4. Results and Discussion

In this section, the results from the case analysis are presented and subsequently discussed. The cases are evaluated based on the criteria introduced in the previous sections. In addition, the problem to be addressed and the intended solution are described.

4.1. Case Discussion: 300Cubits

300Cubits aims at revolutionizing the shipping business by tokenizing the contract between customer and container liner. Their aim is based on the vulnerability of the booking process and adherence to closed agreements.

When booking a reservation for a container, customers do not need to pay in advance, which means there are no consequences in the case that they do not deliver their goods to the port terminal in time. As a reaction, this results in overbooking activities by the container operators, as they can expect 25–30 percent of no shows. These overbookings further lead to the conclusion that a booking made by a costumer might not be able to be shipped. Previous initiatives such as deposits or bank guarantees were not accepted by the involved parties.

As a solution to this supply chain issue, 300Cubits proposes a token deposit system, which is organized as a tamper-proof Blockchain intermediary and utilizes a smart contract. Customer and container liner both pay a token into an escrow account, which results in an immutable agreement. In case one of the parties cannot fulfill its part of the contract, the other party will get both tokens. Due to this contract, no-show and overbooking become consequential.

The case organization shows engagement with the technology. General functions of the Blockchain technology are exploited within the case and the use of that technology seems to be realistic. The case organization is aware of possible entry barriers and offers a risk-free and free of charge testing phase to attract future clients on board. The case stands or falls with the transaction speed of the technology used, the Ethereum blockchain. The case literature mentions the plan to develop an in-house blockchain solution in case Ethereum is not adequate, which seems to be realistic at this time. The case organization presents awareness about the writing into the blockchain requiring some form of accessibility, which, however, is addressed with a parallel booking system, which needs integration into 300Cubits’ solution.

This solution exploits the novelty of the blockchain technology by using the unique trust feature. Due to the solution, an immutable agreement is created and automatically enforced on failure to comply. Thus, neither party has to trust the other or an intermediary any more, and a trustless partnership can be executed.

300Cubits presents awareness of local inhibition and is planning a well-considered rollout program. The solution offers more security but takes away the often-needed flexibility for shippers who may have to change their shipping arrangements after initial booking. Although the case literature mentions costumer complaints about deposits and is marketing 300Cubits’ solution as solving that problem, the token is still a kind of upfront payment. The case, therefore, has to be seen as an attempt to make this payment method acceptable, while it could also drive shippers to other liners that do not have deposits and additional booking processes.

There is proficient knowledge on certain risks for the blockchain solution, as the secondary case literature mentions the transaction speed of Ethereum and the probability of a slow adoption rate for the technology in this specific industry. For 300Cubits to enforce this solution in the shipping industry, they need to build trust into their technology as conventional booking systems might be preferred by the majorities of users. However, to execute the smart contract correctly, a reliable signal proving each party’s compliance is necessary—a serious requirement of this blockchain implementation. The case literature indicates great optimism about the port taking on the role of signal provider. This level of altruistic participation of a multitude of ports in that process might be unrealistic.

In the long run, the solution shows some risk of unintended use of the tokens that could result in alteration to the solution that could affect shippers’ and liners’ attitude towards the solution. When dealing with third-party tokens there is always a currency risk that needs to be taken into account, although this would also apply for a deposit made in dollars, and the case organization has paid attention to this risk.

4.2. Case Discussion: BanQu

BanQu offers a blockchain case for social sustainability by giving unbanked people, who are currently restricted from participating in global supply chains, the opportunity to participate in the global economy.

The case organization addresses the issue of 2.7 billion unbanked people living worldwide, meaning these adults are without a financial bank account to access the corresponding financial operations and benefits. The reason for being unbanked is not always poverty, but may be due to a variety of reasons. Without a bank account, it is hard for these people to connect to the economy, which makes it harder to participate in global supply chains, e.g., receiving payment from abroad or investing in more efficient processes to increase output.

BanQu’s blockchain solution aims at connecting the unbanked community to the global economy by utilizing a distributed ledger as a secure and immutable database. The case organization states that 60 percent of unbanked people do own smartphones, which could be used as a platform to connect them to the economy. The blockchain platform will help the unbanked to record their financial transactions in a credit history, to give them a baseline, provide them the opportunity to leverage financial services on BanQu’s platform, and to own their own data. For LSCM purposes, they create financially viable farmers with traceable farming products and payments to farmers. These farmers are provided with a digital identity and consequently with a financial history presenting trustworthy (financial) behavior. Thus, the solution strengthens the weakest suppliers in today’s supply chains.

