The Relationship between the Company’s Value and the Tone of the Risk-Related Narratives: The Case of Portugal

Abstract

:1. Introduction

2. Risk Concepts

3. Explanatory Theories of Disclosure of Risk Information

3.1. Proprietary Costs Theory

3.2. Institutional Theory

3.3. Signaling Theory

3.4. Agency Theory

3.5. Stakeholder Theory

3.6. Legitimacy Theory

4. Literature Review and Hypothesis Development

4.1. Risk Reporting

4.2. Impression Management

4.3. The Tone of the Speech

4.4. Hypothesis Development

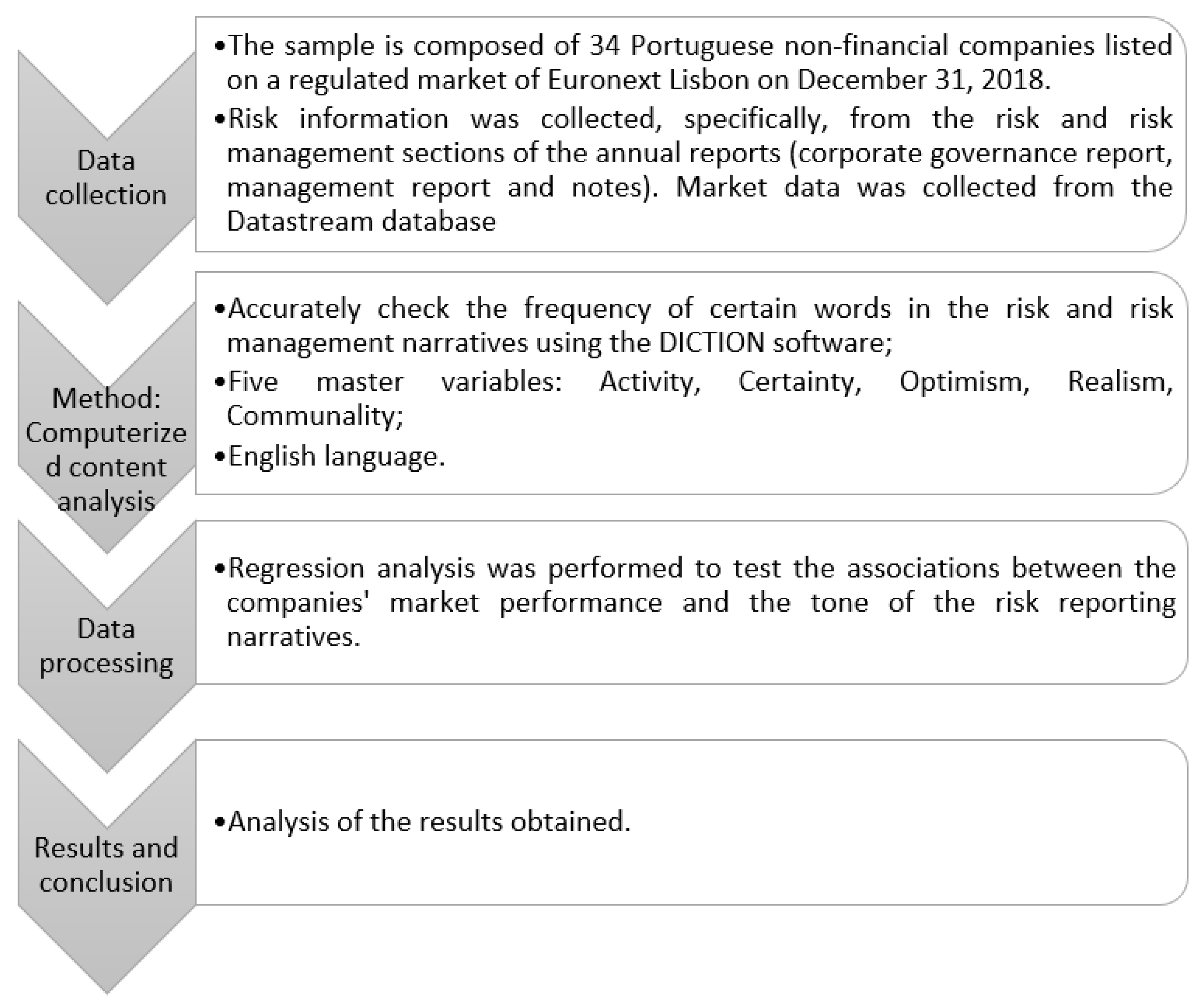

5. Research Design

5.1. Sample and Data Collection

5.2. Econometric Model

6. Results and Discussion

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Author | Sample | Objective | Theory | Main Results |

|---|---|---|---|---|

| Elamer et al. (2019) | 100 listed commercial and Islamic banks in the MENA region. Total 14 Middle East and North Africa (MENA) countries (2006–2013). | Examines the impact of multilayer governance mechanisms on the level of bank risk disclosure. | Resource dependence theory | Authors find that the presence of a Sharia supervisory board is positively associated with the level of risk disclosure. Ownership structures have a positive effect on the level of risk disclosure. At the country level, our evidence suggests that control of corruption has a positive effect on the level of bank risk disclosure. |

| De Luca et al. (2020) | 51 Italian large public interest entities right after the issuance of the Legislative Decree No., 254 of 30 December 2016 on the nonfinancial disclosure CSR requirements. Italy. | Discusses the possible relationship between intellectual capital (IC) and non-financial information (NFI), particularly related to SDGs and corporate social responsibility (CSR), in a stakeholder engagement perspective. | Legitimacy theory and resources-based perspectives | Authors find that Companies with high levels of structural capital must have better quality in the disclosure of their risk-related information since they have better organizational philosophy, knowledge and techniques in the preparation process to support and even explore the effects of uncertainties. The quality of the information can also depend on the characteristics of the company. |

| Leopizzi et al. (2019) | 202 public interest companies (EIP), Italian, required to follow decree, 254/2016 (2016/2017). Italy. | Investigate the level of disclosure of non-financial risk after the introduction of Directive, 2014/95/EU on non-financial information. | Not specified | Results show how the level of disclosure of non-financial risks in Italian companies is better than before the introduction of the directive and also based on the past and present perspective rather than the future. |

| Beretta and Bozzolan (2004) | Non-financial companies listed on the Italian Stock Exchange (2001). Italy. | Propose a structure for the analysis of risk communication and an index to measure the quality of risk disclosure. | Not specified | Authors find that the amount of disclosure is not influenced by size or sector. Thus, the synthetic measure can be used to classify the quality of risk disclosure. |

| Oliveira et al. (2011) | 81 Portuguese companies registered by the CMVM. Our sample comprised all 42 non-finance companies listed on the regulated Euronext Lisbon market as of 31 December 2005, together with 39 non-finance companies not listed on any regulated market (2005). Portugal. | Assess the risk-related disclosure (RRD) practices in annual reports for 2005 Portuguese companies in the non-finance sector. | Agency theory, legitimacy theory and resources-based perspectives | Authors find that Disclosures are generic, qualitative and backward-looking. Public visibility (as assessed by size and environmental sensitivity) is a crucial influence in explaining RRD: companies appear to manage their reputation through disclosure of risk-related information. |

