The Characteristics of Regional Value Chains in the Sector of Chemicals and Pharmaceutical Products in the EU

Abstract

:1. Introduction

2. Theoretical Background and Literature Review

2.1. COVID-19 Pandemic and International Trade

2.2. Internationalization/Regionalization of Production Process of Chemicals and Pharmaceutical Products

2.3. Regionalization of Value Chains in the EU

3. Research—Data and Methodology

- DVA in direct final goods exports (VAX1): ;

- DVA in intermediates exports absorbed by direct importers (VAX2); ;

- DVA in intermediates re-exported to third countries (VAX3): ;

- Intermediates that return via final imports (DVA4): ;

- Intermediates that return via intermediate imports (DVA5): ;

- Double-counted intermediate exports produced at home (DVA 6): .

4. Results of Empirical Research

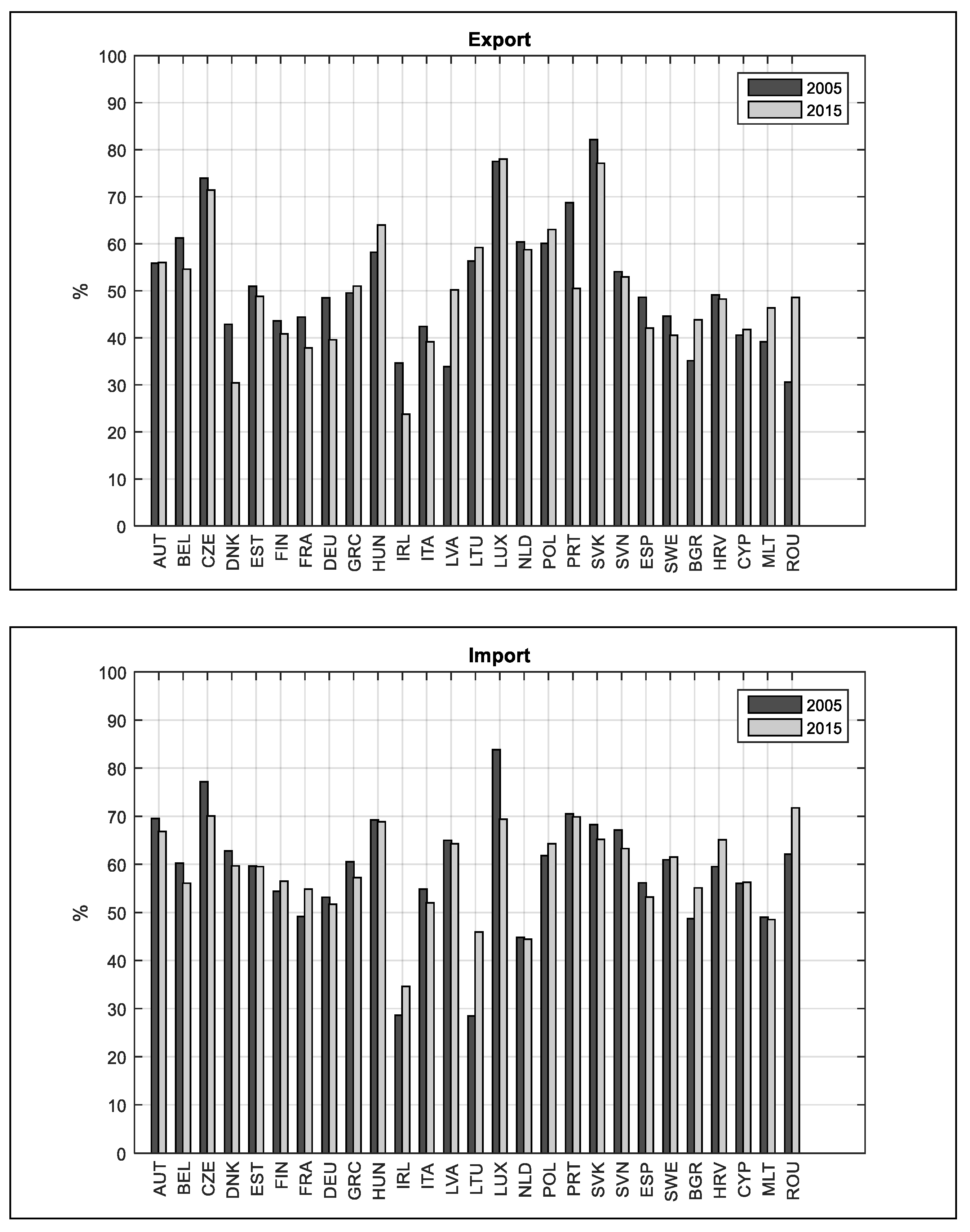

4.1. Characteristics of Regional and Global Value Chains for EU Member States

4.2. Characteristics of Global Value Chains in the EU Competition

5. Discussion and Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Source of Value-Added (Chemicals and Pharmaceutical Products Sector) | ||||||||||||||||

| AUT | BEL | CZE | DNK | EST | FIN | FRA | DEU | GRC | HUN | IRL | ITA | LVA | LTU | LUX | ||

| Destination of value-added (All sectors) | AUT | 66.12 | 0.45 | 1.59 | 0.32 | 0.88 | 0.50 | 0.50 | 1.31 | 0.40 | 3.53 | 0.46 | 0.79 | 0.61 | 0.45 | 0.54 |