Considering the case organization’s publicized engagement with the technology, the analysis of the secondary case literature revealed a number of deficits, which should be examined. Writing into the blockchain requires approval of these transactions by other parties, resulting in costs for the energy used. It remains unclear who will pay for the blockchain transaction considering the case addresses the poorest of the poor. Furthermore, based on the available information, the system is vulnerable to fraud. In order to have trustworthy records in the blockchain, the records have to be provided by a trustworthy source. The literature, however, indicates that any member of the system can write transactions into the blockchain without any oversight, so that members could write a multitude of fake transactions in order to build up a credible financial history. There is no crypto-currency involved that is traded and the transactions are not explained to be coupled to cell phone transactions. In addition, it remains unclear where the decentralized ledger would be stored.

Trust in the financial history of a person, which is usually provided by a third-party organization—a bank—is the novelty of the blockchain technology that is exploited in this solution case. The trust is provided due to the traceability and immutability of financial transactions, which is usually a given due to the transactions being administered by the bank without any option of the bank’s customer to change or manipulate them. However, the trust in these transactions is dependent on trust in the interface between real-world transactions and the writing process in the blockchain, which is not well defined.

Concerning the awareness of local context, the case data display some inconsistency. As discussed in the case literature, not all unbanked people own cellphones. Consequently, not everybody in the target group can be reached with the blockchain-based solution. It is questionable, whether the main target group within the unbanked community, being the poorest in the supply chains, belong to the group owning a cellphone. In addition to the rollout of a novel technology in rather underdeveloped regions, Internet access will definitely be necessary for the concept. Further, unbanked people might be unfamiliar with the investment or insurance concepts presented by the case organization and would have to be educated on the principles of loans and interest, as well as insurance and insurance contributions. In addition, the success of the model is based on how potential partners for the proposed financial services (e.g., bank loan, crop insurance) will value the BanQu-score.

The alternative to the solution provided by the case organization is obviously a financial institution like a bank. Current guidelines of financial institutions do not allow people without identities, credible financial history, or sponsors to create an economic identity. Thus, the BanQu solution, or rather the blockchain solution, seems to be a profound way to create those identities by giving pseudo-banked histories as a gateway. While banks would take on BanQu’s customers in that case, the solution is set up to abolish itself with the charitable goal of lifting people out of an unbanked situation.

Concerning the alteration of these issues, a conceivable alteration might be a government-controlled digital identity for the unbanked and a related government bank. This would make the BanQu solution redundant but, as mentioned above, would fulfill BanQu’s goal. Furthermore, regulation might limit some risk-taking behavior for financial institutions as a result of previous or anticipated financial crises. Accepting the financial history created by BanQu could eventually be rated as a risk-taking behavior and interfere with the business model.

4.3. Case Discussion: Bext360

Bext360 is an organization focused on developing technologies to improve social sustainability in a supply chain. For that purpose, they developed a blockchain to track and trace coffee beans on the complete route from farmer to consumer.

The supply chain relevant problems Bext360 tries to address within the supply chain for coffee beans can be put under the title fairness. On the one hand, farmers of coffee beans are treated badly on a regular basis. They receive either low wages, delayed payments or even no payments at all for their beans. In addition, intermediaries and resellers often take more than their fair share of the product. On the other hand, consumers must rely on the little information they get when buying coffee. The chain of information regarding authenticity of the proclaimed coffee quality or if farmers were paid and treated fairly is incomplete and vulnerable to falsification.

The supply chain relevant solution Bext360 is proposing is supposed to solve the unfair treatment by developing a complete chain of information. They propose that a robot automates the quality evaluation of coffee beans and assigns a fair price. Bext360 plans to use a blockchain implementation to bind the data from this transaction to a token per bag of coffee and, therefore, offers traceability from source to consumer down to the bag of coffee beans. With access to the information on the token they would be able to track the actual transaction of beans and payment, proving a price, which is supposed to be fair to ensure an actual living wage for the farmers, as well as the origin of the beans.

