given the maximum points, for instance, in the context of depreciation of the fixed assets;

- The actual value of points, which corresponds to other values of the indicators, was determined by the direct or inverse proportion;

- All points of the enterprises for the corresponding periods of time were summarized. The maximum amount of points corresponded to a higher level of efficiency of use of the fixed assets in a comprehensive assessment.

4. Conclusions

- Considering its change over time to determine positive and negative development trends.

- Analyzing the structure of the capital in order to determine its rationality.

- Calculating the efficiency of the capital use for the development of measures to increase it in the future.

- Identifying reserves for increasing production capacity for production output and other aspects.

Author Contributions

Funding

Conflicts of Interest

References

- Allen, Ketlin. 2009. Promotion of New Technologies on the Market. Moscow: BINOM. [Google Scholar]

- Arseneva, Natalya V., Ekaterina V. Dzhamai, and Alexander S. Zinchenko. 2015. Research of theoretical aspects of resource management of the enterprise of mechanical engineering. Bulletin of University 12: 5–7. [Google Scholar]

- Burkaltseva, Diana D., Oleg G. Blazhevich, and Anastasiya I. Gladkaya. 2019. The essence of capital, classification and methodology for assessing its use at the enterprise. Science Time 7: 33–38. [Google Scholar]

- Galkina, Elena V. 2019. The influence of the concepts of capital maintenance and profit recognition on the results of economic analysis. Economic Analysis: Theory and Practice 21: 142–45. [Google Scholar]

- Golov, Roman S., Anatoly P. Agarkov, and Aleksey V. Mylnik. 2019. Organization of Production: Industrial Economics and Management. Moscow: The State University of Management. [Google Scholar]

- Ivaniuk, Tatyana N., and Vasily A. Aryshev. 2016. Analysis of the impact of capital structure on the financial status of the company. Bulletin of Turan University 2: 119–23. [Google Scholar]

- Novikov, Sergey V. 2018. The features of innovative processes in the Russian Federation: Analysis of current practices. Espacios 39: 2. [Google Scholar]

- Poelueva, Elena V., and Irina A. Soldatkina. 2019. Ways of improving the capital management of a modern enterprise. Modern Science Research and Development 3: 368–72. [Google Scholar]

- Potolova, Ilona O. 2019. Capital theory and the role of large enterprises. Eurasian Scientific Association 5: 119–21. [Google Scholar]

- Putyatina, Lyudmila M., and Vladimir B. Rodionov. 2006. Enterprise Economics and Finance Textbook. Moscow: Economics and Finance. [Google Scholar]

- Zheltenkov, Alexander V., Andjela B. Mottaeva, and A. R. Zhangurazov. 2017. The organizational change management at the industrial enterprises: Problems and concepts. Economics and Business 2: 968–72. [Google Scholar]

- Zheltenkov, Alexander V., and Olga A. Suzeva. 2016. Management of an organization in the development mechanism. Services in Russia and Abroad 5: 3–12. [Google Scholar] [CrossRef]

| FPC Groups | Percentage Ratio by Year | Active/Passive | General Trend | ||

|---|---|---|---|---|---|

| Base | 1st | 2nd | |||

| 1. Buildings | 10 | 8 | 6 | Passive | relatively constant (+) * |

| 2. Facilities | 5 | 4 | 3 | Passive | relatively constant (+) ** |

| 3. Transfer devices | 5 | 4 | 4 | Passive | relatively constant (+) ** |

| 4. Power equipment | 5 | 3 | 2 | Passive | relatively constant (+) ** |

| 5. Working machinery and equipment | 40 | 46 | 48 | Active | ↑(+) |

| 6. Measuring and regulating equipment | 10 | 6 | 2 | Active | ↑(+) |

| 7. Tools | 4 | 6 | 8 | Active | ↑(+) |

| 8. Means of transport | 7 | 8 | 12 | Passive | depends on the needs |

| 9. Computing machinery | 8 | 10 | 13 | Active/Passive | ↑A (+) |

| 10. Production implements | 6 | 5 | 2 | Active/Passive | ↑A (+) |

| Total FPC | 100 | 100 | 100 | - | - |

| FPC increase | 100 | 110 | 117 | - | ↑(+) |

| Proportion of the active part of the FPC | 60 | 63 | 60 | - | ↑(+) |

| Enterprises | E1 | E2 | ||||||

|---|---|---|---|---|---|---|---|---|

| Years Indicators | Base | 1st | 2nd | Assessment | Base | 1st | 2nd | Assessment |

