Determining the Household Consumption Expenditure’s Resilience towards Petrol Price, Disposable Income and Exchange Rate Volatilities

Abstract

1. Introduction

2. Review of Literature

2.1. Consumption and Expenditure Theories

2.2. Empirical Evidence on the Linkage between Petrol Price, Disposable Income, Exchange Rate and Consumption Expenditure

3. Data, Methodological Approach and Model Specification

3.1. Description of Data

- : is the natural logarithm of total household expenditure

- : is the natural logarithm of total petrol price

- : is the natural logarithm of the exchange rate

- : is the natural logarithm of disposable income for a household

- : is intercept (constant) term

- , and : are coefficients of independent variables

- : is the stochastic error term

- t: is the period.

3.1.1. Approaches

- Descriptive statistics and correlation

- Correlation

- Stationarity and unit root test

- = the first difference of that is −

- = coefficient of

- is a component of a deterministic trend

- is a I(0) with zero mean

3.1.2. ARDL Model Specification

4. Empirical Findings and Discussion

4.1. Descriptive Statistics and Correlation Analysis

4.2. Unit Root Test

4.3. Pairwise Correlation

4.4. Assessment of the Long-Run Relationship

4.5. Analysis of the Short-Run Dynamisms

4.6. Analysis of the Causal Relationship

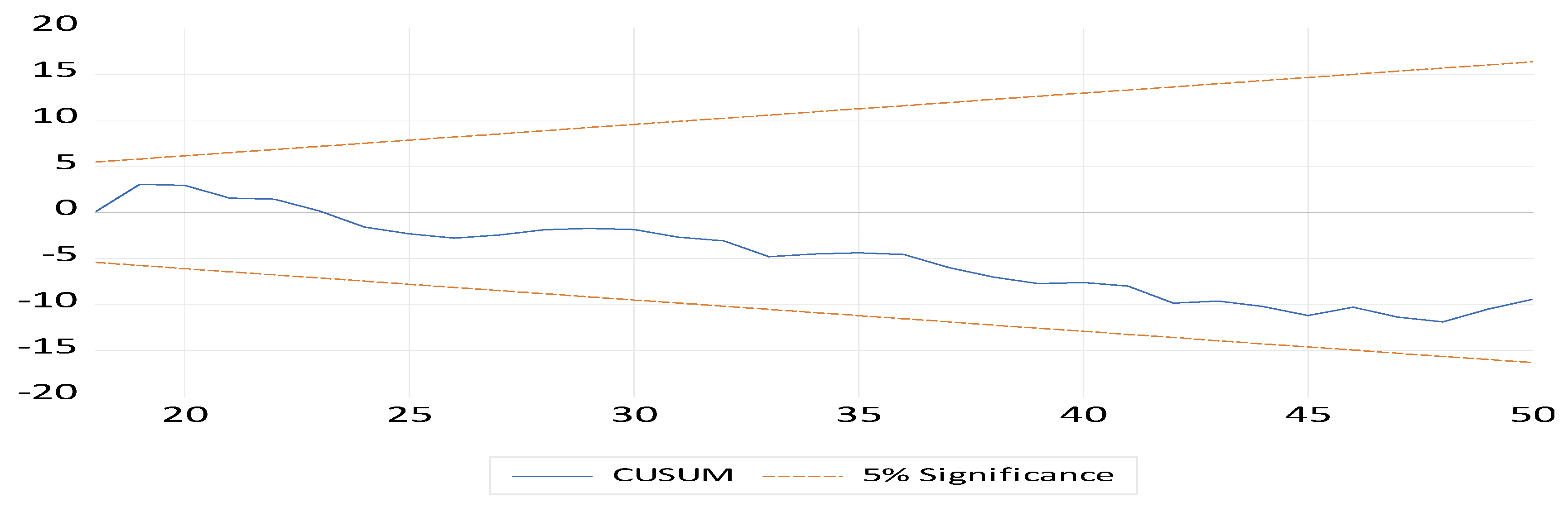

4.7. Diagnostic Tests Results

5. Empirical Significance of the Study and Managerial Implication

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ahuja, Hall. 2013. Modern Economics, 17th ed. New Delhi: Chand Higher Academic. [Google Scholar]

- Algaeed, Abdulaziz Hamad. 2017. The effects of asymmetric oil price shocks on Saudi consumption expenditure: An empirical investigation. International Journal of Energy Economics and Policy 7: 99–107. [Google Scholar]

- Alimi, R. Santos. 2013. Keynes’ Absolute Income Hypothesis and Kuznets Paradox. MPRA Paper No. 49310. Available online: https://mpra.ub.uni-muenchen.de/49310/1/MPRA_paper_49310.pdf (accessed on 25 July 2020).