The case suggests a high level of engagement with blockchain technology. With the use of a crypto token to track the product and all the relevant information across its life span, Bext360 has built a meaningful blockchain case while acknowledging that the data written into the blockchain needs a trustworthy source as well. By making sure the data input is automated and, therefore, genuine, the quality of the saved data can be assured. It is, however, unclear how data manipulation at later steps of the supply chain is handled. Although manipulation or simple lack of data at this stage only influences the tracking quality and not the proof of the farmer’s pay, the consumer might not have full insight into the supply chain.

The choice for blockchain and against other database systems seems logical. To be able to prove the fair treatment of farmers and a clean supply chain, Bext360 must prove the immutability of its data to the external world (consumer of coffee). The ability to manipulate the data, which, in the case of using a centralized database offering this kind of visibility, at least one party would have, is not available to any party in this blockchain implementation.

The mentioned immutability to gain the transparency of data, which represents a novel feature of blockchain technology that this case is exploiting, does, however, rely on a decentralized network of parties storing copies of the ledger. Documents on this case do not explain why a decentralized network is necessary and if the actual network is really decentralized (and, therefore, a proper implementation of the blockchain ideology).

The data of the suggested case shows a lack of local awareness regarding the region of implementation. The possibility of a working and sustainable implementation of automated coffee bean analysis and pricing combined with the need for constant internet connections is questionable considering that most coffee bean farmers are situated in developing countries. It depends on Bext360’s ability to keep the infrastructure working and the robots safe from theft, vandalism, and other damaging exposure (e.g., rain, erosion) as well as confirming rightful usage. To identify the farmers, they have to be part of the process and identify themselves with a unique ID. To fight fraud, e.g., by using a farmer’s ID as a reseller, farmers must understand the process and have the possibility to contact some sort of authority that is able to punish misusage of the process. The idea only offers true benefits if the “real life” application works as planned. In detail, farmers must actually receive the pay that is documented in the blockchain and the tokenized bags of coffee beans have to contain beans of the stated quality. It is not explained how Bext360 is going to make sure of those issues.

The case presents cognizance of alternate approaches to the problem. The “classic” approach of tracking and tracing is expensive, imprecise, and does not address the consumers’ demand for visible transactions on the supply chain. Bext360 has seemingly put fundamental thought into the development of a proper use of the blockchain to approach a problem that has barely been addressed directly with other technologies. No specific considerations of alteration to the task or problem by the case organization was identified. No relevant alteration could be identified by the researchers.

4.4. Case Discussion: Kouvola Innovation

Kouvola Innovation wants to implement blockchain technology to enhance the information flow around supply chains, remove inefficiency and, as a result, reduce cargo transport times, especially in cross-organizational supply chains.

The LSCM problem Kouvola strives to tackle is of cargo units moving inefficiently through cross-organizational supply chains as well as transportation and distribution infrastructure. The cargo units move as efficiently as the surrounding infrastructure allows them to. A bottleneck in cross-country and cross-organizational transportation is the communications infrastructure along the supply chain. Kouvola Innovation claims a communication structure that cannot facilitate data transfers along the supply chain due to a missing data standard, missing connectivity, and missing interpretability results in suboptimal behavior. The transfer of data in the supply chains on which the case organization is focusing is often delayed, the transferred data is inaccurate, or the receiver is simply not able to read or receive the necessary information.

The proposed solution seems relevant to the supply chain. Kouvola Innovation wants to develop and implement a standard for communication in the cargo business based on blockchain technology. In addition, they want to develop a standard for blockchain projects in general. Their goal is to create a trustful and open communication network. However, without standards regarding, e.g., data quality and formats, an open network would not generate any benefits. Their goal is to have a data hub for participants of the supply chain, regardless of data source and base technologies. In essence, Kouvola Innovation wants to change the present peer-to-peer communication to a hub-and-spoke-like system with a central data hub.

In the data, the team of Kouvola Innovation shows engagement into the blockchain technology as the organization seems to have a deep understanding of the blockchain technology as well as other different communications technologies and the different challenges that arise with data gathering or data storage. The case organization emphasizes the blockchain’s inability to gather data and addresses this shortcoming with other technology, such as sensors. Regarding the costs of the system, some questions remain unanswered. It remains unclear at what frequency data will be written to the data hub and what kind of information shall be available to the participants. An awareness of the huge data volume does exist within the case, which might not be handled by the blockchain, but shear data volume does not necessarily result in higher degrees of usable information for participants. A technical standard does not solve the problem of agreeing about the content to be shared. Moreover, this blockchain-based solution does not solve the interface problem, since every participant has yet to create an interface from his system to the data hub.

