Mobile Money Use: The Impact of Macroeconomic Policy and Regulation

Abstract

:1. Introduction

2. Macroeconomic Policy, Regulation and Mobile Money Usage: An Overview

3. An Overview of Mobile Money in Uganda

4. Methodology

4.1. Theoretical Foundations

4.2. Model Specification

4.3. Data and Measurement of Key Variables

5. Results and Discussion

5.1. Unit Root and Cointegration Tests Results

5.2. Discussion of Results

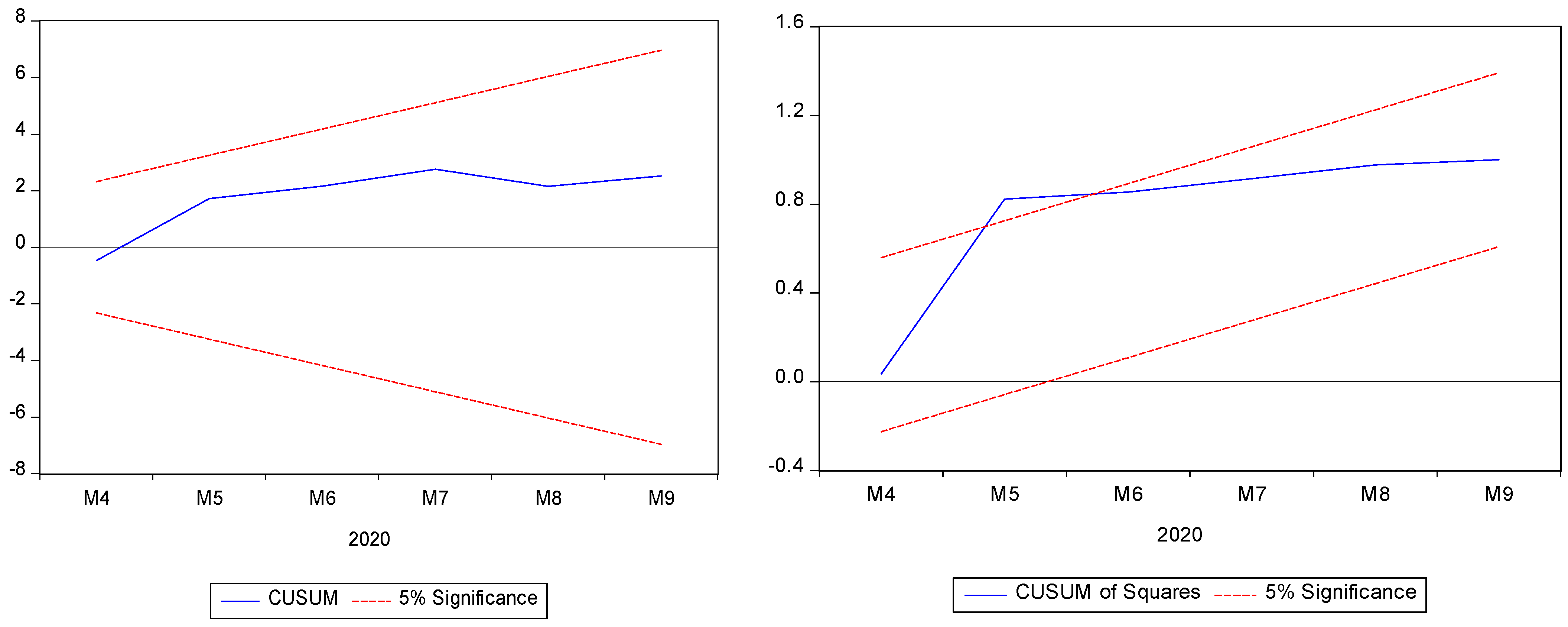

5.3. Model Specification and Robustness Test Results

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmad, Ahmad Hassan, Christopher Green, and Fei Jiang. 2020. Mobile money, financial inclusion and development: A review with reference to African experience. Journal of Economic Surveys 34: 753–92. [Google Scholar] [CrossRef]

- Andersson-Manjang, Simon, Kennedy Kipkemboi, and Tapiwa Jakachira. 2020. State of the Mobile Money Industry in Africa. Available online: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2020/10/GSMA_The-state-of-the-mobile-money-industry-in-Africa.pdf (accessed on 18 January 2021).