| BEL | 1.31 | 67.21 | 1.19 | 1.05 | 1.86 | 1.21 | 2.51 | 2.12 | 1.03 | 1.65 | 3.41 | 1.97 | 0.72 | 1.81 | 5.70 | |

| CZE | 1.03 | 0.40 | 69.74 | 0.24 | 0.83 | 0.23 | 0.27 | 0.70 | 0.17 | 1.92 | 0.36 | 0.29 | 0.44 | 0.67 | 0.29 | |

| DNK | 0.33 | 0.47 | 0.30 | 81.38 | 1.37 | 1.52 | 0.35 | 0.49 | 0.25 | 0.57 | 0.80 | 0.27 | 1.09 | 1.16 | 0.35 | |

| EST | 0.03 | 0.03 | 0.02 | 0.08 | 50.31 | 0.45 | 0.02 | 0.03 | 0.01 | 0.03 | 0.03 | 0.01 | 2.11 | 0.89 | 0.02 | |

| FIN | 0.25 | 0.35 | 0.20 | 0.41 | 6.28 | 77.36 | 0.23 | 0.33 | 0.11 | 0.26 | 0.81 | 0.15 | 1.67 | 1.20 | 0.26 | |

| FRA | 2.67 | 6.38 | 2.62 | 1.64 | 2.90 | 2.15 | 76.82 | 3.65 | 2.17 | 3.75 | 9.79 | 4.10 | 1.42 | 2.28 | 7.30 | |

| DEU | 16.21 | 7.68 | 11.62 | 5.84 | 10.65 | 6.09 | 7.35 | 79.22 | 4.13 | 11.80 | 9.55 | 5.68 | 4.80 | 5.43 | 14.66 | |

| GRC | 0.12 | 0.10 | 0.09 | 0.20 | 0.18 | 0.06 | 0.10 | 0.11 | 82.92 | 0.11 | 0.09 | 0.23 | 0.10 | 0.36 | 0.09 | |

| HUN | 0.84 | 0.20 | 0.62 | 0.16 | 0.51 | 0.13 | 0.20 | 0.32 | 0.18 | 59.80 | 0.24 | 0.28 | 0.25 | 0.31 | 0.22 | |

| IRL | 0.53 | 2.54 | 0.49 | 0.74 | 0.57 | 0.56 | 1.14 | 0.98 | 0.47 | 0.92 | 54.67 | 1.17 | 0.44 | 0.45 | 1.62 | |

| ITA | 2.53 | 1.70 | 2.12 | 0.92 | 2.20 | 0.99 | 2.60 | 2.13 | 2.87 | 3.01 | 3.73 | 78.70 | 1.29 | 1.76 | 2.38 | |

| LVA | 0.03 | 0.03 | 0.03 | 0.09 | 2.16 | 0.08 | 0.02 | 0.02 | 0.01 | 0.03 | 0.03 | 0.01 | 71.38 | 1.38 | 0.03 | |

| LTU | 0.11 | 0.12 | 0.17 | 0.19 | 4.51 | 0.15 | 0.13 | 0.11 | 0.03 | 0.19 | 0.08 | 0.05 | 5.31 | 70.47 | 0.06 | |

| LUX | 0.34 | 1.17 | 0.20 | 0.19 | 0.37 | 0.19 | 0.41 | 0.48 | 0.18 | 0.31 | 5.96 | 0.59 | 0.21 | 0.18 | 60.56 | |

| NLD | 2.14 | 6.93 | 1.73 | 1.74 | 2.80 | 2.51 | 2.38 | 3.58 | 1.20 | 2.92 | 5.33 | 1.83 | 1.22 | 1.73 | 2.19 | |

| POL | 1.50 | 0.91 | 3.07 | 0.91 | 4.59 | 0.95 | 0.76 | 1.54 | 0.51 | 2.80 | 1.02 | 0.65 | 4.28 | 6.08 | 0.92 | |

| PRT | 0.11 | 0.26 | 0.11 | 0.09 | 0.14 | 0.12 | 0.30 | 0.18 | 0.13 | 0.14 | 0.28 | 0.14 | 0.09 | 0.13 | 0.12 | |

| SVK | 0.74 | 0.14 | 2.04 | 0.08 | 0.27 | 0.10 | 0.14 | 0.27 | 0.10 | 2.19 | 0.07 | 0.16 | 0.22 | 0.25 | 0.15 | |

| SVN | 0.44 | 0.05 | 0.14 | 0.03 | 0.15 | 0.03 | 0.06 | 0.10 | 0.06 | 0.54 | 0.05 | 0.15 | 0.08 | 0.09 | 0.08 | |

| ESP | 1.02 | 1.68 | 0.97 | 0.67 | 1.21 | 0.66 | 2.63 | 1.30 | 1.39 | 1.26 | 1.89 | 1.91 | 0.70 | 0.94 | 1.25 | |

| SWE | 0.80 | 0.77 | 0.53 | 2.84 | 4.56 | 3.84 | 0.77 | 0.68 | 0.34 | 0.77 | 1.00 | 0.41 | 1.23 | 1.58 | 0.92 | |

| BGR | 0.14 | 0.10 | 0.08 | 0.06 | 0.07 | 0.04 | 0.05 | 0.07 | 0.68 | 0.22 | 0.06 | 0.11 | 0.07 | 0.07 | 0.04 | |

| HRV | 0.15 | 0.03 | 0.04 | 0.02 | 0.03 | 0.02 | 0.02 | 0.03 | 0.04 | 0.14 | 0.04 | 0.08 | 0.02 | 0.02 | 0.03 | |

| CYP | 0.02 | 0.02 | 0.03 | 0.01 | 0.34 | 0.01 | 0.01 | 0.02 | 0.18 | 0.03 | 0.03 | 0.01 | 0.14 | 0.10 | 0.05 | |

| MLT | 0.03 | 0.01 | 0.01 | 0.01 | 0.01 | 0.00 | 0.01 | 0.02 | 0.02 | 0.01 | 0.04 | 0.01 | 0.01 | 0.01 | 0.02 | |

| ROU | 0.50 | 0.25 | 0.26 | 0.08 | 0.25 | 0.08 | 0.21 | 0.21 | 0.43 | 1.12 | 0.17 | 0.23 | 0.10 | 0.20 | 0.14 | |

| Total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | |

| Source: own calculation based on ICIO tables (OECD). | ||||||||||||||||

| Source of Value-Added | ||||||||||||||||

| NLD | POL | PRT | SVK | SVN | ESP | SWE | BGR | HRV | CYP | MLT | ROU | |||||

| AUT | 0.43 | 0.97 | 0.39 | 2.02 | 3.97 | 0.38 | 0.46 | 2.18 | 3.14 | 0.89 | 2.00 | 1.55 | ||||

| BEL | 3.51 | 1.41 | 1.41 | 1.10 | 1.15 | 1.24 | 1.35 | 1.74 | 0.74 | 1.16 | 2.42 | 1.06 | ||||

| CZE | 0.24 | 1.32 | 0.17 | 4.49 | 0.81 | 0.22 | 0.24 | 0.79 | 0.67 | 0.46 | 0.18 | 0.61 | ||||

| DNK | 0.62 | 0.54 | 0.26 | 0.28 | 0.38 | 0.26 | 2.40 | 0.61 | 0.33 | 0.28 | 0.31 | 0.19 | ||||

| EST | 0.03 | 0.04 | 0.02 | 0.02 | 0.03 | 0.03 | 0.12 | 0.03 | 0.01 | 0.12 | 0.07 | 0.02 | ||||

| FIN | 0.35 | 0.43 | 0.24 | 0.21 | 0.21 | 0.19 | 1.65 | 0.20 | 0.14 | 0.12 | 0.16 | 0.12 | ||||

| FRA | 3.33 | 3.05 | 4.20 | 2.45 | 2.88 | 4.67 | 2.78 | 3.59 | 1.73 | 1.72 | 3.55 | 3.17 | ||||

| DEU | 7.44 | 9.37 | 5.97 | 8.80 | 8.52 | 5.19 | 5.06 | 8.56 | 5.06 | 3.17 | 8.45 | 6.01 | ||||

| GRC | 0.06 | 0.12 | 0.13 | 0.30 | 0.54 | 0.12 | 0.08 | 4.14 | 0.18 | 8.60 | 0.27 | 0.58 | ||||

| HUN | 0.16 | 0.65 | 0.17 | 2.27 | 0.95 | 0.17 | 0.12 | 1.76 | 1.46 | 0.18 | 0.13 | 1.63 | ||||

| IRL | 0.93 | 0.83 | 0.74 | 0.47 | 0.72 | 0.76 | 0.52 | 0.70 | 0.34 | 0.68 | 1.19 | 0.52 | ||||

| ITA | 1.21 | 2.15 | 2.19 | 2.32 | 5.89 | 2.56 | 0.94 | 3.87 | 3.77 | 2.15 | 6.14 | 3.29 | ||||

| LVA | 0.02 | 0.05 | 0.02 | 0.03 | 0.04 | 0.01 | 0.07 | 0.03 | 0.01 | 0.08 | 0.04 | 0.01 | ||||

| LTU | 0.11 | 0.29 | 0.17 | 0.20 | 0.12 | 0.09 | 0.20 | 0.12 | 0.07 | 0.11 | 0.04 | 0.07 | ||||

| LUX | 0.45 | 0.25 | 0.26 | 0.25 | 0.37 | 0.32 | 0.28 | 0.39 | 0.16 | 0.99 | 5.23 | 0.16 | ||||

| NLD | 77.65 | 1.91 | 2.39 | 1.60 | 1.31 | 1.71 | 1.91 | 2.01 | 1.10 | 1.29 | 4.37 | 1.42 | ||||

| POL | 0.77 | 73.32 | 0.54 | 3.18 | 1.80 | 0.58 | 1.02 | 2.93 | 0.92 | 0.71 | 0.98 | 1.67 | ||||

| PRT | 0.30 | 0.13 | 65.40 | 0.20 | 0.12 | 1.08 | 0.11 | 0.14 | 0.07 | 0.16 | 0.16 | 0.15 | ||||

| SVK | 0.10 | 0.56 | 0.10 | 67.39 | 0.54 | 0.10 | 0.08 | 0.68 | 0.37 | 0.07 | 0.06 | 0.45 | ||||

| SVN | 0.04 | 0.18 | 0.04 | 0.21 | 65.80 | 0.04 | 0.03 | 0.50 | 2.63 | 0.08 | 0.05 | 0.15 | ||||

| ESP | 1.34 | 1.19 | 14.47 | 0.97 | 1.19 | 79.67 | 0.76 | 2.67 | 0.74 | 1.42 | 2.13 | 1.09 | ||||

| SWE | 0.68 | 0.86 | 0.48 | 0.53 | 0.52 | 0.40 | 79.61 | 0.49 | 0.31 | 0.36 | 1.39 | 0.29 | ||||

| BGR | 0.06 | 0.09 | 0.06 | 0.10 | 0.19 | 0.05 | 0.03 | 56.97 | 0.13 | 0.50 | 0.25 | 0.91 | ||||

| HRV | 0.02 | 0.04 | 0.02 | 0.08 | 1.47 | 0.02 | 0.03 | 0.25 | 75.64 | 0.03 | 0.06 | 0.10 | ||||

| CYP | 0.01 | 0.03 | 0.01 | 0.05 | 0.02 | 0.01 | 0.02 | 0.08 | 0.02 | 74.12 | 0.40 | 0.04 | ||||

| MLT | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.04 | 0.01 | 0.07 | 59.86 | 0.01 | ||||

| ROU | 0.14 | 0.23 | 0.13 | 0.45 | 0.48 | 0.13 | 0.10 | 4.52 | 0.26 | 0.47 | 0.12 | 74.73 | ||||

| Total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | ||||

| Dark grey= diagonal, DVA absorbed in home country; Light grey= shares above 2%. Source: own calculation based on ICIO tables (OECD). | ||||||||||||||||