- Alkhateeb, Tarek Tawfik Yousef, Haider Mahmood, Zafar Ahmad Sultan, and Nawaz Ahmad. 2017. Oil price and employment nexus in Saudi Arabia. International Journal of Energy Economics and Policy 7: 277–81. [Google Scholar]

- Ambrose, Jillian. 2020. Oil Prices Dip below Zero as Producers Forced to Pay to Dispose of Excess. Available online: https://www.theguardian.com/world/2020/apr/20/oil-prices-sink-to-20-year-low-as-un-sounds-alarm-on-to-covid-19-relief-fund (accessed on 30 June 2020).

- Aucott, Michael, and Charles Hall. 2014. Does a Change in Price of Fuel Affect GDP Growth? An Examination of the U.S. Data from 1950–2013. Energies 7: 6558–70. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, Mohsen, Kutan Ali, and Xi Dan. 2015. Does the exchange rate volatility hurt domestic consumption expenditure? Evidence from emerging economies. International Economics 144: 53–65. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Reneé van Eyden, Josine Uwilingiye, and Rangan Gupta. 2017. The impact of oil price on South African GDP growth: A Bayesian Markov switching-var analysis. African Development Review 29: 319–36. [Google Scholar] [CrossRef]

- Basawa, Ishwar V. 2014. Statistical Inferences for Stochastic Processes: Theory and Methods. New York: Academic Press. [Google Scholar]

- Benigno, Gianluca, and Christoph Thoenissen. 2008. Consumption and real exchange rates with incomplete markets and non-traded goods. Journal of International Money and Finance 27: 926–48. [Google Scholar] [CrossRef]

- Choi, Woon Gyu, and Michael B. Devereux. 2006. Asymmetric effects of government spending: Does the level of real interest rates matter? IMF Staff Papers 53: 147–81. [Google Scholar] [CrossRef]

- Corsetti, Giancarlo, Luca Dedola, and Sylvain Leduc. 2008. International risk-sharing and the transmission of productivity shocks. The Review of Economic Studies 75: 443–73. [Google Scholar] [CrossRef]

- Deaton, Angus. 2005. Franco Modigliani and the life-cycle theory of consumption expenditure. BNL Quarterly Review LVIII: 233–34. [Google Scholar]

- Devereux, Michael B., Gregor W. Smith, and James Yetman. 2012. Consumption expenditure and real exchange rates in professional forecasts. Journal of International Economics 86: 33–42. [Google Scholar] [CrossRef]

- Diacon, Paula-Elena, and Liviu-George Maha. 2015. The relationship between income, consumption expenditure and GDP: A time series, cross-country analysis. Procedia Economics and Finance 23: 1535–43. [Google Scholar] [CrossRef]

- Duesenberry, James S. 1949. Income, Saving and the Theory of Consumer Behavior. Cambridge: Harvard University Press. [Google Scholar]

- Enders, Walter. 2010. Applied Econometric Time Series. Hoboken: John Wiley & Sons. [Google Scholar]

- Ezeji, Chigbu E., and Emmanuel I. Ajudua. 2015. Determinants of Aggregate Consumption Expenditure Expenditure in Nigeria. Journal of Economics and Sustainable Development 6: 164–68. [Google Scholar]

- Friedman, Milton. 1957. A Theory of the Consumption Function. New Jersey: National Bureau of Economic Research. [Google Scholar]

- Gali, Jordi. 1994. Keeping up with the Joneses: Consumption expenditure externalities, portfolio choice and asset prices. Journal of Money, Credit and Banking 26: 1–8. [Google Scholar] [CrossRef]

- Ghalayini, Latife. 2011. The interaction between oil price and economic growth. Middle Eastern Finance and Economics 13: 127–41. [Google Scholar]

- Granger, Clive W. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society 37: 424–38. [Google Scholar] [CrossRef]

- Heim, John J. 2010. Does Declining Rates Help the US Economy? Available online: http://www.aabri.com/manuscripts/09250.pdf (accessed on 15 July 2020).