The case falls short in mentioning proper use or need for the novelty of the technology. The case focusses on traceability of cargo and the availability of information. The possible increase in transfer speed of data and the existence of data history should lead to a more effective use of the actual data. Kouvola Innovation does not address the immutability of data and the case does not suggest a real need for it.

The case displays some inconsistencies regarding awareness of context. The depicted case tries to fit a regional solution to a worldwide system. Much of the use of the central data hub relies on the implementation of sensors per cargo unit. This comes with substantial costs and effort, especially since the project focuses on the Scandinavian area but shipping containers leave and enter this area constantly. To acquire a useful amount of real-time data, a high percentage of cargo units must be equipped with IoT sensors. The transparency of the data has to be restricted to the relevant participants to maintain the safety of crucial information and is dependent on willingness to share data. The project relies on stakeholders’ participation. However, there is no information on how to enable that participation. Not everyone will be interested in a pooled data hub. Powerful players will most likely not want to give up their power of data and information, but rather use this for their personal (monetary) interests. Kouvola Innovation has to find ways to incentivize the participants of the supply chain to offer their information in a more open way, rather than the present peer-to-peer method. Finally, yet importantly, the simple existence of a huge database regarding supply chains in the Scandinavian area does not increase the efficiency of said supply chains. The data has to be analyzed, and appropriate actions have to be taken, to generate benefits.

The case does not discuss the use of alternative technologies. The case does not display the necessity for the decentralization of the database. Most of the data sources in the form of IoT sensors would not have the storage capacity for a local copy anyway. The participating logistics providers most likely do not care for a local copy, as long as they can rely on the integrity of the data. The reason to implement the idea on a blockchain and not in the form of a classical database is not clear and remains unaddressed by the case organization in the documents publicly available.

The EU funds the project, which means that the promised funding is secure. An extension of the research goal or timeframe depends on additional funding. The use of a different standard for the transfer of data should not be a problem. The implementation of Kouvola Innovation offers flexibility and adjustability to changing data sources anyway.

4.5. Case Discussion: Walmart

In cooperation with IBM, Walmart is working on blockchain pilots with the goal of enhancing their supply chain transparency and tracking their goods more efficiently.

Due to lack of transparency in their multi-actor food supply chain and inefficient processes, Walmart struggles to track and identify its products. This issue can become serious in food supply chains if food is contaminated and can causes illness in customers. However, the problem of traceability concerns any product in the supply chain and can be necessary for several reasons apart from contaminated food.

Together with IBM, Walmart developed and started testing a solution for a more efficient data exchange. The solution developed is based on blockchain technology and enables them to identify and track products faster (from six days to 2 s) and to remove recalled goods from their shelves. The solution requires data input for every product into a private blockchain.

The case data suggest a relatively low engagement with blockchain technology. In the available secondary literature, it does not become clear how the data input, especially for small players, is organized with regard to writing information into the blockchain for the individual products. Furthermore, there is a lack of information on how and where the blockchain will be stored. It does not become clear that Walmart is aware of the decentralized nature of the blockchain. Furthermore, the cost of writing data, especially considering the large number of transactions to be written in this case, and the assurance required to create trustworthy data sources—points addressed in the previous cases—are not mentioned in the public material. Overall, it cannot be assured, based on the secondary literature of that case, that the technology and the corresponding problems have been fully addressed.

This solution utilizes the novelty of blockchain technology as it is using its uniqueness concerning traceability as well as increased speed and efficiency. This enables Walmart to reduce its tracking time from six days to 2 s. It is important to note that, in order to accredit this to the blockchain technology, the speed increase should be due to the validation processes no longer being necessary. If the speed increase is solely based on an efficient database, this could also be solved without the blockchain by using a write-only central database. Although the data does not mention it, in Walmart’s specific case, the immutability of the blockchain can play an important role, as continuous refrigeration chains require uncompromised data due to the nature of the products.

The secondary case data displays a lack of local awareness, as it simply does not mention possible local and case-specific circumstances, which need to be considered. As local security plays a significant role, it remains questionable how the case will deal with the fact that companies in the retail business do not want their supply information to be shown to competitors within the blockchain.