- Ansong, Abraham, Edward Marfo-Yiadom, and Emmanuel Ekow-Asmah. 2011. The Effects of Financial Innovation on Financial Savings: Evidence from an Economy in Transition. Journal of African Business 12: 93–113. [Google Scholar] [CrossRef]

- Aron, Janine. 2018. Mobile Money and the Economy: A Review of the Evidence. The World Bank Research Observer 33: 135–88. [Google Scholar] [CrossRef] [Green Version]

- Bahia, Kalvin, and Brian Muthiora. 2019. The Mobile Money Regulatory Index. Available online: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/03/The-Mobile-Money-Regulatory-Index-1.pdf (accessed on 26 January 2021).

- Bahmani-Oskooee, Mohsen, Marzieh Bolhassani, and Scott William Hegerty. 2010. The effects of currency fluctuations and trade integration on industry trade between Canada and Mexico. Research in Economics 64: 212–23. [Google Scholar] [CrossRef]

- Bank of Uganda. 2013. Mobile Money Guidelines, 2013. Available online: https://archive.bou.or.ug/archive/opencms/bou/bou-downloads/supervision/Circulars_and_Guidance_Notes/2013/All/Mobile-Money-Guidelines.PDF (accessed on 24 January 2021).

- Bank of Uganda. 2021. BOU Reforms Monetary Policy Framework. Bank of Uganda | Monetary Policy Framework. Available online: https://www.bou.or.ug/bou/bouwebsite/MonetaryPolicy/mpframework.html (accessed on 25 January 2021).

- Bank of Uganda. n.d. Bank of Uganda | Data and Statistics. Retrieved 18 January 2021. Available online: https://www.bou.or.ug/bou/bouwebsite/PaymentSystems/dataandstat.html (accessed on 18 January 2021).

- Chadha, Sakshi, Brian Muthiora, and Kennedy Kipkemboi. 2020. GSMA | Tracking Mobile Money Regulatory Responses to COVID-19—Part 2 | Mobile for Development. Mobile for Development. Available online: https://www.gsma.com/mobilefordevelopment/region/sub-saharan-africa-region/tracking-mobile-money-regulatory-responses-to-covid-19-part-2/ (accessed on 31 January 2021).

- Clifford, Killian. 2020. The Causes and Consequences of Mobile Money Taxation An Examination of Mobile Money Transaction Taxes in Sub-Saharan Africa. Available online: www.gsma.com/mobilemoney (accessed on 21 January 2021).

- Davidson, Neil, and Yasmina M. McCarty. 2011. Driving Customer Usage of Mobile Money for the Unbanked. London: GSM Association (GSMA). [Google Scholar]

- Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2018. The Global Findex Database: Measuring Financial Inclusion and the Fintech Revolution Overview Booklet. Washington: World Bank Group. [Google Scholar]

- Di Castri, Simone. 2013. Mobile Money: Enabling Regulatory Solutions. London: GSMA, (Issue SSRN 2302726). [Google Scholar]

- Dimand, Robert W. 2019. Revitalizing the Quantity Theory of Money: From the Fisher Relation to the Fisher Equation BT—Irving Fisher. Edited by Robert W. Dimand. Berlin: Springer International Publishing, pp. 45–73. [Google Scholar] [CrossRef]

- Dipasha, Sharma. 2016. Nexus between financial inclusion and economic growth: Evidence from the emerging Indian economy. Journal of Financial Economic Policy 8: 13–36. [Google Scholar] [CrossRef]

- Donner, Jonathan. 2008. Research approaches to mobile use in the developing world: A review of the literature. The Information Society 24: 140–59. [Google Scholar] [CrossRef]

- GSMA. 2019. Mobile Money Metrics-Regulatory Index. Available online: https://www.gsma.com/mobilemoneymetrics/#regulatory-index?y=2019 (accessed on 20 January 2021).

- GSMA. 2021. GSMA | Policy and Regulation | Mobile for Development. Available online: https://www.gsma.com/mobilefordevelopment/mobile-money/policy-and-regulation/ (accessed on 20 January 2021).