- Imam, Akeyede, Danjuma Habiba, and Bature Tajudeen Atanda. 2016. On Consistency of Tests for Stationarity in Autoregressive and Moving Average Models of Different Orders. American Journal of Theoretical and Applied Statistics 5: 146–53. [Google Scholar] [CrossRef]

- Jhingan, M. L. 2002. Macroeconomic Theory, 10th ed. Delhi: Varinda Publications. [Google Scholar]

- Keho, Yaya. 2019. An Econometric Analysis of the Determinants of Private Consumption in Cote d’Ivoire. Theoretical Economics Letters 9: 947–58. [Google Scholar] [CrossRef]

- Keynes, John M. 1936. The General Theory of Employment, Interest and Money. New York: Harcourt, Brace. [Google Scholar]

- Kinni, Kpodar. 2006. Distributional Effects of Oil Price Changes on Household Expenditures: Evidence from Mali. Working Papper No.60/91. Available online: https://ideas.repec.org/p/imf/imfwpa/2006-091.html (accessed on 17 May 2021).

- Kisswani, Amjad M., and Khalid M. Kisswani. 2019. Modelling the employment–oil price nexus: A nonlinear cointegration analysis for the U.S. market. The Journal of InternationalTrade & Economic Development 28: 902–18. [Google Scholar]

- Laurenceson, James, and Joseph C. H. Chai. 2003. Financial Reform and Economic Development in China. Cheltenham: Edward Elgar Publishing Ltd. [Google Scholar]

- Lira, Peter Sekantsi. 2016. Determinants of Real Private Consumption Expenditure in Lesotho. Journal of Corporate Governance, Insurance, and Risk Management (JCGIRM) 3: 58–75. [Google Scholar]

- Macrotrends. 2020. Brent Crude Oil Prices. Available online: https://www.macrotrends.net/2480/brent-crude-oil-prices-10-year-daily-chart (accessed on 21 December 2020).

- Maddala, Gangadharrao S., and In-Moo Kim. 2003. Unit Roots, Cointegration, and Structural Change. Cambridge: Cambridge University Press. [Google Scholar]

- Mavrotas, George, and Roger Kelly. 2001. Old wine in new bottles: Testing causality between savings and growth. The Manchester School 69: 97–105. [Google Scholar] [CrossRef]

- Mukhtar, Shuaibu, Shafiu Abdullahi, and Ibrahim Murtala. 2020. Do Energy Consumption, Interest Rate and Import Affect Household Consumption in Nigeria: What the Empirical Evidence says? Lapai Journal of Economics 4: 1–10. [Google Scholar]

- Muzindutsi, Paul-Francois, and Mjeso Thandiwe. 2018. Analysis of South African household consumption expenditure expenditure and its determinants: Application of the ARDL Model. EuroEconomica 37: 169–79. [Google Scholar]

- Ncanywa, Thobeka, and Nosipho Mgwangqa. 2018. The impact of a fuel levy on economic growth in South Africa. Journal of Energy in Southern Africa 29: 41–49. [Google Scholar] [CrossRef]

- Negi, Pushpa. 2015. Impact of oil price on economic growth: A study of BRIC nations. Indian Journal of Accounting 47: 144–55. [Google Scholar]

- Nkomo, Joshua C. 2006. The impact of higher oil prices on Southern African countries. Journal of Energy in Southern Africa 17: 10–17. [Google Scholar] [CrossRef]

- Nkoro, Emeka, and Aham Kelvin Uko. 2016. Autoregressive Distributed Lag (ARDL) cointegration technique: Application and interpretation. Journal of Statistical and Econometric Methods 5: 63–91. [Google Scholar]

- Ochechuku, O. 1998. An examination of the Keynesian consumption function in Nigeria, 1971–1994. Rivers Journal of Social Sciences 11: 34–42. [Google Scholar]