| Athanasakou et al. (2020) | CFIE dataset for UK annual reports published in calendar years (2003–2014). UK. | Test for a U-shaped relation between the cost of equity capital and the level of disclosure in annual report narratives. | Not specified | Authors find a negative relation with the cost of equity capital at low levels of disclosure, and a positive relationship at higher levels of disclosure, together with implying the presence of an optimal level of disclosure. |

| Kang and Gray (2019) | 185 of the largest firms listed on the London Stock Exchange (FTSE, 100 plus top, 100 from FTSE, 250) (2013/2014). UK. | To examine the voluntary disclosure behavior of leading British multinational firms in respect of country-specific risks. | Voluntary disclosure theory | Results show that British multinationals are less likely to voluntarily report their segment and risk information on a disaggregated geographic country-by-country basis if they are engaged in operations in countries associated with higher levels of country-specific risks. |

| Abraham and Cox (2007) | 71 FTSE, 100 non-financial firms (2002). UK. | Investigated the relationship between the quantity of narrative risk information in corporate annual reports and ownership, governance, and US listing characteristics. | Agency theory | Authors find that corporate risk reporting is negatively related to sharing ownership by long-term institutions, therefore, suggest put forth that this important class of institutional investor has investment preferences for firms with a lower level of risk disclosure. Concerning governance, find that different types of board directors fulfill different functions, with both the number of executive and the number of independent directors positively related to the level of corporate risk reporting, but not the number of dependent non-executive directors. |

| Lobo et al. (2019) | Item 7A from 83,402 10-K filings from the SEC’s EDGAR database. | They examine whether the risk disclosures in the 10-K files contain useful information about companies’ risk management efforts. | Not specified | Authors find that (1) managers are more likely to disclose risks when they receive higher-quality information about risks; (2) managers are more likely to disclose risks when they are confident in their ability to achieve a better risk management outcome; (3) the disclosure of higher quality risks helps to direct management’s attention and to focus on the task of risk management. They support the argument that the disclosure of higher quality risks is a sign of the result of risk management. |

| Bravo (2017) | 95 companies included in the Standard and Poor’s 500, belonging to the manufacturing industry (2009). USA. | To test the effect of risk disclosures on firm value. | Voluntary disclosure theory | Results show that the disclosure of information on risks is positively associated with the value of a firm. In addition, findings highlight that this association is mediated by corporate reputation, which improves for enhanced risk disclosure practices. |

| Schiemann and Sakhel (2019) | 717 European companies- ETS and non-ETS firms (operating in high-emitting industries) (2011–2013). EU. | They investigate whether the decision to voluntarily disclose a company’s exposure to physical risks is associated with less information asymmetry. They also test whether the relationship between disclosure and information asymmetry differs depending on whether or not a company is regulated by climate policy. | Socio-political theories | Authors find that reporting of higher exposure to physical risks is associated with lower information asymmetry for firms falling under the regulation of the EU Emissions Trading Scheme, whereas for other firms, the direction of the relationship reverses. The results are driven by other climate change-related risk disclosures and by disclosures about opportunities arising from climate change. |

| Campbell et al. (2014) | “Risk factor” section in their Form 10-K 9076. 9076 firm-year observations (2005–2008). USA. | Examine the content of the information in the “risk factor” section on Form 10-K. | Not specified | Authors find that (1) The firms facing greater risk disclose more risk factors and that the type of risk the firm faces determines whether it devotes a greater portion of its disclosures towards describing that risk type. That is, managers provide risk factor disclosures that meaningfully reflect the risks they face. (2) find that the information conveyed by risk factor disclosures is reflected in systematic risk, idiosyncratic risk, information asymmetry, and firm value. The evidence supports the SEC’s decision to mandate risk factor disclosures, as the disclosures appear to be firm-specific and useful to investors. |

Appendix B

| Author | Sample | Objective | Theory | Main Results |

|---|---|---|---|---|

| Fisher et al. (2019) | The largest companies listed on the ASX100 (Australia) and NZX50 (New Zealand) (2008/2009). Australia and New Zealand. | Investigate how dimensions of tone vary across different forms of corporate accountability narrative; the impact of tone on readability; and the determinants of tone, including consideration of its use in impression management | Not specified | Authors’ analysis reveals that dimensions of tone vary significantly across narrative types (genres), suggesting that tonal patterns form part of the specific stylistic conventions of each genre. Tone is found to be a significant determinant of readability. |

| Gatzert and Heidinger (2019) | 48 publicly listed insurers in the EU that published an English SFCR. (15 countries). (After the disclosure of the SFCRs). EU. | Analyze market reactions to the first SFCRs for all publicly listed insurers in the EU that published an English report based on an event study | Not specified | Authors show that SFCR key figures matter more than textual features. Specifically, we find a significantly positive market impact of the solvency ratio calculated without transitionals or adjustments and a significantly negative one for the solvency capital requirement (SCR). |

| Boudt and Thewissen (2019) | CEO letters of the firms included in the DJIA for the 12 consecutive fiscal years, 2000 to 2011. 30 of the largest firms in the USA (2001–2012). USA. | Highlight the strategic positioning of positive and negative words in a letter from the CEO as a subtle form of impression management | The serial position effect and peak-end rule theory | Authors show that managers tend to present information in such an order that the reader of the CEO’s letter has a more positive perception of the underlying message. They uncover a smile in the frequency of positive words within the letter, and a half-smile in the intratextual distribution of negative words, with a prevalence of negative words at the beginning of the letter. Furthermore, find a significant positive association between this qualitative impression management and using abnormal accruals in earnings management. |

| Pengnate et al. (2020) | 100 firms: 50 from the USA and 50 from Japan, with broad industry representation. Sample firms’ letters to shareholders were published immediately after the Lehman Brothers bankruptcy announcement in September 2008. USA and Japan. | Investigate the relationships between sentiment, as an aspect of emotions extracted from the letters to shareholders, managerial discretion and the firms’ subsequent performance and performance trajectory during the crisis | Upper echelons theory | Authors show that (1) Managerial sentiment identified in letters to shareholders can potentially be related to the firm’s subsequent performance in the economic crisis, and (2) managerial discretion moderates the relationship between managerial sentiment and subsequent firm performance. |

| Quigley et al. (2020) | 1753 option grant dates representing 659 CEOs across 627 firms. Option grants to CEOs of large US publicly traded companies (2009 to 2013). USA. | Theorize aspects of agency theory that leave information asymmetry in place, offer CEOs an informational advantage that can be used, via print management techniques, to circumvent some of the intended benefits of granting options | Agency theory | Authors argue that the period leading up to an option grant creates a scenario where CEOs are incentivized to reduce the stock price of their firm for personal gain. CEOs respond to incentives by adjusting the tenor of releases from the firm during the pre-grant period, providing CEOs a substantial economic gain. |

| Bushee et al. (2018) | 60,172 firm-quarters with conference call transcripts and the necessary CRSP, Compustat, and I/B/E/S data (2002–2011). USA. | Develop a novel empirical approach to estimate two latent components within (obfuscation and information) the context of quarterly earnings conference calls | Economic theory | Authors contend that our estimate of the information component is negatively associated with information asymmetry, while our estimate of the obfuscation component is positively associated with information asymmetry. |