| Export in Mil USD | VAX1 | VAX2 | VAX3 | DVA4 | DVA5 | DVA6 | FVA | Total | |

|---|---|---|---|---|---|---|---|---|---|

| AUT | 3192.35 | 34.45 | 19.06 | 9.25 | 0.42 | 0.21 | 0.27 | 36.34 | 100.00 |

| BEL | 10,380.34 | 45.85 | 20.35 | 9.44 | 0.23 | 0.25 | 0.45 | 23.42 | 100.00 |

| CZE | 1362.60 | 36.47 | 21.72 | 12.14 | 0.55 | 0.20 | 0.17 | 28.75 | 100.00 |

| DNK | 2914.15 | 71.56 | 12.51 | 6.17 | 0.22 | 0.06 | 0.04 | 9.45 | 100.00 |

| EST | 92.22 | 30.96 | 13.97 | 7.24 | 0.16 | 0.02 | 0.04 | 47.61 | 100.00 |

| FIN | 849.69 | 36.34 | 25.16 | 13.43 | 0.35 | 0.17 | 0.08 | 24.48 | 100.00 |

| FRA | 13,460.94 | 42.48 | 24.62 | 9.63 | 2.81 | 0.78 | 0.65 | 19.03 | 100.00 |

| DEU | 24,730.29 | 44.89 | 22.10 | 9.26 | 2.88 | 1.69 | 1.37 | 17.80 | 100.00 |

| GRC | 546.49 | 60.36 | 16.44 | 8.44 | 0.45 | 0.05 | 0.03 | 14.24 | 100.00 |

| HUN | 2208.15 | 46.46 | 12.75 | 6.26 | 0.16 | 0.07 | 0.18 | 34.12 | 100.00 |

| IRL | 14,610.03 | 71.89 | 16.14 | 8.54 | 0.10 | 0.03 | 0.08 | 3.21 | 100.00 |

| ITA | 7732.48 | 45.41 | 20.65 | 9.69 | 1.52 | 0.82 | 0.35 | 21.57 | 100.00 |

| LVA | 73.23 | 59.73 | 13.35 | 8.11 | 0.66 | 0.07 | 0.04 | 18.04 | 100.00 |

| LTU | 528.70 | 35.37 | 22.48 | 12.15 | 0.35 | 0.05 | 0.10 | 29.51 | 100.00 |

| LUX | 96.79 | 34.29 | 31.27 | 17.07 | 0.09 | 0.01 | 0.01 | 17.26 | 100.00 |

| NLD | 9159.11 | 37.33 | 26.71 | 13.41 | 0.51 | 0.34 | 0.60 | 21.09 | 100.00 |

| POL | 3513.19 | 40.73 | 19.08 | 9.47 | 0.88 | 0.23 | 0.26 | 29.36 | 100.00 |

| PRT | 831.99 | 27.23 | 21.24 | 9.65 | 0.60 | 0.19 | 0.16 | 40.92 | 100.00 |

| SVK | 642.17 | 33.87 | 20.74 | 11.85 | 0.60 | 0.04 | 0.15 | 32.75 | 100.00 |

| SVN | 891.50 | 59.43 | 12.24 | 6.26 | 0.08 | 0.03 | 0.05 | 21.92 | 100.00 |

| ESP | 6840.97 | 45.83 | 19.44 | 8.23 | 1.21 | 0.74 | 0.46 | 24.09 | 100.00 |

| SWE | 3005.49 | 60.39 | 18.04 | 8.68 | 0.56 | 0.14 | 0.09 | 12.09 | 100.00 |

| BGR | 414.69 | 47.07 | 10.65 | 4.69 | 0.13 | 0.03 | 0.06 | 37.36 | 100.00 |

| HRV | 155.07 | 52.94 | 14.25 | 8.89 | 0.17 | 0.08 | 0.03 | 23.65 | 100.00 |

| CYP | 66.06 | 81.75 | 5.69 | 3.19 | 0.06 | 0.01 | 0.00 | 9.30 | 100.00 |

| MLT | 64.65 | 83.81 | 6.19 | 3.09 | 0.00 | 0.00 | 0.00 | 6.91 | 100.00 |

| ROU | 361.89 | 36.59 | 19.29 | 11.22 | 1.14 | 0.19 | 0.08 | 31.50 | 100.00 |

| Sources of Value-Added (Chemicals and Pharmaceutical Products Sector) | ||||||||||||||||||

| Country | AUT | BEL | CZE | DNK | EST | FIN | FRA | DEU | GRC | HUN | IRL | ITA | LVA | LTU | LUX | |||

| Destination of value-added (All sectors) | AUT | 63.20 | 0.25 | 1.17 | 0.14 | 0.45 | 0.30 | 0.24 | 0.70 | 0.26 | 2.28 | 0.12 | 0.49 | 0.39 | 0.27 | 0.39 | ||