- Ohale, Lawrene, and Joseph Onyama. 2002. Foundations of Macroeconomics. Owerri Imo State: Springfield Publishers. [Google Scholar]

- Opazo, Luis A. 2006. The Backus-Smith puzzle: The role of expectations. Documentos de Trabajo (Banco Central de Chile) 395: 1–42. [Google Scholar]

- Ozturk, Ilhan, and Ali Acaravci. 2010. The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary and Romania: Evidence from ARDL bound testing approach. Applied Energy 87: 1938–43. [Google Scholar] [CrossRef]

- Patel, Deeviya, and Gisele Mah. 2018. Relationship between real exchange rate and economic growth: The case of South Africa. Journal of Economics and Behavioral Studies 10: 146–58. [Google Scholar] [CrossRef]

- Pesaran, Hashem M., Yongcheol Shin, and Richard Smith J. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Plonsky, Luke. 2015. Advancing Quantitative Methods in Second Language Research. London: Routledge. [Google Scholar]

- Popp, Jozsef, Zoltan Lakner, Monika Harangi-Rakos, and Miklos Fari. 2014. The effect of bioenergy expansion: Food, energy, and environment. Renewable and Sustainable Energy Reviews 32: 559–78. [Google Scholar] [CrossRef]

- Rangasamy, Logan. 2017. The impact of petrol price movements on South African inflation. Journal of Energy in Southern Africa 28: 120–32. [Google Scholar] [CrossRef]

- Sedgwick, Philip. 2012. Pearson’s correlation coefficient. British Medical Journal 345: 1–2. [Google Scholar] [CrossRef]

- Senzangakhona, Phakama, and Ireen Choga. 2015. Crude oil prices and unemployment in South Africa: 1990–2010. Mediterranean Journal of Social Sciences 6: 407–14. [Google Scholar] [CrossRef][Green Version]

- Shrestha, Min B., and Guna R. Bhatta. 2018. Selecting an appropriate methodological framework for time series data analysis. The Journal of Finance and Data Science 4: 71–89. [Google Scholar] [CrossRef]

- Sköld, Emil. 2020. The Relationship between Unemployment and Oil Price, Oil Price Uncertainty, and Interest Rates in Small Open Economies: A study on Sweden, Norway, Denmark, and Finland. Master’s thesis, Jönköping University International Business School, Jönköping, Sweden. [Google Scholar]

- Supriya, Guru. 2015. Three Important Theories of Consumption Expenditure. Available online: http://www.yourarticlelibrary.com/economics/consumptionexpenditure-function/3-important-theories-of-consumptionexpenditure-withdiagram/37756/ (accessed on 6 June 2020).

- Toda, Hiro Y., and Taku Yamamoto. 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66: 225–50. [Google Scholar] [CrossRef]

- Valadkhani, Abbas, and William F. Mitchell. 2002. Assessing the impact of changes in petroleum prices on inflation and household expenditures in Australia. Australian Economic Review 35: 122–32. [Google Scholar] [CrossRef]

- Wang, Yu Shan. 2013. Oil price effects on personal consumption expenditure expenditures. Energy Economics 36: 198–204. [Google Scholar] [CrossRef]