| Beretta et al. (2019) | 102 integrated reports from European listed companies and available in the IIRC’s integrated reporting emerging practice examples database as of 15 December 2017. (2011 to 2016). UK, The Netherlands, Italy, Germany, Spain, France, Switzerland, Denmark, Greece, Luxembourg, Sweden. | Examine how the content and semantic properties of intellectual capital disclosure (ICD) found in integrated reports are associated with firms’ performance | Impression management and incremental information | Authors contend that ICDs in integrated reports are mainly discursive, with a backward-looking orientation and a limited focus on human capital. On average, more than half of each ICD is conveyed in a positive tone. As the optimistic tone in firms’ ICDs increases, so too does their non-financial performance, as measured in terms of environmental, social and governance aspects. This finding supports the incremental information approach. |

| Roman et al. (2019) | 30 annual integrated reports of the Integrated Reporting examples database setup by IIRC. Most of the selected companies are based in South Africa (11 organizations) and the UK (9 organizations), while the others operate in the following countries: Australia, Brazil, Italy, Japan, Luxembourg, Netherlands, New Zealand, Singapore and Sri Lanka (2017). | Investigate the determinants of readability and optimism, which build the disclosure style of integrated reports | Impression management theory and legitimacy theory | Authors contend that (1) the higher the revenues of the reporting company, the more balanced their integrated reports, while younger companies use a more optimistic tone when reporting. Additionally, optimism seems to be inversely correlated with the length of the reports. (2) entities based in countries with a stronger tendency towards transparency surprisingly provide less readable integrated reports. It was also revealed that companies operating in non-environmentally sensitive industries, as well as International Financial Reporting Standards adopters deliver foggier and thus less readable integrated reports. |

| Craig and Amernic (2018) | 193 letters to shareholders, comprising about 368,000 words, focusing initially on 23 letters signed by CEOs, who are alleged to be hubristic: Browne (BP), Goodwin (Royal Bank of Scotland), and Murdoch (news). | Explore whether DICTION text analysis software reveals distinctive language markers of a verbal tone of hubris in annual letters to shareholders signed by CEOs of major companies | Not specified | Authors contend that language high in REALISM is not a distinctive marker of hubris but is likely to be a genre effect that is common in CEO letters to shareholders. |

| Moreno et al. (2019) | Multiple textual characteristics of the content of the chairman’s statements (1948–1996). Ireland. | Analyze the evolution of multiple narrative textual characteristics in the chairman’s statements of Guinness from 1948 to 1996, with the aim of studying impression management influences | Not specified | Findings show that Guinness consistently used qualitative textual characteristics with a self-serving bias but did not use those with a more quantitative character. Continual profits achieved by the company, and the high corporate/personal reputation of the company/chairpersons, inter alia, may well explain limited evidence of impression management associated with quantitative textual characteristics. |

| Clarkson et al. (2020) | The complete set of 2056 stand-alone CSR reports relate to 1835 distinct firm years. EUA (2002–2016)). USA. | Examine disclosure patterns for a sample of US corporate social responsibility (CSR) reports from the period 2002–2016 | Not specified | Findings show that the two most commonly used disclosure characteristics, number of words and number of sentences, alone can be used to predict reporting firms’ CSR performance type with 81% accuracy. The accuracy of prediction increases to 96% when the top 50 linguistics features most relevant to firms’ CSR performance are included in the prediction model. In addition, we find that the linguistic features of CSR disclosure identified are incrementally value relevant to investors even after controlling for the actual CSR performance score from the professional CSR rating agencies. This finding suggests that the linguistic features of CSR disclosure can be an important venue for capital market participants in evaluating firms’ CSR performance type, especially when professional CSR performance ratings are not available. |

| Martínez-Ferrero et al. (2019) | 273 firm-year observations spanning 9 years. 12 countries: Canada, France, Germany, Hong Kong, Japan, Luxembourg, the Netherlands, Singapore, Spain, Switzerland, UK, USA (2006–2014). | Examine the association between the CSR performance of the firm and the socially responsible disclosure strategy adopted by managers to obtain insights into the factors associated with balance, accuracy, clarity, comparability, and reliability of the information | Impression management theory | Results show that, according to an obfuscation disclosure strategy, firms with the worst CSR performance disclose information that is less balanced, accurate, and clear. Moreover, these reports incorporate more optimistic, longer, and less readable information. Within the realm of impression-management strategy, firms use thematic content and verbal tone manipulation as well as quantity and syntactical reading as impression-management tools. |

| Hummel et al. (2017) | 973 voluntary CSR disclosures were provided by firms located in the USA and the UK over a reporting period of eight years. USA and the UK. | Test the Matten and Moon (2008) framework on these two dimensions: language and topics, concerning CSR. Matten and Moon (2008) argue that firms’ CSR practices and disclosure respond to the institutional environment | Not specified | Results mainly support the rationale of the implicit-explicit framework. The results show that the voluntary disclosure of CSR by companies in LMEs is, in fact, more positive in tone and more explicit concerning education, philanthropy and parental policy. |

References

- Abraham, Santhosh, and Paul Cox. 2007. Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review 39: 227–48. [Google Scholar] [CrossRef]

- Abraham, Santhosh, and Philip J. Shrives. 2014. Improving the relevance of risk factor disclosure in corporate annual reports. The British Accounting Review 46: 91–107. [Google Scholar] [CrossRef] [Green Version]

- Akerlof, George A. 1970. The market for “lemons”: Quality uncertainty and the market mechanism. Quarterly Journal of Economics 84: 488–500. [Google Scholar] [CrossRef]

- Amran, Azlan, Abdul Manaf Rosli Bin, and Bin Che Haat Mohd Hassan. 2009. Risk reporting: An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal 24: 39–57. [Google Scholar] [CrossRef]

- Arena, Claudia, Saverio Bozzolan, and Giovanna Michelon. 2015. Environmental Reporting: Transparency to Stakeholders or Stakeholder Manipulation? An Analysis of Disclosure Tone and the Role of the Board of Directors. Corporate Social Responsibility and Environmental Management 22: 346–61. [Google Scholar] [CrossRef]

- Athanasakou, Vasiliki, Florian Eugster, Thomas Schleicher, and Martin Walker. 2020. Annual Report Narratives and the Cost of Equity Capital: U.K. Evidence of a U-shaped Relation. European Accounting Review 29: 27–54. [Google Scholar] [CrossRef] [Green Version]

- Bansal, Pratima, and Geoffrey Kistruck. 2006. Seeing Is (Not) Believing: Managing the Impressions of the Firm’s Commitment to the Natural Environment. Journal of Business Ethics 67: 165–80. [Google Scholar] [CrossRef]

- Beretta, Sergio, and Saverio Bozzolan. 2004. A framework for the analysis of firm risk communication. The International Journal of Accounting 39: 265–88. [Google Scholar] [CrossRef]

- Beretta, Valentina, Maria Chiara Demartini, and Sara Trucco. 2019. Does environmental, social and governance performance influence intellectual capital disclosure tone in integrated reporting? Journal of Intellectual Capital 20: 100–24. [Google Scholar] [CrossRef]

