Resource Rents, Human Development and Economic Growth in Sudan

Abstract

:1. Introduction

2. Literature Review

- (i)

- how resource abundance and intensity is measured,

- (ii)

- type of resources (point vs. diffuse sources), and

- (iii)

- type of econometric setting and modeling adopted.

3. Analytical Framework and Econometric Modelling

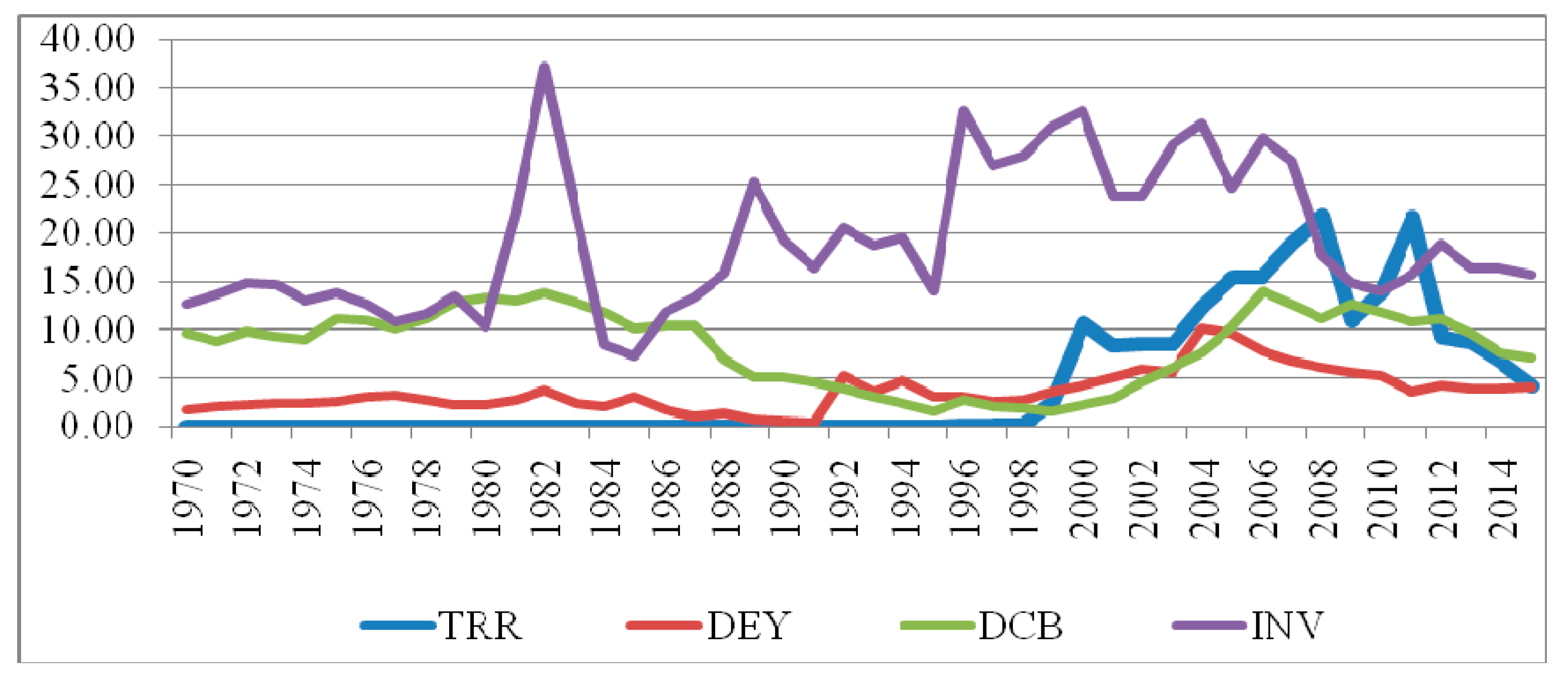

3.1. Analytical Framework

- The direct effect of TRR on GDP growth is negative.

- The direct effect of TRR on education and health is hypothesized to be negative but it could be positive (−)+, while the transmissible effects of education and health to GDP are hypothesized to be positive but they could be negative +(−).

3.2. Econometric Analysis

3.2.1. Model Specification and Estimations

3.2.2. Stationarity and Co-integration Test of the Time Series

3.3. VECM Specification and Estimation

4. Discussions and Conclusions

Funding

Conflicts of Interest

References

- Akpan, Godwin, and Chuku Chuku. 2014. Natural Resources, Human Capital and Economic Development in Nigeria: Tracing the Linkages. Journal of Economics and Sustainable Development 5: 44–50. [Google Scholar]

- Alexeev, Michael, and Robert Conrad. 2009. The elusive curse of oil. The Review of Economics and Statistics 91: 586–98. [Google Scholar] [CrossRef]

- Amin, Karimo, George Adu, George Marbuah, Justice Tei Mensah, and Franklin Amuakwa-Mensah. 2017. Natural Resource Revenues and Public Investment in Resource-Rich Economies in Sub-Saharan Africa. Review of Development Economics 21. [Google Scholar] [CrossRef] [Green Version]

- Apergis, Nicholas, and James E. Payne. 2014. The oil curse, institutional quality, and growth in MENA countries: Evidence from time-varying cointegration panel. Energy Economics 46: 1–9. [Google Scholar] [CrossRef]