| BEL | 0.73 | 62.08 | 0.80 | 0.43 | 0.89 | 0.69 | 1.18 | 1.06 | 0.64 | 0.97 | 0.83 | 1.16 | 0.41 | 1.04 | 4.14 | |||

| CZE | 0.61 | 0.22 | 61.99 | 0.10 | 0.41 | 0.12 | 0.12 | 0.34 | 0.10 | 1.18 | 0.09 | 0.16 | 0.26 | 0.39 | 0.20 | |||

| DNK | 0.20 | 0.27 | 0.22 | 84.51 | 0.74 | 0.97 | 0.18 | 0.27 | 0.18 | 0.38 | 0.20 | 0.17 | 0.75 | 0.75 | 0.25 | |||

| EST | 0.02 | 0.02 | 0.02 | 0.03 | 51.43 | 0.28 | 0.01 | 0.02 | 0.01 | 0.02 | 0.01 | 0.01 | 1.38 | 0.55 | 0.02 | |||

| FIN | 0.15 | 0.19 | 0.14 | 0.17 | 3.30 | 71.78 | 0.11 | 0.17 | 0.07 | 0.16 | 0.21 | 0.09 | 0.98 | 0.69 | 0.19 | |||

| FRA | 1.65 | 3.60 | 1.94 | 0.70 | 1.52 | 1.33 | 75.03 | 1.96 | 1.47 | 2.43 | 2.50 | 2.56 | 0.91 | 1.42 | 5.50 | |||

| DEU | 10.46 | 4.40 | 8.62 | 2.53 | 5.72 | 3.78 | 3.69 | 75.18 | 2.79 | 7.65 | 2.41 | 3.53 | 3.10 | 3.28 | 11.18 | |||

| GRC | 0.07 | 0.06 | 0.06 | 0.07 | 0.08 | 0.03 | 0.05 | 0.06 | 75.27 | 0.06 | 0.02 | 0.11 | 0.05 | 0.20 | 0.06 | |||

| HUN | 0.53 | 0.12 | 0.47 | 0.07 | 0.27 | 0.07 | 0.10 | 0.17 | 0.12 | 57.03 | 0.06 | 0.17 | 0.16 | 0.19 | 0.16 | |||

| IRL | 0.36 | 1.84 | 0.37 | 0.39 | 0.30 | 0.33 | 0.67 | 0.62 | 0.38 | 0.58 | 65.94 | 0.85 | 0.28 | 0.30 | 1.03 | |||

| ITA | 1.52 | 0.90 | 1.51 | 0.38 | 1.12 | 0.57 | 1.24 | 1.10 | 1.88 | 1.86 | 0.92 | 69.75 | 0.81 | 1.05 | 1.71 | |||

| LVA | 0.02 | 0.01 | 0.02 | 0.04 | 1.15 | 0.04 | 0.01 | 0.01 | 0.01 | 0.02 | 0.01 | 0.01 | 67.16 | 0.85 | 0.02 | |||

| LTU | 0.06 | 0.06 | 0.11 | 0.07 | 1.79 | 0.08 | 0.05 | 0.06 | 0.02 | 0.11 | 0.02 | 0.03 | 2.75 | 54.99 | 0.04 | |||

| LUX | 0.09 | 0.30 | 0.06 | 0.03 | 0.08 | 0.05 | 0.09 | 0.11 | 0.05 | 0.10 | 0.60 | 0.13 | 0.05 | 0.04 | 49.26 | |||

| NLD | 1.11 | 3.58 | 1.09 | 0.65 | 1.26 | 1.33 | 1.01 | 1.62 | 0.68 | 1.66 | 1.30 | 0.97 | 0.68 | 0.92 | 1.40 | |||

| POL | 0.87 | 0.48 | 2.18 | 0.38 | 2.33 | 0.54 | 0.34 | 0.77 | 0.31 | 1.72 | 0.26 | 0.36 | 2.71 | 3.59 | 0.65 | |||

| PRT | 0.06 | 0.14 | 0.08 | 0.04 | 0.07 | 0.07 | 0.14 | 0.09 | 0.09 | 0.08 | 0.07 | 0.08 | 0.06 | 0.08 | 0.09 | |||

| SVK | 0.39 | 0.07 | 1.28 | 0.03 | 0.12 | 0.05 | 0.06 | 0.12 | 0.05 | 1.16 | 0.02 | 0.08 | 0.12 | 0.13 | 0.10 | |||

| SVN | 0.29 | 0.03 | 0.11 | 0.01 | 0.09 | 0.02 | 0.03 | 0.05 | 0.04 | 0.37 | 0.01 | 0.10 | 0.05 | 0.05 | 0.06 | |||

| ESP | 0.59 | 0.91 | 0.65 | 0.28 | 0.59 | 0.37 | 1.24 | 0.65 | 0.86 | 0.74 | 0.47 | 1.11 | 0.42 | 0.54 | 0.88 | |||

| SWE | 0.50 | 0.43 | 0.39 | 1.28 | 2.46 | 2.35 | 0.40 | 0.36 | 0.23 | 0.49 | 0.27 | 0.25 | 0.79 | 0.98 | 0.70 | |||

| BGR | 0.08 | 0.05 | 0.05 | 0.02 | 0.03 | 0.02 | 0.02 | 0.03 | 0.42 | 0.13 | 0.01 | 0.06 | 0.04 | 0.04 | 0.03 | |||

| HRV | 0.09 | 0.02 | 0.03 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | 0.03 | 0.09 | 0.01 | 0.05 | 0.01 | 0.01 | 0.02 | |||

| CYP | 0.01 | 0.01 | 0.02 | 0.01 | 0.19 | 0.01 | 0.01 | 0.01 | 0.12 | 0.03 | 0.01 | 0.01 | 0.09 | 0.07 | 0.03 | |||

| MLT | 0.03 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 | 0.00 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.02 | |||

| ROU | 0.31 | 0.14 | 0.19 | 0.03 | 0.12 | 0.05 | 0.10 | 0.11 | 0.28 | 0.73 | 0.04 | 0.14 | 0.06 | 0.12 | 0.10 | |||

| ROW | 16.00 | 19.80 | 16.41 | 7.59 | 23.46 | 14.75 | 13.86 | 14.33 | 13.67 | 17.97 | 23.59 | 17.59 | 15.50 | 27.47 | 21.79 | |||