- Bian, Ran, Fuzhuo Sun, Zheting Lin, Qin Gao, Xiaoxiao Yuan, and Aishan Xie. 2020. The moderating role of interviewer’s regulatory focus in the effectiveness of impression management tactics: Regulatory fit as a source of subjective value. British Journal of Psychology 111: 369–94. [Google Scholar] [CrossRef] [PubMed]

- Bloomfield, Robert J. 2002. The “incomplete revelation hypothesis” and financial reporting. Accounting Horizons 16: 233–43. [Google Scholar] [CrossRef]

- Boder, David P. 1940. The adjective-verb quotient: A contribution to the psychology of language. The Psychological Record 3: 310–43. [Google Scholar] [CrossRef] [Green Version]

- Boiral, Olivier, Marie-Christine Brotherton, and David Talbot. 2020a. Building trust in the fabric of sustainability ratings: An impression management perspective. Journal of Cleaner Production 260: 120942. [Google Scholar] [CrossRef]

- Boiral, Olivier, David Talbot, and Marie-Christine Brotherton. 2020b. Measuring sustainability risks: A rational myth? Business Strategy and the Environment 29: 2557–71. [Google Scholar] [CrossRef]

- Bonsall, Samuel B., Andrew J. Leone, Brian P. Miller, and Kristina Rennekamp. 2017. A plain English measure of financial reporting readability. Journal of Accounting and Economics 63: 329–57. [Google Scholar] [CrossRef]

- Boudt, Kris, and James Thewissen. 2019. Jockeying for Position in CEO Letters: Impression Management and Sentiment Analytics. Financial Management 48: 77–115. [Google Scholar] [CrossRef] [Green Version]

- Bravo, Francisco. 2017. Are risk disclosures an effective tool to increase firm value? Managerial and Decision Economics 38: 1116–24. [Google Scholar] [CrossRef]

- Brennan, Niamh M., Encarna Guillamon-Saorin, and Aileen Pierce. 2009. Methodological Insights: Impression management: Developing and illustrating a scheme of analysis for narrative disclosures-A methodological note. Accounting, Auditing, and Accountability Journal 22: 789–832. [Google Scholar] [CrossRef]

- Bushee, Brian J., Ian D. Gow, and Daniel J. Taylor. 2018. Linguistic Complexity in Firm Disclosures: Obfuscation or Information? Journal of Accounting Research 56: 85–121. [Google Scholar] [CrossRef]

- Callahan, Carolyn, and Jared Soileau. 2017. Does Enterprise risk management enhance operating performance? Advances in Accounting 37: 122–39. [Google Scholar] [CrossRef]

- Campbell, John L., Hsinchun Chen, Dan S. Dhaliwal, Hsin-min Lu, and Logan B. Steele. 2014. The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies 19: 396–455. [Google Scholar] [CrossRef]

- Chakrabarty, Bidisha, Ananth Seetharaman, Zane Swanson, and Xu (Frank) Wang. 2018. Management Risk Incentives and the Readability of Corporate Disclosures. Financial Management 47: 583–616. [Google Scholar] [CrossRef]

- Cho, Charles H., Robin W. Roberts, and Dennis M. Patten. 2010. The language of US corporate environmental disclosure. Accounting, Organizations and Society 35: 431–43. [Google Scholar] [CrossRef]

- Clarkson, Peter M., Li Yue, Gordon D. Richardson, and Florin P. Vasvari. 2008. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society 33: 303–27. [Google Scholar] [CrossRef]

- Clarkson, Peter M., Jordan Ponn, Gordon D. Richardson, Frank Rudzicz, Albert Tsang, and Jingjing Wang. 2020. A Textual Analysis of US Corporate Social Responsibility Reports. Abacus 56: 3–34. [Google Scholar] [CrossRef]

- Connelly, Brian L., S. Trevis Certo, R. Duane Ireland, and Christopher R. Reutzel. 2011. Signaling Theory: A Review and Assessment. Journal of Management 37: 39–67. [Google Scholar] [CrossRef]

- Craig, Russell, and Joel Amernic. 2018. Are there Language Markers of Hubris in CEO Letters to Shareholders? Journal of Business Ethics 149: 973–86. [Google Scholar] [CrossRef] [Green Version]

- Davis, Angela K., Jeremy M. Piger, and Lisa M. Sedor. 2012. Beyond the Numbers: Measuring the Information Content of Earnings Press Release Language. Contemporary Accounting Research 29: 845–68. [Google Scholar] [CrossRef]

- De Luca, Francesco, Andrea Cardoni, Ho Tan Phat Phan, and Evgeniia Kiseleva. 2020. Does structural capital affect SDGs risk-related disclosure quality? An empirical investigation of Italian large listed companies. Sustainability 12: 1776. [Google Scholar] [CrossRef] [Green Version]

- Demaline, Christopher J. 2020. Disclosure readability of firms investigated for books-and-records infractions: An impression management perspective. Journal of Financial Reporting and Accounting 18: 131–45. [Google Scholar] [CrossRef]

- DiMaggio, Paul J., and Walter W. Powell. 1983. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. American Sociological Review 48: 147–60. [Google Scholar] [CrossRef] [Green Version]

- Diouf, Dominique, and Olivier Boiral. 2017. The quality of sustainability reports and impression management: A stakeholder perspective. Accounting, Auditing & Accountability Journal 30: 643–67. [Google Scholar] [CrossRef]

- Donaldson, Thomas, and Lee E. Preston. 1995. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Academy of Management Review 20: 65–91. [Google Scholar] [CrossRef] [Green Version]

- Dumay, John, Geoff Frost, and Cornelia Beck. 2015. Material legitimacy: Blending organisational and stakeholder concerns through non-financial information disclosures. Journal of Accounting & Organizational Change 11: 2–23. [Google Scholar] [CrossRef]

- Elamer, Ahmed A., Collins G. Ntim, Hussein A.Abdou, Alaa Mansour Zalata, and Mohamed Elmagrhi. 2019. The impact of multi-layer governance on bank risk disclosure in emerging markets: The case of Middle East and North Africa. Accounting Forum 43: 246–81. [Google Scholar] [CrossRef]

- Elshandidy, Tamer, Ian Stewart Fraser, and Khaled Hussainey. 2013. Aggregated, voluntary, and mandatory risk disclosure incentives: Evidence from UK FTSE all-share companies. International Review of Financial Analysis 30: 320–33. [Google Scholar] [CrossRef]

- Elshandidy, Tamer, Philip J. Shrives, Matthew Bamber, and Santhosh Abraham. 2018. Risk reporting: A review of the literature and implications for future research. Journal of Accounting Literature 40: 54–82. [Google Scholar] [CrossRef] [Green Version]

- Fisher, Richard T., Chris J. Van Staden, and Glenn Richards. 2019. Watch that tone: An investigation of the use and stylistic consequences of tone in corporate accountability disclosures. Accounting, Auditing & Accountability Journal 33: 77–105. [Google Scholar] [CrossRef]

- Flesch, Rudolf. 1951. The Art of Clear Thinking. New York: Barnes & Noble. [Google Scholar]

- Florio, Cristina, and Giulia Leoni. 2017. Enterprise risk management and firm performance: The Italian case. The British Accounting Review 49: 56–74. [Google Scholar] [CrossRef]