- Arabi, Khalafalla Ahmed Mohamed, and Suliman Zakaria Abdalla. 2013. The Impact of Human Capital on Economic Growth: Empirical Evidence from Sudan. Research in World Economy 4. [Google Scholar] [CrossRef] [Green Version]

- Arrow, Kenneth J., Partha Dasgupta, Lawrence Goulder, Keven Muford, and Kristen Oleson. 2012. Sustainability and the measurement of wealth. Environment and Development Economics 17: 317–53. [Google Scholar] [CrossRef] [Green Version]

- Ascher, William. 1999. Why Governments Waste Natural Resources: Policy Failure in Developing Countries. Baltimore: Johns Hopkins University Press. [Google Scholar]

- Auty, Richard M. 1993. Sustaining Development in Mineral Economies: The Resource Curse Thesis. London and New York: Routledge. [Google Scholar]

- Auty, Richard M., ed. 2001a. Resource Abundance and Economic Development. Oxford and New York: Oxford University Press. [Google Scholar]

- Auty, Richard M. 2001b. The Political Economy of Resource-Driven Growth. European Economic Review 45: 839–46. [Google Scholar] [CrossRef]

- Auty, Richard M. 2010. Elites, rent cycling and development: Adjustment to land scarcity in Mauritius, Kenya and Cote d’Ivoire. Development Policy Review 28: 411–33. [Google Scholar] [CrossRef]

- Auty, Richard M., and Kiiski Sampsa. 2001. Natural Resources, Capital Accumulation, Structural Changes and Welfare. In Resource Abundance and Economic Development. Edited by Auty Richard M. Oxford: Oxford University Press. [Google Scholar]

- Bakwena, Malebogo, Philip Bodman, Thanh Le, and Ki Kam Tang. 2009. Avoiding the Resource Curse: The Role of Institutions. No 3209, Macroeconomics Research Group MRG Discussion Paper Series; Discussion Paper No. 32. School of Economics. Australia: University of Queensland. Available online: http://www.uq.edu.au/economics/mrg/3209.pdf (accessed on 16 June 2016).

- Barro, Robert J. 1996. Health, Human Capital and Economic Growth. Paper for the Program on Public Policy and Health, Pan American Health Organization and World Health Organization. Washington, DC: Pan American Health Organization. [Google Scholar]

- Barro, Robert J. 2013. Health and Economic Growth. Annals of Economics and Finance 14: 305–42. [Google Scholar]

- Barro, Robert J., and Jong-Wha Lee. 1994. Sources of Economic Growth. Carnegie-Rochester Conference Series on Public Policy 40: 1–46. [Google Scholar] [CrossRef]

- Beck, Thorsten. 2011. Finance and Oil: Is there a Resource Curse in Financial Development? Discussion Paper 2011-017. Tilburg: Tilburg University, Center for Economic Research. [Google Scholar]

- Beck, Thorten, and Poelhekke Steven. 2017. Follow the Money: Does the Financial Sector Intermediate Natural Resource Windfalls? Center for Economic Studies & Ifo Institute for Economic Research CESIFO Working Paper No. 6374. Available online: https://www.cesifo.org/DocDL/cesifo1_wp6374.pdf (accessed on 18 August 2019).

- Bhattacharyya, Sambit, and Paul Collier. 2013. Public Capital in Resource Rich Economies: Is there a Curse? Oxford Economic Papers 66: 1–24. [Google Scholar] [CrossRef] [Green Version]

- Birdsall, Nancy, Thomas Pinckney, and Richard Sabot. 2001. Natural Resources, Human Capital and Growth. In Resource Abundance and Economic Development. Edited by Auty Richard M. Oxford: Oxford University Press, pp. 57–75. [Google Scholar]

- Bloom, David, David Canning, and Jayppee Sevilla. 2004. The effects of health on economic growth: A production function approach. World Development 32: 1–13. [Google Scholar] [CrossRef]

- Boschini, Anne, Pettersson Jan, and Jesper Roine. 2013. The resource curse and its potential reversal. World Development 43: 19–41. [Google Scholar] [CrossRef] [Green Version]

- Brunnschweiler, Christa N. 2008. Cursing the blessings? Natural resources, institutions and economic growth. World Development 36: 399–419. [Google Scholar] [CrossRef] [Green Version]

- Brunnschweiler, Christa N., and Erwin Bulte. 2008. The resource curse revisited and revised: A tale of paradoxes and red herrings. Journal of Environmental Economics and Management 55: 248–64. [Google Scholar] [CrossRef] [Green Version]

- Bulte, Erwin, Richard Damania, and Robert Deacon. 2005. Resource Intensity, Institutions, and Development. World Development 33: 1029–44. [Google Scholar] [CrossRef]

- Cockx, Lara, and Natahlie Francken. 2014. Extending the concept of the resource curse: Natural resources and public spending on health. Ecological Economics 108: 136–49. [Google Scholar] [CrossRef] [Green Version]

- Cockx, Lara, and Natahlie Francken. 2015. Is there a Natural Resource Curse on Education Spending? Working Paper 2015.02. Institute of Development Policy and Management. Available online: http://www.uantwerp.be/iob (accessed on 17 August 2017).

