Abstract

This research investigated the correspondence between a sample of Financial Management textbooks and professional learning expectations synthesized in the construct of Expectation of Use. To this end, a conceptual framework developed from research on professional practice was integrated with the theoretical perspective of commognition and the analysis of mathematics education textbooks. A qualitative content analysis was performed on the narrative and the end-of-chapter problems of the textbooks, which identified the experiences they can offer and their relationship with professional practice. It was evidenced that the narrative of the textbooks focuses on promoting the development of concepts, principles, and procedures of financial theory; the financial situations presented in the narrative and in the end-of-chapter problems are artificial and therefore have limited relation with professional practice. It was concluded that, according to the textbooks, the mastery of Financial Management consists of appropriating a broad set of financial concepts that excludes the use of these concepts to address problems that simulate the profession. Restructuring the narrative in Financial Management textbooks and consciously including routines that respond to the professional learning needs of the financial community is recommended.

1. Introduction

Finance studies the structuring of the necessary economic arrangements and the administration of monetary resources for the achievement of an objective of a household or public and/or private organization [1]. In higher education, finance can be the subject of study in undergraduate programs such as finance or financial engineering, a foundational component of business and accounting programs, or an elective subject in engineering and economics [2,3]. A professional can work in positions such as investment advisor, financial advisor, credit analyst, treasurer, financial manager, or financial market operator. The relevance of their decisions in society requires them to have a broad knowledge of financial theory and the ability to apply it to the financial situations of the profession [4]. Students are expected to receive an education that prepares them to participate adequately in the workplace [5,6,7,8]. In particular, the recognition of those educational needs gives meaning to the term learning expectation, which is used “to denominate, in a generic way, those capacities, competencies, knowledge, expertise, aptitudes that graduating seniors are expected to achieve, acquire, develop and use” [9] in their education and professional practice.

The international literature has extensively documented the expectations that employers, practitioners, consultants, and academics expect from finance-related graduates; in particular, emphasis is placed on their ability to solve professional problems [10,11], communicate assertively [12,13,14,15], their knowledge of the work environment [16], and their ability to relate to professionals from other areas within and outside the organization [17]. These expectations have direct repercussions in the contexts in which the professionals work; they are not framed by the needs of a region, but are of global interest [4,6,10,11,12,13,14,15,16,17,18,19,20]. In their study, Hernández-March et al. [15] and Osmani et al. [14] report that employers recognize the contribution of graduating seniors to companies, and they consider that higher education prepares people with a solid knowledge base and analytical capacity that allow a rapid assimilation of new knowledge. However, this educational process does not bring graduating seniors close enough to professional practice. The need to improve the transition of graduating seniors to professional practice and the complaint about privileging some situations suggests that the expectations of higher education are being partially met [5,6,7,8,15,16,21,22].

Research on graduated senior performance in the workplace reports that they are not able to carry out actions related to the application of theoretical knowledge [8,14,23,24], problem solving [6,11,14], evaluating a typical situation of the professional practice of finance, structuring problematic situations in realistic contexts, working with a sense of direction to execute the assigned task, and arguing the proposed solutions [20,25,26]. In this study, we will call these educational needs Expectation of Use, i.e., the ability to apply theoretical and technical knowledge to solve problems in the profession [6,15,18]. Overall, the literature reviewed highlights the relevance of understanding the educational factors associated with these needs and of inquiring about the elements that constitute the student’s experience during the class, such as the curriculum, the content presented, the teacher’s teaching strategies, the activities developed, the textbooks, and the complementary class material.

Textbooks draw special attention since they are a widely used resource in higher education [27,28] and are designed to translate the curricular intentions of a program or course into readings, examples, and activities that teachers and students can carry out [29,30,31]. Identifying the opportunities offered by textbooks provides information about the experiences that students have in their educational process [32,33,34]. In that sense, the textbook provides links between professional expectations and the classroom [29] and represents an interpretation of these in terms of concrete teaching actions [29,35,36]. Based on previous arguments, the purpose of this study is to establish the correspondence that exists between the contents and problems presented in the textbooks used in the subject of Financial Management with the Expectation of Use mentioned above. Therefore, in this article, we intend to answer the following question: What is the correspondence between the contents and problems presented in the Financial Administration textbooks and the Expectation of Use? It was decided to focus the study on this subject, since the topics taught are reported as relevant in professional practice and in the curriculum of programs related to finance [2,3,4,18].

2. Conceptual Framework

2.1. Expectation of Use in Action

In terms of its meaning, Expectation of Use comprises two components: the theoretical and the problems of the profession. The first corresponds to the set of concepts, principles, and procedures (CPP) inherent to financial theory. The second corresponds to the set of financial situations faced by the professional in which the theoretical component is applied.

In the theoretical component, structured situations or structured problems are used in the classroom that require identifying, selecting, and using information on a particular topic in a predictable situation [23,26]. CPPs are explained through descriptions, and then prototypical examples are used with emphasis on correct estimation and interpretation. Finally, students perform structured problems similar to the previously presented examples [37,38]. Structured problems usually include only the information necessary to obtain a correct solution, previously known by the designer of the activity; this kind of problem is the most used method to introduce students to the different finance theories [24,26]. Success in the theoretical component is evidenced by fluency in discourse related to the explanation of CCP, a correct estimation and interpretation of the different elements of financial theory, and an appreciation of the role of finance in a particular context [4,18].

Some authors [6,13,15,16,17,37] identify, in isolation, different characteristics related to the problems of the profession component, such as: they have an ambiguous nature, they do not have a single preconceived correct solution, they require argumentation to explain their feasibility, the process to reach the solution is not predetermined, financial knowledge is implicit, and their usefulness depends on the constraints of the environment. Arts et al. [22] state that when these types of problems are taken to the school context, they are known as unstructured problems. These allow the student to face situations close to professional practice because their objective is vaguely established; the information is rarely adjusted to the requirements of the problem and must be searched for from diverse sources and processed; they do not establish in advance the appropriate methods for their solution; and the solutions are not correct or incorrect, so they are assessed in terms of feasibility and depend to a great extent on their argumentation [13,25,38]. In conjunction with the approaches of various referents that link professional practice with the classroom [8,13,14,18,22,25,26,39], an understanding of the set of actions needed to fulfil the Expectation of Use is developed. A student evidences, in his/her discourse, the fulfillment of the Expectation of Use if, when facing unstructured problems, he/she is able to: define and articulate the questions to be answered; determine an appropriate plan to carry out a precise and exhaustive analysis; gather, assess, or locate information, classifying it as relevant or irrelevant; select the appropriate theories and tools to solve the problem; evaluate the implications of the proposed results; and support his/her proposals, methods, and results, adapting his/her arguments to different target audiences.

2.2. Commognition as a Theoretical Perspective for Textbook Analysis

Commognition is a learning theory within Mathematics Education introduced by A. Sfard that mixes the words communication and cognition as a way of showing that there is no difference between communicating and thinking [40]. This theory provides a set of analytical tools that make explicit the learning opportunities that different discourses can provide [41]. The word discourse denotes a particular type of communication, whether written, oral, or gestural, distinguishable from any other by the use of words, narratives, and visual mediators and their routines [42]. With the help of these features of discourse, participants in a community communicate with each other and tell narratives about chosen aspects of reality.

There is an affinity between finance and mathematics, which is reflected both in conceptual and professional aspects, and in their teaching. Conceptually, finance draws on mathematics to develop models and practices that guide its objectives [43]; professionally, some activities of financial management require the development of indicators, mathematical problem solving, interpretation and argumentation based on data, scenario analysis, and the processing of quantitative and qualitative information to support decision making [4,18,44]. In their teaching, it is possible to identify the applied character of both areas, the recognition of communities, competencies, and discourses [3,45,46]. Likewise, they also share some problems, among them being the emphasis on expository practices, with methodologies based on definition, examples, and exercises [2]. They can also share some theoretical frameworks that, although constructed in one of the areas, can provide useful information for research in the other.

To argue for that possibility, in this study, we describe community and learning in terms of the theoretical perspective of commognition within the context of Financial Management. The financial community is composed of people who participate in the financial discourse as academics, employers, consultants, and practitioners in finance. This community allowed us to establish the construct of Expectation of Use. Consequently, learning is becoming fluent in the discourse of the community [41]. Hence, within a subject, learning can be defined as modifying and increasing the complexity of one’s own discourse [47]. Therefore, teaching implies creating opportunities for participation in discourse and being part of a community [48]. It is possible, then, to affirm that commognition is suitable to research in both mathematics and Financial Management.

As mentioned above, discourse has four characteristics. The first, the use of words, corresponds to what the user can say about (and therefore how they see) the world [49]. It refers to the use of specific finance vocabulary (e.g., financial statements, liquidity, profitability, fixed income). The second, visual mediators, are resources with which an object of communication can be identified and are specially created to facilitate the exchange of ideas [50]. In finance, they correspond to the visual resources used in everyday tasks (tables, diagrams, graphs, images, symbols, among others). The third is endorsed narratives, which are a sequence of utterances framed as a description of objects, of relations between objects, which is labeled as true by the discourse community [47]. Examples of these narratives are the definitions of financial concepts accepted by the community that are usually presented in textbooks. Finally, routines are reiterative patterns or actions that are present in discourses, for example, in ways of classifying, presenting, or viewing situations as the same or different [49]. Routines can be inferred by observing the regularities that exist in the other three discourse characteristics [51,52]. For example, when defining objects, carrying out procedures, or organizing ideas, conscious and unconscious observable patterns appear [53].

In commognition theory, the routine is the unit of analysis for investigating learning [42]. Knowing the implemented routines provides a basis for predicting the learner’s future reaction to a similar situation [47]. A person in a given situation may act on it because there are precedents (routines) that are interpreted as similar, to justify repetition or a variation of what was done in the past [42]. This means that in order to know the learning opportunities offered by a discourse, it is necessary to unveil the routines it promotes.