- Francis, Jennifer, Dhananjay Nanda, and Per Olsson. 2008. Voluntary disclosure, earnings quality, and cost of capital. Journal of Accounting Research 46: 53–99. [Google Scholar] [CrossRef]

- Freeman, R. Edward. 1984. Strategic Management: A Stakeholder Approach. Boston: Pitman. [Google Scholar]

- Gatzert, Nadine, and Dinah Heidinger. 2019. An empirical analysis of market reactions to the first solvency and financial condition reports in the european insurance industry. Journal of Risk and Insurance 87: 407–36. [Google Scholar] [CrossRef]

- Goffman, Erving. 1959. The Presentation of Self in Everyday Life, 1st ed. New York: Anchor. [Google Scholar]

- Hart, Roderick P. 1984. Systematic Analysis of Political Discourse: The Development of DICTION. In Political Communication Yearbook, 1st ed. Carbondale: Southern Illinois University Press. [Google Scholar]

- Hart, Roderick P., and Craig E. Carroll. 2014. Help Manual—Diction 7.0: The Text Analysis Program. Austin: Digitext, Inc. [Google Scholar]

- Hassan, Mostafa Kamal. 2014. Risk narrative disclosure strategies to enhance organizational legitimacy: Evidence from UAE financial institutions. International Journal of Disclosure and Governance 11: 1–17. [Google Scholar] [CrossRef]

- Henry, Elaine. 2008. Are Investors Influenced by How Earnings Press Releases Are Written? The Journal of Business Communication (1973) 45: 363–407. [Google Scholar] [CrossRef]

- Hooghiemstra, Reggy. 2000. Corporate Communication and Impression Management—New Perspectives Why Companies Engage in Corporate Social Reporting. Journal of Business Ethics 27: 55–68. [Google Scholar] [CrossRef]

- Hoyt, Robert E., and André P. Liebenberg. 2011. The Value of Enterprise Risk Management. Journal of Risk and Insurance 78: 795–822. [Google Scholar] [CrossRef]

- Hughes, John S., Jing Liu, and Jun Liu. 2007. Information Asymmetry, Diversification, and Cost of Capital. The Accounting Review 82: 705–729. [Google Scholar] [CrossRef]

- Hummel, Katrin, Stephanie A. Mittelbach-Hörmanseder, Charles H. Cho, and Dirk Matten. 2017. Implicit versus explicit corporate social responsibility disclosure: A textual analysis. Social Science Research Network. [Google Scholar] [CrossRef]

- Ibrahim, Awad Elsayed, and Khaled Hussainey. 2019. Developing the narrative risk disclosure measurement. International Review of Financial Analysis 64: 126–44. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Johnson, Wendell. 1951. People in Quandaries the Semantics of Personal Adjustment. New York: Harper & Row. [Google Scholar]

- Kang, Helen, and Sidney J. Gray. 2019. Country-specific risks and geographic disclosure aggregation: Voluntary disclosure behaviour by British multinationals. The British Accounting Review 51: 259–76. [Google Scholar] [CrossRef]

- Khlif, Hichem, and Khaled Hussainey. 2016. The association between risk disclosure and firm characteristics: A meta-analysis. Journal of Risk Research 19: 181–211. [Google Scholar] [CrossRef] [Green Version]

- Kibler, Ewald, Christoph Mandl, Steffen Farny, and Virva Salmivaara. 2020. Post-failure impression management: A typology of entrepreneurs’ public narratives after business closure. Human Relations 74: 286–318. [Google Scholar] [CrossRef] [Green Version]

- Krippendorff, Klaus. 2013. Content Analysis—An Introduction to Its Methodology, 3rd ed. Beverly Hills: Sage Publications. [Google Scholar]

- Lechner, Philipp, and Nadine Gatzert. 2018. Determinants and value of enterprise risk management: Empirical evidence from Germany. European Journal of Finance 24: 867–87. [Google Scholar] [CrossRef]

- Lee, Kin Wai, and Gillian Hian Heng Yeo. 2016. The association between integrated reporting and firm valuation. Review of Quantitative Finance and Accounting 47: 1221–50. [Google Scholar] [CrossRef]

- Leopizzi, Rossella, Antonio Iazzi, Andrea Venturelli, and Salvatore Principale. 2019. Nonfinancial risk disclosure: The “state of the art” of Italian companies. Corporate Social Responsibility and Environmental Management 25: 358–68. [Google Scholar] [CrossRef]

- Linsley, Philip Mark, and Philip J. Shrives. 2006. Risk reporting: A study of risk disclosures in the annual reports of UK companies. The British Accounting Review 38: 387–404. [Google Scholar] [CrossRef]

- Liu, Xin. 2020. Impression management against early dismissal? CEO succession and corporate social responsibility. Corporate Social Responsibility and Environmental Management 27: 999–1016. [Google Scholar] [CrossRef]

- Lobo, Gerald J., Wei Z. Siqueira, Kinsun Tam, and Jian Zhou. 2019. Does SEC FRR No. 48 disclosure communicate risk management effectiveness? Journal of Accounting and Public Policy 38: 106696. [Google Scholar] [CrossRef]

- Loughran, Tim, and Bill D. Mcdonald. 2016. Textual Analysis in Accounting and Finance: A Survey. Journal of Accounting Research 54: 1187–230. [Google Scholar] [CrossRef]

- Luo, Wenbing, Xiaoxin Guo, Shihu Zhong, and Juanzhi Wang. 2019. Environmental information disclosure quality, media attention and debt financing costs: Evidence from Chinese heavy polluting listed companies. Journal of Cleaner Production 231: 268–77. [Google Scholar] [CrossRef]

- Margaritis, Dimitris, and Maria Psillaki. 2010. Capital structure, equity ownership and firm performance. Journal of Banking & Finance 34: 621–32. [Google Scholar] [CrossRef]

- Martínez-Ferrero, Jennifer, Óscar Suárez-Fernández, and Isabel María García-Sánchez. 2019. Obfuscation versus enhancement as corporate social responsibility disclosure strategies. Corporate Social Responsibility and Environmental Management 26: 468–80. [Google Scholar] [CrossRef]

- Matten, Dirk, and Jeremy Moon. 2008. “Implicit” and “explicit” CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Academy of Management Review 33: 404–424. [Google Scholar] [CrossRef] [Green Version]

- McShane, Michael K., Anil Nair, and Elzotbek Rustambekov. 2011. Does Enterprise Risk Management Increase Firm Value? Journal of Accounting, Auditing & Finance 26: 641–58. [Google Scholar] [CrossRef]

- Melloni, Gaia. 2015. Intellectual capital disclosure in integrated reporting: An impression management analysis. Journal of Intellectual Capital 16: 661–80. [Google Scholar] [CrossRef]

- Melloni, Gaia, Ariela Caglio, and Paolo Perego. 2017. Saying more with less? Disclosure conciseness, completeness and balance in Integrated Reports. Journal of Accounting and Public Policy 36: 220–38. [Google Scholar] [CrossRef] [Green Version]

- Merkl-Davies, Doris M., and Niamh M. Brennan. 2007. Discretionary disclosure strategies in corporate narratives: Incremental information or impression management? Journal of Accounting Literature 27: 116–96. [Google Scholar]