- Collier, Paul, and Anke Hoeffler. 2004. Greed and Grievance in Civil War. Oxford Economic Papers 56: 563–95. [Google Scholar] [CrossRef]

- Collier, Paul, and Anke Hoeffler. 1998. On Economic Causes of Civil War. Oxford Economic Papers 50: 563–73. [Google Scholar] [CrossRef]

- Constantinos, Alexiou, Persefoni Tsaliki, and Hashim Osman Rasha. 2014. Institutional Quality and Economic Growth: Empirical Evidence from the Sudanese Economy. Economic Annals 59: 119–37. [Google Scholar] [CrossRef]

- Corden, W. M. 1984. Booming Sector and Dutch Disease Economics: Survey and Consolidation. Oxford Economic Papers, New Series; Oxford: Oxford University Press, vol. 36, pp. 359–80. [Google Scholar]

- Corden, W. M., and J.P. Neary. 1982. Booming Sector and De-industrialization in Small Open Economy. The Economic Journal 92: 825–48. [Google Scholar] [CrossRef] [Green Version]

- Daly, Herman. 1994. Operationalizing Sustainable Development by Investing in Natural Capital. In Investing in Natural Capital: The Ecological Economics Approach to Sustainability. Edited by A.-M. Jansson, M. Hammer, C. Folke and R. Costanza. Washington, DC: Island Press, pp. 22–37. [Google Scholar]

- Daniel, Philip, Gupta Sanjeev, Todd Amttina, and Alex Segura-Ubiergo. 2013. Extracting Resource Revenues. Finance & Development 50: 19–22. [Google Scholar]

- Daniele, Vittorio. 2011. Natural Resources and the ‘quality’ of economic development. The Journal of Development Studies 47: 545–73. [Google Scholar] [CrossRef] [Green Version]

- Davis, Graham A., and John E. Tilton. 2005. The resource curse. Natural Resources Forum 29: 233–42. [Google Scholar] [CrossRef]

- Deacon, Robert T., and Rode Ashwin. 2012. Rent Seeking and the Resource Curse. Santa Barbara: University of California, Available online: http://econ.ucsb.edu/~deacon/RentSeekingResourceCurse%20Sept%2026.pdf (accessed on 20 March 2016).

- Dickey, David A., and Wayne A. Fuller. 1981. Likelihood Ratio Statistics for Autoregressive Time Series with Unit Roots. Econometrica 49: 1057–72. [Google Scholar] [CrossRef]

- Dietz, Simon, Erik Neumayer, and Indra De Soysa. 2007. Corruption, the resource curse and genuine saving. Environment and Development Economics 12: 33–53. [Google Scholar] [CrossRef] [Green Version]

- Elbadawi, Ibrahim Ahmed, and Raimundo Soto. 2015. Resource rents, institutions, and violent civil conflicts. Defense and Peace Economics 26: 89–113. [Google Scholar] [CrossRef]

- Elwasila Saeed Elamin, Mohamed. 2017a. Resource gaps, foreign capital flows and economic growth in Sudan: An empirical econometric analysis. African Journal of Economic and Sustainable Development 6: 292–316. [Google Scholar]

- Elwasila Saeed Elamin, Mohamed. 2017b. Health and economic growth in Sudan: Cointegration and Granger causality analysis (1969–2015). Turkish Economic Review 5: 192–205. [Google Scholar]

- Engle, Robert F., and Clive W. J. Granger. 1987. Co-integration and Error Correction: Representation, Estimation, and Testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Frankel, Jeffery A. 2012. The Natural Resource Curse: A Survey. NBER Working Paper No. 15836. Cambridge: National Bureau of Economic Research, Available online: https://www.nber.org/system/files/working_papers/w15836/w15836.pdf (accessed on 18 August 2017).

- Gelb, Alan, and Sina Grasmann. 2010. How Should Oil Exporters Spend Their Rents? CGD Working Paper No. 221. Washington, DC: Center for Global Development. [Google Scholar]

- Granger, Clive W. J. 1986. Developments in the Study of Cointegrated Economic Variables. Oxford Bulletin of Economics and Statistics 48: 213–28. [Google Scholar] [CrossRef]

- Granger, Clive W. J., and Paul Newbold. 1974. Spurious Regressions in Economics. Journal of Econometrics 2: 111–20. [Google Scholar] [CrossRef] [Green Version]

- Gylfason, Thorvaldur, Herbertsson Thor Tryggvi, and Gylfi Zoega. 1999. A mixed blessing: Natural resources and economic growth. Macroeconomic Dynamics 3: 204–225. [Google Scholar] [CrossRef]

- Gylfason, Thorvaldur, and Gylfi Zoega. 2003. Inequality and economic growth: Do natural resources matter. In Inequality and Economic Growth: Theory and Policy. Edited by T. Eicher and S. Turnovsky. Cambridge: MIT Press. [Google Scholar]

- Gylfason, Thorvaldur, and Gylfi Zoega. 2006. Natural resources and economic growth: The role of investment. The World Economy 29: 1091–115. [Google Scholar] [CrossRef]

- Gylfason, Thorvaldur. 2001a. Natural Resources and Economic Growth: What is the Connection? Center for Economic Studies & Ifo Institute for Economic Research CESIFO Working Paper No. 530. Available online: www.cesifo.de (accessed on 17 March 2016).