- Harris, Richard, and Robert Sollis. 2003. Applied Time Series Modelling and Forecasting. Chichester: Wiley. [Google Scholar]

- Hye, Qazi Muhammad Adnan. 2009. Financial innovation and demand for money in Pakistan. The Asian Economic Review 51: 219–28. [Google Scholar]

- Ibrahim, Mansor H. 2015. Oil and food prices in Malaysia: A nonlinear ARDL analysis. Agricultural and Food Economics 3: 2. [Google Scholar] [CrossRef] [Green Version]

- Kim, Dai-Won, Jung-Suk Yu, and Kabir M. Hassan. 2018. Financial inclusion and economic growth in OIC countries. Research in International Business and Finance 43: 1–14. [Google Scholar] [CrossRef]

- Kipkemboi, Kennedy, and Kalvin Bahia. 2019. The Impact of Mobile Money on Monetary and Financial Stability in Sub-Saharan Africa. Available online: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/03/The-impact-of-mobile-money-on-monetary-and-financial-stability.pdf (accessed on 21 January 2021).

- Kremers, J. J. M., N. R. Ericsson, and J. J. Dolado. 1992. The power of cointegration tests. Oxford Bulletin of Economics and Statistics 54: 325–48. [Google Scholar] [CrossRef]

- Lahaye, E., E. Dashi, E. Dolke, and M. Soursourian. 2015. Spotlight on International Funders’ Commitments to Financial Inclusion. Washington: The World Bank. [Google Scholar]

- Loayza, N. V., and S. Pennings. 2020. Macroeconomic Policy in the Time of COVID-19: A Primer for Developing Countries. Washington: World Bank, Available online: https://ourworldindata.org/coronavirus-source-data (accessed on 21 January 2021).

- Lwanga, M. M., and A. Adong. 2016. A Pathway to Financial Inclusion: Mobile Money and Individual Savings in Uganda. Kampala: Research Series-Economic Policy Research Centre, vol. 127. [Google Scholar]

- Mahmoud, Z. 2019. Determinants of Mobile Money Adoption. Paper Presented at 2nd Europe–Middle East–North African Regional ITS Conference, Aswan, Egypt, February 18–21. Leveraging Technologies For Growth, 201742. [Google Scholar]

- Maina, Juliet. 2018. Mobile Money Policy and Regulatory Handbook. London: GSMA. [Google Scholar]

- Masocha, Reginald, and Obey Dzomonda. 2018. Adoption of Mobile Money Services and the performance of small and medium enterprises in Zimbabwe. Academy of Accounting and Financial Studies Journal 22: 11. Available online: https://www.researchgate.net/publication/325877641 (accessed on 18 January 2021).

- Mawejje, Joseph, and Paul Corti E. Lakuma. 2017. Macroeconomic Effects of Mobile Money in Uganda. Kampala: Research Series-Economic Policy Research Centre, vol. 260017. [Google Scholar]

- Mawejje, Joseph, and Paul Lakuma. 2019. Macroeconomic effects of Mobile money: Evidence from Uganda. Financial Innovation 5: 2. [Google Scholar] [CrossRef]

- Morley, Bruce. 2006. Causality between economic growth and immigration: An ARDL bounds testing approach. Economics Letters 90: 72–6. [Google Scholar] [CrossRef]

- Mothobi, Onkokame, and Lukasz Grzybowski. 2017. Infrastructure deficiencies and adoption of mobile money in Sub-Saharan Africa. In Information Economics and Policy. Amsterdam: Elsevier B.V., vol. 40, pp. 71–9. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar. 2005. The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics 37: 1979–90. [Google Scholar] [CrossRef]

- Pasti, Francesco. 2019. State of the Industry Report on Mobile Money. London: GSMA, Available online: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2019/02/2018-State-of-the-Industry-Report-on-Mobile-Money.pdf (accessed on 26 January 2021).

- Pesaran, Mohammad Hashem, and Yongcheol Shin. 1998. An autoregressive distributed-lag modelling approach to cointegration analysis. Econometric Society Monographs 31: 371–413. [Google Scholar]

- Pesaran, Mohammad Hashem, and Yongcheol Shin. 1999. An Autoregressive Distributed-Lag Modelling Approach to Cointegration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium. Edited by Strøm S. Cambridge: Cambridge University Press, pp. 371–413. [Google Scholar] [CrossRef]

- Pesaran, Mohammad Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Porteous, David. 2006. The Enabling Environment for Mobile Banking in Africa Report Commissioned by Department for International Development (DFID). Available online: https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2012/06/theenablingenvironmentformobilebankinginafrica.pdf (accessed on 20 January 2021).