The available case data fall short in the comparison with alternative technologies. Secondary case literature only mentions the comparison with the current system regarding the transaction speed (from six days to 2 s), without further describing this current solution. Alternative technologies, such as a central database with write-only access, which could be stored at Walmart itself, are not examined, although the case appears to be a prime example that could be solved with a central database in combination with more efficient processes. Immutability of the data for other actors than Walmart could be achieved with a private Walmart database with limited manipulation rights for other actors. Based on the requirements derived from the data, the necessity for a decentralized solution are not depicted. Furthermore, advantages and disadvantages of the different technologies, especially of the blockchain technology, are not considered in the case data.

Available data present no cognizance of possible process alteration. Possible alteration might include changes in the supplier network, which would lead to the task of rolling out the blockchain technology to and with the new partners. This is an advantage of the blockchain as this would be easily possible and cost efficient. Another alteration can be found in the need for new data records. In case new datasets for each product will be stored within the blockchain, an adaption will also be possible.

It remains unclear whether blockchain is the right solution for Walmart’s case, as the case literature available shows large gaps in the evaluation of the criteria for mindful use of the technology. This conclusion might be explained by the limitations of the research method itself, as this information may exist, but was not made available to the public.

4.6. Overall Discussion

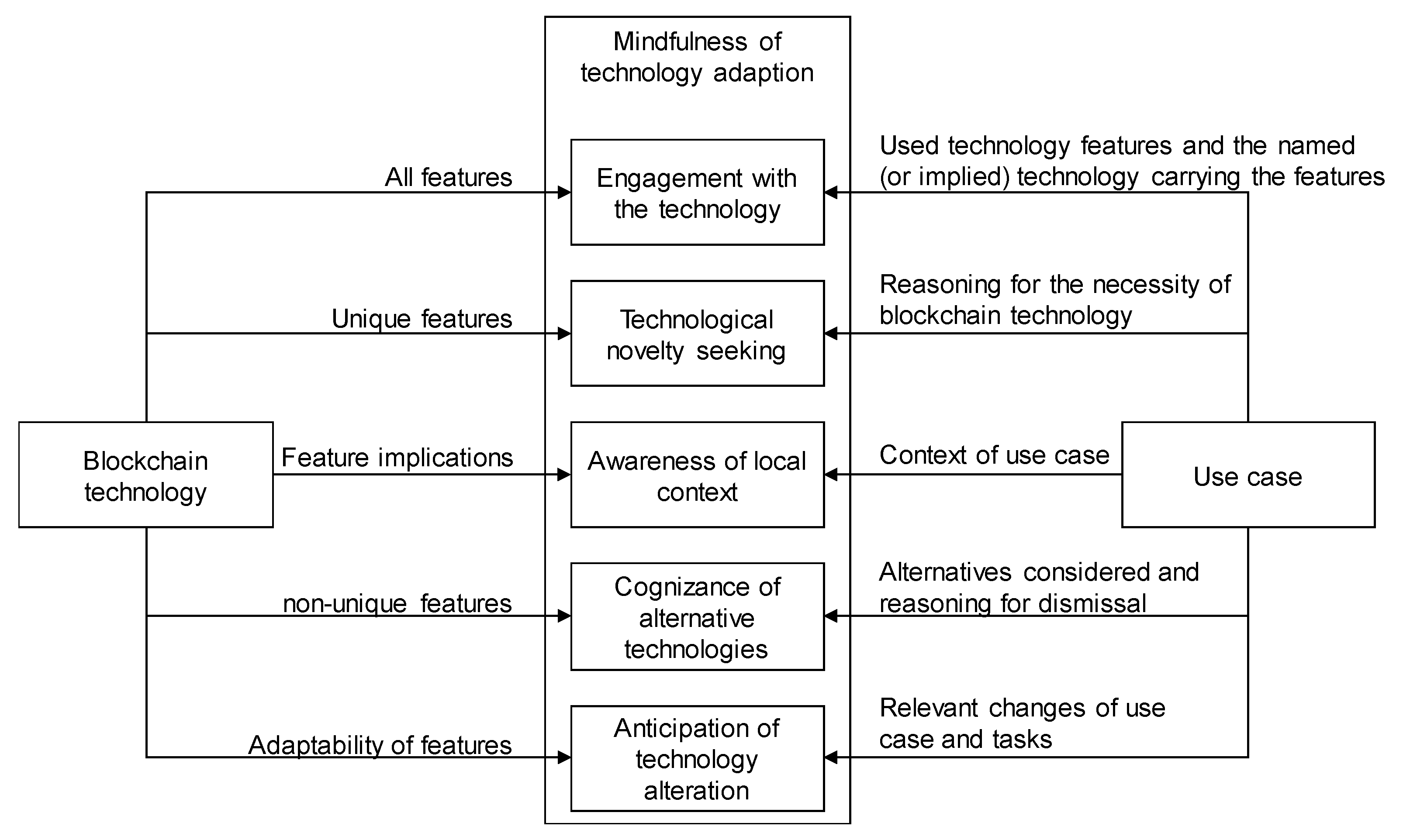

The systematic evaluation of the five cases shows a good understanding of case organization towards problems relevant to logistics and supply chain management. Our results are aggregated in

Table 2. The problems resulting from no-shows by customers, on one hand, and overbooking of capacity by logistics providers, on the other (300Cubits), and inefficient communication in the container business as a whole (Kouvola Innovation) are valid challenges to address. However, in the case of Kouvola Innovation, the problem description only touches the very surface of the problem without identifying achievable goals for the proposed solution. Improved tracking and tracing to increase customer trust (Bext300) or reaction times (Walmart) display a high degree of relevance. Credibility of unbanked people (BanQu) is not a problem with direct consequences to supply chains. However, the potential market impact of integrating unbanked people into the economic system and their more reliable and mature participation in supply chains would enhance logistical endeavors as well.