- Gylfason, Thorvaldur. 2001b. Natural resources, education, and economic development. European Economic Review 45: 847–859. [Google Scholar] [CrossRef]

- Hamilton, Kirk, Giovanni Ruta, and Tajibaeva Liaila. 2006. Capital Accumulation and Resource Depletion: A Hartwick Rule Counterfactual. Environmental and Resource Economics 34: 517–33. [Google Scholar] [CrossRef]

- Hamilton, Kirk, and Michael Clemens. 1999. Genuine Savings Rates in Developing Countries. The World Bank Economic Review 13: 333–56. [Google Scholar] [CrossRef] [Green Version]

- Hamilton, Kirk. 2001. The Sustainability of Extractive Economies. In Resource Abundance and Economic Development. Edited by Auty Richard M. Oxford: Oxford University Press, pp. 36–56. [Google Scholar]

- Hartwick, John. 1977. Intergenerational Equity and Investing Rents from Exhaustible Resources. The American Economic Review 66: 972–74. [Google Scholar]

- Havranek, Thomas, Roman Horvath, and Ayaz Zeynalov. 2016. Natural Resources and Economic Growth: A Meta-Analysis. IES Working Paper 03/2016. Charles University. Available online: http://ies.fsv.cuni.cz (accessed on 20 July 2020).

- Havro, Gøril, and Javier Santiso. 2008. To Benefit from Plenty: Lessons from Chile and Norway; Policy Brief No. 37. Paris: OECD Development Centre, OECD. Available online: https://www.oecd.org/dev/41281577.pdf (accessed on 12 October 2017).

- Ibrahim, Dolapo Raheem, Kazeem Ovanreo Isah, and Abdulfatai A. Adedeji. 2018. Inclusive growth, human capital development and natural resource rent in SSA. Economic Change and Restructuring 51: 29–48. [Google Scholar]

- Isham, Jonathan, Woolcook Michael, Lant Pritchett, and Gwen Busby. 2005. The Varieties of Resource Experience: Natural Resource Export Structures and the Political Economy of Economic Growth. The World Bank Economic Review 19: 141–74. [Google Scholar] [CrossRef]

- Johansen, Søren, and Katarina Juselius. 1990. Maximum Likelihood Estimation and Inference on cointegration with Applications to Demand for Money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Johansen, Søren. 1988. Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control 12: 231–54. [Google Scholar] [CrossRef]

- Karl, Terry Lynn. 1997. The Paradox of Plenty: Oil Booms and Petro-States. Berkeley: University of California Press. [Google Scholar]

- Keikha, Alireza, Ahmadali Keikha, and Mohsen Mehrara. 2012. Institutional Quality, Economic Growth and Fluctuations of Oil Prices in Oil Dependent Countries: A Panel Cointegration Approach. Modern Economy 3: 218–22. [Google Scholar] [CrossRef] [Green Version]

- Kim, Dong-Hyeon, and Shu-Chin Lin. 2016. Human Capital and Natural Resource Dependence. Structural Change and Economic Dynamics 40: 92–102. [Google Scholar] [CrossRef]

- Kurtz, Marcus, and Sara Brooks. 2011. Conditioning the “Resource Curse”: Globalization, Human Capital, and Growth in Oil-Rich Nations. Comparative Political Studies 44: 747–70. [Google Scholar] [CrossRef]

- Lederman, Daniel, and William F. Maloney. 2008. In Search of the Missing Resource Curse. World Bank Policy Research Working Paper 4766. Available online: http://ideas.repec.org/p/wbk/wbrwps/4766.html (accessed on 28 August 2017).

- Leite, Carlos, and Jens Weidmann. 1999. Does Mother Nature Corrupt? Natural Resources, Corruption, and Economic Growth. IMF Working Paper No. 99/85. Washington, DC: International Monetary Fund, Available online: https://www.imf.org/external/pubs/ft/wp/1999/wp9985.pdf (accessed on 26 August 2016).

- Lundgren, Charlotte, Alun Thomas, and Robert York. 2013. Boom, Bust, or Prosperity? Managing Sub-Saharan Africa’s Natural Resource Wealth. Washington, DC: International Monetary Fund, Available online: https://www.imf.org/external/pubs/ft/dp/2013/dp1302.pdf (accessed on 18 August 2017).

- Maty, Konte. 2012. A Curse or a Blessing? Natural Resources in a Multiple Growth Regimes Analysis. Available online: https://halshs.archives-ouvertes.fr/halshs-00793217 (accessed on 20 September 2018).

- Mehlum, Halvor, Moene, Karl Ove, and Torvik Ragnar. 2006. Institutions and the Resource Curse. The Economic Journal 116: 1–20. [Google Scholar] [CrossRef] [Green Version]

- Mehlum, Halvor, Moene, Karl Ove, and Torvik Ragnar. 2011. Mineral Rents and Social Development in Norway. Memorandum, No. 14/2011. Oslo: University of Oslo, Department of Economics. [Google Scholar]

- Mehrara, Mohsen, and Baghbanpour Javad. 2015. Analysis of the Relationship between Total Natural Resources Rent and Economic Growth: The Case of Iran and MENA Countries. International Journal of Applied Economic Studies 3: 1–7. Available online: http://sijournals.com/IJAE/ (accessed on 17 July 2018).

- Mejía, Andrés Acosta. 2012. Using Natural Resource Revenues for Education. Background Paper Prepared for the Education for All Global Monitoring Report 2012. Youth and Skills: Putting Education to Work 2012/ED/EFA/MRT/PI/09. Paris: United Nations Educational, Scientific and Cultural Organization, UNESCO Publishing. [Google Scholar]

- Ministry of Finance and National Economy. 2000–2013. Annual Economic Reports, Issues 2000 to 2013, Khartoum, Sudan; Khartoum: Ministry of Finance and National Economy.