- Merkl-Davies, Doris M., and Niamh M. Brennan. 2011. A conceptual framework of impression management: New insights from psychology, sociology and critical perspectives. Accounting and Business Research 41: 415–37. [Google Scholar] [CrossRef]

- Merkl-Davies, Doris M., and Niamh M. Brennan. 2017. A theoretical framework of external accounting communication: Research perspectives, traditions, and theories. Accounting, Auditing & Accountability Journal 30: 433–69. [Google Scholar] [CrossRef]

- Merkl-Davies, Doris M., Niamh M. Brennan, and Stuart J. McLeay. 2011. Impression management and retrospective sense-making in corporate narratives: A social psychology perspective. Accounting, Auditing & Accountability Journal 24: 315–44. [Google Scholar] [CrossRef] [Green Version]

- Mittelbach-Hoermanseder, Stéphanie, Katrin Hummel, and Margarethe Rammerstorfer. 2020. The Information Content of Corporate Social Responsibility Disclosures in Europe: An Institutional Perspective. European Accounting Review 64. [Google Scholar] [CrossRef]

- Moreno, Alonso, Michael John Jones, and Martin Quinn. 2019. A longitudinal study of the textual characteristics in the chairman’s statements of Guinness: An impression management perspective. Accounting, Auditing & Accountability Journal 32: 1714–41. [Google Scholar] [CrossRef] [Green Version]

- Neri, Lorenzo, Tamer Elshandidy, and Yingxi Guo. 2018. Determinants and impacts of risk disclosure quality: Evidence from China. Journal of Applied Accounting Research 19: 518–36. [Google Scholar] [CrossRef]

- Oliveira, Jonas, Lúcia Lima Rodrigues, and Russell Craig. 2011. Risk-related disclosures by non-finance companies: Portuguese practices and disclosure characteristics. Managerial Auditing Journal 26: 817–39. [Google Scholar] [CrossRef] [Green Version]

- Patelli, Lorenzo, and Matteo Pedrini. 2015. Is Tone at the Top Associated with Financial Reporting Aggressiveness? Journal of Business Ethics 126: 3–19. [Google Scholar] [CrossRef]

- Pengnate, Supavich, Derek G. Lehmberg, and Chanchai Tangpong. 2020. Top management’s communication in economic crisis and the firm’s subsequent performance: Sentiment analysis approach. Corporate Communications: An International Journal 25: 187–205. [Google Scholar] [CrossRef]

- Quigley, Timothy J., Timothy David Hubbard, Andrew J. Ward, and Scott D. Graffin. 2020. Unintended Consequences: Information Releases and CEO Stock Option Grants. Academy of Management Journal 63: 155–80. [Google Scholar] [CrossRef]

- Roman, Aureliana Geta, Mihaela Mocanu, and Răzvan Hoinaru. 2019. Disclosure Style and Its Determinants in Integrated Reports. Sustainability 11: 1960. [Google Scholar] [CrossRef] [Green Version]

- Rutherford, Brian A. 2013. A genre-theoretic approach to financial reporting research. The British Accounting Review 45: 297–310. [Google Scholar] [CrossRef]

- Schiemann, Frank, and Alice Sakhel. 2019. Carbon Disclosure, Contextual Factors, and Information Asymmetry: The Case of Physical Risk Reporting. European Accounting Review 28: 791–818. [Google Scholar] [CrossRef]

- Shad, Muhammad Kashif, Fongwoon Lai, Chuah Lai Fatt, Jiří Jaromír Klemeš, and Awais Bokhari. 2019. Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. Journal of Cleaner Production 208: 415–25. [Google Scholar] [CrossRef]

- Shocker, Allan D., and S. Prakash Sethi. 1973. An Approach to Incorporating Societal Preferences in Developing Corporate Action Strategies. California Management Review 15: 97–105. [Google Scholar] [CrossRef]

- Short, Jeremy Collin, and Timothy B. Palmer. 2007. The Application of DICTION to Content Analysis Research in Strategic Management. Organizational Research Methods 11: 727–52. [Google Scholar] [CrossRef]

- Shrives, Philip J., and Niamh M. Brennan. 2017. Explanations for corporate governance non-compliance: A rhetorical analysis. Critical Perspectives on Accounting 49: 31–56. [Google Scholar] [CrossRef]

- Spence, Michael. 1973. Job Market Signaling. The Quarterly Journal of Economics 87: 355–74. [Google Scholar] [CrossRef]

- Srikant, Chethan D. 2019. Impression management strategies to gain regulatory approval. Journal of Business Research 105: 136–53. [Google Scholar] [CrossRef]

- Suchman, Mark C. 1995. Managing Legitimacy: Strategic and Institutional Approaches. Academy of Management Review 20: 571–610. [Google Scholar] [CrossRef] [Green Version]

- Sydserff, Robin, and Pauline Weetman. 2002. Developments in content analysis: A transitivity index andDICTION scores. Accounting, Auditing & Accountability Journal 15: 523–45. [Google Scholar] [CrossRef]

- Thorpe, Andy, Russell Craig, Glenn Hadikin, and Saša Batistic. 2017. Semantic tone of research ‘environment’ submissions in the UK’s Research Evaluation Framework 2014. Research Evaluation 27: 53–62. [Google Scholar] [CrossRef] [Green Version]

- Verrecchia, Robert E. 1983. Discretionary disclosure. Journal of Accounting and Economics 5: 179–94. [Google Scholar] [CrossRef]

- Yuthas, Kristi, Rodney K. Rogers, and Jesse F. Dillard. 2002. Communicative action and corporate annual reports. Journal of Business Ethics 41: 141–57. [Google Scholar] [CrossRef]

- Zhang, Yi, Gin Chong, and Ruixin Jia. 2019. Fair value, corporate governance, social responsibility disclosure and banks’ performance. Review of Accounting and Finance 19: 30–47. [Google Scholar] [CrossRef]

| Variables Master | Formula |

|---|---|

| Activity | (aggression + accomplishment + communication + motion) − (cognitive terms + passivity + embellishment) |

| Certainty | (tenacity + leveling + collectives + insistence) − (numerical terms + ambivalence + self reference + variety) |

| Optimism | (praise + satisfaction + inspiration) − (blame + hardship + denial) |

| Realism | (familiarity + spatial awareness + temporal awareness + present concern + human interest + concreteness) − (past concern + complexity) |

| Communality | (centrality + cooperation + rapport) − (diversity + exclusion + liberation) |

| Name | Variable | Variable Type | Definition | Data Source |

|---|---|---|---|---|

| QTOBIN | TobinQ | Dependent | Market value of equity plus the book value of total liabilities divided by total assets | (Lechner and Gatzert 2018; Callahan and Soileau 2017; Florio and Leoni 2017) |

| Reporting score index | Tone | Independent | Tone index of the risk section of the annual reports (activity, certainty, optimism, realism, communality) | (Fisher et al. 2019; Craig and Amernic 2018; Patelli and Pedrini 2015) |

| Complexity | Complex | Control | Factors: (1) number of business segments; (2) company size; and (3) proportion of intangible assets in total assets. Dummy variable (=1 if the common factor score for organizational complexity is greater than the median value of the sample and 0 otherwise) | (Lee and Yeo 2016) |