Textbooks provide students with information about the way in which experts participate in a discourse and indications of how to communicate in order to be accepted as a member of a community [54]. In higher education, they are positioned as legitimizers and the authority of disciplinary knowledge; in this regard, commognition expresses that the rules of discourse are established by that which is considered authoritative [47]. The textbook teaches a discourse through a process of supply and demand; it offers the content of a given subject through explanations and examples, while demanding related actions from students in the form of questions and problems [29,30,36,55,56]. The present study uses routines as the unit of analysis to establish links between the opportunities offered by the textbook to Financial Management course students and the discourse expected by the financial community in terms of the Expectation of Use.

3. Methodology

3.1. Method and Research Setting

The aim is to give an account of the favored routines in the contents and problems of textbooks through qualitative content analysis (QCA). Within mathematics education, according to Mesa [57], the analysis of the content in textbooks is a project that aims to answer the question:

“What would students learn if their mathematics classes were to cover all the textbook sections in the order given? What would students learn if they had to solve all the exercises in the textbook?” (p. 255).

The QCA aims to reveal and map the characteristics, frequencies, and/or trends of a text under a particular theoretical lens of research interest through the use of categories [58]. When finding several fragments of content that can be considered similar to each other, these are classified within a category with the objective of reducing large amounts of text into meaningful smaller units [59] that are constructed from the notion of Expectation of Use and the perspective of commognition.

In this research, the process of fragmenting text, coding, creating, and analyzing categories seeks to make explicit the routines defined as the actions that the textbook performs or invites one to perform. Routines are inferred through a process of analysis and categorization of the regularities of the content; everything that can be considered similar constitutes a repetitive pattern or routine [60], which in turn coincides with the definition of category within the QCA. The framework presented in Table 1 was used repeatedly during the process of text coding and category creation. This framework synthesizes a set of concepts or words of interest in the research related to Expectation of Use that make us aware of the possible classification of fragments into categories [61].

Table 1.

Reference framework for content analysis.

For this study, widely assigned Financial Management textbooks were selected to identify globally accepted practices in this subject. The textbooks are published by international publishers, have been translated into different languages, and have a high circulation in the university environment. Also selected were those textbooks whose authors had extensive experience in consulting and research in Financial Management and whose different versions covered not only Latin America, but also other regions of the world.

Based on these criteria, we started with a search in the university library catalogs of the top five universities according to the Colombian ranking for the area of finance in 2020 [62]. This search yielded 24 references, from which the latest available editions of the different authors in English were selected. The final sample of selected textbooks is presented in Table 2. As such, the set of textbooks selected is appropriate for the purpose of revealing the correspondence between Financial Management textbooks and the Expectation of Use. They give an account of global practices, so they are not limited to the Colombian context.

Table 2.

Selection of textbooks and chapters for qualitative content analysis.

In the literature on content analysis and textbooks, selecting some lessons or topics in order to analyze a broader sample of textbooks that represent the experiences of an academic community is recommended [58,70,71,72]. To answer the research question, the data sources were the narratives and problems of the topics that are the focus of the subject of Financial Management and at the same time are directly related to professional practice. According to Hoadley et al. [45], the topics that meet these conditions and were selected for the present study are Analysis of Financial Statements, Financial Planning, and Working Capital Management. Other topics such as CAPM, net present value, or portfolio efficient frontiers were not considered because they are of a conceptual nature to explain the market economy and their applications are not frequent in the workplace [31].

3.2. Data Analysis

For the analysis of the narratives, first an inductive generation of categories was carried out due to the scarcity of literature that analyzes the content of finance textbooks. For the analysis of the problems, we used category systems from mathematics textbooks that have been used in different disciplines that are close to the Expectation of Use due to the existing relationships between finance and mathematics. The analysis started with a pilot study in order to refine and test the category system to be used in the whole sample. Brigham’s book was used since it has the highest global usage, with the highest number of translations into other languages [73].

The pilot study began with a first reading of the chapter. The text was coded line by line, classifying the fragments accompanied by a possible description of the actions performed in the textbook. An analysis of fragments and descriptions revealed that some could be considered similar to each other; this event gave rise to the first group of categories. A second reading classified several fragments in the first group of categories, some were modified, and new descriptions emerged in the coding. The process was repeated, resulting in a redefinition of the previous group of categories and the creation of new ones. Mayring [58] and Kuckartz [61] indicate that the reading–classification–analysis loop should be repeated until the emergence of categories stops and the fragments are classified within them. The completion of the loop means that the entire text is classified within the set of categories generated from the interaction between the textbook, the coder, and the reference framework. This process resulted in eighteen routines, presented in Table 3, that were grouped according to their degree of affinity into four sets.

Table 3.

Category system for coding and analysis of narratives.

A problem is a text fragment that requires a set of actions to move to a desired goal state or solution and these actions have social, cultural, or intellectual value [37,74]. Problems are an opportunity to engage students in situations that can evidence their learning in the subject matter in different ways [30]. Problem analysis consists of classifying problems into predetermined category systems that inform the actions required to solve them [55,74]. Son and Diletti [75], in their literature review, group problem analysis into three interdependent classes of category systems that are presented in Table 4. The first class, Cognitive Requirements, refers to category systems that classify the routines required to reach the solution through a descriptive scale of difficulty or level of user involvement. Problems with low cognitive requirements demand recalling words or generic narratives in relation to various elements of financial theory, while those with high cognitive requirements provide the opportunity to engage in routines that increase the level of participation in a discourse. The latter demand making connections between words, creating endorsed narratives, and using mediators in a particular context. The second class, Type of Response, refers to category systems that group the routines in terms of the actions required to express a solution. The third, Relevance of Non-Textual Elements, refers to systems that describe the use of visual mediators in problems.

Table 4.

Category systems for the analysis of problems in mathematics textbooks.

The selection of category systems for problem analysis was made taking into account that the actions described were related to the reference framework described in Table 1. A group of specialists discussed which routines would make sense in finance and some routines of exclusive interest to mathematics were eliminated. Across the entire sample, the category systems Depth of Knowledge, Cognitive Demand, Opportunity for Communication, and Role of Visual Inscriptions were used. The above category systems (Table 3 and Table 4) were used by three experts and the first author of this article in different textbooks to perform inter-coder agreement.

The main technique used in the QCA as a contribution to research quality is the inter-coder agreement [58]. In this technique, two or more people code the same text independently using the same category system. A coder is an expert who reads, interprets, and assigns categories to the different text passages [61]. Transparency in this agreement provides relevant methodological information for replicating the study in a similar context, which contributes to the credibility and reliability of the research. An inter-coder agreement was performed with 28.9% of the total sample distributed among all books and subjects using the MAXQDA 2020 (qualitative data analysis software). The activities carried out during the inter-coder agreement are summarized in Table 5. In addition to the first author of this article, three other coders were selected who were experts in financial topics, with more than 5 years of experience in the practice of their profession and in financial teaching in higher education.

Table 5.

Summary of the agreement process between coders.

The results of the inter-coder agreement are shown in Table 6. The level of agreement for the narrative prior to activity 7 was above 70% except for the Block et al. [65] textbook. Then, in the meeting with each expert, some misinterpretations of the categories were clarified, and the level of agreement increased above 90% for all textbooks in the narrative and problems. A higher level of agreement was achieved with each expert on the second coded chapter due to previous experience. Finally, the experts were given a category system validation tool inspired by Galicia, Balderrama, and Edel [78], which contains items related to clarity, coherence, and relevance. The three experts assigned the maximum value in the different items for all categories. These results indicate that the routines and descriptions created for the QCA have the capability to classify the different text fragments that constitute the chapters of the coded Financial Administration textbooks. The level of agreement above 90% achieved by the three coders together with the use of the validation tool evidenced a shared interpretation of the content coding process. It is expected that the category system, when used by experts in finance in related contexts, will achieve similar results, which is a contribution to the reliability and transferability of the research.

Table 6.

Information on agreement between coders.

Coding and Interpretation of Data

The first author coded the other chapters of the sample, and three principles guided the process: coding inspired by the frame of reference, the results of the pilot study, and the texts coded by the experts, as well as the records of the meetings with them; this ensured that the system of categories is sensitive to all of the textbooks and is independent of the decision to include/exclude the content of the topics proposed by each book. In total, twenty-one chapters distributed in three topics were analyzed within the seven textbooks in the sample, corresponding to a total of 627 pages and 427 problems (Table 7).

Table 7.

Summary of coding content.

After the coding process, sessions were held with authors 2 and 3 in which the research findings were discussed and interpreted in light of the notions of the Expectation of Use, the needs of the financial community reported in the literature, and the theoretical perspective of commognition. Differences between the interpretations required a review of the coding and the search for information to support a shared interpretation for consensus building. The overall results of the fieldwork resulted in eighteen routines (Table 3 and Table 8) grouped according to their degree of affinity into four sets: Textbook Style (7), Complementary (3), Constraint (4), and Professional Reference (4); a detailed presentation of the results can be found in the following section.

Table 8.

Results of coding by routines in the narrative.