- Mosquera, Roberto. 2019. A Blessing or a Curse? The Long-Term Effect of Resource Booms on Human Capital. (August 2019). Available online: http://dx.doi.org/10.2139/ssrn.3364717 (accessed on 25 December 2019).

- Natural Resource Governance Institute. 2017. Resource Governance Index. Available online: www.resourcegovernanceindex.org (accessed on 11 December 2018).

- Neumayer, Erik. 2004. Does the “Resource Curse” hold for Growth in Genuine Income as Well? World Development 32: 1627–40. [Google Scholar] [CrossRef] [Green Version]

- Nour, Samia. 2010. Assessment of Science and Technology Indicator in Sudan. United Nation University UNU-MERIT Working Paper Series; Maastricht: United Nation University. [Google Scholar]

- Oyinlola, Mutiu, Abdulfatai Adedeji, and Modupe Bolarinwa. 2019. Exploring the nexus among natural resource rents, human capital and industrial development in the SSA region. Economic Change and Restructuring 53: 87–111. [Google Scholar] [CrossRef]

- Papyrakis, Elissaios, and Reyer Gerlagh. 2004. The resource curse hypothesis and its transmission channels. Journal of Comparative Economics 32: 181–93. [Google Scholar] [CrossRef]

- Papyrakis, Elissaios, and Reyer Gerlagh. 2007. Resource Abundance and Economic Growth in the United States. European Economic Review 51: 1011–39. [Google Scholar] [CrossRef]

- Peretto, F. Peitro. 2008. Is the “Curse of Natural Resources” really a Curse? Duke University ERID Working Paper Number 14. The Social Science Research Network Electronic Paper Collection. Available online: http://ssrn.com/abstract=1270606 (accessed on 20 March 2019).

- Phillips, Peter, and Pierre Perron. 1988. Testing for a Unit Root in Time Series Regression. Biometrica 75: 335–446. [Google Scholar] [CrossRef]

- Pineda, Jose, and Francisco Rodriguez. 2010. Curse or Blessing? Natural Resources and Human Development. Human Development Research Paper 2010/04. New York: UNDP. [Google Scholar]

- Romer, Paul. 1990. Human Capital and Growth: Theory and Evidence. NBER Working Paper No. 3173. Cambridge: National Bureau of Economic Research, Available online: http://papers.nber.org/papers/w3173 (accessed on 20 November 2016).

- Ross, L. Michael. 2001. Does oil hinder democracy? World Politics 53: 325–61. [Google Scholar] [CrossRef]

- Sabine, Fuss, Claudine Chen, Michael Jacob, Marxen Annika, Desirazu Roa Narasimha, and Ottmar Edenhofer. 2016. Could resource rents finance universal access to infrastructure? A first exploration of needs and rents. Environment and Development Economics 21: 691–712. [Google Scholar] [CrossRef] [Green Version]

- Sachs, Jeffery, and Andrew Warner. 1995. Natural Resource Abundance and Economic Growth; NBER Working Paper No. 5398. Cambridge: National Bureau of Economic Research. Available online: http://papers.nber.org/papers/w5398 (accessed on 20 November 2016).

- Sachs, Jeffery, and Andrew Warner. 1997a. Sources of slow growth in African economies. Journal of African Economies 6: 335–76. [Google Scholar] [CrossRef] [Green Version]

- Sachs, Jeffery, and Andrew Warner. 1997b. Fundamental sources of long-run growth. The American Economic Review 87: 184–88. [Google Scholar]

- Sachs, Jeffery, and Andrew Warner. 2001. The curse of natural resources. European Economic Review 45: 827–38. [Google Scholar] [CrossRef]

- Sandonato, Silvana, and Henry Willebald. 2018. Natural Capital, Domestic Product and Proximate Causes of Economic Growth: Uruguay in the Long Run, 1870–2014. Sustainability 10: 715. [Google Scholar] [CrossRef] [Green Version]

- Santos, Rafael J. 2018. Blessing and curse. The gold boom and local development in Colombia. World Development 106: 337–55. [Google Scholar] [CrossRef]

- Sarr, Marre, and Katarina Wick. 2010. Resources, conflict and development choices: Public good provision in resource rich economies. Economics of Governance 11: 183–205. [Google Scholar] [CrossRef]

- Selim, Hodaand, and Chahir Zaki. 2014. The Institutional Curse of Natural Resources in the Arab World. Economic Research Forum Working Paper 890. Cairo: Economic Research Forum. [Google Scholar]

- Sen, Amartya. 1988. The Concept of Economic Development. In Handbook of Development Economics. Edited by Hollis Chenery and T. N. Srinivasan. Amsterdam: Elsevier, vol. 1, pp. 9–26. [Google Scholar]

- Shao, Shaui, and Lilli Yang. 2014. Natural resource dependence, human capital accumulation, and economic growth: A combined explanation for the resource curse and the resource blessing. Energy Policy 74: 632–42. [Google Scholar] [CrossRef]

- Stern, David. 2003. Energy and Economic Growth. Resources Policy 30: 107–30. [Google Scholar]

- Stevens, Paul, Glada Lahn, and Kooroshy Jaakko. 2015. The Resource Curse Revisited. Research Paper, Energy, Environment and Resources. The Royal Institute of International Affairs, Chatham House London. Available online: www.chathamhouse.org (accessed on 23 July 2017).