| Total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | |||

| Source: own calculation based on ICIO tables (OECD). | ||||||||||||||||||

| Source of Value-Added | ||||||||||||||||||

| Country | NLD | POL | PRT | SVK | SVN | ESP | SWE | BGR | HRV | CYP | MLT | ROU | ROW | |||||

| AUT | 0.26 | 0.66 | 0.23 | 1.39 | 2.30 | 0.22 | 0.24 | 1.11 | 2.33 | 0.49 | 1.06 | 1.09 | 0.14 | |||||

| BEL | 2.08 | 0.89 | 0.81 | 0.71 | 0.58 | 0.71 | 0.67 | 0.82 | 0.48 | 0.57 | 1.18 | 0.66 | 0.25 | |||||

| CZE | 0.13 | 0.87 | 0.09 | 3.12 | 0.43 | 0.12 | 0.11 | 0.37 | 0.45 | 0.23 | 0.09 | 0.39 | 0.04 | |||||

| DNK | 0.40 | 0.39 | 0.16 | 0.21 | 0.22 | 0.17 | 1.33 | 0.34 | 0.25 | 0.17 | 0.17 | 0.13 | 0.12 | |||||

| EST | 0.02 | 0.03 | 0.01 | 0.02 | 0.02 | 0.02 | 0.06 | 0.02 | 0.01 | 0.06 | 0.03 | 0.01 | 0.01 | |||||

| FIN | 0.21 | 0.29 | 0.15 | 0.15 | 0.11 | 0.11 | 0.84 | 0.11 | 0.10 | 0.07 | 0.08 | 0.07 | 0.07 | |||||

| FRA | 2.05 | 2.13 | 2.66 | 1.72 | 1.61 | 2.99 | 1.49 | 1.85 | 1.24 | 0.94 | 1.86 | 2.21 | 0.74 | |||||

| DEU | 4.64 | 6.58 | 3.80 | 6.28 | 4.85 | 3.27 | 2.63 | 4.33 | 3.59 | 1.74 | 4.31 | 4.13 | 1.45 | |||||

| GRC | 0.04 | 0.08 | 0.08 | 0.19 | 0.28 | 0.06 | 0.04 | 1.74 | 0.11 | 4.09 | 0.13 | 0.39 | 0.04 | |||||

| HUN | 0.10 | 0.46 | 0.11 | 1.67 | 0.53 | 0.11 | 0.06 | 0.90 | 1.06 | 0.09 | 0.07 | 1.13 | 0.04 | |||||

| IRL | 0.59 | 0.66 | 0.52 | 0.37 | 0.50 | 0.54 | 0.28 | 0.42 | 0.26 | 0.34 | 0.60 | 0.42 | 0.49 | |||||

| ITA | 0.71 | 1.43 | 1.31 | 1.60 | 3.14 | 1.52 | 0.45 | 1.89 | 2.64 | 1.15 | 3.12 | 2.22 | 0.51 | |||||

| LVA | 0.01 | 0.03 | 0.01 | 0.02 | 0.02 | 0.01 | 0.04 | 0.02 | 0.01 | 0.04 | 0.02 | 0.01 | 0.01 | |||||

| LTU | 0.05 | 0.18 | 0.10 | 0.13 | 0.06 | 0.05 | 0.10 | 0.06 | 0.05 | 0.05 | 0.02 | 0.04 | 0.02 | |||||

| LUX | 0.15 | 0.08 | 0.07 | 0.08 | 0.08 | 0.08 | 0.06 | 0.07 | 0.05 | 0.19 | 0.89 | 0.04 | 0.03 | |||||

| NLD | 62.39 | 1.12 | 1.32 | 0.98 | 0.60 | 0.91 | 0.89 | 0.87 | 0.67 | 0.65 | 2.11 | 0.82 | 0.34 | |||||

| POL | 0.43 | 66.12 | 0.30 | 2.19 | 0.96 | 0.33 | 0.49 | 1.42 | 0.61 | 0.36 | 0.51 | 1.08 | 0.12 | |||||

| PRT | 0.18 | 0.08 | 61.82 | 0.14 | 0.07 | 0.65 | 0.06 | 0.07 | 0.05 | 0.09 | 0.08 | 0.10 | 0.04 | |||||

| SVK | 0.05 | 0.33 | 0.05 | 56.62 | 0.26 | 0.05 | 0.03 | 0.27 | 0.22 | 0.03 | 0.03 | 0.26 | 0.02 | |||||

| SVN | 0.02 | 0.13 | 0.02 | 0.15 | 66.98 | 0.02 | 0.02 | 0.28 | 2.02 | 0.04 | 0.02 | 0.10 | 0.02 | |||||

| ESP | 0.77 | 0.77 | 8.81 | 0.63 | 0.63 | 70.62 | 0.37 | 1.27 | 0.49 | 0.78 | 1.10 | 0.70 | 0.35 | |||||

| SWE | 0.43 | 0.60 | 0.30 | 0.38 | 0.29 | 0.24 | 79.79 | 0.24 | 0.22 | 0.20 | 0.74 | 0.19 | 0.16 | |||||

| BGR | 0.03 | 0.06 | 0.04 | 0.06 | 0.10 | 0.03 | 0.01 | 54.31 | 0.09 | 0.23 | 0.13 | 0.61 | 0.01 | |||||

| HRV | 0.01 | 0.02 | 0.01 | 0.06 | 0.85 | 0.01 | 0.02 | 0.13 | 69.13 | 0.01 | 0.03 | 0.07 | 0.01 | |||||

| CYP | 0.01 | 0.02 | 0.00 | 0.04 | 0.01 | 0.00 | 0.01 | 0.04 | 0.01 | 71.37 | 0.22 | 0.03 | 0.01 | |||||

| MLT | 0.00 | 0.01 | 0.01 | 0.00 | 0.01 | 0.00 | 0.00 | 0.02 | 0.01 | 0.04 | 55.30 | 0.00 | 0.00 | |||||

| ROU | 0.08 | 0.15 | 0.08 | 0.32 | 0.27 | 0.07 | 0.05 | 2.33 | 0.18 | 0.23 | 0.06 | 71.51 | 0.03 | |||||

| ROW | 24.16 | 15.81 | 17.14 | 20.77 | 14.23 | 17.07 | 9.85 | 24.72 | 13.71 | 15.75 | 26.03 | 11.55 | 94.95 | |||||

| Total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | |||||

| 1 | Medical goods comprise: medical equipment, medicine, medical supplies, and personal protective products, i.e., it is a wider term than just pharmaceutical products. |

| 2 | The dominant products are: medical consumables for imports originating from Switzerland, protective gear for imports from China, and diagnostic testing equipment for imports from the United States. |

| 3 | Haakonsson (2009) emphasized the importance of the World Trade Organization (WTO) establishment and especially implementation of the Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPs Agreement) for higher involvement of this industry in international value chains. He focused his research on the governance of GVCs and made an analysis on the case studies of Uganda, India, and Denmark. Three tendencies characterize the pharmaceutical GVC: branded products, quality generics, and low-value generics, and he explained the way the governance of GVC are changing over time. |

| 4 | China is a dominant global supplier of active pharmaceutical ingredients for many important medications. In 2018, it accounted for 95% of the US imports of ibuprofen, 91% of hydrocortisone, 40–45% of penicillin, and 40% of heparin (D Palmer and F Bermingham, “U.S. Policymakers Worry about China ‘Weaponizing’ Drug Exports”, Politico, https://politi.co/2QXHidx). |

| 5 | Timmer et al. (2014) employed a methodology to the WIOD database that we found not appropriate for our research due to the data limitation, i.e., time coverage was up to 2014 and also the dataset did not include all EU member states. Due to this, we chose to apply the Koopman et al. (2014) framework on the OECD TiVA database. |

References

- Antràs, P., and R. Staiger. 2012. Offshoring and the Role of Trade Agreements. American Economic Review 102: 3140–83. [Google Scholar] [CrossRef] [Green Version]

- Baldwin, R., and R. Freeman. 2020. Supply chain contagion waves: Thinking ahead on manufacturing ‘contagion and reinfection’ from the COVID concussion”. VoxEU.org, April 1. [Google Scholar]

- Bhakoo, V., and C. Chan. 2011. Collaborative implementation of e-business processes within the health-care supply chain: The Monash Pharmacy Project. Supply Chain Management: An International Journal 16: 184–93. [Google Scholar] [CrossRef]

- De Backer, K., and S. Miroudot. 2014. Mapping Global Value Chains. Working Paper Series 1677. Frankfurt: European Central Bank. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1677.pdf (accessed on 2 January 2021).