4. Results

4.1. Narrative Analysis Results

4.1.1. Textbook Style

The textbook is divided into chapters that are constructed as a set of fragments, classified in routines, to meet the needs of a subject matter. Each chapter is developed through a strategy that articulates the routines Description, Definition, and Definition–Description to expose the subject matter in a broad and detailed way that reveals a characteristic structure (Table 9F1–F3). The Description routine contains fragments that establish arguments for studying a topic, evoke simple financial situations, or exemplify concepts without going into detail, thus corresponding to an evocation routine. The Definition routine contains fragments with the concepts and principles of the subject matter, often involving formulas or instructions to carry out procedures and/or interpretations. In terms of commognition, it corresponds to a construction routine, which creates a new endorsed narrative, i.e., any sequence of utterances that aims to expand the knowledge of the presented topic. Finally, the fragments of the Definition–Description routine present a financial situation as an example to explain a CPP. Sometimes, the fragment uses the situation to explain the concept or it is first explained with a Definition routine and then consolidated with an example, so this routine is used to endorse a narrative or as a construction routine. All textbooks in the sample contain fragments of these three routines and represent, on average, 50.5% of the coded narrative (Table 8). The reference framework (Table 1) indicates that presenting CPPs in a predictive and prescriptive arrangement accompanied by examples, as these routines do, implies that they are in correspondence with the theoretical component of Expectation of Use.

Table 9.

Fragments (F) selected from Textbook Style routines.

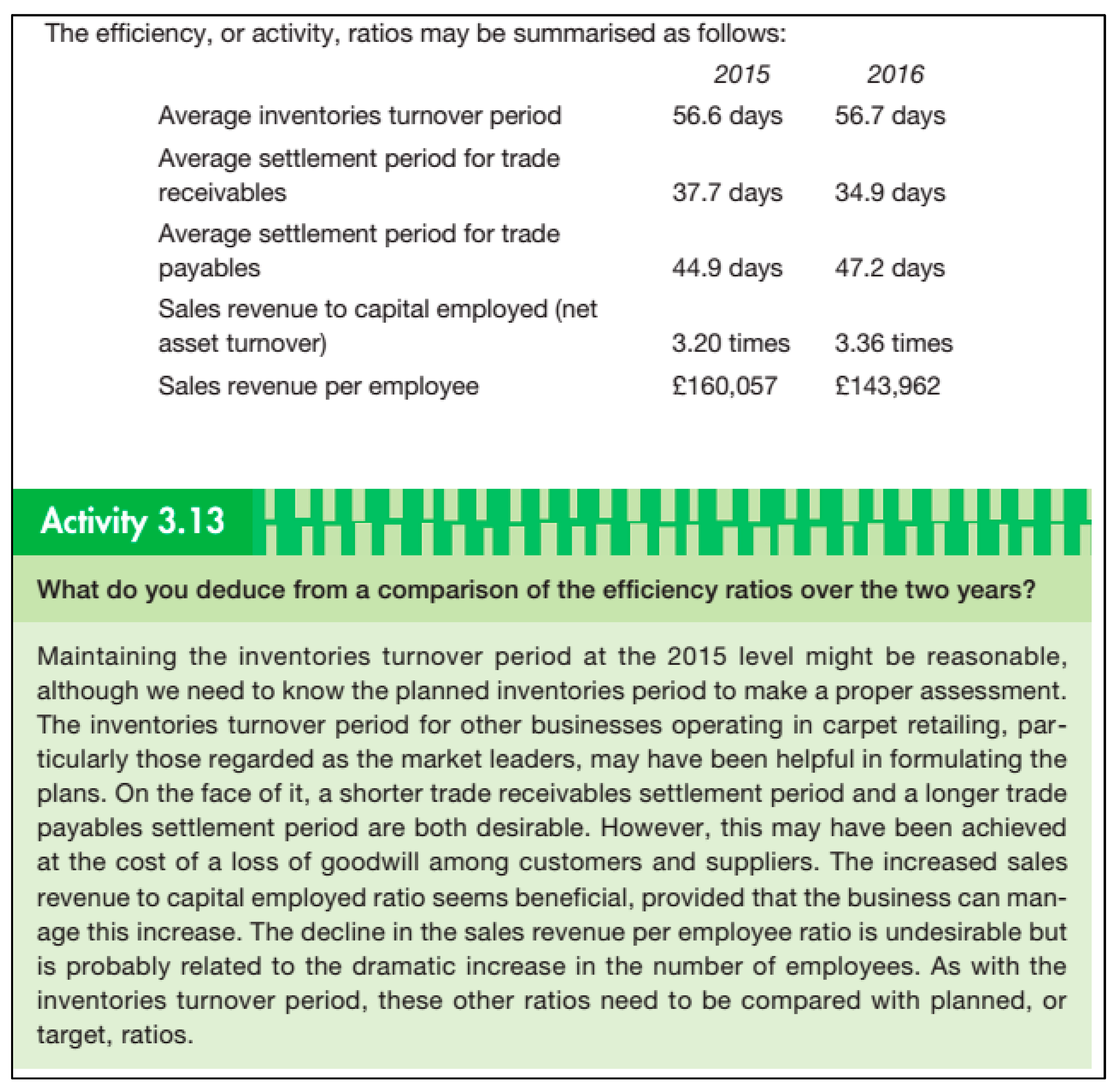

A recurring routine in all textbooks is the Review Activity. This contains fragments at the end of each thematic subsection where questions related to the ideas just presented are asked (Table 9F5). These activities require reproducing some part of the narratives contained in the Definition, Description, and Definition–Description triad, literally or with slight variations. In a similar vein, the generalized use of visual mediators is to assist this triad of routines, as can be observed in Table 9F4. The results in Table 8 indicate that the most used visual mediators are Table (4.4%) and Spreadsheet (3.5%). This is interpreted as a preference for the use of text and not graphics. When the graduating senior must use visual mediators in the profession, he/she will find that the use given to them to explain concepts is not aligned with the problems of the profession. This divergence in the use of mediators can be seen in the studies of Carrithers et al. [26] and Carrithers and Bean [25], where graduating seniors simulate spreadsheet scenarios and use visual mediators to explain concepts seen in class rather than focusing on solving the assigned financial situation. That is, graduates use mediators in a manner similar to that observed in textbooks that is dissimilar to the profession.

The Opening–Closing routine contains fragments that state the objective of the topic, generally accompanied by an anecdote to justify or exemplify its relevance in the business world (Table 9F6). In these fragments, it was found that the textbooks promote actions such as describing, listing, summarizing, and explaining, which are in correspondence with the theoretical component of the Expectation of Use. However, these actions do not satisfy the focus of the textbooks stated in the preface section. For example, in Block et al.’s [65] textbook, they state:

“Throughout the past 39 years, this text has been a leader in bringing the real world into the classroom, and this has never been more apparent than in the 16th edition. Each chapter opens with a real-world vignette and the Finance in Action boxes (found in virtually every chapter) describe real-world activities and decisions made by actual businesses”.Block et al. [65] (p. 5)

In this excerpt, they claim to bring professional practice to the classroom. As such, the textbooks should present a discourse in correspondence with professional practice, but the scope of the actions presented is limited to the theoretical component. This phenomenon, which is also the case in the other books in the sample, suggests that the conception of bringing professional practice to the classroom is not related to promoting routines that are in correspondence with both components of the Expectation of Use, but to inform the different experiences that could be had in the practice of Financial Management.

The last routine belonging to Textbook Style is Analysis Process. This routine contains fragments that integrate the themes of the chapter to reach a conclusion about a financial situation (Table 9F7). This routine breaks with the observed narrative because instead of presenting situations to explain CPP, it uses them to give an answer to financial problems, showing possible uses of it. This routine is interpreted as an approach of the textbook to move from the theoretical component to the problems of the profession Expectation of Use. However, it is relevant to clarify that, excluding Titman’s textbook, its appearance is rare, representing 3.9% of the coded narrative, on average.

The Analysis Process routine presents an opportunity to show the use that should be made of the CPPs of each subject, which until now appeared in an artificial and limited way. The textbook sample presents a centralized structure in the routines Definition, Definition–Description, and Description, which broadly describe the CPPs, leaving aside the activity that these can generate in the exercise of Financial Management, because the narrative does not transition to routines that promote the problem component of the profession of the Expectation of Use. The inclusion of the Analysis Process allows the integration of CPP to address financial problems that have the theoretical component of the Expectation of Use implicit. According to Green et al. [79], it is necessary to scaffold with this type of routine so that the textbook can be mobilized from the theoretical component to the problem component of the profession.

4.1.2. Complementary Routines

This set groups four routines support Textbook Style to make it more user friendly (Table 3). The Anecdote routine is used by all textbooks to inform and exemplify a subject, concept, or historical events in finance in an anecdotal way (Table 10F1). In general, the fragments present examples of large companies such as Amazon, Dell, Walmart, Apple, and CVS. Other fragments present historical information on sectors of the economy, examples of regulations, or personal finance. The fragments within Anecdote present stories that promote interest in the subject matter, but do not describe the situations within the companies, so their capacity to represent professional practice is limited. The business situations of this routine have an informative scope that promotes the recognition of the role of finance in the company, which, according to the reference framework (Table 1), is in correspondence with the theoretical component of the Expectation of Use.

Table 10.

Selected Fragments (F) Complementary, Constraint, and Professional Reference routines.

The Post It routine groups small boxes located in the margin of the page that accompany the narrative, highlight an important idea of the current topic, or repeat a fragment of the routine definition. The last Complementary routine is Consultation Info, which groups fragments where the textbooks recommend university or financial web portals (Yahoo Finance, MarketWatch, Federal Reserve) for the consultation of information in a strict financial sense that does not involve other fields of knowledge. The Complementary routines highlight conceptual aspects in the form of a story, links, or boxes relevant to the learning of finance. It was possible to interpret that they do not have their own meaning within the text; they are limited to assisting the routines belonging to Textbook Style from which it was possible to previously conclude that they are in correspondence with the theoretical component of the Expectation of Use.