| External financing | Extfin | Control | Capital expenditures less cash flow from operations divided by capital expenditures. Dummy variable (=1 if the index of external financing needs is greater than the median value and 0 otherwise) | (Neri et al. 2018; Elshandidy et al. 2013) |

| Total assets | Size | Control | Natural logarithm of the book value of total assets | (Lee and Yeo 2016; Oliveira et al. 2011; Beretta and Bozzolan 2004; Linsley and Shrives 2006) |

| Return on assets | Roa | Control | Net income divided by total assets | (Lechner and Gatzert 2018; Florio and Leoni 2017; Lee and Yeo 2016) |

| Debt | Leverage | Control | Long-term debt divided by the book value of total assets | (Oliveira et al. 2011; Luo et al. 2019) |

| Non-executive directors | Pnexec | Control | Proportion of non-executive directors on the board of directors | (Abraham and Cox 2007; Oliveira et al. 2011) |

| Board size | BDSize | Control | Total number of directors on the board | (Lee and Yeo 2016; Abraham and Cox 2007) |

| Industry | Industry | Control | Dummy variable (=1 if the company belongs to the manufacturing industry and 0 if not) | (Roman et al. 2019; Abraham and Cox 2007) |

| Continuous Variables | N | Min. | Max. | Mean | Std. Dev. |

| TobinQ | 34 | 96.47 | 1720.08 | 650.58 | 281.85 |

| Size | 34 | 9.63 | 17.52 | 13.50 | 1.82 |

| Roa | 34 | −0.16 | 0.54 | 0.05 | 0.11 |

| Leverage | 34 | 0.00 | 71.88 | 35.06 | 17.41 |

| Pnexec | 34 | 0.00 | 100.00 | 60.37 | 22.43 |

| BDSize | 34 | 3.00 | 29.00 | 10.06 | 5.96 |

| Tone: | |||||

| Activity | 34 | 44.65 | 47.68 | 47.19 | 0.59 |

| Optimism | 34 | 46.09 | 49.28 | 48.50 | 0.63 |

| Certainty | 34 | 49.07 | 61.15 | 55.05 | 2.94 |

| Realism | 34 | 29.12 | 41.36 | 30.53 | 2.02 |

| Commonality | 34 | 48.95 | 53.52 | 49.64 | 0.78 |

| Categorical Variables | N | % | |||

| Complex | |||||

| Yes | 17 | 50% | |||

| No | 17 | 50% | |||

| Extfin | |||||

| Yes | 15 | 44% | |||

| No | 19 | 56% | |||

| Industry | |||||

| Yes | 28 | 82% | |||

| No | 06 | 18% |

| Description | N | Min. | Max. | Mean | Std. Dev. |

|---|---|---|---|---|---|

| Corporate Governance report: | |||||

| Activity | 34 | 47.08 | 49.40 | 47.58 | 0.43 |

| Optimism | 34 | 40.46 | 49.31 | 48.22 | 1.58 |

| Certainty | 34 | 44.44 | 66.49 | 55.65 | 5.79 |

| Realism | 34 | 26.78 | 42.92 | 29.78 | 2.54 |

| Commonality | 34 | 48.71 | 58.19 | 49.61 | 1.54 |

| Notes to Financial Statements: | |||||

| Activity | 34 | 42.30 | 47.57 | 46.77 | 1.25 |

| Optimism | 34 | 47.48 | 50.97 | 48.81 | 0.61 |

| Certainty | 34 | 39.57 | 62.46 | 54.58 | 4.76 |

| Realism | 34 | 27.48 | 39.08 | 31.28 | 1.72 |

| Commonality | 34 | 48.67 | 51.78 | 49.70 | 0.65 |

| Management report: | |||||

| Activity | 19 | 44.06 | 47.97 | 47.16 | 0.89 |

| Optimism | 19 | 45.56 | 49.72 | 48.48 | 0.99 |

| Certainty | 19 | 47.42 | 63.76 | 54.23 | 4.48 |

| Realism | 19 | 29.53 | 42.07 | 30.96 | 2.76 |

| Commonality | 19 | 49.01 | 52.52 | 49.66 | 0.86 |

| Test Kruskal-Wallis: | Test Statistics—Chi-Square | ||||

| Activity | 15.018 *** | ||||

| Optimism | 3.330 | ||||

| Certainty | 1.353 | ||||

| Realism | 35.355 *** | ||||

| Commonality | 4.941 | ||||

| Description | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | (14) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Pearson’s Correlation (Continuous Variables) | |||||||||||||||

| (1) | TobinQ | 1.00 | |||||||||||||

| Tone: | |||||||||||||||

| (2) | Activity | −0.13 | 1.00 | ||||||||||||

| (3) | Optimism | −0.04 | 0.59 | 1.00 | |||||||||||

| (4) | Certainty | −0.08 | −0.06 | 0.23 | 1.00 | ||||||||||

| (5) | Realism | −0.05 | 0.13 | 0.03 | −0.31 | 1.00 | |||||||||

| (6) | Commonality | −0.15 | 0.16 | 0.07 | −0.12 | 0.84 | 1.00 | ||||||||

| (7) | Size | −0.24 | −0.19 | −0.10 | 0.26 | 0.21 | 0.32 | 1.00 | |||||||

| (8) | Roa | 0.40 | −0.06 | −0.17 | −0.12 | −0.11 | −0.14 | −0.23 | 1.00 | ||||||

| (9) | Leverage | 0.80 | 0.08 | −0.04 | −0.14 | −0.12 | −0.19 | −0.08 | 0.25 | 1.00 | |||||

| (10) | Pnexec | −0.07 | −0.16 | −0.14 | 0.13 | 0.01 | 0.20 | 0.43 | 0.19 | −0.10 | 1.00 | ||||

| (11) | BDSize | −0.15 | 0.02 | −0.05 | 0.06 | 0.16 | 0.24 | 0.36 | 0.02 | −0.23 | 0.43 | 1.00 | |||

| Pearson’s correlation (categorical variables) | |||||||||||||||

| (12) | Complex | −0.04 | −0.12 | −0.25 | 0.19 | −0.02 | −0.01 | 0.71 | 0.11 | −0.11 | 0.13 | 0.13 | 1.00 | ||

| (13) | Extfin | 0.02 | −0.14 | 0.05 | 0.23 | −0.01 | 0.18 | 0.59 | 0.05 | −0.02 | 0.03 | −0.04 | 0.65 | 1.00 | |

| (14) | Industry | 0.24 | −0.40 | 0.08 | −0.09 | −0.06 | −0.09 | −0.34 | 0.12 | 0.19 | −0.19 | −0.28 | −0.15 | 0.10 | 1.00 |

| Description | Dependent Variable: Tobin’s Q | ||||

|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| Constant | 5718.75 ** | −118.90 | 3.92 | −131.78 | −1686.34 |