- Rulangaranga, Donatus, Eva Mpaata, and Joshua Muwema. 2016. Mobile money regulations and protection of users of Mobile Money in Uganda. International Journal of Management and Economics Invention. [Google Scholar] [CrossRef]

- Turner, Paul. 2010. Power properties of the CUSUM and CUSUMSQ tests for parameter instability. Applied Economics Letters 17: 1049–53. [Google Scholar] [CrossRef]

- Uganda Bureau of Statistics. 2020. Uganda Bureau of Statistics 2020 Statistical Abstract. Available online: https://www.ubos.org/wp-content/uploads/publications/11_2020STATISTICAL__ABSTRACT_2020.pdf (accessed on 25 January 2021).

- Whitworth, Alan, and Tim Williamson. 2010. Overview of Ugandan economic reform since 1986. In Uganda’s Economic Reforms Insider Accounts. Edited by Kuteesa Florence, Emmanuel Tumusiime-Mutebile, Alan Whitworth and Tim Williamson. Oxford: Oxford University Press Inc. [Google Scholar]

- Wiegratz, Jörg, Giuliano Martiniello, and Elisa Greco. 2018. Introduction: Interpreting change in neoliberal Uganda. In Uganda: The dynamics of Neoliberal Transformation. Edited by Jorg Wiegratz, G. Martiniello and E. Greco. London: Zed Books, p. 39. Available online: https://www.researchgate.net/profile/Elisa_Greco/publication/328968636_Conclusions_neoliberalism_Institutionalized/links/5cab1774299bf118c4ba9182/Conclusions-neoliberalism-Institutionalized.pdf (accessed on 20 January 2021).

| Variable | Description | Mean | Median | Maximum | Minimum | Std. Dev. | Observations |

|---|---|---|---|---|---|---|---|

| MMA | Natural Log of Average Mobile Money Transaction value | 10.63 | 10.71 | 11.08 | 10.01 | 0.27 | 139 |

| MMB | Balance on customers Mobile Money accounts (Billions) | 234.09 | 228.58 | 814.11 | 0.60 | 208.74 | 139 |

| MMR | Number of Registered Mobile Money Users (Millions) | 14.85 | 18.70 | 30.37 | 0.01 | 9.66 | 139 |

| CIEA | Natural Log of Composite Indicator of Economic Activity | 4.66 | 4.68 | 4.97 | 4.23 | 0.21 | 139 |

| INF | Natural Log of Inflation (Natural Log of Difference of the domestic consumer price index) | 6.20 | 4.70 | 21.80 | 0.26 | 4.88 | 139 |

| TB | 91-dayTreasury bill interest rate (percent) | 11.16 | 10.00 | 23.10 | 3.80 | 4.26 | 139 |

| LER | Natural Log of Nominal UGX/USD exchange rate (Average) | 7.98 | 7.94 | 8.25 | 7.54 | 0.21 | 139 |

| LFIN | Natural log of Financial innovation (M2/M1) | 0.54 | 0.54 | 0.59 | 0.47 | 0.02 | 139 |

| Unit Root Tests | Augmented Dicky–Fuller (ADF) | Phillips Peron (PP) | Kwiatkowski-Phillips-Schmidt-Shin (KPSS) | Inference | |||

|---|---|---|---|---|---|---|---|

| Levels | 1st Difference | Levels | 1st Difference | Levels | 1st Difference | ||

| LMMA | −1.962228 | −11.86386 | −2.014659 | −12.06845 | 0.458776 | 0.081336 | I(1)/I(0) |

| MMB | 0.473457 | −12.89705 | 0.555081 | −12.83595 | 1.372059 | 0.199461 | I(1) |

| MMR | −0.118995 | −11.79004 | −0.109655 | −11.79145 | 1.443672 | 0.156811 | I(1) |

| LCIEA | −1.300322 | −10.38295 | −1.272236 | −10.37384 | 1.454289 | 0.107708 | I(1) |

| TB | −2.463695 | −7.633031 | −2.106246 | −7.553277 | 0.160929 | I(1)/I(0) | |

| LER | −1.001393 | −7.668598 | −1.273988 | −7.418793 | 1.394466 | 0.076915 | I(1) |

| DLCPI | −3.931403 | −2.693618 | −8.320295 | 0.519801 | 0.041123 | I(1)/I(0) | |

| LFIN | −5.455232 | −5.328579 | 0.294096 | I(0) | |||

| Dependent Variable a | F-Statistic for Case III Intercept No Trend b | Conclusion |