- European Commission. 2020. Foreign Direct Investment, Global Value Chains and Regional Economic Development in Europe. Available online: https://ec.europa.eu/regional_policy/sources/docgener/brochure/foreign_direct_investment_en.pdf (accessed on 2 January 2021).

- Eurostat. 2021. EU Trade in COVID-19 Related Products. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=EU_trade_in_COVID-19_related_products#Per_capita_trade_largest_in_Ireland.2C_Belgium.2C_the_Netherlands_and_Slovenia (accessed on 26 January 2021).

- Folfas, P., and B. Udvari. 2019. Chemical Industry and Value-Added Trade—A Comparative Study on Hungary and Poland. Acta Oeconomica 69: 81–99. [Google Scholar] [CrossRef] [Green Version]

- Fróes de Borja Reis, C., and J. P. Guedes Pinto. 2021. Center–periphery Relationships of Pharmaceutical Value Chains: A Critical Analysis based on Goods and Knowledge Trade Flows. Review of Political Economy, 1–22. [Google Scholar] [CrossRef]

- Gereffi, G., and K. Fernandez-Stark. 2011. Global Value Chain Analysis: A Primer. Durham: Center on Globalization, Governance & Competitiveness (CGGC) at Duke University. [Google Scholar]

- Geymond, M. 2020. The Influence of Local Institutional and Historical Frameworks on a Globalized Industry: The Case of the Pharmaceutical Industry in France and Quebec. CES Working Papers 20011. Paris: Université Panthéon-Sorbonne (Paris 1), Paris: Centre d’Economie de la Sorbonne. [Google Scholar]

- Gölgeci, I., H.E. Yildiz, and U. Andersson. 2020. The rising tensions between efficiency and resilience in global value chains in the post-COVID-19 world. Transnational Corporations 27: 127–41. [Google Scholar] [CrossRef]

- Haakonsson, S.J. 2009. The Changing Governance Structures of the Global Pharmaceutical Value Chain. Competition & Change 13: 75–95. [Google Scholar]

- Hanzl-Weiss, D., S. Leitner, R. Stehrer, and R. Stöllinger. 2018. Global and Regional Value Chains: How Important, How Different? wiiw Research Reports. Wien: Vienna Institute for International Economic Studies, Available online: https://wiiw.ac.at/global-and-regional-value-chains-how-important-how-different--dlp-4522.pdf (accessed on 23 January 2021).

- Hernández, V., and T. Pedersen. 2017. Global value chain configuration: A review and research agenda. Business Research Quarterly 20: 37–150. [Google Scholar] [CrossRef]

- Johnson, R.C., and G. Noguera. 2012. Accounting for Intermediates: Production Sharing and Trade in Value Added. Journal of International Economics 86: 224–36. [Google Scholar] [CrossRef] [Green Version]

- Kersan-Skabic, I. 2021. The COVID-19 pandemic and the internationalization of production: A review of the literature. Development Policy Review. [Google Scholar] [CrossRef]

- Klochko, O., and I. Manuylov. 2019. Canadian Pharmaceutical Industry in Global Value Chains: Influence of Dominant Trading Partner. Mirovaya ekonomika i mezhdunarodnye otnosheniya 63: 14–21. [Google Scholar] [CrossRef]

- Koopman, R., W. Powers, Z. Wang, and S.-J. Wei. 2010. Give Credit Where Credit Is Due: Tracing Value Added in Global Production Chains. NBER Working Paper, 16426. Cambridge: National Bureau of Economic Research, Available online: http://www.nber.org/papers/w16426 (accessed on 23 January 2021).

- Koopman, R., W. Zhi, and W. Shang-Jin. 2014. Tracing Value-Added and Double Counting in Gross Exports. American Economic Review 104: 459–94. [Google Scholar] [CrossRef] [Green Version]

- Los, B., M.P. Timmer, and G.J. de Vries. 2015. Global are Global Value Chains? A New Approach to Measure International Fragmentation. Journal of Regional Science 55: 66–92. [Google Scholar] [CrossRef]

- McKinsey Global Institute. 2020. Risk, Resilience, and Rebalancing in Global Value Chains. Available online: https://www.mckinsey.com/business-functions/operations/our-insights/risk-resilience-and-rebalancing-in-global-value-chains# (accessed on 10 February 2021).

- Mendoza, R.L. 2021. Continuity and change in the drug supply chain: Actors, actions, and aversions. Journal of Medical Economics 24: 689–97. [Google Scholar] [CrossRef] [PubMed]

- Miller, R.E., and P.D. Blair. 2009. Input-Output Analysis: Foundations and Extensions, 2nd ed. Cambridge: Cambridge University Press. [Google Scholar]

- OECD. 2021. Inter-Country Input-Output Tables. Available online: https://www.oecd.org/sti/ind/inter-country-input-output-tables.htm (accessed on 1 March 2021).