- Stijns, Jean-Philippe. 2005. Natural resource abundance and economic growth revisited. Resources Policy 30: 107–30. [Google Scholar] [CrossRef] [Green Version]

- Stijns, Jean-Philippe. 2006. Natural resource abundance and human capital accumulation. World Development 34: 1060–83. [Google Scholar] [CrossRef] [Green Version]

- van der Ploeg, Frederick, and Steven Poelhekke. 2009. Volatility and the resource curse. Oxford Economic Papers 61: 727–60. [Google Scholar] [CrossRef]

- van der Ploeg, Fredrick. 2011. Natural resources: Curse or blessing? Journal of Economic Literature 49: 366–420. [Google Scholar] [CrossRef] [Green Version]

- Venables, Anthony J. 2016. Using Natural Resources for Development: Why Has It Proven So Difficult? Journal of Economic Perspectives 30: 161–84. [Google Scholar] [CrossRef] [Green Version]

- Warner, Andrew. 2015. Natural Resource Booms in the Modern Era: Is the Curse still Alive? IMF Working Paper WP/15/237. Washington, DC: International Monetary Fund. [Google Scholar]

- Weil, N. David. 2005. Accounting for the Effect of Health on Economic Growth. NBER Working Paper No. 5398. Cambridge: National Bureau of Economic Research, Available online: http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.216.7536 (accessed on 20 November 2015).

- Wick, Katharina, and Butle Erwin. 2006. Contesting resources—Rent seeking, conflict and the natural resource curse. Public Choice 128: 457–76. [Google Scholar] [CrossRef] [Green Version]

- World Bank. 2011. The Changing Wealth of Nations: Measuring Sustainable Development in the New Millennium. Washington, DC: World Bank. Washington, DC: World Bank. [Google Scholar]

- World Bank. 2017a. World Development Indicators. Washington, DC: World Bank. [Google Scholar]

- World Bank. 2017b. World Governance Indicators. Washington, DC: World Bank. [Google Scholar]

- Zhang, Dayong. 2008. Oil shock and economic growth in Japan: A nonlinear approach. Energy Economics 30: 2374–90. [Google Scholar] [CrossRef]

| ADF | PP | ADF | PP | ||

|---|---|---|---|---|---|

| Level | First Difference | ||||

| L(GDP) | −0.452 | −0.480 | ΔL(GDP) | −6.135 * | −6.135 * |

| L(TRR) | −0.463 | −0.585 | ΔL(TRR) | −6.745 * | −6.174 * |

| L(DEY) | −2.494 | −2.476 | ΔL(DEY) | −7.729 * | −8.490 * |

| L(INV) | −2.983 | −2.834 | ΔL(INV) | −6.341 * | −11.805 * |

| L(ASE) | 1.450 | 0.906 | ΔL(ASE) | −7.051 * | −14.063 * |

| L(LE) | 1.600 | 2.431 | ΔL(LE) | −5.268 * | −5.322 * |

| L(DCB) | −1.407 | −1.550 | ΔL(DCB) | −4.971 * | −4.995 * |

| CAD | 0.150 | −1.947 | Δ(CAD) | −8.944 * | −9.494 * |

| Intercept | Intercept and Trend | |||||

|---|---|---|---|---|---|---|

| H0 | Eigen Value | Trace Statistic | Max-Eigen Statistic | Eigen Value | Trace Statistic | Max-Eigen Statistic |

| r = 0 | 0.744 | 226.663 * | 58.573 * | 0.899 | 288.297 * | 98.529 * |

| r ≤ 1 | 0.711 | 168.090 * | 53.412 * | 0.713 | 189.768 * | 53.649 * |

| r ≤ 2 | 0.562 | 114.678 * | 35.470 | 0.591 | 136.119 * | 38.430 |

| r ≤ 3 | 0.503 | 79.207 * | 30.038 | 0.504 | 97.689 * | 30.120 |

| r ≤ 4 | 0.435 | 49.169 * | 24.526 | 0.435 | 67.569 * | 24.526 |

| r ≤ 5 | 0.275 | 24.643 | 13.817 | 0.401 | 43.043 * | 22.023 |

| r ≤ 6 | 0.185 | 10.826 | 8.784 | 0.248 | 21.020 | 12.235 |

| r ≤ 7 | 0.046 | 2.042 | 2.042 | 0.185 | 8.784 | 8.784 |

| Lag | LL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | −378.620 | NA | 0.009 | 17.982 | 18.310 | 18.103 |