| Initial Indicators | - | - | - | - | - | - | - | - |

| 1. Qs (millions of RUB) | 2880 | 3500 | 4200 | (+) | 3600 | 3900 | 4200 | (+) |

| 2. Cfix (millions of RUB) | 424 | 427 | 462 | (–) | 379 | 398 | 350 | (+) |

| 3. NIPP (pers.) | 1200 | 1150 | 1020 | (+) | 1300 | 1400 | 1500 | (–) |

| 4. PrBS (millions of RUB) | 288 | 360 | 540 | (+) | 250 | 320 | 350 | (–) |

| Calculation Data | - | - | - | - | - | - | - | - |

| 5. RQs (%) | - | 121.5 | 120 | (+) | - | 108.3 | 107.7 | (–) |

| 6. RCfix (%) | 100.7 | 108.2 | (+) | - | 105.0 | 88.0 | (–) | |

| 7. RPRbs (%) | - | 127.1 | 150 | (+) | - | 128 | 109.4 | (–) |

| Calculation Indicators of the Efficiency of the FPC Use | - | - | - | - | - | - | - | - |

| 8. Cprod (RUB/RUB) | 6.8 | 8.2 | 9.1 | (–) | 9.5 | 9.8 | 12.0 | (+) |

| 9. Crat (thousands of RUB/pers.) | 2400 | 3043 | 4118 | (+) | 2769 | 2786 | 2666 | (–) |

| 10. Pfix (%) | 67.9 | 83.4 | 116.9 | (+) | 66.0 | 80.4 | 105.1 | (–) |

| 11. I (%) | 68 | 72 | 85 | (–) | 50 | 58 | 64 | (+) |

| 12. (%) | 42 | 48 | 50 | (–) | 55 | 62 | 68 | (+) |

| 13. Ruse (dimensionless quantity) | 0.6 | 0.7 | 0.75 | (+) | 0.55 | 0.58 | 0.6 | (–) |

| Enterprises Years Indicators | Maximum Points | E1 | E2 | ||

|---|---|---|---|---|---|

| 1st Year | 2nd Year | 1st Year | 2nd Year | ||

| 1. Cprod (points) | 10.00 | 8.40 | 7.60 | 10.00 | 10.00 |

| 2. Pfix (points) | 8.00 | 8.00 | 8.00 | 7.60 | 7.20 |

| 3. (points) | 7.00 | 5.40 | 5.10 | 7.00 | 7.00 |

| 4. I (points) | 6.00 | 4.80 | 4.50 | 6.00 | 6.00 |

| 5. Crat (points) | 5.00 | 5.00 | 5.00 | 3.20 | 3.20 |

| 6. Ruse (points) | 4.00 | 3.70 | 4.00 | 3.14 | 3.20 |

| Total | - | 35.30 | 34.20 | 36.94 | 36.60 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Arsenieva, N.V.; Putyatina, L.M.; Tarasova, N.V. Methodological Aspects of a Comprehensive Analysis of the Fixed Capital of Machine Building Enterprises. Economies 2020, 8, 73. https://doi.org/10.3390/economies8030073

Arsenieva NV, Putyatina LM, Tarasova NV. Methodological Aspects of a Comprehensive Analysis of the Fixed Capital of Machine Building Enterprises. Economies. 2020; 8(3):73. https://doi.org/10.3390/economies8030073

Chicago/Turabian StyleArsenieva, Natalya V., Lyudmila M. Putyatina, and Natalia V. Tarasova. 2020. "Methodological Aspects of a Comprehensive Analysis of the Fixed Capital of Machine Building Enterprises" Economies 8, no. 3: 73. https://doi.org/10.3390/economies8030073

APA StyleArsenieva, N. V., Putyatina, L. M., & Tarasova, N. V. (2020). Methodological Aspects of a Comprehensive Analysis of the Fixed Capital of Machine Building Enterprises. Economies, 8(3), 73. https://doi.org/10.3390/economies8030073