- Singh, R.K., R. Kumar, and P. Kumar. 2016. Strategic issues in pharmaceutical supply chains: A review. International Journal of Pharmaceutical and Healthcare Marketing 10: 234–57. [Google Scholar] [CrossRef]

- Sousa, R., S. Liu, L. Papageorgiou, and N. Shah. 2011. Global supply chain planning for pharmaceuticals. Chemical Engineering Research & Design 89: 2396–2409. [Google Scholar] [CrossRef]

- Taglioni, D., and D. Winkler. 2016. Making Global Value Chains Work for Development. Washington: The World Bank Group. [Google Scholar]

- Timmer, M.P., A.A. Erumban, B. Los, R. Stehrer, and G.J. de Vries. 2014. Slicing Up Global Value Chains. Journal of Economic Perspectives 28: 99–118. [Google Scholar] [CrossRef] [Green Version]

- UNCTAD. 2020. Trade and Development Report 2020. From Global Pandemic to Prosperity for all: Avoiding Another Lost Decade. Geneva: United Nations Conference on Trade and Development, Available online: https://unctad.org/system/files/official-document/tdr2020_en.pdf (accessed on 15 January 2021).

- UNCTAD. 2021. Key Statistics and Trends in International Trade in 2020, Trade Trends under the COVID-19 Pandemic. Geneva: United Nations Conference on Trade and Development, Available online: https://unctad.org/system/files/official-document/ditctab2020d4_en.pdf (accessed on 13 May 2021).

- Wang, Z., S.-J. Wei, X. Yu, and K. Zhu. 2016. Characterizing Global Value Chains. Working Paper 578. Cambridge: National Bureau of Economic Research, Available online: https://www.nber.org/papers/w23261 (accessed on 15 January 2021).

- WTO. 2020a. World Trade Statistical Review 2020. Geneva: WTO, Available online: https://www.wto.org/english/res_e/statis_e/wts2020_e/wts2020chapter04_e.pdf (accessed on 2 February 2021).

- WTO. 2020b. Trade in Medical Goods in the Context of Tackling COVID-19: Developments in the First Half of 2020. Geneva: WTO, Available online: http//www.wto.org (accessed on 13 January 2021).

- WTO. 2020c. Trade Shows Signs of Rebound from COVID-19, Recovery Still Uncertain. Geneva: WTO, Available online: https://www.wto.org/english/news_e/pres20_e/pr862_e.htm (accessed on 13 March 2021).

| Export (m EUR) | VAX1 | VAX2 | VAX3 | DVA4 | DVA5 | DVA6 | FVA | Total EU | |

|---|---|---|---|---|---|---|---|---|---|

| EU | 108,725.23 | 48.31 | 20.62 | 9.45 | 1.36 | 0.67 | 0.58 | 19.01 | 100.00 |

| GVC | RVC | |||

|---|---|---|---|---|

| Source Length | Destination (Selling) Length | Source Length | Destination (Selling) Length | |

| AUT | 2.45 | 2.68 | 2.80 | 2.74 |

| BEL | 2.41 | 2.55 | 2.74 | 2.69 |

| CZE | 2.47 | 2.68 | 2.51 | 2.75 |

| DNK | 1.69 | 1.79 | 2.19 | 1.77 |

| EST | 2.59 | 2.78 | 3.11 | 2.69 |

| FIN | 2.18 | 2.78 | 2.42 | 2.84 |

| FRA | 2.24 | 2.45 | 2.90 | 2.45 |

| DEU | 2.20 | 2.58 | 2.67 | 2.63 |

| GRC | 2.06 | 2.14 | 2.17 | 2.08 |

| HUN | 2.33 | 2.46 | 2.53 | 2.57 |

| IRL | 2.01 | 1.90 | 3.28 | 2.11 |

| ITA | 2.52 | 2.48 | 2.86 | 2.54 |

| LVA | 2.31 | 2.15 | 2.53 | 2.14 |

| LTU | 2.36 | 2.72 | 2.34 | 2.70 |

| LUX | 2.50 | 2.51 | 2.47 | 2.51 |

| NLD | 2.46 | 2.83 | 2.58 | 2.92 |

| POL | 2.47 | 2.67 | 2.62 | 2.73 |

| PRT | 2.54 | 2.57 | 2.90 | 2.71 |

| SVK | 2.57 | 2.80 | 2.57 | 2.91 |

| SVN | 2.17 | 2.15 | 2.53 | 2.23 |

| ESP | 2.54 | 2.66 | 2.87 | 2.79 |

| SWE | 1.90 | 2.09 | 2.33 | 2.03 |

| BGR | 2.49 | 2.33 | 2.96 | 2.32 |

| HRV | 2.30 | 2.22 | 2.39 | 2.22 |

| CYP | 2.12 | 1.66 | 2.45 | 1.64 |

| MLT | 2.41 | 1.50 | 2.71 | 1.41 |

| ROU | 2.28 | 2.68 | 2.48 | 2.68 |

| Source of VA | ||||||

|---|---|---|---|---|---|---|

| Destination of VA | Country | EU | North America | Asia | Switzerland | ROW |

| EU | 82.68 | 1.99 | 2.03 | 17.64 | 5.68 | |

| North America | 4.27 | 91.29 | 2.12 | 5.73 | 3.91 | |

| Asia | 1.99 | 1.93 | 85.01 | 1.93 | 5.65 | |

| Switzerland | 0.84 | 0.19 | 0.13 | 68.51 | 0.48 | |

| ROW | 10.22 | 4.60 | 10.71 | 6.19 | 84.29 | |

| Total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kersan-Škabić, I.; Belullo, A. The Characteristics of Regional Value Chains in the Sector of Chemicals and Pharmaceutical Products in the EU. Economies 2021, 9, 167. https://doi.org/10.3390/economies9040167

Kersan-Škabić I, Belullo A. The Characteristics of Regional Value Chains in the Sector of Chemicals and Pharmaceutical Products in the EU. Economies. 2021; 9(4):167. https://doi.org/10.3390/economies9040167

Chicago/Turabian StyleKersan-Škabić, Ines, and Alen Belullo. 2021. "The Characteristics of Regional Value Chains in the Sector of Chemicals and Pharmaceutical Products in the EU" Economies 9, no. 4: 167. https://doi.org/10.3390/economies9040167

APA StyleKersan-Škabić, I., & Belullo, A. (2021). The Characteristics of Regional Value Chains in the Sector of Chemicals and Pharmaceutical Products in the EU. Economies, 9(4), 167. https://doi.org/10.3390/economies9040167