4.1.3. Constraint Routines

This set groups four routines that support Textbook Style when a restricted interpretation that depends on other factors is presented (Table 3). The Previous/Subsequent routine contains fragments that refer to other chapters to avoid the repetition of topics. It invites learners to review previously presented concepts or to pass over issues that are the subject of other topics. In a similar vein, the Clarification routine contains fragments that reinforce previously presented ideas that are restricted to some kind of condition. This clarification usually makes explicit ideas that might not be obvious to the unsuspecting reader or that textbook wishes to emphasize. This routine points out limitations in the interpretation of indicators, estimates, and information generally contained in the Definition, Definition–Description, and Description routines and is therefore in correspondence with the theoretical component of the Expectation of Use.

The Ambiguous routine contains fragments in which the text points out a dilemma or constraint whose solution is partial or presents no solution at all. The QCA reveals a preference on the part of the books to present CPPs in different ways, to describe diverse situations in finance, and to continually reinforce the narratives presented. According to Sfard [47], several routines in the discourse are involuntary, so it can be interpreted that the Ambiguous routine is one of them.

The Action routine groups those fragments where the presented content warns about the limitation on the application of a CPP and suggests a specific action to solve it (Table 10F2). The fragments of this routine highlight the need to interpret the indicators in the context of the company, the relevance of the analysis processes, and the risks of generalizations, and seek to adequately use the concepts within a particular context, recognizing their limitations. Despite being infrequently used within the narrative, the Action routine provides an opportunity to broaden the scope of financial situations. Introducing routines such as this one with situations that involve other fields of knowledge, do not have a single correct solution, or allow the identification of the different constraints of the company’s environment and/or presenting solutions are some of the actions that are in correspondence with the problems of the profession component of the Expectation of Use (Table 1).

The Clarification, Ambiguous, and Action routines reinforce the narrative grouped in the Textbook Style. The nature of the constraints presented in the textbooks are focused on highlighting conceptual or procedural aspects that require a deeper interpretation; in them, there is no intention to present a financial situation that simulates the profession. These findings suggest that the set of Constraint routines promotes the theoretical component of Expectation of Use.

The content classified within the triad of routines Definition, Definition–Description, and Description added to the routines that assist them, representing 95.6% of the coded narrative, on average (Table 8). Around this triad, a large part of the rest of the content assists it in different ways such as the use of tables, diagrams, graphs and other visual mediators to facilitate the presentation of CPP; offering clarifications, recommendations, examples, and/or counterexamples; proposing activities, exercises, and/or questions that evoke the content presented; mentioning anecdotes with concepts of the subject matter, interviews, or historical events for information purposes; and using boxes with the main ideas for emphasis. The QCA showed that almost all of the textbook narratives present routines that are in correspondence with the theoretical component of the Expectation of Use, and as a consequence, there is a notable absence of routines that promote the problems of the profession component.

4.1.4. Professional Reference Routines

This set groups four routines that contain explicit fragments related to the profession (Table 3). In the Basic routine, the professional mention is common sense for a student in a program related to finance (Table 10F3). The fragments within this routine present situations that describe the role of a professional in finance according to the subject matter being presented in the textbook. On the other hand, the fragments of the Specialized routine require previous knowledge in finance, although the professional reference is simple, so it is not necessary to back it up with an example (Table 10F4). When gathering together the fragments of these two routines, a broad inventory of the actions related to Financial Management that can be carried out in an organization without going into them in depth.

The Non-Applied routine refers to fragments related to the profession that are limited to advising or suggesting actions that a professional should perform in certain situations without becoming the subject matter (Table 10F5). This routine also provides the opportunity to articulate with others such as Applied, Action, and Analysis Process that allow the inclusion in the narrative of routines that transition to the problems of the profession component of the Expectation of Use.

The Applied Professional Reference routine contains the fragments that present a situation close to the profession and suggest an action or solution (Table 10F6). Using the fragment type of reports is an action that is observed in professional practice because it consists of gathering information to critically analyze it and make decisions within the company [12,18,79]. The reference framework (Table 1) points out that using data from various sources to make inferences and deepen analysis in the face of problematic situations involving constraints and different points of view, as the Applied routine does, are actions that are in correspondence with the profession component of the Expectation of Use. Despite the above, the use of this type of routine is rare in five textbooks of the sample, with an average of 2% of the coded narrative and only Titman et al. [64] and Atrill [69] presenting an average of 10.6%.

4.2. Problem Analysis

The routines of the different category systems (Table 4) assigned to each problem indicate the actions required to solve them and to establish their relationship with the Expectation of Use. The results of the problem analysis are presented in Table 11 and Table 12.

Table 11.

Results of analysis of textbook problems.

Table 12.

Cross-matrix of problem analysis results grouped by routines.

4.2.1. Cognitive Requirements

The QCA showed that the Cognitive Requirements of the problems are low (Table 11)—the progression in the level of difficulty was concentrated in the increase in the available information and in the number of steps needed to reach the solution. According to these results, about 75% of the problems fall into some of the following routines: they require memorizing, specifying, explaining, or relating a fact, term, or property previously presented; they are free of ambiguities and/or the procedure to be followed is explicitly requested or easily deducible; they require capturing information from a prototypical statement to be introduced into one or several equations and obtaining the solution algorithmically; they are focused on producing a correct answer through a procedure; they require numerical answers or when they require verbal explanation, this is concentrated on describing the procedure or reproducing some part of the content; and/or they do not require a connection with financial concepts.