| Tone: | |||||

| Activity | −108.10 †† | ||||

| Optimism | 11.81 | ||||

| Certainty | 9.26 | ||||

| Realism | 18.02 | ||||

| Commonality | 43.01 | ||||

| Complex | 31.05 | 54.44 | 56.02 | 55.24 | 64.35 |

| Extfin | −22.99 | −20.57 | −22.55 | −37.20 | −41.42 |

| Size | −38.28 | −30.47 | −35.03 | −29.66 | −31.13 |

| Roa | 328.62 | 401.88 | 401.02 | 399.57 | 409.88 |

| Leverage | 12.87 *** | 12.21 *** | 12.43 *** | 12.22 *** | 12.33 *** |

| Pnexec | −0.09 | 0.37 | 0.27 | 0.54 | 0.25 |

| BDSize | 6.39 | 4.84 | 5.24 | 4.08 | 4.24 |

| Industry | 22.05 | 86.35 | 81.30 | 121.45 | 118.59 |

| Model Adjustment: | |||||

| R2 | 0.76 | 0.72 | 0.73 | 0.73 | 0.73 |

| R2 Adjusted | 0.67 | 0.61 | 0.62 | 0.63 | 0.63 |

| Statistic F | 8.36 *** | 6.83 *** | 7.09 *** | 7.30 *** | 7.17 *** |

| Durbin-Watson | 2.07 | 2.38 | 2.23 | 2.39 | 2.31 |

| VIF | <3.9 | <3.8 | <3.9 | <3.8 | <3.8 |

| Description | Dependent Variable: Tobin’s Q | ||||

|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| Constant | 936.99 | 264.63 | 126.78 | −59.65 | −513.13 |

| Tone: | |||||

| Activity | −10.13 | ||||

| Optimism | 3.67 | ||||

| Certainty | 5.53 | ||||

| Realism | 16.94 | ||||

| Commonality | 19.50 | ||||

| Complex | 44.29 | 49.17 | 55.04 | 67.53 | 58.46 |

| Extfin | −15.36 | −19.53 | −27.26 | −47.05 | −37.87 |

| Size | −29.60 | −29.30 | −31.40 | −33.52 | −31.73 |

| Roa | 391.32 | 399.68 | 397.26 | 345.95 | 391.82 |

| Leverage | 12.15 *** | 12.19 *** | 12.75 *** | 12.30 *** | 12.33 *** |

| Pnexec | 0.29 | 0.32 | 0.59 | 0.84 | 0.31 |

| BDSize | 4.88 | 4.95 | 4.37 | 4.29 | 4.67 |

| Industry | 82.22 | 88.56 | 94.38 | 125.73 | 115.22 |

| Model Adjustment: | |||||

| R2 | 0.72 | 0.72 | 0.73 | 0.74 | 0.73 |

| R2 Adjusted | 0.61 | 0.61 | 0.63 | 0.64 | 0.62 |

| Statistic F | 6.81 *** | 6.82 *** | 7.19 *** | 7.47 *** | 7.10 *** |

| Durbin-Watson | 2.34 | 2.37 | 2.32 | 2.40 | 2.39 |

| VIF | <3.8 | <3.8 | <3.8 | <3.8 | <3.8 |

| Description | Dependent Variable: Tobin’s Q | ||||

|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| Constant | 2815.63 *** | −552.32 | 406.38 | 204.51 | −1018.73 |

| Tone: | |||||

| Activity | −48.72 ††† | ||||

| Optimism | 20.42 | ||||

| Certainty | 1.03 | ||||

| Realism | 7.26 | ||||

| Commonality | 29.25 | ||||

| Complex | 37.44 | 58.28 | 46.33 | 46.42 | 53.37 |

| Extfin | −43.52 | −23.11 | −16.79 | −23.51 | −22.01 |

| Size | −34.32 | −30.61 | −30.16 | −28.34 | −29.21 |

| Roa | 352.20 | 402.91 | 399.51 | 416.32 | 417.74 |

| Leverage | 12.93 *** | 12.18 ** | 12.09 *** | 12.12 *** | 12.18 *** |

| Pnexec | −0.10 | 0.37 | 0.25 | 0.32 | 0.19 |

| BDSize | 6.87 | 4.66 | 5.09 | 4.42 | 5.33 |

| Industry | 52.88 | 102.66 | 84.87 | 97.15 | 97.95 |

| Model Adjustment: | |||||

| R2 | 0.75 | 0.72 | 0.72 | 0.72 | 0.72 |

| R2 Adjusted | 0.66 | 0.61 | 0.61 | 0.62 | 0.62 |

| Statistic F | 8.20 *** | 6.85 *** | 6.81 *** | 6.86 *** | 6.95 *** |

| Durbin-Watson | 2.09 | 2.40 | 2.32 | 2.35 | 2.22 |

| VIF | <3.8 | <3.8 | <3.8 | <3.8 | <3.8 |

| Description | Dependent Variable: Tobin’s Q | ||||

|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

| Constant | −110.92 | 2257.65 | −77.74 | −486.11 | −1076.66 |

| Tone: | |||||

| Activity | −1.79 | ||||

| Optimism | −56.70 | ||||

| Certainty | −4.45 | ||||

| Realism | 11.85 | ||||

| Commonality | 18.15 | ||||

| Complex | 35.05 | −10.68 | 19.97 | 42.10 | 43.50 |

| Extfin | −78.98 | −84.98 | −86.00 | −78.35 | −83.80 |

| Size | 23.34 | 45.20 | 34.23 | 13.71 | 21.36 |

| Roa | −1321.84 | −1336.92 * | −1330.40 * | −1159.58 | −1311.97 |

| Leverage | 10.11 *** | 9.09 *** | 9.76 ** | 10.42 *** | 10.15 *** |

| Pnexec | −0.03 | −0.71 | −0.25 | 0.42 | 0.14 |

| BDSize | 4.50 | 4.99 | 4.85 | 3.86 | 3.33 |

| Industry | 207.87 | 327.09 ** | 218.10 * | 230.25 ** | 215.40 * |

| Model Adjustment: | |||||

| R2 | 0.90 | 0.93 | 0.91 | 0.91 | 0.91 |

| R2 Adjusted | 0.81 | 0.85 | 0.82 | 0.83 | 0.81 |

| Statistic F | 9.35 *** | 12.34 *** | 9.84 *** | 10.56 *** | 9.60 *** |

| Durbin-Watson | 2.02 | 2.04 | 2.01 | 1.98 | 2.04 |

| VIF | <7.8 | <7.8 | <7.9 | <7.5 | <7.17 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oliveira, M.G.d.; Azevedo, G.; Oliveira, J. The Relationship between the Company’s Value and the Tone of the Risk-Related Narratives: The Case of Portugal. Economies 2021, 9, 70. https://doi.org/10.3390/economies9020070

Oliveira MGd, Azevedo G, Oliveira J. The Relationship between the Company’s Value and the Tone of the Risk-Related Narratives: The Case of Portugal. Economies. 2021; 9(2):70. https://doi.org/10.3390/economies9020070

Chicago/Turabian StyleOliveira, Michele Gendelsky de, Graça Azevedo, and Jonas Oliveira. 2021. "The Relationship between the Company’s Value and the Tone of the Risk-Related Narratives: The Case of Portugal" Economies 9, no. 2: 70. https://doi.org/10.3390/economies9020070

APA StyleOliveira, M. G. d., Azevedo, G., & Oliveira, J. (2021). The Relationship between the Company’s Value and the Tone of the Risk-Related Narratives: The Case of Portugal. Economies, 9(2), 70. https://doi.org/10.3390/economies9020070