| 1 | −97.867 | 443.981 | 3.92 × 10−7 * | 7.901 | 10.850 * | 8.988 * |

| 2 | −27.967 | 84.531 * | 4.08 × 10−7 | 7.626 | 13.197 | 9.681 |

| 3 | 38.105 | 55.316 | 9.74 × 10−7 | 7.530 * | 15.722 | 10.551 |

| VECM Short Run Dynamics | VECM Long Run Equilibrium | |||||

|---|---|---|---|---|---|---|

| Variable | T. Stat. | Prob. | Variable | T. Stat. | ||

| ECTt−1 | −0.58 | −3.761 | 0.000 *** | L(GDP)t−1 | 1.00 | |

| dL(GDP)t−1 | 0.33 | 1.616 | 0.108 | L(TRR)t−1 | −0.03 | −1.250 |

| dL(GDP)t−2 | 0.52 | 2.874 | 0.005 ** | L(DEY)t−1 | 0.35 | 4.452 *** |

| dL(TRR)t−1 | 0.07 | 2.435 | 0.016 ** | L(INV)t−1 | 0.22 | 1.967 |

| dL(TRR)t−2 | 0.08 | 2.360 | 0.019 ** | L(ASE)t−1 | −1.39 | −2.176 * |

| dL(DEY)t−1 | 0.12 | 2.149 | 0.033 ** | L(LE)t−1 | −8.75 | −2.635 ** |

| dL(DEY)t−2 | 0.12 | 1.700 | 0.091 * | L(DCB)t−1 | −0.36 | −8.071 *** |

| dL(INV)t−1 | −0.04 | −0.454 | 0.650 | CADt−1 | −0.00 | −0.246 |

| dL(INV)t−2 | −0.07 | −0.753 | 0.452 | C | 29.90 | |

| dL(ASE)t−1 | −0.51 | −1.113 | 0.267 | |||

| dL(ASE)t−2 | 0.62 | 1.466 | 0.144 | |||

| dL(LE)t−1 | −31.71 | −3.212 | 0.002 *** | |||

| dL(LE)t−2 | −1.15 | −0.130 | 0.897 | |||

| dL(DCB)t−1 | 0.07 | 0.458 | 0.647 | |||

| dL(DCB)t−2 | 0.07 | 0.420 | 0.675 | |||

| d(CAD)t−1 | −0.00 | −1.061 | 0.230 | |||

| d(CAD)t−2 | −0.00 | −1.010 | 0.314 | |||

| C | 0.13 | 2.145 | 0.033 ** | |||

| R2 = 0.68; = 0.45; SER = 0.143; SSR = 0.513; F. stat. = 3.06; LL = 34.20; AIC = −0.753; SC = −0.016; Durbin-Watson (DW) = 2.11 | ||||||

| Diagnosis Tests | ||||||

| Test Statistic | Prob. | |||||

| Autocorrelation | 126.98 | 0.314 | ||||

| Heteroskedasticity | 1242.96 | 0.347 | ||||

| Normality | 55.80 | 0.000 | ||||

| Stability | VECM imposes 7 units, none is out the unit root circle | |||||

| Short Run Dynamics | Long Run | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Variable | dL(GDP) | dL(TRR) | dL(DEY) | dL(INV) | dL(ASE) | dL(LE) | dL(DCB) | d(CAD) | ECTt−1 |

| dL(GDP)t−1 | −2.80 (−2.124) * | −0.50 (−0.730) | −0.66 (−1.557) | 0.03 (0.298) | 0.01 (1.822) * | 0.05 (0.172) | −157.53 (−0.096) | −0.58 ** | |

| dL(TRR)t−1 | 0.07 (2.435) * | −0.08 (−0.829) | −0.03 (−0.491) | −0.01 (−0.795) | 0.001 (2.381) * | −0.01 (−0.159) | 51.18 (0.213) | −0.03 * | |

| dL(DEY)t−1 | 0.12 (2.149) * | −0.10 (−0.270) | −0.18 (−1.462) | 0.05 (1.979) * | −0.0003 (−0.301) | 0.02 (0.267) | 172.87 (0.372) | 0.35 | |

| dL(INV)t−1 | −0.04 (-0.454) | −0.22 (−0.412) | −0.03 (−0.094) | −0.05 (−1.517) | −0.001 (−0.894) | −0.16 (−1.250) | −403.20 (−0.599) | 0.22 * | |

| dL(ASE)t−1 | −0.51 (−1.113) | −2.04 (−0.687) | −1.28 (−0.829) | −0.48 (−0.500) | 0.02 (2.138) * | 1.24 (1.759) | −2658.86 (−0.722) | −1.39 * | |

| dL(LE)t−1 | −31.71 (−3.212) ** | 142.01 (2.222) * | 21.10 (0.632) | −2.14 (−0.104) | 2.56 (0.624) | 11.36 (0.750) | −10149.78 (−0.128) | −8.75 ** | |

| dL(DCB)t−1 | 0.07 (0.458) | 1.00 (1.057) | 0.17 (0.336) | −0.62 (−2.042) * | 0.03 (0.505) | 0.004 (1.682) | −1158.73 (−0.986) | −0.36 ** | |

| d (CAD)t−1 | −0.00 (−1.061) | 0.00 (0.913) | 0.00 (0.424) | 0.00 (0.222) | 0.00 (0.014) | 0.00 (0.318) | 0.00 (1.067) | 0.00 | |

| Causality | Signif. | Causality | Signif. | Remark | ||

|---|---|---|---|---|---|---|

| TRR→GDP | 0.07 | (2.435) * | TRR→GDP | 0.07 | (2.435) * | Positive from TRR to GDP, no RC |

| TRR→DEY | −0.08 | (−0.829) | DEY→GDP | 0.12 | (2.149) * | Negative from TRR to DEY but Positive from DEY to GDP, no RC |

| TRR→INV | −0.03 | (−0.491) | INV→GDP | −0.04 | (−0.454) | Negative from TRR to INV and Negative from INV to GDP, RC |

| TRR→ASE | −0.01 | (−0.795) | ASE→GDP | −0.51 | (−1.113) | Negative from TRR to ASE and Negative from ASE to GDP, RC |