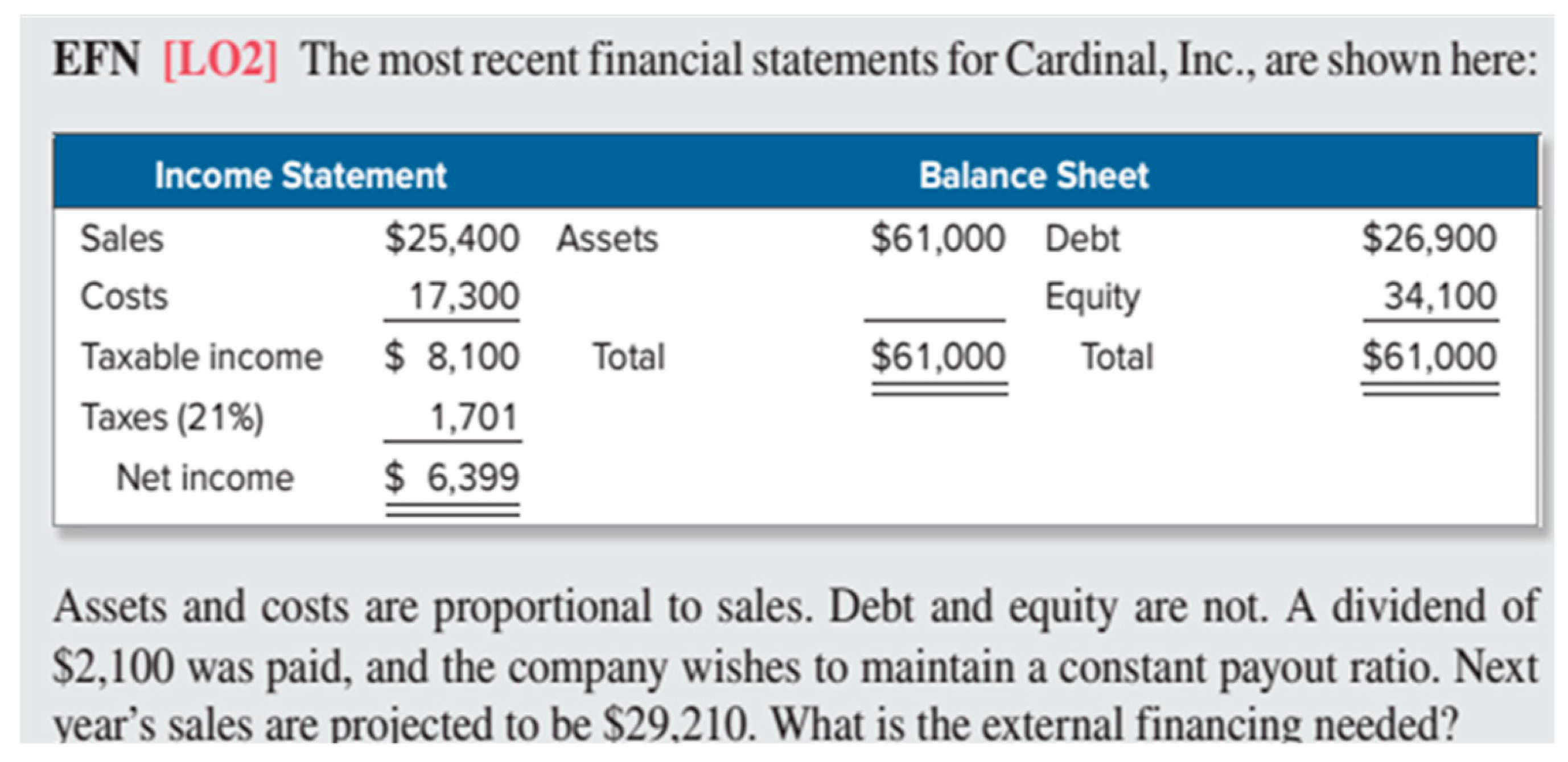

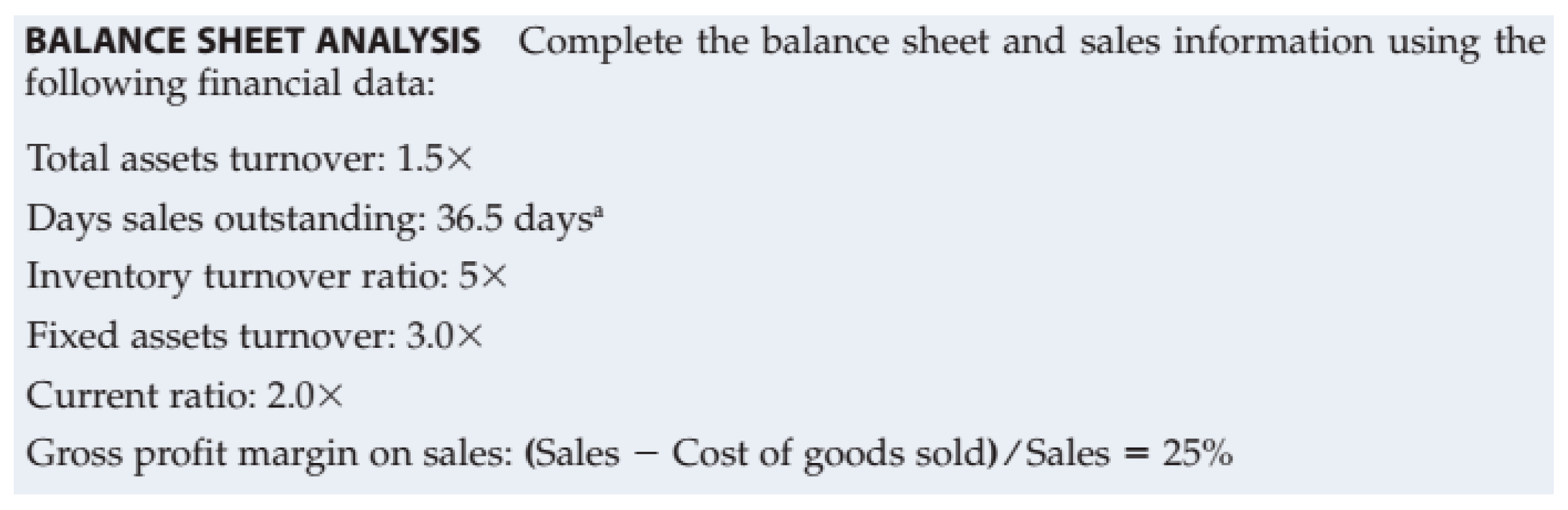

Table 13F1 presents a problem whose characteristics coincide with 70% of the coded sample. This type of problem uses financial language to promote the development of algebraic processes, asking for the replacement of the information in the equations of the subject and to perform the necessary procedures to reach an answer. We interpret that the textbook’s vision of putting the subject matter into practice consists mainly of developing algorithms within statements that use financial contexts that are unlikely to occur in professional practice. According to Jonassen [37], students may become adept at solving this type of problem without understanding the underlying principles represented in the situations. In a similar vein, a kind of problem dissimilar to the profession was identified (Table 13F2)—the situation of finding balance sheet information from financial ratios is unlikely because in the exercise of the profession, it always occurs in reverse. This type of exercise promotes routines that are not related to financial management.

Table 13.

Selected Fragments (F) problem analysis.

In problem types F1 and F2 (Table 13), there was a lack of correspondence with the situations presented in the narrative. These financial situations play the role of facilitating the explanation of CPP and focus mainly on an adequate estimation and interpretation of figures and indicators. On the other hand, 70% of the problems require routines that leave aside the interpretation of indicators; instead, they focus on the development of algebraic processes using financial words, so the routines presented in the narrative will not be practiced with the proposed problems.

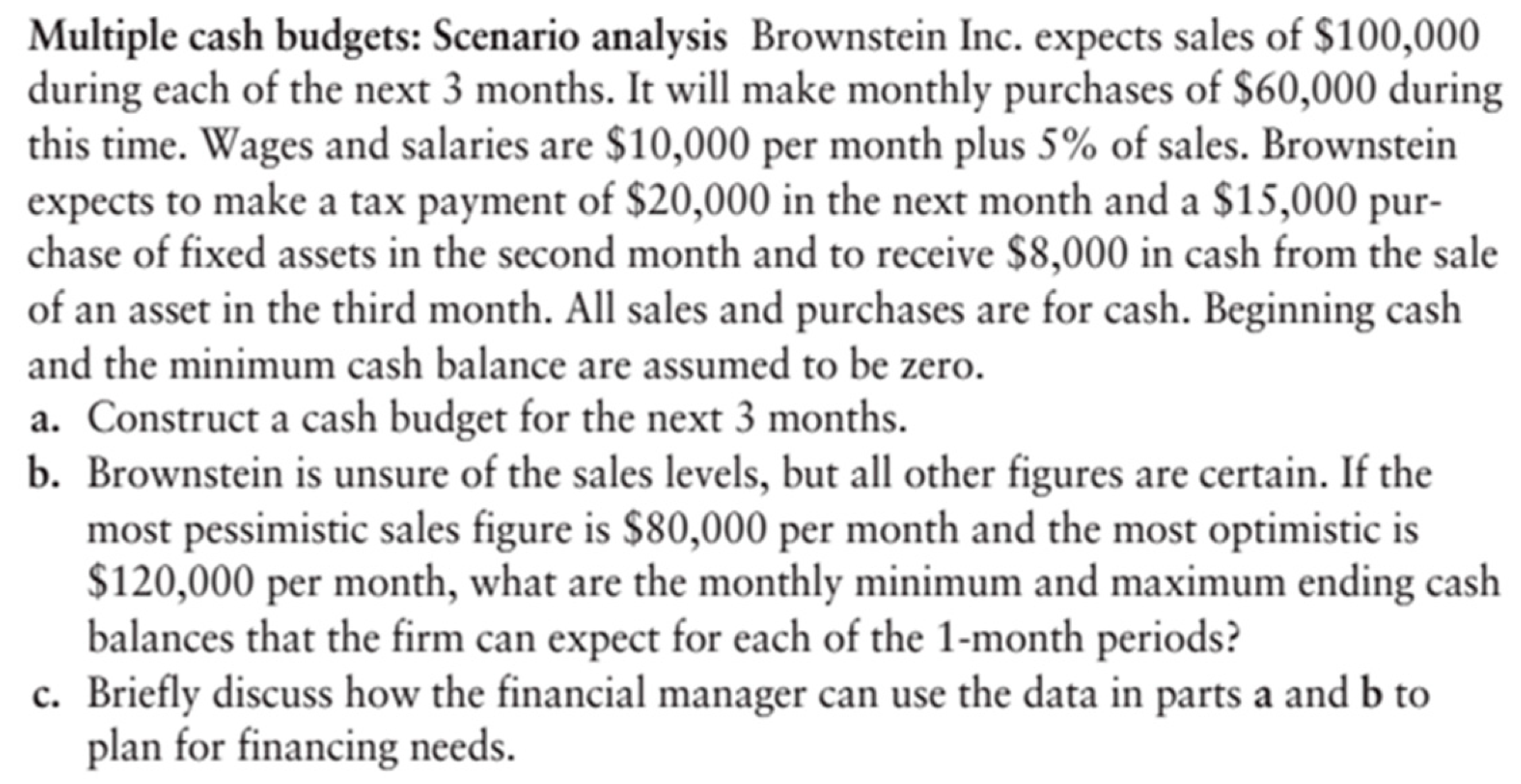

4.2.2. Type of Response Requested and Relevance of Non-Textual Elements

The results in Table 11 show that problems were concentrated in single responses and particularly in those of a numerical nature, as exemplified in Table 13F1,F2. For the Communication Opportunity category system, it was shown that 68.6% of the problems do not require communicating some inference about the situation, while 26.5% do and the remaining 4.9% require the reproduction of some part of the narrative. These results coincide with those obtained in the Cognitive Requirements: about 70% of the problems have a unique solution, either numerical or verbal, with artificial situations that are solved with algorithmic procedures, as shown in the cross-matrix in Table 12. Problems that require some kind of explanation beyond a numerical answer are also classified within the Procedures with Connections routine, as seen in Table 12. This type of problem (Table 13F3) seeks to explain the use of the cash budget to calculate funding requirements, which is a modified version of the situations presented in the narrative and is therefore in correspondence with the narrative.

All of the visual mediators in the exercises are tables, as in the narrative. This result implies that the tasks do not use, nor require using, visual mediators such as bar, line, or pie charts to solve the end-of-chapter problems. In a different vein, Agrawal and Borgman [80], Berinato [81], and Wood [44] argue that these mediators are widely used to present and argue solutions in front of different audiences or support decision making in the profession.

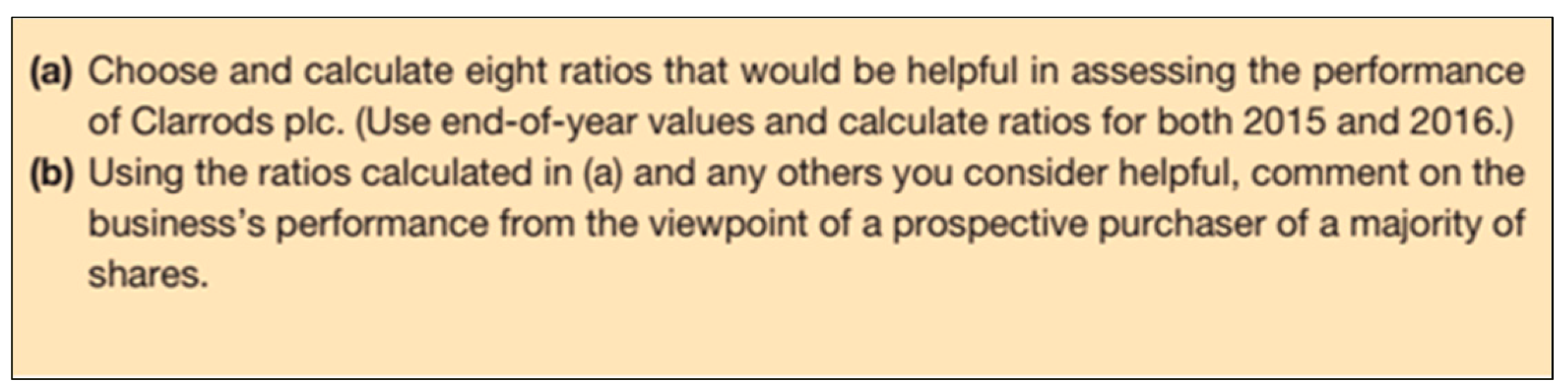

4.2.3. Profession-Related Problems

The results presented in Table 11 indicate that only two exercises in the sample were classified under Extended Thinking, Doing Finance, and Direct Students to Develop Arguments (Table 13F4). In this problem, there are multiple decision points on the interpretation and selection of indicators, the design of arguments, and possible perspectives of different stakeholders. The answers should be similar, but will change slightly for each person trying to solve it. Although the situation is straightforward, peer discussion and preferably the help of an expert/professor is required to establish the feasibility of the proposed solutions. According to Green et al. [79], Griffin and Cohelhoso [13], and Jonassen [37], these are the characteristics that the problems used in class to simulate the profession should have.