| Descriptive Statistics | ||||

|---|---|---|---|---|

| Variable | Mean | Standard Deviation | Skewness | J-B |

| LHEX | 14.395 | 0.075 | −0.505 | 4.312 |

| LEXR | 4.575 | 0.113 | 0.127 | 0.478 |

| LINC | 14.582 | 0.263 | −0.208 | 3.542 |

| LPPR | 7.0297 | 0.241 | −0.630 | 4.137 |

| Variables | Model | Levels | 1st Difference | ||||

|---|---|---|---|---|---|---|---|

| ADF | PP | KPSS | ADF | PP | KPSS | ||

| HEX | Constant | 0.880 | 0.860 | 0.886 | 0.010 * | 0.011 * | 0.097 * |

| Constant and trend | 0.929 | 0.651 | 0.143 * | 0.048 * | 0.049 * | - | |

| EXR | Constant | 0.430 | 0.386 | 0.271 ** | 0.000 ** | 0.000 ** | - |

| Constant and trend | 0.518 | 0.476 | 0.099 * | 0.000 ** | 0.000 ** | - | |

| INC | Constant | 0.913 | 0.915 | 0.936 | 0.002 ** | 0.000 ** | 0.159 * |

| Constant and trend | 0.825 | 0.825 | 0.128* | 0.012 * | 0.000 ** | - | |

| PPR | Constant | 0.366 | 0.407 | 0.802 | 0.000 ** | 0.000 ** | 0.162 * |

| Constant and trend | 0.239 | 0.232 | 0.107 * | 0.000 ** | 0.000 ** | - | |

| VARIABLES | LHEX | LEXR | LINC | LPPR |

|---|---|---|---|---|

| LHEX | 1.000 | |||

| LEXR | −0.394 ** | 1.000 | ||

| LINC | 0.762 *** | −0.360 *** | 1.000 | |

| LPPR | 0.673 *** | −0.387 ** | 0.830 | 1.000 |

| F-Bounds Test | Null Hypothesis: No Levels Relationship | |||

|---|---|---|---|---|

| Test Statistic | Value | Sign in. | I(0) | I(1) |

| F-statistic | 10.04703 | 10% | 2.37 | 3.2 |

| k | 3 | 5% | 2.79 | 3.67 |

| 1% | 3.65 | 4.66 | ||

| Variable | Coefficient | Standard Error | t-Statistic | Probability |

|---|---|---|---|---|

| D(LHEX(−1)) | 0.266140 | 0.084986 | 3.131576 | 0.0036 |

| D(LHEX(−2)) | 0.314134 | 0.094211 | 3.334363 | 0.0021 |

| D(LEXR) | −0.001543 | 0.007802 | −0.197748 | 0.8445 |

| D(LINC) | 0.510629 | 0.054263 | 9.410262 | 0.0000 |

| D(LPPR) | 0.003545 | 0.005567 | 0.636738 | 0.5287 |

| ECT | −0.323699 | 0.043131 | −7.504951 | 0.0000 |

| Excluded Lags | Dependent Variable | Explanatory Combined | |||

|---|---|---|---|---|---|

| LHEX | LEXR | LINC | LPPR | ||

| LHEX | - | 1.397365 | 4.600898 | 11.58947 | 21.65490 |

| - | (0.2372) | (0.0312) | (0.0007) | (0.0001) | |

| LEXR | 20.18872 | - | 2.595125 | 0.774053 | 13.41009 |

| (0.0000) | - | (0.1072) | (0.3790) | (0.0038) | |

| LINC | 5.047126 | 3.706724 | - | 3.800898 | 6.799751 |

| (0.0247) | (0.0542) | - | (0.0512) | (0.0786) | |

| LPPR | 0.162441 | 2.709002 | 1.073403 | - | 17.30356 |

| (0.6869) | (0.0998) | (0.3002) | - | (0.0006) | |

| Test | Null Hypothesis | P or F-Value | Decision |

|---|---|---|---|

| Jarque-Bera (JB) | Residual is multivariate normal | 0.4452 | H0 Not rejected |

| LM Test | No serial correlation | 0.3869 | H0 Not rejected |

| White | No heteroscedasticity | 0.4064 | H0 Not rejected |

| Ramsey RESET Test | The model is properly specified | 0.3517 | H0 Not rejected |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Habanabakize, T. Determining the Household Consumption Expenditure’s Resilience towards Petrol Price, Disposable Income and Exchange Rate Volatilities. Economies 2021, 9, 87. https://doi.org/10.3390/economies9020087

Habanabakize T. Determining the Household Consumption Expenditure’s Resilience towards Petrol Price, Disposable Income and Exchange Rate Volatilities. Economies. 2021; 9(2):87. https://doi.org/10.3390/economies9020087

Chicago/Turabian StyleHabanabakize, Thomas. 2021. "Determining the Household Consumption Expenditure’s Resilience towards Petrol Price, Disposable Income and Exchange Rate Volatilities" Economies 9, no. 2: 87. https://doi.org/10.3390/economies9020087

APA StyleHabanabakize, T. (2021). Determining the Household Consumption Expenditure’s Resilience towards Petrol Price, Disposable Income and Exchange Rate Volatilities. Economies, 9(2), 87. https://doi.org/10.3390/economies9020087