| TRR→LE | 0.001 | (2.381) * | LE→GDP | −31.71 | (−3.212) ** | Positive from TRR to LE, but Negative from LE to GDP, RC |

| TRR→DCB | −0.01 | (−0.159) | DCB→GDP | 0.07 | (0.458) | Negative from TRR to DCB but Positive from DCB to GDP, no RC |

| TRR→CAD | 51.18 | (0.213) | CAD→GDP | −0.00 | (−1.061) | Positive from TRR to CAB but Negative from CAB to GDP, RC |

| Dependent Variable | Chi-sq | DF | Prob. | Decision |

|---|---|---|---|---|

| L(GDP)|L(TRR), L(DEY), L(INV), L(ASE), L(LE), L(DCB), CAD | 41.73 | 14 | 0.000 ** | Reject |

| L(TRR)|L(GDP), L(DEY), L(INV), L(ASE), L(LE), L(DCB), CAD | 15.83 | 14 | 0.324 | Accept |

| L(DEY)|L(GDP), TRR), L(INV), L(ASE), L(LE), L(DCB), CAD | 9.09 | 14 | 0.825 | Accept |

| L(INV)|LGDP), L(TRR), L(DEY), L(ASE), L(LE), L(DCB), CAD | 18.31 | 14 | 0.193 | Accept |

| L(ASE)|L(GDP), L(TRR), L(DEY), L(INV), L(LE), L(DCB), CAD | 19.39 | 14 | 0.150 | Accept |

| L(LE)|L(GDP), (TRR), L(DEY), L(INV), L(ASE), L(DCB), CAD | 25.57 | 14 | 0.029 * | Reject |

| L(DCB)|L(GDP), L(TRR), L(DEY), L(INV), L(ASE), L(LE), CAD | 11.45 | 14 | 0.650 | Accept |

| (CAD)|L(GDP), L(TRR), L(DEY), L(INV), L(ASE), L(DCB) L(LE) | 4.46 | 14 | 0.992 | Accept |

| F-Stat. | Prob. | Decision | Direction of Causality | |

|---|---|---|---|---|

| H0: Dependent GDP | ||||

| H0: L(TRR) does not cause L(GDP) | 2.868 | 0.069 * | Reject | TRR to GDP |

| H0: L(GDP) does not cause L(TRR) | 0.292 | 0.748 | Accept | None |

| H0: L(DEY) does not cause L(GDP) | 10.52 | 0.000 *** | Reject | DEY to GDP |

| H0: L(GDP) does not cause L(DEY) | 0.254 | 0.777 | Accept | None |

| H0: L(INV) does not cause L(GDP) | 0.060 | 0.942 | Accept | None |

| H0: L(GDP) does not cause L(INV) | 0.160 | 0.853 | Accept | None |

| H0: L(ASE) does not cause L(GDP) | 4.662 | 0.015 ** | Reject | ASE to GDP |

| H0: L(GDP) does not cause L(ASE) | 0.269 | 0.766 | Accept | None |

| H0: L(LE) does not cause L(GDP) | 3.246 | 0.040 ** | Reject | LE to GDP |

| H0: L(GDP) does not cause L(LE) | 1.533 | 0.229 | Accept | None |

| H0: L(DCB) does not cause L(GDP) | 3.572 | 0.038 ** | Reject | DCB to GDP |

| H0: L(GDP) does not cause L(DCB) | 1.261 | 0.295 | Accept | None |

| H0: CAD does not cause L(GDP) | 1.391 | 0.261 | Accept | None |

| H0: L(GDP) does not cause CAD | 5.415 | 0.008 *** | Reject | None |

| H0: Independents | ||||

| H0: L(TRR) does not cause L(ASE) | 4.308 | 0.020 ** | Reject | TRR to ASE |

| H0: L(TRR) does not cause L(LE) | 2.502 | 0.095 * | Reject | TRR to LE |

| H0: L(TRR) does not cause CAD | 4.882 | 0.013 *** | Reject | TRR to CAD |

| H0: L(ASE) does not cause L(INV) | 3.142 | 0.054 ** | Reject | ASE to INV |

| H0: L(DCB) does not cause L(INV) | 3.603 | 0.037 ** | Reject | DCB to INV |

| H0: L(LE) does not cause L(ASE) | 3.998 | 0.026 ** | Reject | LE to ASE |

| H0: L(ASE) does not cause L(LE) | 2.829 | 0.071 * | Reject | ASE to LE |

| H0: L(ASE) does not cause CAD | 10.445 | 0.000 *** | Reject | ASE to CAD |

| H0: L(LE) does not cause CAD | 6.356 | 0.004 *** | Reject | LE to CAD |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mohamed, E.S.E. Resource Rents, Human Development and Economic Growth in Sudan. Economies 2020, 8, 99. https://doi.org/10.3390/economies8040099

Mohamed ESE. Resource Rents, Human Development and Economic Growth in Sudan. Economies. 2020; 8(4):99. https://doi.org/10.3390/economies8040099

Chicago/Turabian StyleMohamed, Elwasila Saeed Elamin. 2020. "Resource Rents, Human Development and Economic Growth in Sudan" Economies 8, no. 4: 99. https://doi.org/10.3390/economies8040099

APA StyleMohamed, E. S. E. (2020). Resource Rents, Human Development and Economic Growth in Sudan. Economies, 8(4), 99. https://doi.org/10.3390/economies8040099