The Doing Finance problems show that it is possible to introduce variants that broaden the scope of the problems in such a way that they present situations closer to the profession. The textbook is not obliged to provide all of the solutions to the proposed exercises; it can suggest that they require help from peers and experts to be solved or there is also the possibility of providing hints on the direction to take in these situations in the appendices, clarifying that there is no single correct answer. Increasing the presence of these problems allows students to become involved in situations that go beyond algorithmic procedures and concept interpretation.

The situations in the narrative frequently set the scope of the opportunities offered by the textbook in the end-of-chapter problems [37,82]. The QCA results corroborate such a statement; the routines required in the problems do not exceed the level of difficulty of the narrative situations. To bring the narrative closer to the problem component of the profession, it is convenient to redirect the financial situations in such a way that they involve constraints, ambiguities, dilemmas, and other fields of knowledge and not only to the explanation of CPP [13,26,39]. The textbooks could reconfigure the structure of the narrative and include routines that are in correspondence with the problems of the profession component of the Expectation of Use. As the situations presented increase in complexity, the possibility opens up to do the same in the end-of-chapter problems [37,82].

4.3. Summary of Findings

The asymmetry found in the textbooks between the routines that are in correspondence with the theoretical component and those of the problems of the profession component indicates a very low degree of exposure to the latter. When faced with a related situation, the textbook user may not have sufficient precedent to repeat what was done in the past; therefore, the automatic reaction will be to adapt the routines to which there was a high degree of exposure. This situation unleashes a commognitive conflict as there is incompatibility between the discourse that the graduate learns in the formative process with the textbook and that which is required in professional practice. This conflict is solved through a new training process within the company, which by definition is in correspondence with the problems of the profession component and perpetuates the problem posed at the beginning of the article.

From the QCA, it can be interpreted that, according to the textbooks, participating in the discourse of Financial Management consists of knowing topics, where the CPPs of these topics are presented through descriptions and examples that strive for a correct estimation and interpretation. This is an accumulation perspective that seems to indicate that the mastery of financial discourse is determined by the breadth of the inventory of financial CPPs. In a different sense, Kent et al. [83] argue that in professional practice, a broad inventory of concepts is not required, but rather performing sophisticated activities with a few. A perspective of discourse construction through routines that are in correspondence with the Expectation of Use recognizes the need to broaden this inventory, without leaving aside the possible activity that these can generate through situations that are closer to professional practice.

This research made it possible to establish a correspondence between the routines promoted by textbooks and those evidenced by finance-related graduates. Carrithers and Bean [25] and Carrithers et al. [26] report that graduates fail to effectively solve problems that simulate the profession, do not recognize the structure of the problem, and do not construct a narrative that satisfies the required solution. The authors also observed a pressing need for graduating seniors to replace the information in the different formulas and describe the meanings of the different financial indicators. In the same line, Arts et al. [22] find that the diagnoses of the graduating seniors are extensive, imprecise, and do not solve the problem posed. When comparing this research with the findings, it can be observed that the routines that promote textbook problems are the most recurrent actions in the graduating seniors. At the same time, the routines absent from the Expectation of Use in textbook problems coincide with the difficulties observed in the graduating seniors.

The QCA was able to demonstrate that, in the presentation of the subject matter in some textbooks, it was possible to gradually include information and routines that transition to the problems of the profession component. However, their appearance was infrequent and/or they moved on to other routines quickly. In order to change this situation, the textbooks can expand the prototypical space and the available information where financial situations transition to a less artificial one that allows the presentation of the concepts and at the same time seek to solve financial problems that simulate professional practice. The above also opens up the possibility of raising the requirements of the end-of-chapter problems [82] and that users practice their mastery of CPP at the end of each topic and also some possible situations of the profession that they can address with them. Textbooks cannot represent all of the situations of the profession, nor are they the only way to approach them; some situations require complementary material, special environments, and mainly the teacher’s guidance. There will always be an increasing demand in the expectations held of graduating seniors and higher education [12,84]. Therefore, the findings of this research do not recommend filling the gaps found with absent routines, but aim to rebalance the routines present in the narrative and the problems so that the textbook offers experiences in correspondence with the Expectation of Use.

The textbook offers an environment that ignores interactions between peers, teachers, or experts. It is designed so that the user assumes an active role to a certain extent because he/she must study the content and solve the problems. On the other hand, with respect to the financial community, the role of the user is passive, because the textbook does not provide the opportunity to reflect, propose, or share ideas with teachers and/or peers, but rather the user is restricted to following the instructions provided in the narrative and in the problems alone.

A disconnect was found between the routines promoted by the analyzed textbooks and those carried out in professional practice, as reported by curricular documents and research in programs related to finance. The results show an excess of algorithmic problems, imprecise and/or incomplete narratives, and the absence of certain financial situations. The QCA suggests that in the development of textbooks, the routines present and absent in the textbook are unconsciously neglected. It is therefore recommended that textbooks be restructured based on a conscious construction of routines that respond to the training needs of the financial community.

5. Conclusions

A QCA was conducted on seven financial administration textbooks widely used in higher education. Three actions provided the conceptual elements to establish the correspondence of the textbooks with professional practice: making explicit professional expectations based on finance workplace research and curricular documents; using elements of the theoretical perspective of commognition such as routines, visual mediators, discourse, narrative, commognitive conflict, and precedents; and reviewing empirical studies in textbooks within mathematics education. The discourse present in textbooks to teach finance, like any discourse, is highly situated; however, Sfard’s [47] commognition framework in conjunction with training expectations allowed us to present a classification of discursive routines present in the textbook content. This type of research could be taken to other areas of administration where its objects of study are appreciable in the exercise of the profession and that additionally require a broad use of mathematics.

The results showed a self-contained textbook, which evidences a tendency to present limited artificial situations in which there is a single answer and this is supplied by the textbook. This need to be self-contained by presenting the correct answers limits its potential to promote routines that are in correspondence with the Expectation of Use. A textbook that presents situations with constraints, that promotes different perspectives, that involves other fields of knowledge, and that recognizes the existence and implications of diverse solutions must make it explicit that it is not self-contained. The textbooks must recognize that it is necessary to promote routines and address situations whose answer is not explicit nor derived exclusively from the user/textbook relationship, but on the contrary, will require working with other students, teachers, and/or experts, gathering information from various sources and other fields of knowledge so that it can provide experiences that contribute to future professional performance.

There is significant potential to investigate the relationships between textbook content and different professional training expectations, as was, in this case, the case for the financial community. Insights from practice research can contribute to analyzing and shaping finance textbooks; it was also evident that the classroom and the workplace are two different, but not unrelated, contexts that must have a degree of familiarity and alignment in order to meet training objectives. A change in the vision of the current textbook exposed in the research requires promoting collaborative work between researchers of professional practice, professors, authors, publishers, and higher education institutions that introduce favorable conditions that jointly benefit the learning of their future professionals.

6. Future Research

This research provides some contributions and recommendations on the structure of textbooks, class design, and textbook design in subjects related to Financial Management. The first contribution is related to identifying the current guiding structure of textbooks, making it explicit in routines and establishing the possible experiences it can offer. Secondly, it presents teachers, curriculum designers, publishers, and authors with a set of actions stemming from the demands of the financial community that can be used to design their classes and texts based on a flexible approach that promotes an education closer to professional practice. The third contribution is related to the conceptual elaborations, inspired by mathematics education, which were developed in the research, such as professional expectations, the reference frame, and the systems of categories of problem analysis. These elaborations, which have not been reported in the literature on Financial Management education, can contribute to higher education and to the field of textbooks as a guide for a possible reorganization of textbooks and to promote new research, which in turn will make it possible to build links between mathematics education and finance.

Conceptualizing the requirements of professional communities from different disciplines in expectations allows us to investigate the experiences within higher education and establish their degree of connection with professional practice. Commognition provided elements such as routines, which allowed for a dialog between two distant objects such as the learning expectations of senior graduates and a structured set of repetitive actions present in the textbook. In addition, the concept of routine as a pattern coincides with the definition of a category that constitutes the main element of study within the QCA, the latter of which provided methodological support and scientific rigor to carry out the fieldwork. The results presented reveal a significant potential to investigate the different experiences that constitute the educational process within higher education such as the curriculum, teachers’ lectures, class activities, or textbooks and to identify possible disconnections with professional practice and to take preventive or corrective actions.