|---|---|---|

| MODEL 1 (ARDL 1,0,0) | ||

| MMA | 27.57277 | Cointegration |

| MMB | 4.287839 | No cointegration |

| MMR | 0.840364 | No cointegration |

| MODEL 2 (ARDL 6,0,0) | ||

| MMA | 35.60444 | Cointegration |

| MMB | 4.287839 | No cointegration |

| MMR | 1.275704 | No cointegration |

| MODEL 3 (ARDL 1,0,0) | ||

| MMA | 26.86052 | Cointegration |

| MMB | 4.324306 | No cointegration |

| MMR | 0.785251 | No cointegration |

| MODEL 1 | MODEL 2 | MODEL 3 | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Regressors | ARDL (1,0,0) | LONG RUN | SHORT RUN | ARDL (6,0,0) | LONG RUN | SHORT RUN | ARDL (1,0,0) | LONG RUN | SHORT RUN |

| Intercept | 5.452 ** | 3.776 *** | 5.479 *** | 3.931 *** | 5.406 ** | 3.762 *** | |||

| (2.55) | (5.18) | (4.04) | (6.42) | (2.55) | (5.12) | ||||

| Mobile Money Usage (-1) | 0.492 *** | 0.435 ** | 0.494 *** | ||||||

| (4.22) | (2.40) | (4.38) | |||||||

| Δ Mobile Money Usage (-1) | −0.054 | ||||||||

| (−0.89) | |||||||||

| Mobile Money Usage (-2) | −0.136 | ||||||||

| (−1.44) | |||||||||

| Δ Mobile Money Usage (-2) | −0.137 ** | ||||||||

| (−2.28) | |||||||||

| Mobile Money Usage (-3) | 0.031 | ||||||||

| (0.57) | |||||||||

| Δ Mobile Money Usage (-3) | −0.127 * | ||||||||

| (−1.91) | |||||||||

| Mobile Money Usage (-4) | −0.021 | ||||||||

| (−0.35) | |||||||||

| Δ Mobile Money Usage (-4) | −0.104 * | ||||||||

| (−1.75) | |||||||||

| Mobile Money Usage (-5) | 0.123 | ||||||||

| (1.42) | |||||||||

| Δ Mobile Money Usage (-5) | −0.001 | ||||||||

| (−0.01) | |||||||||

| Mobile Money Usage (-6) | 0.008 | ||||||||

| (0.08) | |||||||||

| Balance on customers Mobile Money accounts | −0.0003 ** | −0.0005 ** | −0.0002 ** | −0.0003 ** | −0.0003 ** | −0.0005 ** | |||

| (−2.18) | (2.14) | (−2.54) | (−2.71) | (−2.16) | (2.10) | ||||

| Δ (Balance on customers Mobile Money accounts) | −0.0003 * | −0.0002 | −0.0003 * | ||||||

| (−1.87) | (−1.44) | (−1.87) | |||||||

| Number of Registered Mobile Money Users | 0.009 * | 0.017 ** | 0.005 | 0.008 | 0.009 * | 0.018 ** | |||

| (1.82) | (2.35) | (1.23) | (1.26) | (1.83) | (2.37) | ||||

| Δ (Number of Registered Mobile Money Users) | 0.001 | 0.001 | 0.002 | ||||||

| (0.11) | (0.05) | (0.12) | |||||||

| Economic activity | 0.484 * | 0.953 * | 1.038 *** | 1.852 *** | 0.477 * | 0.944 * | |||

| (1.87) | (1.82) | (3.01) | (3.73) | (1.87) | (1.80) | ||||

| Δ (Economic activity) | 0.327 | 0.545 | 0.319 | ||||||

| (0.63) | (1.13) | (0.61) | |||||||

| Inflation | 0.017 *** | 0.033 *** | 0.017 *** | 0.030 *** | 0.017 *** | 0.033 *** | |||

| (3.64) | (6.56) | (4.11) | (6.64) | (3.67) | (6.55) | ||||

| Δ (Inflation) | 0.019 *** | 0.023 *** | 0.019 *** | ||||||

| (3.23) | (4.40) | (3.21) | |||||||

| Interest rate | −0.008 ** | −0.015 ** | −0.005 * | −0.008 ** | −0.008 ** | −0.015 ** | |||

| (−2.28) | (−2.73) | (−1.86) | (−2.04) | (−2.28) | (−2.74) | ||||

| Δ (Interest rate) | −0.013 ** | −0.009 * | −0.013 ** | ||||||

| (−2.09) | (−1.68) | (−2.08) | |||||||

| Exchange rate | −0.169 | −0.333 | −0.458 *** | −0.817 *** | −0.166 | −0.329 | |||