However, very different levels of quality can be found in the proposed solutions for the aforementioned problems. Using immutable agreements and deposits as an incentive for correct behavior in the cargo business is a very straightforward and practical approach (300Cubits). The proposal of a standard for blockchain programs is valid, but does not directly address how they will solve the problem of inefficiency (Kouvola Innovation). The three cases targeting tracking, tracing, and transparency also propose solutions of very different quality. Providing full transparency for customers with the combination of automated data input is a very good approach to create trust with customers (Bext300), while creating a trustful transactional history for unbanked people does not work without validation of the input (BanQu). Creating a fully transparent supply chain that allows for quick reaction is a good idea in theory, but the case does not mention how the data is generated. It seems impractical for high-volume, low-value items (Walmart).

While most cases suggest a high engagement with the technology with regard to its restrictions, some questions are left unanswered. Two cases suggest that either the customer or a third-party beneficiary pays for the transaction (300Cubit, Bext300), while one case leaves the answer to the question open (Kouvola Innovation). Two cases do not address the question of who pays for transactions at all (BanQu, Walmart). A similar picture evolves when looking at transaction speed and data capacity. Three cases directly address these challenges (300Cubit, Bext300, Kouvola Innovation), while the remainder do not address the question (BanQu, Walmart). Only two cases explicitly address the difference between data storage and data gathering (Bext300, Kouvola Innovation), while the others, at least in part, falsely suggest that the challenge of data gathering is solved by implementing the blockchain. The problem of incorrect data input is only addressed and solved by one case (Bext300).

Three cases use the novelty feature of trust in trustless partnerships in combination with the immutability of the data (300Cubit, BanQu, Bext300). While all cases mention a gain in transparency, there is no visible necessity to implement it using the blockchain technology in two cases (Kouvola Innovation, Walmart).

Only one case shows full awareness of the regional implications of their solution (300Cubit). Two cases rely on the use of complex technology in regions with little infrastructure and high risk for theft, damage, or lack of supply (BanQu, Bext300). One case suggests a regional solution to the global container market, which does not seem sustainable (Kouvola Innovation), and one case does not address the issue (Walmart).

When considering alternative technologies to solve the problems, two cases make a proper case for the need of the blockchain technology because of the shortcomings of existing technologies (300Cubit, Bext300), while one proposes a stark improvement to an already existing method (Walmart). One case suggest that the solution would be possible in a different way, but is not accepted by the necessary actors (BanQu) and one case does not address alternative technology at all (Kouvola Innovation), supporting the claim that the technology is not used in a mindful way.

Considering the anticipation of technology alteration, no case explicitly mentioned unsolvable problems. The researchers found several minor alterations that are worth mentioning.