Author Contributions

Conceptualization, D.A.-A.; Methodology, D.A.-A.; Software, D.A.-A.; Validation, D.A.-A.; Formal analysis, D.A.-A. and J.A.V.-O.; Investigation, D.A.-A.; Data curation, D.A.-A. and J.A.V.-O.; Writing–original draft preparation, D.A.-A.; Writing–review & editing, J.A.V.-O. and D.G.-G.; Supervision, J.A.V.-O. and D.G.-G. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is contained within the article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Shiller, R. Finance and the Good Society; Princeton University Press: Princeton, NJ, USA, 2012; ISBN 978-0691158099. [Google Scholar]

- Lai, M.M.; Kwan, J.H.; Kadir, H.A.; Abdullah, M.; Yap, V.C. Effectiveness, Teaching, and Assessments: Survey Evidence from Finance Courses. J. Educ. Bus. 2009, 85, 21–29. [Google Scholar] [CrossRef]

- Hoadley, S.; Wood, L.N.; Tickle, L.; Kyng, T. Applying Threshold Concepts to Finance Education. Educ. + Train. 2016, 58, 476–491. [Google Scholar] [CrossRef]

- QAA, QAA Subject Benchmark in Finance. Available online: https://www.qaa.ac.uk/the-quality-code/subject-benchmark-statements (accessed on 4 June 2019).

- Suleman, F. Employability Skills of Higher Education Graduates: Little Consensus on a Much-Discussed Subject. Procedia Soc. Behav. Sci. 2016, 228, 169–174. [Google Scholar] [CrossRef]

- Kavanagh, M.H.; Drennan, L. What Skills and Attributes Does an Accounting Graduate Need? Evidence from Student Perceptions and Employer Expectations. Account. Financ. 2008, 48, 279–300. [Google Scholar] [CrossRef]

- Toledo Lara, G.E. Uni-Pluriversidad: 20 Años de Evolución Del Concepto de Universidad. Uni-pluriversidad 2021, 1–15. [Google Scholar] [CrossRef]

- Gilbert, F.W.; Harkins, J.; Agrrawal, P.; Ashley, T. Internships as clinical rotations in business: Enhancing access and options. Int. J. Bus. Educ. 2021, 162, 7. [Google Scholar] [CrossRef]

- Lupiañez, J.L. Expectativas de Aprendizaje y Planificación Curricular En Un Programa de Formación Inicial de Profesores de Matemáticas de Secundaria. Ph.D. Thesis, Universidad de Granada, Granada, Spain, 2009. [Google Scholar]

- Castrillón, J.; Cabeza, L.; Lombana, J. Competencias Más Importantes Para La Disciplina Administrativa En Colombia. Contaduria y Adm. 2015, 60, 776–795. [Google Scholar] [CrossRef]

- NACE. Job Outlook 2016; NACE: Bethlehem, PA, USA, 2016. [Google Scholar]

- García-Álvarez, J.; Vázquez-Rodríguez, A.; Quiroga-Carrillo, A.; Priegue Caamaño, D. Transversal Competencies for Employability in University Graduates: A Systematic Review from the Employers’ Perspective. Educ. Sci. 2022, 12, 204. [Google Scholar] [CrossRef]

- Griffin, M.; Coelhoso, P. Business students’ perspectives on employability skills post internship experience: Lessons from the UAE. High. Educ. Ski. Work. -Based Learn. 2018, 9, 60–75. [Google Scholar] [CrossRef]

- Osmani, M.; Weerakkody, V.; Hindi, N.; Eldabi, T. Graduates employability skills: A review of literature against market demand. J. Educ. Bus. 2019, 94, 423–432. [Google Scholar] [CrossRef]

- Hernández-March, J.; Martin Del Peso, M.; Leguey, S. Graduates’ Skills and Higher Education: The Employers’ Perspective. Tert. Educ. Manag. 2009, 15, 1–16. [Google Scholar] [CrossRef]

- Majzoub, S.; Aga, M. Characterizing the Gap between Accounting Education and Practice: Evidence from Lebanon. Int. J. Bus. Manag. 2015, 10, 127. [Google Scholar] [CrossRef]

- Klibi, M.F.; Oussii, A.A. Skills and Attributes Needed for Success in Accounting Career: Do Employers’ Expectations Fit with Students’ Perceptions? Evidence from Tunisia. Int. J. Bus. Manag. 2013, 8, 118. [Google Scholar] [CrossRef]

- ABDC. Academic Learning Standards for Finance in the Australian Higher Education Context; ABDC: Deakin, Australia, 2014; Available online: https://abdc.edu.au/data/Finance_Learning_Standards/Finance_Learning_Standards_-_November_2014.pdf (accessed on 2 April 2021).

- Amaya-Alvear, E. Factores Que Explican Los Bajos Desempeños En Competencias Cognitivas Disciplinares de Estudiantes En El Programa de Administración Financiera. In Crescendo 2019, 10, 43–69. [Google Scholar] [CrossRef]

- ICFES. Guía de Orientación: Módulo de Gestión Financiera Saber Pro 2017; ICFES: Bogotá, Colombia, 2017; Volume 23. [Google Scholar]

- Lakshmi, G. An Exploratory Study on Cognitive Skills and Topics Focused in Learning Objectives of Finance Modules: A UK Perspective. Account. Educ. 2013, 22, 233–247. [Google Scholar] [CrossRef]

- Arts, J.A.R.; Gijselaers, W.H.; Boshuizen, H.P.A. Understanding Managerial Problem-Solving, Knowledge Use and Information Processing: Investigating Stages from School to the Workplace. Contemp. Educ. Psychol. 2006, 31, 387–410. [Google Scholar] [CrossRef]

- Chowdhury, M.E. Textbook To Reality: Using Corporate Earnings Reports As An Effective Teaching. Am. J. Bus. Educ. 2016, 9, 147–152. [Google Scholar]

- Barboza, G.A.; Pesek, J. Linking Course-Embedded Assessment Measures and Performance on the Educational Testing Service Major Field Test in Business. J. Educ. Bus. 2012, 87, 102–111. [Google Scholar] [CrossRef]

- Carrithers, D.; Bean, J. Using a Client Memo to Assess Critical Thinking of Finance Majors. Bus. Commun. Q. 2008, 71, 10–26. [Google Scholar] [CrossRef]

- Carrithers, D.; Ling, T.; Bean, J. Messy Problems and Lay Audiences: Teaching Critical Thinking within the Finance Curriculum. Bus. Commun. Q. 2008, 71, 152–170. [Google Scholar] [CrossRef]

- Wiley Submission to the Productivity Commission. Copyright Restrictions on the Parallel Importation of Books; Wiley: New York, NY, USA, 2009; Volume 18. [Google Scholar]

- Joseph, R.P. Higher Education Book Publishing—From Print to Digital: A Review of the Literature. Publ. Res. Q. 2015, 31, 264–274. [Google Scholar] [CrossRef]

- Valverde, G.; Bianchi, L.; Wolfe, R.; Schmidt, W.; Houang, R. According to The Book Using TIMSS to Investigate the Translation of Policy into Practice through the World of Textbooks; Springer: Berlin/Heidelberg, Germany, 2002; ISBN 9781402010347. [Google Scholar]

- Moundy, K.; Chafiq, N.; Talbi, M. Comparative Analysis of Student Engagement in Digital Textbook Use during Quarantine. Educ. Sci. 2021, 11, 352. [Google Scholar] [CrossRef]

- Cardao-Pito, T. Classes in Maximizing Shareholders’ Wealth: Irving Fisher’s Theory of the Economic Organization in Corporate Financial Economics Textbooks. Contemp. Econ. 2017, 11, 369–382. [Google Scholar] [CrossRef]

- Seaman, J.E.; Seaman, J. Opening the Textbook: Educational Resources in U.S Higher Education 2017; Babson Survey Research Group: Mission Viejo, CA, USA, 2017. [Google Scholar]

- Queiroz, M.; Barbosa, J. Características Da Matemática Financeira Expressa Em Livros Didáticos: Conexões Entre a Sala de Aula e Outras Práticas Que Compõem a Matemática Financeira Disciplinar. Bolema 2016, 30, 1280–1299. [Google Scholar] [CrossRef]

- Stokes, L.; Rosetti, J.L.; King, M. Form Over Substance: Learning Objectives In The Business Core. Contemp. Issues Educ. Res. 2010, 3, 11–20. [Google Scholar] [CrossRef]

- Hunsader, P.D.; Thompson, D.R.; Zorin, B.; Mohn, A.L.; Zakrzewski, J.; Karadeniz, I.; Fisher, E.C.; MacDonald, G. Assessments Accompanying Published Textbooks: The Extent to Which Mathematical Processes Are Evident. ZDM - Int. J. Math. Educ. 2014, 46, 797–813. [Google Scholar] [CrossRef]

- Ronda, E.; Adler, J. Mining Mathematics in Textbook Lessons. Int. J. Sci. Math. Educ. 2017, 15, 1097–1114. [Google Scholar] [CrossRef]

- Jonassen, D.H. Learning to Solve Problems: An Intructional Guide; Pfeiffer: Zürich, Switzerland, 2005; Volume 44, ISBN 9780787977054. [Google Scholar]

- Voss, J.F. Toulmin’s Model and the Solving of Ill-Structured Problems. In Arguing on the Toulmin Model; Springer: Dordrecht, The Netherlands, 2006; pp. 303–311. [Google Scholar]

- Jonassen, D.H. Instructional Design Models for Well-Structured and III-Structured Problem-Solving Learning Outcomes. Educ. Technol. Res. Dev. 1997, 45, 65–94. [Google Scholar] [CrossRef]

- Viirman, O. The Functions of Function Discourse - University Mathematics Teaching from a Commognitive Standpoint. Int. J. Math. Educ. Sci. Technol. 2014, 45, 512–527. [Google Scholar] [CrossRef]

- Thoma, A. Transition to University Mathematical Discourses: A Commognitive Analysis of First Year Examination Tasks, Lecturers’ Perspectives on Assessment and Students’ Examination Scripts; University of East Anglia School: Norwich, UK, 2018. [Google Scholar]