| (−1.10) | (−1.21) | (−3.22) | (−4.20) | (−1.09) | (−1.18) | ||||

| Δ (Exchange rate) | −0.439 | −0.871 *** | −0.439 | ||||||

| (−1.56) | (−3.28) | (−1.55) | |||||||

| Financial innovation | −1.803 ** | −3.547 *** | −1.303 *** | −2.325 *** | −1.747 *** | −3.454 *** | |||

| (−2.84) | (−3.32) | (−3.05) | (−3.59) | (−2.74) | (−2.99) | ||||

| Δ (Financial innovation) | −1.191 *** | −0.963 ** | −1.176 ** | ||||||

| (−2.94) | (−2.54) | (−2.59) | |||||||

| COVID-19 pandemic crisis | 0.075 | 0.148 | 0.070 * | 0.125 ** | 0.080 | 0.159 | |||

| (1.41) | (1.29) | (1.91) | (2.00) | (1.34) | (1.26) | ||||

| Δ (COVID-19 pandemic crisis) | 0.008 | 0.007 | 0.008 | ||||||

| (0.11) | (0.11) | (0.10) | |||||||

| Mobile Money Tax | −0.417 *** | −0.821 *** | −0.494 *** | −0.881 *** | −0.126 *** | −0.250 *** | |||

| (−4.70) | (−14.28) | (−5.15) | (−18.63) | (−0.17) | (−1.26) | ||||

| Δ (Mobile Money Tax) | −0.694 *** | −0.718 *** | −0.600 *** | ||||||

| (−9.06) | (−10.49) | (−1.13) | |||||||

| Interaction term | −0.540 | −1.067 | |||||||

| (−0.37) | (−0.38) | ||||||||

| Δ (Interaction term) | −0.171 | ||||||||

| (−0.18) | |||||||||

| ECT(-1) | −0.351 *** | −0.402 *** | −0.351 *** | ||||||

| (−5.17) | (−6.42) | (−5.12) | |||||||

| Model Diagnostics | |||||||||

| Adjusted R-squared | 0.91 | 0.93 | 0.91 | ||||||

| Log-likelihood value | 162.42 | 174.89 | 162.5 | ||||||

| S.E. of regression | 0.08 | 0.08 | 0.08 | ||||||

| Schwarz Bayesian Criterion | −1.96 | −2.04 | −1.93 | ||||||

| Hannan-Quinn criterion | −2.10 | −2.25 | −2.08 | ||||||

| DW-statistic | 1.49 | 1.74 | 1.50 | ||||||

| Bounds Tests F-statistic | 27.57 | 35.60 | 26.86 | ||||||

| Lower Bound | 3.79 | 3.79 | 3.79 | ||||||

| Upper Bound | 4.85 | 4.85 | 4.85 | ||||||

| Optimal lag (SC and HQ) | 1 | 1 | 1 | ||||||

| Residual Diagnostics | MODEL 1 | MODEL 2 | MODEL 3 |

|---|---|---|---|

| Serial Correlation 1 | 1.80 [0.105] | 1.94 [0.149] | 1.76 [0.113] |

| F-statistic | 148.02 [0.00] | 118.36 [0.000] | 133.71 [0.000] |

| Heteroscedasticity 2 | 0.089 [0.58] | 0.592 [0.736] | 2.816 [0.019] |

| Functional Form 3 | 2.18 [0.0314] | 1.74 [0.084] | 2.28 [0.024] |

| Normality 4 | 28.261 [0.000] | 80.86 [0.000] | 27.00 [0.000] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Katusiime, L. Mobile Money Use: The Impact of Macroeconomic Policy and Regulation. Economies 2021, 9, 51. https://doi.org/10.3390/economies9020051

Katusiime L. Mobile Money Use: The Impact of Macroeconomic Policy and Regulation. Economies. 2021; 9(2):51. https://doi.org/10.3390/economies9020051

Chicago/Turabian StyleKatusiime, Lorna. 2021. "Mobile Money Use: The Impact of Macroeconomic Policy and Regulation" Economies 9, no. 2: 51. https://doi.org/10.3390/economies9020051

APA StyleKatusiime, L. (2021). Mobile Money Use: The Impact of Macroeconomic Policy and Regulation. Economies, 9(2), 51. https://doi.org/10.3390/economies9020051