- Lavie, I.; Steiner, A.; Sfard, A. Routines We Live by: From Ritual to Exploration. Educ. Stud. Math. 2019, 101, 153–176. [Google Scholar] [CrossRef]

- Bodie, Z.; Merton, R. Finance; Prentice Hall: Hoboken, NJ, USA, 1998. [Google Scholar]

- Wood, L.N. Practice and Conceptions: Communicating Mathematics in the Workplace. Educ. Stud. Math. 2012, 79, 109–125. [Google Scholar] [CrossRef]

- Hoadley, S.; Wood, L.N.; Kyng, T.; Tickle, L. Threshold Concepts in Finance: The Role of Mathematics. Adv. Financ. Educ. 2018. [Google Scholar] [CrossRef]

- Hoadley, S.; Tickle, L.; Wood, L.N.; Kyng, T. Threshold Concepts in Finance: Conceptualizing the Curriculum. Int. J. Math. Educ. Sci. Technol. 2015, 46, 824–840. [Google Scholar] [CrossRef]

- Sfard, A. Thinking as Communicating; Cambridge University Press: Cambridge, UK, 2008. [Google Scholar]

- Adler, J.; Ronda, E. A Framework for Describing Mathematics Discourse in Instruction and Interpreting Differences in Teaching. Afr. J. Res. Math. Sci. Technol. Educ. 2015, 19, 237–254. [Google Scholar] [CrossRef]

- Sfard, A. Aprendizaje de Las Matemáticas Escolares Desde Un Enfoque Comunicacional; Universidad del Valle: Calí, Colombia, 2008; ISBN 9789586706339. [Google Scholar]

- Morgan, C.; Sfard, A. Investigating Changes in High-Stakes Mathematics Examinations: A Discursive Approach. Res. Math. Educ. 2016, 18, 92–119. [Google Scholar] [CrossRef]

- Fernández-León, A.; Gavilán-Izquierdo, J.M.; González-Regaña, A.J.; Martín-Molina, V.; Toscano, R. Identifying Routines in the Discourse of Undergraduate Students When Defining. Math. Educ. Res. J. 2019, 33, 301–319. [Google Scholar] [CrossRef]

- Martín-Molina, V.; González-Regaña, A.J.; Toscano, R.; Gavilán-Izquierdo, J.M. Differences between How Undergraduate Students Define Geometric Solids and What Their Lecturers Expect from Them through the Lens of the Theory of Commognition. Eurasia J. Math. Sci. Technol. Educ. 2020, 16, em1917. [Google Scholar] [CrossRef]

- González-Regaña, A.J.; Martín-Molina, V.; Toscano, R.; Fernández-León, A.; Gavilán-Izquierdo, J.M. Pre-Service Teachers’ Discourse When Describing and Defining Geometric Solids. Ensen. De Las Cienc. 2021, 39, 81. [Google Scholar] [CrossRef]

- Park, J. Communicational Approach to Study Textbook Discourse on the Derivative. Educ. Stud. Math. 2016, 91, 395–421. [Google Scholar] [CrossRef]

- Rezat, S.; Strässer, R. Methodological Issues and Challenges in Research on Mathematics Textbooks. Nord. Stud. Math. Educ. 2015, 20, 247–266. [Google Scholar]

- Alshwaikh, J. Investigating the Geometry Curriculum in Palestinian Textbooks: Towards Multimodal Analysis of Arabic Mathematics Discourse. Res. Math. Educ. 2016, 18, 165–181. [Google Scholar] [CrossRef]

- Mesa, V. Characterizing Practices Associated with Functions in Middle School Textbooks: An Empirical Approach. Educ. Stud. Math. 2004, 56, 255–286. [Google Scholar] [CrossRef]

- Mayring, P. Qualitative Content Analysis Theoretical Foundation, Basic Procedures and Software Solution. Available online: https://www.ssoar.info/ssoar/bitstream/handle/document/39517/ssoar-2014-mayring-Qualitative_content_analysis_theoretical_foundation.pdf (accessed on 2 April 2021).

- Hsieh, H.F.; Shannon, S.E. Three Approaches to Qualitative Content Analysis. Qual. Health Res. 2005, 15, 1277–1288. [Google Scholar] [CrossRef]

- Viirman, O. Explanation, Motivation and Question Posing Routines in University Mathematics Teachers’ Pedagogical Discourse: A Commognitive Analysis. Int. J. Math. Educ. Sci. Technol. 2015, 46, 1165–1181. [Google Scholar] [CrossRef]

- Kuckartz, U. Qualitative Text Analysis; SAGE: London, UK, 2014; ISBN 9781446267745. [Google Scholar]

- ICFES. Available online: https://www.icfes.gov.co/resultados-saber-pro (accessed on 2 April 2021).

- Brigham, E.; Houston, J. Fundamentals of Financial Management, 15th ed.; Cengage Learning: Mason, OH, USA, 2019; ISBN 9781285065144. [Google Scholar]

- Titman, S.; Keown, A.; Martin, J. Financial Management: Principles and Applications. Global Edition, 13th ed.; Pearson: Harlow, UK, 2017. [Google Scholar]

- Block, S.; Hirt, G.; Danielsen, B. Foundations of Financial Management, 17th ed.; McGraw-Hill: New York, NY, USA, 2018. [Google Scholar]

- Ross, S.; Westerfield, R.; Jordan, B. Essentials of Corporate Finance, 12th ed.; McGraw-Hill: New York, NY, USA, 2019. [Google Scholar]

- Zutter, C.; Smart, S. Principles of Managerial Finance, 15th ed.; Pearson: New York, NY, USA, 2018. [Google Scholar]

- Adam, C.; Gunasingham, B.; Graham, J.; Smart, S. Introduction to Corporate Finance: Asia-Pacific Edition, 2nd ed.; Cengage: Melbourne, Australia, 2017. [Google Scholar]

- Atrill, P. Financial Management for Decision Makers, 8th ed.; Pearson: Harlow, UK, 2017. [Google Scholar]

- Son, J. A Cross-National Comparison of Reform Curricula in Korea and the US in Terms of Cognitive Complexity: The Case of Fraction Addition and Subtraction. ZDM-Int. J. Math. Educ. 2012, 44, 161–174. [Google Scholar] [CrossRef]

- Son, J.; Senk, S.L. How Reform Curricula in the USA and Korea Present Multiplication and Division of Fractions. Educ. Stud. Math. 2010, 74, 117–142. [Google Scholar] [CrossRef]

- Thompson, D.R.; Senk, S.L.; Johnson, G.J. Opportunities to Learn Reasoning and Proof in High School Mathematics Textbooks. J. Res. Math. Educ. 2012, 43, 253. [Google Scholar] [CrossRef]

- Byrne, J. The Story behind a B-School Textbook Fortune. Available online: http://fortune.com/2011/06/23/the-story-behind-a-b-school-textbook-fortune/ (accessed on 25 September 2021).

- NRC On Evaluating Curricular Effectiveness: Judging the Quality of K-12 Mathematics Evaluations; National Academic Press: Washington, DC, USA, 2004; ISBN 0-309-53287-6.

- Son, J.; Diletti, J. What Can We Learn from Textbook Analysis? In What Matters? Research Trends in International Comparative Studies in Mathematics Education; Son, J., Watanabe, T., Lo, J.-J., Eds.; Springer International Publishing: Berlin/Heidelberg, Germany, 2017; ISBN 978-3-319-51185-6. [Google Scholar]

- Webb, N.L. An Analysis of the Alignment between Mathematics Standards and Assessments for Three States. In Proceedings of the Annual Meeting of the American Educational Research Association, New Orleans, LA, USA, 1–5 April 2002. [Google Scholar]

- Stein, M.K.; Schwan, M.; Henningsen, M.; Silver, E. Implementing Standards-Based Mathematics Instruction: Casebook for Professional Development Ways of Knowing in Science Series; Teachers College Press: New York, NY, USA, 2000; ISBN 9780807739075. [Google Scholar]

- Galicia, L.; Balderrama, J.; Edel, R. Validez de Contenido Por Juicio de Expertos: Propuesta de Una Herramienta Virtual. Apert. Rev. Innov. Educ. 2017, 9, 42–53. [Google Scholar] [CrossRef]

- Green, G.P.; Jones, S.; Bean, J.C. Teaching Real-World Applications of Business Statistics Using Communication to Scaffold Learning. Bus. Commun. Q. 2015, 78, 314–335. [Google Scholar] [CrossRef]

- Agrrawal, P.; Borgman, R. What Is Wrong with this Picture? A Problem with Comparative Return Plots on Finance Websites and a Bias Against Income-Generating Assets. J. Behav. Financ. 2010, 11, 195–210. [Google Scholar] [CrossRef]

- Berinato, S. Good Charts Workbook: Tips, Tools, and Exercises for Making Better Data Visualizations; Harvard Business Review: Boston, MA, USA, 2019; ISBN 9781633696181. [Google Scholar]

- Charalambous, C.Y.; Delaney, S.; Hsu, H.-Y.; Mesa, V. A Comparative Analysis of the Addition and Subtraction of Fractions in Textbooks from Three Countries. Math. Think. Learn. 2010, 12, 117–151. [Google Scholar] [CrossRef]

- Kent, P.; Noss, R.; Guile, D.; Hoyles, C.; Bakker, A. Characterizing the Use of Mathematical Knowledge in Boundary-Crossing Situations at Work. Mind Cult. Act. 2007, 14, 64–82. [Google Scholar] [CrossRef]

- Azevedo, A.; Apfelthaler, G.; Hurst, D. Competency Development in Business Graduates: An Industry-Driven Approach for Examining the Alignment of Undergraduate Business Education with Industry Requirements. Int. J. Manag. Educ. 2012, 10, 12–28. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).